Santander Consumer USA is on the forefront of souring subprime-auto-loan backed securities.

Santander Consumer USA, one of the largest subprime auto lenders and the largest securitizer of subprime auto loans, is not alone. But it’s on the forefront. It had $26.3 billion of subprime auto loans as of June 30 that it either owned and carried on its books or that it had packaged into subprime-auto-loan backed securities and sold to investors; in terms of the loans that it collects payments on, 14.5% of the borrowers were delinquent, according to S&P Global Ratings, cited by Bloomberg.

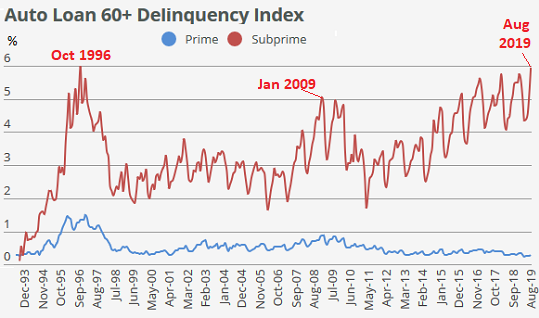

In the industry overall, subprime auto loans that have been packaged into asset-backed securities (ABS) are experiencing the highest delinquency rates in two decades, according to Fitch, which rates these securities. The 60-day delinquency rate surged to 5.93% in August, substantially higher than during the peak of the Financial Crisis at 5.04% in January 2009 (orange line, chart via Fitch):

But “prime” auto loans are holding up very well (blue line in the chart above): Their 60-day delinquency rate is hovering around a historically low 0.28%.

Santander’s loans include a surprising number that defaulted within the first few months, according to Moody’s Investors Service. These early-payment defaults (EPDs) are a hallmark of loosey-goosey underwriting standards that accomplish three things:

- Initially, they boost revenues from fees and high interest rates, and thus paper profits.

- They get weaker borrowers into loans with punitively high interest rates and payments so high that many borrowers will have to default.

- They enable or even encourage fraudulent loan applications.

Concerning the link between fraud and early-payment defaults, Frank McKenna, chief fraud strategist at PointPredictive, told Bloomberg: “We found that depending on the company, between 30% to 70% of auto loans that default in the first six months have some misrepresentation in the original loan file or application.”

OK. But Santander is not trying very hard to prevent fraud. In September, Moody’s pointed out that Santander had verified income on less than 3% of the subprime loans it packaged into over $1 billion of ABS that it was marketing to investors at the time. Income verification is not the only measure, but it’s an important measure of good underwriting practices. In these structured securities, where the highest-rated tranches carried a credit rating of Aaa, the lowest-rated tranches take the first losses, and the top-rated tranches could come out unscathed.

Moody’s said that it expected losses of 24% on this deal, far higher than 17% in losses that Moody’s expected on all of Santander’s ABS.

By comparison, Moody’s cited GM Financial, which also packages subprime auto loans into ABS: In a subprime-loan deal issued in June, it had verified income on 68% of the loans; and Moody’s expected losses of about 10%.

Even though Santander has sold these subprime-auto-loan-backed securities to investors, it is not entirely off the hook, especially when borrowers fail to make the first few payments – the infamous EPDs. It is then obligated to buy back those loans and eat the potential losses itself. According to a Bloomberg analysis, Santander was obligated to buy back 3% of the loans, which according to Moody’s, is a higher rate than Santander’s faced in its earlier securitizations.

But in a deal that it sold to investors last year, Santander has been obligated so far to buy back 6.7% of the loans mostly due to due EPDs, according to a Bloomberg analysis.

So these losses due to early-payment defaults were shifted from ABS holders back to Santander. Moody’s analyst Matt Scully put it this way: “The situation is somewhat perverse in that bondholders are actually benefiting from high early-payment defaults through the repurchases.”

Subprime-auto-loan-backed securities have other protections for bondholders, such as loss-absorbing buffers in form of additional auto loans beyond the face value of the securities.

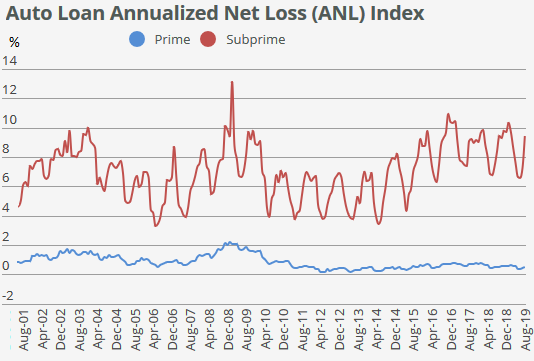

Nevertheless, the remaining losses are being eaten by the lower-rated tranches of the ABS. And the losses are piling up. According to Fitch, the subprime auto-loan Annualized Loss Ratio rose to 9.4% in August, up from 8.3% in August last year. During the peak of the Financial Crisis in February 2009, the ANL had spiked to 13.1%:

In terms of the overall auto-lending industry and the banking system, how much of a problem are we talking about?

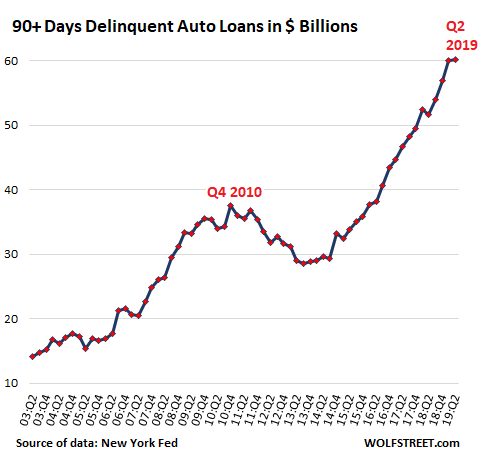

Total auto loans and leases outstanding have soared to $1.3 trillion at the end of the second quarter. Typically, between 20% and 25% of the new loans and leases being originated each quarter are subprime rated. In the first half of this year, about 21% were subprime.

At the end of the second quarter, according to Federal Reserve data, 4.6% of those $1.3 trillion in auto loans and leases – subprime and prime combined – were 90+ days delinquent. This is where delinquencies were in Q3 2009 but below the Financial Crisis peak of 5.3%. In dollar terms, the 90+ delinquencies – most of them by subprime rated customers – amounted to $60 billion:

While delinquencies have skyrocketed, losses are just a small fraction of what subprime mortgages had generated during the Financial Crisis. Subprime auto loans, being about one-tenth the magnitude of subprime mortgages, are not going to take down the big banks. But smaller specialized non-bank lenders could collapse, and some of them have already collapsed.

Given the risks and losses, why is the industry engaging in subprime lending? And why are investors lapping up the subprime-auto-loan backed securities? Follow the money.

Subprime loans are immensely profitable. The dealer gets to sell a car and make a fatter profit on the car itself and on arranging the loan because subprime borrowers know they’re having trouble getting loans, and there is often no negotiation on price, interest rates, or payments. Subprime customers are sitting ducks.

Subprime loans are also high-risk, and lenders want to earn higher rates of return – and charge higher interest rates – to be compensated for the risk. So, until the loans sour, lenders make more money on subprime loans.

At first, everyone is happy. The dealer made lots of money. The lender made lots of money. Investors earn a higher yield on their ABS. And the customer, who is paying out of the nose for all this, is driving a nice car.

But a customer that is struggling and already has some credit problems – which is why the credit score is below “prime” – may have trouble making the payments on a car loan with a 21% interest rate financing not only the car but also the fat profits of the dealer.

It’s quick these days to repo a car and sell it at a wholesale auction. The used-vehicle market is liquid, and transactions are fast, unlike the housing market. So a lender will take some loss on a defaulted car loan, perhaps 30% or 40% of loan value. But given the profits made on the loan before it defaulted and on the loans that do not default, subprime lending, when greed isn’t allowed to run wild, remains a profitable business overall. And it allows customers with subprime credit to buy a car despite the risks for lenders.

How cash-burn machines power the real economy, and what happens to the economy when investors refuse to have more of their cash burned. Read… Here’s What I’m Worried About with the Everything Bubble

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Is it possible to make a profit ripping off auto dealers?

I.e., getting a new vehicle with the intention of reselling with an altered VIN, chopping, renting out?

Or in other words how many of these early defaults are fraud?

They are frauds… but on the part of the ones making the loans.

As Wolf explained they give loans to people they really shouldn’t to inflate the numbers.

Because they know the loans are going to be defaulted they make them as hellish as they can so is not a complete loss. Then they get the car back and is resold. Rinse and repeat. It works well if the load is for a used car, not so much for brand new models since there is risk of damage and the price drops a lot once a brand new car has been “pre-owned”.

I can’t find it on youtube but there’s this routine but some funny guy with an utterly forgettable name, all I remember is he’s funny and wears glasses* but the same POS car is sold and re-sold, some sh!tty little sedan, and I wish I could find it because it’s pretty hilarious.

*glasses can make a career, just ask Drew Carey.

Auto Lending: Last Week Tonight with John Oliver

‘In July 2009, an educational charity sold an 11-year-old Oldsmobile Intrigue at auction, where it was bought by Auto World Auto Sales.

The Sacramento dealership, which advertises “in-house financing,” put the aging sedan on its lot and quickly found a buyer willing to pay $4,899. Six weeks later it was repossessed and sold to someone else. A few months later, the car was repossessed and sold again. And again. And again. And again.’ All by the same outfit.

This is from the LA Times. ‘I entered Same car sold many times’

nick kelly,

What you’re talking about are “note lots.” That business is the seamy underside of the car business. They’ve been around as long as cars have been around. Note lots carry their own car loans, and they work as you described. None of these loans can be securitized or sold to anyone else.

“Tote the note” lots are like pawnshops. Some of them install kill switches that can disable the car once the loan is delinquent for a specified period.

Behold, the unleashed “Free Market” under “Rule of Law” producing millionaires and homeless simultaneously……what a wonderful system we have, IF you are higher up on the class warfare scale.

It’s a full blown Great Depression, somewhat hidden from those who can’t or don’t want to see it by digital money and financial engineering as discussed here.

Screw Econ “theory”. A depression is simply too much wealth in too few hands. FDR didn’t let the last one blow up. The wealthy (who have the ability to make law and policy) had better get wise and soon, for their OWN good….I don’t really expect they will develop any empathy to make them act.

We are all on the same ball in space, there is no place to hide, green new deal and downsize, or we play Somalia, where there is no interference with “business” at all.

Dude, Somalia is run by warlords. You think warlords are the 1% or the 99%?

Somalia is what we have, except that instead of the wealthy having all the loot, they have all the loot AND all the guns. And a posse.

No thanks.

Not sure at all what you are saying, Waz, but I am certain that you personally can’t say “no thanks” to any policy, few can.

15 yrs car sale veteran.

What you’re describing more or less is just out and out fraud.

Scammer usually does business via internet only, no face to face, out of state deal. They use stolen credit info to get approved and arrange a delivery of the vehicle out of state, where they then change delivery location last minute.

Car is gone out of country or wherever before lender or dealer knew what happened.

We just stopped doing out of state deals unless customer shows up, they are typically pain in the ass low profit head ache deals anyways so who cares.

Wolf – it could be much more than subprime auto issues during the next recession (if it ever be allowed to occur). For example, I have two neighbors near me, in $450,000 houses (tax value per local govt), and both had issues paying their $11,000 annual property taxes last year (I seen via online tax records that they both made multiple late payments, using credit cards, as there is a 4% fee for credit cards). So here I have two neighbors who can hardly keep paying for their houses, and low and behold they both bought $35,000 brand new vehicles this year. Where did this extra money come from? I found out this week they both re-financed their homes, pulled out all the “free equity”, and bought new autos with the “free” money. So all is good as long as house values continue to go up 6% per year. One neighbor even told me they are debt free, as they do not consider auto or house loans as debt, only credit cards. I sometimes wonder how people can be so crazy dumb with regards to money, as these are not stupid people in general, they just don’t seem to have much financial literacy.

In summary, numerous “Prime auto buyers” many be in trouble also, once we are allowed to have a recession and house values drop back to a reasonable valuation. I am getting concerned the Fed has caused way more unintended consequences than anyone can imagine, and we will have to deal with them over many years if not decades into the future. The scary part is the actions of others affect everyone, as when people in mass start short selling their houses and having their autos repo-ed, that drops the values for everyone, ants and grasshoppers alike.

First chart is very interesting. Why do the numbers seem to change seasonally? Can’t see it very well – is it lower in summer or winter?

GP,

The low points are always April or May (mostly May); the high points are January or February. So you can kind of figure out what the Jan/Feb 2020 delinquency rate will be.

Lots of things are seasonal, such as bankruptcies. My website traffic has strong seasonality too.

Can’t you show the average yearly seasonality? Would be interesting.

I sometimes wonder how people can be so crazy dumb with regards to money

(1) They’ve never been poor. The wolf at the door gives people a perspective which cannot be obtained in any other way, and even then people often fail to learn from having this perspective.

To wit:

(2) US marketing culture trains people to be financially irresponsible, whether they can afford it or not, abetted by self-destructive access to excess credit. Most Americans have no idea how their personal choices and belief systems are manipulated by corporate influencers.

People persist in telling me the US is a free country. Fine, I say. I’ll take two.

Unamused – Having been very poor myself, it’s not even that they’ve never been poor. Poor people can be idiots with money. If you grew up poor but in a culture/family that planned ahead, had good savings habits even if it’s a coffee can full of small change buried in a secret compartment in the floor under a rug, etc., grew up evaluating the cost/value of things, then great. Once you get money you’ll husband it well, and become a classic “Millionaire Next Door” type.

However, in my own case we went from middle-class to very poor (if your father thinks there’s a decent living in programming computers, well, you’re screwed, kid) and from the age of 13 or so on I was immersed in classic American poverty culture.

Everyone smoked. Food was of a very expensive-for-value kind like boxed Kraft mac and cheese. We drank sugary fruit punch all the time, and sodas. The only fruit and veg we got were what we picked or nibbled on out on our own – thank goodness we were in a climate that had such things.

I tried to save money as a kid, and as an 11-year-old actually saved, literally pennies found on the street etc. in a cigar box, for a BB gun. It was a long slog saving up that $10 but I did it. By the age of 13 or 14 this way of thinking and doing things was wiped away. I learned that any attempt to save would result in my savings being taken by someone bigger/stronger. If you got money, you ran out right away and spent them, like on a bag of potato chips or something you could eat up on the sly.

So that when I was old enough to leave at age 18, and through my 20s, I was horrible with money too. It didn’t matter, I thought, because I’ll make so much more money when I’m older; it’s no time to save now.

At least I had a taste of middle-class life when I was little, and although it’s really late now I know what it is to save and manage money, and I like reading books and eating vegetables, two things the true lower class are taught to hate.

I wonder if the percentage of people who lived as you lived in your youth and transitioned out of that to your lifestyle today is increasing or shrinking?

RD, My guess is that it is getting much smaller. Every thing was easier 40 50 years ago. The wealth gap was much smaller. Many fewer rules and regulations. Collage was cheap and some places virtually free.

RD – I’d say it’s smaller. Social mobility is way, way down from how it was in the 80s, when I was a young adult and *should* have been saving money like crazy.

Plus, as bad as “the boob tube” was when I was a kid, it was about 3 channels and often the reception was so bad, it was much more fun to go out and play.

I remember a sort of flap when I was very little, apparently there was a TV show called Romper Room that very blatantly advertised to kids. It was actually a scandal and it was taken off the air. There was at least an inkling of an idea of saving money etc., and the idea that if you work hard you’ll move up. Even if it actually only worked for relatively few.

Now, advertising for kids is a way of life and anyone who buys into the “work hard and get ahead” trope quickly finds out how false it is. You might “luck” your way out, you will probably never be able to “work” your way out.

It’s almost to the point where the only way to win is not to play. Your mileage may vary, but buying a small farm out in the boonies is one viable way to “not play” in the US, and other ways to “not play” are to move or retire outside the US, or join the Amish or something.

RD – I’ve re-read your comment and I think I interpreted it “upside down”. I thought you were asking about how many kids are able to “rise up” now and I’d say it’s very small – social class is very rigid now.

But I think what you actually meant was, How many kids were middle-class when little and fell into poverty in their teens?

My answer: Tons. We’re losing our middle-class, and most peoples’ life trajectories are downward now. The luckier ones are holding steady.

A hell of a lot of “self made” young people are just hanging on until their Boomer parents die and leave them houses and stuff. What happens when we run out of Boomers to die off and leave stuff?

A good example is one Ran Prieur, a guy who’s my age, and basically (from what I’ve been able to gather) grew up middle-class, and as an adult kind of dropped out. He wrote a lot about dumpster diving back in the day. Well, his whole strategy was to hang on until his parents died and now he’s got a house, a car, a stock portfolio, etc and he sits back talking about how “self made” he is. You can make that work, just be a “hippie” and skate through life, if you know your parents are going to take care of your retirement for you. For most of us (and I’m right on the cusp of Boomer and X) this is not an option. Our parents died in poverty and we probably will too.

Read one time that we get pretty good at making financial decisions that occur frequently like groceries or clothes, but large decisions that we only do a few times in life we tend to feel lost and do a poor job.

Realtors are professional exploiters of this.

These numbers for auto loan debt and mortgage debt seem small when compared to the massive sums of money the Fed now routinely monetizes. These borrowers are smart, interest rates are very low (possibly lower then inflation) and the Fed is clearly paying off everyone’s debt via inflation. Will a $35,000 car loan seem like a big deal when you can earn more then that in a week at a minimum wage job. Wages are rocketing higher with inflation and what was once are large sum of money is now trivial. Borrow and spend, the Fed will cancel out your debts – one way or another.

The government only raises enough tax revenue to pay 70% of spending, the other 30% has to come from the Fed in the long run. The dollar has no value in the future, borrow as many dollars as you can now, while they have value, and pay them back when they are worthless. Going into debt is smart.

Those borrowers pay 21%, not the free money the FED gives away. Also the assumption that the dollar will collapse soon is in my opinion wishful thinking. Especially a collapse so big that $35000 is in 8 years what $600 ($15x40hours) is now,

Van, eventually you will probably be proved right about the USD. In the interim, though, you might get crushed when the Credit Window guillotines shut & liquidity dries up. The next Recession will likely be deflationary at first, then the FED will go through MP #1-3 & end up at MP #4 and finally print. When the Global Recession first hits a lot of Folks worldwide will want to be holders of USD & T-Bills IMHO

Debt forgiveness starts at the political level, and with GOP self destructing the decision to own debt makes good sense. The number of constituents who adhere to sound money, balanced budgets, and the national debt is insignificant. While defaulting on Treasuries may not happen, changes with the same consequences are brewing. Is théorie monétaire moderne really much different? Your point being people who pay their bills resist policies meant to help those who do not repeats the terms of the politics of resentment, but probably not at a significant level to induce real populist change while the line connecting DJT and LW gets a bit clearer. MR steps in just to make that comparison even more evident.

I have lower wealth levels money mismanagement (or lack of frugality, or more susceptibility to advertising, or more need for image due to same, or whatever you care to call it) that is maybe a bit more of an index than anecdotal stories.

When I walk into Wal-Mart I check the most expensive manicure price.

It has dropped from $45 to $35 over the last 9-10 years.

I also pay attention to the license plate fames on more expensive (say $40-$50K new and up…I can’t tell year anymore) transport. More and more say, “joes auto”, etc, than local dealers.

As I’ve said before, most of these people will be screwed when it won’t smog or run for less than $1000+ repair in a year or two or less, i.e., the new cat the guy put in will be toast, or a jumper won’t stop the check whatever light anymore. (I saw a lot of that when I took auto shop just to get current at the local JC 2011-12).

I got ripped off by the CA DMV SMOG on an illegal cat they passed a year earlier for the previous owner. The shop that signed off on that had changed hands and they wouldn’t go after the guy, so I was stuck with the bill. SMOG testing generally has nothing to do with tailpipe emissions, its equipment check and most famously those faulty sensors which trigger the engine check light. And the mechanic warned me after market cats have a shorter lifespan, maybe just a few years. Nice when your vehicle has four of them. The next time that light comes on I will sell the vehicle out of state for whatever I can get.

Yes, it happened to me w Santander crooks. The dealer kept my Monte Carlo cause I needed new brakes. It was beautiful! They said it probably came from up North and was rusted a little underneath. They said I couldn’t drive it then came around front with an ugly white plain Toyota Corolla and said you can buy this. Charged me 1,000 I think and had to pay 360. for 70 months Month on Corolla plus insurance was 268.!! I have the Toyota on my credit report now! Don’t go to Castriota Chevy. They will ruin your life! They kept my beautiful black Monte and I’m sure some worker there fixed it up. Santander has fees and late payments out the wazoo and they are not helpful at all. I think Santander is working with car dealers to rip people off big time!!!

The theory is that auto loans are safer bets than a mortgage because you can live in your car but you can’t drive your house. That’s a quote from an ex high ranking auto exec.

Many if not most sub prime borrowers are self employed.

When it comes to their income it is an unknown unknowable

The lenders are aware the borrowers are guessing.When the

poop hits the fan they call it fraud. It is not. The lenders

deflect to avoid lawsuits and the bondholders buy these things

for yield and are aware of all the risks. They should get nothing

if it goes south.

But if the income verification is, as Wolf wrote, “…Santander is not trying very hard to prevent fraud. In September, Moody’s pointed out that Santander had verified income on less than 3% of the subprime loans it packaged…”, then the Fed is not doing its job! The Fed regulates banking practices. Only 3% verifications on sub-prime borrowers should have caused that bank to be closed down. That’s ridiculous.

Thanks, Wolf, for this insightful article.

If approx. 75% of the loans are prime borrowers, and their default rate is actually declining, maybe the subprime defaults aren’t that worrisome. Correct?

These subprime loan delinquencies are very worrisome for the industry, for the specialized subprime lenders, for investors, and for automakers because when lenders tighten up, sales go down. However, they’re not going to cause a financial crisis of any sort.

That said, we’re seeing these numbers in good times. If the economy gets an unemployment shock of some sort, subprime delinquencies will blow out. And even prime delinquencies will rise. But prime delinquencies are so low now that even if they soar by a factor of 10 to something close to 3%, it’s still manageable for the industry.

WR,

Strong article as always – but on a tangential note, I think you give our crooked gvt a pass on the entrenched, institutionalized fraud that has come to define our housing/auto markets over the last 20 years.

By forcing interest rates way down (via money printing in one form or another – despite soaring debt levels) the gvt,

1) Lowers the interest cost of it’s own huge debt,

2) Creates a phony “healthy” economy that can only survive so long as the artificially induced ultra low interest rates can goose home/auto sales by gutting monthly payments…while also allowing sales prices to soar.

3) Driving savers to fund this whole rotten edifice via ZIRP induced yield starvation. Without gvt created yield starvation, nobody would buy the shitty lower tranches of this endless, bullshit, fraud ridden ABS.

But then our rotten gvt’s rotten economic house of cards would collapse.

No BS rates no BS ABS.

No BS ABS, no BS sales at BS prices.

No BS sales, No BS economic “health”.

No BS health, no more bullshit DC political class

I went car shopping this week since my other (new) car burned (to a crisp).

I expected a sale because I read about the hell in car sales data.

You know what? The prices were $2k more than I paid last June.

That’s for the same exact car model with a 2020 sticker today.

Unbelievable.

I believe Wolf and others have written about this. Auto manufacturers have bragged in earnings calls that they will make up for lower sales by hiking the prices. That works great, until they run out of price-insensitive buyers.

I would be remiss not to point out that Apple has been doing the same thing. I think it is standard policy at this point.

Nonetheless, real US aggregate corporate profits are down 15% from 6 years ago, while real US aggregate corporate market capitalization is up 74%. (Sources: BEA, BLS)

Profits are no longer important.

Fuel prices went up here California. $4.10 an up, just about everywhere.

But all is well. Don’t Panic. Everybody will get big bonuses in time for holiday spend and first thing on January, a big fat raise… problem solved. people will get current on these little set backs.

Gasoline is $2.30 in Georgia. California government is one big tip off machine. Ya gotta really love that weather.

You could always go to electric car. Oh wait they cut off the electricity too.

Bloomberg had an interesting feature on Generac Holdings Inc. on Friday, 25 October.

The Wisconsin-based maker of electric generators is seeing a huge run of demand coming from California, and their stock hit an all-time high.

If I lived in Cali, I would want to have back-up generator. The question becomes, where do you store the fuel if a fire is potentially going to be on its way?

My sympathies to those out in PG&E land without electricity….

That’s such a good point. What do you do with an electric car if there’s no electricity to charge it? ;)

Sounds like you need a Tesla solar roof to go with that Tesla car.

Mike Earussi,

You do the same thing with an EV when there is no power as you do with an ICE car when there is no power. The thing, gas stations don’t work either when there is no power. Payment systems are down. Nothing works. So good luck trying to fill up you ICE vehicle.

In many cases, either EV or ICE, when fully charged or filled up, can drive far enough to get out of the black-out zone.

And yet S&P500 hit an all time intra-day high today. Investors are kinda meh over this and I don’t blame them.

What % of loans are sub prime vs prime? And what was the % mix 10 years ago? And what was the % of subprime dollar value defaulted to GDP 10 years ago vs today? Just saying it was 5% then and 6% now without context around it doesn’t mean much.

And also, it makes no sense that it bottomed out in 2011. In 2011 unemployment was 9%. So you’re telling me more people are defaulting today when UI is 3.5% vs when it was 9%? Sorry but that makes no sense. There’s something funky with this data.

Just Some Random Guy,

“What % of loans are subprime vs prime?”

21% of auto-loan originations in the first half of 2019 were subprime. That is lower than it was a couple of years ago. It went as high as 25% of originations.

“And also, it makes no sense that it bottomed out in 2011. In 2011 unemployment was 9%.”

Yes, it makes lots of sense. The unemployment rate peaked at the end of 2009 at 10%. Then it began dropping as companies began hiring. The low point in non-farm jobs was in Jan/Feb 2010, Delinquencies topped out because by that time, all the shaky loans had blown up. The mortgage crisis had bottomed out by that time too.

“So you’re telling me more people are defaulting today when UI is 3.5% vs when it was 9%? Sorry but that makes no sense. There’s something funky with this data.”

No, there is nothing funky with this data. All other data I reported on had similar trends. Subprime auto lending has gone way overboard. I have reported on this for a couple of years at least, maybe longer. And it just keeps getting worse.

There is something funky, however, with your inability to wrap your head around data that conflicts with your perma-bullish bias. That’s my guess :-]

The problem in subprime auto lending is GREED. If you’re not greedy, if you do it properly and you sell the guy a decent car with the average amount of profit, and you finance that car over five years at 6%, then the loan has a much better chance of making it than plowing $2,000 extra dealer profit into the front end, and $3,000 profit in F&I, to where the chap ends up with a 21% loan on a car he paid way too much for. That’s what kills subprime loans in good times (like now). In bad times, job losses kill subprime loans no matter how the loans is structured.

As my accounting teacher used to say, numbers don’t lie but people does.

Or as they say, bread today, hunger tomorrow.

What happened here was that GREED is horrible, GREED brings the worst in people, and if you combine GREED with stupidity you basically explain why Tesla is still in business.

Planning to buy a used 2018 Camry cash in another 18-24 months, I’m hoping this brings prices down.

Do some research on the tranny. Think ’17 had good 6 speed and ’18 has problematic 8 speed, same as ’19 RAV4 lots bad reviews.

@MB732

Thanks for the heads up. I wanted the redesign and CarPlay, but alas, the prior generation had a rock solid and tested Powertrain, probably capable of 300k without issue.

i hear it depends on your driving habits, and the hybrid has a different transmission than the 8 speed. I bet either are going to outlast a nissan or chrysler.

Wolf, a couple comments about greed.

1. It is easy and tempting to make that value judgement about others, but we cannot know their intentions and we often get it very wrong 2. We do not easily notice greed in ourselves, even though we are in an ideal position to observe our own intentions and motives.

People tend to focus their attention on #1 and little or no attention on #2. Stated another way, we ignore what can be known for sure and form error-prone beliefs on what cannot be known. Not the best recipe for decision making.

3. As you rightly point out, greed is ultimately self-defeating (“…that’s what kills subprime loans…”). The example you give seems realistic enough, but what is glossed over is that the borrower is in fact, subprime. There are reasons for that designation. That involves not honoring a previous contract for credit the borrower agreed to honor, which was quite possibly an act of past greed on the part of the borrower. If we are going to try to connect causes and effects, let’s make an attempt to not pick up the chain of events in the middle or at the end. The borrower’s greed could have easily been the root cause of why they were having to do business with a subprime lender to begin with.

Competition is a strong counterbalance to greed. As you also point out, there could be more favorable terms offered to the borrower by another lender. That is a market opportunity. A business seeking to enter into win-win contracts should expand their business to the detriment of the business seeking win-lose contracts.

You’re projecting on why a sub-prime borrower becomes “sub-prime”. There are plenty of reasons why someone can easily lose credit that isn’t attributed to greed. People get laid off and have medical emergencies. Medical debt is the number one reason people file for bankruptcy. I don’t think it is greedy to want to be alive and healthy.

With increases in student debt, housing and health care costs, the working-class has less room for ANY type of emergency or financial downturn.

GirlInOC,

Please reread point 1. I will not make value judgements about why a borrower is subprime.

21% of auto-loan originations in the first half of 2019 were subprime. That is lower than it was a couple of years ago. It went as high as 25% of originations.

___

Which is why a slight uptick in the default rate isn’t that big of a deal. Higher % of a lower number vs lower % of a higher number.

Of course there is greed. On what planet do you expect lenders to act like a charity? God forbid they make a profit!!

I’m not a perma-bull. I’m a bull presently, because there is nothing to indicate I shouldn’t be one. I’ve been told the big bad recession is coming for 3 years. Where is it already?

In a $20T economy, there will always be some negative economic news to highlight. But you need to look at the overall picture. It’s like a football team that’s 8-2 but you focus on the fact that their FG kicker can’t hit anything longer than 40 yards. Yeah, that could be a problem eventually, especially in the playoffs. But I’m not expecting them to go on a 6 game losing streak and miss the playoffs because of it either.

Santander is a Spanish bank I believe. In theory they could borrow almost limitlessly from ECB and make $$$ just for doing that, and lend almost limitlessly here in the US. We are all Super Ultra Dove Deluxes now by default.

There is no unlimited borrowing for Spanish banks. Despite the negative rates the Euro zone does have some controls to avoid another Greek like crisis.

60-Day Delinquencies Shoot Past Financial Crisis Peak

See there? You can still have a recession rolling through the real economy without having a financial crisis. And unless there is a financial crisis it will never be called a recession. Statistics can always be selected and gamed to show otherwise.

You have to admit, it’s quite an innovation, enriching the wealthy even as the general population gets thrown under the bus. All that was needed was to make financial bailouts continuous.

The 1930s were probably a real ball for the wealthy who were not dependent on the job market and had tons of money stashed away. It’s easy to find tons of stories from the bottom 90% but you don’t find much by the top 10% for whom it was probably a long party. They kept pretty quiet about it.

The dollars the rich had stashed away in 1932, when FDR was elected (the DNC plank swore allegience to maintaining the gold standard, BTW, in light of the havoc when England precipitously abandoned it in 1931*) said “payable demand for gold” (or silver), if not lost in bank failures (no FDIC) instantly lost value so when FDR declared gold ownership illegal and called in all the gold certificates (i.e., dollar $10 and up) immediately after taking office in 1933, the rich were anything but spared, as FDR increased the money supply 68% by re-valuing the U.S. gold reserves from $20 to $34/oz gold. At least they may have had fiat dollars which is more than many. The cruel suppression of the Bonus Marchers had as much as the actual financial crisis in kicking Hoover out of office. The difference today is that the expansion of the money supply is going into the banker’s and not the people’s pockets: the banks that own the Fed still get to charge cardholders 20-30% APR while paying virtually nothing to savers.

* cited by Louis Sullivan in his excellent Prelude to Panic, written in 1934 as the real cause of the wave of U.S. bank failures beginning in 1932: when word got out what happened in Britain, Americans started demanding bullion for their dollars, and the banks had just 40% gold reserves (Fractional Reserve Banking: the original sin of the first bankers, the goldsmiths- compare this to required reserves of under $10 fiat for every $100 on loan- and NIRP even threatens this.

You have a fundemental misunderstanding of where most people hold wealth, which is in private businesses, real estate or the stock market, none of which did well during the depression. It is obviously better to be wealthy than poor during such times, but they weren’t great times for people of means either.

True My great uncle was an MD on Long Island and bought up lots of prime real estate at a song during that era He was a greedy character who had very poor morals and wouldn’t think twice about taking the deed to your home if you couldn’t pay for his services Think Mr Potter My father was more of a George Bailey type of Dentist who forgave the debt of patients who couldn’t afford dental care

I salute people like your Father!!

Unamused, true, there is and has always been a rolling recession among some. And the general population has always been thrown under the bus. However, this is not new and not an innovation.

An innovation would be seeing the blame others game for what it is. It is throwing yourself under the bus. Those who play it find that it is circular and self-reinforcing.

“We found that depending on the company, between 30% to 70% of auto loans that default in the first six months have some misrepresentation in the original loan file or application.” To quote a recent American President on the subject of corporate and elite crimes: “Look forward, not back”

I think we can agree that we have established money for nothing. What I want to know is just where are the chicks for free. Not only are they not free, they’re still too damn expensive.

They’re still on MTV.

MTV was cool when Coke still contained cane sugar.

PS: my aunt would love the Dire Straits/Mark Knopfler banter. ;-)

A source indicated housing prices are falling in China.

Robert Shiller said there are bubbles everywhere.

High subprime auto loan delinquencies fit in with theories of an economic slowdown.

There will be fewer people in China from now fo eternity. China will loose about 10million people a year starting in 2040, so there will be a lot of empty homes and condos with no bodies to fill them. Unless of course China accepts immigration from India or Africa.

Watch Michael Pento on this Sunday’s USA Watchdog with Greg Hunter if you want a good review of what’s going on with the latest “ NOT QE” Repo madness

72 month financing on a $50,000 pickup and a $15,000 bass boat, both parked in front of a $5000 trailer…may not be a good idea?

Who knew? Black swan event.

Somebody has their priorities set correctly.

More like 15 year financing on a $60k tri-toon. At least thats what im seeing.

A Tri-toon might be big enough to carry the trailer and avoid lot fees.

when i was a trucker, all my co-workers seemed to have been sold lots of expensive stuff

Wolf: The solution is very simple! Since the “graft” trend is up (that is good) just re-label the “graft”! See problem solved!

P.S. Graft is Quebec’s favorite indoor sport!

Hi Wolf,

I was going to add to a CMBS thread but they were closed – another mall tenant event reported a few days ago:

“GameStop’s plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.” https://www.nationalmortgagenews.com/cmbs-news

drip, drip, drip

Mars,

Yes, CMBS overall are a much bigger issue than car loans. Even the Fed is worried about commercial real estate valuations and what happens when they deflate. The numbers are huge.

If there is no vetting of subprime loans that means they are immediately packaged and sold and then sold again? This would spread or mitigate risk would it not? But the issue would be that these high yield derivatives would be part of everyone’s pension funds as the funds are desperate for yield. So in the end we will own this risk whether we like it or not?

My brother has worked in a particular segment of software for the last 10 years and its been booming. I swear he jumps to another company for a big raise almost every year. Which segment is that? You guessed it, subprime auto loan software. Huge focus on apps now to make it even easier to get that Beemer at 21%.

Auto loans and Commercial Real Estate are both part of the Asset Backed Securities (ABS) collateral in the triparty Repo market.

It’s gotta be reused somewhere.

And into your pension fund, 401k, Federal Reserve, goes the debt securities.

Why do you rob banks, Mr. Sutton?

Yes, I’ve noticed that my 401K’s only cash proxy has a fair amount of non-investment grade debt in it. JPM of course. There is no cash or money market option.

If / when the value drops, they will claim it was unforeseeable. Open forum questions about this meet only silence. Considering changing jobs just to roll this out into an IRA.

if the marijuana boom is supposed to save the economy, i’ll be happy to try to keep up with consuming the supply

1) The average subprime interest rate are about equal to what Schwab

charges on margin, on midsize account.

2) Many used cars buyers are subprime buyers.

3) Used cars are junk to begin with. They don’t start in the morning, they need a new muffler, new set of tires, brakes…always need repairs.

4) Repetitive repairs and insurance cost are too high for the subprime buyers. Many subprime buyers are new immigrants without financial and driving records. For them owning a car is a matter of ego. You are nothing if u don’t have a car in America.

5) They cut losses, curb ego, stop paying, until the repo truck show up and pickup their car.

#3 is ridiculous, sorry. I’ve bought several two or three year old used vehicles at around half off their original sticker, driven them for five to six years, then sold them still working great when I wanted an upgrade. In almost all cases, all I have ever had to do was the wearable items.

Key is just to stick to Japanese or Korean cars. No American or German brands.

It’s not sorry, actually it works on a huge scale. People with some sort of technical skill (engineers or those who work in the automotive industry) can cherry pick cars that can be daily-driven even with 8-10+ years of use in them. But that doesn’t mean everybody can do that – and labeling cars by country of origin is certainly not how it works.

There are some categories that got more reliable compared to the past (mainly compacts and mid-sizes), but in general a 10+ year/200k+ mile car is usually not trustworthy enough to count on it for a living. And there are cars I wouldn’t count on even with just 2-3 years/40-60k in them (certain modern DI engined ones, including some Japanese models).

Prof,

Are you stuck in a time warp in 1981 or something?

Modern cars will last 100K miles without breaking a sweat. Take good care of them, ie preventative maintenance and 200K miles is doable as well, with minimal expense.

At 200K things start breaking down, because by then no matter how well taken car of, parts wear out and need to be replaced.

I’m not sure if DI was a thing back in 1981 – maybe in research labs.

But what you said doesn’t really contradicts what I wrote – although I would correct it that 100k is doable with good maintenance and 200k with heavy maitenance (certainly not with minimal expense if we compare it to the actual value of the vehicle). Anything beyond that is a gift.

But then again – it depends a lot on whether we are talking of an average car with average road use, and what average means for various people. But rental cars for example never make it to 200k, let alone 100k. I’m pretty sure rental companies would keep them if they could still get money out of them (they are big penny pinchers, so I’d trust them on this one).

Sc7 If you’re lucky that’s true Unfortunately my luck ran out buying used junk long ago And what’s wrong with German cars anyway?

1) They are generally not as reliable as Japanese cars.

2) They are much, much more expensive to fix when anything goes wrong.

That’s what I hear, anyway. I’ve never owned a German car. Come to think of it, I’ve never owned any car that was not Japanese, and that’s going all the way back to 1990, when I bought my first car (a 1979 Toyota Celica Supra).

I did once own a British motorcycle though (Triumph). It leaked oil.

There is a site that purports to have repair data from thousands of auto shops, including the average frequency and average cost of repairs, which I took the liberty of analyzing.

If their data are accurate, then European-branded cars in general are substantially less reliable than US-branded vehicles, which are themselves substantially less reliable than Japanese brands. The Koreans fared the best of all.

Michael Engel You forgot “trash the property” in No 5

The last stop of a junk car, – day one out of sixty, before

delinquency start – is the day the car need inspection.

Mechanics feast on subprime buyers, leave crumbs.

Many nightmares are settle with a little off the table friendly bribery, so the car can run until next year.

For Random,

My tenant has an F-150 pushing 500K on the odometer. I drove it awhile ago and it felt new and tight as a drum due to regular maintenance, etc. Modern vehicles easily attain 250K miles and will burn no oil along the way.

Wolf.. Good data re subprime. For some strange reason thought of the classic car movie “Used Cars”… I agree CMBS are a far bigger problem.

The risk of default is largely held by the dealer for the first year. Many subprime lenders don’t even begin to pay the dealer for the loan until after then. That’s the reason for a large down payment. If lenders are getting hit then dealers really are. Also, after a year of ownership car is probably junk as subprime buyers are not noted for their car upkeep zeal.

Credit card delinquencies at 7 yr high – Marketwatch.

Greetings Wolf,

We operate one of the largest repossession companies in our region. My partner received a phone call from the regional Bank manager last Monday and told him we better get ready. The manager said as a 14 year veteren he has never seen this many delinquencies, time to go get them. Also, more bad news for our area, we have a large employer who build sliders for semi trailers (this is the mechanism underneath the trailers that allows them to slide the rear axles for weight distribution.) They just had a huge layoff and more coming in two weeks. I believe you reported on this recently via Freightiner layoffs, or did I read this somewhere else? I could talk for hours on what I am seeing in our local area, sorry, none of it good. Thanks, I appreciate your work.

M. Everett,

Thanks for the update. Keep us informed about what you see on the ground. Yes, I reported on the Freightliner and Navistar (medium duty trucks) layoffs.

Here in the (near) SF Bay Area, the airwaves are saturated with ads for “Paul Blanco’s Good Car Company” (oh, how far Jerry Rice has fallen). I’ve often wondered who’s backing these obviously sub-prime auto loans; wonder if Santander is in on the fix?

Wolf has spoken previously of “Tote-the Note” dealerships, and I have memories of them from when I lived in San Diego and Ft Lauderdale, albeit I never bought anything from them.

A “Tote-the-Note” dealership has a key difference from ordinary dealerships: instead of acting as the middleman between the customer and the lender (be it an ordinary bank, a shadow bank or whatever) the dealer will finance the vehicle himself.

These days “Tote-the-Note” dealerships blur the line with traditional used car dealerships because they often operate on a mixed model: they may use one or more shadow bank outfits but also do part of the financing themselves. These shadow banks may be legitimate credit intermediaries specialized in high risk endeavors or just fronts used by ordinary financial companies to get a cut of the high yield market.

Please note that most “Tote-the-Note” dealerships have long targeted not so much honest people facing a momentary financial crisis but those with a bad credit rating because they live far beyond their means: back in Ft Lauderdale I remember knowing this chap who bought a huge Lincoln from a “Tote-a-Note” dealership at what I can only call a much inflated price. The damn thing cost him a fortune in repairs in six months, including a transmission replacement. Of course he could have had a used Honda Civic in good shape for less money but he hated the idea of driving “such a small Japanese car”.

You can’t push this economy over with a few deadbeat car buyers. The Fed has implied authority to buy those cars! When they place their balance sheet assets (fleet) on the banks reserves we will see an improvement in collateral value, marked to market MSRP of course and better than any impaired Treasury paper. A car is worth something now, a ten year bond in ten years is worth what? This is Bob Prechter’s notion of payment in kind. He always envisioned private investors being paid in goods or services for the bad paper they held. Skip a step and no one is complaining. The secret is to keep those cars from entering the economy and driving down the price of new cars.

Glad to see we have at least one optimist on this thread Even if I do believe it’s delusional thinking personally

Some Guy said once, “that which can’t go on, won’t go on”.

Apropos I guess.

\\\

With all the numbers intact, and the economy fakegrowig, means that the economic gains made in the recent 10 years are not reaching at all a significant part of the population. And I am not talkig about “reduced”, I am talking about “zero”. I thought it looked bad, but not this bad.

\\\

One point I haven’t seen made here is that modern cars are MUCH easier to repossess.

Why? Keycodes from the VIN you mean? What about transponders? Pretty standard in modern cars. Requires an experienced technician to program at the vehicle through the obd2 port … and takes time and expensive equipment.

You might be right for some reason I’m not aware of, like towing or OnStar or GPS tracking. But one thing is certain; modern cars are waaaaaay harder to steal.

I got a kick listening to a NY politician giving accolades to the police chief and mayor for the huge drop in auto theft in early 2000s. That was ALL due to transponder technology.

You mean to tell me the Carl thieves haven’t figured out a way to disable the transponders yet Hard to imagine They are usually very creative in their trade

I still don’t know why the police haven’t figured this out. While not all cars have remote shutoff they could certainly stop the ones which do, and if you have this feature and someone steals your car no problem. It might be the police don’t want the public watching them control drivers remotely, after the repeal, you would have thought red light cameras were the second coming of Geo Orwell. So car thieves might figure this out first, makes car jacking a lot easier.

No they are programmed by the dealer to shut off if you don’t make the payment…

figures

Here in parts of Europe, and presumably in the US, if an owner falls behind on payments, the finance company’s agents can immobilise the car so he/she can’t use it, and use tracking to repossess it.

Off topic a bit, but, recalling your article on PG&E, might better maintenance and higher investment have reduced the outages in CA associated with wildfire risk?

Just found this, guess it answers my question:

“The company is already seeking bankruptcy protection as it faces lawsuits over last year’s Camp Fire, which killed 85 people. The deadliest wildfire in the state’s history was sparked by ageing equipment owned by PG&E. It spawned billions of dollars in liability claims against the company.”

Last paragraph starts out this way: “It’s quick these days to repo a car and sell it at a wholesale auction.”

I’m curious regarding how the cash for clunkers program is affecting the current subprime autoloans scene.

The cash for clunkers program did probably remove a lot of cheap ( but technically simple and easily DIY maintained ) veichles from the used car markets, so one would suppose that due to this people end up with cars that are quite more complex and needing more expensive mainteinace to keep them running.

If you have to use subprime financing to aquire a veichle, can you the afford to keep it running ? It would be interesting to know the percentage of such auto deals that run sour because the buyer can’t afford neither maintenance nor the financing …

C4C helped the current market. It replaced 1999 and older cars with 2009 models.

Those 2009 models are now on the U Pay Here lots. Without C4C, there would be less 2009 models available.

I think it’s also important to remember that one of the ways Americans have used to cope with the ever-rising cost of vehicles is to lease them. The percentage of vehicles being leased (vs. bought) since 2009 has nearly doubled and now makes about about a third of all new auto sales.

I suspect this may be making the numbers in the article look somewhat better than they can otherwise be interpreted from a historical comparison perspective as people are less likely to default due to lease payments being generally lower than loan payments. In the long-term of course leasing has a major disadvantage – the fact that one doesn’t build equity in the vehicle. Like everything in the economy nowadays though, this too is reflective of the overall increase in leverage and leasing may be the ultimate example… in a lease there is no reserve built-in. The end user owns none of the asset at any point during the asset’s usage.

I worked in design engineering and got exposed to life testing. From what I recall there is usually a great variation in life of a manufactured product. To relate it to automobiles after you get over the initial spike of new product issues your final test failure may be 2 to 5 times your last first test failue. That’s under identical test conditions.

Another thought is life is usually exponential to load conditions such as speed and heat. Think of tires. Race car gets 100 – 200 miles out of them under harsh conditions.

Third thought is design life. Not sure what it is now, but I think 20 years ago design life of exterior finish on a car was 11 years and power train was 150,000 miles.

I’m not sure what the problem is. Just as the S&P can continue up forever, fundamentals be damned, so can junk bonds.

The Fed has alreadey bailed out this industry in the market’s collective mind, so why bother to sell or shun its debt?

Pre-emptive bail-out is the concept, and it tells me the more risky an area is, the more likely the Fed will be to support it, and the more likely I will be able to make money. That’s what they do in Europe with junk debt, and that’s what they’ll do here.

Anyone who understands the above logic and embraces it will become very wealthy. It really helps to be in your twenties when imvesting today, and to have experienced nothing else but the new paradigm.

Gold alchemy, retreaded.

I have been reading here, since the beginning of this year, of various stories,that one is in default, sales of those are going down plus plus. Mean while indexes keep going up and up & are at record levels!

I have quit making sense of what I read in various ‘informed’ blogs quoting facts out there and the reality managed by perception narrative of the Wall St and the Fed!

A surreal mkt unlike any in my life time, where investment matrix learned before ’09 are up side down! Been in the mkt since ’82 and now retired, happily with conservative approach to my portfolio! A collective cognitive dissonance ruling the Financial world!

Whatever coming down(!?) , down the pike, it looks justified already, in my mind!