Down 11 million jobs from pre-Pandemic trend. Like the overall economy, the job market has split in two.

By Wolf Richter for WOLF STREET.

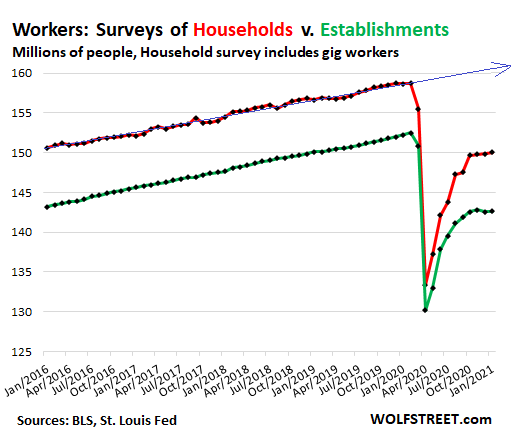

In January, there were 142.6 million jobs at establishments – at companies, non-profits, and government entities, not including many gig workers – a level first seen in October 2015, according the Bureau of Labor Statistics this morning. This was up by 49,000 from December. But in December, the number of jobs had dropped by 227,000. Over the three months since November, establishments shed 178,000 jobs. Over the four months since October, establishments created only 86,000 jobs (green line in the chart below).

Households reported that 150.0 million people were working – including gig workers – a level first seen in April 2015, according to the household survey data also released by the BLS this morning (red line). This was up by 201,000 from December. Over the past four months, households reported an increase of only 362,000 jobs.

Compared to January last year, the end of the Good Times, establishments shed 9.6 million jobs. Households reported having lost 9.9 million jobs. Compared to the pre-Pandemic trend (blue line in the chart above), jobs as reported by households would be down by 11 million.

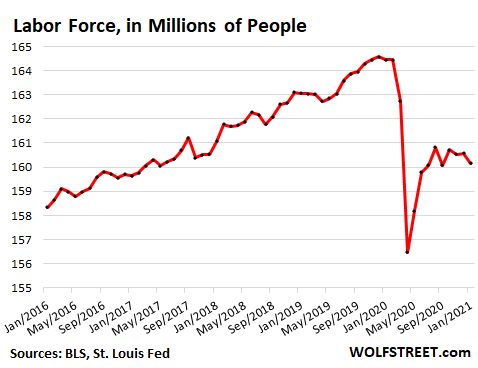

The number of people who are deemed by survey takers to be in the “labor force” – either working or not working but deemed to be actively looking for a job, depending on how they answer specific questions on the survey – dropped by 406,000 in January, to 160.16 million people, the lowest since September and roughly back where it had been in July:

The number of people in the labor force determines the unemployment rate – the percentage of people deemed to be in the labor force who are not working – which, thanks to the large drop in the labor force, declined to 6.3%.

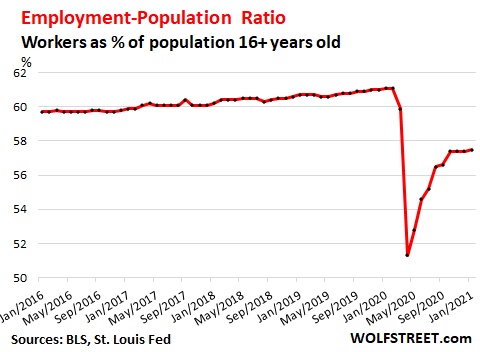

However, the employment-to-population ratio, which is far broader and covers the working-age population (16 years or older), at 57.5% has barely budged over the past four months:

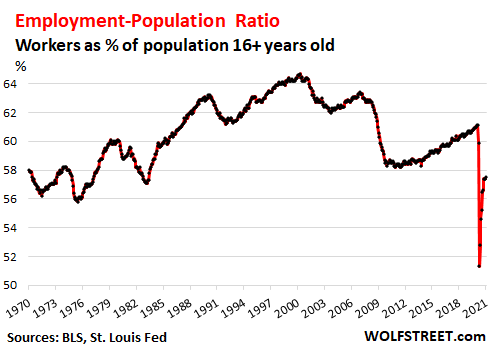

And for your amusement, here is the long-term view of the employment population ratio, which plunges during each recession. Until 2000, the ratio more than recovered each time. But in every recession since 2000 – three of them so far – it has never fully recovered before the next crisis hit. These are the infamous “jobless recoveries” of the modern era, when during each recession, companies vow to bring their costs down, and work is sent overseas:

Like the overall economy, the job market has split in two, with some sectors booming, and other sectors in a depression. Some of those shifts are temporary. But others are long-term and structural.

For example, while employment at restaurants will come back, employment at hotels, the entire travel industry and supporting sectors face a structural issue: Businesses have learned to hold meetings without getting on a plane. The corporate cost cutters are now on top of that, and the profit motive is driving it. There will always be business travel, but much of the travel done before has now been revealed as replaceable by virtual meetings.

Another example is employment at mall stores and some other brick-and-mortar retailers: it will continue to decline, having been obviated by ecommerce, as stores will continue to close, and as malls will be bulldozed and redeveloped over time into housing or office or whatever. And the ecommerce industry will continue to add jobs – from coders and robotics specialists to warehouse workers – but those are not the same jobs as those in brick-and-mortar retail.

The Pandemic has shaken corporate thinkers out of their rut, and consumers have changed too. Each major recession has a lasting impact on how the economy operates. But the Pandemic has triggered shifts in thinking that are far larger than in the prior two recessions. Some of those changes will impact the employment situation for years to come.

When you look at the long-term chart of the employment population ratio above, you can extrapolate how the jobs recovery following this recession might pan out, compared to the past two recessions, having quickly bounced back part of the way, and then having stalled. Going forward, it will be going through the typical painfully slow upward grind, but off a lower level than before.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Fancy a joke?? What’s the unemployment rate?? 6.3%, with around 800k filing for out of work benefits & a dropping participation rate, the level of scamming is truly unbelievable, it’s all worthless information designed to psychologically manipulate people into spending, without jobs & maxed out on debt I fail to grasp what they will spend. A year of around 1 million jobless claims week after week without a single positive print.

I forgot to mention, participation rate continuing to fall, now at 61.4, was 63.4 before the lockdown, bounced to 61.8 on opening & now resuming it’s decline at 61.4%, unemployment rate is 20% not 6.4%, I really feel insulted every time they release number, who do they think we are hey.

Participation rate was at 68% in 1999, which was about ten million less jobs.

https://tradingeconomics.com/united-states/full-time-employment

That’s right.. the US economy has only added ten million jobs in the last 21 years.

And how much has the population risen with immigration in that 21 years?

Considering that the whole population has increased overtime, and the participation rate has dropped to 57%, the actual onumbers of those not workng must be quite large.

Without moral judgment it’s just a mathematical decision for many people to decide not to work in a capitalistic society leaning towards socialism/*communism.

So, to eliminate all this “non-moral mathematical reasoning”, we just drop the socialist/communist “lean”, and throw them all out in the streets to retain our capitalistic society?

Seems simple enough. Would likely need more cops and jails, though, and that’s kinda getting back into socialist “lean”.

Gotta watch out for those slippery slopes.

NBay

I’m not making any decisions about it what to do, I’m just reporting what I thought seemed obvious.

Getting people back to work seems like it should be a priority. That variable seems like it should be good at given considerable weight along with the debt and other but we’ll wait variables

I know the feeling. I feel insulted when they release the inflation numbers, and then receive the annual utilities increase (not to mention the vanishing dream of retirement property). Insult turns to rage.

They haven’t learned how to just hide it, and be done with it.

The BLS is followed by the cabal of charlatans saying inflation is too low and needs to be pumped up. That’s probably the reason to release these numbers, to work over the plebs to accept it.

the saying used to be

it’s a recession when my neighbor is unemployed

it’s a depression when I’m unemployed

but today being unemployed usually means MAKING(taking) more $$$ than when you worked

so xbox and pizza night right

China has more veracity in its economic numbers than the statistics the US government fabricates.

That’s funny ?

Wow, that’s a good one. Didn’t know it was April Fools…

Wildly untrue. The annual GDP growth numbers in China are a pure fabrication. US headline numbers are also fake but you can still back your way into the real numbers. The numbers in China are pure fakery.

I understand the hyperbole, but that can’t possibly be true. The vast majority of Chinese officialdom received their PhDs in economics at US/Anglo universities.

It’s not that BLS is deliberately cooking the numbers, they just publish the BS that comes out of their dear formulas/models.

That they evidently start a chain of fake (and serious) outcomes is a definition of insanity.

Well, the US fabrications are more truthful.

I wish things were as simple as one player lies therefore the other must be telling the truth.

Yesterday I raced to a high end market just ahead of lunchtime, hoping to beat the brats from the local high school plus other stocking up for the Stupor Bowel.

3 people in line at the deli. That’s it. Two people in line for grocery checkout. Have never seen it that quiet on any day. Are people running out of money?

is that SUPER BOWL a big assss bowl with chips and guac in it???

NO SPORTS ALLOWED IN MY HOUSEHOLD – pro or otherwise

THEY CAN GO SWINDLE SOMEONE ELSE

a life long packer fan til 3 years ago

sunday is now MOVIE DAY – now pass that SUPER BOWL PLEASE

Joe..you are just angry that Brady gave your Packers…Yellow Snow..lolol aloha

The number of people in the labor force and the participation rate will go up once all the illegal immigrants are counted?

ru82,

No. Because they’re already counted and included. The household surveys do not ask about immigration status. It goes by address, and they ask about jobs in the household; and the establishment surveys go by address of the establishment and asks about employees.

Is the unemployment rate even remotely reflective of theose that are “unemployed”, or does that rate intenionally leave out the expendable ‘Mericans? Will these ratios get less bad after the census?

Nonsense. Read what I said. Immigration status has NOTHING to do with the unemployment data. The problem with the unemployment rate is how it is calculated and the various definitions that go into it, such as who is deemed NOT in the labor force.

While you are correct about the methodology of these surveys Wolf, what you are not including is the very clear fact that most folks working in USA, with or without legal status do not always/usually tell the truth about their employment status, some fearing, correctly as we have seen recently, that they will be persecuted and perhaps even sent away again, as I believe most here illegally have been one or more times.

You may want to discuss this with someone at ”La Raza” if that organization is still operating in SF as it was for decades, especially when we were putting pressure from all sides on the food chain to unionize the farm workers back in the late sixties early seventies.

I, for one, have been very very pleased to see the clear advances in the fields of the Salinas Valley and elsewhere thanks to Chavez and all the others, with every field worksite containing not only a portable toilet on a trailer pulled through the fields with the workers, but hand and eye wash stations,,, and shaded rest areas right alongside.

If you have ever worked in the fields, you will know how great that is for the workers,,, and, if you think about it, how great it is for consumers that field workers can use these facilities rather than do their business right in the field from which our food comes, without ability to wash hands, etc.

Wolf,

I really can’t see how the employment telephone survey is an objective measure of the undocumented working population. If you were paid cash and worked illegally in a flop house in Germany with ten other underpaid economists, would you bother to reply to a telephone survey from the authorities?

Generally the undocumented in my area are crammed into houses living several individuals to room. Even if we assume they have a land line and someone picks up, it’s doubtful they would give information about the 10 other individuals residing with the respondent. They would likely believe they would get a visit from ICE if they mentioned their comrades.

So I would guess the current stats undercount the number of actual workers.

In theory you are correct, but I doubt those telephone surveys are working the way you imagine.

15$ minimum wage should cure that, right?

A $15/hr minimum wage might hurt small businesses. Some states have already raised the minimum wage. US minimum wages are above the minimum wages for most other nations, thus jobs get outsourced to foreign lands. Many Americans are dependent on government handouts unable to better support the economy.

Most jobs that get minimum wage cannot be outsourced to other countries, such as cleaning hotels and other facilities, working in kitchens, stores, and warehouses, and doing other lower-level service work.

remember its FED min wage not state so it doesn’t involve most

I had landscaper come to me this week suggesting I raise their wages to $15 from $12

I asked if they would turn in w9 so I can 1099 them

crickets after that

Many of those jobs can be automated though. Or prices everyone pays will go up. No such thing as a free lunch. Corporations and owners will not cut margins because of higher minimum wage, that’s for sure.

It’s worth noting that corporations that can automate, typically will try to regardless of wage price in a developed country. Corporations, have to charge a specific profit maximizing price (based on costs), unless the industry is not competive or they are willing to potentially risk future profit.

It’s also important to remember that minimum wage hasn’t kept up with inflation for a long time. Any attempts to significantly increase it, would have to be implemented at say a rate of something like a 75 cent an hour hike every 6 months until it’s at the desired point and not implemented overnight.

“Many of those jobs can be automated though”

So problem solved. I think not.

The current American Way says, All but the lazy and stupid WILL work 40 hrs a week, for their “Hard Earned Money” (unless they “put money to work” and get said “Hard Earned Money” that way)…but it’s all still “Hard Earned”, which is what…’counts”…..I guess.

Also, automation guzzles fossil fuel….possibly a problem down the line with that. ya think…maybe?

It’s why a TOTAL WW2 scale Green New Industry is the only rational CHOICE. Whether it succeeds, is feasible, or not will only be discovered by doing it, right? And like in WW2, Scientists/engineers overrule “managers”.

Any better ideas? Present biz/structure/thinking is obviously a dead end street.

True! That’s why we have in-sourcing!

Wolf..they might not be easily outsourced..but many in time will be ‘Robotized’as well as lower level AI’d in an interesting Techy ‘Goulash’..true?

Automation is encroaching on those low-level jobs – google “automated warehouse picking systems,” for example. Fast-food now employs touch-screen or online ordering.

But, automation is not free. There are resource costs (electricity, etc.), maintenance costs, and capital costs that are amortized over the life of the equipment. The higher the minimum wage, the more cost-effective all that is, and vice versa.

At some point, though, you lay off all your customers so no one buys your product anymore.

Just wait. Soon those hotels will be cleaned by robots piloted by workers in India. Mark my words.

Workers in other countries can handle a lower wage if their basic costs are lower, such as healthcare. Really come down to what the basic subsistence rate is, I think.

Yes especially if we make it effective by 2099. Or maybe….do you recall a song that went something like “In the year 2525….” That might get 60 votes.

Might be a start because consumers who make more money spend more money, which cranks up the economy, and job creation, but might lower corporate profits.

Consumers who make more money pay more taxes. Oh, and when corporate profits dip enough they will offshore or raise prices if possible, or just drop the product/service and move on to something else. Would be very hard on capital intensive industries like cars. Unless you are a visionary young genius in which case you simply sell more stock.

Manufacturing pays a LOT more than federal minimum wage. We’re talking entry level service jobs that are paid minimum wage; those are the jobs that would be directly impacted.

Wolf, keyword “directly” for just the phase-one low-level jobs. As the wage increases ripple up through the economy everything will become more expensive and the quantities sold will probably drop. As planned the government will collect more tax money.

Lisa_Hooker,

Rather than constantly and for decades raising asset prices and prices of consumer goods, and jacking up executive salaries, bonuses, and stock options, it’s time to raise wages at the lower end of the spectrum, no?

And then those wage increases can ripple up into the lower-middle of the spectrum, no?

Those consumers spend every dime they make. So every dime of those wage increases will circulate and boost the economy. And corporate profits might be a little lower, and executives might see smaller increases in their bonuses, and asset prices might be a little lower. I don’t see any drawback here.

There is no functioning labor market in the US because of globalization and unlimited immigration makes the supply of labor infinite. So you can try to end those two conditions, or you can put some minimums on wages.

I personally don’t think every state and city should have the same minimum wage. I think the many states and cities that have higher living wages are tackling the problem correctly. But not all states and cities want an appropriate “living wage,” and that’s where a federal minimum would be appropriate. But I would much rather have locally appropriate minimum wages, set by states and cities, across the US.

A friend of mine owns 6 Burger Kings here in the Houston area. I asked him what he would do if he had to raise the wage of his 100+ employees to $15/hr. His answer was to raise prices and put in ordering Kiosks (eliminate a few employees).

He already has a plan in his budget to do those things when the time comes.

If all Burger Kings closed, it wouldn’t even matter. It’s poison, not food.

Depth Charge: Many retired people eat in BK as it’s all they can afford in this economy that is destroying old people with fixed incomes.

Plus, the BK employees pay taxes so that you could live securely in this Great Country!

Wolf, the hamburger flipper joints find machines to make hamburgers when the minimum wage goes up. Slim profit margins to begin with in fast food. I fear net employment goes down when the minimum wage goes up, read that somewhere about a year ago.

David W. Young,

Hamburger-flipper machines create an entire new set of jobs, which is good, higher level jobs, engineers, software coders, skilled installers, skilled maintenance people, etc. People will be trained to do those jobs and make more money. Your argument has been the forever red herring offered by the proponents of systematic wage repression (which includes globalization and unlimited immigration), which is the system we have here.

BTW, many cities and states have higher minimum wages, some over $15 an hour, and it works just fine, and you can still buy a sandwich that is made by humans.

*insert pic of me in front of American flag saluting Wolf*

Thank you wolf for fighting the good fight on raising wages for the poorest among us. ✊

Oh & *insert chart of stagnant wages alongside productivity*

Some people believe in a visionary future. The one especially not shiny great American slum land. If their grandchildren don’t get in tight with the minority population droning in the corporations, their genetic information will inevitably end up swirling into the sewers of poverty. At least with global warming we can look forward to fewer people freezing to death in their huts.

“Your argument has been the forever red herring offered by the proponents of systematic wage repression (which includes globalization and unlimited immigration), which is the system we have here.”

I stand for neither nor does my comment represent either. Having been a small businessman for 30 years, I know from experience what happens when Government engages in Wage and Price controls a la 1973/74. Uncle Sam knows best what the least skilled workers should be paid in our economy??

Theo move from capitalism towards socialism has exaspersted the unemployment issues.

Wolf, I’m afraid I must disagree (being an engineer who creates consumer products). Yes, new automation creates new jobs, but those workers who are displaced cannot fill those new jobs. A hamburger flipper is not going to be able to be retrained into an embedded systems engineer, for example.

Then there’s the matter of scale. Ten engineers develop a new robot, and one maintenance guy can travel from place to place servicing, say 100 of them. In the meantime, if there were 3 shifts involved, those 100 robots have replaced 300 low-level people.

I agree that there is severe and unconscionable wage disparity, caused by the greed and shortsidedness of corporations, but just raising the minimum wage without addressing that will cause more automation and job loss, even in the low wage service jobs.

Pete Koziar,

In 1996, in the evening of my first day in Japan, my new Korean roommate took me to a ramen shop down the block. Ordering was done at the entrance by a vending machine-type apparatus with photos of each dish. You pressed the button of your choice, threw in some coins, and walked in. By the time you sat down, the chef – only one guy in the entire place – was already preparing the ramen. He had an overhead computer screen with all the orders. And this shop was already run-down in 1996. I don’t know how long ago the cashier and all the other staff had been automated away. Great ramen.

Automation is coming like the sun will rise tomorrow. And it’s nonsense trying to prevent automation. What can be curtailed is globalization of labor and mass immigration of the type that is either illegal or abuses a visa program (such as H1-b). Those two provide an unlimited supply of labor, which is a form of wage repression. Once you cut off that unlimited supply of labor, the labor market has a much better chance of working and pushing up wages from the bottom.

There are jobs, then there are jobs. Robinhooding is now a very respectable occupation.

1. Go to WallStreetBets

2. Take down a hedge fund or two

3. Rinse and repeat.

Add back the 10 million people at WallStreetBets and we are back to normal!!!

I’m shocked nobody’s talking about what’s obvious- the welfare state that has got larger is often the best strategy available.

People don’t want to talk about it because it’s not politically correct, and makes you sound mean and uncaring. But it is just a fact of life that our capitalism has declined. through overspending. We are leaning towards socialism more. It will be a long hard road to save capitalism. There is no easy fix

Implicit,

We have crony capitalism just fine, combined with bailout-socialism for the rich, we now routinely privatize gains and socialize losses. The very top of society benefits from this. The Fed printed $3 trillion in three months last year to bail out the rich. The Fed has destroyed, starting in 2008, the most important function in capitalism — the pricing of risk via interest rates. The Fed has destroyed this pricing of risk so the asset holders can leverage up without paying for the risk of doing so. And when that leverage blows up, and the firms should go bankrupt, the Fed steps in and bails out the shareholders and creditors. And the federal government too bails out shareholders and bondholders, as we have seen repeatedly, including with the shareholders and bondholders of airlines. That’s the kind of capitalism we have.

And you think that unemployment benefits for the laid-off workers has killed capitalism? That’s funny, given where we are.

As usual, well said.

I need a file of Wolf factoids.

Thanks!

People benefiting from unfairness can not see the later by definition.

They think they are God’s greatest gift to the human race.

Mr. Richter:

What you just stated should be printed and on the walls of every American household. It could easily be a manifesto for instant financial rebellion by the masses.

Under the present political/financial status quo we are headed for disaster, both political and financial.

Continued repression of the ability of labor to legally organize and push global business to the bargaining tables in order to improve peoples’ lives, and the continuing belief that “unfettered capitalism” is the answer to society’s ills is not logical and borders on insanity.

Enough.

…Wolf, never mentioned unemployment benefits (though I do think it is being massively abused) . Just observing that unearned money contributes to the change from capitalism towards socialism.

How about recognizing that people need to get back to work for capitalism to be successful. The roads and bridges and infrastructure repair would be a good way to get the money to people that are willing to work. The subsidy would contribute something positive and increase the participation rate, along with the GDP.

Maybe it is too late. Recessions would have allowed a reset, but interestingly the smart people in charge do not see that as part of capitalism anymore. What would you do?

this for mtnfem: you might want to look up the actual definition of factoid, because it is NOT what you and many folks think it is

and very likely does not apply in your comment, which I understand to be intended to be complimentary to Wolf’s great blog

Absolutely obvious! The road back to the Gilded Age is indeed fraught with difficulty and peril.

Perhaps new materials will make 5 cent/week flop houses a more efficient business to run?

Just trying to make your very tough goal seem more achievable, so you don’t have to suffer so much from those “mean and uncaring” thoughts these times are forcing you to utter.

2 yr us treasury note now yielding 0.107, hitting 0.100 today, this says recession, deflation & a massive stock crash, it’s even trying to break that all important 0.100 level. This market is on the edge of a cliff & it’s a very long way down.

But the 10 year is up 2%. What do you make of this divergence?

The 10, 20 & 30 are wrong, they are been dumped by inflation believing traders, the 30 is massively short, the biggest hedge fund short position in history, they will have to cover, the gap between the 2 yr and the rest has to close, this means in my view a massive collapse in longer date bond yield is coming. Everyone in the market is betting on inflation, dumping bonds, buying hyper bubble stocks, oil, other commodities, then you have the desperate who are trying to keep stocks from crashing & moving higher, they are shorting 30yr to a massive record, shorting the Dollar to a massive record, shorting volatility to a level deeper than Feb when the markets crashed. The market now is running on delusion & historic scamming and manipulation, when so many people believe one narrative & gamble on it contrary to all evidence & data it blows up, it simply isn’t possible for 95% to be right, like all crises or crashes only 1% are correct, the other 95% or more are wrong. So hope this answers ya question, the 2yr is the speaker of truth, the others not, the smart money is buying the 2 yr knowing they can hold to maturity & get their money back, make a big gain if yield crash, go negative, safe, then pile into stocks after the crash or whatever they desire, so where ever the 2 yr goes, so will the rest, if you notice the 2yr collapsed Feb & only fell lower, yields didn’t move higher at all, cuz it knows the truth. well the people buying it know the truth.

So, you do not buy the virus subsiding MMT inflation play then? Or 1-2 year recession before that happens?

The right hand on the water nozzle, while the left hand kinks the hose.

Two years is way too long a time frame. The real attention span is more like 90 days max.

I hate to say it but the most accurate price in the market is a 10 year treasury at a lousy 1.1%. Everything else is manipulated more than it. Do I own it? No, I am afraid to go out out past 2 years.

I hear ya. The whole things need to start over again soon, it doesn’t look promising. The light at the end of the double is dim.

End the fed would be a good start, but that is unlikely at this point

Wolf,

Thanks for including the employment-to-population ratio (although 25-54 is better than 16+ because the former strips out any “aging population” excuse that is frequently invoked against latter).

Bottom line, the last 20 *years* have seen failed job mkt recovery after failed job mkt recovery.

Not coincidentally, the same span of time that the Fed has labored mightily to beat interest rates down to essentially unprecedented lows.

Nobody knows better how things are going than the Fed and they have been in ZIRP panic mode for two *decades*.

But the “DC Consensus” will incinerate every last penny of USD value (in ZIRP print operations) before acknowledging that the rise of wholly unrestrained, wholly gamed Chinese mega imports correlate perfectly with the US labor mkt disaster.

Lastly, not a fan *at all* of “labor force” stats…wayyyy too easily gamed by DC sewer creatures taking advantage of nebulous definitions. Likely so misleading that no stat at all maybe better than having this junky one.

Cas127, it’s always been nonsense. The fact is, lower interest rates incentivize borrowing. That’s it. And healthy companies don’t borrow to pay their employees. They borrow to do capital investments, expand, and so forth. So while lower interest rates can make it more attractive to invest in new plants or equipment, it doesn’t make it more attractive to hire someone. You either need the additional worker or you don’t. Interest rates don’t come into the picture.

The unemployment number fell just not enough. The hot stock sectors include Energy, Financials (same thing really), and Discretionary (stimulus check already spent). Despite the hype about Cyclicals, Materials and Industrials lag, and for tech, Apple has lagged this rally. Staples was the worst, even though J&J is getting emergency auth to sell their Vaxx? None of it adding up here getting the uneasy feeling that corporate America will take the money and run; bailouts, ZIRP rates to HY LaLa land, while still offshoring labor (China exports on a tear), and IBM developing new AI robotics to replace every American worker not killed or maimed by the virus. Dystopian couch potatoes drive up stock prices. “When the going gets Weird the Weird turn pro… “

Best comment I read today concerning the current economy and labor market:

Roaring 20’s for the top 10%

Recession for the middle class

Depression for the bottom 50%

The psychology of the bottom 90% will be very different over the next few years as many will start DIYing their projects and services, and that will create more savings as most where not cash reserve prepared for the latest unexpected recession.

Courtesy of the Federal Reserve…which is creating giant gaps in society…

Those who have enough stock, those who do not

Those who work for the govt and have inflation protected pensions for life and healthcare….those who do not

Those who have a house, those who do not…

Already a more robust diy attitude especially amongst cash-strapped youngsters and some Smart middleagers.With the internet comes wikihow,ifixit,youtube,etc. Showing step-by-step how to patch drywall,fix loose outlet,install ceilingfan ir whatever=more workers replaced by tech.Cash savings will not be allowed to accrue due to:logistic issues,inflation,lack of interest earnings,lack of employment stability,digicurrency.

Turning off the TV will reduce the amount of wasteful DoItYourself spending. Brainwashed consumers following home improvement shows are going way beyond home repair.

In my city: Real estate taxes & water rate rising double digits every yr. City council thks we’re all rich because Jerome Powell has inflated our housing in massive inflation. And city pensions are going huge deficit because Jerome suppressed interest rate to 0%, robbing pensions of income this forcing tax increases on us Peasants so Jerome & his rich asset holding friends can get richer at MY (and the rest of the peasants) expense. I want to say the Fed does what the Mafia used to do but I don’t want to insult the Mafia and also there probably are differences.

Mafia has Some sort of code of conduct!! :-)

Doesn’t make you wonder? What the heck are they doing. Have all the fancy Ivy league economic degrees brought us to this?

We need healthy debates to be aired publicly,

Would love to read somebody’s explanation of how it will be fine.

“Confirmation bias occurs from the direct influence of desire on beliefs. When people would like a certain idea or concept to be true, they end up believing it to be true. …”

It has never been so pronounced in the era of group think. This is my confirmation bais :

Math is the closest to the truth we have. Science and statistics are warped by time, change and confirmation bais.

Good points for sure imp, but ya really gotta diverge/consider the differences from your thinking from/about ”science” from all the various and sundry so called sciences, including especially economics, which is just another ”social science” based on many many unproven and unprovable theories, start to finish.

As one who was a very dedicated student of math, physics, and chemistry before getting into an argument with a double Nobel prize guy, which, obviously, I lost, and then I turned to the various social sciences to get my degree the easy way, I will testify, after reading dozens/maybe hundreds of PhD monographs in the social sciences, that not one of them,,, not one, would have been accepted as support for a PhD in the hard science community of just that one university,,, etc., etc.

Just another example of the ”good old boys club” in spite of the many women now similarly included.

The more you know, the more you know that you don’t know. We can always learn more, and improve.

I think we all know the numbers are rigged to a certain extent but Wolf does the best job of anyone on the internet of digging through the weeds to try and get an accurate picture of whats really going on with the economy. It’s two economies for sure which is what makes all of this so perplexing .

Nice Wolfstreet article that underscores our ‘Rona Pandemic K-shaped recovery (instead of the much wished-for V-shaped recovery the pundits wanted.

K-shaped recovery, as I understand it, simply means this pandemic recession has bifurcated into economic big winners and losers.

Winners include Big Tech companies, E-commerce, and Wall Street (finance sector).

Big losers include travel, leisure, food, and hospitality businesses, but especially tragic is decimation of mom and pop small retail businesses– many of which are gone for good. It looks like corporate big box/e-commerce retailers will eat the scraps and emerge even bigger– look at Bezo’s ballooning wealth.

Some observers might see this spectacle as economic ‘creative destruction’, whereby major disruptions reduce or destroy certain parts of the economy and they are replaced with more suitable or fit enterprises. This article mentioned a perfect example of this– airline business travel may never be the same with the advent of Zoom-type remote meetings.

Not creative destruction,just Destruction to bring u.s. To its knees and make everyone desperate,divided,and Pliable!Do not take the bait.Help each other.Not a dem. Vs.repub or Black vs. White thang,its a Humane vs. Horrible thang!! :-)

Meh – the K starts back in 1969/70 where the minimum wage diverted from productivity.

Bingo!

Numbers, numbers, numbers it will all come out in the wash, if they are true the USA will do well, if they are tosh, then most of you can kiss your butts goodbye… We will one day find out….probably nine months or so from now…..maybe.

Yes. It’s All CLASS-based ‘creative destruction’, courtesy of Elite-dase debauchry!

When will the public(s) cast off the soothing partisan blinders and pull that Matrix plug outta their brain stem??

In California some towns have passed an C19 emergency $4 an hour increase for grocery store workers. Kroger says it will close stores.1.9T stimuli has passed the Senate. Those grocery store workers can go home and kick back and hit the Amazon fulfillment easy button. The 12yr high in trade deficit says we Americans are doing our jobs. Consuming and not producing. These are the good times. As long as the producing world will take our paper I say the money printer keeps going Brrrrrrrr…….

Those well-paid unemployed would be Very Wise to learn some self-sufficiency/survival skills because the collapse Is coming,and unfortunately it looks to be sooner rather than later.Maybe reteain to ve E.M.T.s or coders,robotrepair???

Boycott Kroger stores and Boycott automation everywhere. Self Checkout is an open invitation, nay, an excuse to steal everything you can from the corporate job destroying robot.

Get caught? “I don’t understand how these things work, I can’t code.”

There are non profits and co-ops and governments with different goals. A business is created by investors whose aim is to stake up millions of dollars with no guarantee of a profit to try to earn one. If you work for a corporation the earlier you understand they were not created for you but primarily for investors the better off you will be.

Corporations tend to be good at driving down inefficiencies and implementing capital investments that make the place more efficient. It seems like a harsh system but it has been the one that has provided the highest living standards to even the poor.

If you don’t like it you can work in a noncorporate organization and spend your money other places. As terrible as it sounds the profit motive has brought us nearly all of the things we wouldn’t want to live without.

There used to be a saying if you can’t cut it in the corporate world you can always reach. That’s not fair, but I suspect there is a sliver of truth in it.

“…These are the infamous “jobless recoveries” of the modern era, when during each recession, companies vow to bring their costs down, and work is sent overseas:”

Or automated out of existence.

If the machines were taking our jobs then productivity would be growing.

What if the automation is only eliminating jobs and keeping production around the old growth rate? Current measures of productivity are misleading and BS.

You got it. We have millions of people out of the labor force who are not even part of the productivity stats. The typical worker may be producing more, but society as a whole is far less productive because so many are idle.

All utterances by tyranny, government, are propaganda. Not lies, as many are prone to quip.

Propaganda is truth, half-truth, lies, and omissions in support of an agenda. Identifying the agenda underlying propaganda is of utmost importance for the targets of propaganda.

The “employment” numbers the US Tyranny releases are nothing but propaganda. The agenda is, as it has been since 2008, to convince Americans that all is alright and our lack of meaningful employment and continued slide into poverty is temporary and/or bad luck.

Evil and sad.

“we can’t set a $15 min wage across the country because it’s cheaper to live in some areas”

“we will cut off $1,400 checks at $50,000 across the country, even if you live in an area where $50k is low-income”

-Dan Price

Just how are these stimulus payments, based on 2019 income, representing need based on 2020 income? The two income years are a normal year verses a terrible year. How can we base stimulus on the good year? What am I missing?

Dawn, YOU ARE MISSING THE FACT THAT OUR GOVERNMENT IS NOT ONLY STUPID WITH THE PURSE OF THE STATE, BUT THAT THEY HAVE THEIR HANDS IN THE TILL UP TO THEIR COLLECTIVE ELBOWS. Many in government, esp. The Swamp, come in at an upper middle class level, AND WALK OUT THE REVOLVING DOOR AS MILLIONAIRES. What a country!!

You’re being too nice calling this place the “Swamp”. A Swamp is an ecologically balanced entity. This place is more like a cesspool.

Yep, except for a few businesses that are benefitting from the pandemic, most of the economy is in a depression. The unemployment is 20% or more. Most of the government figures are lies. End of Story

At 62 lost job to c-19 shut down still unemployed can’t find a job age discrimination? No more unemployment so not a statistic on govt fake unemployed food lines rental assistance utility assistance had to take social security to survive look in mirror a depression

Exact same scenario as 2008-2010 for those eligible for early Social Security.

I think 62 is good age to get out of the grind and start focusing on your health and social network to live a long and happy life. It will take a while to find your new life. As we age it’s more about health and less about money I think.

Good comment. I would just like to add: 62 is a good age to get out having planned for it ahead of time.

And for most the cruncher is medical services as well as needing income.

Until there is affordable medical access for US citizens many people work because they cannot afford to retire due to sick family member or chronic condition they struggle with. Nothing sadder to see some old grinder in his seventies being interviewed who says he/she has to continue working. Nothing more positive than seeing some old grinder being interviewed who says he/she working because they love what they do and can still work.

Aging and ill health is a huge obstacle for those of modest means looking to retire in their 60s to enjoy non-work life before they are planted 6 feet under.

I blame this retirement crisis on people’s poor life-long lifestyle choices and Big Med/Pharma cartel’s bankrupting policies and prices that erode the measly wealth of most little people.

Best advice to younger people– take extremely good care of yourself so you do not fall into clutches of Big Med/Pharma for rest of your life.

The new administration is looking to lower Medicare signup age from 65 to 60, so if that happens then age 60 becomes a great age to retire, as medical costs force many to retire at age 65 currently.

That said, retirees are going to have to deal with manipulated and low SS inflation cost of living raises each year, even though we will probably be in a 5-10 year stagflation era with 1-1.5% real GDP and 2-5% inflation…not good when the raise SS payments 0.5% per year…

Just this week alone, breakeven rates on five-year Treasury notes (a good measure of future inflation), hit an 8 year high of 2.29%. Oil just hit pre-pandemic highs this week, and the price of oil is the price of almost “everything” (commodities, consumer products, etc). And high oil prices lead to high fuel prices which leads to higher future consumer inflation expectations faster than almost any other mechanism…again, not good.

I agree, if possible retire at 60-62, just be prepared to deal with inflation, even though most think it improbable. Simply put, at some point printing $5 trillion a year and handing it to people who will spend it quickly…that will ultimately push up the prices of necessities. And with the Fed not able to raise interest rates even a measly 1% higher, how do we deal with spiking inflation on a broad scale? They will pretend it does not exist as they print even more money and hand it to people desperate for help, which creates even more inflation, in a maddening attempt to deal with the inflation created by the inflation of money printing. See the perpetual cycle of insanity??? The Fed does too, they just have no other option…plus his $50 million long only stock portfolio is making him very wealthy (Powell is even millions long the small caps…they guy is getting uber wealthy, undeniable conflict of interest beyond a reasonable doubt…)

Just to add my 2 cents worth to your comment, the price of oil this year is bound to go up contrary to pandemic expectations, and that spells trouble for economy and inflation.

And, despite rosy fantasies of green energy crowd, we are dependent on hydrocarbon energy to run the economy for now and foreseeable future, especially IMO with dark winter of a climate cooling age coming, according to scientific evidence (not junk science of global warming enthusiasts now in complete control of current administration).

Even the head of Toyota recently came out and demolished idea that we could move seamlessly and quickly to all electric vehicles to replace ICE cars. Not going to happen, for a number of reasons.

Price of oil appears to be detached from [financial] reality. The only way fracking ends is by decree, and that virtually guarantees $100 oil.

Watch the 30 Treasury Bonds. They are going over 2% heading for 3%. When they get clobbered the carnage will spread down the yield curve. The Fed will not be able to stop it. Next, large swaths of the BBB Bond sector will move into junk. When this happens it will be game over.

In your opinion, what is going to happen considering all of the data?

A replay of the Carter Administration

Yes,we go for 10% inflation within 2-3 years,not deflation l8ke in Japan

Ahh, Malaise on a Grand Scale… So who dons the sweater this time, and who gets a helping of overroasted peanuts?

Once inflation starts getting into Jimmy Carter territory look for these morons to institute wage and price controls in the next election year cycle. Shortages and gas lines will follow.

The Bond vigilantes are warming up the bullpin as we speak. They are going to make the GME short squeeze look like a walk in the park.

I would short the 30 Treasury now if I wanted to make a buck, but I’m not interested. I’m just going to sit back and watch the carnage in the bond market from the sidelines and enjoy a nice cold Bud Light.

So where have the fabled Bond Vigilantes been? Why would they wait in shadows during decades of interest rate suppression and suddenly reappear with all guns blazing? Especially when Fed ‘outlawed’ them.

I believe the Fed-enabled plutocracy euthanized them long ago.

With ZIRP level interest rates, there is really little room for bond prices to appreciate further and one’s risk for buying 5 to 10 year maturities is off the charts, forget the 20 or 30 years. Credit risk is finally coming back into the equation of bond pricing (Bond Vigilantes coming back into town!) and Inflation risk is now present when it has been absent for decades mainly due to outsourcing and importing.

However, just watch the bond market on stock down days (bond prices go down with stocks, NO FLIGHT TO SAFETY! Foreign buyers now have lots of Currency risk with a Shaky Dollar). Yields have to go up in today’s market to catch a bid. New sheriff in town. The Fed does not walk on water, although they think they do.

They’ve been dormant for along time but are ready to emerge with “guns blazing”.

The Bond market and the stock market are the same trade. If the Bond market collapses so will the stock market. And with this 5 trillion of paper just printed you can bet the farm on farm on the long term bond market going south. The only reason it hasn’t done so already is because the economy is in a depression. If they hadn’t printed all that money we would have had a 30% decline in GDP and a total financial collapse of the financial system worse than 2008 and depression worse than 1929 -1933 with civil unrest on top of it all.

Right On, Swamp Creature! The dolts in D.C. are giving your comment handle at bad name!!

I better be careful what I say. A drone strike may be immenent

The inflection point on the 10 yr. for deflation use to be about 4.5% during the last bail outs.

The fed will actively control the rates during this bail out.

It probably is super deflationary at 3.5%; the bankruptcies start getting to be too much from loan unearned money. Perhaps the inflection point is even less than 3.5%

Money destruction creates deflation. Deflation increases dollar value, and makes it easier for the lower and middle class to pay for necessitates.

The rich own the assets that will deflate, they do not like it as much.

My Guess- there will be both inflation and deflation back and forth for the next few fed experimental years.

When do the bond yields hit the inflection point on making it paying back even the interest the loans,and will the public allow another bailout of large companies and banks again at that point?

I think a couple changes might surprise everyone. Consider a job guarantee program which would create full employment. Consider what kinds of jobs will be created; ones where the private sector cannot make a profit. Consider not only minimum wages but make it mandatory for the employed to take four or five weeks vacation–which is the case in a number of European nations. How about a 30 hour work week? Can it be that productivity gains are real? Instead of mind numbing zero rates, the Fed can create whatever rates it wants to create. Think of funding pensions via Treasuries that pay enough interest to properly fund them.

At what point will people stop accusing the government for all the problems? A government that is run by the One Percent is causing all the problems. It’s the privateers that are causing all the problems. They are at the helm of the federal government. What we need is a good dose of old fashioned democracy. We just got a little of it. But we need a lot more.

The biggest disconnect in the American economy started when the people making all the money and hoarding it, the wealthy and corporations, started paying less and less and less, if anything at all in taxes. ‘The flow of money” is broken due to the fact that the wealthy and corporations are making almost all the money, hoarding it and it is not recirculating back into the economy in any meaningful way. Once we start taxing the fuck outta the wealthy and start making corporations pay (I think we must institute and corporate minimum alternative tax) only then can the economy start to regain any semblance of balance. It’s common sense…which is not so common.

You think things would be better if all profits were skimmed off to be spent by government workers?

Wolf, if the Job participation rate is a Leading indicator, the unemployment rate, total garbage number with reality closer to 20%, is a Lagging indicator. So, based on the job participation rate, we are: A. Dead in the water with a no growth economy. OR B. Waiting for the next shoe to drop and the 2020 Deep Recession, structural this time, starts anew.

By any metric, ain’t good news for any fundamental investor, but they don’t exist on Wall Street anymore. ECONOMIC PERFORMANCE JUST DON’T PLAY INTO THE EQUATION ANYMORE!!! 50k more jobs in January, give me a break!

Everyone in stocks and bonds must be a MoMo, momentum, investor, and history shows how that strategy works out. Windows should be nailed shut on Wall & Broad; there will be more Global Warming from all the bodies coming down from the 29th floor.

Maybe traditional P/Es are too low, not accounting for the power some of these companies now wield?

I’d like to know when these school teachers are going to go back to work. They are getting paid full salary, benefits and retirement pensions. THEY ARE FAILING OUR CHILDREN!! Schools have been closed for over a year in this Swamp County with no end in sight.

They keep moving the goal posts.

Now I hear some of them double dipping, doing private tutoring while at the same time drawing a full paycheck.