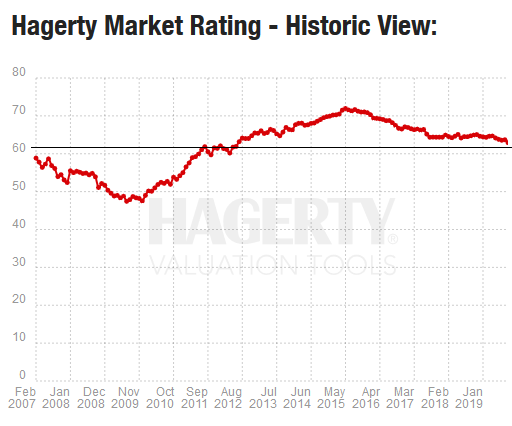

“Expert sentiment is at its lowest point since October 2010, largely due to market observers’ reactions to the Monterey auctions.”

The asset class of beautiful machines, which had already been struggling mightily, got whacked by the events in Monterey, California, last month. “Whether it’s threat of recession, broad economic volatility or too many cars crammed into too few hours, there’s no denying this year’s Monterey Auction Week results were depressed when you compare the results to recent years,” vintage-auto insurer Hagerty explained after the auction. The blow has now filtered into the monthly price index for vintage automobiles, the Hagerty Market Index for September.

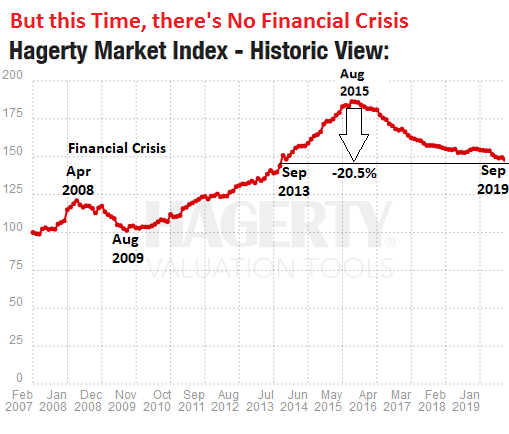

The index dropped 1.3% in September to a value of 148.24, down 5.0% for the 12-month period, and now in a bear market, down 20.5% from the all-time high in August 2015, a deeper drop than the peak-to-trough decline of 16% during the Financial Crisis. The index, after three years of declining, is now back where it had first been in September 2013:

The Hagerty Market Index tracks prices of classic cars that sold at auctions and private sales, similar to a stock market index. But unlike the Dow Jones Industrial Average, the index is adjusted for inflation via the Consumer Price Index.

By August 2015, the index had soared 84% from the Financial Crisis trough in August 2009 and 54% from its pre-crisis peak in April 2008.

Total sales at the Monterey auctions in August 2019 plunged 34% from the total at the auctions a year earlier, to $246 million, the lowest total since 2011 ($197 million), according to Hagerty’s tally.

The median sale price dropped 18.5% from a year ago, to $24,200. The average sales price plunged 26.8% to $319,610. Despite the lower prices, buyers were reluctant, and the sell-through rate dropped to 58%, from 62%.

Of the cars that did sell, these three brought the highest prices:

- 1994 McLaren F1 for $19.8 million (below the estimated price range of $21 million to $23 million). One of these gull-winged supercars – 64 were built for road use – set a speed record in 1998 at over 240 mph.

- 1958 Ferrari 250 GT California LWB Spider for $9.9 million (below estimated range of $11 million to $13 million).

- 1962 Ferrari 250 GT SWB Berlinetta for $8.145 million (just inside the estimated range of $8 million to $10 million).

By comparison, at the 2018 Monterey auctions, two records were set, according to Hagerty: a 1962 Ferrari 250 GTO sold for $48.4 million, the highest price ever paid for a car. And a 1935 Duesenberg SSJ Roadster sold for $22 million, the highest price ever paid for an American car.

But more importantly, here’s what did not sell:

The now infamous non-Porsche prototype that RM Sotheby billed as “1939 Porsche Type 64” and as “the most historically important Porsche ever publicly offered,” with a predicted selling price “in excess of $20 million,” and that the media then gushed over and called the first Porsche ever, though Porsche AG, which was founded a decade after this car hit the road, has steadfastly refused to claim it.

And maybe it should more appropriately be called a VW because it was based on the KdF-Wagen, as the VW Beetle was called at the beginning of its long history (image via Bloomberg):

Alas, the vehicle had been heavily but unsuccessfully shopped for years at prices well below $20 million, according to Bloomberg’s post-mortem after the failed sale, and just about everyone among the small group of people interested in cars of this kind knew about it. Presumably, the idea of selling it at auction “in excess of $20 million,” after insiders had rejected it for less than that for years, was to find some clueless newly-minted Silicon Valley billionaire who’d buy it on impulse or something.

Whatever the motivation, the auction of this vehicle turned into a spectacular farce, when the price on the screen jumped to $40 million and to $50 million and to $60 million and then to $70 million, at which point the whole charade blew up, because in fact the actual top bid was only $17 million, after which everything collapsed.

But it wasn’t the only headliner car that failed to sell in Monterey. Among them were these two standouts:

- 1959 Ferrari 250 Monza, estimated price of $20 million, but did not sell.

- 1962 Ferrari 250 California Spider where bidding topped out $9.4 million, not enough to make a deal.

In terms of “performance against estimates,” the average high bid was 16% below the low estimate, compared to being 10% below a year ago.

“Struggling headliner cars had the biggest impact on declining overall totals,” Hagerty reported. The sell-through ratio for these automobiles that price at over $1 million and at over $10 million plunged from 56% at the Monterey auctions last year to 42% this year.

This data is “signaling a slumping market,” Hagerty observes.

It has been tough all year in this market. For the first seven months this year – so not including the Monterey auctions in August – cars that priced at over $1 million and over $10 million had a sell-through ratio of 55%, and for those cars that did sell in these two categories, the average price dropped 19.4%, from $3.6 million in 2018 to $2.9 million in 2019.

This mood has been captured by the separate Hagerty Market Rating index for September, which fell to 62.93, the lowest since May 2012. This index attempts to rate the market and indicate the “heat” of the market. It includes weighted averages of median and average prices, auction activity, expert sentiment, Hagerty Price Guide indices, private sales activity, insured values for the broad market, insured values for the high end, and correlated instruments (methodology):

Hagerty noted:

“The number of mainstream and high-end vehicle owners who think that values are growing has been trending downward for more than a year, and for September both numbers are at their lowest points since they were first included in the Market Rating at the end of 2009.”

“The expert sentiment section of the rating is at its lowest point since October 2010, largely due to market observers’ reactions to the Monterey auctions.”

This may be a bummer for investors in this asset class. But the beautiful machines, even if they’re increasingly tough to sell, even at lower prices, retain their visceral appeal.

The used-vehicle wholesale auction price index hit a new record in after the longest series of year-over-year price gains since 2001. Read… Used-Car Market Profits from Carmageddon. For Many Americans, New Cars Cost Too Much

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Well, I’m a leading edge boomer who desperately wanted a 1964 GTO…but I’ve gotten over that. Now I’m into a BMW M550.

72-year-old men probably don’t actually need this car, but I wonder what other boomers are doing.

Along with massive square footage McMansions, high end expensive older cars are another asset that millennials are wanting no part of buying from boomers.

It is worse. It is not only that the wants are different for millennials but that if they were like boomers they would like the hottest cars when they were young. A GTO from 64 was not the hottest car when millennials were kids. Not even close.

Millennial here. Wages have not kept up with inflation, and besides the tech industry, there’s not many places for entrepreneurs to make a name for himself. Boomers have filled pretty much every niche possible.

Vintage cars and similar “assets” will be attainable after we can afford our student loan debt, our mortgage, and children. Since we won’t be able to afford those any time soon, these cars will not be sold in large quantities to us, unless the price comes down significantly.

Vintage cars will never be cheap, their value is reflected by the owners need or desperation for the money.

As for the millennials excuses as to why they didn’t purchase a car or aren’t that successful in life it’s simple they aren’t a car guy…

car guys will have that car regardless of the price… it’s a passion.. this goes from the $2000 beaters right up to the $20000000 collector super cars.. you want it bad enough you make it happen..

As for current trends the seller obviously needed the cash an was selling they still made profit.. as for classic an vintage cars. They aren’t making any more of them an prices will always reflect that..

The savvy buyer will find value & profit in cars that yet haven’t hit collector status yet an there are plenty out there..

Antique cars will be expensive to own but not to buy. Nobody has them as their fantasy car of their childhood and they are very expensive to store because they are so big. The price of vintage cars collapses when the become so old that their owners stop having needs (aka as Death).

Even for car guys it is true that you can’t take it with you.

Well Javert Chip, why are you even into cars, cash or material objects at your advanced age?

Is this some kind of desperate last-gasp effort to show-off that you can finally afford a BMW, after a lifetime of slog? lol

Anyway, your limited time is almost up old man, you should really be looking forward to your last-gasp of breath… I mean your next phase of …whatever.

You can’t take your BMW or girlfriends or even your virtual bitcoins with you when your Maker calls you back.

You should know that by now yeah?

Einbert Alstein,

I think you wildly overestimate the eagerness of baby boomers to move on and out of the way. Many still have lots of time and many laughs and plenty of joy left. Javert Chip is now FINALLY at the right age to run for President :-]

Way to go Wolf! I am a boomer and I am not anywhere near ready to give it up. There’s plenty of everything in the world. Unfortunately, the millennial class is being directed into a false sense of scarcity. Ping me in 100 years, and we can discuss whether I want to ‘give it up.’ Spoiler alert: I will not be.

Thank You Wolf!

Great article but next most important and expensive market to explore and write about is vintage comic books many 1960 books selling for tens of thousands of dollars

Albert Asstein, according to readily available statistics, javier has a 50/50 chance of living at least 18 more years.

Hope this helps you. You’re welcome.

They weren’t called the “me generation” for nothing.

hey man, 80 is the new 60

If a hot, red convertible is middle age crazy, the BMW 4-door sedan would be old age crazy … I just keep buying older Caddys, older each time, from other old fogies who drive 2 or 3 thousand miles a year, to avoid getting a car with a TV screen that talks to me and reports everything to Command Control (I think it’s turned off, anyway!).

It’s also a good way to save 90 or 95% of the purchase price of a new one.

I sold a 1970 fastback to a 70ish guy who now has time tinker and enjoy driving these ol cars we grew up with so as far as getting older, keep living your dreams!

Those were cool cars. Good memories of Squarebacks growing up and almost tipping over while in college with drunk friend and 4 other drunks on a tight right turn and saved by good handling…

Well sold my 2015 Boxster last year to a 66 yr old woman retired from IBM. Already had Volvo S60 and just wasn’t cramped sitting low with wife complaining about her hair getting ruined with top-down.

That said not surprised by 60/70 muscle car boom cooling down. Wait till recession hits next year for next leg down.

I’m 70 and into Streetrods and Hotrods. I’m keeping my beauties and will let the grandkids do as they please when I am gone. Right now I still feel like 19 year old in my 32 Roadster or 59 Chevy.

Maybe boomers ought to be caring more about their grandchildren’s future than being obsessed with material items like they have the past 50 years.

LOL, not a Millennial. And Boomers rode a wave of wealth and squandered it.

You are what Plato would call the Appetative Class. If you’re thinking of toys and you’ve only got a few years left to live, maybe it’s time to get some perspective.

Jon – Exactly. In my family on both sides, it appears each generation did a pretty good job of helping the next, letting ’em live at home while attending college, helping them learn a trade, etc. Then something happened, my parents, Silents, and Boomers, seemed to decide it was really fun to climb the ladder and then pull it up behind themselves.

Those “material items” are called hard assets. They help fund the grandkid’s future. Look it up, maybe you’ll learn something, kid.

So Jon, I should kick my millennial stepson, his wife and their two children out of the house just to fit your stereotype view of what a boomer is? I don’t think so.

My vintage dream car is a Lotus Elite. Several years ago, I inherited enough money to buy one. The grandchildren will get the gold I bought instead.

I have a 72 Lotus Elan 2+. Needs more work. Every single time I open the garage door I hear it squealing “Throw money at me!” “Throw money at ME!” Damn Brit 4 bangers.

No amount of money can buy happiness. Enough money can rent it.

Lisa, not counting the TC which was basket in basket out, my British 4 bangers were all BMC A types found in Sprites, Midgets and Morris Minors. Never had a major failure or an end to the minor failures. Hang in there!

Work buddy had a new red Lotus Elan. Cornered like it was on rails. Engine behind us, but I think it was a Renault engine.

Check that…..just remembered it was a Lotus Europa.

Gold is also fine, but can you drive that :)?

My grandfather left me his car – he knew I would take good care of it. It’s the car I learned to drive on, and we went so many places with it. It was a good car then, it’s a rarity worth quite some money today. I could sell it, but quite a lot of our happy family memories, too many to count, are related to that car and I don’t need the money to survive. I also have another classic car that I bought and that I enjoy driving.

Yes, I’m a car guy born in the 60’s. My kids (boy and girl) both graduated in mech. engineering and they like classic cars too.

This said, as an enthusiast, I witnessed the ridiculous prices that classic cars attained with disbelief and I welcome some overdue sense. Just do the math:

Example: Ferrari Dino 246 GT. Bought and sold by collectors and merchants at around 350,000 USD.

Number of cars produced: around 3300. I guess 3000 at least survived.

Therefore: value of all Ferrari Dino 246 ever made: 3000*350,000=1,000,050,000 USD: in excess of one BILLION USD.

It’s preposterous. Welcome sanity.

Classic car market needs to,level out.

B4 all,the players pass away.

,Not many 25. Year olds have classic cars today. Why?? They cost to much., . model Ts are affordable around 10k. . and a few 80s cars in the 5k. Range.,.,next 2 genrations of Caretakers of ,tnese fine old cars, will most likley be ones who,inhiert the cars and not buy them. .

How ’bout a 1950 fiat 500 single cylinder ???

The original Fiat 500 (1936-1955) was actually powered by a four cylinder engine but it was so desperately underpowered, even for the standards of the time, it surely felt like it was running on just one cylinder!

Legend has it was pitched to the Italian Army, then chronically short on motorized transports, as the basis of a small truck but the prototypes proved so unsatisfactory through a combination of low power, unreliable suspensions and shoddy worksmanship the Army preferred sticking to their mules and horse-drawn transports!

Javert, 71-year-old here. Relatively cheap and most performance per dollar for a retiree on a tight budget = Subaru WRX.

X4M is nice.

Well Boogers!!!

I can almost taste the tears of grief as billionaires rare car reach around didn’t hit the market. Imagine if you attended the Pebble Beach auto extravaganza. Just being there puts you in the .001% class.

I am shocked that the 1939 Kupelwagen didn’t hit $20 mil. I have paid that in a heart beat. Immediately after I sold my kidneys, liver, lungs and other body parts to raise the cash

But I did get a heck of a good bid for my first edition Eleganza Longguido Shooting Brake Superfast Bearcat for bus fare. Hot Wheels cars are really catching fire today. The Flameproof Tesla Fiero was top on the list

Sorry

I just couldn’t help myself. Rich boys and their Matchbox toys are too funny for words

Oh, what happened to the Atwood Collection from Rockford ILL? Atwood Industries made car parts. Woe to Rockford! One of those Ferraris?

Buying high and selling low is never the way to go, particularly in a low liquidity commodity.

And buying now is exactly that.

Ben,

This misses the point of the market. None of the items are “worth” 20 million dollars or whatever. There’s no way to gauge the price or value other than what people bid for it. The sellers probably lost no money. They put their savings into something that packs lots of value relative to its size and when they needed some cash they sold it. These are not investments and I don’t buy that the super rich just blow tens of millions of $ to beat the joneses. They buy it because theres a market waiting on the other side when they need money for some other reason. Classic cars, art, antiques, historical artifacts… These have no metrics with which to gauge their value and when people try they fail. The charts are meaningless because the pieces have no relation to anything else like commodities do.

Also, its only less sales this year. No one necessarily bought high and sold low. The cars that sold this year may have not been up for auction for a long time.

Anyways, im not picking on you. Its just a fascinating subject to me and there are so many misconceptions from people (like me!) that dont have 20 mil to squirell away in the form of a classic car.

I agree, there often seems to be a view that sellers who sell up on the ‘wrong side’ of the peak have ‘lost’ money.

Given value is only really realised when you sell into cash, not what people guesstimate/value it at, it’s a bit meaningless to say anyone lost anything.

My best investment to date was bitcoin.

Despite its crash, and Wolf telling us how much money we’ve all lost, I’m still up about 5000% in 5 years.

It could crash to just £500 and with profits taken I’d still be up better than most of the top stocks over the last 5 years.

Whoever moved on that McLaren F1 did well!

Last I looked they were £1mill ish.

I wonder if we’ll now see ripples into the normal market for ‘future classics’ we seem to see for nice ish everyday cars?

Things like 80s and 90s BMW M cars have gone crazy.

I don’t trust Bitcoin. I can’t hold a Bitcoin in my hand … I was given 1/10th Bitcoin and I never got anything in the mail. I just plain don’t trust it.

If bitcoin crashes to 500 pound it is death. It needs the miners to work and they won’t mine if what they mine is so low. Plus there is the whole 50% attack on the ledger.

Knowing I’ll never be in the class that can buy a genuine 62 GTO, I did the next best thing and built a replica. Yes, a kit car, or a tribute. Pick your own word to denigrate the effort to recreate the unobtainable but fashioned for mere mortals. And I love it!

What company did you get the kit from? When my son is a little older we were looking into doing a Factory Five kit. Not sure what other reputable companies are out there.

What chassis did you build it on? What engine?

This market is for the rich. When they stop spending one would do well to pay attention.

It’s also a market for the old.

Not all of us. Anybody for a 1995 Dodge Ram 250 Cummins diesel pickup? Zero to 60 in one afternoon?

I’m 53 now. Bought my first classic car at 20 and still love it as much as ever. Just bought a 1954 Packard ragtop. Not interested in investments with my hobby,just love the motors and the friends and lifestyle I get out of it.

Not necessarily. The majority are enthusiasts, luckily. I’m currently looking at a 7000 USD car that I like, and that I hope will be fun to drive. I spend quite a lot of time fixing, cleaning, restoring. I’ve learned a lot of new skills in the process.

When people start feeling economic pain, the first things to go are classic cars and pleasure boats. My brother used to build yachts but sales fluctuated wildly based on what the economy was doing. He moved into portable toilets and got a more constant demand.

LOL

Would you say the demand was more ….. regular?

Happy I sold my 74 VW Kharman Ghia coupe this summer for $12K…few calls for it compared to the past and the one buyer who came with cash was gladly offered the car…..I sense the market slowly dropping due to a lack of new participants.

My daily driver is a 69 Impala convertible. It’s about 20 feet long and wide as a bus. Everyone everywhere loves this car. Funny thing is how much people in their 20’s are into it. Under 20’s even more. It took some work but this car is economical and reliable. Parts are cheap and available everywhere, even impala specific parts, for the most part.

Installed modern electronics, bluetooth, monster stereo, LEDs everywhere, halo headlights, sequential tail lights, radar detectors, laser jammer, cameras, spare battery, dc inverter, auto start, alarm, power door locks and trunk pop. Insurance under $600 a year at Hagerty. Total investment around $30k.

This car makes me smile every time I drive it. They really don’t make them like they did in 67-72 any more. I can see why someone would prefer a modern car, especially if they have to travel a lot, but for someone like me who lives in a city and drives limited miles this car is a dream.

Those impalas were great for sneaking into drive-in theaters! :)

Despite the lower prices, buyers were reluctant

Theses buyers aren’t economy buyers. Im guessing these cars, even on the low end of the sale price, are basically not used after purchase. No ones kicking the tires, having their mechanic check it or haggling over warranty. So why are they not buying? idk for sure but maybe since all classic cars are unique (sometimes it what gives it value is who owned it previously) maybe there was a boring selection overall? There are storage costs associated with the vehicles so a more expensive car would actually make MORE sense to buy.

The auction house was hoping for a sucker with that hideous ‘porsche’ but instead of LOWERING the price it was RAISED in the hopes it would create a fever. Thats the difference between bidding at auction and a sales lot, they’re exact opposites.

bungee,

The thing is, these sellers — unless they’re in financial trouble — don’t have to sell. So when the top bid would make them lose money on a vehicle, they just don’t accept the bid, and the car doesn’t sell. It didn’t sell because the price as per highest bid was too low. That tells you something about the price action. That’s why everyone is paying attention to what doesn’t sell.

Thanks Wolf. It’s a great article you wrote and the subject of auctions is an important one to me. I enjoy the psychology of the whole thing. How do you know what it’s worth?

To the extent that these cars are unique, there’s little to glean from the market as a whole. Coulda been a bad batch. If Porsche had actually confirmed that the weird spaceship-looking hunk of metal in the photo was, indeed the first porsche; well, 70 million coulda happened. Easily.

I think this was just a bunch of losers. If sales of classic cars at auction are down, they’re just the wrong classic cars. In fact the RIGHT classic cars are sitting nicely in their storage facilities, meaning those of real class and strong hands aren’t offering. This auction was the market explaining to people that their classic car ain’t so classic.

I don’t care much about cars, but I have a certain interest in motorcycles so this may sound like Linear A to most of the readers. I apologize in advance.

In early July an early production (4K engine) Moto Guzzi Daytona 1000 IE went up for sale in Modena, apparently as part of an estate sale. This is an extremely rare and sought after model: five years ago I was outbid on a crash-damaged one which was sold in a flash auction in under 24 hours.

This particular Daytona is in excellent shape: even the easily scuffed white wheels are spotless. The seller is asking for €15,000.

And the bike is still there, waiting for a new owner.

According to your logic we should have outbid each other and sent the price into the stratosphere. After all a Daytona in any condition is a rare catch indeed and they come up for sale only once in a while.

So what went wrong?

First thing: the price itself. Even on a very good day, even in the present economic climate that bike is not worth €15,000 even on a very good day.

Second thing: something is breaking in the collectible/classic market. Too many people bought at silly valuations over the past four years and now that they are trying to sell at even sillier valuations they have run into a wall. Plainly put the supply of people ready to pay even higher prices is running out and prospective buyers are factoring in how much that Daytona will be worth in 4 or 5 years. Surely not €15,000, let alone €20,000.

Yes, I know this sounds like spare change. ;-)

What to do? Simple: go see the Daytona in person (pictures are sadly often retouched), make an offer “in the flesh” and see if we can work a deal. Unless of course somebody else had the same idea first. ;-)

That’s the new reality sellers have to prepare themselves to: the cash is out there, but it has become a whole lot harder to reach as the ultra-optimists who bought at the top got burned.

Wonder if G. Agostini had plenty Minoan DNA? Most likely. What does an MV Agusta go for? I’m sure his are being saved somewhere in Italy, maybe by him if he is still around.

The ‘Porsche’ didn’t sell because the auction fell into chaos and was abandoned. Because of the auctioneer’s indistinct pronunciation, ‘Thirteen’ was believed to be ‘Thirty’, and all the ‘teen numbers sounded like their higher counterparts.

Whoever was operating the TV screen data understood the same thing.

Now, the really weird thing was that everyone was looking at the screen with the higher numbers, and kept bidding up to the 70 million mark until the auctioneer noticed the screen and corrected the amount to 17 million. The auction collapsed amid jeers and boos. Sort of an alternate universe event. Why were they all bidding to the wrong amount? What were they seeing? Would they have paid it?

The reserve was 20 million.

https://www.youtube.com/watch?v=-o2MtsxeZtg

Wolf… Good article. A GTO replica can easily be built by starting with a same year Tempest….. Add the correct engine for the year, trim, wheels, etc… You can end up with clone that most “experts” cannot find fault with.

I believe he was wanting to build the Ferrari, not the Pontiac. There was no Pontiac GTO until 1964.

Your right…. I was giving WR the domestic low cost version…LOL

The median sales price at the auction was $24,200 and the average was $319,610. There are two markets mixed together here. I think with all used car prices rising currently that appealing high production classics in the median price range will mostly retain value if maintained. This is a lot more than can be said about any new car. They don’t build them any more so they will always be getting more scarce.

The key for me in choosing an old car is high production and appealing style. Rare cars have no parts available. You want a high production car because model specific parts are likely to be available on the internet. I hope their prices go down. Good condition classics will go down a lot less than new ones do a month after they leave the lot.

These cars are not for everyone but as new cars get more complicated and fly by wire these vehicles become comparatively simpler. Anyone can fix them with a manual and a few youtube videos.

You have no idea what you’re talking about. Youtube videos don’t show the stripped out broken bolts. Bolt holes that don’t line up. Stretching and bending frames to make panels fit. Do you have a machine shop with press, drill, high strength drill bits. Quality taps. Lathe? What about welding? Stick, gas? People like you always say anyone can fix cars. Well if it’s so easy then why doesn’t everyone do it? Do you know how to clearance rods? Gap plugs? What about tuning? Oh you just watched a couple videos on youtube and now you know more than a real mechanic. Then tell me what’s that metallic tic at random rpm? Does the youtube video diagnose a rod? injector? lifter? Now you have to tear down the engine to find out it was just a ujoint. That just cost you thousands of dollars and maybe hundreds of hours of labor and that’s if you’re lucky enough to still have all your fingers without extremities crushed.

Any reasonably competent person with a garage and some tools can repair most of what goes wrong with cars. I’m not clear why you’re trying to mystify the process. If you’re into this as a hobby, you start small with basic hand tools and basic jobs. Then you expand to more complicated jobs as you get comfortable and more knowledgeable.

The people we pay to repair our cars aren’t the sharpest tools in the shed. Car owners can do better jobs than paid mechanics because mechanics are paid to get the car in and out as quickly as they can. Hell, most don’t even use torque wrenches. The only car work I pay for is alignments. I simply don’t have an alignment rack or I could do my own.

Yes, I have a welder, press and a rod-bolt stretch gauge. As you continue this hobby you collect more and more tooling. If you want to just save $400 on a brake job, you can do it with basic hand tools and a torque wrench.

Note how two of the three failed sale examples were a 1958 and a 1962. The Baby Boomer buyers that bid these up in the past were kids when they first saw them made and coveted them. Now that these guys are older millionaires, they can now afford to bid and finally own one. But what happens when a person who was born in 1972 sees one of these cars? There is no emotional attachment, and the guys that really appreciate them, are getting old and dying off. I predict that there will be continued declines in the 1950-1965 vintages going forward.

This same phenomenon is seen in James Dean and Marylyn Monroe and similar memorabilia. Once the generation that coveted these things dies out, the prices collapse. Ask a kid about Elvis, and you will get a blank stare, but Justin Bieber’s underwear will be selling for millions in 2050.

LOL! My 21 year old son says “John Wayne who?”

Actually his name was Marion Wayne, from a time when quite a few boys were named with girls’ names.

Maybe they can relate to that these days.

JW was Marion Morrison.

Played at UCLA and got hurt. So went acting. Marion Wayne?

Don’t think so pilgrim.

Marion Michael Morrison, and he screwed his back up either playing football or bodysurfing, depending on who you ask. Which is why he didn’t have to serve in WWII.

I have to agree; collectibles are in many cases valued by specific generations. Car enthusiasts tend to be in their 20’s, and they’re chasing cars from 20 years ago to build the current “hot rods”. They’ll spend the next 20 years being too poor to chase cars, spending on home and family. When they hit 50, and provided they can afford a hobby and their tastes haven’t changed, those are the cars they’ll want.

Values of cars from the pre-1930’s seems to have dropped off, and 40’s and 50’s vehicles seems stagnant. Unless it’s something super rare, stuff the average car guy can get into can be had. The problem is, that most of the cars 40+ years old are in rough shape, and bringing them back to life costs more than they will ever be worth.

I talked yesterday to a friend who has a 53 Cadillac. He’s the second owner, the cars has sentimental value, and he’s going to spend more than it’s worth to make it pristine again. He can afford it, more power to him. But when he’s gone the car will either end up in a museum or rust away.

“But what happens when a person who was born in 1972 sees one of these cars?”

My older siblings are younger Gen X’ers, and they have ZERO desire for vintage cars. They DO have a desire to fund retirement and their Gen Z kids’ college tuition. Pretty much ditto for me and my Millenial friends (except add student loans and housing to the list)…I’m wondering if this is less of a generational thing and more of a class thing. I always laugh at the analyses of Millenial spending habits…like it’s a choice or something. (well, I do freely admit to an avocado toast addiction *shrug* sorrynotsorry)

I suspect it’s generational in how the market itself coalesces over time.

A fair number of Gen X had to figure out how to *pay* for a car when they were 16. The twin recessions of the early 80s, combined with the need for emissions testing, new insurance laws, etc., created barriers that didn’t exist in earlier decades. If your parents were middle class or above, it was no problem. If, like me, they weren’t, the option was a ten year old Pinto or Vega — neither of which inspires nostalgia today. If your parents could afford to buy you a Honda CRX or BMW 3 series, you’re probably pining for a restored one when you retire. This, however, is a small market in a small cohort.

Boomers with no money had cheap/free options in a market where most families traded every 2 or 3 years and a 5-year-old car could be had for $50 (albeit requiring work every weekend in the back yard, literally). It was easy to switch out the standard 6 for a junkyard V8, and viola, hotrod. Note that the late 50’s Chevys weren’t popular as used cars, and their depreciation was epic, which is why they were so popular for hotrodding (Cadillac, Olds or Buick engine swapped into a Chevy 6-cylinder body was very common). Cruising was something everyone everywhere participated in, and the fond memories still linger. This creates a very large market in a very large cohort.

For Milennials, divide the market in two: urban and rural. The rural guys are swapping Chevy LS V-8s (from trucks) into Miatas, Fairmonts, and even BMW’s. So this is a cohort similar in size to boomers, but the rodding market is 50% of their parents because urban dwellers tend to eschew cars in general.

Breakdown:

Boomers: Anything 40’s 50’s 60’s. Must be a V-8.

Gen X: Honda, Honda, Honda. Some Subaru/Mitsu (WRX & EVO). BMW (mid 80s to late 90s lightweight chassis). High-strung 4cyl and turbo.

Milennial: Anything a Chevy LS motor can be squeezed into.

It’s intersectional: generational, class, and diversity. Crazy Rich Asians and oil sheik heirs will spend 5M for a hypercar but not a vintage car.

I dunno, my 49er Dad, and a 35er I know well, both had classic/do you uppers 20-30 years their senior.

So childhood attachment is a big thing.

But there is still a strong enough market for older stuff… maybe not one to make mega profit from, but when was that ever sustainable any way?

The first graph is very helpful and telling, the info behind it covers private sales and auctions.

As for the cars that did not sell at auctions, what they were bid up to is not a good way to determine value. When a car is up for auction, and there are no bidders in the room (which is often), the action house bids it up, it is called a “Chandelier” bid. The auctioneer fakes a bid (legal), looks in the general area of the chandelier above the audience and usually bids it up to reserve.

A lot of hype and booze at these auctions, but if your not there to buy and like to look at collector cars they are a lot of fun!

@AGXIIK “Just being there puts you in the .001% class.” Not quite, the .001% class is there to buy the multi million dollar cars, but the are plenty of cars for sale in the less than $20,000 price range.

Correction: usually bids to just below reserve.

Who makes up the estimates? What is their motivation? Any ulterior motives? (sarcasm)

When the average high bid is significantly below the average low estimate, there is probably something wrong with the process. Actually, it appears that something smells bad.

Nobody likes to be disrespected. I certainly feel that these completely out of touch with reality “estimates” are disrespectful.

I wonder how much they will be worth when the internal combustion engine is banned. If you are an investor, that, or even internal-combustion- engine-shaming, has to be a consideration.

Anyone want a second hand private plane?

Oh, I dunno.

Stanley Steamers still have their following – not cheap, either.

people still buy horses

horsies sometimes way more expensive than cars . I have ridden a few thousand horsies in my lifetime, always owned by others. as much as I would love to ride again… too expensive. Have to have the land, barn, equipment, truck, trailer, and most of all TIME, maybe one day I lease a hay burner( yes thousands, former jockey, exercise rider)

CNBC has a show devoted to classic cars. “Jay Leno’s Garage” premiered in October of 2015. Contrary indicator?

Neil Pert & RUSH:

“I strip away the old debris, that hides a shining car

A brilliant red Barchetta, from a better, vanished time

Fire up the willing engine, responding with a roar!

Tires spitting gravel, I commit my weekly crime…

Wind in my hair-

Shifting and drifting-

Mechanical music

Adrenalin surge-

Well-weathered leather

Hot metal and oil

The scented country air

Sunlight on chrome

The blur of the landscape

Every nerve aware”

To keep the brand’s mystique alive and well, Ferrari finished first & second in yesterday’s Singapore F1 Grand Prix.

Yeah. Ferrari has found some speed somewhere. Should make rest of season interesting.

Guess the team thought “the mayor” needed a win to cheer him up?

On the grid before Singapore’s race began, the world’s best automotive aerodynamics engineer, Adrian Newey, remarked that Ferrari’s new nose cone had an interesting airflow shaping underneath, and it allows them to keep front down force and have less drag. Look for it on the Red Bull cars next weekend at Sochi, Russia.

Ferrari does have the best straight line speed, and power must be strong from their engine and KERS (kinetic energy recovery system).

And to MC01, after reading your comment today, I took out my ’02 Kawi ZRX12 for a nice ride next to the Mississippi river!

LC4 dense urban core daily downpour commuting on knobbies. Shattered nerves, I just want to get home. LALALA

A Mickey Mantle baseball card was sold for $525,000. A pink diamond was sold for more than $1,000,000 a carat. While a few got rich keeping old cars, most were sold for salvage value as old parts are hard to find. Better luck was often found in dividend stocks.

While I have owned a couple of vintage cars in the past, the (relevant) market that I know best is that of vintage watches. There was a spectacular run-up in values over the past eight years or so, but the market has now changed noticeably. It has bifurcated, as the the values of the very best of the most desirable models remain strong, while the rest of the market has been under serious downward pressure for about a year. That downward price pressure is accelerating, and like any bursting bubble, those who cling to the hope that they will get what their watches may have been worth a year or two ago, and are slow to adapt to the changing market, will be burned.

Luxury goods are being used to get around capitol controls. This is why certain brands are being bid up over retail. The buyers know they can cash them out in the west at some good price. I heard people hang out at the duty frees in Asia and buy anything that comes in, of certain watch brands, to convert their currencies to assets, which can then be easily taken out and sold in the west.

You’re confusing new (or contemporary) with vintage. What you describe has definitely been occurring, but almost exclusively with new(er) watches. In the vintage market, the values of the most desirable models is simply being held up by collectors and fashion-conscious buyers with real money. The rest of the vintage market is reflecting the same problems, including debt saturation, that other markets are experiencing.

The number of stores trading old and valuable watches I saw pop up in Switzerland over the past decade defies belief, as did the ultra-prime locations they chose to set up shop.

Now they appear to be moving to shall we say less prominent locations and without exception they have removed the multilingual signs advertising “Free valuations” and offering to buy “Whole collections”.

The Asian collectors (chiefly from Japan) looking for rare models in Zurich and Lugano appear to have greatly diminished in number.

I don’t understand a thing about mechanical watches but I know a bubble when I see one and this one has started to hiss air. The only thing that surprised me is how long this thing went on before people started to be cured of their collective halucination.

Good observations, MC01. I am a seasoned collector, not a dealer, but have been selling to Japanese dealers in recent years, as their wholesale purchase prices were roughly equivalent to, and sometimes even more than what I could get selling privately in the Euro/American markets. I also follow the websites of the most prominent vintage Japanese dealers, and the slowdown over the past 10-12 months has been increasingly palpable.

Like every other bubble market, a lot of people who bought high are going to be in for rude awakenings. But what makes the vintage watch market somewhat different than others is that many collectors have never even experienced a down market, let alone a crash, and I expect the denial to be more even more stubborn as a result.

Those Japanese collectors have been a fixture of some Swiss cities since I can remember. They were already making the rounds of the big watch stores and jewelers in and around the Bahnhofstrasse in Zurich when I was 7 or so: they are part of the landscape.

Their numbers increased dramatically over the past decade: I think it’s a combination of asset bubble and the fact that many of these folks are semi- or fully retired and hence have far more leisure (and cash) to indulge in their hobby.

I wonder what will happen when these old collectors will move closer to Buddhahood: Japan has been a periodic source of large motorcycle collections. Plenty of highly exotic stuff up for sale on these occasions.

I believe the same is happening across all antique and collectables categories and it has been happening for over a decade. Hobbies are not investments.

Well, yes and no. I agree with your observation, but “hobbies” can indeed prove to be very good long term investments.

Fine cars and watches, etc., will always be of interest to those who can afford luxuries, and the best have gone up tremendously in value over the past 50, 20, or 10 years. The trick, like any market, is to hold and sell at around the market peaks, and buy during the troughs.

Might be because you can probably get a Tesla for half the price and it’ll likely be just as rare, if not more so, in a couple of years, according to some.

As shown in the above graphs the collector car market has been slowly dying since 2015. I have seen this in many of the cars I am interested in.

The going joke among my friends are, “like the shoeshine boy giving stock tips before the 29′ crash”, when Hedge Funds or Private Equity Firms start getting into the collector car market, it is time to sell, fast!

Fast, especially since collector cars are not a liquid as stocks.

https://news.artnet.com/market/bonhams-sold-to-epiris-1342580

The boomers are retiring at the rate of 10K a day. There’s a lot of downsizing going on, most of them need cash more than expensive stuff. That’s the real reason prices will be dropping at the upper end of most assets. Even financial instruments will start to get dumped as boomers cash out over time. The millennials don’t have the numbers or incomes to start replacing the eroding values.

A friend who buys estate watches says it’s an upcoming perfect storm.

Boomer collections going into probate, where it’s almost a firesale.

Upcoming Recession

Indebted youngins

Youngins don’t wears watches anymore.

Same applies to diamonds, but worse, since there diamonds have almost zero resale value.

Autos are on or near to the consumer side of collectibles which is junk. Consumer items, like Hummel figures are hardly worth their selling price half a century ago. It’s only in rare art items, one of a kind, and rare cars where there is any interest. The wealth disparity gap applies to collectibles. Andy Warhol managed to get the last laugh on that however.

Not surprising that SOME of the prices for the most expensive vehicles did not get realized at auction. Way too many rare high dollar cars that were hyped by the auction houses weeks before the Monterey Auctions.

And it’s becoming obvious that there is a very limited number of people that actually want these rare cars as well.

On the other hand, if you have a nice C2 Corvette or maybe an older Shelby Mustang; it won’t be hard to find a willing buyer

I mean how few people can really afford to invest in these cars.

I have to imagine, realistically that you need a networth at least in excess of 500 millions dollars to justify investing more than $10 million dollars in a vehical, even if its a collectible.

I can’t imagine a person only worth $100 million sinking half their networth into a single asset. But $40 million starts to become not a big deal if you have a networth north of $1 billion dollars I assume…

So literally there are only a couple thousand people I the world that can jusyify such extravagant investing? Or maybe I am underestimating the buying power of some millionairs.

My brother-in-law is one of those people but more for bragging rights instead of looking for capital gains from investments. He has a collection of about 70 vintage cars.

My dad and family have been wrenching since the ’30’s with various levels of classic cars- not the multi-million $ ones. We have gone to Barrett-Jackson, etc.

It’s a very odd market. Collectors’ age dictates which cars they like. Younger people don’t have the same sentiment towards cars. The high end ones trade more like Picassos. One bad day (like the wildfire that went by my brother in law’s house), and your investment can be gone.

Anyway, many (older?) people like cars, but maybe not that much; and in a more unpredictable way than data can report(?).

Yep – 88 – would like to have a 1959 Saab 93 again – who would’a thunk it?

I think younger people do not have the same attitude towards most ‘collectibles’ coveted by the baby boomers. Regardless if its a Studebaker E series truck or a McMansion out in the boonies, tastes changes from generation to generation.

You will always have outliers, but figurines, wood furniture, fine china, Norman Rockwell plates, Thomas Kinkade paintings, etc are all piling up at antique stores.

None of my vintage cars are, nor would have been, considered assets.

As a boomer enthusiast of modest means who has owned several lower end vintage cars over the years, I would like to thank the investor class for destroying my hobby.

Yep. And having a garage along with it. Expect more destruction as they try to build their “dynasties”, although most here are on the menu of the apex predators in the long run, if this “game with no boundaries” has one, which I doubt.

My understanding is that “Collectible Cars” are bought by a guy who really, truly lusted after that particular car when he was in High School, and now has enough money to buy one.

That is to say, he is now 68 years old. Old cars in excellent condition sells for big bucks exactly 50 years after they were manufactured. Some of them hold their value (1965 Ferrari) and some of them do not (1975 Pinto).

I remember when a 1948 Buick Roadster was the most expensive car in America. It was 1999? Now that all of the guys who lusted after that car are, um, no longer buying, I expect that prices have cratered. Nothing against Buick, but this is how it works.

$20 Million for an early Volkswagen? Ridiculous.

Even if you call it a “Kraft durch Freude Wagen”. . .

My dad had a ’47 Buick Roadmaster Convertible- numbers match frame off resto- original 6V, etc.

It was a few dozen thousand $. A totally different experience riding in that vs anything today.

Gone now, however.

My Uncle had a Buick dealership, so my family had nothing but Buicks when I was growing up. 1964-1968 Buicks were excellent cars. People I knew said good things about the early ones, especially the 1946-1949 models.

Kind of a shame about how GM has been taken over by ignorant bean-counters.

I think the Type 64 was an outlier anyway – some of my friends in the “old Porsche” community pointed out that it’s been hawked to just about anyone who may even consider buying it for a lot less money over the last few years. Apparently they all said “no thank you”.

There are also multiple other factors at play outside the “hedgie car buying syndicate” level of collector car purchases.

First, as has been pointed out already, the people who sustained the “up to 1970” market aren’t necessarily building out their collections much further and if anything, are probably looking at selling a few cars.

Second, the people who are still buying are in my age range – let’s call it mid-late thirties to mid-fifties – and even if they still want their grandpa’s car back for sentimental reasons, they’re now looking at cars from the late 60s onwards. Prices of eighties and early nineties collector cars have actually still been going up, but we’re talking about something that may have moved from a couple of grand to, say, $20k (or $40k if it’s a non-turbo 911). And yes, there are a few special cars from that period, but that’s not where the majority of the market is. The market of people who were able to afford Ferrari GTOs (which at some point where like $7k) and McLaren F1s were only ever a few hundred to a couple of thousand people. That’s not changed, it’s just that the prices have gone up.

IMHO cars are moneypits, not investments. There is a small part of the market where you can make money restoring them and consider them “art” but the majority of the classic car hobby isn’t like that. But most of us either don’t count the hours or are willing to sink a relative lot of money into a vehicle that we’re unlikely to get back.

I suspect what we’re seeing here is a market correction at the mid- and high end, where it had been overdue for a few years. Mind you, I wouldn’t complain if some of the cars I still want to own come down in price again. I’ve got some cash stashed away for that exact purpose.

PS: There are a bunch of companies that are starting to make EV conversion kits for classic vehicles. I suspect the more desirable classics will be with us for quite a while.

Robin Williams (who had personal experience) said that, “Cocaine is God’s way of telling you you are making too much money.”

The prices of these cars are analogs and affirmations of Williams’ remark.

Yep, I remember when a plastic septum was a status symbol.

My new 250 Ducati Diana (and many other bikes, road and dirt) were only status symbols when combined with my riding skills.

Maybe they are all part of someone’s collection now. I have no use for them anymore, too old.

What a coincidence the U.S. stock market showed a peak in August 2015 but the Calvary came over the hill (PPT) at 9:45am. Should it have dropped 20 percent the August 2015 peak it would be around DOW 12,000 today.

came close to trading ‘55 chev 1/2t, for a sack of potatoes more than a few times raising fam/career. 45yrs later, close to turning more attention towards the garage (lickety-splitly) and the ol ‘55, patiently waiting w/memories.. that’s an asset.

(btw fine wk on repo, ty).

Wolf,

Is this in any way the canary in the coal mine? The people who buy these can afford most anything and the fact that they are not buying has to mean something. Between this and the whole repo thing, I am wondering if October is going to be eventful.

Bart,

During the Financial Crisis, they were not a canary in the coal mine. They were followers. That market peaked (according to Hagerty data) in April 2008, so maybe with March sales. This was when Bear Stearns collapsed.

In the late 70s I bought and repaired antique pendulum clocks (1880 – 1920) and solid gold pocket watches. Huge demand at the time. Today those old clocks sell for less than fifty years ago. Nobody wants them or can’t find anyone to repair them. The gold watches have gone up but most are only worth the gold price.

And tech stocks keep being bid up!!!

A severe correction in all of those assets like real estate, stocks and collectibles is coming very soon

The intersection of wealth and tinkering ability is pretty slim and getting slimmer. Now you have to have money and the willingness to fully employ an old mechanic if you want to buy old cars.

Plus a spacious garage not otherwise occupied.

Try finding an air cooled Porsche in good condition for under $40K. These were $15K cats in the mid 2000s. Wake me up when they’re under $30K again, then I’ll believe there’s a “crash”.

Those that need to wake up are the owners.

There are tons of collectible vehicles around at insanely high valuations, with more getting added every week. But sales are declining: put it as you want but prospective buyers seem increasingly put off by such frothy valuations.

Leave them stew in their own juice: crash or not reality is already knocking at the door.