Only Treasury securities and mortgage-backed securities (MBS) are still active.

By Wolf Richter for WOLF STREET.

The Fed has now reduced to zero or to near-zero or essentially mothballed and thrown the towel in on three of its five QE and bailout strategies: repos, dollar liquidity swap lines, and special purpose vehicles (SPVs). It has maintained its activity in Treasury securities and mortgage backed securities (MBS).

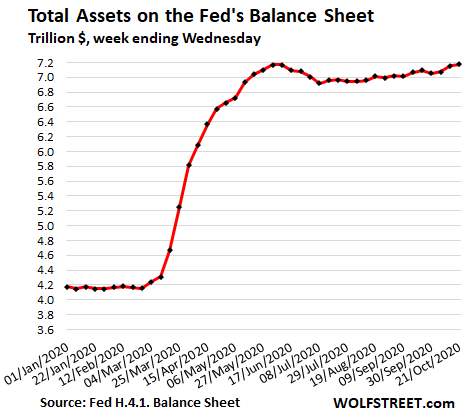

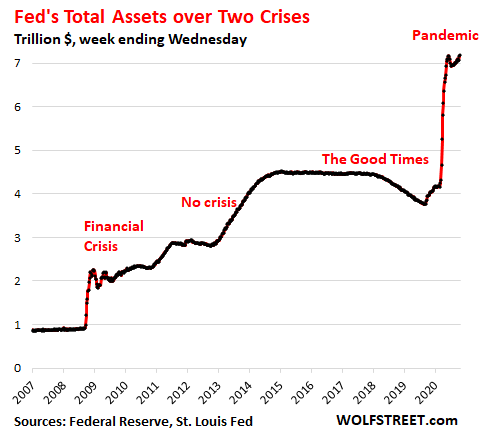

Total assets on the Fed’s balance sheet for the week ended October 21, released this afternoon, rose by $26 billion from the prior week, to $7.177 trillion, for the first time edging past the June 10 high of $7.168 trillion:

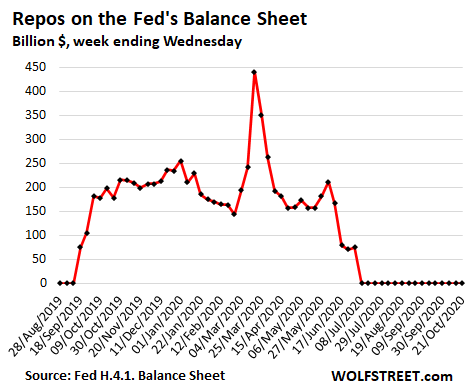

Repurchase Agreements (Repos) remained at zero:

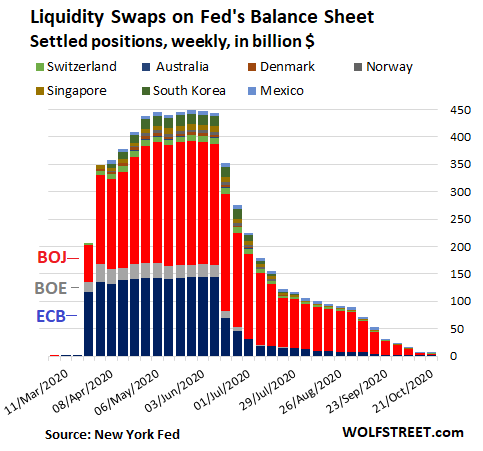

Central-bank liquidity-swaps dropped to near-zero.

The Fed’s “dollar liquidity swap lines” by which it provided dollars to a select group of other central banks, fell out of use and are down to just $7.6 billion, a mere rounding error on the Fed’s $7 trillion balance sheet, from a peak of $448 billion in early May:

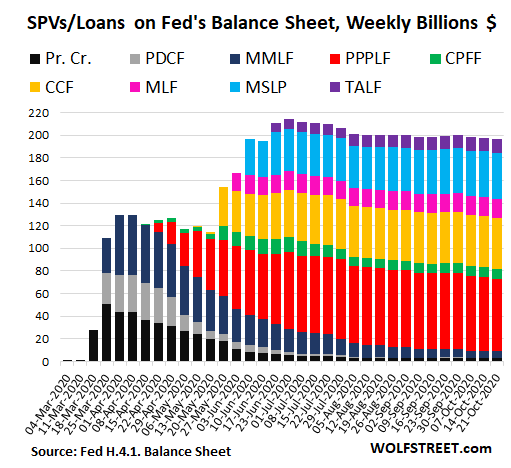

SPVs inching lower for months, now at $196 billion, mostly mothballed.

The Fed loans to the SPVs. The Treasury Department provides the equity capital. The amounts reflected in each of those SPVs is the sum of those loans from the Fed and the equity capital from the Treasury Department. But the Fed has barely lent to them, and most of the amounts you see is the equity capital from the Treasury, much of it unused, and these SPVs have now been mothballed.

Even the SPV that holds corporate bonds and bond ETFs (Corporate Credit Facilities or CCF) has been mothballed. The Fed bought its last ETF in July and only added minuscule amounts of bonds in August and September. At the end of September, the balance of ETFs and bonds was $12.9 billion, practically unchanged. The rest of the $45.4 billion in the SPV is unused equity capital from the Treasury and interest earned from the bonds. There are the SPVs:

- PDCF: Primary Dealer Credit Facility

- MMLF: Money Market Mutual Fund Liquidity Facility

- PPPLF: Paycheck Protection Program Liquidity Facility, with which the Fed buys PPP loans from banks

- CPFF: Commercial Paper Funding Facility

- CCF: Corporate Credit Facilities

- MSLP: Main Street Lending Program

- MLF: Municipal Liquidity Facility

- TALF: Term Asset-Backed Securities Loan Facility

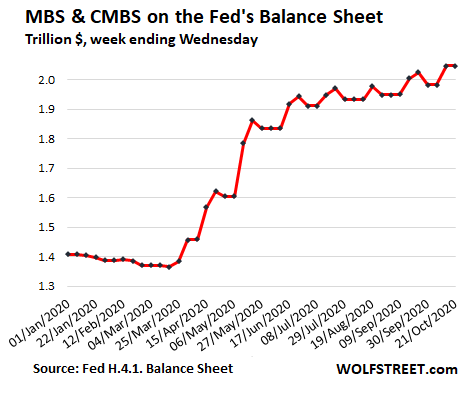

MBS, after rising in the prior week, unchanged this week, $2.05 trillion.

The Fed and all holders of MBS receive pass-through principal payments when the underlying mortgages are paid off, such as during the current refinance boom. In addition, the MBS that the Fed buys take two to three months to settle, which is when the Fed books the trades. These two go in opposite directions, the first pushing down the Fed’s MBS balance, the second pushing up the MBS balance. And the timing is always off. Hence the erratic line:

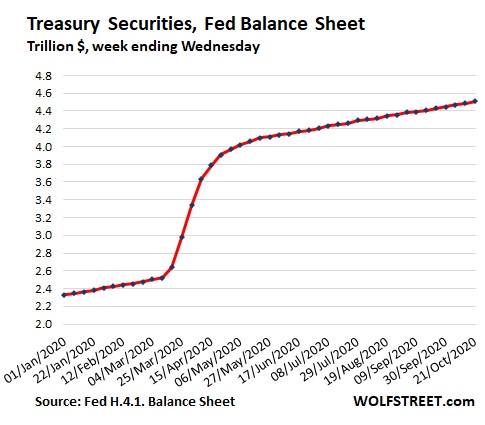

Treasury securities rose by $25 billion to $4.50 trillion.

And for your amusement, the Fed’s total assets since 2007, before all this craziness started:

Under the effects of the Pandemic, consumers and businesses have begun grappling with their own “Reset,” and it has caused all kinds of shifts and new ways, and some of this could be, for the optimists among us, a good thing. Read… “Creative Destruction” or Just “Destruction?”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

We interupt this broadcast. 8:05 pm Eugene OR at about 800 ft.–See a lot of meteorites burn before, but this one just came in around 200 feet above us. Traveling toward SE went from bright white to red flash and then bright green burnout. I could hear the sizzle/fizzle. I know…Mexican skyrocket you say. No way, the real deal. Maybe a small fragment. Fast.

Did you duck? :-)

In all seriousness, was there any noise it being that close?

Just a sudden fast sizzle, no bang. I won’t worry about how low those jets on approach are anymore.

What you actually saw were electronic parts from the Fed mainframe exploding due to the strain put on the system from all of the money printing, sans ink, but with lots of wayward, hyped up QE electrons!!

I think those were probably some of Elon Musk’s low earth orbit starlink satellites. Thats the downside of reusing the Tesla self driving software to run the guidance in your rockets and satellites ( my speculation) . Sometimes things go wrong.

Sounds like the liquidity crisis all over the world is almost over as the dollar stopped strengthening, TED spread decreasing, swap lines going away, and corporate bond lines going away. It’s like a supermarket no longer limiting purchases of eggs because the fear of running out of eggs is over. Everyone can be sane again?

“”WHERE DOES IT ALL END?

Mises to argue that the economic contraction would come if the supply of money were not increased at an ever-higher rate and unexpected rate. Inflation would become hyperinflation.

There must be a default at some point. The question is: “Which kind?” If the central bank ceases to inflate, a recession begins. If the government or the central bank refuses to intervene, many banks go under. This shrinks the money supply. The recession becomes a depression. Bankruptcies and unemployment increase.

Tax revenues fall. The government cannot pay its debt and also meet all of its promises. It must choose:

1. Default on all of the debt

2. Default on part of the debt

3. Tell the central bank to inflate

4. Raise taxes and cut expenditures

Choice #3 starts the process over. The ultimate result: the destruction of the currency. This is default through inflation. It is nonetheless a default.

CONCLUSION

Decide which way of default is most likely. Then decide when. Then plan accordingly.

Or you can do what the policymakers do. Kick the can. Most people do.

But then, one day, there is a day of reckoning. However, until then. . . .

“We’ll have fun, fun, fun till the market takes our T-bills away.”””

They don’t think that way, a partial default leads to another partial default and so forth. There is also a caveat against meeting every gap in asset performance with more monetary inflation. You must pick your fights. System enhancements are based on the political cycle. This is a new political cycle therefore the Fed may not immediately respond to every dip in asset value. They have already done A LOT! There is time to see how the Fiscal side plays out. Any new president would prefer to meet a recession on the first day, rather than on election day. There may not be defaults but there will be a controlled burn. Quite simply the shortage of float in equity shares and the upside in GDP will prevent any massive selloff from occurring. New economic policy (versus none then, and none now) keeps the optimistic premise in place. In lieu of a new regime we face a depression, and Fed has no choice but to default but they will never implement default as policy. That is the losers dream.

This is my analogy when viewing all the skeptics of what’s happening with the Fed’s balance sheets. The numbers and the “expert” opinions are differing, at least for now. Not a perfect time to stay sane….let’s see what happens AFTER the elections

That chart looks like it’s getting ready for the next spike to 10 trillions.

Asset prices are nuts everywhere you look.

If you have savings you are screwed.

If you looking to buy a house for your family, you are competing against the Fed.

But Fed is here to help the little guy, and pretty soon they are going to be in charge of reducing racial inequalities. Good luck.

quadrillions coming up fast

At 77 years old and living on SS (no pension), without savings we would be screwed. However, we are slowly chewing the savings down. Sure would be nice to see 6% CD’s again!

The retirees are shut down.

Interest income is a great economic engine, yet the Fed doesnt look at that side of the equation.

The Fed should learn that for every action, cutting rates for Wall St, there is an equal and opposite reaction, consumption curtailment.

I know a retired guy, and he hasnt bought anything but food and beverage since the Fed cut rates 1.5% in one move.

No vacations, home improvements, out to dinner, nothing.

see this is the problem, people assume the FED is ignorant or makes mistakes or could learn.

the FED is nothing more than a system of theft

The simple truth, being easily ignored since 1913:

Fed is the PRIVATE cartel for about 15-21 mega global banks aka Primary DEALERS (Nothing to do with FOMC members) who own it. Banks in America get some interest payment from the Fed unlike the ECB and the European Banks.

https://en.wikipedia.org/wiki/Structure_of_the_Federal_Reserve_System

The Fed is a hybrid. The 12 regional Federal Reserve Banks are owned by the financial institutions in their districts, as you correctly pointed out. But the Board of Governors is a federal agency, and its employees are federal employees, including chair Powell. Powell is a federal employee, with a federal salary, pension plan, and insurance. He is appointed by the Prez and confirmed by the senate, like other federal agency heads.

House near me just sold in 2 days? Crazy asking. No idea who would fight to pay that for it. If interest rates go up, buyers are going to be underwater if they didn’t bring a lot of money to closing. PITI + HOA would probably be $1500/mo more than I pay for identical place in rent? But if they keep appreciating at lightning speed I will continue to lose out. If price declines they can quit paying mortgage and live free for 5 years like last time.

No no no no Memento, you have it all wrong! They are here to provide liquidity, they are the good guys, they are here for you!!! You’re insane, and you’re dreaming, it’s not like they are devaluing the dollar….

/s

That last chart shows how the Fed is stuck. It can’t pull QE once it’s released into the wild. The idea that it can “mop it up” without triggering a complete meltdown has now been falsified.

The U.S. government is in a similar trap. It can’t raise taxes. It can’t cut military spending. Either of those would hit GDP pretty hard. So the Fed must slowly accelerate treasury purchases for infinity.

CMBS are already dead. Stick them all with a fork. If you think the Fed isn’t going to purchase these things, I want some of what you’re smoking.

This is why we’re all being groomed to accept high inflation. The money is in the system; it can’t be taken out. It’s a classic case of money rolling around in the economy like loose cannons on a ship in a storm. The Fed has figured this out.

Heard of FedNow? From the President of the Cleveland Fed during a video conference on September 23:

“The Federal Reserve’s FedNow service, which is currently being built, will be an around-the-clock service whereby payments can be originated, cleared, and settled within seconds. The service is expected to provide clear public benefits in the form of safety, efficiency, and accessibility of instant payments. …

In addition to offering secure instant payments, an important goal of FedNow is to establish a nationwide reach for the service so that this new type of payment is broadly accessible to consumers and businesses alike. …

Thinking ahead, a service like FedNow, coupled with a directory service with accurate information on where to route payments for final distribution to households and businesses, has the potential to solve some of the challenges the government faced when distributing pandemic relief payments.”

She said the target release date is 2023 or 2024.

By that time, the pain inflicted on the working class from the previous rounds of QE will be so severe that the only way to fix it will be direct payments. AKA Andrew Yang’s UBI.

Now we know why there’s a land grab in the midst of soaring unemployment. It’s the most reliable hedge against currency destruction.

She forgot to mention FED NOW will introduced together with your FB credit score.

…Or in the near future when the states introduce State Now. It immediately deduct a fine for going ,03 seconds or more too late through a yellow/red light. Or the speed signs with their little cameras will also be able to send and collect penalties quicker. George Orwell and Aldous Huxley would be thrilled :>{)

MF…

Exactly. The Fed rescues but never retires.

Bernanke started the QE mess, and in a July 2009 WSJ article promised the unwinding when things got back to normal. (I tore it out and saved it knowing it was a falsehood.) He later mentioned that unwinding would occur when unemployment dipped below 6.5%.

But as late as January of 2020, the Fed was STILL QEing with unemployment at 3.5% and the stock market on all time highs.

What the Fed is doing is misnamed. It is a crutch, because crutches can not be removed without the object elevated falling.

The Fed (and the ECB and the BOJ) paint themselves into corners….and ask for more paint.

In 1791 the Federal government consolidated the Revolutionary War debt of all the States and went into $75 Million debt. It took 218 years for the national debt to grow to $9 Trillion.

It took 11 years to add another $19 Trillion and likely will add $3 more Trillion in the next year. Thats $22 Trillion in 12 years!

9 Trillion in 218 years, 22 Trillion in 12 years.

What the Fed is doing is a criminal enterprise to destroy capitalism and they are about to succeed.

@historicus

‘The Fed rescues but never retires’

The consequence-

“The Rescues Ruining Capitalism”

Easy money and constant stimulus have undermined the basic dynamics of the free market. We’ve paid the price in low growth and productivity, falling entrepreneurship and rising inequality.

By Ruchir Sharma

July 24, ’20 (WSJ)

Apparently no one including Fed is worried about the ‘true’ capitalism’ or the Free Market. Neither is Wall St.

Why buy land that has rotting lumber on it (i.e., an overpriced house)? People should be buying land with oil, gold, copper, minerals, clean water, etc. underneath it. This what will inflate in price.

Also, why pay extra for land near a commerce area, when such commerce is artificially propped up in price? The price of this land seems unstable.

Burn it down, ruin the businesses during riots purportedly to protest rascism in the Opportunity Zones that provide for tax relief for capital gains and buy the ruined properties for pennies on the dollar:

Opportunity Zones Yield Big Capital Gains Savings

https://www.aprio.com/whatsnext/opportunity-zones-yield-big-capital-gains-savings/?cn-reloaded=1

OPPORTUNITY ZONES RESOURCES

https://www.cdfifund.gov/Pages/Opportunity-Zones.aspx

‘Opportunity zones’ fall short on helping low-income communities, study finds

6-17-20

A key White House program to reduce racial inequity has benefited big real estate projects more than minority-owned businesses, a study found.

The “opportunity zones” plan was part of the 2017 tax cuts and has attracted over $10 billion in investments.

https://www.cnbc.com/2020/06/17/opportunity-zones-fall-short-on-helping-low-income-communities-study.html

Do we know the party affiliations of these unelected oligarchs? Whose swamp are they ruling for?

the oligarchs own both parties. it’s a circus.

A vote for either party is a vote for the oligarch’s FED system of destroying your life and future generations

I call them WARFARE and the WELFARE parties. Both love deficit spending and thrive on campaign contributions from Corporations ( K street) and the super PACS!

‘America, the best Democracy money can buy’ Greg Palast 2002

They are all in it together. No discrimination at the top, only games played for grabbing more power and money.

one of their favorite things is if they can keep all the people below them fighting about which party is best

like a casino owner watching two customers argue about which game is best and showing each other how fast they can play them to prove their point

The Dems and the Cons are just sock puppets for the oligarchs. They run the nation President after President, Congress after Congress, and Supreme Court after Supreme Court.

It’s a duopoly — you can vote for Team Pepsi or Team Coke, but either way it’s always neoliberal cola in the bottle …

Federal deficits, Zirp and QE all end up as corporate profits.

Boeing is a good example of downside. Borrow money at extreme low rates to pay a dividend and then when something bad happens, you have a debt payment to make with not enough income to pay creditors. I think percent of zombie companies in US is around 20%.

The longer extreme FED policy goes the the further you get from market pricing keeping things from getting totally out of whack. Next thing you know you have people borrowing money with no intention of paying it back.

I’m waiting for government perpetual bonds paying negative rates. I’m sure there will still be people buying those!

There are almost 17 (+?) Trillions paying NIRP ( 24% of the global mkt), mostly in Europe. And they are still buying!

Yes, but for every €1000 you give them, they still pay you €950 back 10 years later ;)

It has been a decade since TARP and housing has gone up (relatively) steadily since then. Why exactly is the FED still buying new CMBS ??

MLF: Municipal Liquidity Facility – Just adding a well-placed I (for Investment) would have made this name so much better.

Is there a state-by-state breakdown of who is receiving the MILF money, and will it be paid back?

@ Crush the peasants

fyi

Illinois is the Only State to Borrow Money from the Fed

Oct 12, 2020 — Fed is Lender of Last Resort for Illinois Illinois already borrowed $1.2 billion from the MLF earlier this year in an attempt to close some of the state’s 2020 budget shortfall. The borrowing is significant since Illinois is the only state in the country to tap the MLF.

Wolf,

MLF twice on 3rd SPV/loans chart .

Note 1 Yen now buys 10 cents rather than 9 previously hence less swaps?

chrislongs,

On 1: Thanks!

On 2: What it says is that the BOJ no longer needed the dollar funding for its banks and let the swaps mature (Fed paid back to the BOJ the yen it got and the BOJ paid back to the Fed the dollars it got). A dollar swap like this is locked into the exchange rate at the time of the swap contract. Swaps are redeemed at maturity date at the exchange rate set when the swap was entered into. So any change in the exchange rate after that has no impact on the redemption price. Everybody got their money back.

OOps 10 yen buys 10 cents?

We’re goin’ to need a bigger chart.

Funny you should say that. In September Hussman had to bump up the Y Axis on his stock market valuation chart. Higher stock market valuation than just before great depression. Yikes.

Welcome to Weimar America my fellow citizens. The Fed is the purchaser of first resort for U.S. Treasuries, a mountain the Federal Government is more than happy to push higher and higher into the stratosphere! I think Powell and Gang are buying some 65% of all new Treasury issuance today.

No such thing as a Free Lunch in Money Creation to the Moon. Dollar and our cost of living are going to suffer greatly with all of this digitally created moola to plug the dike that is only going to crack in more places in the weeks and months ahead. A $100 bill for a grease laden Big Mac.

Why are bond prices currently declining and rates starting to firm despite the irresponsible Weimar money creation by the Fed?? Writing of higher inflation and lower Dollar not positive for bonds!

There used to be lot of talk about the massive Treasuries holdings of China and Japan and what would happen if they chose to divest those. Their combined holdings are about $2.2T, which is about the same amount as the Fed has bought in the last 6 months…

*Yawn*

Not that they are able to dump these Treasuries, but the USA clearly doesn’t need foreigners to “finance” themselves anymore.

Until recently I would never have believed this to be possible without the US$ getting completely trashed.

It isn’t possible. There is always going to be a lag between printing money and hyperinflation.

Right now, we’re in the eye of the storm.

NO velocity of money – Not getting directly into consumer hamds, yet!

so, no significant inflation.

Fed’s ‘digital dollar direct deposit’ may change that (when!?)

Fed has to by pass Banks and the Congress. Will they allow that?

Wait & see!

Chart of the year: “Fed’s total assets since 2007”

Should be posted at every polling location and taught to all schoolchildren.

This is by far the largest and most brazen theft in history. Makes the Romans look like amateurs.

Ironically, 80-90%+ of Americans cheer for it, vigorously defend it, and beg for more.

Prisoner’s Dilemma

I already said. B**mers and mil***als disagree on almost EVERYTHING, but when it comes to spending and shopping they are united. United Shopping of America is more like it.

Financial literacy is banned in this country. Verboten. Populace is lulled into life of debt servitude.

The Fed is now monetizing Congress’s debt issuance. It’s a perfect match since 2010. This is the last stage…the only question is how long it can last.

How long it will last? A Long Time. Especially if other countries start doing the same.

They’re not doing it nearly to the degree we are.

The Japanese are way ahead of us, relative to GDP that is. Chinese debt too is way up there.

The difference is they are still producing a bunch of things. We produce things too, but they are not as desirable as the ones produced by other countries, except for things like semiconductors.

But hei in the end it’s about military superiority, or the image of one. The fact that we have been beaten by people wearing sandals has not changed that image.

Until other countries are no longer willing to sell us goods and services for our printed paper.

Possible, but not soon. It’s not “other countries” that hold the paper, it’s “rich people in other countries” that hold the paper — and they hold it because they trust your judiciary, rule of law and military more than they trust their own …

1) The sun might shine on TY (10Y Tutures price) in 2021/22, with NR US10Y, because Fed assets goes vertical. That happened to US treasury secretary Mr. Morgenthau, who pumped and used a heavy barbells to lift the economy. The 3M was hugging zero for two decades, throughout the 1930’s and the 40’s.

2) Can u imagine what will happen if JP say, one day : I am not your Morgenthau.

Considering how slow the economy is, and how much money they added to the system, there should never be a liquidity problem ever again. That should imply somewhat that they don’t need to monetize new spending, while long rates backup. What’s the downside of holding a lot of debt which has a low cost to service? Let some air out of the dollar, in case anyone thinks your collateral is worth-less, and they got away with that. Now maybe the currency rebounds on foreign buying and while the gogo 90s ended in 2000, that was a leadership problem. The Fed can probably go on snooze control. Oh wait they already are?

There never was a liquidity problem. The entire crisis since 2007 has been more about solvency and the central banks backstopping debt to kick the can down the road.

In good news >> Apple does not include the charger with the new iPhone 12 Max Pro for $1400. You suppose to use the old plug, to save the planet.

Also iPhone 12 looks exactly like iPhone 5, so premium price for nostalgic vintage feel.

Best Chinese phone manufacturer ever.

This is what the Fed has created…..a new unstoppable beast.. it was out once, and nothing can stop it.

Lets bring S&P to 4K, shall we?