Consumer debt to GDP spikes, but why did credit card balances plunge and new delinquencies decline?

By Wolf Richter for WOLF STREET.

OK, as I mentioned on Friday, things are a little crazy in the consumer-debt arena at the moment: No Payment, No Problem: Bizarre New World of Consumer Debt. But there is another aspect to it – that of the American debt-slaves themselves. And there are all kinds of things happening.

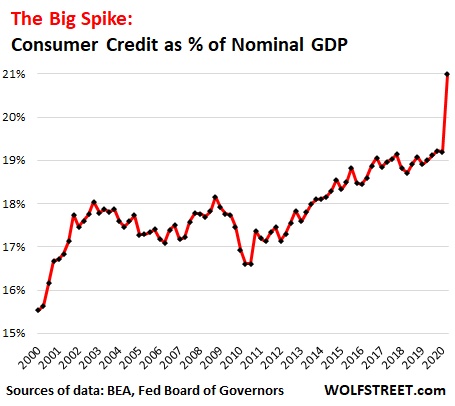

Consumer debt – student loans, auto loans, credit cards, other revolving debt and personal loans but excluding mortgages and HELOCs – declined to $4.1 trillion (not seasonally adjusted) in the second quarter, according to Federal Reserve data. It declined because credit card debt plunged – we’ll get to that phenomenon in a moment. But as the economy took a broadside in the second quarter, with 32 million people claiming unemployment insurance, consumer debt as a percent of “nominal GDP” spiked from the already record high 19.2% at the end of the Good Times in Q4 2019 and Q1 2020 to 21% at the end of the second quarter:

This ratio of consumer debt to nominal GDP shows the debt burden on consumers in terms of the overall economy. Neither consumer debt nor nominal GDP is adjusted for inflation, and the impact of inflation over the years cancels out in the ratio. So this spike in the ratio is another way of looking at the plight of consumers in this Pandemic economy.

The Credit Card Phenomenon.

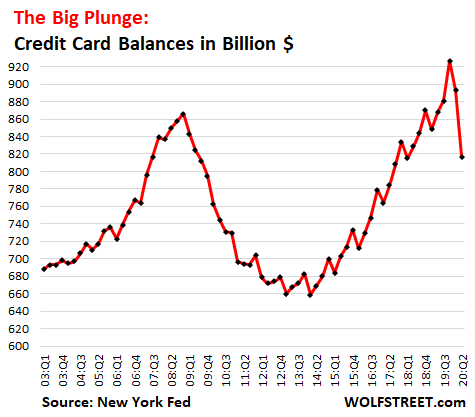

Revolving consumer credit consists of credit card debt and other revolving credit such as personal loans. Credit card debt by itself – a data set that the New York Fed provided in its Household Credit Report – fell by $82 billion in Q2, to $820 billion.

Credit card debt generally declines in the first quarter, as consumers try to get over the hangover from the holiday shopping spree. But the only times it declined in the second quarter was during and after the Great Recession when consumers were forced to seriously retrench: 2009, 2010, and 2012, and only between 1% and 2.4%. But in Q2 2020, credit card debt plunged by 9%! A decline of this magnitude has never occurred in any quarter going back to 2000:

Within Q1, the steepest declines came in April and May and persisted in June to a lesser degree.

But all other household credit categories combined – mortgages, HELOCs, auto loans, student loans, and other credit – rose nearly as much as credit card balances fell.

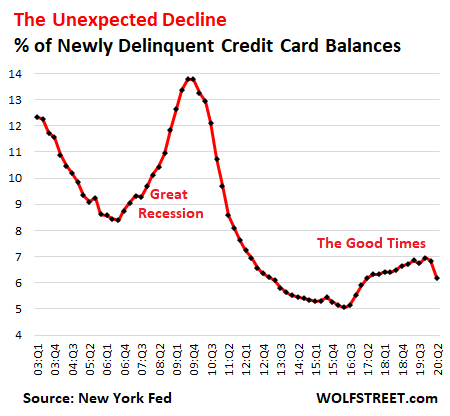

In addition, newly delinquent credit card balances fell – which is the opposite of what you’d expect them to do during an unprecedented unemployment shock.

During the Great Recession, as people who’d lost their jobs were falling behind on their credit cards, newly delinquent balances soared to approach 14%. This wasn’t just subprime, but all balances combined! Then, during and after the Great Recession, as lenders and consumers went through a painful cleansing process, newly delinquent balances declined and finally hit a two-decade low in early 2016. Then they rose again during the Good Times as the subprime segment got into trouble funding these Good Times. But in Q2 came the Pandemic economy, and suddenly newly delinquent balances dropped to 6.2%:

Why did credit card balances plunge and newly delinquent balances decline?

Nearly all consumers below a certain income level received the stimulus payments and most people who’d lost their work received regular unemployment benefits or the new federal unemployment benefits, plus $600 a week extra. Regular unemployment benefits are hard to get by on. But with the $600 a week extra, many people received more in unemployment benefits than they were making in their jobs.

“Two-thirds of UI eligible workers can receive benefits which exceed lost earnings and one-fifth can receive benefits at least double lost earnings,” according to a study by the Becker Friedman Institute for Economics at the University of Chicago.

Combine this with the numerous studies that find that about half of the households don’t have enough cash in their savings accounts for a relatively minor emergency, such as $500.

And the picture emerges that many people operate their cash-flow needs like companies: From revolving credit lines.

For consumers who use credit cards, nearly all payments, other than housing payments, flow through them. And people who don’t pay off the balances every month end up paying interest at dizzying rates on those outstanding balances. When these consumers get cash, such as stimulus checks or the extra $600 a week, they use it to pay down their credit cards, which cuts their interest expense, rather than putting it in a savings account, where it earns nothing. This is a smart thing to do.

Most of the stimulus payments arrived in April and May and contributed to the plunge in credit card balances during those months. And later when consumers buy something, they run up their credit cards again.

Some consumers used the stimulus money in this manner to catch up on credit card payments they’d fallen behind on, and other consumers didn’t fall behind on their credit card payments because of the stimulus money, which would explain part of the decline in newly delinquent balances.

Another Pandemic trend is that credit card issuers are offering deferral programs for credit card holders if they run into trouble, under the theory of extend and pretend. Under these deferral programs, payments are put on ice, and the credit card loan is considered “current,” though no payments are made until the end of the deferral period. This also lowers the rate of newly delinquent credit card balances.

And lending standards are tightening.

Banks, fearing major turmoil in consumer credit and expecting big losses on their consumer loans, have reduced credit limits and/or closed cards of consumers that are flagged by algos for whatever reason.

In the two months through mid-July, another 66 million people had at least one credit card cancelled and/or credit limit reduced, following the 50 million people who had a credit card cancelled and/or credit limit reduced in the prior month, according to CompareCards. Most people have more than one credit card, but still, that is a substantive tightening of credit availability.

The report points out that the actions were across the spectrum, but that some got hit harder than others: For example, in terms of age-group, millennials were most likely to report having a credit card cancelled and/or credit limit reduced; and in terms of income category, people with the highest incomes were the most likely to have reported one or both of these actions.

The actions of closing cards and lowering credit limits don’t reduce credit card balances on the spot but prevent these card holders from increasing their balances on those cards.

So a complex picture emerges of stimulus payments and the extra $600 a week flowing not only into consumer spending, but also into credit card balances, while banks are reducing their exposure to potentially troubled credit card debts and are allowing already troubled cardholders to defer payments in order to avoid having to book delinquencies.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

From my own perspective…all has happened.

Had a credit card limit cut in half. Even though it is always paid on time. The reason “You have not used your credit card up to the limit in the last 12 months…”

When I call a bank or credit card the first voice prompt is “If you need information about forbearance, press 1…”

Friends and neighbors using the free stimulus money to pay off debt. So basically, another back door bank bailout.

Very little “tightening of belts” going on.

Coupon clipping? Hamburger Helper? Chicken feet soup? Make do with what you have?

The good old days…

The one cc I use for everything begs me to increase my limit. I always turn them down. My balance is usually around 50% of my limit. I’m their worst customer though. I pay the entire balance in full, ie no interest, Plus it is a cash back card and I earn around $2K annually, tax free! I use that cc for everything and anything I can. 1.5% cash on everything and then 2% restaurants, 3% pharmacies/grocery sores, 4% gas and every now and then a 5% monthly bonus on certain categories. It adds up fast and that end of the year check is sweeeeeet,.

I always like to think for every customer like me there are 10 customers paying 17.99% interest every year and the occasional $40 late fee. So to all of you doing that, I want to give yo a nice hearty thank you for the subsidy. I appreciate it.

Just out of curiousity, what card do you have that gives you all of that? I get FF miles from mine, but who knows what that will be worth…..

Betcha its a Costco Visa… sounds just like mine.

Anecdotally know three people who had their credit card limits slashed recently based on an “algorithm” when a cc is used for too many small dollar transactions. Apparently it indicates you are headed down the drain when you start buying coffee on credit.

Only the big debtors win!

I’ll bet a lot of this decline in cc use is due to virtually no one flying, going on cruises and general lack of travel spending.

Also, since folks are working at home no credit card purchases of gasoline.

Online spending is through the roof though, and people are buying furniture, hot tubs, garden supplies, decking materials, home-improvement stuff, gadgets, sporting goods, bicycles…

and sex toys….

Yes indeed! We have gotten great deals on home-improvement big ticket items, from contractors and suppliers ‘feeling the crush’!

Support your local businesses, many are offering great prices!

Just look at the chart of Global E-Commerce ETF – EBIZ near 52 wk high! So are ONLN, AMZN and WMT! Even the ETFs – XLY discretionary) & XRT(Con essentials). Tells where all the stimulus $$ going!

But how long with out the further extension of ‘EASY-PEASY” money from Congress/FED?

“…virtually no one flying, going on cruises and general lack of travel spending.”

That would be us. At the beginning of February, we had firm plans – but no commitments – for several extended domestic trips and a cruise or 6 thrown in just for giggles. Then our son was a casualty of the oil and gas cockup and we’ve been chillin’ on the back patio ever since. We’re helping with his day-to-day expenses and won’t be back on the move until he finds employment. Our “cash back” Visa balance is about a third of what it was last year at this time – including some beginning-of-the-year travel – and won’t move much anytime soon. There’s actually more “fun” on hold, but spending is down down down big time and won’t be increasing for the foreseeable future.

Probably many people asked for forbearance on mortgage and auto loans and used the money to pay down credit card debt. It would be a smart move considering that credit card interest rates are much higher than other interest rates, especially in the case of rent, where as far as I know, interest on the amount deferred via forbearance is 0%.

Is paying down credit card debt good or bad for credit card companies’ bottom line? I don’t really know – they are going to be making less interest on reduced balances but then again, if people were going to default on those balances (bankruptcy) then it’s better to have the pay down. I guess from the credit card companies’ perspective, the ideal is for people to be as indebted as possible without crossing over into insolvency.

A friend who works for Fair Isaac says that credit card companies make the highest return on people who are consistently 1 month late in their payments.

Those clients are walking meatbag junk bonds

Makes sense. That’s because when they securitize that debt or otherwise get lending facilities against it, ones that are more than 60 days delinquent are often ineligible. So these get high interest payments, but don’t fall out of the facility borrowing bases.

Plus there is a really good chance – I’d say 75% – that the forbearance amount will never have to be paid back. There will be enough MSM sob stories of single mothers that can’t pay it back to get the govt to forgive it all.

absolutely, like for Doctors and Pharma – the more people get and stay sick FOREVER – the better.

Working class America is no longer going to Disneyland, while money for Disneyland keeps coming in. (600 week). The crisis is turning some policies on their head. Reducing personal debt also reduces the national debt. The solution involves tamping down consumer demand and ramping up savings. Profits need not suffer if corporations raise prices. The US imported cheap labor (products) in the first part of the cycle, in the second they will export consumer demand. A matter of discerning what the rest of the world wants. or needs. The second golden age of retail.

Wow, Ambrose, you might be smoking some of Billy Clinton’s Oxford party favors! Americans need growth in incomes to grow retails sales, even on-line ones, and people will hunker down with available dough as they watch the daily street riots on the evening news. A time for saving, not spending.

Disneyland/Disney World, a stifling covid environment, and low expectations on minimized attractions. Safety and value are still number one.

A woman I work with when to DisneyWorld the week it opened. She was really excited to have got those first available passes. I asked if she was afraid of the Corona. She kind of shrugged, said I go to Walmart and Costco all the time, how will this be any worse?

I hope she enjoyed the visit. Good for her.

I would love to read a post sometime with your thoughts on the answer to your own question: Whither “Extend & Pretend”? You’ve written some great analyses of how we got here and how it works. What are your thoughts about What Next? Where will all the money come from to make everyone whole without crashing the economy?

(I know, you always write data-driven essays about the past and the present. But wouldn’t it be fun to write just one about the future?)

Wolf already has.. He’s shorted the entire market…

Look at the indexes level as of last Friday! All at near record levels!

Remember: Now FED is the mkt!

sunny129,

Here’s the Fed:

But of that Fed pile, US Treasury is sitting on about $1.4T in loose change they have borrowed already but haven’t spent yet… stimulus awaitin’

They’ll need a lot of that to pay for the CARES Act, including PPP loan forgiveness, where the Treasury has to pay the banks for the forgiven loans. That will be a few hundred billion right there. This hasn’t happened yet because the forgiveness program is just now starting to become available. Also unemployment benefits under PUA etc. need to be paid, etc. etc.

‘What Next? Where will all the money come from to make everyone whole without crashing the economy?’

ASk Mr. Powell of the FEd. Just watch the last interview he gave on 60 min on CBS. He just said ( without batting an eye!) that he can create ALL the digital monry needed to infinity!

I had an uncle (by marriage) who could not understand why the government couldn’t give everybody money every week and nobody would have to work. This is not much different than what is going on now.

People in the 3rd world have to labor all day long just to feed themselves. Here in the 1st world you can get any scut job that will pay for shelter and more food than you can eat.

So it’s sort of similar — the wealthier the society, the more wealth is available to spin off to its members, whether through the private sector or the gov’t.

So, the money that paid off CCs were borrowed by government. Thus the debt in fact got transferred from CC holders to the government at lower interest rates.

And lower interest rates are … deflationary for the economy! I’ll keep buying long bonds here.

First time posting here. My wife and I noticed a large debit and then a credit sometime later (over $500 and nothing to do with us) on our Citibank MC. Could there be some manipulation/cooking the books happening? Not paranoid, just curious?

Fraud by a fraudster that managed to charge something on your card, and the bank fixed it for you. Happens.

But you should contact your bank. If it was a fraudster, get a new card (new number).

Happened to my daughter. The FBI wanted to string the fraud along until they could get the whole gang, so the bank was replacing debit card withdrawals as fast as they could make them. Betraying nothing, the bank then sent a replacement card with a new number.

I learned recently that new charges can still go against a old number.

Apparently, it’s a “convenience” so that CC holders don’t have to update all of their subscription services. It took me escalating to a second level of AmEx fraud services, who had to block specific merchants.

@ Fergus

You need to call your CC or the bank for an explanation! Or else it will happen again!

Absolutely NO debit card or Won’t allow any debit or automatic withdraw from checking account at the bank. I do pay all bills online but only after I check the statements/invoices.

This current Government sponsored All-In Bailout should be accompanied by the old British tune played by the surrendering Redcoats at Yorktown of “The World Turned Upside Down”. The Government will try to save the large corporations first, as the Fed has shown in its nefarious Blackstone run programs, then the person on the street. Eventually, the doo-doo hits the fan as the economy continues to stumble at the 20% to 30% lower GDP levels since us Baby Boomers with 2 shillings in our pockets DON’T COME OUT OF OUR FOX OR BAT HOLES. Things just aren’t going to go back to Spendathon at the private level any time in the next 3 to 5 years, vaccine or no vaccine.

This is the classic example of trying to push a Depression down the road, but the pile of dung having to be pushed getting exponentially larger by the hour. The Fed will kill the U.S. Dollar’s purchasing power will all its money printing, inflation raises its hydra-head once again in multitudes, our standard of living goes in the toilet, and NFL players have to take pay cuts ever if they are only down on one knee.

WAKE UP CALL COMING TO AMERICA, stay distant and safe, my friends. I know I will not get the new vaccine during its first year because I want to see how many bodies pile up from those that do first.

Don’t worry. This is why we have hundreds of bases outside of America.

As long as we stir up trouble overseas and make America look safer by comparison, the US Dollar will not sink. But then again the divide in America is so big, we’ll probably do most of the sinking.

Either way, get a second passport before it’s too late. Just in case.

Yeah, all those ‘hundreds of bases’ keeping the USA safe and providing ridiculous data for bloggers to spit out whenever they want to make this or that point.

I’m sure that the ‘base’ in Japan that consists of one antenna or those SF people sitting in a hotel room on Barbados which is counted as another base is really, really important in the big scheme of things and stirring up a whole lot of trouble in those countries.

I’m on a base in Japan right now. I can assure you that’s it’s not “an antenna”, more like a small city with an airport…

It’s really, umm…civilized here compared to the US. We plan on staying as long as we can.

This is just further saying, why ever save money? Why be responsible? We will take care of you until we don’t! But honestly, when you play by the rules, when you pay your credit card off every month. When you don’t take out a housing loan because you realize that housing is insanely overpriced, this is just a reminder that your prudence will not be rewarded. I am being electrocuted like some sick lab experiment. Every time i pull the lever that leads to responsibility i get shocked. Bad bad bad person! MORE DEBT, MORE WE NEED IT

People are getting it. They look at those zero balance CC statements and ask why didn’t we think of this before? Then they suppose, imagine something bad happens, having zero balance gives us a cushion, (just like saving money). Then they say, you know this virus is bad, what about the next one, and the next one. The government is like a cop, never one around when you need one. They can’t stop anything. We have to take care of ourselves. You know all that stuff we have in storage, sell it! Consumer debt reverses.

Right on, Ambrose. I have been cleaning out the dusty closets here for over 5 years, and once you learn to price a sale item on Ebay that has many offerings below the lowest ask, you can move a lot of stuff. Big Brother from the novel “1984” is alive and well in Washington. It is high time for adult Americans to take responsibility for their imprudent actions and their mistakes. Those of us that have followed the wisdom of Aesop’s Ant should not have to subsidize the Grasshoppers!!! Horde of Locusts would be a more apt moniker!! Got Raid?!

The charts show that the virus is spreading faster from one to two then three then four and now, five million Americans. We aren’t gaining control, do not have any government plan to speed up testing, so infected persons can unintentionally spread it while awaiting days for ludicrously slow virus test results, not enough contact tracing or quarantining, and may not have a sufficiently effective vaccine for a year.

Soon, we will need drastic action like lockdowns in entire states or more counties soon. Meanwhile, without constitutionally-authorized action, tens of thousands or more will soon be evicted. I predict a lot more of Americans will soon default on all kinds of loans and credit cards when that happens.

The rate of new cases is declining and has been for a week or two. Additional shutdowns like in March are extremely unlikely.

I sure wish that I could live in your world. Unfortunately, I believe in science. See e.g., “Forecast: 300,000 U.S. COVID-19 Deaths By December 1” at https://www.huffpost.com/entry/covid-death-prediction-us-december-2020_n_5f2ccd9fc5b64d7a55f1126c

I echo the predictions (e.g., implied by Dr. Martensen) that we will get from five to six million infections faster than we got from four to five million infections. (Note that limited testing means that the rate of infections is actually unknown: we do not have enough testing and critically, do not do the random testing that has been used by statisticians to ascertain quality defects, rates of health problems, etc., for a century.)

Prudence is its own reward.

Keep saving and living within your means.

Memento-the essence of wisdom, elegantly stated. Salut.

May we all find a better day.

Met and married Mrs Prudence Mm,,, only ”hitch in the giddy up” was that I didn’t know her first name was Always until it was too late to ”party on dude.”

”Moderation in all things, including Moderation.”… eh

And yes, with her in charge of the household, etc., 20+ years later, mortgage gone,, no debts, and savings of waaayyy more than eva!

Note to all, mostly of course the young and unattached: ”party friends” are found in bars, etc… ”Spouses” in very different places.

Now, no matter what, all OK in spite of all the crazy ‘shyte’ going on in financial and main street economies…

”Spouses” in very different places.”

Please share where these places are?

Dating, if you live in the city, is a choice between BLM protestors and corporate climbers. No room for plain old regular people anymore.

@House: Then your first step is to find people who are looking for life outside the city…

That’s why I grind my own flour and make my own bread from scratch to save money.

Paying a premium for store-bought bread is so imprudent — just throwing money away.

Another aspect, is that employees aren’t travelling for business. Typically these personal CC balances are reimbursed every month, but effectively this activity results in a net static revolving balance. That component of CC debt is now gone. How large an effect is this? I don’t know, but for many business travelers, a few thousand a month is not uncommon.

When I was travelling for my business, I routinely charged $100K per year in business expenses. It’s not hard to do that.

116 million people lost some access to credit (with more likely to come). Their debt-to-available credit ratios will all spike at once. Then, credit scores will trend downward, and average rates paid on credit cards will trend higher.

Neoliberal economists hate this scenario. Paying down debt is counted as “savings” by them. And savers must be punished.

Once this self-reinforcing cycle takes hold, there will be growing pressure for more types of “people’s QE” programs. Remember how everyone laughed at Yang’s UBI a year ago? They’re not laughing now, and it’s the type of people not laughing (C-Suite execs) that’s important. They’re panicking about who’s going to buy their stuff and how.

A UBI (or other “people’s QE” style program) was baked into the cake years ago when rich people were bailed out by forcing Average Joe to pay for it in 1,000 little ways. Prior to covid, the golden-egg-laying goose was already bleeding a little from every freshly plucked feather hole in it skin. Now it’s listing to the side and has a weird dry cough.

The “solution” will be to throw magic money at it. And why not? Magic money cured the last crisis, right? Except only the magicians were entitled to it. Now everyone will demand their portion.

The bleating and hand-wringing about the “budget” and “inflation” is too late. The printing has already happened. Balance sheets everywhere are ginormous. The only way they can be serviced is by allowing the final frontier — wages & compensation — to adjust. The only other alternative is cascading defaults across the entire system.

Few people are aware that actual slavery always starts as unpayable debt. When you have nothing left except your skin, that’s what you sell.

Magic money didn’t cure the last crisis. If it had we wouldn’t be where we are and i’d actually be earning something on my savings account. Magic money delayed the consequences for the last crisis and has been compounding at interest rate of 30% for the last decade.

I didn’t mean to imply Magical Monetary Theory (MMT) is an *actual* solution. Sorry about the confusion. Your lack of return on savings is the case in point. The only way to bail out rich people was to punish savers and crush wage earners.

I’m pretty sure there’s no way to save savers. But wage earners are making a ruckus as we speak. Congress is paralyzed over it. The election is coming. Something will give, and my bet is on some sort of “QE for the People” aka UBI aka UI+ aka Jobs Program.

“…some sort of “QE for the People” aka UBI aka UI+ aka Jobs Program.”

Getting rid of the federal income tax on wages would sure help the working people. Just delete line #1 of the IRS 1040 form, which PUNISHES WORKING PEOPLE.

Disclosure: I am retired and receive no wages. But everything I buy has this Federal Income Tax on the workers built into the price, so without the tax on workers the price should be less.

Mmm. If we had let the market work its magic on Citigroup, Goldman, and the rest, there is no doubt that the initial downturn would have been worse. But we would have eliminated a massive source of economic waste in the bloated financial sector – a major generator of inequality where many of the seven, eight, and even nine-figure paychecks can be found.

The bailout was about saving the very rich and their institutions. We could have rescued the economy just fine without them.

lenert-triple check.

again, a better day to all.

We can actually do both. We can retain the valuable services of these institutions, while reining in inequality through sensible regulation and taxation.

This is SOP in dozens of other developed countries.

I talked to a real estate agent. She told me some people in my 55+ community have 9% mortgages. I met a couple at a community supper. They started retirement fine, then as they aged they got medical bills and had to get a mortgage.

The medical industry in the US is full of vultures. It’s essentially a ransom exercise now.

It seems a little contradictory that credit card balances are plummeting and millions of credit lines are being cut or cards cancelled.

Under the OCC (offfice of comptroller of the currency), aren’t there rules as to what credit card issuers can do to their debts slaves?

I would think credit cards should be availible for emergencies, not just blind consumption.

Robert,

Credit cards can be cancelled at any time, by either party. What happens to the money you owe on your card is another matter. But you won’t be able to use your card anymore.

Get the card that is the choice of all debt slaves!

The “masters card”

I’m trully shocked they haven’t come after master cards name yet???

I think the Braves name is sexist and discriminatory to the Squaws/Maidens and the Papoose’s. Please change it within the next 3 weeks. This politically correct re-naming off everything in sight shows how ridiculous this movement has become. He who is absurd in action will find few followers behind him over time.

Perhaps a few others have noticed this?

Years ago I could pay off my credit card balance the last day of the statement, on the minimum payment date. I religiously paid if off 24 hours before just in case there was a screw up. Then one day ( a few years ago) I noticed they started tacking on an interest charge if I waited until the last day before payment due date. We now pay our balance as soon as the statement arrives. No interest charges this way.

We use the card only for online and gas. Everything else is cash.

I hate CC and debt. A CC is a convenient evil, imho. Hate them.

regards

I get a better interest rate (points) by charging on my CC, than I do in the bank account. The convenient evil has become a very convenient cash cow. Charge now, and pay asap. I make multiple CC payments a month, been doing it for years. Never had an interest charge. The key is, have the money in the bank to cover what you have charged. Not hard to do.

DITTO

I agree with your strategy. I still just pay cash. We’re all different, even those of us in the wrong. :-)

You know something else I do or never do? I have never bought any liquor using a CC or vacationed on it. Just a personal rule. I figure I have the cash I’ll drink if I want, travel if I want, but never on credit. I’ve just seen too many people hurt along the way using credit for fun and stun.

Hats off to you for having the money in the bank to cover the charges. It is what people should do, for sure. I have the money in the bank to do the same, I just hate the monthly bill with a passion.

Not to say the 3% on average the merchants are charged for transactions. Thus as it’s passed on, another 3% onto cost of living. Meanwhile, it’s 0.01% yearly that the same fine people pay on savings accounts. If you think about how many times that 3% is rolled over every dollar, it’ scary.

P.S. The banks are collecting almost a third of what the governments collect in sales tax when we swipe, for another perspective.

Some merchants actually have a ‘cash’ price, passing this ‘savings’ on to the customer. Works both ways.

Exactly! Called the rooter rooter guy out for a job. How much will that be?

“$119”

Would you take $100 cash?

He thought a minute.

“I don’t need a receipt by the way”

“Sure!”

Do the math for bigger jobs. Contractor pays probably 50% in taxes when federal, state, local, U.I. and Social security are figured in. Pay with a credit card, he just lost 3-5% and it’s reported. His expenses are all still deductible from reported income.

Offer him 25% less than his bid in cash.

You both just saved 25%. He’s still covered by his license and insurance by the way.

Yes but for a 3 percent fee, a merchant can sell goods to a person who otherwise might not be able to afford what he is buying. People (many) spend more freely when using a card versus cash.

And there are some benefits to not having thousands of dollars in the tills. Or stored overnight.

I don’t feel that sorry for the merchants. The users on the other hand, yes, there are problems.

There used to be super popular restaurants and bars in SF and LA that were cash only. They were in such demand (and fairly priced) that they could command cash. People paid. (It’s been many years since I’ve seen this.)

Paulo,

I set up my cards on automatic payment back in the early 1990s. The credit card company drafts my bank account on the due date for the amount due. Never interest, never late fee. And if you buy a used car on your card and don’t want to pay it off in one payment, you can change the scheduled payment to what you need. There is no need to hassle with actually paying off stuff manually and take the risk that you’re getting hit with fees or interest.

Good point.

I tried to buy a car once on my CC, a new car. I negotiated the price and it was below my limit at the time. I then pulled out the card. The salesman didn’t bite. He took a cheque, though. Mind you, this was years ago. The price was achieved by trading in a “Scrap-it truck” which earned $2500 off (Govt program), had a rebate from the Govt for actually buying a fuel efficient 4 banger worth another $2500, and the final price was quite low. (This was when oil was $147/bbl.) When I pulled out the card the salesman just smiled and shook his head.

You just didn’t go to the ‘right’ places to buy a car with a CC – try the Porsche, BMW, MB, Jag, or Lexus dealers…………..

My wife and I have two credits cards – one for everyday type stuff, groceries, gas etc. – the other one for any on line purchases only. I pay them on line as they are part of my bank a day or two before the statements close. I will even send in a few dollars more. What I have noticed is that my credit score went from around 815 – 822 to around 838 – 842. Our mortgage has been paid off for over 10 years. Our only other debt is our car lease – that is the one “luxury” we allow ourselves because we take extensive road trips to national parks and the like and we want to know that the car is is good shape.

re: “… I religiously paid if off 24 hours before just in case there was a screw up. …”

Until recently, I did the same (although I usually scheduled the payment 2-3 days before due ‘just in case’). Over a few cycles, I noticed–thanks to all the credit score monitoring provided by all my accounts that have been hacked–that my credit scores were taking a hit (just a few points, and I haven’t opened a new line of credit in years, but I’ve been conditioned to fret the score). Apparently, all the sophisticated ‘artificial intelligence’ the financial companies brag about can’t detect that I always paid off the balance in full (I wasn’t the greatest programmer, but I could have written a simple routine to flag this in a couple hours).

Ya’ll are over exerting over nothing.

They get your real time balances.

The smartest analytics brains with unlimited computing power are digesting every single transaction and the state of your account in real time. They can also blend in other data sources if they want.

There is the “credit score” that you see, and then every company handling your credit file makes it’s own proprietary scores which are different than the score you are looking at and worrying about.

i know because I worked with people who did this.

This happens in the background while everyone is fighting about which is better, Dems or Repubs.

“I hate CC and debt. A CC is a convenient evil, imho. Hate them.”

I had an unpleasant experience at the downtown LA library back in January concerning the use of credit cards.

As I was leaving, the parking garage attendant refused to accept my $5 bill for payment, and demanded that I insert a credit card into the machine for a $5 charge.

I don’t like credit cards for a $5 purchase. Why should I send a portion of the cost to the big banks. And if the $5 charge is the only charge that month, I have to fiddle with a bill for $5. I want to hand over what I owe and be done with it.

But she was adamant. I mulled over trying to escape around the bar which held me and my car captive until I “inserted the card”. I thought about calling the police, or waiting there until another car pulled up and she had to open the gate, leaving the $5 on her station. In the end I “inserted my card”.

The purpose of this request was because this way the parking garage company does not have to handle money. They want the machines doing the transaction so they can hire unreliable employees who might steal or lose the money. And of course, if there were any robberies nearby, well, they know I was in the area. Better than cameras for spying on the people.

A similar incident happened a few years ago on the LAX shuttle. When I arrived in Van Nuys, the attendant also demanded a credit card for a $6 payment, and I had to operate the machine. After hassling with the man, who wouldn’t touch the cash I was handing him and was physically threatening, I “inserted the card”.

The $5 bill has printed on it the statement: This note is legal tender for all debts, public and private.

Apparently, now it isn’t being honored. Is this still enforced? Or is it now just paper.

Anybody (Wolf?) know if the the money is still legal tender? Can we refuse to “insert the card”?

Legal tender laws only apply to paying your wages.

You should have just said

“I don’t have a credit card.

Here’s five bucks. Take it or leave it. If you don’t want it, I will mail you a check.”

In other words, US gov assuming citizens CC debt at a rate of 600 a week per capita.

Jerome has made all his elites whole. So screw em’. My niece told me If she had my credit worthiness she would load it up and throw the bills in the trash. She said that the government has to sell 7$+ “coffee” at Starbucks and iPhones. Her college classes have armed her with the “new” MMT and it is “empowering” all economically oppressed groups. A new day has dawned. I have no argument to offer other than a weak moral/ethic based one. She laughs at that and says who gives a shit about that other than old farts that have ruined the economy before she was born and wants her to pay for our lavish Social Security benefits that she won’t have. She is a big fan of C19 Boomer Remover and considers it Karma. Her argument is a Polemic Cyclone.

Medicaid covers 40% of all childbirths in the US.

Sounds like someone you probably shouldn’t spend much time around! LOL!

(Kind of like my 25 year old granddaughter who got a useless college degree but “knows” everything).

When I was 25, I also still knew everything ?

Wolf and aa,

”When I came home from college after freshman year, I was amazed at how ignorant my dad was,,, and then, when I came home after my senior year, I was amazed again at how much the old guy had learned in three years.”

Wolf, but how much did you remember? ✔

VintageVet,

Great tale! Lesson of the ages.

Dr Doom,

Your niece is the consumer generation of today.

Their attitude, dishonesty and morals stink.

Just remember they are the ones supposed to be earning and paying tax for your state pension.

Remember that businesses have to put up with their dishonest behaviour as customers and employees.

That is the reason that I and a lot of my business friends have quit running businesses as we don’t need the hassle and frustration and become grumpy old men.

Who raised those rotten kids lol. Do as I say not as I do never works out well. I’ve noticed there is a constant “It’s not my fault” with the 60+ crowd for the most part. Especially the successful. Really? Hate getting bit by the ethics and rules you supported directly or indirectly through voting and self-interest? While I am personally saddled with the work hard pay your way ethic, I’d say the niece sounds like a smart person.

I am here for the superb economic analysis done by Wolf. I also enjoy the comments for the most part. But the lack of personal accountability and insight from supposedly morally superior people is maddening. They are your kids and this is your society.

I agree with you, but most people aren’t going to understand what you’re saying.

Yup, you are supposedly morally obliged to pay your bills to corporations that bribe politicians, pay few or no taxes, carry interest over, despoil the environment, screw over their workers, bust unions, hire illegals and destroy small businesses across the nation.

The Ten Commandments apply to your fellow citizens and you create the world you want to live in by following and respecting them.

However, big corporations are not people, nor are they citizens. With very few exceptions, like family run incorporated businesses, it is ok to cheat, steal from and lie to them. In fact, it is your patriotic duty to screw the artificialities called corporations, that have better tax rates than you do, that live forever and suck life and money out of our communities.

Never let an elderly relative die with a zero credit card balance.

Considering 50% of the population has virtually no wealth, those “economically oppressed groups” could have turned things around decades ago just by voting.

Every day I marvel that the peasants still haven’t organized to pillage the plutocracy.

Thanks Wolf,

This makes a lot of sense.

If consumers are using forbearance or the stimulus checks to pay down the 20+% credit cards, I have hope for the average consumer. It is the smartest move. Banks are paying 0.1% up to 1% for savings accounts. No point in saving if you are paying 20% in CC interest.

My opinion is that is also smart to charge as much as you can to a credit card. Many offer 1%-5% cash back. I try use it for essential items but it does take willpower (or Covid 19) not to go to restaurants frequently or go on vacations by air and stay in hotels.

My business travel expense has plummeted from $2K/month to zero. My gas expenses to work, customers, the airport have dropped 90%

Once this Covid Pandemic Crisis has passed, we’ll see how fast air travel, hotels, and dining out rebounds.

If it is essential, I’d rather use the CC and make an average of 3% in cashback and leave my cash in the bank making 1%. or a stable dividend stock making 5%.

I forgot an important point.

I always pay off the CC balance within the 25 day grace period so I never see the 20% CC interest. I continually float my expenses.

Using cash, I’d to lose the 1% interest in the bank for each purchase.

Using the CC, I float the money and receive the 1% interest and receive an additional average 3% back.

Where are you making 3% cash back on CC? The best I can find is 2% at PenFed Credit Union.

Chase Amazon Visa pays 1%-5% cashback.

Costco Citibank Visa pays 1%-4% cashback

Now you know where I spend the majority of my expenses. :-)

If you shop there, it makes sense to become a Costco Member or an Amazon Prime member.

I have kids so the discounts at these places are already better than any other store (Except maybe Walmart, Kohls, or coupon clipping).

The 2% off Costco and 5% off at Amazon is a no-brainer.

In a twisted sort of logic, the Amazon Prime video has almost entirely replaced going to a movie theater for the family. I count Amazon Prime Video as mentally essential expense.

There are all sorts of interesting deals out there, the only trick is remembering to pay this stuff off by the due date. Never accumulate a balance on a credit card.

Add one more, Discover has a rotating 5% cash back every quarter. There are different things that can be applied too. This quarter it’s all payments through PayPal and others. So, everything I have to do through PayPal is going through Discover this quarter. Because why not.

Just made a few Wayfair purchases through PayPal, because 5%. And it’s stuff I have to buy anyway.

re: “Costco Citibank Visa pays 1%-4% cashback”

Not exactly ‘cash’–you get a ‘check’ you can only spend at Costco–but for all intents and purposes it’s as good as cash (yes, I have the card).

Not true, Bob, you can absolutely cash that check, you can also spend it at Costco directly. I have done both depending on the size of the check. But Costco is perfectly happy to give you a wad of $20s if you are so inclined. They also give you a check if you want, usually they do that for over $400 or so.

We always take our Costco cash-back in cash or check.

You do not have to spend it at Costco.

It is better not to spend the cash at Costco and always use the CC to accrue the cashback.

The Executive Membership fee $120/year gives you a rebate on all purchases. That you have to use at Costco. The Executive Membership gives you 2% check every year that you must use at Costco. If you spend $6,000/year at Costco then it makes sense to upgrade to the Executive Membership.

OK, that’s news to me and I learned something. Seems like a hassle, when I usually spend a big chunk at Costco every month or so anyway, and they generally have all I need at reasonable prices (except for some specialty items). I can’t remember the last time I got out of Costco for less than $400.

congrats making 3%. The Fed stole 20% in the first half of this year.

The dividend yield on the S&P has been below 5% since 1980.

Good point. Getting 5% dividend yield is a little more risky today.

On an Index fund, Dow (2.2%), S&P (1.8%) it is safer and pays more interest than the bank.

None of these are FDIC insured so you could lose it all.

So effectively, if you use cash, you lose the 1% on your purchases if you are safe and have all of your cash in the bank.

With a rewards CC, you gain on average 2% to 4% (1% bank interest and 3% cashback) by keeping your money in the bank and float the payment.

You are paying for your money back windfall, it’s only a rebate of your over payment for the goods and services you buy. We are all overpaying for goods and services to compensate for the smarties who think they are getting over on the credit card companies. And the cc companies make money selling your data as well.

I pay cash and I’m not shy about asking for discounts. Mostly I wait for a sale that covers the sales taxes and cc fees, at minimum.

I agree Petunia,

From a security perspective, a CC just opens the door for possible security issues. Even though it is easy and you have the legal right to remove fraudulent charges, it is extra work to monitor your CC statements.

Of course, if you lose your wallet, you are likely out all of the cash in it, You can report your CC stolen and not lose anything.

Putting everything on a CC can also hurt your credit score. If you charge too close to the limit, it lowers your score and you may have a hard time finding a good rate for a mortgage. If you pay cash for a house, no problem.

As far as spam, I get too much already. Mostly are from mortgage lenders and political action. I know where they came from. My fault partly, but if you have your name on a public record, like a county assessors page, they already know where you live and your full legal name.

”Right on the money” P,,, ALWAYS ask about the cash discount!!

In one of my former lives, doing up to $40K a week in construction/remodeling in SF bay area,,, (and still able to run very fast if need be), I bought every possible item for cash, usually carrying a couple $K in my pockets.

Sometimes the discount would be up to 25%, similar to the discount for truck loads of lumber those days,,, but for the small stuff, it worked well, especially when I dealt with the owner of the supply house/lumber yard, etc.

This was before the widespread build out of HD and other ”home improvement” stores and most ”credit cards,” as opposed to store and gas cards.

Still works, but on a smaller scale, usually at least what the merchant pays the CC company plus sales tax, if any.

And I don’t think I’m getting anything over on CC companies. They make money from the vendors and from the people who pay late.

I think it would be a better world if CC companies didn’t allow you to float money, didn’t charge poor people 20+% interest, and didn’t charge vendors 2%-4% in fees.

I’m just playing the current game within the rules set out for us.

Capitalism isn’t fair.

The credit card (interbank) fees are already baked into the prices at the stores so you pay them regardless of whether you pay cash or use a credit card. Good luck negotiating a “cash price” at a restaurant, grocery store, hardware store, big box store, or a gas pump (though some gas stations offer a cash price if you go inside and prepay – which I am not going to bother with). Most contractors won’t accept a credit card at all… so the price is a cash price. A contractor has the weapon of a mechanic’s lien on your property so they are less reluctant to accept a check as they have some recourse.

We use our credit card consistently and pay it off monthly. All groceries go on there, COSTCO, major appliances, construction materials, and online purchases. Using a credit card is particularly useful when dealing with unknown online merchants. Saved me about $300 on one transaction alone when they took my CC payment and then disappeared without shipping the merchandise. Visa gave me back my money with little push back. We average about $2K a year on our “cash back” card. And, presently, our credit rating is higher than it’s ever been (over 900), despite my retiring.

Thus far, we haven’t had any attempts to reduce our credit lines or revoke a credit card. We just have to remember to use them all at least once per year – you can’t let them go dormant. In fact, we’re still getting solicitations offering MOAR credit.

VVN & EK,

You can definitely get discounts at big box stores. Look for coupon codes online which you can use to order online or print out for store use. Lots of them out there for drug stores, hardware, housewares, clothing, etc. Lots of phone apps too, where you can download the coupon to your phone and show the cashier. Also take up the stores on price matches, always do this at electronic stores. We have saved hundreds doing this.

Coupons?

What are coupons?

Never heard of them or seen them in Australia!!

Well, there is this thing called a ‘Seniors Card which if presented at some places will give you a discount.

KFC gives a 10% discount off your purchase with it and if you do an online survey you can get a free drink and chips too – fries to you Yanks – worth something like $4.95.

No such thing as a ‘free lunch’ in this country unless you qualify for some the huge government handouts.

Lee,

Coupon codes are codes you can apply online for discounts. I know they exist in Australia because I follow some fashionistas that offer them all the time for fashion websites.

These codes can also be printed out or downloaded to a phone and used in stores.

Just search: (store name) coupon code

Lee,

P.S. Just checked Davy Jones coupon code and there are a bunch of them available.

Pet is absolutely correct about discounts at big box stores!

Lowes gave me 10% lower than the lowest price lower than their list on $5K of appliances recently; WM will meet or beat any advertised price lower than their best, etc.

Ya gotta work it! They, any of them, are not going to volunteer anything…

Yes, it’s important to be able to understand the terms of the transaction, which would be the better deal. I thrive on military and senior discounts!

Forgot that one Dawns:

Lowes and others give me 10% Vet discount, but, again, I had to show proof of vet status and ask for it each time…

Lowes veterans discount, veteran parking, pay with your credit card and get cashback. You present your papers once, they put your phone number on file. I think HD has the same thing now, but Lowes was first, and they have a better garden section.

Lowes really appreciates vets, show dd253 and it’s in computer, say vet at check out, they verify with your phone number and voila. HD is not vet friendly, have to bring in dd253 and show it each time, most checkers don’t understand and don’t know how to apply it so call for manager, pain in the you know where. So my dollars go to lowes for almost everything.

“For consumers who use credit cards, nearly all payments, other than housing payments, flow through them. And people who don’t pay off the balances every month end up paying interest at dizzying rates on those outstanding balances. When these consumers get cash, such as stimulus checks or the extra $600 a week, they use it to pay down their credit cards, which cuts their interest expense, rather than putting it in a savings account, where it earns nothing. This is a smart thing to do.”

Wolf, I think this is truly the case. Is it incongruous or ironic?

The most interesting thing I notice is that no one is complaining about the banks who are “borrowing” money at 1% and charging 17% on their credit cards

I’m always bringing it up, my credit cards are almost 30%. We need usury laws to be reinstated. I don’t see the left “caring” about that.

Congress is in Banksters’ pocket!

Did you forget already that they got BAILED out in 2008 under TARP although majority of America against it first time. It got passed on 2nd time. Main St is subordinated to Wall St.

America, the best DEmocracy Money can buy!

Have you heard of Elizabeth Warren?

She has been fighting this very fight for years.

Warren is full of crap. She had the chance to cap the usury and didn’t do it. She had the chance to do a lot and didn’t do anything. Her consumer agency bill is a complete fraud.

Bernie Sanders and AOC introduced the Loan Shark Prevention Act in 2019. It will cap interest rates at 15% for Payday and CC interest.

I doubt it will currently pass the Senate.

Really interesting stats. The 9% DROP in nominal CC balances seems totally counter-intuitive. The GOP line is that UI bonuses are just squandered; perhaps they are being used to improve personal balance sheets.

The decrease in delinquencies is hard to interpret; deferrals probably moved the goalposts on “delinquencies.”

Personal anecdote: my own CC charges have dropped substantially due to lockdown (restaurants and gas have fallen dramatically) — possibly the overall reduced purchasing has lowered the bad metrics.

There is an incentive to not pay off your cc every month. Your FICO Score is dinged because you aren’t using enough credit and the issuing banks want debt to package into collateralized debt object to sell bonds and make massive fees.

I was forcible relocated from Slovenia – Yugoslavia to Australia when I was 3 .. I wanted to stay with my grandma & so did she.

When I was 5 my parents purchased a little house .. it took all their money .. there was no money for a fridge ..

They worked & saved & finally we got a fridge.

No debt.

No debt slaves.

Some lay-by capacity existed & loans with monthly repayments but .. you needed references from GOD to qualify & people were wary of being ripped off.

Then it took off & even better C/C’s .. credit cards !!

Business is booming .. there are jobs & everyone is making money.

We became debt slaves .. but business is booming & the whole world goes around a lot faster.

But .. debt slaves is used in derogatory terms ..

Like we are committing a mortal sin ..

Why ??

If credit is taken away we are at a standstill .. or am I wrong ??