Tencent is a giant. Its stock, after plunging 50% in 2018, was a big winner earlier this year. Now the uptrend is broken. Revenue is primarily from mobile video game microtransactions, and warning signs are emerging.

By Adam H. Williams, Senior Associate at E911-LBS, LBSglobe.com, for WOLF STREET:

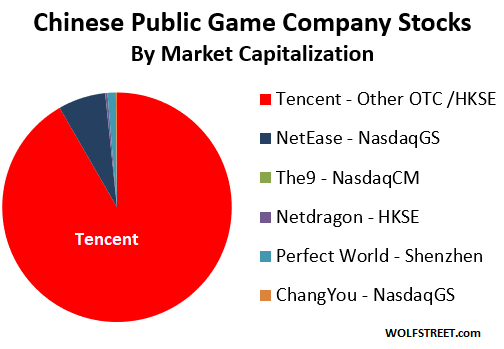

Tencent is one of the top ten companies by stock market valuation worldwide, at around $441 billion. Its finances are a complex web, and its products are the backbone of urban Chinese digital life. It does this by leveraging its mobile gaming revenue into an IT behemoth of infrastructure and tech. Tencent dominates the Chinese gaming market with NetEase a distant 2nd (market cap of $31 billion), with a few other majors, and countless startups picking up the crumbs.

Video Games make up about 1.25% of global GDP and are the largest entertainment market worldwide. Gaming is important financially, particularly in Asian Stocks. Meanwhile, there are signs the mobile game revenue Tencent lives off of is slowing or retreating, leading to potential pain worldwide.

While it is tricky to calculate, gaming appears to represent around $500 billion in market cap in China, or about 10% of total market cap of Chinese stocks. Tencent alone accounts for about 9% of China’s stock market capitalization.

Earlier this year, when the Hong Kong stock market rose it was noticed that of the 16% rise in stock indexes this year, 88% of that rise was due to Tencent. Since then however, that bounce has faded by nearly 20%. The stock itself has been up and down since.

Tencent’s finances are difficult to tease out. It owns stakes in many smaller companies, including significant stakes in US companies, such as Snap, but particularly in China, such as Epic Games along with a number of other ventures. Tencent wholly or partially owns game companies Grinding Gear Games (80%), Miniclip (undisclosed majority stake), Riot Games (100%), Epic Games (40%), Activision Blizzard (5%), Ubisoft (5%), Paradox Interactive (5%), and Supercell (84.3%).

That said, currently Tencent’s income is about 75% from (mostly Chinese) gaming – suggesting the Chinese stock rebound may be directly linked to China’s recent lift of the game ban (though frozen soon after) and renewed growth hope. The Chinese gaming market is unique in that the majority of its spending is microtransactions in games on smartphones, with a modest PC sector, largely closed to outsiders, and having strict internal requirements.

Any resurgent slowdown in growth or reversal in spending (like a renewed game ban, or an economic slowdown causing players to become a bit less willing to engage in microtransactions) could result in a significant hit to Tencent, and by extension, the Chinese stock market. Additionally, new requirements from state authorities are causing some approval issues.

Tencent’s current situation is compounded by unique Chinese dynamics. Its stock crashed nearly 50% in 2018. Imagine Google, Apple or Amazon doing the same! It has since retraced part of it — but is still 25% down from its 2018 high — driving the resurgence of Chinese and Hong Kong stocks. However, recently the uptrend has broken and Tencent’s 2019 Q1 earnings have been disappointing. Their Online Gaming Division seemed to be the source of trouble – with gaming sales actually down 1% year-over-year. Tencent also recently spun off part of its music division via an offering of ADRs of Tencent Music in the US, which was not very successful.

Bonds, Debt and Investments

Tencent also has a huge presence in the bond market. It sold $6 billion of notes earlier this year, bringing the total to over $26 billion in mostly dollar denominated debt.

Recently Tencent-owned Epic Games (Fortnite creator and Epic Game Store creator) had a fire sale in an effort to win over distrusting gamers, offering extreme discounts and eating the cost by still paying the developers the same price. However, this wasn’t exactly well received. Some developers were upset about an unapproved discount, and customers in general seemed to still stay away from the store – though Epic was likely losing money on the sales (to make it up in volume?).

Epic has quite a lot Fortnite cash to burn to get people onto the immature platform – but Fortnite’s popularity is waning with no known major new title in the works. And no in-house Tencent game is actually popular outside of China.

This push all seems to be part of Tencent’s efforts to gain market share outside of China, but with very limited success. Tencent doesn’t really make games these days, it monetizes them. But there is too much competition, and the pay-to-win mobile model that made Tencent’s billions is widely disliked abroad, and a much more open market in terms of game competition is failing to make much headway.

Meanwhile, all that gaming revenue is used to support other tech utilities. In Tencent’s case, WeChat is forming a growing portion of its revenue. WeChat, originally a chat application that has grown into a unified digital portal, basically forms the electronic basis of urban life in China – with an insane amount of touchpoints to other areas of the economy, such as payment systems, the communication grid, delivery services, reviews, and more. All of this is backed up by game spending. The PRC’s social credit score also draws heavily from gamification mechanics.

The Total Picture

Tencent in particular seems to have a web of connections, and if its stock collapses again, or if it has to sell interest in studios to raise capital, it could have serious impact on the tech sector and financial markets.

If the market turns again on Tencent and they have layoffs like NetEase (up to 50% of some departments) or other major game companies, it could become a serious macroeconomic problem in the Chinese tech sector. Not just for the majors; there must be countless thousands of startups suffering and if they go under there are going to be significant ramifications. By Adam H. Williams, Senior Associate at E911-LBS, LBSglobe.com, for WOLF STREET

In the US, the reception of a bill in the Senate has been fascinating. Read… US Senator Aims at Big Gaming, Tries to Ban “Loot Boxes” & “Pay-to-Win,” Puts $50 Billion in Revenues at Risk. Here’s How Gamers Reacted

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Isn’t the Chinese government down on gamers?

Ambrose – I get the impression that it’s a mixed set of (not entirely clear0 feelings – on the one hand, gaming too much is seen as negative, with camps and state-issued controls (including social credit score) being used to move away from it. On the other, mobile gaming keeps Tencent running and the masses entertained. Official data suggest about 1/2 of the population plays mobile games to some degree or another. Young unmarried men, in particular, are known to play a lot of mobile games.

Recently they had a year-long ban on new games, and are increasing criteria to approve new games. Generally, right now it seems more unfavorable. If gaming becomes perceived as too much a social ill, it could spell danger, particularly for Tencent as I tried to highlight here.

Is prostitution allowed in China? All this gaming seems like a libido reducing exercise.

No, but it is ubiquitous like everywhere else.

This point on “keeping the masses entertained”, with gaming as an “opiate of the masses”, if you will, was also acknowledged by a friend who works in strategy at Tencent HQ. Not so much as a goal of the company but as an acknowledged consideration of society and the powers that be.

Incidentally, one notable group of gaming fans is Tencent employees themselves, some of whom reportedly receive a bunch of gaming credits each month. Great perhaps for eating your own dog food, doing market research, and passing the time during lulls in the infamous 9-9-6 work schedule at Chinese tech companies :)

The economy in China is not growing anymore so there’s less income to spend, which in turn means the young people can’t marry and have more consumers. The young are also too broke to marry in the US and the west in general, less consumers being produced all around. This should show up in gaming first considering the demographic is younger than 35 and mostly male.

young people can’t marry and have more consumers.

Quite right. People don’t have children any more. Instead, they have ATMs and units of production.

A mitigated destiny as a cog in something turning doesn’t appeal to me. Your mileage may vary.

I’m going to go have a single-malt and play some darts. Ta-ta.

As stretched like a lot of people are with income, it will be interesting to see what they drop first as the economy slows. Food or gaming? Heating or the phone? Gasoline or the cable?

That’s why most everyone that can is trying to quickly get as wealthy as possible…and with no limits whatsoever. No (or very few) statues of founding father Tom Paine, and no mention of him either. “History is written by the victors”. The peasants by definition losing big time.

So I fear how ethics and rule breaking/bending are tested/ignored is maybe an even bigger question than consumer choices made.

Even having some money, there seems little point to this depressed youngster. Our culture has entirely hollowed out the joy of anything and everything and turned it into a continuous rat race where falling behind means a descent into poverty and even homelessness if you mess up enough.

Can’t even afford what formerly represented affordable real estate, a little patch of land in a safe area 20-30 km from the city. But it makes little difference because it takes both a woman and a man to produce a consumer and I haven’t found my match. I’m thinking I’ll get a dog, and at least it won’t take half my stuff if we divorce, or get child support payments out… It’ll love me as long as I treat it well.

The economy in China is still growing, just not at the breakneck speed of the past. The young are still getting married, and they are still having babies. In fact, there is now a mini-baby boom because of the allowance of the second child.

These non-marrying young people might yet keep the gaming “bull market” going past 35, if cases of social withdrawal become more widespread. Out here in East Asia, the “great growth engine of the world”, articles on hikikomori or social recluses have been making the rounds.

How about Chinese online gambling? I heard that supports a huge part of the Philippine economy albeit not exactly legal. Is gaming and gambling connected in any way?

Iamafan – it is my understanding that gambling is illegal in mainland China. I believe online gambling falls into a grey area but crackdowns have been occurring.

Right now a huge debate is happening globally, namely about microtransactions (which Tencent gets 75% of its income from). Many scientific studies are now showing a pretty clear link neurologically and psychologically between gambling and microtransactions (basically the same) – and governments are looking at restrictions or outright bans. Major game publishers are lobbying hard, but seem to be losing, and most gamers are in favor of eliminating these mechanics. I discussed it in my previous piece about gaming and it’s only becoming more of a thing – recent UK testimony was considered farcical by many. https://wolfstreet.com/2019/05/09/us-senator-aims-at-big-gaming-tries-to-ban-loot-boxes-pay-to-win-puts-50-billion-in-revenues-at-risk-heres-how-gamers-reacted/

My big question is – if most countries start considering classes of microtransactions as gambling – will Chinese regulatory authorities follow suit? If so – Tencent is likely in serious trouble.

Video games? Seriously? An economy so supported by frivolous time-wasting deserves to go into decline.

I stopped arguing that the world had gone mad when people stopped arguing against me.

Porn probably accounts for at least the same amount of market cap as do games and just as frivolous.

You also have to remember that China is still an authoritarian state, and they certainly don’t want their young people to repeat what happened in Tiananmen Square in the late 1980’s.

That second line is quote worthy. Maybe we have the second coming of Mark Twain here?

“When we remember we are all mad, then the mystery disappears and life stands explained” -Mark Twain

Adam,

Thanks for the rundown on Tencent.

A social media/gaming company that wanted to be a hedge fund. The company also owns a 5% stake in Tesla (and may be underwater on that holding).

Tencent and Alibaba make up nearly 10% of the MSCI Emerging Markets Index.

China’s economy is coming apart at the seams (they’re now running a current account deficit). Entities like Tencent cannot afford to see an attack on the yuan otherwise that $26 billion in bonds outstanding will sink the company.

Would not want to be long the stock or the bonds. The reward not nearly commensurate for the risk.

US companies have begun to soutce imports from Vietnam and India instead of China due to tariffs. I suppose their economic problems might diminish discretionary spending on games.

I grew up with monopoly, cards, chess, pinball and a pool table as games. It never became a major driver of GDP, merely a way to pass time.

China’s economy is coming apart at the seams

China is a serious contender for recognition as the First Domino in the upcoming global financial meltdown, but they have heavy competition all over.

The bad news is that such will spread misery to billions. The good news is that existing miserable billions may be relatively unaffected.

The Chinese may have to adopt Western banking practices just to kick the can down the road a bit further. That should frighten you.

In case you’re wondering, global financial meltdown won’t end civilization. That’s still a contest between ecological collapse and nuclear holocaust, and neither of those is a bet worth taking.

If you’re still looking for a good argument, I can’t offer one. I agree with your remarks, in particular, your last paragraph.

Unamused,

“China is a serious contender for recognition as the First Domino in the upcoming global financial meltdown, but they have heavy competition all over”.

Agreed. The EU is sustaining significant collateral damage in the U.S. – China trade war. European banks, due to NIRP, have had to hunt for yield across the globe. Emerging market debt has been a favorite “investment” to provide some semblance of yield. Bonds of Chinese growth (cough…cough…fraud) companies like Tencent and Alibaba fit the bill.

You’re correct, the coming Depression won’t be the end of us. However, it should usher in the long overdue Age of Consequences.

This is only in the spirit of offering a solution, (as opposed to accepting a quite obvious fate). An immediate Green New Deal bigger than FDR’s and on a War/National Emergency footing is definitely one. We still are the biggest dog right now, and should/could try to lead the pack.

Naturally a lot of people will be knocked of their perches, and many “undeserving” might rise to “unearned” ones. It would be a mess, and screaming about “freedom” and “rights” and our “Constitution” would be at an unheard of level……..So what?

It’s staying on agenda that counts….because;

To exist, all critters must achieve homeostasis. Our human “civilization”, from a Biologist’s point of view, is totally man-made (yes, exactly like a fn car) and didn’t have 3.5 Billion years (give or take a measly few 100M’s or so) to be “designed” and tested, under a lot of external conditions, and all under penalty of quick death for failure. (which makes Pharma biz arrogant as hell, but that’s a side story) Maybe a mere 12K years, a tiny blip in bio-time. So as “human civilization” is just another part of the “bio-slime” covering the surface of a ball in space, there is no other choice. Can’t add a room, clever as we are, or bug out into the void.

The other part is ZPG, which even AOC won’t go near, but it’s gotta happen also. Chinese did it, although radically.

So now that we both have had a laugh at me; per your “contest”…. may I suggest the nuclear holocaust option as being more humane? Life itself will still keep on going either way, for a few more B, if that’s any consolation.

Thanks, HR01 – great comment – Tencent’s recent behavior does remind one of a Hedge Fund or some sort of merger and acquisition fund. They do not seem to make games anymore, and primarily are generating revenue from a few smash hits in China – and being the internal Chinese publisher for foreign hits. Those hits though require changes to meet regulatory approval.

Tencent’s acquisition of other games and tech companies reminds me of a lot of Wolf’s coverage of the Chinese firms that have been acquiring foreign real estate. I agree, if a dollar shock would come due, they may have difficulty with funding and game studios are not exactly liquid, and game portfolio value goes down with time considerably to say nothing of their mobile gaming revenue stream.

I see many internet outfits, startups, e-commerce sites, on-line gaming sites, social media, bitcoin mining, bitcoin exchanges etc etc

the modern potemkin villages. Yes the word village should be replaced by a more sexy sounding word just like Telsa. The idea behind is the same. To scam, to cheat, to bluff, to get fools carried away and part with their money. Yes the most sexy part is their willingness to tell you how many billions and billions of clicks each month they have. There is no way anyone outside the organisation who can really verify what is actually happening inside. Take bitcoin.

You are informed regularly about prices going up.

How many transactions each case, who are the buyers and sellers and the nos each time?

How can human beings degenerated to such a stage where scam acts in the 19th century still have relevance in the 21st century.

Tencent has been known to shade their earnings, but it’s still somewhat a legitimate company… Baidu is shady as hell and Ali baba is a full blown fraud.

china’s economy isn’t falling apart cause they consume more oil now then they export vacuums, china’s economy has been falling apart since 2012 cause of financial fraud… Everyday there are bonds defaulting in hundreds of millions to few billions, everyday. PBOC created Dark Pools for defaulted bonds and bad loans so they can bail-out in the dark, too many public bail outs already. They printed between 15-20 Trillion Yuan in Q1 2019, yet Consumption across the board kept dropping like a rock… Debt servicing could be 40-50 % of GDP, far more then current estimates. Inflation is running so rampant, pretty soon you’ll have 1 bedroom condos going for 1 Mil USD + in Tier 1’s, when average salary is 1k USD a month or about 7 000 Yuan a month. In the end, Central Planning an economy always ends up in bankruptcy and misery… Nothing goes to hell in a straight line right ?

As the great Milton Friedman once said:

The Free Market is not only a more efficient decision maker than even the wisest central planning body, but even more important, the free market keeps economic power widely dispersed

As the great Milton Friedman once said

He admitted he was wrong.

Oops.

“the free market keeps economic power widely dispersed” – what the hell are you smoking?

Uncle Milty and friends told #1 moron Ronnie that trickle down “works”.

I have read somewhere that 10 cnts accounting fees for its 600 or so subsidiaries are roughly what a large US auto dealership would pay.

Just sign here PWC.

Where can you even find Accounting costs in it’s earnings ? Cant find them…

chinese don’t go into details in earnings man, it’s mostly just big blobs like Non Operating Income and Non Operating Interest Income, but they leave it to imagination, never detail why the numbers are there, not like the rest of the developed world… The earnings results for chinese is equivalent to off balance sheet accounting, put wtv numbers you want, you don’t have to break down anything

I suspect the source was PWC’s own books which it can’t under cook to the same extent as 10 cents

Interesting write up on Tencemt, very informative. Although I am not sure I agree how much this will affect China’s economy as a whole. Ten cent certainly will be propped up by the government, it has woven itself into the control system of China.

The real question is whether China can indeed move itself ahead on the real parts of the high tech sector it doesn’t currently have parity with the US in, semiconductor, biotech, etc. I am not sure how much, but I think in software, At least consumer software portion, China has pulled even if not moved ahead of the US.

The biggest difference is the model of capitalism China is operating under, that will make all the difference in the world. Because while the US won’t prop up Dell, you can bet the Chinese government will prop up Lenovo.

Informative piece, but afaik tencents q1 was off was partly an effect having their games sidelined and no new game approvals ‘re new age and time restrictions on game playing. Games sidelined until compliant and approved for release.

I find very interesting that out of those six companies only one is traded under Mainland Chinese jurisdiction in Shenzhen: the rest trade either in Hong Kong or New York.

This means we are not dealing with the real Tencent and Netdragon, but with Cayman exempted companies (about 40% of the HKSE listed companies at last count), meaning the ties with the original article are unclear at best and hazy at worst as under the 2013 Companies Law exempted companies are not required to make public their shareholders’ details nor their accounts and liability is limited to the unpaid amount of shares shareholders hold.

Yes, the “omnipotent” Chinese government is perfectly fine with this situation, and even State-owned conglomerates such as the China National Gold Group Corporation use Cayman exempted companies to list their shares on the HKSE.

This leaves an interesting question about the real financial conditions of these Mainland Chinese groups listed on the HKSE and NASDAQ. Technically speaking Tencent has no need to have a whooping $26 billion in outstanding bonds, mostly denominated in US dollars. A company that size can get all the liquidity it needs and some merely by tapping the internal Chinese market. But… we have to rely on what Tencent chooses to tell us, or to be more precise on what the Cayman exempted company controlled by Tencent chooses to tell us.

These maxi-Chinese groups going on acquisition spreads at home and abroad all work the same: they do great and have us gullible Westerners staring at them open mouthed like the slack-jawed yokels we are until suddenly the music stops.

HNA Group could do no wrong until Fall 2017 when it was “suddenly” discovered they had an official $94 billion in debts. The music stopped overnight, as did the big fat acquisitions.

Apparently the Chinese government is stealthly liquidating the group (and losing money in the process) to avoid the embarrassment of a colossal bankruptcy and too many questions. As Tacitus would have asked “Quis custodiet ipsos custodes?”, “Who watches the watchmen?”: why did regulators fail to do their job and why aren’t they being punished?

One final thing. There’s a modern saying in China that has been translated to me as “All vices are illegal and all vices are tolerated”. I find it to be a perfectly apt description of China, surely much better than the black/white idealized view the media present to us, an inheritance of the 60’s Western fascination with Maoism Simon Leys lampooned so well.

“All vices are illegal and all vices are tolerated”

AS long, as you support (Financially), the correct political mafia clansmen.

Well said, this article explains exactly what you said!

https://finance.yahoo.com/news/wanna-bet-1-3-trillion-220001367.html?soc_src=community&soc_trk=tw

American Depositary Receipts (ADR) are in my opinion somewhat worse than Cayman exempted companies trading on the Hong Kong Stock Exchange (HKSE).

The HKSE considers Bermuda and Cayman companies “honourable” (that’s the exact word) and hence allows them to be listed directly. This is a legacy of the dying days of the British Empire which neither Hong Kong legislators nor their Chinese overlords bothered changing.

Foreign jurisdictions other than China, Bermuda and Cayman are considered for direct listings on a case-by-case basis, with British Virgin Islands (BVI), Nevis, Seychelles, Mauritius and Samoa all becoming more and more popular.

By contrast ADR are not a direct listing. They may trade like equities but are actually more sophisticated financial products and at least the least regulated categories require careful handling: for example ADR classified as “Sponsored, Level 1” are not required to have SEC filings and can get away with a yearly financial account on their own website. This account doesn’t need to be audited nor to conform to US GAAP rules.

PS: I checked on the HKSE website and Tencent is listed as, you guessed it, a Cayman exempted company. ;-)

Excellent point! I didn’t know this…

Coincidentally, I just returned from a scuba trip to the Cayman Islands. Lovely place, friendly people.

I was curious that they didn’t stamp my passport. Knowing now about their securities registrations, and having read that there are more registered companies than people there, I guess it makes sense.

Dale, according to the latest Cayman immigration laws “Citizens of the United Kingdom, Canada and the United States” are not required to produce a passport upon entry. You can get away with a birth certificate but, honestly, who keeps one of those around? :-D

Intriguingly enough the “Citizens of India and the People’s Republic of China” have the same benefits… if they possess any type of visa issued by one of the aforementioned three countries!

Given the horror stories I’ve read about visas being handed out like candies I suspect the Cayman Islands see a massive influx of Chinese “students” in their 40’s who haven’t been anywhere near a university in twenty years. ;-)

Agree, I ran across an article about the Samoan action. Who’d a thunk?

Tencent is partly financing Top Gun 2. And in order to appease its communist masters, one of Maverick’s iconic leather jacket patches has been changed from the original. The Japanese and Taiwanese flags are gone.

“Video Games make up about 1.25% of global GDP”

So 37 year old losers playing video games all day is a global phenomenon, and not just an American one? That’s good to know.

Playing video games is a form of entertainment, just like watching TV, or going to the movies or going to a theater or opera. Watching sports is entertainment. As is going fishing. This is what you do in your free time to enjoy life a little. Where do you get the idea that people who engage in this form of entertainment, or any other form of entertainment, are “losers”?

It’s like porn. You can’t define it, but you know it when you see it.

Fascinating piece, thanks Adam!

Wolf,

I think someone just earned a free beer mug.

@somerandom…

essentially everyone male from 1 to 60 has played video games…

Have you seen the article re TENCENT in the Nikkei Asian Review of July 12-2019 : “Tencent chases Alibaba for cloud computing supremacy ” ,

“Battle could decide future of China’s tech titans”.

This article offers a different perspective !