Commercial real estate is in turmoil, but San Francisco’s glut is dwarfed by the fiascos in Houston and Calgary.

By Wolf Richter for WOLF STREET.

During the Good Times, when there was still a “shortage” of office space in hot markets, such as in San Francisco, companies resorted to warehousing of office space. They leased office space they didn’t need, and wouldn’t need for years, because they didn’t want their expected growth, and the expected growth in staffing, to be crimped by the shortage of office space.

They grabbed all available office space and leased it long-term, expecting to grow into the space in future years, thereby creating an artificial shortage.

Tech and social media companies and richly funded startups are infamous for that. And since money is no objective for these companies when they’re in rampant growth mode, or when they’re trying to be in rampant growth mode though they might not yet have much in terms of revenues or growth, it’s OK to blow money on vacant office space – until suddenly it isn’t.

As these leased offices sat around vacant, waiting for things to happen, suddenly things happened. The Pandemic put work-from-home on the map, and companies figured out how to manage it, and how at least some of their current and future staff would be working remotely, thereby shifting office expenses, including rent, from the company to households.

And they figured out how to implement more radical versions of this permanently, and suddenly all this vacant office space that they leased and were planning to stuff people into in future years seemed superfluous and expensive, and since they were locked into long-term leases that they can’t get out of, they put this office space on the market as subleases.

For example, Twitter leases its headquarters building in San Francisco from the Shorenstein Company, which owns the building. Now Twitter has switched to a permanent hybrid work-from-home approach – some employees will still need to go to the office, but others won’t. And it no longer expects to fill the empty space that it has been warehousing.

In September, it put over 100,000 square feet of its office space on the sublease market, hoping to get some rent out of this thing. Twitter doesn’t have to break even, just get some rent to cover some of its costs – and it would be way ahead. And so Twitter, along with the other companies putting office space on the sublease market, can undercut the market and put downward pressure on the rest of the market.

This is how an office shortage turns into an office glut – when this large amount of warehoused office space, that was vacant but wasn’t considered inventory for lease, suddenly becomes inventory for lease.

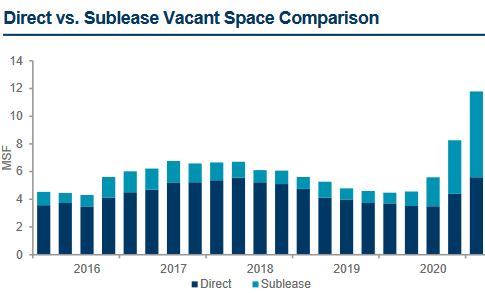

This chart from Cushman & Wakefield’s Q3 MarketBeat Report on San Francisco shows the surge in availability of sublease space in Q2 and Q3 (light blue), even as space offered directly by landlords has risen only moderately (dark blue). Overall vacancy rate has surged by 8.6 percentage points from Q3 last year to 14.1% at the end of September, driven by the sudden appearance of 6.18 million square feet (msf) of sublease space (chart via Cushman & Wakefield):

“This increase in vacancy can be found in all submarkets and size segments from large blocks of 50,000 sf or more down to partial floor tenants,” Cushman & Wakefield said.

While a total vacancy rate of 14.1%, after years of an artificial office space “shortage,” is rattling some nerves, it pales in comparison to the fiasco playing out in Houston.

Houston’s office-market fiasco, by far the worst in the US, started in 2014 with the oil bust that coincided with a Texas-sized office construction boom that drove vacancy rates above 20% years ago. And now, the situation was made worse by the trend to working-from-home. Data according to Cushman & Wakefield’s Q3 MarketBeat report for Houston:

- Sublease space: 6.24 msf

- Direct lease: 45.85 msf

- Total vacancy: 52.1 msf

- Total vacancy rate: 27.4%

Houston’s vacancy rate of 27.4% is by far the worst of any major city in the US. And in North America, it’s second only to downtown Calgary, Canada, another oil-bust-and-work-from-home fiasco where the vacancy rate now exceeds 28%.

San Francisco’s vacancy rate of 14.1% is not in Houston’s league, not even close. Houston transcended that level years ago. But San Francisco is trying to catch up. Sublease space, despite San Francisco’s much smaller office market, is already in Houston’s league, at 6.18 msf, and its exceeds the direct-lease space:

- Sublease space: 6.19 msf

- Direct lease: 5.60 msf

- Total vacancy: 11.8 msf

- Total vacancy rate: 14.1%

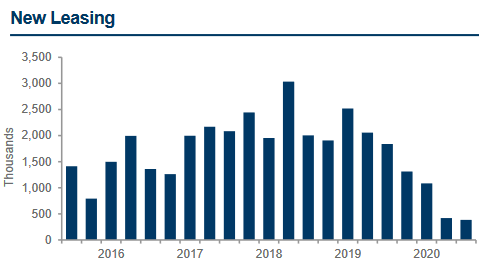

At the same time, leasing activity in San Francisco collapsed to the lowest in “at least 30 years,” according to Cushman & Wakefield, plunging in the third quarter to 385,000 sf, just a fraction of the low point of the dotcom bust of 933,000 sf in Q2 2001 (chart via Cushman & Wakefield):

The sublease space has just now started to put rents under pressure. Asking rents remain confiscatory, at $78.45 per square foot per year on average, but are down 5.6% from the second quarter.

An additional 3.1 msf of office space was under construction at the end of the third quarter. Of this space, 1.4 msf are expected to be completed and be delivered by the first half of 2021. The 1.4 msf have been preleased during the Good Times, on the principle of office space warehousing.

As it happened in Houston, the latest and greatest office buildings generally find tenants that move out from older office buildings, and the older office buildings are the ones with growing vacancies that have to cut rents and are getting in trouble.

Two other projects in San Francisco, including the mega-multi-use Oceanwide Center, have not preleased any space. The Oceanwide Center’s developer, China’s Oceanwide Holdings, ran out of funds. Construction, way over budget and behind schedule, was halted a year ago. The site, which would include two towers, one of which would be the second tallest in San Francisco, is a big hole in the ground, still, four years since ground-breaking. The developer has tried to sell it, and an interested buyer has been found, but the sale keeps getting delayed on due-diligence issues and other entanglements.

The Oceanwide fiasco predated the Pandemic and working-from-home, but any resolution was made vastly more complex by those factors. The project includes in addition to offices, you guessed it, a hotel and condos, just when many hotels in San Francisco are still shut down and their property owners face a crisis amid a dubious future, and when San Francisco is experiencing a sudden and historic condo glut.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I am privately smiling at the current unraveling of the San Francisco landscape. The grand SF City master plan https://archive.org/details/san-francisco-master-plan-1963…over decades has hurt so many lives from illegal rent increases, evictions to random violence (hired by the wealthy) and much more.

The drama unravels nationwide regardless of who wins November 3rd!

Not a ”native” of SF, but enjoyed walking all over the city, from the east bay bus terminal to Ocean Beach in the late 1960/early 70s era, at pretty much all times of the day, including hitching through the city during those times at all hours of the night, especially after a long session at The Family Dog.

SO, I kinda have to disagree with you about causes of decline in safety and general livability for We the Peedons in SF…

While there might have been and probably were some instances previously of vigilante rogues ala “Magnum Force,” in general, the city was quite safe and livable until the political takeover by the left proceeded to the point of not jailing the bad folks (to be sure of every kind, not just the ones typically pointed at) for almost any crime, as continues today.

IMHO, San Francisco will come back, at least to ”scratch”,,, no matter how long and what kind of political upheaval is needed.

Eventually, it will more or less resume its proper place in the pantheon of wonderful cities of the world, as it was for many many decades if not centuries now.

Sounds like their is now plenty of room to house the homeless now so they are no longer sleeping under bridges ect.

– But, but, but ……….. I thought Texas was supposed to be immune from economic downturns like this thanks to the oil sector.

you must be zoomer(gen Z) or mil

Texas imploded in 80’s oil bust

another one in 90’s

etc.etc.

Haven’t you heard the news? The price of oil is way down.

Nor should this be a shock: the energy industry has had many, many boom and bust cycles.

It’s part of the landscape around here in Houston. No biggie….you will need gasoline for a bit longer (and natural gas, plastics, etc).

TX economy overall is much more diverse than in the really big bust in the late 80s. But Houston is still very oil dependent.

If you want to go to an oil town that never really recovered from the 1980s oil bust, go to Tulsa, the former “oil capital of the world.” All the oil companies moved their headquarters to Houston in the late 1980s. It triggered a depression that lasted decades. It was very tough.

Hmm, your description of the hoarding of office space creating a shortage almost would seem to imply that maybe the free market is not always the best way to manage a scarce resource.

They took a risk. It didn’t pay off. So what. That is not a flaw with capitalism. This world is not perfect and never will be. People need to be free to make mistakes.

The gold rush in commercial RE was not a result of capitalism. It was caused by the government. The Federal Reserve dropped interest rates to nothing. I think the situation implies that government should keep its hands off.

Yes obviously MarMar as chief bureaucrat or even king would be way better than free market. Al hail MarMar

Now we’re talking! I welcome my loyal subject Al.

SF real estate is decidedly NOT a free market, it’s heavily constrained by zoning that is the most onerous in the US.

Minneapolis has begun a zoning change program that is referred to as the 2040 Plan. It has polarized the people of the city into two sides: for or against very strongly.

Single family homes, which is the majority of the residential housing, will be allowed to be torn down and rebuilt as multi-story multi-family developments. Will this provide more affordable housing, or will it reduce affordable starter homes?

One of the goals of those who’ve made the plans is to see a city without cars. Increasing density and having everyone walk, bike and use public transit is the underlying objective.

They do this many places, build two story homes and rent out one floor to pay the mortgage. More to the business angle, there is also the commercial downstairs, upstairs apartment model (Bob’s Burgers) Changes based on the return of private business, are not currnenlty in sync with corporate franchise businesses; fast food villages, and miles of cars in suburban islands. Post covid, corporations should introduce virus safety solutions (including the airlines) which private business cannot afford to implement, and then get them passed through the new Congress. The old Congress would have seen this as “too” regulatory. It’s possible that franchises can learn to embed themselves in commercial neighborhoods, something to watch. Basically the private entrepreneur is done for a while. Interest rates will backup, everyone will be working for the man.

This is a fairly complex set of zoning laws that is much more than two story duplexes.

Initially it was set to have three story four-plexes, but was reduced to three-plexes on what is now single family only. Many locations near transit lines have had the code changed for up to six stories allowed. I live close to the light rail.

My next door neighbor to the north was the only no vote on a preliminary plan two years ago before the council. He and his wife are gardeners, and one of our concerns about opening up residential zoning to allow tall buildings – most of which are on 40 foot wide lots from north & south – is how much sunlight should be allowed to be blocked out.

If a six story building is put up to my south, and it takes up most of the lot from east to west, my garden is in the shade. People at city hall make these decisions and laws. Any input on SF zoning being onerous; Wolf and or readers?

My hometown on Vancouver Island is also encouraging high-density ‘infill’ housing development (without a commensurate increase in public parks). They are minimizing parking spaces and creating bike lanes and would love to see everyone on bikes like in Copenhagen. Unfortunately, the demographic is skewed toward seniors with orthopedic issues and the topography extremely hilly – not to mention icy in the winter.

To change Mr Buffet’s quote……..”When the tide goes out, that’s when you discover the bodies” ……………………………………………….

1) For free, because there is no penalty to delinquencies.

2) The Pareto top avoid forbearance because they can.

3) Student got forbearance because they can’t.

4) Student loans forbearance led to mortgages, rent, car loans and credit cards forbearance, all protected by the extend and pretend election relief.

5) Forbearance is the cause of delinquencies and the cause of low Fico.

6) Landlord don’t rent to low Fico prospective. Homelessness will grow unless the gov kick the forbearance can down several times.

7) Car sales will plunge. Dealers avoid bad payers, sitting on a pile of unsold inventory, because the buyers pool have shrunk.

8) Student loans jubilee will lead to rent, mortgages and credit cards jubilee to jump start the economy.

9) The party will be over, debt will be written off, but Fico will stay low.

10) What if there will be no jubilee ?

No jubilee. Because every debt is some counter party’s asset. Who’s left holding el baggo?

Zirp and QE are slow motion debt jubilee with a lot of the same consequences. Boiling the frog slowly instead of throwing him into a boiling pot.

‘What if there will be no jubilee’

Warning!

Don’t read this if one is already ‘depressed’

https://www.oftwominds.com/blogoct20/global-depression10-20.html

I just hope that tt is NOT going to be that bad!?

Allowing for a very generous 200 sq.ft. per inmate, SF needs to find sixty thousands bums to sit on those empty seats; Houston is needing one hundred thousand.

It ain’t coming back – demolition contractors have a rosy future.

Hollywood was using half finished building developments for movie sets two bubble crashes ago

They completely destroyed a building complex in one of the Lethal Weapon sequel movies. Purchased in bankrupt and much cheaper than building one.

Not quite but interesting to bring up. Orlando was going to demolish its City Hall and had an idea to sell video rights to reduce demo costs of 150K. This was circa 1990.

‘Orlando and Warner Brothers have tentatively agreed to let the Hollywood studio use the Oct. 24 destruction of the building as a backdrop in the movie Lethal Weapon 3.

A signed contract paying Orlando $50,000 for the film rights is imminent said spokesman’

Orlando Sentinel

Tract May End in Blaze of Film Glory : Lancaster: The city is talking to filmmakers who may want to burn down an abandoned development as part of ‘Lethal Weapon III.’

LATimes – 1991

Maybe Orlando was LT 1. Maybe they used several. I only looked it up cuz I knew they weren’t going to buy it ‘out of bankruptcy’. even though that would be cheaper than building a new one ( I assume you mean a set) just to destroy.

True except last. Demo is very expensive and dumping fees are through the roof. There has to be a reason to do it, a market or project for the site. With a few exceptions, there aren’t going to be any probably for decades.

If the boom/bust cycle had been allowed to take its natural course, things would be different, but with a politically obedient Fed preventing recessions, overcapacity builds and builds.

Covid is just the pin, ok a pitchfork, into this balloon. Note that Oceanwide was a disaster before covid, and before covid made the tech crowd realize that WFH was not just easy for their businesses, it was a business opportunity to sell tech to most clerical work.

There will be some opportunity to convert office space to res, because you need an H to have a WFH.

But it won’t be many of the abandoned malls, because it would be cheaper if the structure wasn’t there. So may as well look for vacant land, and let residents commute or WFH.

Interesting story, Post Covid officeworker changes to WFH, where after six months mortgage forebearance runs out. Worker moves into old office building which has been converted to RES, and continues to work for same company (at adjusted WFH pay scale, of course).

Billy G didn’t give away Fresca cuz he was a nice guy – he just didn’t want you leaving the office. Ultimately he just built a new shopping mall on campus.

Cheap space for vertical farms?

I have no idea if you meant it as a joke, but I think it’s a great idea.

Let’s replace natural, outdoor farming with indoor lighted, hydroponically supplied farms. This way we can add extra water, energy and transport pollution.

And that even ignores that at $75/square foot – that means an acre of this “land” costs $3.26 million…per month.

Compare that with the cost of buying farmland in the Imperial valley: $8500 to 10500.

1) Joseph was sold as slave by his brothers, because their father was

infatuated with young Joseph.

2) Joseph became Egypt Treasury Secretary because he understood

economic cycles.

3) During the boom times Joseph accumulated assets for Egypt treasury.

4) During the lean years he sold it to qualified buyers.

5) There was no Marxism in Egypt. No jubilee.

6) Those who couldn’t signed on gov papyrus that they accept slavery

in order to survive.

7) Slave labor built the eternal Egyptian infrastructure.

8) Joseph brothers lived in prosperity, but their children became slave.

9) Joseph cycle from start to its end didn’t start with him, was repeated for many generations after his death.

Wonder how much the regional banks are exposed to this. I guess they could repackage to CMBS and desperate fixed income investors to take over their mistakes.

“Wonder how much the regional banks are exposed to this.”

Great question. And pensions, too.

Yes, there is some of that. And Boston Fed Prez Rosengren has been warning about this for years (no one listens to him). But a good portion of this debt has been rolled into CMBS, where investors eat the losses.

iShares CMBS ETF is up 6.5% year to date.

Hey You,

1. Because yields have plunged. Bonds rise when yields plunge. Thank the Fed. Even a risk-free US Treasury note with a 7-year maturity is up 5.3% ytd.

2. And because at this point, the market doesn’t even care about credit risk. What credit risk??? Doesn’t exist anymore.

3. And because… If you buy the high-rated tranches, the lower-rated tranches take the first loss, and that’s where the losses are now. And the ETF you cited focuses on the higher-rated tranches. It will take a while for losses to go up that far.

4. Because CMBS also include property types that are still doing well, such as industrial.

Investors might close their eyes and not give a crap, as long as prices keep rising – but the industry is fretting about retail and hotel loans and they’re blowing up massively. And now all eyes are on apartment and office loans. Give it a few months.

Are any of these empty office spaces economically justifiable and planning suitable for conversion to residential use.? In England, particularly around major cities, property companies have started to think the unthinkable and convert smaller office blocks into either budget hotels or leasehold studio and one bedroom apartments. The Government has softened planning regulations to allow this to happen. Some retail units in smaller towns are also going residential to bring life back to centres, as councils accept that on line shopping is taking an increased market share.

The economy is set to boom in 2021 I’m not sure what anyone would be worried about.

The pandemic is almost done and will be over in a week.

This is an old story in oil country. Not just offices but houses. During the booms new offices and subdivisions are built. After the bust, the Yankees go back to NYC, selling the new houses cheaply, and the steady locals percolate upward. At each step of the ratchet old houses and old office buildings get torn down.

I agree, Houston and Calgary have much more practice at this than SF.

Having gone to school in Houston and family in the area, I read that as Déjà vu, again. Seems like the normal boom-bust for them, and with energy being what it is, they should bounce back again this time, too.

The difference is this is the ‘everything bust’

Previous oil busts were always driven by supplier wars, with Saudi with 1.50 a barrel lift- cost, turning the tap on and off when it felt like it.

When in previous busts were 200 NYC hotels closed, cruise ships docked, planes grounded, and the Fed throwing a trillion a month just to keep the market afloat?

But then if:

‘The economy is set to boom in 2021 I’m not sure what anyone would be worried about.

The pandemic is almost done and will be over in a week. ‘

Sarc?

And just like that, office space became affordable.

— Said in best Forrest Gump voice

“or when they’re trying to be in rampant growth mode though they might not yet have much in terms of revenues or growth, it’s OK to blow money on vacant office space – until suddenly it isn’t…”

A billion dollars…and all you got was a hole in the ground?

The Japanese, at the height of their hubris, at least got fully built office towers and golf courses.

“The site, which would include two towers, one of which would be the second tallest in San Francisco, is a big hole in the ground, still, four years since ground-breaking

When the Go-go Eighties crashed, it started like this. First, the vacancy rate in CRE soared. Then the residential market started to tank.

There’s just no way you can have such massive damage to certain sectors (travel, hospitality, entertainment, commercial real estate) and not have it spill over into the rest of the economy.

The Fed hasn’t fixed a single problem. It’s just jawboned people into THINKING it’s fixed the problem.

NewYorker, the stock market had a wake-up call today and realized that the Emperor, the grossly overvalued equity markets, had no clothes. Actually, the dive in revenues in the quarters ahead will paint the true story of what stocks are really worth. Down, down, down the swirling toilet bowl of overpriced assets go stocks, dragging many a retirement account with them.

The “go-go” eighties with interest rates of 9% through 21%?

Those 80s?

@2b-good reminder.

may we all find a better day.

The interest rates were not an obstacle to real economic good times. Today’s bubble is a hologram on a mirage on acid.

Wolf,

Did the reports have anything to say about the NYC office/sublet mkt?

SF is wacked out but smaller – NYC is a whole different order of crazy, both in terms of size (sf) and, at least historically, price (per sf).

I seem to recall plenty of $100 psf NYC office asking rents (along with plenty of $20-$25 DFW asking rents…)

I was always amazed at the breath-taking gamesmanship of office lessors in negotiation…for whom every unleased sf, every day is a unrecoverable loss (like an unfilled airline seat).

(Presumably this was a problem the WeWonks of the world helped landlords ameliorate)

But, I guess, lessors get good at staring vacancy in the face, knowing that revenue maximization occurs at something significantly less than full lease up…maybe large, smart lessees require most favored nation/best price matching before they commit to those long, long leases).

The real problems occur when the sponsors know that they won’t be able to refinance the balloon payment. At that point, they have no incentivize to do anything to upgrade the property and will just hand it to the bank (or CMBS bondholders) at maturity.

Interesting…but hardly new dynamics….if you are old enough we’ve been here before.

I’m wondering what kind of collateral damage is associated with this wfh implosion!

A lot of office support services will/are cratering.

Coffee services, tenant improvement construction, janitorial, security, parking, copy machine leases, office supplies, temp services, catering,….the hub is gone. Only spokes remain.

Yes, we’ve been here before, but never on such an accelerated timeframe.

And yes, the peripheral industries are going to have much more of an impact than people realize.

One major NYC subleasing tenant, IWC/Regus, is currently looking to close many of their co-working centers:

https://therealdeal.com/2020/10/05/iwg-looking-to-close-20-of-flex-office-nyc-portfolio/

My guess is WeWork and others will soon follow:

https://therealdeal.com/2020/10/23/wework-bonds-now-close-to-default-fitch/

IWC/Regus also has a lot of emptying-out

covidco-working space in San Francisco.Per their listings on craiglist: “50% off for up to a year!” “Three months free!” “Access to 70 locations in the Bay Area!” I wouldn’t be surprised if most, if not all, of those seventy give up the ghost.

“Co-working” and its corollary “co-living” are doing the dodo.

What about all that market priced”Transit Oriented Development” that gets to leapfrog over zoning, open space, density and traffic requirements? (But always has parking slots for those who will drive).

The beanpole from New Jersey, Scott Weiner, keeps pushing his prodeveloper TOD bills through the state legislature.

“But how does that work when there is only a marginal functioning transit system in a city? Or BART ridership is down 90%, because no one wants to be trapped in an infectious horizontal elevator in a tube? Don’t expect any answers from Wiener – or, if his history as mayor is any indication, Governor Newsom.

Manhattan (not New York City) is similar but not as bad. Overall vacancy rate rose to 13.3%, a 24-year high.

Sublease vacant space has been rising for nearly two years — as problems have been building for a while — and in Q3 reached 16.1 msf, a 17-year high.

Direct lease rose a little to 37.9 msf.

If manufacturing re-shoring is true and not just a political talking point, it’s possible some of this space converts to light manufacturing. Speculative for sure but it reminds me of the old brick factory buildings spread throughout older cities. Many of which converted to condos and mixed use after manufacturing was off-shored. Thoughts?

I think most of the space the FAANGs are buying/leasing on the west side of Manhattan will not be mostly for workers, but for co-locating computers. You can consider that light industrial usage.

The FAANGs are scooping up mega amounts of office space on the west side of Manhattan. It’s the cheaper side of town, but it is also closer to the fiber and microwave towers coming and going from flyover country. I think the left coast is over as a tech leader.

Maybe the FANGS realized that New Zealand was too far away, instead they can colonize Manhattan. Then when the torch and pitchfork crowd comes for them they and their bankster buddies can pull up the bridges and hunker down in their office space and luxury condos. That way they can eat at fancy restaurants, and continue to milk the prols with their rackets over the internet.

I think it’s actually going to be “flyover country” that’s going to change the most. It’s the cheapest place available, and once they realize that those transportation hubs (like St Louis for example) will remain and can easily be upgraded to tech centers the move for business that do not require ocean transport of goods will be inland.

Why put up with the politics and hassle inherent in NYC when you could buy the entire city of say, Tulsa, including the politicians, for the price of a couple blocks of Manhattan? Buy a mid-west transportation hub, spend a little on infrastructure, and you have a whole new company town. And the advantage is this, you can afford to house those who have to come into the office for a lot less than any costal city, so you can pay less for labor.

I think Detroit is the best place in the country for data centers. It’s cold most of year, so cheaper to run, and there’s plenty of space to expand. Major centrally located airport as well.

It’s not like Detroit wasn’t already a company town.

Plus over the longer term, with climate change, the northern Midwest will become a little friendlier weather-wise.

Google seems to scooping it up.

https://www.sfgate.com/bayarea/article/Google-San-Francisco-office-space-Two-Rincon-15661758.php

Scooping it up? Ha, that’s funny… “picking up a droplet” would be a better phrase. Just 42,000 square feet. And Google has been negotiating this since 2019…. pre-pandemic.

How is it that Twitter is a tech company? What technology are they creating/using, beyond, let’s say, hypnosis?

I think Twitter is considered tech because they use electricity.

I agree completely. Kind of like Uber- take a taxi service, slap an app on it, and magically, it is a tech company. Profits are optional.

From Dilbert: First has guy saying: ‘We just changed our complete IT, hardware and software.’

Other guy asks: ‘Who advised you?’

First guy replies; ‘the vendor. He said we were using the wrong kind of electricity.’

“…the wrong kind of electricity.”

What, were they using recycled electrons?

Electric power can get dirty. I use a mid-level, and not very expensive 10 lines out, 15 amp power conditioner for my main audio video system. AC line noise filtering is good thing.

Both my moving coil phono preamp and turntable have their own power supply systems. The one for the ‘table is hand assembled and individually matched to the platter motor.

However, there’s a market out there for $800 power cords that can replace the one that came with your amplifier. Even though I’m an audiophile, I’m not that crazy of an audiophile to use these.

And the internet!

Hahahaha. Good one!

When they impose content restrictions they become a media company (even if the restrictions are self imposed) Once the FCC gets involved (such as restricting foreign misinformation) the door swings open. The corporate tax rates change as well. Twitter is really a great way for politicians to reach their constituents, so I doubt they would do too much to change the formula. Potus earned 2B in free media campaign coverage in 2016 being controversial. A lot of that came through Twitter. The takeover of Twitter isn’t going to happen, so I expect Fox to open their own Twitter-like technology and lots of little Twitters all over the place, which the FCC will have to regulate that bandwidth probably.

They’re shit-scared of losing section 230 protection.

Stephen C,

What I said was this: “Tech and social media companies and richly funded startups are infamous for that.”

But generally, “Tech” is a very broad term and includes software (not just hardware), and software is what social media companies design and implement. These companies are full of coders. Their entire platform is software, and that’s really what they are, though they don’t sell the software. What they sell is advertising.

Wolf,

“What they sell is advertising.”

There is a heck of a blog post in the industry economics of that observation.

The world (er, CPMs) has come a long, long way since there were just 3 TV networks and only local newspaper monopolies.

Presumably, this has crushed the cost of advertising for smaller businesses…but the Big 3 TV networks still seem able to use some sort of dark Jedi Mind Tricks to keep their own reported CPMs growing yr after yr, despite ever shrinking audiences.

Ditto the interesting paradox of Google/Facebook being able to ascend to financial godhood on the back of advertising, despite there being approx a bazillion other websites that also offer advertising.

I know Google/Facebook offer semi unique selling propositions and enormous audiences…but still…the bazillion..

Actually what they sell are people, advertising is an intermediary.

Advertising sells culture. You segregate ‘people’ into various demographics, using an umbrella which is mostly nationalistic, you market them with uniform commodities such as information. Every news outlet sells the same stories every night. All wars are culture wars, hence the bias. Facebook advertises itself (like PBS) and to not be on FB is the same as being a total dropout. Ads are intermediaries between people and culture, and the reason why China has no culture?

“I can’t do it, it must be easy”.

— Americans.

“confiscatorily” might be the adverb?

Yes, but no, that’s not what was meant. There was an extra “high” behind it, which was left over and slipped through editing. Confiscatory already means “very high” in this sentence, and was supposed to have replaced “high.” But somehow the “high” survived until just now :-]

Is possible to even covert those buildings in downtown areas to condos?

Of course it is James:

As a now retired construction estimator/manager, I have worked on dozens or more of such transitions over the last few decades and all over USA…

Some of the older buildings will not ”pencil out” until their local area residential values rise enough, but, IMO, right now most big cities will benefit from the current rise of res values, then crash to the point where many more properties will change hands for a nickel on the dollar and then be viable from the cost benefit ratio.

While some will say conversions from office to residential is too costly for various reasons, most of those reasons have been obviated by the great advances in HVAC, PB, and EL technologies that have occurred in the last couple of decades.

Seattle could get interesting.

Amazon, Microsoft, Facebook, Google, and Expedia have been expanding office space rapidly. Microsoft is in the middle of a $4B, two million sq. ft. headquarters expansion, which began before COVID and their WFM announcement.

The office space glut is not going to put anybody in the poor house though. These companies have huge profits and cash balances. They can afford to waste lots of money. But, it might open some cheap sublease space to other companies. Just recently, REI built a new headquarters complex and then sold or subleased it because they decided WFM was better.

The Seattle City Council will kill real estate values more than anything Covid can do. They are viciously anti-business and their plan for raising tax revenue after they’ve driven out all the wealth creating jobs is interesting, to say the least.

Shipping lines are moving south to Tacoma as fast as they can, Tech is headed for cheaper pastures, and I’m waiting to see if the tour ships (should any survive) will move over to Kitsap County.

Wolf I enjoyed this article very much thanks

And who said you can never lose money investing in Real Estate??? I think it was a real estate broker!

TSLA liking that 420 level.

I’m looking for very small office space in small southern town, pop 100,000.

Even in the past week I have seen the listings on Craigslist triple. Hmmm.

A local doc doing a cash practice x 23yrs, staff of 8 can’t make it anymore and closing 12-30-20, putting 3000sf back on the market. Here comes the tsunami?

Relax. When this is over the kids are heading back to the office.

Not sure. I think this is why the economists encouraged programs to keep people attached to business. If the virus was temporary shock everything kind of goes back to normal with short term loss of economic output. Once it reaches a year or so permanent adaptations are made and things don’t go back to the way they were. I think that is where we are going. Economy is going to be very different. Election will matter as well for direction of course.

Wolf blocked my linked article. Google:

End of the Office: The Quiet, Grinding Loneliness of Working From Home

It told the story of many remote workers clamouring to get back to the office and quoted a consultant in the space extensively who’s been advising companies on remote work for years.

Yes things will change permanently, already almost 10% were remote working before Covid but not the office isn’t going away. Wolf has a hard on for commercial real estate for some reason. Maybe he’s short the office REITs.

Commercial RE

Bottomline:

Their ‘KARMA’ is slowly catching with them!

Covid 19, just accelerated it

NO tears here!

As long as we are free people, cities and states must offer a value proposition. There is a hassle and cost with moving, but in reality each location must offer a reasonable value to it’s citizens. Things change and we all must ask as the song says “should I stay or should I go?”

I feel bad for SF folks. Did I see the City placing tent cities outside of a 4 star hotel a year or so ago. But I guess the same city government model is common in many formerly attractive cities.

With high taxes, homeless, heavy regulation, and now with evaporating security, what was to be expected?? A flood of investment in housing and businesses? Why would I come to or stay when chances are my business revenue will drop, and may be looted.

Someone please explain how this model is suppose to work?