But consumers spent a record amount in Q3 on new vehicles due to record prices.

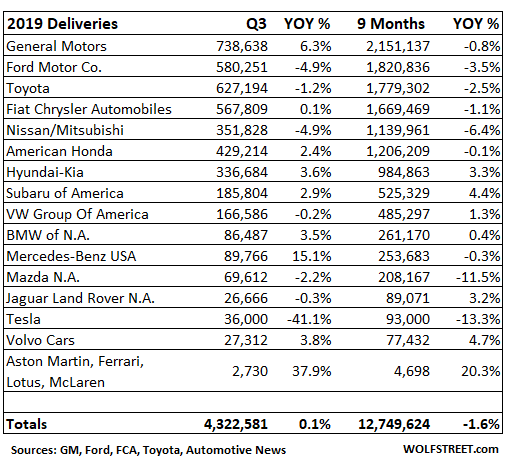

General Motors, Ford, and Fiat Chrysler reported third-quarter new-vehicle deliveries in the US on Wednesday, and Tesla followed with its global deliveries for the quarter on Wednesday evening. Because Tesla doesn’t report deliveries in the US, the industry is stuck with estimating them, and they have plunged in Q3 due to waning demand, and so Tesla is selling its Model 3 production overseas. Other auto makers are still on monthly reporting.

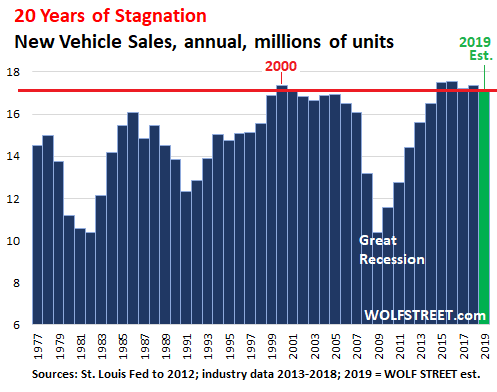

New-vehicle deliveries in the US — fleet and retail combined — were about flat, at 4.32 million vehicles in the third quarter. For the nine months, deliveries were down 1.6%. This puts new vehicle sales on track for about 17 million deliveries in 2019, the worst level since 2014, and below 2000 (17.35 million). This is the nature of a horribly mature market, whose two-decade stagnation was interrupted by the collapse during the Great Recession and the subsequent recovery:

The auto industry in the US is a zero-sum game, at best, where growth by one automaker comes at the expense of others, and where dollar-sales increases for the industry can only happen by raising prices and selling more expensive products, and that’s what has been happening.

The table below shows deliveries by automaker. These are sales by dealers to their customers and include leases (dealer sells the vehicle to a leasing company which leases it to the customer) and fleet sales either by dealers or by the automakers directly to their large fleet customers, such as rental car companies:

GM sales jump 6.3% in Q3.

GM [GM] has had a rough first half, with sales plunging 7% in Q1 and then dropping 1.5% in Q2. But in Q3, sales jumped 6.3% to 738,638 vehicles, leaving year-to-date sales down 0.8%.

Fleet sales – mostly to rental car companies — accounted for 19.5% of total deliveries, about in line with the normal range, and down a tad from last year.

Pickups is where it’s at, powered by redesigned models. Deliveries of the Chevy Silverado surged 18% to 119,641 trucks, and deliveries of Silverado heavy-duty models rose 7.1% to 34,212 trucks. On the GMC side, Sierra deliveries jumped 29% to 66,198 trucks. Combined, these pickups accounted for 30% of total GM deliveries.

Sales of compact SUVs (“crossovers”) skyrocketed 28.3%, powered by new models.

Total “truck” sales – pickups, SUVs, crossovers, and vans – rose 8.8% in the quarter.

But “car” sales plunged 38%. This has been going on for years. All automakers are facing consumers that have lost their appetite for cars – at least for new cars, though they have the hots for much more affordable used cars. For years, I have called this shift “Carmageddon.”

But the category of “cars” does not include “crossovers,” which are counted as “trucks” for marketing reasons, though they’re based on car chassis and car drivetrains. They just look a little different. The fact that crossovers are not included in “cars” though they’re essentially cars renders the classic industry classifications of “cars” versus “trucks” useless.

Ford wasn’t so lucky.

Ford [F] reported that deliveries fell 4.9% in the third quarter compared to Q3 last year, to 580,251 vehicles, knocking Ford into third place behind GM and Toyota. Year-to-date, deliveries, at 1.82 million vehicles, are down 3.5% from a year ago, but remain in second place.

Pickup sales rose only 5%, but reached 240,387, blowing away GM’s total. Ford is still king of pickups.

Van sales, including Ford’s Transit cargo van, soared 21% to 65,288 in the quarter, an all-time high, Ford says.

But disconcertingly, formerly hot SUV sales fell 10.5%, with Ford-branded SUV sales dropping 13.2% to 171,746 units. But Lincoln SUV sales jumped 19.2% to 21,354

Sales of “cars” plunged 29.5% to just 77,231 units. The share of cars is now down to just 13% of Ford’s total vehicle sales. The only Ford branded car line – other than the minuscule-volume hand-built GT – that showed a sales gain, and a huge sales gain at that, was the most affordable vehicle Ford sells, the Fiesta, whose base version stickers for less than $15,000: Sales soared by 32% to 14,717. Fusion sales declined 1.1% to 37,557, Mustang sales dropped 12%, and the other models are moribund or already dead.

When Ford talks to Wall Street, it brags about raising prices and selling more expensive vehicles, even as overall sales are skidding, and as it is losing market share. It reported that its average transaction price (ATP) – the price customers pay after rebates and discounts – jumped by $2,200, or 6.2%, to $37,900 per vehicle at the end of September. But selling fewer and ever more expensive vehicles in a stagnating market and losing market share can eventually turn into an existential fiasco.

Toyota.

For the quarter, deliveries fell 1.2% to 627,195, which put Toyota in second place, ahead of Ford. For the first nine months, deliveries fell 2.5% to 1.78 million units.

On the positive side, hybrid sales in the quarter soared 51%, powered by hybrid versions of the Corolla, RAV4, and Highlander. But sales of the Prius, once a hot-selling car and the most successful hybrid ever, plunged 27.1% year-to-date, to 50,258.

Sales of Toyota-branded cars fell 5.1% year-to-date and sales of Lexus cars fell 10.5%. But unlike Ford, GM, and Fiat Chrysler, sales of Toyota’s pickups – the Tundra and Tacoma – also fell (-0.9% for the year so far).

Fiat Chrysler Automobiles

FCA [FCAU] switched from monthly reporting to quarterly reporting this quarter, following in the footsteps of GM and Ford. The brands include Chrysler, Dodge, Ram, Jeep, Fiat, Maserati, and Alfa Romeo. Total deliveries in the quarter were about flat compared to a year ago, at 567,809 vehicles. Year-to-date, sales fell 1.1% to 1.67 million units.

Two of its niche brands are in serious trouble: Year-to-date, Fiat sales collapsed 38% to 7,463 units; and Alpha Romeo sales collapsed 27% to 13,347 units. Maserati hung on, with sales down only 1% to 8,325 year-to-date.

What’s hot at FCA are its Ram pickups: Deliveries surged 15% in the quarter to 179,200 trucks, a record, and were up 23% year-to-date. It its press release, FCA credited the “refinements” that it “transplanted” from its Ram 1500 to its Ram 2500 and 3500 heavy-duty trucks:

“Heavy-duty customers, including farmers, ranchers, construction workers and small business operators, have responded enthusiastically to the ability to do more work from their front seat during the day and take their families and clients to dinner in the same well-appointed truck in the evening,” it said.

This phenomenon – luxurious heavy-duty pickups, particularly crew cabs – is playing out at Ford and GM as well. These trucks are hot sellers, and very expensive, with speculation circling around which automaker would be the first to actually sell a crew cab for over $100,000.

Carmageddon for Tesla: Plunging US sales.

Tesla [TSLA] reported global deliveries of 97,000 units. Its sales efforts of the Model 3 are now focused on Europe. After pent-up demand in the US was met, Tesla laid off part of its US delivery team earlier this year. Tesla doesn’t report US sales, so the industry is guessing. Based on estimates by Automotive News, US sales of all models combined plunged 41% in the third quarter compared to a year ago, to just 36,000 vehicles, and fell 11% year-to-date to 93,000 vehicles.

Hopes Tesla would beat BMW or Mercedes, or come even close, have been rudely disrupted. In Q3, both sold about 150% more vehicles than Tesla. In addition to whatever other demand problems Tesla might face in the US — including an onslaught of reports of terrible service and unavailability of parts — it is also grappling with, like all automakers, the lack of appetite among Americans for “cars.”

Record incentives needed to get rid of 2019 models

In order to achieve flat unit sales in the quarter, automakers piled on the highest incentives for any third quarter, with the average incentive spending rising 6% from a year ago to $4,159 per unit sold, according to estimates by J.D. Power.

Dealers were sitting on large inventories of 2019 models, even as the 2020 models were piling up, and automakers used those record incentives to move those 2019 iron. J.D. Power estimates that 90% of all vehicles sold in the third quarter were 2019 models, making it the slowest, most dragged-out sell-down on record.

Nevertheless, prices and consumer spending hit record.

Despite the incentives, the Average Transaction Price in Q3 Industry-wide, reached a record $33,321, up 4% or $1,229 compared to Q3 last year, according to estimates by J.D. Power. The ATP for cars rose 4% to $26,736. The ATP for trucks and SUVs — about 72% of total new vehicle sales — rose 3% to $35,725. Which means that much higher sticker prices were only partially reduced by incentives.

Flat volume and higher ATPs mean consumers forked over more moolah, which is what matters the most to the horribly mature industry where unit sales have been flat for two decades. J.D. Power estimates that consumers spend $121 billion on new vehicles in the third quarter, an all-time record. So it’s not like consumers stopped spending.

Classic cars took a big hit. “Expert sentiment is at its lowest point since October 2010, largely due to market observers’ reactions to the Monterey auctions.” Read... Asset Class of Vintage Cars Drops into Bear Market, Down by More than in 2008/2009

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

For the GM/UAW strike.

Probably the worst timing of a strike in the last 50 years.

It’s the “greed gene”, human nature, the more your make the more you want.

It’s called lifestyle creep, and it’s very much a real thing.

As ex-GM bondholder who got close to wiped out – UAW and Government Motors deserve each other’s company and soon miseries.

Obama’s GM bailout was really about bailing out DNC’s union card-carrying base as the GM bondholders got the raw deal with the Feds and UAW AHEAD of bondholders and eviscerated equity shareholders.

You do realize bush bailed them out, right?

No! It was Obama! And he stubbed his toe this morning and that was Obama too!

Bush gave them a bridge loan. Obama finished the bankruptcy in mid-2009.

Think “establishment government politicians”.

No it was Obama. I know as ex-bondholder who saw it through with fatcat UAW.

Driving the Bond Markets to Ruin

MAY 29, 2009

But there is no escaping the long-term damage that has been inflicted on credit markets by the Obama administration’s attempts to reward the United Auto Workers, one of the president’s strongest supporters in the last election, while trampling decades of legal precedent regarding owners of corporate debt.

https://www.nytimes.com/2009/05/30/opinion/30glassman.html

Shush, he’s on a roll!

In the past, both GM and UAW management had weapons grade stupidity. GM has kind-of learned its lesson, not so much the UAW, which very much wants to go back to the good ole’ days.

After Obama’s GM bankruptcy, the UAW was GM’s largest shareholder (18%), including a seat on the board of directors. The UAW has now sold over half its GM stock, no longer qualifies for a board seat, and the UAW is taking us all back to a destructive (to all parties) strike…just like the good ole’ days.

My last American (Detroit) car was a 1973 Chevy Monte Carlo. UAW membership 1980 = 1,500,000; UAW 2019 = 540,000 (400,000 @ GM).

To show the depths of the depravity, the story goes that the GM CEO, when informed of the bankruptcy and that he would be fired, first wanted to know if the head of UAW also was getting fired; not the fate of employees, investors, or whomever else…

The heads of many of these corporations and unions are truly mentally off in some way.

If you are going to get laid off you might as well stand in a picket line. Now the workers can draw on their union reserve. As I recall from my salad days it is always better to get fired, than to quit, because if you quit you cannot draw unemployment. This case reverses the process. It also lead management to the option of shifting those jobs overseas, which is not what they want to do, or the president wants. Politically the move plays well either way, Democrat or Republican.

The elephant in the room is the GM strike. Personally I think workers made a big mistake voting for it because GM will fire them all and cite rising labor costs as the excuse. I just read an article about a steel products company that did just that, approved a 10% over three years raise, then declared bankruptcy right afterwards. The 300+ workers are shocked, said they didn’t see it coming. Welcome to the gig economy.

Petunia, “…a steel products company that did just that, approved a 10% over three years raise, then declared bankruptcy right afterwards…” That happened here in the city where a very old steel producer did just that about 15-years ago. The employees were all excited and smiling that the company met their demands, and within about six months, the company declared insolvency, bankruptcy, etc., the executives got their rich severances, the CEO a very generous golden payoff and pension, and the employees got bupkis!

Be careful what you wish for nowadays :-)

The company I cited went bust just this week.

So since the GFC GM workers gave huge concessions to the company. In the past 8 years they have got nothing, but GM has done 15B in stock byubacks. How would you feel?

The UAW, being big contributors to obama, got to break 100 years of contract law and cut in front of all bond holders in the GM bankruptcy.

A “bankruptcy” that cost the US taxpayers $17 billion in the end.

The UAW kept thier insane pensions and amazing health care benefits (obamacare is for you and not for them).

And they got 10% of the new GM stock with options for 15% more at a discount price.

How would I feel? I would keep my mouth shut and thank my corrupt lucky stars.

Well said and definitely about “forgotten” facts here. Thanks!!

Bondholders got more than they would have had if the government had not gifted GM billions so they should not complain. The gift giver decides who he gives presents to not bankruptcy law.

ps. The US got that 17 billion back in not having a great depression so IMHO it was cheap and wise decision.

Indeed! As ex-GM bondolder (Class B and C) I got hosed. I can see how the Feds were #1 since bailed out Government Motors but how in the HELL did UAW get ahead of the bond holders with sweetheart deals???

That ‘insane pension’ is about 1500 a month before taxes. Not peanuts but not living high on the hog. Even in Flint MI. One should wonder what a traditional bankruptcy would have cost tax payers. Pension offed to the already heavily in debt PBGC. And then with the tight credit at the time many suppliers would have followed them right into bankruptcy. And let it be known that this strike is more about temps than traditional employees. Many work 6 days and as long as 5 years in temporary status. IMHO that should not be a fight the union should even have to take on. But we will stand up for those that work beside us. In solidarity. Electrician on the Final Line at Flint Assembly.

I’m not sure, but arent employees always prioritized in bankruptcy? Seems appropriate that wages and benefits get paid before passive investors.

Investing in GM turned out to be a huge mistake. Own up to it.

First of all I’ll state openly that I don’t like unions. I grew up in a union family, maritime, and the maritime unions killed the industry in this country. I got to see that up close.

It is my understanding that the auto unions are now big stockholders in the big 3 as a result of past negotiations. As big stockholders, the union’s interests are naturally aligned with management, not labor. If the workers haven’t figured this out in the past 8 years that is too bad for them.

GM didn’t do 15B of buybacks in the dead of night, it was out in the open, and the union’s stock went up as a result. If workers don’t understand the union and management are now one, I have little sympathy for them.

My prediction is that the unions want to go to Mexico and organize there where labor is cheaper and less demanding and their stock will become more valuable.

For God’s sake, Petunia…and a few others. Maritime unions didn’t kill the industry but contracting out and offshoring sure had an effect. You can’t compete against indentured and desperate labour.

If an industry can’t pay their employees a decent liveable wage and provide acceptable working conditions, then they shouldn’t exist.

The problem with GM and ilk is having to compete with overseas labour rates for a comparable product. It can’t be done. Some industries think they’re immune from it, but with cheap overseas transport even food products are now processed overseas. Given time, we’ll be back to sharecropping. Like said above, welcome to the gig economy. And with the ‘gigs’ will come dislocation, more addictions, family dedline, reduced education opportunities, and an even more entrenched class society.

In that race for the bottom, I guess when we all arrive the only ones left floating will be the rich. I remember reading about the International longshoreman’s Union in BC because I wanted to understand why they were so reactionary and corrupt. When I found out how longshoreman were treated loading the old time sailing and steam ships it began to make more sense. The same for coal miners.

I’ve worked equally union and non-union over my lifetime. Teamsters local 213 (pilot), IWA (sawmill worker), Carpenters Union, and BCTF (teachers union). Some of my best jobs were non-union or gig (contract) because they had to compete with union employment in order to attract. Take away the unions the boss doesn’t negotiate your labour conditions, he dictates and only the suck-ups remain. I always liked that good old 40 hour week and overtime pay for above and beyond. Take away unions and you lose it all, one chip at a time. You don’t have to look very far to see it happening.

Paulo,

I am very pro labor, but being pro labor and pro union are not the same thing. I learned to distinguish from the corruption I heard about and saw destroy the shipping industry in the US. My father got his jaw broken forming the maritime union and lived to see it destroy the industry. Yes, it also involved the dock workers, they killed their jobs as well.

Please explain how maritime unions killed the industry?

I saw an interesting documentary movie called American Facotry on Netflix about Chinese auto glass company taking over the shell of closed GM assembly plant in Dayton OH and invest close to half a billion dollars.

Talk about crash of cultures and misunderstandings… Anyway UAW try to unionize the shop but was BEATEN with only 1/3 pro-union votes which surprised me since OH is in the smack middle of UAW country.

Paolo as usual you are dead on. Unions raise wages for everyone, Union and non-Union. Unions got us the 40-hour week, and tons of other benefits libertarian short-sighted types take for granted. Fortunately with modern communications, it’s very possible for unions and unionist movements to go international now.

I think unions are viewed differently depending on generation.

The boomers see them as protection for workers.

The early gen-x’ers see them differently whether they saw their wages protected, their entry blocked, or they were stuck with a two-tier wage system.

The late gen-x’ers barely saw them in working age, mainly in context with bankruptcies or reported public-sector largesse. I’m in this category … I heard a lot of negatives about corrupt unions growing up (unions have gotten bad press for decades after all) but my views on everything drastically changed after 2009. I work in construction, but I’ve never been in a union and most of the construction unions here (Los Angeles) are barely hanging on and don’t have much bargaining power. Their workers have to go much further afield to stay busy.

The millennials never really saw much of unions and they aren’t sure who to believe on them, they just know they have a pretty raw deal in comparison to previous generations.

Personally, I think a lot needs to be done for labor … it just seems that labor has been an afterthought at best for the last 25 years. We’re merely Human Resources after all, not people. To a corporation or government bureaucracy we’re simply NPC’s in their game, like little resource-gathering machines.

Lance

you say: “…In the past 8 years they have got nothing,…”.

I strongly disagree. GM workers get GM profit sharing checks (I don’t have the time or the interest to research earlier profit sharing checks):

– 2018 @ 10,750

– 2017 @ $11,750

That’s not exactly “nothing”.

I’ve never heard a union leader talk about the value proposition for the customer, you know, they guy who buys the company’s product.

The cold hard economic reality is there is too much auto manufacturing capacity.

By ‘fire them all’ I assume you mean by closing the plant and laying them off.

If you mean ‘fire them all’ literally, you don’t want to be the guys trying to replace them or driving in parts.

No one’s tried that since Ford in the 30’s and no one is going to try it now.

This strike is already hurting all the supporting businesses around the plants and nobody is doing anything. Even Canadian plants have closed and not a peep.

What do you mean, nary a peep? The layoffs and shut plants have been announced in our press and the affected workers are laid off or expecting a lay off, very soon. Are they happy about it? Of course not, but it is just the way it is for a workingman. It is also the way it is for support business in an industry town. The restaurants and car dealerships love the well paid workers in the good times, and when there is a strike they know anything descretionary will be a distant memory. Smart workers, who have been through it before, always have a few bucks set aside to see them through. I used to go up north and worked three month contracts…10-12 hour days for 100 days straight. Made huge money but obviously never stayed. Sometimes, you just have to go on strike. Does anyone ever win a strike? Not really, but there is a point where you are forced into it or have to quit and move on.

Unless you’ve worked in a plant or factory where you are treated like a number and liability, it is impossible to understand. My Father-in-Law worked for Pacific Press when it was owned by Conrad Black. They went on strike every contract, often for months at a time. Conrad Black is still trying to steal back their pension funds; a robber baron, political friend, knighted, and jailbird crook. A real bastard to work for, obviously.

Good companies never have strikes to worry about in my experience.

The latest numbers are that the average loan term length is at 69 months, while a full third of all trade-ins now have negative equity at trade-in (which is rolled into the balance of the replacement vehicle loan), double the percentage in 2009.

Basically, it’s all about credit or in other words, the low rates courtesy of central banks have been a huge bail-out program for the car companies.

Yes heard the stealers make more on 7 or 8 yr financing than selling cars. The sheeples want new trucks/SUVs and dumb enough to give #s when sales leeches ask how much can you afford to pay monthly leading the sheeples to 8 yr loans on the asset that depreciates 15% once drive off the lot.

Dealerships nowadays make A LOT more of their profit on every sale in the F&I backroom (from things loan fees and kickbacks from lenders, extended warranties, ding warranties, prepaid service plans, etc.) than they do from the sales guys in the showroom.

I currently sell both new and used cars, have been for the past 15 yrs.

The whole dealership is a profit center. Your claim about F and I products is only factual in the sense that we make money in that dept.

I would say we make less now as costs of the products have risen which means less profit for me. If they can’t pay the price I either have to cut or risk a no sale on that product.

I can also say with 100% certainty that I am making less money this year per hour worked than I ever have, relative to the amount of work required to complete a sale.

BS regulations at the state and federal level are always time wasters and new ones appear every year.

Most everyone on this site I am sure hates dealers, judging but the constant talk about their 97 Toyota that’s paid off and they don’t have to walk into a dealership, or how they beat the salesman up for $20000 off of a $30000 car or whatever BS story they tell to make themselves feel good.

Every business makes a profit or they wouldn’t be in business.

^ No clue what you are talking about.

You are focusing too much on B-Lot low credit buy here pay here type stores. If I have a customer who has a buy rate in the teens or 20s, very little change they take delivery, and even if they do, the bank is ripping us and them with fees.

The bank is making money on the loan, period. If I don’t bump up the interest rate then I don’t make s#$@ on the financing.

And only weak ass sales people recommend 84-96 months because the payment is lower, it puts the customer in a horrible position.

You seem like a pretty good mooch…I mean bargain hunter. I’m sure you negotiated your mortgage rate down to 0.00% before you beat up the car salesman for 50000 off your 40000 car.

I am amazed new car sales have climbed this high. I would expect this will not be a growth industry in the foreseeable future. With most states having raised the full driving age to 18 driving is no longer a right of passage. And liability insurance for under 25s is “freaking” astronomical. And most young people who can afford new cars are probably working in larger cities with public transport. Uber has helped them give up car ownership as well. Most of the young people in my family and my wife’s in the 18 to 24 age group have yet to get a driver’s license.

Perhaps once the true Uber costs are passed on to the riders, things may change, but the youth population concentration in the cities doesn’t seem to be slowing down at all.

Old Engineer.

So true. My son does not own a car and my daughter never learned to drive. They live in big cities. When my son comes to visit, he is diugsted that the freeway is now 8 lanes in either direction. It would not surprise me if he never buys another car.

QQQBall and Old Engineer:

Have a granddaughter who has good job (medical research) in SF; sold her car first year living there (rents with two others). Of course SF is kind of different in that there is a fairly decent kind of public transportation. And, there’s Uber/lyft etc…..

Another commenter mentioned the extremely high insurance costs for young drivers; many of them (or their parents) just can’t afford those costs anymore. Something has to change.

That’s what this article shows.

I just don’t understand the high costs of new cars today. Yes, there is much improvement in operations, longevity (in many). But somewhere along the line we run up against a brick wall of costs.

Wolf mentioned something about the, “$100,000….” vehicle for probably everyday use (extended cab pickups). Wow!

One of my neighbors who owns a extended GMC (fifth wheel tow) pickup diesel explained to me what is happening in that area of engines; the attempt to make adjustments to the exhaust systems that will push the cost of his pickup from around $40,000 to upwards of $80,000!

No wonder we may need lots more “free” money to keep our economy going!

Old Engineer, good observation there. I was thinking along similar lines but with a little morbid angle. Pretty soon, there is going to be a huge glut of used vehicles (both sedans & trucks) for sale on the cheap.

Picture this:

– retired Boomers and gen-Xers still with jobs are the only ones with the cash to buy vehicles, whether new or used.

– Millennials are not into driving or vehicle ownership, at least those in major cities and besides they’ve got little spare cash to burn with their faux “gig-economy” jobs.

– Once the boomer demographic inevitably, and in increasingly greater numbers shed their mortal coils, there is going to be a huge inventory of these great used vehicles on sale (their kids don’t want ’em & they are great vehicles cos boomers generally maintains their vehicles fairly well).

In other words, Fire Sales… or maybe slow-burning used vehicle Sales as the boomer population bulge expires.

If you can wait, my take is don’t buy vehicles now (I’m getting lots of dealers messaging me every other month about their new models … which I ignore. Anyone else can sense their desperation ;).

When those boomer-used vehicles hits the market, the new vehicles segment will have keen competition too and they will be hard-pressed to reduce prices just to clear out their inventory sitting in their showrooms or warehouses for months/year.

That’s the time to drive a hard bargain, whether you’re into new or used.

In fact, I’d probably buy new but an older model.

New vehicles gets warranty and frankly a minor tune-up is all you need if she has been sitting in the showroom for some time.

Heck, I have been married for 20+ years and I choose cars like I’m choosing a wife, you’ve got to avoid the fanciful high-maintenance, high-priced models and find the hidden gem in the backroom sitting there languishing but decently maintained. lol.

$4000 for a 10 year old pickup body plus $3000 for a new engine sure beats new prices. I could buy 7 recycled pickups for the cost of one new one.

I am driving a 17 year old GMC Sierra 1/2 ton in absolutely new condition. Showroom condition. It has 80 thousand original miles on it. New tires, lumber rack, headache rack alone are worth $2500. I paid 4K cdn for it…$3 k US dollars. New? 40K, minimum. Just the new tires are worth $1000.

Done for me…reached post limit. :-) regards

I drive a 2016 Prius C which I purchased new for 16k in 2017 as the dealers were clearing their prior yr inventory. It gets 60 mpg. I’ve measured it myself repeatedly. I love it.

Always paid cash for my new vehicles including a Jeep J10 pickup in 1978 , a 1992 BMW 525i and a 2000 Porsche Boxter among others just paid cash for a 2016 VW SUV Sleep better at night this way It’s true that millennials are less car oriented than we were My son didn’t mind having no car during his 4 years at Georgetown

That’s a poor financial strategy if you can take advantage of low or zero interest rate loans and invest your money instead of tying it up in a depreciating asset.

Just saying.

“Investing”money always has some risk. Paying cash and avoiding interest is a 100% guaranteed sure thing. Also, it’s refreshing to avoid the Vaseline-lined snakepit of debt. To me, it’s a virtue, not measurable in dollars. I haven’t owed a penny in 15 years.

I think it really depends are your ability to make the monthly payment, your credit, and your choice of investment. If you can afford to buy a new $65K car cash, then you can probably afford the payments without touching that $65K no problem.

Say, for extreme example, you get a $0 down 1% loan for 5 years, your payment is going to be roughly $1100/month. In total, you’re paying $1700 in interest. If you take that $65K and put it in a 5 year CD at a paltry 2.5%, you’re going to make over $8500. So, what makes more sense if you can afford it?

But, if you pay cash you deplete your savings (of course if you only deplete them by some comfortably small percentage, then it doesn’t matter).

What I learned in 2008 is that the debt doesn’t matter as long as one has unencumbered savings corresponding to about 6 months income. Because those savings buys you time, space, flexibility to move and ‘responsibility credits’ with your bank.

The bank will find a way to ‘fix’ the debt. They don’t want it written off and on their books.

In my case I negotiated 1 year of not paying anything, with no interests and no fees. That time was used relocating to a new job and acquiring a much cheaper home. I could pay he deposit immediately, because of the savings, thus securing the deal. I then saved all the money that I didn’t pay on the debt, which pleasantly enough cleared what I owed after finally selling my old home at a loss. If I didn’t have that cash, I would have been forced to stay in my old home, probably going bankrupt after 3 years, because the bank would have refused a short sale.

It’s all about flexibility and resilience now.

Having no debt at all but few savings is bad, loads of debt with few savings is very bad, loads of savings and no debt is good but hard to do in practice. I favour a balanced stance, some debt, some savings, home *not* mortgaged ‘all the way up’, against all tradition.

With headlines saying consumers paying more for financing than cars (correct or not it’s headed that way), looks like another industry is being gobbled up by the Financialization Cookie Monster.

Real estate wasn’t enough for the Financialization Cookie Monster. So it moved onto Education (student loans) and conquered that. Then cars, and it’s working hard on healthcare.

Ain’t it great in America? You get sick, you see the Financialization Cookie Monster and bye bye goes your life.

Only in America.

Gotta have that Growff!

Finance is primarily a parasitic activity like mould. We do want it in some areas like cheesemaking. We don’t want its tentacles growing through the whole house in the form of dry rot, but, that is what unlimited growth in FIRE industries represents: Everything will be broken down to nutrients for the finance fungus infection! Until the house collapse and the heating goes out!!

And it ain’t ‘Only in America’; The rule was that Europe traditionally lags on the introduction of ‘American Stupidity(tm)’ by about 10 years. But, in the case of Boris Johnson getting elected to PM, and Bannon-equivalents like Farage ceaselessly tooting their one-note horn over all media, the lag was only two years, which could be a trend break, which I think would be very bad for us all!

What’s going on with Mazda? Their product gets good reviews. Not enough advertising?

I was looking at new cars recently. I did look at Mazdas because they did get great reviews.

The dealership would barely negotiate on price and were pretty arrogant – like they were the only game in town. I found a much better deal on another quality brand of car and purchased it.

The Mazda dealer called me about a week later. Could not believe I purchased another brand.

So based on this one single data point – Mazda better get off their “high horse” and start dealing.

I’m guessing Dan was looking for educated opinion or citation of industry fact rather than a single anecdotal story that doesn’t mean anything either way. Just guessing though.

Mazda is late in the trucks/SUV game. Their brand reputation in that segment is virtually non-existent next to Honda, Toyota and Subaru.

Mazda is tiny compared to Honda, Toyota, or even Subaru. I don’t see how they are late to the SUV game when their best selling vehicle is the CX-5 compact SUV. It sold more units than all of their other models combined last year.

Well in all reality the last 10 years sure have been just one debt fueled BENDER of car buying(borrowing) for most…and with a recession on the horizon and the average payment around $600/ mo? What do you think is going to happen ??

I bought an 1800 sq ft house in Florida in a nice neighborhood in 1994. Monthly payments were $584.00.

Kent We just might be back to those days soon if this collapse accelerates which is looking more and more likely everyday

Buy the dog : F.

I’m thinking GM is extending this strike cause it’s

not costing them anything.Lots of inventory to sell and

no labor to pay.

The cost of driving in the only Anerican produced vehicle that you can drive on the beach and look cool is too damn high!!!!

+++++++++

Jeep Dealer’s $50,000 Sticker Shock Captures Auto Sales Stress

Finance.yahoo.com | October 2, 2019

But just as investors doubt the U.S. car market can sustain near-record results for much longer, the Georgia retailer is apprehensive about a key issue: sticker shock.

“Prices are crazy on cars nowadays — all of them,” said Loehr, who sells Jeeps, Rams and other Fiat Chrysler models from a showroom northwest of Atlanta and has been in the business for 35 years. “They’re crazy to me, and I do it every single day, all day long.”

New Jeep Gladiators — the truck version of the rugged Wrangler model — can easily fetch $50,000 and are emblematic of a trend toward eye-popping prices carmakers are commanding for the pickups and sport utility vehicles making up an ever-greater share of their sales. Even as manufacturers and lenders increasingly stretch out auto loan terms to more than seven years and subsidize interest rates with incentives, average monthly payments keep climbing.

Affordability could become more of a risk if the mounting concern that the American economy is headed for recession ends up panning out. Those fears drove the benchmark S&P 500 down more than 2% on Wednesday, to the lowest since August. General Motors Co. and Ford Motor Co. shares slumped by even more.

https://finance.yahoo.com/news/gm-ford-t-shake-anguish-145336365.html

I paid 5500 USD for a spanking new J10 4 wheel drive Jeep pickup in 1978 the year I got out of University to do general contracting work NOT to drive around with an empty bed Straight6 and 4 speed stick Loved that truck

Why be so unfair with Tesla ? Is all your other data as wrong as those ?

Are you so afraid of them ?

Tesla delivered 97 000 cars in Q3 worldwide (not 36 000).

Tesla delivered 145 725 cars in last 9 month in the US only.

And they also sell everywhere in the world. (not 93 000 for the world)

Nomad Tom

Learn how to read before commenting. The deliveries here are in the USA, not global. In Q3, Tesla delivered 97k globally and 36k in the US. Get over it.

5000 forkers bought Ferraris so far in 2019! Five Thousand! And sales in that segment are up 20%! Mother&^%$#@!

Probably the same kinda folks who could afford a $16 million beach front vacation home in Martha’s Vineyard.

kiers,

I think you’re looking at the combined US sales of Aston Martin, Ferrari, Lotus, and McLaren.

Still… Same “demon”graphic

Wouldn’t the Aston Martin, Ferrari, Lotus and McLaren number include Mini Cooper sales?

Not exactly the Ferrari buyer demo…

And I bet half were in California Not so many in flyover country

The lemmings mesmerized by 1 of the biggest con Elon Musk is a sure sign of bubble about to pop. Trashla was NEVER GAAP profitable and managed to lose $400 mil in Q2 shipping about 95k cars and Jonas from Morgan Stanley think they will lose $600 mil in Q3 for shipping 97k cars. It’s like more they sell more they lose and share trades at $230…

$400,000,000 loss divided by 97,000 Teslas sold equals a $41,237 loss per car sold.

Maybe math is wrong?

That’s rather simple back of napkin calculation. Suggest take a look at TSLA’s income statement and balance sheet – something TSLA bulls ignore in cult-like Branch Elonian.

R U Kiddin,

Decimal slipped into the wrong place: $4,123

My only beef in all of this was the massive “bailout” and the phony claims that it was all paid back. Pure fallacy. If they want strike, let them. If GM has to raise prices and sell less cars, so be it. But if it implodes, do not bail them out to “save all of those jobs”. Let the freakin market work and stay out of the way…………………..

I was listening to NPR radio. The GM strike is affecting companies supplying GM. There might be layoffs and pink slips.

There already are.

I’m 30 minutes from the brand-new Volvo and Sprinter facilities in South Carolina. No strike, but many of the suppliers have already been furloughing and laying off workers. Bosch, Cummins, etc etc

The strike is going on 18 days with no signs of a breakthrough.

The “UAW strike fund” is $250 per week.

At three weeks – $250 x 40,000 x 3 = $30 million.

That is mucho democrat contributions that won’t be made in 2020.

That is assuming that all of the fund would have gone to democrat contributions. Why waste our time with an obviously fallacious statement?

Probably because John Calvin would have liked it.

I think a lot of aspirational types are resigned to never affording the McMansion and are buying trucks and high end SUV’s to status signal.

Interesting observation…

Drive through any trailer park. How many vehicles cost more than the trailer? What’s wrong with these people?

Even more interesting observation……

This last Saturday afternoon I was at the local Mercedes Dealer to pick up oil filters and air filters for my 93 E class diesel ( the last car I ever plan to own). As is the current style the parts counter is in the center of the showroom and shares the waiting area with the service department.It took them a while to find my stuff back in the dark reaches of the parts inventory so I had time to observe. The place was really dead and the only customers in sight was a rich old guy buying a convertible for his 30 something “Niece.” Two years ago I was in the same place, at the same time buying the same thing and the store was hopping. Lots of Rich Chinese folk picking up AMG rides and G wagons, plus multiple C class coupes and sedans going off the lot to middle class looking folk. Huge difference, not looking good.

I have a Lexus and it always amazes me how often many of the customers in the waiting area happen to be clergy.

What amazed me was the outrageous 900 bucks they charged for a very routine 30k service on my wife’s ES350. The Subaru waiting area across the street is just as nice.

Master cylinder for the “Smart Car”…

2000 Canadian. Predatory parts prices.

Doesn’t seem that smart.

The following might be a controversial view, but isn’t it usually only in communism where unprofitable businesses (Tesla, Uber, Lyft come to mind) are being kept alive indefinitely? Furthermore, the funny thing is, that only after Tesla turns a profit, it would be valued on the same basis as its competitors.

Agreed in full.

The other thing that used to be only associated with communism is “not actually owning your stuff.” But now:

Pelington – the exersize bike that requires a subscription service … so you don’t actually really own it.

Apple products that are very precisely designed for rather rapid planed obsolescence – so sure you still technically own it, but it becomes a useless (expensive) brick so to maintain a “functional” apple product in your life, effectively you are just renting as you jump from (indirectly) mandated upgrade to upgrade

Education expensive enough that the student loans make sure that many are just renting their education for life.

Condos with monthly fees over 1K – so effectively you are just renting even after you buy it.

etc…

I used to call paying student loans “paying a mortgage on your job” but that’s no longer true as a college degree, even one in tech, is absolutely no guarantee you’ll have a job in that field, or a job at all.

I think it’s more about platform domination. The momentum crowd will buy into any “story” that sounds good.

The stories aren’t that good though. Food delivery? Subletting? Vegie burgers? Are these earth-shattering ideas, or lipstick on a pig?

This is simple fleecing of naive unwitting investors.

Tesla is collapsing in the US because of the end of generous free government subsidies for electric cars!

Demand for electric is nowhere near as strong as greenies think. High price + low-range anxiety = no good.

When I buy a car I spend hours researching a short list of models. I check on reliability scores from as many sources as I can find. I google ‘complaints’

No stone is unturned when I finally make the decision.

Try doing that for Tesla and you will find endless information about the difficulty in finding spare parts, incredibly high repair bills, body work out of alignment and so on.

Literally endless.

What blows my mind is that even a single person would by a Tesla.

I guess they don’t research or perhaps they believe they are saving the world so they take one for the team.

Which is all a bit silly considering the electricity to charge a Tesla generally comes from a fossil fuel burning plant.

Spot on Rat Fink. Trouble with Tesla, beyond losing billions $$$ since 2003, is that there are may be limited pool of potential well-off think green buyers drunk in Musk’s kool-aid. They all seem to think “their” unicorn-like electricity comes from the renewable sources despite coal often being #1 source of electrical power.

I’m seeing a few Teslas here in Modesto, California, otherwise lifted truck, SUV and muscle car territory. Electricity is provided at (currently) reasonable rates by the Modesto Irrigation District, which is 100% renewable hydro (and none of the dams have submerged particularly scenic areas, unlike SF’s Hetch Hechy).

I’m not a Tesla fanboi–I drive a Mustang GT–but the value equation makes, perhaps ironic, sense here.

“Pickups is where it’s at, powered by redesigned models.” Must be that new 6-fold tailgate, dropping jaws nationwide. /s It will be interesting to see how useful people find that to be, and how well it will wear (seems like a lot of moving parts that can break). I just can’t imagine paying $40-$60k for a truck. That’s a down payment on a house, or in my area, the full price of a small house! And the beds are so small anymore…I think 5.5′ is the norm now? You just can’t haul stuff like you used to. I couldn’t even move my couch in most of these new trucks.

Yes, I can’t do construction out of a modern pick-up, besides being too expensive to scratch up. Oh, but that feeling of riding high, apparently (and special tailgate). I use a van because you can haul and lock up a lot more things. 1996 van that is. I just keep fixing it up, can’t imagine paying almost 30k for an empty shell.

I had a VW pickup back when. Bed was 6′ long and too narrow to lay a 4′ wide sheet between the wheel wells. But it was low to the ground. I easily loaded and hauled a metal lathe and an upright piano that would have been a real chore to lift into a regular pickup. And an 8′ sofa hanging out the back. It was a great little truck when it came to actually doing the work.

Yeah, what passes for innovation at GMC. Remember the last thing they did, greater than sliced bread? That rear axle setup that steered your trailer? Long life that ridiculously complicated jury rig had. Identical chassis and drivetrain as Chevy, but sign me up for a couple thousand extra on bling. I feel for the guys who need discardable workhorse boxes and are stuck buying this extra crap.

Once they started advertising Rx drugs, nothing makes my jaw drop anymore.

Back to GM…. weren’t they the guys with the Rubber Rooms where the employees with nothing to do went and sat all day doing nothing and getting paid for it…such a deal.. remember reading an article about them in the WSJ 20?? years ago… and then we bailed them out!!!!!

I remember when the 2009 crisis hit, I pulled up to a Honda dealer and the salesman cut me a great deal because they hadn’t sold a car all week, and this was a big dealer. I bought a new Honda Accord for $18,000. Down the road, I could have bought a new Lexus SUV for $30,000. A couple of my friends bought those.

Dealers may be cutting losses as they are saddled with paying interest on the cars sitting on the lots. Same thing with new “standing inventory” houses. I think better deals can be had in buying slightly used off-lease cars during recession.

I’m a 70 y.o. Boomer car guy, having owned about 40 vehicles overall. Last new car wife and I bought is her 2007 Mercedes C230, a wonderful gem now at 83k miles. I maintain all of our cars in excellent condition as that’s what I’m used to from aviation. I look at cars frequently, but only used as I have no intention of setting foot in a new car showroom ever. Today’s offerings are far too expensive and the quality is not up to snuff for me.

Alfa Romeo not Alpha Romeo.

I’m looking for suggestions for buying a used car. I’ve only ever had Honda’s/Subaru’s (all of them bought new) and have loved the reliability and low maintenance. For this one, I’m trying to decide between a Lexus/MB compact sedan/coupe that is not too old (3-4 year old may be the sweet spot). I’m in no hurry and am looking to buy one over the next few months. I’m not handy, so reliability is important. Any suggestions from the experts would be greatly appreciated!

Hands-down, it’s the Lexus.

IBM alone fired 100 000 workers in the last couple of years according to a lawsuit. Most of those US jobs got shipped over to India and China or converted to low pay contractor jobs (without benefits) with the assistance of US House and Senate. Our country is up for grab and obviously it has consequences. Sadly.

It’s all part of a grand Master Plan: we sell the country out to China, India, Mexico, you name it, then declare national bankruptcy. China, et al are now bagholders, and we take the country back in receivership … Genius!

Tesla is still production constrained. Their numbers in North America decreased because they started international deliveries. The model 3 is actually competing with cars like accord and civic in addition to cars it’s class like BMWs. They are sure to face challenges but hardly an apocalypse scenario. Which I could say the same for the other OEMs.

https://cleantechnica.com/2019/10/06/just-as-expected-luxury-gas-car-depreciation-getting-slammed-by-tesla-model-3/

Dude, extrapolate a little more. Just because it’s flat for the last couple of years doesn’t tell the rest of the story. Your wonderful Wolf Street plot – which was nicely linked on Dave Stockman’s Contra Corner – tells a far more woeful tale than 20 years of flatness in auto sales.

Since 1977, the sales have gone up you bet. New vehicle sales have increased from 15 million to 17 million units in 42 years. 0.32% annual growth. That’s, um, 6400 cars per year, dude. Tesla’s stuffing 87,048 cars per quarter into the US market. When unicorns beat your a**, Detroit Steel is doomed.

The car market has been moribund for over 40 years. I think the way out will be to revisit the Model A problem. Ford found that marketing the Model A with replacement parts glutted the market, and nobody wanted new ones because they had old ones they could fix. While the psychotic finance market has nearly doubled the PRICE of the Toyota Camry (thank you, Jisoo Kim), the only thing keeping sales alive is the threadbare principle of “this year’s model.”

The internet’s full of 20-year-old programs that have been “repaired” like Model A’s to keep them on the road. No rebuild from scratch. Someday someone’s going to build a car with 2 or 3 models, designed to replace or run indefinitely until the driver wrecks it. Just watch.