Neither the Fed nor the Treasury can bail out brick-and-mortar retailers.

By Wolf Richter for WOLF STREET:

Macy’s announced today that it would lay off “the majority” of its 123,000 employees after it had closed all its Macy’s, Bloomingdale’s and Bluemercury stores on March 18. Even before the lockdowns, its headcount was already down 17% from four years ago, in line with the decline of its brick-and-mortar operations. It said these stores would “remain closed until we have clear line of sight on when it is safe to reopen.”

Whenever that may be. But “at least through May,” the furloughed employees who were already enrolled in its health benefits program “will continue to receive coverage with the company covering 100% of the premium.” And it said, “We expect to bring colleagues back on a staggered basis as business resumes.” That is, if business at these brick-and-mortar stores resumes.

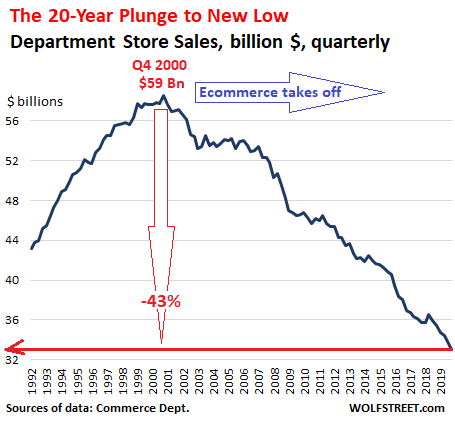

Department stores have been on a 20-year downward spiral that has ended for many of them in bankruptcy court where they got dismembered and sold off in pieces. The survivors, which have been shuttering their brick-and-mortar stores for years, are now getting hit by the lockdowns.

The chart depicts the brick-and-mortar business that Macy’s, Nordstrom, Kohl’s, JCPenney, Neiman Marcus, Sears, Bon-Ton Stores, Barney’s and others are in – or were in. Over the past 20 years, department store revenues declined by 43%. And now they’re getting whacked for good by the lockdowns. That declining line of revenues is going to make a 90-degree downward kink in Q1, Q2 and Q3, to violate the WOLF STREET beer-bug dictum that “Nothing Goes to Heck in a Straight Line”:

Macy’s said today that its online sales would continue. Its online sales in 2019 were already 26% of its total sales, according to its annual report. According to eMarketer, Macy’s ecommerce business made it the seventh largest ecommerce retailer in the US in 2019:

- Amazon

- eBay

- Walmart

- Apple

- Home Depot

- Best Buy

- Macy’s

- Qurate Retail Group (QVC, HSN, Zulily, Ballard Designs, Frontgate, Garnet Hill, and Grandin Road)

- Costco

- Wayfair

As many brick-and-mortar stores have shut down, and as people are fearful about going to those stores that are still open (such as grocery stores), ecommerce sales have exploded. Americans have long been reluctant to buy groceries online. But that has changed overnight.

Amazon, Walmart and other online retailers have gone on a hiring binge to deal with the onslaught of online buying, including the stuff people normally bought in grocery stores. Online retail is the huge winner of COVID-19. When the Q1 and Q2 ecommerce revenues emerge, we will see a historic spike in online sales even as brick-and-mortar sales went straight to heck.

During the lockdown, even Macy’s remaining hard-core brick-and-mortar customers are going to get used to shopping online. And when the lockdowns are over, there won’t be a return to the “old normal.” It will be a New Normal in which Macy’s brick-and-mortar stores are largely irrelevant.

All major department store chains and many shopping malls have shut down. Hundreds of thousands of employees have gotten laid off as retailers are trying to figure out where to go from here. And they’re now pushing online to the max – because for them, that’s the only thing there is.

More department stores have moseyed over to the bankruptcy-filing counter, including JCPenney and Neiman Marcus. All their stores are closed. And ecommerce isn’t going to suffice for them. Neiman Marcus is reportedly already in talks with creditors about filing for bankruptcy.

How many of these department stores and apparel stores will even reopen after the lockdown?

That stimulus money being handed out by the truckload – and the retailers will gladly take what they can get – will do nothing to make brick-and-mortar department stores viable in the post-lockdown New Normal.

There is a good chance that Macy’s, Kohl’s, JCPenney Neiman Marcus, and others will use the lockdowns as reason to not even reopen certain stores afterwards, and that there will be a pandemic of closed stores that remain closed after the lockdowns are over. COVID-19 will speed up the inevitable process by a bunch of years.

It’s going to be a financial mess.

Stores are going to negotiate with landlords about not paying their rents, or just refuse to pay their rents, while their stores are under lockdown. Landlords are going to check out government-encouraged offers of forbearance from lenders or servicers to see if they can skip some mortgage payments since their tenants skipped lease payments. Many of those loans have been packaged into commercial mortgage-backed securities (CMBS), and those CMBS are now facing default. And this is where it gets messy.

When a CMBS loan defaults – or even when the loan hasn’t defaulted yet but when a mall backing a CMBS loses an anchor tenant, such as a department store – servicing gets switched from the master servicer to a “special servicer.” This is laid out in the pooling and servicing agreement (PSA). The special servicer’s job is to determine if the borrower can become current through a loan modification or a debt workout. Under many PSAs, a special servicer has the right to purchase the property at a discount if that same special servicer decides the loan cannot be brought current. Even under normal circumstances, this invites self-dealing.

Retail-exposed CMBS have already been defaulting across the country. Now, this is likely to happen on a large scale. Which is one of the reasons the CMBS market is in such turmoil, and why S&P began slashing the credit ratings of many CMBS with retail exposure, some of them by multiple notches, including one deal by nine notches. And this is why the Fed and the Treasury and the Primary Dealers are now conspiring to bail out the CMBS market.

But they cannot do a thing about the underlying dynamics – the previously gradual and now sudden shift to ecommerce.

Those retailers will close their brick-and-mortar stores no matter how many bailout-trillions are being doled out. The retailers will default on their leases, the mall mortgages will default, and the CMBS will default – no matter what the Fed does.

Many of these malls or stores can eventually be torn down and redeveloped into a mixed-use high rise or whatever; but this will be by and for new investors. And it won’t be of any benefit to the holders of the defaulted CMBS.

Just astounding. So many downgrades in just of a couple of days. And zero upgrades. Here’s who got hit over the past couple of days. Read... The Downgrade Massacre Has Started

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

There is just one problem, Trump can and will likely declare Amazon and all online shopping (other than groceries) to be nonessential. This is due to reports that the virus is spreading through the distribution centers.

Plus there is a chance that online streaming (except for You Tube itself) might be declared nonessential as well. The internet is is being frayed due to all the people working at home.

The Internet cannot “fray.”

Some ISPs haven’t invested enough in delivering services to their customers with sufficient bandwidth, but they will have to upgrade or lose business.

I’m on home fibre from Verizon and have no problems at all… its the people on underinvested overpriced cable internet who are facing issues.

This also bodes well for T-Mobile’s pending 5G internet service.

According to the ad above, I am supposed to run in place on their treadmill!

While I am running in place, I can order online anything I want, from their built in screen!

No thanks!

I have a terrible image of what will happen to me, if I forget to keep running while trying to navigate their screen!

Don’t you just love the Emperor’s new clothes?

I know you do.

You love the Emperor’s new clothes.

Reality:

I don’t think the Emperor would want the holy clothes I am wearing!

They might be able to compete with Wolfe’s “stained shorts”!

Haha, you guys sound like a couple of “HoBo’s”. Me? I’m sitting here wearing a pair of 15 year old Navy blue sweats with no more elastic, a T-shirt, and Holy socks. Lol!!!

These retail businesses like Macy’s, Kohls, and others won’t be selling stuff online either. With incomes down everywhere, money will be devoted to food, cell phones, meds, and internet connections. They will all be bankrupt by the end of the year.

I’m not convinced of that yet. I find it hard to believe that most B&M retail is going away – clothing stores, coffee shops, gas stations, restaurants, office supply, etc. If they can keep grocery stores open on a safe basis, why not everything else?

People can’t be cooped up in their houses and apartments much longer for mental health reasons. It’s particularly hard on young people. Humans are social animals.

I think they’ll be a vaccine on the market soon, or they’ll find ways to open stores while employing better social distancing, like grocery stores are doing. I think states will get on board with that concept in order to reduce retail unemployment. The unemployment checks for these people cannot continue forever.

That said, many B&M retail locations will close because of reduced sales levels. The bigger outfits will survive, but this is a death sentence for small and specialty retailers that have managed to make it this far.

Maybe the other way around Bbr: I was formerly living in a small town with county population of 35-40K, many smaller retail outlets were doing just fine in spite of the largest WM new supercenter that was a ”cruise” destination every Saturday evening, kids outside while parents inside shopping, etc.

Some smaller specialties had stuff in stock WM did not have, to my certain knowledge; other smaller folks knew how to get any specific piece of hardware, for instance; and still others had better prices than WM for the exact same product, and they made sure that was the case.

IMO, smaller specialty stores that emphasize Service will continue, at least for the immediate future, including hardware, grocery, and clothing because customers are treated as people, not cattle.

Retail is on my list of things to own on the turn. The age of mass produced products has passed. Service is the way you understand your client. If the virus changes our lives, it is in the way we trust. In virus matters people trust their governors and mayors far more than they trust the president. Trust in buying begins at the retail level. ( I consider Amazon a wholesaler) It’s known that the bins are often salted with knock off versions of the item, which is why manufacturers often do not honor the warranty. Warehouse shopping went in vogue during the 70’s recession, that trend will swing back to retail as long as store rents, and markups, are competitive. The old retail had pricing power and was well suited to an inflationary economy.

VNnet: Totally agree. The market is shrinking but there will still be a market. In my town I much rather go to the smaller hardware store than Home Depot. The service is great and they have an awesome selection of nuts and bolts etc.

Because the virus is mutating and there are already many variations, my understanding is that much more data, plus a testing process, will be required to get any vaccine that can be effective. One to two years is a timeline researchers have offered. Would be better if it was faster, but this may not be possible.

“I think they’ll be a vaccine on the market soon”

I just read an article that included a fella that has been working on an HIV vaccine since the 80’s.He said 18 mos. for Sars2 vaccine is wishful thinking.

If they can figure out rapid testing of the virus it would be easier to quarantine those who have the virus and let those who are clear go to work. Someone needs to do an X Prize like contest for a fast virus test.

I saw the other day they now have a test that gives results in 5 minutes.

So are we going to have an Amazon’s Thanksgiving Parade this year?

Essential parade people only, everyone else watch it online. They can dub in the cheers.

Amen, except for niche stores with grocery products like Target and those owned by bankster cronies or administration cronies: the Fed bankster cartel will bail out the former; the treasury, the latter.

With enough, rapid testing more infections could have been identified, after tested, contacts traced, and quarantined. This was a man-made disaster in those places.

Most hotspots would not have progressed. The US, UK, and Japan (which released infected persons from the cruise ship virus incubator without testing everyone) were shown to have much competent governments than tiny places like Singapore.

I meant much less competent governments in the US, UK, and Japan than in Singapore.

Wow! Thanks for the insight Mike.

Too bad you did’t publish your thought earlier and save us all.

There will be a long, fat tail of opportunistic post virus complications.

Albie-check. ‘…never let a good crisis go to waste…’ as so well reported/commented on at this fine establishment.

May we all find a better day.

This abrupt shift to work- and shop-from-home will have consequences for the auto industry as well. I expect we’ll see much longer trade cycles showing up in the statistics two and three years from now, even if the economy were to magically snap back post-COVID.

Good call. More by-the-mile insurance too, I imagine. I switched recently and am still in the “analysis” phase… My driving was already very low, now they’ll be basing my bill on 12 miles per week. ?

ChangeMachine,

the name of the insurance company please?

motorcycle guy,

I get their fliers in the mail all the time. I even checked them out and got a quote (wasn’t a good deal for us). They’re easy to Google.

From my very limited experience, the pricing comes with some interesting data monitoring:

o where you go

o When you go

o How fast you go

Little or no disclosure on the data captured, who gets to use it or data security.

Make sure you drink a large bottle of Caveat Emptor before touching this sruff.

Javert Chip,

Do you know if they put an internet-connected device on your car as part of the deal, if it doesn’t already have one, in order to collect this data? Rental cars have that, as do certain types of lenders.

Wolf

Yes, the company (St Farm) wanted to install a device (roughly 3-4 years ago).

What really stunned me was the abject lack of protection for the monitoring data to be gathered. I’m an old CFO, not a lawyer, but sometimes I do read the small print.

I did the by-mile insurance. Great deal. After they made around $28/month total for two cars over two years they sent me a letter that they were discontinuing the plan and offered standard insurance at about $98/month. I found another, better insurer. Never did like low-ball bait-and-switch.

I’m a commercial real estate banker for a prominent national firm. I’ve been working remotely for over a week. My colleagues, clients and investors are all signing the same refrain- Hey this works. Think of how much I’m saving in commuting time and expenses; wardrobe costs (sweats being the new uniform) and going out to lunch every day.

Woe betides office landlords; clothing manufacturers and retailers; gas stations and restaurants.

A family member just lost his job, after 25 years, in a NYC office building. Blue collar union job connected to building out spaces for tenants. A real shocker to him, they tell him there is no more work. His employer is also telling him not to apply for unemployment — what a dirt bag.

That dirt bag should be reported, screw him!!! (and to a guy they had working for 25 years!?!?! this makes me livid!)

But the employer cannot control whether or not the employee applies for unemployment right? So why should your family member cares what the employer says once the family member has been laid off?

Z- i have a feeling that the laid-offs may be getting told if you don’t claim unemployment, you will be first in line to be brought back once things improve. if you file, don’t expect to get your old job back. no evidence, mind you, just a hunch based on some things i heard around the office, before we got sent into work from home purgatory today.

Very true. I work from home and my wife is retired. Her year old car has 5k miles on it and half of that was from our daughter and her family taking it on a trip to CO. My little over a year old truck has 13k, only because I have a 5th wheel and pulled it to FL and CO last summer. Both vehicles sit at home most of the time except for short trips to the store and other errands. My last truck, that I traded in on this one, was 6 years old and only had 49k miles on it. Only traded it because I needed a bigger truck to pull the 5th wheel. Not sure if I’ll ever trade again unless I go to something smaller in my old age.

Would be interesting to see if the B&M get a slight bump (people wanting to get out of the house) or feel a greater decline ( people still scared or dont have the money to spend) after the masses are released from quarantine.

The bump will be for hair salons, neighborhood bars and grills, sandwich and waffle shops, auto parts and, of course, hardware stores….just like 1931-40.

By the way, the grocery where my son does produce (his little business locked down) is full of black families and poor people AND the elderly well to do church folks. Those folks will never let anybody else chose their collards.

If you’re tired of those empty shelves at Krogers and Publix, I suggest finding a franchise local store with fresh local produce…nicer crowd too.

Deanna Johnston Clark,

“auto parts and, of course, hardware stores…”

At least in California, hardware stores, auto parts stores, auto repair operations, etc. are deemed essential businesses and are allowed to be open. I don’t know about other states though.

Same in FL at the moment, but here it’s mostly ”local” call shut down rules, except for SE area.

In WA, the hardware stores are still open, but they shut down the contractors. I was scheduled for work, but he had to cancel and is concerned about staying in business. Worst part is I have a leaky pump in the pump house. Hopefully they will ease or at least use a little more common sense with the lockdown.

Minnesota Governor Tim Walz has declared that bike shops are essential businesses which may stay open in his ‘Stay-At-Home COVID-19 order.’

“While Walz urged Minnesotans to stay home, he also has encouraged outdoor exercise as long as people keep their distance. And, as public transit systems in the Twin Cities pare service in the wake of the coronavirus pandemic and passengers worry about keeping far enough apart on trains and buses, more essential trips will be made by bike.”

Dan,

Keeping bike shops open makes sense. The lockdown in California also encourages people to get out of the house for exercise (but keep your distance). And that too makes sense imho: it’s great for your tortured spirit and can keep you sane.

FWIW, I went to Home Depot (Portland OR) and there was a big line outside being trickled in. Drove home still needing building materials, but I might order from Parr, who delivers. Another thought, city inspection services are a crawl on A GOOD day. Now their offices aren’t even open, so good luck getting permits this decade.

Good for Amazon. Everything seems to work in Amazon’s favour. This lock down is a boon for solid tech companies. Bill Gates and Steve Ballmer want the lock down extended a few more weeks. Good for them.

Work from home, use plenty of technology and avoid people. Strange in a way but it looks like the new normal.

Tech Titans 1 Rest Of The World Nil

Delivery services have completely collapsed throughout most of Europe, not as in “deliveries are delayed” but as in “deliveries literally disappear a few miles from home and good luck getting a refund”.

And with that the Amazon model has pretty much evaporated overnight.

Next up “Back to the Mesolithic”. Ops, wait: at least during the Mesolithic you could go out and look for something to dig out of the ground for dinner.

I’ve always wondered about the moral hazard of robot delivery, assuming the tech works.

Steve Sedgewick read my email on Squawk Box Europe where I said delivery drones would be shot down. Going along with the joke he added ‘we cannot condone illegal conduct’

But seriously it would have to be pretty nice ‘hood’ if a trolley full of goodies can trundle along safely.

PS: in most states there are huge sentencing differences between stealing from a human who is present and stealing when no one is around: robbery vs burglary.

First offence for stealing a car might get probation or a few months. Stealing a car from someone in the car, or carjacking, up to life.

The point: at this stage of law, robot deliveries have nowhere the legal protection of personal delivery, itself a dubious undertaking in some areas.

Even if they did, there is the practical issue of enforcement, e.g., witnesses. And for the techie crook, there is the possibility of jamming or even hacking the robot’s signals.

With so much of the vaporware the computer revolution has inspired, there is a difference between the possible and the practical.

Nick-even living in an semi affluent rural area where Black Bart pulled more than one stage job, I still have little doubt if the robots come his ghost will (walk-he never rode) again.

May we all find a better day.

Then there’s new new business of net capturing drones, disassembling them, and selling the pricey components on ebay.

MC01,

Not the case in the US. Just got a package yesterday from Japan and day before yesterday from a US shipper. The postal mailwoman still shows up and delivers junk mail. People I know in Germany are still getting stuff delivered to their door and mailbox. Not sure what the problem in Italy is.

Death?

Is The Spanish logistical network Still up and running.

This is going to accelerate the rise of robots in things like delivery, imagine if that logistical network become the primary method of disease transmission.

I’d love to know it too, but something definetely broke. Deliveries going missing, tracking not working, shipping company websites collapsing… never seen anything like this before. I’d settle for 3-4 days delays, thank you very much.

To give an idea I’ve lost a whole shipment two weeks ago and I haven’t even been able to file an automated complaint yet. The website tells me complaints will be once again accepted on Friday but I bet I won’t be able to file anything for a looong time.

MC01,

If I understand your location correctly, you’re somewhere near the core of the hot spot in Italy. I can see where there are some local issues — staffing, etc. where employees get sick or just don’t want to go work (understandably) — at the post office or DHL or wherever.

There are problems cropping up at Amazon’s fulfillment infrastructure, including in New York, with its third-party vendors. It had a huge burst of business and its warehouse don’t have enough space for all the stuff going through. So Amazon is now doing triage in certain areas as to what it accepts into its warehouses from third-party vendors to have enough room and capacity for essential items.

The Italian model of porch thieves and “it fell off a truck”

“at least during the Mesolithic you could go out and look for something to dig out of the ground for dinner”

I’ve been doing that for weeks since the snow thawed. Kale, spinach, arugula, mustard greens – from seeds planted last fall.

Nice. Me: “I planted daikons?”

As for shipping, I think my Fein tool blades from China were a little late, but they arrived, so even China is shipping within normal range. Sorry MC01!

Emmmm, this is not the case in U.K. At least not yet.

We have had supplies from various grocery, foods, booze etc suppliers keeping us stocked last three weeks. The only thing I go out to fetch by myself is bread and milk.

Everything else is delivered to the door.

I suppose as long as oil is cheap (hurray MBS and Mr P), and there are bodies available to drive vans and trucks, the rest of us punters are good.

Although I think coppers seem to know something us plebs don’t; gradually all commons (public parks in states speak) are being blocked off to visitors. As if the powers want us to be at home and protect it. What from?

Stan, the UK is merely copying Italy. All public spaces have been closed for a couple weeks now after the rumor spread joggers and dogwalker were spreading the virus.

It’s all part of the “grasping at straws” virus containment strategy. ;-)

I lived in Europe for years, and “customer service” is an oxymoron there. I am not surprised to see this hold true for delivery services as well; I remember the extremely poor quality of trade craft (especially hpme electricians) and the exorbitant pay demanded by incompetent tradesmen in the UK and France, who took no pride in their work.

As European governments go bankrupt, a lot of the vestiges of socialist institutions that enabled sub-mediocre performance will disappear. The lack of these institutions and the slouching they enable has always been an advantage in North American society; Amazon packages make it to their destinations as a result.

Maybe, maybe not. There will be heightened pressure to break up these companies that have enjoyed nice near monopolies. Google, Microsoft, Apple, Facebook, and Amazon (especially). The world cannot funnel it’s business through five companies.

I suspect the intersection of business and politics will cause a lot of interesting events and turmoil. There are “labor” strikes being called for today or tomorrow as well as “rent” strikes. It should be interesting to see if these take hold, especially if this crisis drags on.

bobber

As many giggles as we all get from fact-free rants, I’m always intrigued why some (but obviously nowhere near all) consumers want to destroy excellent consumer companies (…”Google, Microsoft, Apple, Facebook, and Amazon (especially)”…).

We’ll use Amazon, since you singled them out for special disapprobation:

o $280B 2019 AMAZON retail sales

o $3,75T 2019 US retail sales, excluding gas, auto, restaurants

o $60B 2019 US e-commerce sales

– Why do you want to destroy Amazon for representing 7.4% of US retail sales (47% of total US Ecommerce)?

– Do you even realize there are 1,800,00 other Ecommerce platforms available in the US (link: a umber of other ways nhttps://www.etailinsights.com/online-retailer-market-size)?

– Other than random rants, courts use various rules of thumb, one of which is “…Courts will usually look at a company’s market share for a particular product or service to see if a monopoly exists…market share of greater than 75 percent…probably considered a monopoly”; other criteria are also used. Link: business-law.freeadvice.com/business-law/trade_regulation/monopoly_power.htm#ixzz6IIhh1wCy

– Hundreds of millions of US consumers get to vote using their purchases and lots of folks seem to think Amazon does st least a fairly good job.

– ADVICE TO BOBBER: IF YOU DON’T LIKE AMAZON, DON’T SHOP THERE, BUT DON’T TELL THE REST OF US HOW TO BEHAVE.

I’m not telling you to do anything. I’m merely expressing an opinion, which should be clear from my simple post. Didn’t you know that policy is formed in a democracy by people expressing opinions?

My three sentences hardly qualify as a rant. Your reply, however, clearly fits the bill.

By the way, I am not misinformed about Amazon. I live in Seattle and I know all about them. They subsidize their retail business through a cash cow cloud infrastructure business. Sounds like unfair competition to me. Plus, they are fighting the IRS over billions of taxes because Amazon has chosen to pursue aggressive tax loopholes instead of paying tax in accordance with the spirit of the tax law.

You probably don’t realize it, but you accidentally made a counter-case with your rant. The leading company in any market should not have 47% market share. If one company has that market share, the number two has to be nearly as big just to complete with the scale. So you are proposing the existence of two competing companies in every industry. I don’t even see the basis of an argument there.

Granted you get an opinion in a democracy; even a fact-free one. I suppose wanting the government to destroy what most view as great consumer businesses counts as an opinion.

I don’t understand the “counterfactual”; Federal courts (refer to link), not me, do that.

All the above is interesting, but my initial question, quoted from above, still stands:

Why do you want to destroy Amazon for representing 7.4% of US retail sales (47% of total US Ecommerce)?

Other than some version of envy, I literally do not understand how you justify what you want; I’m willing to get educated, but not by a fact-free lecture.

Javert Chip,

I really have no interest in debating you. You stated out by calling a three sentence comment a rant, then you confused an opinion with an edict, then you got all emotional and personalized everything. I’ve met many accomplished people, and rarely do they do these things on a consistent basis. I know you are regular poster here, and that deserves deference, and I probably have liked other posts of yours, but you came out of the gate backwards on this one.

Amazon is nothing more the tax evasion scheme. The whole system will be bailed out. Somehow, I don’t think the administration is high on Amazon.

“Work from home, use plenty of technology and avoid people. Strange in a way but it looks like the new normal.”

Retire at home, use plenty of ( relatively safe, offline) technology and avoid (most) people. My “new normal” as of 42 years ago.

It has served me well.

What’s good for Amazon is the hypocrites who complain on and on about BIG government, BIG corporations, and BIG banks….then keep their checking in BofA and shop at Krogers or on Amazon.

I call ’em as I see ’em…. we all need to live by what we believe!!!

BIG Government has used tax dollars to design ventilators that are BIG corporations are not making available to us.

via ProPublica –

“Five years ago, the U.S. Department of Health and Human Services tried to plug a crucial hole in its preparations for a global pandemic, signing a $13.8 million contract with a Pennsylvania manufacturer to create a low-cost, portable, easy-to-use ventilator that could be stockpiled for emergencies.

This past September, with the design of the new Trilogy Evo Universal finally cleared by the Food and Drug Administration, HHS ordered 10,000 of the ventilators for the Strategic National Stockpile at a cost of $3,280 each.

But as the pandemic continues to spread across the globe, there is still not a single Trilogy Evo Universal in the stockpile.

Instead last summer, soon after the FDA’s approval, the Pennsylvania company that designed the device — a subsidiary of the Dutch appliance and technology giant Royal Philips N.V. — began selling two higher-priced commercial versions of the same ventilator around the world.”

….

An HHS spokeswoman told ProPublica that Philips had agreed to make the Trilogy Evo Universal ventilator “as soon as possible.” However, a Philips spokesman said the company has no plan to even begin production anytime this year.

Instead, Philips is negotiating with a White House team led by Trump’s son-in-law, Jared Kushner, to build 43,000 more complex and expensive hospital ventilators for Americans stricken by the virus.”

IdahoPotato

It’s very easy to read your post as Royal Phillips is a filthy villain in a national emergency; some clarification:

o We agree USDH paid $13.8M for a government approved designed for an inexpensive ventilator

o FDA governmental approval of the design took 4 years

o In the mean time, Royal Philips was producing other, more expensive ventilators for sale in other countries (not requiring FDA approval)

o Last September (4 months prior to virus crisis) was the first time the government actually tried to contract to actually buy 10,000 (as opposed to design) ventilators

o Last September (4 months prior to virus crisis), Royal Phillips did not want to shift capacity to make less expensive ventilators; the USNH was free to take the FDA-approved-design to another vendor

It’s totally unclear what Royal Phillips is doing right now, in the face of a life-and-death virus emergency.

…and, no, I don’t own Royal Phillips shares.

“Instead, Philips is negotiating with a White House team led by Trump’s son-in-law, Jared Kushner, to build 43,000 more complex and expensive hospital ventilators for Americans stricken by the virus.”

What the heck is a real estate developer like Kushner doing negotiating medical equipment purchases? Trump is really treating USGOV like an extension of his family business.

JC- you sound like someone who has seen small groups of the peasantry skulking around the neighborhood with torches and pitchforks in hand, and interprets that as a bad thing.

DJC-‘…shocked! shocked! to find gambling in the casino!’. Gamblers gonna gamble. And, in ignoring that the odds overwhelmingly favor the house usually do so neither wisely or well (probably in anticipation of a a bailout from somewhere…).

But I do catch and embrace your drift, and always enjoy your posts.

May we all find a better day.

I used to have great fun with all the Occupy Wall Street activists of 2009 and 2010 when I would ask them if they hated Big Corporations badly enough to cut up their Citi credit cards, trade in their Chinese-built Apple computers for US-made Windows PCs, and give up Whole Foods.

Funnily enough, all the OWS activists I ever met refused — every last one — to give those things up… while simultaneously demanding “systematic change.” Ironic.

Perhaps what these OWS activists wanted was a return to the prohibition on investment houses intermingling with banks for the sole purpose of taking advantage of FDIC when they had finished looting, and saddling taxpayers with an ever-ballooning deficit. It almost got fixed, but alas not yet.

Ballmer retired years ago; Satya Nadella is the current MS CEO (and a pretty good one at that). I think Ballmer bought a pro sports team (don’t they all?).

Amazon is completely disarray. Their work-force is in complete rebellion. Second, Amazon retail is simply not profitable. The political push pack against them is going to be unimaginable. City and States aren’t going to destroy tax base.

Amazon retail is profitable; notably Prime.

As for regions trying to protect inefficient local monopolies who pay off politicians to vanquish superior competition, we have already seen how that movie ends — poorly.

“Tax bases” made up of inefficient, high cost retailers aren’t a worthy tax base at all. Any region seeking to block higher quality, lower cost competition will simply ensure the demise of their entire local economy, as the higher costs of the inefficient “local competition” ripples throughout the local economy and renders the entire region uncompetitive.

If your region is unable to pay its bills without a rentier “tax base” of inefficient, poor quality local producers, it is because your local government is spending well beyond its means — a problem best solved by tackling a lack of local competitiveness rather than seeking to ban superior competitors from outside.

Amazon is unlikely to have a distribution center in a town so they by definition are not part of the tax base. better to have an inefficient tax base than no tax base. And lets not have talk about why a distribution center is bad for a town and its workers, because it is.

If these CMBS are part of the $4T bailout packages, who receives the stimulus $$ as they file BK and continue to shutter?

Beardawg:

It is interesting how the mechanics of DMBS are not being addressed.

Is this to allow the hidden self dealing DMBS mechanics to do its dirty work and fleece J. Q. Public?

I rather think so.

Washington and the fed need to stop proping up the dead corpses of these companies. Capitalism requires creative destruction so new services have a place to grow. Old dead doentown industrial space from 2009 became the packed nightlife microbreweries in 2019.

10 years ago I’d hear Americans laugh about China’s zombie companies. Now it’s 2020 and the USA is the authoritarian regime dedicated to proping up worthless zombie companies with taxpayer money.

“Washington and the fed need to stop proping up the dead corpses of these companies. ”

Naw Washington and The Fed exist to service The War Party Of The Rich.

Our owners

Amen. Recall that when Trump boasted (!) in the State of the Union Speech that he was spending $2 trillion on defense, congressmen on both sides of the aisle rose to their feet and competed as to who could clap and cheer the loudest. The empty pockets when it came to masks, hospital beds, emergency equipment domestic infrastructure, etc. now makes a mockery of that. $13 billion for a single new aircraft carrier- and the lives of the men on that, now a Petri dish, at risk. It sounds like an Aesop’s fable.

Halleluia!

Why does everything have to be about the past and the good old days?

What are we now, old Confederate soldiers singing Dixie around the cracker barrel, longing for the sweatshop stores of the 1990s?

What a good analogy.

Warehouse workers and delivery drivers are the new ‘sweatshop’ employees (or should I say ‘independent contractors?’).

Seriously doubt it.

The vast majority are non-minimum wage employees.

Since CA decided to tell people what kind of employment contract they had to have in order to work in CA, there are a whole lot less contractors.

Good reminder Deanna, one constant ditty in my childhood in my home town late 40s/early 50s was, “Save your confederate money boys, the south shall rise again.” There was an amazing amount of that money around, though no one took it seriously as far as I can remember.

At this point, I feel blessed to have gotten out of there alive.

As my best friend lives in Charlotte and designs the suspension and steering systems for one one of NASCAR’s top teams – but still can’t adjust to living where he and his family do, I like to quote to him a line from ‘Night at the Museum.’

Larry: (speaking to Civil War diorama figures)

“The North wins. Slavery is bad. But the South has the Allman brothers … and … NASCAR.”

My friend is working out of his home these days.

Thank you MC01!

Track number 4 of the album “Up the Dosage” by Nashville Pussy.

There’s a very good reason I consider Blaine Cartwright a genius.

Maybe temporarily during lockdown, but long term, I dont see online beating B&M in clothing. If it’s been 20 years of decline and online clothes shopping is still as small as it is, I don’t online being the main threat. Changing consumer shopping habits is the main threat. Considering how cheap clothes are to produce, and how cheap they are to design. In the future we could see ultra cheap, but same quality “the clothes not the store appearance” B&M clothing stores pop up and just move massive volume “the interiors would be similar to clothing sections of TJ maxx, but the entire store would be purely clothes”. Once people stop caring enough about the brand of their clothes, the current crop of department stores is done.

Also right now clothes shopping is probably not the biggest thing on people’s minds. Wal-Mart and target are still open they will absorb alot of clothes shopping, the effects of people buying genetic brand clothes at Wal-Mart and target will damage the big name clothing brands for a long time. And speed up the process.

Thomas Roberts,

You’re still in the B&M dreamworld where somehow people will always want to go shopping at a mall, and that this newfangled internet thing is just tiny and will never matter. So let me explain it this way:

Online apparel was over one-third of total apparel sales last year, before lockdowns. It’s now somewhere around 80%!

The last time I bought any apparel, including shoes, at a B&M store was years ago. There is no need for apparel stores. My wife buys all her stuff online. And people figured it out in every larger numbers, and now under lockdown in huge numbers. Apparel stores are among the easiest targets. On the internet, you can find every size, every color, every brand, and it only takes 5 minutes to find it and buy it, and then they bring it to you.

Walmart is a huge online retailer — behind only Amazon and Ebay. The ecommerce business of Walmart is growing at about 40% a year. It’s B&M business is stagnant.

I think in the end the cheaper way will win “the greater market share”, and that B&M wins if their price is tied. Personally, I don’t care which one wins.

I just think that “for clothing” if you had an ultra competitive B&M store vs an ultra competitive online store, the B&M store could win on price. Having everyone come to a central location that does require some staff, just seems to me like it would be cheaper than having every single order shipped to every single house “I’m also picturing the entire process of the supply chain with this as well”. Right now the biggest problem that I see is that Department stores are based on presenting their items as high value and then charging a premium for that “this strategy affects their entire business model and supply chain”. B&M “clothing” will lose that fight. The entire model would have to be changed for B&M to win. They would have to do many things like destroy brand loyalty and drive down prices, a push towards no name but, high quality clothes. Next, greatly reduce staff and move towards automated checkouts “because the clothes are cheaper, theft becomes a smaller issue”. Focus, only on clothes and accessories. And alot needs to be done on the entire supply chain.

Also, I don’t thinks malls will survive. “Not many at least”

A distinct possibility, is that online shopping wins at first “could be winners for a while”, then an online pricing war starts, causing said push towards no name brands. The Victors be they Walmart, Amazon, or others will dominate the online clothing shopping after the pricing war “and change the entire clothing supply chains in the process”. New challengers fail to break into online and instead make use of the newly emerged clothing supply chains “that emerged from the online pricing war” and begin to setup new B&M stores.

So it’s possible Online Shopping definitely Wins at first and later on it loses.

I’m not sure how Walmart or Target who have both B&M and online and will probably continue to be around, fit into this “It depends on their future decisions”.

P.S. I don’t like clothes shopping online or in person.

The only thing that could put the brakes slightly on online clothes shopping is a return policy change. Many women order many more items than they plan to buy to do ‘try on’s.’ Then clothing not chosen is returned at sellers expense. Will be interesting to see if retailers can no longer pass on this expense in the new ‘lean’ America’

Me neither…

But you’re both overlooking the YOUNG….they care about pollution, are rejecting black and denim, and the rare ones care about Labor rights. Brands have no tropes…they are realists. They grew up with that crud and it’s SO 5 minutes ago!

Target has a whole section for these customers…earth tone pastels…and a whole section of fair trade denim jeans.

When I look for clothes I hate half of the cheap materials I find these days. There has been such a decrease in the quality of the materials in clothing over the past 10 years or so, it’s important to see in person. So B&M works in terms of finding stuff made of materials I don’t hate.

T-Shirts ordered online are usually fine, of course.

I was thinking of trying some of the “American made” clothing online stores to see what kind of quality they produce — but it’s an expensive gamble.

Thomas Roberts

If your point was that a small but willing-to-pay segment of the market would prefer a “bespoke” B&M experience (a la Savile Row in London), you’re undoubtedly correct.

The question is, can this tiny market segment support the presumably limited and geographic disperse (eg: NYC, Chicago, Dallas, LA, et al) number of B&M locations?

Looking forward 10 years, I doubt B&M will disappear, but I bet 70-90% of many large retail segments (eg: apparel) will have vanished.

Other than a gun, golf or fishing store, how long has it been since you bumped into a B&M salesperson who actually knew something about the product they were trying to sell you?

Javert Chip,

The real question is whether B&M could become cheaper than online, I think it could, that’s why I think it will win. Every major type of good has its own situation. And online could win, then more nimble B&M stores arise and win. It has more to do with price than experiences.

It’s important to consider every major type of good separately, right now for B&M with the percentage of sales they have for each department, in some departments they might be willing to give up marketshare if that produces the most profit, but once online gets big enough, the strategy could change.

Add to that,

I finally found a reliable supplier of runners (tennis shoes for you Yanks). The brand is what is advertised, the sizes are correct, shipping is free and the price was lower to begin with!! I will never again have to look at the piles of boxes and have a clerk come up and say, “Sorry, we don’t have that size, but I can order some in for you”. (So can I)

The mail lady brought them to my door!!

My last order I brought in 2 pairs and one remains in the closet still boxed up. Might bring in some more before they change the brand or style at the factory.

“My last order I brought in 2 pairs and one remains in the closet still boxed up. Might bring in some more before they change the brand or style at the factory.”

Did the same thing a couple of years ago (Dr. Scholl’s with velcro closure straps!). Don’t put many miles on my shoes anymore, so the new pair in the closet may never be worn. Alot of the stuff I use is “banked” that way. Savings not measured as savings in the official financial statistics.

Wolf,

is the new 80% about equal to the old one third?

What am I to do with Amazon puts.

Amazon is overvalued, and so on a logical basis, your puts should be OK. But in reality, who knows. This is a crazy market.

andy,

That’s a good point.

It’s worth noting that I’ve seen alot of Amazon and eBay items go up in price, during lockdown “I havn’t seen clothes prices specifically”. Don’t know if that’s reflected in change in online vs B&M sales. B&M stores haven’t changed their prices “as far as I’ve seen”. Also, online shoppers possibly may tend to be better off and their spending habits will take longer to be impacted, as well as they have jobs that might take longer to be impacted.

The one B&M retailer I miss is Toys R Us.

Online is great when you know exactly what you want. But often when shopping for the kids, I didn’t. I would just walk up and down the aisles until I saw something that I thought would appeal to them.

You can still do that at Walmart, but the selection is MUCH smaller.

Boy ya got that right DinTx: I used to take the grands to that place for their birthdays, with the proviso that they had to carry their choices to the cash register; it was a ton of fun to see them pick up something, change their mind, put it back and pick another, sometimes many times… and they loved it!

Wolf, I am wondering what this situation is going to do to the ”thrift” stores?

I know ”thrifty” people who have bought all their outside clothes at Salvation Army, etc., since working their way through college many years ago; one convinced me to try it, the first time I went, I found brand new ”office dress” shirts for $1 that were approx. $60 at that time.

Thanks,

There are many websites that sell used clothing for cheap.

I’ve also been wondering about the fate of my favorite thrift stores myself, e.g. the Goodwill and others. Lately that’s where I buy clothing and occasionally household items. The Salvation Army store near me underwent a facelift a few years back and up went their prices so I don’t frequent it as often, and have a rule that I only buy items that are half off.

Perhaps I’m preparing for retirement which is not that long off, or my hunter-gathering instincts are at work as thrift store shopping for me has become a hobby and stress reliever. Yes, I wash the clothing before I wear it, and yes, I wash the dishes or vintage glasses before I use them. I often walk out empty-handed, as I don’t want to accumulate more stuff that I won’t use.

The online Goodwill store is much, much less satisfying, the bargains are – in my opinion – less, it’s a lot more work, it’s not as fun and the shipping fees can be high. I have to yet to make a thrift purchase this way.

I’m guessing – hoping – thrift stores will re-open or come back due to demand. Personally, although I do look online, I rarely buy and just don’t enjoy online shopping as much as the in-person tactile experience.

Go Wolfy!!! – Personal anecdote Follows… Wife and Daughter represent a tiny sample of Wymyn (heh heh..) – They stopped going to malls YEARS ago!! – 90% or more of ALL shopping is ONLINE – They slowly sucked me into the vortex.. more and more and more online shopping – WORLD of choice, online advice and ratings (Gotta be Careful there.. lots a Liars!) – All price ranges and Quality levels at my fingertips… So, Last time I was in a Mall.. it seemed kind of Quaint and Dowdy!! – That is the new world… The online total value package is pretty unbeatable except in rare circumstances…

I certainly hope all B&M does not go the way of the Dodo. I have to try shoes on–if I buy online I have to send them back because they don’t fit properly. I also buy almost exclusively at consignment shops because it suits me very well. Underwear and socks, no, but I have even had to send underwear back because it didn’t fit. That really irritates me more than going to the store. Consignment shops are here to stay I think. Lots of people with no money, and wonderful variety.

Portia, I’m with you. I have to try shoes on, although I’ve bought running/walking shoes successfully online. I hope and pray that consignment and thrift stores are here to stay as I’m also not a fan of sending back returns, packing and taping up the box, making sure I did it right, hoping the package is delivered, having to follow up and see if my credit card shows the return. I find it stressful.

Not to mention, I live in the city in a building with an exterior, unsecured foyer. If the packages are left in the outside foyer and not brought inside the building, I have to worry about theft, a common occurrence in our fair city. Yeah, I’ve heard about Amazon lockers, etc but that seems like an annoyance also.

SuzeB,

FedEx and UPS have neighborhood pickup locations at stores, such as Walgreens (FedEx), UPS Stores, etc. My cleaners was a UPS pickup location until it closed. Good to find out where they are.

After this Wuhan Coronavirus, will US consumers buy clothing from China? Other products?

re: “… will US consumers buy clothing from China? Other products?”

Do we have a choice? At least, until other third world countries–Vietnam, etc.–ramp up their production capabilities and CEOs see ‘shareholder value’ in moving their plants. Also, don’t be surprised if much of the Chinese-made products become ‘accidentally mislabeled’ as being made elsewhere. I believe there’s some of this going on already.

Nobody needs to mislabel country of origin. When labor costs in China went up, the garment industry stopped using factories in the South of China and changed to factories in Vietnam, Cambodia, and Bangladesh. They open a bank account and register a company in the foreign country, and presto! country of origin is no longer China, but all the cash flows to bank accounts back in China. I have a niece who just did that. She retired last year, quite wealthy. She’s 47. A lot of the companies from non-Chinese Asian countries are actually Chinese owned.

Pretty much as everyone now refers to it by its proper scientific name, yes.

Harrold & Tom :

Actually the correct scientific name is : Sars Covid – 19 if I recall correctly.

WT Frogg

WHO can call it whatever their bureaucrats want; Wuhan Virus works just fine for me.

Everybody was pretty comfortable with Zika Virus and Spanish Flu.

Frankly, I’d much rather have medical doctors and like scientists working on actual health problems as opposed to buildings filled with bureaucrats fighting over politically correct names of stuff that can kill people.

Head dude at WHO is a PhD, not a medical doctor…just saying

Agreed Javert.

Zika

West Nile

Lyme

Ebola

MERS

Chikungunya

Wuhan

All named from the locality they originated.

The Primark model. Works but not for the whole market and they need to sell a lot of clothing per worker to make money so in aggregate only a few stores and workers

I wear designer brand clothing. It is my guilty pleasure.

My primary brands are Polo, Michael Kors, Cole Haan and Tommy Hilfiger.

I already know my sizes for all three brands. I can peruse the styles online, and there are often sales from various competing retailers where a good pair of Polo jeans or Cole Haan shoes sells for about what one would pay for lower quality generic goods at a big box store.

Why do I need physical retail in such a world?

“Over the past 20 years, department store revenues declined by 43%”

Is that in today’s dollars? Any inflation adjustment? That’s just too brutal to grok, even having lived through it.

This is in current dollars as reported over time by retailers. If you adjust it for inflation it takes your breath away.

Beware of the special servicers! Thus far, I have been hearing its business as usual…middle finger to the borrower by the master servicer. Only a transfer to the special servicer will get an ear…but the self dealing and conflicts of interest that were so prevalent in the first crises are ripe to reappear..despite Dodd-Frank. Read your loan documents!!!

Will we finally see the end of Sears??

And K-Mart?

And JC Penney? I spent the last ten years of my working life in their supply chain. My wife and I both worked there. We had our 401Ks loaded up with company stock while it was on a run. When it plateaued, we sold it all. That was at $82 a share. Today it is 36 cents. Not dollars, cents. They just can’t turn a profit any more. The supply chain is antiquated, state-of-the-art 1982. It costs them a lot more money per unit to get the product from China/Vietnam/Cambodia/Bangladesh and to the store than other retailers. Also, billions of dollars in debt that must be serviced. It was a good run, but it’s over.

Penneys made huge mistakes, HUGE.

Just for openers, the store here looks like a 3rd world flea market…without the charm and fun. It looks like a big recycling truck got lost and dumped into Penney’s.

Penneys is the cautionary tale for all dept. stores…where do I begin? The windows, the computer inventory, the lousy cosmetics.

However, I salute you and your wife…the sales help at our Penney’s is the very best part. They are friendly, kind, and love to help.

Just wondering, I never heard of JC Penney’s, being U.K. based, but, were they by chance during their more fruitful years, ever a subject of a leveraged takeover?

That seems to be clear indicator of an approaching death experience.

stan,

No, JCPenny is publicly traded and has not been subject to an LBO. That’s why it’s still around. If it had been owned by a PE firm, it would have bled to death several years ago.

Sears is already gone. They’re down to under 90 Sears stores and something like 60 Kmarts (both are under Eddie Lampert).

Sears-Kmart once had over 3,500 stores — they’ve already closed 95% of them in the USA, and 100% of them in Canada.

I wonder if the Simon Property Group and Authentic Brands acquisition of Forever 21 was ever finalized? They were making announcements about it in mid-February. They previously acquired Aéropostale to keep its stores open in their malls. Years ago, smaller tenants had “go dark” provisions in their leases; if an anchor left, they could leave without penalty. Don’t know if that’s still the case.

LA malls are closed, Century City, Beverly Center. Shops beyond Rodeo Dr., on Melrose, etc., have removed their merchandise. Others have boarded windows.

Do your mugs come filled with Fed liquidity or do we have to use our own?

I have reached out to the Fed but it refused to fill the mugs with liquidity. They’re not big enough, it said. You have to be big to get the liquidity, it said. The minimum size is a tanker truck.

Come to think of it, the mug artwork would look awesome on the side of a septic tank pumping truck.

I’m giving that comment the benefit of the doubt as a compliment.

Even then it was pretty rough.

ps: Wolf, my TWO mugs look perfect in the china hutch, sitting in front of an army of Baccarat St Remy wine glasses

Javert Chip,

Glad you enjoy them. And thanks! When we came out with those mugs, I never imagined that I and we all would have so much fun with them these days :-]

Good riddance. We should have fewer brick & mortar stores and malls anyways. The retailers with a strong online presences will survive. Those who dove into CMBS’s, well, you are out of luck.

We could lose two thirds of retail stores and be at the 1960 level of square footage per retail dollar spent.

-Howard Davidowitz

And the remaining workers could earn a living wage with much higher same store sales.

Same thing can be said about the restaurants which have come up in large number in every nook and corner of every neighborhood.

Sure, we’re learning to do without

brick-n-mortar stores;

it’s a game changer, amazing.

After looking for some weeks,

I was finally able to find some

reasonably priced canned food on Amazon.

I was limited to 36 cans.

Shipping date unknown;

projected arrival date:

> 29 days after purchase.

From my perspective, comedy has

suffered the most from this lockdown;

every joke just dies, crickets.

I think the end result of this will be fascinating. Commercial construction will be heading down. Residential also as the number of jobs decline. Auto sales down as people don’t travel to work as much. Gasoline sales will decline. People telecommuting don’t need nice clothes to wear everyday.

I’m telecommuting now and can’t stand sitting in my house all day. So I’m playing more tennis and golf and boating on the weekends. But the upcoming generations seem to be more video game focused than actual life.

I wonder about the regional banks. From what I understood lots of them had CRE loans not bundled into CMBS yet. Rosengren at the Boston Fed:

“Noting that real estate holdings are widespread, and that the tools for handling valuation concerns are somewhat limited, Rosengren believes we must acknowledge that the commercial real estate sector “has the potential to amplify whatever problems may emerge when we at some point face an economic downturn.”

Thinking of banks, the small banks have lots of subprime credit, that can’t be good.

From a Canadian POV the US is grossly over banked, with some 5000 FDIC insured. Recently read a bit in New Yorker (about origin of paper money) where the author/banker casually mentioned that a US bank with under 140 million base only needs 3 % reserve. Both numbers are shocking, and would be considered a joke in Canada. Apart from the 140 ( I guess you can have less!) you would think it should have more rather than less reserve.

I gather this has something to do with states rights or something. I bank at Bank of Nova Scotia and that province never crosses my mind.

I very much doubt it’s HQ is there but don’t know. Same with Bank of Montreal (it pretends to be in Quebec but real HQ is Toronto. None of the Big Six are regional with Canadian Western being the only sort of.

Are there 100 times as many regulators and inspectors in the US ?

No lost a dime in a Canadian bank during the Depression when almost 10, 000 US banks went under taking many deposits with them.

We’re all for Wild West entrepreneurs but not in banking. We’d rather have them a bit staid, boring and solid.

1) The malls are empty. US largest city lost their pulse.

Nobody dribble NYC Fifth ave @ 8AM .

2) Paper oil in coma. US + Russia are cutting production. Rouge SA add salt on the wound, gouging our eyes. Its the norm.

3) When SA will become delinquent on their defense debt, LMT should

confiscate ARAMCO Houston refinery, the largest in the country…

And all the dollars Saudi makes with selling oil.

Oh, wait. No more petrol dollars.

Personal anecdote: I find that the long delay, relative to the 48hr delivery of the past, is decreasing my online spend. I would rather drive ~40min roundtrip and get [whatever] today instead of waiting three weeks for an e-commerce Co. to deliver.

There is no way that the country can just dip into Depression-level unemployment, then magically bounce back up once the lockdowns are lifted. The economic circumstances of original Great Depression not only directly killed more people than would die if we allowed the virus to circulate unencumbered, but led to the Holocaust and WWII, which killed even more people. What are they expecting this time?

It would make much more sense to save a greater number of people by not shutting everything down. Rather than shutting everything down and bailing out the 1% while throwing bread crumbs to the masses, they could have spent the money building quarantine facilities for the weak and vulnerable while allowing the public at large to continue its subsistence.

uh, Kim-closer inspection might show the 1% are STILL being bailed out, and despite the happy talk of the msm re the economy, if you’ve followed this site for any length of time you’ll know that another real crash into the 99% has been ‘…just a shot away…’.

May we all find a better day.

We are getting a look at who benefits from the virus.

Retail, transport, or medical and pharma and political scoundrels?

If you’re looking for the winner, here it is: K Street always wins.

Franchises in Australia are going bankrupt.

In 1933 there was almost 25% unemployment in America. People starved to death.

The Fed forecast 32% unemployment. Shutdowns might do more harm than good.

Oh someone please explain the new FIMA repo by the Fed. I see the FIMA participation in noncompetitive Treasury options but this new Facility is interesting.

These foreign central banks all sit on stacks of US Treasuries. So normally, if they need dollars, they sell Treasuries. And when they get dollars, they buy Treasuries. In the new FIMA facility at the Fed, the foreign central banks sell those Treasuries to the Fed for dollars under repurchase agreements, and then when those repos mature buy the Treasuries back for dollar cash.

What this system does is give foreign central banks a way to turn their US Treasuries into cash without selling them outright in the market. If the amounts are smallish by Fed standards, I don’t see much impact. But if China suddenly decides to turn up at the Fed’s FEIA window with its $1 trillion of Treasuries, well then, we’re going to raise our collective eyebrows.

The Fed is scared of a fire sale :-)

What is the purpose of the FIMA Repo Facility?

The FIMA repo facility is designed to help maintain the flow of credit to U.S. households and businesses by reducing risks to U.S. financial markets caused by financial stresses abroad. The facility reduces the need for central banks to sell their Treasury securities outright and into illiquid markets, which will help to avoid disruptions to the Treasury market and upward pressure on yields.

Take away all China’s US Treasury reserves, give them dollars and make them buy American goods? How does that work out? They certainly don’t need dollars, and probably don’t want them. Were they to issue tons of new debt denominated in dollars, they could benefit from continued devaluation. The EM sells debt in dollars at XXX and pays it back in X. (and yields are rising in the EM) At some point FED has to stop those dollars from leaving the building. Right now they are shoveling them out the door as fast as they can. Fed claims no fealty to the currency, fears a dollar freeze up. An old fashioned credit crisis is the next (well choreographed) policy blowup.

I am not sure if it was China’s rumbling or Japan’s. Something is going on and we need to know.

Oil states income is in dollars and their income is in freefall. I expect it to be the oil states

The Fed is creating a shiny new “7th liquidity window” repo facility.

Foreign and international monetary authorities (FIMA) who want more dollars can borrow them by offering Treasuries as collateral.

Borrowing dollars against borrowed dollars.

“Everything is happening as I have foreseen.” (Evil Emperor Darth Sidious).

All is well. All is well!

(Que the Animal House video)

Deep buried in the detail (pdf) is the reason why.

They get 25 basis points over IOER which is at 0.1 today.

That’s a lot better than 0.00% in short term T bills.

You want to cry more? Those cash management bills that are auctioned nowaday have positive rates. They cannot be bought through Treasury Direct or simple Vanguard Fixed Income Treasuries. Money for the banks, zero for the people. Democracy at its best.

Just to make it clear this is Repo so the Fed is lending starved foreigners of reserves for 0.125 %.

Meanwhile there is reverse repo at around 250 billion at almost nothing.

FIMA can simply buy short term CMBs from the Treasury for positive rates.

I wonder why?

Think of all the liquidations that will take place after this crisis. The products and inventory thrown on the market at fire sale prices, as companies exit premises, exit the business world for good. And likely few buyers, people unemployed with no money or keeping their money with debts to pay or maybe finally realizing they need to save for the next rainy day (when the pandemic resurges in the fall or winter). This is such a disaster on so many levels. V-shaped recoveries and pent up demand….what a bunch of garbage……Only the auction houses and bankruptcy courts will be flourishing after this…..

for small-timers who have managed to somehow live within, or better yet below, their means, it will be the equivalent of the “blood-in-the-streets” buying opportunity usually reserved for the investor class.

B&M will further bifurcate, just like the real economy, smaller and split between the very high end and the very low end. The bifurcation is here already but will become more apparent after this crisis is over.

If you follow the luxury markets, there are already fashion houses that have websites but sell only through their stores. Their merchandise is allocated differently across their global network. If California is shut down, merchandise will go to Paris or Dubai, wherever the beautiful people are congregating.

The rest of us will be shopping mass market at the outlets.

Or at small, very close by stores that keep their shelves full and their prices down, like IGA and Dollar General.

Sweatpants for all then.

Not funny, but that’s probably all we (the masses) will need going forward.

All this terrible news and yet the stock market continues to rise. We are less than a month into this with the worst by far yet to come and everyone is acting like it’s over already.

You have to wonder if people will start to finally wake up to how fake our markets really are. I’m just waiting for the S&P 500 at 3,500 as unemployment hits 30%, deaths rise to >500 (or even >1000) per day, people refuse to pay any bills, and everyone is huddled at home just trying to survive.

I’m a surgeon outside Chicago and while we don’t yet have many cases at our hospital it already looks bad. We announced yesterday that we are completely closing most of our clinics until this is over (there will be some emergency slots open but overall we will see <10% of the patients we usually see). All elective surgeries are cancelled and now we are even cancelling cancer surgeries if the cancer is deemed low risk (ie it is unlikely to spread in the next 30-90 days). We've been told we need to make each mask last at least a week (usually you change masks every time you see a new patient) and are now required to wear a mask, eye protection, and gloves whenever we are in the clinic or the hospital (even when not in a patient room). Again, we have 10 people, no air travel) may need to be in place until we get a vaccine hopefully next year. The issue is that the moment you lift the lockdown the virus starts spreading rapidly again and you are back where you started within a few weeks. This is likely to be the defining event for most people alive now (ie similar to the Great Depression or World War 2 in that it shapes our outlook and behavior for life).

But the Fed is printing tons of money and corporations are getting bailouts, so I guess none of this matters. In some ways I find the disconnect between the real economy / ordinary people and the markets more frustrating than virus itself. The virus will eventually be solved to some extent / stop controlling our lives but I don’t have much hope we will ever fix our broken economic system.

It appears my comment got truncated / a large chunk was cut out. I meant to say (After “10 patients at our hospital have the virus”):

Virginia just announced a lockdown until June 10 (72 days) and I have friends in public health saying even that won’t be long enough. At least a partial lockdown (bans on gatherings >10 people, no air travel, restaurants closed) may need to be in place until we get a vaccine hopefully next year. The issue is that the moment you lift the lockdown the virus starts spreading rapidly again and you are back where you started within a few weeks. This is not something that is simply going way. This is likely to be the defining event for most people alive now (ie similar to the Great Depression or World War 2 in that it shapes our outlook and behavior for life).

Those were sold to the public as out-of-the-blue ACTS OF GOD as well. Wonder how this will be retold in the bar of history!

X- thank you. both for doing what you are doing (big picture-wise) and for reporting on what is going on in the real world.

hoping to use lockdown time to make some masks, for the people i am close to, but also to donate to courageous people like you that can make a difference.

you have inspired me to try a little harder.

Not to worry. Because of course the Fed end all it’s “emergency” measures sending assets sky higher just like they did for 2008 financial crisis.

Truthfully, no. Asset booms were typical historically. Now, it is driven by the service sector and supported by lack of rules. The Fed only can swap assets with the dealers. Its part of the reason they are irrelevant during the short but sharp “covid crisis”.

SN you are so right. This brief 2-3 year epidemic is only a blip in the wider scheme of things. Eventually things will return to normal – or something else.

USA should take a lesson from this and bring manufacturing of all critical items back home.

Not trying to sound inhumane, this virus seems to be doing the pursing/cleansing of earth.

The stock market is a leading indicator. I’m not saying this problem is over, but it will start on its way up when things seem bleakest.

I got another stock market sell signal today, so took action. I use three signals- got one a month ago, and one today. I don’t trade on news.

The action today seems bearish, although port rebalancing may occur tomorrow. Bunches of asset allocation models will load up on stock at end of month/quarter, so I expect a bounce.

After that? I don’t expect a strong market.

If the stock market were truly forward-looking, it wouldn’t have hit all time highs on February 19, 2020.

Xentago – Just a small clip, from a great blog in Canada – Often has “Down in the Trenches” types of analysis of financial matters – http://www.greaterfool.ca – Here is one (small) snip – those swimming naked, will be exposed…

From a blog dog in Ontario:

I had to write in to tell you a story after reading “The emergency” blog. A friend of the family, late 30s surgeon making $800,000 a year, tells my family they are applying for government benefits because they have no income after elective surgeries have been cancelled. They just spent over $250,000 on kitchen (not the whole house just the kitchen) renovations. They have no savings. Live large with big ski holidays, biking adventures and apparently single room renovations that cost more than some people’s homes.

I never thought it possible that people with this billing capacity could have no savings. But there you go. Even those responsible for the lives of others don’t have enough common sense for basic financial responsibility. Thank you for helping all of us readers from becoming a jaw dropping example of this foolishness.

Meanwhile, CALPERS Pensioner Curtis Ishii will still get his $35.000 a month pension forever while those in the private sector who pay his pension starve.

CA is one of the most corrupt state , may be like any others. I usually vote for all tax increases in CA as I know for sure it’d be misused.

If we’re going to online with groceries, about half of what’s available in B&M is dead, maybe more than half. Fresh produce, dairy, frozen, fresh meat, the bakery is mostly what fills shoppers baskets. It’s not feasible to ship these things Fedex much less, do you want to have someone pick out your produce and meat for you? Are we going all processed food now?

If any entity needs government support, it’s the fresh food infrastructure. Just one item, say bananas, is so complex an industry already because fresh food needs almost perfect timing and correct amounts. Milk just doesn’t pop onto the cooler shelves like magic in stores. This stuff just can’t be available off-on, stop-go. Retailers may look like the face of the food industry, But their supply of fresh items is in serious trouble.

Walmart has a patent for system using cameras/robot arm to allow people to self-select produce via the internet.

seriously? i guess it’s finally time for the hair shirt and sandwichboard declaring “THE END IS NIGH!”

this ride stinks, i wanna get off. and thanks for all the fish. and get off my lawn.

All the issues (FKA problems) that you cite are already resolved or will be in the next couple of years or less:

Amazon is (was) delivering from Whole Foods the next day, though I am not sure if that included produce or cooler goods yet. I got exactly what I ordered, free shipping, a month or so ago.

Produce will soon be delivered with the guarantee that if bad, per cell phone photo proof immediately upon delivery, cost will be refunded; likely some way to keep stuff cool for 48 hours, hopefully fully reusable, will develop if not already, etc.

Something like instant shopping cart will continue and likely grow based on concierge pricing and level of service.

And I would not be the least bit surprised to see development of odor transmission digitally become widespread in 5 years, which would just help to confirm bad produce or other cooler goods.

And don’t forget, SecAG said yesterday not to worry everything is just fine and dandy in the USA food chain, probably due to stables of genii!!

Whole Foods delivered to me yesterday in 2 hours.

once upon a time i couldn’t really afford to shop at Hole foods. now i boycott them because amazon. YMMV, but just sayin’.

There is absolutely NO WAY that “odor transmission” will EVER happen, let alone “in the next 5 years”.

Zantetsu:

Odor transmission is already here!

Everything STINKS!!

@VV – none of that is possible nor will it be necessary. We’ll just walk over to the replicator and say “Earl Grey, hot!” No problem.

I am guessing the vast majority of the increase in online retail is Amazon. Ebay’s 2019 US 4th quarter sales are actually down. “…..U.S. GMV fell 9% from the year-ago quarter…..”

This is quite amazing. My son just texted me from his quarantined room that his wife lost her pregnancy due to coronavirus. She worked in a Brooklyn hospital that’s one of the hotspots. More info needed. This is strange. I can’t believe it.

Iamafan I’m truly sorry to hear that Prayers going out to you and yours friend

Thanks. I can breathe now. False alarm. No virus at home. Just groggy people after the surgery. I’m serving my best whisky and grilling steaks for a taste test.

Update. My son was pulling my leg. No Corona virus. Just an ectopic pregnancy. My daughter in law called her boss at the Brooklyn hospital. Straight out the boss asked if she left NYC. She said it was the right thing to do unless you want a proceedure in a tent. That’s if you’re lucky.

Your son is an ***hole.

Good job!

Nah. My daughter in law was prescribed oxy for her operation. I misunderstood what she was communicating. She had an ectopic pregnancy operation. She was referring to a patient in her hospital in Brooklyn who miscarried due to coronavirus. Mixup ok.