And so far, so good.

The Fed and other central banks have done an endlessly mind-boggling job in killing off any notion of risk – and therefore the pricing of risk – in the bond market, which just veers from curious to curiouser. All kinds of entities, metrics, bond-market watchers, and credit fretters have been warning about the pileup of corporate debt and record corporate leverage.

This is especially the case at the high-yield or “junk” end of the spectrum where cash flows tend to be negative, and where this leverage poses real credit risks. But no problem.

Every time another warning goes out, sure enough the bond gurus at Goldman Sachs and other investment banks that make a killing in fees off underwriting these bonds, and that have to sell these bonds to their clients, come out and soothe our jangled nerves. Don’t worry, be happy, they say; ignore the risks, this is a buying opportunity because this time it’s different.

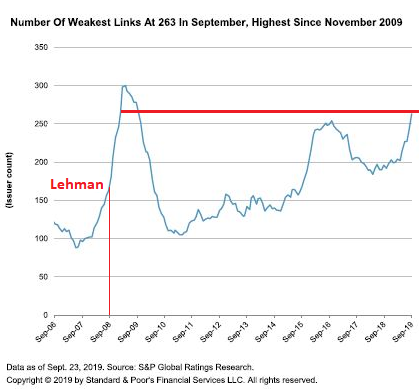

So here we go again. S&P Global Market Intelligence came out with some hair-raising metrics and warnings: “The number of ‘weakest links’ among debt issuers jumped to 263 in September, from 243 in August, marking the highest level since November 2009, when the global speculative-grade default rate was at a record high 10.5% amid the financial crisis.”

The number of “weakest links,” in normal times, would be a key metric. Their default rate is “nearly eight times greater” than that of the broader junk-bond market, S&P says. It defines “weakest links” as companies with a credit rating of “B-” or below, and with negative outlook or whose ratings are on CreditWatch with negative implications, meaning a possible downgrade.

B- is six notches into junk. One step below is “CCC+” which is deep junk, with a substantial risk of default. Two steps further down is CCC-, meaning a default is imminent (here is my plain-English cheat-sheet of corporate credit ratings by S&P, Moody’s, and Fitch).

“The rise in the weakest links tally may signify higher default rates ahead,” Sudeep Kesh, head of S&P Global Credit Markets Research, explained.

The number of weakest links is not at quite the same level as during the peak of the Financial Crisis, but getting nerve-wrackingly close, and is substantially higher than it had been during America’s Lehman Moment in September 2008 (chart via S&P Global Market Intelligence, red marks added):

The hump around 2016 is when credit began to freeze up for the energy sector amid numerous bankruptcies of oil-and-gas companies and coal miners, with fears of contagion spilling over into other sectors.

Five sectors account for 147 weakest links, or 56% of all weakest links (263):

- Consumer products: 52

- Oil and gas: 28

- Media & entertainment: 27

- Retail and restaurants: 22

- Health care: 18

OK, but a couple of days ago, the Wall Street Journal raked the ratings agencies over the coals for being too lenient with companies by not down-grading them when leverage ratios rise beyond a given point. This over-the-coal raking was about the lower end of investment-grade where a one-step or a two-step down grade could reduce those bonds to junk.

“It’s pretty eye-popping if you’ve been doing this for 20-plus years, to see how much more leverage a number of these companies can incur with the same credit rating,” Greg Haendel, a portfolio manager at Tortoise overseeing about $1 billion in corporate bonds, told the WSJ. “There’s definitely some ratings inflation.”

And so the WSJ – falling in line with all the other worry-warts, fretters, and warners about the corporate debt pile-up and record leverage – continued:

Years of rock-bottom interest rates have fueled a boom in borrowing, driving debt owed by U.S. companies excluding banks and other financial institutions to nearly $10 trillion – up about 60% from precrisis levels.

Leverage – how much debt a company owes relative to its earnings – hit a high in the second quarter of this year, according to JPMorgan Chase & Co. data on investment-grade bonds going back to 2004, which also excludes financial companies.

And the “ratings inflation” is likely impacting not only investment-grade bonds, as the WSJ pointed out, but also junk bonds, and the “weakest links.” In other words, reality, which already looks very sobering according to S&P, could look even more sobering. But no problem, not in this bond market where investors are convinced that the Fed has abolished risk and thrown the pricing of risk out the window.

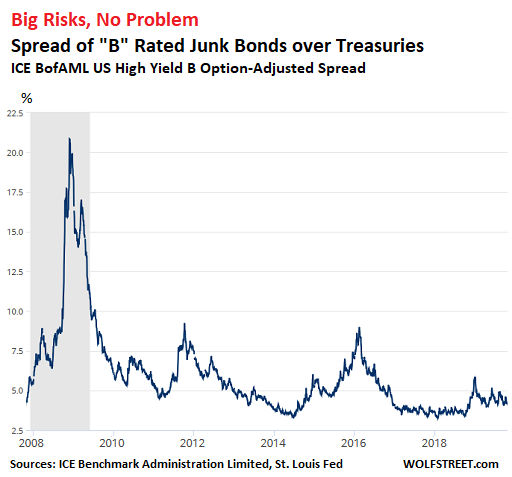

Investors in average B-rated junk bonds currently demand a credit-risk premium of only 4.17 percentage points above the equivalent US Treasury yield, according to the Option-Adjusted Spread of the ICE BofAML US Corporate B Index.

This is less than half the credit-risk premium investors demanded during the 2016 energy-bond credit-freeze (9 percentage points), though there were fewer “weakest links,” and it’s just a fraction of the risk premium investors demanded during the Financial Crisis which exceeded 20 percentage points in November 2008 after the Lehman Moment, and when there were about as many weakest links (chart via St. Louis Fed):

And so now we hear all the reasons why it’s different this time, why the “weakest links” suddenly don’t matter, given the wild yield-chasing these days, why low interest rates have reduced credit risk per-se. We hear that investors don’t have a choice if they want to beat inflation and make a little profit on top of it, and why they have to risk the farm to do so, and why it’s OK that investors are not being compensated for taking these risks.

And so far, so good. If a cashflow-negative company can continue to issue new debt because it has concocted a story that investors want to believe in, engulfed in an environment where central banks have abolished risks, then it can borrow new funds to pay off old investors, no matter what its cashflow is. And as long as the old investors have new yield-chasing investors coming in behind them, there is no problem. The problem arises when new investors wake up and refuse.

How cash-burn machines power the real economy, and what happens to the economy when investors refuse to have more of their cash burned. Read… Here’s What I’m Worried About with the Everything Bubble

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Not a single junk bond was issued last December. Should I laugh or cry?

Not sure what the politically correct thing to do.

Re: the WSJ piece. At least if a guy is told the outfit is junk and decides to pick up nickels in front of the steam roller anyway, that’s his call.

But who would suspect that a slew of very solid sounding names like Kraft and Campbell Soup are BBB, just one notch above junk? And who would would suspect that 60 % of investment grade( not junk) bonds are just one notch over junk?

The WSJ pretty much says that a lot of this BBB stuff is actually junk but the ratings agencies are scared to offend the source of their income ( the companies pay to be rated)

So we inhabit a junk universe!

Nick Kelly:

When “insanity” appears to become the “norm” then, “….Huston, we have a problem!”

Hi Wolf,

Thanks for your work! That “263” graph is scary. Every econ course I sat through (both of them) brought your title theme up so I googled.

loosened regulation, credit defaults, contagion, etc.

https://www.economist.com/media/pdf/this-time-is-different-reinhart-e.pdf

From that PDF:

“Inflation rates in Germany, Greece and Hungary in the mid-20th century ran so high that expressing them requires scientific notation (9.63E + 26 denotes Hungary’s annual inflation in 1946, meaning that the decimal point lies 26 spaces to the right).”

Pretty impressive. I don’t know if the US is exceptional enough to ever match that.

In your next to the last paragraph about cash flow-negative companies, aren’t you pretty much describing a classical Ponzi scheme? So isn’t it more or less just a question of time? I mean, the basis of the Ponzi scam is selling low risk investment.

But I also think they are not selling that it is “different this time”. I think they are selling that it is the “same as last time” in that if anything starts to go south the Fed will bail everybody out. (Perhaps by increasing their repo funding?)

Ponzi schemes always end but this one goes on (and on… and on… and on….) because the central banks are enabling each and every one of them with easy, free money.

If the Fed had backed Bernie then he would not have been found out and he’d still be living large.

I am pretty sure Bernie was laundering donations to AIPAC. It’s always the dog that didn’t bark.

One thing that actually is different this time is you don’t have AIG cranking out CDS with no idea of how they would pay them.

I’ve been saying this to whoever will listen for the past 12 years, that the Fed has made it so that there is the view by everyone, on every asset class that there is NO RISK in any of it. There are no longer any measures or indicators that are of any use, where someone would say, yes that is risky, and the asset re-values accordingly. No, they just keep getting more inflated. That is the essence of the very problem with zero interest rates, AND, QE, when both work together, it turns everyone’s brain to mush, and it eliminates all ability for anyone to properly assess risk. That is WHY, when people ask, something as powerful as the Fed funds rate, for the US dollar, being the worlds primary reserve currency MUST be very near 5%. Today. Now. Not tomorrow, not next year. There isn’t a soul on the planet, other than perhaps you Wolf, that is publicly taking a position and stating emphatically that all asset classes are incredibly mis priced, precisely because there is no longer any truthful measure that has any teeth, where risk is assessed appropriately, and the ‘asset’ (item, company, whatever) is properly marked to market, and valued. To put it in laymans terms, the dollar is basically trash, and every asset valued in USD’s, is also trash, except for the blind and willful and highly subjective opinion given by players who have too much of other peoples money under their control, with NO RISK to themselves personally for making a ‘mistake’ on assessing said risk.

when the bottom starts to fall out of everything, and no one apparently is willing to have the guts to envision this, it will fall so far and for so long, that items like Tesla’s, and Lambo’s, will be sitting on the sides of rural roads, like so much trash tossed on those same roads now, and bikes and the tiniest of ‘transport’ vehicles (or animals even) will be in demand like $20,000 per ounce gold. Entire city blocks of 30, 40, 50 story commercial buildings, will be nearly vacant in cities like Chicago, NY, LA, Atlanta, and hundreds of thousands of 5000 SF to 30,000 SF mansions in suburbs across the US will be literally abandoned and/or boarded up. 70% of every strip mall will be abandoned, and regular large malls shuttered completely. 50% of US power plants will be idled, and entire cities will have no lights at night. Semi Trucks will be repo’d, and there will be scenes of trucks captured like all the airliners that were taken out of service after 9/11, and parked in the desert, except these trucks will be parked anywhere and everywhere, never to return to service again. 80% of most distribution centers will be entirely vacant. People will ACTUALLY be fleeing this country (many on foot, and maybe the formerly ‘rich’ by air or sea) like there is no tomorrow. Encampments will form in places no one would ever expect. very few subdivisions will be safe or even stay in tact. anyone in the military, abroad will have to drop their uniforms, and somehow find somewhere to live. No gas stations. No walgreens. No meds. All but dried up. It will make what occurred in the 1930’s seem like a sunny walk in the park with ice cream sundaes.

The hair on the back of my neck stood up, while reading your words.

A glimpse of the possible future clearly revealed. Well done, unfortunately.

Welcome. Make yourself at home. You are in the right place. Now sit down and have a Valium sandwich. Everything is going to be just fine.

And you can talk yourself off that ledge my friend by taking solace in knowing that there is over $100 trillion around the world sitting idly in money market funds with bugger all else to do.

akiddy111,

Everything in the money market is invested in something, and to get cash from the money market into the stock market, you have to sell something to someone to free up that cash and take it over to the stock market. Meanwhile the entity you sold this something to had to bring cash in to buy it, and the person you bought the stock from gets your cash to take it out of the stock market or do something else with it. For each buyer there must a seller, and the amounts match. There is no such thing as cash sitting on the sidelines. It’s a myth. The only thing that changes is selling pressure and buying pressure and prices.

Apologies. I should not have said money markets. I should say the total global net worth of individuals .

This total global individual net worth has grown substantially since i started a humble individual brokerage account with a discount broker called Scottsdale Securities in Seattle in 1996, just months before Alan Greenspan had said equity valuations were frothy.

In the USA alone there is housing net worth of over $25 trillion. Blackrock has AUM of almost $8 trillion, Vanguard $6 trillion, Fidelity $2.5 trillion, your Schwab folks have $3.25T, etc. etc…

Almost $45 trillion in net worth. And this is just mostly belonging to people in the USA !

People are enjoying net wealth that is far, far higher than when i opened my meager online account 23 years ago in a cold and frothy autumn day in nineteen hundred and ninety six.

It’s all good. By the way, where is SoCal Jim? Was he ridiculed off the stage ? I liked his optimistic opinions.

But Wolf, what about the cash under my mattress? And the coins in my piggy bank? :)

Seriously, though, isn’t ‘money market’ just another way of saying Treasuries, commercial paper, and the like?

Wolf,

Are you sure that all dollars in the money market are invested? That there aren’t idle dollars just sitting? Are there no reserve requirements for money market accounts?

(You are much appreciated.)

The “money market” is like the “stock market.” Every dollar in those markets is in form of some kind of security. In the money market, the securities are short-term securities that corporations and government entities issue (they’re borrowers in the money market), and that investors buy (they’re lenders to the money market).

Even the “cash balance” in a mutual fund isn’t “cash” but cash equivalent, such as very short-term and liquid securities of the type that are traded in the money market.

There is un-invested cash elsewhere: actual paper dollars stuffed in wallets and under mattresses and bank reserves.

The ones who coined that term – money in the sidelines- need to see the size of the repo wholesale money market. You’d never think of it again as a sideline.

A few years back some analysts at my broker were predicting the time would come when investors would borrow money to invest in MM accounts. I keep trying to figure out the implications, the MM account has FDIC, is linked to my portfolio line of credit. Do I have FDIC on my stocks?

Sounds like Utopia! I hope your right!

Mike R. You don’t mention what will be the inevitable result of the nightmare scenario you describe (it’s death & destruction on a vast scale, so I won’t mention it either..)

Back in 1981 I had a sort of..not a vision..but more of strong sense & certainty of where things were heading. Close friends/family tried not to laugh in my face, not always successfully..so I gave up long ago.

And of course, they were right. Good times rolled. Until now. Now almost all sensible & thinking people realise we’re right at the cliff edge, the ground under our feet is crumbling, and there’s no way back. We truly have burnt our bridges. Human greed & selfishness has done its work. Not just the bankers & money movers & shakers; I look in the mirror.

Many of you will have read “The Fourth Turning’ a decade or so ago; well, that’s where we are now, on the cusp of massive change and it will test humanity to its limits. All part of a bigger plan – but no fun to unwilling participants.

You reference gold at $20,000 and that will happen, at some stage. But my feeling is that gold is about to raise its middle finger and drop precipitously – just to shake out the last ‘true believers’. If we’re to have earth shattering events, why should a few gold bugs escape? Bloody smart a***s..

If gold raises the middle finger it won’t be for long and will be a wonderful buying opportunity. The problem with gold is confiscation.

The problem with confiscation, gold or guns: Confiscator has to find them – by the millions!

Confiscation Lead will prevent that from occurring with the people I know that own gold anyway Or maybe just buy silver as it’s too heavy for TPTB to cart away easily

When all this debt finally implodes and we see defaults and bankruptcies everywhere there will be few dollars to be had. Interest rates will go up as risk is not not only recognized but fear of risk will go beyond the mean in the other direction. People will hoard what little cash they have.. Just look back to the last real depression we had in the country.. When all this happens, gold should go down in price along with all other assets as there will be fewer dollars to buy anything with.

What makes you believe gold would go to $20,000? Have I got my logic contorted or what am I missing?

If the sustained response to a deflationary outlook is money printing and fiscal deficits, which accidentally lead to high inflation, gold could hit a very high price level somewhere along the line.

Some gold in your portfolio is a good thing in my opinion.

You’re correct. Cash will be King and that’s why in many places cash is under attack with draconian laws against cash purchases over a certain quite low limit – all to ‘counter the evils of terrorism & drug runners’ .. while the real terrorists rule countries of the left & of the right – those who rule are not always in government.

What’s coming up looks to be massive deflation as the system begins to implode and yes, in that case gold will fall in price not just because people won’t buy, but as gold holders unload to free up cash to pay off debt.

It’s the next stage that gold will ‘shine’ – but for all the wrong reasons. Think collapse of government & rule of law and a rise in anarchy. The ripples have already begun: France; HK; Venezuela; Barcelona; Chile. Have I missed a few? Let’s see how Brexit turns out. My fond memories of London and Maggie may soon be all that’s left.. Brexit could take the ripple to a wave to a tsunami. Or not.

The World is polarised, left & right, rich & poor, black & white and it’s irreversible. It’s no accident, some people/groups just have evil designs, but will eventually pay the price, now or later (I’m pretty sure..alright hopeful..)

So it’s when chaos reigns, when the center does not hold, that gold will be at $20,000 – but will life be worth living?

And how many, in times of turmoil, will have the steadiness & resolve (I’m talking ‘relatively ‘ ordinary folk here, not the super rich) to buy at say, sub $1100 and sell at or near the top; how many will get the timing right? Not me. Forty years ago when I was young & naive, my mentor, an ex- Wall Street Broker/Banker who started life at 15 as a chalky, explained in some depth how it all worked and left me to figure out what to do and when. Not a word of advise, just explanations and facts. My actions were pretty much correct, just 40 years too early.. No regrets, it’s all been good and wouldn’t change a thing. Except… Oh never mind..

(I enjoy ranting to myself, therapeutic…thanks Wolf Man.

BTW sterling job. I note you’ve relaxed some of your rules and that’s sensible. Very difficult to hold a blog strictly to economics, simply because of the over-lap of politics and more. And some/many exchanges between posters can be entertaining & informative and good to see you let some run…with the deleted ‘reply’ as a hint.

I read somewhere that ZH makes in the millions simply because of the sheer volume of views or clicks.. beyond my limited understanding of things technical…but if that’s where you want to go, I’ll be interested to observe how you manage it.

whilst maintaining control and economic/blog integrity. Quite sure you can..

Ah! The drinks trolley, at last!

The only way for the U.S. stock market to go higher is the total destruction of the U.S. dollar as the major stock market indexes are about 100 years in the future today. That would push gold into the stratosphere and all the stupid money in stocks would flow into gold.

My devil’s advocate contention is that dollars will not disappear. When debt implodes (defaults), it results in a lender losing a receivable. The lender’s net worth is diminished, but the dollars the lender lent are still in the system.

You are pretty much correct about the outcome but consider this.

If you were running a central bank or if you were a member of the elite (i.e. mega wealthy with influence), it is absolutely obvious that the actions that are being taken will end badly.

I am in contact on a regular basis with senior level finance people and every single one of them is just waiting for the next shoe to drop knowing full well that the next iteration of this will be cataclysmic.

I know of a number of these high fliers who are bucket listing in a major way because they understand it’s kinda now or never to take that Antarctic cruise.

They know what those in command are doing is going to end very very badly.

So if they know, and many of us know, then surely those pulling the levers know.

So why, if you already have all the power and all the money do you burn down your house?

What is it you are fighting that is so bad that it warrants such ‘insane’ policies? What is it they FEAR so much that they are willing to do anything to try to keep inflating the bubble?

Socialism.

How soon we forget!! People today can’t fathom what happened less a hundred years ago. Maybe just give a thought on what you could do if you woke up one day with the utilities offline, the stores and banks are shut down and you have just a debit card in your pocket.

Isn’t that a few places in California today?

For my Polish relatives, the end of the line was a place called Belzec where they were gassed in the fall of 1942. Any time I think of how bad things might get in the US, I remind myself of how bad things got for my oldest second cousin. He was among those relatives who were gassed 77 years ago at the age of 15!

“Already computers are more powerful than humans in some cases … Technology is just another means of evolution. We are changing the definition of what it is to be human.”

– roboticist Hiroshi Ishiguro

I think back to the time nearly fifty years ago, in a young married couple’s church group, saying I believe the next stage in human evolution would be a physiological discontinuity, where humankind would proceed as non-organic entities.

I remember joking “Pass the screwdriver, Honey, Let’s make a baby”.

So, The problems associated with organic embodiment may be transcended.

But not to worry: The tin men will be killing each other, same as the organic men did.

RD Blakeslee:

“……. where humankind would proceed as non-organic entities.”

Wow! Another believer!

I totally believe that if “humans” are to escape this crust of dirt hurtling thru space to who the heck knows to where”…..that we must “evolve” into something besides “human”. It reduces all the “burdens” of most space travel, food, waste, etc…….to just “…get the hell out of here!”

Well done!

We are the Borg……!

Or, We are Beyond the Borg!

Why would any asset be left idle? That makes no sense to me.

Today’s problem of overpricing will eventually be solved by lowered prices. In a deflation scenario, ownership of assets would transfer from leveraged weak hands to financially strong hands, at much lower prices. Some assets may be mothballed, but the majority of assets would be utilized to provide huge financial benefits for their new owners.

The intrinsic value of an asset and it’s pricing in fiat currency are two very different things. The intrinsic value never changes. The fiat currency inflates and deflates based on the whims of central bankers.

It’s not the hard assets that will be left idle. It’s the currencies and related financial assets that are at risk of being shunned.

Regarding the “Mad Max” scenario, why would this extreme happen? Since wealth at its core is just the function of mixing labor with resources, why would a recognition and adjustment of a corrupted financial system result in such a dire situation as you describe? Resources, labor and productive power do not disappear.

I would be curious and appreciative to see your sequence of events, cause and effect, that would place us in such a condition.

Courtesy of Northman on twitter:

First repos were temporary.

Then they became permeant at $75B

Then they announced $60B per month Treasury bill buying

And now they raise o/n repos to $120B.

All this in 4 weeks.

—-

Me: I’m getting more worried than my normal worried self. There’s something going on that they’re just not telling us. These are not the actions of a healthy economy / market. Makes me think that there’s already something blowing up that we just don’t know about yet.

Most the repos this month have been undersubscribed. For example, the overnight repo this morning (will unwind Th a.m.) was for $49 billion. So why did they raise the limit to $120 billion? Because they worry of bigger things to come, but for now there is no need to raise the limit.

Raising the repo rate could also be a response to the considerable pressure to reduce the fed funds rate.

It’s very possible that Powell doesn’t plan to reduce rates further unless a crisis forms – and that raising the repo limit is a way of assuring others that he is being cautious.

I admit I thought he’d cave by now and I bought TLT at $144 just to have it stopped out a week or so later at $139. I chose a level comfortably below resistance in case I was wrong. Part of the reason for the drop was that the Powell “QE” is only at very short duration – probably because he wanted the yield curve to un-invert and steepen.

It’s kind of funny that even though I lost a bit on that bet, I actually agree with their actions on keeping rates steady.

We just had the largest accepted O/N Repo this 8:45am. $89.154b

Term Repo rate was again lower than overnight rate.

Weighted Ave. is only 1.747%. Stop out at 1.73%.

This is below the lower limit of the target Fed Funds rate.

The other blog I was reading today said that the overnight repos were undersubscribed, but that they raised the flow rate on the spigot anyways. But the 14-day repos were oversubscribed (by about 1/3rd IIRC.)

So, there’s money available for the people who can pay back tomorrow. But, there are too many people who say they can’t afford to pay you back tomorrow but please give us 2 weeks to pay you back.

I don’t find that comforting.

big trouble in the credit market more and more apparent

It is a signal that something is seriously wrong

The New York Fed announced it is increasing its temporary overnight repo operations to AT LEAST 120 billion a day from the current 75 billion In addition to the repo increase term repo operations are rising to AT LEAST 45 billion from 35 billion

My comment is that price discovery of debt will bring about a gigantic crash. You saw this instability in the repo market last month. As soon as debt is offered at market, the value of the debt collapses. When the air is let out of the debt balloon, everything goes bust and hyperinflation ensues when debt needs to be converted to cash to cover the loss of collateral valuation. The fed is the repo market. No one else can print the money to feed debt valuation collapse.

I am reminded of the lyrics of the 60s song, Ha Ha Hee Hee, they are going to take [us] away, Ha Ha.

“The problem arises when new investors wake up and refuse.” – what if FED and other CBs starts buying this debt forever? Eventually all fiats will collapse but it can go for while.

It’s always different, until it’s not.

“[A] crash is coming, and it may be terrific. …. The vicious circle will get in full swing and the result will be a serious business depression. There may be a stampede for selling which will exceed anything that the Stock Exchange has ever witnessed. Wise are those investors who now get out of debt.”

Roger Babson Sept 1929

If the overnight lending process needs Fed help that would indicate that strong banks are refusing to extend loans to weak banks. Is that refusal based upon a risk assessment? Or is JPM, et al, playing games with the Fed, forcing them to give money to weak banks.

“This is not, I repeat, this is not quantitative easing”. Really? Then what is it?

Something about this repo action doesn’t pass the smell test.

If they simply allow a real market on interest then it will flow to its natural supply and demand level. But what we are seeing today in repo is a manufactured rate. The Fed has been pouring billions in both overnight and term repos to get what it wants. The added T bill purchases over the regular SOMA add-on longer term note and bond repurchases to increase the level of bank reserves, now around $1.5 trillion.

Who knows where this economic experiment will get us? Not manufactured prosperity.

Given who’s in charge, it will likely end up with a few oligarchs who get even richer.

Every time it is different and every time it ends the same

The corporate debt/GDP ratio is the highest since the start of the last financial crisis.

The median age of a US citizen has risen since 1960. The number of people over the age of 65 is growing.

Mining technology increased as the average grade of copper ore decreased. One mine uses self driving trucks.

New battery technology allows for wholesale storage of solar generated electricity.

I am always reminded of the video clip of GW testifying for TARP help, “This sucker could go down”. No fears, look at the current level of world wide stable leadership. Ouch.

Scary article. As a ‘no debt’ person for most of my life I’m not too worried about our personal situation, but for sure there is a mess on the horizon. I mentioned last week our own family disconnect about the economy. My American sister and family think the Market represents a ‘booming’ economy, and that all is well and really humming along. We left our discussions at that, an agreement to disagree.

But hey, our political leaders bring such comfort. And knowing our rich economic leaders have most likely already squirreled their riches away somewhere, what can possibly go wrong? Enjoy the days. Skol.

Yes, it’s booming with debt alright. When you have college kids graduating with gigantic student debt with very little hope and means to pay for it, you have to believe that something is very wrong. Where is the hope?

If you take a snap shot the US is doing pretty good right now, but really that doesn’t mean much. What you have to do is compare where the economy is at from the same point in the business cycle preferably both peak to peak and trough to trough. From that point of view we aren’t doing so good.

I will give President Trump credit that he has tried to make a more favorable business climate in the US. Confronting China is a drag on economy, but that is chiefly a national security issue and that relationship needed to be changed to no longer give China a developing nation pass.

$34k median, $17k mean is gigantic? That’s a fully loaded Camry or Corolla, respectively. For a lifetime earnings increase of $1mm, I don’t see this as the problem.

I have no idea where you are from. But here in the Tri-State NY/NJ/CT area, we have student debts easily in the $150k area.

I don’t bother to read national numbers, since they are meaningless to me. My new daughter-in-law had that big a loan because she was an NYU grad.

The model in my mind is political. It’s pretty easy to grow the economy using debt. As long as systemic leverage is allowed to grow from 1 × GDP to 3.5 GDP our masters are comfortable. Somewhere around 4 × GDP evidently is the ultimate limit where growth is no longer possible.

Then the solution has to be a relatively quick reset. Economists like the sneak over the weekend reset as they can say it’s over and we will never do it again to reset psychology that yes we took the majority of your savings but growth can return now. Alternate is just to run financial repression by 1% – 2% for a long time to work off the debt, but like in Europe politicians can not resist the cheap money.

Would you please explain your reset. How would a reset take savings? If you are talking about a debt jubilee, that just a transfer between debtors and lenders.

also, regarding your last sentence …….. financial repression is cheap money, isn’t it?

1) Alexa, is Ford junk ?

Alexa : Ford is AA+

2) Alexa, why Ford export Lincoln Corsair/Alexa to China from US at 30% loss ?

Alexa: the Chinese taste buds equate Lincoln with freedom. Lincoln is good is a good thing in China, especially in HK.

3) Alexa, but China will cannibalized Ford EBITDA even further !!

Alexa : no problems. LIncoln Corsair/Alexa will be produced locally

in China. Great demand and profit. Since PBOC prohibit sending

dollars to Dearborn, Ford will export its profit in form of finished

products. Lincoln Corsair/Alexa will be imported from China, at lower cost. It will improve margin, provide redundancy when UAW strike.

4) Alexa, I get into my new F-150 and drive twice a week to Walmart

to buy groceries. What shall I do if oil spike > $100 : buy Ford/ Mahindra

basic solution, or Lincoln Aviator Alexa/EV 400hp ?

Alexa : pay WMT $98 annual fee for an unlimited delivery service. WMT guys in the aisles will do your job. Ford transit van will deliver

your groceries, twice a week, for free, while u will be listening to Kreutzer.

Another thing that is different the time is the size of the bond ETFs. Should there be a crisis of confidence and people want to exit, especially in the junk space, there could be a situation where there are no buyers for the liquidated shares. Epic fire sale ensues. This has been a worry for a long and it has not happened yet, but that does not mean it won’t.

I like the concept of when you see a problem you should invert it in your mind. There is probably going to be some great bargains in this area at some point in the future. I might try it on vanguard high yield fund during middle of next recession. If you can buy with 15 – 20% yield and improving financial conditions it could be a big winner as rates drop back to normal.

There is some real doom and gloom on here.

It’ll never get there, because governments go to war on an ‘enemy’ to prevent their population going to war on their governments.

We’ve seen decades of boogeymen being created to diffuse societies ire from those really to blame.

The key is to figure out where to put your wealth to make it through.

You’ll never go far wrong investing in yourself and the things you need to make an honest living if needed.

You’re right Kenny, far too much doom & gloom here. A war will fix many personal problems, permanently. You’ve cheered me up immensely!

Simply put a ponzi scheme.

The bond traders (the banks) will continue to flip this garbage until they run out of greater fools-mainly pension funds who have to buy because pension rules say the must. I guess the pensions are more the shackled than fools. Bond flippers are essentially mining regulations, and no doubt had a lot to do with putting sucker friendly regulations in place-that is getting the fish in a barrel to shoot. What is the final trigger for junk bonds and the abyss? Well the same one as for the everything bubble. It will go on until it stops, then the crash.

It’s probably different this time because the Fed look like it is panicking. They are now doing everything (ahead of the curve) to forestall a recession or a crisis because they know that both parties will blame them for the impending problem. They are politically fighting for their own existence now.

We just saw the grilling of M. Zuckerberg. I don’t think the Fed wants to be in the same seat or in the line of fire of you-know-who.

The rumor of Tesla’s death has been exaggerated once again. Up $45 this morning, 17%.

Revenues FELL year-over-year. Fantastic growth story, no? Quarterly profit likely due to a big pile of tax credits, which it wisely did not disclose in the earnings release. But we will find out when it files its 10-Q with the SEC in a few days, and I will cover that, for sure. So stay tuned.

Happy days! And gigafactory 3 is about to come online, Model Y has been moved up to this summer, and the Tesla pickup will be pre-viewed in November. All good stuff.

Nice to see the Tesla trolls rolling onto this site. The gig is up fellas. Sales are falling. Peak Tesla. You really should be looking for another ‘job’ about now.

I would not buy an EV because they are powered by coal and the batteries are big lumps of toxic chemicals that end up in the dump.

The batteries do NOT last (I got a ride with a green mate in his Prius the other day — he’s replace the battery THREE TIMES in 8 years)

And I prefer not to sit around waiting for a battery to charge when I can put 700km into my petrol car in about 3 minutes.

But if I were forced to buy and EV and had the choice of a Tesla (bottom of the barrel in reliability scores, crazy expensive to repair IF you can get spare parts) OR a Porsche Taycan (100 years of pedigree producing some of the best high performance vehicles on the market).

I would choose……….. drum roll please……………….

Well you know which vehicle I am going to choose. No suspense here.

Tesla is on the cusp of being nothing more than a bad joke.

And, as pointed out by WallStreetforMainStreet on YouTube, according to what he been told by a ratings agency insider, there is major pressure being applied to NOT rate bonds that should be rated junk as junk. Again, ratings agency malfeasance just as there was prior to the GFC.

Great to see Kitten’s mug (literal – not figurative …) as the donor button!

If I’m not the greatest fan of her writing and graphic style, I wannabe.

Once again with the inflation boogie board. LoL. Boomers should worry about asset deflation. That is what will impoverish the most, and is not expected.

So it shall come to pass, even lower rates are ineffective against disinterest in buying.

The really funny part is the perpetual fear of the childhood trauma of inflation

If assets are overvalued, wouldn’t asset deflation be a good thing. Cheaper stocks, bonds and houses sound good to me.

Cash flow with purchasing power is important.

Bit it IS different this time:

1). NIRP is on the table. It’s a part of the “tool box” and several Fed-sters have openly advocated using it.

2). We are all Super Ultra Dove Deluxes now.

This could on essentially forever, in our lifetimes.

All negative interest rates will do is force money into alternative currencies like Bitcoin or precious metals Who in their right mind would pay a bank to hold their wealth That’s insane in and of itself not to mention bail-in laws

Thank you Wolf. At my work, first time ever, they offered a limited matching in investments, but the catch is the investment company they used limits us to 22 investments THEY pick. Well I checked each investment out, with the exception of one; none of them were worth the risk. And with bonds and other investments going to “negative interest” globally and hearing this starting in the U.S. as well. I left the company’s money offer on the table and walked away. It’s not worth losing their money and mine in poor performing investments. I’ll do much better putting my money in REAL assets, not fiat paper investments. Oh, and check out RoadtoRoota guy, he’s reported last night, news how Bit-coin value was lowered in 2017, by GVT creating derivatives of it. “Nothing from nothing leaves nothing”

I don’t think the status quo lasts much longer. The political environment is headed for some big changes. There is much more political pressure now to support working people. The question is – will the support come from the wealthy, or will they simply put the charges for this support on the national credit card, which would accelerate a debt/currency crisis.

Neumann from WeWork could subsidize quite a few of us Deploreables by himself whether he likes it or not

\\\

Ladies and gentlmen, we introduce the new FED policy called: “No bond left” behind. The plan is to give an A+++ rating to all bonds for attendance, and allow a constant flow of no-risk investment oppportunities for the pension funds!

\\\

It’s part of the FED effort of the new moto soon to be printend on the 7$ dollar bill:”Personalise the gains, and socialize the losses!” or in latin “Populus payus allus billus, hahaha-us”.

\\\

Regulatory capture seems to be the problem. In most dangerous human activity the organizers take steps to mitigate the danger. The NFL limits how one can block or tackle an opponent. Auto racing limits power output and vehicle designs. Sponsors of mountain climbing no longer support ‘free solo’ climbers because they don’t want to be responsible for the death of their climber. ABC made Nick Wallenda wear a tether when he walked across Niagra Falls on a tightrope.

Corporate Finance has eluded all attempts at regulation even though a disaster here can cripple entire nations and destroy millions of lives. When S&L industry collapsed in the late 1980’s there came to be known what was called the ‘Texas Ratio’ which measured non performing loans against tangible equity and loss reserves. If the former exceeded the latter the S&L was shut down. Surely a similar ratio could be applied to issuers of bonds and remove the rating agencies from the picture. If you exceed this critical measure you cannot issue bonds or receive new finance of any sort.

The rise of corporate debt at the expense of government debt continues to puzzle me? The corporations gain more power, lobby for tax cuts, put more pressure on government to fund itself, government then lowers rates further. Rinse and repeat. Does government finally disappear? When does it become necessary to raise rates for savers, constituents, and fund necessary infrastructure so corporations have water, power, transportation and electricity? Government also provides regulations and tariffs to protect them. The rise of the corporate state seems about complete, except for some ah ha moment, when maybe the president says, I am done here. You have any complaints call Apple customer service.

Nothing further from the truth. But Goldman Sucks is doing God’s work so they claimed.

Read the case of Malaysia’s 1mdb bond issues

arranged by Goldman Sucks when the then PM was Najib. Only the overthrow of the government of Najib were those misdeeds brought to light. And carried out by a small third world country. What about those larger countries where these bankers are operating?

I was struck to see Consumer Products leading the list. Interesting, I said arching an eyebrow. So, I followed the link to the page with more details.

“S&P Global Ratings currently forecasts the U.S. default rate to be 3.4% by June 30, 2020, with the consumer products and retail and restaurants sectors expected to generate higher percentages of defaults than other sectors over the next 12 months, given their sector-specific stressors .”

So, the Brick and Mortar meltdown is starting to hit home. And since all of these reports of failures usually see stories of big leverage bailouts of these now failed chains, I’d guess that there are more chains out there who are heavily leveraged by vulture capital which are going to sing “Another one bites the dust.”

Not only has the central bank abolished risk, it also abolished time. In some cases, it has even managed to go back in time and pilfer from us in the past. No risk, no time, no real price discovery = no innovation, no research and no creativity.

Could this repo money be going into the stock market ?

Good article Mr. Richter. Berkshire Hathaway has $122 billion parked in treasuries and other short term highly liquid low risk assets. If Warren can’t find anything worth investing in then who can? Is he waiting for good assets to go on sale? We’ll just have to wait and see. Remember when he lent money to Goldman Sachs at a very high rate at the time with very little risk? A true capitalist will sell you the gun to shoot him with. These investment banks are nothing more than clearing houses creating paper, charging absorbent fees and reselling it to someone else. Lately they have been contributing virtually nothing when it comes to creating or facilitating real assets.