The Fed is funding consumption circuitously via Treasuries and government stimulus spending, shifting impact from asset prices to consumer prices.

By Wolf Richter for WOLF STREET.

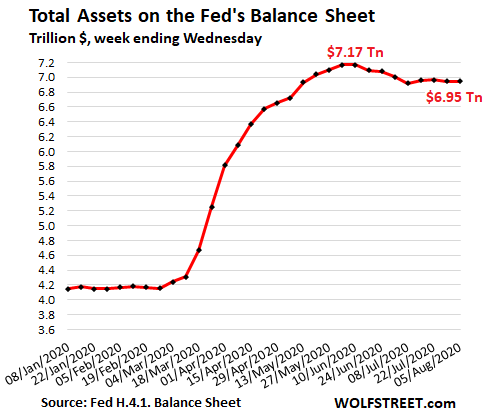

Total assets on the Fed’s balance sheet for the week ended August 5, released this afternoon, declined by $4 billion from the prior week, to $6.945 trillion. In the week ended June 10, total assets eked to a peak of $7.17 trillion. In the eight weeks then, they have fallen by $224 billion:

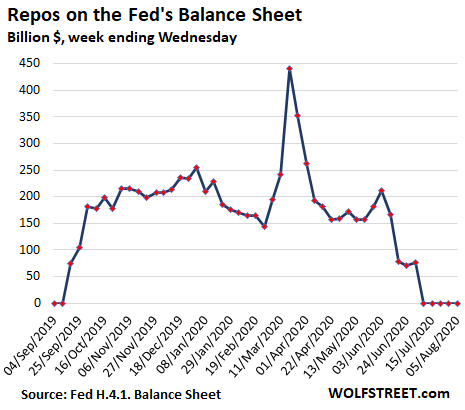

Repos continue to be zero, week 5.

The Fed is still offering huge amounts of repurchase agreements every day, but since it made them purposefully less attractive in mid-June by raising the bid rate, there have been no takers:

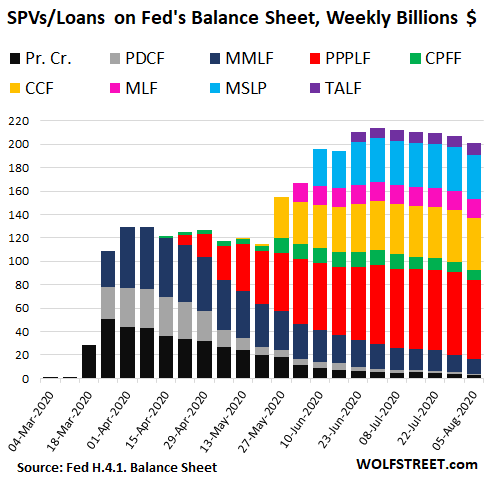

SPVs & Loans fell by $6 billion, 5th week of declines.

These Special Purpose Vehicles (SPVs) are entities that the Fed created and that it lends to. The SPV then buys assets or lends. Currently these are the active SPVs:

- PDCF: Primary Dealer Credit Facility

- MMLF: Money Market Mutual Fund Liquidity Facility

- PPPLF: Paycheck Protection Program Liquidity Facility

- CPFF: Commercial Paper Funding Facility

- CCF: Corporate Credit Facilities: includes the SMCCF (Secondary Market Corporate Credit Credit) and PMCCF (Primary Market Corporate Credit Facility). Buys corporate bonds, bond ETFs, and corporate loans.

- MSLP: Main Street Lending Program

- MLF: Municipal Liquidity Facility

- TALF: Term Asset-Backed Securities Loan Facility

In addition, there is Primary Credit (labeled “Pr. Cr.” in the chart), which are loans the Fed makes directly to banks.

Their combined balance fell by $6 billion from the prior week, the fifth week in a row of declines, to $201 billion, the lowest since June 17. The composition has changed, with the original three entities being phased out, and new ones having remained roughly stable over the past few weeks.

The largest SPV, the PPP loan facility, where the Fed buys PPP loans from banks, dropped by $3 billion to $68 billion, the first real decline since it started, indicating perhaps that some of the PPP loans are starting to be forgiven (taxpayers eat them) and are coming off the banks’ books:

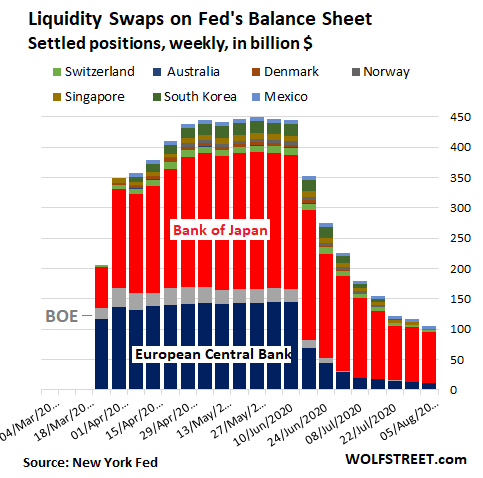

Central-bank liquidity-swaps dropped by $12 billion.

The Fed’s “dollar liquidity swap lines” were implemented and expanded during the crisis to provide dollars to select other central banks. But they have fallen out of use, as maturing swaps are rolling off without replacement. After eight weeks in a row of declines, swaps are now down to $106 billion. The Bank of Japan (red) accounts for about 80% of the total:

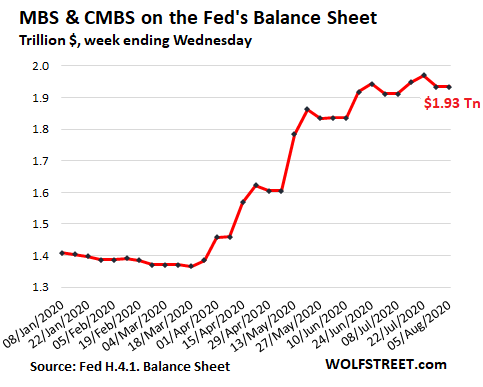

MBS unchanged at $1.93 trillion.

The balance of mortgage-backed securities remained at $1.93 trillion, after having dropped by $37 billion in the prior week. These balances appear erratic, for two reasons:

MBS come with pass-through principal payments as mortgages get paid off. During the current mortgage refinance boom, there has been a huge volume of principal payments that are passed through to the holders, including the Fed, reducing the balance of MBS on the Fed’s balance sheet. Just to keep the balance level, the Fed has to buy large amounts of MBS.

MBS trades take 1-3 months to settle, and the Fed books them only after they settle. So what we’re looking at today reflects purchases from 1-3 months ago that finally settled, less current passthrough principal payments. Today’s balance is about equal to the balance on June 17:

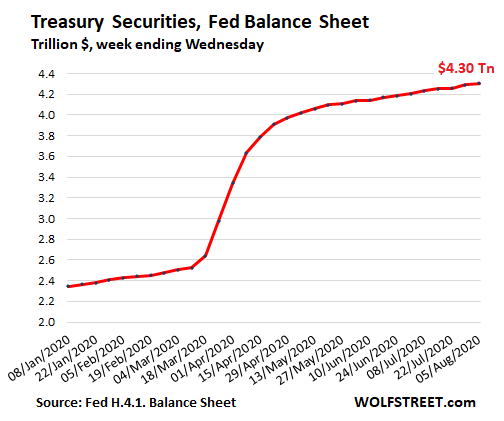

Treasury securities rose by $12 billion to $4.30 trillion.

Think about this: The government is issuing an enormous amount of new debt to fund the stimulus spending, such as the stimulus payments to consumers and the large-scale unemployment insurance payments. Much of this stimulus money is spent by consumers which supports the economy. When the Fed buys Treasury securities as the government issues them, it in essence sends its funds on a circuitous route via those Treasuries and the government stimulus into consumption. This mechanism is shifting part of the impact from asset prices to consumer prices.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I guess this is good news. Atleast the little people are getting money for spending and asset prices are not being propped up by FED

Unfortunately, it has encouraged little people to open brokerage accounts and invest in some of the most expensive markets in history. Since we didn’t get permanent UBI, it’s almost begging for a crash when the benefits are withdrawn or reduced.

Agree. The “saving” of equities is essentially denying reasonable entry levels for those not “in” already.

With zero rates, we get desperation investing and yield chasing, with terrible risk / return .

So saving for that “rainy day” where you can “get in” is essentially being prohibited by the central bankers defending the markets, keeping them expensive. Let them find their own value, you know, like in a free market.

Right, exactly. I’ve said similar things in the past, that all this does is props up the wealth of current asset holders at the expense of young people just starting out. It’s great for people who bought their houses for $150k 30 years ago who have now seen them worth $1.25 million, but it’s not so great for that young family trying to buy their first house.

It’s often the people who can’t afford it that gamble. Once I was walking through the parking lot of a casino and noticed the cars. A lot of beaters with children’s car seats.

Yeah and? The American worker, who built this country and made it what it is/was had their financial carpet/jobs/economic prosperity ripped out from underneath them over 40 years ago. Good paying jobs, factory jobs, industry etc. was replaced with the white collar ivory tower financial takeover thanks to the wealthy elite, owners, bankers, and both political parties. What do you expect people to do? We don’t have the social safety net that say a socialized Europe does………people need to eat, people are desperate. America has become a racket, economy based on the “degree” as the only entry point to a middle class lifestyle anymore. And it’s costing American young people TRILLIONS to attain it. America has become an absolute failure on so many levels. The blue collar working class has been gutted and destroyed. While I’m part of the white collar educated sector of our country I can’t wait to see all these worthless uppity do nothing white collar elites have their little lifestyles destroyed and their way of life plundered and pillaged. It’s coming. Once the stock market and real estate bubbles pop, and pop they will, game over.

So yeah, it’s sad what Americans have to do in this once great country to survive nowadays.

People have called the lottery a “stupidity tax.” I suppose casinos and overpriced equities markets are even worse.

> and pop they will

I feel ya Nick, same perspective, same guilty conscience. But what makes you think they can’t inflate this thing forever (or at least another few decades)?

I think the pandemic or a climate crisis just might topple the house of cards that is our consumer-driven economy, but I also think they might not. In that case, it might take actual rebellion, which to me still seems pretty far off (at least as long as dollar hegemony continues to enable Americans of all classes to consume food and energy at a fraction of the price paid by the rest of the world).

I don’t know why people don’t see that this only has one end and it’s bad. There is not one person that can offer even a bs explanation of how this all will work out in the long run…much less a realistic one.

I just yearn for us to admit responsibility and do things the right way. It would be better and easier for everyone. Yeah stock values need to fall 50% or so …but they were never supposed to be here. Like historicus says here it’s in essence creating losses for anyone going forward…we are all paying too high a price and eventually it will either have to correct or in the best scenario they have just stolen some of our gains already undeservedly.

I just long for a realistic, common sense approach and admitting that this has failed and we have to go back to real markets and telling people…”if you screw up and are irresponsible you pay for it … it’s not the government’s or taxpayers job to make sure that every business value is increased regardless of their actions”.

(I know,… I’m dreaming)

As I mentioned before 90% of my stash was in vanguard short term treasuries fund for the last four years waiting for the crash. Last 12 months it returned 4.78% as interest plummeted. Now yield is -0.01%, or about negative 1.5% in real terms. Probably hang out there til election and try to find another place to hide. Folks that had the stones to ride long term treasuries down are real winners.

Agreed. We might as a result of this find an overdue return of sanity to the overpriced equity market and a shakeout of zombie companies that should be allowed to fail.

Just read that assets to GDP has blown out to 6.2 times. The fed better put the toothpaste back in the tube before it’s too late.

1. Coronavirus Bill II

2. Federal Budget 2021

This paltry pullback is going to be wiped away as if it was nothing.

Note: I know there has been more than two Coronavirus bills, but I’m focusing on the behemoths.

It’s really only good news for those receiving the benefits. Because there is no new production of goods and services associated with the payments (e.g. the $600 weekly unemployment supplements), the disbursements are a transfer of purchasing power to the beneficiaries from everyone else.

Those who aren’t included in targeted programs (e.g. the employed the retired, etcetera) experience the loss of purchasing power in the form of rising prices without a corresponding rise in income.

It’s true some get money, everyone gets debt. But, prices are determined by a number of factors. For average house, it’s mostly determined by max loan average person can get. For cell phone service it’s determined by max amount they can manage to steal from you. It varies greatly by good and service, what causes that price. In America, monopolistic competition is the main reason behind price increases.

As for total us debt, eventually, America will have to default, if America can get the EU countries, Japan, the U.K. and others to default at same time it could easily cause everyone to come out unscathed. Because poor developing countries only own a small amount of this debt, this part of the debt should be honored, which, will also help keep economies working. The only alternative to defaulting is deciding to erode us dollars value (which is a much worse choice). First though, America has to make it through this crisis and then create a balanced budget (no longer paying interest on debt can be factored into this). Right after the crisis or at least on the rebound, global synchronized debt default.

America won’t have to default. By constantly printing money the dollar is worth less every year because of inflation. The debt is serviced with increasingly shrinking dollars. Eventually we have Zimbabwe.

The US dollar hasn’t lost value, it’s doing very well against all major currencies. Lack of real competition in America leads to higher prices and makes the dollar seem like it’s losing value. Over the long term, yes, all fiat currencies slowly lose value, but, wages and GDP have kept up against that (I think). There’s a reason some things in America are incredibly cheap and other things, the prices keeps disproportionately rising every year.

Exactly.

And don’t forget those who are nominally in the targeted groups, but haven’t yet got a penny due to bureaucratic inefficiency.

Other groups losing money rapidly are those in the grey and black economies.

Then there’s the criminals – lockdowns are really affecting their businesses badly, added to which is the ease of spotting them when hardly anyone else is moving about. Our local police have had a lot of big drugs busts since January. Counterfeit cash is also more obvious and there have been several arrests here. I don’t think the criminals, certainly not their low level henchmen, can take much more lockdown.

The Fed and the billionaires are playing for all the marbles here, because IF there’s any kind of revolt their theft of the general population’s money is so obvious it’s going to result in the tumbrels rolling down the street, and I think the MSM will be in there with them.

Finster:

Retired and received and thrust into my stash the $1200………so, many retirees did get some cash……..

What I haven’t received for which I filed, first week of April 2020, IRS refund in past 4 months…….

A one shot $1200 payment is a far cry from $600 week after week. Not to mention the $600 is in addition to regular unemployment benefits and $1200 too.

Of course if the $1200 were made a recurring payment…

But that’s not my point. Rather that these are all transfer payments; whatever purchasing power is gained by their recipients is lost by everybody else. No new goods and services are created. Net purchasing power results from the production of goods and services, not the production of currency.

Only there is a 2T divide in the Congressional spending package currently under consideration. The FED is going to monetize the money that is already spend either way.

Jon, I love your cynicism! I’m quite confident these numbers are all factual, just like the Friday morning jobs numbers. One million, seven hundred thousand jobs created…. I’m terribly sorry. I had to laugh out loud when I read Wolf’s blog. I’m sure there is nothing nefarious happening at the Bureau of Labor Shitistics, either. LMMFAO!!!

In the classic model, the Fed “primes the pump” and then the consumer spending and bank lending restart the economic engine. If the FedGov and FedRes spending is doing its job, total credit in the system should outrun the credit destruction from all the loans gone bad.

So it’ll be good now to watch the Fed’s H.8 report on total bank credit. The third full table has the absolute numbers without the seasonal fudges.

Somehow I think the provisions for loan and lease losses (although rising fast) are a bit small…

https://www.federalreserve.gov/releases/h8/current/

Wolf

Timely update.

However, no matter how hard the Federasts may try to inflate credit, the decline in velocity could do it to them–again.

And then there is their concept of “Special Purpose Vehicles” or “SPVs”.

Somehow, Bernie Cornfeld of the late 1960s bull market comes to mind.

He could distribute mutual funds like no one in history.

With the ultimate being his “Fund of Funds” mutual fund.

After a few attempts to get the DJIA beyond 1,000 the stock market died.

As deflated by the CPI the DJIA fell by 60 percent to the dismal low in 1982.

There is a rather large lag in MV and the surge in the monetary base appears to be fading. When those stars point downward together is there any hope left?

Bob,

Very happy to see you here from tome to time. I love your podcasts. Always looking forward to hear & learn from you, thanks.

And I am short this market…

So far not working out…

We will see what happens…

Be aware that it is hard to short this mkt when FED is the mkt!

I bet on frequent spikes following any down and that is more profitable!

Bet on gold/miners and corp credit bond ETfs! Fed continues to support the Corp credit mkt!

One more SOFR spike, this time from ZLB where 50% of transactions are already above EFF is all it will take… +$1.5 quadrillion in derivatives ready to unwind overnight on puny couple trillion global “stimulus”… hope you aren’t levered up like the rest of the actors are lol

There is some risk theory about blow off tops and why they happen, so it’s probably going to hurt the most right before you are right.

Meanwhile: (Courtesy of Zero Hedge)

Falling confidence in the greenback has been masked by the Fed’s aggressive buying, as central bankers in the Eccles Building now fear that the asset bubbles they’ve blown are big enough to harm the real economy, so we must wait for exactly the right time to let the air out of these bubbles so they don’t ruin people’s lives and upset the global economic apple cart. As the coronavirus outbreak has taught us, that time may never come.

And: (From CBC and Global News)

10% tariffs to instigated (again) on Canadian Aluminum.

What a freaking train wreck.

Regarding WS article: This mechanism is shifting part of the impact from asset prices to consumer prices.

And now you can add measurable increases in cost to anything aluminum bought and sold in the US.

Maybe not. Some of part of that tariff, maybe

but absorbed by the aluminum producers to

maintain market share. Perhaps it means

more aluminum is produced in the US. I’d

rather we had higher tariffs and lower income taxes or higher tariffs and tangible services

like universal healthcare.

Tariffs mean nothing when the exchange rate can fluctuate widely.

If the CAD depreciated 10%, that will nullify all 10% Tariffs on all imports from Canada.

Just what we need in a world wide depression. High tariffs. Did we learn anything from the Great Depression?

I have reached the point where I believe that those who leveraged up to buy their 10th investment property and sent RE prices into the stratosphere in the process have ruined my life and may the devil take them.

The fed has facilitated assets if taken as a whole to at least 2X their normal value. That has hurt working people. In fact I would say if you were a working stiff trying to make an honest living most decisions out of DC have stolen your real income and devalued what you do.

The ES (S&P Futures) is within spitting distance of all time highs. They refuse to let the markets correct like they should. Same old story for the last 11+ years. Precious Metals i.e. gold & silver are also being ramped up & so is Bitcoin. The dollar is being destroyed. I used to think there was an end game to all of the financial engineering, but now I’m not so sure. This crazy crap by the FED is insane & there is no end to it. Deep down I think everything is going to crater when everyone least expects it. Best to prepare when the sentiment is off the charts.

I think we can look at history and see where we are going. At sometime the country will have to recognize it is broke like Great Britain after WWI and WW2 and the standard of living will drop and the rich will get their estates in those days taxed away from them so that it was better to destroy them than to pay taxes on them. Congress has nearly unchecked power to tax. I don’t like it it, but we voted them in

Very interesting analysis Wolf! I completely agree. Strange times we live in.

Wolf,

I noticed one item here in the list is a little acronym called MLF. Is that supposed to be used to bail out municipalities that start to go deep under water on their budget?

Yes, of sorts. But they all have been able to borrow in the markets — anything flies in this market if it pays 1% yield :-]

I guess it’s all about yields these days. I’m curious on when the market will wise up….

Actually, I take that back, the market is probably already wised up, the intermediaries are slicing and dicing these municipal bonds and bundling them into AAA packages and then selling it to retail or pension funds and calling them high yield/low risk assets.

And it wouldn’t surprise me in the least bit if pension funds like CALPERS is buying right into various CA muni bonds. Wouldn’t that be odd.

As for 1% yield, I’m surprised they don’t pile it all into Marcus, that’s still yielding close to 1%. More liquidity for Goldman to conquer the world.

End of QE? No. Markets are doing the deed for the FED, so there is no need for them to continue increasing their balance sheet. Why should they? Once markets stop doing it, the FED will quickly restart. Recently trending reductions are therefore meaningless.

As for creating increases in consumer prices in lieu of asset prices, also not likely ever going to happen in any meaningful, consistent way. Their stimulus is largely directly creating deflation in prices of anything that is not constrained by natural limits. The money the FED and Government are spending is not being disbursed evenly to society. Therefore the substantial majority of the population is only getting enough support to continue their relatively feeble existence. They don’t have any windfall wealth to spend on anything…just enough to get by as before. The majority of the stimulus is landing in the pockets of very few people, hence the increase in asset prices. But those people are not going to buy 50 TV’s with their extra riches. Or extra food. Or non-exotic cars.

The FED has created a circular argument in exclaiming their intent of keeping rates at ever lower levels until inflation ramps up but it can’t/wont with those low rates. It’s briliant! You want inflation? Raise rates to something positive, let marginal producers fail, tolerate the layoffs and massive industry downsizing (violation of full employment mandate), and whamo you will have consumer price inflation in most industries!

I read that 2/3 of people receiving unemployment are making more than they made when employed. Some not insignificant percentage are making twice on unemployment than what they made when employed. That is real money that is flowing to people who can now spend more money than they did previously on products. Which should lead to price inflation.

The whole point of the $600 a month, or part of it, was to be able to AFFORD HEALTH INSURANCE of some type!!!! Wake up! We are one of the only countries in the world that have our health insurance tied to our jobs. It’s a complete and utter disgrace on so many levels. People making $15-20/hr which is barely anything nowadays to support a family of 4 all of a sudden are left without insurance. Well guess what happens when they have to go to the doctor or afford medical care. They rack up debt, they put it on credit cards etc. If the Republicans had a functioning brain (the democrats obviously don’t) they’d address this huge elephant in the room. But they are as out of touch as the democrats with the average American worker. And it’s the AVERAGE AMERICAN worker that keeps this country afloat and from turning into a third world dump. Yes those “AVERAGE WORKERS” who make $15-$25 per hour. It’s hell for those that make even less than that.

Maybe you should consider your own thinking about this. You call the democrats brainless yet they are the party that tried to get your American workers universal health care. That was completely destroyed by vindictive republicans. You look like a fool for not seeing this.

In general, state UI programs replace about half your lost paycheck. The median income is roughly 5k a month, state kicks in $2500 the feds kick in $2400, the median worker is coming out even or a little less. So then the three-month old stimulus check amounts to an extra $300-$400 a month for the last three months which people used to pay down card balances (consumer credit falling).

All of my millennial DINK friends who are still working have been ALL IN (5K/month) the market since the shutdown has limited their Entertainment-Industrial-Complex expenditures. Also, a couple of them cash-out refi’ed 100K+ into stonks.

Crazy.

EIC

“Entertainment Industrial Complex”

Brilliant.

We are going into a historically bad period for the markets…

September…

and with the prospects of a contested election, the manufactured voting procedural conundrum by the Democrats, the table is set for some bad times for this country.

The weird Democrat ticket, the idea of four more of Trump, the Durham Report….and the Trillions in relief packages proposed…not to mention the schools shuttered and the virus…..urban destruction…my goodness…what has become of us?

A Thought Experiment: Using an FTT, let’s say we want to pay down the National Debt before our children reach 65 AND provide mostly free health care to just about everyone.

Assume:

NYSE: The average daily trading value was approximately US $169 billion in 2013. Volume since 2013 has probably doubled, so call it: $340B (we’re going to be doing a lot of rounding during this thought experiment).

National Debt: Gross federal debt stood at $23.7 trillion at the end of March 2020 — $6.0 trillion of which represented securities held by government accounts. Call it $24 trillion (I mean, who’s counting? Unfortunately, apparently someone is, although it damn sure doesn’t seem like it sometimes).

Medicare for All: After it is renamed something more sane to be phased in over the next decade, this is a hard number to pin down as some costs go up and some costs go down and folks tend to only complain about the direction they don’t like.

{SideBar: The phase in? Drop the Medicare age by 5 years every year. Sure the young get screwed. But really, looking at the current reality we’re leaving them, can you honestly say you now care? If so, when did this happen? Just tell ’em they’re statistically healthy and so need to wait their turn}

Biden says $30 trillion over 10 years; Sanders says -$2 Trillion over 10 years; Trump says gather your children and run for the red lined burbs. Call it 15 trillion just for fun, or $1.5 trillion yearly.

Generation X & Z: Researchers and popular media typically use birth years around 1965 to 1980 to define Generation Xers. Let’s say born under a bad sign in 1973, thus turn 65 in 2038 or 17 years from when we have a change of administration (Really? You think you can make the thought experiment work otherwise? Extra credit for that).

Transactional Tax: a levy on a specific type of financial transaction for a particular purpose.

Foreign-Owned American assets: So how much of the U.S. stock market is owned by foreigners? Through the end of the second quarter of 2018, the most recent period for which the data is available from the U.S. Treasury Department, the answer is $8.1 trillion, which is the equivalent of about 35% of the $23.0 trillion market capitalization of the S&P 500 at that time. Close enough? Ok, let’s go with that. And if you can’t tell from the paperwork whether they’re foreigners or not, then dagnabbit, them’s foreigners suckin’ off our hind tit.

And let’s say the 1%ers are now ‘chasing yield’ in stocks – because they already mostly own, in some form or fashion, all the real estate and bonds, are now bored Boomers, with most having inherited their money (meaning some are working but most just look like they’re working to keep appearances up) and find the only fun thing left is ‘chasing yield’ in stocks (although they don’t really know what that means just that the ‘chasing’ part sounds cool and there is probably an app for that) – and are going to keep buying stocks with money they somehow can never lose. You know, they’ll keep the engine going.

Now Then:

As for a thought parameter, let’s say we want to pay down the National Debt before our children reach 65. That would be nice, don’t you think? So call it 17 years. And for the hell of it let’s say there is no interest involved (which might make some sense as half the folks on this page say deflation is coming and half say inflation is coming).

So we want to pay off $24 trillion in 17 years, or $1.5 trillion each year. And we want to provide damn near free decent health care to more and more people each year (while refusing to confront the high fructose corn syrup lobby), or another $1.5 trillion each year. Having fun yet? But what to do?

Remember the Transactional Tax (FTT)? Probably not because it went away in 1966 after Johnson traded it to get more money for his little Southeast Asian War about something, I forget what (even though, with a draft number of 37 I should remember stuff like that better). If not, the Wikipedia link is listed below, assuming the ‘Wolf Allows’ – which has a kind of the ‘Dude Abides’ rhythm to it, don’t you think? Let’s go with the ‘Wolf Abides’. Well let’s do an FTT on every damn thing the stock market touches, shall we?

https://en.wikipedia.org/wiki/Financial_transaction_tax

So, while this is not exactly akin to an Einstein Thought Experiment, what type of FTT would we need to pay $1.5T each year on the National Debt while also paying $1.5T for Single Payer Universal Health Care (which sounds so much better)? So 3T yearly for 17 years where the NYSE generates $340B in trades each year.

Now, quit your bitchin’ and step up with a plan!

Your answer must be in writing, preferably in bullet points which can be read by a machine. Judging by the half life of this page, it should be submitted no less than 12 hours from seeing this assignment. What’s the prize? I hear there are matching funds for a WS mug available. You know, some people, lots of people are saying this. I’m just saying, lots and even more sometimes.

Good luck to you all. It’s been my pleasure this semester.

PS. Extra credit goes to all answers correctly noting that with a FTT, 35% of our debts will be paid by foreign interests. Almost makes the money we spend on the Navy making commerce on the high seas safe for the world worth it, doesn’t it?

PSS. Please don’t rip me a new one over my math/figures. I’m a proud product of American public schools. You know, your tax dollars at work.

WOOOOW!

Crazy Chester STILL ain’t so crazy, even after everything.

x

Crazy Chester:

Really!

Alternative to untangling what you wrote, forget the particulars, just give me the damned bowl (Said Socrates) and drunk greedily!

In Australia, health care costs remain low because of large volume pricing available to the government. Enjoy parsing that simple logic. I may have plenty of issues with my government, but that is not one of them.

In Australia health care costs are GENERALLY low because of the numerous differences between the USA and Australia.

First of all there is a huge number of government owned and operated health care facilites and hospitals. The people there work for the government and are paid government wages and salaries. Treatment at public hospitals is free. It doesn’t cost you one cent for any treatment in them. Lucky me over the past year.

Second there isn’t the same kind of lawsuits taking place where every Tom, Dick, Harry, and Sally are suing the crap out of every doctor, nurse, hospital, and medical outfit in the country.

Third, medicine here is much cheaper as a result of the government’s system, PBS, whcih sets the price of medicine. (One of mine has a full cost of about $50 which will go down in price once I spend so much on medicine in total. This one is the USA is priced at around $US300 retail, but I’ve seen it as low as $US125 or so at some places. So about three to four times more expensive in the USA – I suppose with health insurance it doesn’t cost that much though.)

Fourth, what is expensive here are specialists and the private system. If you want something done that isn’t life threatening and have to go on a waiting list for the public health system, you could be waiting for years to get it done. For example, I needed to see a specialist for a problem a number of years back.

The public hospital waiting list was something like two years. So I ended up visiting a private specialist – the wait was only three months and the cost was ridiculous.

I’ve always said that the Fed QE was not the reason for stock prices, at least not directly. Most of the cash the Fed printed for treasury bills in March and April went to banks to shore up their balance sheets. I suspect little of it was used directly to buy stocks.

It’s more that the Fed created the confidence in people that they were “backstopped” and thus incented to pile into risk assets. The Fed didn’t actually have to do much at all, as regular investors took over for them.

Right now, I think what we’re seeing in the market is a situation where no one sells, so prices continue to go up. Those who may have sold and taken profits in the past haven’t, because they think it’ll still keep going up. That’s why volume has been relatively low.

The insane increases in FB, AAPL, and DIS are emblematic of the market as a whole. There was never anything on those days that justified those price increases.

What it’ll take to snap people out of this mentality, I don’t know, but I’ve been saying now for a while that I think a 1987 >20% drop in one day is possible. It’s like the entire investing world is in a trance, and when the spell is broken, you could have a mad rush to the exits all at once like never seen before.

Unfortunately rnyr, I have to agree with you about the mad mad mad world and likely dump down doom day developing sooner or later…

Sooner being before the election in order to get rid of the incumbent no matter how much bribery his team can bring to the table up to the crash.

Later being after the election if our oligarchy/masters/rich somehow become convinced that the incumbent is going to somehow be better for their financial and personal safety.

Possibility of severe corrections both time frames, per 1930 era exists for sure, and then continuing as per then also.

In any case, we are keeping our powder dry for now, in spite of on going debasement, etc., as I am anticipating at least temporary deflation before the inevitable inflation sets in once again.

BTW, one of the real world ”metrics” I have used for the last 50-60 years is the prices of used sailboats; it appears to be going down lately, though it is very hard to track ”short time.” Low end RE also seems to be going down, with some very attractive outliers appearing in the mkts I am interested in.

And where exactly those exits lead to?

RightNyer said: “Most of the cash the Fed printed for treasury bills in March and April went to banks to shore up their balance sheets.”

______________________________________________

How does a bank trading treasury bills for cash shore up their balance sheet?

Because it gives them cash for capital requirements when they have to take losses on loans or other assets.

O.T., but part of this:

The Stench of Desperation in San Francisco commercial real estate. Just completed, view blocking, view blocked, high density hives, around Main and Folsom, mostly built on landfill, from a Craigslist ad:

“This quiet unit is on the 8th floor of The Lumbago,

[I changed the name] Each bedroom is large enough to fit a king size bed (or 2 twin beds in the guest bedroom). Asking rent is for 12 month contract. Valet parking for one car at additional cost. Landlord will provide 2 months free rent if the other 10 months of the contract is paid upfront along with deposit of $8000 “

Wolf, you said: “When the Fed buys Treasury securities as the government issues them, it in essence sends its funds on a circuitous route via those Treasuries and the government stimulus into consumption. This mechanism is shifting part of the impact from asset prices to consumer prices.”

Are you referring to INFLATION? If so how does that happen? I know Chris Martenson has said many times The Fed sacrifices the 99% for the 1%.

Jeff Bezos is 1%er among Billionaires. Winning!

Oh, not quite fair: it doesn’t sacrifice them, as such: they are simply not noticed at all.

Fortunately, too, the 99% are somewhat divided, and their squabbles are a convenient and effective distraction from the real game.

Not all Big 5 stocks are above a Trillion dollars yet. In fact only 4.

Outrageous to stop printing now.

The World has not lost track of the Big Ben lie of the 4.2 T that didn’t normalize nor tightened. The head fake of 224B tightening will proabaly not convince anyone that another 2 or 3T won’t be tacked on. If Gold is assuming its fated role of Money which so far is agreeing with the falling dollar we are in Big trouble and the 4.2 T “Old Lie” might not be ignored by a 3% “Head Fake” on the remaining 3T. More coming.

Yes, this is a bad kind of inflation. If the cost of consumer goods inflates without any wage inflation, there will be big problems. I hope that doesn’t happen too much.

If somehow (there really are a few mechanisms), we can get some wage increases at the lower end of the income scale, things will get better (even if there is CPI inflation- as long as it’s not too high).

Would not call this a new day, or stealth MMT. Dems are trying to clawback some of the 6 trillion? they signed off on that, like asking for a kinder gentler Iraq war (same number by the way) Kerry said, we can do it better. America stuck with the original devil, not the one they did not know. Most of that MBS is REFI not mortgage origination? Those who work for sweat money do not want to die for the privilege of singing for their supper. The readership here is not in that demographic. So when you say people are being helped the first thing I ask is ‘what people?” Then I ask what money, but I do think they will get most of the 2T but it will be hard fought and long and too late to help some.

Wolf, how is the article on the latest BLS report coming along?

:)

Expecting one to drop some time today.

I got tired of writing about the BLS.

Don’t blame you a bit for getting tired of their Blatantly Lying Shyte Wolf…

Been saying that for a long time, many years of having to use their very very bad data to try to anticipate labor costs on huge projects that might take several years to complete.

Especially the last crash when at least 50% of the experienced top hands in the construction industry were out of work at one point, and the BLS folks were saying unemployment was 15%,,, and these were the last ones to be laid off, and were also the first ones to be rehired when work began again.

The lower paid guys had it worse by far; many of the guys who had been working with very good, verifiable ”papers,” usually purchased south of the border for $500 per set, verified through the e-verify system even, just hung it up and went back home or went totally ”black market cash under that proverbial table.”

Jon, I love your cynicism! I’m quite confident these numbers are all factual, just like the Friday morning jobs numbers. One million, seven hundred thousand jobs created…. I’m terribly sorry. I had to laugh out loud when I read Wolf’s blog. I’m sure there is nothing nefarious happening at the Bureau of Labor Shitistics, either. LMMFAO!!!

So by election time, our jobless rate will look pretty good.

I was off by almost 1 million plus (was thinking 3 million), but hei there’s always next month.

Plus Atlanta Fed’s GDP Now is forecasting a 20.5% bounce for the 3rd quarter.

20.5% “annualized”

Got it, but that’s always been the case with all our GDP figures no? Like it’s really NOT TRUE our GDP crashed 30% last quarter. If that’s true, then annualized it’s 100 and above :)

I am convinced that this market will just keep going up. Why wouldn’ t it?

(1) There is no where else to put your money in this low interest environment (2) The Fed has proven it will back this market no matter what, certainly through the election, (3) Many people are fearful and the market usually climbs a wall of worry, (4) Trading is inexpensive, (5) Many stocks are highly overvalued so they will simply become that much more overvalued. If Tesla can go to 1700 plus, if bankrupt Hertz can sell for so much, valuation simply no longer matters. (6) There is so much money slogging around this economy thanks to the Fed, the market is the only place for it to go. (7) investing based on fundamentals is now dead. So long as a company has good earnings to drive the company forward, the sky is the limit. I have finally learned my lesson. The Fed drove the market way up after the Financial Crises and the same thing is happening now. Will it all eventually come down? Probably….but that can be years from now. Shorting this market, except for a trade, is likely a losing game. Good Luck all.

I don’t agree there is no where else to put your money. People invest in stocks because they are ownership interests in a company that makes money. If you’re not investing for earnings, you might as well just be buying art, Bitcoin, gold, or something else entirely. What you say might be true for the short term, but I don’t think it’s true for more than a short blip.

So the Fed is funding consumption…and (thus?) providing stimulus.

Is consumption stimulus ? Or is life support?

What provoked these questions was a piece on politico comparing now to 2009 and the Fed stimulus back then. It made the point that although at the time it was seen by some as overkill. later most agreed it should have been larger. The implication was that today’s stimulus should also be larger.

My point, put on their comment section:

In 2009 the economy was like a car out of gas and miles from a service station. It needed a few gallons to get there,

Another example, which goes back to the 30’s and the New Deal is ‘pump priming’. As anyone knows who has had to start a pump, sometimes you have to add a little water manually, before it can develop suction.

In both cases, the idea is that ‘stimulus’ is a relatively small investment that can soon be tapered and even paid back as the economy is kick started.

Today doesn’t look anything like 2009. In 2009 a bankrupt airline could be restructured and resume flying. But now how does it do that? How can any amount of debt make an airline profitable if there are no passengers and how can a plane- maker survive if the airlines don’t need planes? How can malls, office buildings, theaters, etc. or one of the largest US employers at 16 million, bars and restaurants, survive long term if people can’t gather in fairly close proximity?

Government money to buy food or pay rent etc. is all very well but surely the term ‘welfare’ is more appropriate than ‘stimulus’.

BTW: the term ‘welfare’ is not intended as pejorative, any more than disaster relief is pejorative to the victims. And please, this is not a call to gather at parties and damn the results.

One point is not to expect much economic growth from this kind of ‘stimulus’.

Not making fun, but how is your short position, Wolf?

Are you still holding? Is your thesis intact?

Fine, yes, yes. It’s down about 6%. Meh (for now).

@ Wolf –

What does Meh mean?

No big deal. Don’t care. Indifference.

BlackRock must be handing all that FED money.

Just watch the chart of BlackRock’s high yield ETF’s chart HYT and other their credit bond ETfs! Any one could ride ride along with them! Recent Qtr their profit was ( I think?) just over 700 Billions!

There’s a blog post by the Martens recently showing the blatant conflict of interest between Jerome Powell’s personal finance management and BlackRock, who also manages the FED’s corporate bond buying facility. One has to wonder how much of the FED’s printed fiat is under management by this particular “service provider”.

The SPVs reflect the amounts. BlackRock isn’t the only manager. There are several others.

Municipalities in general seem to be ignoring the large looming problems of more layoffs, reduced stimulus and decreased revenues. My own small town, 25K, talks about the recovery and ever increasing property and sales tax taking us into the future of more RE development, shopping and Tech jobs….. LOLOLOL ??

Hi Wolf –

What about the absolutely enormous amount sitting in the treasury cash balance ($1.82 trillion)? Maybe for once the market has it right: Congress is going to eventually come to an agreement on a stimulus bill- then when this money gets released, we will continue with the bull market for quite a while until fiscal policy is tightened / liquidity properly removed

https://fred.stlouisfed.org/series/GDTCBW

This money goes into consumption… keeping people and companies afloat that no longer produce anything because they lost their jobs or customers. In my book, this creates demand for products and services by these consumers and businesses that don’t produce, and so this is going to increase consumer price inflation — and it’s already showing up in some corners.

The Fed is devaluing the purchasing power of US $ in order to favor the debtors at a cost to prudent savers. Also has the audavity to claim that they have NOTHING to do with wealth & income disparity! Wow!

This is a direct offense to anyone that’s built a modest savings account by exchanging their time for dollars. The time and effort put to obtaining these dollars is being stolen by the insidious process of central bank engineered money supply inflation. Year in and year out, these earned dollars will be worth less and less.

Moreover, normalization is a Fed lie. It never happened. Yes, $700 billion was contracted from the Fed’s Balance sheet between October 2017 and August 2019. But that was in the wake of a $3.5 trillion expansion. And it was quickly followed by another $3 trillion balance sheet expansion this spring.

The Fed’s real priority was never to reduce its balance sheet. The Fed’s real priority is to keep the Treasury and the big banks flush with cash.

The interest of MAIN street is subordinated to Wall St! Otherwise, everything is hunky dory, right?

I get your sentiment. Unfortunately, with hindsight it is easy to see the “prudent” savers weren’t “prudent” at all. They would have been better off to be asset buyers with debt. I know more than one 2008 debt burdened asset holder in distress at that time who are now rolling in money and net worth. They are quick to say that is because they were risk takers and were properly rewarded for taking the risk and deserve everything they have.