#TheZooHasGoneNuts: One press release about an EV, but no money, no tech, no prototype, no facilities, no plans, no nothing. Getting pretty thick, even for our crazy times. SEC, are you awake?

By Wolf Richter for WOLF STREET.

The Nasdaq might be down 12% from its high on September 2, and Apple might be down 21% from its high on September 1. But the day-trader nuttiness – the new technical terms is “Robinhood traders” though they may trade on any platform, not just on Robinhood – isn’t letting up, and hedge funds might still be trying to front-run them and fleece them for a quick buck.

And that’s a huge temptation for a tiny Chinese company that installs solar-panel projects in various countries, with just $97 million in annual revenues in 2019, and nothing but annual losses going back years, whose penny stock, issued by a shell company in the Cayman Islands, is traded on the Nasdaq. It received a delisting notice on March 23 because its shares had been below $1 for 30 days in a row and because its market cap had dropped below $15 million. Given the Pandemic, the Nasdaq gave it till December to regain compliance.

And so now the company launched this scheme that ruthlessly took advantage of these “Robinhood traders” to drive up its share price – and boy, did the Robinhood traders blow our ears off today, “literally,” so to speak ?

This is how it worked: SPI Energy, headquartered in Hong Kong, issued a press release this morning in which it said that it – the tiny solar-panel project installer – would launch an EV company, called EdisonFuture, and suddenly manufacture EVs.

OK, there is no car, no prototype, no technology, no capital to develop anything, no nothing. In normal times, it would have been laughed out of the room.

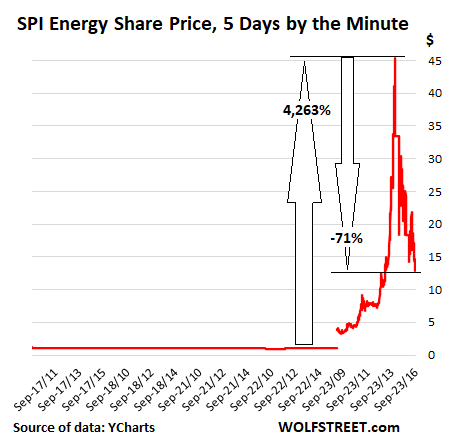

But Robinhood traders saw to it that these are not normal times. Upon the announcement, its shares spiked by 4,387% from $1.04 at the close yesterday to $46.67 at 2:06 pm today, for just the briefest moment before collapsing by 71%, giving up over two-thirds of those gains and closing at $13.28 (by-the-minute share prices via YCharts):

In fact, trading was so nutty that shares went from $13.41 at 1:28 pm to $46.67 in 38 minutes. But I doubt many people could unload at levels above $40 because shares traded above $40 for just 7 minutes. Shares traded at 45:39 at 2:06 and then one minute later, they were at $33.53. WOOSH.

For crying out loud, this is a tiny money-losing outfit that installs solar-panel projects, with a delisting warning hanging over it, and no money to develop anything – it had just $2.7 million in cash at the end of December, per its annual report that it filed late with the SEC on June 29, 2020.

And it issues just one simple press release about creating a subsidiary that would develop EVs, and nothing to show that it’s actually seriously thinking about EVs, and Robinhood traders went hog-wild, triggering this massive idiocy in its shares.

Clearly the company knew what it was doing. This wasn’t an accident. And with this scheme, it wrapped the Robinhood traders around its little finger. Fine with me. And if hedge funds were able to front-run them and fleece them too, fine with me. But I’m wondering: SEC, are you awake?

In the grander scheme of things, it does shed light on just how crazy this market still is, how nutty, disconnected, logic-less, and as in this case, idiotic, the trading still is. And it tells me that the market won’t stop going down until this nuttiness has been blown out.

“Some things actually work really well virtually”; but “the vast majority of us can’t wait until we can be back in the office.” Read… There Will Be Permanent Changes: Apple CEO Tim Cook Weighs in on Working from Home

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The Sleeping Easy Commission let Elon off the hook last time. To be honest, I am not quite sure what they do nowadays.

SEC is NO different than FAA to aviation industry. Most of the federal regulators come from the SAME industry they are supposed to ‘regulate’

Regulatory capture regular feature and NOT a bug for Corprate America!

Wonder, why Madeoff was off the radar for nearly 20 yrs until DEc 2008!?

The SEC (Suck em Clean) only collects money. It seems very rare that anyone from large corporations go to jail. They pay a fine and admit no guilt. Now if it’s a little guy that can’t pay the fine they go to jail (Mafia?). What does the SEC do with that money that they collect? Subscribe to porn sites? Google it. Seriously what do they do with that money?

Wasn’t there a news story from years ago that a bunch of SEC employees were caught spending half their day just watching porn while at work? Our justice promoting institutions have been gutted and now serve as daycares for adults.

Jay Clayton is also the Southern District AG in NY.

The best commission money can buy!!!

He made the mistake of stealing from connected people.

Because of SpaceX, Elon has congress by the balls. The SEC is lucky they weren’t punished for bothering him, but, you do have to go to court, in order to be found not guilty and have your slate cleared.

Russians are still in the space business and they are relatively inexpensive.

True, but, America needs Russia as an enemy to justify massive military spending. Also, because of corruption, America needs to have a private American company be responsible for getting America to space.

And what about the regulators in charge of the commodity exchanges?

Have you taken a look at the price of silver over the past week?

It’s gone from $27 or so an ounce to $22.26 as I type this. A one way trip down the drain with massive volume starting on the 21st.

Back up over 24 dollars October2nd

Collect a Salary, that is enough don’t you think?

They are just killing time until they get hired by banks and hedge funds. Hey, SEC, what’s on your computer screen?

They WANK 24/7, whilst investing in ‘revolving door’ manufacturing!

I know a robinhood trader who thinks she’s saving the world with investments like this. All emotion, no common sense. Just watch the TV news and do what they say.

So many humans are bothered by thinking for themselves.

To be fair to Robinhood traders, it’s basically like playing the stock market, but, very fast. This penny stock and a couple others do reflect most stocks, just their ups and downs are highly accelerated.

Also, alot of people who own stocks, regardless of amount, are arrogant about it.

Yeah, but losing hard earned money is no fun for anybody and in the age of Google you would think that 90% of people would take 10 minutes to learn some corporate/market history before laying down what maybe took a year or two to save.

Also, I would like to see some volume stats to go with Wolf’s price stats…almost by definition high volatility goes with thin volumes.

And thin volumes really signal very, very little about broader mkts.

So, if 50 Robinhoodies nationwide are circle jerking each other up and down over some obscure penny stock…that isn’t exactly a bellwether indicator.

It’s a thin float causing that kind of volatile

Cas127,

The robinhood behavior accurately reflects typical stock market behavior. Alot of unicorns have laughable impossible business models that could be proven nonsense in under 10 minutes.

In either circumstance (robinhood trader or not) some guys collect money for the ignorance of the 99%.

The biggest difference is robinhood traders could lose a year or 2 of savings or win really fast. Traditional 401k owners might lose a lifetime of savings over a lifetime.

Prerequisite for thinking: It requires a Brain

Doesn’t help when they are ALL to be found Abynormal. We ain’t getting over this hump without some serious pain-pathway ‘stimulation’ …

“Uttin on the Witzzzz!”

These charities and “investments” are merely virtue signaling for people who don’t really give a crap. They don’t want to get their hands dirty or even get close to the problems, because they secretly despise the people they claim to be helping.

Any Chance her name is Ms P.T. Barnum…? aloha

Up 4,387% and back down in less than 8 hours? Could this have been caused by some faulty computer algorithm rather than individual traders?

what is even more funny is that they are still at over $13 :)

I saw that in real time. Between this and the Kodak scam you really wonder what it will take for people to actually get locked up.

Actually admitting to screwing up will land you in jail. Ask Bernie Madoff. It’s much better to blame everything else, if you lose others money.

Does anybody know when Jon Corzine is due to be released? Oh right he was friends with Obama and a Goldman alumni Foolish me

It could, but an algo isn’t the only way.

A penny stock – market cap is tiny. It doesn’t take a large buying injection to sent it soaring.

When you think SEC think: I’m from the government and I’m here to help.

When you think SEC think: revolving door, think Bernard Madoff, former chairman of the NASDAQ stock market.

The Securities and Exchange Commission and dozens of other government agencies have done this for over 70 years.

But in the average history or economics text, these agencies emerge in response to public demand.

There is never a hint of the regulatory-industrial complex.

We’re told that the public is being served.

And it is, on a platter.

Well MAX, how many “compliance officers” do you think they had at wells Fargo when all those shenanigans were going on? Thousands and they were co-located right there at HQ!

True very true!

Max

Nobody should entertain thoughts about the SEC ensuring every company (FOR GOD’S SAKE, ESPECIALLY CHINESE COMPANIES) is sparkling clean. The financial security of idiots is not the primary mission of the SEC.

Investors (as opposed to gamblers) are expected to have some understanding of prospective investments and the environment in which they operate.

As currently configured, I am adamantly opposed to allowing Chinese companies access to US Capital markets. However, I am LMAO watching “Robinhood sheep” in their Darwinian quest for riches as these jejune fools hunt for rainbows so they can steal the elve’s pot of gold.

The SEC didn’t pay attention either when US banks were committing fraud with their mortgage crap prior to 2008. Did anyone go to jail then? The answer is no.

MonkeyBusiness

Just because you don’t like stupid crap that hurts a lot of people doesn’t make it fraud.

To be clear in my response:

o at the time, many (including moi) thought what banks did was risky & stupid

o retrospectively, lots more people now think what banks did was incredibly risky & stupid.

(I’m not a lawyer) however, what the banks did probably wasn’t fraud, which requires all 4 of the following to be proven in a court:

1) Purposeful misrepresentation of an important fact;

2) Knowledge that it is false;

3) Victim justifiably relies on the misrepresentation

4) Victim suffers actual loss as a result.

Undoubtedly, #3 & 4 occurred; proving in a court of law that #1 & 2 occurred is the hard part.

Just selling crazy stupid stuff over a period of years that thousands of supposedly sophisticated investors were begging to buy (senior rated, relatively high interest instruments), that blew up in a once-in-a-century financial melt-down does not “prove” fraud (emails between the guys selling the stuff discussing knowing it was designed to melt down is a different story).

Only the government can file criminal fraud charges, but damaged individuals can also file civil fraud charges. The problem is the same for both civil & criminal charges: you have to prove #3 & 4 in a court of law.

US government regulatory agencies are, by and large, reactive.

The EPA, FDA, SEC and others were created in responses to egregious abuses in the past.

They primarily react to egregious abuses today.

It sucks, but to complain about it is to complain about being American – this is what “freedom” really means.

c1ue/well-said. Regulation akin to ‘generals always fighting the last war’. The need is always there, the necessary ethics&talent, not so much…

may we all find a better day.

c1ue

Despite 91B20 1stCav (AUS) kudos, your statement simply demonstrates a firm grasp of the obvious (which is more than quite a few people can do these days…).

Regulators (with the support of legislators & courts) basically have 4 jobs:

1) Detecting & prosecuting out-and-out fraud

2) Drafting & enforcing ever-more-arcane regulations to prevent fraud/damage/manipulation

3) Learning from experience & disallowing certain crazy stupid practices that are highly likely to cause large-scale damage (liar mortgage loans, etc)

4) Being attentive to future unknown financial practices that may or may not damage the system.

As a retired CFO, I’m certainly not a regulator, but, for my money, US regulators do about the best job in the world (don’t believe me? Go invest in China…or Africa…or Russia…or Latin America). You can’t know what you don’t know, and the usual way of learning about it is when something goes wrong.

I’d sure like to learn about it if/when someone claims regulators (and generals) can read & regulate future unknowns before they intrude into the present.

As Monty Burns would say “Excellent”.

I am starting a company with the money in my pockets.

It will do EV-crypto-covid vaccine all at once leveraging new secret technologies.

It will be called the OhmSteinmetz company.

$3 billion IPO next week.

You will be sued by C. Ponzi Technologies for scam infringement.

Lisa-STOP IT! I sprayed my coffee over EVERYTHING. (…reckon it shows my lung function’s still okay, though…).

may we all find a better day.

Do you take me for a fool? It’s only worth $2.5bil tops. Drop it to $2bil and not only am I all in, I’ll get my merry band from Sherwood Forest to invest their life savings too. :)

Photons? I hear they have a bright future.

The real money is in torpedos.

Hey! …. SEC

Why u no have Spock’s brain$??

“relatively” of course…(sorry).

For insight into the question of what does the SEC really does refer to the scene in “The Big Short” when Baum goes to the office and finds out….LOL LOL LOL LOL ??

Love that scene, and that whole film.

We are in the middle of it right now.

That wasn’t the SEC, that was Moodys rating agency. Same thing though.

We desperately need to return to long forgotten values of thrift, humility, honesty and kindness.

If not coronavirus, some other catastrophe will make sure the pendulum swings. The sooner the better.

I’m fairly certain those values were always reserved for stupid poor people.

Quite so.

And if ever a king turned up – and it did happen – who was honest, humble and kind, the nobility and priests made pretty short work of him.

So he’d have to cunning, ruthless and avaricious, too……..

This is like 1999, excessive speculation on companies with no income. I would not trust China. These companies do not pay a dividend.

South Florida delinquent mortgages are a catastrophe. They were ground zero for the first wave of COVID-19. Some had to cross county lines to find hospital beds.

Hoolllddd on…isn’t the Edison name still protected requiring licensing to use it? I’m thinking EdselTuckerNoFuture might have been a better choice for this one.

Dear Mr. Richter,

The following letter is to notify you that the Securities and Exchange Commission is launching an investigation into Wolfstreet.com and its principle operating officer for unfounded statements against the agency. We deal with hundreds of cases on a day to day basis engaging with perpetrators of massive fraud and outright theft against the citizenry of the United States. People like those guys down the block from you…. and some guys over in some farm house claiming subsidies… and sucking E… you get the idea, we are busy. But never to busy to defend our integrity and honor.

See you in Court. Mr. Richter.

The SEC (we protect the people)

?

My next company will be called GuaranteedLoss. It will only do two things only:

1. Crypto

2. EV

You forgot pot, or marijuana, or cannabis, or just weed.

Your company must be focused on buying weed using crypto to smoke in EVs.

But hey, on the bright side, in 15 years, new cars in CA will be entirely emissions free. So, that’s a boost for Mr. Musk. And CA will ban any company that sells anything other than EV or other zero emission vehicles. (I know they didn’t add in that second line, but would be hilarious if they did)

MCH,

Weed is like so 2018.

That’s ok, I was born like 40 years+ before that. So, by that standard, I’m really with it.

a self driving car I hope

No blood tests?

Back in the day when the Vancouver Stock Exchange was THE speculative arena, the exchange had some rules for hot markets.

Which often based upon a mining discovery would be wild.

However, the authorities did have a rule.

If the stock was up by, say, 20 percent within a trading day, the stock was halted.

Until the company made a news release.

Sometimes when there was no legitimate news.

But the news release had to be made.

It often cooled the action.

Most developing countries still has such rules with 10/20% change in either way.

Of course, in the modern world financial economists have dispelled every concern about the inefficiency of markets, thus any such scrutiny is pointless (hah) :)

This is why so many entities are trying to come up with some kind of Covid vaccine approved for the market. It will take months and years to see if the stuff actually works, but meanwhile, stocks will soar on the first ones out the gate.

But the mkts will jump every time there is impending vaccine just ‘around the corner’ for atleast 12-24 hrs.

Global mkts need an enema, they are going to get it within 4 months!

Secular Bear roller coaster:

Lower of the HIGHS and Lower of the LOWS, with many BEAR traps on the way.

No circuit breaker on the way up then.

Oh no, never ever!! Only on the way down.

Yeah, never understood that…

Like interest rates, except in the reverse. ;)

Courtesy of the Fed….

Are you certain this is the fault of Robinhood traders? I would sooner blame computers.

Just a couple years ago, the buzzword was “blockchain”. A company — any company — would announce that they were maybe thinking about looking into “blockchain” someday if they had some spare time, and their stock price would leap instantly.

So this year the buzzword is “EV”. In two years, it’ll be something else. Whatever the computer algorithm programmers feel like it should be.

The algos are designed to front-run trades. I think it starts with speculative traders and the algos basically end up leveraging those increases to even higher levels. So, it’s probably both.

Although, with the current state of machine learning becoming more advanced and being able to train on all of the bubble minded behavioral data we’ve accumulated over the years, I think there’s a strong likelihood that there are some pretty good trained models for monitoring the moment when investor psychology starts to shift. Everyone thinks they’ll get out before everyone else, but study after study shows most people are heavily biased towards projecting linear trends in their minds, then greed makes them over attribute what little possibility of that might exist. These days the algos are probably mostly the ones getting out first because they know exactly which indicators to look for. People, with their “animal spirits” and such, probably are not difficult opponents for an advanced ai in this casino.

So, right after saying “OMG he outdid Elon Musk”, we find ourselves saying “OMG he outdid Trevor Milton”.

There’s more coming. I can just feel it LOL.

Seems to me it was the brilliant Ray Dalio shop that missed The Tesla tsunami and so sought to get in on the ground floor of an EV situation backed by The Revolutionary & Democratic Republic Of China…PJS

“…..what is even more funny is that they are still at over $13”

I think there is still time to short this mother…..!!

You can’t blame Portnoy’s raiders when its the Federal Reserve/federal government causing it.

A decade ago I kept my savings in a treasury only money market account just trying to preserve purchasing power of my savings. I was used to seeing about $300/month increase. Fast forward to today. I have much more money in my treasury only money market account. This year started at $100/month and this last month was, i kid you not, $1!

So this year I started day trading GDXJ a junior gold mining ETF. Now I’m averaging $300/week! This very day was my biggest day ever. I bought twice as much as ever before. Must admit to being a little nervous.

I don’t think the Federal Reserve had this in mind when they invoked ZIRP. But it’s exactly the effect they’re causing.

The nice thing about trading is for every profitable seller there’s a buyer. For the economy as a whole it nets out as a wash. The only factor that jacks up market caps is a dearth of sellers. Their time will come.

Heh heh heh

Made $1800 in the first half of the day. Still have 25% of yesterday’s purchases. An extra social security check this year all for one days work! Ain’t gambling fun!!!

Well done!

… back like it was ’99 again

I’m dying here out of laughter and amazement. Still valued at over $13? SEC Is worthless…

Olé!

With shares at $13, their market cap will have risen above $15m, right?

So, they can remain listed on Nasdaq?

Happy days for the management and ccp

That was the purpose of the announcement, according to my theory.

Exactly.

I was trading this today and they had to halt trading about 5 times… wow, what a rush hahah

To be fair… SPI was showing up in basically every watchlist I have because of unusual volume and price increase etc… when you start to monitor those and everyone has it on their watchlist, those are moves you want to get in on…. I kept trading with bracket orders and hitting my target so many times it was impossible not too… sold half at $45 and the rest sadly got hit hard with a Market stop loss that triggered right after they opened trading for it again.

At one point early on I tried to short it but it’s not one available to short… thank god it wasn’t I would have had a very different day lol ?

Just wait for the day robinhood allows for shorting!

how nutty, disconnected, logic-less, and as in this case, idiotic, the trading still is.

I was thinking along the lines of corrupted, unscrupulous and downright scandalous but those descriptions work too.

“Tis the Times’ plague, when madmen leads the blind.” Shakespeare

Nothing new under the sun…

The whole Nasdaq deserves a similarly shaped graph. Forget the Chinese, Wall Street has been taking the piss since the late 1990s. If the Nasdaq goes back to where it was in 1998 that’d be about right and logically priced. It’s a casino and that’s what the SEC is aiming to protect.

I am sure a lot of the Robinhood traders are young kids with a negative net worth due to student loans and cc debt. Student loans are currently in forbearance and as we all know paying for past consumption is about as depressing as it gets.

Other idea I had is 20 years ago solar was all the rage and Germany gave massive incentives to average Joe to install solar farms. Now that times are tough in Germany the incentives are ending leaving the average Joe with a pig in a poke. EV might be the same way. It’s all great to incentavize utopia until the the tough choices have to be made. What’s a politician going to do fund pensions or fund utopia thirty years down the road?

Depends on who owns the utopia company and how he profits from it. Oops, hope that wasn’t too political.

Smoking utopia does not a battery make!

Recall the Madoff whistle blower comment…

The agencies designed to keep an eye on these industries are all waiting for jobs in that same industry. They dont want to make waves or cause an issue lest they ruin their future job opportunities.

“Are you listening SEC?”

I would add to that, “Are you listening Federal Reserve?”

The Federal Reserve has implemented so much financial repression that asset prices have gone through the roof, leaving young investors nothing constructive to invest in. Young people need to build some capital for legitimate reasons, but the Fed has taken away all means for them to do it, so they resort to speculation (i.e. hope).

Gotta protect the wealth of the Boomers somehow so they don’t have to make any sacrifices!

RightNYer

“Ok Boomer” probably gets you high marks as a cute phrase (so what?)…however, it’s not Boomers keeping Uber, Lyft, Hertz, and a thousand other unprofitable wet dreams alive.

Probably wasn’t boomers getting sheared in the SPI Energy fiasco.

Just saying…

Ilan fuel tank :

XLE:QQQ spring // XLE 240 min.

There’s significant inflation in food, clothing, rural housing, cars, toys, services, etc and yet it looks like the private fed’s plunge protection team has arrived on the scene today. The Boston private federal reserve chairman Rosengren is hollering for more fiscal stimulus and quantitative easing this morning. What a joke!

He called for continued low interest rates, not more QE.

“While I think it would help to do more quantitative easing, I’m not sure it would be nearly as supportive, for example, as fiscal policy,” Rosengren said.

Rosengren suggested that the Fed could ramp up its purchases of mortgage-backed securities and U.S. government debt.

The central bank left the door open to further leveraging its $7 trillion balance sheet by saying last week that quantitative easing, or QE, could be used to “maintain an accommodative stance of monetary policy.”

Yes, they always say, from Powell on down, “we can use our entire toolbox.” Emphasis on “can.”

But that’s different than “hollering for more … quantitative easing.”

Rosengren:

But Rosengren cautioned that purchases of long-term debt may have reduced effect with bond yields already so low. As of Thursday morning, the 10-year U.S. Treasury (^TNX) was hovering near 67 basis points.

The private fed is not truthful and does things w/o revealing it. We know they did illegal acts when they recently bought stocks and bonds of corporations. The maestro played an integral part in the deregulation process that enabled the looting. A few months ago Professor Mark Skidmore and his staff at Michigan State revealed the the private fed added 70 more trillion to the federal debt that was never accounted for, ie, the treasury bonds were never floated, just money that was printed and spent.

To be accurate most of the volume in this stock was on the 21st at between $4 and $8 and the stock is now around $15. These moves aren’t unusual. Being Hong Kong based this company probably has the blessing of Bejing, which may be a gesture to ameliorate some of the tensions.

Very strange Tim Sykes has a completely different take on this ;)

I’m wondering if the truth behind the Kodak pump, and who in the West Wing participated, will ever come to light.

Probably through Vance in NY they leaked those bank reports on money laundering, part of his investigation. Doesn’t matter how much light you have, if no one wants to look

1. I heard entire value of Robinhood traders is only in billions like 20-50billions max. Is that true? How these guys can cause this situation.

2. Real stock market is worth in millions. RH targets mostly penny stocks.

3. RH is just a symptom not the cause of the malaise.

4. Young people have a tendency to do what they are told not to do.

5. (asking for a friend) If we report such obvious fraud to the SEC, do we get any snitch reward?

(sorry) Real stock market is in trillions….

Wanna pump your share market and save the real estate industry at the same time and do it with a stroke of the pen?

Just change the law.

From Australia:

Banks power 1.5% ASX rise on lending law backflip

“Treasurer Josh Frydenberg has unveiled plans to overhaul the laws governing mortgages, personal loans, credit cards and payday lending to streamline decisions on whether customers can afford loans”

And while this is going on:

“The federal government has also revealed its biggest deficit on record $85.3 billion or 4.3 per cent of GDP for 2019-20.”

And just wait – the estimate budget deficit for next year is around A$200 billion and the longer the lockdown in Victoria lasts, the bigger that number is going to get.

No end to the lock down here until 28 October……………………maybe.

Some easing on the 28th of this mnoth, but nothing dramatic as the curfew and 5 kilometer restrictions still apply.