Actual rent collection data from over 11 million apartments and 80,000 single-family rental houses, compared to a year ago.

By Wolf Richter for WOLF STREET.

The CDC’s federal eviction ban was re-re-extended to March 31. Some state and local eviction bans have been re-re-extended further out. A number of internet surveys of tenants attempt to estimate unpaid rents and the number of tenants facing eviction after the bans end.

An estimate by the Mortgage Bankers Association yesterday, based on an internet survey of a few thousand renters, found that in December, 7.9% of them had missed or delayed a rent payment, or had made a reduced payment. From those surveys, it concluded that 2.62 million households across the US were behind in some form, and that landlords were owed “as much as $7.2 billion” in missed rent payments.

What these tenant surveys don’t explain is how many tenants were behind a year earlier, and how much they owed a year earlier, and how much worse it has gotten this year – because even during the Good Times, there are always tenants who are behind and owe rent and face eviction. Tenants that don’t pay rent are a normal feature of the business of being a landlord.

But there is data from landlords that shed light on how much worse it has gotten during the Pandemic, compared to the Good Times.

Based on actual rent collection data from over 11.1 million “professionally managed apartments” – corporate landlords that own apartment buildings, not single family houses – released by the National Multifamily Housing Council (NMHC) today:

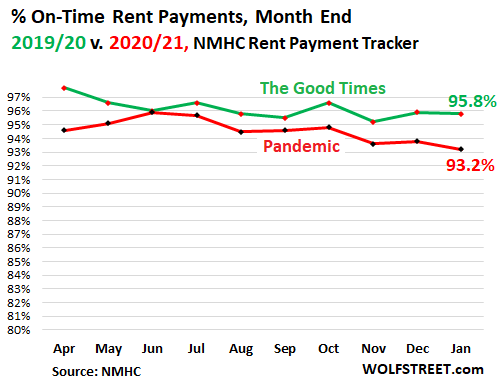

- Of the rents due in January, 93.2% have been collected by February 6, meaning 6.8% of the tenants were behind and at risk of eviction.

- Of the rents due in January last year, 95.8% had been collected by February 6. Meaning, even during the Good Times, 4.2% of the tenants were behind and faced eviction.

So, rent collections deteriorated by 2.6 percentage points: from 4.2% of renters who were behind a year earlier, to 6.8% now. This was the largest year-over-year deterioration since April, when rent collections fell by 3.1 percentage points from prior year:

The year-over-year deterioration of 2.6 percentage points for January, amid the 11.1 million-plus renters, means that about 289,000 more renters have fallen behind compared to a year ago.

These apartments, represented by the NMHC, account for about 25% of the total 44 million renter households in the US, and for about 42% of all rental apartments.

The NMHC obtains this rent collection data from five property management software providers (Entrata, MRI Software, RealPage, ResMan, and Yardi), used by thousands of larger property managers (rather than mom-and-pop operations). These are market-rate apartments in multifamily buildings. They do not include subsidized affordable units, single-family houses for rent or condos for rent, privatized military housing units, or student housing.

The largest landlord of single-family houses saw similar deterioration.

Invitation Homes [INVH], with about 80,000 houses for rent, reported for Q3 (it hasn’t reported Q4 results yet) that revenue collections deteriorated by about 2 percentage points, from a “historical average” of 99% of monthly rent billings to 97%.

Its “bad debt” from uncollectable rents rose from 0.5% of gross rental income in Q3 2019, to 1.9% in Q2 2020, and to 2.1% in Q3 2020. Given its $460 million in gross rental income in the quarter, its bad debt increased by $7.4 million year-over-year. It is likely that bad debt ticked up further in Q4, given the deterioration described by apartment landlords over the period.

But Invitation Homes also reported rising rents in its markets, to where its net income, despite the deterioration in rent collections and bad debt, ticked down by only 3% year-over-year to $33 million.

Both, the NMHC data on apartment buildings and the Invitation Homes data on single-family rental houses, show a deterioration in rent collections in the range between 2% and 3% compared to the normal rent collection problems during the Good Times.

But neither covers subsidized and affordable apartments, and other low-end units, where many of the people live that have been hit hardest by layoffs in the services industries, including restaurants, retail, and personal care. More of these tenants might experience greater difficulties in making rental payments.

Stimulus money helped pay the rent.

Note in the chart above that rent collections picked up in May, and in June caught up with June a year earlier, and remained relatively close to prior year for the rest of the summer, as the stimulus checks and extra unemployment benefits (which expired in July) were being used to pay rent.

A new stimulus package is being put together in Congress. Once that money flows into tenants’ bank accounts around the US, landlords will get a portion of it, as some of the renters that are now behind will use these fund to catch up with their rents, which is what many of them did last summer.

High costs, working from anywhere, and sudden dislike for towers trigger large-scale shifts in the housing market. Read... Big City “Exodus” & Distortions: Rents Plunge in Most Expensive Cities, Explode in Others. Boston Plunge Steepens, San Francisco Plunge Pauses

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The new $1.9 trillion stimulus bill proposed by Dems has earmarked considerable funds for housing-related items.

According to ZeroHedge:

* $25 billion for rental assistance

* $5 billion for the homeless

* $10 billion for direct assistance to homeowners for mortgage payments, property taxes and utility costs

I suspect these deadbeat renters will line up to receive their allotment of rental assistance monies, no strings attached.

Wolf’s article mentions that “landlords were owed as much as $7.2 billion in missed rent payments”.

So it might appear gubvarmint (if this bill passes intact) will make all the landlords whole and then some.

Then rinse and repeat in about 12 months. Hey, it’s all good till until US collapses from its colossal debt.

Its funny how everyone became concerned about the national debt after Jan 20th.

Up to 2020.. BEST ECONOMY EVAH… Cues Trump blaming it on tax cuts and deregulation, pay no attention that he was running up a greater budget deficit than Obama 2nd term.

Now Democrat in office . Deficits matter!

Thanks Two Santa Claus theory!

Harrold,

“Its funny how everyone became concerned about the national debt after Jan 20th.”

Nope. Neither funny nor true. On this site, we’ve been concerned about the national debt since 2011, when this site (or rather its predecessor site) started. A few years ago, around the time of the tax cuts, I kicked off my now infamous “debt out the wazoo” chart, which you will likely encounter once again over the next few weeks when the debt hits the next milestone.

well wolf – you should have been around during REAGAN years then

1st time POLITICIAN BOUGHT OFF RETIREES with $TRILLION A YEAR GIVE AWAYS – medicare then big pharma give away for drugs

you haven’t been paying attention to MASSIVE DEVALUATION(govt calls it inflation – I call it govt STEALING) since nixon went off gold standard

it’s been guaranteed DOWN HILL SLIDE EVER SINCE

Wolf

Since Japan’s DEBT to GDP is around 240%, many think we can follow them since we are at 120-130% !

Japan owns nearly 90% of it’s bonds. Will Fed do the same?

sunny129,

You cannot really compare the US and Japan in that respect. Japan has very little immigration, a big trade surplus, ultra-low unemployment because there is so little immigration, and a huge pile of foreign exchange reserves with which to defend its currency. The US has none of this.

The Quadrillion milestone?

Say, Wolf, should we make a wager here on whether or not we’ll see this milestone in our lifetime?

Well, that’s a little loose, how about in 20 years. That’s a nice solid number we can hang our hat on.

I’m wagering yes. What do you think?

The problem is that I’m not going to take the other side of the wager :-]

Come on, Wolf, the current debt it only 27 Trillion, to get to 1000 Trillion in the next 20 years, that’s pretty good odds for you if you said no….

In 2001, it was only 5.8 trillion, you’re not at even a 6x over 20 years. These are great odds, to get to a Quad, you’d have to go almost 40x.

You’d have to get a genetic mutant of Greenspan, Yellen, Bernake, and Powell amalgamated together to get any where close to that level of printing, that and a combo of Bush, Obama, Trump, Biden on some kind of super spending steroid.

:P

Wolf, why does having a huge reserve of foreign currency allow Japan to defend its own?

It can sell its dollar-denominated and euro-denominated assets (for example the $1.1 trillion in Treasury securities it holds) for yen, in essence buying yen, and thereby pushing up its exchange rate, if it wants to do that.

Got it, thank you. So basically, having a huge government debt is much more of a problem when the money is owed to foreigners than when it’s owed to your own people.

That intuitively makes sense, but I had never pierced together why. Thanks.

the “national debt” does not exist–it will never be repaid–according to a professor from univ of mi the true “debt” is at least 90 trillion -he has a way to sniff out expenditures,digital entries -the “national debt” is no more than a operating expense-as long as that is met it can go on forever—it is kinda like bitcoin,”fresh air in a can”!! it could go to 50 million a coin! who cares,it is all a game.like one digital entry chasing another… a big joke,but as long as the players are playing no end in sight–I expend about 100 k in digital entries per month and get back about 120 in digital entries-i take out 2000 in cash each month and put it in my safe–my silver holdings are in that same safe…what a pathetic undertaking–we are close to a bank lock up,credit freeze according to the Fed after their recent bank stress test–there is massive debt not being paid–it will take about 10 trillion to keep it all afloat–doubt it will work-this all started with the repo market 18 months ago–when the velocity of money goes to near zero it is over,no atm,no credit card payments,nothing….ugh

I’m really getting tired of this stupid meme from liberals “Republicans weren’t concerned about the debt prior to Biden taking over” and “Republicans had no issue with X or Y bailouts, so why not give $2,000 to everyone now?”

Many actual conservatives (not necessarily all of the charlatans in Congress pretending to be conservatives) opposed all of thus. I opposed TARP. I opposed the auto bailouts. I’ve opposed nearly everything Congress has done in the past 15 years, and I’ve said so strenuously, time and time again.

Nice work!

I don’t think whether we care about the debt matters. We have no control over it we can only control our own finances. I’ve been reading the book When Money Dies about Weimar, Germany. Regular people got hammered but farmers, people who lived in the country , and people who owed money did fairly well. Some interesting times coming down the pike!!

Cmoore, why would people who owe money do well? Wouldn’t the lenders take the collateral, even in a collapse situation?

RightNYer,

The debtors who had fixed-payment loans to pay off made out like bandits. Can you imagine paying off a $500,000 mortgage when you are getting paid $200,000,000 per week?

@right

People who owe money do VERY VERY WELL when there is massive inflation. The debt is paid back with weak dollars or marks. Even with low inflation – how many people do I know with “million dollar homes” whose monthly mortgage payment is a few hundred dollars?

No, many of us have been concerned for a long time, D or R in charge, whether born of tax cuts or excessive spending, or both.

But this particular bill is an order of magnitude beyond anything previously contemplated and is being passed before the last bill has even been spent, it’s lunacy.

“But this particular bill is an order of magnitude beyond anything previously contemplated…”

No it’s not.

If I google the cost of the corporate tax cuts for the rich, they are larger than $1.9 trillion.

If I google the cost of the GWB tax cuts for the rich, they are larger than $1.9 trillion.

If I google the cost of the GWB tax cuts made permanent by his successor, they are larger than $1.9 trillion.

Reds think deficits are only caused by spending and that tax cuts increase revenue. Just look at the claims made for all those tax cuts for the rich mentioned above. Or go back further and see how earlier tax cuts for the rich were sold as revenue increasers.

Timbers, nonsense. Those tax cuts cost that amount over a ten year period. Biden is trying to spend $1.9 trillion more THIS year (with more to come), after we’ve already spent $4 trillion last year on COVID “relief,” in addition to everything else that was spent.

RightNYer,

“Those tax cuts cost that amount over a ten year period.”

That’s not true.

Many/most of these tax cuts are still with us long after 10 years, with a far greater cumulative affect that a mere one time $1.9 trillion.

You also ignore other difference. Laffer Curve marketing, when Reds bombarded us how tax cuts increase revenue, not reduce it. Rinse, wash, repeat for just about every major tax cut for the rich like capital gains cuts for the rich. Same for Corporate tax cuts were sold as increasing revenue.

Reds think tax cuts for rich increase revenue

Reds think the only cause of deficits is govt spending.

Timbers, I’m not saying the tax cuts were a good idea. But comparing tax cuts that cost $2 trillion over 10 years and $1.9 trillion in new spending THIS YEAR is not an apples to apples comparison.

But comparing tax cuts that cost $2 trillion over 10 years…”

No, that is wrong. It is only one of the many tax cuts.

Again, you ignore:

Reds say tax cuts for rich increase revenue, only mostly only spending cause deficits.

“deadbeat renters”? What do you think the scheme is? “Oh, if I just lose my job during a pandemic and stop paying rent, there’s a remote chance I won’t have to pay a couple of months rent? I think the real deadbeats are the powerful corporations, the elites that run them, and the government pawns they control. The same deadbeats who have orchestrated the financial destruction of this country. “Deadbeat renters”… Give me a break.

Many people have gotten more than they made while working between the various “stimulus” and “enhanced” unemployment. There is zero reason for these people to not have paid their rents.

You are assuming they earned a living wage before the pandemic. The U.S. has been creating more and more empoverished citizens for a lot of reasons over the last 20 -30 years.

Like i have asked before here the national debt is a problem but what is the solution? No way can we pay it back. So far printing more money has not become a serious problem. There is no upside to taxing more for a politician so collapse or just walk away from debt is probably it. To me MMT sounds as rationale as any plan I have never seen to pay off the debt.

What would our economy be without the debt?

Of course the rational thing to do was not pay rent, live frugally, put everything in the stock market, and retire and not have to work. The Fed’s been telegraphing this for years.

You should see all the huge SUVs I see in the Walmart parking lot.

The little guys (deadbeat renters/homebuyers) are just emulating the fat cats that they envy.

Two wrongs don’t make a right.

But two Wrights make an airplane!

Three rights make a left.

Just saying…

2banana – I’m stealing that!

Amen.

Thank you,exactly!!!Obviously there are true deadbeats first in line fir any giveaway,deal,gov. Program,But like the uber driver I talked to who rescued a few animals and was also caring for two kids,Many people are barely making it or are in a leaking lifeboat saddled with health issues,bad credit,unreliable transport,unreliable family and daycare.These people work one or two jobs concurrently sometimes and then hours get reduced,the foodplant or whatever closes for a while unexpectantly(maybe a looted store-equity and all),or they lose onbe or both jobs.They now go to the back of unemployment/foodstamp hell along with tens of thousands of others.They may not qualify for unemployment because of the chaotic workhistory.

Heinz,

It’s alot more complicated than that. The actual job and money situation varies hugely by area. In my mine, it’s pretty good at the moment. It’s helped also by the fact it’s a lower than most cost of living area. In my area, most people live and own their houses, though apartments are definitely on the rise. An apartment renter tends to be low income to lower middle class in my area. If a tenant falls behind, even if there are programs out there, they usually won’t go after them, until they are at the point of eviction. Then they might start to figure it out, I’m not sure about these upcoming programs, but for the existing local rental assistance programs they don’t fully cover unpaid back rent, typically a tenant will come in to the landlord and say i can get half of the rent for this month from 2 or 3 different places (and they claim they will get more), accepting the money from these local charities, means you are not supposed to Kick tenants out, overall, it’s a very bad deal for the landlord and I dont any who ever accept it.

In my state, there was as part of pandemic relief a rental assistance program, I’ve never heard of anyone making use of it. For these upcoming programs, we would have to actually find out what’s gets passed and how it works. But in order for them to work, they must be very quick (unlikely) and cover entire ongoing rent (ideally, also back rent). For it to make sense for most landlords. Even if the program was quick and covered everything, alot more than you think, won’t make use of it, if there is an eviction ban ongoing. Ideally, the landlord could apply to these programs directly in exchange for forgiving unpaid rent.

Wolf,

I’m not sure why you focused on the more insignificant month to month numbers…CNBC and Bloomberg are showing the *total* cumulative Covid arrearages to be from $60 to $70 billion so far.

https://www.cnbc.com/2021/01/25/nearly-20percent-of-renters-in-america-are-behind-on-their-payments.html

That seems like the more important number (and I’m pretty sure there are higher totals out there…I’ll Google).

A running cumulative total avoids month to month reporting lags/mismatches/etc…plus it is the amount *somebody* is going to be made to cough up ultimately.

Cas127,

Do the math: There are 44 million total renter households in the US. If they all combined owe $70 billion, EVERY tenant in the US would be $1,600 behind.

This is just total BS.

They’re citing a study based on some internet survey of 1,000 renters. We have seen these “studies” for months. The numbers are total BS.

These analysts cannot even do basic math, or more likely, they’re running some propaganda operation for more stimulus money, and the reporters or algos doing the reporting are brain-dead.

That’s why I post ACTUAL numbers from one quarter of all renters in the US, not 1,000 internet surveys. These BS articles about garbage “studies,” often with an agenda, are the MAIN reason I post the actual numbers.

But their garbage sure makes good click-bait, and you fell for it lock, stock, and barrel :-]

You could have done your own math before posting this link here ($70 billion divided by 44 million renters is all you needed to do to figure out that this is garbage).

Renting is a choice for most renters. They have reasons why they rent, including the flexibility that comes with it (if you hate your neighbors, you can move) and not having to worry about the building. Some renters are poor, but many are not. They’ve got plenty of money. Nice rental apartments in expensive cities go for $5,000 a month for a 2-bedroom, and something like $11,000 a month for something a little nicer in Manhattan. Special units are much more expensive.

https://wolfstreet.com/2020/11/30/vacancy-rate-at-iconic-manhattan-tower-with-899-apartments-hits-26-this-example-shows-how-fast-massive-the-exodus-has-been/

The median asking rent – meaning half are more expensive and half are cheaper — in the 12 most expensive big rental markets for a 2-bedroom apartment starts at $2,000 in Seattle and goes to $3,500 in San Francisco. That’s the median. Luxury units are much more expensive. Something like 66% of the housing units in San Francisco are rentals. Most of them are occupied by people who earn a nice living, many are working from home.

https://wolfstreet.com/2021/02/02/big-city-exodus-housing-distortions-rents-plunge-in-most-expensive-cities-but-explode-in-others-boston-plunge-steepens-san-francisco-plunge-pauses/

Wolf,

I’m still a little confused, are you saying the $60-$70 billion arrearage figure is too high or too low?

Based on the monthly numbers you are using and your suggestion that the CNBC/Bloomberg sources are gaming the stats in hope of getting more gvt bailout money, it sounds like you think $60B is too high.

If so, okay…I’ll do some envelope math and think about it…but at 44 million apt rental units and assuming a (low) $1000 median rent, that works out to about $528 billion a yr in apt rents in a non Covid yr.

That seems a bit low to me for the 2nd largest component of the housing supply (food from supermkts is about $650 billion in sales per yr, and food pales relative to housing costs)…but I’ll go with $528 billion in annual apt rent for now.

My general impression of the country being close to wholly shut down for 3 months and seriously impaired for another 7-8 might be wonky…but a 15% hit to annual rent revenues with gvt moratoria, etc. doesn’t seem absurdly impossible…and that would be about $80 billion after a year.

Perhaps I am underestimating the rent-safeguarding provided by the PPP, unemployment kicker and the outright grants by DC (but, then, why the eviction moratoria, if G money was effectively nearly replacing it? Seriously, why, if the G money was in fact flowing to landlords…would landlords have to be legally *blocked* from evictions? They would be more or less getting paid due to G money)

It’s way way way too nigh. It’s a ridiculous overstatement. Lots of renter households are doing just fine, working from home, or working at the office, paying rent to a grateful landlord.

“Renting is a choice for most renters.”

Given that 2/3 of the US population can’t come up with $1000 cash to cover an emergency, I’m not so sure the majority of renters can afford to buy a home. A 6% down payment for the median US home price of about $300,000 would be $18,000 down.

Unless the banks went back to their old NINJA ways when I wasn’t looking.

“Given that 2/3 of the US population can’t come up with $1000 cash to cover an emergency, I’m not so sure the majority of renters can afford to buy a home.”

It’s easier to buy a house than to rent one. In order to rent you need first, last + deposit, and oftentimes a higher monthly income multiple than a bank would require. Around here, a decent house is $2,500 per month. That means at least $6,000 cash up front, oftentimes $7,500.

Robert,

Many homeowners and renters have zero in their savings accounts, and may not even have a savings account. Their cash management system is their credit cards, like a company with a credit line. Works very well. You pay it off when you have money, you dip into it when you need to. So when they get these stupid surveys that ask if they have $1,000 in a savings account to pay for a repair, they say no. But they have $50,000 in their 401k, they have $80,000 in two cars.

If you ask them if they can pay by whatever means for a $1,000 repair, they say, sure, no problem, that’s what plastic is for.

It’s all how you ask that question. This is a standard survey that has been done for decades, and it hasn’t changed. But the way people manage cash has changed.

Thank you!

Wolf, $80,000 in cars doesn’t reflect the $95,000 in debt on those cars. How many can sell their car at a profit after a couple of years. I agree many have money in an IRA. But they won’t touch it and for good reason.

America’s colossal provides vital top shelf collateral to the all-important Eurodollar market in the form of Treasury debt. There is a SHORTAGE of such debt. Now what?

> $10 billion for direct assistance to homeowners for mortgage payments, property taxes and utility costs

I’m more interested in the wave of foreclosures that can allow for renters with savings to buy a house for cash and fix it without having to face the Fed’s artificially inflated prices.

I am actually surprised at these numbers because anecdotal evidence in California indicated a much bigger problem. It might be that these numbers come from areas with fewer infections, wealthier areas with more reserve resources and greater ability to maintain a high credit rating, and/or maybe less panicked, sheltering in place. (Average Americans cannot afford to miss work, so each increase in unemployment will correspondingly increase defaults.)

My understanding is that forbearance and future payment plans are also being offered to avoid recognizing some rent/lease/mortgage defaults but presumably, that would be reported in some numbers? At least, I think now we have an idea of what the “Federal” Reserve has chosen as its future policy to try to avoid stock market crashes and disasters and the pricking of its many, fragile bubbles.

It clearly has decided to use its QE and other manipulations to create increased inflation to make the financiers’ debts (including arrearages, bankster/crony debt, which means consumers’ bank deposits and corporate bonds), and admittedly government liabilities, get reduced by that inflation. I wonder if we will see more messing around with the computations of the CPI to hide the increasing inflation from the sheeple or if the prior CPI manipulation, changes creating a circular reduction of the CPI if interest rates are lowered, were enough to keep it hidden. See mises.org’s “Problems with the CPI” (which must be searched for on their site) and the excellent, Forbes Magazine’s “The Major Problem With CPI And How It Hurts The Economy.”

Presumably, someone will also be secretly getting more “loans” at very favorable terms on the condition that they buy stocks to keep the stock market bubble going. The RE bubble will be prolonged by promoting more inflated-prices with more loans, not foreclosing, and providing forbearances. We will see if nothing can go wrong: historically, hyperinflation has not been preventable after a certain point.

Nothing to see here, sheeple! Move on! If something does go wrong, of course, it could never be the fault of the FOMC of the banksters’ “Fed” They are incapable of error.

RE:”I suspect these deadbeat renters will line up to receive their allotment of rental assistance monies, no strings attached.”

I suspect that as more and more US citizens are hit with the immediate results of the timely and strategized data mining that is occurring by globally opportunistic plays for short-term money flows, that you might even experience those immediate effects and become, relatively speaking, just as much of a deadbeat as the rest of ’em. Unless of course, you are one of the few that has been most opportunely one of the first comers to the real market advantage makers. If that is your predicament, start sharing the wealth, before it gets taken away, when you least expect that action, because you don’t have the latest AI version that really counts first.

“Go ahead, give the poor all the money you want, the rich will have it all by nightfall, anyway” -Mark Twain

Thanks to computers, they will obviously now get it all in an hour or so.

You should be happy about that.

If the US collapses, it will be from colossal net wealth inequality, not debt.

Perhaps some Eisenhower level taxing with an extra big “death tax” kicker would help. Maybe even a max net wealth, $10-15M seems like plenty of “incentive”, in case your daddy never taught you how to enjoy the many kinds of work? Or sport? Or learning for it’s own sake?

And don’t forget that special wall of names and even statues for those that continue to contribute millions to the country year after year.

Maybe even special vanity plates/badges that give them extra privileges. Or even a public ceremony….TV time… you know, like pro hall of fame stuff. Hell, someone like Buffet or Gates could even get “building fathers” status.

It’s all just big ego stuff with these guys, right?

One would think, but no one actually seems to like statues these days. They’d rather just jocky for positions on the Forbes scoreboard. It’s truly insane to me what these people could fund and accomplish with that much money. You could really leave a legacy in the world and be in the history books to a much larger extent. You could build your own city with skyscrapers converging into a glass sky palace and reign over it like a archangel for pete’s sake. It’s almost like their egos aren’t actually that large.

People tell me you’ve only got one life to live, don’t waste it (whatever that counts as), but I look at the ultra rich, these paragons of idyllic success for many people and I just see addicts who can’t stop themselves lusting for more. Maybe that’s all most humans are after all.

I should say though that they probably can’t liquidate much of their stock holdings without collapsing the share price anyway. The kicker is it’s phantom wealth to some extent, so don’t pop their bubble!

A “wasted life” means absolutely nothing at all from a biology perspective. Nothing whatsoever.

Cultural perspectives are quite another thing. We invented every single bit of our more or less shared one, including the ability to say “me” and have it carry a “meaning”, although very dependent on context. “me” now sure as hell isn’t “me” in my 20’s. But some previous behaviors do “add up” biologically.

And we can change any damn part of it we want. Excess resource consumption and alternative collective efforts are two we had better get a handle on and fast.

Because there are fundamental physical things happening detrimental to human life, that could care less about our “culture”, or the species that invented it.

Once upon a time I lived in Chicago. They have the Field Museum, Shedd Aquarium, Adler Planetarium, indirectly the Yerkes Observatory, &c. Once the Government increased taxes and took over public building the rich quit.

Yeah, when that nasty government drags them all down to that last $100M-$200M+ or so, it’s just no fun at all to be “nice” to the less fortunate anymore…..I suppose.

Only Carnegies, Rockefellers, etc, had a big enough cushion to stay “nice”.

Those little old ladies who volunteer to work in thrift shops and soup kitchens never impressed you very much at all, “once upon a time”, did they?

I guarentee you they impressed others.

The reckoning is coming to the US of A which has been living beyond its means for 3 decades. And Wall Street will become Dead Street.

20 years would be more accurate. Repealing of glass Stegall was where it really started (1999?). Everything went downhill after that.

50 years…there was a reason the US had to bail out on Bretton Woods…the US could see it had *zero* chance of being able to meet even Bretton Woods’ watered down intl trade/finance stabilizers. Trade deficits had already shown themselves to be hopelessly addicting.

The actual reason America dropped the gold standard, was that the French President at the time, was not a fan of America and planned to continually exchange US dollars for gold and then sell the gold for more US dollars until America’s gold supply was depleted. Nixxon in order to prevent this, simply made new US dollars not exchangible for gold. Effectively ending the gold standard. No alternative solution to this kind of attack, has ever been suggested and this above all else, is why the gold standard, is possibly unworkable for a modern large country.

TR,

The reason the “gold arbitrage” against US’ Bretton Woods obligations was even possible, was because the US had started to run perpetual trade deficits.

Historically, the gold standard was what kept intl trade “honest”…countries simply couldn’t print/inflate their fiat in order to pay off habitual trade deficits (like the US for last 50 yrs)…the *required* ratio between gold and fiat kept them from doing so…a few yrs of un offset trade deficits would result in demands for the gold (vs. the funny money fiat).

After a nation’s gold was gone, the jig was up…no more trade deficits allowed, import prices would soar to re-establish intl trade equilibrium.

Post WW 2, Bretton Woods softened/weakened this system of discipline, in the interests of,

1) Allowing European reconstruction via lengthy trade deficit finance and,

2) allowing a greater ongoing degree of individual national macro policy control (gvt deficits, trade deficits, etc.) without quickly triggering the intl trade discipline that hard gold standards would.

But Bretton started the world off to the utterly fraudulent state we find it in today (when baloney fiat can be printed at will to “pay” perpetual trade deficits).

By the early 70’s even the milksop standards proved too “harsh” for perpetual trade deficit countries (the US was going to run out of gold) so the whole stabilizing/discipline system was scrapped.

Currencies were free to float against one another in order to reflect trade surplus/deficit relations.

(But countries could still print domestic fiat – creating domestic inflation – in order to weaken their currency internationally, in the service of export industries/at the expense of domestic consumers. This is the path that Japan took for a long time.)

(China has done the same thing for 20 years, using different tools…such as forcing conversion of export proceeds into Yuan, creating an artificially undervalued Yuan).

In 1959 Yale professor Robert Triffin announced that Bretton Woods was doomed. He even wrote a book about it in 1960.

Thus the ‘Triffin Dilemma’ idea was born– essentially stating that a world reserve currency (dollar) had to run current account deficits to provide international trade liquidity while at same time having account surpluses to maintain international confidence in dollar. Obviously we succeeded extremely well at first task, but failed at latter.

When it became apparent that US could no longer convert dollars to gold by 1971 the jig was up.

This charade has continued in a fashion to today– US runs crippling trade deficits as well as fiscal deficits. Final outcome has been curiously delayed but it is not in doubt– dollar will be replaced by some other form of reserve currency.

Let us hope us commoners will come through in one piece when all is said and done.

Those were factors in America dropping the Bretton woods system. But, Charles de Gaulle (French President 1959 to 1969) administration and the ongoing French policies intentionally trying to undermine the system, meant that reform was impossible and that America would be forced to abandon the system.

The triffin dilemma is a real thing that could be managed properly under a responsible government (a long shot at this point) along with reasonable trade deficits. Fiat currency would make this alot easier. Fiat does make it easier for all kinds of shenanigans to be pulled off against the 90%, but they can pull it off without that. The gold standard vs fiat has substantial advantages and disadvantages for each, but, if developed countries had to maintain net trade balances it would crush most devoloping countries and make their future development difficult. Either system will succeed or fail based on the government. Holding precious metals is still a good way to store value regardless of either system. Under a gold standard, you always have to worry that the issuing government will uphold the conversation.

Going back to a gold standard might be possible and desirable (for devoloped countries), but it wouldn’t be simple or good for all.

If those damned North Vietnamese (and allies) had just left our puppet “domino blocker” alone, we probably wouldn’t have had that problem, at least not until the next large proxy war.

We might have even learned to make proxy wars smaller and cheaper, yet still get a good test bed for the latest equipment and tactics, and along with some changes to corporate law, sitting on a balanced budget. We had paid already off WW2 by then, ya know?

Yep, Wells Fargo is still pushing the stock market every time I go in there to make a routine transaction. They dropped their interest rates to 8 basis points on a savings account, and now they imply that I’m a loser for not getting back in the casino.

I thought the Volcker rule got rid of this crap

If they treat you like a loser, perhaps you should bank somewhere else..

+ 1

Property rights no longer exist.

Despite what you may read about – No one has to go to court and provide any proof of hardship. Tenants can just stop paying both residential and commercial and if you leave a unit before you end up in front of a Judge (which they are no courts dates at this time) then they will be no recourse either. So even “if” in the future we have the ban lifted the Judge will not allow you to go after anyone for back rents.

We just worked out this deal with a industrial Tenant made no payments from March -Dec occupied over 20,000sf bakery supply company who’s niche was office and schools.

A Tenant who received PPP money btw, Just leave and give us the keys… The L&T Attorney said your lucky they gave you the keys back. Lucky with all that rent not accounted for with the 60 yards of trash that we had to pay to clean out the space. The Tenant even removed door locks and the motors to the roll up gates.

In addition we just received our assessment for our RE taxes and they increased what a tragedy.

Or how about a different location the Laundromat Tenant opened for business 7 days a week has made no payments and in addition stopped paying the water bill which falls on the LL in NYC and in exchange for non payment you are hit with penalties and interest the equivalent of credit card fees.

No property rights in America = worthless real estate. Lucky many Tenants still have Integrity but for the ones gaming the system makes you wonder what’s really going on behind the curtain?

The plan is to drive small business people and landlords to bankruptcy and to replace them with corporate entities. It is the corporations that pay the elected officials, and that is who runs the government.

The working class was only valuable to the wealthy so long as they were needed to provide the labor, and fight the wars.

Now automation is ready to take over the duties that the working class were once needed for. Once the working class is no longer needed for the purpose of exploitation, they become a liability, and the need to exterminate them becomes apparent. Thus you have man made viruses designed to exterminate and sterilize targeted groups of the population. Welcome to the dystopia of the 22nd century.

Quite right.

This is not an accident/incompetence/COVID.

Jdog,

First half is true. As for the rest, the real plan is just to turn America into a nation of serfs and the Ariistocrat class. Eventually, though something will happen as a response to their actions, the question is what.

As low skill jobs disappear, replaced by automation, the population will depend more and more on social programs increasing the tax burden on upper classes, and increasing demand for wealth redistribution. The working class will also become increasingly angry and violent being trapped in a downward spiral. This is the breeding ground of revolution. The wealthy people in power fully realize this fact, and that they will be the target of any revolution. They therefore have every incentive to want to do whatever they can to alleviate the danger to themselves. Planet depopulation has been a subject discussed by the elite for some time now….

You may want to push that century back to 21st century, seeing as you summed up the present picture pretty clearly.

Me thinks you’re referring to the Amerikan-styled Dekulakization.

They are going to have to come up with something, that’s for sure, and I doubt diseases are it….too much of a shotgun approach.

Ever since I saw that kid make his drone fire his Glock, I’ve tended toward that type of solution being more likely.

Keeps me wondering, though, especially about how organized they are.

Since they can’t do jack by themselves, they need some amount of skilled and highly skilled (Docs, etc) labor force to tend to them….and polluting fossil fuels won’t do it, so robotics are out.

Meanwhile, massive incarceration (and threat of same) has bought their think tanks quite a bit of time. Find a chart of how incarceration skyrocketed when their puppet Reagan was installed.

He had some other duties, too.

Here tis’…..one of my favorite “what changed with Reagan” charts…among many others. Note Dems followed suit….same masters.

https://en.wikipedia.org/wiki/Incarceration_in_the_United_States#/media/File:US_incarceration_timeline-clean.svg

It looks like you got a real dose of what’s really going on. Are you willing to divulge any further identification of the Tenant? Not any names, but some generalities, of geo-location or other identifier? Your example is pretty relevant to understanding real guerrilla warfare of a different kind, that unfortunately exemplifies the real street level of the predatory cycling that is occurring, and is quite real to all levels of scale. It’s just not real obvious yet for everyone to talk about on any level publicly. The cognizant awareness has not yet become really mainstream. When it reaches that level- well, I don’t even want to think about that level yet. Everything will just be unmentionable by then.

I found it quite curious as to the agreement that Mall of America taxpayers pickup the tab for building maintenance etc. , essentially all annual costs, while who gets to “OWN” the land??? Same cycling for a few other urban tax deals, that who is, were, and are making more of?

Sorry for your losses at hands of irresponsible tenants. Moral hazard strikes again.

Whole issue of rental/house payment moratoriums is fraught with uncertainty and conjecture.

Who is cheating (that is renters and homeowners who could make monthly payments without undue financial stress but refuse to) and in what numbers is clearly not understood.

And I have a feeling the gubvarmints who enabled this situation really don’t want to know the extent of grift and fraud they created.

Hey, it’s all good anyway.

“Go ahead, give the poor all the money you want, the rich will have it all before nightfall, anyway”

Mark Twain

“So long as all the increased wealth which modern progress brings goes but to build up great fortunes, to increase luxury and make sharper the contrast between House of Have and the House of Want, progress is not real and cannot be permanent”.

Henry George

Governments, if they endure, always tend increasingly toward aristocratic forms. No government in history has been known to evade this pattern. And as the aristocracy develops, government tends more and more to act exclusively in the interests of the ruling class — whether that class be hereditary royalty, oligarchs of financial empires, or entrenched bureaucracy. -Politics as Repeat Phenomenon

Frank Herbert. Children of Dune (1976)

Capitalism, it is said, is a system wherein man exploits man. And communism is vice versa.

Daniel Bell, The End of Ideology (1960)

You can get much further with a smile and a gun, than with a smile alone.

Al Capone

The rental eviciton scam is non sequitur. Leave the tenant in house and they have a chance to catch up on back rent, throw them out, they’re gone. I wonder more about the REFI market, lenders sitting on paper securitized with deliriously high piles of equity, all tied to loans written at a fraction of the value. You can’t go wrong putting the pinch on those people. And if you throw them out, so much the better, you get yours at liquidation.

100+ years of contract law got thrown into the dumpster fire with the GM bankruptcy.

Those that should have been first in line, bondholders, got destroyed so that a political supporter (UAW) at the back of the line was made whole and actually benefited.

All those calculations to buy GM bonds were based on risk and return. How does anyone price these now?

No one stopped it.

And those in power saw they could destroy other contracts at a whim to buy votes and power.

Mortgages and leases? How do you price these now?

The bidding starts at $2,000 in stimulus plus no payments for at least 18 months.

I was floored that the judiciary did nothing to stop the Obama administration during the GM fiasco. I swore at that time to never buy a GM or Chrysler again, and I haven’t.

We crossed the moral hazard bridge in 2008/2009.

Behaviors and expectations seem increasingly absurd as the days go by. Now it’s greedy for the landlords to expect rent from tenants, selfish to oppose student loan cancellation. All arguments driven by “they got the handouts, why not me?”.

Let the government purchase all debt (rents, mortgages, student loans, auto loans, utility bills) and cancel it all. Just put it on the national debt tab, that we have no realistic chance of ever paying back.

The Germans, in the final days of WWII, had a name for it which escapes me.

But basically the threw great outlandish and drunken parties as they knew there wasn’t going to be another party for a generation.

I can’t believe our leaders think they can do this and still retain our reserve currency status.

I think there is something called “moral hazard” in which canceling the debts would only cause there to be more debtors the next debt cycle because now everyone knows the new rules.

Here’s “realistic” for ya;

Per the Fed we have about 110-120 TRILLION NET household wealth in just the USA (including a few “non-profits” like churches and other personally managed “do-gooder funds”…..heh-heh-heh…)

So that soaks up the Nat’l debt, and the stock market cap….any ideas on where it is?…and that’s only the stuff the Fed knows or talks about….not $$s offshore, gold bar piles under Aspen vacation homes, etc, etc……

Those of us, mainly seniors, that own our homes free and clear of any debt: AREN’T WE THE SILLY ONES!!! We should leverage the heck out of our abodes and use the proceeds to buy Tesla, Amazon, and Twitter stocks. And when we lose that money, which is inevitably in the Craziest Stock Market the World Has Ever Seen, we stiff the mortgage company because the Government says we can. What’s not to like??

Yes, whilst the State sponsors the unfortunate/lazy/overspenders, the sensible are disadvantaged by having to pay for it.

Ultimately the problem is not the State, but the people who voted for it, your fellow citizens.

Your income and assets have no Constitutional protection from any amount of taxes, so effectively a majority of the population can vote for the rest to support them. This is the Tyranny of the Majority, and given every western country is living beyond its means as a result of government spending of which voters seem to approve, and none of them have any protection from unlimited taxes either, we are all in that Tyranny.

Sailor, that’s exactly why the founders required that you owned land to vote.

Land ownership is not the only way to ensure that people have a stake in society. Wars where a country would be totally enslaved if it lost have always required those who were/are essential to the war effort be given the vote. This is true from WW2 right back to Ancient Athens. You are not going to get the genie back in the bottle by taking away the right to vote of those who now have it, especially with the Dems now in power. What needs to happen is that government spending be limited, and/or government taxing/borrowing be limited. However, reducing spending will kill electability for the party in power, and also kill much of the power of both politicians and bureaucrats, as well as forcing vast numbers of useless/counterproductive government employees to go get a real job. I can’t see that happening without a revolution of some kind – turkeys don’t vote for Christmas.

Sailor, I agree that you can’t remove voting rights with more voting, because people will never vote to remove their own vote. It won’t happen without a collapse, after which sober men will take over.

I would change my call name from Sailor to something else. As a Navy Vet I recall a sign in Norfolk which states:

“Sailors and dogs keep off the grass”

Old Master Sargent breaking in new Canadian base commander.

New base commander to Master Sargent: There is a bald patch in the grass in front of the enlisted men’s mess hall, could you please fix it?

Short time later, new base commander to Master Sargent: There is now a bald patch in the grass in front of the officer’s mess!

Master Sargent to new base commander: I suppose you want me to fix that too?

Base commander to Master Sargent: No, that won’t be necessary. I will get someone else to fix it!

If you bought your home >20 odd years ago, you basically bought an asset returning 7-10% compounding imputed rental yield (and tax free if you live in it). Such an investment with that sort of risk profile does not exist anymore.

Hence for people to have a hope of obtaining the same level of wealth you have accumulated over your lifetime, they are forced into risky investments. I also think it is reckless, but as ones’ age ticks higher and it starts to dawn on you that there might not be a reckoning during your economic life, you really start to feel the pressure to join the herd.

Cool.

Put interest rates back at 8%.

End all QE.

Throw bankers in jail.

Little to no taxpayers guarantees for mortgages.

20% down.

Go back to the Paul Volcker days.

18% Mortgage rates

21% Prime rate.

That will separate the men from the boys.

Those were the good old days!

I was going back 20 years. Pick a time.

Somehow the woked “everyone gets a trophy” crowd thinks that it was all so easy with high interest rate, no bailouts, no QE and loans were for those who could prove they could actually pay it back with an 18% ROI.

Want to know how an IPO on a company that never made a profit and never would make a profit would work?

Yes with those interest rates the interest on the US debt would go from 300 billion currently to 3.4 trillion. Might that cause some interest in reducing the debt?

I’m one of those silly ones. I can’t easily get a loan since I haven’t had a job in many years, so I’d have to use some kind of asset depletion loan.

I strongly feel that if you’re not levered, it’s like throwing money out the window. Isolated companies and individuals will be allowed to go bankrupt, but if you’re slightly more conservative in your borrowing than the most reckless ones, then you’ll be bailed out indefinitely. I can’t imagine a realistic scenario in which it pays to be debt-free.

Moral hazard is endemic these days.

When companies and individuals observe that there are little or no consequences (bail outs at all levels/debt forgiveness etc.) to risk-taking and bad economic behavior they are emboldened to up the ante.

That is, until our rulers run out of other peoples ‘money’.

You can own one house worth $300k with no debt or four such houses for which you make a $75k downpayment each. In 30 years after the debts are inflated away, the only difference is that in one case you own one house, in the other case you own four.

Orthodox,

regarding your comment: I can’t imagine a realistic scenario in which it pays to be debt-free.

I respectfully disagree. It always pays to be debt free. In 2003 my wife and I planned to relocate. Because I was debt free my credit union extended me a LOC which allowed me to purchase a rural home without a mortgage, inspection, subject to, or delay. It was a simple cash bank draft with immediate possession. I then turned around in an additional 3 years and sold our house in town; a house that had appreciated 100% in just 5 years. This gave us time to renovate and rebuild our new home with the LOC. The LOC was minimal, and usually just covered an overdraft for building materials which was not secured by our assets in case we got hung up with more house than income. The LOC was based on our track record of having no debt. I had to pay 1-1.5% more than money secured, but it allowed me the freedom to walk away if need be.

When I was in my late 30s, I wanted a career change which required a return to university after two years of doing under grad by correspondence. (This was before the internet and online offerings). Because I had no debt, I was able to do so.

I know many people who did similar actions. I followed the simple dictates of David Chilton’s book, The Wealthy Barber. My son, at age 37 is doing the same right now, as is my daughter at age 40. People often say that saving no longer applies to millennials and today’s reality, but I disagree. Certainly RRSPs (401Ks) are pretty much a waste of time, but not the general focus of deliberate steps with measurable goals.

My 23 year old nephew is doing the same thing, sending $200-$400 per month into an account that he can’t touch, and he is a 1st year apprentice living in a high expense city (Victoria BC). He has a plan to own a home up Island and is achieving it step by step. Meanwhile, he is still a normal 23 year old red blooded male who works OT whenever the boss requests it.

How did this happen for us? We lived a good life but I followed the old adage of “pay yourself first”, putting 10-15% of net pay into a savings account and forgot about it. It didn’t exist. Within a few years we had enough for a house down payment. The 15% came from driving a junk used car, and packing my lunch. No restaurant meals because we were too tired to cook. We meal planned and shopped accordingly based on sales. My wife stayed home at that time with our children. We bought a tired house and renovated. Our vacations were local camping trips or local beach picnics rather than Disneyland, etc. In many ways they were very very good years and lots of fun.

Paulo, you are definitely Old School in your thinking and practices regarding Debt and Savings and doing without today, to do better tomorrow. In Aesop’s Fables, you would be the industrious Ant who toiled mightily and saved to weather the coming Winter Storm, and unfortunately, the majority of Americans fall into the Grasshopper category that frittered his time and resources away during Summer (the Good Times) and did not make it through the Winter Storm. If one looks closely over the horizon, there are some very dark, frigid winter clouds forming.

I have this idea that our economic and financial system is like a poker game and a Ponzi game in one. With the tailwind of exponential credit expansion anyone who played the game right over the last decades should have become a centimillionaire no problem. I kept myself ignorant of all things economics and finance on purpose most of my life, and I’ve never had any debts in my life, but that doesn’t prevent me from recognizing that I played the game incorrectly, the unorthodox way. I think you are pointing out that debt-based consumption sets you back in life, and I don’t think anybody disputes that. I’m talking about borrowing to invest.

Paulo:

I pretty much followed the same script except I didn’t get married until 40 and wife stayed home to look after the 2 kids. Then at 47 I lost my job, never working again due to deafness and blindness.

People forget savings give you options and confidence when badly needed.

This mentality is not dead. We live the low-debt/no-debt life and so do many of our friends and family members under 40. Yes it requires a little sacrifice but if you start early and have a little discipline to tell yourself no, it’s really not that hard.

The 08/09 financial crisis burned strongly into our minds since it hit right at the time we went to hit the “real world”.

WES

Your situation has always been a nightmare scenario for me. That is, physical incapacitation preventing continuing to work.

At nearly 63 still slogging it out in the corporate world with dire consequences if I can’t continue for at least another 5 years.

I wonder about the next crash that poses “systemic risk.” Will the taxpayer be required to bail out speculators, as in 2008 and 2020?

Thus far, the 99% have gone along with these “emergency” wealth transfers — no riots or protests at the Fed. Can this regime last?

I think Yellen & Powell will follow the time honored tradition of bailing out the banks, its intermediaries but also a third creditor namely landlords when the next relief law is passed.

Well, sure they can, at least to kick the can a bit further down the lane, by labeling ANYONE who disagree (meaning those very same 99%ers) a domestic terra ist!

Delinquencies up 2-3% after wiping out 5m jobs and half a million lives seems not bad to me but I don’t quite know shite.

“So, rent collections deteriorated by 2.6 percentage points: from 4.2% of renters who were behind a year earlier, to 6.8% now.”

Managing apartment for most of my life, I can say with reasonable confidence that the 2.6% will be much lower had the government done nothing instead of eviction moratoriums.

How do I know this?

If 4.2% didn’t pay their rent pre COVID, imagine the incentives not to pay when the government is telling you so.

I know many tenants who can pay but simply choose not to. And because I collect their garbage and recycling, I can attest to the expensive liquor being consumed, all curtesy of our government.

Whatever gubvarmint encourages or subsidizes, directly or indirectly, spawns only more of same.

So what could possibly go wrong if you tell renters (and mortgage holders): we got your back and you don’t have to pay so just squat and stay

This is definitely affecting the property owners desire to have more apartments. They announced yesterday that new multi-family starts had collapsed in Portland compared to a year ago. I noticed this morning as I crossed the Fremont bridge eastbound that there were zero tower cranes in sight on the east side. For the past 5 years there has always been at least 6 or 7.

Robbing Peter today to pay Paul means Peter isn’t going to build a house for Paul to live in tomorrow.

Ahh .. But Mary will hail neither coastal Peter or Paul. They both get to reside in some weathered, soggy, beat-up refrigerator boxes …

She will pass them by, as she emigrates to the free state of LowerMokestan!

‘;]

The way I punch the numbers the government Covid programs are at about $20,000 per person. If you didn’t get $20,000 you are probably going to be on the paying end later on.

Seneca,

Crane activity has moved to Vanc. (WA) side along the waterfront industrial ghetto area (directly in line with PDX airport West approach/ departure) being repurpo$ed.

Historical note: Previous mega crane activity epicenter was NW&SW dwtn PDX, ended in ’09 and left some very deep & large holes when the funding ran out.

This cycle was in NE….some in (long dormant) N area.

Remind them that Actually W.F. Is lucky to still be in business considering the Many Illegal tactics theyve used including fraudulently pushing people out of their homes and redlining not to mention moneylaundering.I would bank elsewhere like at a creditunion.Bailins have happened in recent memory and probably will happen again!!who wants to live in a violent,anarchist,nolaw zone full of haters harassing bookstores and outdoor diners?

After over a year of this with no end in sight, why would anyone be paying their rent? FREE HOUSING. Itts clearly never going to end. STOP PAYING. Let it all burn down.

I was listening to a Peter Schiff podcast last week where he said anybody paying their student loans through all this is a damn fool. Wait for the bailout.

At this point the best resolution would be to encourage those holding student loans to file bankruptcy. Not sure how they implement that policy, maybe call all the loans for those receiving stimulus checks? If you owe a lot in student loans in this economy, you may as well bite the bullet. In 2008 bankers were telling mortgage holders to default when it wasn’t necessary and lot of them lost their houses. Certainly if you can pay your loan do so, or take the stain of Ch11. (Wonder what that does on your resume, if you need a security clearance?) Schiff is probably wrong about this, when macro guys start giving micro advice, steer clear.

The banks had an incentive to do that. The houses with the most mortgage paid were foreclosed first. Some were held long after the “selling moratorium” before being sold by financial interests. Banks are in the real estate business, either by owning the buildings directly or investing in the funds which own the buildings next.

They probably have even more incentive when the SHTF now. Because they’ve had many years experience manipulating the systems.

Wolf,

Thanks for the info on rentals. A pandemic called covid 19. For the grace of God go I, I learned. The Fed printing money, for a fiscal policy now to save lives. I’ thinking inflation is more fiscal now than monetary. Any thoughts on that? So with all the QE and banks not lending kept it down. They are still not lending I’ve read somewhere.

In the rental area, I anticipate there could be some sort of non-violent expansion of the Gamestop mindset.

If disgruntled people get together in numbers, they can not only take down a couple hedge funds, they can take down the financial system.

They may hurt themselves in the process, but do you think the people who bought Gamestop at $400 care about that?

Instead of “buy Gamestop”, I fear it will be:

“Don’t pay your rent”, or

“Don’t go to work”

“Don’t pay your taxes”

“Don’t buy this product”

“Don’t buy anything”

Huge groups of people are fed up with the financial system.

Black Swan ahead?

“If disgruntled people get together in numbers, they can not only take down a couple hedge funds, they can take down the financial system.”

Sort of like the election? Wait, nothing really changed with the election. Sure on the surface, something changed, but underneath it all … business as usual.

Nah, Americans love taking it at the back and we thank powerful people for that privilege. There’s not going to be any change, etc soon. And history has shown that real changes require an elite or two to lead the charge. So far the elites are still co existing peacefully with one another. Wait for a number of them to fall, and maybe something will happen. Otherwise waiting for muppets to do something is like waiting for Godot

Much has changed, the red team is now the Whigs 2.0 but they don’t seem to know it. Don’t let the silence fool you, it’s not business as usual out here.

It’s a house of cards. A mouse fart could knock the thing down at this point.

Do you remember what knocked down the 2000 bubble? Neither do I.

Bobber, I am going to be very careful from now on when I come upon a mouse!! I think in 2000 the markets just ran out of buyers since most people had more sense than “investors” today.

Remember interest rates were much higher back then, so taking out a -5% Home Equity loan was not feasible.

Mouse fart…is that similar to SoCalJim’s calling it “compression at the margin” like when you pass a $15 minimum wage, those extra pennies Bill Gates or Mark Zuckerburg might theoretically have pays somewhere down the road and need to fold into their cost margins, that will cause a toppling of the trillions of wealth accumulated by the elites because their is is oh-so-very-fragile.

I think it was the euphoria hangover. If the 3Com spinoff of PALM was not the top, it was certainly close.

Too late!People are already talking about taxstrike and various boycotts and workstoppages of the traitorous,censors and oppressors.Many already formed various regional rentstrike groups last spring. People should stop helping China beef up its superarmy of genetically-manipulated soldiers and refining its military or election hacking abilities.You think that there is a bad container ship backup now,wait till China decides to punish Americans more for various offenses and holds the ships in Chinese ports a couple more months!!!!

What is the justification for this moratorium on evictions? They’re giving these people money to pay the freakin’ bills. Why on earth are they allowing them to stiff the landlords ALSO? Gee, let’s burn the landlords to the ground so these deadbeats can buy new cars. WHAT A JOKE.

The justification is that if you evict people during COVID times, they may have to go to a homeless shelter, stay with family or friends, and thus, expose themselves or other to COVID.

That’s the stated justification anyway.

I think America will collapse on its own weight in the next couple of years.

10 million jobless Americans. Job openings rose. Payrolls contracted.

Homeless shelters full. Section 8 housing waiting lists. Very low single family housing inventory. Home construction company backlogs.

An executive order stopped oil and gas drilling on Federal leases. Gasoline prices are rising.

Yeah, we’re screwed. I have a hard time sleeping these days, I’m that worried about the next year or so.

Exactly!Pluuuussss…rents in Many places =outrageous,shelters dont take pets,families,couples quite often plus they may well have bedbugs and lice infestations.Naturalgas prices=astronomical=Very high utilities,smalltank propane shortage,propertytaxes increasing even though they are Insane in some areas like Cook County,IL.Reagan started cutting the h.u.d. Program and It’s been natorious for being a moneylaundering blackhole,just ask Katherine Fitts.There has been far too much economic damage that was Not covered by the various programs because the Huge players like hedgefunds run by the Treasury point man’s father who got a multibillion dollar handout or UnitedWay and Catholic Charities hoovered up too much funding and left scraps and loans for the rest of the applicants.That doesnt even touch upon the BIG smallbiz who got big payouts.Ive heard of some legit smallbiz–10 employees getting $1000 or less.RE. Rent,of course there are many who could have paid and I have seen alot of temp. Licenseplates in n. IL.But,also talked to several people who Never got any stimulus check,like my son and I even though we filled out the proper app. Online,didnt move or change accounts,0 A tax credit wont help if none is owed.Many people fell through the cracks-not eligible for any of the unemployment combined with drastic reductions in hours or job eliminations,domestic violence,transport/childcare problems/eldercare problems=Millions of women lost jobs,opportunities,$,sometimes housing as some locales did proceed to kick people out.

I’m not as conservative in my thinking yet but I am a rental property owner, and have done a mediocre okay job with it. I’m getting more annoyed with the mentality that Bezos and others should get their money first before I get the rent. I never grew up with the idea that you skipped rent and then bought a bunch of stuff.

You know, in the peninsula part of the SF bay area, there is recently an uproar over a rapist who was going to get a rental at the tune of $7500 a month. Now, this was not just any run of the mill rapist, this was someone who was described as a “sexually violent predator.” His crimes were well documented, and he was not exactly young at the age of 69… but nevertheless, massive uproar on the community, along with the shaming of the landlord who was obviously taking in a bunch of government money, cause this guy has been in the big house for decades, and one doubts he could afford rent at $7500 a month that was being charged.

But to go on with the story, the original notification of this “gentleman” moving into the area came from the county sheriff’s department and local cops. The locals of course were very grateful for this information and organized all the necessary shaming campaign, but oddly enough, less than six months ago, there was a fairly active defund the police movement in the area.

So, anyway, what was the point to all of this. Well, it’s kind of funny, but the peninsula of the bay area is like its northern and southern neighbors (SF county and SC county), just a little liberal with great social awareness. They elect the local officials (all jackasses with no dumbo in sight), and then they are shocked and outraged by some of the results that came out of the progressive policies. After all, this old gentleman might have caught Covid in prison or wherever he was coming from. But no predators allowed, the message from the local citizenry who helped to promote these policies were instead wondering why the state couldn’t banish the guy to the Mojave or somewhere in Death valley.

Meh, I guess that’s just the way things roll. But you have to love the irony. (I’m going to bet I triggered the filter here… let’s see if this goes to moderation)

what the… oh, I know I didn’t use the trigger words, justice and equality.

Woke!!! :-) :-) :-) :-) :-) ha,ha,ha!! :-)

We might be ‘choosing’ between a number of ‘Americas’ as things ‘progress’ down the rutted road …

One never knows how History will present itself.

A democracy cannot exist as a permanent form of government. It can only exist until the majority discovers it can vote itself largess out of the public treasury. After that, the majority always votes for the candidate promising the most benefits with the result the democracy collapses because of the loose fiscal policy ensuing, always to be followed by a dictatorship, then a monarchy.

Why do landlords deserve more income than workers, or car companies? They don’t.

There’s a difference between saying landlords should be subsidized and saying that we should have the right to temporarily steal their property by telling them they can’t evict non-payers.

Exactly! WTF is Petunia smoking?

Workers are getting their incomes taken by this crisis, why do landlords deserve to have theirs preserved, they don’t. And besides, housing is an essential service just like the utilities, and the utilities are carrying the burden as well, without all the endless whining.

Only one person upthread mentioned the landlords’ local property tax bill. The governors and mayors are responsible for the shut downs and restrictions. Let there be a moratorium on paying property taxes tied to same on rents and watch everything open up pronto!

If the government imposes a moretorium on rent, then it should cough up some money from it’s coffers and cover the losses the landlords are taking. It’s simple. If this is a human crisis, and housing is a human right and we are all in this together, then we should all chip in. I don’t understand why Americans always think one group should be a victim of circumstance and get the short end of the stick. Tough luck landlords, you deserve this (and don’t forget to pay your property taxes and pay for upkeep on those properties). It’s not the landlords fault, similarly it’s not a workers fault for working somewhere that had to be closed down due to covid.

If someone had the balls in government they could easily come up with a tax on corporations making a killing during the pandemic or just provide some basic income ( keep those printing presses churning), then distribute the funds to people and businesses shut down by the pandemic. Say 60 percent of original earnings to keep them afloat. It’s all funny money at this point. Private citizens should not have to fend for themselves due to the restrictions created by the government in an emergency. This pandemic would have been over by now if they forced everyone into lockdown for 8 weeks, with the caveat that you and your obligations were fully covered. A staycation if you will. It would have been a huge upfront cost, but what’s the cost of the economy limping along indefinetly, bet it’s higher.

Petunia, please stop making a strawman argument. Nobody is arguing that the landlord’s income should necessarily be “preserved.” If the tenant can’t pay, the tenant can’t pay, and the landlord has to use the legal system to try to collect. But it’s quite another to argue that the legal system should be UNAVAILABLE to a landlord whose tenant doesn’t pay.

And Darwin, exactly. It’s unconscionable that not only did the government shut down Amazon’s competitors, but gave people money so they could buy stuff from Amazon. I didn’t see “enriching Amazon’s shareholders” in the government’s mandate.

RightNYer,

The legal system, in its highest form is congress, they were the ones that codified this current system. People were put out of work and landlords had to share the pain. That’s the current legal framework.

I don’t know why you think the courts should favor a landlord’s claim to rent, over a worker’s claim to their job.

A worker’s “claim to a job?” Huh?!

Why do you think you can just steal a landlord’s money and live in their property for free?

I think during this crisis everybody needs to share the pain. Landlords too.

“I think during this crisis everybody needs to share the pain. Landlords too.”

Financial windfalls aren’t “pain,” Petunia. These people have more money than they ever have in their lives. They’re getting UE bennies, the “extra $400” per week, AND free rent.

I think Petunia forgot that landlords, who most likely worked hard to save enough money to buy the rental, probably have families that rely on the income the landlord gets from his job (renting).

Heck, they may even have “bosses” that they have to pay each month (banks who loan them the money to buy the rental) from the income they get from the renters.

But, yes, everyone is suffering a bit.

And the landlords WILL share the pain even without the government putting its foot on the scale, because most tenants, even if they can’t pay, would be evicted and would never pay the backrent. But it’s a whole different ballgame to tell them that you can’t even use the normal legal remedies and you must take even more pain.

I think everyone should read, then reread Darwin’s above comment, to grok what really needs to happen for the Country to enable weathering the knock-on effects of this ‘pandemic’. ‘Favorites’ should not be the Game as has currently been played. Big Corp./Wall$treet already made bank. Time to play nice or the Country will collapse into chaos if the majority become destitute through no fault of their own!

Petunia lost her home and now all landlords have to suffer. “If I can’t have my American dream then no one can!!!”

LOL.

Misery loves company indeed.

@Petunia

Why don’t Landlords deserve their rents? is a better question.

Why do Airlines that can’t do anything now or it looks like for along time deserve billions of $? or cruise lines or any of the other big bailouts including Wall St deserve money for doing nothing. Whilst at least landlords deliver housing to those that need or want it get screwed over. Oh I know big bad landlords are capitalist’s? yet the others aren’t? your comment makes zero logical sense.

You are assuming real estate is a preferred asset class, as an investment, over ships and planes. The govt has actually decided otherwise, you just don’t know it. Those ships and planes are just as valuable as infrastructure as housing, you just don’t know it.

If you understood how the economy really functions and the govt as well, your comment would make zero logical sense.

If I understood how the economy really functions I could name my price. The economy is no longer being managed in terms of long-term responsibility, it is being managed by expediency. More Money Today – we’ll worry about tomorrow when tomorrow comes.

We need a nationwide DEBTOR’S STRIKE until the government takes effective action to end this pandemic.

No tax, no insurance, no car registrations, no mortgage, no rent, no credit card, no interest payments, no student loans, no car loans, no fines, basically everything is held in abeyance, until EVERY Covid expense is paid for by our previous federal and state tax dollars.

Let’s quit screwing around and implement Medicare for All before we fund yet more bullcrap like another new fighter plane, more wars, equity commissions and other boondogles.

“No tax, no insurance, no car registrations, no mortgage, no rent, no credit card, no interest payments, no student loans, no car loans, no fines, basically everything is held in abeyance,…”

No food either. Everything stops.

I need to lose weight, Wolf, so maybe that will be good for me personally. I do think that we will have an old-fashioned bank holiday of some variety in the years ahead. Financial system freeze.

and your suggestion is what, exactly? … millions thrown out into the street, destitute and homeless? Beneficence from Mr. Fink? Biden forcing half the country into some sort of servitude .. for a measly one-time come-down of stimulus, courtesy of our thorougly corrupted Congress? I’m not being flip here, Wolf.

What to do, to right this sinking ship?

polecat,

There are people who need help, that have lost their jobs, and their industry has shut down. Let’s help them. I’m all for it.