Bloodletting after record IPO Hype in 2018 of Chinese companies in the US.

There are about 300 Chinese companies that are traded in the US, either on exchanges or over the counter, either as American Depositary Receipts (ADRs) or as shares. And they’re just about all getting crushed, crushed, crushed.

Even Alibaba, the biggie – which has gotten off easy so far. Its ADRs [BABA] fell again on Friday, closing at $155, having plunged 18% in March so far and 26% from the 52-week high.

Weibo [WB], a social media giant, fell 3.8% on Friday to $43.66 and is now down 69% from its peak in January 2018.

Baidu [BIDU] has plunged 26% over the past six trading days alone to $114.47, and is down 58% from its 52-week high.

JD.com [JD], an online retailer, has plunged 48% from its all-time high in January 2018, to $26.32.

Tencent Holdings, the conglomerate with holdings in social media, payments, video gaming, and tech: Its ADRs [TCEHY] have dropped 25% from the 52-week high and 33% from the peak in January 2018, to $40.86.

Sina Corp [SINA], an internet portal, plunged 5.9% on Friday and 37% so far in May. It’s down 67% from the top of the range it traded at in the January-March period of 2018. The shares have traded in the US since its IPO in March 2000, just as the dotcom bubble was starting to blow up. These shares are now down 70% from their all-time high in 2011.

Then there are the Chinese companies that went public in the US via IPOs in 2018. It was a banner year, in terms of the number of companies: 33, the most ever. They accounted for 17% of all IPOs in the US in 2018. By deal size, 2018 was second largest year: $9.2 billion, behind only 2014, the year of Alibaba’s $25 billion IPO.

Here are the four largest IPOs by Chinese companies in the US in 2018, and to what extent their shares have recently gotten crushed:

#1. iQiyi [IQ], the video streaming company that had been hyped in the US as “China’s answer to Netflix.” It went public at an IPO price of $18 a share, giving it a deal value of $2.4 billion. It had a tumultuous ride, first down into the $14-range, then up to $46.23, and then back down to $18.70 on Friday. It has plunged 19% since May 3, 32% since March 18, and is down 60% from its peak.

#2. Pinduoduo [PDD], the online group discounter. The IPO in July 2018, at a price of $19 a share, gave it a deal value of $1.6 billion. Shares fell to $20.28 on Friday, down 35% from the 52-week high in February.

#3. NIO [NIO], EV maker that had been hyped in the US as the “Tesla of China” at the time of its IPO last October, which was when Tesla traded at around $350 a share, not at $190 as on Friday. The IPO price of $6.25 per ADR made this a $1.15 billion deal. These ADRs fell 1.8% on Friday to $3.86, having plunged 38% below the IPO price, and 72% from the peak of $13.80 at max-hype after the IPO.

#4. Tencent Music Entertainment [TME], the music division of Tencent Holdings, has plunged 28% since April 2. In early December, days before the IPO, the IPO was still hyped as “hotly-anticipated.” But it wasn’t so hot. It took place at $13 per ADR, at the bottom of the range indicated, still extracting $1.1 billion from investors. The ADRs reached a high of $19.11 on March 18 and closed on Friday at $13.62, having plunged 29% from their peak.

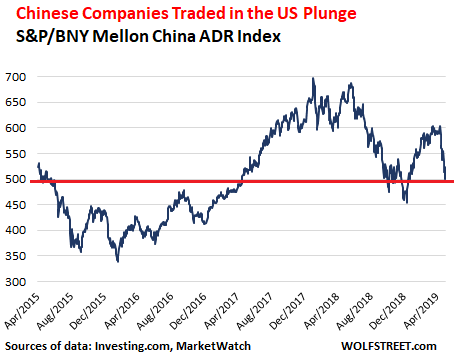

There is an index that tracks US-traded ADRs by Chinese companies, the S&P/BNY Mellon China ADR Index. It closed on Friday at 500.1, down 29% from its peak in January 2018, and down 17% so far in May. The index is dominated by Alibaba’s ADRs. Note the plunge in May to below the level where it had been in April 2015 (data via Investing.com, Friday’s closing price via MarketWatch):

Clearly, all the razzmatazz about the US-China trade war, the “new cold war,” the “tech cold war,” and all the global entanglement around Huawei are not helpful. But there is a lot more to it.

SMIC, China’s largest semiconductor maker, said on Friday in a filing to the Hong Kong stock exchange, where its actual shares are listed, that it had notified the NYSE of its intention to apply on June 3 to delist its ADRs that are traded on the NYSE. The delisting is expected to happen after June 13, whereupon the ADRs will trade on the over-the-counter market, it said according to the South China Morning Post.

Upon the news, its ADRs [SMI] fell nearly 5% to $5.24 on Friday. They’d first started trading in the US in early 2004, reaching a high in April that year of $15.60. For buy-and-holders, this has not been a good ride. In the 15 years since that peak, the ADRs have plunged 66%. And they’re down 40% from November 2017.

The company cited low trading volumes of its ADRs and the high costs of maintaining the listing in the US and complying with reporting requirements and related laws in the US, according to the South China Morning Post – and these US reporting requirements and laws are of course precisely what are supposed to provide investors a modicum of protection against the biggest abuses and scams.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

BYDDY stock, the big EV and lithium battery maker, which Warren Buffet invested in 2008 when it was cheap, is still doing ok in its Hong Kong listing

ADRs are not really for serious investments in foreign companies. I think they are mostly based on the greater fool concept

If you mean buying ADRs are a bad idea in general, as opposed to just buying mainland China stocks, can you explain?

Wolf, thanks for the outstanding piece.

Every year I make ten risky bets and pray that at least I get 7 right. Betting that Xi Jinping would become Mao’s reincarnation is obvious today but it was a risky bet in 2009.

My bet for China in 2029 is that Xi Jinping will continue purging any sign of dissidence and will have sealed China, very much like Mao did. More to prevent people from leaving the country than to prevent people from entering.

The second part of the bet is that the Belt and Road Initiative, one of the biggest frauds of this century, will fail to achieve its political objectives. The Communist Party of China believes that it will be able to coerce loyalty through the Belt and Road Initiative. They couldn’t be more wrong about this.

Hmmm, just read the Wikipedia entry on “bakumatsu”, the very chaotic period of Japan’s opening to the West.

Bottom line points:

1. Perry is all Americans ever read about, he accomplished very little other than securing a treaty to safeguard American whaling ships

2. Lots of violent conflict and people getting killed on all sides before the issue was settled and Japan fully opened to the West.

3. The US was preoccupied by the Civil War and its aftermath when that finally happened and so the British, French, and Dutch were the ones who took most advantage

Ever wondered why the US had to force Japan and Korea to trade with the US?

Perry’s mission is what got us Pearl Harbor.

Doubt it.

Japan was happily ensconced on WWI’s winning side with the US & the Entente Powers. However, at the end of the war, the split of territories assigned to winners was perceived as very unfair by Japan.

Japan’s WWII activities actually started about 1936 in China and include such activities as the Rape of Nanjing, which was accomplished over a period of 6 weeks as the Japanese Army was allowed to rape, pillage and kill (primarily by bayonetting) an estimated 50,000-300,000 civilians. This type behavior, oft repeated, lead the US to terminate exports of scrap metal & fuel to Japan for their military use.

The US was a competitor for trade with China and the rest of Asia. It was obvious the US was not going to give Japan a free hand to subjugate China & other Asian nations. The Japanese military prioritized sinking the entire US Pacific fleet to ensure the US was incapable of interfering with planned Japanese conquest of China & selected other bits of Asia.

That is what lead to Pearl Harbor on Dec 7, 1941.

A very brief Wikipedia search would indicate Korea and China have fought each other since about 1000 BC. Their relationship has been anything but “peaceful co-existence”. So much for “…tolerance towards other cultures and systems…”.

Europe is a much smaller geographic area than Asia, and Westerners (apparently including you) are very unfamiliar with Asian was & history. Korea (especially N Korea) and China STILL don’t like or trust each other (the China-N Korea boarder is guarded on BOTH sides of the river).

You are, however, correct that ancient China was not an Anglo-Saxon imperialist. China was a frequent and very aggressive Asian imperialist.

√

the references in

https://www.amazon.com/Beware-Dragon-China-Years-Bloodshed/dp/B0062GKUMY

will take you to some interesting materials.

china is the global poster-child of civil wars and rebellions.

Since china started using printed money, almost all of those insurrections, have been rooted in excessive money printing..

\\\

I strongly disagree with your stance on the Cino-Korean relations, as well as other topics, but our further discussion would leave the intended scope of this commentary. And we can, I believe agree about our disagreement. Thank you for commenting.

\\\

It seems that the theme here is that the USA is crushing China. The US has tried to dominate Eurasia for many decades, wasting many trillions of $ and achieving very little. That doesn’t give much credibility when talking about the BRI.

Emperor Xi has been reading too many Communist Party of China press clippings.

1. China needs U.S. dollars from their exports into the U.S., by selling U.S. dollar assets including treasuries, or from borrowing.

2. The Belt and Road Initiative cannot be funded on Yuan.

3. Trump called China a currency Manipulator before, now China is desperately trying to hold the peg. But that is like holding your breath under water. Trump has manipulated them into a “damned if you do, damned if you don’t” position

But worst of all for China? The growing economy of the past 20 years has given the peasants hope. All effective dictators know never to give the peasants hope.

Dedollarizatian has started. The BRI is a long term project. Underestimate the world at your peril, USA!

I’ll take the other side on a few of those. XJ is not going to launch a retrograde cultural revolution. There are 200M muslims in E China where the government balances their freedom to worship with crackdowns on radicalism, much as China allows capitalism to coexist with Communist party doctrine. They have reverse engineered American pragmatism. China can manage its own economic problems but it’s effect on the global economy is dubious, so some loss of trade should be expected, or at the very least foreign investment. The PBOC is tired of playing hot potato with UST reserves and will dump them like Russia.

Now that the wild growth has ended, China needs to urbanize. The BRI will provide a much more sustainable trade than the now precarious relationship with the US.

– I have read that there are A LOT OF chinese stocks (incl. ADRs) listed that are completely (what one Donald Trump would call) “fake (news)”. A LOT OF fluff and no or trumped up earnings. Never touched those chinese stocks/ADRs anyway.

Willy2,

I didn’t even list those. I stuck to real companies that are well-known. That said, corporate accounting and disclosure in China is a horrendous mess, and as a matter of principle, you cannot trust their financial statements. Here is my reporting on Chinese companies that had listed large amounts of “cash” on their balance sheet that then wasn’t there when the companies defaulted.

https://wolfstreet.com/2019/01/23/record-defaults-by-chinese-companies-fake-cash-fake-accounting/

I wonder what would happen if BIDU, BABA, etc, starts to pull their ADR out and relist in HK.

It will make things so weird.

I’m a little confused. What’s the difference between ADRs listed in NY and shares of the same company listed in HK? Shouldn’t they trade the same, courtesy of arbitrage? Are there similar waterfall declines in the Chinese listings?

Friday the Pboc took over Baoshang Bank cause it was about to pop!!! I told you guys… Hold on to your hats, 2020 didn’t even start yet.

First takeover in two decades, many more to come by end 2020

IQ earned a billion dollars in 4 months, 100 million paying subscribers and 800 million non-paying users (advertisement revenue). They are the biggest on planet Earth. They are creating unique content and it costs money, yes. There are two ways to argue this: A) basically at the moment loser Americans are financing Chinese people watching premium content at a discounted price. B) Building membership base and proprietary, unique content costs money/time. While I can not tell you when to buy IQ but if the bloodbath continues then you might want to keep an eye on this stock and get some when the time is right.

Why buy anything China related at this point in time? The countries are talking about boycotting each others’ products. Everything in China explodes if US exports drop.

Er, Walmart and Apple would have to shut their doors if a total boycott of anything made in China were put into effect. 70-90% of consumer electronics and other durable goods would disappear from the US. There would be massive inflation as supplies of common items like hairdryers dried up and remaining stocks were bid up in price.

100% of consumer grade hairdryers and things like Christmas decorations are now made in China

In a few years, other cheap countries could take over production, but such a sudden cutoff in supply in the US would result in several years worth of massive shortages and inflation to rival the Arab oil embargo and gasoline shortages and inflation of the 1970s

Hair dryers vs oil? Wal Mart model suffers? Bring it on. Chinese equities down over 12 % since 4/22.

Hair dryers and Christmas ornaments are useless objects that bring neither utility or happiness. Stop buying this crap. Your hair will dry on its own and you already have too many Christmas ornaments.

There is already too much stuff. We don’t need more stuff. We need food that is not garbage and housing that is affordable. A van works for me but even I would concede it’s not the ideal situation for raising kids.

Snap out of it, let go of your obsession with things, shopping is a hollow experience that will leave you feeling empty. Find a more worthwhile pursuit and let China keep all that useless garbage they are peddling on Amazon. Let consumerism die its well deserved death.

Van – Plenty of kids growing up in parking lots in my area. They’re not going to school but they’re learning to scrounge for scrap metal and would test about their housed peers in that area.

I get you on the cheap Chinese stuff but I’m sure getting happiness from my new Japanese branded Chinese made butane stove and wouldn’t have taken the things I got at Daiso yesterday all those miles on my bike if they weren’t worth it to me.

I am sure there would be some middle man that could take care of this. Ship the hair dryer to Mexico and stick a new “made in mexico” sticker on it. That stuff happens all the time.

Or: People could learn how to fix broken things, again.

Well if they were faced with a united front then of course you would be right. Unfortunately the ‘go it alone’ strategy leaves China with many options to mitigate the issues.

I guess you don’t want any in the U.S. watching TV or using phones or toasters or wearing clothes.

You’re my kinda guy/gal…would love to see the guys I work with naked.

I have not purchased clothes in 3 years, the clothes I have continue to work just fine. Thrift stores are full of clothing looking for a home and we dump millions of tons of used clothing on third world countries. This is not the 1880’s, textile mills can be set up and operating in less then a year. We came close to total dependency but we are still capable. We will begin to grow our manufacturing base again. People want to do useful work, many are tired of bullshit jobs that accomplish nothing.

Van – I’m pretty sure my Chinese made t-shirts from MUJI will outlast the (ostensibly) US-made “Fruit Of The Loom” ones I used to buy.

No, it’s the other way around. The tarriff tax will hurt US consumers more than anyone.

Consumers who want to buy junk and tech stuff yes….for most things that you need to live….zero…what more do you need as consumer….

China has everything to lose…..

Admirable thought, but a dream.

China doesn’t just provide cheap consumer goods – they also provide an enormous portion of the raw and 1st/2nd stage materials for things like pharmaceuticals, steel, aluminum, chemicals, etc.

cd, shopping crazy USAnians just looove the Chinese gooodies, and now that they’re not doin’ too good the can’t for more expensive stuff. The tarriffs will contribute to the retailcalypse.

I sold my shares of BIDU the other day. I have been reading about the coming bifurcation of the internet. I took some loss but a rule I have is. When I no longer understand a trade I am out.

Also when the markets now subscribe to “the trump put”. Ie tweets. It’s game over for this bull market. Fed put is one thing

But the tweet put is a step too far So much for market discovery , other than discovering it’s all a mirage

Sold your ADR’s which are not shares. I have never trusted the Chinese to come good on ADR’s if a conflict breaks out. You would be left holding Caribbean paper.

They are gonna got to charge tons over 200bps over 10Y to create cash. I’m undecided however they create it. although they get cash at the wholesale market at > two.4% there’s not that abundant unfold left.

It’s odd, there are still people who doesn’t believe this is a trade war. Stocks are going to be the last things people worry about in a couple of years.

The only chance that this gets resolved is if Trump gives in, I would give this even chance of happening because he wants to be re-elected. There is no way Xi is going to back down, it will be ruin for him if that happens.

Oddly enough, I think Trump getting a deal is the best chance of resolving things, because the Dems probably don’t want to do that if they get into office.

Of course, if Trump does cave, he is also finished, and that just kicks the can down the road for another decade or two.

It will probably go like NAFTA, Trump will get the status quo with a couple of minor changes he can vocally brag about to convince the rednecks he “won”, and Xi gets the same.

Except the status quo is not to the US favor in the long run. Xi understands the situation better, ultimately, it isn’t about him being well off, if he wanted that, he could retire. Xi is in it to make China #1, vs Trump, who is only in it for himself.

That’s the difference with China, from its point of view, if it is dominant, no one can lord over them or take what’s theirs. China don’t necessarily want to have it’s system be adapted across the world, it sees the problems with foreign adventures. It is just terrified that the US would try to strangle it. To guard against that, they have to displace the US as number one.

It comes down to this, there can be only one.

I am one of those who doesn’t believe this is ultimately a trade war. To me it’s a war about who Controls. Trade is part of the equation, but this is about controlling Communications, Commodities Access, Technology, and on.

To me, this debate between China and the US (West ?) is much more involved than just a trade war.

Trade is the banner the MSM gets to publish day-to-day.

I agree with you Lion. I think number 1 this is about control in surveillance and everything else after that.

It’s become crystal clear that the trade war is too expensive. They need to slash tarriffs MASSIVELY. Then they can keep on and on talking about everything else.

The US Admin has been insisting that Huawei etc is a separate issue. Yeah right, in the middle of some rather important negotiations? Do you think the Chinese believed that for a nanosecond? Interesting then, that 45 has said that Huawei can be a subject in talks. I don’t interpret that as a sign of strength.

Well, for once Donald Trump has picked competent people on the “Trade War With China”-Team. We could be in for a long conflict here, but, it will be resolved eventually. What I think, anyway.

There’s this laughable idea that China will do what the USA wants it to. The tarriffs hurt too much, so they’ll have to slash them and keep on talking – or mainly blaming each other – for years to come.

I’ve never taken this “trade war” seriously because Trump simply doesn’t have the conviction or any set of real principles to see this through the inevitable economic pain that it will cause. However, now Insee a risk where Trump loses control of the situation, and is no longer able to modulate it as he has over the past 12 months.

His advisors are supposed to be comprised of the foremost experts on everything China, right? How could they possibly have believed that China wound ever agree to those demands (which the public is FINALLY privy to)? I’m a layman and to me it’s clearly obvious that those concessions they supposedly reneged on were just too good to be true in the first place.

Just Tencent dot com alone lost $200 Billion in value, with another $450 Billion to go. Like 2/3 $Trillion never existed.

Maybe Hussman into something saying $10 Trillion will just evaporate.

Cayman Islands : Alternative Dispute Resolution (“ADR”)

Then here we have “American Depository Reciept”, so which is it?

The courts in the Cayman seem to think ADR means a dispute mechanism, but perhaps the crony’s on wall-street sold the ADR to the west a ‘deposit’? ( I understand the reality, which is a BABA share is Cayman-Island ‘right’ to a percentage take of the BABA-NET, which of course is a joke, because a clever Chinese Accountant can expense all the profits and leave the net to be zero )

IMHO I think this fraud will collapse, because there is no reason for these powerful chinese companys like ‘baba’ to be chained to USA structures, better off to move this stuff to HK; The real problem of course is the west can never have ‘real ownership’ of a Chinese Corporation, especially a tech company, I remember back in the day when the PLA owned all tech company’s in China. Thus it would be insane to ever think that real ownership could be conveyed.

Another thing not mentioned is that Jack Ma is now CCP and he’s in charge to tech, this is why he stepped down as Alibaba CEO. I don’t think that ‘Ma’ will want to punish his investors, so they’ll figure out a way to make the investors ‘WHOLE’, but that said, I doubt the ADR in the Cayman’s has much future, after what the USA did to Ren’s Huawei daughter lets remember here, Ren is the most important man in China, and his daughter is like a princess, and the USA had her arrested, this BS will NEVER be Forgiven by the Chinese public.

Lastly, I’m long BABA, believe in the company, and think its long term potential is +10X of AMZN ( NSA ). I hate this Cayman Island BS, but its the only way at present to play BABA.

Noticing many comments ignoring that China has The Most Powerful Ally All – Mr Market. China CAN NOT LOSE the trade war because Mr Market is on her side and she knows it. Even Tarrif Man worships adores and serves Mr Market and says his job will be judged by Mr Market.

Exactly. If it were a man or woman with a genuine set of principles and genuine conviction, then the market would be SUBSTANTIALLY lower.

Let’s remember here that this isn’t ‘blood-letting’.

BABA’s instrinsic value is $139 (DCF), and it traded at that just 6 months ago down to that level, but didn’t go below. ( Growth is still +30% )

For now BABA is at $155, if it goes below $140, I will certainly BUY more.

Why BABA went recently up to $200, was just pure speculation, hope people who trade sold out the high.

Personally I’m a long term value investor, which means whenever it dips below intrinsic-value I buy more. The real ROI on BABA or any of the better Chinese investments will take years for the current political problems to get resolved. Probably ‘Post Reset’ is IMHO where the new structures will be forged.

WRT to the other “ADR’s” IMHO most look like SV unicorns. Hikvision is rock solid, and I use the equipment, but those are the only two that I have firm conviction. If Huawei was publicly traded as a stock I would BUY as much as I could under intrinsic value, sadly its not available. Now that Trump has disrupted Huawei maybe they’ll open the door for cash infusion :), as HUAWEI has to make 10X infrastructure investments to fab their own SW&HW 100% local. CCP just announced two year+ tax exemption for HW/SW startup’s, expect to see the greatest high-tech revolution in human history in the near future.

What on Earth is a ‘value investor’, in a weird financialized world wherein growth is achieved not by paying people more, but by offering them more cheap credit to bury themselves, and in which the wealth and income gap grows to evermore staggering levels?

What is a ‘value investor’ in a weird world wherein corporations achieve growth in their stock price via borrowing to buy their own stock?

Anyone claiming to be able to spot ‘value’ in stocks these days is, basically, just ‘full of it’. It’s a casino – nothing more.

Hmmm, good question, but it seems to me that Longterm has a good strategy.

I get your point and recognize your justifiable anger. The “value investors” are in hibernation. Just because the stock market is hyperbolic doesn’t mean that, value investor, has no meaning. It has meaning in the right context.

Personally, the word that has lost its original meaning most is “liberal”. The founding fathers were all liberals in that they wanted liberation from oppression and the king. That’s been the history of “liberalization” – escape from tyranny and the status quo, particularly status quo based on economic tyranny. But the populists and rednecks have turned the word liberal into “the enemy of the people” and now “socialist”. If Orwell saw and heard what’s going on in the Western world, he’d spin in his grave.

I so totally agree. The word liberal has totally lost its meaning.

What on Earth is a ‘value investor’,

The old joke: Someone who bought a stock for a quick in-and-out and then it dropped 10%.

For half-trillion US dollars these ‘value investors’ value every Alibaba employee their weight in gold.

Huawei growth required China government infusion. They can never go public because the world would see what a corrupt company they are. All the thier products would be selling at a loss and the only way they have stayed in business is from the chineses government financing.

Just like Tesla….

This is just part of the trade war going off between the US and China

Damage limitation on the part of the Chinese

What America has to soon face is a BIG sell off by China of their USA bonds

And I am not talking a few $Billion , I mean selling the whole shebang

How would Trump like them apples ?

We can and do print all the currency we need to soak up treasury supply. The Fed has announced plans to resume the purchase of treasuries after August of this year. Every administration increases the size of government and deficit spending and the Fed has made clear politicians need never worry about funding. As Bernanke said: it is impossible for the U.S. government to ever face a funding crisis. Currency crisis? well that’s a matter the Fed doesn’t seem to give a damn about.

Bernanke is insane if he thinks he will escape culpability after the currency crashes. Bernanke created this mess – in fact he chided the government for not increasing deficit spending even more – said they were not doing their part.

Oh boy, if they sell it all the interest rates may rise to the level of two weeks ago.

Okay guys,

I want you all ( I mean all of you commenters here)

to revisit your comments here around (DECEMBER) 2019.

After doing so, please make a real appraisal To your understanding of the world history.

You’ll find yourself backpedaling on lots of misconceptions big time.

PS .. i enjoyed reading the comments and having a great laugh .

Ok, this will be the first WR article I’ll flag and save. We’ll meet again…

Jack: You actually study history!

And I thought I was the only one!

Do they still teach history in school anymore?

No Wes they don’t!

Maybe, just maybe a good dose of history is what we all need sometimes!

Just to see that we’re Not inventing much new, “ Nothing is new under the sun as they say”!

Anyway, I am very pleased to know you do read history and mull over the human stupidity while (hopefully ) enjoying a Scotch ! :)

My Chinese wife has forbidden me to trade any Chinese stocks due to accounting fraud prevalent in mainland. She has a good point.

My American wife feels the same for stocks here in the States. Wonder what country has “honest” accounting.

Care to give 3-5 examples of major American public companies currently engaging in accounting fraud?

That’s above my pay grade. Doesn’t the SEC or the Justice Dept have to prove it in court. The point is I don’t trust their accounting, both of them.

Funding secured comes to mind. The name Shkreli comes to mind. American companies have been corrupt for decades, living in a glass house and throwing stones.

Iamafan: Way back in the 1960s one could at least determine if a company was cash flow positive by checking to see if the company’s employee pension plan contributions were up to date.

Now that companies are no longer in the pension business there is no longer a real way to tell if the company is cash flow positive.

Now company financials mean whatever you want them to say!

Look at two different charts.

First, the SSEC. See how it has moved slowly lower (down -3.4%) over the past six trading days.

http://schrts.co/NiXMRyiy

Second, BIDU. See how it … absolutely cratered (down -25.5%) over the past six trading days.

http://schrts.co/HQTHItjG

Isn’t that interesting? I wonder just how many shares the PBOC is buying over there to support their market.

Over the past two weeks the Central Financial and Economic Affairs Commission has approved a long series of incentives for several sectors of the Chinese economy, from generous tax breaks for some categories of real estate to equally generous subsidies to electronics manufacturers like SMIC and hi-tech companies like Tencent.

Coupled with the fresh flood of renmimbi the People’s Bank of China started unleashed shortly before the Chinese New Year, this should have sent assorted speculators in a frenzy over buying US traded ADR’s and stocks of Chinese companies: after all this is the kind of stuff that is guaranteed to send stock prices soaring regardless of anything else.

Instead these financial products have been bludgeoned, and their fate has been made worse by the glaring difference in performances with stock market indexes. What is going on here? Why aren’t people buying these Chinese financial products?

I think the reason, as always, is rather complicated.

Some of the initial enthusiasm about these stocks and ADRs has evaporated as people discovered they aren’t really buying shares in a highly profitable or fast growing company in China but merely certificates issued from a PO Box in George Town or by a shell company in St George’s.

The discovery that many of these Chinese companies have what can only be called a cavalier attitute towards generally accepted accounting principles, and that the Chinese government doesn’t seem to be bothered by this, has no doubt had a part in this. You don’t want to hold stocks in the next HNA Group, at least not when the tide turns.

Also while sponsored ADRs are SEC-regulated, and as such at least subject to some regulatory oversight, unsponsored ADRs that trade over-the-counter aren’t. They are “sophisticated” (read: risky) financial products, not your standard AAPL stocks.

Finally many are beginning to suspect this whole trade dispute between China and the US won’t be solved quickly. Believe what you want but Huawei is not likely to be the last Chinese company to be targeted by US authorities. And there’s nothing more toxic than stocks (or ADRs) bearing the name of a company that ended on the wrong side of the US government. Better be cautious and reduce exposure to them: the stock market’s doing well after all so there are plenty of alternatives.

There is already a target list under whatever guise you want to call it. I have heard a lot of facial recognition companies are being targeted, ostensibly because they supply Chinese government with the tech. Then there is that not so veiled shot at Foreign drone manufacturer, read DJI.

It is a bit hilarious in two ways, first, talk about the kettle calling the pot black. Second, I wonder if the US is starting to adapt to the government supported capitalism idea that China has running, at least insofar as critical industries might be concerned.

Morning…….. Some of the comments suggest a read of the abovementioned Wolf article from 1/2019. Not everyone appears to fully grasp the China way of “doing” business… Have a good MDW…

Hello American,

You have already feed up a tiger to attack you and you still think not to feed it will hurt your consumers.

Relay on single supplier is very dangerous and nowadays Bangladesh & Vietanam make cheaper clothing, Thailand make cheaper electronic, Philiphines fruits …….etc.

You need to know China is a liar country and I learn it hard since 1997. I wish you alert this and don’t recognis when there is no return.

China is a aggressive country and it only want to control everyone, every where.

Dymo: Looks like you learned the truth the hard way!

The school of hard knocks! She is a hard teacher!

Wolf,

Amen. Chinese companies are pure fraud, even these supposedly “legit” ones cited above.

Ten Cent has incinerated tons of capital as it tried to become a hedge fund. For example, the company bought 5% of Tesla more than 100 points higher than today’s share price. They also purchased 10% of Spotify near the top.

A lot is made of the American consumer being hurt by tariff war. Let’s take that as a given. I think it’s also likely that international trade in general gets deemphasised as well. But doesn’t that mean “local” trade is enhanced? This should benefit the American worker. But the American worker, wearing a different hat, is the American consumer. So, it seems a tariff war is pretty much a nonevent for average Americans. Maybe this is why the economy continues to chug along nicely Tahnk you very much.

May 31, 2019 Top 5 Trade Promises China Has Broken | US China Trade War

The US China Trade War is in full swing as Trump and China battle it out. Here is a list of the 5 biggest trade promises China has broken with the WTO (World Trade Organization), including intellectual property theft and hacking, that pushed the US over the edge and caused the tariffs and trade war.

https://youtu.be/PK5x5IZ2Jvw

America need to cut off China now or Americans middle class will all be slaves to your new overlord from the East, China CCP leaders. This is a do or die mission for America.

Here is the statistic.

If China continue to suck all the wealth from around the world, China top CPC leaders will own 80% of the global wealth by 2025.

China leaders control more than US$20 trillion savings in the Chinese banking systems.

China leaders control more than US$50 trillion in assets world wide mostly located in China.

China CPC entity is the richest in the world which even Rothschild, Freemason secretive groups are no match to China top 10 CPC leaders.

Almost half of global GDP are control by China SOE (state owned enterprise).