“In May, what market? I don’t see no market”: Realtor.

By Wolf Richter for WOLF STREET.

The “combined COVID-19 and oil shock” are going to do a number on the U.S. housing market, Fannie Mae warned in its monthly report on Wednesday. Actual data for homes sold after the lockdowns began will not be available for a while, and everyone is grappling with preliminary indications of just how ugly this is going to get.

The Home Purchase Sentiment Index (HPSI) plunged 11.7 points in March to 80.8, the largest single-month drop in the data, Fannie Mae said, “reflecting quickly diminishing homebuyer sentiment.”

A survey conducted by the National Association of Realtors in the first week of April, cited by Fannie Mae, showed that 90% of the responding Realtors reported declining buyer interest, with half of them reporting declines of over 50%.

Contract signings in early April plunged by about 35% to 40% from a year ago, Fannie Mae estimated, based on Google Trends data.

Existing home sales will plunge 34% in the second quarter, to an annualized rate of 3.76 million homes, it said, “a sales pace similar to the lowest quarters of the Great Recession.”

And as bad as these sales are, it said that the numbers will be inflated by the April data of closed sales that were deals signed in March and February, before the lockdowns. This inflated sales data from February and March would give “modest support” to second quarter sales.

But going forward, it is “likely that monthly sales will decline to an even lower annualized pace, in part as evidenced by the decline in the HPSI.” And this – given the delay between signings and closings – would “lead to a drag on third quarter home sales, even as economic activity is expected to begin gradually accelerating.”

And total sales of existing homes for 2020 overall, despite its “projection for strong sales” in the fourth quarter, would still drop by 15%, it said.

New home sales will drop 40% in the second quarter, rebound some in the third quarter, and for the year overall drop 12%, it said.

The boots-on-the-ground warnings are starker.

Thomas Stone, a Realtor in San Francisco Bay Area’s Sonoma County, told WOLF STREET what he is seeing, given the lockdown and the new social-distancing rules governing the process of home sales.

“In person showings are only allowed if virtual tours are unavailable, the home must be vacant, and they are by appointment only. Two people at a time, max,” he said.

“More than 200 homes have been pulled off the market, and new listings so far in April are down 75% year-over-year,” he said. Potential buyers are unmotivated and leery. And they’re facing, or are already tangled up in, the largest unemployment crisis in US history.

“We still have homes that went into escrow before the lockdown, and a lot of those buyers are getting cold feet,” he said.

“The March sales numbers do not reflect the lockdown’s effects,” he said. “April will be very bad. And May? What Market? I don’t see no market.”

Given the importance of tourism in Sonoma County (Wine Country), vacation rentals are a big thing. But tourism is dead – even local tourism. And he warned: “The folks who paid a premium for [home-sharing service] VRBO-suitable homes are going to be hurting, as will everyone who bought in the last two years.”

“We are going to see the fastest and hardest price correction ever in Sonoma County history,” Realtor Thomas Stone told WOLF STREET.

The more we grapple with early data, the worse it gets.

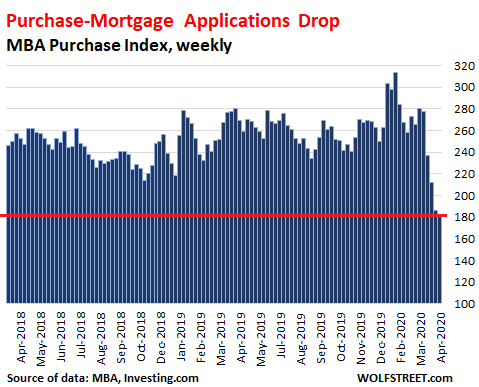

Mortgage applications to purchase a home in the US during the week ended April 10 plunged by 35% from a year ago, and by 42% from the peak in January, the Mortgage Bankers Association reported on Wednesday. It was the fourth week in a row of year-over-year plunges:

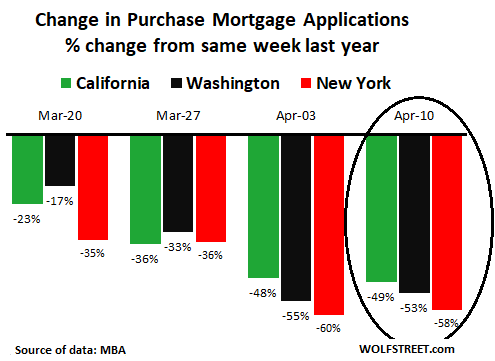

California, New York, and Washington are the states where lockdowns started first, and the metros in these states are also among the most expensive housing markets in the US and are therefore the most severely impacted by the current plunge in availability of jumbo mortgages. And so, the year-over-year plunges in purchase-mortgage applications were far steeper than US average of -35%.

For the survey week ended April 10, purchase mortgage applications in California plunged by 49%, in Washington by 53%, and in New York by 58%. This chart shows the progression over the past four weeks for each of the three states:

Who is still buying?

Purchase mortgage applications are an early indication of demand by potential home buyers.

Demand by nonresident foreign investors – who either come in with their own cash or finance overseas – is not reflected in purchase mortgage applications; and those investors have been locked out, and demand by them has collapsed.

Demand by large domestic investors that fund their purchases at the institutional level, such as REITs, is also not reflected in purchase mortgage applications. But these investors are now struggling with a liquidity crisis and have other things to worry about.

But refis are red-hot.

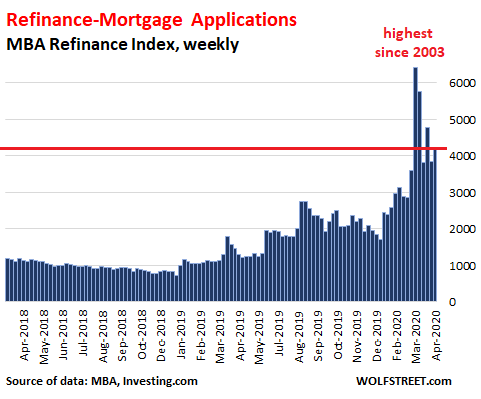

Driven by lower mortgage rates, applications for mortgages to refinance existing mortgages nearly tripled from a year ago, though they were down from the historic spike in early March when refi applications hit highest level since 2003. Refi applications are now over three-quarters of all mortgage applications:

The MBA obtains this data via weekly surveys of banks, nonbanks, and thrifts that cover 75% of all residential mortgage applications.

It doesn’t help that mortgage lending standards have suddenly tightened – and in some areas drastically, such as for jumbo mortgages. But how loose were those lending standards to begin with, how did they compare to the lending standards in mid-2006 right before the Mortgage Crisis, and by how much have those lending standards now tightened? Read… Going to be Tougher for Lots of People to Even Get a Mortgage. Expensive Housing Markets Most Affected

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Everything’s going to be okay in the housing market. I mean, worst case sceario, the market has a flat V shape recovery over 20-25 years. So just buy the dip!

And what about boomers like me that are retired and are looking to buy a house now? For a youngster, waiting 3 years for a correction to play out is no big deal. But as a boomer, I’m tired of waiting around for house prices to correct. I guess I’m saying that there will always be buyers at the start of correction, for one reason or another. We are not oblivious to the correction, just running out of time to live our lives.

Haha

O My

Not to take it out on you personally because everyone has their own situation and yours may be valid and correct and special.

But boomers who have had the benefit of riding the interest-rate decline from 1980 down to zero over the past 40 years, With the concurrent boom in price the never ending boom in price except for the hiccup in 2008,complaining about their current situation in the housing market?

When every freaking idiot I’ve ever known who bought an “over priced” house in an expensive location has turned out to be a “genius”? please

Millennials have it easy just waiting for a 3 YEar dip before they can buy and get on the escalator up?

Everyone’s going to get screwed on this one, but dude, if you As a BBer were not able to hit the pitch that came in over the last 40 years, there’s not much else to be said.

Very true I bought my first house in 1978 in Brooklyn NY and have owned perhaps 10 others since then always profiting from the sale and moving up so any Boomer with half a brain should be set housing wise by now Or one would think anyway

Word.

Aren’t most boomers looking to sell and downsize?

Make an even swap for someone who wants a larger home and has a smaller one. House prices saved and everyone’s happy!

You forgot the /S

James Stockdale talked about how he cultivated the mental strength to survive 7 torturous years as a POW in North Vietnam.

When asked, “Who didn’t make it (out of the POW camp),” Stockdale replied,

Oh that’s easy. The optimists. They were the ones who said, ‘we’re going to be out by Christmas.’ And then Christmas would come, and Christmas would go.

And then they’d say, ‘We’re going to be out by Easter.’ And then Easter would come, and Easter would go. And then Thanksgiving. And then it would be Christmas again.

And they died of a broken heart.

“This is a very important lesson,” Stockdale continued. “You must never confuse faith that you will prevail in the end—which you can never afford to lose– with the discipline to confront the most brutal facts of your current reality, whatever they might be.

Amen

In the short term I suspect many holiday letters without income coming in will be desperate to sell now or very soon which will bring prices down in that sector.

I think reduced buyer numbers in the residential market will encourage owners to rent their property out so any buyers left will have reduced stock to pursue which will prevent a large downturn in sale prices. So prices will look largely unchanged however the longer term effects of the QE will erode the value in properties which will give a slow correction in favour of other asset classes.

As properties correct more people will be able to afford them so demand will return. It does seem possible that other countries may be less inclined to invest in the Western property markets so even if the numbers will be managed not to scare people I cant see prices rising without the overseas investors.

But who really knows?!

I’m interested to hear other opinions.

All markets are, once again, in a state of mass delusion, thanks to the Fed. Nothing is coming back anywhere near normal anytime soon. Whoever is keeping these markets elevated on the vapors of bubbles past is once again proving themselves idiots beyond all comprehension.

Exactly.

Sales volumes (leaving C19 out of it for a minute) would increase if asking prices fell from their ZIRP inflated levels – simple demand curve economics.

Demand curve indicates lower price means more sales. But is the real price lower? Stock market correction and house price correction also take some money out of the game that was borrowed into existence. Then there is the huge labor market disruption, a period of uncertainty and some shift in personal values wrt risk management.

While this is not a major war it us close to it and simple extrapolation has to be done with great caution.

The Fed can buy up all the properties, houses and hotels on the Monopoly game board. They can keep rolling the dice, printing new money and moving the game pieces all by themselves. Why should anyone make a mortgage, rent or tax payment? Like Soviet Union in its decline.

Hopium springs eternal and everyone has a plan until the get hit in the face.

People can stay idiots longer than you can stay solvent, or something like that.

They cannot remain idiots when they lose their jobs. They can only be idiots when they can float new credit to overpay for things…..

If I was able to manipulate the markets, I would want a good rally in order to bail out..

As for the current real estate market. There will be between 25% and 35% unemployed over this next year. Extreme leverage was already baked into the markets. The Everything Bubbles weren’t fake news. Covid19 punctured a huge hole in them.

So huge numbers of unemployed and a blown up bond market way bigger than the FED is able to patch is just starting to show itself does not make any kind of a bull market. People may still be buying but I guarantee they will be sorry.

We haven’t yet started to see the corporate defaults. There is no way to go back to January’s highs in any of these markets. This is Minsky’s Instability Hypothesis on steroids. Good luck trying to catch that falling knife.

I agree 100% Anyone foolish enough to buy housing now will be sorry shortly

They told me “Buy now or be priced out forever!”. But I didn’t. And I feel okay with that. Okay seems pretty good right now.

Escape artist?

From the Everything Bubble to the Almost-Everything Bust!

“Nothing Goes to Heck in a Straight Line” has become a “Straight-Line Decline”?

Everything is deflationary … except the Federal Reserve. The Unstoppable Deflation vs. Infinite Inflation. Just add a few zeroes to that immense balance sheet, with the rest-of-world’s balance sheets dangling off of it at various angles and rates of exchange.

The Fed will win, eventually. Never Fight the Fed.

But it takes more than credit to restart the economy, it takes millions of people’s smart choices and hard work, and time. And in that time, a lot of badness is upon us.

And there’s a serious distribution issue. Those who get the magical Fed Credit will be able to buy out those without. Wasn’t it our very own Treasury Secretary whose company bought and/or foreclosed upon millions of houses using Fed Credit to expel those caught offsides in the last bust?

Soon, it may be one of the best times in our lifetimes to buy a house – but only if you have Fed Credit. For the rest of us, it’s going to be a tough time just hanging on and trying to make rent.

A good question to ask is why the ZIRP goosed home price inflation is not drawing enough new supply into the starter home mkt.

Too expensive,

Most local gov have raised the price of a building permit from $100 to $50k in 20 years

Why would anybody build starter homes, when they have to front so much cash?

Better just to buy toxic waste and sanitize/flip

Your “never fight the Fed” law of the universe is about to be proven false. The Fed has it limitations, and anyone who thinks it does not is a religious zealot making their decisions based on faith, and not real data and logic.

Debt default is going to be an avalanche world wide and will dwarf anything the Fed is capable of offsetting.

China is now nearly a month into their reopening of their economy and still the customers have not returned to the businesses.

They are staying home and hoarding their money.

Our economy is based almost entirely on credit purchases. That means for it to begin recovering, not only do people have to begin to spend money again, they have to have confidence to take on debt.

I feel quite certain that people here will not have much more confidence than the people in China. In fact if they are at all aware that the damage to our economy is much more severe than China’s due to our service base, they will be even more conservative.

Jdog: Thanks for the”never fight the Fed ” push back. I have been standing in front of the fed my whole life by not having debt. The Fed is being countered by the rest of the world as I am typing. De-dollarization has been accelerated by its actions. When the dollar goes the fed product of DEBT is gone. Most people in this country have drank the kook-aid of denial even when their eyes see their country being destroyed by debt and mal-investment via the fed.

I can confirm this. I deal with Chinese PCB manufacturers and they are sending me multiple emails a day offering me money off vouchers and upgrading me to a higher status on the order system ( lower piece price etc). They have never done this in the 5 years in have been dealing with them.

Never? Not so sure. Maybe once in a blue moon.

I would turn the statement about never fight the Fed around and say the Fed will inevitably lose eventually, WS.

What central banks are doing is essentially just storing energy by permitting ongoing bad practices to continue, which will eventually exacerbate the storm that will sooner or later be released.

Central bank interventions will eventually come back to haunt us with interest when a large enough mass of pension and social security payments come due, and people go out and seek to convert financial assets into real goods and services, and either payments must be reduced or much higher inflation will ensue (I’d bet on option 2). But it may also start to unravel earlier, as the monetary interventions are now becoming completely crazy, and I suspect we’ll shortly see many more interventions from world central banks. I’m frankly surprised that we haven’t already had a new Bretton Woods type gathering or something due to confidence in the current system evaporating.

Another type of rebellion I can see happening sometime soon in the Eurodollar system, is that once foreign currency capital flows into countries like e.g. Turkey from new debts incurred gets permanently ecplipsed on aggregate by outgoing capital flows through debt servicing costs in those foreign currencies, then I can easily see someone like Erdogan takingdomestic entities into Turkish Lira (maybe in conjunction with a New Lira or something), and making it illegal for those entities to service debts in other currencies. And once it gets started I can see others, like Duterte in The Philippines, doing the same, and eventually many more jumping on the bandwagon. It certainly won’t make for more friendly international relations, but once the current Eurodollar system clearly stops providing funding advantages to many participants, then they will bail on it, I reckon.

Sorry, I mistakenly managed to delete some text got from the last paragraph i wrote there. The sentence is supposed to read like this:

“…then I can easily see someone like Erdogan taking the initiative to forcefully convert all foreign currency debts owed by domestic entities…”

This is the PERFECT scenario for renters who had been patiently saving like myself.

The question will be: at which prices can we sure that we aren’t paying a cent above what we should in order to not be affected by the brain-dead policy of housing price inflation through cheap credit and lax lending standards?

>>at which prices can we sure that we aren’t paying a cent above what we should<<

As always, it depends on the neighborhood you are buying into. One can look at the value of the land plus the replacement cost for the house, the later amount which is depreciated for age and condition. However, if you follow that approach you will likely fail. Instead, don't aim for the cheapest value but the best value. A best value is determined by other parameters that greatly affect marketability and therefore price. Those other parameters are:

1. Quality of nearest elementary school and middle school. (School demographics are updated each year unlike the census which is updated every 10 years.) Look at the schools statistics showing the percentage of students from low income. That will tell you the true disparity in income for your target neighborhood. One website is greatschools dot com.

2. Crime statistics by neighborhood and town, which are available on websites like neighborhoodscout dot com.

3. Pension burden (per capita) of the city/town on future property taxes. This pension burden is going to be a big problem for older, even wealthier towns.

4. Proximity to sex offenders. There are free mapping services that show these numbers. A house near a sex offender will have a much lower marketability. Do you want your young kids and wife living near that neighbor? 'Nuff said.

5. Distance from neighbors. I believe this is the NEW emerging trend due to the Corona virus thingy. As an example, older people might choose to not live in a high rise condominium complex (e.g. southern Florida luxury hi-rises) for this reason.

6. Survivability of the HOA or condo association. You don't want to be burdened with excessively high HOA fees because of a significant number of neighbors defaulting on their HOA fees. This can really cause a lot of financial headaches during a downturn, as was the case in south Florida in the last recession.

So, as you can see, from my long experience in life, your choice shouldn't be just about purchase price but about quality of life and other issues.

S Agree on all your points and add to the HOAs the fact that some sites have extremely rigid rules regarding renting your property out which could have an effect on value one way or the other

If you can find that bottom, please do let us know here. :)

A wise man once said, when people really, really, want to sell, then buy. And when they really, really want to buy, then sell……

A lot simpler than all that analysis that ti didn’t really read below, is to look at the what the rents are going for where you’re buying

if the rents are a fair bit higher than what you have to pay for a mortgage then guess what you’re getting a good deal

think about this

imagine a house that goes for $450,000

what’s the likelihood of the owner getting someone to rent it for the equivalent price he pays for his mortgage?

Not high.

Imagine someone buying three $150,000 apartments / condos / houses?

What’s the ( relative) likelihood that he will be able to find three different tenants who will be able to pay that mortgage for each one of those three places? Answer: very high.

In the future people will not be buying real estate based on the prospect of it going up in value. People will not be buying houses that have rooms in which they will never be using,

For example, they only need three bedrooms, But they will buy one withfour or five because the Great Fools going to come by and give them more money for those extra bedrooms.

What’s going to happen is people are going to buy houses/apartments/condos based upon what they can be rented for > they will be valued based upon their income potential.

jean, it will take at least a year for the defaults to turn into foreclosures and then Real Estate Owned by the lenders.. In the mean time, prices will very slowly recede.

I’m thinking that because of the predictions on the run of this virus and when a vaccine will be available, we may not even be out of the woods, so to speak before, 2021.

Most likely scenario is that the bottom in real estate won’t be for a few years at least. Patience is a virtue and haste makes waste!

Patience is a virtue and haste makes waste!

Couldn’t agree more. If you’ve been ‘good’ and waited on the sidelines while the circus of asset price inflation had been going on for the last 10 years or so, the last thing you want to do is act in haste now and get in before the bottom is in. While no one can predict the bottom but at least going by the verifiable economic data coming out, we are far away from the bottom of any kind, in either stocks or real estate.

This crazy bounce in the stock market definitely makes you question your analysis/decision-making because the Fed intervening in such a strong way is no doubt influential. However, how much longer will the stock market continue to defy cold, hard economic realities? Maybe longer than any reasonable person’s estimates? Maybe not? I wish I knew.

I am a renter and former homeowner. Purchasing a home is about the most complex decision in the world because it combines so many factors regarding lifestyle, location, security and financial stability. The best tool I have found for the financial modeling is Michael Bluejay’s rent versus buy calculator which is free on-line. It will basically solve for an equivalent rent and a break even date as buying is always more expensive the first month due to transaction cost.

A lot of the financial decision comes down to opportunity costs of doing something else with your money and the value you place on the liquidity of paper assets vs. somewhat illiquidity of residential real estate.

What is different in this ongoing real estate crash is that many of the jobs that were previously considered to be safe are failing too. Here in Portland the two largest physician owned medical practices layed off most of their staff, and reduced the pay of the physician partners to $3000 per month. Those docs won’t be getting a jumbo mortgage anytime soon.

Once the bans on non-essential procedures get lifted, there’s gonna be a lot of pent-up demand for hip and knee replacement surgeries!

But of course, the private equity firms that own these physician staffing agencies won’t restore those salaries though; they’ll just keep the extra income for themselves.

Yes indeed. Had a hip done last October & it is fantastic! Planned on having a knee done three weeks ago. When it’s time, it will happen …

I used to bike race with titanium parts in my carbon-fibre disc wheels. Now I have titanium parts in my body!

I will get new neighbors next week as the home to my south was listed @ $269k on Thursday, 19 March, and sold on Saturday the 21st for $280k.

‘Synergy’ asked for an update when I commented on this on the 25th, and that’s it.

Thanks for the update and glad your hip surgery went well.

Hip and Knee replacement surgeries ? Does anyone actually still have those procedures done in the US? I suppose if you have a platinum policy otherwise there are a lot of much better places around the world to have those things done Root canal too It’s a racket in the states I had mine done in Poland for 10 cents on the dollar

Krakow is one of my favorite cities!

My orthopedic surgeon, Dr. Richard Kyle, was one of the people who designed the polyethylene acetabular cups that are now being used. When he started doing hip procedures, there were only four different sizes being used. He worked on shaping them and having 2 mm incremental sizing being ‘industry standard’.

I’m proud to have had him as my doctor, to put a 58 mm cup into my pelvis. Cool looking X-rays I now have too!

Hennepin Healthcare in Minneapolis with Dr. Kyle working the scalpel (and grinder, and saw, and drill, and hammer) is, in my opinion, the best place in the world to get a new hip.

Hmm I need to remove 4 root canals and replace with implants. Do they have biological dentist in Poland and how safe is it? It’s a fortune here around $36,000.

What do you define as a real estate crash? Big price drops haven’t shown up yet. Of course current sales and future near-term closings would take a hit because know one can go out and lots of people cant go back to work.

But what’s the crash sales, price or both.

They have in places like Connecticut and Illinois but taxes are outrageous in those places plus lousy weather

New York, NJ aren’t far behind

People live in states like Illinois and Connecticut because THEY WANT TO BE THERE. We have 4 seasons instead of summer and a couple weeks of sh#tty weather.

I’m really sick and tired of these stupid arguments about leaving because of taxes. Taxes pay for SERVICES. I’m thrilled to be out of Texas. If you don’t like where intelligent people live, please keep it to yourself.

I don’t think prices have crashed yet. Like at least 20-25 down from the peak. Perhaps they will but they haven’t yet.

If you tell me the high end houses, multi-million dollar homes have dropped that amount in certain markets, thats okay. Most of us can’t afford those and it’s only a small segment of the housing market.

Some believe that there’s balance between homes being pulled off the market and demand for homes such that home prices won’t move much before this is over.

I’m not sure what to believe because the Fed has decided it will be the savior of all. I’m not so sure we really live in a free market anymore. Wtf is going on in the stock market? Is that the new QE already inflating us to the next bubble?

I believe if they successfully paper over this recession that before too long we’ll get a depression so bad it’s gonna destroy civilization and the only thing that will be able to reset it is another world war. It’s like debt doesn’t matter anymore and Uncle Sam will save everyone so why not take as much risk as you want…

Mostly true…but the Fed has let hundreds of energy companies go BK.

Mostly the Fed “saves everyone” when its own systemic, continent wide insanity/stupidity (see endless ZIRP) blows up.

This is Round 2 – Fed as*holery will guarantee rounds 3, 4…

We may get a depression or world war or both. But it won’t matter to the stocks they will tell us it just means the bottom is near and they will rally on each and every bad to worse piece of news and will hit ever new all time highs. And why wouldn’t they with the Fed throwing trillions of free $$$ at them 24/7.

Yes, the way I see it, FED is definitely setting up or laying the foundation of the next giant bubble, one even bigger than the current one once things are somewhat back to normal especially if a vaccine eventually shows up and save the day. I can imagine if the current rally is a bear trap on the next leg down in the next couple of months, FED will have more kitchen and bathroom sink to throw at it to keep the market prop up, buying up stock won’t be so crazy of an idea anymore. Only caveat is that, instead of pumping up the next bubble, unintended consequences is that we mirror the path of Japan but then again there’s different dynamic here it might not turn out that way, likely outcome is that asset price will go through the roof and house humpers can once again brag about how their crap shack is now worth multi millions and their 3 shares of Amazon stock are now worth somewhere north of 6 figures.

Oh, but Shirley you realize there is nothing to worry about? For if a vaccine is discover the Fed with forth-with terminate all it’s temporary emergency measures! Why it will make all it’s rich friends give all those trillions it gave them and everything will be OK again.

Question:

Remember the scene in The Big Short where the stripper freaks out at the news that her loan is going to Heck and then admits she owns 5 condos on top of her house on pure liar loans?

So does this remind us of the Air BnB surge that had people mortgaging/Re-fi their homes to buy 5 to 10 Condos for income?

I think this will get ugly.

Don’t call me Shirley….

A-Bomb

You stated “…Some believe that there’s balance between homes being pulled off the market and demand for homes such that home prices won’t move much before this is over…”

I own low end single family (turn key rentals) in Kansas City. These are $65K houses AFTER I put a $40K remodel into them. The inventory there is non-existent and I am not seeing a slowdown of investors wanting to at least kick the tires on my turn key tenant-occupied cash-flowing homes.

In short – I agree there will be stable markets in different places throughout the U.S. despite 20% dow requirements and no more jumboze.

20% “down” not “dow” sorry. :-(

So how enthused are these leveraged landlords going to be when their tenants stop paying rent, and the government tells them they cannot evict them? How much demand do you expect when unemployment is at 20%?

I am old enough to remember what a pain in the backside it can be to be a landlord when recession hits and people cannot pay rent.

A few ongoing dramas with unemployed tenants that drags on for 9mos. and entails lots of trips and bills from an eviction attorney tends to dampen the enthusiasm for being a landlord. You will be surprised how fast property owners start dumping rentals when it starts to be a PITA to own them.

It only takes a few homes in neighborhood to bring the comps of all the homes down

Markets will be a lot more stable where houses are $65k, than where houses are $650k and people struggle to put together a 3.5% down payment to get a loan that eats up ~50% of their take home pay.

As always, really good reporting on the market and what’s going on, actual info I can rely on. Will be interesting to see how this will push home price down more and more hopefully in LA, SF and NY market. Funny thing is, the other side is already building counterpoint as to why this won’t mean house prices will come down anytime soon.

https://www.marketwatch.com/story/mortgage-rates-almost-drop-to-another-record-low-heres-why-a-housing-market-slowdown-wont-necessarily-push-them-lower-2020-04-16?siteid=yhoof2&yptr=yahoo

https://www.ccn.com/housing-market-supply-shock-blindsides-crash-crazed-millennials/

This “supply shock” (CNN) is such a silly concept. Sellers are pulling their homes off the market because there are few buyers, and if there’s a potential buyer, it’s hard to even show the home. Unemployment will hit 20% here pretty soon, and everyone is worried about their job. The Chinese and other foreign-resident investors are gone. There is no supply shock. There’s a demand shock. It’s gone.

You think that’s ridiculous, try this on for size. Mainstream is gonna push that FOMO and buy now real hard in the next couple of months…

https://finance.yahoo.com/news/barbara-corcoran-educated-buyers-can-get-the-deal-of-a-lifetime-right-now-164141514.html

Middle eastern oil barons, Russian oligarch and oriental rich people are still willing to buy the residential properties in bulk. Once the crises is over, plenty of rich folks will buy all these properties. Again, let these graph go back to the good ol’ times of 2008, then we can get a good picture.

Someone tried to vandalize the US constitution, with the words “total authority” in the national archives. The problems is as the guards later found, both of the words, total and authority were misspelled. How come they misspelled “total”? It took the investigators 48 hours to determine those words…

They might be willing to buy real estate in their own markets but buying in the US? Especially when rents are already becoming an issue? Highly doubt it.

Hey Wolf!

Always look forward to the housing articles each week, as an agent in the hot real estate market of Boston.

Homes are still having multiple offers here and the home buyers are 1000% first time home buyers.

I am surprised at how these homes are still going under contract. We are blessed with low inventory here. I believe the tightening of jumbo loans are going to cause a problem since the average home in boston is around $750,000.

Boston recovered quickly from the 08 crash and only took an 18% hit with some neighborhoods with only a negligible dip.

I would love to hear your thoughts on this city as I believe that there is not a city that is recession proof, but with top primary/secondary education, finance, university, health care, low inventory,

IS BOSTON THE CLOSEST CITY TO BEING RECESSION PROOF as you can get?

Thank you in advance

That sent my BS-o-Meter redlining.

My BS-o-Meter is redlining constantly these days.

I am not sure I am woke an idiot or a fool but it is driving me crazy.

VeryAmused:

My BS-o-meter’s pointer is permamently wrapped around the max stop post!

A quick google search shows that there’s some truth to JM’s post

The highly educated population base really does drive the area’s economy. Something like 70 colleges in the Greater Boston area.

The freezing winters keep out the riff raff retirees, tourists, homeless, and foreign plutarchs, unlike San Francisco. Real estate purchases largely limited to people who actually want to live there for a long time.

I lived in Boston for 2 years. Great city and people. Freeze your nose off winters, very cold spring and fall. Big mosquitoes in the summer

Yeah, except there are very few deals happening. That’s why this comment by Joseph Maiorana is Propaganda BS.

Hmm, I am sure this has nothing to do with his comments at all..

Joseph Maiorana

Day Trader and Licensed Realtor in Boston Metro

Greater Boston Area 500+ connections

Never visited and no such plans, but from the movies I’ve seen, Boston is like depression on steroids.

Growing up in India, from the movies I saw, all of America seemed like Baywatch!

I was in Boston in February red hot vacancy is what you have…

Washington street plagued with vacancies and a homeless crisis.

Supported local shop Kenmore army navy selling a made in America peacoat. Owner of the store said $20,000 monthly rent with RE tax is no longer sustainable. Could only imagine now…

Please come back here with a market update this time next year.

The massive BioTech in Boston means there should be no problem. The govt is pouring billions into that industry. Jobs, jobs, jobs. Also, homes fell slightly in 2008, on the order of 10% because the job market stayed strong through the last recession. Boston is the future more than any other US city. The depth of their ivy league educated workforce is second to none.

SoCalJim,

The Boston area has only ONE Ivy League school, and that would be Harvard.

The Other colleges, universities, and schools of higher education in the Boston area include:

MIT

Boston University

Tufts

Northeastern University

Boston College

Wellesley College

Brandeis University

Babson College

University of Massachusetts Boston

Bentley University

Simmons University

Emmanuel College

Emerson College

University of Massachusetts Lowell

Gordon College

Stonehill College

Berklee College of Music

Massachusetts College of Art and Design

Wheaton College

Suffolk University

Framingham State University

Eastern Nazarene College

Lasell University

Bridgewater State University

Boston Architectural College

MCPHS University Boston

Benjamin Franklin Institute of Technology

Endicott College

Salem State University

Lesley University

Bay State College

Olin College of Engineering

New England Conservatory of Music

Wentworth Institute of Technology

Merrimack College

Curry College

Regis College

Boston University Fenway

Bunker Hill Community College

Boston Baptist College

Pine Manor College

Roxbury Community College

Urban College of Boston

Hebrew College

Quincy College

Fisher College

Cambridge College

Laboure College

Dean College

North Shore Community College

MGH Institue of Health Professions

Middlesex Community College

Longy School of Music of Bard College

Saint John’s Seminary

MassBay Community College

Northern Essex Community College

Massasoit Community College

NorthPoint Bible College

Fine Mortuary College

Lawrence Memorial/Regis College Nursing Program

Hellenic College/Holy Cross Greek Orthodox School of Theology

Boston Graduate School of Psychoanalysis

Hult International Business School

William James College

New England College of Business and Finance

New England College of Optometry

New England Law Boston

New England School of Photography

North Bennet Street School

The point being that the Education and Healthcare/Medical industries are huge in Boston. And these are a bit more resistant to the COVID pandemic and other service industries

Just these alone:

MIT

Boston University

Tufts

Northeastern University

Boston College

Brandeis University

Babson College

These might not be in the ivy league, but every one of these are top-tier, world-renowned schools that consistently are in the top ranks. They all have ivy-league faculty, administration, and collaborate regularly with the ivy leagues on initiatives and research. MIT and Boston University are part of the AAU.

I can’t think of any other area with anywhere close to as many well respected/research producing institutions in the country.

I do know a lot of posters on here hate academia and think the whole thing is a “scam” and that people should “learn a trade” or take an “Amazon certification”. They don’t realize how different these schools are than say a Suffolk University, SNHU, or (yuck) Liberty University. The financial aid they give makes cost of attendance rival public schools (people should do research before spouting off), and they have much, much greater research activity. These are mission driven organizations focused on the greater good.

Sounds like the place is overrun with pompous parasites.

Don’t think this sector is immune from a real contraction.

A number will depend on private tuition, not government money and this can dry up fast. Also the gov student loan book has become such a fantasy that it’s hard to see it being expanded at the previous rate.

I have nothing against any field but if I could do my time again I sure as hell wouldn’t be getting a degree in English. Along with a number of other liberal arts, the only economic reason to pursue a Masters is to get a job teaching B.A s, and the only reason to get a Ph.d is to teach M.A. s pursuing the Ph. d. It’s a self sustaining reaction until it runs out of its fuel, the First Year Fodder.

Of course there are nice guys with these docs and even some with intellectual curiosity, but here is a true story about a pompous one. A close friend was on the phone in a Uni travel office making the flight arrangements for this guy to attend some junket. ‘So Mr. (X) is confirmed on the 10 AM flight?’

X leans over and says: ‘Excuse me, it’s actually Dr. X’

Friend replies: ‘If a passenger is unwell can you attend?’

So he decided to fly as Citizen X after all.

Gandalf,

Yeah, but those campuses are CLOSED. Now everything is distance learning, and you can live anywhere to do this.

THIS ARTICLE WAS ABOUT REAL ESTATE UNDER LOCKDOWN not education in Boston BACK in the good old times.

@Nick Kelly

English degrees, the favorite target of Fox News, make up a very small percentage of grads. STEM + business continue to grow. Did you know that tuition growth has slowed markedly since the first half of last decade? With growing endowments and financial aid, average 4-year price paid is almost unchanged YoY. Sorry you find academics all pompous. A lot of PhDs have questionable return, but many of the top PhDs are the reason we have much of the technology and medicine we have today. The schools that will suffer from lost tuition money will be the small liberal arts schools with high acceptance rates, not the schools with <25% admission rates, with wealthy students banging on the door trying to get in. Boston's educational presence is much more of the latter, not the former.

@Wolf

The lockdowns will subside and residential education will return. Maybe not until 2021, but distance learning has been consistently shown to have subpar educational outcomes. Lab sciences, research, collaborative work, etc. can all not be done effectively. Any time anyone advocates for online education, I ask them to try hiring only online school graduates, and see how that turns out. They're recipients of a cookie-cutter, pre-packaged knowledge regurgitation. Those programs by and large fail to deliver meaningful improvements to critical thinking, offered by top-tier, residential education.

To Sc7: re: ‘I’m sorry you find all academics pompous’

My words: ‘Of course there are nice guys with these docs…’

So right of the bat you misquote me.

Moving on: next time you are at a party ask how many people have , or know people who have, degrees in math (the M in STEM) compared to any of: law, business, psychology, education, economics, and trailing off, sociology, anthropology, music, history etc.

By any measure, the US is grossly over lawyered, with the numbers in California rivaling the rest of the world combined. They threaten to strangle the economy.

In the two export powerhouses, both running huge surpluses with the US, Germany and Japan, there are virtually no B-schools.

The first in Germany (Heidelberg) only dates from 1995, purely to attract international students.

It’s worse in Japan where the concept of studying business in general with a view to entering management of an actual business is barely translatable.

Moving on to psychology, psychiatry, here is a quote I know almost verbatim:

“It’s easy to create a false epidemic in psychiatry and we’ve done it with three: autism, attention deficit, and childhood bi-polar. The advocacy groups and pharmaceutical cos play a huge role. Kids who used to be considered different or eccentric now require treatment.’

The writer: Dr. Allan Frances, editor DSM. IV

So yes, although I have the greatest respect for genuine inquiry and great literature ( which is not of course produced by Doctors of English) I think a lot of what is on the market falls short.

Boston of ALL places……really?

Boston had a MASSIVE influx of Chinese buyers (see Boston Magazine article 2014–if this article doesn’t scream bubble I don’t know what does) These buyers now looking to get OUT. fast The housing stock is also ancient.

Moving vans are lining the streets with college students breaking leases left and right with plenty students never coming back (transferring closer to home except for the Harvard-MIT level students/and graduating…why stay—everything is closed!). Landlords looking to convert rentals into condos ASAP citywide. So much for “low inventory!”

The HUGE International student population in area colleges in Boston may not be coming back in anywhere near the capacity in Boston in September. Startups will be folding like crazy soon. This was a problem before COVID. People buying 1M dollar floors of a quick fix Home Depot fake hardwood floor and white granite fixture 3-decker in questionable neighborhoods is just not sane IMO. Stores in Harvard Square and similar former popular spots have been boarded up for well over a year due to the Commercial landlords taking over the empty storefront/accounting tax break loopholes.

I expect a minimum 30% drop in 2 years if we are EXTREMELY LUCKY. Who wants to buy a 800K old 600-700 sq footrun down condo w/ PITI when you can rent it for 2K or less? We shall see!

I want to correct myself, median sale price in boston condos in 2020 (YTD) is $679K with inventory of 1.1 Months, Days to Offer 15. compared to 2019 (up to april 16): $665K inventory of 1.44 Months, Days to offer 18.

I can say that 100+ homes have gone under contract in april just within boston city proper with a little bit more than that coming onto market.

I am not saying that they are going to make it through this without a dip, but boston may be top 5 metros performing through this next phase. If schools are closed for fall, that would definitely cause a huge problem.

Boston area saw only a 10% drop during the great recession. It did much better than comparable cities such as SF, DC etc. Look at the data, it is easy to verify this on Trulla. I have lived here for more than 10 yrs, am well versed with the RE market and an looking to buy as soon as prices drop a little bit. Right now only about 10 % of buyers and sellers are in the market, the rest are waiting on the sidelines. There are many condos with a ‘coming to the market soon’ sign, but have not been listed yet. Most of the buyers and sellers at this point are locals either up sizing or downsizing, not many from outside. The rental investment market seems to have stopped for now, people are waiting for price discovery. The large number of new apartments, combined with the possibility of students not coming back in full force for the fall semester will weigh on that part of the market.

But the medium and long term outlook is pretty strong. The primary driver of RE appreciation is gentrification. Boston has plenty of tony suburbs which are not connected well through public transport. As schools get better, and commuting gets more painful (bostonians will know what I am talking about), more and more people are selling their million + dollar houses in the suburbs and moving into the city.

While the local govt does not provide granular data on rate of gentrification, one can assume it (as I have) by downloading data on the demographic composition of public school students in MA. Outside of Mattapan and Roxbury, boston is rapidly gentrifying, and the school grades are improving faster than the rate of gentrification. Our local public elementary school went from a failing grade 7 years ago, to one of the best, beating out schools in tony neighbourhoods such as Lexington and Dover.

I plan to wait a year and then start buying into the >500k condo market. I would avoid the lower end of the market though, and would avoid places not connected to the T.

Jay,

Housing stock in Boston isn’t ancient.

Housing stock in Boston are historical landmarks

Hey Joe I seem to remember the situation in New England housing in the early 90s and it wasn’t a pretty picture and they had all of your mentioned attributes at that time as well I think you have blinders on buddy

My $.02 as someone who has lived here and bought/sold multiple properties over the past decade.

I think you’re still seeing multiple offers because so much inventory is being held off the market, the remaining buyers (of which there are fewer) are still competing for the handful of properties coming online, which is way, way lower than usual. I heard that sales in MA are down 48%. I suspect by the fall, inventory will come online while demand will be reduced after economic impacts are felt. Remember, most people still have no clue what is on its way economically, or what GDP even is for that matter. People were buying in 2008 until about September. Remember, housing is like a cruise ship, the effects are usually felt months after a recession is over, not during the recession. These lockdowns are inning 1 of a 9 inning game. Plans to buy a home have plunged the most since 1979, while Boston may be resistant, it’s not immune to changes in sentiment that big.

I do expect Boston to remain relatively stable. I think suburban towns outside I-95 will take a price hit when this is all said and done, to the tune of 10-20 percent. There won’t be enough buyers for $600k splits in Natick, Reading and Burlington, nor $500k splits in Billerica, Tewksbury and Southborough. But, for the <$1m inventory in Newton, Needham, Wellesley, etc… they'll be just fine, perhaps nominal cuts in pricing temporarily.

Boston isn't recession proof, but it's one of the most recession resistant markets there is right now, and probably will be for the foreseeable future. Diverse job base, academia (which only becomes more important as we move to an information/tech society) and healthcare.

It's stable because there's little speculation possible (it's built out), and tourism is such a small slice here it's irrelevant. AirBnBs in the city may suffer, but to the point someone else made, most people buy here to live here a long time. I don't see that changing. The weather sucks, so that, combined with a high CoL, mean it's not a retirement destination either.

That said, don't hang your hat thinking things as a realtor will be fine and continue as-is. This market did seize up in late 2018 when interest rates hit 5%, so I do not expect any different when this makes its way through. I expect this Fall/Winter to be a very slow market, and the "hot" days of 6+ offers over asking will probably disappear for a while. But, like everything else, it will be temporary.

Oh, one other thing to add. I think you’re onto something with the jumbo loan issues doing some damage, but a lot of $700k-$1.2m homes are purchased with large downpayment, so many of them get a mortgage that actually fits in the conventional bracket.

If conventional credit tightens further (such as more lenders following JP Morgan and requiring 20% downpayment or some variance), that WILL hurt the Boston market. There are a lot of cash-rich buyers who can do 20% down, but not enough to sustain the entire metro market, particularly the outer suburbs. I see starter inventory further from the city (drive till you qualify) being hurt more than luxury inventory. Many, many homes in the outer suburbs are purchased with 5-10 percent down.

Long shot theory: Worcester is poised for long-term growth as an eventual affordable sister-city to Boston, as aging housing stock and poor infrastructure limit growth near Boston. Not my preference personally, but IMO, a great place to invest in a long-term rental property or two, if one is so inclined.

BS. Nothing special about Boston if there are no jobs.

You’re screwed. Same advice you offered Vancouver.

Ok, define no jobs? If there’s somewhere with a high proportion of white collar professionals who work in an office, but are easily able to work from home, it’s Boston.

Vancouver is very different than Boston.

Just to give everyone the numbers and facts (The info below is a 5 year report pulled from Massachusetts’ MLS. I have access to this. anyone with access can pull the same results:

all numbers are Boston City Proper Condos (not the metro areas) 2016-2020 YTD april 18:

Units on Market (2016-20): 477, 521, 674, 849, 720

Units closed (YTD 2016-20): 893, 927, 1026, 905, 1023

Ave sale Price (YTD 2016-20): 779K, 831K, 926K, 829K, 973K

are there some sellers keeping their properties off market and still willing to sell at the right price? Yes. Realtors have a network for this to get these sold.

Are people still buying? Yes, though it is not the craziness we saw in february (5 offers per property). One can expect to get 1-3 offers first weekend on market.

My buyers are advised to wait, to protect them from buying something right before the floor gets pulled. Everyone else seems to be in a time of irrational exuberance right now.

Boston was one of the first areas to shut down as well (3/23). Though I’ve seen units go under contract, it usually takes 30-60 days to close (sold status). Though the numbers I track each and every morning to see the movement in the market are surprising to me (things are going under contract), we will see how many closings we actually have 5/1 (first of the month has a lot of closings) and how those numbers look after that.

The #1 critical thing I am watching out for my buyers: if fall 2020 semesters are online. Rental leases run based on the semester. Most leases are all the same and start 9/1. If schools do go online for fall 2020, many of the studens will be staying at home with families instead of signing another lease.

This can create havoc for landlords who have rental properties with mortgages. THIS is boston’s achilles heel. For buyers looking to invest, this can create an amazing opportunity.

also, with so many medical labs, biotech happening here, if we saw a shift of schools moving to online in the future permanently. There is still a large population of grad students in science and medical fields who need to live here to learn their craft. There are no options to split cells in your kitchen. It is not like boston will become a ghost town, that is what I am saying.

Inventory: bostons inventory is hard to increase because the airport runways point straight at the city. So, boston is vertically challenged. tallest building is 660 ft. i believe. on top of that, people want to preserve the history so many buildings cant even be more than 4 floors in different neighborhoods, then there are rules about “shadows” from buildings, blah blah blah. it gets messy.

I saw someone mention about homelessness. Boston does have a homeless population, however it is dwarfed by anything in Denver, chicago (where I used to live), nyc, SF.

I hope these numbers help!

again, Boston is not recession proof. but has performed stronger than other metro areas previously. However, if fall 2020 goes online, I would expect more than the 18% drop in prices that we saw in the last crisis.

I also don’t expect this time of irrational buying to continue much longer. These are buyers who have been frustrated losing out on properties for months.

Boston.. I’d never live there unless I am forced

I dont think Boston is special and is protected

Question:

Remember the scene in The Big Short where the stripper freaks out at the news that her loan is going to Heck and then admits she owns 5 condos on top of her house on pure liar loans?

So does this remind us of the Air BnB surge that had people mortgaging/Re-fi their homes to buy 5 to 10 Condos for income?

I think this will get ugly.

There is a silver lining to this RE crash. It might solve the recent shortage of migrant laborers entering the country to pick crops. Soon the house flippers , developers, agents, and investors will be so wiped out they will have no choice but to become traveling fruit pickers.

The silver lining to this RE crash is there appears to be NO RE crash.

He’s baaaaack !!!

Socaljim:

Tell that to our friends who’s $2.2M oceanfront Huntington Beach home sale has fallen through for the second time. First one = cold feet from Covid-19: Second one couldn’t get their jumbo done.

There is no third one.

Why don’t you tell your friend to sell it to the FED? Soon or later, forget MBS, think they’ll be buying houses, old bicycles, used panties..anything that’s “asset” related to save us all from any price discovery.

2.2M oceanfront Huntington Beach single family home? That would be the deal of the decade. Must not be oceanfront or it is a condo.

@scjim

Let your friends know that it is now their “1.2M” home

Once the fed stepped in and temporarily saved all his RE investments from crashing he stopped panicking long enough to come post a few.

I bet he disappears again within a year.

:)

Hahahahaha Coming from a “ broker” that doesn’t carry much weight somehow

The housing price destruction will be dependent upon jobs. If homeowners are getting laid off and cannot afford to pay their mortgage, then they will have the forbearance clause to cover them for a year. After this 12 months is up, they will have to pay a balloon payment of 12 months payments. That is when we will start to see massive home price destruction in the markets. It may take a year or so. If the economy is humming along a year from now, then all may be okay.

You have touched on an aspect of markets that has intrigued me for years. I sold real estate in the Vancouver, BC area in the early 80’s, a time of 20% mortgages and 40-50% price drops. I can honestly say I witnessed considerable pain in a few segments of the populace. I was astounded, therefore, when the markets rebounded quickly in the following couple of years. Did the crash impact only a narrow segment of the population, and perhaps for only a short period of time. I contrast that with my parents whose experience during the Great Depression scarred them for life. Social safety net notwithstanding, I believe there is a tipping point where the hard lessons learned create a fear and caution that can last a lifetime. I don’t believe there is anyone alive who could warn me of that impending moment, but I do believe it exists for me and perhaps for everyone. For my parents, it was probably year after year after year of lean times that reset permanently their expectations for life. I personally don’t believe a viable vaccine for Covid-19 is in the offing any time soon, and a great reset is in the cards. My parents never lamented their new reality, and lived long and fulfilling lives. My father, born in 1900, said he just forgot about most of his life before the Depression, and just carried on. I can only surmise that our pampered populace will be up to the task to do the same.

I don’t think they have a balloon payment, It will probably be rolled into the loan and the term extended. Still, chances are only a minority will be able to find jobs paying what their old jobs did so many of those who are displaced will end up defaulting later instead of sooner. It seems to be the theme of this crisis just to delay what is happening as long as possible.

Individual payment plans will vary by lender. Lenders can’t roll the overall payment into the loan without a loan modification which some may opt for.

Fed saviour is the new fundamental’s

Many landlords/ sellers will hold out until they cant no more.

Inventory wont reflect reality for sometime. L&T court is suspended until September (for now).

Single family home owners take advantage of the spring, sell now before it gets worst. You can still get away with selling for decent price for numerous reasons. Take the cash if you have equity, go rent for 1-2 years ride out the storm on someone elses expense. Come out of this ahead of the pack cash in hand ready to buy.

Some realtors are preparing drone and video tours.

Tech overrated, cant substitute that “this is the one feeling” sights, sounds and neighbors all absent. Realtor photos already misleading.

Will they apply CGI and Green screens in the video tours?

Commercial RE Still dinosaur industry, no need for a website, videos, drones.

Vampires dont require tech they requires pints of blood.

Got blood?

Few more months until the wounds start to leak out and the 2nd wave will create infection. The real deals will happen in the dark vampires exchanging cash for blood doesnt commence in the sunlight.

When pints are being sold in the sunlight that’s the point we hit bottom.

Stay focused, stay safe

Sad to see the HPSI dropping 11.7%. I know some people pay attention to those sentiment numbers for whatever strange reason.

Meanwhile Nasdaq futures are climbing day in and day out without taking a breather. Staying at home and staying connected on our multiple devices helps it to grow like a weed. Good to know that the stock market is forward looking.

“Good to know that the stock market is forward looking.”

The stock market saw nothing coming, peaked on Feb 20, even as everything was coming unglued, it completely ignores everything except the Fed, and then it panics and sells off 30%. In terms of “forward looking,” the stock market is a dumb-f**k.

Haha stock market is a dumb f**k that found support from a bigger dum f**k with unlimited ammo, a true union of dumb and dumber at everyday Joe’s expense

Nothing is unlimited. I have never been religious, but have found wisdom in some of its teachings. This is one I never really understood until now… Thou shalt not worship false gods…….

AWESOME! It is!

“In terms of…”

Lol, that’s bumper-sticker worthy Wolf.

The Stock Market cheerleaders play all possible sides.

They are *already* looking forward to Q4 2021 to justify their viewpoint that the market today has “room to run” and then proceed to pump and cheer and lie to coax it higher.

Yet they refuse to look backwards to yesterday (or this morning), where it is clear that the market has room to fall further, because they believe we are at the bottom.

One of my neighbors who is a money manager is not worried in the least. He says Dow will be at 30K, no question, by end of 2021. He argues that the Fed will need the wealthy to tap their asset portfolios as their income levels decrease, so to keep the entire nation from collapsing. He believes strongly the markets will be propped up to keep the wealth effect going for the top 10%.

Oh… he was also happy that he no longer has to analyze historical P/E ratios prior to 2008, since there is no benchmark comparison prior to that, so he is very happy now… very content and he loves what the Fed has been doing. He is not worried at all, and is living a great life (so he says).

If you put this on a mug, I’m buying a set of 6!

What I always wondered about tech and social media is the reliance on advertisements to generate revenue. At what point will local and to some extend national business stop by advertisement with large scale media outlets like Twitter and Facebook? Im sure this will also run the same withe Google?

Apparently the national newspapers in the UK even those with subscription models are really struggling with the lack of advertising revenue…

One further point, if you are one of those people for whom buying a home now makes sense for personal reasons expect the escrow period to be 60 days or more.

There are severe restrictions on who can enter a home even if that home is vacant, this includes home inspectors and appraisers.

If the home is occupied, forget it.

Buying a home without having thorough inspections done is accepting a degree of risk only a fool would be comfortable with.

And any agent who encourages a client to buy under those circumstances is inviting a lawsuit that could drag on for years.

Don’t be that guy.

I’m curious, don’t many foreign buyers buy without visiting the property in person?

I totally agree with this comment. Don’t be that guy.

I am a realtor in South Florida, we are practicing social distancing (better than what you will find in the local Walmart or grocery store). We are still doing inspections and showing homes that ARE occupied. The sellers wait outside and the buyers have to take off shoes wear mask and not touch anything. Sellers leave lights and all interior doors open. Still selling but closings are having some hiccups due to title companies working from home. My preferred lender is busier then ever. I guess RE is local.

The City of Vancouver has sent an SOS to the provincial and Fed govt based on a small survey that sounds apoplectic and to my mind exaggerated. To read the piece in Van Sun enter: ‘Vancouver Bankrupt’

Here is a slice:

‘Stewart said that Research Co. polling commissioned by his office found that a quarter of all property owners would not be able to pay more than half their property tax owed in 2020 and that six per cent were not expecting to pay anything at all.

The poll also found that 68 per cent of Vancouver homeowners did not pay their full mortgage on April 1, and that 55 per cent were not expecting to make their full mortgage payment on May 1.’

Note that the mayor’s office paid for the survey.

First: the owner does not have to pay his taxes at year end and this account receivable is a pretty good credit. There is no way the mortgagee is going to let the city get the title for taxes, they’ll pay it. Well, not quite true, it got a few in the Depression. Well quite a few. Sorry to interrupt myself I just remembered that. But I just can’t see that happening. Foreclosures, sure, but the most expensive property in Canada is not going for back taxes.

So arrears taxes may create a liquidity issue but not a solvency issue. It’s not a bankruptcy issue.

Second is the slightly bizarre claim that: ‘The poll also found that 68 per cent of Vancouver homeowners did not pay their full mortgage on April 1, and that 55 per cent were not expecting to make their full mortgage payment on May 1.’

Ordinarily, you can’t make a partial mortgage payment, so I’m not sure what ‘not full payment’ means. Could the mayor be using the tax issue twice: the owners elected not to pay taxes monthly?

No doubt a lot of Van owners are stretched but is it possible a large majority can’t pay their

mortgage on the first month of the crisis??

I agree with you Nick, it does sound suspect. Ki da like ‘the dog ate my homework’.

Dave:

Or my alcohlic teacher telling the class her dog accidentally knocked their essays into her washing machine!

Nick,

I think many many YVR buyers got in to the RE market by the skin of their teeth and were barely hanging on in the best of times. And now, it must feel absolutely terrible knowing they bought a depreciating asset that is now underwater. I listened to K Stewart yesterday on CKNW and I think he was just trying to push for funding and got called out on it.

That is only one side of the equation. What about Commercial real estate? There is a very big problem brewing there, and it is going to hit lenders very hard. Many lenders do both commercial and homeowner loans so if they get in trouble because of the commercial side of their portfolio’s that may translate into problems for the homeowners side as well. In addition, I can see States having severe money problems going forward, and they may become very aggressive to get their money.

I agree this is a very interesting comment… the lenders who do both commercial and residential, and how they will manage their lending issues moving forward with (what it seems to be) an obvious deflation of commercial property asset value. If anyone else has insight on this concept, please elaborate.

Regarding the equity markets, the US is just like China! If not worse. Very sad. Privatize profits and socialise loses.

What I am observing is another massive wealth transfer from the masses (via future taxes) to the few that are wealthy and getting wealthier via these TRILLION dollar bail outs.

All the mismanaged companies that are getting bailed should be left to go under in pre-pakaged bankruptcies and then they can come back stronger. I’ve seen this happen many times in the telecom industry (I’m famailiar with it).

Also, when companies go Bk or die, if there’s money to be made, new companies will pop up to take advantage of the opportunity. The US is behaving like China, Russia,… so sad. I guess that’s himan nature to be self-serving and greedy.

A friend and fellow Realtor who saw this post just called me and asked if there was any property in the SF Bay Area that I wold buy right now?

The answer is yes, the N3 ranch.

51,000 plus acres stretching across 4 Counties priced at $68MM.

When a truly unique and magnificent property like this comes on the market you either buy it when it does or wait for several generations for it to come back on the market.

And no, it isn’t remotely within my budget.

Drat.

These kinds of properties take years to sell.

True that Wolf: and one always needs to keep in mind re such ”legacy properties”, especially in CA,,, a relative had similarly wonderful property in Santa Barbara county, purchased by his dad in bottom of the (so far ) greatest depression, actually confiscated by local guv mint, AKA eminent domain.

Though, with the demise of the Coastal Commission, that somehow was able to stop cuz from selling for a couple of decades, things may be different this time, eh

I’m in N. VA. Nearly every buildable lot was built on a long time ago. I value every bit of open green space that’s left, and the wildlife – the deer, foxes, squirrels, raccoons, and coyotes. I’m hoping things slow down for a long, long time. However, this area being next to DC, I’ll probably be disappointed in short order.

Who needs green space and all those varmints anyway? Hopefully all the insects will go away with the varmints, who needs those flying pests? Bees? They just sting! Trees? Who needs ’em?

They paved paradise and put up a parking lot? Parking lots ARE paradise! Build, build, build! Pave, pave and more pave! More luxury apartments and condos on every street corner, please! That’s what you call “progress”!

Just remember kids, the 2 year Treasury yield is a proxy for where the 10 yr Treasury yield will be a year from now, thus start thinking lower mortgage rates ahead, like below 2 per cent

It takes more than low interest to get people to buy depreciating assets…

I get there are millions of cheerleaders who do not want the prices to fall… so they cheer… and cheer… and cheer.

I don’t want my fellow citizen to have pain, but I am warning those who might be interested in getting their feet wet:

Please wait this out if you can until at the very least 2021. You will hate yourself if you buy in the next few months and find that your asset has depreciated greatly.

I agree with the above, it takes more than low interest to buy depreciating asset. If enough people choose to wait, because they believe the asset will depreciate – no matter how many wonderful fabulous cheerleaders that are out there trying to convince you to buy now… the price will go down. Everybody needs to be patient and to avoid panic.

That and 40-50 year mortgages

I saw a condo listed in a downscale neighborhood of Boston recently. 1 BR, 700 square feet in a 120 year old building. Third floor walkup, no elevator. One small alley marking space for a small car.

$550K asking price.

That’s a tiny starter home that sold 20 years earlier for $80K.

Under the current mortgage requirements tightening access to those with a 700+ FICO and 20% pmdown payment plus closing costs, how many young or single buyers are gonna rush in with $125K for down payments and closing costs, plus a monthly payment including taxes, insurance and association fees of $3,300 with a 20 year mortgage… for a tiny starter home?

Most of these places were bought with 5% down mortgages. Those no longer exist.

I like this comment, because it’s kind of like boots on the ground. I totally get the folks that say there will be a balance between supply and demand, where homes are taken off the market, etc, but this comment illustrates the psychology of the individual: miniature home… sure it’s historical, and I am sure it has some wonderful historical and construction quality attributes, but Jack and Jill think – even maybe – there is a chance the price will fall, will they really fork out $125K for the down payment. I say, no they won’t, because they would be losing a lot if the price dropped.

Also, kudos to the post that reminded everyone that Japanese real estate hit its peak in 1989, back when their central bank started buying everything.

Great blog… love the articles and love the comments.

Many chain stores in malls are having financial trouble . This will result in declining value of mall real estate .Companies are realizing that many of their employees can work at home , so they do not need as much office space . The result is less demand for office space and lower value of office real estate .

Millions are unemployed and can not pay their rent . The result is less demand for apartments and declining value of apartment real estate.

Chinese buyers have been the marginal buyer of residential real estate in many cities . Given the increased tension between the US and China with a emphasis on declining travel between the two countries , it is very likely that these Chinese buyers will be much less of a presence in these cities.

Some are arguing that the US is on a similar path to Japan because the central bank becoming the main buyer of assets.I remind readers that both real estate values and equity prices in Japan topped out in 1989 and have not approached those levels since

So, I like the comment about refi, right now, the pipeline is so clogged that the rates are actually higher than they were before the Fed cut to zero.

We locked on a 2.75% 30 year about 3 to 4 weeks ago, got the appraisal back, and indicates 50%+ equity, and our credit is pretty good; >780. But, the pipeline is such that we’ll probably close in late May if we’re lucky. We’ve been told the rate lock is good; but I’ve never seen a refi take so long.

Yep. Everyone in the industry is over capacity from refi demand.

Purchases are pretty dead. Lost 1 today where buyer got Covid feet (see what I did there?). Lol

But, ya, refis are extremely busy.

Lenders are tightening up guidelines, but, those with either and good credit and a job are getting great rates.

A buyer backed out? In this market? But Boston… it’s so hot. Like so hot that every person on the planet should be there already, did you not try to sell that buyer a house in Boston? You should try Boston.

Can you taste that sarcasm, goes good with popcorn and a pint.

I have this vision that all these measures and stats of markets and the economy are like the non-sensical instrument readings of a jet plane as it plunges to earth breaking apart on the way down. With dials spinning and lights flashing, the Fed pilot and Treasury co-pilot are desperately trying to control the plane not knowing that half of it is already gone. Still they push buttons, pull on levers not really connected to anything anymore, as luggage and plane bits fly by. Meanwhile, the ground gets ever more closer. Of course, maybe they can V shape it back up to blue skies and sunny horizons, any minute now……

@augusto

Nice analogy

Re being a landlord….If you are a smaller player with <5 rentals you rely on a good cash flow to make it all run smoothly. I've been there and wouldn't to be there now. I have always kept the file folder titled"stories" to remind me why.

The biggest problem with being a landlord is the tenants problems, end up being your problems…..

I expect to see a lot of residential income units coming on the market in the next year.

Been there, done that. Got rid of my rentals for the same reason. Once rented to a nice family. A month later they had 20 people living in the house, cars parked on the front lawn. In the back sun room, they cut a hole in the carpet, built a fire pit, cut a hole in the roof to let the smoke out. I ratted them out to the building department who condemned the house and gave them 72 hours to vacate.

It’s what the Owners of the MONETARY SYSTEM want…

So I am guessing this is all bullish, eh?

As far as single family homes is concerned, this is an immediate drop in both supply and demand. This is not like an overbuild situation with an inventory glut, or a natural disaster inventory destruction. In some specific areas the short term rentals may have an outsized impact with supply going up. A few months from now we’ll see if the job losses have a large impact on SFH with foreclosures nationwide. There will be some for sure, but it may not be as bad as it looks right now.

I had the same thought in 2007 but we all know how did it end that time.

May be this time is really different. Economy is in doldrums and stock market climbing up every day. This may happen to hosing as well.

But remember, it took 3 plus years in 2008 to bottom up for hosing and 2 years for stock market to bottom up.

From what I see, everything ties to main street if the people have jobs and confidence, they would spend and buy these over priced homes.

Home prices are steady in my area. Not a lot of traffic on the roads.

The stock market was on its way to heck, then did a U-turn.

The price of a Hershey bar was 5 cents in the 60’s. There used to be penny candy. Quarters were made of silver. There were five and dime stores. How the landscape has changed.