Stimulus and huge shifts in spending, wiping out entire industries and fattening up others.

By Wolf Richter for WOLF STREET.

American consumers – let’s face it, consuming is the number one top job during these trying times – have paid down their credit cards again.

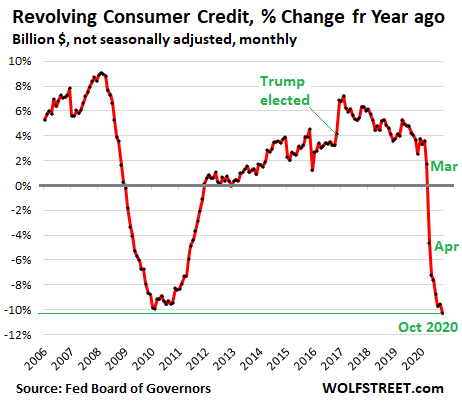

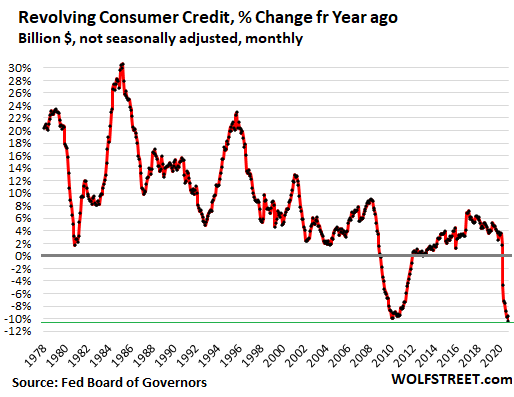

In October, credit card balances and other revolving credit ticked down again from the prior month, and plunged by 10.3% from October last year, the steepest year-over-year drop ever, eking past the peak year-over-year drop during the Financial Crisis (-9.9% in January and February 2010):

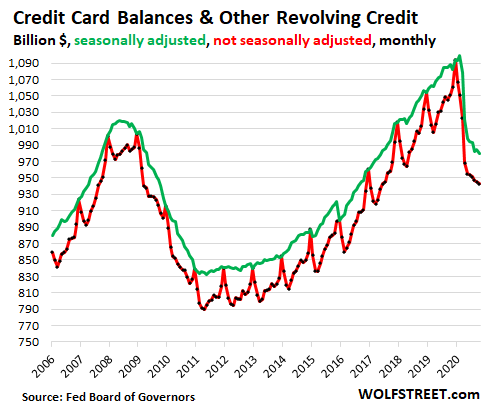

On a seasonally adjusted basis, credit card balances and other revolving credit declined to $980 billion (green line in the chart below), according to Federal Reserve data this afternoon – a balance first seen in October 2007, despite 13 years of inflation and population growth.

Not-seasonally adjusted, credit card balances and other revolving credit ticked down to $943 billion (red line), a balance first seen in August 2007. Since the peak in December last year, balances have plunged by $151 billion.

And this is something we have seen in other data: The seasonal adjustments can no longer adequately grapple with the new borrowing patterns that defy seasonality. The classic seasonality in consumer borrowing, established over many decades and utterly predictable, has been obviated by events:

The mega-plunge in credit card balances in April was a result of the dual impact of stimulus payments that were applied to credit card balances and the lack of spending opportunities when big parts of the economy, where consumers normally use their credit cards to spend money, shut down, such as malls, restaurants, cruises, plane travels, and hotels.

Before the Financial Crisis, there had never been a year-over-year decline in revolving credit. For decades, Americans had been in the mode of piling on credit card debt with astounding passion and double-digit year-over-year surges in the early years, which allowed them to buy things and do things that they couldn’t otherwise afford, and it cranked up the US economy. The scheme lasted until the blowup during the Financial Crisis that caused the first-ever year-over-year decline. Now there’s the second year-over-year decline, and the steepest ever:

It has now become clear that there have been huge shifts in how and on what consumers spend money in this Weirdest Economy Ever, wiping out entire industries and fattening up others – with the net total still being negative, meaning a decline in consumer spending compared to last year.

Spending has been powered by stimulus money and extra unemployment benefits, and by record low mortgage rates that triggered a tsunami of mortgage refinancing that resulted in lower monthly payments, which freed up money to spend on stuff, while many homeowners did cash-out refinancing, encouraged by the surging price of their home, and some of this money thus freed up or borrowed against their home is getting spent on stuff, and some of it is being used to pay down credit card balances or keep them from increasing.

And for those consumers able to pay down their credit cards, that’s a good thing, given that banks and credit card companies often charge usurious interest rates, such as 25% or more, in a zero-interest-rate environment.

For banks and credit card companies, it’s a tough fate because with the high interest rates they charge, that’s where they make big fat profits. No doubt, the Fed and economists are concerned about this development of consumers trimming the banks’ most profitable business.

But consumers who are able to get out from under their credit card debt, and stay out of it, should rejoice because there is a lot of stuff that they can buy with the money they didn’t spend on the 25% interest on $10,000 in credit card debt.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Uber in trouble. Dumping self driving unit at $3 billion loss. Obviously business is hurting and they are desperate to stop cash bleed. Didn’t they always say self driving was the key to profitability?

AirBnB going public when properties are empty. I hope stock investors recognize when execs are bailing.

Door Dash also going public while restaurants going under. Any kid with a driver’s license can deliver food without giving them a cut.

It will be interesting to see how AirBnB plays out. My county in WNC provided hotel and rental tax receipts for YTD last month. Our tax receipts are up year over year as people are flocking to the mountains to get away from it all. Hiking, fishing, GSMNP, etc. This is despite motels not being full occupancy. While they can’t break out what kinds of properties are being rented on AirBnB because AirBnB remits taxes collected in a lump sum AirBnB rentals picked up much of the slack. I would guess it will be market determined Madrid probably sucked. The mountains are AOK.

Beware on Airbnb policies such as; holding all payment till renter checks in before release to owner; if cancel they keep 50%, nothing to owner; no response when trying to contact them with problems; and many more issues.

I believe they were living off the float and fees in the good times.

Our current experience is owners and rentors are looking for alternative solutions in how they rent their units, especially on extended days like family vacations, ect..

Boiler plate says people are taking more vacations close to home. Want a vacation? Go live in your neighbors house for a week.

Howdy neighbor!

Seriously dude! We do that with friends who live in Marin and it was great! No airport, easy drive, new sights and lack of city noises, smell of trees, an interesting walk down a nearby commercial street, everything different for a weekend. Put the sheets and towels in the washing machine and go home after a great stay.

All the stuff we no longer see and take for granted was novel to them in the city. Total cost; half a gallon of gas and bridge toll. Same for them, except for a parking ticket after they ignored our warnings.House swaps are where it’s at.

Friends do this all the time between L.A. and S.F. They meet at a gas station on I-5 and exchange keys, give instructions about animals = “Friends B&B.” Alternate? Spend $300 or more a night at a decent hotel? No way.

Bob Carol Ted and Alice? Real estate is the new sexuality. Wonder why Wolf reports on it so often?? :)

You are brilliant .. ???

My neighbours on the one side .. do not even know me .. only seen me in peripheral vision 5 times & I am as quiet as a mouse & they don’t want me here.

Mkkby,

Uber originally bought a company (Otto) from a guy from Google’s self driving program and who stole all their research and development (Google’s). It was found out and a court ruled they couldn’t use anything they developed or bought up to that point, setting them back years. It was officially for trucks, but, i would bet, that r&d was intended for passenger cars as well.

Self driving cars were the key for Uber, but, because of the pandemic, they don’t have the time or money to develop it for themselves. Thus probably ending any real chance, Uber will be around in the future. If another company develops and licenses self driving cars, Uber will have little advantages and a lot of debt.

You are right. I do wonder if they found some profound problem with self driving. Perhaps, it would need a higher level AI to deal with all risks and not just a relatively limited, narrow AI.

Musk said that by next year, Tesla will go fully self driving and that already his (clearly narrow AI) makes driving much safer. Maybe the pandemic will delay that a year or that might be just a hopeful promise.

Perhaps, Uber has just realized that competitors are going to beat it to the narrow AI, self driving prize. If so, they may all adopt and install the narrow AI (software) that works, as with Microsoft and Windows.

I would not want to buy any shares in AirBnB now. I think that people will have a residual fear of any more pandemics being released. The gain of function experiments apparently continue.

I think that Americans spent like money was water when they could not see any dangers and thought it was always going to be wonderful. Now, with the baby boomers retiring, and with that appears to be a non-recovery (since no adequate stimulus looks likely to pass), clearly the good times are behind us.

Even the goofiest of customers may have realized what will happen when reportedly, 40 million Americans get evicted or are in such dire financial straights. I do not think that the government is going to step in and pay the rent outstanding for millions of Americans, so I do not see how these evictions will be avoided.

These evictions will rapidly be followed by mortgage defaults and the real estate market will fall dramatically, at the very least commercial real estate. How will the evicted get new housing? Will we have millions living homeless on the street in all states?

People that grew up in the great depression were notoriously thrifty. At the very least, I will avoid debt like the plague. I suspect thousands of Americans will also not want to be in the same positions as those poor evicted Americans.

The banksters will have to think up a new scam, unless they want to just rely on their “Federal” Reserve to funnel money to them via dividends. It reportedly now owns most US MBS.

No debt, no problems…

Amen.

Mo money, Mo problems :-)

No income, Mo Mo problems.

Money, cheap city to live, No debt, Mo Mo good.

People may be wising up. They are moving from high time preference to low time preference and saving by paying off debt. And they are choosing the best savings account with a 24% yield, revolving credit. The Chinese are notarious savers due to the lack of safety net infrastructure in China. What does that tell us?

re: “… And they are choosing the best savings account with a 24% yield …”

Just where are you getting 24% on a savings account?! Loansharking?

they are getting from -24% to 0%

not paying interest on the CC cb,,, best deal we always take every single month these days, eh

used to be a ton of $7 ”payday” for $5 today out there in the real world,,, but ya had to be at the end of the payday process line to get your ”loan” back,,, and ya had to have some ”friends” that you shared some of the proceeds with if you wanted to keep doing it more than anecdotally from what old friends have told me…

other than that, certain ”connected” folks will do still do similar from what I read,,, and there is always plenty of RE money at 10%, secured by the dirt of course,,, and it does help to close deals quickly sometimes,,,

your local RE attorney/accountant will know how to arrange it, as long as the ”deal” makes sense to him or her

CB,

Let’s say you have four credit cards, arrange them by descending interest rates. Pay off the one with the highest interest rate first, even if it’s a small amount.

Opportunity cost is the massive interest, minus taxes on that which you’d earn in a bank.

Know any people who are really old, or are deathly ill? They need to get lots of credit cards and convert their credit lines into useful things for their relatives. Corporations do that all the time with their pension plans, local taxes and vendors.

Bloody Hell!……maybe the end of that awful word…”consumer”

Its just the ‘Consumers’..thinking that paying down/off your Credit card balance..is a form of savings…lolol What comes down..will go up..aloha

Cynic……. a A person who believes all people are motivated by selfishness

……b Those who believe virtue is the only good and self-control the only means of virtuousness

Glad to hear I’m not the only one who has always hated that word; as if we’re all nothing but ‘units of consumption.’ We are, but there is, or should be, much more to us than that.

And, what’s wrong with ‘customer?’

Consumer as The word to describe human beings was Purposely chosen and favored to creaye the filter or framing for self-concept no matter what one’s ethnicity,religious beliefs,political bent,age,generation,sexual-orientation,education,job.Consumer first,all else follows,subsumed and that is a key reason for destructed world,relationships,health.The myriad of beautiful,inspiring,spiritual,intellectual,creative dynamics of human existence are degraded,disregarded,disrespected and commoditized down to gdp,productivity,economic activity,stuff,and ,$$!

Lately I’ve heard more and more people using the word ‘worker drones’ as if that isn’t dehumanizing

I’ve been bothered by the word consumer for a long time but the truth is – especially for most Americans it’s the better of two alternatives – the other being what comes out the other end after consumption.

I wonder if consuming has not replaced a social society.

Social events that we can no longer afford.

Once upon a time 2 generations ago men & women went to the local Town Hall on Friday & Saturday night to dance .. it didn’t cost much & they walked home talking the nights events.

Meat was cheap .. you could put a nice steak or a couple of chops on the barbeque & everyone would bring their on bottle of beer or lemonade & a salad.

Today, a ticked to ride the social scene is an extravaganza .. & because domestic livestock break wind so often meat is frowned upon & priced beyond our budgets.

It’s not our fault that we have been squeezed into this tight corner .. hey.

As an ugly word .. it reeks of those who have deprived us of the simple pleasures of life we once had.

Dunno, Wolf; ten percent YoY just ain’t that much, especially when compared to the percent of restaurants indoor seating going unseated and the percent of movie theaters going unmovied and and the percent of vacations going staycation.

People were happy with a certain spending mix; some of those “outlets” disappeared; the income & substitution effects would tells us to expect that some of that money would go unspent, eg, that bank balances would go up and credit card balances would go down.

Yeah, I don’t know. My imagination tells me that it’s not so much that people are going to war with their debt as it is that people are over-spending a little bit less.

How are Goodwill stores doing, anyway?

Haven’t we seen the same behavior before (like about 1989), only to see a more massive swingback in the other direction? They’re not trying to cut the cord so much as hold on to less inflated plastic balloon they can blow up at the next party.

This is just absolutely intolerable. The teachers are not doing their jobs these last few years. They need to go back into class and tell the kids to spend money, stimulate the economy, it’s all for the greater good. Debt is nothing to be afraid of.

What is this world coming to, what the heck are we paying the teacher’s unions for anyway. Stop cramming ideas like 25% interest is bad, just shut up and pay it, it’s normal. Geez, how dare the sheeple actually go out and educate themselves and figure out maxed out credit cards are a bad thing.

Yes… that was sarcasm.

And good sarcasm. Those high schoolers need to stop thinking about the opposite sex during economics class

What? It’s not possible!

What economics class?

XD

Our economics curriculum is as piss-poor as our civics.

In Economics the ‘opposite sex’ is often a ‘luxury good’…………………

Or start thinking about economics during opposite sex class?

Maybe schools are playing that clip from Financial Peace University that exposes credit card companies giving away free pizza at colleges like drug dealers and their free candy.

Haha that reminds me. They actually did this right by my college dorm. It was a free Jimmy Johns sub in exchange for filling out a credit card application. Luckily my card met the scissors as soon as it arrived. At the time it didn’t seem so slimy, but in hindsight… wow!

Something like that happened to me when I was in my early 20’s. “Would you like to save ___% today by signing up for a ________’s card?” The person in line in front of me said yes so I did too! I think I saved $2 and some odd cents. I felt pretty dumb afterwards and canceled the card.

Lured towards slavery by a sandwich or $2. It’s sad. Not going to let my son navigate this world without being able to identify the financial predators.

Some of this is due to all the retail chains going out of business, many had store cards which no longer exist. Some is due to department stores closing existing accounts. Saks closed my account because I didn’t use it enough. Oh well, I’ll now be spending my meager budget elsewhere.

People have money to buy stuff online, pay streaming services and basically buying takeout.

So no movies on the cinema, no restaurants and no shopping outside, more so on malls.

Debit cards can be used online and in apps.

I will add another reason behind this trend which is not mentioned in the article: debt moratoria. Money not being used to pay mortgage, student and/or auto loans is being applied instead towards revolving credit.

Yep, “weirdest economy ever” is a fitting term to describe the situation we’re in now.

In any case, fear not… the debt being paid off by consumers is more than offset by the gargantuan quantities of debt being piled on by governments and corporates.

Government debt just grows, instead of being paid back, that has been the case since the space race against the commies at the very least.

And big corps avoid taxes.

“debt moratoria.”

Yep.

Wolf, how about an update on estimated apt rent in areas/mortgages 90+ past due?

I think it has been a while since I’ve seen the numbers (particularly apt rent in arrears).

……Classic timeless financial advice! Don’t buy stuff you can’t afford…….Steve Martin & Amy Poehler Saturday Night Live Skit….approximately two minutes and thirty seconds long….poignant, humorous financial advice…..on YouTube

……NOTE: Do a web search of Steve Martin, Poehler, budgeting if it doesn’t work…..This film clip is a popular search on the Internet

Thanks. That was great. :)

My wife and I fortunately had this epiphany as stressed-out newlyweds. Sleeping on a futon and eating on a card table eventually paid off. We eventually traded sticking a quarter in the ALDI basket for Whole Foods delivery.

Delayed gratification is a real challenge. Like any diet, it must be a lifestyle.

Wow … Amy was a heck of a lot skinnier back then (almost didn’t recognize her). Was that Chevy Chase as the ‘narrator?’ Don’t think so, but it kinda looks like him.

“Was that Chevy Chase as the ‘narrator?”

No, a thousand times no.

Not even close.

I think you might have your generations of SNL regulars *very* mixed up.

Chevy rolled across the USA to become a moovee stahhr….Holiday Roooooh,oh,oh,oh,oh,oad!

Use to show this to every one of my econ classes. You could tell that this was a revelation to a number of them.

Wolf, the rise of the buy now pay later (lay by) is taking a massive share of wallet from credit card providers here in Oz. We have a company called Afterpay that has gone from a small cap to large cap. The young get they don’t need a credit card and use the buy now pay later option.

1) Credit card balance : the LT trend is up. All those dots since May 2020

are clustered together, shortening the thrust.

2) Credit card balance previous peak was in 2007, creating a double hump in 2009, an UT, during a recession, with a limited reduction in between.

3) Oct 2020 low is backing up 2009.

4) Gov stimulus and the shutdown cleared c/c balances in the first half of the year.

5) Small businesses use c/c for rent, payroll, to hit the road…

6) Small business usage fell due ppp loans and US comatose. A large number of them are already gone.

7) Black Friday and Xmas are next.

8) With no stimulus insight c/c balances will popup.

9) During recessions, after a saving rate plunge, c/c usage rise.

10) In Apr 2020, during the lock down, the saving rate reached a new all time high. From 33.7% in Apr down to 13.6% in Oct, still the second highest level, below 1975 rejuvenation from the bottom of Dec 1974.

You might be right. The drop in credit card debt might simply be a drop in transactions, not a drop in borrowing. My business pays for travel, utilities, supplies and maintenance with credit cards. It’s done for convenience not for debt. The charges get paid off monthly before the end of the grace period.

This credit card debt is the sum of outstanding interest-accruing balances.

What’s the actual definition of interest accruing balance? I normally charge $15-20 thousand a month on my credit card. I pay it off promptly — never paid interest or late fee. But when the bank pulls my credit report it always shows average credit balance on this card of ~$10 thousand.

I guess this behavior goes back to the adage from Ben Franklin, “A penny saved is a penny earned”. This record paydown also shows how uncertain these times are, and credit card balance holders are trying to get more solvent should the unthinkable happen to them: They lose their job. Credit cards are the last source of income for those desperate to attempt to make their financial ends meet.

The spreads that the credit card companies enjoy are totally absurd. Where are our governmental protectors in this giant rip-off?? The banks pay the consumer no interest on their money (or a rate that you need a magnifying glass to see!), and then turn around and charge credit card holders rates in excess of the inflation rate before Paul Volcker put the heat to short-term rates.

Our Fed today has no backbone, and is grossly conflicted with the relationships between the members of the Fed and the total banking community. This needs to change and soon. Unfortunately, the patient, the American consumer, will pass away on the operating table first.

Don’t forget credit card payments can be in forbearance, which essentially means if the customer isn’t paying, their credit is frozen while being current.

With you on most of your good comment dwy,,,

until you got to, “is grossly conflicted with the relationships between the members of the Fed and the total banking…”

Unfortunately for WE the PEED ONs folks that is just not correct: Federal Reserve Bank is owned by the same folks who own the banks and now, after years of the Fed doing their bidding, most of everything else.

The Fed serves the banksters and the very very small minority of folks who own both,,, and that is their job,,, to serve their owner / rich folks.

We can hope all we want that the Fed will act such as they can at the same time wish that their actions were universal,,, but, in fact, in spite of or perhaps because of Kant trying to make such a thought predominate, they serve their masters/owners,,,

And to hell with WE the Peed Ons,,, not that that is different than the vast majority of time for eva,,, at least now a days they don’t get to ‘have at our brides’ on our wedding nights these days,,,

so some progress in the last thousand years or so, eh

Could it be that consumers have realized that the “stuff” they thought they had to have because of effective marketing by big retailers is not that important? Now they can go online and look and see everything and compare and the excitement and motivation to buy just isn’t there like it used to be? And all people have more and don’t feel the pressure to keep up with so and so. All their credit card and bank balances are at the tip of their fingers online too. So maybe they are smarter consumers. Another effect of the internet?

According to the Feddie Mac data, cash out and HELOC really started to ramp up Q4 2018. 2020 estimate looks like a significant jump over 19. Maybe the Skymile payeroffers arent trying to up thier balance as diligently and just using debit.

I can see people doing refinance at the ultra low rates thinking it would be a good time to get rid of the credit card debt. With home values getting a bit bubbly it certainly would not be hard.

Yeah. It would be interesting to see a ‘Credit Card Balances vs. HELOC Balances’ WolfStreet chart. I’m guessing an inverse relationship.

Actually HELOC has not been that bad, I think people are going for cash out. It is a lot simpler when doing a refi.

1) There is a divergence between consumer spending rate and c/c balances.

2) Consumers c/c spending rate is trending down since mid 1980, reaching NR in 2008, while c/c balances are trending up.

3) When consumers spend less, when their c/c balance is already high, because they are frugal, their next statement can show a higher high, if they only pay the min.

4) In 2009 and in 2020 c/c spending rate was NR (-)10%. It might sink lower low in 2021.

Isn’t this incredible stock market surge entirely premised on vast borrowing and huge spending underwritten by permanent bailouts and multiplying stimulus?

Oh dear….

Maybe this is the reason behind Congress dragging its feet on the $1200 stimulus renewal…people are retiring their credit card debt.

I’m pretty sure if there is another $1,200 per adult and $500 per kid to every household, it would cause credit card debt to plunge again in April-like fashion.

Wolf,

Respectfully, my household received zero government assistance payouts! We make to much but Seattle is expensive so unfortunately we don’t feel rich! I’m good with nothing…….I don’t begrudge others but not needing is good. We’re simple people!

C

OK, yes, my statement was sloppy. Apologies. Should have said “to every eligible household.”

If the government is paying you more money to not work, why shouldn’t you be able to save?

People living on low wages/income have a lot of needs which are delayed due to lack of money. When they finally get some extra money, they buy the shoes they need, the clothes they need, the haircut they need, the car oil change which hasn’t been done since last year, etc. The bank account is not the first place their money flows, it’s the last.

Yeah, this seems like more proof that wages and incomes are too low for the 99%.

Hmm.

I wonder what the cable TV ($70+) penetration rate is?

Or the share of households whose vehicles were bought used?

Or that buy exclusively branded products (at a 40% premium to store brands).

There are a zillion ways to economize…very few are taken advantage of by many.

Cas127,

If poverty was so great everybody would be giving away their money. It’s no fun not being able to afford basic things like haircuts and new underwear. It is really hard to live that way and $1200 barely buys a month of groceries for a family.

lenert,

I watched part of a live stream on unemployment benefits this past Sunday on Utube.

One person asked if telling their kids Santa had Covid and wasn’t coming this year was ok.

Ohhhh…that’s funny in a sad kinda way.

“It is really hard to live that way and $1200 barely buys a month of groceries for a family.”

Really?

US$1200 a month?

What are they eating steak and lobster twice a week?

The price of food in the USA must have gone through the roof since I left the place.

Not even in high cost Oz have we ever paid that much for food.

One thing about people in the USA I can’t understand is that I often hear that people ‘don’t eat good or fresh food’…….

Yet I see a whole bunch of empty yards with no vegetable gardens in them.

If people are poor or lack a lot of cash income and have a house with a yard, why in the world aren’t they out there planting a garden?

From an economic point of view a packet of seeds provides one of the highest returns in the world to an individual. The food is also good for you.

Simple crops likes, peas, beans, spuds, and even corn are easy to plant, grow, and harvest.

Here in OZ the price of fruit and vegetables is set to soar as there is a lack of people to pick it. A lot of stuff is paicked by foreign backpackers who do the work while visiting the country.

The La Nina may also reduce amounts produced too.

As a result of the travel bans and people moving out of Oz when the virus hit along with some dumb government policies our pool of pickers has fallen.

Of course, the work is hard and done in piss poor conditions which means most Australians won’t even consider it.

In fact I would suggest that a lot of Australians couldn’t even do it as their physical condition is so bad that they wouldn’t last a day let alone weeks.

They are also too busy spending up big time as a result of all the free government money here which was one of two reasons that the economy grew here during the last quarter.

The other was a huge increase in corporate profits as a result of, you guessed it: that consumer spending and government handouts.

And while doing all that spending the ‘other half’ also put a huge amount of those handouts and grants into banks which saw their deposits soar as well.

With the huge increase in deposits banks dropped their interest rates on accounts to the lowest level on records as well while maintaining the rates on variable rate mortgages.

Gotta offset the losses on other lines of business somehow and no better way to do that stick it t the loyal, long term customers…………………….

Trump should demand Pfizer repay all the money that they obtained in tax cuts under his regime, then arrest their massive number of lobbyists that are bribing our congressmen in Washington, and finally fine them around 100 billion for fraudulent designation as an American company.

Dave Ramsey finally getting his message through :)

If wish Uncle Sam would get on board.

The Fed has been waging jihad against thrift for 20 years.

50+ years

WFH is a good raise, think of the expenses saved not walking out the front door each morning. I’m retired but I sure haven’t had the same routines this year, and I don’t see going back. It’s a lot of money not leaving the bank account. Does anyone in their right mind want to splurge in these times?

I don’t, but apparently a lot of Americans do!

There is nowhere to splurge. Going to the urban core to meet with women friends, go to the theatre, and out to lunch – nope. Friends and I to see an evening of jazz – $5. donation at the door – nope. Walk the art faires and buy Christmas gifts – nope. Find my favorite food trucks – nope.

I haven’t needed to buy lipstick due to mask-wearing. :(

Good news story even if it is just another baby steps moment.

The other day we received a letter from our MasterCard provider explaining why/how their interest rate increase was being made to better serve their valued customers. We had a good head shaking laugh as we never carry a balance, in fact, I have even started buying gas with cash. Screw it. never did debt and I don’t like what easy credit has done to undermine many worthwhile values I grew up with. If consumerism is the driving force of society and our economy ……. just imagine if we had tapped this energy for other priorities; housing for those without, better education with universal access, maybe accessible healthcare? Parks? Research? High Speed internet for everyone? The list is endless,

I understand Chia Pet now offers a Richard Simmons like grow medium. Can’t make this up. Probably made in China. :-)

Sounds to me like the letter I got from life insurance company that said they were looking after customers and to serve them better they were ‘adjusting premiums’ for customers as a result of the recent government inquiry into financial services.

Then on the other page found out that those being ‘served better’ were those under 55 and those getting the shaft were those over 55.

My premiums for the same amount of coverage were adjusted up 400%……….

One guess as to what I had to do……………………

Learned a couple of things about banks this year.

1) Always thought ‘Cashier’s check drawn on a bank was same as cash, but ran into bank holding funds for two days on checks over $50,000.

2) Banks have different limits on debit card transactions. Friend went to purchase a car out of town on Saturday from dealer. Bank had limit of $10,000 on debit transfer even though $18,000 in checking. Transaction had to be ran through as credit I assume so the bank could ask m the 3% fee. Dealer would not take personal check and ate the fee to get the deal done.

I guess it depends on the bank and dealership. I bought a Kia with a personal check (local bank) for $36,000 a year ago. The dealership said that’s fine as long as they could run a credit check. They took their pretty time depositing the check too, to the point where I almost felt like the car was still theirs. It bothered me for a couple days.

Use as a short term loan payoff monthly no interest get rewards simple common sense if u pay 25% interest u get what deserve bankruptcy

The US trade deficit with our trading partners is still rising and approaching a trillion dollars. We, as a country, are not saving, ie, the government, corporations, and we, the people, are not saving, otherwise the deficit would not continue to go up as we close out the year.

The Starbucks economy, get them out of the house, and they cannot drive two miles without making superfilcious purchases. How much of this is automobile related – I am not wondering if I could go a year on a tankful of gas – or roughly 500 miles? My car insurance co keeps sending me checks. Would like to see how debit card use is going, my guess the CC balance drop is really consumers keeping the Debit card in their wallet.

I fill up once a month now and it’s like $20 for my 8-seater in TX. It’s amazing because when I was living in CA before the first housing bubble popped, one crises was people paying $500/mo for gas to and fro work. Such a contrast between time, place and situation.

“There’s no great loss without some small gain” – Caroline Ingalls

I see a lot of silver linings, actually.

Do you go around the block? I’m driving a manual Honda 1.7, 35 per gallon, am retired and spend 5 times that.

Not that economizing on trips is a bad thing. I am in Canada where gas is more$ and I could cut out maybe half of miles but couldn’t get below $40.

Actually, I usually switch on sport mode and enjoy acceleration. COVID made us realize we prefer being home. Since I work from home and we home school, we usually only drive for local outdoor recreation or to see Grandma who lives nearby.

Amazon Prime and grocery delivery takes care of all our buying needs except prescriptions, but I see there’s Amazon Pharmacy now. We’d be totally set if USPS could deliver my PO box’s contents. Maybe I should switch to another service.

Our gas is $1.85 USD a gallon right now. How does yours compare up in Canada?

Thesis: Using a “tankful of gas” for one year.

Caveat: ethanol blended gas begins to break down (H2O conversion) in fourteen days. Fuel system will be trashed in one year unless the gas is ‘clear’ (non-ethanol).

More expensive up front, but (depending upon your locale/availability*) far less fuel system issues in long term. Also 1-2 mpg gain without ethanol.

LT storage: 100LL Avg gas which has a guaranteed shelf life of two years.

* Gasbuddy, Pure-gas references

re: “Caveat: ethanol blended gas begins to break down (H2O conversion) in fourteen days.”

But by how much? In California, we’ve gotten nothing but ‘gasahol’ for decades, I’ve not had any issues with it, even with long-term ‘storage’ in a couple old British cars (have heard anecdotally that others have, but multiple anecdotes != data).

re: “LT storage: 100LL Avg gas which has a guaranteed shelf life of two years.”

Caveats:

1) 100LL is loaded with tetraethyl lead; the ‘LL’ (‘low lead,’ blue) is relative, something of the order of ‘only’ 2g per gallon of elemental lead as opposed to 3g/gal in the 130-octane avgas (orange) of decades ago. TEL is EXTREMELY toxic and readily absorbed by skin or by inhalation.

2) Run 100LL avgas in a modern car and your catalytic converter will be toast in a couple miles (that’s a multi-thousands of dollars repair for some cars).

If you have an STC to run autogas in your aircraft–gasahol not recommended–and you want to do the paperwork you can get a tax refund for the ‘road tax’ you pay for autogas.

Speaking of gas, I’ve never bought an oz of premium gas.

Here is the US Federal Trade Commission

‘It may seem like buying higher octane “premium” gas is like giving your car a treat, or boosting its performance. But take note: the recommended gasoline for most cars is regular octane. In fact, in most cases, using a higher octane gasoline than your owner’s manual recommends offers absolutely no benefit. It won’t make your car perform better, go faster, get better mileage, or run cleaner. ‘

The FTC thinks consumers are wasting hundreds of millions on higher octane gas.

re: “In fact, in most cases, using a higher octane gasoline than your owner’s manual recommends offers absolutely no benefit”

True in some instances, but not all. Modern cars with computer-controlled ignition and cam timing can retard both and run OK on regular (87-octane), but many can and will achieve greater performance with higher octane gas. For instance, my Mustang will get 475HP on 91-octane–highest generally available in California–‘premium’ and 480HP on 93-octane gas. I blended some 100-octane racing gas–at $8/gal–to get mathematical 93-octane, but my butt-dyno couldn’t tell the difference.

Isn’t 100/130 avgas green?

Anyway you can get an STC for UL94 instead of mogas so you get the quality control of avgas with the lead-lessness of mogas.

use Stabil or other similar product sam,,,

fuel use for my truck this year less than a full tank, but filled when down 1/4,,, and such product introduced when evident that less than a grand on the odometer in 12 months,,,

never had any of the problems with the ethanol other than a cheap chain saw with deficient plastic fuel tubes,,,( oh yeah, an ’84 vehicle too,,, needed a couple new tubes…)

friend who is a honcho/ crew leader in a garage for MB and Chevy dealer says ”older tubes” can be challenged by ethanol, but can be replaced very cheap BEFORE they fail,,,

Actually, Ambrose a company called gas buddy passes on gas savings to members for using their Debit card at the pump. Around 5 to 12 cents per gallon on average, which would add up for ca and western state drivers. Basically, a debit card tied to your checking account. The service station saves money vs. a credit card, part of which they pass on to Gas Buddy. Probably a trend.

1) Two people with chronic conditions died after getting PFE vaccine.

2) WHO, Dr Margaret Harris : the vaccine is less effective than people think, isn’t a Maginot line. It will NOT prevent Covid spread. More restrictions are necessary.

3) PFE vaccine is dangerous to pregnant women & children.

4) A strong immune system that reject any type of invaders might develop a Cyco Storm that is more dangerous than the virus itself. Mass production inoculation might harm the weak elderly with compromise conditions, instead of saving them.

5) Dr Giror : ignore online rumors.

6) How effective millions PFE inoculation will be between storage @(-)70C, room temp and body temp of 97F.

7) There is a difference between winning the battle on paper and real life actions.

‘6) How effective millions PFE inoculation will be between storage @(-)70C, room temp and body temp of 97F.’

No problem in developed world. The minus 70 is for medium term storage as from factory. Shorter term ok warmer, final in clinic is ok for days in fridge. Dry ice does this job all the time, problem is to crank up supply.

In developing world, like HOT rural India and Africa, big problem.

We will know a lot more in about 3 to 5 years. The world is the guinea pig for the vaccine.

The CARES Act provided some guidance for credit card forebearance. Is there also an effect when bankruptcy court eliminates credit card balances?

Another dynamic could be the sharp pullback on credit availability after covid struck. This hits credit scores and gives people an incentive to pay down balances to try to get their scores back up.

It would be nice to have some perspective as to what happened in 2010, when consumer credit exploded upward. There was a slow recovery from GFC, but what triggered the excitement to use credit (again)?

I was also looking at FRED:

Household Financial Obligations as a percent of Disposable Personal Income

Did disposable income begin to crash in 2010, offset by use of credit, then remain stagnate for10 years — then crash during this pandemic? If that’s so, then, we seem to have a unified rejection of credit use linked to more and more people not having disposable income.

Thanks Wolf, good data like this always leads to improved questions. How much of an impact does employee spending (put on personal credit card, and then reimbursed by company) have on this data? For instance, I used to purchase/expense a few thousand a month while traveling for business, and now $0.

Inno,

I’m not sure how that would wash out. I would assume that the reimbursement of travel expenses — the actual money when the employee gets it from the company — would be used to pay down or pay off the credit card. In that case, it would have not much of an impact on credit card balances if this traveling suddenly stops.

But then, there might be people that spend this reimbursement money on Christmas gifts and whatever (hard to imagine) and not worry about paying the credit card balances that now include the business-class flight from New York to Tokyo and fancy hotels and fancy food in Tokyo. And if this type of business travel suddenly stops, it would impact (lower) credit card balances.

Ah, makes sense…this is balances. That clarifies things. Yes, if everyone operated like me these corporate expenses would wash out within 30 days, and not show up in this data, at least if everyone operated like me.

However I know a lot of folks who wait until year end to get reimbursed (some of them in a “self-forced savings plan to avoid their own impulses). That could explain the data as shown…

Hope springs eternal for the consumer becoming economically aware, I just doubt it.

Would less credit card debt influence the REPO rates? It seems like it would…

I feel like the contraction in CC debt is 100% due to eviction moratorium. If the plan is still to let that end Jan, the debt will spike until day 1 of Biden admin which says they will put the moratorium back in place, although I’m not sure they legally can without congress.

Yet most believe the government GDP numbers. CC Balance decreases more than 2009!

Even though there’s a global belief that we live in a new debt-free world, it still seems possible that there will be a need for income and disposable income stuff.

At some point, as stocks go higher, there will be fewer people that have money to play the stock bubble game. In addition, the concept that a country like Japan can have negative GDP, ZIRP-based treasury yields and buy more and more expensive assets, within this bubble, is increasingly absurd. It seems to be working, so maybe that model will work globally — and currencies will all adapt, and everyone will be blissful?

This is a world where a monster corporation like Amazon is the landlord and can use its equity to build its monopoly scale, converting cash into a perpetual motion machine. Yet, as they increase scale and steal market share from virtually everywhere, how will that impact a world where fewer people have jobs and stuff like disposable income?

Will we see the US Treasury, and other nations invest tax dollars into Amazon’s equity position and base our future on a tax-evading corporation that needs more robots than humans?

It would be interesting to calculate what percent of consumer credit card balances are taking place at Amazon …

American sheeples have less and less saving with more and more depression and body mass.

True happiness comes mostly from emotional and spiritual well being.

Make friends with inner yourself, and family and friends (unfortunately many don’ t have such).

Eat quality food (which excludes almost all processed and dinning out) by buying fresh organic raw materials and cooking at home.

Buy things we need, and save everything we would spend on wants because raining days are ahead of most of us.

If they are smart they would have squirreled something for the upcoming Rentapocalypse. But perhaps it’s us who keep paying rent who are dumb.

Not if what Klaus Swab is saying is true that you will “ Own nothing and be happy” Renting May turn out to be a savior in disguise

I was complaining about people not paying rent, not rent itself. But then again hopefully the rental market will collapse further. I want to live in a swanky condo with a swimming pool ;)

Failing that, would be nice to be able to live somewhere in SF’s Japantown for 1200. Studio is perfectly acceptable.

I have requested most of my friends esp who are unemployed to stop paying rents.

I am sure, more forbearance and moratorium are on their way. If not the economy would collapse.

Rent is another person’s income, which probably means someone will lose their house if you don’t pay rent because he/she can’t make mortgage payments.

Also, a rental obligation is a contractual one, not discretionary spending.

Many purchases are influenced by the perceived future devaluation

of money.

Many purchases are influenced by basic human need by people who know nothing of currency devaluation, the debt, the deficit, aggregate demand or Dynamic Stochastic General Equilibrium.

Nope. This is Murica. The strong lives, Muricans buy.

Muricans always buy. They only stop when there’s no moolah.

Moolahcans?

Yeah but they should be buying gold and silver certainly NOT overpriced real estate that can easily be confiscated by TPTB ( taking off tin hat now ?)

Yeah, ’cause no one can ever take your gold and silver bars away from you.

You’ve never slept under an ingot, obvs.

You can keep them hidden forever.

“There’s no great loss w/out some small gains.” – Caroline Ingalls

“When a strong wind blows, even turkeys fly.” – unknown

Note: “Shakedown Street” unfolding in Seattle: Pot retailers in Seatac being shaken down for for 15% of profits ( ____ activist groups) for allowance to do biz. Police respond with ‘Iraqi salute’ to allegations.

Cash only (no cards).

You still have police in Seattle? I thought you modernized and furloughed them all.

I’m 180 miles to the South. ie ‘Peoples Republic of PDX’.

SEA police quitting in droves, being recruited by other municipalities across the USA.

Well known ‘secret’: PDX/SEA trains the rest of the country’s police force.

I’m only supporting local independents, garage/estate sales. No big boxes, chains or Amazon. If the politicians can play favorites then so can I.

“Alice’s Restaurant”.

in the unlikely event you haven’t already taken this step, start a garden. it’s another way to vote by not participating.

After borrowing 1.2 billion earlier this year, the state of Illinois is going to borrow another 2 billion more from the federal reserve using a federal government plan that allows borrowing up to 5 billion for emergency funding. This was necessary after Governor Pritzker’s state ballot to increase taxes on the rich failed. The failure was probably due to all the TV ads by the republicans that deceived the not well read public into voting against something that was good for most of them.

In the meantime, the city of Chicago will borrow 1.7 billion to help pay its bills and refinance the balance at lower interest rates, This will be the largest “scoop and toss” in Chicago’s history using a program made famous by Rahm Emanuel. Public hospital bills and lost revenues due to Covid 19 plus increasing costs for its defined pension plan for city workers is creating a record budget deficit.

Ahh yes, voting for a tax on someone else is “good for people.” No one can possibly think in good faith that such a thing sets a bad precedent.

Team Red wants $600 direct consumer check stimulus, team blue pushing for $1,200. As of today, I’m confident that the next stimulus bill will not pass without direct checks, as both Red and Blue want it included, and multiple on both sides refuse to pass stimulus without direct checks.

Thus, Credit Card balances will fall further over the next few months. Not a good sign for future bank CC “frau-fits” via screwing the poor.

Crocodile tears…

I am willing to compromise. I will accept both a $600 Red Team check AND a $1200 Blue Team check. That should make everyone happy.

Chicago needs to declare bankruptcy like Detroit did because it can’t pay its bills. When Detroit came out of bankruptcy in 2014, it was in much better shape financially because it cut pension benefits significantly for retired city workers except for the police and fire department and placed new workers on a 401(k) plan instead of the defined pension. It also was able to cut other debts in bankruptcy and did not have to make any pension payments until 2024. Well, Detroit took off after dumping all that debt, but Covid has hurt them more severely than most cities across the US and now there is danger of them going backwards again.

Last week the bank that issued my credit card closed the account because it’s been inactive for two years.

I had used that card exclusively for travel expenses. If it weren’t for the pandemic we’d have charged up close to $20k this year. We always pay the payoff balance each billing period so as to have no interest charges. But still……

for those who take a while to pay off their vacation charges, I wonder if they’re continuing to pay those off from old travel, but not charging up new travel since folks mostly aren’t doing that now.

A bit off topic, but what happens to the (Dec 15th) Electoral College process, if the (CR) budget doesn’t go through (this Friday) and the gov starts a shut down?

Is that priced into all the others stuff going on?

“White House Chief of Staff Mark Meadows said Wednesday that he “can’t guarantee” lawmakers will be able to reach a deal to avert a mid-December shutdown of the federal government.”

one of these days a government shutdown will cause turmoil. until that day it will continue to be a forced, yet ultimately paid, vacation.

If consumers actually do pay down their credit cards, and keep them paid down, then the banks will need to come up with another way to fleece us all. Wonder what that will be.

Banksta’s have multiple schemes awaiting to be hatched…conveyed via apparatchik’s bought off for campaign support.

Thesis: “Damn it feels good to be a ‘banksta*’. ”

* adopted from Geto Boys {’92 hit}

the IRS?

A paid down credit line in Zombieland! Anyone keeping a real close eye on that Twinkies supply?

Last firecracker for me.

I am done with them. I have to cancel the last two by the end of December. Never really used them anyway.

Eventually it gets to the point where you get so tired of owing these people money. It’s annoying.

So the consumer, the people who dont have enough in the stock market to make a difference, are shutting down. More Central Banking backfire.

Backfire-The sound of a twelve cylinder block full of dirty plugs and a bad distributor, all running on cheap gas.

Has anyone here ever been poor? This is a totally rational exercise if you realize that credit cards are the “new savings account.” You pay down the cards when you expect hard times to hit so you have a way to survive. If half the country can’t come up with %500 in cash, there’s only one way out of an emergency – use the credit card. You pay them down when you expect bad times because that’s the only economic lifeline you have. The federal government already told you to go die quietly, who else can you count on?

Theoretically nice, but probably applied better to the working stiffs called “the lower class”. The poor are generally so far up sh*t creek with charges, debts, & such that they have little chance of paying credit lines down any substantial amount. We really should stop using the term “low income housing” as most of those dumped into it are “no income” impoverished poor & section 8’s. Working stiffs try to get out if they can get past the barricades set up to prevent their escape, and the whole system is set up to suppress them to keep “clients” for the so called not-for-profit game.

I have a friend who does notary and she has been busy as all get out for months now, compliments of extremely low mortgage finance rates. The bulk of her signings (95%) are refi’s and many have conditions requiring mortgagee’s to pay off outstanding credit cards with some of the proceeds of their loan. Could it be that these debt slaves are just trading one debt for another?

interesting post, thx