Housing craziness is front and center.

By Wolf Richter for WOLF STREET.

The Bank of Canada, which already holds over 40% of all outstanding Government of Canada (GoC) bonds – compared to the Fed, which holds less than 18% of all outstanding US Treasury securities – announced today that it would reduce by one-quarter the amount of GoC bonds it adds to its pile, from C$4 billion per week currently, to C$3 billion per week beginning April 26.

In its statement, it pointed at the craziness in the Canadian housing market – “we are seeing some signs of extrapolative expectations and speculative behavior,” it said.

Back in October, the BoC made the first reduction, tapering purchases of GoC bonds from C$5 billion per week to C$4 billion, and it had stopped adding mortgage-backed securities, of which it had never bought many to begin with.

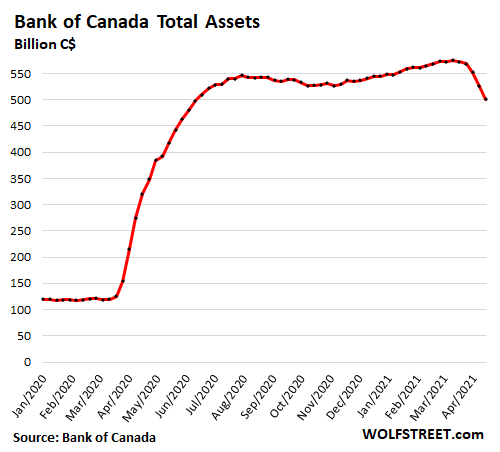

In March, the BoC announced that it would unwind its liquidity facilities, thereby reducing its total assets by about 17%, from C$575 billion at the time, to C$475 billion by the end of April. And this has progressed as planned.

The BoC cited “moral hazard” associated with this central bank craziness as one of the reasons for the unwinding of its liquidity facilities, what are now mostly repurchase agreements (repos) and short-term Government of Canada Treasury bills. Its total assets dropped by 13% over the past month, to C$501 billion on its most recent balance sheet through the week April 14:

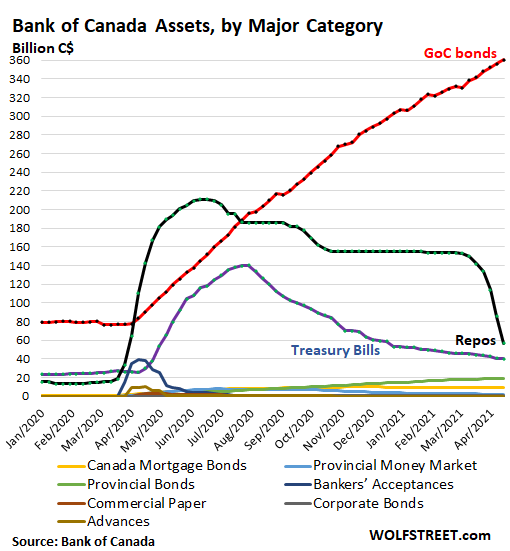

The total amount of the assets has declined because the BoC is unwinding its liquidity facilities. The largest remaining categories are the term repos and the short-term Treasury bills. As they mature, the BoC gets its money back, but doesn’t replace those securities, and the balance declines. The remaining asset categories, such as MBS, provincial bonds, corporate bonds, etc. – the lines at the bottom of the chart – have mostly been unwound or are minuscule.

The red line represents the still growing pile GoC bonds, but their growth will slow from C$4 billion per week to C$3 billion per week, starting next week:

The BoC also announced in the statement that it would maintain its policy interest rates, with the overnight rate at 0.25%, the Bank Rate at 0.5%, and the deposit rate at 0.25%.

But rate hikes were moved forward to the second half of next year, and as early as July next year.

Or maybe sooner or later: “In the current context, though, there is considerable uncertainty about the timing, particularly in light of the complexity involved in assessing supply and demand that I mentioned earlier,” BoC Governor Tiff Macklem explained in the opening statement.

But the housing market craziness that has been unfolding in Canada was front and center.

“The Bank will continue to monitor the potential risks associated with the rapid rise in house prices,” it said in the policy statement.

“You won’t be surprised to hear that we also spent some time discussing what is happening in the housing market,” Macklem said in his opening statement. Here are some tidbits:

“The pandemic has led to some unique circumstances. With so many households working and studying at home, we see many people wanting more living space. And interest rates have been unusually low, making borrowing more affordable,” he said.

“We are seeing some signs of extrapolative expectations and speculative behavior,” he said.

“Given elevated levels of household debt and the risks that households may overstretch in the face of rising housing prices, we welcome the recent proposal by the Superintendent of Financial Institutions to introduce a fixed floor to the minimum qualifying rate for uninsured mortgages,” he said.

“New measures just announced in the federal budget will also be helpful,” he said, including the annual 1% tax on vacant homes owned by non-resident non-Canadians.

“We are watching developments in the housing market very closely, and we will have more to say about this in our Financial System Review next month,” he said.

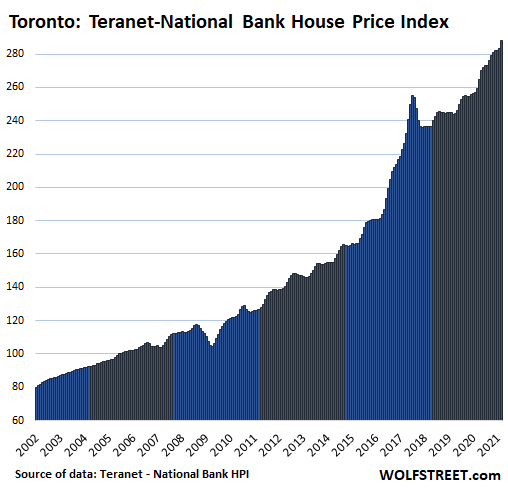

And for your amusement, here is the house price explosion in Toronto, according to the Teranet National Bank HPI, whose method (sales pairs) is comparable to the Case-Shiller Index in the US. Over the past two years, the index has jumped by 18% from already very high levels:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The beauty of being small… the Bank of Canada can drop its Total Assets by 17% in two months while the Fed took two years to pull that off.

The more bonds of its government debt a central bank owns the better because all interest accrued on assets carried on a central bank’s balance sheet is given back to its government minus expenses. The interest payments are lost to bonds held by the public. The Fed is nothing more than an extension of the US Treasury and the bonds held by the Fed are in actuality the US Government borrowing from itself and paying interest to itself. During the 1830s onward after the charter on the 2nd US National Bank expired, the US Treasury printed its own money interest free under the law called “The Independent Treasury Bill”.

Yep, this works just fine since they also issue the currency and require people to pay taxes in the issued currency as well.

If things get too crazy (i.e inflation) , then they can raise taxes too.

The main problem I see with Canada is 3x fold.

1) They want to keep wages down for low skilled job. They do this by importing “temporary foreign workers”

2) They are growing the population via high rates of immigration to obtain jobs at higher “experienced worker” pay levels. This is in order to have empty balance sheets they can leverage up. (it’s hard for a new uni graduate since they get entry level pay and have student debts)

3) I’m convinced the government tax base and housing/credit market requires an ever growing input of new highly educated Canadians with a blank balance sheet via immigration. (for mortgage, credit cards and vehicle leases)

The rates of population growth seems to be faster than puplic services, good paying jobs (economy) and housing supply can grow.

I have no idea how this will end, but hopefully it will be a controlled crazy VS a huge train wreck.

Guess it’s like the old saying, when times are good, people are happy, when times are bad, you see what you are made of.

I hope the Canadian elites know what they are doing.

“and it had stopped adding mortgage-backed securities,”

If the Fed did that, mortgage rates would shoot up.

You are right that Canada is actually a trap for immigrants.

They come educated, with some work experience, and most importantly without debt, and they are supposed to hit ground running, gobbling up available credit. However, their kids will not fare that well, as they will have student debt, lack of good paying jobs.. all the good stuff.

Now, regarding canadian elites, I prefer to bet on their incompetence. There is no chance in hell that former snbowboard instructor and ex journalist can lead this country towards more efficient and competitive version of itself.

Our choice will be between stagflation and reset which will be painful for many. Your preference depends from the point of the property / asset ladder you are finding yourself at. Probably leading towards more polarized society in the future.

Snowboard instructor says, “Slide down hill really fast. If something gets in the way, turn.”

(Better Off Dead movie quote slightly adjusted)

“Yep, this works just fine since they also issue the currency and require people to pay taxes in the issued currency as well.

If things get too crazy (i.e inflation) , then they can raise taxes too.”

I think I caught a whiff of MMT in the air.

Yes, me too. A putrid whiff of MMT and wilful currency destruction, which is the same thing.

“If things get too crazy (i.e inflation) , then they can raise taxes too.”

Why would any citizen want to live/work under such an abusive system?

1) Work hard/save long.

2) G (without a vote) prints money at will, diluting the currency, seizing buying power of savers.

3) As inevitable inflationary consequence of (literally) non productive G money print takes horrible hold…tax workers/savers *again* to offset inflationary consequences of gvt forgery.

The only people who don’t think such a system obscene, are the people in bed with the corrupt G.

“The Fed is nothing more than an extension of the US Treasury and the bonds held by the Fed are in actuality the US Government borrowing from itself and paying interest to itself.”

The government isn’t borrowing from and paying interest to itself. The government is printing money to buy its own debt as a way to eliminate the interest payments. This an epic scam that destroys the integrity of the traditional model of debt issuance.

And the printed money is channeled into the asset markets which transfers wealth to the top while dumping crushing housing inflation on those below.

Wouldn’t we have a more balanced economy if house prices rose more in tandem with wages instead of being juiced higher by one-sided money printing and artificially low interest rates?

Great comment, jrmcdowell.

This: “The Fed is nothing more than an extension of the US Treasury and the bonds held by the Fed are in actuality the US Government borrowing from itself and paying interest to itself.”

This smacks of MMT or maybe something that Paul Krugman said offhand at a dinner party when in his cups, and a journalist jotted it down.

It might be more correct to say that the Government is now just an extension of the banks that make up the Fed.

Joan of Arc: The process between the Fed and the Treasury is designed to expose the nations wealth so that a selected few can exploit the nations wealth with that very process. This process of a central bank handling the wealth of the country was a fear that Thomas Jefferson held second only to a standing army within the country. We will regret not paying due attention to these two very specific fears of a dead old white guy.

“The more bonds of its government debt a central bank owns the better because all interest accrued on assets carried on a central bank’s balance sheet is given back to its government minus expenses.”

Where have I heard this before? Maybe every article about the BOJ for the last 30 years? “We’re cool. We owe the money to ourselves”.

Joan…

Agreed that the Fed is in partnership with the Treasury.

And never more than in the past 12 years. Notice what happened.

National debt up $20 Trillion and rising. If this is the “good” that comes from this arrangement, explain.

The Lender became slave to the borrower …. beginning around July of 2009 with Bernanke’s “temporary” QE.

Now, who is the largest borrower you can think of?

Who empowers the Fed?

Same answer.

With this arrangement of Treasury / Fed came a suspension of the fundamental of free market forces…supply/demand price discovery.

(regarding debt instruments). Good thing?

I love wolfstreet.com. Now if only I could get Wolf to interview Bill Mitchell or Stephanie Kelton or L. Randall Wray. Then he’d have the suite of solutions, rather than just enumerating the problems. We have been MMT for decades. We just didn’t know how to wisely use it.

MMT is even worse — a lot worse — than the current mess we have. The current mess is bad enough. There is no reason to make it worse.

History tells us government funding themselves with printed money ends up in economic collapse.

JoA

Absolutely true. But, but, but :-

Govts buying their own debt nowadays is frowned on as a practice inviting comparison to banana republics, Zimbabwe, Argentina, Weimar etc. Generally a term of denigration which proper states would never ever indulge in at any cost. Ask any Central Banker.

States cannot function in the current situation without funding their debt at contrived low interest rates. Quantitative Easing is a very elaborate and contrived mechanism to obfuscate the fact that they are, in reality, buying their own debt and thus avoiding the opprobrium that should accompany such a practice. QE can only be made to work by co-ordination between certain Treasury officials and certain Central Bank officials. Whether, or not, that is ‘legal’ depends on the precise wording of the mandates of the Treasuries and the Central Banks.

Here in the UK I am personally coming to the conclusion that it is not properly legal but the transactions are so complex and obfuscated it’s devilishly difficult to follow all the trails and I don’t think this is an accident. There is a very smart ‘MP’ on the case but his party runs the show so let’s see what happens.

Please, Joan, can you get somebody to employ the infinite energy accessed by your marvelous monetary system to go back in time and inform everyone who has worked on arriving at the laws of thermodynamics that they got it all wrong.

I honestly didn’t know the Bank of Canada was buying bonds and securities, or that they were printing money to keep Bay St happy. No one tells us little people, the taxpayers.

I noticed, however, a foreclosure sale on a BC fixer-upper house today, and the bank expected the full, assessed value, plus 10%.

I’m coming to the conclusion that all banks are inherently predatory, superfluous, and evil, and the credit unions aren’t much better.

The 3billionC$ per week QEing equals the 150billionC$ deficit just announced in the fed budget for the coming fiscal year.

Don’t believe the rate hike BS or the reduction in Federal deficit in 2022 as Canada is structurally broken. 10s of billions under the CEWS and other welfare programs will be required for many years if not forever. For example Billions promised and given over the past year to the auto companies so they don’t pack their bags and head to Mexico! Canada another Western country that can only survive by printing 100s of billions in fake fiat currency. (approx 400 billion in QEing fake currency will be printed 2020 to 2022). Hey, that’s all these structurally broken, defacto banko Western countries have left is debasing their currencies that ravages their economies with inequality and inflation while destroying savers and pension funds. Like many American states the highly indebted provinces(Ontario the largest by far non-sovereign debtor in the world) are primed to crash and burn!

Didn’t justin castro sell Canada OA Pensions fund to CHINA recently?

Shocking…….the amount of sugar I consume daily dropped from 32 teaspoons per day to 30 just recently. Normal male consumption is no more than 9.

I’am going to apply to be a fed governor based on my restraint. Bet they snap me right up.

fred flintstone,

The amount of sugar would drop form 50 teaspoons per day through October last year to 40 teaspoons per day through this week, and starting next week to 30 teaspoons per day. So that’s already a 40% drop. And then, pretty soon you’re down to 20 teaspoons, and then 10 teaspoons, and then no sugar.

that’s what you said when the fed was on ‘autopilot’ too, Wolf!

seems to me for every one step back it’s five steps forward. we shall see. I’m betting on type 2 diabetes.

The Fed was on autopilot until Trump started beating up on Powell because the markets were swooning (2nd half of 2018). That’s when the Fed was taken off autopilot and did a U-turn.

I have some shares of the CANE ETF, so get out there, fight the good fight, and shovel some more of those sweet granules into your craving body, Fred.

There are more people in California than Canada.

Zillow showed 60 homes for sale in Ottawa the capital of Canada for less than $500,000 CAD. That is $400,000 USD.

Two issues with that, we are earning salary in CAD, and houses typically go 200-30Ok over the list price these days.

I went to look at a house the other day, not Ottawa, Paris ON, but it’s the same everywhere here so close enough. Asking price was an insane 699k for a 40×86 property. We decided not to offer. Our realtor told us the got offers but declined them all. Apparently the owners were expecting something in the 800k-1m (!) range. Now, here’s the interesting thing. This house and the two ladies who own it live there and Run a home based business that has been shuttered since March 2020. The bank will be foreclosing on their asses before long, yet they think the can hold out for more. They deserve to be homeless. This province has lost its damn mind.

What is a “40×86” property?

Thanks in advance

We won’t have to wait much longer for the markets to turn, it will be interesting to see how sticky Real Estate prices are this time.

With the mindblowing disparities of wealth these days it’s quite possible for some segments of the RE market hold value very well in comparison with other asset classes.

Not the low end, that’s going to get crushed over the next 4-5 years.

National prices ( measured by the Home Price Index) were up 20.3% compared to the same month last year, per the Canadian Real Estate Association…yet Canadian CPI is 2.1%???????????

Canadian CPI Core-Median (Y/Y) Mar: 2.1% (est 2.1%; prev 2.0%)

Canadian CPI Core-Trim (Y/Y) Mar: 2.2% (est 2.0%; prev 1.9%)

Hey FED, Canada has made their first move, will they backtrack later once the bubble starting to pop? Interesting they even said this, stating to? Did you guys just wake up from hibernation from 12 yrs ago? I guess that 40% really back them into the corner more than expected.

“we are seeing some signs of extrapolative expectations and speculative behavior,”

At least Canada is saying it, I have no hope of the FED ever to be hinting at the same message for the US. Best we can hope for is POS Jay Powell go on 60 mins again telling us how wonderful and normal both housing and stock markets are.

I totally commend Jay Powell for such a wonderful job he is doing. His mandate is to work for the rich and wealthy people and I see he is not failing.

Good Job JPO

If there’s a picture definition of what a tool is…I nominate Jay Powell’s picture right next to it, maybe with smaller pictures of Yellen, Bernanke, Greenspan having smaller pictures next to it.

It’s comforting for them – the rich – knowing they have someone running the nation’s bank who thinks only of them and how best to make their wealth increase.

Now finally it has become fashionable to dish on the Fed. Great to see.

People who were calling for abolishment of the Fed were labelled as nuts for years.

Fed is the easy target for criticism because they are at the front and center of it. But it’s the Congress that legitimizes the Fed. Rather than doing it’s own work correctly, it has given an almost unlimited and unrestricted monetary mandate to the Fed. Rather than showing fiscal effectiveness, it spends recklessly and sends the bill to the Fed.

Call out the congress, call out the system, not just the Fed chair.

As long as real interest rates are low, and liquidity to absorb the debt is there, why would Congress rock the boat? You don’t bite the hand that feeds you.

Nacho

Dead on.

The Fed has gone completely rogue.

QE was to be temporary….Bernanke

How did that turn out?

They unilaterally expand M2 by 27% in less than a year. Digital Minting….

The power to “mint” lay with Congress.

They impose an inflation tax upon us….though their mandates INSTRUCT THEM TO FIGHT INFLATION..stable prices.

They promote all time lows in long rates when they are INSTRUCTED TO MODERATE (not extreme) long rates.

The citizenry has no control, no representation on the Fed. The Fed imposes a tax upon us. Thus we have TAXATION WITHOUT REPRESENTATION. ring a bell?

The Fed lends money to the Federal Government, with QE, UNDER THE INFLATION RATE, forcing rates into unrealistic, historically inverse relationships.

The Fed is ROGUE and the 1%ers are cashing in big time.

NL

With you on that.

In UK, equivalents of Fed & Treasury are meant to act ‘totally independently’ of each other but if that was true, QE couldn’t work because, when the Treasury came to market to sell debt, interest rates would automatically rise. They don’t because the money needed is already there from the Fed via QE. That’s only possible if the Fed knew in advance that a debt sale was coming, which means they must have been tipped off by the Treasury which is not therefore acting totally independently. Devilishly difficult to prove but that shouldn’t stop us all trying.

.

Damned straight, jon. The epic tale of Powell:

Out of the Mists of Fear and Unease strode forth the unheralded Man whenceforth proclaimed The New Reborn Disciple.

Boldly proclaiming Great Intentions He set forth to make known unto the World His Nobility and His Purity through Rectitude.

Whereupon the assembled Financiers shuffled their Doubting Feet in great Disquiet, and yet in their Great Reverence returned to courageously lift up the Hallowed Markets. And Rectitude was observed, and The Disciple remained steadfast as the Morn of the Feast of Harvest waxed, nary two Years gone by.

Whereupon The Markets became beset by the Great Evil of the Madness of the Serpent of the Repo. And The Disciple conferred with the Great Council of Financiers to devise Salvation from Despair by way of the Rebirth of the Virtue of Recititude in the Virtue of Bounty. And thus the Path of Bounty was reborn from the Ashes of the Path of Rectitude.

And the Financiers rent their Garments in Ecstasy and proclaimed the Great Invigoration as Eternal.

And yet Evil lurked, and from the Shadows of Despair once again strode forth the Forces of Evil, whence they assailed with Doubt the Great Twin Pillars of Growth and Inflation upholding the Virtue of Bounty, and were Sharply cast down by the Disciple, enshrining Purpose and defeating Doubt.

Whereupon the Great Pillars were again beset by Evil, using Plague as Its Tool, and again the Disciple and the Council of Financiers conferred and bade Conference with the People, to drown the Evils of Unbalance with the Floods of Plenty.

And the Forces of Light, united in Great Strength under the banner of the Disciple, and Armed with Great Plenty, forced back the Tide of Evil besetting the Virtues.

Unto this Day the Disciple stands an unabending Vigil.

The Bank of Canada has to do something or no immigrant coming to Canada will be able to afford rents of any type. The Chinese have driven prices up about 75 percent year over year in Richmond Hill, Markham, Unionville and Stouffville. Rents will follow so either the government will have to subsidize all the immigrants or stop taking in immigrants.

Would now be a good time to short the Canadian banks that are heavy into residential real estate? Even a 1% rise in rates makes a huge difference in house payment when you are paying $1 million plus for a shack.

I would never short irrational exuberance, i.e Tesla, bitcoin, canadian housing market, unless I’m really sure what I’m doing and have solid escape plan.

Heard a good analogy for successful shorting from Fleckinstein “Don’t smother your victim, stab them in the back” as in wait for the downturn and then ride it down .

That only works if you don’t die of old age before the downtown comes.

Canadian banks` residential mortgage risk largely off-loaded onto Canadian taxpayer via CMHC. You would want to be very sure of your homework before shorting Canadian banks.

Exactly as realist said. Gov has ensured banks will never get burned. Even if it happens, the gov will bail them out. Canada gov is obsessed with having Canadian corporations that are ‘successful’. See their recent multi billion handout to Air Canada. The poster child of corporate welfare.

Agree. A “Lehman moment” in Canada is unthinkable.

The banks make more money when interest rates rise. The Chinese mostly pay all cash for homes so interest rates don’t affect them. There is no first time buyer in Canada so the banks are safe there.

The “Short Canada” trade has been on for almost a decade. Hasn’t worked out so well. I’ve been looking to buy puts on major Canadian banks, but the trade looks crowded, with well out of the money puts trading at a huge premium to the equivalent out of the money calls.

Such puts live in hope, to die broke.

“extrapolative expectations”

That was a gem LOL

“extrapolative expectations”

The latest Dickens novel.

Straight from the Department of Redundancy Department. What are expectations if not extrapolative? Reminds me of a decade ago, when suddenly a “regulatory response” became a “macroprudential” response. ‘Regulatory’ didn’t sound sophisticated enough I guess.

AM

I love extrapolations.

In 1800 ‘experts’ warned that all Londoners would be suffocated by ‘horsesh*t’ by 1825, Didn’t happen.

Never happens.

Actually, it did happen, but later. The Great Stink of 1858 led to the building of Joseph Bazelgette’s masterful sewer system which is still doing the job with double the population 150 years later. The key point is that Parliament only did something when Parliament itself, right next to the river, became affected by the problem. If you want something done, it has to affect the elite personally.

Sailor

I should have said physically buried by HS but I thought that might be too crude for the refined folks on this site.

My ‘experts’ were worried about the depth of HS on the roads and not a health or smell issue. It was 6″ in 1800 so they reckoned it would reach 6ft by 1825, their target date, bit like global warming really when you think about it.

1) Canada is the best country in the world according to US News & World Report, but many Canadians doubt it.

2) SPX & TSX made a new all time high in Apr. TSX daily was down to close the Apr 1/5 gap, moved up today and formed an Engulf, under an open gap at the top, on lower volume. Something is wrong.

3) RY, TD, BMO monthly charts, Canada’s largest banks, with the largest market cap : an upthrust, shortening of the thrust at the top.

4) BNS & CM monthly : indicate potential future troubles.

5) Canada 1M @zero, the 10Y @1.53 and the 30Y @2.03. That’s why bank’s total assets are flying.

6) USDCAD is plunging for over a year from 1.47 to 1.24 in Mar,

forming an inverse H&S. The rising $CAD have real consequences.

7) The gap between WTI and WCS is minus $12, down from a minus $4

a year ago. One day, due to the current US policies and the

TM to Asia and China, this gap will flip and become positive. Canada will be flying.

“according to US News & World Report”

Once upon a time these were responsible, rigorous institutes run by people with experience, knowledge and integrity.

Now only the name remains. They’re all now run by neophytes who think the whole world is represented in Twitter and other social media.

Brand names don’t mean much anymore. It’s just a crutch used by people with low or no information.

BOC always wants to blame others but we are the opening gambit of hyperinflation due to the massive money printing.

The gal of them to announce 2.3 percent inflation when its closer to 25%.

Why?

https://tradingeconomics.com/canada/money-supply-m0

The Bank of Canada never addresses the root cause which are the Chinese and their housing ponzi where every Chinese buyer knowingly pays more to help each successive buyer make money. They slap a one percent tax on empty foreign owned homes in the budget. So the foreign Chinese just get the local Canadian Chinese to buy everything for them circumventing the one percent tax.

““The pandemic has led to some unique circumstances. With so many households working and studying at home, we see many people wanting more living space. And interest rates have been unusually low, making borrowing more affordable,” he said.”

At least they were honest enough to say that low interest rates have made “borrowing” more affordable. Our evil sycophant leaders like Janet Yellen instead say that low interest rates make “housing” more affordable, which is of course BS, as sellers just raise their prices.

Canada’s housing bubble is a bit different than the USA version in that homes in the hinterlands, er their version of flyover, are worth a lot more than here.

The average price in Manitoba is over $300k!

Wow. It requires a special brand of sick twistedness to pay $300k for the privilege of living in Manitoba. Just 90 years ago, the government was giving away 160-acre plots for a $10 registration fee.

They aren’t making any more muskeg!

The politically correct term is Canada No. 1 Consolidated Moose Pasture!

I can show you economic wastelands all over the west coast of the US where a $30,000 per year job is “good,” and where median house prices are well above $300k.

“But rate hikes were moved forward to the second half of next year, and as early as July next year.”

The hubris of these clowns is remarkable. They act like they are clairvoyant. They don’t have a freaking clue.

CHMC was thinking, even in September of the last year, that prices will go down 9-18%. Instead they went up 25-30%.

They don’t have a clue. Governance and public service today is an exercise in public relations. Governing by twitter / news conference…

https://www.bnnbloomberg.ca/cmhc-stands-by-forecast-for-sharp-price-drop-in-canada-1.1497129

You are so right.

Let’s see should I go to South America and discuss immigration rates, contributing factors, possible policy changes and co-operative programs with government officials – or…. go on The View to talk about what kind of ice cream I like or how the US is racist?

Right. Everything they say is BS, and nobody ever brings it up in hindsight. How did Bubbles Bernanke ever get away with “subprime is contained?” That clown should have been terminated with no severance or retirement. Complete dereliction of duty and incompetence. Instead, he was rewarded for failure. The worse job these people do, the more money they make.

Yes, I am not the least bit surprised that the cost of building igloos has risen 21% in the last year.

This is because Justin increased the taxes on snow by 21% to fight climate change..

Starting in the 70s businesses had their labour supply almost double with women fully entering the labour force, which kept their wage expenses down well below inflation. Result… more profit at labour’s expense. By the 80s with 2 incomes needed for a household that previously ran on one, they needed another trick to continue to increase prices and profits, but that would require people to have money to spend. Economic theory said that would mean wages should rise. But economic theories didn’t account for mastercards and visas being issued en mass. So mass consumer credit was gifted to the masses instead of wage increases. Business owners made out like bandits, and profit margins grew and grew. This consumer credit in lieu of wage growth has grown steadily since with the addition en mass of mortgages, refis, helocs, etc. and even payday loan sharks. Profit margins are massive for business owners across all sectors because labour now is dirt dirt cheap. On top of this, businesses have been given massive gifts by the taxpayer along the way… An across the board permanent 10% bonus in 1992 with the HST (tax burden shifted from business to the consumer/worker), and the massive slashing of the corporate tax rate from 52% in the early 80s whittled down to the 26% today, all shifted to the working family. On top of all this was the “free trade” scam allowing business owners to arbitrage labour cost globally while selling goods to Canadians at Canadian prices , further eroding Canadian wages. But today, the working family is tapped out. Everyone in the household is working and having side gigs. Their credit cards, mortgages and helocs are maxed out. I guess the latest trick is this desparate massive immigration. Wage slaves are pooched. Best time to be a pure capitalist. Doesn’t matter what type of venture you start, start one NOW.

Well said. MMT is, in point of fact, anti-debt. Both public and private. Wolf is fantastic at reporting the data. But for reasons I cannot fathom, he and his readership is stuck in the gold system. Using debt instead of dollars is crazy.

So let me repeat it here: MMT is even worse — a lot worse — than the current mess we have. The current mess is bad enough. There is no reason to make it a lot worse.

J.Powell: “Too low-inflation harms American families and businesses”

Yes, he literally said that. You can’t make this stuff up.

Frightening. And never hard questions for the Fed.

They are INSTRUCTED by their stable prices mandate to FIGHT inflation, NOT promote inflation.

They can’t change the meaning of words…or can they?

And what of the third mandate, “promote moderate long term interest rates”? Moderate means “not extreme” …and record low long rates are extreme by any metric. Crickets.

Regarding real estate.

The Fed has jumped into their own orifice.

The want to “goose” housing, and they have done that.

But now the housing market is dysfunctional.

Lumber and copper up how much? Contractors cant bid on jobs because of the shortages and roiling prices.

People with homes just saw the replacement costs of their homes jump by about 35%. Those without homes locked out.

People who wish to sell cant find other houses to move to….sellers have pulled back.

In the past, when CPI was running 2.6% (1999 and 2006), 30yr mortgages were 6%. Now the Fed has created a situation where 30yrs are circa 3%.

50% lower than what was once normal.

So people can borrow to buy homes, basically, at the current inflation rate….for 30 yrs. …. but home supplies dry up and building stops because of the inflation and shortages created by loose money.

Nice job Fed.

If the BOC slows buying Canadian government debt, either 1) someone else has to buy it or 2) the government has to slow down spending or 3) increase taxes.

I don’t ever see 2 happening. Who do you see to replace the buying? I think increasing taxes will solve their housing boom but not help Canadians with their mountains of personal debt.

Wolf, this article ended just before it got interesting. How about some guesses?

When long-term yields tick up, buyers emerge and grab the debt. This has happened in the US in the past few months. So if the BOC reduces purchases, all that will do is allow yields to rise, and then buyers will grab the debt.

The goal of QE is to bring down long-term interest rates. When QE fades, rates go back up. That’s the dynamic here – there will always be buyers of government debt if the yield is high enough.

The Chinese machine has found another gear. New townhouses 30 miles from Toronto now sell out the first 10 minutes at over 2 million dollars apiece. Soon the Chinese will drive the price of studio apartments well over the one million dollar mark. Anyone non-Chinese will be forced to leave the country or pay 5 thousand dollars a month to rent a townhouse once Covid-19 blows over. Wages are falling in Canada not rising like in America.

Wages are not rising in America. They are flat at best. What is happening is the transfer of high income families to lower income/expense areas. The stats haven’t kept up with the reality.

When a high income Californian moves to Texas on the WFH wagon train, it doesn’t show up until they stop paying CA taxes. Same thing with the NY to Florida migration.

Canada has benefited from coziness with the US for decades, is the ability to taper a function of living next door to a spendthrift?if Weimar-knabe was jawboned by djt to reverse Fed tapering, seems it would be easier in a quasi-socialist country to flop to monetary accommodation, the first rough patch they hit. Running immigrants through quality control for education and indebtedness smacks of Ellis Island, didn’t know you could still get away with that, unless you’re Switzerland. Canada enjoys the natural advantage of having no failed nation-states in close proximity that immigrants/refugees can walk from, unless you count Detroit. And it’s expensive, aging, and cold. A cat-lady economy, living upstairs that you do occasional honey-do’s for to be neighborly. If you’ve got money, health care and a warm house there, fine. As a business plan for a sovereign state, it’s precarious. Somebody’s got to pay for cat food and kitty litter, and they’re assuming a future productive populace that’s not yet in evidence. And jobs for them. But then so are we, gov debt is packaged future tax receipts, and unless the youngsters find our hidden loot, they cover the tab. Unless they’re smarter than we were, not a stretch. Good article about a largely neglected topic given how big and close they are. Obviously I don’t know anything about it. I’m told it’s nice.

I made a similar point the other day. A lot of this Central Bank expansive monetary policy is due to a failure of the political branches of multiple governments to expand fiscal stimulus in a counter-cyclical manner (IAW Keynes).

But now that COVID has a vaccine and the economies of the world are about to rebound… if you were the Canadians why on Earth would you engage in fiscal stimulus when the American behemoth to your south is pushing the petal to the metal on fiscal stimulus? Isn’t the smart play for Canada to simply go along on the ride?

If so, then the Bank of Canada should be praised for getting its house in order. A 17% drop in Total Assets in less than two months is pretty substantial. With more to follow in the coming months even… I will bet the Fed is green with envy!

Is this all connected to China’s efforts to tighten credit? Makes you wonder if there should another C in BRIC?

It makes sense to reduce your holdings when other central banks are crowding out their markets. The Fed let Europe and Japan monetize its debt in addition to their own after 2013.

If US continues to pile on more debt, and real interest rate gets more and more negative, then an inevitable result is countries like China and Japan that hold a huge amount of our debt will dump more and more, which will cause yield to spike and the Fed can no longer afford to borrow from foreign countries. This whole American system of borrowing from foreigners will collapse.