The week after the year-end Repo Chaos didn’t happen.

By Wolf Richter for WOLF STREET.

The feared chaos in the repo market over the year-end period didn’t materialize as the Fed had flooded the market with cash via repo operations and purchases of T-bills (Treasury securities with maturities of one year or less). This kept repo rates glued to the bottom of the Fed’s target range for the federal funds rate at just over 1.5%. But it sure took a big flood of liquidity to douse that potential chaos – $410 billion between September and January 1 – and now some of that liquidity got drained.

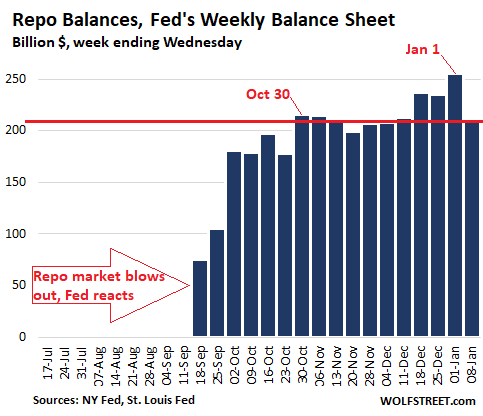

As of the evening of January 8, the Fed had drained $45 billion in liquidity from the repo market, according to the Fed’s weekly balance sheet released this afternoon, bringing the total repo balance down from $256 billion on January 1, to $211 billion on January 8. This was by far the biggest weekly drop in total repo balances since September. It knocked repo balances down below where they’d first been at the end of October:

From September 2019, when the repo market blew out, through January 1, the Fed engaged in a series of repo market interventions. Under these repurchase agreements, the Fed buys securities (mostly Treasuries) with a commitment to sell them back on a set date and at a set price. The repo takes securities off the counterparties’ hands and puts cash into their hands, which adds liquidity to the market. At maturity, the repo unwinds, the transaction reverses, and that liquidity is drained from the market. Overnight repos unwind the next day. Term repos unwind, for example, in 7 days or 14 days. This repo activity is a constant in-and-out.

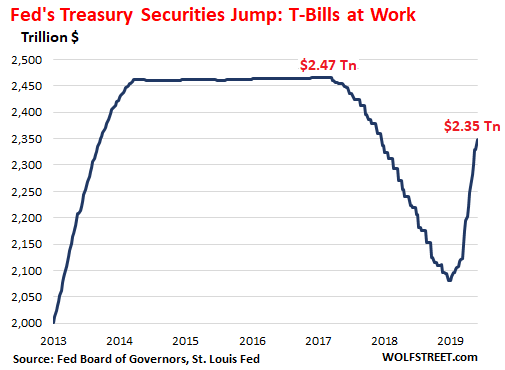

Over the same period from September through January 1, the Fed had also increased its holdings of Treasury securities by $233 billion, including about $169 billion in T-bills. However, over the same period, it continued to shed $80 billion in Mortgage Backed Securities (MBS).

So, on net, the Fed had doused the money market as of January 1 with about $410 billion in liquidity. With its repo operations between January 1 through January 8, it mopped up $45 billion of this liquidity.

But wait… the Fed mopped up liquidity with one hand via the repo market; but with the other hand, it doused its crybaby cronies on Wall Street with more liquidity by purchasing T-bills: over the past 7 days, it increased its holdings of Treasury securities by $19 billion:

Over the past seven days, there has been no change in the Fed’s MBS account. This will come later in the month.

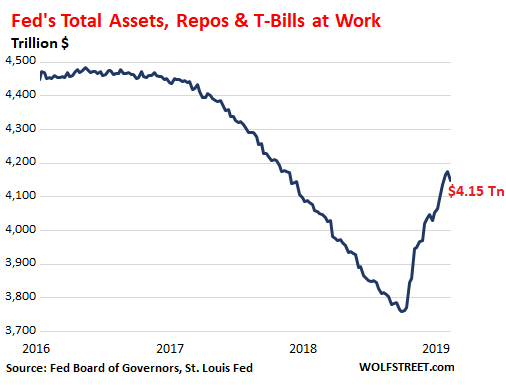

And the Fed’s total assets on its balance sheet as of the evening of January 8, given the $45 billion drop in repos and the $19 billion increase in Treasury Securities, fell by $24 billion.

This decline is so minuscule that you have to put it under a microscope to see it among $4.15 trillion in assets on the balance sheet, but it’s the biggest week-to-week decline since July 2019, when the Fed was still engaged in Quantitative Tightening:

Obviously, there is no telling what the Fed will do if something changes. But as of now, various Fed heads have fanned out across the land to pat each other publicly on the back about how well the repo crisis has been resolved – meaning that the Fed feels like it has this now under control and that it can back off with its efforts.

It wouldn’t surprise me if the Fed continues to gingerly drain liquidity out of the money market as it backs away from repo activities and slows down its T-bill purchases as per its announcement that it would do so when excess reserves reach some “ample” level of magic, even as the Fed continues to roll off its MBS at a rate of $20 billion a month.

Something funny’s happening in NIRP land: long-term yields are rising, negative yields are turning positive, and investors are getting punished for having handed their brains to central banks. Read... How Much Money Have Folks Already Lost Who Bought that Negative-Yielding 30-Year German Government Bond last August?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This money must be leaking into Tesla stock.

Somebody has something wrong here…

“The Fed announced on Thursday (Jan 9 2020) it is adding another 83 billion in “in temporary liquidity to financial markets” And, in a development that will surprise no cynic anywhere, the Fed also noted it “may keep adding temporary money to markets for longer than policy makers had expected in September.”

https://mises.org/wire/fearful-fed-keeps-pouring-money-repo-market

This is much simpler than it appears to be.

The Treasury is auctioning too many bills, notes and bonds. The market has to digest it. The Fed has to come in and help while contolling the narrative. A good story for those who believe. But where else can you put your savings? Not QE or that 409k?

After 20 years I am assuming the Fed continually lies. It’s an institution built on lies. They were optimistic on all their dot plots. Even the language they use is lies. In reality QE is monetizing the debt. In reality forward guidance is lying about the future. Never trust a word they say. Only look at the actual interventions in the market for clues. If you can print, you can steal from one and give to the other.

historicus,

This Mises article you linked uses the typical ignorant BS headline about repos to get clicks (the WSJ does that too). It’s wrong and garbage.

Repos are in-and-out. The headline only refers to the “in,” not to the “out.” Every week, 5 overnight repos mature and unwind and drain liquidity. Every week, 2 or 3 term repos mature and unwind and drain liquidity.

The headlines willfully ignore this. It’s only the new repos the headlines mention, never the ones that unwind.

What matters is the net effect of new repos minus matured repos:

For example, this morning’s repo which was way undersubscribed: The Fed bought $40.8 billion in securities, of $120 billion. And yesterday’s $48.8 billion overnight repo unwound this morning. So the net effect today in terms of overnight repos is +$40.8 billion -$48.8 billion for net a DRAIN of -$8 billion.

Worse still, it uses the story from Caitlin Long, a cybercurrency nut. Like that can’t be manipulated, too. Garbage.

They’re not taking 8B out of the market they are rolling over 8B less, or about 85% of the previous days after 34B on a 14 day REPO the day before. 85B a MONTH was the old QE. 40B a day compares pretty well, rolled over in perpetuity. Fed is considering a standing facility. REPO is Tbills or cash equivalents for cash, this is a money printing machine. PDs have Treasury paper sitting on their books, (rates are low, nobody wants it? Fed will swap them for cash to buy stocks and you get 30% a year in returns!) All this to avoid a crisis. Uh huh!

Hear! Hear!

I occasionally tweet the actual numbers as a reply to the junior reporter @WSJ who got stuck writing the article that day.

As I pointed out in another comment, it is also not true that the change in the outstanding repos is a result of decisions made by the Fed. The New York Fed keeps making the same overnight offers every day and two-week offers twice a week and it is the decisions of the Primary Dealers to bid that determine the repo balance on the Statement of Conditions, so the headline “Fed Drains $45 Billion from Repo Market” is also inaccurate. (When the $50 billion of 32 day repos mature next Friday, assuming the Fed doesn’t make another $50 billion offer, it will be draining that money from the repo market.)

Great article.

Who benefited?

Banks, Wall Street houses and the ultra rich.

And why the “wealth gap” is the widest in history.

REITs and Hedge Funds benefited per an article by Wolfstreet …

and why the Fed must serve these entities seems outside their purview.

But, who’s watching?

“AGNC lists $106 billion in total assets on its 10-Q filing with the SEC. Of them, about $93 billion are mortgage-backed securities guaranteed by Fannie Mae, Freddy Mac, and Ginny Mae. The second largest asset are about $9 billion in receivables from reverse repos. Plus, it shows $1.2 billion in Treasury securities, and some other things in smaller amounts.

But the company has only $10 billion in equity capital. So how does the company fund these investments?

On the day of June 30, AGNC owed $86 billion to the repo market, out of $96 billion of its total liabilities. In other words, nearly all of the cash to fund its investments comes from the repo market.

During the six months period through June 30, the company cycled nearly $2 trillion with a T through the repo market, borrowing short-term, paying back the required amounts when the repos mature, and then borrowing again, constantly rolling over the increasing pile of short-term debt.

So over the first six months this year, this company has cycled through nearly $2 trillion in repos. This is up from $700 billion over the same period last year.”

Historicus, thanks for the analysis. Apparently, AGNC is in that club that George Carlin kept referring to.

I benefitted being long tech stocks

The stock traders riding this market have no respect for the FED, (Stocktwit). This was a crisis when Fed opened 100B line in Sept, what’s their reason now? Not-QE QE is a joke, and the FED has done something no one wants to see, throw their credibility under the bus. I can almost see why they are doing it, and the FED report on policy is good criticism, so the worse things get the more the FED feeds the stock speculators?? Tomorrow is jobs report, and general feeling is makes no difference, they are going to take this market higher. When banks take out a 100B a day and roll it over, it is not a one day loan. Hello Congress this is taxpayer money. When over night contracts bust you pick up the bill. Meanwhile traders buy calls. Double down. Thanks Jerome

Wrong.

As of 1/9/20

Overnight=48.8 billion

Term repo=33.3 billion

POMO= 1.5 billion

Term/POMO cumulative =429.3 billion

TOTAL= 478.1 billion

Hank,

I didn’t bother to check your numbers. But you chose a different day, Jan 9. Even if you’re right on Jan 9, you will be wrong on Jan 10. This data changes daily. So my data is as of the Jan 8 balance sheet. The Fed’s balance sheets are fixed points in time. My next data set will be as of the Jan 15 balance sheet.

https://mises.org/wire/fearful-fed-keeps-pouring-money-repo-market

historicus,

This Mises article you linked uses the typical ignorant BS headline about repos to get clicks (the WSJ does that too). It’s wrong and garbage.

Repos are in-and-out. The headline only refers to the “in,” not to the “out.” Every week, 5 overnight repos mature and unwind and drain liquidity. Every week, 2 or 3 term repos mature and unwind and drain liquidity.

The headlines willfully ignore this. It’s only the new repos the headlines mention, never the ones that unwind.

What matters is the net effect of new repos minus matured repos:

For example, this morning’s repo which was way undersubscribed: The Fed bought $40.8 billion in securities, of $120 billion. And yesterday’s $48.8 billion overnight repo unwound this morning. So the net effect today in terms of overnight repos is +$40.8 billion -$48.8 billion for net a DRAIN of -$8 billion.

The fact that these Fed machinations are so confusing says plenty. The confusion is deliberate.

Fed driven Liquidity is INCREASING! That’s why the S&P and others are going bonkers.

Between mid-September (when the so-called repo problem started) to the end of December:

Treasuries held by the Fed increased about $223 billion while MBS decreased -75 billion. 52% of the treasury increase was less than a year while 48% were longer term (about $106B). The decay rate of longer term treasuries down to one year or less to maturity is about $350 – $425B. That is the amount maturing each year, But since the Fed bought T bills, the amount maturing 2020 jumped about $117B.

Excess Reserves went up more than $221 billion and the Treasury TGA account increased by more than $132 billion. Repo added more than $225 billion to the balance sheet.

In short, the amount of new money was $225B for Repo, $117B T Bills, and $106B Notes and Bonds = $448B. Subtract the reduction of MBS -$75B. So net increase est $373B.

Thank you Santa. PS. I don’t fight the Fed so I bought S&P all the way up and won on my trades. This was simple.

Seems to me the fed is being bullied by something. To cut or not to cut, is being bullied. Is stopping repo an option? Maintaining the wealth effect of more and more? Until, the selling happens and then they cut? Largrde wants to target different interests rates? So make up some paperwork about windmills? Apple at 300? That’s not enough after more than 20 years? I guess not. Indexing by institutions, the problem? So many dollars out there! Scary! Thank you Wolf.

Futures are up (as usual) so I’m guessing that tiny blip down on the balance sheet has already reversed and moved higher. No balance sheet bubble equals no stock market bubble, Powell knows this and he knows Trump knows it and he does not dare poke that bear again. Balance sheet will continue to rip higher and the market will continue to rip higher from here all the way to $ => 0.

Of course Powell knows he is hastening the ruin of the dollar and with it the economy but he lacks the courage to care. My bet is placed on debasement, my bet is placed on hard assets.

Jan. 10, 2020

above, van_down_by_river: “…guessing that tiny blip down on the balance sheet has already reversed and moved higher…”

As Wolf remarked in the blog above, so far the decline is “minuscule”. In fact, what jumps out from the graph (3rd down in this blog) is the trend line upward.

I have some respect for Rick Santelli on CNBC, so when he remarked this morning (Santelli Exchange) on the Fed’s growing balance sheet, it seemed to contradict Wolf’s blog. Having studied the graphs above, especially the 3rd graph; and having read some of the commentary, I think I have come to a finer appreciation of the Fed’s stories and the role the Fed plays in the larger U.S. economy…..in a nutshell, the Fed continues to spin gold into straw.

Thanks, Wolf and commenters

Since the Repo crisis started in September 2019, I have yet to see a proper explanation for why this happened.

The best explanation I have read is that this was a deliberately created crisis by the deep state to try and cause a recession.

Remember Mr. Dudley back in August calling upon his staff at the NY Fed to create a recession to prevent the President from being re-elected? That was one strange statement from an ex-NY Fed head.

Well either the NY Fed staff deliberately overlooked something or they conspired with crybaby Wall Street’s bankers to suddenly create a crisis.

If you think that is strange, then consider earlier the media talking about a looming recession. Yes they did try to wish a recession into being.

Go back around June 2019 or so, the Fed was testing their system buying T bills. Why????

Looks like the whole thing was planned. By October it was official, 60b a month.

Look at my comment above. How did long term Treasury holding INCREASE??? I thought they said they were only buying T bills?

Repo was just an excuse to increase their balance sheet and goose the markets. If this stops watch out below Mr. S&P. No one crys while the Champagne is still flowing.

The one explanation that seems reasonable to me is that the spike in the repo markets on September 16 and 17 was caused by the spike in the oil futures markets on September 16. There were attacks on Saudi oil facilities on Saturday, September 14 and the media reports absurdly overstated the impact. In the oil futures markets where traders sell oil they don’t have for future delivery to traders who have no intention of ever taking delivery the only thing that is real is margin. When prices spiked in those markets on Monday traders on the wrong side needed huge amounts of cash by Tuesday to meet margin calls. The repo markets are the place to get huge amounts of cash quickly and on Monday, September 16, a day when quarterly and monthly Federal tax payments were also due, the volume adjusted average rate increased to 2.43%, with a 99th percentile rate of 4.60%. On September 17, the average rate was 5.25% and the 99th percentile rate was 9.00%. The Federal Open Market Committee was meeting on September 17 and 18, and was widely expected to cut the federal funds rate target range to 1.75 to 2.00% effective on September 20 but in reaction to the repo market fed funds has also spiked with the EFFR (effective federal funds rate) at 2.25% with a 99th percentile rate of 3.00% on the 16th, 2.30% and 4.00% on the 17th, and 2.25% and 2.50% on the 18th. This was the first time that the EFFR rose as high as the top of the range (there had been a few days when it dropped below the bottom by a basis point or two). The FOMC did cut the target effective the 19th and the EFFR at 1.90% was comfortably below the high end of the target range.

Most folks, including the financial media, don’t bother to look at what the Fed said about why it is purchasing T-bills and offering repos. It is not to provide liquidity to the markets. Instead it is to insure that reserves, the money depository institutions including banks have parked of the sidelines of the economy, remains “ample” even as other Fed liabilities increase. Specifically the Fed wants reserves to remain at or above the level of early September 2019. Ample reserves have been part of the FOMC’s plan for at least the last four years.

Oops. The first reference to the Fed cutting the rate target should say September 19, not 20. Thanks for cleaning up my mistakes!

The point of the repo liquidity added by the Fed appears to have been to keep short term interests under control, i.e., low, consistent with the other short term rates the Fed controls. Wolf’s article today regarding negative interest rates (“How Much Money Have Folks Already Lost Who Bought that Negative-Yielding 30-Year German Government Bond last August?”) and the consequences of holding same in the event of rising interest rates permits the inference that at the first sign of rising short term rates in the US there will be a massive dump of the $US13-17 trillion in neg yielding bonds now outstanding and even bigger rush into US markets from neg-interest land.

Not only that overall rates need be low (because of excessive debt levels) but they also want a positive yield curve. Then liquidity has to constantly be pumped or we’ll have a heart attack.

See https://blogs.cfainstitute.org/investor/2020/01/10/negative-interest-rates-the-logical-absurdity/:

“Nevertheless, this author does not think it precisely right to say that negative rates are absurd. In and of themselves, upside-down rates — almost exclusively restricted to the sovereign bonds space — do make sense. They reveal the high cost of staying solvent — a cost borne by the financial institutions that purchase these securities.”

“The modern monetary system operates on credit. But after the financial peripeteia of 2007–2008, extending credit on an unsecured basis became inconceivable. Therefore, the post-2008 monetary order funds the global machinery of international commerce and investment almost exclusively on a collateralized basis. Secured funding only.”

“But here is the problem: There is not enough collateral. So financial institutions will pay “anything” for it, including “guaranteed” losses on sovereign debt, assuming the government obligation is held to maturity, which it is not. These negative-yielding bonds are not investments but balance-sheet management tools. ”

“The [negative-yielding] bond serves as collateral for a short-term loan to tide over the bank because, by the very nature of the business, there is a timing mismatch between liabilities (e.g., short-term cash withdrawals) and assets (e.g., long-term mortgages). ”

No riddle me this: what will eventually happen that short dated term repo collateral is locked up in their repo contract (or outright sold to the fed), and a broke-dealer bet goes sideways without enough of the borrowed (or new) cash on hand to buy back its collateral?

“True collateral is created from economic progress, rule of law, human advancement, and national development in the present and expectations of it in the future. These beautiful concepts are hard to come by during an economic depression.”

“It is a self-reinforcing cycle: no trust, not enough new collateral, hoarding of existing collateral, impeding economic potential, further reducing trust, further dimming economic potential, etc. Negative interest rates are a “logical” consequence of the larger, absurd picture: an unacknowledged, silent depression. “

That is absurd.

If these speculators are so desperate for collateral, they should be paying a high price (a high yield) to the Fed (or money center bank) to get it. Lenders would be demanding crazy high interest rates.

Negative rates suggest collateral is so abundant that they can’t give it away — which is clearly not the case. A lot of over-levered speculators with too much junk collateral / not enough high quality collateral.

Negative rates are absurd, and are causing far more damage than the problem they were supposed to fix — and they aren’t doing that either. HUGE mistake

>… they should be paying a high price…

Well should is not the same from what is. Obviously, central banks and governments disagree with you, since that would drive up their rates as well.

> … not enough high quality collateral.

What does that say when broke-dealers wont even lend with each other with UST/ABS collateral which is supposedly “AAA” rated?

Seems like you missed: “Negative interest rates are a “logical” consequence of the larger, absurd picture: an unacknowledged, silent depression.”

The author doesn’t disagree with you, but chooses not to just call something absurd and pound sand about it without digging into the details.

We are saying similar things…

They SHOULD BE paying higher rates *IF* their BS reason for central planning were honest. They are lying, negative rates are absurd.

“The market” doesn’t believe UST are AAA, and evidently the Fed isn’t too sure either. Just because legislators decree the stuff is AAA doesn’t make it so.

I did read the CFA article, and to me the author appears to be all over the place. The whole negative rates thing is 100% absurd, the result of Bush/Obama appointing two fools (BeRNanKE and yellen). The fools were not up to the job of actually fixing the economy, nor were they up to the political task of selling a big lie.

@Yak Now

>They SHOULD BE paying higher rates *IF* their BS reason for central planning were honest.

and *if* most people stopped believing in them… which is not the case yet.

>“The market” doesn’t believe UST are AAA, and evidently the Fed isn’t too sure either. Just because legislators decree the stuff is AAA doesn’t make it so.

Umm, these are rating agencies like Poor Standards, and Moody’s handing them out (lol yeah…). But yeah the repo market (outside of the Federal Reserve at ~1.51) may not accept short dated paper as a valid collateral type, but investors are still loading up on them…

>and to me the author appears to be all over the place…

Perhaps be cause the symptoms of the *greater* absurdity that explain that makes holding zero coupon sovereign notes to borrow against them logical persists all over the place…these issues started long before those stooges… and populous is complicit…

“….. AGNC Investment Corp, which is funding all its long-term investments in the repo market. It’s just one of many examples. I’m not picking on it, and I have no opinion on it. But it is publicly traded and has to file its financial disclosures with the SEC, and so I can get this data since it’s public, and we can see how this works and what kind of company is on tenterhooks when the repo market blows out.

I’m neither long nor short the stock, and I have no opinion on it. I have seen no data that indicates that this company had any kind of trouble in the repo market. It may have sailed through the repo turmoil without any issues. I’m just using it as an example of who is relying on the repo market and for what purposes.

AGNC is a Real Estate Investment Trust. In essence, AGNC buys mortgage-backed securities issued and guaranteed by the government-sponsored enterprises Fannie Mae and Freddy Mac, and by the government agency Ginny Mae. It also buys Collateralized Mortgage Obligations. These are long-term assets.

And it funds those purchases mostly in the repo market. It makes money off the difference between the higher yields on mortgage-backed securities and the low cost of borrowing in the repo market.

It’s essentially trying to create profits in a highly leveraged manner by borrowing short term at the lowest rates available in the US for a company like this, namely the repo market, and investing in higher-yield long-term securities. This works more or less — until the repo market blows out.

If repo rates spike to 5% or 10%, as they did, suddenly a company like this loses money. And if the repo market counterparties are unwilling to play this game, then any company in this boat would suddenly no longer be able to fund its operations and its leveraged bets, and all heck could break loose. A company borrowing in the repo market to fund long-term investments could blow up in no time.

How much money are we talking about here?

AGNC lists $106 billion in total assets on its 10-Q filing with the SEC. Of them, about $93 billion are mortgage-backed securities guaranteed by Fannie Mae, Freddy Mac, and Ginny Mae. The second largest asset are about $9 billion in receivables from reverse repos. Plus, it shows $1.2 billion in Treasury securities, and some other things in smaller amounts.

But the company has only $10 billion in equity capital. So how does the company fund these investments?

On the day of June 30, AGNC owed $86 billion to the repo market, out of $96 billion of its total liabilities. In other words, nearly all of the cash to fund its investments comes from the repo market.

During the six months period through June 30, the company cycled nearly $2 trillion with a T through the repo market, borrowing short-term, paying back the required amounts when the repos mature, and then borrowing again, constantly rolling over the increasing pile of short-term debt.”

from wolfstreet

https://wolfstreet.com/2019/11/06/whats-behind-the-feds-bailout-of-the-repo-market/

Well, somebody has to finance our 30 year mortgage exceptionalism. You need these arbitraguers, Japan and Taiwan.

Lots of people writing on lots of blogs that quantitative easing was a dumb idea, and not surprisingly it didn’t work in USA any better than Japan — now finishing its THIRD lost decade after QE “success”.

The Fed wants to be the big scary floating green head with fire and smoke shooting out, the last thing Jerome Powell wants is for Dorothy’s little dog to pull back the curtain on the old guy running special effects.

Quantitative easing was a disaster, and the Fed is desperate to distance itself. Whether it can is the $64k question… well, $64k inflation adjusted

One Question: Where i can find a table when the MBS Holdings mature ?

Thanks.

Marcus,

About 95% of the Fed’s MBS mature in more than 10 years. The roll-off here is almost exclusively from the pass-through of principal payments of the underlying mortgages.

As homeowners make monthly mortgage payments, or as they sell the house or refi the mortgage and thereby pay off the mortgage, those principal payments are passed through to the MBS holders (including the Fed).

Mortgage rates have fallen over the past 12 months, and so refis have surged, and there has been a massive wave of passthrough principal payments that exceeded the Fed’s roll-off cap of $20 billion a month. So the Fed has been buying some MBS to replace the excess passthrough principal payments in order to stay within its $20 billion cap on the roll-off.

Ho so there are no defaults. These are not toxic bonds. Year right. I have got a bridge to sell you.

Hank,

They’re as good as the US government since they’re agency MBS. So sure, if the US government collapses, those MBS are toxic. If the US government doesn’t collapse, which I consider the more likely outcome, those MBS are just fine for investors, though taxpayers may be be asked to step up to the plate.

As wolf alluded to but didn’t say, the MBS are as good as the word of Congress… and by implication as good as the tax base that backs congress (aka the US economy). The full faith and credit of the US congress is only worth what it’s taxpayers can support.

If the economy / tax base is really in enough trouble to justify sub CPI rates (or worse negative rates), it means the tax base is in trouble. That means congress ability to pay is in trouble.

If you believe rates should be negative, you are really saying that treasury are not AAA because the tax base is in trouble.

@Yak Now

They can always print and pay you back with inflated currency (or money). At least you get paid something.

@IamaFan,

Zimbabwe pays its bills by printing money. That is a default.

I’m not going to play along with the con artists who pretend like printing currency is the same as repayment. Addicts of all kinds lie to themselves

The MBS bonds the fed holds can default but the fed doesn’t take the hit. The issuing agency has to make them whole and they take the hit. Since the agencies aren’t private anymore, we are the ones taking the hit, still.

One of my one the record predictions for 2020 is the IPOs of the agencies.

Many thanks for the explanation!

@Petunia

There are three issuers of “Agency” MBS. One, Ginnie Mae is an actual Federal Agency. The other two, Fannie Mae and Freddie Mac, are still Government Sponsored Enterprises (GSEs), private corporations, although they have been in the conservatorship of the Federal Housing Finance Agency since 2008. As for “we are the ones taking the hit” it isn’t really true. We, the American people, used borrowed money (not tax money) to become the senior preferred stock holders of Fannie and Freddie. The terms were harsh, for most of the time defining the dividend due to us as all of the earnings of each firm which made it impossible for them to repurchase the shares. For example, through Q3 2019, we have collected $181.4 billion in dividends from Fannie and are still owed the $119.8 billion Fannie drew from the line of credit we provided.

DS,

The full faith and credit of the US is the taxpayer. Any money the govt has comes by virtue of taxes or taxpayer financed activity.

The old stockholders of Freddie and Fannie are acting like victims to take the agencies back. The disinformation campaign is now on full official Fake News.

I have been following Tesla this week as it’s risen in price. Reading the message boards you find a lot of true believers. The government has created this monster in at least 3 ways:

1. Easy money has allowed company to have $80 plus billion market cap without making any money with deep junk credit rating.

2. Easy money allowed government to finance the tax credits they gifted out to buyers.

3. Easy money allows people to finance expensive car at near zero interest rate.

Was reading a blog from 2017 where a husband and wife had financed two $100,000 Teslas and recharging station, picked up tax credit plus less than 2% interest rate. If I remember correctly $2000 down payment.

That while grandma’s CD was getting strangled two and a half years ago.

Just read about Tesla sales in e.g. Norway, even crazier incentives than in the US with the result that Tesla dominated the high end market for a few years. All so the high income earners can buy an additional almost-useless car for their driveway (useless in most parts of the globe when it comes to climate / energy efficiency), often for way below real production cost. Whatever spin you put on this, it certainly is bad for the environment given the high environmental cost or production and (ultimately) recycling/disposal of these cars that often get very little use; and yes, also bad for the people who are ultimately paying for this like savers.

You see how this works.

The Fed provides liquidity, speculators take it to run up the stock markets.

The Fed removes liquidity, speculators take it out on the stock markets. The Fed isn’t fooling speculators. They know the Fed will up liquidity to keep the stock markets from falling. And they do.

What does the real economy get out of it? Continued survival. Either the stock markets stay up or speculators take the real economy down with them. It’s a hostage situation.

It wasn’t supposed to be this way, but CB bank policies intended to boost the real economy have had the effect only of boosting the financial economy. The policies’ stated purpose is to increase spending by increasing lending by banks, which are supposed to be the vehicles for liquidity to flow from the financial to the real economy. But it can’t work because all it does is increase non-productive debt.

Other than continued survival, the real economy gets nothing because it’s just a hostage. There’s little point in investing in the real economy. That’s demand-driven and consumers have to ratchet up their debt on Fed liquidity just to keep the ball rolling. They’re tapped out and getting moreso all the time. They’re already spending more than they’ve got. They can’t spend any more unless their incomes go up, and that’s not going to happen. So the money is in financialisation, not investment.

Even CEOs borrow money against their own companies and leverage it to bump up stock prices. That’s liquidation, not investment. There oughta be a law. There used to be one, but speculators like it better this way. They get rich on free Fed money. Instead of putting money in risky investments they can make money risk-free on stocks and bonds and real estate.

Meanwhile the real economy slowly starves to death for lack of real investment and the speculators lose their hostage.

What do people who work for a living get out of it? Debts they can’t repay on McJobs and gig work.

This will all end in tears. The real economy is already teetering. It might last the year. It won’t last until 2026. I was wrong about that. Sorry.

The one stock I am invested in had between 17 – 18 million shares traded in two days on a 90 million share float on no real news. That’s a two week holding period. Pitiful.

>> This will all end in tears <<

What indicators, red flags, markers… are you watching, for a first signs that sh$t may be starting to hit the fan?

Sector weaknesses and non-recoveries in the real economy; loan defaults; escalating financial predation. Cross-referenced.

WR will let you know.

Thank you very much for response

Well said. Also recall the headwinds of demographics are increasing. 65+ age group expanding with reduced consumption and deleveraging. Prime age young population not expanding, even declining, Population in the middle, flat. For the vast majority, debt donkeys with no more blood to give. The idea of economic growth is based upon growing, economically consuming population which is not the reality.

1) Fed total assets. The trend is up. The trend is very strong.

2) Up 3,700B from about 800B in 2007 to 4,500B.

3) Down 700B to 3,800, a retracement of 22%, a thud.

4) Target : 3,800B at the bottom of 2019 + 3,700B from 2007 to the peak ==>

min future Total assets 7,500B.

5) No inflation. A future with severe deflation.

6) When assets will destroyed, including XLE assets, oil and

other commodities, including gold, will ignite inflation that will

blowup Fed assets.

In order to fuel inflation you need excess demand and cash. The only place inflation exists is in middle class needs and wants, but they are increasingly topped out. Increasingly subjected to working in the gig economy where there is no financial security.

There is not enough demand or capacity out there to ignite the inflation you are expecting. No matter how much money they pump into the economy, it all lands up in housing and in the markets. Demand in both those sectors is local, not national, so not controllable. We have islands of prosperity surrounded by oceans of financial devastation.

With all the trillions they have pumped into the system, they cannot create the inflation they need to inflate the debt down. The money never gets to the real economy, it stays on islands of prosperity.

I find it funny that people still take anyone in a position of power seriously. What you’ve explained was obvious as soon as the plans were announced back in 2009. Either the people telling us the “plan” are insane by continuing to do the same thing and expecting a different result or they know what they are doing.

They knew they were propping up the banks at the expense of savers and workers. But they work for the banks, so propping them up is always the “plan.”

There is of course serious inflation in the price of:

Higher education.

Healthcare.

Automobiles.

Homes.

To name a few.

There has been an uptick in asset prices. Stock market up, the dentist charging more, home prices up, property taxes up, auto safety systems improved while auto insurance bills rose. I was not able to find anything to short. The market might crash some other day. That scares me, yet I held.

What happens when the Fed sells all MBS’s?

They won’t and they can’t. There is no one else who can buy that big.

We are stuck with QE and they will be buying more of something already.

She was talking specifically about the MBS’s. Not too many left and they will run off without anyone else having issues. No shortage of Treasuries to QE into as needed. The Fed, and arguably the US Government as a whole, should not be involved in mortgage securities.

Sorry, not “she”, but presumably “he”, being John.

Technically they are not selling. They are simply allowing a run off of maturity/prepayment up to 20b a month. The rest is reinvested in newer mbs.

We dont know how long this can last. And whether the same ratio of mbs/treasury will hold at repo.

“It wouldn’t surprise me if the Fed continues to gingerly drain liquidity out of the money market ”

I’m sure everything in your article is currently accurate but the stage has been set for future “Non-QE, QE” injections. Many recent articles indicate the markets can only go up from here. The Old-style trading of pre-2009 is gone, the FED is now regulating the stock market.

When traders are offered near unlimited funds at the repo rate of 1.55%, they buy stock.

Jim Bianco (analyst/trader) made the comment that when repo is in the hands of the big banks they do credit checks on clients before loaning them the money (even though they need to put down bonds as collateral). They will charge a higher repo rate if it is a distressed client.

But the FED loans the repo money to anyone who shows up at the repo window. No credit check needed, all distressed borrowers are welcome! That’s a major difference and it’s why the market is partying like it’s 1999!

All repo window clients have excellent credit by definition, they own the place.

1) EW Wave 5 of 5 of 5 of 5 of 5….the highest of all highs,

might be here.

2) A great trading book by 2 PLA colonels for the 2020’s :

Un- Restricted…

by : Qiao Liang & Wang Xiangsui.

Available on AMZN for $15.96

3) It explain Pompeo trading.

Wolf Richter

Jan 10, 2020 at 10:48 am

Hank,

They’re as good as the US government since they’re agency MBS. So sure, if the US government collapses, those MBS are toxic. If the US government doesn’t collapse, which I consider the more likely outcome, those MBS are just fine for investors, though taxpayers may be be asked to step up to the plate.

NOWAY dude. Congress is not going to do another 2008 bailout. The people will not have it.

The Fed has told us where its focus lies and it is not the overall balance sheet size but instead the level of reserves. It has said it will “purchase Treasury bills at least into the second quarter … in order to maintain over time ample reserve balances at or above the level that prevailed in early September 2019” and “conduct term and overnight repurchase agreement operations at least through January … to ensure that the supply of reserves remains ample even during periods of sharp increases in nonreserve liabilities, and to mitigate the risk of money market pressures that could adversely affect policy implementation.conduct term and overnight repurchase agreement operations at least through January … to ensure that the

supply of reserves remains ample even during periods of sharp increases in nonreserve liabilities, and to mitigate the risk of money market pressures that could adversely affect policy implementation.”

So the key thing to look at is the level of reserves in early September and now. The best place to see that is not the weekly H.4.1 release that includes the Consolidated Statement of Conditions (the balance sheet) but the H.3 report which is issued weekly but only updated every two weeks because the reserve period lasts two weeks. The level in early September (the reserve period ended 9/11) was $1.472 trillion. The level at the last update as of January 1 was $1.634 trillion. Next Wednesday is a day on which there will be a “sharp increase in nonreserve liabilities” since it is the due date for Federal income tax payments from individuals and payroll tax payments from large and mid-sized employers.

The Fed only sets the maximum amount of repos it offers to its Primary Dealers who decide how much of the offer is picked up and at what interest rate. Since December 13, for overnight repos, the offering has been $120 billion each day except for December 31 when it was $225 billion (split between $75 billion in a one day forward offer on December 30 and $150 billion offered at 7:45 AM on December 31. Wall Street goes home early on New Year’s Eve.) The term repo offers were $50 billion for 32 days on December 16 and two week offers of $35 billion each on Tuesdays (Mondays in the holiday weeks) and Thursdays. Except for December 31 and January 1, the amount of repos available has been the same everyday. Since the counterparties decide how much of the Fed’s offers they draw down, their decisions, not the Fed’s, are reflected in the decline in repos outstanding.

Finally, in the only repo markets for which the New York Fed publishes statistics, the New York overnight Treasury repo markets which the Fed calls “Secured Overnight Funding”, the Fed has not been a very big factor. For example on December 31, total volume was $1.010 trillion of which the Fed funded $22.65 billion, about 2.3%. On Thursday, January 9, total volume was $1.011 trillion of which the Fed funded $24.4 billion about 2.4%.

The Feds motivation, when discussed here, is mostly in terms of its “deliberate” effect on this-or-that financial interest or entity.

It occurs to me that the underlying motivation may be to keep the balloon in the air until this November. I doubt there’s one member of the Fed, or any of their crybaby cronies, who would welcome the presidency of any of the “woke” democrat contenders.

Also, shoould any of the Fed members move on from their current posts, I’m sure they fully understand the QE they do now will pay dividends for them when they enter the job market.

Why, just check out Jerome Powell and his past business affiliations in Wikipeadia. What goes around comes around.

What more need be said?

you fixed it

Another excellent article, thanks Wolf.

It could be the case that the WSJ columnist/journalist isn’t aware of the process involved in the purchase and redemption, for every REPO transaction?

However if the likes of WSJ and the MSM are going to comment/report economic/financial issues the onus has to be on them to report accurate and truthful information.

Wolf’s article has helped dispell some of the disinformation reported in sections of the MSM