Not just exports and manufacturing – but services stall.

By Nick Corbishley, for WOLF STREET:

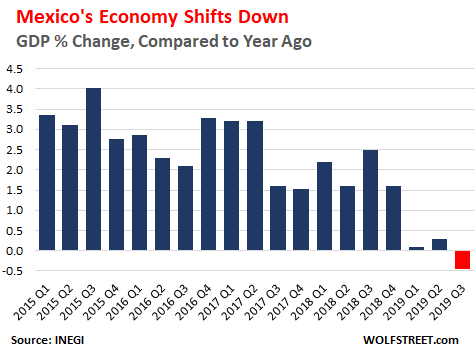

In the third quarter of 2019, Mexico notched up its first year-over-year decline in GDP since the final quarter of 2009, when it was in the midst of a sharp recession brought on by the Financial Crisis. According to a preliminary estimate published by Mexico’s statistical institute INEGI, in the third quarter, the economy shrank 0.4% compared with the same quarter a year earlier.

On a quarter-to-quarter basis, GDP in Q3 ticked up a minuscule 0.1% from the weak second quarter (0% growth) after an even weaker first quarter that had booked a 0.3% decline. That tiny uptick in Q3 and the 0% growth in Q2, following the 0.3% decline in Q1, were enough to avert a “technical recession,” defined as two consecutive quarters of negative growth. But it wasn’t enough to pull GDP in Q3 up to where it had been last year — hence the first year-over-year decline since 2009.

Services, which account for 60% of Mexico’s GDP, stagnated with no growth on a quarter-by quarter or year-over-year basis.Manufacturing contracted by 0.1% quarter-by-quarter and 1.8% year-over-year. But agricultural production grew by 3.5% on a quarterly basis and by 5.3% year-over-year.

After successive quarters of managing to weather the storm generated by the U.S.-China trade war and the slowing global economy, exports in Mexico fell by 1.3% in September compared to a year earlier.

The worst affected sector was oil exports, where exports tumbled 29% year-on-year. But this is probably the result of President Andres Manuel Lopez Obrador’s strategy of refocusing Mexico’s state-owned, massively indebted oil behemoth Pemex’s output toward the domestic market as oil imports also fell year-on-year during the same month, by 17%.

For Pemex, the third quarter was a decidedly mixed one. On the negative side, it was blighted by the company’s fourth straight quarter of losses, totaling $4.6 billion. That stands in stark contrast to the $1.5 billion profit it registered in the same quarter of last year. On the positive side, Pemex’s crude production increased on the previous quarter by 1.2%, to 1.7 million daily barrels per day.

Growth in manufacturing exports is slowing to a crawl, up only 0.8% in September compared to a year ago, down from increases of 5.1% and 5.4% in July and August. Further compounding those concerns is the fact that imports of capital goods — goods that are used to produce other goods, which are then often exported — plunged by 13.5% in September, compared to a year earlier. According to Jonathan Heath, the deputy governor of the Bank of Mexico, this sharp fall in capital good imports is “the most disconcerting aspect of the September trade data.”

Another alarming trend is the dramatic slowdown of Mexico’s construction industry, which has notched up 10 straight months of declining output. In May, construction activity registered its biggest year-on-year fall (-10.3%) since records began, in 2006. Since then, the situation has continued to deteriorate. In August, the last month on record, year-on-year decline was 10.2%. This is happening due to two main reasons:

Private investors are afraid to invest. Since Mexico’s new government came into power in December, there has been greater enforcement of laws, rules and regulations concerning construction, which has made life more difficult for companies in the sector.

Public sector projects have ground to a virtual standstill. In the first half of 2019 Mexico’s government had invested just 20% of its projected budget for construction. This slowdown in public sector construction has been particularly pronounced in the capital, Mexico City, where almost 500 public and private development projects — over 40% of all the projects under way — have been halted or cancelled by the new city council.

Now, the declines in manufacturing and construction appear to have spread to the all-important services sector, which accounts for around 60% of Mexico’s GDP. In Q3 and Q2, the sector, which includes health services, financial services, transportation, education, and the like did not grow at all, following years of uninterrupted growth.

There are sharp differences among regions. According to the Mexican daily El Universal, 22 of the country’s 32 states already registered negative growth in Q2 of 2019. Eight of them (Sinaloa, Baja California Sur, Tabasco, Guerrero, Hidalgo, Chiapas and Michoacan) are apparently already in recession, having strung together two or more consecutive quarters of negative growth.

The disappointing economic data, the official inflation rate of 3% (lowest since 2016), and the Federal Reserve’s rate cut yesterday have intensified the pressure on the Bank of Mexico to slash its policy interest rate, which currently is at 7.5%, following two rate cuts over the summer. By Nick Corbishley, for WOLF STREET.

Mexican exports of new vehicles to countries other than the US have plunged, tripped up by the global auto slowdown. But some US automakers have shifted truck production to Mexico and have raised their imports from Mexico. Read… GM, Ford, BMW, VW, Honda Shift More Production to Mexico. Auto Imports Surge Despite Decline in US Sales

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Trump better get that wall done ASAP

So had Canada.

El Chapos kids just defeated the Mexican military.

And they did it in brutal fashion.

We need a lot more than the wall along our southern border.

I am going to out on a very small limb and opine that massive corruption is stifling both the private and public sectors.

Private investors are afraid to invest.

Public sector projects have ground to a virtual standstill.

Are you claiming or implying that corruption has worsened under Lopez-0brador? Did you click on the link about construction slowdowns and cancellations?

there has been greater enforcement of laws, rules and regulations concerning construction

It sounds more like a decrease in corruption is stifling profits.

It’s happening! Who’s next?

We just don’t know how deep the hole is gonna be this time.

You know it’s going to be deeper than most can imagine. What will be sad will. E how central banks will pour more salt into the wound. Then the realization they can do nothing to fill the wealth void. And then? God help us!

A little bit off topic. I know you guys are car experts. But I had to track where the car I just committed to buy is “physically”.

In my area, cars from Japan are mainly shipped through the Port of Davisville in Rhode Island. Tracking RORO Car Carriers is fun.

I also learned that cars assembled in Mexico bound for New England also use the same port. Port scehdules shows that the port only has one scheduled car carrier arriving this month and it is from MEXICO. So I looked at the history, and it showed several car carriers coming from MEXICO in the near past. So now I wonder, why only one boat in the near future? I guess you can track all the car carriers departing Mexico.

What’s happening? Is the car economy this bad?

Rail, perhaps?

It connects to the rail and I-95. This is where customs clear and serves as bonded facility even for Canada!

https://www.noradinc.com/

No. Rail thru Mexico is incredibly exposed to pilferage. They may not be able to take a car of in one piece, but they can take it “one piece at a time”. And given the opportunity they will.

Car carriers are much cheaper than rail, and will be until the rail is robotic (which the unions will fight until they kill their industry.)

The Toyota Group (Toyota, Lexus, Hino, Daihatsu, plus Mazda, Subaru and Yamaha) has been making a lot of adjustments to their logistical chain worldwide over the past two years.

Traditionally Toyota has moved their bulk of their cars through Toyofuji Shipping, which they own, but lately Toyota has been getting very cozy with Sumitomo-Mitsui and as it always happens in Japan this means all sorts of agreements publicly signed to great fanfare but negotiated behind closed doors in the strictest privacy.

Sumitomo-Mitsui controls one of the world’s largest car carriers, Mitsui O.S.K. Lines or MOL for short, and Toyota has been shifting a lot of business over to MOL over the past couple of years. So all those cars that were previously arriving Davisville, RI, are probably arriving in another port with a MOL terminal and are being shipped to New England by rail or road: intermodal has been chewing through maritime transport at a very past pace over the past three years, especially in the US.

Honda, in spite of their independent stance, has always gravitated around Mitsubishi and hence has always been a big customer for Nippon Yusen, the largest car carrier in the world, owned by Mitsubishi.

But Honda has been moving an awful lot of production to Mexico lately, especially SUV, and hence their logistical chain is shifting from shipping cars from Japan, Thailand or China (where the old Jazz/Fit was assembled) to shipping them from Mexico. Again intermodal is winning out big time here and those Mexican-built SUV are increasingly being shipped through means different than ship.

Mexico is somewhat dependent on autos and agriculture. Autos are more reliable now and don’t require replacement every four years and agriculture is being decimated by violent, organized crime that have begun to demand protection money from farmers – payments the farmers can’t afford – eventually the organized criminals will take over the land and pay workers subsistence to pick avocados and other cash crops. And how does a country maintain a tourist industry when murder is openly tolerated.

I cry for Mexico, it’s a victim of its proximity to the US and I pray the wave of rampant corruption and crime doesn’t overtake Brazil but I’m not optimistic – weapons manufacturers are always seeking new markets. Brazil has its problems but at least they can still claim they have not become Mexico – ojala.

Mexicans should save their income as S&P500 credits instead of pesos or dollars, corrupt players it would seem have a keen interest in always inflating US large cap stocks and if you can bet on the same team as the corrupt players you will never lose (market has been down today – does anyone believe the market can still finish in the red, inconceivable).

Victim of it’s proximity to the US? On balance it’s a huge plus to be next to the US and to have a free trade agreement, Mexican agriculture and industry would not exist without these two factors. It is certainly true that the drug trade is a negative consequence of proximity to the US, but if proximity to the US was the main factor, Canada would also be a basket case. The main problem in Mexico is and has always been corruption and a lack of the rule of law. If Mexico were moved to the other side of the globe it would look a lot more like Somalia and be even worse off.

Give credit where due! Some to USA, sure, but how about the legacy of toxic classism, nepotism and plutocracy inherited from Spain? Or the inherent function of capitalism? And trickle-down culture? While camping with my friend from Ciudad Mexico, she remarked that things like park benches wouldn’t last a minute in Mexico before being stolen. Get it before someone else does! To me, Mexico is a cautionary tale of top down rot, and our future if we don’t reign ours in.

I’m not really a student of Mexico’s manufacturing economy, but with the realignment resulting from manufacturing moving out of China, I would have expected at least some of the outflow to move to Mexico.

If I’m reading this article correctly, that’s not happening because investors are leery of dealing with a corrupt Mexican government and various manifestations of gang warfare.

After I read something like this, it tells me that the only thing left to try is QE directly to the people regardless whether it works or not. QE 2 and 3 were utter failures. The current Fed repo and do-not-call QE purchases and rollover of $60 billion in T bills is another doomed to fail try. I guess we can try something new.

Mexico ranks #15 in terms of GDP compared to other nations. They have some manufacturing facilities close to the US border.

US and European corporations and politicians have been trying to divvy up the spoils of Latin America since the Monroe Doctrine, and have mostly only succeeded in making a mess of things for over two hundred years. It’s a long-established tradition.

Like other countries south of the Rio Grande, Mexico has tried several times to right itself with democratic reforms, always successfully undermined by external competitors. When you see that a hundred years ago it was Standard Oil backing a democratic progressive and BP backing an ambitious general the paradigm becomes obvious.

Friedrich Katz, The Secret War in Mexico: Europe, the United States, and the Mexican Revolution. Chicago: University of Chicago Press 1981

Lars Schoultz, Beneath the United States: A History of U.S. Policy Toward Latin America. Cambridge: Harvard University Press 1998

The bottom lie is will this economic downturn in Mexico speed up or slow down the “reconquista.”

“Bottom lie” Freudian slip there?

It’s certainly a historical fact that the US has meddled with governments in Latin America.

But the problem with Mexico isn’t outside forces, it’s the complete lack of the rule of law and corruption of the government forces who should be trusted to maintain rule of law. The combination of violent gangs and corrupt police is toxic and the country cannot move forward until this is corrected.

Mexico has one big problem that many may not be aware of, and its not really their fault. Crude oil production is now down to about one half of what it was when production peaked around 2004, and it has fallen steadily year by year, mostly because of simple depletion of their original natural endowment.

Government’s don’t usually run efficient companies. I suspect Pemex didn’t invest enough to maintain production.

What if Mexico defaults again? Are we ready for this? Back to the 80’s.

Iamafan,

All your comments are sent into my moderation queue by my AI-driven anti-spam system. I have no idea why. The system also looks at how your comments are routed — for example, if they go though a server along the way that is known to be a spam server, the system reacts allergically to it. This happens to a lot of people here. For a while, I happened to MCO1. Then it stopped. There is a whole list of people here. But I think it’s the first time it happened to you. So please be patient. Someday it will likely go back to normal.

Petunia is caught up in the same thing right now as of today for some reason.

\\\

This is nothing but a reaangement of priorities, a healthy step the Mexical country needs. I hope they do some meaningful reforms, because they as a country and people deserve a better life.

\\\

I have to wonder about one thing: with the ability to adjust GDP upwards in dozens of different fashions, this means that either the statisticians hired by the Mexican government are comically incompetent or that the situation on the ground is somehow even worse than we imagine, so bad in fact that this is all that modern stistics can do.

My limited experience with Mexico this year seems to hint that among the many causes for this fiasco is one depressingly common the world over: wages are not keeping up with real world inflation.

Mexico’s repressed wages are what has been attracting foreign investors like moths to a flame: in US dollar terms they are ridiculously cheap, especially in very poor and very corrupt States such as Guanajuato.

Problem is the cost of living is racing higher and that credit cards and bank loans are not coming to the rescue as they have been doing in Turkey (which shares a lot of economic similarities with Mexico). Their use is still somehow limited by widespread diffidence even among relatively wealthy people. And given what we know about local authorities and banks I’d say rightly so.

This is hardly conductive to sending consumer spending skywards, and regardless of what some people say consumer spending is what ultimately makes or breaks an economy.

As all over the world most Mexican retail activity over the last 5-6 years has taken aim squarely at the top incomes: one only needs to look at all the mega malls, where items of clothing cost four or five times as in ordinary shops and markets, not to mention the huge number of “sports bars” selling overpriced beer to their patrons.

Now all these businesses have to face the fact their customers haven’t increased by 15-20% per year like they expected. In a normal economic situation bankruptcies would have already started but these days we just have to scratch our heads at those “investors” who keep on throwing good money after bad.

Can’t help you there. The system has always been deeply flawed, but then it was deliberately corrupted. As always, the moneyed classes will insist on continuing to amplify their privilege and their greed, which is how the system has now come to be so very broken. They will not allow the system to be reformed, and alternatives will continue to be suppressed, so the situation is terminal. It will continue badly, and it will end badly.

Sucks, doesn’t it?

blockquote>

pâro

n. the feeling that no matter what you do there is always somehow wrong—that any attempt to make your way comfortably through the world will only end up crossing some invisible taboo—as if there’s some obvious way forward that everybody else can see but you, each of them leaning back in their chair and calling out helpfully, colder, colder, colder.

Unamused, sounds eerily familiar to what we have here. I think the path here in the US is going to end with a Latin America Model eventually, where you have the extreme haves & extreme have nots. The difference though might be in the Norteamericanos ability to mount a successful revolution. We are, as a nation, armed to the fvcking teeth.

I would argue that the one good thing the Mexican People have is their resistance to the financialization that has wreaked such devastation on the US & the rest of the Western World. Thank God that Mexico is still primarily a Cash Economy.

This is not resistance: it’s just plain old and well justified lack of trust in the government. The same phenomenon is observable everywhere, but in countries like India or Mexico, where governments and banks have worked real hard to establish a reputation for corruption, cronyism, inefficiency and rapine they keep on reinforcing, it’s deeply embedded in the local psyche.

As my mother would say “it’s a matter of survival”.

Financialization is another matter completely: Mexico is neck deep in it. Just think about the billions in US- and euro-denominated bonds issued by Mexican companies. Those like Grupo Bimbo, whose revenues come over 60% from foreign markets, chiefly the US and Europe, are making the proverbial killing. But think about all the retailers and mall owners that operate exclusively in pesos. They will have a day of reckoning that not even Fed and ECB idiocy will be able to postpone.

MC01,

I was referring to the avg. person conducting a large percentage of their purchases in cash: oftentimes, even large durable goods. This is rapidly changing from observational & anecdotal experience of having spent a lot of time down in Mexico on overnights (Airline Pilot) and traveling extensively by RV & Motorcycle all over the Country. Mexico is such an incredibly diverse nation in so many aspects; from the astounding & diverse geographical zones; to the fascinating cultural diversity (especially in the south). Mexico gets a bad rap that I personally have found to be undeserved. I find it to be one of the coolest places on the planet and with some of the best cuisine.

I really hope the best for the Mexicans.

Mexico reflects what’s happening to the poorest among us.

The Fed is derelict in its duty to observe to

the inflation rate, take-home pay, and working hours

of the inner-city poor.

Riots in Chile, Hong Kong, India and France could come here.

The Fed funds rate is still too high.

The yield curve went flat October 11th,

after having been inverted since May 22nd;

but will soon re-invert, I think.

Riots in HK are because the government is not representing the people and the people are being violently suppressed.

Riots in France were because the government raised fuel taxes.

I don’t see people rioting because the fed funds rate is too high. If anything, retirees should be at the gates of the fed with their pitchforks demanding market rates for their bonds and cash.

The Mexican economy is enormously dependent on oil.

Unfortunately, the country can no longer rely on oil for growth:

Mexico’s Pemex produced 1.62 million barrels of crude per day in January, less than any month in almost three decades, the state-owned oil company said on Friday, underscoring the challenges facing a government that vows to pump far more in a few years.

The company’s crude output for the month was the lowest since at least 1990, when Pemex’s publicly available records begin.

The firm’s crude oil output has declined for 14 consecutive years since hitting a peak of 3.4 million bpd in 2004, as Mexico’s most prolific fields have dried up and new ones to replace them have not been discovered.

https://www.reuters.com/article/us-mexico-oil-pemex/mexicos-pemex-crude-output-lowest-since-records-began-idUSKCN1QC00E

Maybe that wall thing is not such a bad idea?

No, The Fed Funds rate and other central bank rates, bond yields is not too high, it is too low.

We need a good clearing out of the over indebted that should of never been in business in the first place. When interest rates are below inflation rates and should be 2% minimum above that inflation rates you know they are creating more distortions and future financial disasters that will be worse in the future. You can’t create artificially winners out losers and think that there will not be dire consequences.

Sure, a 30-year T-Bond yield of 20 %, after inflation,

would be wonderful but the Fed can’t make that happen,

decade after decade, for 40 years.

Q. What is the Fed capable of doing ?

A. It can ( but shouldn’t ) invert the yield curve,

shocking the system, adding volatility.

It would have been worth mentioning Spain’s investment in the Mexican economy. Dominoes.