Fed shifts to propping up consumption by businesses and governments, and away from propping up asset prices.

By Wolf Richter for WOLF STREET.

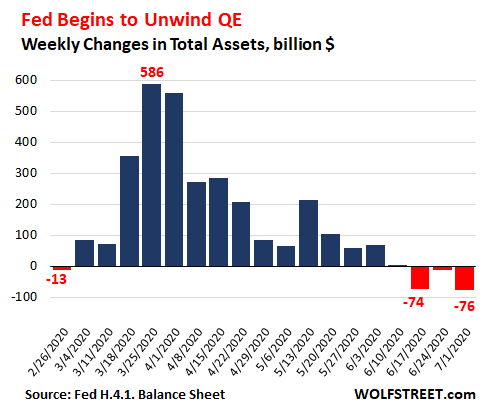

The Fed added some assets and shed other assets, and the net effect on the balance sheet for the week ended July 1, released Thursday afternoon, was that total assets dropped by $76 billion, after having dropped by $12 billion a week ago, and by $74 billion two weeks ago. That three-week drop of $163 billion was far faster than any three-week decline during the official QE unwind from late 2017 into 2019:

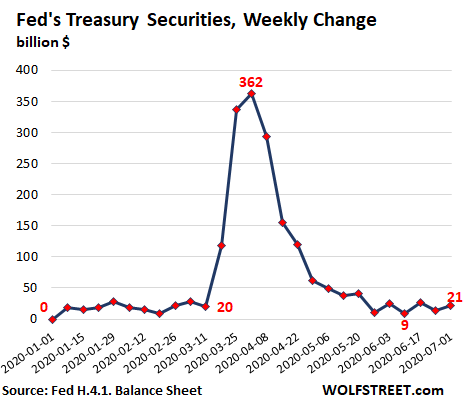

The chart above shows how the Fed front-loaded QE when the crisis erupted, throwing $1.5 trillion at it in the first four weeks, when financial markets came unglued and when credit was freezing up, and when investors in overleveraged hedge funds, mortgage-REITs, and other risk-takers were about to learn a lesson about capitalism – which the Fed’s bailout made sure they didn’t have to learn.

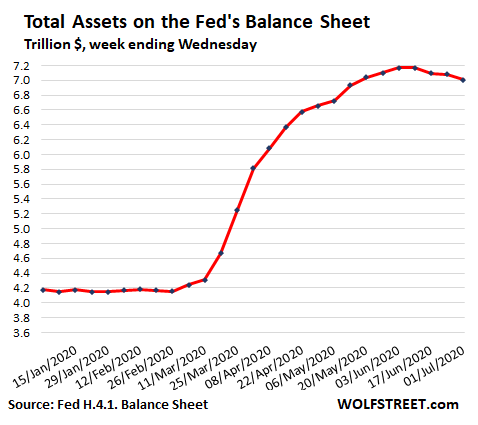

The $163-billion decline in total assets over the past three weeks brought the Fed’s assets down to a still mind-blowing $7.01 trillion.

The curve in the chart below shows the sudden ramp-up, the fairly quick taper, and then, over the past three weeks the drop. This was planned from the beginning: Give it all up-front but don’t let it drag out for years as last time:

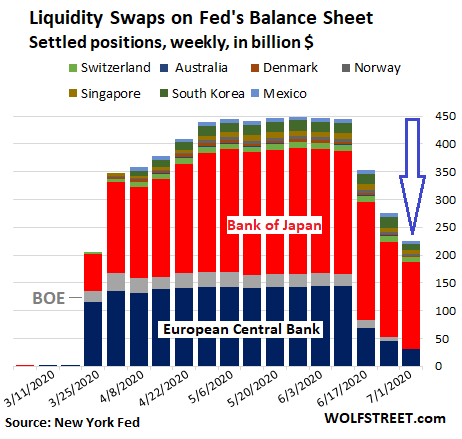

Central-bank liquidity-swaps dropped by $50 billion.

The Fed’s “dollar liquidity swap lines” with other central banks fell by $50 billion in the week ended July 1 to $225 billion, the third week in a row of declines. They have now dropped by half over those three weeks.

To enter into a swap, the Fed lends newly created dollars to another central bank and takes their newly created domestic currency as collateral. The swap lines drop when swaps mature and the Fed gets its dollars back. The fact that maturing swap aren’t rolled over into new swaps shows that other central banks don’t need the dollars any longer:

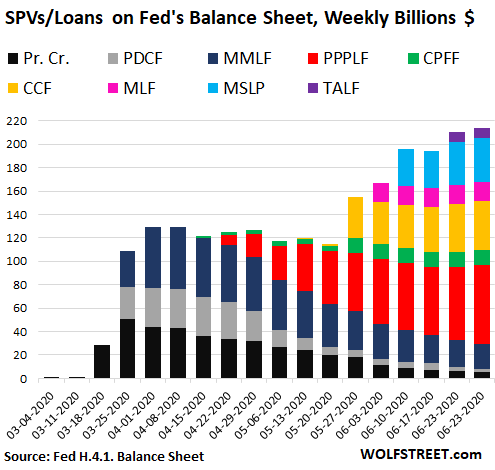

Fed Alphabet-Soup of SPVs & Loans edged up by $3 billion.

The Fed has by now created a bunch of these Special Purpose Vehicles (SPVs), that, as it says, are authorized under Section 13 paragraph 3 of the Federal Reserve Act, as amended by the Dodd-Frank Act, which is why Jerome Powell calls them “thirteen-three facilities.” The first line, Primary Credit, contains loans made directly to lenders:

- Primary Credit (Pr. Cr. on the chart below)

- PDCF: Primary Dealer Credit Facility

- MMLF: Money Market Mutual Fund Liquidity Facility

- PPPLF: Paycheck Protection Program Liquidity Facility

- CPFF: Commercial Paper Funding Facility

- CCF: Corporate Credit Facility: SMCCF (Secondary Market Corporate Credit Credit) and PMCCF (Primary Market Corporate Credit Facility)

- MSLP: Main Street Lending Program

- MLF: Municipal Liquidity Facility

- TALF:Term Asset-Backed Securities Loan Facility

The Treasury Department puts equity capital – taxpayer money – into each of these SPVs as loss protection for the Fed. The Fed lends to the SPV at a leverage ratio of 10 to 1. The SPV then buys securities.

All those SPVs combined now carry a balance of $214 billion, up $3 billion from a week ago. The largest are:

- PPPLF (red column in the chart below), which buys PPP loans from banks. It grew by $6 billion last week to $68 billion, accounting for 32% of the total alphabet soup.

- CCF (yellow) rose a smidgen to $42 billion, accounting for 20% of the alphabet soup. This SPV buys corporate bonds, bond ETFs, and corporate loans.

- MSLP (baby-blue) remained flat at 37.5 billion, accounting for 18% of the total. This SPV buys loans from banks that banks have extended to small and medium-size businesses.

- MMLF (dark-blue), the money-market bailout SPV, has declined from $53 billion in early April to $21 billion now, accounting for 10% of the total.

The big three SPVs and loans in March are fading away. But new SPVs have sprung up. The latest creation is the resurrection of TALF two weeks ago (top purple). It has stayed flat at $8.8 billion. This SPV lends to investors against asset backed securities, such as subprime credit card ABS and other structured assets on a non-recourse basis. If this bet blows up, investors wash their hands off it, and the SPV eats the debris.

But the astounding thing about all these SPVs is this: After three months of ceaseless hype in the media about the hundreds of billions of dollars each would purchase, amounting to trillions of dollars in total, those SPVs now only hold $214 billion in assets combined. By Fed standards, they just haven’t bought much:

Treasury securities rise by $21 billion

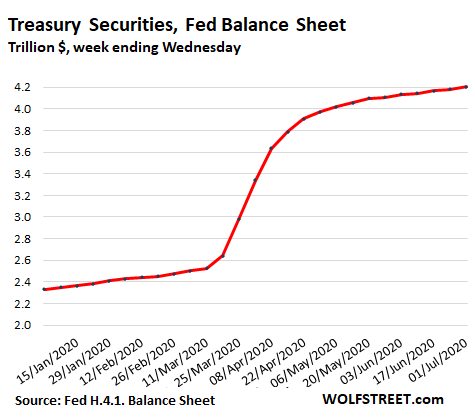

The balance of Treasury securities rose by $21 billion during the week, to $4.2 trillion. Over the past six weeks, the balance increased in the same range between $9 billion and $26 billion a week. Note the front-loading of QE:

The curve of the total amount of Treasuries on the Fed’s balance sheet has gone from crazy-steep in March and April back to the same slope that it had in January and February before the Everything-Bubble bailout mania:

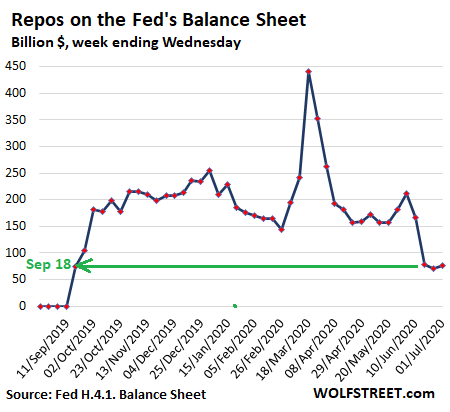

Repo balances ticked up $5 billion, still at Sep 18 Low.

The Fed is offering theoretically huge amounts of repurchase agreements every day, but it has made its offering terms less attractive, and now there’s little appetite for them. What’s left on the balance sheet are mostly older term repos that disappear when they mature. And few are getting rolled over. The total repo balance ticked up by $5 billion to $75 billion, after having dropped by $8 billion last week, and by $88 billion the week before:

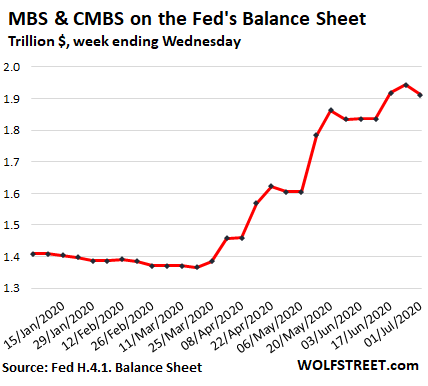

MBS dropped by $32 billion.

Mortgage-backed securities – by their nature – are an erratic element on the Fed’s balance sheet for two reasons.

One, holders receive pass-through principal payments as the underlying mortgages are paid down or are paid off. The current boom in refis due to record low interest rates has created a torrent of pass-through principal payments that reduce the Fed’s balance of MBS, and the Fed would have to regularly buy a big chunk of MBS just to keep the balance level flat.

Two, MBS trades take a month or two to settle. For example, the MBS the Fed bought at the end of June will settle in July and August. And the Fed books MBS trades after they settle.

On this week’s balance sheet, MBS fell by $32 billion, to $1.91 trillion, not because the Fed sold MBS – it doesn’t sell them – but mostly because of the pass-through principal payments, which gives you a feel for how big they are from the $1.91-trillion portfolio.

The Fed continues to buy MBS to replace the pass-through principal payments, but the settlement dates a month or two away never match the pass-through principal payments. So you get this erratic chart below. The Fed’s huge MBS buying binge in March didn’t show up on its balance sheet until April and dragged into late May, by which time the Fed had already drastically slashed its MBS purchases. The purchases now showing up reflect trades of a month or two ago:

I didn’t expect the Fed to start unwinding its balance sheet this soon. When I first started pointing out on April 9 that the Fed was drastically cutting its massive QE binge, and as I kept pointing out this trend, I expected the Fed to bring the growth of its assets to zero, as it had done in January and February this year, after the repo market bailout – in other words, that it would only buy enough to replace maturing securities and pass-through principal payments, with no net-change in the balance of its assets.

But now, we see this QE unwind: $163 billion in three weeks is far faster than anything in the period of the official QE unwind that started in late 2017 and lasted into 2019.

And we see a shift – much of the new activity is geared toward propping up consumption by businesses and governments – the PPP facility, the municipal liquidity facility, the main-street lending facility, etc. – rather than propping up asset prices.

Here are the 84 companies whose bonds the Fed bought, and the 16 bond ETFs it now holds. Read… Fed Discloses it Bought Tiny Amounts of Corporate Bonds, Including a Whopping $15.5 Million (with an M) in Junk Bonds

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The Wolf Theorem of shorting the market is still intact.

I am not that brave. But I am selling winners and adding to the dry powder pile.

“But now, we see this QE unwind: $163 billion in three weeks is far faster than anything in the period of the official QE unwind that started in late 2017 and lasted into 2019.”

If you were a Millennial on Robinhood, you would be dumping the losers at a loss and trying to HODL with the winners.

Went back and looked at market cap to gdp ratio back at bottom in 2009 and present. Ratio is 2.5 times higher now. In other words people are willing to pay 2.5 times as much basically for a unit of sales as they were only 11 years ago, even with a pandemic going on. I think the ratios are 0.67 then and 1.55 now. A new record high.

I see inflation quickly on the rise as businesses add in extra costs of this Pandemic on health and food costs.

I see deflation, as fewer consumers have enough funds to buy things. The higher production costs for complying with the extra costs of operating during a pandemic will mean businesses shutting down because they can’t turn a profit, leading to more job losses and more businesses going under.

A consumer economy only works when there’s enough sales volume to support economies of scale on the production side. Assembly lines aren’t profitable if there’s insufficient demand for the goods being produced. It looks as though we’re heading for an accelerated shift to a Malthusian future, where few have jobs, and goods are made to order at high cost.

The least costly and effective place to put a stop to the spread of a virus is at the borders of a country. Did you already forget how the democrats almost lost it when Trump finally started to shut down incoming flights and talk about quarantining folks coming inside our borders? But in the end whether sooner or later this virus continues to spread quite effectively all over the world no matter how wise or clownish their leaders are.

Really, just simply childish comment. Adds nothing to the pool of knowledge of Wolf’s articles, which is why we subscribe.

Agree with inflation coming eventually J,,, but only after the deflationary period that RA suggest comes first.

As someone wanting to make a very safe investment for long term, (been thinking tax free municipal bonds so far,) my question and IMO THE challenge is to anticipate the timing and extent of both.

Another challenge for this approach is to determine if said muni both can and is likely to go into some form of BK that will wipe out their bonds.

Any additional insights with regard those three factors — or others — for/of/about tax free muni bonds will be appreciated.

Thank you

The thing with bonds is that they are the most expensive they have ever been. Might be better to look at an asset that is way off its highs.

I’ve read that up to 25% of all restaurants, for example, will go out of business this year. Even fast food places are closing – for example, the local Burger King shut down for good last week with one day of notice for its employees and customers.

If this is a good indication of the ongoing decline in commerce in most municipalities, then tax revenues are going to crash by perhaps as much as 25%. There could also be a positive feedback loop, where businesses shut down for good because nobody is buying anything, and their workers lose their jobs and then quit buying stuff, and it’s ‘rinse and repeat’ until the economy bottoms out.

It’s not clear that municipal bonds are ‘a very safe investment for the long term’ if the tax base that generates the money for those bonds evaporates. If cities need to issue huge additional amounts of debt because their revenue crashes, then either the Fed monetizes that debt by buying lots of munis, or else interest rates increase and existing debt falls in value.

The major problem with investing today is that you are, in essence, guessing what the Fed will do next and trying to front-run the Fed, rather than using the actual economy as a guide for your investment decisions. The real economy has little to do with finance these days.

what state is the bk in?

The BK is in PA.

Amen as to necessaries. Of course, as UI benefits cease and Americans face the likely health insurance premium increases, they will have less funds to buy any luxuries or even things that are not absolutely necessary for survival. Most Americans now have lives in which they cannot afford to pay for a $400 emergency, face stagnant wages constantly reduced by the “Federal” Reserve’s efforts to create inflation to help banksters, and face ever-increasing health care costs, because Wall Streeters will block any reform.

Meanwhile, like intelligent rats, who realize that their ship is sinking, trying to quickly grab and eat last of the cheese, the “Federal” Reserve and its banksters have been trying to transfer the remaining portion of Americans’ wealth to themselves and their cronies via ultra-low interest rates to their insolvent corporations, junk-bond buying, SPVs to bail out the banksters risky investments, etc. Massive corruption has stolen the American Dream. See Simon Johnson’s “The Quiet Coup.”

We are reaching limits. E.g., reportedly by 2025, interest payments on the acknowledged, federal debt will exceed the defense budget. High national debt has been recognized for decades as imposing severe negative pressure against a nation’s economy. The US also has other liabilities that are estimated to be over $200 trillion. We are likely to become like Japan, with a lost decade, if things continue as they are.

‘…those SPVs now only hold $214 billion in assets combined. They just haven’t bought much’

NOT yet. Besides, when Jaw boning is doing that job very effectively than actual buys! QEs are NOT yet done deal at this point, c19 spikes coming back.

It dumped 3 Trillions in March to support the asset prices, with record reversal of 35% Bear in less than a few weeks, in mkt history. The pending defaults in CMBS has been postponed for a while, but how long?

We all know Mkts are disconnected with the economy, on the ground. Fed has shown more zeal in supporting asset prices than the ‘real’ economy. Trillions went into Wall St compared to around 500 B+ to the main street!

Correct me if I am wrong.

Nothing has settled either in Wall St and or the Main street, as of now!

I realize everything has a context, but:

“…SPVs now only hold $214 billion in assets combined. They just haven’t bought much…”

In what alternate reality is $214B “not much?”

Sure makes JBOD (Joe Bag-o-Donuts) feel small.

Sadly in the one we’re living in Beardawg… Soon Trillions will be everyday figures too, and we’ll move on to quadrillions as the yardstick.

These numbers are beyond our ability to readily mentally envisage, anyway, so if they translate into stacks of notes reaching to the Moon or to Mars or to Alpha Centauri, they’re beyond our intuitive grasp and just become some big numbers that we adapt to on an ongoing basis. And sums that are smallish fractions of those large sums become small sums.

Sometime we’ll maybe have to be buying our groceries for those sums, however, once enough of the stored up debts start to need to be liquidated into consumption in large enough amounts… Then we won’t be quite as blasé about it all, I guess.

Some of this comes to a head by August when the additional $600/week in virus stimulus is withdrawn from those 13+million unemployed at the end of July.. It may happen even sooner if people start conserving rather than spending.

I keep hearing/reading how Jpow is smart. He was also anti FED balance sheet before he got the job. He could be having cold feet and maybe even having some aw shit moments?

Why should he have s*** moments?

Did you see him on 60 min interview at CBS, couple weeks ago? He had absolutely qualms about creating Digital $ out of of thin air to infinity! He said we can pay them in ‘later’ years! He is absolutely NO different than his predecessors including Greenspan, Barnake and Yellen. None of them have scruples of any sort! Just serving the top 1%!

He had reservation and admitted on record in 2013 FOMC meeting re QEs but forgot all about it later. they all are shamelessly hypocrite and intellectually dishonest just like politicians of either party!

Sadly I rely on covid 19 to get the RESET needed out of all these insane decisions of our CBers!

Serving the top 1%? Jerome is part of the top 1%. He’s serving himself and the others in his caste benefit along with him.

Agreed

New All Time Highs… MSFT, AMZN, PYPL, etc……………………………..

Craziness at all-time highs, is that what you’re trying to say?

I certainly wouldn’t want to short the market at all-time lows, for sure :-]

It’s my understanding that valuation has no real predictive power on overall stock returns til you get out past five years. That means you have to use something else for a short term bet. I know you mentioned you were using Fed policy data. Wondering if you have fast and hard rules or it’s part hard data and part intuition?

I know Hussman uses different measures of what he calls dispersion of risk assets to go long, neutral or short. In other words he is trying to determine how risk adverse the market is at any given time.

I tend to just be valuation investor which means you are going to be wrong most likely for a long time.

‘Valuation’ is hard when the FED is the mkt and price discovery has been suppressed since ’09!

Old-School,

I agree with sunny129 that, at this stage, valuation is a tricky game when there is no real price discovery because the Fed inflated and distorted the markets. So it’s the Fed that matters. Don’t fight the Fed. Sooner or later, the markets react to the Fed.

I refuse to accept traditional price discover has gone the way of the dinosaurs…so i am carrying my short. Perhaps my investment will go the way of the dinosaurs lol.

Ray Dalio had an interesting interview on bloomberg a few days ago. This very topic was covered and I agree with the majority of his thoughts, but i still find myself in a state of melancholy when i hear these talking heads stating “the fed is doing the right thing.”

Reality – there is no price discovery in markets where the fed is active.

If I had to guess and pick one bearish factor amongst Covid wave 2, Q2 earnings, Fed behavior etc., I’d say this Fed pullback is the driver of the WR short. :-)

It’s time to start shape guessing for the second graph (Fed’s total balance sheet):

will it be inverted “Z”, “2” or other curiosity.

♾?

Wonder why MSM haven’t brought out flipped J shape..i think that’ll be a pretty realistic scenario.

An upside down cane, or a hollowed-out paddle ..

none of which are very effective, where velocity is concerned.

‘;]

Thank you Wolf for another Great Article!

IMHO, in this case, the FED is doing what needs to be done to save us from irrational crashes in stocks and bonds.

It should get out just as fast as the economy and market recovers. Even get out faster than the market recovers and let the Free Markets determine pricing again.

The Fed should be like Welfare. Only used in extreme cases and then removed. It would have prevented a lot of irrational pain in 2008 if it was applied quicker.

It is, but should not be used to prop up markets to aid political campaigns long term.

It is good to see it is being removed. Maybe not fast enough but it is in the right direction.

Everything the Fed does should be short term and then dissolved.

That’s the issue people who own assets don’t want the market to price them now that they own them. The wealth has been distributed and everyone is happy bow things are!

Yeah, whilst those ball bearings – young know, the 80 some odd % .. SooN to be the 90+% .. that Actually MAKE/PRODUCE Stuff, doing all the yeomen work .. when they have any, as they roll on, wearing away …

‘Behold the future, All you GRUBS!’

Signed,

The Percentaged few Thousand

If investors don’t face any risk, then they should pay the same tax rates as us wage earners.

I agree, but they should have been anyway. The double taxation should be reformed on cap gains and everybody pays the same rates period. While they are at it lower the rates overall and then put the fed out of business.

“Everything the Fed does should be short term and then dissolved.”

Ya! I’m skeptical. Didn’t this start almost ten years ago? What’s your definition of “short term?”

good summary bob,,

been saying exactly that since i was blind for a while and the welfare of the time helped a bunch to get me back on track….

IMHO, all these things of the supports for WE the PEEDONs have their place in the world we live in today,,, but only in place of the family and churches of yesterday, that could and should be not only promised but actually put in place for any kind of a ”rational” world to proceed from here…

Please understand that no matter how much any guv mint promises,,, most, if not all of those promised bounties will go to provide even more corruption at every level of guv mints everywhere…

Please get this clearly, and communicate it clearly to all the people your love,,, otherwise, they, will succumb along with all the others who do not understand this basic principle…

thank you

Thank you

‘the FED is doing what needs to be done to save us from irrational crashes in stocks and bonds’

LOL!

That’s exactly they did since GFC, instead of addressing the underlying structural imbalance in our Financial and Global banking system, which brought the housing bust and the sub prime mortgage scandal

They just masked all those problems with repeated, insane credit infusion since ’09! Barnake was hailed as ‘hero’ for ‘saving’ the economy!

Remember this is the same gang who brought us already TWO boom-bust cycles in this century. They created the the current, 3rd largest bubble ‘everything’ bubble as a ‘CURE” to the previous two.

DEBT has been used as a panacea for all our financial problems, private/public, all over world wide! Global debt grew 50+ or more to 255 T since ’09. The collateral for that global GDP is around 100 T.

Now, you think they did the right thing again, with the same tools – More Debt will cure the ills brought upon by debt!

WOW!

Yeah, i had to laugh too, good thing people like this are on the other side of my tail risk position :P

Been in the mkt since ’82. Retired over 15 yrs. I have gone thru more than one BEAR. Lost nothing during GFC! MY livelihood for the rest of my life is guaranteed. Trading is just one of my hobbies during retirement. Read voraciously and enjoy it!

I am nearly 50% in cash. Employ more ‘tactical; trading (using options as RISK management tools) than my earlier structural/strategic investing.

AS a seasoned investor I have learned live and trade with risk-adjusted returns since 2000. As option trader I trade both ways of course with hedges, including taking TAIL-RISK. Part of game between Bull vs Bear!

Good luck!

If stock prices drop back to sane P/E ratios, is that irrational?

Irrational crashes. How about a totally dislocated crash up. Which is actually a much higher risk for a “ dislocation “ low. The fed has prevented a free market and price discovery for years. Investors will pay for this as in 2000 and 2008. Markets will eventually return to the level of breakout in 2016. Which contrary to any hysterics still leaves the indexes in a huge bull market. This is how parabolic insane it is.

Good luck to your short Wolf. I think a retest at a higher low in August.

Welfare is in the 5th generation. Do you mean short term help like that?

Bob,

It’s questionable whether the Fed should exist at all. It would be better if it was abolished. Considering how harmful it’s activities are in and after moments of crisis (for which, they are often partly responsible for), but, still congress needs to authorize other government organizations to give out loans and money to the average people and businesses. It really makes you question the purpose of the Fed’s existence. It’s very clear the Fed is a tumor on America. But, the 1% have learned to feed off of said tumor.

TR,

“feed off” is a more polite term for the very clear stealing/theft that the Fed actually performs FOR the oligarchial folks who OWN the Fed.

According to the theft that I have personally witnessed in the last 60 years or so, there is no doubt in my mind that the constant and continuing theft is the desired outcome of the actions of the Fed degrading our money.

This can best be illustrated by my memory of bread selling for 10 cents a loaf — for a 24 inch loaf of white sandwich bread, the most common ‘store bought’ type when I worked at supermkt in early 1960s — and not just once in a while.

I have read that bread was available in 1907 for ONE PENNY!!!

Clean House, Senate too, each and every election is the only way to have the puppets/politicians beholden to the people and not totally/onlythe servants of the rich folks.

I just got a letter from the state of NC. Employment Security (Dept of Commerce) stating that as an employer I get a U.I. Tax credit for Q2 equal to payments made in Q1. Also any outstanding balance due from Q1 are forgiven. Sounds like NC is anticipating to stand in front of a fresh spray of the Money Printer going brrrrrr…..In order for the Fed to cut 7T in half at the present rate it will take about 62 weeks. That’s assuming all damage and future damage by C19 is in and the recession has been fixed to boot and Zombie Corp Bonds are A++ or just don’t exist and un-employment is fixed and demand destruction is a fable. The pot o’ gold at the end of this Fairy Tale rainbow is 1/2 of 7T , which puts us back about where the Re-Po surprise put the whole thing in motion , excluding the C19 surprise. The Fed needs to start its Thursday balance sheets out in big block gothic letters that read . ONCE UPON A TIME….

Your note about the rate of expansion is prescient. The Fed wants to inflate the monetary base, gradually. Prorated money supply gains is what keeps a bid under stocks. This will be difficult when government hits the deficit brick wall later this year, and the Fed has to add another trillion of monetized debt. Benchmarks fall like confederate statues. Employment can remain low until corporate America has made the transition. Fed is changing their balance sheet mix, but this is consistent with YCC. They have to extend QE to keep the banks solvent and keep the upward bias in asset inflation. A lot of that expansion was jawboning, and short duration securities. Their world is one big REPO market crisis after another. Equities drop, corporate bonds collapse, YCC is the only answer.

That is a sad scary scenario.. One mistake or unforeseen event and it is all over?

Have you read the theory of ‘UNINTENDED’ consequences of a poorly thought out, planned decisions in human history?

For each DEBT there is a creditor on the end, be that be a landlord, lending institutions, including banking(+shadow banking) hedge funds, MFunds, pension funds( state/private), insurance Cos and all kind of investors (retail/institutional) ++ Worldwide!

When the Govt tries to manipulate/distort/ defer/delay the payment structure of debt from borrowers to lenders, there are unforeseen ‘unintended’ consequences, which they have to face in the coming months!

Paraphrasing Mike Tyson ‘ every one has a plan, until you get unexpected jab on your mouth’!

( Been in the mkt since ’82, gone thru more than one bear, seen it, been there and done it, too!) But nothing like this surreal bull mkt of my life time!

Covid 19 is unraveling it and challenging Fed!?

For each debt there is NOT a creditor on the other end. There is a name. Treasury issues a bond, a cusip number, and it must have a name in order to monetize the debt. That name could be yours? You may wake up one morning and find a 70K T bond in your account. (Your share of the debt). The bond is an asset which cannot be sold without harming it’s value, therefore a liability. Their only manipulation is giving us a free pass on tax revenue in order to fund spending. When they stop kicking the can the can stops at your house.

@ Ambrose Bierce

The comment is addressed at the ‘PRIVATE sector’ and NOT the PUBLIC sector where the Fed is the lender, which can print digital money out of thin air to infinity- MMT in the near future!?

Fed can support the private – Corp CREDIT mkt indirectly by buying bond- ETfs! How long?

What about other segments of our Economy – Auto loans, CC loans and student loans ++

I appreciate these periodic reviews of Fed balance sheet activity–especially with the information about what they mean.

Of interest to a non expert such as myself: a little more detail about what some of those SPV’s: example, what exactly is PCCFF :primary credit. Perhaps a one or two sentence description–like the four you did define.

Can anyone tell me what the end game for all this is? The fed got away with a mild version of this in 2008 by pumping up a second asset bubble that juiced growth ( on paper anyway) enough to keep the debt and janky finance from swamping us, but what about this time? Does anyone think there is another bubble waiting to be blown, or is it just ,” run the sucker till the engine blows.”

Remember this is the same ‘gang’ ( Greenspan, Barnake, Yellen and noe Powell) who brought us already TWP boom-bust cycles in 2000 & 2008. All CBers are complicit now. They are trapped by design of their own making. For any financial prob debt was the answer. With no outrage from Public/Congress, or accountability, they kept at it, without 2nd thought!

They created the current, 3rd largest ‘ everything’ bubble, as a cure to the previous ones by creating insane credit creation. DEBT on debt has become the panacea for all our financial problems (private/public) world wide, unlike limited to tech bust – dot com and housing bust.

All bubbles ultimately burst. For this one, looking for a pin, Covid is/was the answer – a kind of BLACK SWAN, landed.

How long this ‘circus’ can go on, is any one’s guess. Every one is in denial of REALITY and want to kick the can, down one more time, just like last time!

How is not the Fed propping up asset prices if it keeps interest rates at zero?

I guess the Fed’s goal is to deal with the short term and Fiscal policy should deal with the long term. My understanding is in theory if real rates are zero then that allows a lot of bad projects to be done that will destroy the capital base and productivity in the long run. Supposedly the beauty of individuals deploying their own capital vs central planning is that we will try to ensure we make a reasonable profit.

With the Fed supporting assets to keep the wealth affect going and confidence high they lull the speculator into thinking the Fed can backstop the market. I am told that when panic hits, the Fed is powerless. I don’t know for sure if that is true, but I think normally the Fed is trying to stimulate all the way down.

The Fed can always do another SPV to do “whatever it takes”.

SPVs are starting to sound like our Special Forces.

Fed and the Int RATE

Friedrich von Hayek won the Nobel Prize in 1974 for articulating that interest rates, like other prices, should be set by the market rather than central planning committees.

With each wave of artificially low interest rates, generating ever more distortionary monetary effects, bond quality has fallen concomitantly, as shown by OECD research in 2019. We are now at the stage where low-quality debt, rather than being the exception, has metastazised through much of the economy. This is reflected in the growth of Zombie Cos from 2% in 1980s to 12% in 2016 ( BIS) and now probably 15% to 20% of S&P!

Artificially low interest rates send false price signals to markets: debt goes up, savings go down and resources are directed from productive uses to more interest rate-sensitive, debt-fuelled sectors (including, of course, financial speculation). The virus was not predictable, but what is happening to the economy is entirely predictable. Sooner or later something was going to burst the bubble.

Just two generations ago governments in Britain, the US and elsewhere engaged in widespread price-fixing including fuel, wages and consumer goods. The abject failure of those policies was a painful lesson to learn, but the most important lesson of all will soon be delivered—interest rates, like other prices in a capitalist economy, should be set by the market rather than by central planning committees.

h/t Max Rangley (the Cobden ctr)

The theory is wrong simply because if you allow the market to set interest rates, they will be forever low. Much like we are seeing today. Free money trumps the theory without question.

“Oh no! Interest rates went up 1/4%! I’m going to have to pay some interest on all those millions I borrowed! But I already spent it at the track! What am I going to do? Won’t someone care about the over-leveraged millionaire in these tough times?” Quoth Richard von Cranium III.

‘Much like we are seeing today’

Wrong!

The price of capital has been kept LOW, artificially by Fed/CBers since ’09 at a cost to productive economy. Zombie Cos allowed to thrive at a cost to those prudent and efficient!

It also favors the debtors over the savers. Capital over Labor (debt slavs) and Asset bubbles. Insane credit creation and financialization of the Economy has led to rich getting richer and increase in wealth & income inequality, unlike any time in the past!

In USA, top 1% own nearly 50% of Wall St wealth, top 10% – nearly 90%. Bottom 90% – less than 10%

World wide- top 0,7% own 45% and the top 8% own 88% of global wealth!

Social upheaval on the way!

@ Fat Chewer

FYI

Friedrich von Hayek won the Nobel Prize in 1974

for that ‘THEORY’

So he is wrong and the unworthy of Nobel prize? Wow!

Did you read the comment completely?

October has always been a cursed month for stocks, looks like this October is lining up to be especially full of risks.

A,

That is what I thought, plus I wonder if someone is doing some ear whispering to ensure the election goes just one way to remove an ongoing crisis from public office?

Finally the Fed is micro-managing the markets. Over time they should get it as perfect as the yield curve. A permanently high plateau. We shall all be equally broke.

Hussman has an interesting chart that shows the anticipated 10 year returns for five different US assets: t-bills, 10 year treasury, utilities, corporate bonds, sp500.

Sp500 was negative annual returns, t bills, bonds and utilities under 1%. Highest was corporate bonds at around 2.5% annual return. Maybe the Fed thought there was a little more risk premium they could squeeze out of that asset to bring some juice forward and then there would be no where to go for a return until a correction occurs.

Credit mkt is the foundation upon which Equity Mkt ( and debt based Consumption Economy) in US and all over the world for the past 20-30 yrs.

So Fed is directly supporting the Corp credit mkt now by purchasing IG grade, HYG and JUNk grade bond- fund ETfs like LQD, HYT, JNK, SLQD, SJNK.

Blackrock is their official purchasing agent! Look at the chart of their Corp high yield ETF- HYT. if you didn’t get this hint in late March and repeatedly by Fed announcement, you are kind of late. Check out ALL the charts ofETFs of Corp credit Bond ETFs issued by Blackrock – ishares.

ZH and also wolf street published the lists. it is/was open secret!

when the defaults of CMBS come later a few months, I wonder how much more Fed print and increase it’s balance sheet beyond 7 T into 10T or more!?

Wait and see

That doesn’t really support those markets though. Cash flows do. I suspect the US corporate bond market is going to be destroyed by officials after this crisis. Will look much more like Europe which does not rely on bonds nearly as much.

Read somewhere that stock market has stopped being a derivative of fundamentals and is derivative of Fed policy. If you add Fed balance sheet expansion, plus federal government deficit plus interest rate reduction we must be at the equivalent of 25 – 30 trillion in stimulus to grow real gdp about 1% per capital per year. Might have been better to have done nothing and let the economy adjust to market supply and demand.

@ Social Nationalist

Where does that ‘cash’ flow come from?

If Corp credit mkt tanks, so will be US Equity Mkts! The END!

Eu Banks are nearly bankrupt. So are their Sovereign Bond Mkt. They have NOTHING like Corp credit Mkt compared to US!

It wont be “The End”, just the start of a new cycle, probably inflated by more debt money, from way lower prices after the 85-90% of the HY corporate bond market gets wiped out (and takes equity with it) due to it being unsecured when most of these corporates have effectively no cash flows or negative cash flows.

Sure, you been in the market since 82′ but you can’t ignore the internals: in 2008, HY was 40% unsecured, today its 90% unsecured.

I’ll say it again: it matters not if Jerome buys at prices greater than zero from insiders dumping, when these corporate default, these bonds will go to zero, even while on FRBNY balance sheet. No matter what central banks do, there will be a washout, it’s always been that way.

@GotCollateral

‘ in 2008, HY was 40% unsecured, today its 90% unsecured’

true.

-Fed had NEVER bought any kind of MBSs, in it’s entire history(since 1913) until March of ’09!

-QE was NOT born of any research or previous record. It was just from ‘the seat of pant’ response, from Mr. Barnake. When asked, he was unable to explain(theory) but claimed it works in practice

-Price discovery was allowed before March ’09 under Free Mkt Capitalism – NOT any more!

– There was never been a suspension of MKt to MKT accounting standard before. Fantasy accounting was adopted, with the complicit of Congress, to save MBSs loss for Banks.

-There was no ‘stimulus or twist and what not, before!

– Buy-Back shares was ILLEGAL before 1986

My understanding, learning and practice of ‘Investment MATRIX’ went upside and the fundamentals mean zilch, once, Fed killed the true traditional Free Mkt Capitalism and replaced with Crony or shareholder capitalism.

That’s why I call this SURREAL Bull mkt of life time! No rationality or logic in the stock values once the FED’s PUT

became forever! Mkt is in’ LA LA’ land

Now, FED is the mkt!

> -Fed had NEVER bought any kind of MBSs, in it’s entire history(since 1913) until March of ’09!

And? One asset swap for another at a time where most people who had exposure already got washed out. They were buying trash all the way down from sept 08.

> -QE was NOT born of any research or previous record. It was just from ‘the seat of pant’ response, from Mr. Barnake. When asked, he was unable to explain(theory) but claimed it works in practice

The japanese have been doing this much longer, and still no where near their bubble peak, people all in before were wiped out or still down in their long term portfolios.

>-Price discovery was allowed before March ’09 under Free Mkt Capitalism – NOT any more!

There have been many series of government intervention in markets before March ’09, and that has never stopped crashes from happening throughout history.

> – There was never been a suspension of MKt to MKT accounting standard before. Fantasy accounting was adopted, with the complicit of Congress, to save MBSs loss for Banks.

> -There was no ‘stimulus or twist and what not, before!

> – Buy-Back shares was ILLEGAL before 1986

And the funny thing is, global banks balance sheets have SHRUNK since 09, becoming less and less important in the allocation of resources in a society. Is it unfair they get to be bailed out time, and time again? Yes, but they only hasten demise in importance in time, as those who don’t have access to CB debt money trough like they do are effectively locked out of traditional debt markets unless they want to accept +20% interest rates.

> My understanding, learning and practice of ‘Investment MATRIX’ went upside and the fundamentals mean zilch, once, Fed killed the true traditional Free Mkt Capitalism and replaced with Crony or shareholder capitalism.

> That’s why I call this SURREAL Bull mkt of life time! No rationality or logic in the stock values once the FED’s PUT

became forever! Mkt is in’ LA LA’ land

> Now, FED is the mkt!

I guess that I never subscribed to the traditional notions investing or trading even though I’ve worked for places and coded models and systems that supposedly do. I rather let other people throw their money in typical 60/40 allocations and subjected increasingly sharper tail risk scenarios because the fragility and excess in the system is not allowed to be drained naturally and find exposure to the cheapest ways to benefit when those tails start to show up.

@Gotcollateral

I am unable to discern whether you are agreeing or NOT, with my observation with re Fed’s policies!

I have positioned my portfolio (50% cash) both for Deflation and inflation scenario- diversified with uncorrelated assets, short&long, with div paying ETFs-corp bonds, div paying Equity ETFs in various sectors world wide. More tactical trading with options++ than my previous strategic/structural investing. Retired 15 yrs ago.Been in the mkt since ’82.

THIS TOO SHALL PASS!

If instead, the Fed just directly purchased the stocks and assets that Powell, the rest of the Federal Reserve members, Nancy, Mitch, Shalala, Mnuchin, Trump, etc owned, there might be no need to pollute the entire rest of the economy with QE and ZIRP.

Another thing:

Extending loans to local governments it’s especially stimulative because the funds have to be paid back. Or not as stimulative as a direct gift funded by Federal spending which Powell finances with his Fed printing…like he does for Powell’s own stocks, Federal Reserve members, Nancy, Mitch, Shalala, Mnuchin, Trump, etc.

Getting local govt onto the addictive debt treadmill opens the door to privatization and crapification of govt services at way higher costs down the road, being administered by Zombie like companies and those of the corrupt corporate monopolistic crowd the Fed is subsidizing.

You’d almost think it’s all been planned out that way.

Anyone who’d read the MadAddam dystopian trilogy gets it, as anagalous to what you just described, timbers ..

It’s has All the makings of the veritable, insinuating ‘CorpseCorp!’ .. who had a wantonly corrupt hand inside EVERYONE’S pocket. And if you could pay, well….

I think Margaret was quite prescient about ‘trends’

Being a gambling man I often look for things that people don’t see. The classic for me was Brexit and Trump where , here in the Uk, I managed 8 to 1 on both bets.(yippee for me) What did I see? Well,(with Trump and Brexit) polsters going up to people and saying that, for example, I look at what is going on in the USA and think, they can’t come out with the same line……but they do. Same for the Fed and this virus but I have a bit of a twitch this time. My gut is telling me that something is not right and that there is a plan out there, that I can’t yet see.. All my betting instincts are screaming out that somewhere, someone is playing us all and that the real Black Swan event has yet to come. I would’t be too surprised, for example, to see a massive fall in the USA stocks somewhere around the end of September..( for whatever reason)

Now, for the election, at just 2.8 for Trump to win(Biden 1.71) there is no value anywhere this time. On top, too many markets look like they are run by the old mafia numbers game and so I can see why the Wolf has gambled by shorting. I feel he may win his bet.

I feel the same way. To me, it feels that we are all in a giant drama play, especially this year. I don’t think we have come to the real event that will become the hallmark of this grand play.

I bought Oct SPY puts at a 303 strike two weeks ago. I think there will be another act in this drama within that time frame.

Also a gambler at heart – spent too much time with vietnamese while younger. I also drink heinekin and smoke cigs more than I should.

Is the Fed going to buy up the Reparations Bonds so they dont hit the credit market?

Hussman has the theory and data that low treasury yieldss should not mean higher stock valuations in the long term because low treasury rates indicate low future growth. I think we may do well to hit 4% nominal gdp growth and if maybe less. When you start calculating stock values with a 3 or 4% long term sales growth rate, it’s a different ballgame than when nominal growth was 6%.

Is the data you presented always rear-view mirror stuff? Did the Fed originally just say ‘we’re going to expand the balance sheet’, and then you find out later how much it expanded or contracted, or do they mention specific ranges of purchases.

For instance, if the Fed decided to next week to expand its balance sheet, would it take you a week to find out? (although skyrocketing stocks might be a hint)

For those keeping track of how much corporate bonds the Fed has bought, the latest ( July 1st) total for the Fed’s Corporate Credit Facilities LLC which includes purchases of both ETFs and corporate bonds, the Fed disclosed that as of June 25, there was $9.7 billion in book value of holdings (the Fed does not break out how many actual bonds it has bought vs ETFs), an increase of $1.4 billion from the $8.3 billion a week prior.

Which means that the Fed continues to buy around $300MM in corporate bonds and/or ETFs every single day.

ZH

I have been buying and keep buying various Corp credit bond ETFs along with Gold & Gold Miners ETFs! Just a matter of the Fed balance sheet will shoot close to 10T and beyond! I don’t see any other tools in their tool box! Do you?

Robert,

Data by definition is “rear-view mirror stuff.” Predictions are forward looking.

I said months ago that the Fed had front-loaded its QE ad was slashing it. So this scenario didn’t surprise me.

If the Fed expands its balance sheet, we will find out when it publishes its weekly balance sheet (which is on Thursdays afternoon). So you can check the balance sheet on Thursday and see. I will write about it on Thursday or Friday – unless I skip it because I don’t write about the balance sheet every week, especially if the changes are minor.

The data in this article was released yesterday afternoon.

I expect the balance sheet to decline again next week, but there will certainly be weeks when it rises, in part due to the erratic nature of MBS.

Wolf seems to be shorting due to reduced future liquidity flows from the fed. I’d also add that the fuzzy unemployment data released this week will have a negative unintended consequence by early August, basically some politicians in the Senate will not want to give out a second round of $1,200 stimulus payment per person ($4,800 per family of 4 as kids were to get $1,200 also instead of prior $500). Also once the extra $600/week unemployment gets dropped to say $200-$300 per week at best, we are now talking of hundreds of billions taken from those who would spent it like we have seen these last few months. So not only is “QE forever” in taper mode, we have at least $500 billion of “QE for the people” that is likely to go away due to conservative actions by politicians led astray by fuzzy econonmic data. It is going to have consequences by Nov/Dec in a big way, about the time we find out our political future and thus new or old tax system construct. This should add to the perfect storm of uncertainty that will be upon us by year end 2020. I would guess at the very least we get a huge amount of volatility, perhaps enough for the Fed to start buying stock ETFs…as we need a big trigger for that to happen. I’m all in at that point, with my brain turned completely off while I enjoy the market euphoria, while it lasts. In summary, good economic news could slow the gravy train, until reality bites the markets, and then I would expect the fed to pull out the ulitmate bazooka of buying stock ETFs. Turn off your brains least you all go mad, as reality will not matter as the entire system will finally be “gameified” on almost every level, with a huge dose of luck required to time your own exit from the game. Good luck players, we are all part of the same game now…

All the Fed is doing by inflating asset prices is ensuring that anyone who pays the new price is going to get a lower return on the investment. Eventually it will become obvious that paying $3000 or $4000 for sp500 when earnings fall to under $100 in a recession is stupid and everyone will try to get out the door.

There should be a good surge in stimulus coming, but it’s all about the timing for elections. Helicopter money seemed to work pretty well for May and June so let’s see how the Dems and GOP play this out to benefit themselves (and of course also try to make the other side look bad). We’re about to see some political engineering and name-calling at it’s finest before July ends.

I don’t know who in their right mind would even want to be president for what’s coming the next four years but I suppose someone like Biden can do ok laying low forever in his basement.

The Fed had perfectly good exits in 2011, 2012, 2013, 2014, and even 2015. Then it was too late.

As Jim Grant puts it: The firemen are also the arsonists.

With Covid cases hitting records at 50,000+ a day, I’m looking for Congress to pass another big stimulus bill of $1-2 Trillion. The Fed will have to monetize the additional debt to finance this stimulus so watch the Fed balance sheet soar another $1-2 Trillion in July and August!

This is a given.

I also expect a major bank failure, so you can add in another 1 or 2 trillion there.

A lot of the 50,000+ cases a day are due to massively increased testing. Another round of stimulus will be very inflationary.

Then again, ol’ Sol could surprise us with a Carrington-like ‘event’ .. to add insult to injury, or one or more major Volcanically induced ‘eruption(s)to impose on one’s hemisphere, or a meteor.. giant, cluster, or what have you .. with a target on Terra’s back

That would be some pretty bad juju.

We all jaw about things economic .. when a combination of entropy, physicis, and chemistry, could come together at any time, to give us Gaian fleas an ass-kickin shake up.

.. a different kind of symbology altogether .. and in many ways, more real.

Good article and comments. Reinforcement for my decision to purchase 01/2021 Calls for Ag and Au miners along with a Jr miner leveraged fund. Should be interesting times later this year ??

“…SPVs now only hold $214 billion in assets combined. They just haven’t bought much…”

Isn’t the decline in the FED’s balance sheet just the transfer to these SPV’s?

Transferring the risks, being able to pretend there is no QE? These SPV’ can do what the FED is not allowed to do. They didn’t buy much, because it’s not the moment to do right now? This is pent up energy in my view. I wonder when it will be released and what effect it will have. In fact, i’d rather not know while being part of the equasion. That’s why i’m long gold.

> This is pent up energy in my view. I wonder when it will be released and what effect it will have.

It is, I track about ~1200 CUISPs of HY traded daily underliny HY credit indexes, in august 2018 the moments of log normal returns from par were: – 0.01 avg, 0.071 stdv, -3.17 skew, and 19 kurtosis. We all saw how that unfolded end of 2018.

Now, july 2020, after central banks are in: -0.05 avg, 0.28 stdv, -6.24 skew, and 53 kurtosis.

So ~5 times worse returns from par now, ~4 times the stdv of returns, ~2 times more skewed towards negative returns, and ~2.7 times more tailed of the negative returns.

And then you have 100’s retirement funds still down on the year going adding 10s of billions into leverage on the even more unsecured equity tiers… sisephus would admire the work CB’s are doing now :P

The SPVs are included on the Fed’s balance sheet and are integral part of it. They’re NOT off-the-balance-sheet entities. They’re just a legal fig leaf to get around the legal limitations put on the Fed.

Every dollar that the Fed puts into those SPVs is accounted for as part of its assets and QE.

Wolf,

Can you elaborate on MBS transactions by fed? I dont understand whether they are loans like repo facility or are they actual purchase/sale transaction. How do they settle?

Desai,

They’re actual purchases of mortgage-backed securities. The trades are handled by the New York Fed. It buys the securities in the “to-be-announced” (TBA) forward market, where about 90% of all Agency MBS trade.

In these TBA trades, the exact securities that will be delivered to buyers (including the Fed) are chosen just before delivery, instead of the time of the trade.

At the time of the trade, both sides agree on the sale price and on some basic characteristics, including coupon rate, issuer, and approximate face value of the securities to be delivered.

Separately, the Fed also engages in repos where it takes MBS for the term of the repo. But these are accounted for under the repo account.

Thanks. Essentially Fed is taking both risk and reward associated with ownership of MBS in order to bailout investors and wallstreet. Socialism for rich clearly.

Going short is like playing poker against a guy with stacks of chips to the ceiling. He is waiting and watching your little stack get eaten away with each margin call. Then he ponders, maybe I’ll take TSLA and AMZN private and make the short sellers pay for them by cornering the market for the shares. Right now, the risk of this happening is very high but the short seller cannot make over 100%…what a gyp.

Interesting assessment of short play tactics in the stock market “casino”.

What do you think of non-players who own, live on, and enjoy their capital and don’t give a damn about it’s “price”?

What if this is all not an evil plan, but rather, an enlightened one? After all, the best way to defeat your enemy is to play his own game better than him until you are holding the upper hand. Fact 1…you can’t get rid of the population so you need to put them in better shape supporting you rather than going for revolt. Fact 2…divisions into States is interfering with plans to have a single-minded national set of rules targeted at treating the individual equally with every other individual. Fact 3…the idle rich are of little use to the active makers and could be suppressed back into the general population much easier than trying to crush the hordes of peasants who are useful. So, plan to blow up all the debt instruments and shareholder claims and allow the real assests to fall under the the control of that which holds ultimate claim, the Fed member banks. It’s too risky to wipe out the currency, but it could be treated as real claims against Fed held assets, to then be redemed for a new money system. As the house is cleaned, the Federal government then takes control of all corporate chartering to include new banks, as well as all taxation etc.. Could we be looking at an entirely insane gamble to re-boot the nation under a new framework?

Reportedly, Mnuchin has a 500 billion dollar secret ‘slush fund’ as part of the care act. If true, where might that public debt show up and be accounted for if it ever is?

OutWest,

It’s all borrowed money. The way they have to borrow it is by selling Treasury securities, which all together form the gross national debt of the US. And we track that closely. The US gross national debt is now $26.5 trillion.

Junkie markets received a huge hit, but they’ll be back for more and more. Normalization is a Fed fantasy. Endless dollar debasement is the future.

Great analysis Mr. Richter. Thanks for taking the time to put it all together. We’re now firmly in MP3 according to Mr. Ray Dalio. Last week he came out with the statement on Bloomberg that we don’t have “free markets” anymore.

Do the Blackrock acquisitions appear on the balance sheet or in “never never land”?

Yes, they’re part of the SPVs. Blackrock was the asset manager to set it up. There are now several other asset managers dabbling in it.