The Fed provides the data quarterly, I dissect it at the stunning per-capita level.

By Wolf Richter for WOLF STREET.

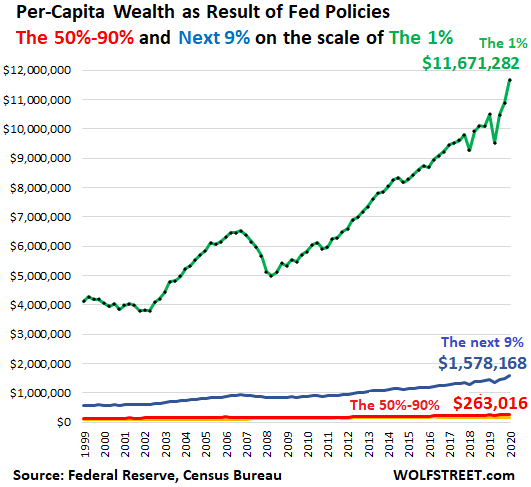

The Federal Reserve is pursuing monetary policies that are explicitly designed to inflate asset prices. The rationalization is that ballooning asset prices will create the “wealth effect.” Today we will see the per-capita progress of that wealth effect – what it means and what it accomplishes – based on the Fed’s wealth distribution data through Q4 2020, and based on Census Bureau estimates for the US population over the years. Here are some key results. At the end of 2020, the per-capita wealth (assets minus debts) of:

- The 1% = $11.7 million per person (green);

- The next 9% = $1.6 million per person (blue);

- The 50% to 90% = $263,016 per person (red line at the bottom).

- The bottom 50% = $15,027 per person. That amount of wealth is so small it doesn’t show up on this per-capita chart that is on a scale of wealth that accommodates the 1%.

The total population in 2020, according to the Census Bureau, was 330 million people. The 1% amount to 3.3 million people. Back in 2000, the population was 283 million people, and the 1% amounted to 2.8 million people. So the 1% has grown by 473,000 people because the population has gotten larger. And the 50% – the have-nots, as we’ll see in a moment – have grown by 24 million people.

Among the bottom 50%, there are still large differences: The group ranges from the homeless and the desperately poor, to those at the upper levels of the bottom 50% that have a small-ish 401k and some equity in a house.

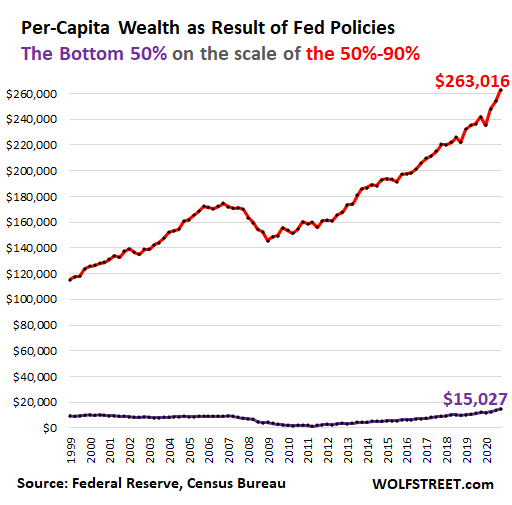

The chart below shows the wealth of the bottom 50% (purple line) on the scale of the 50%-90% (red line). At the end of 2020, the per-capita wealth of the bottom 50% was $15,027. Note that this “wealth” of the bottom 50% has grown by only $5,000 in 20 years, as all other wealth levels, even the 50%-90%, have pulled away, thanks to the Fed’s policies of asset price inflation.

This “wealth,” if you can call it that, is not adjusted for inflation. In real terms, adjusted for inflation over the past 20 years, it looks a lot worse for the bottom 50%:

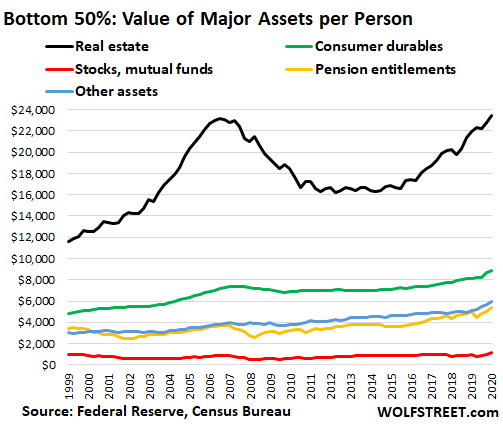

That wealth of the bottom 50% is composed of $45,866 in assets minus $30,383 in debts per capita.

Real estate is the largest category at $23,457 per person (black line in the chart below). What this means is that relatively few households in the bottom 50% own real estate.

So when the Fed inflates the housing market, most people in the bottom 50% don’t benefit because they don’t own a home. But they have to pay more to rent, and they get further locked out from buying a home.

The second largest category at the bottom 50% is durable goods of $8,899 per person, such as appliances, cars, and cellphones (green line). That amount ticked up over the last three quarters as folks used their stimmies from the government (not the Fed) to buy some durable goods.

Stocks and mutual funds, the smallest category of the assets, account for only $1,131 per person (red line). So when the Fed inflates the stock market, the bottom 50% don’t benefit at all. That’s reserved for the top 10%:

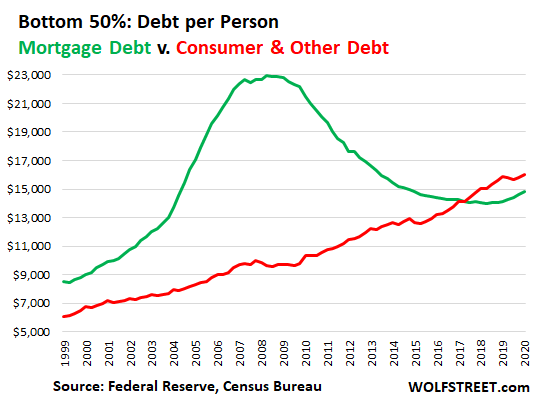

But the bottom 50% do have a lot of debt, relatively speaking, particularly consumer debt – auto loans, student loans, and revolving debt such as credit cards. In 2018, on a per-capita level, the amount in consumer debt and other debt surpassed mortgage debt and reached $15,990 per person at the end of 2020:

The wealth effect was designed for the top 10%. At the bottom 50%, their financial well-being got intentionally gutted by the higher costs of living that the Fed’s asset price inflation has caused.

In 2017, Fed Chair Yellen saw perhaps that the wealth effect had gone far enough and started backing off by reducing the balance sheet. And Fed Chair Jerome Powell continued backing off the wealth effect and reducing the balance sheet. But when stocks were spiraling down and long-term interest rates were surging, and mortgage rates hit 5%, and the housing market was starting to wobble, Trump, who’d taken ownership of the DOW, started lashing out at Powell amid rumors that he was discussing firing him. It didn’t take long for Powell to cave and do his infamous 180 in 2019.

And then in the spring of 2020, Powell showed his true colors as the wealthy suddenly found themselves a little less wealthy. All heck broke loose at the Fed to correct that oversight and push the wealth of the top 10% to new historic highs and thereby push the disparity between the top 10% and the rest of the Americans, and particularly the bottom 50%, into the stratosphere.

This is an effective way to tear a country apart.

Over the 12 months from the end of 2019 through the end of 2020, the wealth of the top 10% increased by $409,000 per person, thanks to the Fed.

Over the same period, the “wealth” of the bottom 50% increased by $3,152 per person, largely due the crumbs handed out by the government (not the Fed), including the stimmies.

And the wealth disparity between the top 10% and the bottom 50% soared by over $400,000 per person to a new historic high.

Not to speak of the wealth disparity between the 1% and the bottom 50% that ballooned by $1.1 million per person.

The Fed is trying to cover it up with its ludicrous rhetoric. Politicians in Washington of all stripes – who could stop the Fed’s policies with legislation – are fully on board with the wealth effect because they’re among the primary beneficiaries. And to heck with the bottom 50%.

Not even populists on the left and the right, whose base is getting hit over the head on a daily basis by the wealth effect, are decrying the Fed’s policies. On the contrary.

There is now one nuance of difference between the left and the right in terms of the wealth effect: Now the left wants the top 10% to surrender a few crumbs of the wealth effect to the bottom 50%, which has triggered an outcry on the right. But beyond the outcry over a few crumbs, they’re all singing wealth-effect hallelujah from the same page of the Fed’s song book.

In an op-ed, Powell rationalized and defended these policies. Gimmie a break, will ya? Read...Powell in WSJ Op-ed: “I Truly Believe that We [the Rich] Will Emerge from this Crisis Stronger and Better, as We [the Rich] Have Done so Often Before”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks once again for the excellent reporting Wolf!

My only question is, are these numbers means or medians per capita?

I may have missed that detail, but it does seem relevant with these huge and getting more huge differences.

VintageVNvet,

Average (mean) per capita: dollars of that category divided by the number of people in that category.

Since this is broken into levels (1%, next 9%, etc.), the differences (pros and cons) of median v average within each level are not as significant as they would be for the population overall where the 1% and the bottom 50% and everyone in between would be in the same bucket.

To distill all of the down, we have over the last 20 years turned the US into What looks like a 3rd world country in terms of wealth inequality.

Wonderful, this effect really accelerated since 2008 from the initial chart, but looks like it had its start in 2003 but has a bump in 2007 and 2008. Wonder what happened that year to start this process along. The bottom 50% really got whacked because of it. Or rather the Fed kept the bottom 50% down. One wonders how many people even realizes this.

Yep. Everything is becoming a monopoly. All the productive money leaves your community.

Money would stay in the community if people would shop at their local mom and pop stores.

Instead now you buy DIY at Home Depot. The profit leaves your community money goes to Atlanta and Wall Street

You buy coffee at Starbucks or Dunkin Donutes it leaves your community.

You buy junk at Walmart, Target, or Amazon, the profit leaves your community.

You buy food at a chain resturant, the profits leave your community.

I grew up in a small town that did not allow Pizza Hut, Walmart, McDonald to enter The small town kept the nice main street with local stores and shops. The upper middle class was the mom and pop business owners. They donated to the local community baseball teams, etc.

The two town both 30 miles on each side allowed Walmart, Pizza Hut, and McDonalds to move in. Within two years after Walmart moved in the down towns were 60% boarded up. You could see the picket fences on the housed not being painted.

It is time incentives for local community mom and pop stores are implemented. They need to do what they did for the internet online shopping and allow local stores to not charge sales tax.

This economic effect would also (partially) explain the increasingly 3rd-world-like politics in the U.S.

MCH

how to reverse the trend and really really make AMERICA great again?

Read. (ru82)’s comment below.

2003 – Peak conventional oil started to plateau.

ru82, speaking of money leaving the community, don’t forget that money spent locally through what’s called the MULTIPLIER EFFECT circulates and recirculates around Eight times, hiring people, being taxed, buying local things, before finally drifting away via big box store spending.

What do you think the effect of immigrants, legal and illegal, sending hundreds of billions a year out of our local economies is?

In 2016, $28.6 billion in remittances flowed to Mexico (up 9.3% from the previous year) – a total that accounted for over a third of remittances to all of Latin America and the Caribbean. After Mexico, Guatemala ($7.5 billion), the Dominican Republic ($5.5 billion) and Colombia ($4.9 billion) received the highest amounts of remittances in the Latin America and Caribbean region in 2016.

Worldwide, Mexico ranks fourth in remittances sent by migrants, behind India ($62.7 billion), China ($61.0 billion) and the Philippines ($31.1 billion). Together, these four countries accounted for almost a third of all remittances sent in 2016.

Gee, wonder why so many communities don’t have stores and are food deserts? The money to support them has left town and the country.

So these are not the upper bounds as I understand, just average.

i.e. The guy at the 90th percentile doesn’t have $263k

Its all the people between 50th and 90th percentile on an average have $263k. So if we assume an even distribution within the bracket, then its most likely that the person at 75% percentile is the one whose wealth is $263k. The person at the 90th is probably much higher.

The same applies for other brackets. The average 1%-er has $11.7 million but thats the guy in the middle.. so the bar to enter the 1% is probably lower than that.

Yes.

One possible image for the “Trickle Down Effect” has been proposed by the underclasses as of late…

A member of the 1% stands on a large Executive Type Desk…

Gleefully Urinates on a pack of servile underlings…

As they open their mouths and beg for a few more drops…

THE TRICKLE DOWN EFFECT.

There… that should help you..

Curious that the Fed actually thinks a 1% or even 2% interest rate would harm employment.

Ridiculous.

Those incremental changes, those levels of borrowing likely have NOTHING to do with hiring.

Lumber, copper and the soaring prices of other commodities likely put more people on the sidelines.

Central Planners INTENTIONALLY assist one group at the EXPENSE of another…..Hayek.

Its been 12 years now of the same being helped at the expense of the others. All by design, all to the harm of those who did nothing wrong but save their money. Shame on them, huh?

“Curious that the Fed actually thinks a 1% or even 2% interest rate would harm employment.”

Our dear leaders at the Fed need to take a course in high school economics.

‘Gentlemen, this is a football.’

Another version is how John Kenneth Galbraith put it:

“The theory is that if you feed enough oats to the horses some will pass through to the sparrows along the way.”

This is what happens when you reward speculation and not hard work. It used to be said that the FED’s job was to take away the punch bowl when the party got started. That has morphed into “all you can drink,” with a shooting gallery in the back room. Jerome Weimar Boy Powell is an economic terrorist and enemy of the American people.

When we personalize it, let’s not forget all the previous charlatans. This started some thirty years ago. Chairman Powell is just one not too smart or imaginative follower.

right. this is systemic, not a personal failure. a fed chair isn’t going to risk power vacuums. anyone who would even think about thinking about doing so won’t be allowed near the controls. it’s the part of the cycle called the end. stay ice-cold through this and have a plan. blood-lust will bring you nothing but trouble. find people you can trust.

Depth…

Indeed.

The providers of services, the workers of this nation are being poorly served by this Fed.

Those who wake up and wonder how much the stock market will be up today, and how much money they will make without getting out of bed, well served.

Now comes the eventual inflation that will crush and pound those working families.

It will first be explained away…..shortages, etc.

Next it will be described as a sign of healthy economic activity.

Finally, it will be waved at by a slow moving Fed that will issue 1/4pt raises, well behind the curve.

When the prices of pitchforks and torches soar, then the time to pay the devil.

DC

Well said

Trickle down economics = trickle up poverty.

Water flows down.

Wealth flows up.

Great article But this article would bring the current financial state of the U.S. population ,into sharper focus, if the graphs were adjusted for inflation

Yes, on a CPI adjusted basis (per BLS inflation calculator), the bottom 50% lost about $1,000 in wealth over the period of the charts. In other words, adjusted for CPI, they’re worse off today than in 1989.

Doug:

Your request is easy to fulfill! Just tilt the “grafts” down to the right!

The correct amount of tilt is reached when the top 1%’s slope becomes horizontal!

Then all horizontal lines are nicely slope downward!

Nancy Pelosi proudly proclaimed there was “a floor under the stock market” as she went on a stock buying spree herself. You get what you vote for.

Lance –

I did comment on the article. Instead of attacking other commenters, why don’t you comment on the article and offer something useful so as not to appear a dull troll?

Because the article already pointed out the fact that politicians across the board are prime causes of this problem, choosing a particular politician to single out, especially one that is so often made a target of derision by one party and so staunchly defended by the other, would seem to be politically motivated.

So what do you do? It’s simple, Buy Stocks.

Depth Charge

Excellent point, that is painful to observe .

I continue to hope against hope that the people, the citizens of this country;

STOP self pity, cross the ( artificial divide that is imposed on them by the asinine politics of destruction by both sides of politics)

and understand that if they don’t join forces and topple the current system of deep corruption,

in a few years time they will have NO country to hand over to their children and grandchildren.

Yep,actually many plebes know this Very well.Talk of International Amazon union movement is encouraging,though I think it may hasten the human demise in favor of more artificial workers who buy 0. Been saying for decades:but local and used if at all.Hire union members if possible.Hire Americans,your fellow citizens and taxpayers,english speakers.Stop sending $ to China,bigbox stores,wealthy overlords who get Insane taxbreak. while paying slave wages.

“Regulatory capture.” It’s what’s for dinner.

One of the great drivers of the wealth effect being orchestrated by the Fed is quantitative easing. But the entire underlying concept of QE is completely ludicrous and makes a mockery of forthright debt issuance.

Governments print money to buy their own debt in order to 1) lower interest rates, 2) lessen the debt burden by effectively eliminating interest payments on the monetized portion of debt, 3) depreciate the currency, 4) provide windfall gains to bond holders, and most importantly, 5) line the pockets of the rich through asset-price inflation.

How in the world did this three-card monte scheme become the de facto financial policy of the entire globe?

The US and Great Britain peddled this scam to the entire world. But when you boil it all down, it’s really nothing different than we’ve seen throughout the history of mankind. It’s the wealthy controlling everybody else while they live like kings at society’s expense.

Agreed. From a historical perspective — across time and cultures — what you described is the norm.

jrm..

Think of this upside down arrangement.

The Fed pushes for 2-2.5% inflation. That rips 22 to 28% respectively off the dollar in ten years. (stable prices?)

The Fed then runs out and buys federal paper at well under their inflation target. Five years at .5%, ten years at 1.65%, MBSs at under 3%.

So the Fed is lending BELOW their inflation rate target. Why?

We can suspect.

The Fed is instructed by their mandates to FIGHT inflation, not to promote it! And not one Congressman has pointed this out.

Dear Readers and Commenters,

As Peak Prosperity is getting spun off from the parent company, my interviews that used to be on Peak Prosperity are now on Wealthion which now has it own YouTube channel. This new YouTube channel where my future interviews – and those of other regulars — will appear is:

https://www.youtube.com/c/Wealthion/videos

To subscribe and be the first to see the interviews, go to Wealthion’s YouTube channel and click on the red “Subscribe” button. YouTube will then send you an email notification when a new video interview gets posted. Cheers.

New bookmark installed.

Also enjoyed your 2 part discussion with Max and Stacy.

So did I.

I’ve followed Max&Stace on RT(UK) since they started years ago. That’s how I got to Wolfstreet.

Wolf will choke them for that.

Great show, never miss it.

I enjoyed your interview with Max Keiser. He uses your charts frequently.

Money has to come from somewhere. Either you

print or you take from the poor or both. America has

decided to do both. Since we won’t let the poor

earn any real money-they can’t unionize, therefore

have no benefits or pension-our only way out is universal basic income.

Unions or no unions, if/when wages go up then temporary inflation has transitioned into permanent inflation.

Isn’t it funny how the rules of economics apply to the bottom 50%, not to the top 50%? The graph of debt vs income shows the official birth of the debt slave.

Tom S – you’ve swallowed the brainwash. “Rising Wages = Inflation” is a false meme, or at least only true in limited circumstances.

Wages went up for decades in the 1940s-1960s but there was little inflation because production was also going up.

The emphasis should be on production not income. A people who are producing more become wealthier. So long as the distribution of that new wealth isn’t skewed, then everyone should benefit.

Simply raising wages without increasing domestic production would be inflationary.

Today’s economy doesn’t work well partly because the monopolies and grifters siphon off too much to the already-wealthy. Those doing the producing aren’t reaping enough of their output as income, so they can’t afford what they make. End result is that both demand and production stagnate and actually everyone ends up worse off.

I do agree with you with regards to needing to be a producing nation. But, I think the scenario the white house and the fed are trying to avoid is if the inflation runs hot into 2022 then people will need raises to pay for gas and food and housing. Then we could enter this feedback loop where inflation expectations feed into higher prices and then interest rates can only do so much so quickly to tamp it down. Hence all the language about it being temporary.

You are right that as production meets supply inflation should wane, and possibly quickly for example in automotive, but there are huge increases in raw material costs that haven’t made their way into final goods prices yet.

Deeper still, where is the desire to produce? We are busy throwing cash into bitcoin and other nonsense because they’ve managed to kill the desire to innovate something useful. I’m no expert in economics, but I did read a neat white paper by Edmund Phelps about “dynamism” and it really makes me wonder what the next phase of American capitalism will bring.

Wages wont be the driver unless the wages are set by government.

Illegal immigration will otherwise damper wage increases.

As I have pointed out on several blogs, had the US government taken the extra $5 trillion it has appropriated and spent in the last year for COVID and simply written a check in the name of every individual resident of this country– 330 million people, it would amount to $15,100 per person. A family of four would have received $60,000 in the last year.

How much did you get last year? I got $3,200 directly from the government, and I am a retired millionaire (in assets, not income). The question the citizens should be asking and aren’t, is where did the other $11,900 go? I, of course, received part of it as the increase in my stock and bond portfolio, but I am not the average or median citizen.

Yeah, a big part of the problem here is that for the Great Recession you couldn’t get the Congress to spend the money necessary to boost the economy. What it did spend was largely misspent. It fell to the Fed to try to push the string and that has helped those who own assets but not the lower or middle classes.

Sooner or later the Fed will take away the punch bowl and it will be interesting to see what happens then. My guess is that if Biden gets his infrastructure spending bill through then QT will not be far behind. All of that combined should shift these wealth effects a bit.

“the Fed will take away the punch bowl ”

Disagree. The punchbowl will be broken by too many drinking from it at the same time.

The Fed will NEVER willfully take away the bowl. They may be forced to by inflation, but never to moderate that which they have set in motion. IMO

Party on Jerome.

historicus

I agree!

The will to do anything proactive to stymie the horrendous implications of the nuisance policies that have being prolific in the last 15 years in particular have all but disappeared.

The key to solve a nation’s economic problems are in the hands of it’s legislators.

Alas, with the kind of legislators that the country have elected in the last opportunity when given that hope have evaporated as well.

There is going to be a shock that will be needed to awaken the dead.

Otherwise it is a long long long night ahead.

The problem is not ever “why didn’t the government spend more money “, this is not the function of government, you have bought into a false narrative. Recessions are necessary to allocate resources away from bubbles, the artificial suppression of recession is the problem.

Stop asking these uncomfortable questions about where the money went. You just have to know it’s for the good of the people.

?

Remember it’s put to work paying off the hard working bosses in ways other than monetary compensation. If you have to ask, then you didn’t have the need to know

?

And yes, giving $60k to a family of four in the bottom 90% would have meant a great deal, but screw it, let’s give them something even better, price inflation. And by the way, still waiting for that awesome Mileage tax from Mayor Pete, cause that will help with inequality. Along with green credits for buying electric cars and increasing the gas tax cause you know, save the Earth.

?

Were I to be endowed with telekinetic powers, I’d wish All the Banksters d##d. Tis a pity, thou ain’t ..

I got $0. Also I gave $15,000 of my stock market gains from last year to my mother and sister, who do not have enough money to invest in the stock market. It’s always an uncomfortable question to ask yourself how much of your own money is too much and should go to others, I’m not sure I got the answer right.

On the one hand, I think the system we have is highly corrupted in favor of the rich. On the other hand, I think a large number of US citizens occupying that bottom 50% are not globally competitive because they are under-educated and under-disciplined. It is to some degree a vicious cycle.

I figure that’s why so many of them are up in arms about cheap labor immigrants, it’s taking simple labor jobs opportunity away from them and what lifestyle they have managed to achieve. Retraining takes a lot of time and effort on all parties. I don’t know if our system is set up to be all that effective on that front. Don’t see it getting much better I gotta say.

They are scraping by. Not all uneducated. Just underpaid. Everyone has their talents and not all are respected or paid well. My husbands a teacher and ppl like to complain he’s overpaid. We both work and can’t afford to buy a house where we live and his job requires us to live in the City. Unless we want to live in a crime ridden neighborhood.

Many are educated with worthless degrees; degrees for which there are few jobs available and little demand.

Better said, perhaps a large percentage of our population is over-educated, in that there is no market for their ‘skills.’

Neoliberal macro was designed specifically to protect and enhance the wealth of the already wealthy. It has done a magnificent job.

My small business got $150,000 in PPP “loans.” I ended up not needing the money but it was forgiven anyway. I did not get any other stimulus as my reported income is too high.

Cripes how much more would you *expect* above and beyond $150,000 free money?

I would love to see these charts divided into age groups to illustrate who is truly getting screwed by the Fed.

The prospects for the under 40’s to live what was considered a middle class lifestyle must be dwindling fast.

+1

All 3 of Hubby’s daughters are living a nice middle class to upper middle class life. The oldest is 42.

Somehow, I suspect that the children of anyone on this board are not representative of America as a whole.

THAT’$ for sure, RNYer!

I’d bet all my sunken galleon quatloos that most folks are scrimpin and clawin they way down to third-world status. They just don’t quite grok it yet.

When the propaganda finally fades, watch out!

“Build better Backflips”

Anecdotes is not plural for data.

That was formerly true for all kmf, but no longer:

Around the middle of the 1970s, statisticians ”decided” that anecdotal information aggregated in the way they decided was correct WAS and IS data to be relied upon.

”And so it goes.” Per Kurt Vonnegut…

Maybe that is what actually led to the apparent election of the ray gun guy, you know, that guy who was the POTUS who acted formerly for money, and ”ratted out” many of his colleagues for the fame,,

and then kept acting to front for all those who wanted to start the process to steal the money from all WE the PEEDONS workers and give it to his rich and richer puppet masters…

aw, Kurtis-, you’re such a buzzkill…

may we all find a better day.

It really depends on training and education….plus timing and location.

My kids are doing great as well, oldest 41, youngest 37. But they are also educated/well trained and don’t carry debt.

What I have really noticed is that there is virtually no opportunity for anyone without a foundation of skills and experience. For example, the job my father in law did throughout life, which saw him into retirement with a very good wage and pension, does not exist anymore. Many jobs are now automated or off-shored. Young people we know are floundering and there are scant good jobs for them to luck into. It takes a family effort to get kids on track and Lord help anyone who falls by the wayside for awhile. It is scary tough out there for anyone vulnerable without a family lifeline.

If you go to the link Wolf gave out you can see the data like that. The baby boomers have significantly increased their share.

I was thinking the same thing. There are bound to be people in the bottom 50% that are 0 to negative net worth due to being in school, or debt from school. And I assume the top 10% skews much older as it takes time to accumulate that kind of net worth unless you are born into it or get lucky at a startup.

I have heard that a child born into the lowest income quartile in the US has only a 50% of reaching the second income quartile in their lifetime. I have also heard that near 50% of boomers have no retirement savings.

It would be interesting to make comparisons with some measure of economic mobility included.

Growth of wealth percentiles can be impacted by immigration, procreation, and transition. Also, mortality on the exiting side. It might be nice to see the contribution of these factors to changes in the growth of the weallth percentiles. In my case, I have definitely transitioned, and can absolutely say that in the USA with hard work, persistence, stable family environment, and luck, you can certainly rise into higher wealth percentiles.

Crush the Peasants!

The bottom 50% cannot rise above the bottom 50%. That’s mathematically not possible. There will always be a bottom 50% in every society. But why does the Fed have to try so hard to enrich the top 10% to create this mind-boggling and destabilizing wealth inequality? That’s the issue here. So for just one minute, look beyond your own stocks and see what the Fed is doing.

But hey, given your purposeful alias — “Crush the Peasants, exclamation mark” — that’s too much to ask obviously.

Add to that, why did the last administration and Congress squander the opportunity to enact meaningful reforms and instead passed that ridiculous 2017 Tax cut and Jobs act which only increased the wealth inequality further. Pushed up asset prices and took away middle class tax deductions.

Yep, give me back my SALT… that means you JB and KH.

Seriously though, one impact of of the changes in deduction is that it probably helped the lower 90% more than the old code did.

And give us back our personal exemptions, $8,400 for two which were taken away. What a con job that tax bill was, an no one is talking about it.

It entirely depends on which state you live in and how much you make. I know this, I would be better off under the prior tax scheme since I live in CA. But I also know people who are better off under the new Trump tax scheme because of the standard 12k/24k deduction scheme. It helped out the middle of America, the coast, it depends who you ask.

It’s not complicated who benefitted from the 2017 tax scam. Everyone in the 0.1% is laughing to the bank while the plebes argue about how they know a guy in a different state who might have come out ahead by $50.

Let me say this. I’ve been doing my own taxes for 30+ years. The 2017 Tax cut screwed me and most middle class folks who have been paying their fair share and playing by the rules. I don’t care whether its a red state or blue state. One big medical bill from some illness in your family and you are SOL because you lost the medical deduction alone. Forget about the other lost deductions Forget about SALT. You’re screwed and don’t even know it.

The 2017 reform largely benefitted the bottom 50% by enlarging the standard deduction and greatly simplified taxes for most people, more than 80% of returns now utilize the standard deduction.

The 1% didn’t gain much because the Capital gains rate didn’t change and SALT elimination hurts the 1% disproportionately. The smaller part of the 1% that has regular income as the majority of earnings, like rent or bond income, did very well, as did those in zero income tax states. SALT is one of the most progressive taxes and it’s very telling that many in the left are not advocating for a return of that deduction because it benefits people like Buffet massively.

The people who really got screwed are upper middle class and middle class people in high tax states, presume that is you based on your posts. People in this category should be looking to move to lower tax states, not advocating for the rest of us to subsidize their overly generous state pension funds.

Wolf,

CtP does have a point with regards to hard work and education. That’s what enables one to rise above, it doesn’t detract from your point at all.

The Fed is supposed to act as a moderator of excesses, instead it has become the accelerant, under those circumstances, it’s not surprising that things went side ways. Now, the only way for the Fed to keep everything from crashing to keep pouring fuel onto the fire. That in turn makes it worse.

But the problem is structural in nature, over the last thirty years, the fundamental education of the US citizenry has been systematically neglected, people pay lip service to STEM because it sounds good, but as that path for advancement gradually narrows to non-existence, so does the opportunity for social and financial mobility. How else could you explain a school board that for over a good part of last year prioritized changing school names over back in person instruction. I was talking to a friend in Austin, TX, not exactly conservative central there, and their kids have been in school since a little after Labor Day… that’s public school.

None of this takes away from your point here, but it is literally a reminder that the only way to succeed in life is through hard work and education, the possibility of achieving success though is narrowing in part due to the poor education system and in part due to the fact that the Fed and the government is actively putting its thumb on the scale the other way.

Crushing the peasants works for a while, but as Nick Hananauer warned, they’ll soon have people with pitchforks coming for them.

Russia 1917, Algeria 1958 anyone

I’ve got two. You can barrow one, if it suits you ..

Good trivia question? Only 1 person in a thousand would ever get this right.

What major or regional war (Civil or otherwise) started on August 1st and affected the income, assets and security of a large world power’s population.

I forgot who said it but every nation has two choices: peacefully distribute wealth down, or violently distribute poverty up.

What part of trickle down economics don’t you understand? As the rich get richer they will upgrade the washers and dryers at all of their 10 luxury homes plus all 3 of their yachts. They’ll buy new shoes and convert the carport into a den. They’ll dine at restaurants more often instead of just 7 days per week, and finally trade in their 2010 Prius for an Escalade. They’ll be able to afford vacations to Disney World and hire landscapers to fix up their yards.

I can’t believe you don’t see the benefits. The only downside I see to making the rich richer is that the price of politicians would go up.

Swamp

France 1792

Swamp.

USA 2024 ?

That means lots of free washing machines, bicycles and old refrigerators for the native peasants, if the alien gardeners don’t grab them first.

“Crush the Peasants!” always read to me as a tongue-in-cheek name. I think you missed the joke, Wolf.

Zantetsu,

That’s possible. I thought about that option early on, but then the comments kind kept falling into the same rut, similar to this.

“Crush the Peasants!” … Joke or not joke, it’s just not funny and, only gets worse and more distasteful !

I will repost one of my favorite quotes from Fredrick Douglas:

“The life of the nation is secure only while the nation is honest, truthful, and virtuous.”

Well folks, just where is the life of this nation when its heart seems to be mired in mindless consumption and doing on to others before they do unto you – just plain “bass awkwards”.

In other words, NOT living simply so others simply CANNOT live.

Remember, it’s usually the last place team with nothing to lose that often spoils the party for the team that must win for the division title.

Because Jerome Powell and the rest of the elites think let them eat crumbs is just a little too nice. Let them eat sawdust is about as much compassion these greedy poor excuse of human beings are able to spare at this time

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship. The average age of the world’s greatest civilizations has been 200 years.” DeToqueville

The Federal Reserve…

an unelected body on which the citizenry has NO REPRESENTATION.

The Federal Reserve that lays an inflation tax upon us….YET, we have no say, no REPRESENTATION on the Fed.

Is that “Taxation without Representation?” Methinks so.

Ring a Bell?

The Federal Reserve, designed to provide liquidity to assuage banking events. Now, the minter of money. They digitally mint an M2 increase of 27% in less than a year. Is that permanent or temporary liquidity to meet an emergency? And by what power does the Fed “mint” money?

Article I, Sect 8 gives Congress both those powers…to TAX and to MINT. Not an unelected body who answers to no one. Congressmen, at least, must answer to the voters.

What we have is a circumventing of our form of government, and those who are allowing and promoting the circumvention are getting filthy rich.

Phoenix Ikki- I honestly believe that a lot (all?) of these people believe their macro-economic theories that say “all trade is good”/”trade causes GDP increase”; “when GDP increases, all boats eventually get raised”/”social welfare is a fine long-term remedy to wealth and income inequality”. There are LOTS of academic papers that conclude these things.

Example of fallacy: if you provide social welfare long enough, you remove some humanity from the recipients. They don’t know how to prepare for a job, (even have a resume’, communicate properly, etc.), and in addition they have no expectation of such.

It’s unsustainable.

Wolf, I have transitioned from the very bottom of the bottom 50% – no RE, no durable goods, no inherited family wealth, significant debt and technically bankrupt – to the 90-99 percentile. So I have been a crushed peasant. I am merely saying that transition is possible. And yes, the gaps between the percentiles are widening over time, but people have shot the gaps from the dregs of the bottom 50 in 1990 to 90-99% in 2020.

Total Wealth (Federal Reserve Data)

Percentile Q41990 Q42020 Change

bottom 50 0.78 2.49 219%

50-90 7.75 34.81 349%

90-99 7.9 46.99 495%

top 1 5.02 38.61 669%

Crush the Peasants!

Yes, sure, lots of people have these kinds of stories, even the 1%. I came with nothing but a backpack to this country many decades ago, and did well, and hugely benefited over the decades from asset price inflation and the Fed’s shenanigans.

That doesn’t make me blind to what actually the Fed is doing, and how it is ripping off the bottom 50% that I left behind decades ago, and how it is tearing this country apart with its wealth effect policies. I could choose to think: “I got mine, so f**k the rest of the people.” But I don’t.

The Fed is the contributing factor, but globalization is the main culprit. You can’t pull the global poor out of poverty without impacting the unskilled workers at home.

Artem-very well-said. In an effort to avoid the horrors of a WWIII the western Allies (okay, the U.S., as last nation standing) saw ‘pulling the world out of poverty’ as the answer. At the time, like most visionary goals, it had an appealing general sense, but has been steadily hobbled in seeing the long-term domestic effects by the inherent difficulties of even vaguely forecasting the future environmentally/demographically/technologically and culturally (do the the terms ‘hubris’ or ‘exceptionalism’ apply here?).

(Perhaps the largest problem with this particular remedy is current legacy-most of those who suffered first-hand the experience of those earlier, unbelievably-bloody conflicts are gone, those of the subsequent generation who may have absorbed what had happened and the reasons for the remedy are leaving, and those who greatly-expanded numbers remain no longer have those conflicts as a direct relatable other than as what a few might absorb through the unfashionable study of history or the limited and distorted lens of a mass-entertainment observation…).

Times change, and SWOT analysis, whatever your station, requires constant and robust implementation. Its lack leads to increasing frequencies of ‘bad luck’, otherwise known as ‘history’s wheel’.

may we all find a better day.

There are also larger structural factors in the economy – the Fed isn’t the only factor behind worsening inequality in the US, and I wish that were clearer in this article. But I appreciate what Wolf lays out here.

Crush the Peasants – I find your posting tag amusing, and I’m 70-90% confident it is in jest, especially because of the “!” mark as my dark humor finds that part the amusing part, and I’m a pretty empathetic individual deep down.

As far as “hard work” to get ahead, that was from 1940s to 2000, as from 2000 to 2021 the biggest way to get ahead is front-run the Fed. “Stable family” might help, but yet I know a lot of successful people who are successful because they had anything but a stable family…it motivates kids to be independant early, and be nothing like the unstable family in which they came. Over the years I have learned bad can be good in the long run, no pain no gain in a sort of way. “Persistence” is definately required to get ahead. Yet the biggest factor that most wealthy people do not admit is luck plays the largest percentage reason of how they got rich…right place, with the right service/product, at the right time…that is luck. Yet to accept “luck” is to accept it was not “hard work” or “intellect”, and that allows negative guilt feelings when one drives their $300,000 car past a group of homeless people…thus many rich go with the “I worked harder” meme to not feel bad for those with much, much less. Many super wealthy also like to say the are running for President to fix everything, and then never run. That seems to be a common way to relieve perverse wealth guilt…HA

I’m 80-90% confident Wolf is right that the Fed has created an economic nightmare for the bottom 90% of the population. So much so that I plan my future around the unintended future, yet predictable, consequences of a centrally planned economy. When you dig as deep into the data as I, or Wolf does on a daily basis, it really is a multi-decade mess in the making, with a less than predictable ending which is going to take years to decades to reverse the unintended consequences.

Personally I think if we had 20-40 year olds in power, things would be different as all the 60-80 year olds making these poor long term economic decisions for the entire world know they will not be alive to deal with the consequences. J-Pow gets rich, lives his last 20 years in luxury, and someone else gets to clean up whe mess when J-Pow is not around anymore. 60-80 year old may be the most wise through experience, yet they simply do not have enough skin in the game on a long term 50-100 year horizon…

No disrespect for 60-80 year olds, I’m hoping to get there someday myself and most of my good friends are decades older…yet I am surprised so many 80 year olds are running the country in Congress. Seems like age discrimination to require that a person has to be 35 years old to be president, yet can hold office at 120-150 years old (Biden age, right?)….=)

TOTALLY AGREE Y:

If I were king, prez between 35-55,,, senator b/t 30-60,,, federal representative b/t 25-50; and, most importantly, ALL Laws, rules and regs, etc., apply equally to ALL Fed folks, elected or appointed, and this includes medical, retirement systems, insider trading,,, etc., etc.

Especially angered at what I see of folks my age, including present and last POTUS, really screwing the pup(s) of my grand children’s age…

Now several younger ( than my kids ) family and friends telling me they will not have kids due to how screwed up our global situation has become the last few decades.

So, perhaps the restitutions of ( especially the sw portion, ) many of the lands of USA will return some balances put out of whack by the theft of those lands; otherwise IMO, WE the PEEDONs are in for some serious serious social consequences.

Aristotle pointed out that democracies eventually become oligarchies. So new bottles, same old wine. I bet some wise man said the same thing a thousand years before Aristotle. The cure for this mess? Tax the top end of town, beginning with Biden’s idea to reverse the 2017 tax cuts (partially, apparently). Then restore progressive rates applicable to all incomes, including the ‘unearned’ variety. Deleverage the markets. End derivatives. Invest in infrastructures and pass a national job guarantee–a real ‘right to work’ one. It’s ridiculously easy to see, but first you have to break the rich donor to Congress nexus.

I don’t disagree with much of this (not all), but we also have to confront the fact that a large percentage of our population makes endemically bad decisions, generation after generation. We need a return to personal responsibility, from the low income people who have kids they can’t afford, all the way to the top, to the CEOs who constantly want bailouts when they make bad decisions.

Right to work, or requirement to work? For many unskilled jobs, our entitlement programs have a higher “pay”

Yes, Yort, luck certainly plays a part, but it cuts both ways, you know? And you are less likely to benefit from good luck if you do not put yourself into position to be able to. And that goes for bad luck as well.

Like the saying goes, “luck is when preparation meets opportunity”…yet I’d suggest the opportunity part is based on a lot of “luck”…right place, at right time. Of course bad luck plays the reverse roll, yet can be as random as good luck seems to be…

Crush/Yort-‘Luck’ vs./with ‘Hard Work & Persistence’ really begs an honest discussion of Estate Taxes, doesn’t it?

may we all find a better day.

Yeah, me too. I bought 4 tickets, one won, and bam, wealthy as hell. Between the stock market, Bitcoin and the lotteries (only minor qualitative differences), Americans have come to believe in luck more than hard work.

This same Strategy is being executed around the world.

In the UK the average person salary has a multiple of 10 times salary to purchase an average priced home.

In London the multiple is 12!

Wealthy from around the world bought £4 billion worth of property in prime London areas last year.

They never faced the music in 2008; put the whole system on emergency life support with the results being they can now never normalize. Not that normal was that great anyhow but at least a semblance of trust and faith existed.

That trust being our debt would be paid and faith they wouldn’t over print the currency. I wonder if they even know how ridiculous it all has become.

Obama had a chance to put all these fraudsters in jail and reshape the entire financial system. Instead, he was bought off by Jamie Dimon and Co. Now he lives in an estate on Martha’s Vineyard. Obama is perhaps the most corrupt of all Presidents in history. He ran on a platform of “I’m not running for office to help out a bunch of fat-cat bankers,” and that’s EXACTLY what he did.

It continues to astound me in the comments here and elsewhere how many people are mad at the wrong politicians. Obama was far from perfect, but he isn’t the one who pardoned a dozen people convicted of stealing from the government. The policies that got us in this mess and coverups that keep us here almost all come from the right side of the aisle.

No original thoughts. Some posters can only recite Tucker’s talking points.

It continues to astound me how people continue to fall for the Right vs Left paradigm. Divide and conquer works on cowardly people…

@Bob – DC’s point was that Obama had 8 years to fix the problems that you incorrectly attribute. In fact, with 8 years, he fixed nothing and further screwed up healthcare insurance which was already bad.

Tell us what this saintly person did regarding the Fed, which is the engine of 90% of our inequality problems?

It’s amazing how one can get to be President of the U.S. here with not much in the way of family “wealth” and come out a multi-millionaire on a salary of a couple hundred thousand dollars per year and end up with big houses in nice locations.

This truly is a great country with lots of opportunity for all races and minorities. Since I am 100% Lithuanian and came from a dirt poor family, it can happen to me if I work hard at it too! (Maybe in 2024 I’ll give it a shot)

Get a deal with Netflix.

I believe it was Bush Sr who took out the conflict of interest restrictions on the President due to national security or some other bullshit. That makes it legal to grift the world.

I believe the quote was:

“My administration,” the president added, “is the only thing between you and the pitchforks.”

https://www.politico.com/story/2009/04/inside-obamas-bank-ceos-meeting-020871

Don’t worry, they gave him $400k a speech after he left the Presidency. I believe the term is “The post-bribe”.

I think every president has had that chance, all have failed.

I had high hopes for Bernie Sanders. But he’s swimming against a very strong tide in our corrupt government.

Bernie swam with the money current!

“Bernie swam with the money current!”

I was shocked how quickly Bernie endorsed Joe B for president after he dropped out of the election. If the man had grit, he’d have abstained. He’s been assimilated.

He also seems to be running neck-n-neck housing wise, with a certain vaunted BLMer …

Keep in mind that 2008-2009 was entirely bipartisan. Presidency changed hands, Congress, you name it … only the Property Party was ever represented in Washington.

“There is only one party in the United States, the Property Party … and it has two right wings: Republican and Democrat. … essentially, there is no difference between the two parties.”

Gore Vidal said it, and it’s true. The partisan divide is mainly cosmetic, or theatrical posing. It’s the actions that matter, not the marketing, and on the issues that have financial substance the actions are pretty much the same regardless of whether the Property Party’s leadership wears a (D) or an (R).

What the nation needs is a centrist-but-populist overhaul. Not the nuts on either side, and not the statist-corporatists.

Agreed!!

Need to see how much government support the bottom 50% gets. Government spending on bottom feeders is done on the back of deficit spending, no taxes needed! Government workers, in the middle, earn retirement benefits, and their pension fund buys stocks. The biggest disparity gap is between workers in private businesses and workers in government jobs, or businesses with government contracts, or subsidies. The pandemic really drove the split home. This is the 2/3s service industry. No goverment pension, no subsidized employment, and no home equity to cash in at retirement. That is probably the biggest shock here because home equity has always been the retirement nestegg.

I think the biggest thief of wealth on the bottom 50% is the medical industry. If you are in this group and a home owner, don’t get sick and don’t go into a nursing home, because you will die broke courtesy of the medicaid recovery scam.

My inlaws had a small condo that went to medicaid when they died, because my MIL was in a hospice for a couple of years. The value of their small apt was around 50K and medicaid took it.

I never wanted to grow old in NYC, like my parents, because it was a dismal down slide. Now I don’t want to be old in America, for the same reason. The entire system is rigged against working people.

Petunia- yes. I do not have a good solution for the medical cost issue. However, I do have a few ideas to improve it. One is to change the pharmaceutical price protection regulations. Also, more competition is needed. However, if the current nationalization by way of Medicaid, Medicare, etc. doesn’t change significantly, the market competition will be thwarted, predictably.

The other item that has completely gotten out of control is college education costs. I don’t know what fraction of the CPI this is, but probably not anywhere near enough.

This is how you get “populism” as we have now (even though it is an inexact science in terms of defining that word).

Also- the wealth effect has turned into the “poverty effect” in the past, e.g. during “financial crisis”. That scares the Fed (and elites) to death.

I’ve been in exile for over 35 years. It’s really hard to do worse than the USA.

Even LTC terms out after a couple years. My mother had an inhome policy, and when the company went into receivership after GFC they capped the benefits. She had investments but after that the income dried up, and pretty soon she wasn’t making enough to pay taxes. This is what they do, they impoverish old people in this country, so you better put up something against the day.

Ambrose Bierce- Yes. At end of life the (“they”) government doesn’t care whether a person is made completely broke. That’s the bargain that was made when Medicare happened. The difference is that now old people are not broke 20 years before they died (as it was in the ’60’s and before).

Perfect example of “no free lunch”.

Yeah, but for the Banksters … ANNNND CONgress, Brunch is 24/7.

Forty years ago traditional pensions that could typically guarantee middle-income workers a middle-class standard of living in retirement have largely disappeared, especially in the private sector. If a worker hopes to maintain a middle-class standard of living in retirement, they have to accumulate assets in a 401(k) or some other retirement account.

The money in a retirement account is included in standard calculations of wealth. Traditional pensions generally are not so a person with a 401(k) is much wealthier than a person with a traditional pension, even if they have no better prospects for retirement income.

“home equity has always been the retirement nestegg.”

Supported by the Fed buying MBSs at rates that are under the REAL inflation rate. How much longer?

It is a little bit interesting to see how the 1% were hurt the most by the Quantitative Tightening from 2016 to 2019. There will come a point at which the Fed has to do that again. Reminds me of the Alabama song lyrics…

“Well somebody told us Wall Street fell

But we were so poor that we couldn’t tell”

According to the Fed, in McKay’s “Extraordinary Popular Delusions and the Madness of Crowds” the mania exhibited by groups of stupid people in large numbers was an example of the Wealth Effect.

Perhaps we should call it the Wealth Side Effect. QE and Covid Stimulus are some serious meds, but like most people I know who blindly take pharmaceuticals because their doctor said so, don’t even read the label. I’ve had some people tell me, “that’s the doctor’s job, to know what it says.”

1) TSR : Total Share Holders Return on capital gains and dividends.

2) Thanks to the FANG, the top 1% unrealized net assets is $12M.

3) The bottom 50% TSR is $15K. No AAPL’s for them

4) In the next downturn thanks to SF & NYC RE a tarnished

FANG the top 1% will flip to NR. US bonds are not dead.

5) Fed assets will rise due to to the rise of their bonds and notes assets.

6) Banks NPL will be balanced by the banks growing US treasuries assets.

7) Brokers always make money on “slippage”.

8) If u trade a $5K position 3x round trips a day, the broker slippage is

3 x 2 round trips x$10 “slippage” = $60/ day.

9) U might make money for a sandwich, but the broker make $60 on

your $5K position, or 1.2%/day, on day traders.

10) 1.2% x 5 days per week = 6%, without risk. Per year ==> 1.06^52 = 21%.

11) The brokers also make 8% on each Trillion margin debt.

12) Can a guppies beat that.

Why did Caesar lead the 13th across the Rubicon? Patricians hoovered all the money and land and also switched to slaves, leaving much of Rome unemployed.

Bread and circuses.

As long as the populace isn’t too hungry and isn’t too bored, it’s all good.

Caesar did not have big tech and the media propaganda dividing the lower classes in half .

“I can hire one half of the farmers to shoot the other half”

https://quoteinvestigator.com/2017/10/29/hire-half/

It has been translated to workers, but I believe this was the origin of the quote.

In the end game, when the barbarians came knocking, there were no free Romans left to defend the elites, so the elites fled east!

Caesar crossed the Rubicon to become dictator, not to help the plebeians.

Oh, I didn’t mean he thought he was a liberator. But the patrician class gave him the opportunity, and the plebs welcomed him with open arms.

There are marked parallels between the history of Rome and the modern West, certainly the US.

But we have Central Americans, not Germans, storming our borders. And the Europeans have their own border challenges as well.

And it will not end. There is no way to stop illegal immigration, especially when their home countries are effectively driving them out.

With all due respect, the idea that there’s “no way to stop illegal immigration” is nonsense. Of course there is. It just requires political and moral will we don’t have, as too many “elites” benefit from it.

There are international protocols we must adhere to, just like our allies in Europe. I would not mind coordinating with the Central American countries to eliminate the mortal risks the immigrants face, maybe a plan to address MS-13?

The best indictment of the big theft by Wolf.

I only wish the journalist who interviewed Powell on 60min showed him that chart.

Our journos come out of the same schools that Powell and his ilk attended.

And don’t forget they need access i.e. if they ask too many “hostile” questions, their access will be revoked.

Well observed comment about journos. They understand the rules if the want to keep their corporate media job. Also note how many former journos work as public information officers in govt agencies and vice versa.

Hahahahaha… ?

Ok… getting serious for a minute… MUhahahahahahaha. ?

Ok, calming down now from the hilarity of the statement about journalists. The so called journalist today are nothing of the sort, at best they are a bunch of stooges because they know what’s good for them if they step out of line.

The implication that today’s journalists, not just the financial ones are anything but the defenders of the status quo and will vigorously crush down any dissent is just laughable. They are there for the expressed purpose of making sure the bottom 99% are busy pointing fingers at each other and the top 1% and their supporters are not accountable.

Speaking of the charts – Wolf references $8899 (green line) and $1131 (red line) in “Bottom 50% Assets” chart. Those numbers look to be significantly off from where the lines are reflected in the charts.

Fantastic article though which gets down to the nitty gritty, as promised.

OOPS. Thanks. Chart got tangled up. Chart now disentangled. Thanks

Given that inflation is a regressive tax the bottom 50% didn’t record and real wealth increase during the central banks money printing bonanza but they are ones that will get brutalized when inflation goes from asset price inflation to consumer price inflation. They got screwed on the way up (no assets to inflate) and will get screwed on the way down (no increase in wealth to compensate them for consumer price inflation).

The Japanese government owns 92% of all its public debt. Inflation is non existent and employment is far more stable than in other so-called developed nations. As for growth, it too is better than most developed nations. With the notable exception of China, which has had a 6% plus annual real growth rate for what? Twenty five years.

The trouble is it’s just a “wealth effect”.

At the end of the 1920s, the US was a ponzi scheme of inflated asset prices.

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth.

1929 – Wakey, wakey time

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth, but it didn’t.

It didn’t then, and it doesn’t now.

This generation would never believe in the markets again, but a new generation came along that didn’t have those painful memories.

I’m a boomer, worked in finance and banking, and I haven’t believed in the markets since the 1990’s. The markets didn’t reflect reality back then, they surely don’t now. I really have no sympathy for anybody who loses money speculating.

It was over for me when Clinton took Greenspan to the woodshed over the “irrational exuberance” quip in 1996 (although I think the S&P was up 44% the prior year, which was extreme). Two years later LTCM and Russia implode and the Fed Put became real.

I was trading tech at a hedge fund in 2000, nothing made sense, we kept hearing “new paradigm” but nobody could define it.

401(k)s, Information Technology, Globalization. They seem to drive or explain a lot, but all I see is a smash and grab on the defenseless.

I agree with your drivers, but you forgot deficit spending, trade deficits, interest rate suppression and funny money creation.

and, perhaps immigration policy, legal and illegal

Nailed it.

Current incomes & cash flows don’t support current asset prices at any interest rate above zero.

To me, we have 2 possible outcomes from here, and they both lead to higher interest rates…

1) Zero/negative interest rates enforced until a currency crisis forces interest rates up…

2) The populous realizes that a low interest rate devalues their labor, and elects leaders that will raise interest rates…

There will be strange stop-gap measures along the way (e.g., wealth redistribution via yellen’s global corporate tax rates). But eventually interest rates are going to rise. And there will be bag holders.

History will not be kind to the central bankers of the past 30 years.

The difference between 1929 and now is that the central banks have gone apesh!t printing money. Bird-brained Bernanke, a so-called “student” of the Great Depression, has gone on record saying the Great Depression was a result of the FED not printing enough. So now they think they can just print to eternity to prevent any sort of redux, and central bankers are “all in,” now. We shall see how that turns out.

Yes, … but money printing is the only thing he knows how to do!

Every problem is solved by printing money!

An observation. The Treasury and the Fed, with the Congress compliant, attempt to replace the ‘gap’ in spending created by the pandemic infused recession. Fundamentally not a radical idea. What is missing is spending directed at increasing employment (jobs). It’s the composition, stupid. Spend money down to the bottom half. It will get spent. Tax money away from the top. It will reduce asset inflation. Do infrastructures. Creates jobs. It’s incredibly simple. But the One Percent loves its socialism so the politics don’t line up.

Few problems with their plan. First, they replaced 4 times the economic activity that was lost, leading to the overshoot Wolf wrote about.

Second, most of the spending was not productive, as it went to durable goods that benefited China, not us.

The plan was a failure. It gave money to a lot of businesses that were not eligible, and left out a lot of ones that really needed it. The Treasury Secretary Mcuchian oversaw the debacle. Banks like JPM and Wells Fargo milked the program for every dime they could and got away with it. People should be going to prison. They were fired, that’s all. I’m still waiting for a list of all the firms that defrauded the PPP program. I intend to boycott every single product and service from them. Also what about the additional debt that has been left for the next generation to pay back. Who’s speaking for them! NO ONE!!!

Take a drive down the main commercial strip here in the most affluent county in the country and I’ll show you 80% of the businesses CLOSED. Looks like all that money printing didn’t save anything but make the top 1% richer and the Wall Street crooks salivating.

100%, the politicians in their deference to the banking-insurance controlled medico-pharmaceutical industry cratered the economy and filled the hole with money while making it rain all over themselves.

What will the effect be of pulling all this consumer demand forward in such a massive way? Reduced future demand is deflationary and negative for future corporate earnings. This epic spending spree of pandemic jubilee money is going to lead to a big hangover.

I’ll fix this for you….”There is now NOT one nuance of difference between the left and the right in terms of the wealth effect…” And all other major issues. A few marginal 2nd & 3td tier issues of little to no consequence to the ruling class are throw about to maintain the illusion that the 2 parties are different and pretending to oppose each other.

And the longer they have been in the swamp, the more responsible they are for the dysfunctional system we now have.

Nancy Pelosi is an 81 year old career politician who has presided over the entire thing. She is one of many responsible for this whole mess, yet she thinks she can dupe the American public into thinking she has some sort of answers. She should be in prison, along with many others.

Chuck Grassley is an 88 year old career politician who has presided over the entire thing. He is one of many responsible for this whole mess, yet he thinks he can dupe the American public into thinking he has some sort of answers. He should be in prison, along with many others.

That’s called “deflection,” Harrold.

Harrold..

Has Grassely pushed unread TRILLION dollar bills through Congress?

That’s the point. Your response please.

I’d love to see the real Venn diagram of the parties. This has happened on both watches and, after 40 years, it may be time to consider the inequality is not a fluke. But guns! And gay marriage!

I’ve said this since 2005, and I was always told “you are blind.”

ROFL. If the outcome’s the same no matter who’s in power, then by definition there’s no difference between the two.

Dallas Fed President Richard Fisher, speaking on Monday, 24 March 2014, at the London School of Economics,”I don’t think there is any doubt that quantitative easing enabled the rich and quick. It was a massive gift.”

“Our massive monetary accommodation will not have the effect we would like it to have, …” he added.

But as candid as Mr Fisher was about the Fed & QE; the Fed’s announced effects were to lift GDP growth. However, the real mission was to fuel the bond market with low interest rates, juice stock prices with easy share buy backs, and most importantly, make the top 1% even richer.

Seven years later, Mission accomplished!

As always, thank you Wolf for telling like it is.

I would urge readers to remember that in 1913, the Fed was created with a twenty year charter. Had Congress not intervened in 1927 with the McFadden-Act to have the Fed continue in perpetuity, it would have needed to have its charter renewed or it would have been abolished – like the first two central banks of the USA were.

1) If u are a small importer and u bring $10M of gadgets from China,

in a container ship, the bank will finance most of it, if they trust u,

along with the insurance co. and your custom agent.

2) If your capital is relatively small, the bank will finance 80% of each transaction, several transactions per year.

3) Suppose u import a total of $50M from China and every time u

are sold out. Nothing left because your customers love u.

5) Your bank make about 5% between order and due day, x5 times

a year,because u never pay late fees.

6) The bank make = 0.05 on interest x 10M each transaction x 0.80 loan x 5 times/year = $2M, without pain.

7) Your bankers and insurance broker will be your best friends, until

the music stop.

The richest “individuals” are now the big corporations. Considered “persons” by the Fed.

Fascism: the fusion of state and corporate.

Against We the People.

That was the plan.

Now delivered.

The next step is to physically remove the serfs.

I have an idea….

History will show that the serfs can only be pushed so far by a greater wealth disparity. Remember what happened to the Russian Czar Nicholas and Louis XIV of France. The 50% outnumber the !% 50 to 1

I guess you confuse 14 and 16.

14 died of old age and gout.

But that didn’t happen before he bled the country dry.

I won’t even mention the commie countries who are still in the hands of the happy few (with enormous accounts overseas).

Be Careful Benito. Mussolini and his wife were chased down by a mob and strung up in the street.

When you give a pig the lever to his slop, you get 2,000 lb porkers for days. That’s what we’ve got going on. The FED is in charge of its own slop. We will find out if they eat themselves to death, because clearly this is not a sustainable path.

It seems to me they think endless stimulus and MMT is going to cover up their egregious sins. It can’t work. It’s a faulty model. The only reason it’s lasted this long is because we are the world’s reserve currency and so all the other governments allow this currency debasement, as they operate in lockstep with their own currencies.

Note how, when asked about the low inflation over the past 40 years after the high rates of the 80s, Powell cites globalization and the inability of workers to demand higher wages. They have invented a model which creates enormous asset price values, yet suppresses labor rates and destroys living standards for the masses.

And you wonder why these globalists are doing everything in their power to snuff out populism within the US, pitting the people against each other? They are desperate to keep the ripoff going. This system is rigged from top to bottom, by the wealthy, for the wealthy.

Depth.

Dead on point.

We have been importing deflation from the pacific rim for decades.

Now, suddenly, shortages. Semi conductors and chips at first. Next will be lightbulbs, spark plugs, etc.

Then we will wake are realized we dont make anything here and are in the back pocket of the Chinese.

“And you wonder why these globalists are doing everything in their power to snuff out populism within the US, pitting the people against each other?”

And in a larger but similar context, why is the US insistent on provoking other nations into war? Seems like the US would love an armed conflict with Russia (via Ukraine) and China (via Taiwan). And through the endless war in Afghanistan and elsewhere. Are the elites trying to destroy this country ?

Wolf, a very interesting analysis as usual. I wonder what your first chart would look like if it extended back to 1971 instead of 1999, when gold convertibility of the fiat Fed note ended?

HB Guy,

The data goes back only to 1989. Yes, it would be interesting to see. There was also a lot of inflation during the 70s and 80s, and it would be interesting to see what that did to the disparity in wealth levels.

All I have goes back to 1989. So here the chart with the extra 10 years. Same trends already underway:

It goes back to 1989 because that was the year the Nikkei crashed by 50%. The fed probably wanted to track the US v Japan to see how bad things could/would get.

I have a hypothesis, a Classical, even Marxian one: American capitalism has reached the point when real profits are so meager that the “real economy” is no longer worthy for capitalists, I mean, capitalists, the owners of capital, the real rulers. In order to avoid soup lines, and what could perfectly end up being a revolution after the closing of businesses and whatever factories are left, the capitalist class must be kept happy. Let’s allow them to see their accounts inflate and inflate in the stock market for which they have to keep the doors of the businesses and factories open. That way the workers keep clocking in and clocking out, and everybody “happy”. The FED cannot let the market crash. This, of course, is a self-fulfilling vicious cycle where the “happy slaves” will be poorer and poorer, but again, while the doors of the businesses are opened they will keep thanking God for having a job.

Inflation robs people of their savings. Not having money in savings put people in danger of borrowing with their credit cards at outrageous interest rates.

Through most intervals the stock market outperformed real estate as an investment.

I read a Forbes article about Chinese housing. The price of a home in China nearly quadrupled in 20 years. That means the value of their currency dropped in value relative to housing prices.

The largest asset most people will own is their home. 65.8% of Americans own a home (Statista).

CNBC today showed that 53-62% owned their own home in America last year (depending on age), as it looks like that “65.8%” percentage may have went down somewhat over the last few years.

Per CNBC:

Last year, the homeownership rate among older millennials ages 33 to 39 was 53.8%, according to an Apartment List report, which uses calculations based on an analysis of the Census Bureau’s Current Population Survey. By comparison, about 60% of Gen X owned homes at the same age and 62% of baby boomers.

———————————————-

So not only does the Fed create a house asset wealth effect for only 60% of the population, most of that wealth is for homeowners that own multiple and expensive houses. Making 10% on a $350,000 home is $35,000. Making 10% on seven houses that total $100,0000,000 is $10,000,000. Feeling trickled down on yet???

Same goes with stocks. The top 10% own about 84% of financial assets, and the top 1% own about 38%. Sprinkle 16% of total assets on the bottom 90%…nothing but crumbs trickling down from Fed Heaven…

Wolf and company needs to start up that old commercial where they zoomed into an egg splattering grease while cooking in a cast iron skillet… and state “This is your brain on drugs”. I’d change it to state “this is your brain on Fed”.

Want an example of your “brain on Fed”…Sunday J-Pow said the following on CBS “60 Minutes”:

“there are people who think that the stock market is not over-valued, or it wouldn’t be at this level”.

So the most powerful human on Earth, J-Pow, believes in “effect and cause” versus “cause and effect”. Vudoo economics at best, I really would like to know if the Fed is as stupid as he acts, or just playing dumb on purpose…kind of think both. So does the Fed believe the Fed prints money because the stock market is up??? Bizarre…

I do believe the Fed is “bizarre” enough to enact negative rates someday, which will convert debt into assets…thus at that moment in time get all the debt you can handle, as the old rules are “fried”.

I do believe the Fed is “Bizarre” enough to buy stock ETFs like Japan if the market drops more than 20-30%, just like Treasury Grandma Yellen proposed in the MSM on Sept 29, 2016 (Search “Yellen says Fed purchases of stocks, corporate bonds could help in a downturn”)…thus at that moment in time get all the stock ETFs you can handle, as the old rules are “fried”.

“Bizarrely”, the best we can do is front run the Fed’s monetary meth, side-step the future tax steam-roller, and lap up all the free fiscal gravey, without remorese, from Uncle Sammy…as the old rules are “fried”…

And as the Fed would “Bizarrely” say “there are people who think that the ‘Top 10%’ is not over-valued, or it wouldn’t be at this level”! So basically the Fed is either super genius or special needs…so place your bets accordingly as bizarrely the Fed is placing his bets for the entire world right now…

That may not be exactly true. The Federal Reserve’s Distribution of Household Wealth in the U.S. since 1989 data reveals this about RE as a percent of total assets by wealth percentile:

1: 11.71%

90-99: 19.35%

50-90: 33.06%

Bottom 50: 51.12%

Crush the Pleasant – Do note that 40% of all Americans own no home, thus your stated “Bottom 50%” is in truth the “bottom 50% of the top 60%”.

Thus 40% of Americans households rent a “household”…therefore; they have missed the Fed housing transitory “Wealth Effect” (Fed said inflation increases would be transitory, correct, predicting the future failure of said “Wealth Effect” experimento grandes, no bueno, sí …???)

Look, the Fed can play Pinocchio paradox all day long with word games, but the truth language of the universe is math, and the math shows the Fed is making the rich more rich, and the poor more poor, and as a Gen Z would say, the fed is “SuS”…

Home ownership in 2020 is about 65%. In 1960, home ownership was about 63%, according to the US Census Bureau.