Meanwhile, away from the stock market mania…

By Wolf Richter for WOLF STREET.

Income from wages and salaries that consumers earned in December ticked up to a new record, as high earners and executives were making lots of money working from home though 10 million other people, mostly lower income, had lost their jobs; and income from unemployment insurance for those less lucky ones jumped. But spending on goods fell again as Americans cut back after the binge, and spending on services remained at dismal levels.

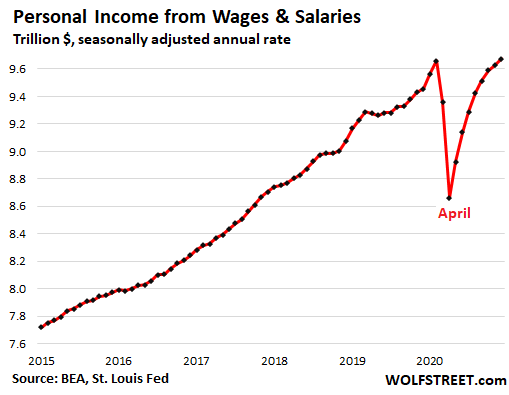

Income from wages and salaries, including from self-employment, rose by 0.5% in December from November, to a new record of $9.67 trillion (annual rate), according to the Bureau of Economic Analysis. This level “in aggregate” of all earners combined reflects that many people, particularly high earners, have done exceedingly well during this pandemic even as 10 million others – many of them lower-paid workers – lost their work and remain out of work:

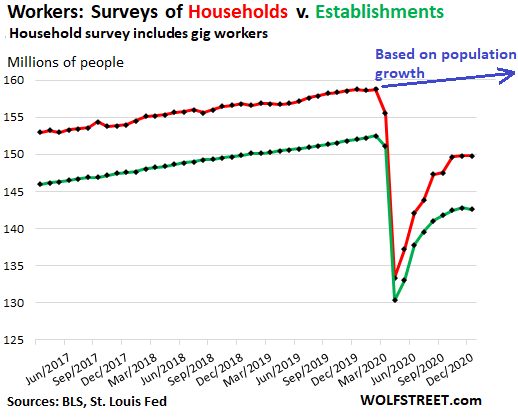

So the Bureau of Labor Statistics reported that in December, nearly 10 million more people were out of a job than had been at the end of the Good Times in February. And the Labor Department reported that 16 million people were still claiming state or federal unemployment benefits at the end of December.

The chart below shows the results from the BLS survey of households (red) and establishments (green), in millions of people with jobs. The blue line indicates the progression of jobs needed to cover population growth:

So lots of people have lost their work. But many people working from home have done exceedingly well, and executives have done superbly well. Executives getting raises and bonuses worth millions of dollars lifts an entire income bucket full of low-paid workers. In addition, quite a few industries have boomed due to the shifts during the Pandemic – including real estate and ecommerce and everything around ecommerce, from warehousing to transportation.

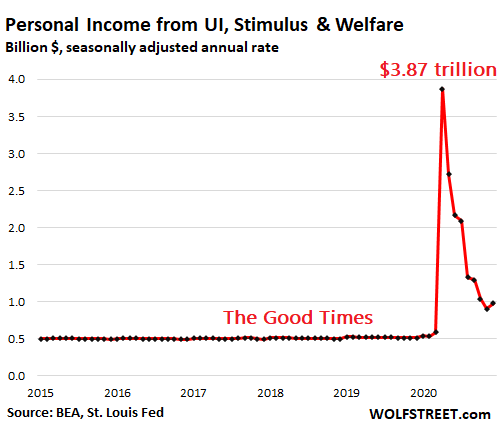

Income from unemployment insurance (UI) jumped 14% in December to $321 billion (annual rate), from the crisis low in November. During the peak in June, it had exploded to $1.40 trillion, powered by the new federal unemployment benefit programs.

The new $600 stimulus payments started pouring into bank accounts on December 29. Some of these payments may have been captured in today’s data. The BEA adds stimulus payments to welfare and other payments, which before the Pandemic amounted to roughly $500 billion (annual rate). In December, the combined stimulus and welfare payments rose 5.6% to $654 billion from November.

UI, stimulus, and welfare combined jumped by 8.3% from November to $975 billion (annual rate) in December but remain much lower than the huge spike in the spring:

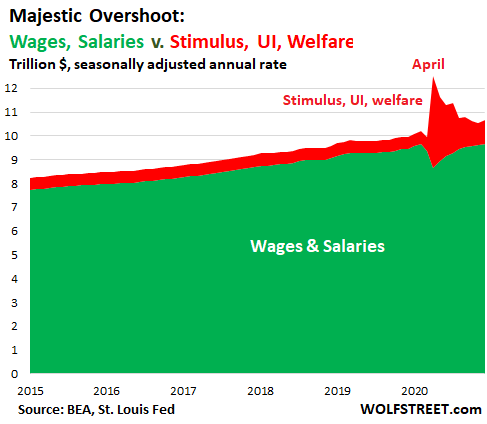

This produces the Pandemic Money Overshoot, with stimulus and unemployment payments (red) generating much more income than was lost in wages and salaries (green), which is in part what triggered the Weirdest Economy Ever:

Income from other sources in December inched down 0.6% from November and fell by 1.7% from the Good Times in February. Below are the changes from the Good Times ($ amounts in annual rates):

- Supplements to wages, such as employer contributions to benefit plans and social insurance: +0.5% ($2.76 trillion)

- Proprietor’s income, farm and nonfarm: -6.8% ($1.64 trillion)

- Rental income of persons: +0.4% ($805 billion)

- Interest & Dividend income: -0.9% ($2.95 trillion).

Government transfer payments to persons under Social Security, Medicare, Medicaid, and the Veterans Administration rose by 5.7% from February to $2.78 trillion (annual rate). Though Medicare, Medicaid, and many VA benefits are paid to healthcare providers, they’re considered “personal income” because patients are the beneficiaries of the services.

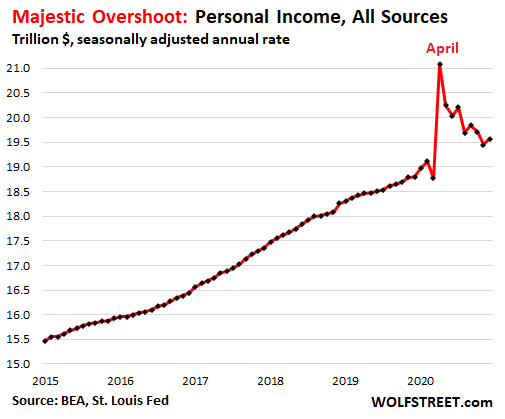

Personal income from all sources in December ticked up 0.6% from November, which had been the lowest since March, to a seasonally adjusted annual rate of $19.57 trillion, according to data from the Bureau of Economic Analysis today. It was down 7.2% from the stimulus-and-extra-unemployment spike in April. Compared to the Good Times a year ago, total personal income was up 4.1%. The actual income for all of 2020 was $19.73 trillion, for an average of $1.65 trillion per month:

And Americans cut back.

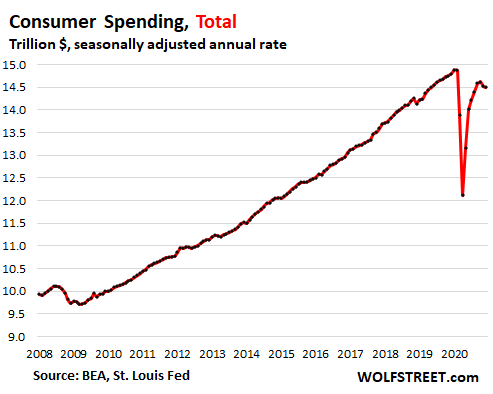

Total consumer spending in December edged down 0.2% from November to $14.49 trillion (annual rate), the second month in a row of declines. Compared to the Good Times a year ago, spending was down 2.1%. The decline was due to bigger drops in spending on goods, particularly durable goods.

For the year 2020, the surge in spending in the summer and fall didn’t fully cover the hole in the middle and fell 3.1% from 2019, to $14.65 trillion.

When adjusted for inflation, spending in December fell 0.6% from November. For all of 2020, and adjusted for inflation, spending fell 3.9%.

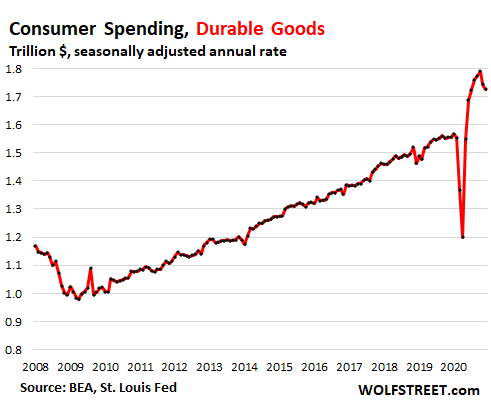

Spending on durable goods fell 1.0% from November and 3.6% from October, to $1.73 trillion (annual rate), the lowest since July. But this was still up 13.0% from a year ago as consumers had spent a portion of the Pandemic money on laptops, smartphones, appliances, new vehicles, or rowing machines – I just learned that the models by the most established brand are still on backorder. Many of these products or their components are imported, leading to a record trade deficit.

For all of 2020, durable goods spending jumped by 5.6% to $1.62 trillion, despite the hole in the middle.

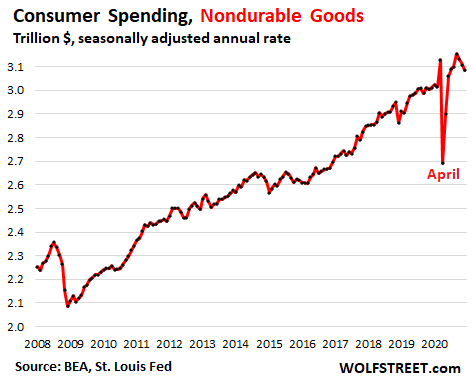

Spending on nondurable goods declined for the third month in a row, in December by 0.7% from November, to $3.08 trillion (annual rate), the lowest since June, but was still up 2.5% from a year ago. This includes food, gasoline, tissue paper, clothes, and the like. For the year 2020, spending on nondurable goods was up 2.2%, despite the plunge in the middle:

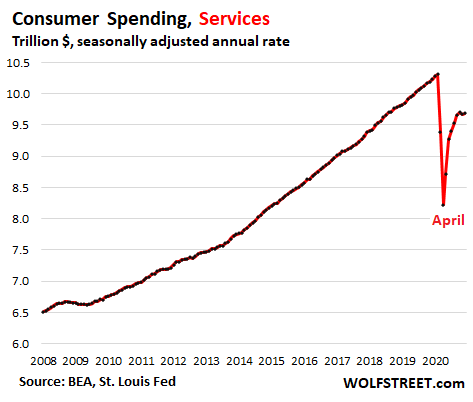

Spending on services was essentially flat in December with November, and at $9.6 trillion (annual rate) was down 5.4% from a year ago, and was down 6.1% from the Good Times February.

For the year 2020, spending on services dropped 5.4% to $9.49 trillion. Services matter. And they’re mostly produced in the US, rather than imported. They accounted for 65% of total consumer spending in December and include rents, healthcare, insurance, plane tickets, education, hotel bookings, movies, wireless subscriptions, etc.

It looks like the Pandemic-driven purchases of goods, particularly durable goods – from equipping a home office to installing a hot tub on the deck – are backing off. And spending on services is still dismally low, given the many restrictions that impact services.

For some Americans, 2020 was great in financial terms. They made more money than ever, their investments and home values were inflated by the Fed’s $3 trillion QE, and they’re exuberant, and they bought goods they wouldn’t ever have bought otherwise, and they spent money on goods that they would have spent on services such as vacations at far-flung locations. But for many other Americans, 2020 was a horrible year, where everything fell apart.

GDP fell by 3.5% in the year 2020, the worst annual decline since 1946. Trade deficit in Q4 hit new all-time worst. Read… The Year of the Plague in Charts: Weirdest Economy Ever

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So those who have jobs, had a great year making more money than ever.

So those who lost their jobs, were given higher paying government jobs making more money than ever.

So everything is great!

Why don’t I feel so great?

The first Federal stimulus package provided Federal unemployment benefit payments of $600 per week on top of State unemployment payments. The second Federal stimulus package provided Federal unemployment benefit payments of $300 per week but the second stimulus bill also somehow reactivated State unemployment benefit payments that had run out and were exhausted…so the average unemployment benefit payments from the second Federal stimulus bill probably averaged $600 per week when combined with the newly activated State unemployment benefit payments. Those stimulus bills are composed of hundreds if not thousands of pages and no one really reads them, especially the US Senators and US Representatives.

You don’t feel great because everything is financed by debt. 27 trillion and counting. Just like the Roman empire … one day it will all be gone.

@anders….yawn…..thanks for the bedtime story pal

If you are look at the debt clock the 27 trillion is manipulated. The actual outstanding debt is the bottom left quadrant “derivatives” where the estimate is between 300-600 trillion. No amount of austerity will pay that bill.

Wanna guess how many millionaires a trillion can make? A million. Wanna guess how many millionaires a quadrillion can make?

Millie Brown,

The debtclock is an algo and a silly joke.

The US Treasury debt is made up of Treasury securities, and each one of them is known and accounted for. They’re traded in the markets, and you cannot manipulate the number and face value outstanding, though you can manipulate the price and yield as the Fed does via its monetary policies.

> Why don’t I feel so great?

Because you know that’s temporary.

Wages are resetting lower across the board thanks to remote working, globalization and automation.

A great thing imho, we have to aim at being competitive. Inflating housing costs doesn’t make American workers more competitive against a global work force.

leanFIRE_Queen

“A great thing imho, we have to aim at being competitive”

Competitive at what?

I read so much that the USA have outsourced manufacturing to China; that it is not worth fracking for oil because of the low world oil price, minimum wage will be US$15 per hour.

The average Thai worker manufacturing Toyota cars (well paid job) gets US$660 per month for a 45 hour week.

So who is the USA you going to be competitive against?

Anything the USA designs is copied quickly and on the market fast by China and china is just getting good on the technology side thanks to the west outsourcing it.

What you don’t get is as wage levels drop, so will prices. All those $15HR workers can never afford the high rents the rentiers expect. The rentiers too will take the hit, eventually.

So reset away, and watch corporate incomes drop with the general price levels.

There is people who keep their jobs but made less money.

Or had to take pay cuts because they are now working from home.

There is people who lost their jobs and haven’t got a new job yet.

Yay!

Maybe don’t exercise enough? Overweight? Take too many meds? Bad diet? Too much Fox? Don’t have enough “stuff” yet?

Just suggestions.

That all colored in chart kinda proves Twain right;

“Go ahead, give the poor all the money you want, the rich will have it all before nightfall, anyway”

It’s all by design.

The few will gobble up anything I do not let go.

Then the lenders will gobble up all that I cherish.

And I never ever carried debit of any kind. -K

Here in flyover land, we can’t find workers who want to work. The pork barrel

Stimulus package of giving an extra $600.00 or $300.00 a week over unemployment benefits is insane. Unemployment was meant to get a person or family through a tough time, not buy big screen TV’s, hot tubs and new vehicles. This will not end well for the United States. That stimulus money should have been used for an infrastructure package and keep that money in the U.S..

Oh mr farm hick ..

it’s a tough one feeling remorseful about yourself as others clearly suffer a harder fate in life…. ain’t it?

How your doing in “flyover land” during the ronald reagan / bush years when they invited everyone from all over the world to come to fly over to work?

JUST TO BUST THE UNIONS and DESTROY THE MIDDLE CLASS?

Two questions mr. hick…

Why you think a couple 300 dollars per poor slob and others gonna hurt?

Why you think your piddling tax contributions could even catch up to the simple happiness and basic relief this tiny amount WILL bring to fellow Citizens?

Never mind,

-k

Providing “happiness” to the people through printed money to splurge on durable goods is not a proper function of government.

It might be, when those formerly ‘durable’ goods crap out.

In my mind, happiness is a functional clothes washer … not some rocks to beat the dirt out!

It’s all or nothing with you calvinistic Ideologs!

Okay, but that argument can only be used to justify UBI, not stimulus or pandemic relief. If someone hasn’t lost income, giving them money to buy foreign made washers is not stimulating the economy. If someone has lost income, then unemployment will not cause an increase in “stuff” buying, as they’re just trying to keep their heads above water.

The health of capitalism is directly related to it’s citizens’ work ethics. This would seem to be intuitively correct.

It’s fine as long as you don’t call it capitalism anymore because it’s not.

Nothing is perfect, economic philosophies come, and go in cycles.

There’s a lot of things that could be done to try and fix this capitalism, like allowing a recession. Bring back Glass Seagull, prevent lobbyists bribes, break up the big monopolies..

hat’s a good start, then you can get to the real ethical stuff that most ignore that would save money : stop the drones from killing innocent people and calling it an accident of war in the middle East. Hold the programmers

and those in charge that let the algorithims commit murder responsible, I think that yuse science and math to write the algorithms, what could go wrong?

Decent people complain about this when Greenspan came up with his demented “wealth effect” inflating housing costs and during Bernanke’s QE insanity.

Not when the poorest among us are finally given a break after policies that relentlessly take from them to give to asset owners like the landowner above. We should just increase land taxes IMHO.

I’ve been actively decrying the Fed’s actions since Bernanke (I was too young during Greenspan’s reign to really understand what was happening).

Why not?

They do it all the time.

If a little bit of help can bring a simple easement I am in favor.

Why the hostility?

It is common knowledge that generous unemployment benefits remove the incentive to work.

Smart-ass lecture not needed or appreciated.

There are no jobs for people to go back to!!!! That’s the point!! Why would a bartender who can make several hundred dollars a shift possibly going to school to better his life want to move to a podunk town and work a farm labor or worse meatpacking job for $10 an hour??? He’s competing with 3rd world Somalis and Mexicans. Do you expect college educated laid off workers to do the same? As the article states executives and those who just happen to be in the right career are doing great! You sound like the idiot politicians who think oil pipeline workers can just go build solar panels or learn to code. America is dying because of the “I got mine, eff you” mentality.

What’s even worse?

My neighborhood is full of “Welfare Queens” driving BRAND NEW Teslas!

Giving $$$ to corporations and rich people that don’t need it (DJT’s tax cuts) is good! Giving $ to poor Americans makes me sick. I’d rather children starve than a rich guy lose his vacation home or yacht.

Remember when they asked John McCain how many homes he owned? He wasn’t sure how many!

And didn’t Ayn Rand end up living in public housing and cashing her SOCIAL(ism) Security checks?!

Oh those GOP rubes…they just keep voting to slit their own throats don’t they?! :)

Smart-ass lecture not needed or appreciated.

Mr C, right on. Some of the commenters on this blog have degenerated a good bit over the past many months. Covid related no doubt!

Oh Nick American way of life is dying when the bummer attitude took hold

Zzzzzzzzzzz

Unions in the public sector enrich themselves at the expense of the taxpayer. Unions in the private sector eventually destroy the industries they dominate because someone else will do it both better and cheaper (see UAW). So they are a great deal for the people who get them for the 20 years or so until disruptive businesses undermine their inherent wage and work schedule inflexibility.

The little people who worked at a VW plant in rural BFE Tennessee a few years ago voted against having a union.

A VW executive flew from Germany to address them. He said: “Individually you can beg….collectively, you can negotiate.”

He did what was better for the worker then the corporation. My father, who was in WWII, would roll over in his grave if he knew Germany companies treated their employees better than US companies.

@keppered – if we just gave them much bigger checks they would be much happier.

Who are they?

You and me?

This is not the future our fathers left us.

keppered you have that so right. This isn’t even close to the future I anticipated 20 years ago – when I was in the future anticipating business.

Kep-

Forgot the who is “we” that “gives” part.

Anyway, “future anticipating business”? Cool!

Like a writer for Popular Science?

I have tried to hire domestic workers. The problem is that they don’t see the pay rate as worth their time. They show up for a couple of days and then we see them no more. We hire only Central Americans and when we need help our workers recruit their friends and family members from their villages. They are happy to work doing roofing and general construction labor. And they do not do so many drugs on the job which is a big plus in a high rate worker’s comp environment.

I beg to differ Felix,

Only because your statement echoes year after year of ignorance towards other peoples time and management compared to yours.

Perhaps your sense of time and management differs from others?

Perhaps we dig a little deeper?

“We hire only Central Americans and when we need help our workers recruit their friends and family members from their villages.“

God bless you !!!

DO YOU TREAT YOUR WORKERS FAIRLY?

OR send them away as no good “Domestic Workers” as a problem when something ain’t right?

Now I can go on ,

Do you have profit and loss issues?

Do you own the property under your business?

Do you abide by the United States Federal and Local laws as will as …….

All the rest of them.?

Don’t b….S…. me boy you find one good down to earth hard living boy or girl they will buy your business out and still make sure you and yours are taken care of.

From Central America or saint Louisiana.

Peace out

It’s a sad state of affairs when your salary for domestic workers cannot compete with $28,800 per year under the UI stimulus program. The 2020 poverty threshold for a four-person family in the U.S. was $26,200. Try supporting a family on that income. The stimulus was designed to do exactly that, help a family that had lost their job reach poverty level. A single wage earner family suffered the most. One reason that many families had surplus was because of two wage earners, when only one lost their job. Often, the second wage earner was earning less than the UI stimulus payments. They had no time or resources to means test benefits, which happens for most state UI programs. Have a heart. Some poor people actually did better for a little while. It won’t last.

My brother and his wife are professional musicians in NYC, all gig work, managed to eke out a nominal living, month to month and were fine with that. Good luck to them at the end of this pandemic. They have taken retail stocking jobs during the Christmas season, but those were seasonal. They’re gone and so are many, many theater and musical companies…they will survive because both have other skills, but, sheesh…

My brother and his wife are professional musicians in NYC

you said it all in 1 statement

guess those MUSIC DEGREES aren’t working out to well

maybe they should find ACTUAL WORK INSTEAD

I like music, played in band when young and then realized I NEEDED TO HAVE A CAREER(or 3) and MAKE MONEY TO SUPPORT FAMILY

so I worked hard, lived WITHIN our means and SAVED/invested

finally after 30 years WE NOW HAVE GROWN UP FAMILY(with KIDS who have skills and ARE WILLING TO WORK)

now we have 5 more years to SAVE SAVE SAVE for retirement

but we have good foundation

Joe,

The majority of professional musicians in NYC don’t have degrees. They have been practicing their craft since childhood. They can make a very nice living, with Broadway, concert venues, the club scene, recording sessions, etc. It is a business based on reputation and skill.

While they can make a lot of money, many are not good at managing it, which is why they have the reputation of being broke. But I knew many that did very well.

Oh lordt. Another “artists should get a REAL job!” comment.

After months of being stuck at home to watch movies, read books, listen to music, learn a craft… all made by artists… people still think everyone should be an MBA? Or whatever job doesn’t require student debt but makes 6-figures to be able to afford houses & children & debt free life? It’s just so odd to hear that so often here when irl, I know plenty of wealthy/successful business people that value the arts and go out of their way to support artists. Most of them know what dull lives they’d live if they were forced to be around people like themselves.

A threshold you stated is not the same as poverty level. Sadly slice it by a quarter. A major discrepancy AND major theft of middle class income come from construed financial data.

The construed data lends to the belief we are all doing OK or better then which we are.

That’s the hateful of what is transpiring, we are being killed softly with their song.

Personally I think the show will go on a much longer.

Don’t lay down and roll over.

Felix,

New home sale prices have *doubled* in the last 20 years, during one of the worst periods of US employment growth ever.

By destroying interest rates paid to savers, the Fed’s ZIRP has handled an inconceivable windfall to home builders (by grossly perpetuating the “affordable monthly pmt” scam that allows builders to Jack actual sales price).

And, yet, the builders are so desperate to screw down their labor costs (despite doubled sales prices) they eagerly and openly engage in widespread criminal activity to import millions of illegal aliens.

I don’t think the problem is with your US candidates.

actually in past 20 years the FED has DEBASED THE VALUE OF $dollar by 1/2(ie need DOUBLE FOR SAME VALUE)

I don’t think the problem is with your US candidates.

how so 1% builders OWN our candidates which is why CORRUPTION RUNS RAMPANT in DC/states

just remember that YOU WORK FOR STORE and BUY FROM STORE at STORE PRICES

don’t like – no problem but there are NO ALTERNATIVES LEFT NOW

“…actually in past 20 years the FED has DEBASED THE VALUE OF $dollar by 1/2(ie need DOUBLE FOR SAME VALUE)…”

But wages haven’t doubled, so your argument as it pertains to housing prices is bunk.

But wages haven’t doubled, so your argument as it pertains to housing prices is bunk.

and yet I’ve managed to go from $80 an hour in 2000 to $40 in 2020 and STILL CAN BUY

of course I bought in 2009-2014 when prices were reasonable

but not in 2006-2008 when to high

so right now you DO NOT BUY

but maybe in couple years prices will slack off and then you buy

but hey you can call it bunk – but truth hurts

I agree, another example is the American agriculture industry , heavily subsidized while employing a large workforce of ILLEGAL aliens.

It looks like new US administration is pulling out all the stops to hobble ICE and encourage more illegal immigration.

I think in future you will have more cheap Central American workers than you know what to do with.

I live in Tucson – 80 miles from border

been here 35 years now

I can tell you there is NO SHORTAGE OF WORK at decent wages

but you have TO WORK

friend of son – was building wall and made $2,400 a WEEK

now he’s out of work – oops now working at HOMELESS DEPOT for $12 an hour

he refuses to take UI and has 2nd child on way

so much work and to few WILLING TO WORK

the woke folk are comfortable playing their games on TV and sedating themselves with MJ’s

The home builders will be overjoyed!

11 million is a joke….my mexican cousins even laugh at that number….30 million will come……get ready…..this is not your 1980’s amnesty anymore……no american should pay one penny for any illegal alien, ever……..go to any other country see it it works…the 2 headed corpocracy party snake is killing america……that’s the real issue…

BOOGIE-BOOGIE-BOOGIE!!!!

The HORDE is outside my door right now!!

HELP!!!!

Ahhhhhhhhhhhhhhhhhh……..

Hey, take a look around you.

See all these really serious problems?

See the botch Covid-19 response?

See the corporations / Wall St. / Banks/ Big Pharma running roughshod over little people?

See the opioid crisis?

See the lack of healthcare, education, etc.?

Notice a mob sent by a US President to interfere w/certification of an election he just lost? That’s called a Coup Attempt.

None of these have anything to do with some poor brown people fleeing violence. Are you an American Indian?

Probably not, which means your people came here from somewhere else too.

If a poor person from Honduras can take your job, you must have little to no actual skills. Your priorities are wrong.

Kind of like what ron regan did as a way to destroy the american middle class? He signed executive orders, forced legislation, turn his back on strong policy and destroyed the labor unions by enacting strong border laws and not enforcing them.

Hence we have our brothers and sisters with us and they have been among us for four decades.

YOUR argument is old and tired and completely unknowingly, all though I hope you try to educated first yourself and then those who may be near you!

Aliens are unable to get on welfare, and to live properly demands a good work ethic. Just a very general observation please don’t shoot me. Rough crowd today

Once they have citizen children, the parents can get housing assistance, food stamps and cash. California offers Medi-Cal coverage to undocumented adults. Haven’t you heard?

Private charities do not discriminate and offer housing, food and shelter to non citizens.

Having a child born in the U.S. gets you on the welfare, ADC, food stamp, etc, train.

It is a rough crowd, Implicit. I don’t know if it explains the lack of civility these days, or reflects it.

I don’t like the name calling and snide comments when the real issue is just a difference of opinion.

Sometimes people need a hand up, especially if they do not have family that can help.

As for the comments about ‘illegals’, reminds me of the Italians, Irish, Poles, Okies, whatever group is in vogue to denigrate and demonise. Migration will occur, and always has. Climate change will bake it in. Two choices, buy guns or buy bread, and hope it isn’t you that ever needs a smile.

Cities like Phoenix are unsustainable. Most of the SW is living on borrowed time. Where will you and/or your children move to? How do you wish to be treated?

Paulo,

“Migration will occur, and always has. ”

One of the great lies of the Left regarding illegal immigration (which in reality is a barely concealed ploy to create political advantage) is to somehow pretend there is *no immigration* if *illegal* immigration is halted.

(The ploy? The “demographic inevitability” Dems like to ballyhoo…while obscuring its criminal origins)

The US has large annual numbers of *legal* immigrants who follow the rule of law of the country they are coming to reside in.

For those legal immigrants, their first act in this nation isn’t criminal.

The millions of illegal aliens (and their US financial and political Co conspirators) are simply placing the immediacy and primacy of their personal desires over the rule of law…and have been unapologetically doing so for decades.

Been knowing folks who came here legal and otherwise for several decades, at least back to mid 1960s.

In those days, folks from all over the world came here to work to earn more than they could at home, and send most of it back home to support family, etc.

Still pretty much the same thing happening recently with folks from all over Asia, ME, Europe, south and middle Americas,,, every region of the earth coming to do better, never mind any BS excuses from them or from corrupt crony capitalists in USA who know full well they can exploit hard working folks, at least for a while, for cheap labor who will work hard for much less. ( These days I believe $5/hr is going cash rate.)

Exactly why majority of rich folks supported any and every likely candidate anti former POTUS politician with millions,,, millions that will soon be ”realized” as extra profit due to $5/hr instead of $15/hr for one glaring example.

This kinda stuff been going on here in USA since one of my alleged ancestors came over in the Mayflower as a slave, so said some group that denied a relative a college scholarship on account of that.

And the ”holier than thou attitude” has been here as soon as some early English folks found they could use it to drive down the cost of the labor of Germans, Irish, others from Europe north and south,, and so on until today.

German ancestor had to change his name or lose his job in anti German hysteria WW1 era,,, Irish ancestor had her name changed at Ellis Island, along with her entire family,,, or they could choose to go back to Ireland in the midst of famine, etc.

USA will change,,, and keep on changing,,, and we can all do our part to at least try to keep those changes moving us toward more democracy and actual capitalism.

Ok, just a quick issue with this line of thinking. Only 1 in 5 people eligible for housing assistance are able to access it. Unlike food stamps, which is accessible to any citizen (not undocumented workers) based on income, housing assistance has wait lists that are so long most states have them closed. There are NO housing guarantees for the poor. And housing prices are unaffordable for min wage workers in every state.

There’s a reason housing advocates have been sounding the alarm these past months. Housing was already unaffordable, before Covid. For the poorest among us? This is an emergency & necessitates aggressive funding. I’d argue regardless of citizenship & based on humanity. But I know that’s a tough concept for some.

Paulo, My parents were aliens, and didn’t get their green cards until I was 8yrs. old. They were very hard workers, and managed to get us (6 kids) out of a triple decker in the city. Initially my dad was denied work work due to NINA- No Irish need apply, but was later hired as a scab welding rebar at the old Boston Garden. They taught us all a good work ethic. Showing -up is half the ballgame.

Presently I work part time (25 hrs/wk) while collecting SS. I have been fortunate enough to not miss any days of work, unless scheduled since starting this retirement job 7 yrs. ago. I have worked with challenged individuals my whole life, orthotics and prosthetics for 35 yrs, with 30 at my own small facility. In my retirement job I still work with challenged adults, not just the physically impaired individuals. I have always had empathy for the less fortunate

My dad only had a 6th grade education , but he was very smart. When I asked him how he knew how to do so many things, he responded “I had to because we didn’t have money.”

Felix,

Perhaps you could tell us specifically what $/hr you’re paying that results in the problem you’re experiencing. I’d also wonder what the cost of living is there.

If posting the actual city seems too non-anonymous, just think of a different city with similar costs.

It’s not difficult to understand your complaint, but some actual specific data points would be very useful. If you’re offering $10/hr in San Jose CA, then I have an idea of what the problem is.

Paulo

There has been very little “climate change” since this issue was raised about 30 years ago. Of the approx. half degree C of warming since then, it is unknown how much of this is man-made and how much is natural variation. There has certainly been no evidence presented that justifies the present hysterical catastrophic man-made global warming conjecture that pervades the news media. We have much more important, real problems to address.

I appreciate the quality of you contribution to this blog, but I sincerely suggest that you reconsider the evidence on this issue.

Best

Bruce

Well, basically crickets from Felix so far.

Perhaps he will respond and it would be particularly useful if he honestly responded with what he offered to legal American candidates per hr (total comp) vs. what he has been paying illegals (total comp…but common 30% benefit premia very unlikely because they would leave a paper trail back to initial criminality).

Again, this is all playing out against a backdrop of,

1) a *doubling* of new home prices over 20 yrs,

2) powered by DC’s ZIRP gutting of savers’ interest,

3) allowing homebuilders to rapidly double home sales prices while keeping all important “monthly payment” dangle constant,

4) during a period which has seen some of the slowest employment growth in US labor in US history.

But the huge ZIRP subsidy isn’t enough, outright criminality has to be employed in order to ensure that the huge ZIRP expansion in margins accrues solely to homebuilders.

Bruce-suggest you reconsider the evidence on climate, FRESHWATER and its recharge rates vs. mountain snowpack/glaciers in the American west (see current levels Lakes Mead and Powell, falling aquifer levels in California’s Central Valley and the plains Oglala aquifer. A push is on now in Nevada to take water from the Ruby Mtns. in the northeast because Lake Mead can no longer supply Vegas’ requirements vs. the other straws that are in it) especially in a time of growing populations demanding even more from their environment. The development assumption was that plenty of freshwater could always be found-but those resources are in a current, serious, decline. Paulo is right (and not only about Phoenix) concerning the sustainability of large populations in what were semidesert or desert areas to begin with.

We could go on to areas dependent on glacier-fed rivers, such as Southeast Asia from the Himalayas, but we won’t.

Breathable air doesn’t come out of the sky, freshwater from a tap, or food from the supermarket. Perceived small changes in temperature can and does have a very large effect on all of these things that civilizations and our species need to survive. The planet cares not whether we make it or not, taking care of that which takes care of us can hardly be considered ‘hysterical’ imho.

Best to you, Bruce, and-

may we all find a better day.

Yeah, literally 100’s of million years for all that carbon to go from CO2 to C-Hn. And then only 150 or so to reverse it all. A very natural process, to be sure. And Paulo is up there where the ice is melting big time, so what would he know?

At least we finally get a Northwest Passage (although that was more the age of sail dream). But it will burn a bit less fossil fuel, anyway, and it looks like Canada has the best dibs on it.

Not to worry Felix. Your biz will be scaled up and/or eliminated by the corporations, and you, or whoever might have inherited it, will find a place amongst the corporate slaves, or end up in a ghetto, or both, and maybe even homeless. But in any case, being despised for begging for scraps from an ever shrinking “democratic” government. This “program” has been going on a long time. You likey have even been voting for and promoting it.

Being a trusted and respectful domestic in the “big house” may yet again become one of the premier “jobs”, working for those few with a “position”, not a “job”

Anyway, your current “labor management” problems are close to an end, FWIW.

I can always tell when somebody has a employee mentality. Less than five percent of people have ever been self employed and probably less than one percent have employed a significant staff twenty, thirty or fifty employees. These commenters who hate on you are ignorant people with strong opinions. I employed fifty people in the dry cleaning business and i have to agree with felix 47 the latinos work circles around other workers and are reliable the asians (hmongs) were very good retail clerks.

Gordian,

You define “good employee” as someone who will maximally break their back for minimal pay, in order to maximize *your* income.

Fine, you want to maximize your business income (while *not* maximally breaking your *own* back…you are perhaps working very, very hard…but you aren’t working alone).

Again, very understandable and very human.

But don’t denigrate (“employee mentality”) those who have not given themselves over to what, in the end, is *your* agenda (*their* maximal effort for *your* minimal payout to them).

In point of fact, they are making the exact same effort vs. return calculus that *you are*…except they are negotiating against your short/long term interest so it pisses you off and you wrap it in a philosophical agenda (“can’t find good help anymore…ie, they all want to be paid more now that business revenues have doubled, what lazy *ssholes…)

The middle path is to have workers who energetically contribute to the growing profitability of the business…*but then share in that profitability of that business through higher wages*).

This all started from my observation that 20 years of Fed ZIRP, while impoverishing savers, has doubled the prices of new homes (by creating affordability illusions via keeping the monthly mtg pmt flat).

Yet, despite this doubling of homebuilder revenues (during one of the worst periods in US economic history) the homebuilders are *still* so dissatisfied that they are willing to engage in large scale criminality (illegal immigration facilitation) in order to *fully* screw down their labor costs.

I’m not on board as seeing that behavior as some noble, beneficent enterprise.

And I’ll also say it is a pretty short sighted “owner mentality” because it incurs big risks (employee apathy, labor unrest, criminal consequences, etc) all for the sake of what likely amounts to cost increases that could be accommodated in the context of revenue doubling.

@ CAS127 –

Impressive response to Gordian. Worth saving.

I believe I remember you managing or owning apartments. I think your same argument could be applied to landlords. After all, rental property is useful to the extent that it siphons productivity through the renter to the rentier.

Pretty much the same argument could be attached to renters of money.

cb,

1) No, not an apt owner. I’ve just thought about ZIRP a lot and my sense is that the Fed’s “plan” circa 2001 (and non course corrected for 19 yrs as the country fell apart) was that gutting rates would empower purely domestic industries (shielded from intl competition) to greatly expand output and employment via greater mtg affordability.

2) The homebuilders responded by instead doubling new home prices and keeping affordability and wages/employment flat.

3) And that ZIRP windfall (relative to non debt contingent industries) *still* wasn’t enough for homebuilders, despite doubled revenues and everything that suggests about their profit margins.

4) The builders *still* have to roll out the old saw about “lazy Americans who won’t work 100% accruing 100% to my own benefit” and engage in mass criminality in order to generate the necessary labor supply leverage.

5) Broadly see your pt about rents/money arbitrage but I’ll have to think about it for a while.

It is the players engaged in two sided screwings powered by ZIRP that tend to irritate me the most.

(Homebuilders who have jacked prices while using crime to screw down labor costs and CDO makers who market doomed consumer debt and then feed it to ZIRP starved savers)

“Employee mentality”…….Us worker bees are just stupid, Knot, why else would we be worker bees?

That’s your thinking…..which justifies treating us as commodities, (Human Resources…the HR dept) not people….just put us in warehouses or back in the dirt as your business needs require.

And always buy at the lowest possible price for best ore grade possible, like any other commodity purchase, and not one penny more….that’s YOUR hard earned money.

Brings again to mind Paulo’s “…you pretend to pay us, and we pretend to work…”.

may we all find a better day.

@Cas127

I think you miss the point.

It is not about employer-employee duality.

It is about being active or passive in life.

Dont worry.

Help is already on the way from the south.

And the Wall won’t stop them! (maybe I should have commented in Spanish?)

Brazilians speak Portuguese, and in general exhibit a great work ethic. I would hire one in a heart beat.

been going on for 50 years now

over 1/3 our population is hispanic

yet PROFESSIONALS are busier than ever making good living

but you know THEY HAVE SKILLS and ARE WILLING TO WORK

Joe, it’s 40% Hispanic here (Texas). I really need to learn their language.

I hired a crew to paint my house. When the head guy, who spoke some English, was not with the crew (went to another job for a bit), I could not communicate with the painters.

I also speak fluent Lithuanian, and leaning Spanish is soooo different. LOL!!

No ethnic group in California has a majority. The Hispanics are the largest ethnic group in California. A number of these are not old enough to vote. The Asians are the fastest growing ethnic group in America and have a higher median income than Caucasians after Asian professionals immigrated to the US.

Historically, a goodly part of this issue seems to devolve from a ‘low-paid working population vacuum in wealthy societies’. One nation’s ‘low (and avoided) pay’, however, is a step up to those in a neighboring land. How much, as a business owner, do you choose to honor your own country’s immigration laws over your personal profitability? How easy is the victim-blaming of workers from either side of the border? (a big tip of the helmet to Cas/NBay).

may we all find a better day.

Could be the workers in flyover land are in Washington trying to overthrow the government? How much of that UI money is being spent on AR-15s, ammunition, and para-military equipment? What’s left is donated to dubuious political causes, and hate groups. The failure to post an infrastructure bill the last four years was a blessing of sorts, before the priorities were set. Security is now a top concern, and health security. Rural hospitals came up short in the pandemic. Be a shame to spend a trillion on potholes while the Russians are in our computer systems, Covid is everywhere, and terrorism is making a comeback.

Like a Green New Industry? And fixing/upgrading other useful infrastructure that goes with it?

And while you may know people who bought bigger screens or hot tubs, I sure don’t. The new crap vehicles, sadly, yes, although mostly used new crap. Lotta folks can’t live without transport.

BTW: whatever happened to that stupid marketing driven “how many ways can your PU tail gate bend?” crap? I never have seen anyone showing their’s off. Marketing seems still very much in charge at US vehicle corps, sadly.

Here in ghetto land, we too can’t find workers who want to work.

Wolf – any parallels to Japan? I understand that Japanese became savers about 30 years and still won’t spend excessively. It appears that Americans suddenly have slowed down consumption and are now pouring every loose penny into savings/CDs and paying all credit card balances off each month.

Whoa! New cars and pickups are in short supply around here! Somebody is buying them,

Anthony A. : The new cars are *short* because of the shortage of microprocessors. Assembly lines are being shut down due to a lack of components. Most of today’s new cars are rolling computers.

Really, I did not know that. Thanks!

Actually they are rolling LANs. Look up CAN Buss and you’ll get the idea.

Here’s a link to make things easy. And if you get an intermittent open/short anywhere the Buss goes, good luck. Shop instructor picked up $50K worth of new Saab convertible for $20K because nobody could fix it. He kept at it and finally got lucky playing with connections at radio and got weird symptoms (wipers went on, lights, horn, etc,) and narrowed it down and found cold solder joint.

https://en.wikipedia.org/wiki/CAN_bus

Interesting. Believe that this spending won’t stay like this. People are already preparing before the next stimulus.

I think your observation is correct. people are paying down debts, and will continue to do that more, at least till the free money stops coming in.

It might be different than Japan long-term due to US export deficits

Much if that has to do with the median age of the population, Japan has the oldest population of any country on earth.

Let’s not forget the artificial earnings that falsely screwed the honest.

The fake new money is as bad as the fake earnings. Cantillon Effect.

When every transaction you make has a skim going to banks, government, and financial elites, it’s awfully hard to retain wealth.

Even if you’re the one producing the wealth.

Taxes are too high. Fees are too high. Corporate profits are too high relative to wages.

JPM Chase just sent me an email saying they are raising CC carry fees to 29.99% from 26.99%. Other fees are raised also.

JPM Chase is a criminal sydicate

Vanguard has led the charge towards lower fees for financial products.

That said, interest rates for student loans and credit card loans (and probably many personal loans) are still unjust in how high they are relative to libor and mortgage rates

Maybe the sector on top did well last year, but unless folks are absolutely clueless there is a lesson to be learned from those who suffered.

If it can happen to them it can happen to me.

For those on WS who have gone through tough times I’m sure you will concur it leaves a lasting impression. And what can anyone do when times are tough? Cut back and prepare for declining income. They put the cancer pictures on cigarettes for a reason. Only a fool believes they are immune from misfortune. This is not a time to be complacent unless you are sitting on a big big pile of cash and hard assets.

“One man gathers what another man spills…”

The Grateful Dead

True-things can change:

“Now your hanging from the window sill, the same one you saw so clearly through before”

Robert Hunter- Song writer for the Dead

“…the trouble with you is the trouble with me-got two good eyes but still don’t see…” -hunter/garcia

may we all find a better day.

Drivin’ that train, out of cocaine, dear Mr. Powell better watch your speed.

Paulo, I agree. Having had a LOT of debt 10-12 years ago (when the real estate merry-go-round stopped down here in Florida) has made us very debt-averse these days.

dent sleeps with the devil….best to not have it…true freedom

No, First Saddam and then Bruce did, but things have changed a lot since then.

I think the only people who are *really* complacent (and perhaps now not so much behind their new wall and concertina wire – DC’s Brown Zone) are the political class that controls the money printing machine.

The machine that has helped to paper over habitual policy f*ck ups for 50+ years.

The machine that gives them everything and demands of them nothing (well, perhaps utter hypocrisy).

Paulo – the coming inflation will do in all who are sitting on a big big pile of cash. Especially old farts on fixed incomes with no job.

Beg to differ,

Wall Street tough times, not since I recall. But I played a different score.

Theses crooks are your friends, even if you try to join them.

-K

Keppered, I believe Paulo typed WS referred to those Wolf Street readers who have ever experienced a rough time.

In a 0% interest environment, the only way to make a real return on your assets NPV is belt-tightening. I started in 2015, and have achieved an annual average rate of -5% YoY…

Easy to do, when you start from a stupid spot…not everyone has that luxury.

Rough times, I recommend one not pay attention to nominal values. Good luck to all.

“In a 0% interest environment, the only way to make a real return on your assets NPV is belt-tightening.”

True. And then saving even more until you squeak.

That is, unless you have the bravado and daring-do to run with the big dogs in the tall grass, i.e, play the casino (markets) at this late stage.

At near negative rates and near zero interest rates for the last ten years who the hell in their right mind is still playing the saving game?

Me, for one.

But last decent paying bonds are maturing, so it just goes into the bank and shrinks. Not sure how much more downsizing I can do, but always thinking/planning for it.

… not stupid if you recognized it, and acted accordingly ;>{)

Me too brother. In a Zirp environment every $1000 per month you can take out of your lifestyle is about $500,000 you don’t have to accumulate to live off of. I think when I did the numbers 15 years ago cutting lifestyle $1000 per month was about $250,000 you didn’t need to save. It’s a lot quicker to the goal line to cut than it is to accumulate.

Old-great observation! Reduction of laps on the hamster-wheel reduces the need for caloric intake-physical and financial (note i am NOT saying this can be taken to ‘reducto ad absurdium’…).

may we all find a better day.

Very wise.

A whole lot of rentier rental property owners have made real returns by simply refinancing. Dramatically increased cash flow on the same asset/debt base, just a lower interest rate.

What suppresses the saver helps the debtor.

Interestingly, the consumer price index doesn’t include the “cost of retirement”, but you can actually price that out.

If you want your own pension, the insurance companies will sell you an annuity which pays you income for the rest of your life. Then you die broke.

Price of such an annuity depends on your age and exactly which options you pick, but a vanilla “lifetime” annuity starting at age 60 will cost you 20x the annual income you want to buy. If you include spouse’ lifetime too, or an inflation adjustment, those cost more.

Surprisingly, in 2007 the cost of an annuity was only 14x the desired income.

So as interest rates fall and markets soar (thus reducing _future_ returns), those who want to retire have to save 50% more to get the same retirement income (and more like 80% more to cover inflation too).

The Fed’s obsession with consumer prices has blinded them to the massive standard of living destruction wrought by asset price inflation.

Much as people can’t afford overpriced houses, they also can’t afford a retirement that costs 50% more than it used to, or 80% including inflation.

WISDOM SEEKER

This is a sobering observation. Many Wolf Streeters are in that age category. I took the cashout on a small / medium sized pension about 7 years ago because I sensed the “annuity” option (monthly pymt for life) would not keep up with inflation as calculated by the govt….AND….I would leave nothing to my heirs. So far, I guessed right. More than doubled the cashout principal (so far) and am receiving passive income which is more than what the annuity would have been.

By all measures, I should be ecstatic….but the scary part is…..what’s next ??

Are you. Sitting down?

Limited savings withdrawal (2010-present), limited stock purchases (Jan. 2021), limited credit/debit card transactions (Feb. 2021), limited app purchases (Mar. 2021), communication cost doubles for Americans (Apr. 1 2021), April 18th the internet goes out and only credit worthy Americans can get reconnected.

“limited credit/debit card transactions (Feb. 2021)” that and the roaring ahead inflation in real things means that smart people will use their cards to buy everything they will need for many years ahead, like TODAY.

Monday is February, who knows what surprise announcements take affect then.

Besides, items may not be available, at any price soon. U.S. defense establishment is proposing a new generation fighter to distract from the flying turkey F-35.

How about building a mask plant first?

Some national health care?

Infrastructure?

I think it’s best you work till you drop. Even if part time. Nothing wrong with that since it’s all about survival in the end. Our politicians going back many years have created a system full of obstacles for American citizens to live a good life in their older years. I read an article recently and I agree with this writer. He said the Chinese are trying to build their Middle Class and the American govt. is trying to destory theirs.

True that. Give you a good reason to get up in the morning when your bones are aching from injury and age.

Plus, if you get SS ben., they keep growing.

do you have a link to the article? seems like an interesting read….

China is working to change their very generous retirement pension program so that it is much less generous. They are careful because it is a 3rd rail and will likely destroy the communist party if done poorly.

You caught that to?

The consumer price index doesn’t include the “cost of retirement”, but you can actually price that out.

Priceless…retirement?….

As interest rates fall …. negative zero? A future retiree will need to double the egress to what is clearly a loss or surly soon to be a loss.

Simply sounds like a losing proposal as far as even for a robinhooder (sp).

In less somebody has a quick solution like two days ago GameStop thief’s …there ain’t no retirement at zero interest rates.

Now it’s been discussed here at great length and the wolfs knowledge be supreme…

The interest rates ain’t gonna go up or down.

These clowns are stuck and the middle class just got …..

You can’t live forever (yet?), so you CAN retire with rates at or below zero, and inflation above zero, as long as the gap between isn’t too big, and you don’t expect to live too long. Instead of 20x income you’d need 30 or 40. The insurers selling annuities will price it all out for you…

Mathematically, there would come a point where rates get too low and inflation too high, and a lifetime annuity would have nearly infinite cost.

Yup. Try finding someone to write an inflation-protected annuity.

Maybe true but I had to take a few swigs off the old Brandy to digest this.

It all makes sense now.. what am I living for?

You say that the Fed is “blinded to the standard of living destruction”. Do you really believe that they’re not aware of it? I’d wager that they’re aware of it, but don’t care since it’s not an issue for the elites whose interests the Fed serves.

Jeff, elites at those levels have underlings that are trained to not deliver bad news so as to not upset said elite. It’s always been like that……

What it really is, is the CONSUMED & PUNKED Index – a 3-fingered governiod salute to peons across the Realm ….

All Cost, No Gain!

The FEDs only obsession is to benefit it’s constituency, and that is not most of us here. We are the payor’s.

@WS – Since 1998 I have always felt that the price of equities should be included in the CPI. We are continuously told that we need to invest savings in the stock markets for our retirement. I’ve never bothered to calculate, but I wonder what the CPI would be if it included the recommended 10% “spent” on the S&P 500 every year.

The economy is extremely fragile. I’m not sure it can handle another disruption.

How broke is everybody really? How stretched are they? If the top has all the money and is not stretched but the bottom and the middle class are stretched… What happens?

This SPACs thing. Is it the 2021 version of credit default swaps? Is Robinhood the 2021 version of Ninja Loans and Adjustable Rate Mortgages? And forbearance and eviction moratoriums… that is like after the 2007 real estate market crash when people were looking for loan modifications… but now it is before the real estate market crash of 2021… it reminds me of a Tupac song about a woman that shows up in all of his buddies videos….

Indeed, I would like to see a complete reveal of how actually well off (or not) people are broken down by income bracket.

Middle class, or what remains of it, seems to be holding on to American Dream (big house, vacations, expensive cars, etc) by the skin of their teeth and lots of debt.

Occasionally ‘surveys’ pop up about how the average American doesn’t have enough cash availabe for a $500 (or whatever) ’emergency’. Umm, very interesting.

As the hackneyed saying goes (I think from Uncle Warren), when the tide goes out we can finally see who has been swimming naked.

I was just listening to the real estate show I like and it reported that in December there were 1.07 million units 16.4% down from November down 23% from one year ago 1.39 million units.

I’m middle class or low class… or something. I need to move; I’d like to buy, but I don’t want to pay too much because of a temporary cut in inventory. I can buy at an inflated price or rent at an inflated price… while others pay no rent and come spend it at the local hotels on the beach. I have enough money to buy a heck of a nice house – 4 months ago. Today, similar houses are running at about 10-20% more.

And people are still diving in to the empty shelves of this government induced rationing of houses- like oranges and bread shelves in a USSR supermarket-

Joey Biden, tear down this wall.

we will find out this week if robinhood is the 2021 version of LTCM or lehman. but it being 2021 and all, i have a feeling the fed will print the culpable insiders to further prosperity while some internet yahoos get to pay the price by getting martha stewart-ed.

Yeah, saw SEC is looking at “market manipulation” charges.

So is buying back stock, or was.

Guess it’s all about one’s connections, and “Justice” being just another commodity, sold to the highest bidder.

pfssst …. hey bud, gotta hot tip – the watch word of the daze is now

…. s☆i☆l☆v☆e☆r ….

‘;]

I read 50% of Americans don’t have three months savings.

The economy isn’t fragile at all. It survived both the virus and the related shutdowns with only minimal damage. Historically the nation, and the world, have been through far greater disruptions too.

The issue isn’t fragility or lack of output, it’s maldistribution.

Wisdom, eh?

How many “T-T-Trillions” in stimulus $$$ does it take to keep this carnival tent standing through the storm? Not fragile at all, huh…

There is only the illusion of temporary prosperity. Peel back another layer…

…not enough substantial heart wood left to prop this shit show up for much longer.

Wisdom and Pituitary, are you two speaking at cross purposes? Economy vs. stock market?

“Income hits,” not “Income hit.” “Income” is a singular noun and the verb should also be singular. Sorry. I taught English as a Second Language for many years in France and elsewhere. You’re not the only person who makes this mistake of using plural verbs for singular subjects. I see examples of it every day.

Jagor,

Sheesh, have you ever heard of “past tense?” As in something that happened in December? Do you know what the past tense of “hit” is? And of “cut?” The headline is in past tense, if you know what that is. “Hit” and “cut” are irregular verbs, of which there are not many in English, unlike in French. But I do recommend you study them.

Jagor is right. Hit or hits is referring to income and should be singular. Incomes hit. Income hits. Your financial and economic stuff is brilliant though. (Or is it are brilliant though?)

@Sit23: It’s “is” brilliant — “stuff” is the object, so the verb is singular.

Took a lot of English classes because that was where the girls were.

Sit23,

Nope. It’s past tense. Read the headline. Past tense of hit = hit. Past tense of cut = cut. Singular or plural. They are irregular verbs. Basic English grammar that you should know.

Try “hit” as verb in the first sentence and you can understand Wolf’s usage in the title:

“Income … in December hit a new record”

Or to simplify:

“Wolf hit a ball”

The base (or infinitive form): hit.

The past tense: hit.

The past participle: hit.

As a teacher of English as a second language for many years in Spain and Korea, it is obvious the headline is in the past tense since it refers to past events. I agree with Wolf.

Wolf is always going to get a pass from me on these grammar issues. I am continually amazed at the output, particularly when one considers the amount of data and lack of added political fodder within.

I understand that you’re trying to be helpful, but understand that the rest of the world uses a phrase, “grammar nazi” to describe people that engage in these kinds of comments.

Jeff, how true, the content is great. I can do with a grammar thing or two.

At my age, my spelling is getting fuzzy and I used to write big technical reports read by lawyers. But, I can still write in cursive, a method of communicating thoughts, which my 14 year old grandson can’t decipher (not the message, the cursive).

Kids today think cursive is a way of communicating curses!

They only teach kids how to print letters these days, and none to successfully. I started keeping annual journals about ten years ago and one of the major reasons was to write in cursive with a fountain pen. The skill comes back with practice.

Grammarians destroyed the once flourishing international Latin language, and if given heed today they will ossify and kill English. Much to the chagrin of credentialed teachers, people learn language from their mothers and a second language from their sex/marriage partners, or they just dive into the challenge of adjusting to a new culture after emigration. We don’t need no stinkin’ teachers! On a more serious note, the study of grammar was in ancient times understood as a philosophical journey of high order. It’s unfortunate that is has been used ever since as a torture-lite for the lower orders. And yeah, I get it, about the need to learn a certain style for college and professional life, but that’s not a good enough reason to embrace the Nazi within.

Steph C.- not a day goes by that i’m grateful to have grown up as a native English speaker, with its myriad conundrums/oxymorons. Huge admiration for anyone who has made it their second language, and who often practice it at a more-proficient level than the ‘natives’ (lookin’ at YOU, Wolf!).

may we all find a better day.

I could lie and say that I threw in grammatical errors just to mess with y’all, but honestly they were typos stemming from being in a hurry. I’m not retired so I tend to rush. I apologize to this fine crowd.

@ Jagor –

Not that I give a rat’s rear-end about the technicalities of English, but can’t singular income suffer multiple hits?

Or, it could be hit multiple times.

To all those that do not own a copy of “The Elements of Style,” Buy one, it’s cheap. It’s very short. Read it. Re-read it. A nice thing to do for the English language.

It doesn’t take much effort to get the gist of someone’s comments, and that’s what counts. As a fluent speaker of the coastal logger redneck tribe dialect, I drop back into it easily around friends.

It don’t make no difference here either.

as consumers had spent a portion of the Pandemic money on laptops, smartphones, appliances, new vehicles, or rowing machines – I just learned that the models by the most established brand are still on backorder. Many of these products or their components are imported, leading to a……..

Oh please..

Kinda like the Shrubs 300 dollar barf give away. Gee… I think I’ll spend it on my self for a new washer and dryer?

So concurrently yes nothing gained nothing was realistic helpful.

It’s to little stupidity to small amount to late and is a complete slap in the face.

Let s consider stopping the repeated corporate giveaways in the tune of hundreds of billions dollars (god knows what the perverts do with the money the use to buy back defeat stocks)?

And stop the horridly year after year crime this half republic has suffered on the federal government/corporate since the thieves of the early eighties sold us down the river.

Just sayin,

-k

You know, if a person steals money and give a person 10 bucks to buy some ice cream and chocolates they won’t care when the thief gives 20,000 dollars to his governor friend who buys a nice dinner for his family in Napa and keeps his own business afloat… during COVID… when all his competitors are bankrupt…. or something.

Yep, this country has been a banana republic for a long time, it’s just that it’s so wealthy that the skim isn’t noticed as much by the average prole and the graft is transferred in far less obvious and legal fashions.

That’s the big myth. We’re not wealthy at all. By all calculations, we are insolvent. We’re just riding the coattails of when we were wealthy in the past. We’re like the guy with the big credit card limit whose bank hasn’t yet realized that he lost his job.

Mr Right – that’s one of the best analogies I’ve heard yet.

Good one rnyr!

Knew a guy couple decades ago who claimed he did that for almost 2 years before he ran out of credit on his card and went the BK way.

Said he just took out some cash once a month and made the minimum payment or a little bit more each time, and I suppose that was all it took to calm the computer watching until he finally failed to pay.

Did also have some cash from selling previously acquired fancy ”stuff” for a dime on the dollar, and had bought a live on sail boat for cash at the beginning, so just moved slowly around FL, on the hook, until getting pushed out by the local authorities, etc…

Only hitch in the giddy up was he got bored with the whole situation, went back to work for the entertainment of it???

“We’re not wealthy at all. By all calculations, we are insolvent.”

Give me a break… Insolvent NOW, not in the prosperous, post-WWII past when our competition worldwide was destroyed and we were a major brain-drain from the rest of the world’s rubble.

Now, we are only “wealthy” in the debt-based, fiat monetary aspect and via the two-steps forward, one step back bubble/bust transfer of REAL assets at fire-sale prices to the 0.1%, the skim is taking place.

Buckle up. Another 2.8 trillion $$$ is on its way (900M +1.9T proposed).

I’m not sure why it isn’t even higher. When none of this money is being collected via taxation, what’s the difference between printing 5T, 10T, or 20T? And after you tell the public they’ll get (some of) it… talk of consequences just vanishes.

That’s the guises of the the problem of the the orchestrated thief of the middle class. The lenders to this thievery won’t stop until they are the owners of every last breath we pleps goy out in anguishing dumbfounding stupidity.

Just sayin!

The thing is, all of this is doing is hastening the “reset.” The fact that the dollar has dropped 10% against foreign currencies at a time when the foreign central banks are being similarly reckless shows that we are NOT the “cleanest dirty shirt” as proponents of MMT like to say.

If we keep printing trillions, which is basically a way of trying to get foreigners to subsidize our lifestyle, eventually, we will have a crash that will lead to EVERYONE becoming poorer, from the top all the way down to the bottom.

RightNYer: “If we keep printing trillions, which is basically a way of trying to get foreigners to subsidize our lifestyle”

_____________________________________________

It’s a way to steal from existing savers, foreign or domestic, of dollars.

A low tide grounds ALL boats? Don’t bet on it. The rising tide analogy didn’t work as advertised.

They never mentioned trickle-up poverty.

You have heard of sales tax? More to the point with this next check I might be able to afford to hire somebody to help me around the place. So it’s not just the CCP who is getting rich off this.

There’s a remarkable podcast of The Grant Williams show on Podbean (and probably others) where he and Bill Fleckenstein (former money manager for Paul Allen) interview Chris Cole of Artemis Capital. I think it’s only 2 months old or so.

Chris (IMHO) is a genius when it comes to volatility. The entire discussion is eye opening, even if many parts will be over many peoples heads.

The most important decision anyone will make for retirement in their future will be getting deflation/inflation correct, and when.

Someone above noted your option (and rising costs) of buying an annuity. I’ve never forgotten a show with Jim Puplava on Financial Sense Newshour (podcast) where he discussed the ravages of what inflation did to a bond investor who went “all in” in the 60’s, only to emerge with less than half the purchasing power in the 70’s.

Investors suffer from incredible “recency bias” of (supposed) deflation over the past few decades. I would not bank on that same scenario in the future.

I encourage all to listen to Chris Cole. Well worth your time. Personally I expect the future to look absolutely nothing like our past 40 years.

Chris Cole is interesting; I liked Jeremy Gratham’s recent interview with Bloomberg… but I also like the kwak brothers- such an interesting way of looking at real estate.

You couldnt conceive all the fraud that illegals engage in ,fake ssi #s, tax fraud etc. I know an illegal Honduran that bought a house under an assumed name.

2/26/2017

California State Senator Kevin de Leon said: “Half of my family would be eligible for deportation under Trump’s executive order, because they got a false social security card, they got a false identification, they got a false driver’s license prior to us passing AB 60, they got a false green card, and anyone who has family members who are undocumented knows that almost entirely everybody has secured some sort of false identification.”

So, when does Biden name him head of DHS?

It really has affects on people’s lives. A lot of legitimate businesses were priced out of the market in residential construction by the gray market in illegal aliens. Politicians encouraging an illegal subculture was giving the finger to people playing by the rules of paying income taxes and providing workers comp.

I realize that we are getting inflation presently, but It is still up in the air if we will keep getting inflation for the rest of the year.

There is still a good case for deflation due to the weak velocity of money related with unearned printed money. MacroView: 2021 – A Disappointment Of Growth And Disinflation. by Lance Roberts

The smart people I read are not worried about protecting their portfolio from inflation at the present. They believe there are leading indictors that allow you too reposition. Hope they are right.

Getting inflation presently? Open your eyes! We have had massive inflation post 2008, the average home price has roughly doubled, tuition and property taxes similar trajectory, food, healthcare, etc. The Fed says less than 2% because it deliberately measures an index that downplays all of this with imputed rent and hedonic adjustments that are pure snake oil.

Thanks for the reference for the podcast. I listened to it today. Quite startling and informative.

The next one you should check out is Luke Gromen on MacroVoices podcast. Episode #254. Also on Podbean & others.

Between those two you’ll really be thinking!

For a chaser find the latest #256 on MacroVoices as well. I’d never bet against Russell Napier. Wicked smart economic historian.

All the people worried here about illegals working are distracted from the big picture. They see the trees, not the forest awaiting a match by the Fed & Treasury. That match is coming my friend.

I like the recent (22 Jan) YouTube video “Why Grantham Says the Next Crash Will Rival 1929, 2000”:

“Jeremy Grantham, co-founder and chief investment strategist of Boston’s GMO, believes U.S. stocks have become an epic bubble and will burst in a collapse rivaling the crashes of 1929 and 2000. In this interview, he explains why, discusses the futility of Federal Reserve policy, criticizes the state of American capitalism, and shares his thoughts on gold, Bitcoin, emerging markets and climate change.”

“The most important decision anyone will make for retirement in their future will be getting deflation/inflation correct, and when.”

I’ve been reading arguments regarding deflation and inflation for the past several years, and there are good arguments for both. If these people who are far more educated and experienced than myself cannot agree, I have no hope of choosing correctly and getting the timing right aside from pure luck.

I am as diversified as a man of my limited means can be, but in an everything bubble with manipulated markets there is no way to know which asset class or currency will collapse first and how, when or if the others will follow.

Wolf,

Thx much for the info.

The Fed released the Q4 Velocity of M1 Money Supply data today — down from Q3. This is a double-dip recession with mass unemployment and an ocean of cheap debt for speculators.

The reflation stock trade is a pipe dream. Perhaps all this liquidity can keep the zombie casino jumping, but I still say deflation first, then inflation.

Hello LA,

They are bit behind the curve and playing a very slow game of hardball. It is as the owners of this monetary crime is at its last vestige (footsteps) , or what?

I am betting these wrinkled old family players are down to shooting craps.

But this is no clean hustle.

The world casino stop enforcing the rules.

-k

Yep. MacroView: 2021 – A Disappointment Of Growth And Disinflation. by Lance Roberts with some nice charts to support that thesis:

That was a good one!

Suppose food was free, by government decree.

Immediately, you couldn’t buy it.

Millions aren’t paying rent.

What “geniuses” came up with such a “plan” ?!

The taxpayer, present and future, is paying that rent. Perhaps the majority of them just don’t realize it yet. As stated in a previous comment on a previous Wolf post, I have read on a Marin county official Covid-site that at least the State of California got billions to help landlords out, all in the CARES act. I haven’t heard much else about this in mainstream media. I would love to hear from the bevy of small landlords on this site, who’ve been somewhat silent lately, if this is true and if so, do they have to go through a lot of paperwork to get their bailout.

I suppose births leveled out as well in 2020 as people are now horrified at the cost of raising more kids BUT working at home gave more time for woopy. The numbers evened out.

Whoopee (or whoopie in some sources ca. 1930)

Inflation:

I have an inflation stat I’m oh so very sure the Fed will catch in it’s CPI.

Recently popped into the store to see if they had stocked up grass seed for coming spring as I contemplate spot seeding my front yard (did back yard last year). Guess what? Vigoro – generally the least costly bare bones seed and nothing but the seed – has now adopted the “coating” like other grass seed brands which means you’re only getting 50% as much seed because the coating takes up the other 50%.

About same price range, though. For half the seed. They claim the coating improves performance of the seed.

IMO the coating impedes germination based on my limited experience. I tried one without, and without, last year. The all seed and nothing but the seed seemed to work better. I found the coated seed to germinated more slowly, and less so.

Quick guessitmate…100% inflation for grass seed this spring in my corner of PeasantryVille, USA.

Turf if an overrated anachronism from the past. I’d rather have a viable food garden in front of my humble manor/castle, then a green …especially in these tumultuous times.

I suppose you could plant Wheatgrass instead .. one can at least eat that.

Agree. Am taking a bit different direction than yourself, planting shrubs and Oak trees (slow growth) and River Birch trees (moderate growth) and Japanese Maples and Magnolia trees along with creeping myrtle for ground cover. But will keep grass in shaded locations because it doesn’t require summer watering & chemicals to flourish when protected from dry summer heat by tree shade.

Yeah, that sounds like a good strategy. Might consider some fruit/nut trees/shrubs (aside from those acorn producing oaks..) Doing double-duty as it were: ornamental AND edible to boot! That’s what I’ve tried to do, on our tiny speck of Terra.

I just shake my head when I see homes with plunked-in ersatz foundation plantings and resource intensive (for All the wrong reasons..) lawns. Thujas and bermudagrass just don’t cut it in my book. Not trying to sound virtuous, but people Really need to wake-up to the possibilities of severe food shortages, and of ever greater food ingredient adulteration/crapification of whatever IS available ..where corporate intentions and gov. oversights are concerned.