They haven’t gotten over Financial Crisis 1 and the Euro Debt Crisis. Now there’s a new crisis. Deutsche Bank’s CEO going on TV to soothe nerves didn’t help matters.

By Nick Corbishley, for WOLF STREET:

The biggest European banks have started to report their earnings against a bleak backdrop of locked down economies, plunging economic activity, surging business closures and rising loan defaults. Each earnings call laid bare the scale, scope and complexity of the problems and challenges facing a European banking sector that never really recovered from their last two crises — the Global Financial Crisis followed by the Euro Debt Crisis.

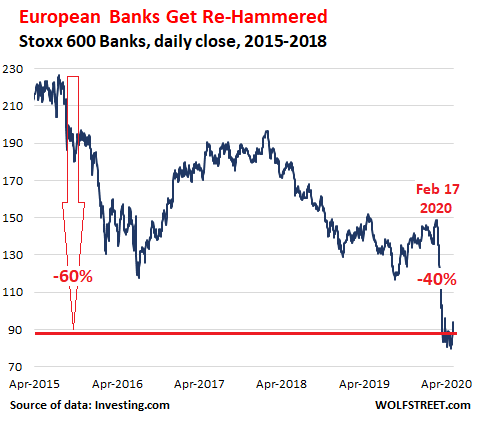

The Stoxx 600 Banks index, which covers major European banks, fell 4.5% on Thursday. Today, continental European stock markets were closed (May Day), but the London Stock Exchange was open, and the index ticked down another 1% (to 88.8). The Stoxx 600 Banks index has already collapsed by 40% since Feb 17, when the Coronavirus began spreading through northern Italy. After the initial 40%-plus plunge in late February and early March, the index has remained in the same dismally low range:

On April 21, the Stoxx 600 Banks Index had closed at 79.8, down 83% since its peak in May 2007, and the lowest since 1987. The following day, the ECB announced it was going to accept junk bonds as collateral when banks borrow from it. Yesterday, the ECB was excepted to go even further and announce that it would actually buy junk-rated bonds, as the Federal Reserve announced a few weeks ago. But the ECB didn’t announce it, and the Fed hasn’t bought any junk bonds yet either.

Unlike the Fed, whose 12 regional Federal Reserve Banks are owned by the banks in their districts, and to whom bank stocks are therefore hugely important, the ECB couldn’t care less about bank stocks, as long as the banks themselves don’t collapse. The ECB’s primary focus is on keeping the Eurozone together, a task that is growing more difficult by the day.

Now that we are in the grip of yet another full-blown financial crisis, triggered not by the banks this time, but by a pandemic and the response to it, central banks are throwing just about everything they can at the crisis, which is moving far faster and wider than the last one.

This was amply borne out by the quarterly earnings reports of the following four European banks:

Societe Generale reported a net loss of €326 million after revenue from its equities trading slumped by a staggering 99%, which the bank duly blamed on coronavirus-related market volatility. The French lender also set aside €820 million to cover bad loans and warned that provisions — including for defaults and two fraud cases — could hit €5 billion by the end of the year. The bank’s shares, already the worst performing among large European lenders, slumped 8.6% on the day of the report and are now down 55% since Feb 17.

BBVA, Spain’s second largest bank, reported its worst ever quarterly loss, amounting to €1.8 billion, after the bank took a whopping €2.1 billion write-down in the United States. This came on the heels of a €1.3 billion write-down of its stateside operations in the previous quarter. Profits also plunged 40% in its biggest market, Mexico, which for many years has accounted for well over a third of the group’s global profits. The bank also faces risks in another major market, Turkey. Its shares slumped 5.5% on the day and are down 43% since Feb 17.

HSBC, Europe’s largest lender by assets, declared a pre-tax profit of $3.23 billion, down 48% year over year. The bank has increased its bad loan provisions by $2.4 billion to $3 billion, its highest quarterly level in nine years. That includes a significant charge related to “a corporate exposure in Singapore,” which is likely to be the insolvent oil trader Hin Leong. HSBC’s shares have plunged 31% since Feb 17.

Banco Santander, the Eurozone’s second-largest bank by market value, after BNP Paribas, saw its quarterly net profit dive by 82% as it set aside €1.6 billion to cover expected loan losses caused by the COVID-19 pandemic. The bank saw particularly sluggish growth in its domestic market, Spain, and the UK, while reported income in its most profitable market, Brazil, fell 3.7%. Santander’s shares have fallen by 49% since Feb 17.

Neither of Italy’s two largest banks, Unicredit or Intesa Sanpaolo, have released their quarterly results yet. Given the duration and severity of Italy’s lockdown as well as the problems that already plagued the country’s economy, they’re unlikely to be pretty.

UniCredit was the first major euro zone bank to warn that it was writing down the value of its loans to reflect the fallout of the virus crisis.

Intesa Sanpaolo is on the verge of consummating another shot-gun takeover of another Italian rival. This time the target is UBI Banca, Italy’s fifth largest bank. If the merger goes through, it will value UBI at €2.7 billion, down from €4.8 billion just over two months ago, when the offer was first announced. It will also create the euro zone’s seventh-largest banking group, which should be enough to finally propel Intesa into the top league of global systemically important banks. In other words, Europe will have another Too-Big-to-Fail monstrosity on its hands, right in the thick of yet another financial crisis!

Deutsche Bank shocked its investors on Wednesday with its darkened outlook and a loss of €43 million. CEO Christian Sewing provided some much-needed comic relief on Wednesday when he said in a televised interview, apparently with a straight face, that German banks probably won’t need to be bailed out this time around.

“We are really dealing with stable banks in Germany,” he said, adding that banks’ balance sheets had been paired down and equity capital increased since the last financial crisis. “We have more than 200 billion (euros) free liquidity reserves, that’s more than 20% of our total balance sheet, and that means for us, too, that we have to be part of the solution now, especially at this time.” Shares fell 5.3% upon the news on Thursday, to €6.78. By Nick Corbishley, for WOLF STREET.

The process of reopening Spain has been dubbed, rather ominously, “Operation New Normality.” Read… Life Under Draconian Lockdown: I Can Barely See the Light at the End of this Long, Dark Tunnel

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

No matter how much the banks get hammered, somebody jumps in to save them.

Until they totally fail, it’s all crap.

The big reason why Central Banks keep jumping in to save larger banks is because the latter are key to how the Central Banks actually operationalize their control over their economies – those entities are welded together at the hip but neither side likes to talk about it.

The CBs need the “private” banks to operationalize the “multiple expansion of money” – the lending and re-lending that all starts with the Fed’s injection of base fiat/”High Powered Money”.

The banks like the patina of private ownership and the profits that come from being a “friend of the Fed/CB”

And as for the CBs, they prefer the public to remain ignorant of just how much their “free mkts” are actually centrally controlled via interest rate policy and bank “regulation”.

Operating via “private” banks provides the Fed with plausible deniability when things collapse (“It wasn’t ZIRP induced distortions…it was all those crappy loans that bank board okayed…”)

CBs do let smaller banks go to the blade (who wants the overhead of riding herd on thousands of pissant banks?) but when the Big Boys implode…many, many, many questions get asked from independent quarters…and nobody at the CBs want that.

Given their leveraged nature, there is no way that C19 won’t kick the crap out of many large banks…it will be interesting to see just how many much ballyhoo’d “living wills” of the banks are ever allowed to go into effect.

> The big reason why Central Banks keep jumping in to save larger banks is because the latter are key to how the Central Banks actually operationalize their control over their economies – those entities are welded together at the hip but neither side likes to talk about it.

True

> The CBs need the “private” banks to operationalize the “multiple expansion of money” – the lending and re-lending that all starts with the Fed’s injection of base fiat/”High Powered Money”.

Not necessarily true, (global) banks today in theory can (and have done/ continue to do) lend money into existence, and borrow overnight to meet withdrawal requirements… the problems start to show up when banks don’t lend to each other overnight… Sept ’19 anyone, di mana corona? :P

> And as for the CBs, they prefer the public to remain ignorant of just how much their “free mkts” are actually centrally controlled via interest rate policy and bank “regulation”.

This is as much control as giving a toy steering wheel given to a toddler to drive from the backseat of the car. The toddler believes its driving… (i.e even after Jerome made its “We buy Junk bonds ad in brookings (cdx spreads are up about 100bps on cdx na HY B, cdx na 70 on HY BB, 3 month LIBOR was trading +100bps above SOFR, only started to come down this week as banks started to lock in month end funding over a week ago and global banks had to lower rates to still be 50bps above SOFR now in order to get access to dollars/ they still need via unsecured lending)

Not sure there is any “high-powered money” anymore, at least not in the USA.

They (St. Louis Fed) have stopped publishing the money multiplier, but it was just over 1 at the end of last year, down from a high of 3.2 many years ago.

Not sure where I ever got the idea it was 5 or more, but recall the theoretical limit being 1 divided by the statutory reserve ratio.

You must be referring to M2V, its updated quarterly and the one for q1 2020 is 1.374, an new record low!

“The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.”

But you wont hear people talking about this, you’ll just get endless articles on the M2 going through the roof (OMG INFLATION!), not about how M2V is dumpster diving at the same time.

“operationalize”, word of the month ?

What a mother to do with all these bank children. Do I remember well that the IMF has some choice comments for Deutsche Bank? Then you have the Italian banks such as Monte dei Paschi di Siena, heavily connect the the PD (Partito Democratico – read socialist) and politically papered over for now. Then Banca Popolare di Vicenza that even Beppe Grillo referred to as “la mangiatoia”….which means basically a hog feeding at a never ending trough, which is really saying something coming from him. It’s just a barrel of laughs out there.

Not just one Haversham Cake, but a continental table full.

And we little mices, skeptical of them all.

The point at which the red mist descends is the memory of when one first thought ‘Hang on a minute….’ For me that was the bailouts during the sovereign debt crisis.

But what do I know, I’m just a swivel eyed loon…

So angry I can’t even type my handle correctly – Tin should read Tim.

But I liked “Tin”

I felt obligated to complete you Tin.

Lead is better.

We deal in lead, friend…

Depleted Uranium the best

Tim:

Add copper to your “tin” and you could turn into bronze!

My feather spitting post is in moderation..

Yes, because you put a typo into your name – Tin instead of Tim – and thereby became a new commenter :-]

Well, in a world that is not physical, ‘repairing a balance sheet’ is just a matter of an electronic transmission – like an email! There is nothing there – just some digits typed from a keyboard somewhere that hits a server somewhere that then goes into some database or spreadsheet.

It may have some more key strokes and turns than shat I have described above, but when the world went digital in the information age, the we left behind a sort of ‘accounting’. One cannot account for infinity. So, there is only one question to ask. Are you part of the digital transaction process? If you are, then you have massive leverage over ‘physical assets.’ If you are not, you have very little access to ‘digits’, hence your ‘physical world’ is much more limited. I suppose if you can become a master of code, you may be able to hack your way to these digits – and that’s all they are.

There was a time when people traded furs or seashells for everyone to see. We have transitioned to a most opaque system.

> I suppose if you can become a master of code, you may be able to hack your way to these digits – and that’s all they are.

A lot more you can bang 1’s and 0’s with these days, like a kid with a cheap modded ham radio can pass thru unsecured DOD satellites willing to pass their signal through LEO to spoof that drone flying over your hea…with the missiles in the under carry… “enforcing quarantine”… from bangladesh… :P

Doesn’t Deutsche bank have trillions of derivatives out there? I remember seeing some numbers as high as 16T. Given the current perfect storm that’s happening, aren’t those time bombs will be going off soon?

Looking at their share price it appears to have already started

The shareholders may get wiped out, but the directors of these Too-Big-To-Fail-and-Every-Day-Getting-Bigger Banks have not a care in the world as they collect their seven-digit salaries. What no one posting seems to realize is that these are the very banks that own the Fed and each of the other central banks. It is not as if they are taking orders from the Fed. To the extent that the national debt can be expanded, there is always money to bail them out. Remember that!

Actually, didn’t DB indicate that it would start applying negative interest to accounts with >100k euro in deposits?

Just say no to the middle class I guess.

No surprise there, if there is a bank scandal anywhere in the world you can take for granted that DB is involved. It’s just a question of how big it is and how much spotlight it will get.

I think Deutsche Bank has taken up the mantle of scandal-plagued Japanese banks from the late 80’s/early 90’s like DKB and especially Sanwa. Size apart the similarities between Sanwa and Deutsche Bank are striking in that both were originally mostly industrial banks (meaning their chief business was providing credit to manufacturing and allied sectors) which then moved, and very aggressively, into pure financial speculation.

DB shares with Sanwa what looks like a culture of aggressively pushing local and regional managers into any scheme that will allow the bank to turn a profit to cover up massive losses in their shrinking core business. Just before this crisis started one of my German vendors amended the list of banks to be used for payment and much to the surprise of nobody DB had been replaced by National Bank AG, which despite its grandiose name is just one of Germany’s many small local banks.

Sanwa was ultimately quietly gobbled up by Mitsubishi Bank through a series of typical fictional mergers, after Japanese savers and taxpayers had paid handsomely for cleaning up the mess.

The big problem with DB is there’s no bank in Europe, let alone Germany, that could quietly gobble it up. With the present mess an outright nationalization is out of question and no government wants to be responsible for all the rot DB is hiding.

The only solution is to do what the Chinese government has been doing with HNA Group: quietly and slowly dismantle the whole sorry lot. Sell out the least compromised assets and liquidate the others. What remains can the restart as independent bank, become nationalized or just disappear.

Governments have been very quick giving themselves the power to lock us all up like we are crminals. Fine. Now they can give themselves the power to deal with eminent disasters like deutsche Bank.

US banks are deferring payments during months of forbearance to the back end of the mortgage. How can they do that? Turning a 20 year loan into a 21 year loan? I wonder if this is the same bad advice they gave people in 2008 to not pay their mortgage? Some people might take the forbearance who don’t need it, and lose their house. I suspect banks in Europe they don’t have anything like this: implied Euro banks always look worse than their US counterparts, when the opposite is really true. https://www.pbs.org/newshour/show/what-to-do-if-you-cant-afford-to-pay-your-mortgage-right-now

AB

It’s nuts to think European banks are stronger than their American counterparts, either straight up or relative to their respective markets. What really matters is the ecosystem in which they operate; EU economy is nowhere near as vibrant as US.

Remains to be seen how US & EU recover from COVID-19, but if I was putting money on it (betting economy, not banks), US gets my cash.

EU has kicked the “banking problem” can down the road for so long that there’s no more road…and the can has disintegrated…and the kicker has bloody toes.

One significant banking difference between US & EU banking is large EU companies are much more inclined to borrow from a bank; due to deep US capital markets, large US companies generally sell bonds (there is some bank borrowing).

Vibrant? That’s a good one

My immediate thought too.

Rather than outright defaulting. Great pretenders.

1987 was a good year for me. I wish everything could go back to 1987.

I was thinking the same thing 77 was even better 97 was fair and 07 was well it was 07

Why don’t European banks set up a corporation in the U.S., setup a hedge fund, borrow to the gills, and get a bailout loan from the Fed they can use to buyback their own stock? But first quick change CEO & C suite compensation linked to share price. If they go bankrupt who cares? The ECB will buy their worthless shares and junk bonds maybe. Maybe even the Fed & ECB will get into bidding war buying up all those stocks & junk bonds and CEO & C suite laugh all they way to the bank, so to speak. Problem solved. We have to save the credit “market” Gods, dontcha know.

Don’t give them any ideas! Especially for free.

Last time the banks were bailed out, they gave themselves b8g fat bonuses at tax payers expense…

Sounds like a con job to me.

Wolf, any thoughts on Target 2?

I understand Germany is on the hook for a trillion euros, yet this seldom gets a mention in the financial press.

When this is all said and done, neither Draghi nor his successors will lose their pensions, I suspect.

they already do this, see frbny list of primarily brokest dealers -> newyorkfed[dot]org/markets/primarydealers

> BNP Paribas Securities Corp.

> Credit Suisse AG, New York Branch

> Deutsche Bank Securities Inc.

> HSBC Securities (USA) Inc.

> Societe Generale, New York Branch

[ Dear editor, please edit this, if necessary,

so that it meets your standards ]

No-Fault Evictions are a basic human right,

same as no-fault divorce;

and I say this as a staunch tenant-advocate

( better tenants are forced out, and suffer ).

Where are China’s homeless ?

“Re-Education” camps ?

Honestly, I believe society wants

certain “sinners” to die for their “sins”;

hookers, for example, are placed in harm’s way

— Canadian lawmakers blatantly admit it.

I’m just a property manager; still,

I can’t stand seeing the behavior

and attitudes of certain tenants/squatters;

it’s demoralizing, stressful, depressing.

Perhaps she’ll sell some of her properties,

and the Fed will print enough money to stop

housing prices from falling, like 2008.

But that’s just killing the pain,

not solving the problem.

One day, our addiction to “free” money

must come to an end.

The Nasdaq 100, NDX weekly :

1) From Feb 18 2020 top down to Feb 24(L) // up fast to 9.000.46 on Mar 2(H).

2) The current weekly bar is the smallest in the last ten trading weeks, including this week.

3) Its half the size of last week, but volume is higher.

4) This week high is an upthrust > Mar 2(H) @ 9,000.46.

5) If next week (C) < 8,238, or a drop of more than 480 pts, NDX is probably going down.

My apologies. I’ve calmed down now.

We’ve known about BBVA and their overseas exposure for a long time.

What about the French and other European banks legacy exposure to Italian banks, left over from the last face-saving exercise?

Has that – if I remember rightly as not being insubstantial- exposure gone away?

It all seems like the steam roller scene from Austin Powers International Man of Mystery.

Some of that exposure has been transferred from German and other country banks to either the ECB or the Italian banks themselves, for sure.

I couldn’t find the data for Italy, but here is the data for Spain, Greece, Portugal, and Ireland. The mechanism would be exactly the same, as long as DB and other big banks were wise enough to take advantage.

https://ftalphaville.ft.com/2018/10/10/1539147600000/A-look-back–what-Eurozone–risk-sharing–actually-meant/

Remember the common complaint that the European people were really, really bailing out DB, not Greece?

It was no lie, though the flow of money probably benefited Greece substantially, even if most of it was used to pay creditors.

Every bailout is a bailout of bondholders.

@ Wolf-

and shareholders.

Or it would do if there were not the futures of many on the line if this merry-go-round actually stops.

Then it’s not funny. Not funny at all.

1) $BKX the global banking index, monthly : up to 93.34 in July 1998(H) //

down fast to Oct 1998(L) @ 54.57.

2) $BKX weekly, on Mar 23 2020 BKX dropped to 55.40 // and up fast to

76.31 on Apr 6.

3) This week BKX had an upthrust, turned down and produced

a shooting star candle. That’s bearish.

4) From Dec 9 2019 peak @ 114.37 down to 55..40 and a thud

this week.

5) Its very likely that the Oct 1998 support line @54.57 will be breached.

5) BKX monthly : BKX peaked in Feb 2007(H) @ 121.16.

6) After 2007/09 great recession it reached a lower high in Jan 2018(H)

@ 117.14.

7) BKX dropped to a swing point in Dec 2018(L) @ 79.85, a spring

above July 2015(H) @ 80.87.

8) Dec 2019(H) @ 114.37 was another lower high.

9) When BKX breached the Dec 2018(L) swing point, it produced a huge

monthly bar(L) @ 55.40 on Mar 2020.

10) Mar 2020(L) was below Feb 2016(L) @ 55.99.

11) Mar 2020 might become a failed spring if the downturn resume.

small typo!

Yesterday, the ECB was excepted to go even further and announce that it would actually buy junk-rated bonds

>> should be expected

tnx for all your work!

Deutschebank what a stitch up. Brexit plus CV plus a DUMB pizza clear out – unsettling must be for those fallen from grace – big reveal – who has balls – week after next bitcoin halving – deep pools of crystal clear blue water coming to wash it all clean. Whatsyore dream? Eberybody hassa dream! Google GPU renamed adreno – on chrome – bang bang in your face – what can you do when a few mad devils believe they hold more sway – surround them with mirrors I say – let em buy their own junk – feel what others feel – let them finally admit there is no longer a viable game to play. Let them say sorry. We will all feel better when the mad few are rejected ousted exiled while most of us settle into cosy AI surveillance connectings. The next bridge. A I – who runs the stocks and shares game – a computer – they all laughed histerically at the thought

“On July 21, 2011, when the GAO released its audit of the Federal Reserve’s secret $16.1 trillion in bank loans during the financial crisis, a foreign bank ranked number 9 on the list of the largest borrowers. The loans went not just to the largest banks on Wall Street but to foreign derivative counterparties to the Wall Street banks. The foreign bank that ranked 9 on the list of the largest borrowers was Germany’s largest bank, Deutsche Bank, which took $354 billion in revolving loans from the U.S. Federal Reserve.”

https://wallstreetonparade.com/2019/04/after-a-354-billion-u-s-bailout-germanys-deutsche-bank-still-has-49-trillion-in-derivatives/

Is there a way to see what exposure Australian banks have (they own the big NZ banks)?

The detail is interesting but not the main point. European banks are all insolvent. The ECB pretends they are not, and gives them some facilities to use, play shell games with, and rewrite their press statements while everyone keeps smiling but the brute fact of the matter is that they are insolvent. Deutsche has – by one count – gone bankrupt 4 times since 2008. But the problem is the design of the eurosystem, which ensures the fates of all are tied to the fates of each, and the doom loop between EU member sovereign credit and commercial banks. The broke state and the insolvent bank walking a wayward line down the pavement leaning on each other for support like a couple of drunks. And singing badly.

This should be no surprise to any reader of this blog.

Where things get really interesting is the close and immediate correlation and coupling between EU banks, London and NY. The contagion effects from any one of the GSIFIs in the EU to the other centres would be catastrophic, such as cascade default on a major class of derivatives. So now we have the G10 all colluding to prop up European banking and the Eurodollar market because to do otherwise would detonate the City of London, Zurich, and Wall St, and every other international money centre but they don’t really count.

Got swaplines?

C

They do do controlled demolition for retrieving gold and or destroying culpability records. Market crashes are contrived – North Korea had no Rothschild bank but watch this space. The detonation you refer to should be a walk in the park for these mad devils.

A Haversham Cake is a shell. All icing and no cake.

I understand the Euro is in question, which is the third rail of EU policy. The currency was disinflationary in the first instance. The collapse opens the door for Russia, and certain chaos with their gas deals. (To return to the LNG market) Europe is going to pay and pay a lot more without the Euro. In near term expect a blowoff in the dollar and NYSE.

They are two crises in one: a financial/banking crisis which began in mid-September in the United States and an economic crisis which began in March and is due to Covid-19