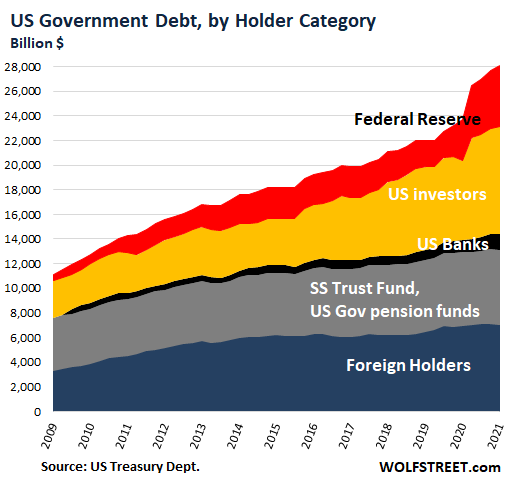

The Fed did. Nearly everyone did. Even China nibbled again. Here’s who holds that monstrous $28.1 trillion US National Debt.

By Wolf Richter for WOLF STREET.

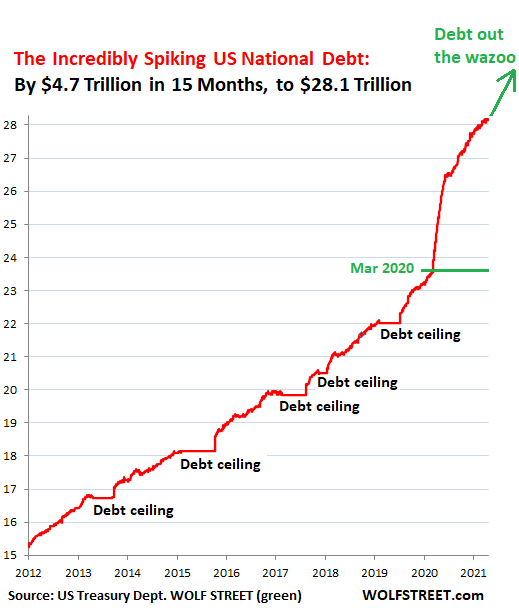

The US national debt has been decades in the making, was then further fired up when the tax cuts took effect in 2018 during the Good Times. But starting in March 2020, it became the Incredibly Spiking US National Debt. Since that moment 15 months ago, it spiked by $4.7 trillion, to $28.14 trillion, amounting to 128% of GDP in current dollars:

But who bought this $4.7 trillion in new debt?

We can piece this together through the first quarter in terms of the categories of holders: Foreign buyers as per the Treasury International Capital data, released this afternoon by the Treasury Department; the purchases by the Fed as per its weekly balance sheet; the purchases by the US banks as per the Federal Reserve Board of Governors bank balance-sheet data; and the purchases by US government entities, such as US government pension funds, as per the Treasury Department’s data on Treasury securities.

Foreign creditors of the US.

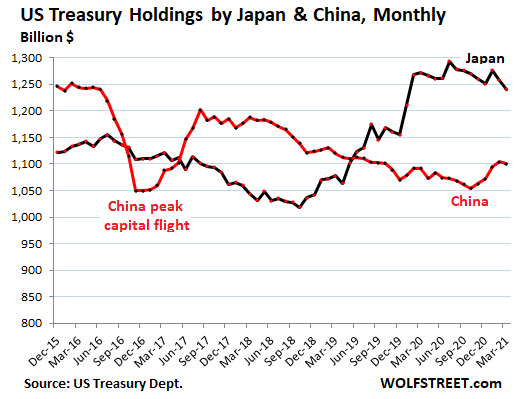

Japan, the largest foreign creditor of the US, dumped $18 billion of US Treasuries in March, reducing its stash to $1.24 trillion. Since March 2020, its holdings dropped by $32 billion.

China had been gradually reducing its holdings over the past few years, but then late last year started adding to them again. In March, its holdings ticked down for the first time in months, by $4 billion, bringing its holdings to $1.1 trillion. Since March 2020, it added $9 billion:

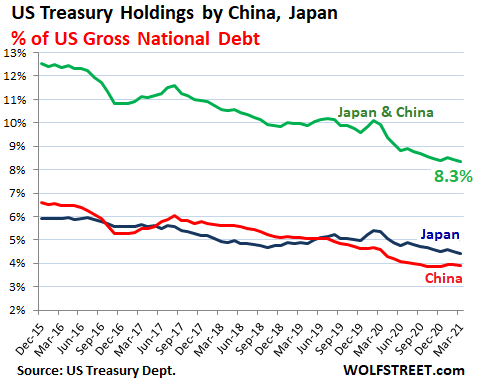

But Japan’s and China’s importance as creditors to the US has been diminishing because the US debt has ballooned. In March, their combined share (green line) fell to 8.3%, the lowest in many years:

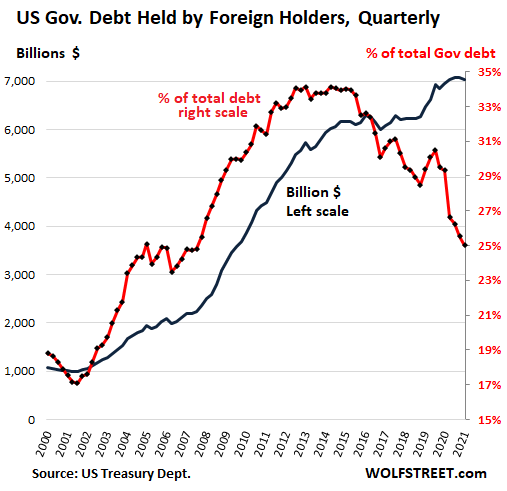

All foreign holders combined dumped $70 billion in Treasury securities in March, bringing their holdings to $7.028 trillion (blue line, left scale). But this was still up by $79 billion from March 2020.

These foreign holders include foreign central banks, foreign government entities, and foreign private-sector entities such as companies, banks, bond funds, and individuals. Despite the increase of their holdings since March 2020, their share of the Incredibly Spiking US National Debt fell to 25.0%, the lowest since 2007 (red line, right scale):

After Japan & China, the 10 biggest foreign holders include tax havens where US corporations have mailbox entities where some of their Treasury holdings are registered. But Germany and Mexico, with which the US has massive trade deficits, are in 17th and 24th place. The percentages indicate the change from March 2020. Note the percentage increase of India’s holdings:

- UK (“City of London” financial center): $443 billion, -5.6%

- Ireland: $309 billion, +13.8%

- Luxembourg: $283 billion, +14.8%

- Brazil: $255 billion, -3.4%

- Switzerland: $255 billion; +4.2%

- Belgium: $236 billion, +14.4%

- Taiwan: $232 billion, +12.9%

- Hong Kong: $227 billion, -11.3%

- Cayman Islands: $215 billion, +2.8%

- India: $200 billion, +27.8%.

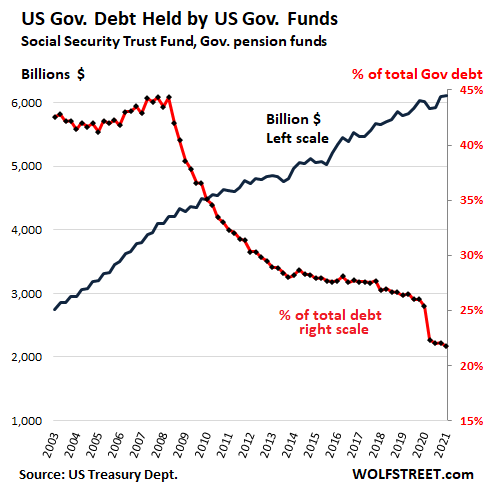

US government funds hit record, but share of total debt drops further.

US government pension funds for federal civilian employees, pension funds for the US military, the US Social Security Trust Fund, and other federal government funds bought on net $5 billion of Treasury securities in Q1 and $98 billion since March 2020, bringing their holdings to a record of $6.11 trillion (blue line, left scale).

But that increase was outrun by the Incredibly Spiking US National Debt, and their share of total US debt dropped to 21.8%, the lowest since dirt was young, and down from a share of 45% in 2008 (red line, right scale):

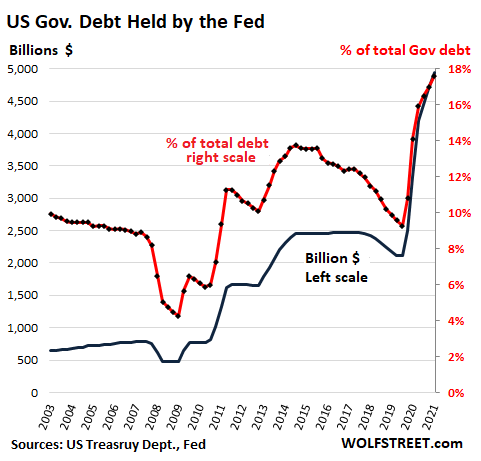

Federal Reserve goes hog-wild: monetization of the US debt.

The Fed bought on net $243 billion of Treasury securities in Q1 and $2.44 trillion since it began the bailouts of the financial markets in March 2020. Over this period through March 31, it has more than doubled its holdings of Treasuries to $4.94 trillion (blue line, left scale). It now holds a record of 17.6% of the Incredibly Spiking US National Debt (red line, right scale):

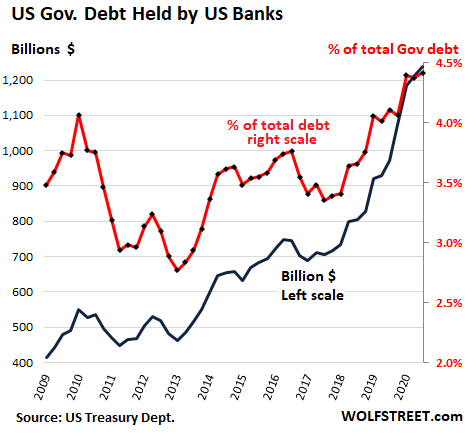

US Banks pile them up.

US commercial banks bought on net $28 billion in Treasury securities in Q1 and $267 billion since March 2020, bringing the total to a record $1.24 trillion, according to Federal Reserve data on bank balance sheets. They now hold 4.4% of the Incredibly Spiking US National Debt:

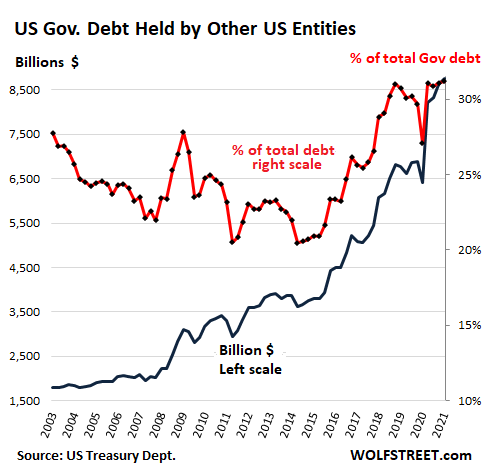

Other US entities & individuals

So far, we covered the net purchases by all foreign-registered holders, by the Fed, by US government funds, and by US banks. What’s unaccounted for: US individuals and institutions other than the Fed, the banks, and the government. These include bond funds, private-sector, state, and municipal pension funds, insurers, US corporations, hedge funds (they use Treasuries in complex leveraged trades), private equity firms that need to park billions in “dry powder,” etc.

These US entities hold the remainder of Incredibly Spiking US National Debt. Their holdings surged by $149 billion in Q4 and by $2.35 trillion since March 2020, to a record $8.76 trillion (blue line, left scale). This raised their share of the total debt to 31.2% (red line, right scale), making these US individuals and institutions combined the largest holder of that monstrous mountain of debt:

The Incredibly Spiking US National Debt and who holds it, all in one monstrous pile:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Decades? Wasn’t it only 7 or 8 trillion around 2008? One could argue any “growth” since then has only been an addition of debt.

In the year 2000, as George W. Bush assumed the role of 43rd president of the United States, America’s national debt stood at $ 5.7 trillion, while the annual GDP was $10.7 trillion. (Web)

When Reagan assumed office, the debt was one trillion. Running on lower taxes he doubled it in 4 years .

PS: in politics, this began the era of ‘deficits don’t matter’. You don’t elected by worrying about deficits.

BS.

FDR increased debt 10 times.

*tenfold

FDR forever changed USA from a self-made, responsible country to a nanny state.

He made tall promises (social security, medicare) and won many re-elections. We are struggling to keep those promises at great expense each year.

He showed by example, how easy it is to bribe voters with their own money.

Reagan won the Cold War. If you are not at least 65-70 you would not know or understand. A trillion to win was cheap

Anil,

Thanks.

Getting a longer term historical perspective is important…and Wolf can’t carry the entire load.

Fiscal conservatives have known the nature of the government beast (always spend more, never less…that is how power is accrued) and warned about it for decades.

All that happened in the interim?

Being ignored, with the foreseeable eruption of various disasters (both citizen and DC made).

And at the end of it all,

The last, wholly impotent DC political potentates wringing their useless hands, crying, “Who could have known?!”

Cas127

Putting into perspective; in 2000..$5.7t..against GDP;10.7t whilst 2021 it is $28.5T against GDP. 21.0T..(5 fold increase in debt over twice GDP ).

Good time to brush up on your Mandarin.

Guess we will find out if deficit spending is sustainable (pretty tough to service the debt and grow at the same time when all the growth comes from deficit spending).

The hubris and stupidity of the Fed&politicians really shines when they talk about keeping up the record spending and QE for longer and longer with no tax raises to pay for it.

The american people are to blame. Greedy and stupid. My fellow Americans, you really deserve what you will get.

American society has become vapid, the attention span of a millisecond. There is literally no public debate of issues that is worthwhile, it is all a game of choosing sides between the two parties that dont intend to fix anything, because for every dollar of debt there is a special interest group that is benefitting.

I am researching countries to take my money and run. Researching how to protect against the demise of the dollar and the soon to come implosion of the stock market.

“The american people are to blame.”

Fairly true, but let history record that a political class of pimps and whores, both elected and unelected, poured every ounce of their worthless existence into promoting deceptions that made the outcome certain.

America is enough of a democracy that its end might have been avoided, but a mass media oligopoly also endured just long enough (and lied comprehensively enough) to seal the fate of the nation.

So the last generations of degenerate citizens are certainly to blame but they had a pusher-junkie relationship with a leadersh*t class of rare distinction.

LS,

Please let us know what you find,,, I want to be able to advise my grand children of your findings, so they will have some place to consider when the poop really and truly hits the paddle here in USA compared to the rest of the world in 50 or 60 years.

Thanks,

One of the things iTulip.com used to do – back when it first started – was look at how the number of dollars needed to generate $1 of GDP was dramatically increasing over time. Note this is in the 2005-2006 era.

Clearly we’re in a whole different scale now…

Things that can go on forever will stop.

I think the reckoning will be abrupt and brutal.

Let’s all hope our weakened democracy will survive the event.

Not to mention world peace. I fear it is going to get really nasty this decade. Don’t forget China is in big trouble too with their massive debt and housing bubble. Many governments are going to need some flag waving to prevent riots in the streets when the wheels come off.

People buy treasuries because they think we are headed for a deflationary collapse. Ironically, the thought that the Fed might lose control is the only thing that creates demand for treasuries, which keeps the Fed in control.

What’s new? Anyone ever bother just getting some sun and relaxing? None of us, neither Sensei Wolf or the person reading can stop what’s about to come. Oh yes, history repeats all too often. So gather around with your family while you still have time, smile and eat, and listen to great music. The very same people we are against are smiling and smirking while people like you are reading what countries have whose debt and what not. They’re all the same anyway lol, so what good and what SAY do any of US have in the policy? I mean we don’t get to ask questions, we just wish to ask them and frown if our desired questions aren’t asked. We don’t make the news, we’re fed and so questioning is a big no no, so why even bother trying in this zero sum game? You know they’re printing out the wazoo and you know why they’re hoarding a bouquet of RMBS on to their balance sheets, and all of use KNOW how this is going to end. So enjoy the ride up until the tippy top. Other than that, do what you can to prepare, and the rest is you.

Glad I’m not you…your would view is a bit depressing…

You must be a millionaire, I mean, being able to predict the future and all. Are you long, or short?

He’s just realistic. And reality is depressing sometimes. Especially the financial state of the state(s) and the outcomes history teaches us will be.

I’m with him. Long life, short financials. And prepare while you can, how you can and see fit. Most of us readers have no other influence on the matter than voting with our wallet and feet.

Speaking of voting, SOMEBODY elected the people who are driving this bus.

Did any of you vote for any of these players? If so, take ownership or go hide in your safe space.

It’s not all bad news. Your retirement age is up 10%.

@Michael Gorback

“It’s not all bad news. Your retirement age is up 10%.”

Yes, and I think that bullmarket in retirement age won’t end anytime soon.

“Did any of you vote for any of these players? If so, take ownership or go hide in your safe space.”

Study – Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens [Princeton University, 2014]

Excerpts:

A great deal of empirical research speaks to the policy influence of one or another set of actors, but until recently it has not been possible to test these contrasting theoretical predictions against each other within a single statistical model. We report on an effort to do so, using a unique data set that includes measures of the key variables for 1,779 policy issues.

Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence. The results provide substantial support for theories of Economic-Elite Domination and for theories of Biased Pluralism, but not for theories of Majoritarian Electoral Democracy or Majoritarian Pluralism.

In the United States, our findings indicate, the majority does not rule—at least not in the causal sense of actually determining policy outcomes.

When a majority of citizens disagrees with economic elites or with organized interests, they generally lose. Moreover, because of the strong status quo bias built into the U.S. political system [that describes the overwhelming influence of the administrative state and lobbyists – W], even when fairly large majorities of Americans favor policy change, they generally do not get it.

To be sure, this does not mean that ordinary citizens always lose out; they fairly often get the policies they favor, but only because those policies happen also to be preferred by the economically-elite citizens who wield the actual influence.

The Federal Reserve and the United States Congress have essentially declared war on the dollar and the Law of Economics; which states that capital has future value.

As citizens and residents of the United States, we can only observe the actions being taken. (And stop voting for Team Red and/or Team Blue) We must position ourselves accordingly. No, it is not a free market, and yes, the game is rigged.

“It is the unemotional, reserved, calm, detached warrior who wins, not the hothead seeking vengeance and not the ambitious seeker of fortune.”

-Sun Tzu

True….we are in the minority worrying about stocks.. The bottom 50% of the U.S. people do not even own a stock and of this bottom 50% hardly any have a 401k and if so it is very little.

They do not car about the stock market.

I think his advice is, get out of debt. ??

He is right though. There isn’t much you can do against all this. So enjoy your life now while you still can! It can all fall apart tomorrow.

That said, it is just hard not to feel worried, angry and depressed about all this sh!t. Look how good we had it, and how it has all been f*cked up just to enrich a small percentage of the population (a scam that just keeps going on).

I’m no millionaire, and I’m pretty sure that HK’s assessment is spot on. It’s not depressing; it’s just the likely outcome from what’s happening now and has happened in the past.

I’ve got half a tank of gas, some taco bell left overs and an old pain pill proscription somewhere in the cabinet. I’d say I’m geared up well for armageddon.

You and me and a big chunk of America are in the same boat.

However we do have an afterlife to look forward to so it ain’t all that bad !

Since to you, nothing matters, this includes your comment. So why not leave the conversation to those who believe the future is not determined, but depends on present action.

There is no “future”, it’s only a concept (in yr head). Yr next action was already predicated on the present situation and previous experience. You have no real choice, unless you’re fantastically stupid. It just “happens” and you take credit. Relax.

Read the Guidestones

Nick, there is nothing I can see that tells us that is true.

To my eyes we’re no different from any other organism. Without external forces to limit us we consume the growth medium in our environment at an exponentially increasing rate until we collapse.

And the signs of collapse have for decades become ever increasingly apparent in everything from societal infrastructure, both social and physical, to escalating environmental degradation, to resource depletion, to overloading the climate system’s absorption capacity.

So the message seems positive enough in that light we may as well make the best out of it whilst we can still dance and make merry.

“All things are wearisome, more than one can say. The eye never has enough of seeing, nor the ear its fill of hearing. What has been will be again, what has been done will be done again; there is nothing new under the sun. Is there anything of which one can say, “Look! This is something new”? It was here already, long ago; it was here before our time. No one remembers the former generations, and even those yet to come will not be remembered by those who follow them.”

Ecclesiastes 1:8-11 NIV

“There is no profit to man: but that he eate, and drinke, & delight his soule with the profit of his labour: I saw also this, that it was of the hand of God.”

The same book has much to say about peoples’ vanity.

There’s no prep for the end. You can stock up on canned goods or learn foraging if you want. But civilized humans don’t survive without civilization.

We should love each other, be kind, be creative, and enjoy life while we can, before we die. And get vaccinated if you think it is helpful. God won’t judge you for either accepting or refusing a medical treatment.

When is the end coming? We’ve been muddling through for many years, we may have many more to go. But many scientists have concluded logically the world may well come to a conclusion within a couple of decades.

Great music? Hendrix! or The Doors. Wowzah! Jim Morrison. Babylon Falling. Ship of Fools. Enjoy the Soft Parade, the strange days of beautiful madness. I think Jim is upstairs looking down at us, that wicked laugh, laughing at us all.

“When is the end coming?”

How long has Japan been limping along on central bank life support? The rules here will be changed to allow this: “The Bank of Japan’s Unstoppable Rise to Shareholder No. 1 – August 14, 2016”

Can you picture what will be – so limitless and free

Desparately in need – of some – stranger’s hand

In a…desparate land.

HK said: “and all of use KNOW how this is going to end”

____________________________________

Tell us, big shot.

I understand what you’re saying but if you tried this thing called a “paragraph”, it would make it more digestible for human consumption.

I get it…might as well lay back and enjoy whatever awful thing the death of the Democratic Republic has in store for us next. (Ex. “Next time, we’ll bring 30K guns!” said a treasonous seditionist on 1/6/21.).

However, no problem has ever been fixed w/out identifying it first. So yeah….talking about all of this is probably a good idea!

That is what the billionaires want you to do. Are you enjoying seeing all of America’s wealth slowly gifted to the men who actually own the “Federal” Reserve and their friends?

When you are old and eating out of trash cans, remember how meek and accepting you were and how you failed to even protest. I, for one, will be kicking, screaming, scratching, biting, and eye-gouging as they rip us all off each month as they are now. I will not be a sheeple.

“Fed bot $2.44 trillion since it began the bailouts of the financial markets in March 2020”

Wasn’t off by much…2.5 t

That’s my gift, pls stop being assholes with it

Numbers, charts and two decades indicate single direction increases to Federal Reserve debt. Borrow and spend our way out of this crisis. So if we follow the plot lines they would seen to indicate we will be up to 200% GDP by 2030. What could possibly halt or alter the shenanigans from continuing?

Japan is close to 300% debt/GDP.What makes you think the US Dollar (World’s reserve currency spent and recognized in every country on Earth)

I would bet we could go to 500% yes inflation how much? who knows?

All to try to maintain a massive speculative bubble created by the FED. Absolutely revolting. Just sickening beyond belief. Put these SOBs in prison.

The sick bastards will do their best to start a major war before this whole Ponzi scheme of an economy finally unravel for good.

I suppose you haven’t noticed how our society works:

Hoard cats = Crazy Person

Hoard magazines = Call a Shrink!

Hoard $$$, tv time, fame, twitter clicks = THIS GUY IS AWESOME!!!

When you make $ your God and forbid any real oversight (the dreaded “regulations”!!!), “this” is inevitable.

Perhaps from the smouldering ashes, the remaining people will look around and say “We should it do it differently next time…..”

Only 82% to go before psycho Fed owns 100%…so at least we have a count-down timer…81%, 80%, 79%…HA

Tick tock, tick tock…psycho Fed gonna own it all…

How is the Fed going to default? Print more money? Who is going to be the screwee or screwor? Doesn’t this sort of thing typically lead to war?

John Knox,

The Fed, the way it is set up now, cannot default because it creates its own money. It can destroy the purchasing power of the dollar, though, and that is exactly what it is doing. Its goal is to this this more or less gradually.

“It can destroy the purchasing power of the dollar, though, and that is exactly what it is doing. Its goal is to this this more or less gradually.”

Is that really the Fed’s goal? Won’t that result in the US Dollar losing it’s reserve currency position.

The idea is to this in parallel with the other major currencies, and so far, that has been about on target. If the dollar collapsed all on its own, that would be a different story.

I’m trying to understand better – what are the ramifications? Can’t the US just forgive the debt it owes itself? Isn’t it pushing itself interest?

Gk,

No, debt forgiveness is a DEFAULT.

Who are the people that the US would default on? Pension fund beneficiaries, such as current and future military and civilian retirees from the federal government, plus current and future Social Security beneficiaries, etc.

The US government doesn’t owe that debt to itself; it owes it to the people that paid into its pension funds and the Social Security system. This notion that the US owes this money to itself is BS. This money is owed to real people for their retirement.

Well, the bright side is more and more US debt is owned by US entities, which means we can easily write it off in the worst case scenario or simply pass our bonds to our grand kids.

Writing off any debt is the destruction of an asset. A US Debt default would wipe out the global financial system.

But yes, we’re passing that debt on to our grand kids. That’s for sure.

Don’t they also get the assets?

The single largest ‘asset’ of the federal govt are student loans.

If you transfer the assets (collateral), if there are even any assets, to the creditors, it’s to satisfy the debt obligation. So if the assets = 100% of the debt and creditors get all the assets and experience no loss, it’s not a “debt write-off” because they got their money back. This does happen in bankruptcy court with debts that are secured by good collateral and are at the top of the capital structure.

But that’s not what Optimist was saying. Optimist said: “…we can easily write it off in the worst case scenario…”

So holders of these Treasuries to be written-off get nothing. Their asset just goes up in smoke.

Agreed Wolf but, to be entirely fair, our grand kids also get a country full of assets to go with the debts.

Whether or not they would want an out of date and rusty fleet of aircraft carriers is maybe up for argument, and that really is the point about any discussion of National debt.

Yes the U.S. Debt is staggering but to the FED, it’s business as usual as they stroke the masses into believing they have a grip on an imploding economy. All they can do is continue to print or it’s immediate game over for the World. Most people can’t fathom that or refuse to believe it’s even a possibility. It’s ‘I just want to get back to normal’ now that I’m vaccinated, except normal doesn’t exist anymore.

Crude Oil (1/3 of the Holy Trinity) is being propped up only because it trades in the U.S. Dollar and the mighty M.I.C.’s (military industrial complex) survival depends on its continued price escalation. The U.S. Dollar is being pounded down by corrupt entities creating a massive inflation bubble, allowing the entire Inflation Farce to continue unabated as orchestrated by the FED. There is no demand for anything other than that artificially created. Zero. When that stops it’s game over for world economies.

Vulnerability will eventually surface & before long huge cracks will appear in that aura of invincibility. Oil at $67/barrel – How about $27 or sub $20 where it should be. The markets are very fragile. It won’t take much to create panic selling when fear starts spreading like wildfire.

Most people have no idea what is almost upon us. I believe it’s best to prepare accordingly now while we still have a chance to not only survive, but thrive.

DD

I know some guys have ‘a thing’ about the Fed being the source of all evil but, all I would say is that, the ‘deficit’ is entirely the responsibility of your elected representatives who have decided you won’t elect them if they tell you the truth about how much tax you would have to pay to support the amount of spending they do on their ‘pet’ projects.

They have 3 basic choices to cover their costs, Tax, Borrow, or Print. The officials in the Fed and the Treasury get the lousy and difficult job of juggling these 3 to try to get the best overall outcome for the country.

In my experience, officials hate politicians even more than the public do because they know them better and how devious and stupid they can be.

One could hypothesize…. the fallout from the global pandemic has pushed the inevitable forward about a decade. That isn’t to say something bad will happen, but that whatever was going to happen will merely happen earlier than previously assumed. In that same vein, we know China’s economy will surpass the US earlier than previously expected. If anyone says they know what the world will be like in ten years, they are lying….but we can surely predict the general outline and discern trends with reasonable success, still…..the USA remains the core of the issue, and the unpredictable whims of 160 million American voters will determine the course for nearly 8 billion humans on this planet Earth ie. the rest of us. We are living in interesting times.

One of the smartest people I ever knew, a British World History professor named William Woodruff, told me in 1996:

“The 19th century was the British century. (We went from ‘the sun never sets on the British Empire’ to a 3rd world country w/nuclear bombs.)

The 20th century was the US century and

the 21st century will be the Chinese century.”

You could see that last chart as evidence that the role of the US$ as a reserve currency is receding. Foreign holdings are really flattening out.

So inflationary policies are not “sticking it to foreigners” as is often argued. US debt is mostly held by Americans. And going with this chart, US holdings have roughly tripled since 2009.

Of course this still excludes the elephant in the room that is unfunded liabilities such as social security, medicare, unfunded pensions etc, which is much bigger than the headline debt and much of which cannot be “inflated away” anyway because they consist of goods and services that need to be provided.

Interest rates are so low, treasuries are barely better than cash, and so they’re basically just extra money supply that the govt can devalue the currency against. As most realize it’s just another form of inflation taxed savings. That the govt “invests” in them to help fund it’s own liabilities and then devalues against them just goes to show the circular logic nightmare that the U.S. govt is creating. Unless the govt eliminates military spending or social security or medicare and ceases these massive spending bills, then they will have to tax the crap out of the rich to run a more balanced budget. Otherwise inflation will destroy social security and medicare anyway while wealth inequality rockets upward.

I don’t know if there’s a way to fight it really unless inflation and inequality gets bad enough that the average people start to protest and riot out on the streets. In which case our goal should be a pyrrhic defeat type strategy of helping the Fed f*** itself by refusing to hold dollars and dollar denominated debts. The error of their ways needs to be made glaringly obvious so that the frogs hop out of the hot water.

Unfortunately, there is very little you can do. You can spread your risk a bit by investing in real assets, but most of them are hugely overvalued now and the government can always take take them away from you by confiscation/ taxation.

I take pleasure in taking at least some of my money out of the banking system and put it into gold and silver based sound money (see link under my user name). It is a bit of a tail hedge, but it also gives me the feeling that I’m doing at least something to give the finger to central banks that try to destroy my savings with inflation and negative interest rates.

“I take pleasure in taking at least some of my money out of the banking system and put it into gold and silver based sound money …”

I’ve never been a precious metals fanboy but more and more these shiny ‘precious’ (tip of hat to ‘Lord of the Rings’ story) are looking more authentic and real than anything else in a dazzling holographic ‘Everything Bubble’ our elite rulers have conjured.

What surprises me (foolish me) is that otherwise intelligent people have jumped on the bandwagon for real estate, cryptos, stocks, etc., have dug in their heels, and are determined to speculate to the very bitter end, which is not far off IMO.

I’ve put money into beautiful and functional objects made of silver, gold and platinum. They yield a regular return in pleasure in addition to being a hedge.

I heard that the administration is proposing to implement an IRS reform plan that will involve uploading everyone’s banking records to the IRS, real time, to be stored in a massive server farm, much like the NSA’s server farm in Utah which stores phone records. Every check you write will be recorded and stored, and later data mined by authorities for law enforcement purposes. Any financial privacy will be gone forever.

On 4/5/1933 FDR issued executive order # 6102 forbidding ownership of gold coins, gold bullion and gold certificates and required owners to deliver their gold in exchange for $20.67/ ounce .

Numerous prosecutions were made under this law.

Given the ease at which executive orders are now issued , expect a similar order sometime in the future if gold prices go parabolic .

MAO stated that political power grows out of the barrel of a gun. Confiscated Gold will not act a hedge an irresponsible government ; owning a gun might help

@Rcohn

We simply don’t work what will protect us and what won’t. So we need to spread our bets and not put all eggs in one basket.

Social Security is funded at 70% over the next 3 decades.

It’s our $. It would be funded at 100% if the govt would make rich people pay their fare share (instead of capping contributions at $138K/year).

It’s the single most successful social program in US History, lifting over 20,000,000 citizens out of poverty, especially elderly and children.

I know because I was one of those children.

Once the greed is so out of control that Grandma can’t get her $600/mo. check, you’ll know the US “experiment” is truly over.

SS is an “Unfunded liability”? That’s most ridiculous thing I’ve ever read.

Node centre publican’s left:

Congratulations, you were the lucky one.

All Ponzi schemes pay off early withdrawals very well – that’s how it rolls. Ask Bernie Madoff’s customers.

SS contributions have grown each year both in percentage terms and tax base terms. Benefits have only gone up meagerly based on tweaked COLA numbers and paid off in diluted dollars.

Check if SS pays minimum living wage.

“single most successful social program in US History” *puke*

nodecentrepublicansleft,

Thanks for pointing this out! Particularly your last sentence. Saved me some time :-]

Here is more info and charts too:

https://wolfstreet.com/2020/10/10/status-of-the-social-security-trust-fund-fiscal-2020-beware-of-vicious-dog/

“Social Security is funded at 70% over the next 3 decades.” I commend your optimism given the hacked CPI numbers and dollar devaluation.

“It’s our $.”. Heh, communism much?

“It would be funded at 100% if the govt would make rich people pay their fare share (instead of capping contributions at $138K/year).” Again with ‘fair share’. Do you know initially the cap was 3k and in year 2000 cap was 76k? It has increased to 143k. Not fair enough?

US experiment was freedom, bill of rights, not handouts. It’s not greed that’s out of control, it’s stupidity.

Nacho Libre,

Social Security is not a “handout.” If you think it’s a “handout,” you don’t live in the US. Because if you live in the US and work in the US, you know that you’re paying into SS all your working years, and your employer is paying into it, and when you retire, you get paid monthly so you don’t starve.

That’s how a pension works. People need to get off this BS that SS is a “handout” or an “entitlement.” It’s a pension system you pay into, and then draw out of.

But I’m wasting my breath. It’s too politically convenient and easy to post thoughtless nonsense about SS, and people will keep doing it no matter what the facts are.

Wolf, you ignored my whole comment, took a part of it and mischaracterized it.

From my comment it should be clear I understand how SS works.

I was answering node centre’s snark “Once the greed is so out of control that Grandma can’t get her $600/mo. check, you’ll know the US “experiment” is truly over.”.

Such rhetoric and emotional appeals is how we step into these. One should ask why is the government paying grandma only $600? Was it the promise when it took money from her when she was working? Does $600 provide her ‘social security’? Would she have been better off investing her money somewhere else?

SS is a mandatory pension and insurance program. To keep going, it needs to keep increasing the contribution rate and wage base. And it pays back less than promised. You know this.

Nacho Libre,

Apologies. What line your comment addressed wasn’t clear to me.

Shit. I am old and don’t like the taste of pet food. But is that what I will be eating?

Nah, Fray Bentos meat pies all the way…

Those things last for ever.

Sir, I’ve run across some delightful recipes for Paleo Cricket Snaps, Spicy Critter Fritters, Insect Ramen, and Cricket, Mealworm, and Grasshopper Burger.

A little bug fare goes a long way at the table.

Bon Appetit.

Insanely hot peppers! By burning out your pain receptors you will have no idea of what it is you’re eating.

300% of GDP by 2028 after that it is follow the route/timescale of all colapsing empires, Rome, Ottoman, Spanish, British, etc, etc, a slowish decline into insignificance, By 2028 you will discover you only need 9 carrier groups, then 8, then 7, then who cares South Korea can go sing, and Europe can look after itself, and Russia it turns out is really our friend.

LOL. This is too optimistic. Defense spending will never be cut. Before that happens, all social spending will first go to zero. We will have 90 carrier groups, heck we might have a Starfleet, but there’s no home to go to, but then again that’s why the Starfleet will be built, so they can accompany Elon to his new home in Mars!!!

US Debt is estimated to be ~ 140% of gdp by the end of the year. This is exceeded only by Italy at 155%, Greece and Japan over 200%

Using the standards of the EU , neither Italy nor Greece would be admitted to the EU with that much debt. And neither would the US.

In 2020 the US budget deficit ran around 18% and is expected to run about the same this year. In 2020 the average country budget in the EU ran around 8.5% / gdp.In a very real sense the US has become the “dirtiest shirt”

Japans stock market topped out in 12/1989 even in the face of its rising budget deficit . For most of the last 40 years Japan has run trade surpluses with the exception of 4 years following the Fukuyama disaster and 2018 and 2019, while the US has consistently run trade deficits since 1976.

Economist Herbert Stein once stated “if something can’t go in forever it will stop”

The large budget deficit and the large trade deficit can not go on forever and will eventually stop. The question is will it when . The US is no longer the economic behemoth that it once was . We have only retained our military leadership.

This show will keep going on until dollar is a reserve currency and accepted globally without a question. After that there will be a war, another pandemic or anything else that may help to keep the status quo. However one thing is certain, the real income of most US families (measured by the amount of goods and services the can buy) passed it’s peak and will be going down. Don’t depress yourself, prepare or ignore.

China, Russia, and India have been de-dollarizing via gold reserves for more than a decade. Our world reserve status is already gone.

We can’t even make US companies pay US taxes, so they don’t need US dollars either. One of our biggest govt contractors would rather hold Bitcoin than USD. Only the broke countries who borrow in USD need USD. Some endorsement.

That guy from the Big Short has a big position on Tesla. Then Tesla stopped taking Bitcoin. Hard to guess which way that falls. We may have seen peak euphoria in the BRIC. This is the season when we wrap up unfinished business. Russia and the Cold War, and failed projects long in the tooth, monetary experiments, the state of Israel? The dollar could have a phoenix like fate, and rise from the ashes. Even on paper this nation is the best.

TSLA announced that it would take Bitcoin as payment only in late March. At that time TSLA stated that the price in bitcoins would be good for only 5 minutes.

Can you imagine going into your local Dept store and being quoted a price that is good for only 5 minutes.

TSLA s 5 minute policy is testimony to bitcoins volatility , making it impractical for transactions.

As of 2019 , the dollar accounted for 88% of all forex transactions with the Euro a distant second at 32% with China in ninth position.

While I agree with point, the question is always what will replace the dollar. ?

This is the highest core CPI since 1982.

To put that into perspective, at that time interest rates were at 19% as the Fed was desperately trying to control inflation.

This time around, the Fed has rates at ZERO while printing $125 billion in new money per month.

The theft continues. J Powell drives the getaway car.

Above comment should have quotes

If furreigners couldn’t buy UST’s, what would they do with the dollars?

There is no reason that the USG must issues UST’s to spend money. Surely doesn’t prevent out of control spending.

1. India borrowed lot of money from western nations. Never paid back anything. What went wrong?

2. Inflation is not a big problem. Just print more money. People can afford more stuff.

3. Fed is not printing if its just QE

4. There is no “Debt Ceiling”. Just a bargaining chip to reduce useful public spending and increase tax breaks.

5. Other countries must buy US treasuries because that is the only way to ship goods to US. Otherwise, money will be less, people buy less goods and finally less trade.

6. Even a minimalism seminar costs $500. How can I pay it?

Minimalism is as follows: don’t buy things! Or buy used if necessary. Fix things yourself, make things yourself.

Back in the day we just called that being frugal. I’m afraid it has long gone out of style in Debt Nation USA.

Who are the US investors? Why are the pension funds not jumping into junk or equities?

They have, MASSIVELY!!

What will happen to the pensioners when their junk and equity laden funds blow up by 50-70%? Maybe more?

Junk bonds yielding below inflation. What could possibly go wrong? Risk is so mis-priced, it isn’t even funny anymore.

What is a “Pension”?

I explained this previously.Junk bonds are trading at such low yields because the stocks of the underlying companies are trading at stratospheric levels . Thus it is far cheaper for such companies to raise monies via selling more stock then by going into more debt. This trend will continue until the stocks of such companies have a massive correction.

Recent examples of this are GME and AMC

@nodecentrepuclicansleft

Exactly. I think they followed the path into non existence, like rotary phones and 8tracks and VHS.

When interest rates rise the ratings on high yield junk rises, by implication. The real advantage of junk is when the bond is coupled with revenue. US treasuries have none, or not nearly enough. The US government is worse than a junk bond funded corporation. Pension funds get in trouble when they can’t meet their long term growth expectations of 8% or more. The shift will be from retirement savings to wage increases. New employees opt to take it all up front. The effect of that shift would be to decrease savings and increase economic activity. In turn new employees would use cash in hand, to buy assets, houses, land, even stock. The quaint notion of your pension behaving as a hedge fund will probably end. Also health care will commoditize, which is a huge drain on employee earnings. Meanwhile old pensioners have padded benefits, which get eaten up by inflation, if it’s slow enough, or you die soon enough.

I’m on the border of the next tax bracket. If I work any harder I get rewarded by paying 42% of what I earn AFTER EXPENSES to the government. So before I drag my sorry a$s out of bed and plunge into the Swamp to some very bad neighborhoods and risk my life & limb helping people buy homes I may try just going into my backyard and finishing my little wildlife refuge project that I began at the beginning of the pandemic. Taking off a month to get the vaccine shots and recover anyway.

Swamp Creature,

I know how you feel. I had planned a no buy year and the govt sends me all this money to spend. So after careful consideration, we buy a new BBQ and some patio furniture to enjoy our outdoor space. And now it won’t stop raining. Sometimes you just can’t win.

A new BBQ was the only thing I bought last year, a Webber grill for $695. Ms Swamp bought it for a fathers day gift. We use it nearly every day, rain, snow or shine.

Never got my stimulus money nor my 2020 tax return processed. Will use it for uncovered dental medical bills if it ever comes in.

My wife and I are taking the last three months of the year off. If we work the entire year, we’ll be bumped up into the next bracket and pay so much more in taxes that we won’t be able to have any savings for 2021. I know it doesn’t make sense, to work less and think we’ll have more money at the end of the day, but this is mainly because if we go over a certain amount, we will lose all the “temporary” benefits that we have gained in the recent stimulus packages. (Free Medical coverage now-yay!-thanks to Biden/Newsome.)

We also got a PPP loan, most of it is going to be forgiven, not to mention a 5K California Relief Grant that is about to come in.

The key here is not to go traveling and spending it all. The key is to save it and find some sort of sound investment, somewhere, and prepare for what’s coming.

If we’re going to use fake buyers of treasuries, Uranus seems like a better player than the supposed countries that just can’t get enough of a good thing. Venus would also be most excellent for subterfuge.

The slice held by the Fed is such that, it can (and I expect will) continue with this ,monetization of debt for decades.

Based on this, I don’t expect a real estate or Mr Market crash of any sustained magnitude for a long time.

The difference in “This time is different” really is diffferent:

The Fed has discovered it’s tools in it’s tool box, and has learned to use them immediately – instead of hesitantly or in too little too late half measure – when ever Mr Market commands it to.

This is the difference, folks. The Fed has only had these tools – or should we say toxic poisons – since abt 2008.

So yes – this time is different. It will work until it doesn’t. A guess? Maybe a few decades or more.

The Fed doesn’t have any tools. It can print money. That’s it. No matter what fancy term or acronyms it ascribes to what it does, all it does is prints money. I expect that they’ll ramp up this printing as they see it appears to “work,” but this acceleration means an acceleration of the day when it no longer works.

I don’t expect it to last for decades.

“Decades”

That’s “transitory” in Fed Speak, right? Because aren’t we all dead in the long run?

The Fed is in a very dangerous corner right now. That is why they feel the need to “go for broke” on heavy inflation that sticks. That is the only way to get some breathing room. Ironically, that involves creating more Treasury debt, but the calculus is that this new debt is only a small portion of the overall and inflation will erode it as well.

If wages don’t come up substantially, this will be the mother of all stagflations which will require the Biden to provide even more bail out money to the populace or risk a general pitchfork uprising.

My money is still on/in gold. When this reset occurs, the other leading countires are going to insist on some level of gold backing for a basket of currencies to be the reserve currency. If you don’t have 10% of your assets in physical gold, you aren’t protecting yourself adequately for what is to come.

“Going for broke on heavy inflation” is one of the dumbest ideas they could ever come up with. It severely punishes the poor, and ultimately will lead to massive riots or worse. These clowns are dangerous idiots.

Look for general strikes like transit strikes, utility workers, post office employees, teachers etc across the board when they don;t get what they want. Saw this in NYC in the 1970s. When wages don;t keep up with inflation this is what happens.

A long time ago someone stated that true communism does not work since who will get out of bed when everything is free.

It is becoming apparent that true democracy does not work since the voters can vote themselves everything free.

In 1792 state legislators elected senators and voters for president and congress were land owners. It was a republic not a democracy……and it worked for just about 200 years.

We don’t have true democracy, voters opinions are heavily manipulated.

True democracy would be smth similar to Ancient Greece where political representatives were chosen through pure lottery for a term no longer than one year.

We have entrenched oligarchs in our system.

yep

eastern bunny,

“True democracy would be smth similar to Ancient Greece…”

So lemme see if I remember this right. Voting in ancient Greece (where and when it was practiced, namely in Athens) was only for the privileged free men. Women weren’t allowed to vote, and of course their slaves weren’t allowed to vote, and other non-privileged people weren’t allowed to vote. That “democracy” existed to promote the benefits and well-being and safety and wealth and privilege of the privileged. One heck of a democracy.

I was talking about the principle of electing politicians through a lottery system.

The fact that we have more people with voting rights doesn’t change that.

And the slaves educated the children.

You don’t have to go that far back.

Didn’t Ben Franklin say the same thing

According to Sir John Glubb, if you are successful, you get about 250 years, more or less. That’s been pretty consistent over the past 3,000 years.

Lumber is $233 down at this moment to $1323. Oh no, there goes the housing mkt?? We’re starting to see cracks in the ceilings (no pun)??

Jpow may be buying lumber futures today to add to his portfolio?

The lumber bubble popped massively. As I said on Wolf’s thread about it – it was nothing but a massive speculative bubble. The bottom fell out. It’s down almost $600 since the peak, and I mean straight down. Right now it’s $1,264.

I was mentioning on Wolf’s thread about “shortages in lumber” that I could get anything I wanted, and as much as I wanted. Well, all of a sudden that’s the word from all of the lumberyards and mills. Seems that “shortage” was already gone when I was posting that there was no shortage. The shortage was last year.

Isn’t this a by-product of the Fed’s monetary policy?

People have lost opportunities to invest in anything stable, so they look to the latest speculation. Important things like oil, lumber, housing, etc. become objects of speculation, which actually impedes economic progress. Prudent players that want to invest in the economy cannot do so because prices are distorted.

Depth Charge,

That’s how shortages get worked out. Price gets too high, people stop buying it, demand sags, commodity price plunges. This is how it always works in a market system. See housing starts for April, reported today, way down.

while the number of permits rose.

New housing starts dropped 13% in April from a month earlier.

I wonder outloud how much GDP growth we will get out of the next $1 Trillion of Biden Rescue Money out of Washington. With inflation pushing 5% per annum like many of us on these pages predicted months ago, a good portion of this Free and Printed Money will go to stoke the Fires of U.S. Inflation. We are past the point of diminishing returns for Government freebies and Money Printing. Watch the Dollar sink like a stone in the weeks and months ahead. The money tree that I have found resides in both physical Gold and Silver.

Forget the cryptos. Governments are going to legislate them out of existence, just watch. The Colonial Pipeline ransom payment of $5 Million in crypto currency may have left more of a prosecutable trail than the the hackers ever expected. Crypto is now associated with economic terrorism and money laundering , not places to be when it comes to enforcement agencies like the FBI.

“enforcement agencies like the FBI.”

Give me a break. This is the most corrupt Agency in the Federal Government from top to bottom. Should be broken up and disbanded, and its functions transferred to the U.S. Marshal’s service.

They can still send you to prison for transacting in a fake currency, like them or not. Okay, the U.S. Marshal’s service will arrest the crypto purveyors, take your pick. Maybe it will be the NSA, but the black coats/ Glock carriers are coming to a crypto vendor near you.

Have lived in the D.C. metro area for over 40 years, have worked on cases for the F.B.I.

That’s what criminals have been saying for years, everybody from Al Capone to John Gotti to some money laundering condo salesman:

“It’s a witch-hunt!!!!”

If you’re really guilty, you can fire the FBI Director and install your cronies throughout the system to CYA! Remember Nixon’s “Sat Night Massacre”? Those were different times, people had spines.

Those politicians said “Our Country is more important than our political party and certainly one man. He’s a crook. He has to go.”

Woops?

Wolf: “In March, it purchased a not of $4 billion, bringing its holdings to $1.1 trillion”

Should this be “a lot of $4 Billion”, not “not of”?

Cheers!

Great charts, you can see if they break the bond, where the hammer lands. How would the unwind unfold? Yields start rising, impairing all those US bond owners, and depending on the dollar and wink wink the direction of dollar policy, the currency starts to rise and foreign buyers get the green light. Interesting choice, if the Fed maintains its tolerance of rising rates much longer, who gets hurt? Fed bought up a ton of bonds in the secondary market at the start of the pandemic, (Drunkenmiller proposed that when the time came to monetize NEW spending their balance sheet would explode). Anything the Fed owns they can disown, without calling in the cash. Hyper-deflationary in the extreme, but just cut a zero off the hunrdred dollar bill and you have a ten.

Thanks Wolf. I like these easy to understand summaries of facts no one else will tell you. Let everyone draw their own conclusions from the facts. A novel idea these days.

It’s interesting that the only businesses being expanded these days are the platform companies racing to obtain or maintain near monopolies. Aside from that, who would want to purchase equipment or hire people?

The long-term effects of the Fed’s QE and money printing policy are now clear. The winners are monopolies, gamblers, high-end and low-end welfare recipients, passive asset holders, and those who seek to game the system rather than work. The losers are millennials, risk-conscious investors, potential home-buyers, students, pension funds, workers, and people desiring to retire some day.

Which group is more meritorious? Which group makes a positive and lasting contribution to society?

Bobber

Great juxtaposition of the competing factions in our current economy – even if they don’t consciously know they are competing.

My daughter just forfeited her unemployment through September (approx $2400/Mo) to take a $10/Hr job. My brain said “stupid,” but the intangible benefits of working are numerous, regardless of the financial compensation. I believe her decision will pay life dividends.

Is her new boss cute? What kind of “fringe” benefits?

The low wage job should make her eligible for food stamps and free healthcare which may outweigh the value of the UI. The War on Poverty on display.

Bobber, you for got to mention the already retired folks as “losers”.

They began throwing retirees under the bus 20 years ago. Many of them died penniless during the GBYP Death March (Greenspan, Bernanke, Yellen, Powell). Yellen and Powell have been particularly brutal with the QE whip.

Some of us that’s missed being thrown under the bus back then are still left…and worried.

AT&T merging with Discovery. Just what we need. More big mergers. More vertically integrated monopolies, more debt piled upon debt. Like AT&T didn’t have enough debt already

In this economy the Fed has created, corporations can only make money through divestiture. You buy a another company, cut jobs, and fine tune your oligopoly or monopoly. Once you have the dominant platform in place, it doesn’t matter if the general economy tanks. You have the ability to squeeze more blood out of the turnip. If competition ever arises, you buy them out early with your cash stockpile. Worst comes to worst, you are too big to fail and qualify for corporate welfare.

Serious question: Are big mergers like this another sign of a stock market top?

Bobber

Sounds just like Germany 1922/1923. All the people that played by the rules got wiped out. All those who gamed the system won out or at least survived. You saw what that led to.

Monopoly/ platform companies are what land owners were in the past. Internet ownership is the new rent-seeking landownership. The peasants that are living on and are depending on the land will be exploited to the point that they can only just exist.

Land ownership is still with us and is ultimately the best rent-seeking.

“Low end welfare recipients” are BIG WINNERS, just like Facebook, Tesla, Twitter, Amazon, etc, etc.

What the hell are you talking about? That’s preposterous.

But then again, you probably remember in the Global Financial Crisis, when ILLEGAL immigrants, teacher’s unions, gay people, abortion rights/gun control activists, and all those poor people crashed the US economy, right?

Perhaps recognizing reality over social wedge issues promulgated by millionaires working for billionaires would serve you better?

Putting welfare recipients in the same sentence w/bankers? JFC…..

I consider any type of government assistance or subsidy to be “welfare” in the sense it was not earned, but given.

The housing crisis was caused by “high-end” bankers and financial parasites receiving welfare, but on the other side of those deals were glossy eyed greedy individuals using government subsidies to buy houses, furniture, boats, toys, etc., that were way beyond their needs and ability to afford.

Yes, I put them in the same boat, and deservedly so. Greedy speculators come in numerous shapes, sizes, and means. The common denominator is they take advantage of the government’s largess.

That said, I want government to provide a safety net for those in poverty, no matter how they got there, but any kind of housing subsidy has nothing to do with providing safety or basic opportunity. It is ridiculous that the government still suppresses mortgage rates in an era when home prices are at all-time highs relative to median income. This is a pure government giveaway to RE speculators and the massive RE industry.

It’s not the amount of debt that matters. It’s whether debt was taken to fund productive activities. Seems like in America, we spend big on the following 3 things: defense, health care and speculation (share buy back, speculation, name your own thing, etc).

Spot on MB.

National debt is money owed by American tax payers to all the holders of the debt on Wolf’s chart. So long as they keep buying, and taxpayers can afford the interest there is no foreseeable problem any time soon.

It is entirely a moral and philosophical argument as to whether or not, it is ‘right’ to pass on debts to future generations of Americans. If they got bare earth and had to start from scratch it would clearly be wrong. However, if they got beautiful buildings, schools, hospitals, roads ,bridges, reservoirs ,etc etc, they might think their predecessors were the most wonderful folks for leaving them a heritage so cheaply.( especially if the debt gets fried at 3% pa)

It boils down to who spends the money on what. If politicians were sure they were spending on what people really wanted, they wouldn’t be scared to ask you to pay taxes for it, in which case there would be no deficit and your kids would get a free pass. However, they know you wouldn’t want to pay for what they spend the money on eg wars, weapons, bureaucracies, regulators, programs to target specific voter groups, etc etc.

They kick it all off to the future because inheritors don.t get to vote on the ‘tab’ they pick up. ‘Twere always so.

As far as the US investors go it has to be insurance companies, people with 401k target retirement funds, etc. Nobody in their right mind would actually go out and voluntarily/knowingly buy a treasury bond. As a side note I’ve been freeloading off this site far too long and using my ad blockers. Just sent Wolf a donation. I enjoy the comments on here almost as much as the articles themselves.

debt doubled from around ten years ago. as everything compounding 7% anually does. Big deal?

Don’t know. Same thing can be said for cancer too. I mean if the number of cancer cells in your body compounded by 7% a year, would it be a big deal?

Growth spurt. That is what this looks like. Teenage growth spurt. There is no going back They just had one of those teenage years but in regards to debt. They hosed the markets with so much cash that they can’t get it back. Like a job. You get raises some years and others you don’t and make do. But the trajectory is hopefully always upward +++

Well I can’t see the governments every relinquishing the cash they have used to drive up stock and housing markets. Truly all things aside we are as a nation that much more prosperous while some might disagree that it only helped the rich I think it helped America

Is USA a sovereign nation?

I can’t tell, but she sure has a big mouth!

This gets back to my question in an econ class I took around 1988. The asian professor laughed at me when I asked “What happens if investors stop buying the treasuries?” That’s when I stopped studying “modern” economics in college.

This country has nowhere to go but increase the debt. And have it monetized by the Fed. Either directly or thru swaps with other central banks.

The central banks cartel is owned by a bunch of families.

They control the money.

They control the media.

They control academia.

So they’ll call modern theory, when it’s just the same old game of bankrupt empires: money debasement.

It destroys civility, investments, industry, politics, ethics, honesty, everything.

That was the playbook of Lenin to destroy Russia or Chavez to destroy Venezuela, or Hitler to take over Germany.

Same old, same old.

Got physical GOLD?