Mexico and Brazil, having seen the economic destruction that high inflation can wreak, don’t want to see it again.

By Nick Corbishley for WOLF STREET:

Latin America will soon be hit by a wave of business bankruptcies and defaults, according to Jesús Urdangaray López, the CEO of CESCE, Spain’s biggest provider of export finance and insurance. CESCE insures companies, mainly from Spain, against the risk of their customers not paying due to bankruptcy or insolvency. It also manages export credit insurance on behalf of the Spanish State.

CESCE’s biggest clients are large Spanish companies with big operations in Latin America. For many of those companies, including Spain’s two largest banks, Grupo Santander and BBVA, Latin America is its biggest market. CESCE’s three biggest shareholders are the Spanish State and, yes, Spain’s two largest banks, Grupo Santander and BBVA.

BBVA, which is heavily invested in Argentina, warned about the worsening situation in the country. If Argentina’s economy continues its inflationary spiral, it could end up affecting BBVA’s overall performance and financial health, the Spanish bank said.

Argentina’s government is once again trying to restructure its foreign-currency debt with the IMF, having already defaulted on the debt once since the virus crisis began.

Ecuador was first to default on its foreign currency debt, followed by Argentina, then Surinam, Belize, and Surinam twice more — six sovereign defaults so far in 13 months.

Latin America has been hard hit by the virus crisis. But the region’s cash-strapped governments with weak currencies and surging inflation cannot afford to provide the sort of financial support programs being rolled out in more advanced economies. The fiscal response has added just 28 cents of extra deficit spending for every dollar of lost output. By contrast, governments of more advanced economies have boosted their spending by a dollar for every dollar of lost output. A few, such as those of the United States and Australia, have been significantly higher.

Such fiscal largess was never an option In Latin America. The result has been a massive slump in economic output. The region’s GDP shrank by 7% last year — the worst contraction of any region tracked by the IMF. In some countries, particularly those that are heavily dependent on tourism, it was far worse than that. Peru’s GDP, for instance, contracted by 11% while that of Mexico, the region’s second largest economy, tumbled by 8.5%.

Brazil shrank by just 4.1% last year, as public spending soared. But its debt ballooned. By the end of the year, government debt had reached 89% of GDP, over 30 percentage points higher than the regional average (55%). The Central Bank of Brazil’s decision at the start of the crisis to slash interest rates to 2%, their lowest level on record, helped support the economy.

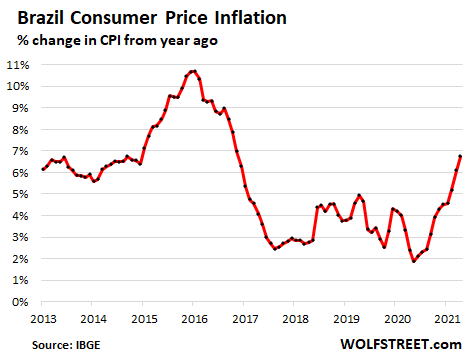

But it also stoked inflation. In April, consumer prices rose at an annual rate of 6.8%, the highest since 2016 and well beyond the central bank’s upper limit of 5.25%.

The central bank, in trying to tamp down on inflation, implemented a surprise shock-and-awe rate hike of 0.75 percentage points in March, and in May hiked its policy rate again by 0.75 percentage points to 3.5%, and at the time indicated that a similar rate hike would come in June. Rising rates are going to make it harder for businesses, consumers, and the government to service their debt obligations.

Inflation is rising more slowly in some Latin American countries (e.g. Peru, Chile, Bolivia) and more quickly in others, particularly in Argentina and Venezuela.

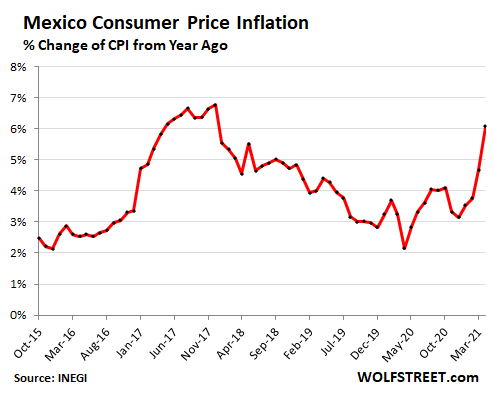

Mexico is also seeing a surge in consumer prices though the government adopted a more restrained fiscal response to the virus crisis. The Bank of Mexico cut its policy interest rate to 4% earlier this year, but that remains relatively high. Inflation spiked to 6.1% in April, double the central bank’s target rate.

The price of food is rising sharply. Corn prices have more than doubled since August last year. This has fueled higher prices for corn tortillas — the quintessential staple in Mexican diet and cuisine — which have reached their highest average level since 2017. One of the last times prices rose this fast, in 2006, it led to food riots.

Mexico, like Brazil, has seen the economic destruction that high inflation can wreak and it doesn’t want to see it again. If consumer prices continue to rise, the Bank of Mexico may have to begin hiking rates, which will make it even harder for the economy to emerge from its deepest recession since 1932.

It will take time for the initial round of rate hikes to have an appreciable effect in slowing consumer price inflation. And they may not even be enough to tame inflation, given that most of the pressures stoking consumer price rises are largely global in scope. They include low inventories, supply chain shocks, rising shipping costs, surging demand for certain commodities and consumer goods in developed countries, particularly the US, and facing these supply constraints is massive fiscal and monetary stimulus in advanced economies.

Even as that stimulus threatens to fuel breakaway inflation in the world’s poorer economies, central banks in the northern hemisphere have shown little interest in taking the foot off the gas. These price increases are transitory, they say, having adopted a wait-and-see strategy. And that means prices are likely to continue to rise in Latin America even as the region’s economies remain mired in deep crisis. By Nick Corbishley, for WOLF STREET.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’m wondering if the countries that were unable to issue massive debt to offset the pandemic will in the end result be better off? The only reason why ‘so called’ first world countries are getting away with insolvency is that they simply have not been called on it yet. Certainly, the immediate result is belt tightening in Latin America, but what about in 1-2 years time? Or is it the case that other countries will never have to address their debts?

I will be very interested to read other opinions, because the more I read about this issue the more confused I am. Are you better off living a frugal but low debt lifestyle compared to borrowing and shuffling bills and payment dates to just carry on with what is not affordable?

In my opinion, so call rich countries will never address that problem. Look at Japan and look at US in 2007 and now 2021, what the debt number? These so called rich countries might made some magic show, say reduce 5% of debt overtime and later add in another 100% or more when crisis come. Arithmetically, it doesn’t made sense. There is no end until all these poor countries come to realize they can be these rich countries as well.

No longer take in USD and demanding other local currencies for trade. No longer import inflation stoke by rich countries currencies devaluation after massive printing.

Just imagine if someday you can print money like RICH COUNTRIES while some folks cannot. Obviously you can keep splurge with these newly printed $ as long as those POOR COUNTRIES still in the “NAIVE STATE” to accept the $ you print.

But everybody know tax cuts for the rich and corporations and invasions doesn’t cause deficits, they produce surpluses. Iraq only cost us $50 billion we were told and got us more revenue than that, we were told. Only govt spending causes deficits.

In fact, as many have posted here in response to this, tax cuts for the rich and corporations increase revenue and balance budgets.

Everybody here knows that.

The worlds most serious travel writer, and a substantial historian, Paul Theroux, toured Mexico for a recent book. In one small town he notes it is so poor that actual cash is rarely seen. In one of the photos he is standing next to a woman who is holding a woven, tourist- type sombrero and a small bowl of corn. She is taking it to a mill which will take the hat in exchange for grinding the corn into meal, paying her, in effect, less than 5 cents for the hat.

Compared to Mexico the ‘so called’ rich countries ARE rich. You are sitting at a computer, there is power, you turn a tap, water comes out. Not that way everywhere.

Oh, poor Japan! You want an example of rich? There will be no spectators at their Olympics. No foreign tourists, no extra hotel rooms, no gate, and they are going ahead anyway, knowing there will be a huge loss.

Mexico would love to just print, see the ‘Tequila Crisis’ where the peso went off a cliff. Kind of like the Russian ruble now worth one US cent, if you are trying to get US$ for rubles.

The idea of Russia, where pensioners cling to existence on about 100 $ a month, riding to the rescue of poor countries, is another topic. But anyone could begin by looking up Russian GDP per capita. Less than 10K US$, far behind Argentina at around 13K .

I read a Big Mac in Russia is $1.87.

John: in most Russian restaurants, bars, clubs in the areas where Westerners might be, the price is in US$ but it’s illegal to accept payment in anything but rubles. So in terms of local purchasing power, after the US$ is exchanged at the lousy official rate, that Big Mac is expensive for the average Russian.

If the lady expended less effort on making the hat than on she would have in grinding that corn, she has contributed to the efficiency of the marketplace. How many cents is irrelevant, imho.

Crunchy: yes it is an efficient choice, given those options. But note the context with people with all kinds of better options referring to themselves as so ‘called rich’

The point is she’s dirt POOR and they’re not.

nick kelly,

Russia is not a good country to use as a reference or benchmark. Per capita nominal GDP is about $11,500, PPP per capita is nearly $30,000. For many reasons, they have a very unique economy. While most of the population is still quite far behind German standards of living (a good benchmark for apartment based cities), they are continuing to develop and are successfully building the only self sufficient advanced economy.

Tired of continually hearing the lies about the so called “Clinton budget surpluses”.

Never happened and US government debt rose during the Clinton years.

Mar Mar..

Clinton was forced into the arrangement.

The GOP and Gingrich specifically and the “Contract with America” and the GOP controlled House balanced the budget.

GWB did okay for awhile, but in the final two years, when the Dems had the House, GWB signed off on large deficit spendings.

The national debt was around $7 Trillion.

Now nearing $30 Trillion….up $20 Trillion plus in 12 years…

Cheap cost of borrowing is the real culprit. Interest rates under inflation (nearly by 4% now) provided by the Fed funds the profligate spending.

This has been debunked many times. There was no budget surplus during Clinton. What there was was a situation where there was a surplus of social security tax receipts, due to a combination of factors unlikely to repeat again, such that the Treasury didn’t have to issue Tbills (except to the Social Security trust fund). But there was still a deficit in the general revenues.

The rich countries and their globalist central bankers/IMF sphere of influence have rigged the financial system against the developing world. The multinationals, extraction industries, and defense contractors with the IMF/WB/WEF/CB’s control the export trade in poor countries through currency manipulation, bribery, usury and employing mercenaries to protect their investments. Naive?….or Conquered?

Cash need a place to park, what else beside USD? EUR? USD bear can’t figure out.

CAD$ isn’t doing so shabby. It’s practically a safehaven.

Swiss francs …?

Look at gold and silver too … both are “cash”

Paulo, sometimes I feel you’re blissfully naive about how the world really works. Who will bailout South America?….look to China, they are the only country with the cash and initiative to do it. – of course, they will demand a price; access to markets, trade routes, and raw resources. Some regimes will fall to popular unrest, and no doubt new refugee/migrant surges will form on the US/Mexican border unless there is concerted effort to forestall the worst.

Brazil is headed for a new election in a short while, they may get a reprieve from the worst consequences of their poor handling of the pandemic.

Paulo doesn’t seem to be aware of the extent of Chinese “investment” in his own country. China owns most of the mines and controls the price of real estate in Canada through money laundering.

Pet,

Not only does China have their ownership of property in USA and Canada, but read recently that they own over 700 properties in Japan within 10 kilometers of various military facilities including US military bases.

Some of those properties are allegedly capable of establishing ”choke points” on land travel, others are in the islands that are considered critical to Japanese defense.

Wonder what the locations in US and Canada are? Not seen anything about this regarding US, Canada, Europe, South and Central America, and now Africa.

Interesting to see the entire globe become a playing board for a real ”long term” war game, eh?

My dad encouraged me to study Spanish language in the early 1950s because he thought it would become very important in USA,,, now a days, I would encourage young folks to study Mandarin, at least, maybe Urdu as well.

The price of real estate in Canada is mostly controlled through government policies and BOC/Commercial banks low mortgage rates (1.5%). They stopped allowing farmers to sever land 20 years ago, all the commutable land is a green zone now. They control the market from both sides, supply/demand fundamentals, immigration and building permits. Municipal development costs have also skyrocketed.

Petunia,

China does not ‘own’ most of the mines in Canada. Actually, mining is somewhat of an endangered species here looking forward due to environmental history, and indigenous land issues. Nor, do Chinese own the Oil Sands, Gas fields, etc. The 10 biggest mines are all publicly traded.

After the imprisonment of the Two Michaels because of the Huawei debacle, views are pretty jaded here about doing business with China.

Money laundering is a fact of life around the world and it isn’t just Chinese.

Due to our long long history with Chinese immigration, our ties to GB and being a member of the Commonwealth, it was no surprise when hordes of immigration started around 1995. What has been a surprise for everyone is that the current Chinese regime allowed so much money to flee the past 10-15 years. It landed everywhere, same as Russian swag after their collapse.

There is a different set of rules for the rich, no doubt about it.

Remember when the Japanese were buying up everything? Germans bought up all available farms and homesteads in BC decades ago. It wasn’t a German plot, rich individuals just wanted a frontier lifestyle. Chinese just want to take their spoils and render it safe, and available. However, as soon as anyone calls for restrictions the cries of racism are heard.

Coincidentally, foreign ownership of land in Mexico is tightly controlled, especially anything near the ocean. Should we all do the same?

@Petunia,

If state-owned interests from China were intent on accruing large amounts of real estate in Canada – they would be working ceaselessly to *lower* the price of real estate.

There is considerable real estate investment by Chinese investors in several metro Canadian markets right now – but these do not appear to be state-owned interests.

When the CCP of China procures a resource in vast quantity – it takes steps to *depress its price* on the open market before procuring it.

Nicko2,

China isn’t nearly as rich as people think it is. Their economy is approx. 1/3 smaller than they claim. Their GDP is probably under 10 trillion and that is spread out over approx. 1,260 million people (the claimed 1.4 billion number is made up), This comes out to a GDP per capita of under $8,000. Every single number that comes out of China has to be approved and is usually made up. Because all the numbers are made up, the PPP cannot be correctly calculated.

Approx. half the population lives in villages (almost everyone there is poor). Approx. half lives in cities, of those who live in cities, most are lower class. The lower class in cities are usually considered migrants in their own country and usually lack household registration status. Without household registration status in that particular city, many things such as public schools, any form of public welfare and much more can be cut off from you. Most lower class live many to a single apartment, sometimes these are family members, often it’s just random roommates.

Approx. one third of their economy is housing and that is a very major bubble waiting to burst. Because of the massive housing bubble and CCP greed, the costs of living have greatly increased over the last 10 years and the bulk of the Chinese population is worse off today than 10 years ago. There is also massive debts by the city and provincial level governments and even more worrying large household debts.

Almost every country that makes deals with the CCP gets screwed over, China just doesn’t have the money to make good on the agreements, much less the desire to.

Increasingly, the wealth of China is being hoarded. There is also massive capital flight, and this includes by the families of top ranking CCP members.

They don’t have the cash. Also, once the China market dream bubble pops, most countries will probably just nationalize CCP held assets and move on.

Paper dragon.

If you know inflation is going sky high tomorrow you would load up on debt. We don’t know that of course. With inflation savers get wiped out. Those in debt get rewarded. Very very sad indeed.

Larry Cheeta,

Yes – purchasing hard assets with debt is the wise decision…

…so long as you are discrete and can maintain ownership of what you purchase.

All the people, that I knew and loved, born in the last 20’s lived frugal well below their means. In the shadow of their passing, we have all witnessed the grotesque distortions of their wisdom. This endless debt is not for the people, by the people. Quite the contrary, look no further, the signs are everywhere

You obviously did not know my parents and their cohort Yac.

Born in the last ’16 and ’22, they both were ”party animals” from start to finish, and they did finish early to be sure, as they had promised for many years…

They and all their good friends, some from their childhood adventures in elementary school even, some from their older adventures sailing around the world ( in a home made sailboat ) in the, so far, ”Greatest Recession” ever, aka Depression, including a Tahitian princess who visited in the 60s with her very rich EU husband,,, and many other wise bros and sis’s from those years came to visit this goggle eye’d youngster in the booming early 1950s and into the 60s, or so they said to me who had gone US Navy by then…

The message here is, “JUST GO DO IT”,,, and don’t hang around waiting and complaining!

In my direct experience as one who tried to at least come close to a parent who bicycled across Europe in ’39, there is ”work” available everywhere for those who WANT to work; sure, pay can be lousy, but my work as a ”deck hand” who became the ”pearl diver” on a 125 foot staysail schooner was a wonderful experience even thou I drank up all of my pay by the time we hit port, though I did get the benefit of having the duty to siphon the 180 proof rum out of the huge barrel to make the punch for the passengers as part of my duties after the former ”steward” literally jumped over the side and swam ashore when we anchored off the coast of his home island in the Caribbean.

(I was the very ”junior” deck hand, so in all fairness, the ”steward” role fell to me, just to be clear about the old fashioned way of ”working your way UP… )

Thank you sailor. It is undoubtedly solid advice, and beautiful reference of the past to balance the horror I wrote. Funny you say otherwise but then mention Sailing around the world in a home made boat. That sounds exactly like what I was referring to. Ingenuity abound, fearless resilience and independence all backed by real work, work ethic. These things are becoming less common to say the least, esp in combination, and there are reason beyond the individual (as well as many internal) that need to be brought to the light. Those forged by adventure, the seekers amongst us have little concern for status quo in search for answers. Sometimes you need to see the world from both sides ;.)

The United States has benefitted greatly from technology development, which is really the only thing propping up the economy. If we didnt have major technological revolutions going on right now, our economy would be a shambles. We shipped all the production off to china and stripped our economy of many jobs. Our economic policy and government over-spending has been terribly destructive, but the productivity of the tech revolution has somewhat masked this.

If we could have combined tech progress with sane government policies, the US would currently be enjoying such a dominant economy and the citizens would have unparalleled prosperity and future. But our future is much worse than the present, as we edge closer and closer to the edge of the cliff.

Not really. Tech is only about 6% of GDP and around 35% of market cap. It’s a little bubbley right now.

Nope. The poor countries will be a lot worse off, the rich countries will be a exponentially better off. Because they have power, they make the rules, the poor does not.

Debt and it’s affordability is just based on convention, it is not “physics”.

If a poor country decides to default on their debts, convention says that rich countries make them suffer for their many sins and immoralities.

When a rich country defaults, there is not much anyone can do about it, and, indeed not much that anyone wants done about it because “we are all dining at the same table, at the same club, we don’t want poor people at that table dragging down the ambience, so, something will be done about the regrettable, but temporary, inconvenience of the rich country”.

PS –

Always being debt free or always being indebted are not a reasonable position to take because circumstances change. Real wealth comes from having the choice between them.

For example, Right Now in Denmark, one is pretty damn stupid and set up to lose if one is not mortgaged way over the hilt with the 30 year, 1% fixed rate mortgage – one is short a couple of millions worth of those soon-to-be-worthless 30 year mortgage bonds *and* have a nice home! Win-Win!!

OTOH – One could not just get that loan unless one also have significant savings, they like to see a sustainable 15-30% of after tax income saved for some years (Keeping the afforementioned table clean)!

So it is not like savings are useless, but, overdoing the savings and never borrowing is simply not going to lead to a happy and productive life here.

I don’t know why these smaller countries with garbage currencies haven’t all taken to the idea of using crypto backed by gold. It just seems like such a good solution for the people of those countries that all have smartphones and could just easily now have access to a gold backed currency to use.

I don’t know why Combining the disadvantages of gold (fixed amount of currency available) and Crypto (complexity, hackers, China running all the servers, … one little glitch and it is gone) has not caught on :)

This poses huge opportunities for China/Russia which are large net capital exporters (Russia went into the black a couple years ago).

Many of these countries are on the cusp of becoming failed states and will require mass infusions of foreign capital to avoid going the way of Lebanon.

Needless to say the USA is in no position to fill that role. I’d say the Organization of American States is doomed.

Russia talks a big game…but they don’t have much to offer except second rate weapons and ‘little green men’ to prop up flailing regimes. Only China has the long term stability, industrial might, and growing global network (via the new Silk Road) for large scale intervention…of course, they’re still new at this.

China does have a demographic issue. Heard that Chinese population is on track to be half of what it is now by 2100.

“The business of China is business, the business of America is war”

Not I who came up with this, but it is fitting.

Nicko2,

The “new silk road” is just a bunch of debt traps, disguised military projects, and shoddily constructed corruption schemes. Alot of the military projects were dependent (in order to work) on building a port on the coast of Pakistan. That seems to be failing after China’s treatment of Muslims have enraged local populations in Pakistan.

Some of these projects are dams. Predating the “new silk road” was the Coca Codo Sinclair Dam in Ecuador, that hasn’t gone so well, the Coca Codo Sinclair Dam, blew the countries electrical grid, when it was first fired on and only generates half the electricity it should. Though, it predates it by 3 years, it is a good example of the quality of construction of the “new silk road”, it could burst at any time and kill many thousands of people. Other Dams officially a part of the “new silk road” also have been shown to be able to burst at any time.

This is from Wikipedia describing the Coca Codo Sinclair Dam. As of December 2018, 7,648 large and small cracks were identified in the generator hall, surrounding equipment. The cracks were first discovered in 2014 but the full extent of them is unknown as a thorough assessment would include deconstructing portions of the power plant which is cost prohibitive.

The “new silk road” has not enabled any new global trade.

Meanwhile China just landed a rover vehicle on Mars … not so backwards then.

It’s not that China isn’t capable of anything, it’s that under CCP leadership, especially the Xi faction, China’s abilities and general welfare are greatly reduced.

It’s a fact that the CCP has sent spies to steal technology across the world, including NASA. This includes plans for many things that were never built or things to do. There are many things to do yet in space, so far the CCP are using stolen tech, manufactured with foreign parts and machine tools to basically retread old ground. With the recent launch, they couldn’t even design the rocket to land safely. It was sheer luck that it didn’t crash into a city or on foreign ground. They might eventually accomplish something new in space, but unless it’s something major, consider me uninterested.

China has been trying and failing for decades to build a good jet engine, something western countries did decades ago, even when trying to reverse engineer and rip off foreign ones, especially, the Russian fighter planes, they keep ending up with terrible low capability knockoffs.

The actual list of what China can do under the CCP leadership isn’t very impressive. The only thing they actually invented was the small drones. Their quality of construction and innovation leaves alot to be desired.

“Argentina’s government is once again trying to restructure its foreign-currency debt with the IMF, having already defaulted on the debt once since the virus crisis began.”

Someone should tell Argentina about MMT. Then, no need to even have foreign currency debt.

“Such fiscal largess was never an option In Latin America.”

Who says? The IMF? Of course it would say that. That’s it’s job.

Not sure why this would be. Only if they tie their currency to USD would they not have MMT as an option, would in fact give them fiscal largess as an option.

timbers,

Argentina knows all about MMT. It has been practicing MMT for decades and has thereby DESTROYED ITS OWN CURRENCY. No one wants the peso anymore, not even its own people. They exchange it asap into dollars. Argentina cannot borrow in pesos because no one wants those MMT pesos. That’s why it borrows in dollars. Inflation is 40+%. Argentina is Exhibit A of why MMT is total bullshit and destroys a currency and causes enormous economic damage.

MMT is an economic religion for the brain-dead.

Thank you, Wolf. These MMT crackpots are dangerously stupid.

I agree with you, but the argument MMT defenders use is that the U.S. can get away with it, because “we’re the reserve currency,” “we’re the cleanest dirty shirt,” yada yada.

I’m of the belief that we can get away with it for longer, but given that MMT is a falsehood, no one can get away with it forever.

Great example of how hyperinflation is a government policy phenomenon.

100% True, I live in Argentina and the economy just has been getting worse and worse since several decades ago.

Wolf, MMT clearly stipulates that the gov debt must overwemingly be in a currency they can print. This is largly the exact opposite of Argentina, so no they are not up-and-up on MMT nor an example of attempting it.

What you see in Argentina now is the CONSEQUENCE of decades of MMT. As I said, MMT destroys the currency, and then you CANNOT borrow in your own currency anymore. That’s how MMT turns out.

Argentinean here. Can confirm. Pesos are for day expenses only. USD is our gold.

If there were significant inflation in USD, most national savings (80% outside the country’s banking system) would be wiped. I’m personally running away from the USD, to stocks, real estate and agricultural investments. I got burned with AR bonds, so never again.

MMT is crazy and I hope your institutions put a stop to it before it’s too late. Remember, the German Mark was also a global reserve currency, and international investors also paid the price when it disappeared. Then Hitler came along.

The 100-year bonds are denominated in USD. I’d say Argentina never learns, but its the bond investors that have short memories. I think they also issued debt denominated in Swiss Francs.

They tried tying their currency to the USD decades ago. Corralito didn’t end well.

Governments sell bonds in USD in order to get USD and keep the FX in check (while debt grows). Issuing debt in ARS has its own problems due to the obvious inflationary consequences of printing enormous sums of money — interest rates must be above expected inflation to make sense. In a country with 30-50% inflation, that’s a lot of future printing as well.

So, MMT, meaning, money printing, generates inflation in your own currency, you issue debt in foreign currency , you manipulate the FX and create a sense of purchase power of anything imported. Until 2017, when carry trade finally exploded, Paris, PARIS, was cheaper than Buenos Aires.

HAHAHAHAHAHA!!!!! IT WILL NEVER HAPPEN TO AMERICA!!!!! I AM PRINTING MONEY AS I SPEAK!!!!!!!! BBBBBRRRRRRRRRRRRRR!!!!!!!!! WHENEVER WE RUN OUT OF MONEY, I WILL JUST PRINT MOOOOOOOORE!!!!! HAHAHAHAHAHAHAHAHAJAHAHAHAHA!!!!!!!

The solution is very simple. Mexico should invade the United States. They should retake Texas and California at the minimum. The US government and the Fed will collapse and happy times will be here again.

Do it Mexico!!!

Agree MB, but it’s already been happening, for years.

Have said for decades that the immigrations from “Latin America”,, ALL of it, is just the early stages of the ”long game” of the Spanish Grandees from whom TX, NM, AZ, and parts of CA, CO, UT, etc., were stolen in middle of 19th century.

I have ”heard” it took Grandees of Europe several centuries to recover their property after a couple of earlier invasions; no doubt in my mind they will get back the lands given to them by divine right in the New World, eventually.

Mexico will have to fight off the arriving Californians for a piece of Texas. LOL!

(I am currently asking myself why I am still here! – nothing like being caught in a crossfire!)

Talking to people I know in Texas, I think they’d rather have the Mexicans than the Californians.

LC:

The clear enough reason for the last century or so, that all the black folks went to GA and the ”Yankees” went to FL was that GA got first choice.!!!

No doubt in my mind that TX folks would prefer the usually hard working and honest and good family MX folks to those sorry CA ”leavers.”

Especially at this point where it is SO clear that the majority of CA leavers are NOT the hard working folks who have come to CA to work, but, rather, those transients who only came for the profits based on taking advantage of those who do work…

Bravo Nick.

Thanks for breaking through the pathology of American Exceptionalism.

Thanks for throwing us a bone about how supply side issues are causing price increases in other countries as well.

Even those countries that didn’t send out stimmy checks in March.

Maybe we can start to make alternative conclusions that throwing people a consolation prize of 1400 checks for doing the best they could to make it 10 months through a pandemic on poverty wages, isn’t the actual problem here.

But somehow I think the sour grapes morality crowd isn’t going to have it.

davie,

You’re confusing countries. The $1,400 stimmies weren’t sent to people in Mexico and Brazil. They were sent to people in the USA and contributed to the demand spike and shortages in the USA which contributed to the price spikes that are rippling around the globe. Your logic circuits are twisted.

– Why do people continue to think Inflation is going through the roof in South America ? Yes, CPI is rising because the currencies are falling making (e.g USD denominated) imports more expensive. But since wages haven’t pace with rising (impoert) prices the overall impact is DEFLATION. On top of that rising rates are DEFLATIONARY !!!!

Willy2,

Are you being sarcastic? If not, this is total and utter nonsense.

No it isn’t. Wolf, your criticism is due to confusing rising prices with inflation and what I will admit is poor presentation by Willy2.

Indeed, the earliest use of the terms inflation and deflation (since Copernicus promulgated the Quantity Theory of Money in the 16th century) referred to money supply, not prices.

Later economists believed in the Quantity Theory of Money. Most of the arguments about money supply among Keynes, Friedman, Mises et al were nuanced when it came down to their formulas and which variables were most important but they all recognized it in some form. None of them denied it.

Inflation is an increase in money and credit. Deflation is the opposite. Prices are symptoms.

Willy2 is right. Rising rates drain money from the system. People and businesses will have a harder time borrowing or be hesitant to borrow and banks will be lending less.

Money is loaned into existence and decreased lending is at the minimum disinflationary. If money and credit contract it’s outright deflationary.

He’s also on the right track about wages. You can’t sustain conditions where the economic growth rate is lower than interest rates. He talks wages, but he’s in the right neighborhood. One thing that keeps this circus going is that artificially depressing interest rates softens the impact of economic stagnation.

However, I think credit is more important than money base. For one thing there is far more credit in the system than money.

Correct me if I’m wrong, but as I understand it despite massive injections of money for years (including the extraordinary step of buying equities, effectively, nationalizing the stock market) *private* Japanese debt continues to fall from its peak while prices have not increased to headline levels.

Doesn’t anyone see similar desperation when the Fed buys junk bonds and other financial poison? They are deliberately acting as the Greater Fool of Last Resort.

And although you and I will continue to disagree, I maintain that merely printing money via the Fed is just futile “going Japanese”. Stimulus checks are helicopter money delivered straight into the consumers’ hands. Look what happened.

Government intervention like that is the root of hyperinflation. I’ve seen people talk about how what’s going on will end in hyperinflation because banks will have to keep lending in order to keep their loans good. They say eventually your monthly paycheck will be so high it could retire your mortgage.

No. Hyperinflation is a political result. Zimbabwe’s hyperinflation was not bank-induced, nor was Weimar or all the other hyperinflation poster children. Remember John Law?

Hyperinflation is a collapse of faith in the value of fiat money. War, political unrest, a perception that the government has lost control, etc. Biden’s American Family Plan, UBI, free food, free clothing, free shelter, the right to a living wage, trillions to fight climate change – all political.

Eventually people realize the party’s over. Eventually borrowers are going to be tapped out. This is often, like so many financial phenomena, a change in emotional status. They start defaulting. They start liquidating assets to retire debt, thus devaluing cars, houses, stocks, bonds, etc.

There might conceivebly be a paradox of thrift event, although the auto and housing market might disagree. Even the most math-challenged buyer has to realize now that the advantages of low mortgage rates are gone, swallowed up by price inflation.

That’s when prices deflate across the board. That’s when the value of the collateral held by banks deflates. That’s what scares the living crap out of the banks.

Two main factors here: (1) deflationary forces are, and have been, at work for a long time, (2) Monetary policy doesn’t work. You will see more of the same monetary stupidity in the future.

Who will be on the hook when this tsunami of debt deflation finally hits? Probably us. The banking system is far too powerful to take the hit.

Meanwhile DON’T take on debt. RETIRE THE DEBT YOU HAVE, and set aside some cash so you can buy houses, re-po’d cars, stocks, etc for half their peak price or less.

Concerning the beginning of your comment: The ONLY thing we’re talking about in the article is consumer price inflation, including on the charts in bold huge font. Inflation has many meanings. But every single mention in this article is “Consumer price inflation.” Conflating “consumer price inflation” with “deflation” is bullshit, no matter how you want to twist it.

Wolf,

* Title of article: Spiking Inflation, Rate Hikes, and Debt Defaults in Latin America

NOT “Spiking price inflation”

*In the body of the article “If Argentina’s economy continues its inflationary spiral,”

NOT “inflationary price spiral”

* In the body of the article “But the region’s cash-strapped governments with weak currencies and surging inflation . . .”

NOT “price inflation”

* In the body of the article: “But it also stoked inflation. In April, consumer prices rose at an annual rate of 6.8%”

NOT “stoked price inflation”

When I read “inflation” I think “expansion of money and credit”. That is absolutely not the same as price inflation. If the terms are flipped back and forth in the body of the article with imprecision, is it the reader’s fault for misinterpreting?

And who is conflating price inflation with deflation? Who said that?

Are you OK? In all the years we’ve communicated and collaborated I’ve never seen you use the word bullshit, and the response to Willy2 was uncharacteristically harsh.

Who put the gunpowder in your coffee this morning?

I’m sick and tired of certain commenters (really just 1 or 2) conflating consumer price inflation with “deflation.”

“Willy2 is right. Rising rates drain money from the system.”

Good,

Lets begin the draining process now.

What about all the malinvestment that has occurred as a result of these artificially low rates. All this will have to be unwound eventually resulting in pain for everyone. Or inflated away. Which disaster do you prefer?

And what about all the retirees who depend on interest income to fund their retirement. They don’t count apparently.

Willy2

This is the same bogus logic that the financial ministers used in Germany in 1921/1922. They argued that because the mark was depreciating so rapidly peoples wages, even those under Union contracts, were not keeping up with inflation and thus the effect was deflationary. The solution they argued was to print more Marks, and print them faster to create more money to head off the deflationary forces. Read the book “When Money Dies” and educate yourself.

Oh right. One Book to Rule Them All.

A book about ONE hyperinflation event as seen by ONE person.

I think we’re gonna need a bigger library.

The same hyperinflaton happened in Austria & Hungary at the same time. That’s three hyperinflation events fueled by the same uncontrolled money printing.

Try again.

you guys are all dancing around the truth: hyperinflation is a response to a deflationary event in a fiat system. as credit defaults there is suddenly not enough money. if more is printed to the point of shaking peoples confidence a vicious circle begins. deflation and hyperinflation are twins. regular inflation stands alone, separate from these. regular inflation is too much money. hyperinflation and deflation are not enough money. that people can’t even agree if we are experiencing inflation or deflation means they are discounting the third option as impossible. the wazoo charts will be quite a sight.

Hmm!? I was always under the impression that hyperinflation was simply the loss of confidence in a currency. It is deflationary in the sense that the REAL value of assets declines. HI is not simply even-bigger inflation. Credit disappears and then there is not enough currency to pay government stooges etc. Then the printing starts and wheelbarrows appear. The printing and wheelbarrows are symptoms, not causes.

Beats me.

The weimar hyper inflation is mostly the result of the fees, reparations etc… that the Treaty of Versailles required Germany to pay. I.e. the treaty effectively forced massive foreign debt on Germany all denominated in other peoples currency, and for which the equivalent of default was not permited. Such conditions basically guarentee forcing hyperinflation and money printing, but the situation is not at all indicative of contries that are not in internationally enfored debt peonage.

All books and other analyses of the weimar hyper inflation that don’t link it to the effectivd guarentee of hyperinflation that the Treaty of Versailles imposed are basically selectively edited histories for the generation of propaganda.

This article shows once again that inflationary policies eventually also lead to defaults. The idea that you can “inflate away” your debt in any significant way is bogus. Once your currency goes, you lose all power and you will be at the mercy of forces you cannot control.

From your lips to Jerome Powell’s ears.

Well, you CAN indeed inflate away your debt. But it’s one of those things you can only get away with doing once.

No, inflation has been going on ever since I can remember. My dad used to say in the great depression you could buy a brand new house for $10 down and $10 a month. One of those houses here,now would be between $500,000 to$700,000.

Once a century. Remember, people have exceptionally short memories. The Great Depression was only 3 generations ago?

You can inflate away debt but it entails inflating away your purchasing power.

As i showed in another post if you have an income of $50k and 10% debt 10% inflation will lower the value of your debt $500 but decrease your purchasing power by $4500.

Someone smarter than me made the point that a lot of the US off balance sheet obligations can not be inflated away because they have promised services and not a fixed amount.

@Old school, EXACTLY! And these unfunded liabilities are much more than the officially published national debt.

Amen!

My post about this is “pending moderation “. I don’t know why but I hope it goes through .

That depends on your income/revenues. If your income/revenues grow fast enough due to price inflation of the goods/services/labor you sell, or the taxes you collect, then inflation does not necessarily lead to a debt default.

The thing about price inflation is that you’re defaulting on your debts the soft way: by paying back your debts in dollars, pesos, etc. whose purchasing power has been slashed.

A lot of people made a killing on the hyperinflation in Germany as well as Austria and Hungary. That let to the massive income disparity, and eventually to some violence and some very unsavory characters taking over when the party ended in 1929 to 1933.

If you have a balanced budget or a deficit that is smaller than real economic growth, then that is true. But in that case debt is not a problem anyway because it can easily be serviced.

However, the problem we are dealing with now is that there is no credible path towards a balanced budget, especially taking into account all unfunded liabilities that are coming due in the future.

So yes, you can deal with debt with negative real rates to a point, but not when your budget isn’t balanced (when including growth).

Often the post war debt is taken as an example how debt can be dealt with. However, at that time we had a balanced budget, high population growth and solid (sustainable) economic growth. None of that exists today.

Stealing money via inflation is just as immoral as stealing hubcaps from the muscle car down the street. Just because you dress in a suit and tie and have a nice fancy office and talk a good line of bull s$it doesn’t make you any better than the local street thug.

It depends what your debts are denominated in. If more than a smidgeon of your debts are in other people’s currencies, as is the case with most of South America, then they cannot be inflated away. The people who talk about inflating away debts are talking about debts that exist like >99% in the inflating currency.

And what is the reason why many countries cannot borrow in their own currencies anymore? they had previously dealt with their debt by “inflating it away”.

People keep saying that, and yet no one points me to a time and a place where that was ever true, or at least the whole truth. I am not saying they don’t exist, I am saying all-of-human-history is a large space to try and do the research to find what you claim. Can you actually point me to a time and a place where that happened so I can study it and learn.

@Nat, start with Argentina. At the turn of the previous century (1900) this was considered a country that was rich and had a great future. But basically most countries that now borrow in foreign currency could once borrow in their own currency.

Thank you Nick, a very interesting article.

Spanish banks and their Latin American exposure was a more talked about theme until the virus.

I sort of wonder what other problems, that we used to spend more time thinking about, are rumbling along in the background?

Could there be another 2019 sort of repo crisis in Europe as the problems of emerging market debt default come home to roost?

So many trails of dominoes leading to a central house of cards.

Japan’s bubble popped in 1989.

Ever since, the government has been buying stocks & bonds

( to prop-up the market ).

32 years of that ! & The world is following their lead.

China is next.

Deadbeats run the planet now… & they love “asset inflation”.

Free “bread & circuses” too. Free rent.

And for all those shenanigans Japan hasn’t moved the needle at all.

Maybe that strategy doesn’t work or do they need 30 more years?

But ‘Free “bread & circuses” too. Free rent.’ is not within the purview of the BOJ. It’s a political policy move. If you want to see hyperinflation thats the recipe.

I strongly disagree. I don’t see any free bread or circuses here. Where do I sign up for it, cos it’s better than living like an ascetic monk.

Most Latin American countries renamed their currencies in the 1980’s & 90’s after they fell apart, Pesos became New Pesos in Mexico (from 3,300 Pesos = $, to 3.3 New Pesos = $) Argentine Pesos became Australes, Peruvian Soles became Intis, etc.

None of this worked, by the way. The new & improved currencies just continued falling in value.

What can I buy with a fist full of Harriet Tubmans?

An underground railroad, Elon over @ the Boring Co. might be of assistance.

Trivia re: currency changes. The norm in Africa, South Am and recently India is the change makes the old ones worthless. Sometimes with notice, sometimes very little, with bags of currency abandoned at one African airport.

About 20 (?) years ago the US finally announced an update on the $100 note to make it harder to counterfeit. The news initially caused a world panic including Russia. Then came the calming news: the old ones are still good.

Check out Zaire. When they had severe inflation they moved from the currency (imaginitively named the zaire) to the new zaire (not a very creative country, Zaire).

A New Zaire was worth $3,000,000 old zaires.

BUT, the people of Zaire understood that the government could print more New Zaires. They also understood that no more old zaires would be printed.

Guess what? They started conducting their business in the old currency since it couldn’t be debased.

So save your Confederate money. The South may not rise again, but they’re not going to print any more Confederate money. ;-)

3,000,000, not $3,000,000

Spiking Inflation, Rate Hikes, and Debt Defaults in Latin America.

I was surprised to see “Latin” in the title…

Before you can have a new bully on the block you need

someone tough enough to take out the old one.

There is nothing right now to replace the U.S. buck.

Nick,

What does the average middle class Mexican invest in to hedge inflation? Is it real estate, silver, gold, or do they hoard USD, etc.

All of the above, Petunia. Federal Treasury Certificates (Certificados de la Tesorería de la Federación) are also quite a popular investment choice. They gave a pretty decent rate of return — well above CPI — before Banxico slashed rates last year.

Note from Brazil: real estate is booming. Home prices and rents are surging. A lot of buyer with FOMO the lowest interest rates ever. New project are selling within a month. Construction costs gone thru the roof, metals got 70% hike in 12 months. Likely to se a lot of developers bankruptcies in the coming months.

Does Luxemburg have their own currency? I’m gettin tired of holding everything denominated in the frickin US dollar. I see a 30% devalualtion coming sooner rather than later.

I see Israel’s shekel is going digital…try some of those.

I always keep some funds in vanguard international index stock fund to be diversified out of dollars. It’s a cheap way to do it.

Euro.

Wolf, is it really an alternative to USD? Very interested on your take about the Euro.

Martin W,

I don’t see the euro as an alternative to the dollar at all.

My answer, “Euro,” was in reply to Swamp Creature’s question, “Does Luxembourg have their own currency?”

I guess there is no hard currencies anymore. The Euro is another worthless currency.

No, but Switzerland does!

Use a gold based currency. Likely to pay more yield too. It is now just as easy to use as any other currency.

Not a single on of those exist currently. Why not just invest directly in gold instead of something that doesn’t exist any more?

Unless maybe there is a crypto that does that? I wouldn’t know, but if there isn’t a crypto that does that your advise is basically “invest in Dinosaur futures.”

Kinesis Money. Check the link under my name. They are up and running and even have launched a gold based parallel currency in Indonesia in partnership with their government.

Nick,

Nick Kelly in passing referred to this in his post above, but how does the informal economy help mitigate inflationary pressures in these countries, if at all?

There is another severe drought in Brazil affecting the corn crop. According to one report it is a twenty year drought.

Some nations expect bumper wheat crops.

A severe drought is underway in about ten SW US states fed by Colorado. Driest in over a century and may be the start of a mega- drought lasting decades.

When even the top 1%er Wall Street Journal is publishing articles about how the Fed induced high inflation would quickly raise inequality for the poor and middle class, what else is left for the central banks to be forced to take notice? I suspect a govt entity who can not get elected because either the govt get blamed for high inflation, or the Fed gets blamed by govt agents attempting to get re-elected, and forced to chance course from anti-price stability to price stability.

2022 Mid-terms are coming to America. How many voters will vote for “Higher Everyday Price Guarantee” on necessities of life??? Even a fool can see this inflation train wreck coming…

Free WSJ article today – “Inequality Would Widen if U.S. Policies Spur Sustained Inflation”

Cost of living is rising faster than paychecks despite efforts by administration and Fed

Federal Reserve and administration officials say economic inequality is bad and they aim their policies in part at helping to reduce it. In the short run, at least, those policies might be widening inequality, not shrinking it.

Mexico CPI might go to 1%. Brazil to NR.

Goldman Sachs expects substantial home price increases for at least several more years The gods have spoken. What else do you need to know?

Personally, I am less bullish than Goldman. They expect smooth home price gains through 2024.

While that would be nice, I expect home prices to stall sometime in the second half of 2022.

Again, none of this is rocket science. Every actions has an equal and opposite reaction. When you have substantial inflation, people cannot afford to buy as much. Consumption falls.

Yes, but not necessarily deflation. If you buy a consignment of goods, you aren’t going to sell it for less than you paid for it, unless you are truly desperate. We aren’t there yet.

How do you know? Deflation and recession is something no one, including the best economists never recognize when it begins. They always look back several months later and identify the point in time when deflation and recessions began..

There is a ton of debt driven monetary loss going on right now..

No mention of Crypto. Must be a factor in Latin America.

BTC has plunged by 27% in about a month. It’s down to $47,000 at the moment. Mentioning it is a waste of breath.

Don’t blink, Wolf, it was just down to $43k and change. Some store of value, huh? Anything that can be wiped out with a Tweet is nothing but a speculative joke.

That might be 43k too high. When people start loosing money something emotional happens. They say the emotional response is much more with a loss than with a gain.

Has Super(limited edition)money been exposed to Crypto-nite?

Cryptos are crap. But the blockchain technology itself is very useful. It has enabled re-monetisation of gold and silver, which are now emerging as money again.

And for buying six-figure animations of rainbow-propelled cats, that anybody else can watch — for free.

Turtle,

NFTs aren’t meant for the likes of us…

Think of it more like the Davos crowd buying and selling renaissance paintings looted by the Germans in WWII amongst themselves.

Also, it’s a way to protect rent-seeking on creative works – even if states begin to chip away at copyright laws.

(i.e. “Hey, country XXX you can’t say that I can’t levy a fee on use of this work – because country YYY & ZZZ already recognize that I am the holder of the NFT for it”)

Remember when Paul McCartney bought up all the songs from those old Disney films?

Consider it the new frontier in rent-seeking behavior – impervious from any state’s attempt to thwart it.

YuShan,

The problem with non-state-sanctioned crypto is that no obvious leader among the currencies has emerged.

Essentially, the need for a global inflation hedge has arrived — but there is not an obvious crypto to fill the need. Effectively, the existing players are out of time.

Why did that happen? Excessive financialization.

As I have written before, the Indonesian government has partnered with Kinesis Money to introduce a gold based parallel currency in the country, while they had introduced a blanket ban on crypto in 2017. So there is a clear leader in that country.

Of course in case of gold and silver as money, even if they are different tokens they refer to the same thing (provided they are truly redeemable for the metal and they represent direct title to the metal) so with such a currency there is no risk in adopting something that could become obsolete – just redeem it if that happens.

Can this possibly end well?

39 Million Households Including Most U.S. Children To Get Up To $3,600 Stimulus In Monthly Payments

In the latest evolution of creeping Universal Basic Income, Biden administration officials said on Monday that a poverty-fighting measure included in the COVID-19 relief bill passed this year will deliver monthly payments to households including 88% of children in the United States, starting in July. The Democratic-backed American Rescue Plan, signed into law by President Joe Biden in March as a response to the coronavirus pandemic, expanded a tax credit available to most parents.

Treasury and the IRS also announced the increased CTC payments, will be made on the 15th of each month allowing families who receive the credit by direct deposit to plan their budgets around receipt of the benefit. Eligible families will receive a payment of up to $300 per month for each child under age 6 and up to $250 per month for each child age 6 and above.

Eligible recipients will get up to $3,000 per child between 6 and 17, or $3,600 for each child under the age of 6, in 2021, subject to income restrictions. The benefit will reach 39 million households, many automatically and by direct deposit every month, starting on July 15. It is one of several measures the administration says could lift more than 5 million children out of poverty, half of the total number of U.S. youngsters in that situation, according to Reuters.

kleen,

“39 Million Households Including Most U.S. Children To Get Up To $3,600 Stimulus In Monthly Payments”

Let’s clarify:

1. It’s instead of the $2,000 tax credit they’re already getting. It’s an increase of up to $1,600 a year (an increase of $1,000 a year for many).

2. It’s only for this year unless extended.

For the first time ever, I had a customer tell me they’re unable to continue with my services because INFLATION is eating their lunch. They’re in Argentina.

Just some facts about Brazil’s debt:

The debt is 89% of GDP but the country has about $350 bi in currency reserve which bring the net debt a little over 60%.

By the way, the debt is 97% in local currency and 90% held by brazilians…. Which clearly change the way we should look at those numbers. Thanks to the recent commodity boom and the depreciation of the Real, Brazil has a huge trade surplus and positive balance of payment.

Inflation is really spiking (as everywhere) but as you said, the central bank is really trying to do something about it unlike what we see in the US and elsewhere. As you said, Brazil has experienced 25 years ago hyperinflation and does not want to see that again. I do no think this country is in such a bad situation compared to many others considered safer.

Hey everyone. I am in the location referenced in the article. I try to repair my own vehicles. Currently a vast shortage of car parts including belts, hoses, filters, pads and other common consumable items. In the construction sector, the supply of building materials is inadequate at best. Price of available products increasing at a disturbing rate. Cost of groceries has gone up 10-20% since 2020 with smaller sizes. For example the indent under the tuna can is at 3/8″. I feel bad for the children. They should be in school. They are not even receiving virtual lessons anymore. Teachers still getting paid though. Soul crushing watching this gorgeous paradise slowly sinking wondering when to bail.

I’m always saddened that so much of Argentina’s regular economy is dedicated to food exports, but their own people have difficulty finding affordable food.

“BBVA, which is heavily invested in Argentina .. warned .. about the worsening situation in the country.”

I’m speechless ?

What do I know anyway, okay.

The business/corporate world are a bunch of cowboys riding & not having a clue on how to ride a horse.

It’s a global phenomenon.

It can’t be that #$%&*#! hard .. how ?? .. business was being done at the Temple in the time of Jesus Christ .. they didn’t know #$%& then & yet they understood business.

But today it’s a one great mysterious black hole ..

In any direction that we choose to look it is crisis after crisis.

Is it a new trend maybe ??