The market is working on a solution to the “Housing Crisis” and “Exodus.”

By Wolf Richter for WOLF STREET.

San Francisco has long lamented its “Housing Crisis,” a phenomenon where housing – whether rented or owned – is so ludicrously expensive that middle-class workers, even if there are two in the household, can no longer afford to live in San Francisco, or have to spend so much of their income on housing that they’re effectively poor in every other aspect, and cannot spend money on other things.

So now the market is responding to this phenomenon: More people are leaving, fewer people are coming in, vacancies are surging, and rents are sagging, amid a massive churn by tenants who move to similar apartments for a lot less and get “three months free,” or who chase after the “free upgrade” to nicer apartments.

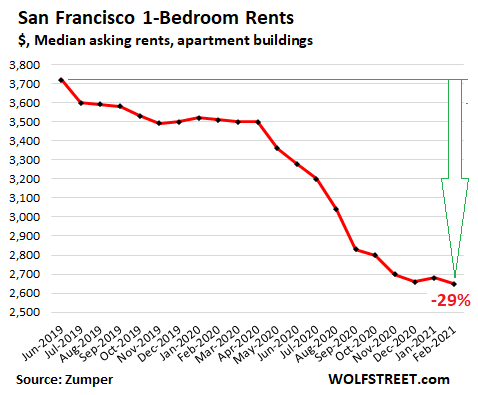

The breath-taking downward spiral of the median asking rent of one-bedroom apartments continued in February, dropping to $2,650 a month, the lowest in years, down 24% from a year ago and down 29% from June 2019:

Despite this drop, San Francisco remains the most expensive major rental market in the US, according to data from Zumper.

The median two-bedroom asking rent in San Francisco, at $3,500 in February, is down 24% from a year ago and down 30% from the peak in October 2015, when it was $5,000. Which is just nuts when you think about it. “Median” means half the asking rents are higher, and half the asking rents are lower. This is the middle, amid small-ish apartments, not glorious luxury.

Following that peak in October 2015, rents began to correct, dropping by over 10%. Then the Trump-bump set in after the 2016 election, and rents rose again. One-bedroom rents eked past the old record and set a new high in June 2019. Two-bedroom rents got close in June 2019, but did not quite set a new high, and have now plunged 30% from their October 2015 high.

And that’s a good thing for the city and for the “Housing Crisis” and for businesses – the lucky ones that are still hanging on and those that haven’t left yet. The market is in the process of correcting a mega-problem that the City has had: housing was too damn expensive, and was driving a lot of people and businesses out, and was killing local businesses.

I understand that property owners – landlords and homeowners both – want property prices to only surge. Because it’s just money, and getting rich off this surge is the name of the game.

But then out of the other side of their mouth, in a deafening hypocrisy, they bemoan in a politically correct manner the “Housing Crisis” and they lobby for taxpayers or developers to subsidize a few “affordable” housing units.

Housing costs are a leech on the economy. What people spend on rent and mortgage payments in San Francisco cannot be spent on other things – the lucky ones that can even afford to live in San Francisco and haven’t been driven out yet by high costs.

Local businesses suffocate if locals don’t have money to spend. Sure, you can rely on hordes of tourists to come in and drop loads of money. But as we have seen, tourism can be fickle, and bleeding tourists dry doesn’t create a vibrant city but a tourist trap.

Local businesses are already being suffocated by landlords that have raised their rents into the stratosphere when the 10-year lease came up for renewal. Before the Pandemic, shuttered stores along the commercial strips and in neighborhoods were already an eyesore. Now they’re a pandemic in their own right.

Small businesses with thin margins, such as retailers and restaurants and some service establishments, cannot survive if their costs, such as rents, keep getting jacked up while their customers are squeezed by housing costs. This is a toxic combination – and it has been visible in San Francisco long before the Pandemic.

And forget the once thriving community of artists and musicians with notoriously uneven incomes that have long ago abandoned the City.

Small businesses have trouble hiring because the people who work in kitchens and shops cannot afford to live in the city. $20 an hour in San Francisco is very tough to get by on. But businesses cannot pay higher wages – unless they’re serving the very high end of the market – because their potential customers are squeezed dry by housing costs and cannot spend the money to sustain those businesses.

Then there’s the exodus of bigger businesses that has been going on for years. High housing costs – and the high salaries they require – and high office rents are among the primary reasons. It’s just money. The list is long. And let’s not blame the Pandemic: among the pre-Pandemic departures are Charles Schwab moving its headquarters to Texas and Macy’s shutting down the headquarters of macys.com, Product and Digital Revenue, and Technology. This trend just accelerated during the Pandemic.

You get the idea: Money spent on housing goes to Wall Street, banks, investors, mega landlords and their investors, and small mom-and-pop landlords, from where it goes to the banks, Wall Street, and their investors. Housing has been completely financialized and every aspect has been turned into a global financial asset class.

Sure, some work is done to repair and maintain the rental properties from time to time – replacing a roof, painting, etc. – which boosts the local economy a little. But there’s not a lot of it, and the workers live elsewhere and car-pool into the City because they cannot afford to live in the City, and so they won’t spend their money in the city, except for a sandwich if they forgot to bring their lunch. And sure, high housing costs are generating some local tax revenues – but at what cost?

The solution is to let the market correct this bizarre phenomenon of rents (and more broadly, housing costs) strangulating the City. The Federal Reserve could help by ending its asset purchases and by raising short-term interest rates at tad. This would speed up that process of curing the City of the Housing Crisis.

Sure, some big landlords might walk away from the properties and let the lenders have the collateral. And some small landlords might too. But lenders and investors got paid to take those risks, and they pocketed the income from interest and fees for years, so it would be their turn to eat the losses. They will eventually sell the properties, and the new landlords with a lower cost base can make those properties work with lower rents. And tenants would have more money to spend on other things in the City.

Once housing costs become reasonable, some folks will come back, and new folks will arrive, and businesses can hire and thrive, instead of having to pack up and leave or shut down, and just maybe a new vibrancy might emerge. And that’s of course when the next boom will start in San Francisco’s boom-and-bust cycles, along with all the ultimately self-defeating housing craziness…. OK, I give up.

The massive Pandemic shifts that triggered plunging rents in the most expensive cities and surging rents in cheaper cities are still on display. Read… Exodus from Big Expensive Cities Running out of Steam? Maybe. But Rents in San Francisco & Los Angeles Hit New Multiyear Low

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

We need to look at the other side of the equation too. The need to raise the minimum wage to something other than poverty level. A working wage that can help sustain the long term health of the economy. $15 per hour is a bare minimum we should start with, but corporations should be made to pay their fair share.

After $15, should be $30, and perhaps as high as $50. After all, why should your grocery clerk be paid less than a computer programmer or an engineer. We need to have an equitable distribution of wealth, and an escalating minimum wage is one way to provide this.

hmmmm. curious to see if this will make it through the filter.

i hope you are joking.

Why should a minimum wage be a joke?

That said, a job that has taken time and effort to train for such as a computer programmer or engineer should clearly be paid a higher wage than a low skill job such as a grocery clerk (would this be grocery check out staff? Sometimes our shared language needs a translation…).

As an ex-hospitality employee, the fiasco that is the US tipping system and the effect it has on waiting staff wages and what they actually manage to take home leaves me incredulous.

Wait staff work is and always has been a very good living for many many folks who care to maintain a pleasant and welcoming ”vibe” for their customers, including sometimes to the saintly level. That not only gets good gratuities, (tips) but also brings back the customers, frequently year after year.

Many friends and family have done much better, per hour spent serving food and beverages, etc., than any other typical non union blue collar work, including construction.

The problem is for cashiers and stockers and folks like that who work hard, on their feet all day with insufficient movement for proper exercise, etc., etc., etc. Those folks almost never see ”tips” AKA gratuities, in spite of what good vibes they maintain, etc… and those folks should have a living wage.

Couple/5 years ago, I was discussing what was a living wage for NorCal friend working hard, hustling 1,000 miles a week or so, as a manufacturer’s ”outside” rep; comparing rents, food, transportation and other ”needs”, with reference to moderate wine, ”events”, etc., we came up with $10,000 PER MONTH.

And that is exactly the problem Wolf summarizes above.

Perhaps the worst of this is the lack of housing for the wonderful artists of all sorts in bay area, some of whom were able to live on one or three sales a year at Gumps, etc., now a certain impossibility.

If that programmer resides in India or Vietnam, should that programmer still be paid a higher wage than a grocery clerk?

How, pray tell, does this help raise working standards and minimum wages?

11 million new amnestied citizens per the Biden Plan, plus the ongoing rush of those coming across the border to be in place for the next amnesty?

“You cannot have a welfare state and open borders.”

The 11M are already working, but with little recourse given poor treatment from employers, normalization will level the playing field. This should be good for most workers-this why labor is for normalization. Of course if you are an employer taking advantage of the current situation, its not so great

“Infographic: Visualizing the Real Value of the Minimum Wage” https://www.visualcapitalist.com/visualizing-real-value-u-s-minimum-wage/

The monkeying around with the CPI index (and its other defects), which is incorrectly believed to actually measure inflation, means that most Americans are actually earning much less than they did even five or two years ago. See Forbes Magazine’s two articles: 1) “If You Want To Know The Real Rate Of Inflation, Don’t Bother With The CPI” then 2) Is Headline CPI Inflation “Fake News”? And then “The Major Problem With CPI And How It Hurts The Economy” and “Will The Real Inflation Please Stand Up? Why Paying Attention To Asset Price Inflation Is Important For Investors”

Interest rates will go up: ordinary, private lenders will start to charge higher interest rates as inflation will increase due to the reckless, money creation of the (not-government-owned) “Federal” Reserve, e.g., with its $2 TRILLION bailout of the banksters in 2019 to 2020 (and secretly, probably also in 2021, at least) by its buying their uncollectible, mortgage-backed securities for inflated, above-FMV values, and its other, out-of-control, money-creation (QE).

Inflation has already occurred but others will then notice it and will react and increase prices more in a vicious circle. Thus, increasing the minimum wage per hour to only $15 may well not be enough already to keep wages at recent levels in real dollar terms (when the pandemic eases) and definitely will not be enough soon due to the coming hyperinflation.

This was boiling for a long time and will now overflow. Remember how even Trump announced, correctly, that the stock market was in a bubble already in 2015!

Nationalize all the numerous, now-legally-insolvent banks by conditioning any bank bailouts (by their “Fed” with US legal tender or from the US government) on their turning over bonds convertible to 10,000% of their outstanding or authorized stock (whichever is the greater number, since some banks have not issued all stock that they are authorized to issue.) Enough is enough!

The biggest problem with wages is the cost of extortionate medical insurance and care. When we control medical costs, then we can determine a livable wage level. Right now, $15 HR is not enough anywhere because of medical costs.

Real Life Example:

$15HR = $30K a year,

$3K medical insurance,

$3K potential deductible,

$6K taxes.

Leaves $21K on the high side to $18K on the low side. This is roughly as low as $1500 a month to live on or $1750 a month on the high side. This is why we have working people living on the streets.

Unfortunately, we as a society can not do anything about medical costs.

Free Market must flow.

Definitely some truth to this.

However in your example you cite a $15 an hour worker meeting a $3,000 deductible. Most people in the $15 an hour of range are less than 30 years old and use essentially no healthcare unless they’re having a baby or a significant accident. There are healthcare copays are often relatively low also.

But the cost of health care is definitely part of the problem.

Lastly, most of the people living on the street are not doing so because they can’t meet a deductible, they are doing so because they have an addiction problem or mental illness. this is well proven and we should not pretend that cost of living is the proximate reason for people living on the street.

You are absolutely right. I favored and STILL favor Medicare for All, because it can be MADE affordable by careful drafting of its provisions and requiring competitive bidding to keep the benefits of private industry competition: e.g., as in Germany. It can limit the services provided, so that it can use its pool of funds to provide essential services.

Like with current seniors’ medicare, those wanting more services, can buy supplemental plans from private providers that provide the missing or extra, desired services. Most developed countries have some form of single payer or single provider health care system, because it enables the government entity to use its negotiating power to limit prices for essential services: e.g., in California, nurses and other medical providers with limited training get paid more now than the average salary of lawyers in the same areas.

The US has been ranked as having the worst and most expensive health care system among developed nations due to the purchased politicians’ insistence on not reforming it to preserve the $100 billion a year profits of the billionaire, health insurance/HMO owners. See “U.S. Healthcare: Most Expensive and Worst Performing” in The Atlantic. See “Sanders Targets Health Industry Profits. Are His Figures Right?” in knh dot org, which said that sum was an underestimate of health industry profits.

A minimum wage increase of that magnitude will force low-margin businesses (restaurants, grocery stores, retailers) to offset labor through technology.

“We’ve seen really the last decade be characterized by global disinflationary forces and large, advanced-economy nations struggling to reach their 2% inflation goal from below,” Mr. Powell said.

LOL why can he just come our with it and say ‘deflation’ instead of disinflation? The Fed’s attempt to force inflation will actually create the opposite effect. The supply of American workers will increase, thus putting downward pressure on labor wages. Would you take a $15 hour job if you knew there was minimum upward wage mobility?

If equitable wealth distribution is the goal, the minimum wage needs to be something like a percentage of the average CEO pay, a percentage of the S&P 500 index, or a percentage of the average (not median) home price. The trick we’ve been playing is to give people more money, but the rich get richer even faster, so no progress gets made.

“If equitable wealth distribution is the goal, the minimum wage needs to be something like a percentage of the average CEO pay…”

How about this:

“If equitable wealth distribution is the goal, the maximum CEO pay and the pay of Congress and The President of the United States should be $15 per hour, without healthcare benefits, because the President of the United States, Congress, and CEO’s are on record opposing healthcare of all Americans.”

Think outside the box.

“If equitable wealth distribution is the goal,”

Why not widen the net and zero out gvt employee guaranteed pensions…the other 80% of the workforce don’t have them but pay for them.

There you go, Comrade Timbers. We need to make everyone feel special…. *insert evil cackle* So, that no one is special.

Hmmm, where is my Syndrome costume.

Cas127… because working folk deserve a pay raise not a pay cut, and working folk didn’t crash the economy in 2008 and get bailed out and get a get out of jail free cards, and working folk didn’t oppose healthcare for all, and working folk didn’t start those ME adventures.

Not enough.

Give them their salary & benefits, and retirement pay.

Zero on the money laundering…..speaking fees, books, media,

corporate board positions, lobbying & consulting.

No carry over on staff.

Excellent idea. I do believe that it is many times more effective to reduce the pay of the rich than to increase the pay of the poor. There needs to be an incentive for the rich to retire because otherwise the goal is to become the #1 richest person in the world (just as athletes strive to be the world champion). This is why Jamie Dimon made the comment “I’m richer than you.” I’m sure he has enough to retire already.

Why monkey around with all these different thresholds like the minimum wage. The best way to normalize income distribution, while maintaining incentives to work, is to add more progressivity to the tax rates. The wealthy pay more, the poor get some money back, if they work.

It doesn’t require a new regulations, a new study, or a new governmental unit.

Warning MCH’s mind may have been hacked!

I’d rather have the government subsidizing health care, utilities, etc. They could pay with this a multitude of ways like less military adventurism, cutting yearly military expenditures, controlling immigration, controlling welfare bums and requiring work for pay, etc. I’d even support some type of subsidizing of housing in the sense of government contribution to a mortgage for those in lower pay scales. Still if you got to work two jobs, that’s life. I’ve worked both my job full time and renovated rental houses for years. Finally, working less, but still working.

Also, I would have a value added tax on gadgets like iphones, computers, etc. Doesn’t have to be a lot, but something. This junk isn’t made in America anyway or maybe if at least 50% made in USA, then a smaller tax. Tax the consumer goods that those that have money buy.

Sales taxes and VAT are among the worst and most damaging type of taxes. Actually enforced income taxes and tax reform (treat most capital gains as ordinary income) are the only way to fix budget deficits.

Forcing made in America should happen, but it would have to be done with a lot of different techniques, among them, the guise of protecting the environment.

Subsidizing the use of energy is usually a bad idea as it encourages inefficient use of it and leads to more pollution and many other bad things. In general, subsidies have to be done very carefully to be effective and to achieve desired outcome.

Controlling immigration is a must.

The minimum wage is extremely important, because it’s the base wage and it helps set wages in brackets above it as well. Right now, if you work at a factory and make 15 an hour and now suddenly little chain stores pay 15 an hour, that factory will have to pay more to keep you. The jobs that suck more than working at a factory that might currently pay 25 to 30 an hour, will then have to raise their wages to keep workers.

In 2019 the US GDP was $21.433 trillion with a labor force size of 163.54 million equally diving the total income between all the labor force which includes full time workers, part time workers and some of the unemployed would come out to about 131k a year. Equally dividing the income would obviously be bad, but for reference compared to how important your job is, it’s useful to compare. Current minimum wage at $7.25 an hour full time is about 15k a year.

Also, who names their money dump “zumper”, I’m nominating them for start-ups I want to see gone.

Sales tax is the only fair tax. It’s the only tax that doesn’t discriminate. Income tax isn’t fair because people, accountants like me, know income tax is only for poor people. Property tax isn’t fair because it’s seen as a money tree that can be shaken down when governments are least effective. Sales tax is the only tax you can say “you are right government, I don’t need that xbox.”

Jacklynhunter,

OK, I bite. Fair tax? 0.1% federal sales tax on any and every sale, stocks, houses, entire companies, bonds, options, yachts, corporate jets, any and all services, such as financial services, insurance… anything that ever gets sold anywhere in the US triggers a 0.1% federal sales tax. That $4 loaf of bread triggers a federal sales tax of 4 cents. That $60-billion corporate acquisition triggers a sales tax of $60 million. If a HFT trader churns $1 billion in stocks every day, it triggers $1 million in federal sales tax per day. That would be a “fair tax.” I’m all for that.

That, plus 25% tax on ALL imports of goods and services, including work done in cheap countries, such as software coding. A tax on imports is a tax on corporate profit margins.

The US is the only developed economy without a Fed sales tax, or more precisely a Value Added Tax.

Wolf, that’s kind of my point. The government will tax everything and kill everything. Black markets will sprout up everywhere. And sales tax will cause revolts. People will save and refuse to spend. All of these things would happen. I’m just saying that’s better than what we have now or any other alternative. It would force government to make fiscal decisions over political decisions. Sales tax is truly, truly awful. Sales tax on food or prepared food should be a crime. Price gouging at sports events should trigger luxury taxes. Carbon costs are being desubsidized forcing consumer prices to double, so maybe we should scale that cost by charging a high carbon tax on non-essential items or a ridiculous level of luxury tax.

None of these things are isolated.

Jacklynhunter,

Tax loopholles only exist, because people let politicians get paid off and make them. It’s extremely easy to reform the tax code and eliminate all of them and make changes if a loopholle is discovered. Most loopholles were intentionally put there by lobbyists.

Charging a tax on imports or federal sales tax on certain assets could be good. But, general sales tax can screw up markets and causes many bad things in an economy. A small sales tax shouldn’t have too much impact, but should remain small ideally no more than something like 5% total. Sales tax and VAT is very easy for the rich to get around, they can go on big shopping trips abroad or even possibly buy things online in foreign countries, but can avoid VAT. It also doesn’t apply to homes and money taken out of country.

VAT exists in Europe, because of how small the countries are and how frequently stuff passes between them, before it’s finished. It’s less relevant to america, especially as automation and most consumer goods soon to run out of innovations will result in less steps in production and fewer links in the supply chain. Also VAT is needed in Europe, because of a lack of unified tax rules (each country should tax in a similar way, but doesn’t).

Lower income taxes and higher sales tax/VAT is the worst imagineable tax system and is extremely regressive. And you better believe what costs how much sales tax will be heavily skewed.

When you look at an economy like Germany, which seemingly looks almost perfectly run and despite having a very efficient economy the average jo doesn’t really have that impressive of a living standard, there’s a reason for that. Mind you, it’s still one of best places to live, but an average jo there should be much richer than they actually are. The Germans on average live basically the same as the rest of the EU. Letting the top have too much money actively screws up the system.

Much higher income taxes that actually reach the top 1% and top 10% to a lesser degree are necessary in any country to restart economic growth. Real economic growth happens when the average jo isn’t struggling. It’s also when the most meaningful technological progress happens. Actually having real competition and many other things are needed as well.

“I’d even support some type of subsidizing of housing in the sense of government contribution to a mortgage for those in lower pay scales.”

______________________________-

if the government would get the existing subsidies out of the housing market (HUD, FHA, VA, etc.), housing would be much cheaper.

Why not pay those poor people $200 per hour? Better yet, have the business pay them $400 per hour. That will make them all rich, (if they can find a job)

Richland, at $200 – $400 an hour they would have to pay high taxes. I’ll bet that wouldn’t go over well with them!

Absolutely! The high school kid who just learned what it means to show up on time and put the bread on top of the canned beans should make as much money as the woman who runs the regulatory department for a biomedical firm. Any person who can fog a mirror and has the most basic skills that provide a modicum of value to a commonly should be paid an hourly wage that can support a family living in a 3/2 with a nice yard and organic dog food for the dogs. Let’s pass a law that prohibits a willing worker who is unable or unfit, yet, for a competitive job from entering into a compact with a willing employer where the employee can cut his or her teeth and earn more responsibility and better pay as the value they contribute to the company grows – we can call it the living wage law and it won’t have any unintended consequences, I promise.

I posted too quickly. I also want to point out how unfair it is for a star basketball player – something anyone is capable of becoming if the right laws are passed – to get paid millions of dollars per year, and for what? Just because they have the talent to draw in many tens of thounsands of fans to the sport? The point is that it’s just as rare to find a produce person as it is to find a doctor, engineer, professional athelete and the benefit to the community from any kind of labor is practically identical both to a business and to society. A star athelete helps to sell millions of dollars worth of tickets and merchandise, and the local taxes that are generated are practically the same as the what the produce guy helps to generate.

Do people really not understand this stuff? How is it possible that a building inspector can’t make as much money as a certified welder, but a certified welder can make as much money as a licensed engineer but not as much money as a surgeon? And why is a stylist allowed to make more than a waiter? Who decided that guy with the Class A license delivering the kegs should make more than the barkeep who dropped out of high school? Don’t all of those occupations require the same aptitude, commitment, education, sacrifice, training, risk, dedication, etc…? And aren’t those occupations in equal demand? What am I missing here? Since we’re all capable of the same feats in life, I say a welder can make as much as a surgeon but only if a dental assistant can make as much as the guy who works the counter at the pet store. Is that a deal, everyone?

This is one lot of sarc or one lot of crazy.

I think you are close to the answer BuyHighSellLow –

If we just move the minimum wage to $200,000 per year, we can all be very comfortable.

MCH,

I understand you’re trying to be funny. But it’s not funny. People who make hundreds of dollars an hour don’t understand what life is like at $15 an hour. So it’s easy to joke about it. But it’s not funny.

I immigrated from Italy to this wonderful country as a 10-year-old with my parents. I’m from southern Italy, a beautiful land blessed with wonderful people, most of whom, much like my parents, lack a good education and financial resources. I watched my parents struggle to keep their business afloat and make ends meet, but we made due and we never stopped striving. I only wish they could’ve averaged minimum wage for the first 15 years of their quest to give my brother and me a better life. They made bad decisions and had to learn how to make better decisions. I know what poverty is like on two continents.

If ones life is on a flat trajectory, a self imposed stagnat existence in the labor force, whereby income potential is proportional to the lack of personal and professional investment in oneself, I find it implausible to think that artificially increasing the value of someone’s contributions to the labor force via a minimum wage should cure the woes of life at $15 an hour when the world around them will adjust accordingly.

There should be a minimum wage, without question. However, the question that always gets dodged is why only $15 an hour? Because somehow the markets will not circumvent the artificial increase at this magical amount?

My second job in high school was working part time for my woodshop teacher who had a shop outside of teaching. He started me out at $12 an hour back in 2003, which was almost twice what I was making working at the local ice cream shop. He knew I was making minimum wage at the ice cream shop, but he saw my skill improving over the course of one year in his class and paid me what I bacame to be worth. The kid scooping ice cream was worth ice cream scooping wages, until he learned a little autcad and basic joinery, and then he wasn’t worth ice cream scooping wages any more. The work was more difficult but it was also infinitely more satisfying and, in retrospect, it taught me something about personal potential.

I don’t pretend to know the answer, but I have to ask: if today there’s a kid working at an ice cream shop making $15 an hour, does the wood shop now offer the kid $30 an hour, or does the shop pay the new $15 an hour minimum wage and the kid figures it’s easier work scooping ice cream for the same money as cutting dovetails? Oh, and what about the three-year apprentice who was making $25 an hour at the wood shop, how much is he going to get paid? And one last question: how much of a raise does the wood shop owner get?

The topic at hand isn’t minimum wage, it’s unfortunately inflation. UBI and minimum wage are accounting variables that can’t be calculated until you decide the inflation percentage for your time value of money and future value of money calculations. Without that inflation number it’s not possible to calculate a minimum wage or UBI.

On your last question, the wood shop owner had to start the business, buy all the tools, pay the taxes, hire an accountant, buy insurance, etc. He took the RISK and any money he makes after paying all the bills, is his reward for taking the RISK. It has nothing to due with his hourly wage.

The answer to the minimum wage story is simply for congress to determine a reasonable level and then peg it to inflation so we don’t have this constant political football. Not raising the minimum wage for a decade or more makes no sense.

More importantly, the federal minimum wage needs to take into account regional differences and not necessarily be what’s right for all regions (because then it may be too high for other regions). States and cities need to bump up their minimum wages if it is warranted (e.g. Seattle).

Lastly, the arguments on both sides are old and tired. The idea that raising minimum wages will destroy businesses doesn’t take into account that the clerk who gets an increase is then going to purchase more goods, go out to eat more, travel more etc.

Allowing those at the bottom to have a little more money means that virtually all that extra money will go into the economy, unlike money that comes into the top – which goes into stocks or even overseas. Isn’t it better for stocks to rise because they have consumers spending more money rather than going up to overpriced levels because the wealthy have no where else to put their money?

I’m not against raising the minimum wage, I just don’t think it’ll work as intended. And excellent point about regional parameters that must be part of the equation. Maybe raising the minimum wage will have more positive outcomes than negative ones, I would say run the experiment and let’s see what we can learn from it.

One cautionary thought, however. If we wanted to write out a plan to raise the minimum wage and have that effort fail at its objective, here’s how it would probably play out: every year we let tens of thousands of people migrate illegally so that there is a fresh, constant supply of people who are desperate and willing to undercut the labor force to compete with those in similar circumstances who came before them. In other words, do we continue to import a de facto underclass of people without also figuring out how to STOP them from being exploited, or does raising the minimum wage also take care of that? Hard to stop the exploit as long as there’s paper money around.

Wolf, for the first time I call BS about understanding. I have quite a number of friends who make hundreds of dollars per hour. I worked with them when we were all making under ten dollars per hour. We know about Campbell’s Pork & Beans, pasta with oil and garlic, and ketchup sandwiches. And sharing a roof and a car. It wasn’t funny then and it’s not funny now. The people we need to help are those that are sufficiently physically and/or mentally disadvantaged such that they cannot effectively work in our economy. The rest need to learn to make better choices. — OK, I probably deserve what’s coming. ;-)

This is such a boomer POV lol. Grow up in the easiest economy of all time and think it’s because you made good choices. Yep, there’s no systemic issue at all and inequality is only increasing because of poor choices.

good start LH, but some of us older folks on here might remember the mantra I had almost every day growing up, from a parent who went through the depression formerly known as the greatest, up to now,,,

”better eat every bite on that plate youngster, we might be back to jam sandwiches any day.”

A jam sandwich was when you took two pieces of bread and jammed them together…

Phoenix, I’m a millenial and in 100% agreement with Lisa. Though, I don’t think this is an age-specific viewpoint. This is reality for many of us who came from nothing or less, and watched *some* friends and family slowly build their life up, working extremely hard in the process (often multiple jobs for each parent was the norm, with kids helping after school for example), to reach a financial or life goal. Amazing how many immigrants end up doing very well in the US, even though many don’t have more than a couple grand upon entering the country (or less depending on when they came over), without speaking the language, knowing the culture, etc.

Wolf,

Not really trying to be funny, other than the dark humor that’s involved here. The concept of living wage is completely broken in this country, it varies so significantly from one part of the country to another, it’s laughable to think that any Federal mandate would fix this kind of problem. BTW, from someone who worked at a fast food earning far less than half the $15/hr in my youth. I entirely understand what it’s like to try to survive on minimum wage.

The real point here is that mandating these types of minimum wages is a feel good measure that doesn’t do anything to address the basics of supply and demand. It also fundamentally ignores other forces that at play which will very quickly overshadow any gains of those feel good measures. For example, how quickly inflation is eating up whatever wages that does manage to make it through, or the huge debt these ideas will impose. Not saying that I am opposed to rules or regulations, but these ideas that are coming from our government is becoming increasingly nonsensical when you take into their actions as a whole.

That said, you are completely correct, I did derail the thread in an unintended way. I would fully support deletion here. Because, as I said before on your comment section, we are here at your pleasure, and we should never complain if we are booted because we aren’t playing by your rules.

MCH said: “The real point here is that mandating these types of minimum wages is a feel good measure that doesn’t do anything to address the basics of supply and demand.’

————————————–

it distorts the basics of supply and demand. It temporarily increases purchasing power of those who get the raises. It pushes up wages of union workers, government workers and those skilled workers with relative bargaining power. It shifts the tables against those with low incomes that are unable to do work or gain employment. It trickles into inflation and boosts prices and rents. The larger the asset owner, the better they love it. It provides cover for the money digitizers and problem makers – the FED, Wall Street and politicians.

Cb,

Supply and demand of labor???

As long as labor can be outsourced to cheap countries, and as long as an unlimited supply of labor can be brought in via legal and illegal immigration, there is unlimited supply of labor and limited demand for labor.

This is the wage repression system the US has had in place forever. Without minimum wage, the bottom end of the wage scale, given unlimited supply of labor, would be near zero – meaning starvation. So minimum wage was put in place, instead of closing the borders and massively taxing the offshoring of labor.

@ Wolf –

That minimum wage was put in place and it keeps rising along with money printing. The answer is to stop interfering with the markets and protecting asset holders via bailouts and money printings, thereafter trying to inflate away the debt burden through interest rate suppression, minimum wage raises, government pay increases, etc. The answer is to let asset, and housing prices fall.

And you are right, our immigration and outsourcing policies have been an assault against the working and the middle class, all in favor of the heavy asset owning class. Pathetic.

@ Wolf: “Supply and demand of labor???”

_____________________________

I was mostly talking about shifting purchasing power which pushes costs and inflation and negatively impacts savers, the destitute and the elderly and disabled on low fixed incomes.

All the inflation inducing efforts are a great bailout for the the FED, the Banksters, Wall Street and large asset holders. Rental property owners love them as their cash flows and property values benefit from upward pressure.

Oh, and the large asset holders love huge immigration. It expands the market for goods and services, reduces the cost of labor and drives rents. As for the working American —- best to have them like serfs — they are much more agreeable that way.

MCH,

I now see that you derailed this comment section with this STUPID comment.

When you post the first comment, it comes with a responsibility not to derail the rest of it. I should have deleted this drive-by nonsense.

MCH,

If you don’t know what I’m referring to with “stupid,” it’s also called: reductio ad absurdum

To be fair Wolf, 75% of your regular commenters do the same thing wrt logical fallacies. They can’t help themselves

That’s true.

all comments contain logical fallacies, including this one, eh fire bird??? LOL

all seriousness aside, that alone seems to be one of the major factors in the lack of progress in the hard sciences in the last few decades, more or less since Einstein went to that great physics challenge in the sky…

for better or worse, what we as a species seem to be failing to grasp fully is not only the inevitable downslope of any kind of ”social engineering”, tons and tons of which have been applied globally since, say, end of WW2, ( hopefully applied in the hopes of avoiding any such global catastrophe in future, which seems to have happened in spite of the ”local” wars and ”police actions, etc.), but the full on need to forge ahead with total or almost total support for the hard sciences that were clearly very very important in that war.

This is a massive and rollicking sidetrack! I never make the first comment because the responsibility is too great!

Happy1,

I think it’s the biggest most massive sidetrack ever on this site :-]

One problem with higher minimum wages is that, while they give an initial boost to those who receive them (and often a nice boost, too, to unionized workers whose pay is a given amount above minimum wage), they ultimately just raise the cost of things, especially housing. [More competition for a set amount of space=higher rents, because large cities often resist new housing construction.]

The $16/hr minimum wage in San Francisco is responsible for high cost of housing?

I would argue that the past year shows that cost of housing in San Francisco is independent of minimum wage and very dependent on high wage earners living in the city.

We need to diversify away from the US, a country where the center of all issues seems to be how to serve old homeowners with healthcare issues.

I’m young, healthy, renter. The US doesn’t offer me much and I rather ask said homeowners to use their home equity for their healthcare, for example and become renters like myself.

When it comes to housing, the US doesn’t have much to offer, but countries abroad do. Hence, remote work is just a way to get there.

The most valuable thing in every human being’s life is their time. It is finite for all of us. We only have so many days on this earth. It does not matter if we are talking the CEO of a Fortune 500 company, or the janitor cleaning offices on graveyard shift, their time that they pledge is of equal value. For too long, too many peoples’ time has been taken advantage of. The system is rotten to the core.

Years ago somebody calculated the value of a human life. I forget the metrics that they used, but the conclusion was that a human is worth $10,000,000 or some such. There needs to be a calculation for pay that takes into consideration the value of the life of a human being where everybody’s base pay is derived from that, then they get bonuses based upon skill level, education, etc.

Totally agree, with your first paragraph. Then you get to “After all, why should your grocery clerk be paid less than a computer programmer or an engineer. ” I dunno, maybe because one of those job classes requires high intelligence, skills most people are incapable of, and important to advancement of our society?

Where would we be without Candy Crush?

And here I thought that Karl Marx had been thoroughly discredited.

I can think of several reasons why a grocery store clerk should be paid less than a computer programmer or an engineer.

Marx has been disparaged, disputed, despised, and disingenuously distorted, but he has never been discredited.

Gene/two (as you intimate)-have always observed ol’ Karl being rightly demonized for his bonkers, disregard-of-human nature solutions to the age-old economic/social exploitation of general humanity.

Have yet to hear, however, a convincing argument refuting his extensive analysis and critique of capitalism preceding his proposed remedies.

One outta two ain’t bad, but lends only another informational viewpoint to a situation that has never, long-term, lent itself to binary thinking…

may we all find a better day.

Minimum wage should be imposed on a State and County wide basis. NYC has a much higher cost of living than say rural Arkansas. National minimum wage doesn’t make any sense. Should be adjusted periodically based on the Cost of living increases in the particular area, just like the military does.

You clearly have never owned and operated a business. This topic requires much more explaining and discussion, rather than simply saying pay your fair share, and equitable distribution.

Wake up an smell the homeless MCH… SF/Oakland property values will decline to to Detroit levels

Here is traditional housing math that was true for the last 100 years before funny money/bailout/taxpayers guarantee all mortgages nation.

As interest rates go up, housing becomes more affordable.

The average house should cost no more 33% of household take home pay for all housing costs (P/I, taxes, utilities, insurance and basic maintenance).

Average housing costs should be about 120x average monthly rent.

Housing costs should only rise by about the rate of inflation.

The solution is for many of us to become remote workers and leave the US. This country is not offering the young a good deal anyway, and Europe and Latam can offer a better quality of life already imho.

Taking jobs abroad helps other countries too to diversify their economy.

Most of the highly livable places you describe.

1. You can’t buy property unless you are a citizen.

2. Tough and enforced immigration and work permit laws.

> Most of the highly livable places you describe.

> 1. You can’t buy property unless you are a citizen.

This just show lack of resourcefulness.

The only ones thinking they determine “desirability” for the rest tend to be NIMBYs. To me, living around NIMBYs is what’s undesirable.

BTW Buying a 1 euro home in Italy, every week a new country issues visas for remote workers. We need to get out of the US if we want housing and healthcare to make sense.

I’m coming from a super healthy family, the time we are willing to put to extend sick years is negligible in comparison with what Americans are willing to trade of their own healthy years, a gross amount imho.

A D-Visa is very hard to get in Italy. And you are unable to apply if Decreto Flussi is not open.

There is no visa for a remote workers.

>Europe and Latam can offer a better quality of life already imho.

I completely agree! Especially affordable to live in Eastern Europe. If you’re a techie/mba-type, you’ve got it made. Many Swedes I know and work with have moved to Poland to work remotely, making the same money, while paying 1/4th the housing cost, and enjoying much better food and beer. :-D

I don’t know where you are, but around here the back of the envelope calculation used to be 100x rent for house prices. And they were 2.5x incomes, max. Now they are over 10x.

Society in the US might benefit from lower longevity given that housing supply has been made inelastic by the NIMBYs.

Young families need housing in order to have kids.

Better for the old to have lower longevities than for fertility rates to be dictated by housing affordability.

As a home owner who rents people think it is all luxury and opulent. It is not. I always think back and wonder why I didn’t keep the first or second rental property in SoCal. Then as I get hit with another un-expected water pipe that burst, before that was the water heater have a massive failure and destroyed the brand new flooring I had installed. Then last year there was the electrical catastrophic failure that needed emergency crews at emergency rates to get the power working again. SO there goes several years of reserves in about 15 months. Told the renters they have 60 days and that I would be moving back into my unit. It is not all milk and honey with people who really don’t care about the property

I get your point, Nathan. I also rent out a house and plan on buying another for the same purpose. My son does the same. But this article is not about small time landlords, it is about landlord corporations chasing the almighty dollar. We rent our homes out well below the going rate as a reward for good tenants and to keep them from moving on…..kind of a win win situation. It’s enough return for us and a fair arrangement for all concerned.

This was a very good article and what was said needed to be said. I often ask myself where will it all end in the States? So many citizens dodge paying taxes. Health coverage is prohibitive. Housing costs are unaffordable. Food prices are rising, and fat cat pols are fighting $15/hour by 2025. Think about it…if someone gets that proposed wage it works out to 30K per year if they land a full time job. You can’t begin to live on that and it isn’t even offered until 2025. It is right out of a Charles Dickens novel.

Every few weeks Wolf writes an article about ‘debt serfs’. We might as well just write and read about serfs….period. Rent serfs, cost of living serfs, no education serfs, poor healthcare serfs, etc etc. It’s brutal out there, and getting worse.

My father in law started out with nothing, raised in Manchester during the blitz. He moved to Canada in the ’50s and never looked back. My dad started out in the Great Depression as did my mom. Barely high school, but they did well in life. F I L had grade 8 due to the war. Neither would have had a chance in today’s World…..not a hope in hell of prospering. They would have been the working poor, unable to afford rent. When they excelled in their careers and business the wealthy were taxed over 70%. CEOs made just a few times the average shop floor wage. Reagan’s trickle down sop was a pile of crap. A reckoning is long overdue.

In California, landlords are all in on higher minimum wage – the higher the better. It just gets magically pushed into higher rents,

Minimum wage won’t solve the problem in California. It will just band-aid the problems for a while, a short while. The problem is concentrated power and wealth, promoted by the the money printers and financialization and assisted by big special interests and politicians.

> Minimum wage won’t solve the problem in California. It will just band-aid the problems for a while, a short while. The problem is concentrated power and wealth, promoted by the the money printers and financialization and assisted by big special interests and politicians.

The problem in California and Colorado are the NIMBYs that make housing supply inelastic with outdated regulations that incentivize the least energy-efficient form of housing: single residency.

They then claim to care about climate change when it’s time for their home to get burn by wildfires. People are too greedy for their own good.

“It is right out of a Charles Dickens novel.”

Much less so if you don’t live in SF, NYC, or a handful of other mega metros, which, despite their own claims, are not the sole places on Earth fit for human habitation.

Pretty sure the pitched wage was not limited to the highest cost metros…

YES P, THE reckoning is long over due,,, that’s for damn sure!

Only point I disagree with is your ”not a hope in hell of prospering.”

Young neighbors/friends, brothers not even HS grads, have gone two ways:

One as retail clerk for a while, now training with high tech manufacturing as assembler/QC inspector making well over $15/hour while still learning.

One the full on slave to illegal drugs bum, won’t work, in and out of jail,,, etc., etc.

Other has gone to work in the landscape biz, for good wages for being a tree climber at first; 8 or so years later, after taking the time to study for and pass the appropriate exams to be state certified, now with his own biz making very good money = far more than local union electricians, and he has more demand for his services than he can handle because of attitude and performance.

Seems to be lots of potential out there for those willing to work hard.

And, most importantly – LEARN, and NEVER STOP LEARNING.

LH-so, so true. Would add that this will likely keep you happier/healthier longer. (Have seen too many of my fellows (probably not now, as the U.S. employment environment has greatly changed over my seven decades) leave high school/college, with their only goal being to ride the time-clock train to a ‘retirement’ which was unexpectedly unhappy and short).

To borrow the last line from R.A. Heinlein’s list of ‘what a human should be able to do’: ‘…Specialization is for insects…’.

may we all find a better day.

Fyi…here n Boston, downtown, I pay $20/hr. No one will work for $15. State law is $13.75

A good place to acknowledge 91B20’s ace post and this one.

Milton Friedman and that whole contrived “Chicago School of Economics” will be forgotten, Marx won’t.

Make that “posts”.

I have a friend that often uses the phrase “insect conciousness”……disparagingly. We are both glad we spent most of our lives being unable to easily answer the question, “what do you do for a living”. But when we were young there were all sorts of little companies doing all sorts of things.

The most evil socio/economic/legal construct ever invented, the “corporation”, ate them up or just bypassed them entirely in the relentless quest for “economy of scale”, and of course ridiculous wealth for those few at the top.

I really hope all the kids of today don’t just accept the fact that they are essentially living at the very bottom of many chain letters, and get very, very pissed off about it. As pissed off as at least a few of us old hippies still are about “conspicuous consumption” or “displays of excess”.

Why we had so many sell outs is still a mystery to me, but I suspect it was relentless advertising, of stuff and lifestyle, and things like “turn off the lights Alexa” have now gone into the realm of the absurd.

NBay-thanks for the nod, and back atch’a.

(your experiences vis ‘what do you do do for a living?’ resonate strongly, here. Would answer with a Don Everly lyric “…and if you ever wonder why you ride that carousel, you did it for the stories you could tell… ).

I often wonder, as well, at what you’ve termed the ‘sellout’. Perhaps if one bought into (pardon pun) measuring one’s self-worth simply and solely by the expedient of increased net (or highly-leveraged) worth? Flash the numbers & the toys and that’s all someone else needs to know?

may we all find a better day.

I left London years ago. It has since become a feudal rentier state where the Zirp allowed vast amounts of leverage to be used to exploit the inhabitants. I knew a guy several years ago who was manager of an overground railway station in a working class suburb ( a responsible and well-paid position) of the s.e. but could no longer afford the private rent and was in a hostel hoping to be allocated a social housing flat or studio. He was last in the queue. I knew, then, that the country had become totally corrupt.

I am shocked, shocked that government council housing did not fix that problem. Apparently America had it’s own failed experiments with public housing. The saga continues.

One could argue the Homestead Act was a major driver of the settlement of the American west and a huge success.

You could generalize such conclusions, but only if you believe someone wrote “We hold these myths to be self evident”. Legislative intent has been regularly defeated by corporatists. Federal lands in Oregon were ending up sold from homesteaders to lumber operations where some of these guys appear to have been nothing more than front-men for the interests in the Southern Pacific Corporation of Kentucky and some San Francisco banking concerns. It is a very convulted mess that sometimes goes to incorporations in Nevada but operating out of the bay area. We will probably never know just how deep the filth went, nor how widespread it may have been in other states. There were some positives that came of it on the surface, but it sure did not play out as intended…public lands meant for settlers ending up in corporate hands was not the idea. (Too bad we don’t take the issue of Treason seriously enough.) And don’t get me started on the myth of the GI Bill.

Don’t mention the GI Bill here. A lot of people here think it was their god given right.

The G. I. Bill helped me get through engineering school right after I got out of the military in 1868. I earned that money ($222/month – paid for tuition).

Evidently Harold thinks the $10K your family got if you came home in a box was sufficient.

As long as tech stocks are where they are and the market keeps making new highs, housing in the Bay Area’s not going to become affordable. There’s far too much money in the area from the techies, enriched by their high salaries and stock options, for prices to go down. If people end up going back to the office, which is a possibility, then rents will go back up to where they were pre-pandemic because whatever landlords and builders charge techies, they know they will pay. It screws up everyone else further down the ladder but that’s the reality.

A major stock market crash is what’s needed to reset things a little.

DIH

I agree. Cities are wealthy (or poor) based upon the industries which support them. Before becoming a private lender, I owned rental homes. A GM plant closed in Ohio and rents in the hood dropped 25% overnight, as did the home values. Lost a ton when I sold it.

WOLF makes an impassioned plea, but SF rents and home values will (or have) flattened. DotCom bust #3 is the only cure.

Or a 1% interest rate hike.

But I merely echo you…

“One thing leads to another,

Then it’s easy to believe,

Somebody’s been lying to me”

Oh Fed, SF housing needs its next Fixx

yes

The idea that it is now only $2650 a month, is simply nuts!

That amount is not “normal”!

I won’t be moving to SF anytime soon!

MCH

There never has been and there never will be a consensus on “equitable distribution” of wealth. One person’s opinion may violently upset another. This is not the kind of issue settled by a group hug.

The “social justice” solution is to have a Bunch Of Guys Sitting Around Talking (aka: BOGSAT) – union activists, priests, couple lawyers, university professors, homeless advocates, government poobas, you get the drift, who are somehow blessed with the ability to divine an “appropriate wage for job X” (literally out of thin air), and impose it on employers & job applicants.

The BOGSAT must also determine how many of each job title will be allowed to exist to control scarce or excess demand. This foolishness inevitably cripples the ability of a society to generate wealth (name an true socialist or totalitarian regime that’s succeeded at producing significant wealth). You can’t distribute what you can’t produce.

The BOGSAT is commonly tried in various incarnations of socialism and stripes of totalitarian regimes. It doesn’t matter if it’s well intended or Stalinesque- employees and employers end up being mismanaged by unaccountable bureaucrats, forcefully telling others how to run their lives.

…now perhaps if we actually had a culture where parents and kids understood the correlation between a good education and reasonable control of your own future, we’d also recognize way too many of our school systems (we’re talking about you, California) have been declining for decades.

Productivity, not a BOGSAT, is the key to higher wages.

Productivity. Yes.

But with the results of productivity being left with those that produce (at least largely), as opposed to the results being fully skimmed off by those that finance the process.

“the results of productivity”

Presently Capital hires Labor. Why should this be the arrangement, when it is Labor doing the grunt work?

Turn it around to Labor hires Capital (and Management), and the world would look very different.

Nobody is keeping “labor” from aggregating their capital/labor and starting their own businesses based on wholly non hierarchical principles.

In fact, nobody has come close to stopping them for 100+ yrs.

And, yet, there are very, very few labor Co-op businesses out there.

Why?

Cas127 said: “And, yet, there are very, very few labor Co-op businesses out there.

Why?”

________________________________

I’m sure it has nothing to do with the lack of capital or opportunities that most laborers have.

Very well said, Javert. Reality is messy, but it works. Theorizing, however, puts us on a Procrustes’ bed, and whatever doesn’t fit gets chopped off. Ultimately, it is destructive and brutally inhuman.

I refer those that disagree to read “The Road to Serfdom.” A short book.

Growth for growth’s sake is the ideology of a cancer cell.

I am in San Diego and housing market is on fire

Everyone who owns a house or two thinks this time is different and the home prices would keep on going up

Some person has reason that FEd won’t let the assets price go down

I feel we are special in San Diego and this time is indeed different

)

Sure it’s different, just like the stock market, and GME, this time, it’s different, cause we’re special…

You folks make me feel like I am special, even though I live in Texas!

I always liked “I wasn’t born in Texas, but I got here has soon as I could.” The last few years not as much.

Definitely seeing more “Welcome to Texas, don’t mess it up!” these days.

In fifty years, who among the Texicans will be chanting “Remember the PayPalamo!”? Anyone heard “Don’t Californicate Oregon” lately? Calli Kulture is a viral monster which flows down the river basins of interstate highways. There is no aquired resistance by any population group. Once infected, mutations appear everywhere. Cowtowns will fall to Spandex Levis.

Buy-just the descendants of Depression/Dust Bowl refugees going back home. As someone whose ancestral families came to CA in 1910 (Sweden) and 1932-6 (AR/OK/TX/KY/TN), i can only concur that CA is now living proof of the great Berra’s observation: ‘…no one goes there anymore-it’s too crowded…’.

Verbal rocks are often heaved at the Golden State by those in other states, but who now seem to blanch at the prospect of their wild geese returning to their little slice of (?) heaven. Folks will ALWAYS move to where better opportunities may only be perceived, and CA has been dealing with that type of influx longer, and more recently, than any other state in the union. Prepare, for it appears it’s your turn now-and, who knows?-given enough time it could be ‘…as goes (fill in name of your state here) , so goes the nation…’.

may we ALL find a better day.

Yeah, I know. San Diego seems different this time. Inventory is practically zero. Rents are up. This time it’s different. Prices will never go down again, not in San Diego. It’s a bullet train to the moon! ;)

Waiting on the sidelines,

Turtle

I work in hi-tech and most of my friends in bay area are looking to exit California for good

They earn good money 200k or so but can’t afford anything there

A lot of companies are enabling remote work and or moving head quarters

It won’t take all to move out even small numbers would make a big dent

We live in a rentier society where landlords (and renters of money) get to extract the productivity of others. Wherever you have concentrated ownership, you will have those that own squeezing those that don’t. The economist Henry George wrote about this in the 1800s.

Some of the most successful capitalists live off of rents? Let others do the hard work of business, of providing goods and services. Much better to own property and collect rents. Then you can extract your pound of flesh from the business owner, and extract a few ounces from his employees.

A few things to reduce housing costs, which is a terrible burden on our society:

– End the FED

– end interest deductibility

– end depreciation for rental property

– disallow foreign ownership of real property, particularly residential property

– discourage corporate entities, private equity, and other collectivization of capital entities from investing in residential housing, particularly 1 to 4 unit properties

– eliminate all subsidized lending, ie HUD, VA, etc.

and so on …..

–

End the tax deductability of advertising, a useless product that does nothing for the country. That would lower costs and raise taxes.

Want to raise wages and lower housing costs? Restrict immigration, which is the main driver of population growth and housing “shortages.”

“If California’s growth continued at the pace it did from 1960 to 2000, then there would be one person per square foot in the state within 300 years. Soon after, he said, people would have to “stand on each others’ shoulders” in order to fit.”

“Under former President Donald Trump, the US forced more than 70,000 migrants from Central America and other parts of the world who were seeking asylum at the southern border to stay in Mexico until their immigration court hearings in the US. Post Biden’s executive order, the asylum seekers who arrived Friday were transported to a hotel in San Diego where they’ll quarantine for a period before relocating, said Michael Hopkins, CEO of Jewish Family Service of San Diego.”

“Hopkins underscored the gravity of the day, drawing on past experiences with asylum seekers who have come to the organization’s shelter.”

Landlords rejoice!

Is advertising REALLY tax deductible, like across the board, all of it? No limit? Like buying capital equipment? Help Wolf!

If true it really changes my viewpoint on a whole lot of things. I looked up “advertising” but couldn’t find any mention of it.

NBay,

Yes, advertising is tax deductible for a business. It’s an ordinary business expense, like rent. You can even deduct it if you’re a sole proprietor and file a Schedule C.

In terms of limits, I’m not aware of any.

There are some forms of advertising that are not legal in the US (to commit fraud, etc.), and I don’t know what the deductibility status is.

And something to democratize housing costs, specifically worth mentioning:

– eliminating rent control

cb,

The way rent control is set up in San Francisco, it’s not a big issue. Only older buildings are rent-controlled. Rent control means the landlord can raise rents annually at a rate tied to San Francisco CPI, which is higher than national CPI. When the tenant moves out, the unit goes on the market at market price.

There are other cities where rent control can be draconian. But that’s not the case in SF.

Thanks Wolf. But remember, there are a ton of older buildings in San Francisco.

Yes, there are a lot.

But rent control applies only to apartment buildings completed before June 1979. All buildings built since then are exempt from rent control. Also, all condos and single-family houses are exempt from rent control.

In these rent-controlled buildings, the allowable rent increase for 2020 was 1.8%. This occurred as market rents plunged by 29%. If you live in a rent-controlled apartment, you have might gotten a rent increase!

There is a balance: once market rents fall enough, people in higher-priced rent-controlled apartments move to nicer digs. So the landlord of a rent-controlled building might not want to raise the rents – because this might trigger move-outs at a time of high vacancy rates and plunging rents.

Many rent-controlled units are dumps. When they come on the market, they compete with brand-new units that are gorgeous. So the landlord ends up having invest lots of money to bring the rent-controlled unit up to snuff. This takes many months in SF, where everything takes forever. And it costs a lot of money. So the landlord faces many months of no rent, plus tens of thousands of dollars in investment to get the upgrades done — as opposed to just collecting rent.

Rent-controlled units have a lot more stability. So in an environment like this, with a lot of churn and high vacancy rates, rent-controlled buildings don’t have above normal vacancy rates and they don’t see much churn. The high vacancy rates are in newer buildings without rent control.

And rents in rent-controlled buildings are allowed to rise at a rate a little faster than national CPI. So I just ran this through the national CPI calculator: rent of $1,800 in January 2000 in a rent-controlled building would be $2,800 now. So now add the SF CPI differential to it, and it might be well over $3,000.

During that time, market rents plunged by over 25% twice, amid massive vacancy rates! And the first time it took over 10 years to recover.

Rent control can be a real benefit for landlords in times like these.

@ Wolf –

Thanks for the education on SF rent control.

@cb – or you could eliminate all this fine-tuning crud and simply eliminate inheritance – everyone starts out the same. I don’t expect this to be popular with any parents.

It would also be unpopular with many trust fund baby beneficiaries. Watching the fallout could be a spectator sport.

Perhaps a bigger issue to even up the starting line, is to drastically curtail Corporations, particularly their perpetual life.

Lisa/cb-brilliant in sagacity and simplicity, demonstrating again some national myths we observe primarily in the breach (…well-shod ‘rugged individualists’ proclaiming that the bootless should firmly grab imaginary bootstraps to improve their lot (…conundrum being the difficulty of squaring an actual broad and unequal spread of individual human capability against the ideals of ‘equality’ in a nominally democratic society) while making sure that their own offspring possess a closet full of shoes. Offspring’s starting lines aren’t the same.

(Mr. Mungers’ comment today that wealthy families usually lose their quasi-dynastic money easily and often may be true of the 1%, but is it a case of most of those losses accruing to the .01%? Discuss.).

Munger and Buffet both preach their own interests.

The rich love to talk merit, as long as their wealth can rig the game.

91B20 1stCav (AUS) said: “(…conundrum being the difficulty of squaring an actual broad and unequal spread of individual human capability against the ideals of ‘equality’ in a nominally democratic society)”

_________________________________

True, but as has been point by Lisa, the begger conundrum is starting out at different starting points. You have a naked babe born to a poor, unresourced, unconnected family in a mature capitalist economy competing with those born wealthy and asset rich. What a joke to talk about a meritocracy in that situation.

cb-i’m afraid my overlong observational-cum-parenthetical sentence obscured that i’m in total agreement with you and Lisa vis starting points. (Ah,the apparent infinite ability we humans have exhibited in squaring/cubing conundrums!). My apologies.

may we all find a better day.

Great article Wolf. An impassioned plea for free market economics in your home town. It’s a no risk world until it isn’t. Funny how the no risk financial environment is juxtaposed with a seemingly high risk health crisis. Risk is a numbers game, and most of America sucks at math.

Can you have free market economics in a City where the majority of dwelling units are rented? where large numbers of units are concentrated in few hands? where rent control exists, and some tenants will never leave because they would have to pay more to rent a comparable unit in Oklahoma City? Where Prop 13 has legacy owners paying a pittance of property tax as compared to new “market” buyers? Where Prop 13 legacy rental owners have irreplacable yields, even with falling rents, due to low property taxes? Where Real estate is purchased as an escape valve by foreign entities wanting to transfer wealth to shield it from their country of residence? Where the FED is still active and suppressing interest rates? etc.

@cb – from what you wrote it sure seems that it’s government that screwed everything up,

While rents are dropping, car-dwellers continue to increase. The Sunset is getting downright clogged with RV’s, campers, and the trademark of the true amateurs: small sedans with towels hung over the windows.

Powell today on car price inflation not being inflation:

Car prices rising because of a chip shortage and supply-chain constraints in the tech industry “doesn’t necessarily lead to inflation because inflation is a process that repeats itself year over year over year” rather than a one-time surge.

Yes Jerome. Those chips became hedonically more valuable over night.

Keep in mind, inflation is probably about 10% now.

Housing: 10%

Cars: I checked Prius prices. Bare bones models were about $25k pre-covid. And still are list price. Except bare bones models don’t exist so you have to get the 30k car.

Healthcare: Need anyone say more?

Things I buy discretionary: sellers have dried up. What I paid $35 for pre-covid is now $40-45. No change in list price. No price increase. But if I want what I could have gotten pre-covid, those are the higher prices I have to pay today.

No Timbers, it is not 10%. Stop spreading fake news. :)

Cause Jerome says its not 10%, and so does the rest of the Fed.

Next you’re going to tell me that C19 is a government conspiracy. You need to follow the right set of rules that everyone plays by. Namely, the dollar is almighty, and the government is telling you the truth. Especially the non-partisan Fed, real inflation is negligible. I can’t emphasize that last sentence enough. I mean after all, that’s what the mainstream media is saying, are you calling out the integrity of our journalists in the trusted 5th estate?

And by the way, I have a bridge on one side of Manhattan I’d like to sell you.

:P

In terms of car inflation, it made me wonder if Powell is reading this site :-]

“inflation is a process that repeats itself year over year over year…”

You like stock markets, Mr. Powell?

Powell better be careful otherwise some reporter might connect the dots and ask the wrong (or right) questions.

*You mean like stock markets, Mr. Powell?

The reason inflation doesn’t necessarily assert itself is that consumers determine costs. If consumers can’t pay $2 a pound for chicken, there is no mass market. (High end shoppers pay these prices for free range organic we know). SF is not a housing mass market, although the bay area probably is. In SD we used to import service workers from TJ, but immigration was declining before Trump, and prices in TJ rising. Immigrant workers imbedded in local communities, resist more immigration (job competition). One measure in our economy is how many hispanics fit in a 2br apartment? In some cases I have seen merchants charge two scales, a lower price for their paisanos. Supermarket chains in minority neighborhoods rip off their low income clients, but the store we have is minority friendly. Stereotypes fall. Eventually the service workers bring down costs, and there are exogenous reasons for SFs rise and fall in housing values. Finally the wealthy want gated communities, and they leave, because nobody making six figures wants to live in a building where bums are sleeping under the awning, and downtowns like SF have always been incredibly egalitarian which is how it gained status as a culture center. I constantly consider the economic (inflationary) and cultural benefits of living in an area with a large hispanic population.

In December there was a 1.9 months supply of homes for sale in the U.S. One writer reported this is the lowest inventory of homes since 1982.

I suppose someone should start a new home price inflation index.

JNJ should get their COVID vaccine approved any day now.

The real inflator to watch is oil, the mother of all inputs;

WTI just hit 63$ or getting towards 50% over 2020 average.

The gov can exclude the price at the pump in CPI, but with oil being in everything one way or another ( plastic feed stock, price of e-commerce delivery etc. ) it will show up even in CPI soon.

Good point, Nick. A lot of people, smart and otherwise, really don’t know the extent that hydrocarbons are intertwined in much of what we own and use today.

Good call. When air/car travel resumes, the pent-up demand will push “obsolete oil” through $120 — maybe $150 before all the shut-in supply comes back online.

[Long $CVX]

When the “true amateurs” you refer so casually to above learn how fast and easy it is to steal and sell a catalytic converter, you will wish you were

[long $Rhodium]

Wolf,

Totally agree Wolf. It’s a damn shame, rents being so high. I agree with your targeting of rates and MBS’s. Are there monopolies in housing?, I think so. Some reits during the last financial crisis just scooped up housing all over the country. Affordability a big problem.

One of the other things that needs to be considered whenever discussing rent is the difficulty of creating new units. The process in many large cities is byzantine, raising costs and ensuring that only luxury and heavily subsidized units get built. Meanwhile smaller structures, housing 4 or 6 or 10 units get shut out. Over time, the lack of new units reduces supply and increases the price of renting.

One recent example I saw in Boston. A property owner wanted to convert his property, a former gas station, into a three-unit structure. One of the neighborhood boards was in favor, but another one is against, as is the local city counselor and two at large ones (one of whom is running for mayor). My guess is it won’t get built because of the opposition of one group of neighbors.

Thomas Sowell pointed out this problem decades ago. Clearly it has not been solved.