Store liquidations in 2019 have blown past the full-year total of 2018.

The phenomenon of the Brick-and-Mortar Meltdown is proceeding with relentless momentum, trailing in its wake store closings, job losses, bankruptcies, and liquidations. Just this week:

A’Gaci, a young women’s fashion retailer based in Texas, filed for Chapter 11 bankruptcy protection on Thursday, for the second time, after having filed for the first time in January 2018. This time, it will liquidate. All its remaining 54 stores in seven states and Puerto Rico will be closed – the “bulk” of them by the end of this month. Bankrupt retailers are notoriously difficult to restructure and turn into success stories.

The company blamed the “challenging business environment,” particularly the “shift in consumer preferences away from shopping at brick and mortar stores to online retail channels.” And it blamed “hurricanes that impacted its most profitable stores” along with a botched “implementation of an inventory management system.”

On Wednesday, Walgreens Boots Alliance said in an SEC filing that it would close “approximately 200” stores in the US, accounting for about 3% of the company’s footprint. This move is part of its “Transformational Cost Management Program,” which indicates that there are more such moves coming in the future.

Also on Wednesday, this one in the “Dead Meat Walking” category: TransformCo, which Eddy Lampert had set up to buy certain Sears assets out of bankruptcy earlier this year, including 425 stores, announced that it would shutter 21 Sears stores and five Kmart stores, citing among other things a “generally weak retail environment.” And it said it “cannot rule out additional store closures in the near term.” So more store liquidations to come just in time before the holiday shopping season.

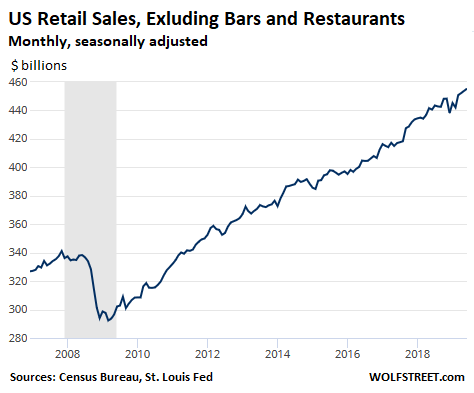

This phrase, “generally weak retail environment,” that TransformCo used is of course nonsense. Just about everything Lampert’s TransformCo says publicly can be considered nonsense. US retail sales are growing at a decent clip, up 3.3% in July compared to July last year, powered by the relentless boom in e-commerce, though brick-and-mortar department stores, clothing stores, and many other types of stores that populate malls are getting crushed. The weakness is in brick-and-mortar stores, not retail in general. And Sears, once the biggest mail-order house, totally and forever missed the train of e-commerce:

The problem for Lampert’s stores is two-fold: One, Lampert, a hedge-fund guy, is clueless about retail; and that two, his #1 priority, as hedge fund guy, is to strip the stores clean one more time – which he has done for years before the bankruptcy, and which led to the bankruptcy, and for which he, Treasury Secretary Mnuchin, and other “culpable insiders” got sued by the legal team that is picking through the remnants of Sears Holdings, alleging that these “culpable insiders” committed a series of massive “fraudulent transfers.”

On Tuesday, luxury department store Barneys of New York filed for Chapter 11 bankruptcy. Its restructuring plan calls for closing 15 of its 22 stores. Liquidation sales at those stores have already started.

Following the back-to-back-bankruptcy-filings strategy to total liquidation, it intends to keep five flagship stores open for the second filing – two in Manhattan, one in Beverly Hills, one in San Francisco, and one in Boston. Rent alone is a store killer in those locations. If the plan manages to emerge from bankruptcy court, and the company doesn’t get liquidated this time around, it is doomed to file a second and final time for bankruptcy and be done with entirely.

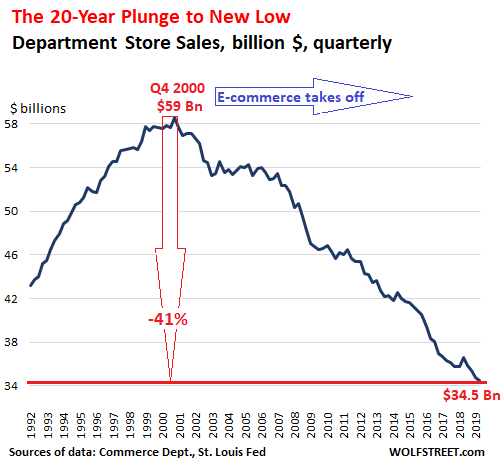

These beaten-up brick-and-mortar department stores have zero chance against online retail. They’ve been sitting ducks since peak-sales in the year 2000, though they spent 15 of those 19 years denying it:

The only chance these retailers have is building up a vibrant e-commerce organization, including a fulfillment operation that will let them survive as mostly an online retailer.

But they should have started 15 years ago, when they still had the resources. Now weakened, over-indebted, and bleeding cash, they cannot even contemplate investing the massive resources it takes to build up their e-commerce fulfillment infrastructure and catch up with everyone that has left them in the dust. So their online efforts are feeble and confused, and they’re doomed to be eaten alive by e-commerce powerhouses such as Amazon, Walmart, Macy’s, and others, and by manufacturers selling direct on platforms such as Amazon or eBay, or any of the others, and by the many thousands of smaller operations, including mom-and-pop operations, that have established a presence on the internet.

“Legacy retailers” – that’s what Barney’s et al. are now called; retailers left over from a prior era, to be mostly wiped out in the not too distant future.

And that was just the cream of the crop this week. It has been going on all year, and it has been going on for years, and I’ve documented it for years, this relentless and pervasive structural change in how and where Americans buy.

2019 has been record-setting brutal already

This year through July, about 7,500 store closings have been announced, up 20% from the full-year total in 2018 (5,864), according to estimates by Coresight Research, cited by Trepp, which provides analysis on Commercial Mortgage Backed Securities, such as those backed by mall properties.

The full-year total in 2019 is on track to reach 12,000, which would blow past by 50% the record established in 2017, the terrible brick-and-mortar-meltdown year when 8,139 stores were scheduled for liquidations,

In terms of the square-footage of liquidated stores, the record was set in 2018, the year of big-box store liquidations. This included Sears, Kmart, Bon-Ton, and Toys “R” Us stores, resulting in 155 million square feet of retail space that had been vacated by liquidations, according to estimates by Costar, cited by Trepp.

This year so far, a lot more stores are being liquidated, but mostly smaller stores, such as the 2,700 Payless Shoesource stores, with less square footage per store. So in terms of square-footage, the 2018 record will hard to beat.

Despite the shakeout and store closings that have been going on for years, still-healthy retailers will continue to close stores, including big-box stores, to reduce their brick-and-mortar footprint as they have become more reliant on e-commerce. And there is still a long list of retailers on the bankruptcy and liquidation watch list, from J.C. Penney on down. Sooner or later, they will succumb. J.C. Penney’s shares closed at 60 cents on Friday.

In 2013, I called Goldman Sachs a “snake-oil salesman” for underwriting a $1-billion J.C. Penney stock offering. Investors got wiped out. And now its longer-dated bonds, including a 100-year bond, have collapsed. Read… I’m in Awe of How Long Zombies Like J.C. Penney Keep Getting New Money to Burn. But Bankruptcy Beckons

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yes, retail sales are growing at a 3% clip, which is why thousands of stores are closing.

Makes perfect sense.

Ecommerce is booming!!! Ecommerce has been booming for 20 years. Ecommerce sales will reach $600 billion this year. It has been growing at 12% to 15% per year. So yes, you’re right, it makes perfect sense.

And don’t forget LBOs, that’s the cause of a least a third of big stores closing these days.

Hi Wolf,

How about newly opened stores? The newly opened stores in place of the closed ones. I know from anecdotal evidence that at least some of the retail swuare footage is recycled by other retailer. Around my place in South Bay in the Bay Area, many vacant stores have been recailed and filled rather quickly afyer they are vacated. It should be true for many other parts of the country, too.

Costco is always opening new stores, and each store has a ton of retail square footage. The small fitness centers have been on a rampage as well. Also, there is a lot of new retail space going into the street level of all the new apartments and condos that are being built. Finally, I’ve seen lots of newer fast casual chains like Five Guys and Mod Pizza expanding their footprint rather rapidly.

In general, within the retail B&M retail sector, I think higher priced, specialty retailers are closing stores while larger budget retailers like Costco and various national/regional chains are opening them.

Adam Smith Engineer and Bobber,

Two new big malls in San Francisco have been cancelled. One is already finished (South of Market) and is now empty. The other will never be built. The developer recently requested a change in plans to be approved by the City. It’s going to be an office and residential building instead.

For every new mall or store that gets built there are dozens that get torn down and redeveloped, and others that get repurposed into something else, and others that are just zombie malls with a defaulted mortgage, in a location that makes it hard to do anything with.

Grocery stores such as Costco are not yet targeted by the boom in online sales. They are considered “online-resistant.” But gradually, Americans are starting to experiment with buying groceries online. It’s still only a tiny percentage. But all the big grocers are getting ready for it.

Greetings:

Costco also Sells Online for Quick Pickups; and many outlets sell – Gasoline – with Pricing Set to be amongst the Lowest in a 5 Mile Radius.

I went to Walmart yesterday to buy car soap for 7.97 that sold for 17.97 at Amazon. When I bought my first bottle at Amazon, the vendor shipped it to me on a Walmart box. I really felt I’ve been had.

There is no doubt that before you hit “submit Order” on Amazon you need to visit the actual manufacturer’s website. I purchased a pair of speakers for my computer, Klipsch, and after purchasing them I went into the website for a technical question and I observed that the same pair of speakers were not only $20 cheaper but that Klipsch was offering Free Shipping….

There are some clues, usually the product has no reviews, and does not have a direct add to cart button. Also there are other listings for the product, albeit in different sizes at the real market price.

Some of those mom and pop e-commerce shops specialize in buying cheaply at Walmart or at sales in other retail stores and reselling at huge markups online. Sometimes 2-3x their cost

So brick and mortar retail is not dead yet

I bought some machine screws from eBay and it was Amazon Prime’ed to me. I left 1 star reviews.

It messed up Amazon sellers quite a bit.

Rarely these days does Amazon have the best price, and even more rarely when the product of interest is also at Costco or Walmart (or Kroger or Target).

But for rural folks without those stores, or those who just want to avoid the hassle of B&M, online is the way to go.

What always amazes me is how many people are addicted to Costco paper products, filling carts, imagining they save money. In general, if people would look at sales at Safeway, Kroger or walmart, they’d find that Costco has brainwashed people onto thinking that bulk sales are great deals. I see the see thing with a block of cheese at Costco, e.g., a 2 pound block sells all day for $8.99 and over at Kroger during a sale, same block is $5.99 — same thing happens with soap, cereal, meat, fruit, etc. It’s a behavioral thing, where people are just blind! I agree very much that you need to compare prices and be aware of prices! I think people with money don’t care and that explains a lot, as they don’t care if they spend $3.00 more on cheese.

Dirt Cheap, you’re not kidding. I have yet to buy paper towels or TP at Costco. They sell these massive bales but a quick per sheet calculation proves they are no deal. Consumers are so programmed to buy bulk to save now, that they mindlessly do so even though the bulkyest package is often the highest per unit price. For laundry detergent (I use Tide Ultra Stain Remover exclusively) the best deal is in fact the smallest bottle. When they’re on sale, I can easily get a far cheaper price per load or per ml than I could buying the big bulk Tide huge at Costco. And those aren’t even Ultra – they’re a less effective version of Tide with fewer stain removing enzymes.

I wonder when the tipping point for malls occurs.

Even free rent does the merchants little good

if the customer doesn’t show up.

Poorly run malls will close. E-commerce will kill them.

Well run malls will prosper.

Shopping is an experience. An experience you cannot get online.

For example – I was at King of Prussia Mall not too long ago.

The place is booming. Crowded and busy. Fun. Unique stores. The place to be seen. Great places to eat. Clean and safe. Etc.

https://www.simon.com/mall/king-of-prussia

It’s also in the middle of a prosperous area. I don’t doubt that it’s well run, but if it was a less prosperous area, a big boatload of of good management might not be enough for it to prosper. Location, location, location.

at first glance (from the link provided by 2banana) it looks like a disneyland for shoppers. you could put this anywhere with good weather and an airport near enough. if it had access to national parks and/or metro areas it could be considered a legitimate vacation destination when compared to others like vegas and the aforementioned disneyland.

True and it is mostly pretty high end stores. …

Poorly run malls and/or obsolete malls (particularly older malls that only had one or two anchor tenants) are already closing and/or are being converted to local community college campuses or mega churches. In fact, one mall in my hometown that used to house a JC Penney store and Bergner’s (Bon Ton) store is now a mega church and community college respectively. There are some tiny stores out there, but they are all mom and pop operations and resale thrift stores.

I was also at the K of P mall a week ago. It recently did a large expansion to connect its two malls and it was packed. Lots of people were carrying bags so they weren’t just window shopping or getting out of the heat. Of course it is back to school time so a lot of often empty stores are seeing lots more traffic. But the poor Plymouth Meeting Mall not far away is languishing terribly. They are trying to make it a restaurant hub. Hope that works. It was the first indoor shopping mall in the Philly region if I am not mistaken.

On the other hand, I’ve seen stores with high margins and lots of traffic pull out. The rents are too high, and the REITs don’t seem to have any problem with zero rent income for 10 years. But if a REIT had to pay a 5% vacancy tax each year they might be encouraged to lower rents. (In the one case I investigated the property tax is less than 0.1%.)

Any details found during research about renegotiating rents? Falling rentprices? Because nobody makes money on empty commercial real estate, right?

And how about all those employees that are losing their job?

I’m also curious if there is any data that shows if rents are the driving factor for many of these closures (excluding the cases of PE firms that strip the assets and load up on debt). Near me both a Cheesecake Factory and a Starbucks closed and in both cases the rumor was that it had to do with staggering rent increases. Both places were always busy as far as I could tell. If true, I don’t understand the end game of landlords driving their customers out of business.

What about land”lords” up to their eyeballs in debt and interest charges? I was offered to participate in a new shopping mall investment in 2008 with a guaranteed interest payment of 11%/yr.

And, the real estate price gain came on top of that after 10 years. I didn’t buy it and lo and behold : after 2 years, the whole affair imploded. Only the foundations and the concrete structures are now standing – empty. Investors who participated lost every penny.

So, for operating malls/stores with similar funding conditions, I can understand they NEED to boost rent pricing. It’s suicidal, but they have no alternative.

The purpose of being a commercial landlord is to get all the profits out of a business but keep the businesses going. So you sign a long lease that gets the company up and running, let them build up a customer base and profits. Once the lease is up, you jack up the rent to suck out the value. If they don’t sign, you overplayed your hand.

Joost Hoogstrate,

If a retailer signed a 10-year lease in 2009 and that lease comes up for renewal this year, you can expect a tough outcome. RE prices have doubled or tripled in many big cities over this decade. Both the landlord and the retailer are faced with a very tough decision.

The landlord will make a deal but cannot get back to 2009 pricing. And the retailer might not be able to survive on anything other than 2009 pricing. Barney’s claimed that this type of situation at one of its stores triggered the bankruptcy filing.

Bankruptcy is a common way for a retailer to try to break existing leases or renegotiate existing leases. And many landlords do what they can to keep their properties filled.

Here is John McNellis (a retail landlord who has been in this situation) and his take on it, and the shenanigans that go on in that respect…

https://wolfstreet.com/2019/05/19/this-is-what-happens-when-retailer-asks-landlord-for-a-rent-reduction/

The average mall space rent in the US (Lower 48 States) was about $40/ft² in 2018, down very very slightly from $41/ft² in 2015. However this data is not inflation adjusted and doesn’t include a common provision in mall rents, percentage rent.

Percentage rent means that after a “breakpoint” in sales is reached, a percentage of gross sales over breakpoint will be paid to the landlord on top of the minimum rent. Typical rent percentage used to be 5%, so if breakpoint is $800,000 and your store had $1,000,000 in gross sales, you’ll pay 5% of $200,000 ($10,000) on top of your ordinary rent.

Percentage rent used to be where landlords made the big money which allowed mall REIT’s to pay such hefty coupons, especially in Flyover Country where mall retail prices were high and minimum rents low. But percentage rent is steadily evaporating: a big part of the discount landowners offer tenants is reducing percentage rent or doing away with it altogether.

Mall operators are not going burst all of a sudden because minimum rents cover their expenses and provide a small profit but doing away with percentage rent will ultimately prove highly damaging for two reasons.

First, it will eat into those high yields mall REIT used to offer and which allowed them to raise capital so quickly and easily.

Second, it incentivates their tenants (retailers) to engage in some 90’s mall price gouging: these guys live so much in the past they think people will massively overpay for their wares just because they provide a “mall experience”. Amazon thanks them and shareholders laugh all the way to the bank.

Very interesting, MC01, but how does a landlord keep track of a tenant’s sales?

The same way as the tax man

Here is aus, we have astronomical rent for retail space because of massively inflated property prices. One wonders how any retailer can make a go of it. In the “high street” many shops are now being shuttered. One wonders what sort of a moronic land lord would demand unaffordable year on year rent increases when it is plainly obvious that nearby shops are becoming vacant for longer and longer periods. The council rates (taxes) and commercial property taxes still need to be paid if the property is vacant or not. At some stage a whole lot of “bag holders” are going to go under. The (new owners) banks don’t put too many properties onto the market at one time (so as not to spook the market), but at some stage that will also change as they try to fix up their balance sheets. We now have a plethora of “coffee shops” as traditional retail dies. But just how many coffee shops can you have in a row? Can you have a mall full of coffee shops? Judging by the American experience, the answer appears to be “no”. And just how long can the tapped out middle class afford to buy overpriced coffee anyway?

You could will be talking about the UK. My local town centre has been decimated by the same reasons you describe. I remember as farback in the 70’s and I have never seen it anywhere near as bad as it is know. There are only charity shops and homeless people. The empty units have sticker’s in the windows to make them look like a proper shops.

Seeing as the retirement planning industry is in an uproar over millennials not saving and choosing to buy coffee instead (that’s the story they push, I’m sorry), one would assume that it’s either the stock market or our malls full of twenty-five coffee shops each that are getting the axe. Well either way, people often just want an excuse to get out of the house and sit somewhere. When it comes time to slash the budget, I figure a lot will reduce their eating out budget before they give up the $tarbucks. Restaurant workers beware.

Went to get a battery for my car remote/key at battery plus on bush st. Closed. I was thinking on the way there: how do these guys make it? There’s a huge, misplaced sachs fifth ave in vacaville’s nut tree mall that I’ve been thinking: when are these guys gonna shut down? Last month I saw they are closing. Finally.

To make it as a brick and mortar one must have a service attached to the resale item. Like an oil change shop, where they can charge more for oil than if you buy it yourself from AutoZone plus they get the service charge. Only problem with that is the store has to pay people that actually know how to do something.

Funny you used the example of oil. My experience is that while the oil /petrol cost is more or less static over 10 years, auto lubricating oil has increased by a factor of 3 or so.

I’ve recently decided that the cost of auto maintenance is small relative to the exploding costs of vehicles, and comparable to DIY.

Oil has changed a lot over the past 10 years.

Sachs wasn’t always was “misplaced”.

In 1980 Nut Tree was (I thought, as a stop there was part of early pilot training) a fly in mall. General aviation folks have plenty money….that pastime will take every single dime ANY big “winner” chooses to throw at it. (Yachting on bay pales in comparison, and at the time that pastime was described to me as, “standing in cold shower with clothes on throwing $20s down the drain”, by foxy mortgage broker gal on VB team, who blew me off by talking yachting stories). Anyway a Sachs was perfect for wife/gf to kill time and $s in, while you talked pilot talk with others at restaurant, or on tarmac.

Do these store closure figures include the businesses that abruptly ceased operations?

Benetton for sure is going down too.

I was out shopping with wife in Malmö and wife went in there out of brand loyalty. The shop is a dump, there is a suspicious smell inside and it is clear that no attempts were made to align the exhibits, they were sort of dumped there. Everything looked dated, like in a charity shop.

This is just one outlet, however, it is in a prime location and chains usually send a brand consultant round to all outlets to make sure they present the brand well and according to the storybook. Nobody has been in Malmö for a long time or they don’t give a toss meaning that operations are underfunded.

I did buy a device from Clas Ohlson’s ( a company in Sweden ) webshop delivered in such a way that I’d pick it up from one of the company’s local stores ( because no one is stupid enough to trust the local postal services if there is any other option, Postnord is a beautiful catastrophe ).

Total chaos, their system said the package was there, but nothing was found at the location, it ended up simply by the employee fetching a package from the shelf in the shop and I was satisfied, I did get what I wanted.

Well, after a while I started to recieve messages about having an item waiting for me, but I didn’t bother to contact Clas Ohlson’s sales department, I simply didn’t care to waste the extra effort.

To make a long story short, one beautiful day I did recieve a message stating that the item has been returned and I was refunded the amount paid …

Somehow I suspect that if my experience with their online sales is more or less typical, I think that the company in question will be among those not surviving the next decade…

You have to remember that you are speaking of Malmö, the template of what Sweden is turning into ….do neither wonder why the Jewish congregation is rapidly shrinking into oblivion in Malmö …

Thought about writing to the Company directly?

Whats the draw to a brick and mortar store in the first place? Maybe its the long checkout lines? Or could it be they have the style but not your size? Or maybe its the poor merchandizing? Maybe its the help you don’t get when you need it? Maybe you enjoy the indy500 parking lot.

The above reasons is exactly why I moved to buying online. I can sit in the comfort of my own home and make my purchase then get it in a day or two. Another reason I moved online shopping because I can do it 24/7.

I recently bought some new house slippers at Nordstrom’s off price store on San Francisco’s Ninth St. The small shopping center shares space with a Trader Joe’s and several other retailers and a bank. I never knew that this Nordstrom’s even existed until I did an online search. The slippers were about the same price as my nearest Target store was asking for slippers of a much lower quality. Fortunately, Target had few men’s slippers for sale and none in my size. Many items lend themselves to online shopping (especially for people who don’t drive), but slippers is not one of them.

Even with the many US store closings recently, I suspect that it still has much more retail space per person than other countries. Commercial landlords who get too greedy with their asking rents will sit with empty stores. But they will still have to make their mortgage payments and pay the property taxes on their empty buildings.

I bought my amazing slippers online the last two times. After visiting three physical stores that did not have them because they were “out of season”. Even slipper buying is disrupted.

One use to be able to go to one of a number of nearby retail stores that was marketed to your class – poor, working, middle, upper middle, wealthy that was fully stocked and fully manned. You could go in, look at, try out, talk to the clerks, buy what you wanted, and leave. In a few hours. Clothes, furniture, tools, books, whatever. One trip, maybe two if I had to be fitted.

As the selection, backstock, service, and locations have all gone away, then online buying becomes attractive. I do not buy online because I want to, I buy online because there is no other choice.

It’s like having to buy Chinese instead of American.

This is all very true, and I don’t like shopping (whoever made the remark about “the mall experience” or “being seen” had me in stitches), but getting a pair of shoes in the mail that really don’t quite fit, or a pair of slacks where the length does not seem what was advertised, and then having to go to the post office to return them is my idea of a pain in the a. Not to mention the possibility of being sold seconds.

Buying online can work out ok, but there is no substitute for actually seeing, touching, and personally evaluating merchandise. And it is emotionally healthy to talk with a salesperson or clerk, and to mingle with other people. We are all becoming even more isolated from one another, which at its worst eventually contributes to some people becoming depressed, and in some cases, going berserk.

Spot on! I’ve been waiting for SF Neiman Markup store to close and finally declare Bankruptcy https://investorplace.com/2019/02/8-companies-disappear-2019/

Hooray for the success of SF’s Real Real Luxury Consignment Online Retailer

NM is hooked up with an online reseller, Fashionphile. I don’t know exactly who does what but they are now in the reselling business.

My iPad is my local store, it’s just as simple as that! And I can shop 24/7.

It’s easy to find anything I want and I have a lot to choose from. And I don’t have to drive anywhere, find a parking space and walk around in stores…, maybe just to find out they did not have what I wanted after all.

I really enjoy my local store where I can get what I want, whenever I want it.

‘The company blamed the challenging business environment particularly the shift in consumer preference away from shopping at bricks & mortar..”

Surely it was nothing to do with …

*poor business management.

*over investment in an already saturated market.

*shortage of consumers due to massive unemployment.

& as for the drop in real estate value a similar coincidence & shonky building regulations resulting in unlivable buildings due to the danger to life aspect.

Not building out an aggressive e-commerce strategy 10-15 years ago, including fulfillment infrastructure = “poor business management.”

I just passed through Tokyo with my Japanese GF and did some shopping. She says in contrast with the bubble years where it was all about YSL, Burberry and other brands the young people now eschew labels and go to UNIQLO, MUJI and similar stores. The Uniqlo store in Ginza was packed. (50% or more Chinese tourists.) She herself does almost all her shopping at those two stores.

Not sure about US trends but I suspect few millennials even know what Barneys is let alone would shop there, even if they had the money.

Barneys was originally a men’s suit shop. Millennials don’t wear suits. And Madison Ave was where grandma shopped.

One of my millennial granddaughters makes a trip to Tokyo every year just to buy clothes. She likes the interesting and slightly weird styles that just aren’t available locally (SF bay area).

Let’s face it, the financial circumstance of today are not that of even 10 years ago. We are pretending yesterday & in reality tomorrow has been & gone.

The filthy rich are no rich.

The Money is worthless.

It cannot be that it was ONCE true but not today.

Family Dollar is closing 390 stores. Dollar Tree may need to raise prices from $1.00 per item. Five and dime stores are a fading memory. One online merchant worth seven figures bought items from a brick and mortar store and then raised prices for sale online. I got athletic shoes cheaper at Payless than I saw advertised online.

I saw a Planet Fitness moved into a shopping center with more parking spaces than parked cars. Little restaurants come and go. A Goodwill charity thrift store was full of seniors looking for bargains.

I purchased a small air fryer type gadget to make chips – I love chips/frys.

Harvey Norman online – it arrived & it did not work. I returned it at the local Harvey Norman store.

It cost approx: $19 more online & wasted a week.

Only that I had mucking about & I could have had a treat with the $19.

Whatever happened to honest markets?

Sucking out as much money from people for products that are inferior.

Scam after scam.

Forcing people to have licences in a vast many areas.

Forcing insurance on everyone even though Canadians are covered for health…

Just see soooooo many different enforced scams.

Well, Honest Ed’s in Toronto, which sold low priced goods to generations of the city’s recent immigrants, closed at the end of 2016. The land is currently being redeveloped for high rise condos. The Internet and low priced long distance calls have made more scams possible. But they have also made lower prices possible in many areas e.g. stock trading commissions and mutual funds.

“let the buyer beware” comes to mind…

“Don’t follow leaders, and watch the parking meters” comes to mind…

You’re not segmenting. Malls suck and high end has issues but off-price and discount are doing well and have been for years.

Tell Ross, Ulta or Five Below that bricks and mortar is dying …

Down to business –

Maps – Satellite View – East Melbourne, Victoria, Australia.

*is up for grabs.

Though it looks like private owned residential it is in fact mostly state owned real estate. The same with Fitzroy. Richmond & much much more.

These properties were GIVEN to medical, legals, academics & the like for free

However were the titles of these properties made to reflect resident ownership or did they remain state owned ??

Carlton & Carlton North also.

And guess what – with the decline in wealth amongst the fat cats what’s the bet these properties will not be seized back to state possession & developed.

Most certainly St Vincent’s Hospital all the way to Napier St will see the bulldozers soon, equally the Royal Eye & Ear Hospital & The Eye & Ear on the Park.

All billion dollar real estate.

Greed is good !!

One modern bricks and mortar business we haven’t seen yet, but I expect soon will, is 3D printer shops (and knitting shops and maybe more sorts, who knows). You’ll down load digital CAD/CAM drawings of the basic item you want made, edit it to suit your needs/style before sending the g-code to your local 3D printer shop. You’ll pick up the item later or maybe it’ll be delivered to your door by a self drive car (maybe Uber?) on its way to a customer living nearby. That’s not to say we won’t see a reduction in bricks and mortar retail but some of what’s now gone online will come offline and be manufactured locally. Which is good for your local economy. Much of the material used will be recycled, of course, and electricity generated locally. Any bricks and mortar business premises not utilised can be converted to flats and houses. The future is brighter than you think, especially if you think local economy.

The internet has brought massive change and will continue to do so for years to come. Ditto mobile phones, which are becoming integrated with the net. The revolution will not be centralised.

Medial’s comment made me chuckle. My wife recently ordered some birthday presents from our neighbour across the river. She had tea at her house and went over some examples of her work, and the neighbour will trot out her loom and have the shawls ready in a few days. Price is about 1/2 of what a vendor sells for, either online or in a store, and the workmanship is priceless and beyond comparrison.

Hopefully, this model will be more available after this current orgy of debt fueled consumption is over.

When I visit a store, any store, I see unbelieveable amounts of goods on the floor and on shelves. Staff seem to be minimum wage earners who know very little about what they are actually selling. Might as well buy online and save the time and driving, for if a buyer doesn’t know what they need, then perhaps they don’t really need to buy anything at all. Online product reviews are readily available and don’t have to be accessed at the vendors site, either.

“Shopping therapy” is being replaced now by SSRIs, by the more frugal, maybe?

Saw big end of aisle display at CVS. In 4″ high letters, “Serotonin, the feel good drug”. Never looked at “product”, that sign was enough.

I can easily kill an hour in wait line for back pain pills by just reading types and costs of all the OTC meds.

We aren’t just “debt slaves”, “take this for that” is burned into most brains. “pill slaves”

Related. Our retirement community ( 4980 homes ) is partnering with local high school ( tech department ) which will bring 3D printing to community. Each week a machine, teacher, classes, etc. starting this fall. HOA budget already has dollars for $1500 machine to purchase and put in computer lab. Lots of resident interest and sign up sheet almost full and we haven’t even announced it yet.

Similar is glass fusion ( a hot area for hobbyest types ), we are remodeling space for $ 3500 kiln and strong demand. There are retail stores opening ( ex: there are 3 in Eugene, Ore ) that cater to demand for glass, classes, etc. This is the type of small retail that is very hands on, unfortunately the small size of shops will replace only a minor percentage of those going away.

Not any time soon. I’m guessing you’ve not really done much 3-D printing. We do quite a bit of it in my lab; it’s useful for prototyping but not really good for production. The standard materials turn out pretty weak once they are printed; the materials that yield a stronger product are really expensive.

– Brick & mortal breakdown need support.

– My C1 through L5 are old, cracking down.

– Every chart need a backbone for support :

1) Ken Starr 1998 Clinton high / lows supported the SPX infrastructure above and below, from 2007 peak, to 2009 bottom, all the way to 2009/10, for 11Y.

2) JFK DOW high @ 741.30 on Nov 1961 and low @ 524.55 on

June 1962 was the DOW backbone til Aug 1982.

The DOW curved a nasty smile at Nixon resignation with Oct 1974(L)

@ 573.22 and Dec 1974(L) @ 570.01.

JFK backbone lasted for 21Y, until the jump.

3) McKinley was a R/R king, but TR was the backbone of the chart.

Theodore Roosevelt DOW 40 / 80 served the DOW for 33Y, from

Roosevelt to Roosevelt, through Taft, Wilson, the Cool guy, Hoover

and 1932 DOW at 41.

1934(L) and 1942(L) are backup on TR.

4) Next will come the 2015(H) & 2016(L), the Obama backbone, testing

brick & mortar and the US retail consumers survival. It will be a fresh and flexible vertebrae, that will support energy lows, tech lows, online lows ==> and very high level of debt.

5) It must be a strong backbone.

Bio-Finance must be really really new exotic discipline, nothing at all at NIH-PubMed……

Most everywhere I’ve been in Asia, which is no slouch in the online shopping department, there are fabulous shopping malls that are crowded, and new! These coexist with online shopping very well. I suspect this problem has more to do is popular regional business models than anything fundamental. Specifically, I think many businesses going bankrupt now have not been providing the kind of experience needed in today’s market.

When I left California, the Stonestown Mall in San Francisco was still flourishing although the small book stores were dropping like flies. I noticed a strong Asian presence in the stores in Stonestown and wonder if they can keep it going despite heavy on-line shopping now. Asians tend to be prodigious shoppers, both online and brick and mortar.

Don’t mean to change gears but I wonder about manufacturing and the auto industry, will auto makers be hit like retail in the not too distant future? I still have shares of Ford Motors which pays good dividends

plus I’m emotionally attached to them (my bad I know…)

Yikes!

Ford (F) down 46% ($17.50 to $9.45) over last 5 years – and I mean consistently down

And the number of people who can afford to “shop” for entertainment is declining, continuously, if slowly. Also the increase in sales is measured by dollars value, not by units sold. With the continuous increase in prices (it is not inflation!) that has increased significantly in the last year, I wonder if there are fewer units being sold, even though the dollar value increases. And I don’t think stores have been able to pass on cost increases (and tariffs have been a new one) the way they used. I have the impression that online retailers are struggling as well. The incentives I am being offered by the likes of Rockler, LLBean, and others has increased a lot in the last 6 months.

Have you been to the new and fancy Chinese shopping malls lately? You might be in for a surprise. China has moved to e-commerce faster than any other country, catching mall developers and landlords completely by surprise.

1) Landlords shakeout is coming :

10,000 stores/Y x 10Y x min 2,000 sq/ft per store = 200,000,000 sq/ft.

2) In recessions u can change the rules ==> tent cities in.

In many areas, the supply infrastructure has already been reduced to the Walmart truck and US Postal. Online shopping is great as long as you don’t need fresh food, milk products, frozen, gasoline, etc. There have already been Walmart closings in some smaller populated regions making people drive 30-60 miles for fresh food items and gasoline.

Get home delivery. Move somewhere civilized.

grow your own food.

Just in time. Has trouble written all over it

Out here on the Olympic peninsula we are totally dependent on trucking over bridges. Earthquake. No food. I am in the process of trying to make myself more produce independent. In south Texas I have seen oil workers clean out Walmart Superstores by lunch. Centralization for food delivery is a perilous infrastructure.

I shopped at Barneys when there was only one, and it was in the cheapest part of New York City, Seventh Ave. The rent in their now flagship Madison Ave store was increased to $30M a year. There is nothing on Madison Ave or NYC which warrants this kind of rent.

I’ll go back to my assertion that retail is the most mismanaged industry in America. Right across the street from the original Barneys was the only Barnes & Noble, also in the cheap part of town.

Henri Bendel had their one and only flagship store, not on Fifth Ave, but around the corner on 57 ST. All these retailers were highly successful when they were in the less traveled part of town because they were well managed, controlled costs, and didn’t over expand.

It’s not about the internet. One well placed store with a website can grow a huge business, if they don’t waste their money.

The WSJ years ago had articles on the “flagship store on 5th Ave syndrom”, all of those retail and other businesses seemed to be declaring their peak and demise with the prestige addresses.

I’m not sure I’d group Macy’s in with “e-commerce powerhouses” Amazon and Walmart. While they have made an effort to shift to the online model, their offerings are stale and increasingly downmarket. The stock is at half of its 52-week high and fell 4.38% on Friday alone. We’ll probably be watching “The Very Last Macy’s Thanksgiving Day Parade” within a few years.

Macy’s brick-and-mortar business is in terrible shape and sales are declining and stores are getting closed. But its ecommerce business is booming. Macy’s is something like the 8th largest e-commerce vendor by sales in the US (eMarketer). It has spent billions of dollars building out its fulfillment infrastructure. It will survive as an online vendor as its store count gradually goes toward zero.

You think that’s bad? You should see the typewriter business. Something like 99.9% of companies went out of business. A recession is coming for sure.

Retail is dying because people no longer go to stores. But you keep trying to extrapolate some economic calamity out of it. It,’s a societal shift that has been taking place for 20 years and will keep happening, good or bad economy.

Just Some Random Guy,

“But you keep trying to extrapolate some economic calamity out of it.”

You’re NUTS. Read my stuff before you post this crap.

I didn’t mean you, I meant the royal you ie commenters.

Had artist couple friends working on new horror comic book for a while, early 70’s, I think. Title was “Brenda and the Filler People”. Also came up with, “Honk if you pee in the shower” bumper sticker. Never followed up on either. Could have been rich by now, maybe?

Years ago I used to buy typewriters at Goodwill for $5 then sell them to hipsters online for $75+. Still have a beautiful Smith-Corona Galaxie 12 in two-tone blue. Looks like a bunch on Etsy for $100+. Maybe I should get back in the game?

Burn baby, burn. These store closings are the march of progress. The corporate raiders merely accelerated what was coming. This is the opportunity for a renewal of American life beyond “purchasing more stuff”.

The malls and storefronts can now be re-purposed to: Entertainment and sport centers, gyms, offices, residences, storage, churches, indoor agriculture, kiddie day care, doggie day care-boarding-spas, schools, showrooms for manufacturers (a la Tesla). Some square footage may need to be turned over to non income producing uses to attract foot traffic: parks, art installations, picnic areas.

In posh parts of SF I see formerly abandoned storefronts turned into yoga studios and kettle bell gyms. Clear everything out, paint the walls, lay down some wood flooring from homedepot, install a heater and presto: hot yoga classes at 20 bucks a person/session. Downtown you can shovel out the 15 dollar salads and sandos to the lunch crowd.

Landlords will have to get off their keisters, put their ears to the ground, and redevelop their empty properties… or sell at a loss to someone who will. However, I suspect most are over leveraged and cannot make the investment required for this. In a low interest rate environment, it will take time for banks and CMBS trustees to foreclose on these properties, and a generation of real estate dinosaurs who can only think in terms of formula retail will have to die out.

I hear the sound of a drain whenever I hear the names “Tesla” or Uber. If they were so great they might make money, or a plan to make money. Retail is moving to online, restaurant industry is growing because of fast food. What people are doing with their extra time is questionable because most complain about being ” so busy “.

Probably: waiting for package delivery, waiting to communicate with all those to whom your call is important.

nope. staring at their favorite social media feed, stuck in traffic or, increasingly, both.

I use most spare time in my busy life to watch South Park or DVD sets of Matrix and Lord of the Rings…..which makes me a REAL sicko.

Wolf, you might want to compile a “Guide to Corporate Speak”.

“Transformational Cost Management Program” is one I will use with the bank if I ever default on a mortgage. Love that one.

Of course I will follow that up by saying the act is “Accretive to the holistic enterprise of re-energizing my fiscal growth and enhancing the ROI to myself, my immediate stake holders and society at large”.

I’m sure they will understand…

I’ve been vaguely thinking about a “dictionary of corporate speak” ever since Sears Canada said it was closing stores due to “footprint rationalization” about a year before it went bankrupt.

thecorporatedictionary.com

Would sure help me learn faster here, last I recall of being in on things was when Personnel became HR.

Here’s an entry: “customer intimacy”. Place in the oxymoron collection.

I think B&M has a future, using the Trader Joes inventory method, which is to only add things when they are available at the good price. You can never count on finding the same thing at TJs, even in the store brand. The mass produced item is no longer de rigueur anyway. Do you buy a Hawaiian shirt off the rack at Walmart or from a specialized supplier?

An interesting side story is the success of Outlet Malls. From what I can see most of the stores in these places are not real outlets for manufacturers excess but actually branded stores that sell a second tier of lower end merchandise with the name brand on it. I think many people still crave the status of name brands but can’t afford the real thing at whats left of the department stores or their websites. Will these places stay successful or will the outlet business move to the web soon also.

The premium outlet malls are not just malls, they are destinations. There’s one in upstate NY called Woodbury where people go in limos from NYC.

For some time, I’ve been curious what happens to communities (rural or metro) when more and more retail stores stay vacant. Back at the height of The Housing Boom in about 2008, our little town had several strip malls come in as well as a few Big Box stores. The little malls remain 70% vacant, with occasional American Dreamers trying to sell pet food for a few months, trinket shops come and go also. Thus, as the social fabric of brick and mortar commerce evaporate, the public function of interaction decrease, along with old fashioned jobs. While online provides some employment with call centers, that entire online or on-phone function becomes a fast paced automated faceless task that is robotic by nature. As more communities cease to be connected and have social interactions I assume people will become less tolerant of each other, more demanding of the remaining grocery clerks, more demanding of service people, more demanding of instant gratifications, which at some point will cause more and more conflicts, more aggression, more anger and more people unable to communicate, except with the exception of an easily obtainable gun. It also seems obvious that this robotic and tattoo’d society will indulge in more drugs — and perhaps for those lucky ones untouched by the polarity of darkness, they can embrace Evangelical authoritarianism and express themselves by using politics and tax evasion as a way to become superior beings. Then of course, for the retail that does survive on-the-ground, it’ll be the very same battle of the wealthy versus the poor, where elitist stores cater to the stylish whims of excess while their humble neighbors live in hell. I guess it’s always been this way in one form or another, but the fragmentation that is under way will at some point become destabilizing. If nothing else, as an example, imagine a town that becomes too dependent on online delivery, and then when the system breaks down, in an emergency, people will be looking around wondering where their suppliers are … it’s all good, we get the society we deserve!

I think you’ve just described the plot of the Time Machine by H.G. Wells. The Morlocks toil ceaselessly underground, while the Eloi or leisure class enjoy the fruits of the Morlocks’ labor. The twist is that the Morlocks feed on the Eloi which is unlikely to happen in our current environment.

Online retail is another system of mass control.

http://www.oftwominds.com/blogaug19/gulag-mind8-19.html

I don’t trust any blogger who posts a picture of himself playing a guitar.

The judge-a-book-by-its-cover approach to blog preferences.

How about a picture of Me without a guitar?

I guess the poor malls landlords who lost all their retail customers will be laughing soon enough. Convert them malls into residential/office/live-work spaces and you resale rate is 3x of what you were budgeting on as commercial. Additionally, the vastly overcapacitated parking lots can be halved at least, and rebuilt as 3-4-5 stories of residential instead. Many more square feet at resi rates.

And the buyers – well that’s easy, there is an endless supply of people from Central America (if you’re in the States), or Africa and Middle East (if you’re in Europe), eager to come along. And when they come, and they will be encouraged to do so, they become the valuable contributors to the Ponzi God called GDP, and will become new Consumers and new Bearers of Debt to prop up the surreal mechanics or perpetual growth on in a limited physical environment.