No, it’s not yet a reflection of home prices during the Pandemic. Be patient. Reporters or spaghetti-code algos should have read the methodology before misleading their readers.

By Wolf Richter for WOLF STREET:

OK, dear reader, I feel like I’m fighting a one-man battle against media misinformation or something. I didn’t want to descend into housing-data purgatory with you, and you didn’t want to either, but now we’re on the way after the horrifically brain-dead misreporting in the media about the Case Shiller Home Price Index this morning by lazy-ass reporters, or increasingly by spaghetti-code algos, who didn’t bother to read the Case-Shiller methodology – or better yet, my past articles about the Case-Shiller Index.

These brain-dead reporters – or the spaghetti-algos that wrote the reports – went like this: National home prices rose 4.8% year-over-year in April, during the peak of the lockdowns and despite the pandemic, showing how vibrant the housing market is.

But that is bull malarkey because the S&P CoreLogic Case-Shiller Home Price Index doesn’t work that way. It lags massively behind. With the Case-Shiller Index – my favorite home price index because of the way it is structured – you have to be patient. That’s its big drawback.

The Case-Shiller Index operates on a “three-month rolling average” basis. And the price data is collected from public records. So the release today, titled “April,” was the three-month moving average for deals whose data became available in the county deed recorders in February, March, and April.

There is also a time-lag between when a deal closes and when the data becomes available in the county deed recorders.

So what the Case-Shiller showed today were closings that had occurred in prior months and that became available in the county deed recorders in February, March, and April. This included some of the deals that closed in January and excluded some of the deals that closed in April.

This is not a secret. S&P publishes the methodology. And reporters should have studied it before reporting bull-malarkey and misinforming their readers, many of whom paid a subscription to be misinformed.

The Case-Shiller Index uses the “repeat sales method” where it compares the sales price of a house that sold in the current month to the price of the same house when it sold previously. To make it into the index, a house has to have been sold at least twice.

This sales-pair method makes the index immune to changes in the mix of houses that sold, which is an advantage over the common median-price indices. The index essentially tracks price changes for each house in the index separately over time and then builds an index out of the sales-pair data. The index provider also applies some algorithms to iron out certain issues, such as improvements made to the house over time.

First signs of the pandemic.

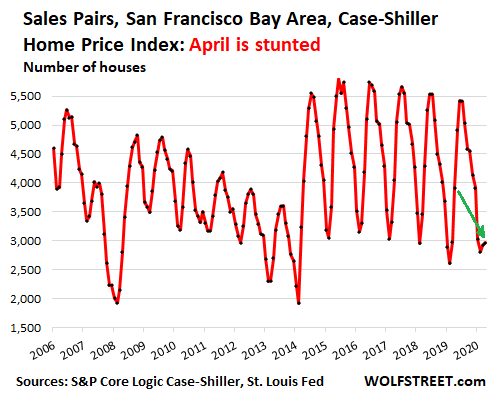

It is in the number of “sales pairs” in April where we can see the first impact of the pandemic. I will use the sales pairs of houses in the index for the five-county San Francisco Bay Area (counties of San Francisco, San Mateo, Alameda, Contra Costa, and Marin) because it is this area that went into lockdown before any other area in the US, on March 17.

The Bay Area is the earliest where we can see the impact of the lockdown. And even here, the impact of the lockdown only shows up in the April sales pairs data, and only in a much-reduced way.

The index used 2,970 sales pairs for April in the Bay Area. Meaning, data points of 2,970 houses whose sales were made available in the public records in April, and which had been sold previously, entered into the index. That count was down 24% from April last year. This is the first sign of the pandemic’s impact.

In March, the sales pair count was down only 2% from a year ago, well within the normal year-over-year fluctuations of the sales pair count. In other words, the lockdown that started on March 17 had not yet, or had only barely, impacted the public records data.

In February, the sales pair count was up 7.7% year-over-year, also well within the normal fluctuations of sales pair counts.

The chart below shows those sales-pair counts by month for the five-county San Francisco Bay Area. This is an indication of home sales volume, which is subject to strong seasonality. The low month in terms of sales appearing in public records is always in February. The high months are June and/or July.

This year, February was also the low point, and there was a small uptick in March, but April, when home sales volume normally begins to surge, was stunted, which caused it to be down 24% compared to April last year (green arrow):

And the pandemic’s impact was even smaller…

April sales pairs, by being stunted, accounted for only 34% of the total sales pairs in the three-month rolling average. Last year, April accounted for 41% of the rolling three-month count. In prior years, April accounted for 39% to 44% of the three-month rolling average.

In other words, price changes in April were further watered down in the rolling three-month average by being seasonally under-represented in terms of volume.

So the Case-Shiller Index for “April” in the Bay Area, the first of the 20 city indices to reflect the pandemic, contains, roughly speaking, 80% of pricing data from sales before the pandemic, and 20% of price changes from sales during the pandemic.

The National Home Price Index, which was cited in the headlines this morning, was even less impacted by lockdowns and the pandemic than the San Francisco Bay Area index because all other markets in the 20-city index locked down later than the Bay Area.

So, what the national index told us today is nearly all based on home prices before the impact of the pandemic. It will be another three months – the index to be released on September 29 – before every month in the National Case Shiller Index’s rolling three-month average fully reflects home prices of sales that closed since the beginning of the lockdowns. Each month will get us a step closer. And even then, it will take a while because house price data is sticky and moves slowly. So be patient.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Very good. Thanks for the detailed information. This is why I visit your site.

In other words, we gotta be patient.

Be patient for bad news?? The Fed will print up another 2 trillion dollars while you are being patient and expecting a negative outcome.

So, what do you propse I do? Okay, I’ll go stop the Fed and knock some sense into them. Which way to Washington? Wait, I gotta weed the garden first.

Sure, they’ll listen me. Thanks for the encouragement.

I think that we can safely assume that (unless you have prime, cheap land and a beautiful, rural house within commuting distance of a metro area to which people might flee if this new Chinese, swine flu reported gets out of China) RE prices have gone down substantially: FMV is what a willing buyer will pay a willing, capable seller. We may want to sell our real estate, but many people will not want to buy now or will not be capable of buying — unless you have very, low-cost real estate so that it is cheaper than renting in your city.

These indexes have serious problems with unusual events and data. They are designed for normal times and cannot respond or measure sudden recessions, etc.

“I think that we can safely assume that (unless you have prime, cheap land and a beautiful, rural house within commuting distance of a metro area to which people might flee if this new Chinese, swine flu reported gets out of China) RE prices have gone down substantially”

104 forested acres, 6000sf shop stuffed with machine tools, 100 prime-age and bearing fruit trees, one mile of river frontage, 25 minutes from a quart of milk…two and a half hours drive time to a city of any size. I care not if the market value goes to zero…ain’t for sale.

Fake news is working OT to let speculators exit unscathed. It is amazing how all this people are able operate in synchrony. Being a believer has its benefits.

I am seeing a few people moving out per week from my neighborhood in DC. Rental market is flooded with lower priced and nicer quality units. Redfin is flooded with a lot more supply but the same prices as pre covid.

Why do I get the feeling that all the stats are designed to put the general public in a false state

of security? These agencies are in place to inform the public and help them make a sensible decision on their future. How are these people allowed to manipulate and continually portray a positive view in order to falsely influence any decision they make for their families future??

Paul,

I don’t think the Case-Shiller is designed to give you a “false state of security.” The various city indices plunged during the housing bust. It’s just that the Case Shiller is not useful to document sudden changes in the market in real time. It just doesn’t do that. It documents them, but it takes its time to do so, and you have to be patient.

Reading your comments are equivalent to attending a graduate school course in economics

I have a few questions.

1) There are 5m forbearances. But interest rates are so low, won’t people just wrap the amount not paid to the back of the loan at a low interest rate?

2) with interest rates at under 3 percent, won’t it cause the bubble to rise a couple more years?

3) no houses are being built keeping inventory low?

Wolf, what is R-star? Is the Phillips curve real? If M·V=P·Y and V simply balances the equation, do we have a money flow problem (possibly due to income inequality) or is inflation truly understated and real wages are actually shrinking for the majority? Is the quantitative theory of money real?

Oh, have a heart.

The writers of Case Shiller reports might be out of jobs the day after the report was presented.

These reporters had done what their jobs wanted them to do:

Misinformation so that the governments get to take more on taxes; in this case, probably property taxes. And how convenient it was reported right after the property tax appeal deadline….

We are patient. The game has just begun.

I would like to point out that according to Dr. Shiller, there is a tendency for home prices to return to their 1890 levels, adjusted for inflation, etc… I look at the CS index as a gauge for how much recent speculation or stability there has been in the housing market, not what the price per square foot of a home will be next week. I agree with Wolf, the CS index is meant to document and characterize the housing market for those who are patient and know what it was meant for.

If the price ticks down – does that mean that people are no longer buying? Or are sellers more motivated?

There seems to be a lot of low interest rates and approvals going around, but not enough inventory (according to my friends in RE and lending) .

First time home buyer looking to purchase in the next 1-2 years

As Wolfe reiterates the tool ( Case Schiller index) was misinterpreted and the public mis informed. Hence the reason to get info ‘outside the box’ like Wolfstreet!

I realized this fact almost 20-25 years ago and started reading independent, verified and credible blogs to get unbiased info as much as possible. I went thru a lot sites, before settling on a few.That’s one reason I got unscathed during GFC ( housing bust).

Knowledge is power. So is critical thinking to filter that info!

Would you please list a few independent, verified and credible blogs

her for us?

Thank you.

Yes Please S129,

As someone who got OUT of the SM in the early 1980s when I realized I had not made any ”real” money without what is now called ”insider information/trading” I too would really like to know what JLS asks for because, once again, our savings appear to be at even worse jeopardy (not the game on TV) than they have been, even with the very low interest rates of recent decades.

So now, even my very thrifty spouse is listening when I spout off about getting our/her money out of the bank and into something that just might keep up with huge increases in cost of utilities, etc.

Thank you,

VVN,

On a marginally related note, utilities (commonly perceived to be safe invts) are one of the most heavily indebted industry sectors (in absolute dollar terms). They have the second or third highest amount of debt rated BBB-…which in many cases is really just junk debt masquerading as invt grade.

It will be interesting to see future battles as utilities try to ram through rate increases tied to failing debt.

It would be nice to think the public rate setting agencies would fight back…but they had to sign off on the stupid debt levels initially, so it is very unlikely they will/can reverse course.

There lists of ‘BEST of Financial Blogs’ by googling or published various financial/business publications. One has to try each of them to see if it ‘fits’ their needs. I also tried various subscription services during their trial period also over the years.

My approach is ‘tell me some thing’ I don’t know already. It depends upon which level of knowledge, one has already attained. Of late, one google the question and get some answers, not all credible. It is continuous learning, you pick some and shed some along the way.

I hope Wolf allows this

Here are some of favorites besides Wolfstreet-

oftwominds by Charles Hugo Smith. Mishtalk, nakedcapitalism, realinvestmentadvice (free and pay), Yahoo/finance, seeking alpha, morningstar(free & pay) ZH slectively

BTW: I am also life member of AAII ( American Association of Individual investors – monthly mag around $35-$40)

fyi

Some of the above blogs get reposted at ZH!. Another one for techies – Northman trader (free and pay)

Correction

AAII (non-profit)

yearly subscription around 40+

you get monthly mag

weekend seminars, evening talks by professionals (major metros) WEBINARS and weekly meetings. Their web site is very informative.

Lawrence Yun wrote all those “articles”

MB,

I’m a big fan of Lawrence Yun…I love stand-up comedy!

Not a stand up comedian but isn’t he a well respected economist? About as respected as Kudlow as an economic adviser? Now that’s stand up comedy there

Excellent. yes it is an interesting index. But as you write very much a lagging one.

You may have given it before, but I’d appreciate an interpretation of the strong growth in new home sales contrasting with the slowdown in re-sales of existing housing.

I presume that this is people moving out of the cities doing the easy leg of the trade first. But I guess it might be house builders cutting losses early to financial investors.

In suburbs outside Seattle, where new houses are being built, I see new houses selling for a much lower price/sq foot than existing homes. I think this is why new homes are selling at a faster rate. People can get a new home for a less price. Plus, there are no funny smells, no old toenail clippings stuck in the carpet, no mold, no weird rooms, no unusable space, trusty mechanicals with no maintenance to speak of, etc.

Also, not only are the finishing new, the houses are laid out better, more in line with today’s demand.

Michael, anecdotal response, My sister started a new job selling new homes to build on new land from a model home in Jan/Feb in San Antonio area. She said they have been selling many. Part of this is because of many military bases in the area constantly are moving personnel. Other customers are saying that they have been renters for years, but all the covid news and living close to so many people in apartments has them scared.

Thanks Wolf. This sort of crap goes on in nearly every reporting of economic data news. The last monthly B..LS. employment coverage was similarly absurd. It would be a wonderful if you could have a look at the upcoming June report. They are already busy shuffling data to suit their needs. They would sell their children if it would help squeeze out a positive headline for their corporate bosses.

Wolf,

CS index is kind of dumb to begin with since it is as you say a 6 month backwards looking report. Fine for historical purposes, useless for knowing what’s happening in real time.

However, May new home sales are off the charts. May existing home sales (which were really March/April sales) are also off the charts. Seattle reported today that prices for April (ie homes that sold in Feb/March just as the Corona was taking off) were up 7.3% vs April 2019. Also in Seattle, pending sales for May was higher than for May 2019, and this was with less inventory in 2020 vs 2019.

All the data is showing overwhelmingly that real estate has not just escaped the Corona, it has in many ways been helped by it. Today you can get a 30 year fixed mortgage for 2.875% which was unheard of in the pre-Corona days. Millions of people have taken advantage of these rates to either buy or refinance, or both in some cases. And it’s why houses are selling nearly instantly all across the country.

Thanks Lawrence. Best time is to buy now..increase in traffic/activities, housing goes up forever. We got it, CV19 is good for housing.

Mock all you want. If you want to rent while home prices increase 10% yearly and fixed mortgages are under 3%, be my guest. But if you do that, don’t complain that boomers or (fill in your favorite villain here) are keeping you poor.

You want to bookmark this page and come back in 2 years and see if your 10% YoY home prices theory still holds any water? We can even take a bet on it now. Heck we can even only focus on hyper hot market like SoCal or NY and see if your 10% assumption comes true.

Just Some Random Guy,

The 2008 housing bubble was based on a quant’s idea that housing would appreciate at 6% per year. Now you are saying 10% per year increase? Do the math. Please. In just a few years, there are no affordable houses for first time buyers. Then the bubble bursts.

I am not a housing bull and don’t think housing prices can sustain these unreal prices amid these high unemployment rate

I am in San Diego and so far, I don’t see any material impact on the ground.

But again, housing market is like a slow moving titanic and it’d take at-least a year to see any meaningful impact.

At this time, in my place, the housing market is quite hot.

I am in Texas – where the real estate market has been hot-hot-hot since 2005 (we didn’t even see much of a dropoff in 2007-2009). We really never felt the effects of the GFC due to the inflow of people from other states.

I am in 2 markets – Austin and Corpus Christi. Houses are selling in Austin fairly quickly still with prices flat-to-slightly-up. So far it is attributed to lack of inventory as we have far fewer homes on the market than what is usual and some of that seems to be attributed to forebearance options available to homeowners. We continue to have a LOT of people move here from other places, such as CA, OR, WA, NY and NJ based on the realtors that I interact with and that is keeping our market from softening too much… All of this inflow of people will probably insulate us again from feeling the effects of the recession – unlike other parts of the country which are going to get hurt over the next few years.

In Corpus Christi, we are flooded with inventory due to the airBnB bust – there are 100’s of those homes that have come onto the market over the past 2-3 months and are creating significant dislocations. I just purchased a home in CC with beautiful waterfront views and negotiated a price that was 17% below list – all due to so much inventory in the market. Spoke to the home inspector and he said that he has not had a day off in 6 weeks, but that falling home prices were the big reason for so many sales – as he is seeing homes sell for well below list. Definitely a buyer’s market in CC.

My 2 cents FWIW.

Not surprising.

Austin, Denver, and Portland are the most common responses in SF to my question: “Oh, you’re leaving? Where are you heading….” when I find out my friends are pulling the rip cord.

The Seattle numbers reported today that you reference were the CS numbers. Even if you go by the May numbers it’s far to early (aside from the fact COVID numbers are rapidly increasing in Seattle) – May sales were mostly from March and April.

Right, I said May numbers were from March/April. And the point is even at the height of the lockdowns and hysterics, housing was still doing well. Going into July (sales in May/June) will be interesting since CHAZ and riots scared a lot of people into bugging out of Seattle.

Rates actually do very little. On a 1.5M property with 500k down 3.3% rate vs 2.75 makes only a ~$300/month difference. Freely, in that scenario, it won’t be the 300 that makes or breaks the deal. The true impediment is getting into that bracket, given that there is nothing affordable in sight. This story of impact of rates is largely a myth. For sure 3% vs 5% or 4% vs 6% matters. But not the .5% plus or minus. By contrast, rates might incentivize people who have the means and will gladly pocket a little savings on mortgage rates. They will jump in or refinance but not because the lower rates made home-ownership affordable to them but rather because it is yet another way for them to save a buck and so optimize their accounting.

A buys a house for 1M puts 100K in upgrades and sells it to B for 1M and 50K more, and housing prices rise?

In Canada, it is organized Real Estate that manipulates data to what they want the media to print. Always must buy now or miss out. Their is no actual real data collected that a home buyer can say is solid truthful data.

Decades ago merchants used to report facts only to have their stocks get crushed so now flubbing the data is normal practice.

Thanks Wolf, really appreciate in your explanation on how we should decipher this data. You and I know that mainstream narratives is already running OT on attention grabbing bull headlines without providing this level of context to the data.

It will be interesting to see what Sept’s number will look like especially in those areas that are full of anecdotal stories of bidding wars or selling like hot cake places like SoCal. What’s your prediction on how that will look?

One anecdotal story here: another slew of moving vans double parked in the neighborhoods of northern SF (Russian Hill, Nob Hill, Marina, Cow Hollow). Lots of renters moving out, but also families leaving. I checked craigslist for RH the other day out of curiosity, and couldn’t believe it compared to 2013/2014 when maybe two apartments would pop up in a search. Friend put a bid in for a house in Marin and said things are red hot up there, and out in the Lamorinda area.

City living is not hot right now, for obvious reasons. A breakdown within these metros will be very interesting to see over the next 6 months. Overall, the trend could be flat, but there could be big shifts between urban and suburban trends within an area.

It’s the end of the month. It’s when renters move ie Uhauls double parked.

I agree that city living is not too hot right now. But I don’t think moving vans near the 1st of the month prove anything.

I am comparing the number of moving trucks the last two month-ends versus a “normal” end of month turnover for the last decade. Usually you see a few here and there on the last weekend, but we’re talking 2-3 on each block since Covid ramped up. People are just leaving.

Rents are down ~10% already per the local media, and For Rent signs are up, it will be interesting if and how it bleeds into RE prices and inventory over the next 6-12 months. Starting to see price drops more regularly in the city, but its still early.

Finally, we were priced out of there years ago. Greedy landlords, exorbitant rents, property management companies. Especially Angelo San Giacomo’s Trinity Properties.

Now, revenge is at hand.

Go to Craigslist and look at the most expensive rents, basically anything over $75 day per bedroom. FLAG THEM! This deletes the listing if enough people do it. Mr. Greedy Landlord can eat his investment, maybe even lose it. :-)

Tony,

No such thing as a greedy landlord. Landlords operate businesses. You as a consumer have a choice to buy their service/product or buy someone else’s. Calling them greedy and pulling childish stunts on CL is just that, childish. Not everyone can drive a BMW, someone has to drive a used Hyundai. Calling BMW dealers greedy is what you’re doing.

Just Some Random Guy:

Lived in a house for years, tended the garden, painted, maintained the place, helped pay the mortgage, kicked out by new foreigner owner who doubled the rent.

Example, not our landlord:

“The ability of a rarely seen liquor magnate from Thailand to evict nearly 100 elderly tenants for no stated reason perfectly captures the state of landlord-tenant relations in San Francisco in 1977. No laws stood in the way of landlord greed. San Francisco landlords could force longterm tenants to move by simply issuing an eviction notice and awaiting the sheriff’s arrival.”

http://www.foundsf.org/index.php?title=Tenants_Movement_1977-1979

The Magic Hand is waving goodbye to most Americans. Talk to us after it becomes a fist and smashes Your future.

Tony – I wish more renters were like you. But yet you’re a renter, and if the agreement you had in place does not work fo the new landlord, well, she has the right not to renew it with you.

One more data point contrary to the recession/depression mindset.

My wife’s lease is up this summer. She wants an SUV as a replacement. Cool I said. We’ll get a Macan or a Q7!! Nope she says, I want a Telluride. A what I said? A Kia Telluride. Apparently it’s the hottest thing in the wine mom SUV segment. A Kia!! Ugh shoot me now and get it over with.

Ok whatever, it’s your car, let’s go look at some. Quick search for my local dealership shows they are selling OVER MSRP for the SX model which is the “give me every option you got” trim level. And apparently this has been the case since it was introduced last year.

Kias are selling for over MSRP. We’re all living in a Twilight Zone episode. But really, when Kia SUVs sell for over MSRP, and people are claiming we’re in a recession/depression, the two don’t correlate.

Yes, Tellurides are HOT. Been HOT for a while. Kia hit a home run with them.

Last time I rented a bunch of cars for a multi-state trip, out of all the different brands I drove, the Kia minivan was by far the best. I never considered buying a Kia until I drove that van.

Also I think the little taste of bailout billions that the Fed/fed.gov gave to peasants via stimulus checks and enhanced unemployment has had quite an effect. Magic The Gathering pricing (kind of like a collectable board game) is on fire right now despite expectations.

Telluride us one hot SUV and deservedly so.

It’s really awesome.

I just can’t wrap my mind around people going crazy over a freaking Kia, LOL. Yeah I’m a car snob. But in fairness for $50K you get a fully loaded Telluride with all the bells and whistles. A Q7 starts at $55K and you have to around $70K to get all the options. So I can see the appeal.

MOTORTREND picked the Telluride as the 2020 SUV of the Year.

It is assembled in West Point, Georgia.

From MOTORTREND: “But this award is the deserved recognition that today’s Korean auto industry has evolved to possess the skill and talent to design, engineer, and manufacture world-class vehicles – ones able to best their mainstream Japanese, European, and American rivals in terms of style, dynamics, refinement, and build quality.”

One trend in housing that I’ve seen is happening in Holland with modular floating homes being built up quickly and relatively inexpensively.

So we’re going to hit 17 million auto sales again this yr, right?

Spoiler…no way in hell.

Right around the sales levels of the late 90’s (with tens of millions more people in the US now in 2020).

But the economy is booming because one model, from one maker is outselling a deliberately throttled supply?

Cas127,

You assume Just Some Random Guy wants to have a rational discussion. But he doesn’t. He just loves getting under people’s fingernails.

Toronto, Canada housing should be getting hammered into oblivion with the massive Airbnb vacancies, desperate people to leave the city, more condos coming on line and no immigration currently, office buildings empty and people working at home, plus the city has increased many new bi-laws with hefty fines and 50 new speed limit areas and parking fines increased.

Doesn’t sound like a city I would even visit now.

And yet….

“New single-family house prices remained relatively flat in May of 2020, according to the BILD, at an average of $1.11 million. New condo prices, on the other hand, shot up 24.6 per cent, year over year, to reach an average of $984,436 in the GTA.”

https://www.blogto.com/real-estate-toronto/2020/06/toronto-new-home-sales-20-year-low/

Should be interesting to see what happens in a few months. People that took advantage of the deferred mortgage payments are finding out that when they go for a mortgage renewal or new mortgage they are having to pay up to 2% higher than they previously were paying. Also, some people aren’t getting approved for new mortgages. This is what I am hearing from some GTA (Toronto) mortgage brokers.

Credit ratings are mostly computerized as well. So, missing payments can be shown on your Credit scores.

What were the sales volume numbers?

But that doesn’t explain the “nice” rise in prices. Only that the data is likely not accurate. My guess, inspired by your analysis, is that sales continued at the high price end– but sales were truncated at the low end. And why?

High wealth people moving wealth into non cash assets like property, being scared about inflation. People not so concerned about price, willing to pay more, expecting more price rise of such investment because of future inflation.

The bottom end falling off more, scared off because they fear not being able to pay the mortgage because of Corona. My GUESS is that it’s at the lower end of the market where the weakness was more evident.

What the data is saying is that the price rise is pre-covid.

Wolf

I understood you to say it was MOSTLY pre covid. But a little bit of the data was from April, No?

As I recall there was some covid concern even in March. I know I was concerned. And also in March the Fed had committed to do another $1.5T spending . That got my inflation attention–when they announced that. Maybe my time perception is a little off.

My reason for thinking it overall data was so positive is that April data would be mainly from buyers at the high end–concerned about inflation. But few buyers in April at the low end–because of covid.

And if I’m wrong, it wouldn’t be the first time.

The number of high end properties “just outside of the urban core” that have recently gone pending on the east and west coast is striking. The high end urban core properties are weakish.

Hi Socaljim…there you are. This is what my brohter in law – a broker – told me a week or so ago. I don’t (yet) agree RE is going up in a braod based way but I don’t rule it out, either, with trillions floating around looking for some place to go. A local broker where I live in Massachusett sent out a flyer braggin the just sold 2 homes on the same street near me, at substantially over askind as is offering cash back to any house he list not sold in 10 days. So I emailed my in iaw asking what he thought.

I thought his reply might make you feel good:

“Yes, we are experiencing the same thing in Santa Barbara/Montecito. Santa Barbara is about an hour to an hour and a half from Los Angeles and there are a lot of people trying to get out of LA. Homes in Santa Barbara that have been considered very over-priced and have been on the market for over 500 days have sold to Los Angeles buyers. One of our listings that has been on the market for five years with a different agent, is pending sale now with an LA area buyer.”

Does it mean the prices in LA would should go down ?

In LA, the pattern seems to be areas that have “gentrified” since the start of the Obama administration are weak.

My grandfather said to me in 1999, “All this financial reporting since the 80s that now happens reminds me of the incessant financial reporting of the Commies in Russia. Always trying to remind people how good they got it, when they don’t. The wheat harvest was big. Another record in car production, stocks up, Etc.”

“Always trying to remind people how good they got it, when they don’t.” Yup. Nail on the head there.

I put up a For Sale sign this morning and already had multiple offers from family members. It’s unreal how hot the housing market is. It’s so hot, we closed the deal just an hour ago in which we’ve agreed to stay in our respective houses just at higher valuation!!!

??

Made my day!

(this question may be too private for you to answer: did SoftBank fund those deals first at the old valuation and then at the new valuation to create that instant surge in “valuation” for its upcoming investor meeting?)

Masayoshi-san did reach out. He didn’t talk about the deal using such terms. He simply called it the senpai-kohai (senior junior) deal structure ;)

Hopefully no Japanese reader will be offended. I am a student of the Japanese language and will always be a fan of the country.

Masayoshi Son.

Son-san.

“son” (損) is Japanese for loss, damage, injury etc.

Ah forgot that Western media would flip the order of the name around.

Pending sales in my zip (charleston, sc) are nuts. Been looking for a newish (2016+) luxury SUV also. In February, deals were plentiful. The past two weeks, I can’t find anything. By limiting expenses, the shutdown generated a lot of extra cashflow for employment-secure workers.

The one thing that concerns me is that a lot of professionals around here (we’re heavily dependent on tourism) don’t realize that their jobs are zombied, propped up PPP loans. For example, most of the restaurant groups here furloughed all their service workers, but kept all the managers at current salaries (up to pro-rated 100K), even though they were shut down for 3 months. Once those PPP loans dry up, we’re gonna see a lot more professional class unemployment.

Here in the Phoenix area, prices ARE really moving up. It’s weird. It’s mostly because of people moving from California here. Lots of San Francisco folks, I can’t tell you how many SF stickers have I seen in the Gilbert/Chandler/Queen Creek area, and how many I’ve talked to (I’m a RE broker).

Here’s what they say. They are of course fed up with 1) high RE prices in California 2) high taxes in California 3) homeless people everywhere 4) congestion. Some quote how California is becoming more communist than China and refer to it as “People’s Republic of California”.

What also comes up is the lack of rental housing in California. Quite a few “housing refugees” from California come here to Arizona. And some of them tell me there is simply NO HOUSING AT ALL for them, even out there in the sticks.

Talking to my buddies in California (I used to be a broker there), we figured it’s the new rent control in California (AB 1482). What happened is that many housing rental developments were canceled or converted to expensive high-end condos because of this rent control. I understand why Newsom pushed for rent control (to help poor folks), but as per usual, the only true consequence is preventing new construction from being built. It limits the rental increase to hard 10%, which is fine for now, but if the inflation picks up in the years to come (which it will), anyone who wants to go into rental business in California is CRAZY in my opinion. It’s crystal clear to me how rent control destroys affordable housing.

So while San Francisco prices (and elsewhere) may be falling, I don’t see that happening in the Phoenix area any time soon. Lots of companies from Democratic states are moving here – lower taxes, no natural disasters, more and more jobs every day, good weather. I understand jobs are lost in many parts, but there’s a huge influx of these companies – just a few days ago a billion dollar Seattle financial company announced moving to Phoenix because of the failure of Washington state authorities to provide the safe environment. It’s just one of many.

I am not saying things will stay this way, but all markets are local, and it seems Arizona is one of the few where prices are moving up. I am personally not thrilled with that, because I wanted to buy an investment property, but it isn’t easy…. Can’t have it both ways I guess.

It’s the dry heat that attracts people, like a blow torch!

If they don’t like the dry heat, they can always come to Houston….wait a minute…they are coming!

Is there enough water in Phoenix? Will this be a new problem?

Title could be simplified: “There Sure’s a Lot of Brain-Dead Misreporting”

On any topic with any depth whatsoever, the ready-fire-aim, print-first-think-later corporate media gets it wrong more often than right, nowadays.

And sadly, the media’s errors and lies run all over the world before the truth can even get its shoes on. Bug, or feature?

In a time of universal deceit, telling the truth is a revolutionary act. VIVA LA WOLFALUTION!!

Is it the ‘media’ or is it people? People like to lie and people reject truth. Why did you lie? I was just doing my job. :-(

Of course it’s people, but people-in-mass-media have a greater responsibility, since they’re communicating to far more people than your average Joe.

Extraordinary Popular Delusions and Madness of Crowds…

Great article!

How does the Case-Shiller “repeat sale methodology” control for renovation work?

Some houses have been significantly renovated while others have not been upgraded.

That’s explained all over the S&P Case Schiller Methodology. Ctrl+F “physical changes”.

I doubt that you could control for it. You could inflate prices dramatically. I suppose one way is to look at the $/ft^2, but that would not capture things like a remodeled kitchen or bathroom.

But the problem with that measure is that you don’t get an absolute number, the problem is that you can’t just look around at one number and expect a whole story from it. That’s the problem with a lot of these numbers and measures, all the granularity is lost.

They have an algo for that :-]

They make adjustments to reflect renovations and the like. I don’t exactly know how it works. But you can read more about it in the methodology.

That may work with relatively new houses where you can guess within reason what the cost to renovate a bathroom or kitchen is for a zip code and adjust for it. But the older a house is the harder that is to determine. Take a 75 year old house. That house can be a full down to the studs renovation, with new everything including wiring and plumbing. Or it can have a hodge podge of DYI projects, a 1980s kitchen, 1970s bathrooms, needs a new roof and still has original wiring. How in the world do you compare sales for the same house over the years when the value can range so drastically? It’s a cool idea to take the same house and figure out its value over time. But I just don’t think it’s possible to do it when there are so many variables at play.

And many people renovate their home “off the grid” without pulling permits or being noticed by city inspectors & county assessors.

JSRG and Dan,

Yes, many variables at play for sure, and yes, many folks do/did ”some” updates/renovations without permits.

Was in that biz from early days as part of what used to be called, “The Berkeley Corps of Engineers” who could and did do anything that a home owner wanted without the blessing of the local gendarmes, AKA Building Inspectors…

Not so easy anymore, as the banks have cracked down HUGELY on non permitted additions and major changes, and have been requiring changes be ”permitted and inspected” before closings; several homeowners of my certain knowledge were required to take down drywall, etc., to expose framing, electrical, plumbing for inspection, etc., and even to dig up slabs on grade to expose plumbing before bank approving and closing new purchases.

My fave process was taking a ”termite inspection report” to city hall for a permit, then entirely gutting inside and out and replacing everything with new… inspectors were happy to come when the licensed PB or EL called them, etc., and would instruct if an additional permit was required,,, etc., it WAS a very good system to get dangerous old houses updated with minimal red tape,,,

Now, it appears all the jurisdictions just want the money,,, duh

Last I heard, some cities now require a permit to sneeze, especially if you are outside your cage, eh

Houses are a lot like cars in that way. Plus- who did the work? What materials are out of sight?

Privately held National Bank of Canada, the smallest of the six chartered banks, publishes the “Teranet-National Bank House Price Index”.

On June 17, they reported that sales pairs volumes to May were down 22% in the last year, while the Price Index was up 0.2%. Marc Pinsonneault wrote “In our view, declines in home prices lie ahead.”

They break activity out into 11 major metropolitan areas, with Alberta looking flat to lower, B.C. flat at a high level and the Toronto/Ottawa areas hitting higher price levels again. This data must have similar lags to the U.S. data.

I checked the low end of the market around Alberta for apartment style condos, which used to be at least $200k in major cities. The ones 40 years old are showing up below $100k and 15 year old are sometimes $130k to $150k now, in nicer neighborhoods. Condo fees are $350 to $550 a month.

Single family homes and duplexes in good areas seem to be holding their asking prices much better here, but I’ve heard stories from people like my dentist that some rental property owners are getting out after the economy has been soft for five years and vacancies take their toll on cash flow.

Thanks for the independent thinking Wolf.

Useful stats, so…

…incoming anecdote alert!!!

I’m sure some RE perma-bull will shortly tell us about how his aunt’s uncle’s stepson’s neighbor’s cat’s dog flipped a $10 doghouse fixer upper for $1,000,000

A clarification of these dates. If I understand the article correctly the Case-Shiller price index is based on data that became publicly available in the county deed recorders in February, March, and April.

1- home sales transaction usually take 45 days to complete and it isn’t unusual for deed registrations to take an additional 5-10 business days to record. 30 days closes are possible but rare.

2- The establishment of the home value and sales price occurs as the beginning of the transaction when the contracts are signed.

3- A deed registered and publicly available in January is likely based on home value/sales price agreed upon by buyer/seller 45 days + 5 days prior to deed registration i.e. Late October through November.

Therefore, the latest report would be based on home values from November – January.

Yes. Agreed. That lag between meeting of the minds and the close is always a problem with price indices that are based on closed sales.

Wow. Thank you. That is so important. That would mean Zillow’s sold numbers would be 45 +5 days as well?

Heheh, this is fun.

Dear Mr. Richter,

It appears that you are continuing your Wolf-o-Lution in spite of our reasonable request that you stop. You have been warned. Nancy, Dianne, and Jerome’s personal representative Jan will be coming over to provide you with a direct lesson of the proper narrative you need to put out. enjoy.

Keep in mind, you asked for this because you keep wanting to stick to annoying things like the facts and not use cherry picked data. We are doing this for your benefit. Wolf-o-Lution not approved.

P.S. you know it occurs to me that our intrepid reporters in our media is not brain dead or stupid.

They just understand differently. (Kind of like think different, but with a twist). The wall of text is confusing to them, kind of like a prey animal hiding in the tall reeds, but I think that you, Mr. Richter, can help them and help yourself too.

Are you any good at drawing pictures? They say it’s worth a thousand words.

?

I read the Case Shiller is still valid because the newest sales data, which is April is overweighted while the oldest sales data is underweighted. So, while it is true the number is a moving average, the Case Shiller result is most sensitive to the April sales data. Now, I have not reviewed the formula to verify this, but it sounds like it might be true.

SocalJim,

You’re correct in that there is a lot of weighing going on in the index, but not within the 3-month moving average.

Maybe what you are referring to are the different weights assigned to sales pairs depending on the time period between the two sales.

For example, a house that sold in March, and had last sold a year earlier has a higher weight in the index than a house that sold in March but had last sold 20 years ago. There is an issue with these long timespans in terms of estimating the remodel work, etc., and so they’re given a lower weight in the index than more current sales pairs, which makes sense.

From what I understand, the moving average formula that would covers Feb, Mar, and Apr data weighs Apr more than Mar, and Mar more than Feb. That is a standard approach.

Real estate was peaking before the recession. Now every professional knows we’re in for a crash. They’re working overtime to find bag holders to offload their property to.

The shock of 2008 wasn’t fully reflected in home prices until 2010. The shock of 2020 won’t be fully felt until next summer.

The Las Vegas economy has the highest unemployment rate in the whole nation. If there’s going to be a real estate crash, you’d think it would be here. I just sold my second vacant property to a real estate agent who said he’s a flipper. My property is too nice to flip and unless we see a quick surge in price, he won’t be making much of a profit. He plans to rent it out. Our governor just said that evictions for non-payment are to resume September 1st, so no worries. I’m checking the inventory situation every couple of days. It’s going down, down, down. Prices going higher, higher, higher. I’m getting constant unsolicited phone calls and texts from investors wanting to buy. In a way, it makes some sense: if the economy shrinks then housing becomes a bigger percentage of the total economy, so as long as you flood the system with money, it’s one of the few sure bets, although I still don’t quite understand the logic of why Las Vegas is a good place for investing in rental properties. What happened to all the Airbnb superhosts? Why aren’t they panicking and selling? Speaking of bagholders, the true bagholders in the end are the people who hold bags of Federal Reserve Notes. As a home seller, I’m the bagholder, since I’m trading my home for a bag of cash, so to speak. But the homes I had were in a bad neighborhood. I can’t deal with the type of tenants who want to live there anymore, and I don’t trust property management.

“Speaking of bagholders, the true bagholders in the end are the people who hold bags of Federal Reserve Notes.”

Yeah…that’s why 8 million households (out of 50 million with mortgages) lost their home following 2009…

The Fed along with the government made the same mistake of providing too little stimulus twice in a row in the dot com crash and the GFC. They aren’t going to make the same mistake a third time. There will not be another asset price crash, except from much, much higher levels. When home prices dropped 75% in Las Vegas last time, it was unbelievable that ordinary people would be allowed to buy homes at fire sale prices (you’d think they’d figure out a way for banks to wait until prices are back up before allowing foreclosures and short sales). The $600 a week unemployment benefits are so generous, they can’t discontinue it in any meaningful way because the economy might crash. Asset hyperinflation is next because only a rising CPI will stop the printing, and that’s not in the cards.

“So the Case-Shiller Index for “April” in the Bay Area, the first of the 20 city indices to reflect the pandemic, contains, roughly speaking, 80% of pricing data from sales before the pandemic, and 20% of price changes from sales during the pandemic.”

Don’t tease us, Wolf – what was the average price change for that last-recorded 20% of sales pairs?

That’s not disclosed :-]

I think the period right now is a little like the old joke about who is the mark in a poker game. If you are the one buying a new home for over-list as the u-hauls from the neighborhood are heading for the on-ramp then you are the mark.

But I’ve been told by some internet rando that his uncle’s niece’s podiatrist’s pool guy’s side piece just made over $2 million flipping a rented storage unit!

I think the helicopter money made some incomes rise. It is not a typical recession when the income of laid off workers rises. Gasoline prices average above $2.15 a gallon again and are on an uptrend. Home listing prices in my area rose since April. Unsold inventory dropped. They are building new homes as there is population growth.

Another great article. Thanks for being one of the few that informs not misinforms. So glad I found your website.

I just watched a 3 minute commercial on YouTube for a house in Florida. Not a beach front house or on a golf course, just a very nice 4 BR with a pool. It reeks of desperation.

low to mid 300s?

Just curious.

I looked it up $925K.

Ouch, this is FL? Must be a nice part… a very nice part of town. Because you could actually get smallerish houses in San Jose for that much.

say 2 bd, 2 ba. 6K sq ft lot or abouts ( at least according to zillow pricing) not sure how good the neighborhood is, I mean it isn’t great school district, but not a ghetto either.

What are the Comps on zillow?

Can’t afford to feed the gators in the pool anymore so making them a bit nervous?

Here’s a few things I don’t understand.

Our lockdown (army in the streets, couldn’t even go for a run etc) ended on May 4 but the construction industry had actually restarted on April 13 already; realtors were among the very first businesses allowed to re-open.

The government announced they would cut taxes on second homes to prop up sales when one couldn’t even go and “enjoy” his second home and developments that had stalled before the crisis were greenlighted with what I can only call obscene haste. Goodbye fields and woods, hello concrete monstrosities.

The media went into their usual hyperventilating “buy right now or be priced out forever” routine… can’t these folks be original for once?

Fast forward almost two months later. The healthcare emergency is long over. 13 out of 20 Regions dropped facemask mandates already one month ago and they have seen no new “spikes” nor “second waves”. Tourists have already started to trickle back. Cinemas, spas, dance halls etc have reopened in all the country.

But the real estate market has turned over and died.

Q1 sales were down 15.5% year on year and Q2 sales are “expected” to be down around 10% year on year. This prediction comes from the same “buy now” crowd so you know things must be bleak indeed.

However we do already know that in June prices were up 0.9% year on year, but that’s a very common post-epidemic condition in all sectors: shrinking sales, high inventories and booming prices. It’s funny how one has to wait and look hard for bad news (unless they serve the catastrophists in the media and their chums in the government, business etc) while good news are reported almost instantly.

The Italian GDP is expected to shrink between 9% and 13% this year. While I am sure we are asking China to ship us some of their wizard GDP statisticians together with more “sound” advice of the kind that killed our economy and thousands of people to boot, that is catastrophically bad and as the saying goes you cannot have the cake and eat it too.

There’s a giant ****burger here (sorry for the coarse language) and everybody has to take a bite, including government employees (another story for another day) and real estate speculators.

Is there any understanding of how many people in Italy still has the virus or has it been so suppressed that there are literally no carriers left over?

In BC house and commercial const never stopped. We have a house for sale and the sign goes up today. Small inventory around here, and people still moving to Vancouver Island. Many many retirees and people escaping the city.

Covid new cases across Canada is 280. Extrapolated this would be 2440 new cases per day in the US if that country had followed through with the same mitigation efforts made north of 49. Instead, there is 40K+ per day and Fauci warned of 100K in a few weeks. Covid19 is out of control in much of the US as of now. This virus surge lends a whole new meaning to the term, Red States.

As such, housing prices and sales is the least of concerns, imho.

And this is summer, for God’s sake. What happens in the fall? My Province of 5 million had 12 new cases yesterday, no Covid deaths, and just 152 active cases being monitored. Full tracing is possible and ongoing. The total death toll has been 174, mostly due to nursing home outbreaks around Vancouver. Despite these low numbers gatherings are still restricted to 50 people, no bars or nightclubs allowed to open, and restaurants restricted to 50% capacity with 2 meter distance and/or screens between tables. Max…50 patrons. Our economy is improving as well. Our Provincial health officer has total authority over what happens going forward and politicians remain quiet. My wife and I just returned from a trip up Island to some remote beaches. There were quite a few people when we had expected none, and the highway had lots and lots of RVs, trucks towing boats, work and freight trucks.

Mitigation works and must be successful if there is any hope for the US economy going forward. The Dow is up as I write this. Real Estate and housing sales? Really?

Nuts.

@Paulo

” …some remote beaches”

One is Tofino, I would guess? :)

What are the others worth visiting? Please advice.

Been planning to go there for quite some time.

There’s a giant ****burger,… you must have meant meatburger, lol

No, fishburger. Those things are absolutely vile. ;-)

The mass media has gone crazy, exploiting the population, saying anything to attract eyeballs. I guess real life is too boring for them. They have to find the extreme outlier and report incessantly on that.

…or just make stuff up, as in this case.

Either the CS index is flawed or the explanation is flawed. There should be a factor to account for time between the two selling prices. For example a 10% price change over a six-months is different than a 10% price change over 50 years.

Neither. How the CS does this is explained in detail in the Methodology. Too long to explain here. But the Methodology is linked, so go check it out.