Sign the already weak goods-based sector is getting weaker.

Boeing, where art thou? Boeing is suffering from a sharp decline in orders, and this translates into a sharp decline in orders for “civilian aircraft” in the durable goods data trove released this morning by the Commerce Department. But it’s not just Boeing. It’s broader and deeper, and it caused forecasts for GDP growth in the second quarter to get slashed.

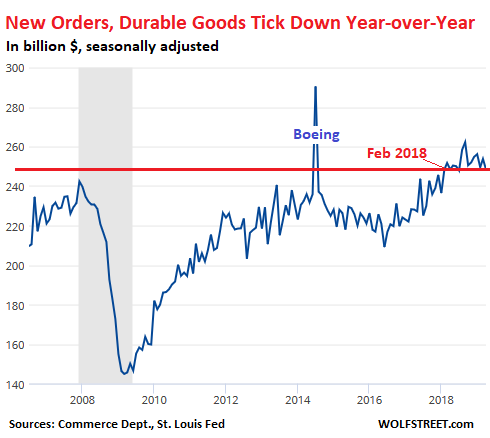

Orders for durable goods – such as cars and appliances and other items designed to last at least three years – fell 2.1% in April compared to March, to $248.4 billion (seasonally adjusted), and were down a smidgen from April last year, the first year-over-year decline since January 2017, which had been the tail-end of the two-year-long decline in the US goods-based sector.

In the chart above, the historic spike in orders in July 2014 was caused by Boeing when it reported a huge order of 324 aircraft in the month.

The year-over-year decline in orders in April comes after February and March had been essentially flat year-over-year. This makes three months in a row of no growth when compared to the same period last year. And the data for orders in March still hadn’t been impacted by the Boeing fiasco that was just getting started.

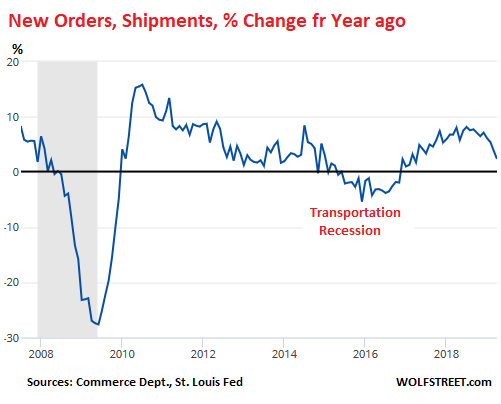

Shipments of durable goods – goods that had been ordered in prior periods and were shipped in April – fell 1.6% in April from March, to $253.3 billion. They’ve been ticking down fairly consistently from their peak in December. Thanks to strength last year, shipments in April remain up 3.2% year-over-year.

This chart shows the year-over-year percentage change in Shipments. Note the period in 2015 and 2016 – the “transportation recession” – because a decline in shipments causes a decline in the transportation sector. At the time, for the year 2016, GDP grew at a miserably slow 1.6%:

Parsing the durable goods orders further:

- Excluding transportation, so excluding the fiasco at Boeing, orders in April were flat compared to March, but remained up 1.4% year-over-year.

- Excluding defense, orders fell 2.5% on a monthly basis and fell nearly 2% from April last year.

Forecasts for GDP growth get slashed.

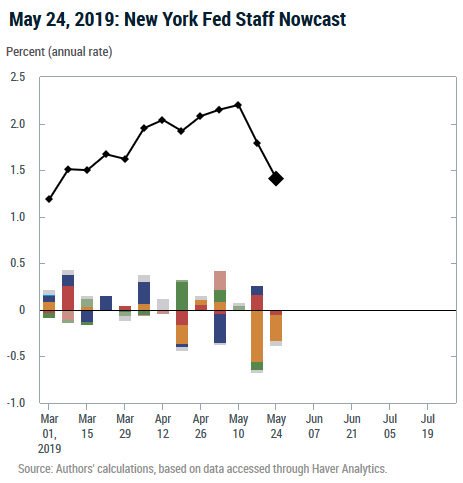

After this data was released, forecasts for GDP growth in the second quarter were slashed, including here, cited by Bloomberg:

- JPMorgan Chase to 1.0% (from 2.25%)

- Barclays Plc’s to 2% (from 2.2%).

- Oxford Economics to 1.3% (from 1.6%).

The New York Fed’s Nowcast, which is reported every Friday, was taken down 38 basis points today, to 1.41% growth (from 1.79% on May 17), after having already been taken down 41 basis points a week ago (from 2.2% on May 10). That’s a cut of 79 basis points in just two weeks:

Today’s drop of the New York Fed’s Nowcast incorporates the durable goods data, including manufacturers’ inventories, unfilled orders, shipments, and new orders. The decline in shipments (second chart from the top) was responsible for 23 basis points of the 38-basis-point cut today.

In addition, yesterday’s decline in sales of new houses took off 4 basis points.

The Atlanta Fed’s GDPNow provides another point of view. Today’s release ticked up to 1.3% growth, from 1.2% growth on May 16.

This is still very early in the quarter. We’re just now digesting April data. May and June data require some patience. So this quarter can still turn around, just like the first quarter did after a very lousy series of early data points. That strong data better show up quickly, given the data so far. But the crummy Purchasing Managers Indices (PMIs) for services and manufacturing in May that we were handed yesterday, did not paint a promising picture.

These PMIs show the slowest growth in orders since October 2009. Read… Suddenly US Service-Sector Growth Dives, Manufacturing Gets Even Weaker

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Gee Wolf, hope the Fed doesn’t see that number, cuz if they do they are bound to raise rates, right? Just like GDP, right?

Pass the koolaid.

Thanks, Wolf.

Slowdown arriving on schedule.

Fed’s hands are tied this time around. Inflation already on the move and headed higher still the balance of the year.

Stagflation? Anyone remember that term?

Stagflation = high inflation and high unemployment combined

Like inflation at 18% levels

Never happen. This is the greatest economy in history. And if it’s not, it’s somebody else’s fault.

Now stop being so pessimistic before you cause a global economic catastrophe or something.

Has anyone’s shoeshine boy given them stock tips yet?

Unamused, obviously you love to post. It would be nice it once in a while you posted something other than snark. That is, if you have anything else….

bemused:

The global political economy in general, and the US political economy in particular, are so unjustly rigged against the people, and so hideously rigged against the survival of civilization, that it’s not actually possible for anyone to dish out the kind of snark they so profusely deserve.

And even I have my limitations.

Food for thought:

Stagflation, which befuddled economists, occurred as the Baby Boomers entered the workforce.

The complete opposite (low inflation and low unemployment) is befuddling economists, as the Boomers exit the workforce.

Maybe we’ll discover a unifying mechanism responsible for these mirror phenomena.

Thank god they didn’t award Taylor with a Nobel already.

The last period of stagflation to effect the US economy was in the early 70’s, I’m a baby boomer and I remember it.

Back then inflation was high and it was a recession with high unemployment.

Growth is low, unemployment is high, irrespective of Government surveys, and when the tariffs work through the system, inflation will get a jump start?

I recommend stag deflation. Falling asset prices and rising wage and service sector inflation. The Fed is obligated to defend asset prices, and drops rates. Inflation at 5% is nothing really, with interest rates at 2.5% the spread is 100% while the media only sees the top or nominal number. The 1% is focused on assets. The 99% finds higher wages and lower home prices helpful if only banks were lending? Demand for inflation bonds rises while the premium at auction offsets any increase in real value, if you didn’t buy early. Fed allows for temporary overshoot, politicians take a victory lap. GDP soars and Kudlow insists rates should go to zero commenting from his home in suburbia.

Do you have a subscription service that you recommend stock or option picks? Enjoy reading your articles.

Regards

Terry

Welcome aboard, Terry. To answer your question: No. What you see is what you get. And it’s free.

Will retailers use the trade war as an excuse to jack up prices? They would if they could because these days it’s not what you pay for the product, it’s what you can charge on the shelf. Corporations are continually looking for a way to RAISE prices, not sell at a continued steady mark-up. They’ll swap brands, offer different sizes, remove cheaper items, biting into the consumer dollar someway. Inflation is good for stock prices.

When will people realize consumers are not benefiting from Chinese made merch in most cases, because they are marked up 100-400% over cost. Retailers could load shelves with US made merch at the same sticker price, but their mark-ups would fall to 50% to 150%,— simply a horrifying thought for CEO’s

You ain’t seen nuttin yet compared to what would could happen.

China – which we all know has fewer retaliatory options in a trade war against the U.S. – could nationalize iPhone factories and blow up the stock market (and a big slice of 401K retirements funds) so important to are most import politicians and ruling class elites – and issue an arrest warrant for Steve Jobs unless the U.S. reverses it’s ban on superior Chinese 5G. Or she could transfer all her business to Airbus and destroy Boeing (but she doesn’t need to because Boeing is already destroying Boeing). Or she could double triple or more rare each prices to the U.S. Or she could call the all powerful Mr Market to bring trade sanction to a heel.

But then maybe I forgot that the U.S. holds all the cards in a trade war.

China is going to dig up Steve Jobs and arrest him?

“Weekend at Bernies” meets “My Cousin Vinny”

In the ‘Greatest Economy’ of all times young people cannot afford to start a family, buy a home, and owe scads (economic term) of debt that affects all of the above. Then, there’s health care, or lack thereof.

In the Greatest Economy the minority is doing well, but most are not. Pundits, spare us the phony statistics and cheerleading, please.

I suspect a long overdue war is being hatched, as if all the proxy wars are not enough. Anything to divert attention from all this prosperity.

Tonight was a ‘no news’ evening for us. God, was it refreshing!!! My wife is teaching our granddaughter to play chess, the dog is begging desert, and I’m going back to my book. I have long thought our only real hope is for this Trade War Nationalism Movement to crash the economy. Only then, is ______________ possible. Don’t mind me, this is a week for breeding cynicism.

Annual inflation (YOY) has gone from 1.6% in January to 2.0% in April.

https://www.usinflationcalculator.com/inflation/current-inflation-rates/

I remember we got stagflation after Nixon’s deficits, Vietnam War, Cold War, Watergate and tariffs. Gerald Ford had a Whip Inflation Now (WIN) campaign that failed. Interest rates rose through the 70’s. Interest rates peaked in 1981 at double digit rates. http://www.fedprimerate.com/mortgage_rates.htm

There was a really bad recession in 1981-1982 with 9% unemployment. In its day it was the worse recession since the 1930’s.

I’d like to put in prospective what Boeing is doing.

Starting on April 15, Boeing cut 737MAX production by 20%, from 52 per month to 42. To avoid disruptions to the supply chain large contractors like Spirit Aero Systems, which manufactures 737MAX fuselages in their Wichita factory, are keeping component deliveries unchanged.

This means that Boeing is still manufacturing 737MAX in Renton (the only site where the 737 is assembled since 1966), albeit at a slightly reduced pace and that Boeing vendors are still supplying parts at the same pace as before the 737MAX grounding.

However the Charleston plant recently came under scrutiny due some aircraft being delivered to customers with exterior damages.

Charleston was originally a component plant which Boeing turned into a secondary assembly plant for the 787 (whose main assembly site is at Everett) to access generous fiscal incentives by the State of South Carolina which are rumored to run over $90 million/year.

Boeing has had all sorts of headaches with the Charleston plant since opening, from labor disputes to some customers openly expressing doubts about the quality control procedures used in the factory and I suspect the only reason final assembly hasn’t been switched to Everett yet is because shipping there the 787-10 fuselages sections manufactured in Charleston would be prohibitively expensive.

I won’t even get into the Space Launch System (SLS) fiasco, of which Boeing is a major contractor. Suffice to say it has been renamed the Senate Launch System for pretty obvious reasons. ;-)

Everybody is talking about Boeing’s demise due to the MAX situation. Airbus has currently no spare capacity and with orders stretching towards 2030 will not disrupt the current duopoly. However the A380 assembly programme could have an accelerated closure timetable thus releasing capacity in 2021 for another existing Airbus type. The supply chain has the capacity quality. With the FAA at last having the balls to take on vested interests, expect a slow return to service of the MAX. Another software failure on the 50 year old design will not be an option for the FAA..

“Everybody” should learn to be a bit more cautious when opening his/her mouth, don’t you think? ;-)

The ATR joint venture was proclaimed dead and buried in 1987, when an ATR 42 crashed in Italy with no survivors. The aircraft is still offered by the French-Italian manufacturer today, albeit backlog is a crummy 10 aircraft. What slowly chocked ATR was the meteoric rise of regional jetliners such as the immensely successful Embraer E-Jet family, not the press which back in the day blamed the “plastic aircraft”. (The ATR 42 was the first commercial airliner to make large use of composite materials; at the time this was widely seized upon by the press).

Boeing did a huge mistake in putting the Yellowstone-1 (Y1) on the backburner once it became apparent Airbus had done the same with the NSR to focus on the re-engined A320 family: Y1 was to be the 737/757 replacement using the same technologies as the Yellowstone-2, which became the present 787, and was in a far more advanced state of design than the NSR was at the time and would have probably preceded it in service by 3-4 years. But Boeing executives at the time were not exactly known for their patience nor foresight.

Regarding Airbus, they have been trying to increase A320neo production for almost two years now. I have been given a monthly target of 64.

But engine manufacturers Pratt & Whitney and CFM have both put their foot down and neither has committed to increase engine delivery to a level which would allow Airbus to assemble more than the present 55 A320neo per month.

There were problems with a batch of CFM LEAP engines back in 2017 (defective shroud coatings) and the P&W PW1100G has been suffering from excessive vibrations whose true cause has still not been discovered and which pushed Lufthansa to ground their A320neo. Manufacturers are stretched at the limit of what can be considered safe.

Again, differently from what some people think passenger and crew safety is paramount.

MC01 luv ya man/woman. Always look forward to your articles and read them and your comments at least twice. Very interesting and informative. But…

You seem not to be your objective self regarding Boeing. You say to put things in perspective, 737Max production is down only 20% (you didn’t write ‘only’ but I inferred it) and they are still producing them albeit at a slightly reduced pace.

While I appreciate the realities of supply chain economics, aren’t you ignoring the 800 lb gorilla? What are they doing with them? They can’t send them to customers, can they? They certainly can’t bill for them. They’re liabilities as are all the planes already shipped.

Even if they could fix the bad design (they can’t) or create some other fix, what airline is going to want them? One more crash for ANY reason will probably bankrupt the airline for flying a plane they knew was defective. Boeing will be bailed out but that’s beside the point.

I look forward to your likely brilliant and humbling reply. But, just on this one, I don’t think you are being objective ;-]

Just curious, how many H1Bs would you estimate work for Boeing?

Boeing files an average of 100 labor condition applications for H1B visa per fiscal year.

However it must always be remembered Boeing also fully owns and controls a number of foreign subsidiaries (such as Boeing Canada), controls a number of US companies which maintain their own separate H1B applications and/or foreign subsidiaries (like the infamous Narus Inc.) and maintains very close working relationships with companies such as GE Aviation and United Technologies, which are completely independent from Boeing.

A lot of the stuff Boeing is involved in, such as the United Launch Alliance, is considered highly sensitive by the US government and anybody working there requires through screening which complicates the H1B process. Everybody still has nightmares which start and end with Dr Adbul Qadeer Khan.

Ironically, this brings to mind the following conversation from the movie “Airport” (1970) between Burt Lancaster’s character and George Kennedy, who was trying to get a 707 out of snowdrift at Chicago’s O’hare airport, and ultimately succeeded:

Conga Leader, Snow Desk. Move.

BL: Joe, this is Mel. There’s no more time. Stop all engines and get out. Repeat. Stop all engines.

Co-Pilot: Mr. Patroni, she won’t take much more.

GK: Well, anyway, she’s gonna get it.

BL: Joe, shut down!

Co-Pilot: Mr. Patroni, don’t you hear? We have to shut down.

GK: I can’t hear a thing. There’s too much noise. Hold on, we’re going for broke.

Co-Pilot: The instruction book said that was impossible.

GK: That’s one nice thing about the 707. It can do everything but read.

GK: Nice going, sweetheart. Remind me to send a thank you note to Mr. Boeing.

Pure Hollywood B.S.

Also an old saying:

‘If you want to get going, fly Boeing’.

That can now be interpreted a couple of ways –

“get going” as in one way, or to the poor house.

Or “boing”, like a piece popped off.

I like Nondefense Capital Goods Excluding Aircraft as proxy for business spending and investment https://fred.stlouisfed.org/series/NEWORDER. Note these data is not adjusted for inflation. Guess it kind of shows why increases in productivity are so disappointing. It would be fun to plot it against the money going into stock buy backs.

China Calling.

Recessions, source NBER :

1) Oct 1873 – Dec 1900, when America became great again,

using tariff : x7 recessions ranging from (-)14% to (-)37%, x3 of them hit hard, over 30% decline.

2) 1900’s x2 recessions : (-)16.2%, (-)29.2%.

3) 1910’s x3 recessions : (-)14% to 25.9%.

4) 1920’2 x4 recessions : (-)12.2% to (-)38.1%.

5) 1930’3 x1 recession : (-)18.2%.

6) 1920’s x2 recessions : (-)12.7%, (-)1.7%.

From 1950’s till May 2019 : x10 short recessions ranging from

(-)0.3% (between Mar 2001 til Nov 2001, for 8M) to the deepest recession : (-)5.1% (between Dec 2007 to June 2009).

A total of x7 light weight recessions < 3%, inthat period.

The DOW can lurch down, but there was no GDP inverse

Matterhorn for 70 years. Politically it was ugly, but not too bad economically.

That might change.

2025-2030 china overtakes the US as overall largest economy; new ballgame.

No doom & gloom here. Out here in flyover country, I’m seeing the youngsters starting up businesses, and working to restore small town mainstreet.

We need a lot more of them. To many have been indoctrinated that

risk is to be avoided. I’ll take the freedom to try and fail..or succeed, and the ingenuity it fosters, over a government run state.

I have hope that our youngsters will fill fight to keep, and restore

freedoms we gave up, or did not hold accountable.

Not trying to be a downer, but people starting businesses to restore failed downtowns is unsuccessful, more often than not. There is a reason they failed in the first place and they will be trying to start up in a horrible brick and mortar environment. But best of luck to them.

Tom:

Crowd funding money is great. Convince people to invest in some crap idea you have come up with. Pay yourself and your mates nice salaries and expenses from the crowd funding money until it runs out.

Move onto next project.

Americans are addicted to cheap imported goods….my ass. Outside of some consumer electronics Americans cheap goods end before the retailer in the pocket of mfgs and wholesalers.. Then, they are charged what the market will bear and a monopolized market will see some hair raising mark ups. High prices with low wages

real per capita durable goods and cap ex have been below early ’90s (!!!) levels since 2008- and were not good before that. The distress started in 2000 (.com bubble- which I think is the mother of all the bubbles).

Buffett’s thing about “everybody can afford a Coke” (razor blade, potato chips, etc.), is true. The true health of the economy is shown by these durable/cap expenditures: they show confidence and ability to pay.

Either the confidence or ability to pay or both have been bad for ~ 20 years now; why I say the upper 50% = good economy, bottom 50%= bad economy. Average ~ = just OK. (compared to the rest of the world? excellent on average).

It’s a big world with lots of details.

This is what keeps DAISO and MUJI going, Lots of small cheap things. I mean, at MUJI not all cheap, but lots of things that you need … pens, good T-shirts, pillowcases, “bulldog” clips, brown packing tape…

Whatever happened to the “rates are going to the moon” crowd, rekt!