“The capital markets for oil and gas remain extremely difficult.”

By Wolf Richter for WOLF STREET.

The Dallas Fed’s Fourth Quarter Energy Survey, released today, portrays an industry that is turning increasingly somber. The data is based on responses of executives (names are not disclosed) of 170 energy companies – 111 exploration and production (E&P) companies; and 59 oil field services companies – located or headquartered in the Dallas Fed’s district, which covers Texas, northern Louisiana, and southern New Mexico and includes the most prolific shale oil-and-gas field in the US, the Permian Basin.

This time, there were additional questions, including on the reasons for “flaring” of natural gas in the Permian Basin. Natural gas is so abundant in the hydrocarbon mix produced at these wells (“associated” natural gas), and natural-gas pipeline takeaway capacity is so insufficient, that the surge in production led to the collapse of the price of natural gas in the area, reportedly dropping below zero on occasion. And it led to a record amount of natural gas getting flared in 2019.

Flaring large amounts of gas is a waste of natural resources, a source of air pollution, and a big financial drag for the already struggling oil-and-gas companies, investors, and banks.

To get a better handle on this, the Dallas Fed asked what the executives thought “the main reasons for the increase” in flaring in 2019 were (multiple choice, with the option to “check all that apply”):

- 73%: insufficient pipeline take-away capacity for gas

- 49%: lack of gathering and processing capacity for gas

- 45%: processing and transportation fees for gas that exceed the value of the gas

- 15%: temporary outages/issues with gas infrastructure

Among the comments on flaring, which ranged across the spectrum, there was one that I think is particularly interesting, in part because it was a suggestion on how to solve this issue:

“As a small independent producer, I would like to see the Texas Railroad Commission [the state regulator of the oil and gas industry] do its job and prevent waste of resources. Flaring should be allowed only for a short time to test and clean wells up after they have been hydraulically fracked. Once this has occurred, if the operator cannot find gathering/pipeline options for its natural gas production, the well should be shut-in until takeaway capacity is available.

“This would not only prevent waste, but would also slow the pace of drilling, decrease field production and drive natural gas prices up to a reasonable level. Low production wells are going to be prematurely plugged, with the resource lost, if natural gas prices do not improve soon. With industry support, this would also be seen as a good-faith effort to reduce air pollution from this waste of resources.”

And if takeaway capacity can finally be built out, gas production in the Permian, at least in one executive’s vision, will have a big impact on the global LNG market: “Permian associated natural gas is a still-emerging story that will change the Western Hemisphere liquefied natural gas market once infrastructure can catch up with natural gas production.”

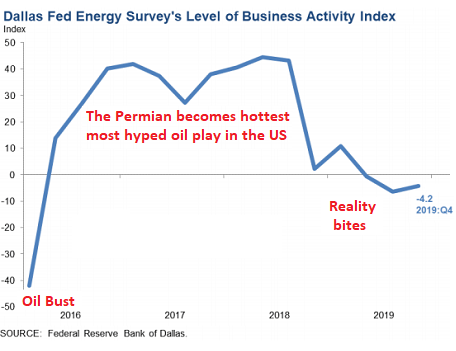

The Dallas Fed’s Business Activity Index, the broadest measure of conditions in the oil and gas sector in its district, has been in the negative for the third quarter in a row, at -4.2 (zero = no change). This came after the enormous boom that started in 2016, during the Oil Bust as the price of WTI had collapsed to below $30 a barrel, when the Permian became the hottest, most hyped shale oil play in the US. Note that for now, the index has barely dipped into the negative, compared to the levels in 2015 (chart via the Dallas Fed, red marks added):

The Business Activity Index by segment:

For E&P companies, the Business Activity Index was positive, at +5.4, up from zero in the prior quarter, indicating “modest growth.” Within that group, the oil production index rose to +24.7, and the natural gas production index rose to 15.6. But this surge in production is precisely what keeps oil and gas prices too low for these companies.

For oilfield services companies, the Business Activity Index plunged to negative -22. Within that group, the equipment utilization index was at -25.8 (unchanged), the index for prices received for services plunged to -24.5 (from 18.5) and the index for operating margins “plummeted,” as the Dallas Fed said, to -39.7 (from 24).

The overall Employment Index dropped to -10.0 (from -8.0). “We are having to divest properties in order to keep dropping employees,” one of the executives commented.

Given these conditions, the executives of these oil and gas companies now increasingly see expect to reduce their capital expenditures in 2020:

- 21% said they would “decrease significantly”

- 20% said they would “decrease slightly”

- 25% said there would be “no change”

- 26% said they would increase “slightly”

- only 8% said they would increase “significantly.”

This means that 41% of the companies would reduce their capital expenditures in 2020, and 34% would increase them, pointing at an overall decrease. Compared to the Oil Bust in 2015, this is still a relatively minor dip. And it wasn’t evenly distributed:

- 36% of E&P companies expect to cut expenditures, while 40% expect to raise them, with the remainder expecting no change. This indicates a slight increase in capital expenditures.

- But 49% of oil field services firms expected to cut capital expenditures, while only 24% expect to raise them, indicating a substantial cut in capital expenditures.

Investors and banks have lost their appetite to fund these cash-flow negative operations, according to several comments, including these:

- “The capital markets for oil and gas remain extremely difficult. The risk appetites of the banks for energy lending are much lower.”

- “I have noticed a significant investment decrease by oil and gas professionals. This may be partially attributed to the serious erosion of investment capital in listed securities. Many nonconventional shale wells are not achieving production expectations, thereby constricting cash flow for new wells and projects. Natural gas prices are insufficient to justify reworking old wells, which further constrains cash flows. The future seems uncertain.”

The Dallas Fed’s Oil Patch is not that unlike other oil-and-gas producing areas in the US, except that few experienced the boom starting in 2016 that the Permian experienced. Across the US, the oil-and-gas industry is feeling the pain, but not nearly to the extent felt in 2016, when the price of WTI dropped below $30 a barrel. Today, it’s over $60 a barrel. This makes a world of difference. But it’s still too low for the shale oil industry; and the price of natural gas, except for a few local spikes, has remained punishingly low for years.

In 2019 so far, a slew of oil and gas drillers in the US have filed for bankruptcy. Investors who’ve jumped into this in 2016, thinking they’d picked the bottom, have grabbed falling knives, including fracking billionaires. Read… Fracking Blows Up Investors Again: Phase 2 of the Great American Shale Oil & Gas Bust

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I guess the Fed can pay for the equipment and the pipeline for lng and share the “profits”. A good gas is terrible to waste.

Definitely a head turned down shaking in justification moment…

Thank you Wolf, interesting, now that the rig count has been falling. Time will tell.

US shale producers have been eyeing worldwide markets for a decade now, chiefly to sell their own natural gas (in LNG form) abroad at a premium.

The problems for them are two.

First is that building large scale LNG infrastructures is neither cheap nor quick. It takes many years to build a regasification terminal and even more to build a liquifaction one, and that’s if angry locals are completely disregarded.

Second is that everybody else is playing this game, not merely US producers. Australia, Indonesia, Oman and Qatar are all enthusiastically aboard the LNG train and let’s skip over the pipelines because we’d get too political too quick.

The US energy industry invested heavily on LNG exports: huge conglomerates like Kinder Morgan have thrown billions at liquifaction terminals and adjoining infrastructures. They betted heavily into an LNG boom, but either underestimated their foreign competitors or overestimated LNG consumption growth worldwide or a combination of both.

Problem is the US energy industry just cannot slash production like that.

As the Saudi attempt to send oil prices upwards have shown they can be successful, but the big question is who benefits from them.

In the oil case the Saudi used carrot and stick to force OPEC to cut (including pulling every string in Washington to cut Iran off most markets) but it was US shale producers who reaped the rewards of higher oil prices. The Saudi were left looking like complete fools while their US competitors laughed all the way to the bank.

If US energy companies cut NG production, Australia and Qatar will just step in and cash in, hence what looks like some sort of ultimate staring contest with a far from certain outcome.

Do we really need to even export? Can’t we just keep it as NG and use it in America? Wonder what’s the politics here?

@Iamafan – You want to export your excess gas production, otherwise you get an even bigger glut which leads to extraction operations getting shut down, jobs lost, etc. Limits to Growth predicted in the 70’s that we’d be out of natural gas in the 80’s, yet somehow there’s still plenty of it more than 30 years later. Don’t worry, the doomsters were wrong (again) and we aren’t running out any time soon.

I don’t imagine we’re near running out of NG soon, but cherry picking one extreme estimate by one person that said we’d run out in the 80’s is a great way to start a bad conversation.

CNG powered autos would be a great start.

In India for the last 4-5 years CNG is used as cleaner fuel for private cars & being “mandated “as a fuel for public transport. Fully Elecric cars & Hybrid cars have never been introduced in India like USA.

All Auto rikshaw’s (Tuk-Tuk ) which is the poor man’s Taxi (cheap compared to sedan Taxi )use CNG as fuel .Petrol ,Diesel & CNG (for car ,bus & tuk tuk’s ) are available in all gas stations. Most city bus use CNG not diesel.

Suzuki& Hyundai have70% Sedan/SUV market share in India , Ford/GM/Cheverlot failed miserably in India. Suzuki/Hyundai 1/1.5L sedans come in Petrol/ Diesel/CNG fuel options .

https://www.carwale.com/best-cng-cars-in-india/

https://www.tuktukind.com/tuk-tuk-cng-auto-rickshaw.html

80% population use Gas stove with “LPG”cooking gas in 15-17 kg cylinders for cooking.(not piped gas not electric ovens) Induction stoves just getting popular with singles in metros in tiny studio apartments

Sammy Iyer,

I thought Tuk-Tuks are switching to electric propulsion because they’re cheaper to operate.

CNG used to be very popular in Europe immediately after WWII for the simple reason petrol and diesel fuel were not merely expensive but difficult to come by, whereas CNG was readily available, at least in the cities. This CNG was called gaz de houille (coal gas) because it was obtained as a byproduct of coke coal purification and had been in use since the late XIX century to light city lamps. Some European cities such as Vienna still have the original buildings where this gas was stored: they were generally decommissioned in the late 60’s/early 70’s as natural gas became widely available.

Immediately after WWII there was a desperate need of transportation but there was also an enormous number of surplus military vehicles suitable for CNG conversions: US military lorries like the famous GMC CCKW and Dodge WC were especially sought after because they had gasoline engines and were sturdy, reliable and easy to work on.

That was the peak in popularity in CNG.

While it has long remained available, popularity has slowly but steadily declined in face of a number of headwinds, chief among which are price (CNG price increased far more than gasoline and diesel fuel over the past decade), fuel economy (albeit with biodiesel, ethanol and butane mandates that’s debatable), the need for expensive periodic maintanace to maintain roadworthness and finally the competition from LPG.

CNG buses had a peak in popularity about a decade ago due to big EU subsidies but their numbers have been quietly whittled down as they become too expensive to keep on the road and cheaper to run and more reliable hybrids become widely available.

There was some interest in building a turbine-powered hybrid bus running on CNG (turbine running at constant speed to provide power for the electric drivetrain) but purchase costs were astronomical and the need to maintain the CNG storage and delivery systems negated all over advantages.

NG autos were supposed to be the bridge between gasoline and what comes next. butt then politics and SJW dictates came along.

Cheap natural gas is good for developing economies, expensive oil is good for renewables. I see no problem either way.

The price of WTI crude oil has risen 35.92% over the past 12 months. That is a greater 12 month increase than the S&P 500 returned in the past 12 months. People buying the S&P 500 Index a year ago have seen greater than 30% gains. Some short sellers had a year of panic. Such large gains may not be sustainable over the long term. 1929 started out as a very good year. They were on the gold standard back then. There was less money printing.

The price of WTI crude oil rose again this week as the U.S. Energy Information Administration reported another decline in oil and refined products inventories.

Individual oil companies are at risk due to mismanagement.

The use of coal in the US is declining as people switched to natural gas and renewables.

“They were on the gold standard back then. There was less money printing.”

Gold doesn’t stop money printing in any way. Banks print money through lending. What it does do is force a full crash of the economy when the lending stops, because the fed can’t step in an and print fiat to stabilize the banks. The gold standard gives more great depression than great recession.

O.K., so when does the printing stop?

There’s nothing wrong with printing per se. It depends on your national goals. I would like to see an economy in which banks lend to create industrial startups which can employ a lot of people. Others prefer to lend to drive up asset prices, because that’s where they make their money. Making payments on loans is the opposite of “printing money”. It’s burning money. So you have to constantly printing in order to keep ahead of loan repayments. Otherwise the economy starts shrinking.

Making payments on loans is the opposite of “printing money”.

But what do you call it when someone can’t make payments on loans, and is then given the money through fresh printing?

Problem is the US energy industry just cannot slash production like that.

Sure it can.

***

Let’s look at the real reasons for why there’s such colossal waste of money and product to keep that output high:

1) To increase the rate of climate change so as to melt off the poles and open them up for every other kind of exploitation.

2) To prevent the fossil fuel industry from losing market share to alternative energy producers.

3) To enable the US fossil fuel industry to increase their share of global markets by undermining foreign competitors – essentially a manifestation of economic warfare conducted for geopolitical reasons, using natural gas as a weapon.

Choose whichever ones you like. They’re all good.

If US energy companies cut NG production, Australia and Qatar will just step in and cash in

Therefore requiring US companies and investors to continue to piss away money so companies in other countries won’t make money.

Which points to Reason #3 above: economic warfare.

But what about the other two? Aren’t those also important? Isn’t it necessary to assure the domination of the fossil fuel industry, even if it also assures the ruin of human civilisation?

Pretty nasty game if you ask me. But I have no interest in conquering the world, so why should I want to play? And you wonder why I’m Unamused.

My response to MC01. Sorry.

Not that it matters. China is ramping up coal in a big way, and in short order will surpass the rest of the world combined by a wide margin. Methane concentrations are also accelerating, much more rapidly than carbon dioxide, and it is a far more potent GHG than carbon dioxide.

All this will guarantee that the chances of avoiding catastrophic climate change are exactly zero, while also guaranteeing that nearly all people alive today will be its victims, one way or another.

Arguments over the science are irrelevant. It’s not politically or technologically possible to reverse these trends or even to slow down the rates of acceleration, and it never will be. I just thought you should know. In a few years it will be taken for granted.

So don’t mind me. Carry on.

I have to agree with you Unamused, nothing can stop the momentum of the catastrophe we face. But in this highly unusual instance, the Fed might be right!

Nevertheless, I will be clutching my oil stocks in my cold dead hand.

I was going to reply to MC01 but will down here.

In article: “The Dallas Fed’s Oil Patch is not that unlike other oil-and-gas producing areas in the US, except that few experienced the boom starting in 2016 that the Permian experienced. ”

Should read: …..”is not unlike other SHALE oil and gas producing areas…..” And, unfortunately, there are few Jed Clampett plays that have not already been found, drilled, and produced. Shale is the bottom of the barrel, literally.

Shale drill sites, despite branching laterals allowing fewer drill pads, ramp up too fast and decline too fast with light hydro carbons. They do not last long enough to justify building pipelines. Pipelines need decades to return investment costs and Shale wells decline 60%+ after the first year alone, and are done producing within a few years more. This is an industry made for ZIRP forcing yield search. In fact, the nature of Shale mimics our current investment climate as a whole.

Thus, Flaring. The numbers look good in political articles, but the nature of Shale is actually self-defeating. There is almost an immediate surfeit of supply, the gas cannot be easily utilised, and no one makes any money. But, it looks good on paper and ramps up the energy self-sufficient propaganda meme.

By the time additional LNG plants can be constructed the gas will have already been flared. Plus, the aforementioned competition.

“LNG Canada was the first large-scale LNG export facility to announce a final investment decision in British Columbia. The project is a joint venture partnership between Shell, PETRONAS, PetroChina, Mitsubishi Corporation and KOGAS to build an export facility in Kitimat, British Columbia.

Status: Final investment decision announced, preliminary construction activities underway.

Connecting pipeline: Coastal GasLink

3 more BC projects proposed and in various development stage.

https://www2.gov.bc.ca/gov/content/industry/natural-gas-oil/lng/lng-projects

regards

The price of LNG dropped.

Unamused thinks they are smart.

No One knows the future, not even God. If God exists they are a mind, by definition. If a mind exists it must be able to learn, by definition. If learning exists there must be a time before and after. QED

No one knows the future, not even Unamused. It is probably still technologically possible to avert climate disaster. It is certainly possible that the present political system will be overthrown soon enough to avert disaster. QED

No one knows the future, not even Unamused.

The sun will rise tomorrow. Get back to me if it doesn’t and I’ll send you some enlightenment so you don’t have to fumble around in the dark.

“The sun will rise tomorrow.”

Ahem, beyond some latitudes at some times of the year the sun actually doesn’t rise as the planet turns. The question then, of course, might be if it technically constitutes ‘tomorrow’ or not, or if the today/tomorrow cycle might be considered as suspended in such areas at such times… Otherwise you’ll be dispensing enlightenment to penguins one half of the year and polar bears the other half, until the ice dispenser can’t keep up any longer.

The sun is always rising somewhere in the world, Saltcreep. That’s what makes it such an easy prediction.

Other predictions are also easy because an appreciation of the nature of substances and of causality enables it, like knowing that dumping billions of tons of carbon into the atmosphere every year for decades on end is bound to have some effects. Now that those effects have manifested themselves it’s not so easy to deny them and their causes, although some people do manage it.

Which is sort of why the term ‘tomorrow’ possibly is most meaningful when used together with a given location on the planet, Unamused. In respect of the predicament we find ourselves in as relates to our impact on the composition of our atmosphere, you needn’t dispense unto us who already are aware that we’re dispensed with…

Climate change is happening….it MAY be possible to avert catastrophic climate change. The Greenland glaciers are already melting much faster than most expected….but it was predicted they would melt. Sea levels will rise in most of the world by at least a meter (or more) in the coming decades, this will affect 90% of the world. Some countries will adapt, others will collapse and trigger mass migration. It’s already happening in countries like Bangladesh. Another example, many theorize the spark of the Syrian civil war was a prolonged drought and collapse in food prices. One can also look at India and growing social tensions due to water scarcity and crop failures. The thing is, we are in the post-global era, everything is connected, everyone is affected to some degree.

That is some really garbled (or at least difficult) verbiage Paul. I realize languages (including math) are all we have, but it’s just my guess you should sit down with a candle and some wax and try again. Can’t hurt.

Unamused:

It is bloody cold up here in Canada!

Could you please increase your global warming efforts!

You haven’t been trying hard enough!

WES, please be damned careful what you wish for!

I heard Canada is already battling with other nations for the rights to the Northwest Passage when it fully opens, and even before then, when it is seasonal or can be done with a few icebreaking channel opening ships.

BTW, this flaring of gas reminds me of hundreds of brand new homes being bulldozed in Victorville during the FC, or before that, hundreds of brand new Honda 600s loaded back up on ships and dumped in the ocean off Seattle in the 70s.

In all cases it was the most “economical” thing to do?

My only possible conclusion as a layman is that Economists are sick fucks.

Guardian 21 Feb 2004

“Climate change over the next 20 years could result in a global catastrophe costing millions of lives in wars and natural disasters..

A secret report, suppressed by US defence chiefs and obtained by The Observer, warns that major European cities will be sunk beneath rising seas as Britain is plunged into a ‘Siberian’ climate by 2020. Nuclear conflict, mega-droughts, famine and widespread rioting will erupt across the world.

The document predicts that abrupt climate change could bring the planet to the edge of anarchy as countries develop a nuclear threat to defend and secure dwindling food, water and energy supplies. The threat to global stability vastly eclipses that of terrorism, say the few experts privy to its contents. ”

How did that work out.

Well there’s still 3 days left.

Call Al Gore for a new forecast – unless he’s too busy counting his mega-millions he made from the last scare. But he could be an unprecedented two-time Nobel ‘Prize’ winner, so there’s that.

Did no one notice the historically disastrous floods in Venice? Billions of dollars in damage. Another great example is the powerful hurricane that wiped out half the Bahamas a few months ago.

Tex, if you have the misfortune to finally realize mankind has gone too far, you had better be good at Ts & Ps so JC shows up.

Saying, “Oh shit” won’t help.

And, Lordy, what will you tell those sons you are so proud of “creating”?

that is the first i have heard of china ramping up coal production. all i have heard in the past few years has been the NG pipelines coming out of eastern russia/siberia supplying china with NG.

are you sure about the china coal thing?

After Katrina, it was difficult not to notice just how resilient casinos were; how quickly infrastructure and services rebounded to get these critters back to throwing bad money after good? The entire premise of peak oil was demonstrated as Exxon & Chevron were trying to complete 36K’ deep wells, Shell’s Gulf TLPs (in 4,800′-6,900′) were replaced with 10,000′ deep slick-water fracked wells and everybody tried moving to where arctic sea ice and permafrost used to be, to awaken the Kracken (so we could be sold geo-engineering, GE monoculture extractive agricultural and carbon swap snake oil schemes… and Fiji water?)

All those bird choppers in Texas don’t help. It wasn’t that long ago, after Katrina and Rita, the muni utility I worked for couldn’t even buy natural gas. Conoco wouldn’t sign any new long term supply contracts. Everyone was scrambling and retail users were paying more to heat their homes than on their mortgage payment. $13 even $14 per thousand cubic ft at the Henry Hub was normal. Today its closer to $2.

Wind power is a fraud and depends on ‘going first’ in the supply of electricity to be viable. Its unreliable too and one windmill requires 250 tons of steel and 170 tons of met coal to manufacture. Then you have to ship the components to the boondocks, pour concrete and erect the thing, build transmission lines and econuts call that ‘green’ even though it consumes more energy than it will ever produce.

All those bird choppers in Texas don’t help.

Wind turbines kill between 214,000 and 368,000 birds annually — a small fraction compared with the estimated 6.8 million fatalities from collisions with cell and radio towers and the 1.4 billion to 3.7 billion deaths from cats.

econuts call that ‘green’ even though it consumes more energy than it will ever produce.

Because the electricity from wind farms is sold at a fixed price over a long period of time (e.g. 20+ years) and its fuel is free, wind energy mitigates the price uncertainty that fuel costs add to traditional sources of energy.

That makes wind power is three times as cost-effective as fossil fuels.

Why do you have to disparage energy alternative advocates as ‘econuts’? Desperation?

Yeah, this particular gas/ oil econut bought yet more wind, PV & battery stocks & ETFs after Trump’s latest tirade. Hard to ignore the pattern where he’s chewing this or that carpet to distract our tag-team kleptocracy handing him tax-scams, rabid judicial appointees, impromptu neo-Confederate/ Dominionist/ K Street constitutional revisions… as his pals buy up alt-energy, resilient infrastructure equities they’d simply ignored or tried to stomp out, previously? They might still be chauffeured about in Maybach or Daimler diesel limos, but… follow the money.

Why do econuts have to use Washington to force the use of their pet projects? Surely if wind and solar was viable they would not require utilities buy their output whether they wanted it or not. Market forces would suffice just as if I could sell a hamburger for less than McDonalds but ‘green energy’ doesn’t work like that.

I requires a bunch of parasites in Washington to construct artificial markets using unverifiable theories about climate change and getting enough fanatics to believe in them to force their crackpot beliefs on everyone. Meanwhile goofballs like Jerry Brown and Gavin Newsome praise some pitiful solar project as California belches out toxic smoke from out of control wildfires. You can’t smoke a cigarette on the sidewalk but you can smoke a joint and everyone breathes the smoke and soot from the fires.

Ad hominem fallacies, Loaded Question fallacy, false premises, false assertions. No one would think less of you if you simply admitted you’re wrong, you know.

I requires a bunch of parasites in Washington to construct artificial markets

That’s a Freudian slip. It’s also the only valid statement in your whole rant.

Unamused is correct. Climate change is a perfect example of 3rd party externality cost which even economists say Mr Market is useless to remedy. Hence the need for vigorous govmit regulation to stop man made global warming.

Look 472, there has never been and never will be a “Free Market”.

All markets are dominated by the biggest players, and they naturally fight (using “law”, religion, Econ, and other social constructs) to keep it that way. Along with help from any minions they help out along the way with decent jobs.

Why would you call it desperation?

You have already concluded we can’t escape

” catastrophic climate change”.

At least you did not pick a year like others have.

Why would you call it desperation?

People typically resort to invalid arguments, like ad hominem and deception, to protect or advance an otherwise indefensible position, for the same reason a coach selects low-percentage plays when they’re behind and time is running out: desperation. If they had valid arguments they’d use them.

At least you did not pick a year like others have.

It’s a rolling disaster, and it’s already begun, so there you go.

I need not present any argument. If people can be persuaded by reality then reality will persuade them, and if not, it won’t. And neither will I. I’m not desperate, and I have better ways to waste my time.

“1.4 billion to 3.7 billion deaths from cats.”

Say what?

“Cats that live in the wild or indoor pets allowed to roam outdoors kill from 1.4 billion to as many as 3.7 billion birds in the continental U.S. each year.” Here is the article that reported on the study:

https://www.usatoday.com/story/news/nation/2013/01/29/cats-wild-birds-mammals-study/1873871/

Probably would have taken you less time to just do the google search. Certainly would have saved the rest of us some time reading your comment and responding.

Oh good lord! Even sane people are still passing that absurd claim around of windmills killing birds! Debunked!

And then service those expensive gears which requires a crane and movement to a shop and back.

“call that ‘green’ even though it consumes more energy than it will ever produce.”….sadly, this is a conspiracy theory. Wind/Solar are expanding across the world at an accelerated rate, Africa/Asia/Europe….even parts of the US are catching up. Unfortunately, the US is still woefully behind in wind power generation.

One use this gas flaring[1] is being put to is mining bitcoin! So at least it’s not a total waste. Well, unless you think bitcoin a total waste!

[1] Plug “bitcoin gas flaring” into your favourite search engine.

Sounds good, but wait…

You’re skipping a few important steps. To power the computer systems necessary to mine bitcoin, you need to convert the gas into electricity. OK, so now you need a gas-fired power generator on location. But hey, once you have that setup, you can use the power thus generated to power the local drilling operations and other equipment on site that is now powered by diesel generators. Why waste this valuable power on “mining” a scam when you could use it instead to replace the power from diesel generators and thus burn less diesel?

OK, to use the gas to generate electricity to power local operations is a good idea, and it wasn’t me who had it. It is now being done. These generators aren’t cheap, and the setup isn’t simple, but it seems to work, and some drillers are doing it.

One has to wonder, is there an advantage in perhaps building gas power plants in the Permian. At the end of the day, the big difference is in the type of energy transmitted and the method of transmission. It would also solve the NIMBY problem, at least a little.

And heck, it would reduce the glaring problem. As for the bird choppers, build more. We need more fowl in our diet.

You would still need the processing and pipeline infrastructure to process and collect the gas from thousands of wells in the area. Once that is done — and this is a big part of the problem — you could supply a power plant in the Permian, or you could supply one closer to a population center. I don’t know which makes more economic sense — long transmission lines or long pipelines.

But one thing is for sure: that gas should be put to good use.

Hi Wolf. Are micro turbines still around? Input the current flared gas to micro turbine to generate electricity to grid or specific user.

Yes, they’re still around, if barely. Capstone Turbine, which IPOed in 2000 under huge hoopla and shot up to $12,000 (figured after reverse stock splits that were implemented after the stock collapsed), now trades at $3. I went to see them before the IPO and looked at their product. The prototype was a filing-cabinet-size micro-turbine generator that produced less power than a 5hp Honda portable generator. Micro turbines are VERY inefficient. Turbines are efficient only when they get large. However, turbines can run on a mix of hydrocarbons that piston engines cannot run on, and so there might be a niche.

I see ads here for gas turbine UPSs that look like they are sized for hospitals, command centers, etc when there are power outages. Been meaning to check them out but haven’t yet.

We also had (probably still do) a “dump gas” generator at the county dump. I met the guy who operated it at VB. Single man operation, carried a pager. Boss was back east. Great job!

Anyway, for not much that flared methane could be put to use, even on site. Lites if nothing else.

End the Fed

The Unconstitutional Fed should not exist and should not be producing surveys.

I also question if producers would be flaring natural gas if cheap fed currency loans were not available encouraging al kinds of malinvestments.

Agree with you The FED is a parasitic cancer that needs to be eradicated and I think you are also correct about the cheap money creating the malinvestment

John Williams was promoted from San Francisco Fed to NY. No one recalls SF fed taking a survey of wells fargo’s fake accounts!

Calvert Energy Group has the commercially viable solution to transform flare gas into Pure Synthetic Wax and Zero Sulphur Diesel Fuels. We pay top dollar for your gas and finance build own and operate our patented GTL.

OT but I’m buying companies that will strip mine the sea beds. They are going to the hydro-thermal vents/everywhere to vacuum up the nodules of copper, manganese, and rare earths (neither rare nor earths, but that’s another issue entirely). haul them to the surface and dump tailings back onto ocean at what depth? Does it matter? Oceans die we die…

Chemists call them lanthanides. “Rare Earth” is a 1960s pop group with no industrial applications.

Frickin’ ‘eck, Tankster. So now we’re actually strip mining the sea bed and making it a toxic open tailings dump just next to the sources of the life forms that might be able to eventually evolve to replace us after we screw up the surface of the planet? as if our existing trawling up of ocean floor life wasn’t already enough?

Shale, has been a fraud on the capital markets, IMHO. It’s the big 1980s like S&L level misallocation of capital of the 2000s. Skullduggery around accounting, constant capex, extreme unpredictability of life of wells. It’s a snake oil industry that sucks equity shareholders with regulator blessing. Added bonus: the pollution and ground rape, and red-state popularity. What’s not to love. keep going.

PS: added bonus #2: They offload some risk to “public utilities”. rest to shareholders!

So California has state of the art renewable energy plants but a third world electric grid that starts wildfires that emit more pollution than a coal power plant. Smart! Of course you can’t build wind farms or solar power plants in downtown SF or LA so you need long transmission lines to get the power to where it is needed which increase capital costs and fire risk. Smart! Can’t frack because it might cause an earthquake but you can inject water underground to get renewable power because that has no risk.

At the end of the day California will either have to do without electricity or import it because the solutions they are backing don’t work or aren’t scaleable.

Expensive energy hurts the poor disproportionately. I always find it amusing that the same group of people who pretend to be on the side of the “working man” do everything they can to make costs prohibitively expensive for the “working man”.

The French working class/yellow vests are on to that in spades after the Socialist leader slashed taxes on the ultra rich immediately followed by gas tax increases on the working class to allegedly save the environment…err…pay for the tax cuts for the rich. If only Americans could learn from the French.

Radical idea: cut ALL taxes and cut ALL spending.

Whoa!

Not radical at all. In fact it’s the oldest idea of all. It’s called barbarism, the time before man separated himself animals.

Duh, because the working man is too stupid to know what’s good for them. We need some ivory tower geniuses to guide them. After all, we need to incentivize the rich more in order to build up the industry of the future, and to reduce air pollution, raise the taxes on gas, let economics drive those gas guzzlers owned by the poor people out. They will either switch to eco friendly alternatives like bikes and EVs or they will move out of state.

But don’t worry about the lack of labor, we have an abundant source of cheap labor just south of us, just open up the borders and we can have all the cheap labor we want. And then there is ICE to enforce our will if the cheap labor doesn’t cooperate. We just have to control the media enough to look good decrying ICE but keep them sufficiently funded as a control mechanism for the serfs.

Fertility rates in the US just hit a new record low. Japan’s population decreased by 500,000 last year. Immigration is the only solution.

There is little connection between the source of electric power and the transmission lines sending it. Much longer lines send power from hydro dams in Canada to New York.

No one for many years has built generating stations of any kind in the middle of a city ( except maybe China) That would only be necessary if we only had Edison’s original DC plants that need the generator to be a few miles from from the customers. With AC, power can be stepped up to high voltage and shipped very cheaply.

Along with a grid that no doubt could use some work, (like a lot of other grids where there aren’t these fires) the main prob in Cal seems to be many thousands of miles of lines snaking through bone- dry brush and periods of very high winds. When PG& E shut down part of the grid during some 90 mph winds, the customers who want to live far from urban life, complained bitterly.

Actually Calpine has some large NG power plants in the SF Bay Area. NRG had one on Potrero Hill in San Francisco but I don’t know if is still in operation. Probably turned into condos or something.

Thats the thing about natural gas power plants. They don’t require a lot of land and can be built where the demand is without expensive ( and vulnerable to fire and terrorism) transmission lines.

California “wild” fires: Burn houses completely to the ground, melt engine blocks but somehow don’t burn trees.

No. DC high voltage power transmission is very efficient at longer distances.. Additionally, HVDC transmission lines are around 30% cheaper for materials and land than equivalent AC lines. Edison did AC for the advantages of transformer step-up/step-down voltage and synchronous motors, neither of which is critical today.

True. I was amazed to watch how switching PSs and triacs could handle more and more voltage and current (power) when I had a Digikey catalog subscription in the 80-90s and was breadboarding stuff. Transformers are expensive and heavy.

One can only guess what is now available to the big boys.

Definitely will be part of the Green New Deal.

Can’t build solar in downtown LA? There are hundreds of square miles of rooftops absorbing solar energy and doing nothing with it. That’s a start.

In Weymouth Massachusetts, impending construction of a facility to store & process a LNG facility has generated enormous local opposition which my friends talk abt. They tell me a lot of it is needed to be sent to Canada. When I suggested Canada’s govt get its head out it’s arse and stop taking orders from US warmongers and instead but cheaper readily available Russian gas their jaws dropped. Never occurred to them. They don’t want their property values to go down.

All New England needs is more pipeline capacity from US gas-producing regions. There is a problem of oversupply in the producing regions, and a shortage in New England. Pipeline infrastructure to connect the two solves the problem. But it takes a long time to build these pipelines. Some have already been built. Others are moving along. This problem is getting solved, but too slowly.

Another problem for pipelines in New England is bedrock is frequently close to the surface. That’s why there aren’t a lot of pipelines in New England and why many New Englanders heat with propane/fuel oil transported by trucks. Very expensive to dig a pipeline through rock.

Shale oil was a “last gasp” technology brought on line well before actual necessity–all it did was guarantee that it’s value was squandered on a race to the bottom of oil prices. Another decade, and the vaunted petroleum independence of the US will be gone. A side effect of this is that the gas that was known to accompany the oil is largely wasted–if the oil can’t pay for the well, the gas certainly won’t. Gas too, is another wasted resource from the shale oil “revolution”.

This is what happens when you fall into a hole and the don’t stop digging.

On a global scale there is a lot of NG under development with more coming as the US has shown technology (which, btw, continues to improve efficiencies) is disruptive.

H120 – Israel becomes energy independent and a net off-shore exporter of NG in region ; new off-shore production Africa, Malaysia, Guyana, Brazil, etc.

And, new development continues using conventional drilling as well as fracking technology in Chile and just about all South American countries where E&P companies were previously wary of political situations are creeping forward with new capex and government partnerships. Think of it this way – the geology under South America is similar (this is a broad generalization) to what exists under North America. Why wouldn’t they develop O&G assets??

New LNG hubs under construction in US Gulf region to take US NG to other markets, the Russian Nord 2 pipeline almost finished but in limbo due to sanctions will be finished at some point – all these and more global NG put downward pressure on Henry Hub price, all things being equal. Then, add China:Hong Kong:South China Sea (think Gemany:Czechoslovakia 1938), North Korea, twitterings, the usual hotspots, and the dynamic remains unknown.

As an anecdotal aside (and poking the eco-bears) I’m pretty sure the fires in Australia in just a few months have contributed more to global CO, ozone destruction, tons of airborne particulate pollution, watershed polltion when rains come, destruction of wildlife, and you name it (as surely someone will) then all of the flaring in North and South Dakota, ever.

Dislcosure – short NG, NG completion, transfer 3rd pty contractors.

Raw natural gas instead of being flared & wasted should be processed at site as CNG or to separate the LPG (constituent gases: propane, butane and isobutane.) It can be placed in large CNG /LPG tankers for export . CNG as auto fuel & LPG cylinders as cooking gas has a very big market in India (1.2 billion population )which is 2nd biggest user in the world (China (1.4 billion population) is 1st)

“should be processed at site as CNG or to separate the LPG”

this made me laugh as well as other comments.

Yeah, just go down to Home Depot and grab a compressor station. They are outside with the Building Materials just past Lumber through those glass doors. You can assemble once you get it to the site with the enclosed allen wrench. Just plop it down about 50 feet from the wellhead. Yeah, just do THAT. ;)

The number of engineering inputs for EACH well – wellhead pressure in bars, do you need gas lift, separation of sulphur, liquids, other condensates, etc; do you need a refrigeration unit, dehydrators, how many horsepower, how many stages, who delivers the diesel to run the Caterpillar, other gathering data, pipe diameters, number of wells, are you flaring vapor from a tank battery due to vapor pressure and temperature differentials, is the well site large enough for compressor skids and layout, does the well site already have compacted structural fill as a pad substrate, once you have collected onsite in storage vessel how often do you have to pay a transport service to pick up from well site – what is that charge per cu/ft at what pressure, and, of course, none of this accounts for human labor, maintenance, repairs, re-design, re-mobilize if shut-in or worked over, etc, etc, etc.

Tell me, if an oil well produces 1600 cubic feet of gas per barrel of oil and production is 159 bbl/day. The closest NG pipeline is 17 miles away and oil is stored in 5 tank battery with it’s own flare. What are your options?

What if you are an operator of a producing field drilled 30 year ago of 75 oil wells with 40 acre spacing? Each well has 1-5 tanks in battery and production ranges from 6 b/d to 78 b/d and all batteries have a flare. Do you buy 75 compressors or build your own collection pipeline? What are your costs for surface rights across all of the farm land to install a pipeline? What is the cost of the pipeline? What is the average over-run on estimated compressor and pipeline installation costs?

Break it down and run the numbers. What is the free cash flow point on compressor cost relative to gas production? Let me know. I can add it to my fat DD file on compressor rental/service companies ;)

I could go on but my GF told me to stop typing 30 minutes ago…

Happy New Year!

Nailed it. Shame your point is likely lost in translation.

I lived in California when Carter put into place the tax credits for solar and alternative energy. Companies popped up all over like mushrooms after a rain. I also remember how quickly they were shuttered when Reagan came into office and any push into any kind of energy conservation or natural conversation of any kind was quickly stomped out. How far ahead would we be now? Why be tagged an “econut”.? Human ,not human caused ,conservation sounds like a good plan. As for flaring. Yep I am quite familiar with that. The oil co’s were allowed one flare, but they quickly built the pipes to hide the second one. Making a wall of methane across south Texas. Right across the front of the Eastern flyway of birds migrating up from Mexico. No telling the death toll and costs from that. My farm was just above the cut off line for oil leases. My farm produced condensate. Just south was the nat gas line. Those landowners never got any leases. I have not checked in the last few years but willing to guess they still do not. Not enough market.

What would one expect otherwise in the FED Money Grab? Certainly not investing for the long-term. You could burn some of the gas to run compressors, charge batteries (LOL!) Green revolution right?

The Oil industry is so often its own worst enemy…and I say that as someone who worked in it. Excessive Flaring of gas is so wrong in so many ways: waste of a resource, does long term damage to formation recovery, unnecessary CO2 production, hurts the industry’s reputation, and a practice for incompetent, irresponsible and financially troubled operators (i.e. let them go broke and stop their making everyone else go broke by dumping product on the market). Old problem, new again, everyone has to have everything, now, now, now…..and yet all this wailing and gnashing of teeth about the environment of the future…

Wolf,

I know you don’t like politics on your website, but since this article had such a large section about flaring off of natural gas at the well sites, I believe you were remiss is NOT mentioning, even in passing, that the Obama administration had instituted rules that would have BANNED the flaring of natural gas at wellsites, and that this rule was reversed by the Trump administration.

I’ve mentioned this FACT at least twice in previous posts I’ve written here. I guess nobody (including you) was paying attention

Again, not a political judgment, just simple logic – the corollary of that FACT is that if Trump had not won the Presidency, the Obama ban on flaring off of gas would almost be certainly in place, the berserk excess drilling and fracking would have had to slow down just to deal with the excess natural gas accumulation and this rule banning flaring, and the environment and practically everybody, including the berserk frackers themselves, would be better off.

But try telling an oilman/fracker that Obama was doing the right thing and Trump has just made things worse for them. Naaaaaaaassah……

What a bummer. Trump FORCED them to over produce and drive down

NG prices. Of course that hammered coal.

These evil oil guys have done more to reduce carbon emissions than solar & wind. Have not seen the breakdown this year, but through last year we #1 in lowering carbon emissions.

I say ban fracking, and lets get back to making COAL king again.

Please correct me if I am wrong , but did not the Obama rules only apply to drilling on public (federal)lands and not private lands.While there is obviously a large number of wells on public lands,is not the vast majority of fracking in the Permian and Delaware Basins located on private lands on Texas ?

Rcohn,

You are indeed correct. This was a rule promulgated through the Bureau of Land Management in the last two months of the Obama in late 2016, and never implemented, as it was quickly reversed by Trump. The rule applied only to Federal and Indian tribal lands over which the BLM had jurisdiction. Oil and gas production in Federal and Indian lands constitute only about 8 and 9 percent of total US production, with New Mexico being the largest territory involved

The corporate bond market is not going to collapse based on the numbers, junk and junkier, it will fail when a recession in energy tears through the system. When Powell did the REPO dump he knew he was putting a bid under energy prices and jobs, which would delay that recession. However the spec in price is running inversely to the economics on the ground. Or to put it another way, the buyers got in early, anticipating the last driller to close shop will signal a low in the futures contract. If there was a fiscal spending program for NG infrastructure they could really get this thing going. Too bad the EV and renewable crowd is running the show. A little less futuristic BS and a little more pragmatism.

I always thought CO2 was food for plant life. What am I missing here?

Everything.

+1000. succinct reply had me laughing out loud. thanks

Ditto. . . . made my entire family LOL this morning. A very cleaver comeback.

Ron, you are correct. Below about 150 ppm CO2 in the atmosphere most plants die, And us with them. On the other hand many food crops give maximum yield at about 1500 ppm. There may well be some minor climate change as atmospheric CO2 rises, but we all face certain death if CO2 falls below 150 ppm. Take your choice.

You are referring to carefully controlled greenhouse studies where plants have been exposed to 1500 ppm. However, plant growth isn’t as simple as you are portraying it. If the Earth’s atmosphere contained 1500 ppm. of carbon dioxide, this would produce the following effects:

1) Temperatures would become warmer (actually, a LOT warmer), causing moisture to evaporate from plant tissue and soil at a much higher rate. This would make plants more vulnerable to drought.

2) Plant would grow faster with 1500 ppm., but their larger size would increase the amount of moisture evaporating from plant tissue. This also makes them more vulnerable to drought.

3) Much land surface, where crops are currently cultivated, would disappear underneath seawater because ocean levels would rise considerably at 1500 ppm. All of the ice in Greenland, the Arctic ice cap, and Antarctica would melt.

4) Plants require more than just carbon dioxide to grow. They also need water, mineral nutrients, and sunlight. A shortage of any of these would restrict plant growth regardless of carbon dioxide levels. Farmers would have to increase costly fertilizers in order maintain this accelerated growth rate, otherwise the soil of agricultural fields will become depleted of nutrients more quickly.

5) Rapidly growing plants tend to have lower amounts of nutrients in their tissue (by weight) than plants growing more slowly. This would lower the nutritional value of the food that is produced, meaning more empty carbohydrates and/or water, but less protein, vitamins, and minerals per unit of weight.

6) It has been found that plants growing more rapidly when exposed to high carbon dioxide levels are more vulnerable to insect pests and disease organisms. This is because the defensive toxins that are produced in plant tissue become more diluted under these growing conditions. This increased vulnerability, of course, will lower the productivity that would otherwise be achieved.

7) Larger areas of the Earth closer to the equator would simply be too hot to grow conventional agricultural crops (e.g., corn won’t cross-pollinate as well if temperatures during the summer rise above 90 degrees F.). This would mean moving agricultural areas closer to the poles. Unfortunately, the sun is also weaker near the poles because it hits the atmosphere at an angle, soil fertility is lower, and it is more acidic (more peat bogs). This would lower productivity of crops per acre.

Now that would make a great movie. Except, where’s the evaporation?

I mean, we just melted a bunch of ice. You telling me you didn’t impact relative humidity?

No worries, according to many, it is already to late

to educate you. Our fate is sealed. Build the ark, learn how to swim, and hoard the sun screen ( if its still legal ). And make sure to get in early

on the Barrow AK real estate boom.

\\\

It is beyond me how it could come to this stupid situation. I mean, one could calculate the total gas output and compare to transport capacity and markets available to export years ago…How can an industry this wealthy and powerful be so shortsighted and stupid? What was the surprise? Snow in January? Wet roads during rain? The red nose on Rudolf? They could have hired Wolf and in a weeks time, going through publicly avilable data, he could pinpoint the botlenecks and challanges.

\\\

When this much of money results in this much “stupid”, i don’t think there is anything that can be done.

\\\

I quickly learned one lesson when I got employed out of engineering school. Everyone has a great idea, but its a competitive world and what someone is willing to pay is the rule that gets a lot of ideas tossed out.

Another thing is if something is currently being done, don’t assume it is stupid. At least at some point in time it probably made sense. Legacy items need to be carefully considered before being tossed.

Here are 2 unanticipated outcomes of changing times.

Second space shuttle blew up because of change in flourocarbon regulations. The new insulation was more brittle. Engineering failure to say the alternative was good enough.

Super high efficiency engine large diameter engine on 737 caused crash due to instability of engine placement. Engineering failure to not pull plug on design, but it kind of tells you company culture. Somewhere I suspect there is a engineering FMEA Failure Mode and Effects Analysis spreadsheet that identifies the failure and the corrective action needed years before the failure occurred. Many times these are BS but I guarantee it would identify that one sensor failing is a critical item and having redundant sensors is a way to prevent failure.

\\\

Dear OldSchool, regarding your comment on Boing I believe you are spot-on. It’s definietely a companny culture issue. And that is regretfully one of the most challanging if not impossible aspects of corporate to change. What use is a good FMEA without the courage and integrity to follow through on the same? Quite a few industry giants have the same disease. When the cheap money dries up we will see who is left standing.

\\\

In manufacturing you have line balancing. That is to make a uniforme load and tackt time for workers on the line to reduce stress and optimise capacity. In system design, that is system balancing. In our case it is to predict a surge in manufacturing, assess transport cost and market capabilities. Then you analyse the transport and market need and define actions to be taken.

\\\

There is a slew of 7 digit CEOs and other “experts” who are payed to know this. I have very little tolerance for failure of such highly paid individuals as it is their job to handle data, predict trend and enact data driven estabished policies for long term growth. An entire industry failed to deliver. And that is $tupid with a capital “S” and a hint of $.

\\\

Merry Christams and Happy New Year.

Texas Regulators Facing Pushback Over Natural Gas Flaring Practices

December 4, 2019

Pipeline giant Williams is suing the Railroad Commission of Texas (RRC) for routinely approving natural gas venting and flaring, which it claims violates state law.

In the new lawsuit, Williams and Mockingbird said the RRC has set a dangerous precedent with the extended approval for Exco, which “reflects an evolved practice at the commission under which it has not denied any of the more than 27,000 requests for flaring permits received in the past seven years.”

“Moreover, the exception was granted despite the fact that Exco’s wells are connected to a gathering system that is available to gather its gas, and there was therefore no actual need for the wasteful flaring. The grant of an exception to the no-flaring rule in this case is especially significant because this is the first known protested flaring application, and the commission approved the application despite there being no need to flare.”

and from those that have pooped in the pool..

June 25, 2019

WASHINGTON — A new federal study has found that an oil leak in the Gulf of Mexico that began 14 years ago has been releasing as much as 4,500 gallons a day, not three or four gallons a day as the rig owner has claimed.

-Japan’s METI says it’s safe to dump radioactive water from Fukushima nuclear disaster into ocean

The industry ministry said Monday it would be safe to release water contaminated by the Fukushima nuclear disaster into the ocean, stressing that on an annual basis the amount of radiation measured near the release point would be very small compared to levels to which humans are naturally exposed.

– A nuclear expert from the IAEA said in 2018 that a controlled discharge of such contaminated water “is something which is applied in many nuclear facilities, so it is not something that is new.”

Texas is a state that does not regulate if regulation would slow growth.

Average temperature on earth is about 59 degrees. We all need shelter and most try to keep temp within 68 – 76 degrees. Its a little hard for me to believe mankind will not adapt to a changing world. I predict global warming will not be in top 5 causes of death in 50 years.

Put your money where your mouth is and buy land below the 1meter contour land along the sea coast.

But, you are probably right. They’ll play games with the deaths, and few will be attributed directly to global warming. When there is mass starvation due to crops not growing, we’ll be told its starvation and not global warming that is the cause. When there are massive flows of refugees as all those massive cities along the coast become flooded and destroyed by storms, we’ll be told the refugees are the problem and as long as we machine gun them all down there won’t be any problems.

But, we probably won’t see many of these deaths attributed to global warming. Exxon’s contributions to politicians will make sure of that.

So far real estate prices in areas you describe are microscopically less expensive. So people are putting their money where their mouth is, and most of them are judging that a change of a few inches in Sea level and a degree in temperature probably won’t materially change life as we know it.

And why don’t you put your money where your mouth is and purchase future cropland in Manitoba?

Um…. It’s not all about us. It’s about everything else we need to subsist. Like food from the ocean, the right climates to grow food…..a bit human centric much?

I guess we better tell all the fish to get their act together. Oxygen is after all ,over rated. And the farmers to suck it up and get busy.

I predict global warming will not be in top 5 causes of death in 50 years.

I agree. Starvation and war caused by global warming will top the list and death from excessive heat will be relatively minor.

Its a little hard for me to believe mankind will not adapt to a changing world.

Tell that to the Rapanui, Mayans, Incans, Hittites, Taino, Kasamins, Chuds, and Tasmanians. They were also skeptical. Historical Tralfamadorians were not actually humans.

There will come soft rains.

I live modestly so my carbon footprint is pretty small. I like to look up the mansions that the global warming billionaires and actors live in. Their carbon footprint is 100 X the size of mine. Why do they not care enough to change their lifestyle?

Why do they not care enough to change their lifestyle?

I am just a poor boy, though my story’s seldom told. I have squandered my resistance for a pocketful of mumbles. Such are promises, all lies and jest.

Still, a man hears what he wants to hear and disregards the rest.

That implies perhaps that other causes will find cures, or just outright avoidance. Leprosy was common in biblical times, still exists, just not a major problem. Organic foods, and air pollution control, and clean water, may cure cancer. There will be population dislocations, and crop weather patterns. The CIA did a report on climate change which they put on the president’s desk.

Climate has been changing for a long time. Example: seabeds that become salt flats…climate change has been with us forever. The real question is does your personal carbon footprint really matter? To which I answer no..it doesn’t. Volcanoes have a carbon footprint that matters. Mines with their tailing dams full of poisons have a carbon footprint that matters. I’m sure there are many manufacturing processes that have a carbon footprint that matters. Making me pay more for cooling my house or flying an airplane is pure B.S. It just makes me poorer and doesn’t stop climate change. Nothing will stop climate change. The climate changes and sometimes those changes have adverse effects on agriculture. What part of this is so hard to understand.? My little poops aren’t going to change the weather, but a volcano blowing off in Mexico would most certainly affect the climate.

I’m with Old-school on this. Maybe let’s all get together and invade Manitoba or Saskatchewan when things get warmer.

“This means that 41% of the companies would reduce their capital expenditures in 2020, and 34% would increase them, pointing at an overall decrease.” This is misleading. We don’t know the magnitude of each of these companies’ capital budgets so it’s not appropriate saying this points to an overall decrease.

ALL PMIs, manufacturing surveys, etc. that ask executives what their company is currently doing and will do work that way. Given the number of companies in the survey, it averages out to be a fairly accurate prediction of what the direction of the dollar amounts will turn out to be later.

“Permian associated natural gas is a still-emerging story that will change the Western Hemisphere liquefied natural gas market once infrastructure can catch up with natural gas production.”

Change the market by driving process down even further? I’m convinced.

As most shale fields are gassing out, US producers want to produce oil, yet manage mostly on producing gas, condensates and NGL. Of the 12.9 mill bbl per day of liquid production just 2 mill bbl per day are crude oil according to WTI standards. API 45 – 50 production has tripled from 1 mill bbl per day to 3 mill bbl per day in just two years. And propane production is going vertical.