A near-real-time roller-coaster of home sales during the pandemic via charts.

By Wolf Richter for WOLF STREET.

On May 28, I reported how the National Association of Realtors’ Pending Home Sales Index for the US had plunged 34% in April. These are sales where contracts were signed in April, and were expected to close over the next month or two. The index gives a preview of what closed sales in May might look like. In the comments, some people said that sales in their bailiwick were jumping while others said that sales were slow. Real estate is local.

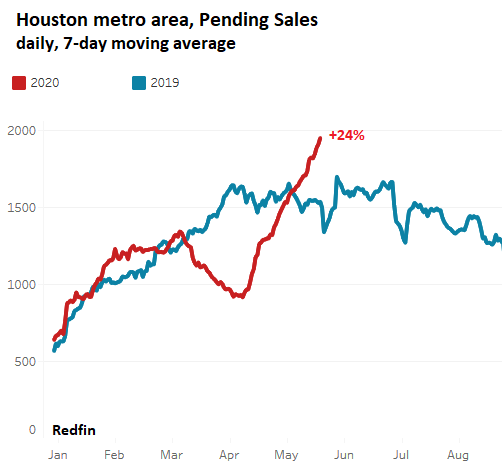

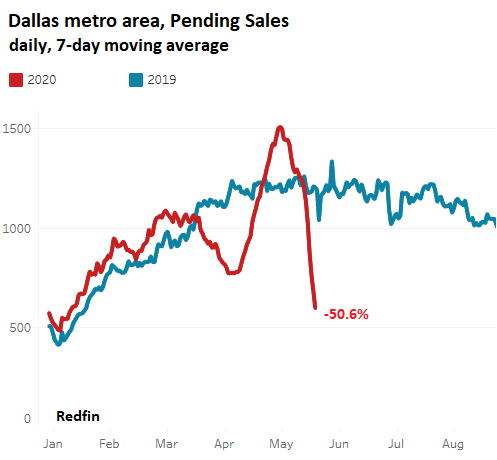

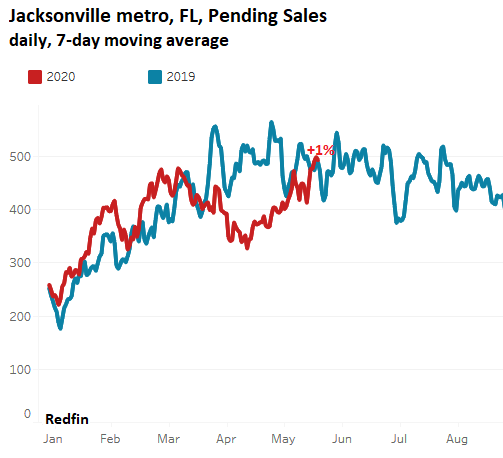

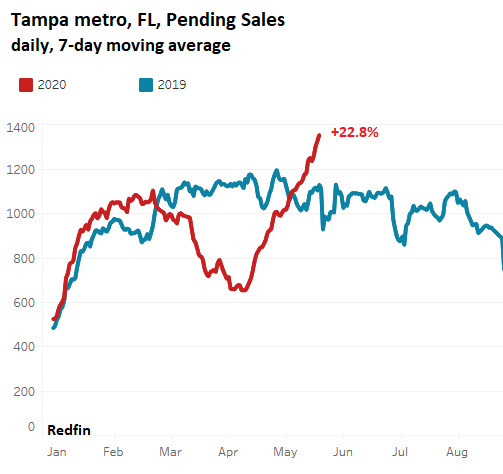

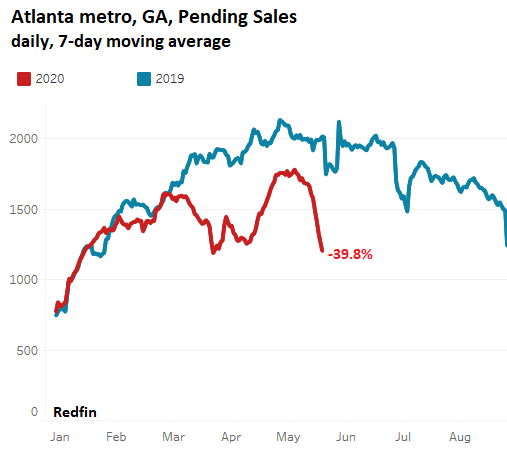

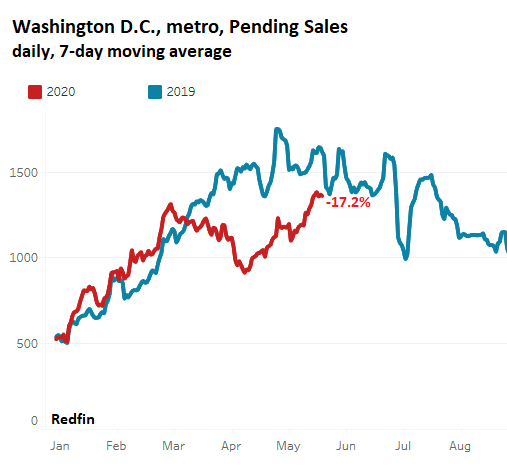

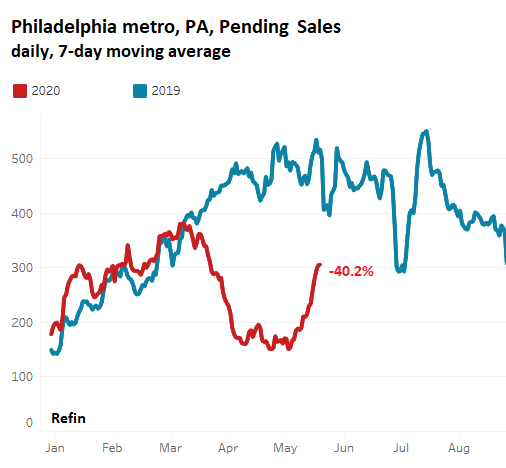

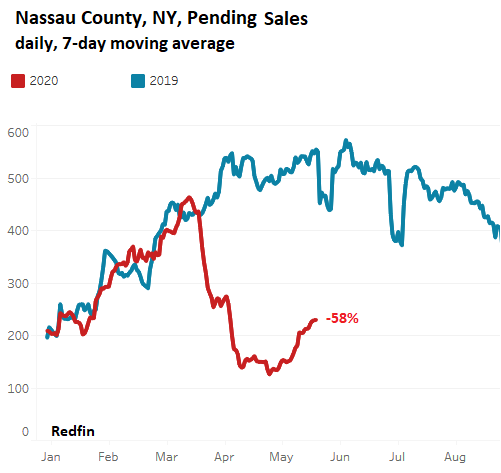

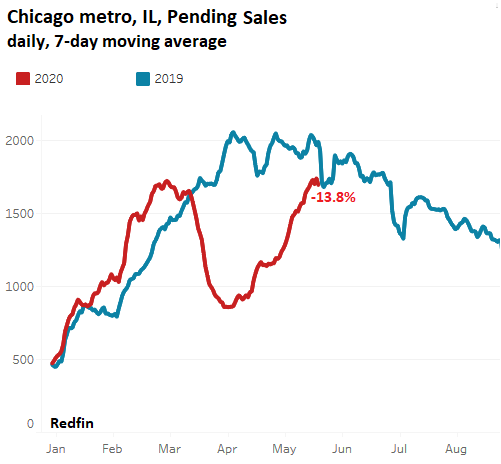

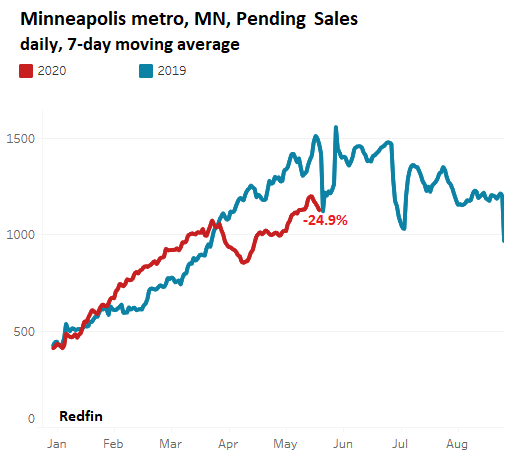

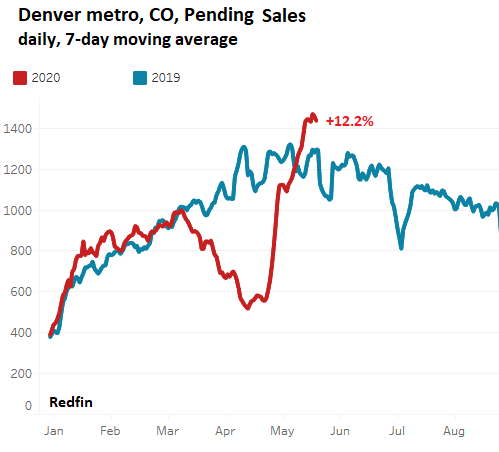

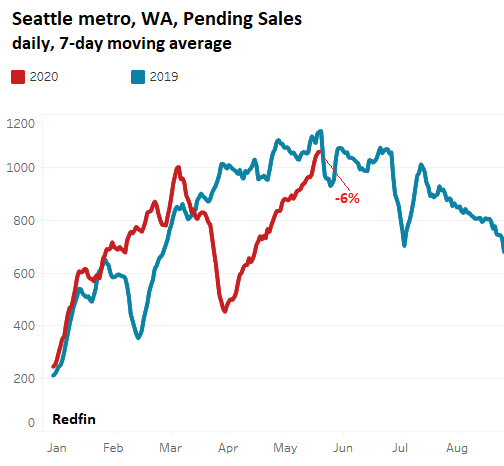

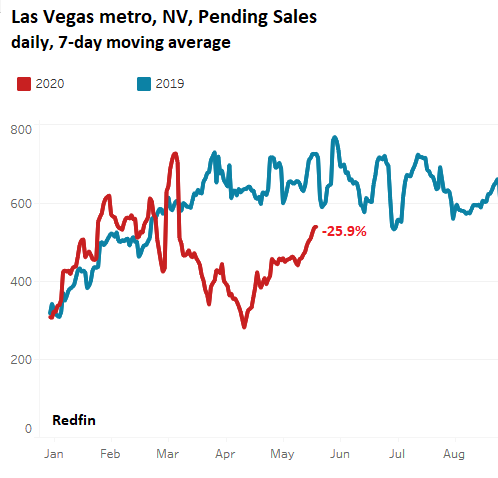

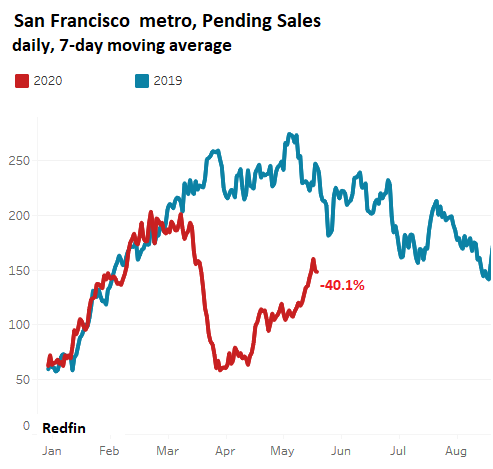

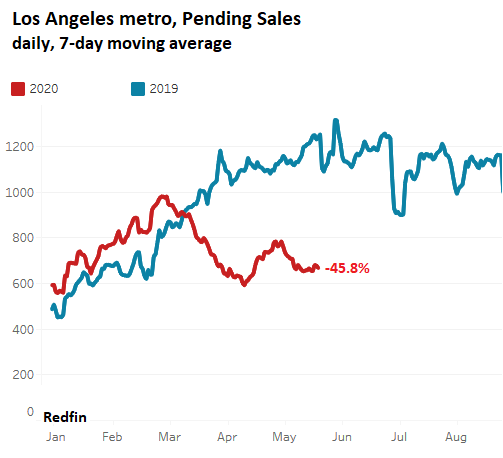

So here are pending sales – with contracts reported as signed in May through May 24th, for 15 big metro areas in the US, computed daily and shown as a 7-day moving average. The data is compiled by real-estate brokerage Redfin, from local multiple listing service (MLS) and Redfin’s own data, and was released at the end of the week. The charts are also from Redfin. However, the data is not available for every major city. The percentage in red indicates the change of the 7-day moving average through May 24 this year compared to the same period last year.

And let me assure you that real estate is local, that “nothing goes to heck in a straight line,” as it says on our WOLF STREET beer mugs, and that sales are headed in astonishingly different directions depending on the local market, from red-hot to ice-cold, with whiplash effect, sometimes in the same state as in Texas.

Houston metro area, TX, Pending Sales:

Dallas metro area, TX, Pending Sales.

WTF?!? Did pent-up demand from people who’d gotten stir-crazy suddenly collide with the oil bust? Will Houston show a similar phenomenon in a week or two? A mystery for now.

Jacksonville metro, FL, Pending Home Sales:

I couldn’t find Miami data in the Redfin data base, so Tampa will do.

Tampa metro, FL, Pending Home Sales:

Atlanta metro, GA, Pending Home Sales:

Washington D.C., metro, Pending Home Sales:

Philadelphia metro, PA, Pending Home Sales:

I couldn’t pull up the pending sales data for New York City. So here is Nassau County, on Long Island:

Nassau County, NY, Pending Home Sales:

I couldn’t get the data for Boston, so west we go.

Chicago metro, IL, Pending Home Sales:

I couldn’t get Redfin data on Nashville, St. Louis, Detroit, and Kansas City. But here is Minneapolis.

Minneapolis metro, MN, Pending Home Sales:

Denver metro, CO, Pending Home Sales:

Seattle metro, WA, Pending Home Sales:

Las Vegas metro, NV, Pending Home Sales:

San Francisco metro, CA, Pending Home Sales:

Los Angeles metro, CA, Pending Home Sales:

So this was the grand tour of the pending home-sales roller-coaster during the pandemic, with whiplash and all.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Re-posting exactly what I wrote yesterday from the previous housing article talking about the slow down:

This is only anecdotal, but, my purchase business has exploded the last 3-4 weeks.

Received 5 new purchase contracts this past week, and, pre-approved 5-6 new buyers.

My referral agents are getting very very busy, after the lockdown lul. It feels like people are fatigued from waiting, and are now moving full steam ahead with their purchase decisions.

Lender guidelines are also loosening back up. Not to the pre-covid point, however, definitely removal of the very conservative restrictions imposed at the height of the lockdown.

Remains to be seen what happens over the next 30 days, but, no joke it’s somewhat of a frenzy right now (from what I see).

Dan,

It is just common sense. Nobody can live more than 120 years old so the economy cannot expand more than 120 months. Wait until after the election ….

Just like the stock market a quick bounce after the plunge, investor don’t want to miss the boat.

I bet that sellers panic and cut their price drastically on offers that was already tabled. I would love to see the data on what was offered and the final sales price.

Yep. I see dead cat bounces everywhere.

Wondering how deflationary will the drop in consumption from the end of the $600/month extra of unemployment be.

We are just 2 months away from the cliff.

Not complaining, I LOVE deflation.

The government should care much more about putting a floor on incomes than putting a floor on asset prices.

Couldn’t agree less. My house is just on the market at a steep price and we got an offer the first day – at list. Nobody in my area is offering a discount, on the contrary it’s multiple bids. We are moving because we want to escape inevitable steep increases in school taxes, and the market is suddenly favorable because there is not much for sale.

There are many who think that there will be no second wave. They are acting now betting that this is a V shaped downturn with recovery now.

Unfortunately, the fact that heat sharply decreases the survival time of this coronavirus was known at the start: warmer countries with outbreaks may just not have practiced hygienic precautions until now. Thus, we will see during the fall and winter if that bet is wrong.

I hope that I am wrong and the claims of two French doctors of the virus weakening are right.

Unfortunately, if your viral exposure is low due to heat, the infection might be more easy to defeat. That might make it seem that the virus is weaker now in summer.

Got any for Northern NJ? Seems like everything is hunky dory here. 40 million unemployed and I don’t personally know ONE person unemployed. It doesn’t make any sense at all.

That’s why they gather broad based statistics, individual observations rarely coincide with what is happening overall

It would be nice if there was some fancy app software thingy that can post what you just said above as a reply to every other post of anecdotal rubbish about the US housing market.

Damn, no Boston again.

Update:

Median Sale price of condo and single family: up 7% YoY to 689k.

Inventory down around 25% YoY.

Buyers are out. Demand is still strong especially under the 650k line.

They want to take advantage of the low mortgage rates. It’s a straight up sellers market. Higher price levels have a softer demand.

The team listed a 447 sq ft 1 bed in Cambridge for 429k (not even a dish washer in the unit). Now underagreement after multiple offers at around 5% over asking. 4 days on market.

With My buyers, I explain to them that it may be better to wait. Some understand, and are waiting to see what happens. Others actually just want to own a home and disregard the market. They have their reasons. The best you can do is provide the information. Ultimately, the choice is theirs.

Thank you for being honest with the buyers. It’s nice to see this… It seems that prices are being driven by monthly payments and not overall costs these days.

Btw I am seeing doubling of housing valued in the last three years in my xburb of Boston. This is beyond ridiculous.

“seems that prices are being driven by monthly payments and not overall costs these days.”

Story of past 18 years.

Love these articles. Lots of data. Feed me!

Apparently the lockdown has somehow created more money than normal day to day.

If that’s the case, why not do more frequent lockdowns?

That money was previously headed somewhere else. Other than landlords, B&M stores, and restaurants; there are a lot of people and businesses losing out. Many of these businesses, we might only find out about, later on. Also, money printing.

Anybody got any guesses for unannounced types of businesses, currently losing big?

Hair salons are getting hammered, deemed ‘nonessential,’ at least here in California. I finally found a good barber, but it appears she went out of business as her salon has been subsumed by a neighboring State Farm office.

exactly I couldn’t agree more. How in the world can you have the largest economic disaster of the last hundred years but the housing market is doing just dandy? On what planet does that make any sense?

Planet Wall Street, and the Moon planet that orbits it, Planet Fed.

That’s no moon…it’s a death star. Quick, turn this ship around!

The same one who’s stock prices are not reflecting the fact that half the companies are loosing money. Big.

Reality has not bitten yet…. but it will.

They just need to channel their inner Tesla….

We also have protests right now across major American cities. We have Covid19 and protests shutting down American cities.

So as suggested by NAR, good time to buy then? We truly live in an upside down world, if this is the new reality then we can truly thank the FED for mission accomplished. Inflate asset value forever until some future generation way down the road pay the ultimate price. Fall of an empire, it has to start somewhere

Ikki,

It is nothing new. Japan has experienced it already from 1986 to 1991 and the lost 20 years from 1991 to 2010.

Those years were not a loss at all.

Remember that savers WIN with deflation! Pretty awesome.

I wouldn’t mind US, as an aging demographic now, to get stuck with deflation until I’m done, say: next 4 or 5 decades.

Actually, the way I understand it, housing in Japan has never recovered from it’s peak in the late 80s early 90s. To me Japan is a fascinating case study.

Bull&Bear:

Nice to see protesters pre-ordered pallets of bricks and had them delievered to protest sites so as to be handy to throw through windows in all of the cities they decided to thrash!

More broken windows will go a long way towards inflating GDP numbers!

Brick sales are up too!

CCTV footage would show people and vehicles and regn plates delivering bricks.

No, Bull&Bear, we have RIOTS all over the country right now. Protests do not involve burning cars, smashing windows, and looting stores. The Poor People’s March was a protest. What we have this week are RIOTS. Making correct distinctions is important: Protest/riot; propaganda/fact; scam/investment; loss/profit. You’re welcome.

The last couple months, people had a lot of time on their hands to surf the net, reviewing home sites like Redfin, Trulia, Zillow, etc. This could have accelerated things. Once it became stocks prices were not going to stay down, they pulled the trigger.

There could be some truth to this, based on my own experience. My wife spent a ton of time looking at real estate the past couple months. She found something interesting (to her), and she made me go look at it. We didn’t buy anything.

Some others may be worried about getting an inflation hedge, after the Fed just printed $3T of new money.

Bobber,

Warren Buffett and Berkshire Hathaway have cash reserve of $137billion as of March 2020. He is staying on the sideline and I wonder why? The smart money is not buying anything right now, except the retail investors.

Buffet is the leading indicator-during the mortgage crisis in 2007 he loaned/bought shares of BOFA and goldman in billions and that was the turning point.So we should assume that either he waits for a sell-off or he is calculating/ waiting as all values (share-real estate..etc) on the planet has to be recalculated as human beings should live-work-eat -have fun in new ways..

Not completely true The really smart money is buying physical Precious Metals

Wrong. The smart money bought gold a LONG time ago.

We have a debt crises-induced deflationary cycle going forward.

So… DEFLATION is the keyword.

IMO you are correct on both points you make Bobber.

The last time around, we had to move back to tpa bay area to take care of elderly parents; I started looking here in late 13 when it became clear that we must move; prices then were half or sometimes less than they had been in 06-07; by the time we were able to sell and move, they had gone up quite a bit by early fall of 15.

So, thinking it’s likely to happen more or less similar: First comes the dip, some locations may be bad, others very bad, others not so bad; next comes the inevitable inflation from the degradation of our money…

One of the big BIG factors last time was the PE and Hedgie folks buying anything they could for fast cash driving up the prices.

Question for all on here is IF that is going to happen this time, OR, IF we are going to see some sort of controls put in place to keep homes available for WE the PEEDONS?

Anyone hear from Unamused, creator of the ”peedons” label, lately? I miss his wit and wisdom.

Thank you

Who needs a house? Just retrofit a van and leave the consumer-based system altogether.

Coolest trend in Youtube as we speak.

I wonder how deflationary this trend is.

Unamused appears to be gone, and it’s a real loss. Sad.

Wolf,

Houston isn’t just oil and gas drilling anymore. The eastern metro areas, especially Baytown and the Ship Channel, hosts one of the largest petrochemical industrial areas in the world (you can sure smell it as you drive eastward!). With the price of oil going down (gas not so much), that just makes petrochemicals cheaper to produce and boom more.

Houston has also diversified a lot into other manufacturing industries. It has survived much worse oil and gas crashes before and isn’t as dependent on just oil and gas drilling for work. It will survive this bust just fine.

Oil crashed because of weak demand i.e. the economy is weak. How does that translate to a boom in petrochemical is beyond me.

Oil/energy is a common thread in the economy. Next you’ll say plane travel will boom because airlines can price their tickets lower. Just because you can supply something cheaper doesn’t mean the demand will be there.

Petroleum feedstock, lower cost of goods?

No demand = game over for asset owners including manufacturing companies.

Lack of demand has always been Capitalism Achilles heel.

They cannot get demand going with the wealth effect at this point, they inflated prices so much that people are just leaving the system (van living, for example).

CZ,

You are correct, but where is the boom demand for petrochem pdts (largely plastics) supposed to be coming from?

Petrochem serves as a bit of a natural hedge to oil volatility, but only to an extent.

Plainly put the ready availability of enormous quantities of dirt cheap natural gas as feedstock for ethane production has driven the mother of all overcapacity bubbles in Houston and Corpus Christi.

Metro Houston now has 42% of the whole US petrochemical capacity and that is bound to increase: US plastics production was scheduled to increase 75% (not a typo) from 2016 to 2023, most of it in Texas and Louisiana. Too many projects are now too far advanced to be idled or stopped: that (over)capacity is coming on line, like it or not.

Already last year it was projected the present glut would drive down prices and profits for plastics until 2030 at earliest, and the Houston petrochemical sector was predicted to be facing a “glut-driven bust” in 2023-2024, as new petrochemical developments come into line around the world, from Brazil to Qatar.

What did we know, the bust arrived a few years earlier, but it’s still a glut-driven one.

Natural gas prices were comatose even before this sorry show started: the present situation hasn’t affected them. Naphta, the other major feedstock for plastic production together with ethane and a major product and export of Gulf Coast refineries, has never recovered in price from the 2014 oil bust. It’s not a matter of cheap feedstock anymore.

What right now is important is demand, and while demand for pretty much everything rebounded since late March/early April it remains at recession levels worldwide. Off Bolivar Roads there are dozens of tankers now: some carry crude oil from as far afield as Libya but the rest are waiting for orders to load. About one third of them are chemical tankers: some have been there for over a month now, waiting to have enough orders to at least break even for the owner. It’s not exactly encouraging.

June is predicted to be the month when recovery will restart worldwide. I am not making any prediction right now but folks in Houston right now seem to be making huge bets on their future. Right time to buy a massively overpriced piece of real estate?

Petrochemicals also include the production of stuff like isopropyl alcohol and its primary feedstocks acetone and propene, and polypropylene.

Production of all of that has skyrocketed because of the COVID pandemic and still can’t keep up with demand (been able to find isopropyl alcohol at your store at normal prices lately?)

The eastern metro Houston area produces that stuff too.

Polypropylene used to be imported from China dirt cheap – that’s not happening so much anymore, in part because of the trade war and in part because China is keeping more of its PP for its own uses.

China has a huge plastics industry also and was selling cheap to the US before all that started

There are many other petrochemicals used to produce the PPE or sanitizers to protect against COVID. Polyethylene (disposable gowns), PVC (gloves, etc).

Usage of PPE has skyrocketed in the healthcare industry. As far as I can tell the eastern Houston area produces all of that and the feedstock chemicals

The 18-year real estate property cycle is a useful method for predicting the future direction of house prices.

The cycle states that there will be a house price crash approximately every 18 years.

The first house price crash started in

1953 to 1954, which was followed by two crashes in

1971 to 1972 and in

1989 to 1990.

1989 to 1990 + 18=2007 to 2008

2007 to 2008 + 18=2025 to 2026

Is that the cicada cycle of housing?

Suzie,

18 is a spiritual number in Judaism. The cycle repeats every 18 years.

There is quite a bit of published research about this cycle, including “The Secret Life of Real Estate and Banking” by Phil Anderson, and “The Power in the Land” and several other books by Fred Harrison.

Apparently Redspin’s charts need some help. Having lived and worked in both the Houston and Dallas markets the discrepancy with those two charts defies logic, as well as the recent home sales data.

For DFW’ 4 most populated counties we currently have over 8000 pending home sales. The number is over 10,500 if you count option pending status in that mix.

Looks like something is seriously off. I see they are using a moving average, but the representation still doesn’t fit with recent boots-on-the-ground activity.

It’s hard to see on the charts, but on May 17, pending sales in Dallas were still on par with the same period last year. It’s the last 7 days through May 24 when the sharp drop occurred. These are daily charts (presented as a 7-day moving average).

The “Great Escape from HongKong” effect?

– Wonder how much that has got to with these crazy charts?

I don’t think so: while air travel will start to become somewhat easier this week with several countries dropping mandatory quarantines between them, travel from China and her dependencies still remain very difficult and is likely to remain so for a while.

While it’s well possible to buy a house over the Internet, one just cannot email himself overseas as an encrypted attachment to go live there. And in that case what good is a “bolthole” of any kind?

There’s also another thing: Chinese emigrants tend to “stick together” by origins. For example the bulk of most recent emigrants to Indonesia and Malaysia originate from Hebei and Tianjin. Hong Kong emigrants have traditionally favored the “Anglophone Pacific Rim”, meaning Australia, Canada and New Zealand: this is unlikely to change as these emigration patterns go back to well before China legalized emigration.

Emigration to the US follows the same “local to local” pattern: again to give an example recent Chinese immigrants to the Northeast overwhelmingly originate from Fujian.

Buying a house doesn’t grant you automatic residency.

If that’s the case, all those rich Indians working at the big tech companies would not have to wait for so long.

I just saw some Long Island realtor talking about people moving from NYC and how the phones are ringing off the hook for LI real estate. The Nassau figures don’t back that up.

But of course, realtors are just salesmen.

That realtor was probably not from the bedroom community of Nassau County but from further East where I used to build houses Eastern Suffolk County or the North and South forks and Shelter Island

I guess the internets that said real estate has bottomed were right.

It the stocks go up, the real estate will go up.

And the Fed has outlawed the stocks going down.

Gosh, aren’t the internets just the ones with the smarts…

Tried to book a viewing at a property in San Diego this upcoming week. Took much demand to even get in to view the home. Houses are going like hot cakes.

The time when you can just walk in for an open house or have a broker show you a house are over. Now, to actually physically tour a house, it’s by appointment only, and you have to jump through hoops to do it. Try a virtual tour.

It would be so weird not to do a real walk through. If I were buying, I would insist on it.

Depends on the home owner. Some are still showing open houses in the PCT (pre-covid times). But appointments are filling up quickly. I’m with the other poster that would nix the idea of purchasing a home strictly via a virtual tour. My first question is what are they trying to hide?

In LA/OC, some houses go like hotcakes, and some do not. Highly dependent on the location.

AND price point!

Priced right; a property has multiple offers today.

Priced outside of reality; it will sit and sit and sit.

By the way, many on here have this mis-conception that realtors want to list and sell as high as possible. Untrue, realtors want to move the property and close quickly and easily. Lower list price and quicker closing is in their best interest as opposed to higher list and having it sit and age and potentially taken off the market.

At some point the Fed’s new money will show up!

Yup , hopefully some of it in Silver

Hey Wolf, there’s blood in the streets tonight, literally. Does that mean we should buy property? (Baron Rothschild famously said so).

Riots are bad for Realtors. Or good. It depends, I guess.

Weird times we live in.

What happens when August and September hit? August will be first week without the Maga-bucks and while most likely rents and mortgages will get paid for August what happens for September mortgages and rents? Many people I know were/are doing fine while on the relief aid, some making more per week than while they were working. If they’ve already entered forbearance when it became available will a slew of properties enter preforeclosure in late third and fourth quarter????

We are still 2 years from the peak of the baby boomer retirement wave so I expect those that have cash are still in the market for those homes at least. Real Assets at record low interest rates vs fiat cash could be another driver.

We are listing a house next week, (estate sale). Apparently, in that small city on Vancouver Island prices have not dropped and a decent home in a good neighbourhood has been selling in a couple of weeks, occasionally over list price. In particular, ranchers (no stairs) with 3 bedrooms are the first to go. Retirees continue to move here from Canadian cities, as well as folks who work away and simply want a decent home base. Prices have been stable the last 3 months. Spec building continues.

Our uncomfortable moments are deflecting RE agents who want the listing as there is no supply due to Covid. We just say a private sale is pending, which is not imminent, but partly true. (We have already picked out our agent if the sale doesn’t go through.)

Anyway, sign goes up next week unless there is a hiccup.

Maybe this will take the edge of the claims that WR is biased/ bearish in selecting RE info.

This new euphoria is what it is….and it’s crazy.

Yes the Fed printed an unprecedented pile of dough and it has disappeared down the US gullet with scarcely a burp. Like a nest of greedy birds, many many players have their beaks stretched wide as they squawk: ‘more more’

The maker of 12 seat personal jets gets a bailout. Madness? Well, if you have to, or more likely want to fly, and don’t want to mix with the masses…maybe there will be demand. Question is whether there will be a bunch of good used jets dumped on the market. We do know there will be a million barely used cars coming our way.

Re: claims of a recovery based on a month or two: if a survey was taken in September 1941, based on two years of data since September 1939, it would reflect certainty that Germany was not only winning the war, it had won the war.

The virus is defeated! Maybe it was all a hoax. Good weather will kill the bugs, if they exist. Everything can open up, and if a few get the sniffles, this is how to develop ‘herd’ immunity.

Even if the fate of most herds is not inspiring, we are not just any mammal, like rabbits or pigs that periodically have massive viral wipe- outs. When we have to quarantine and cull swine, that red stuff that squirts out is a cheap facsimile. We are exceptional.

Back to reality. Where are we in this production? With apologies to WSC: this is not the end, this is not even the beginning of the end. This is the beginning of the beginning.

The virus is defeated? Now it’s growing exponentially in my area among the meat processing facilities (the south). Meat and many food prices are soaring. It doesn’t feel like a hoax. Race riots increasing in the streets speaking of reality.

In more ways than one, BL. we are on the same page.

Viewing the current street turmoil as “race riots” is a major part of the problem.

Yer:

At least the rioters are throwing new bricks through windows to goose GDP!

BLS folks will appreciate their thoughtfulness!

It will make their job of manipulating the GDP numbers so much easier!

LA is a virus hot spot which may reflect it’s tepid recovery to this point.

LAs virus mortality rates per population is low. A percentage increase of a small number is still a small number. The MSM loves to create fear with the “hotspot”, but that is false.

The Northeast and upper MidWest have high mortality rates per population. While those areas are seing decreases, their numbers are still high. My bet is the weather is warming in the Northeast and MidWest so their numbers are decreasing. However, LA always has warm weather, so the number never got high.

Of course the Virus is defeated – asset prices are going up. Nothing else matters. That’s all this was ever about on Planet Fed.

Herd immunity or not, there are (potential/possible) side effects of the C19 that have been noted from other viral infections. If you get C19 and die, well, at least your troubles are over. If not, at least to me, the possible long-term side effects are scarier:

https://www.sfgate.com/news/article/Researchers-warn-covid-19-could-cause-15305291.php

1) Most charts had a deep correction in Feb/March 2020. Few cities recovered to a lower high, but Minneapolis had the most stable and impressive pending sales uptrend, until this weekend.

2) Both Minneapolis & Houston had almost uninterrupted uptrend.

3) Minneapolis & Houston pending sales are dead cat bounce.

4) Option #1 : our burning cities will lead to anarchy and total collapse, because there is no Buffer to protect us.

5) Minnesota is ==> Ferguson Antifa dead cat bounce. It will lead to decay and lower economic activity, in our major cities. City dweller will reject the invading anarchists burning businesses, destroying jobs and homes. The 80 years trend that started in the 60’s since LBJ is almost over !!

6) It will lead to a stable society after rectifying Fed distortions. It will shrinking the gap between the poor and the elite. The Fed positive feedback loop will turn negative, neuter the top 1% of Pareto chart, bringing them closer together.

7) Sir John Glubb 1776 to 2020 ==> 250Y empires life expectancy, will

be delay. CV + riots viruses are cleansing, purifying process.

They are a gift !!

Where are the rest of the likely options ME?

Surely you can come up at least a dozen or so, and I say that based on reading every one of your great posts for the last several months since I found Wolf’s site!

Thank you,

“CV + riots viruses are cleansing, purifying process.

They are a gift !!”

—-

XXXXXOOOOOO!!!!!!

Now if we can just cop the BIG ONE on the San Andreas or maybe the meteorite…

nah. you’re acting “young” Mr Kelly/ this is where it’s time to look to the triumphant beauty of the blues and bent notes. this is Come to Jesus stuff.

baptism is dying/re-birth.

those who’ve already “died” or suffered and still here see this. / this is why we need old people around and not shut away like Lost Knowledge.

Last night at my liquor store, East Lake Liquors, the local customers gathered around the store and on the roof, armed and ready, for the second night in a row. It is the only liquor store left standing on the west side of the Mississippi river along Lake street for a few miles.

At my grocery store/butcher shop, Longfellow Market, the same.

My next door neighbor had non-violent protesters at his home in the early hours of Saturday morning. He sits on the city council, and is a wise man who uses common sense and logic to make decisions when he votes. “Defund the Police” slogans and signs were posted all over his yard and my vehicles parked on the street in front of my home (2.5 car garage plus driveway is not big enough …)

Andy, his wife and ten month old child did not stay home last night. My neighbor across the street and I stayed up, armed and ready to protect. Thankfully all was quiet. We will stand watch again tonight.

I love my south Minneapolis location and neighbors! We will rebuild, but it’s fycking crazy to bicycle through the looted and burned down expanse near the 3rd Precinct headquarters. The troublemakers are not from the Twin Cities, and it has very little to do with the killing of George Floyd.

On real estate:

This is the time of the year, especially in Minneapolis, that a lot of homes go on the market. There’s a lot of recently posted ‘For Sale’ signs and it will be interesting as always to see what happens.

One last though to share:

As I enjoyed my dinner last evening on my back patio, there were a few Nation Guard Blackhawk helicopters flying low and slow. As one moved NW @ 200 meters or so altitude, a beautiful bald eagle glided straight east to the river about 200 to 250 m above the ‘copter. It only moved its wings a few times, and after it passed over the helicopter, it started a slow descent.

I can only imagine what the eagle thought of all the shit going on below as it looked down. There’s a nesting pair, and kids, high up a pine tree in the backyard at 2814 W. River Road.

Dan,

I remember the NYC riots back in the late 60’s to early 70’s, the looted shops never came back, not ten years later, not twenty years later. Yours won’t come back either, why would any rational small business person invest there now. This I relate from personal experience, I didn’t read it somewhere.

In regards to your neighborhood, it has now changed forever as well. You now live in a damaged zip code, demographically speaking. Watch for prices to drop because no non govt investor will buy the mortgages. Your zip code is now in a no go zone. This I also know from personal professional experience.

The reality is that what happened there shouldn’t have happened anywhere in America, but it does, and it happens much too often.

Be well.

P.S.

Just in case you missed it:

https://finance.yahoo.com/news/minneapolis-progressive-image-burns-streets-190550018.html

Thank you Petunia.

I hope you are wrong about my neighborhood’s future prospects. It’s been twenty-five years since I bought my home, and I figured I would reside here for another twenty-five.

I roughly added all the contracts on the y axis and came up with about 12,500 pending contracts. That’s 650,000 annualized total. If they all sell would this reflect a strong market? Hell , I don’t know. My wife and I are trying to sell her parents house in Wilmington N.C. . We have had 2 signed contracts over the last 8 months and could not close . The potential clients left a total of $3000 on the table .”Pending data ” are similar to deer tracks. Exciting , but you can’t hang’em in the barn.

That’s all very interesting Wolf. But kind of an quant analysis of past history.

Do you think the BLM riots are going to have an impact on real estate sales: for example in Minneapolis?

In the bigger picture, do you think the odds of bankrupt states getting a Fed bailout have changed?

I never saw the appeal of the city, having lived in the Bay Area for so long, I didn’t have any desire ever to move to SF. Seeing the riots hasn’t changed my thinking.

“… BLM riots …”

Huh? The Bureau of Land Management is rioting? Maybe because Trump is planning to give millions of acres of land belonging to the people of America to his cronies (for pennies on the dollar of their worth, you can bet). Say goodbye to Bear’s Ears, Grand Staircase Escalante, the ANWAR, etc.

Hah! funny. When I first saw “BLM” in these posts I also thought of the Bureau of Land Management. I think your joke will be understood by many who live in the Western USA, but not so much in the midwest or east coast.

God you guys are old. BTW, the TV has been invented.

I’m not in favor of selling national land to oligarchs. Maybe we should burn it down in solidarity to prevent that.

“Certain conditions continue to exist in our society, which must be condemned as vigorously as we condemn riots. But in the final analysis, a riot is the language of the unheard. And what is it that America has failed to hear?”

I’ll bet all the up markets are where the mega landlords and ibuyers are scooping up properties. Where I am all the listings are up 100-200K over prices a year or two ago. It doesn’t make sense because nothing in the economy warrants it. The only time price doesn’t matter is when you are spending other people’s money.

yup, it’s war, Petunia.

x

New beer mug: “No single dot plot on a chart goes to heck in a straight line”

1) China economy dead cat bounce : since Jan 2020 ==> 480,000

(no typo mistake) Chinese co went BK.

2) Many of them are mom & pop, but many are important mfg in the supply chain.

3) US co will have a major problem if one or few of their suppliers

are among them, without redundancy.

4) China cannot blame themselves for transmitting Wuhan cv globally. So, they blame Trump.

5) US globalist can either reboot and rejuvenate China, or build a new supply chain in US, Mexico, Canada, India, S. Asia….

6) This systemic change will produce jobs in the inner cities and keep their communities busy.

7) Rejuvenated US will increase demand for infrastructure and energy.

8) Quebec hate the traitors of the south & the West, after losing Bombardier, but Alberta oil will benefit from US.

“5) US globalist can either reboot and rejuvenate China,

OR

build a new supply chain in US, Mexico, Canada, India, S. Asia….

6) This systemic change will produce jobs in the inner cities and keep their communities busy.”

—-

i see it TOO!

x

This article is a very interesting change to the RE perspective. Coupled with what was written the other day about the fear of elevator use in high rise offices and apartments during and after Covid, I’m not sure if suburban and rural RE won’t be more and more enticing going forward? My question, how will anyone actually sell a multi-story condo and relocate? Will people just walk away? And if folks do move out of cities, what does that mean for crowded public transit? Where will people work?

I think this is (as Nick K said) the beginning of the beginning. And it is only June. A sweltering summer, high unemployment, frustration, all fertilised by misinformation could lead to any situation going forward, especially if the infection rate rises with wishful openings.

Anyway, off to pour concrete for a few hours. regards and hang in there.

Funny you’re off to pour concrete, Mr Paolo. i see split things i can make no sense of and i want to enumerate the “visions” like Mr Engel. / but i see a split or underground (?) emerging not among my former “artists,” but probably from the folks who can pour concrete and the ones who work/live/play online.

with the death of small business (people who DO things), like me, they won’t be so quick to re-invest in above the line biz as the regulations are numerous and insane for little people.

i wonder if this is my irritation in no gyms for 5 mos. but if there was a private club gym clubhouse, we could use it. i got this idea of circumventing gym regs for a stripped down basic free weight (no electric/machine fluff) from buying drink tickets at events to fill in for buying the actual DRINK, and skirt liquor licenses. artists would do clubs on the low to get around regulations.

i started thinking supra legally creative private ideas like how gentlemen’s clubs were for gay people to be themselves.

yeah, they got raided (shrug) but…

i hope think pray that a lot of pissed off entrepreneurial scrappers start over in a new landscape.

my optimism has also blossomed because this uprising needed to happen. this isn’t an earthquake or a meteor or some natural freak natural disaster. this is human made. we do this to ourselves. let this happen to ourselves.

and now this uprising is what i’ve lived my life for and i’m glad it’s all happening when i still can fight back.

i think this revolution will take years, though, because i see the elite/media will cling to its ways on the above and can’t divide us po’ folks –and that’s why i think there’s going to be something re-emerging on the low from the productive people who won’t wanna put everything into the system again.

i got chills in my arms and tears in my eyes when i saw all those angry white arms raised up in solidarity.

The Story is Over. / Time for New Story…

this is a very exciting time. yeah… probably mask wearing scared frightened safe space trigger warning circle social distancing-needing people will fly off to the suburbs and GOOD.

and sorry to you rural folks getting gentrified next.

i don’t know ANYTHING. this is me just babbling. no insight other than i was here almost a decade ago. i haven’t cut my wild hair in a decade, i make bread twice a week so James has fresh bread for his bacon sierra nevada cream cheese and lettuce sandwich with local olive oil and raw garlic with social distancing!

but i’m excited by all these new friends to play with.

this is what i saw the Wolf Meet being.

Power to the People you all. as the Panthers used to say here’s to all people power– yellow black white red brown.

this is exciting. let the stock market go up and be detached…

we’ve got people like PETUNIA on our side.

as i said: i see a future division like Old Religion/New Religion.

people who worry how things look vs. people who live in the real world.

this is a very exciting time!

x

KL,

You are a wonderful writer and artist, use what you have and do what you know. Chronicle this mess with your talents, in your own way.

In ancient times, the women would quietly embroider history into beautiful tapestries. They turned the bloodiest battles into something better. Make this mess into something better.

(PETUNIA, my reply to you got emotionally long so i’m going to repost fresh, below)

xxxxx

Not clear of the “recoveries” are due to pent up demand – i.e. in process sales completing due to relaxing of restrictions, as opposed to anything organic.

We’ll see in a couple months.

Waiting for the big collapse in the real Estate market seems like a dream to me, with those rigged markets that we have. With all the money printing going on, we will see asset inflation everywhere, starting with the stock markets, and it will reach the real Estate market too. For sure, you better choose well, but if you get something you could easily rent for a 4% return on total invested amount (meaning 10-12% on your own capital after loan), you’ll have a safe investment. Interest rates are and will stay artificially low, the central banks have no other choice. So my bet: nothing is really going down price wise. Land price in good locations goes like gold.

Money flocks to hard assets, in tough times, and so far RE has been a number one priority of the Fed. The real question for opportunistic buyers is am I trying to catch a falling knife? There are potential market losses that could take decades to “bridge”. Smart money is still in stock, probably.

If the smart money was in stocks the fed wouldn’t be buying etf’s. The fed is filling the vacuum. The smart money is in cash, like buffet.

The smart money is well diversified with a slight overweight to inflation and cash.

>> If the smart money was in stocks the fed wouldn’t be buying etf’s.

Again, please keep in mind that Fed is buying BOND ETFs, not STOCK ETFs.

I don’t mean to be argumentative, but the debt of a commercial enterprise being propped up by the govt, is exactly the same as propping up their stock price. If the govt wasn’t doing this, the value of the stock would be on the way to zero.

It may very well be the case in many instances that propping up the market value of debt (bonds) also props up the value of the equity (stocks). But I say it is important to be very precise about exactly what the Fed is or is not doing. Also not being argumentative.

Also, I should add that it is not easy for a retail investor to keep track of, in real time, which and how many company bonds, if any, are in a certain BOND ETF, how much of this particular ETF Fed owns, and therefore to what extent that holding is supportive of company X stock price. The devil is in the details, and the average Joe does have the details at his fingertips.

…does NOT have the details…

1) Renters make up to 67% of NYC population.

2) Vector up/ vector down : the federal gov spent $2T, but states,

municipalities and cities cut $6T from their budget. Total gov spending is negative $4T, great for US GDP.

3) Many NYC residents can leave the city without selling RE.

4) NYC is too expensive, too explosive and to risky to the elderly.

5) If retirees get a nice offer, they might take it, go away. before NYC

goes BK.

6) NYC packed restaurants and streets are deserted, the fun is gone.

7) They might invade rural areas. Landlords and RE agents will love them, but for the rural population they are bone in the throat.

ME:

Nice to note NYC’s rats are starving!

The RE sales data doesn’t reveal the reasons the buying and selling.

I wish I had a detailed parsing of that.

I m hoping to sell my Southern California mountain home in a couple of months, I ve had it with bad tenants, they trashed it pretty bad..the state is trying to force state wide rent control and landlords have no rights here anymore.. so I am really paying attention to what Wolf says on the real estate market. I m not sure if there’s still a window open to sell at this time. But I m going to try. Here’s the problem that makes me think a complete and utter collapse is coming in the housing market.. 1st massive unemployment in real terms as much as 40-50%, 2cd much tougher loan requirements… 700 credit score, 20% down, 3rd less foreign buyers.. how is this going to improve the market in any way??

A home in the SoCal mountains was once a dream and is now a nightmare….this sure seems to be the penultimate statement of conditions in the United States for forward guidance! “What’s a mother to do?” when Pleasantville has gone to hell.

Depends on whether you are just trying to maintain, or leverage, your value, or buy another property, or sell the one you have. Fed policy is an asymmetric credit freeze. Draw all the equity out of the property while valuations are still high, and shut the rental down.

That’s a real shame!!! I’m also in So Cal and have often thought how nice it would be to get a home in the mountains. I will pay much attention to your story!

What area are you talking about? Big Bear? Wrightwood? Idyllwild?

My dream location would be somewhere near Mammoth Mountain/ June Lake, but pretty much out of my price range.

My wife laughed at a piece of mail that she opened. I rather like my wife so asked her what was the humor. After a fair amount of hesitation she told me that it is a dunning notice from the city for taxes. The goomint is charging me for 265% of what I paid for the property. The dump had a tax referendum to borrow a thousand million to do stuff for a school district of fewer than twenty thousand

It is getting very easy to gin up hate for them..

In 2026, the oldest baby boomer will turn 80 and the youngest baby boomer will turn 62. Congrats to the luckiest generation.

oh man, Petunia… you’re making me cry because this is what my pops told me when things were going bad for me in NY when my career and life and beliefs went completely up in flames almost ten years ago and i was being stalked as if by a supernatural DEMON chasing me away for GOOD.

my pops said it cryptically as he would say when he’d get these “insights” or warnings like my grandmother would blurt and you LISTEN even if you don’t know WHAT it means. he said writing would save me.

funny you mention them putting history into tapestries when i feel like this clothing thing is somehow RELATED and yet i don’t know HOW. but it’s similar to when i’d do a study emulating Michelangelo’s figure studies and i’d feel this mystical flattening of time and ..i’d feel skinless like this is all a mirage, time death and our perceived “separateness.”

one of the “insights” or thoughts that kept coming to me when i died as i was an opened back up to be raw and skinless like when i was a kid, was that even though everyone seemed connected in the collective internet phone world, that psychic connections were going to come BACK and stronger and weird things that had seemed crazy weird mystical magic in the 1970s when we were kids, would become commonplace among the miraculous.

this is long and i’m leaving for the store on my bike because i need to MOVE, but THANK YOU, PETUNIA for making “THE DIVINE FEMININE” seem casual and commonplace HERE. (do some of you even KNOW what you’re witnessing? Wolf does. Trust that.)

thanks, Petunia, because i’ve been avoiding writing about someone/something because… well, i just have. my baby girl goddess studen, Gema, she told ME to write about it when i was punking out for the wrong reasons.

i’ve gotta go more Live with these “secrets” we know, Petunia. and that is hella dangerous. but it also calls forth others to step into their OWN magics if i do it properly. this is a delicate operation because this world turns everything holy and sacred into crap so i’ve gotta dive INTO the darkest waters to make sure i’m CLEAN. i’ll do my best…

but thanks for letting me know your expectations of me, and calling me UP to them.

DO YOU ALL KNOW WHAT YOU ARE WITNESSING? THIS IS IN THOSE CRAPPY SHITTY SHOWS YOU ALL ARE BINGEING ON. BUT IT CAN BE REAL LIFE WHEN YOU STEP UP AND DARE TO BE HONORABLE AND NAKED RAW AND NOT KNOW ANYTHING.

but i could be full of it.

and VietNam Vet, i think Unamused is off doing the same thing: i think he’s re-calibrating himself and his beliefs and what he SAYS to all that’s going on. you can’t just keep on chattering or typing and have anything RELEVANT to say.

this is all truly …speechless…. i’ve NO WORDS for all this. can’t heap on enough metaphors as i’m already in skinny reply territory as it is but phone people… deal with it. /the world is a mess so is your feed.

but you have to go offline and feel and be quiet and just BE with all that’s happening because what’s so exciting is that NO ONE ALIVE ON THIS EARTH HAS EVER BEEN THROUGH THIS. WE ARE ALL “WHAT THE FUCK!”

and that, as players and hustlers and magicians and lovers and TEACHERS know, THAT is when things get truly amazing and you taste water again.

i think this is the “mass psychic” thing i kept seeing. the people who have dead botox faces and live on phones and those who pour concrete, wear rhinestone flip flops, and make fresh bread.

THIS is love affair stuff. not swiping and sexting into bored jackhammer blue pill penises and dried chochas.

we’re back to The Long Kiss…. and yes, Petunia, i’m gonna do all i can to push the little ones back to the magic of forever kisses and frustrated grinding with no release for MONTHS…

but it’s also time to learn to gentrify our own neighborhoods with OURSELVES this time. that’s the position i want to get into once the cities’ tax bases are gone and people leave.

x

This is good news if it sticks. I am not a negative person but I have no idea how in the world the stock market and the real estate market keep going up with the GDP shrinking to unheard-of levels and the unemployment in the double digits. Markets either expect a quick recovery or inflation.

RE has lost it. Not seeing much of a rebound.

That would be Wrightwood, it’s a nice town with easy access to the 15.. 8.4 miles and 3000 ft drop.. but after I divorced and my last daughter moved out.. I had to rent it out. My ex wife is in mammoth.. I got remarried and ended up 5 miles where I grew up. At least I live in a high end suburb town.. but I hate the city.. if I can sell the house, then I will hold on to the money and wait for the market to drop..in my opinion , all signs point to the market dropping massively. I can no longer handle the snow, but I will find a nice semi rural area..