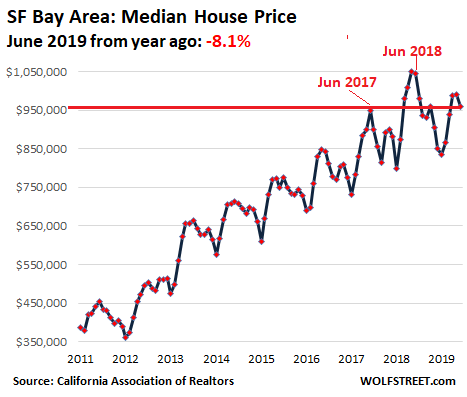

For the 9 counties, the median price in June dropped back to June 2017 levels.

Today we got the final numbers from the California Association of Realtors (CAR) about the status of the housing bubble in the nine-county San Francisco Bay Area, which includes some of the most expensive sub-markets in the US, such as the most expensive zip code in the US, plus the Wine Country (Napa and Sonoma), Silicon Valley (Santa Clara and San Mateo), San Francisco itself, beautiful Marin just across the Golden Gate Bridge from San Francisco, the East Bay (Alameda and Contra Costa), and Solano County, toward Sacramento.

In eight of these nine counties, house prices fell in June compared to June last year. June is around the seasonal peak in terms of prices, but by Bay Area standards, it just wasn’t very peaky. The median price of house sales that closed in June dropped 8.1% compared to June last year, which put it back on the same level as June two years ago:

Sales volume of houses in the SF Bay Area fell 9% in June compared to a year ago. If June was the seasonal peak in prices, the housing market might face an iffy summer and winter as potential sellers are apparently running out of willing and able buyers at these prices.

Sales volume of condos fell 16% in June compared to last year. And condo prices fell 3%.

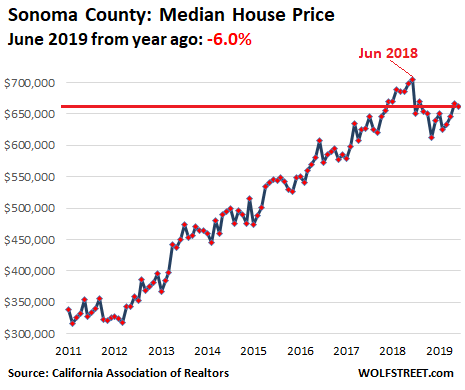

The Wine Country first, to get us in the mood.

Last summer I stuck my neck out to describe the end of the housing bubble in Sonoma County in practically real time, and it has progressed nicely. In June, the median house price fell 6% year-over-year to $662,500:

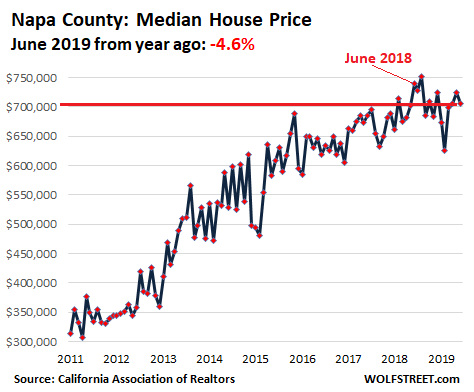

In Napa County, the median house price fell 4.6% year-over-year to $705,750:

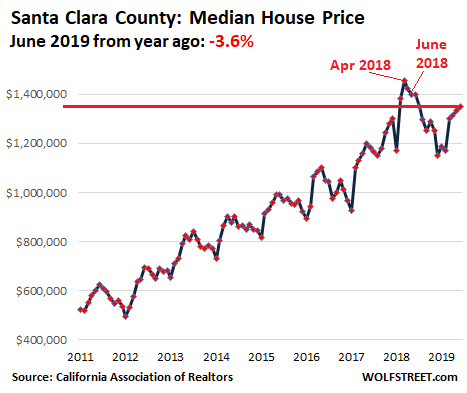

Silicon Valley next, because…

This is where house prices were going to explode because all the IPO billionaires and millionaires from Uber, Lyft, and a bunch of other companies would be suddenly buying homes, a time-honored real-estate hype theory that had been proven wrong before. And the results from those IPO billionaires and millionaires are trickling in.

In Santa Clara county, the southern part of Silicon Valley and the most populous county of the Bay Area, the median house price in June fell 3.6% year-over-year, to $1.35 million, and is down 7.2% from the peak in April last year:

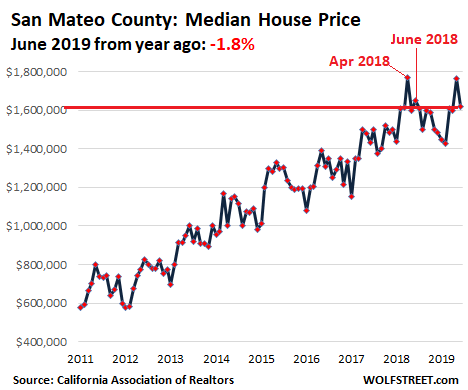

In San Mateo County, the northern part of Silicon Valley, the median house price in June declined 1.8% year-over-year, to $1.62 million. This price is on par with February 2018, and is down 8.5% from the peak in April 2018:

San Francisco

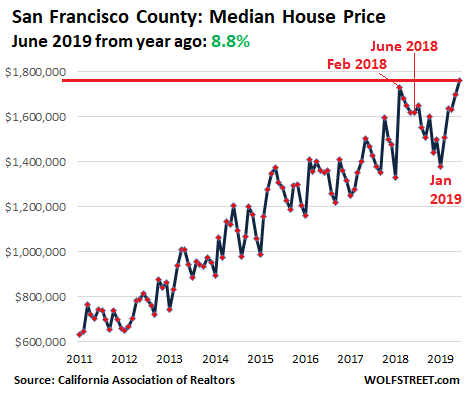

Back in February 2018, house price in San Francisco went on a one-month nutter, jumping without rhyme or reason $400,000 from January to February, or by 30% just in one month, to a fabulous $1.73 million. Then the median price spent the next 11 months climbing down, dropping by $354,000 in the process, to $1.376 million by January 2019.

Then spring buying season kicked in, and in June, the median price reached $1.76 million, up 8.8% from June last year, but up only 1.7% from the prior record in February 2018. This was the only county of the nine Bay Area counties with a year-over-year price gain. And, well, sales volume in June plunged 21% year-over-year.

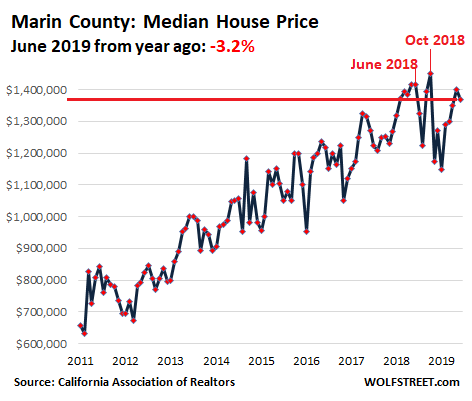

Marin County is famous for Sausalito, Mount Tam, National Monument Muir Woods, and its Pacific Coast among other places. So it’s not exactly a focal point of modern industry and it doesn’t have a lot of high-paying jobs. But it’s only a bridge or a gorgeous ferry-ride away from San Francisco, and so it serves as bedroom community for San Francisco and other parts of the Bay Area and ranks among the most expensive places in the Bay Area. The median house price in June fell 3.2% to $1.37 million. This is on par with February 2018 and down 5.5% from the peak last October:

The East Bay

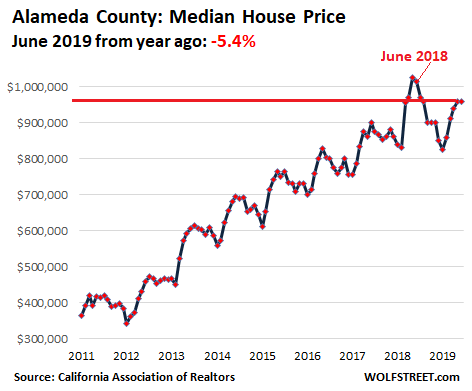

In Alameda County – where Oakland and Berkeley are – the median house price in June dropped 5.4% year-over-year to $960,000 and is down 6.3% from the peak in May 2018:

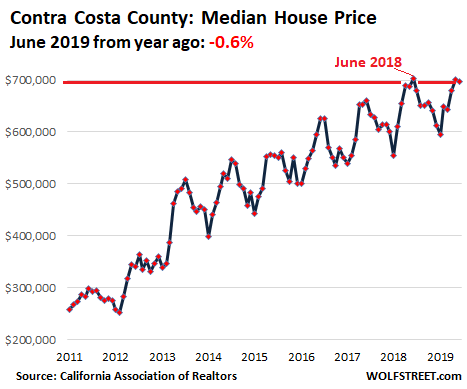

In Contra Costa County, the median home price in June ticked down 0.6% year-over-year to $698,000,

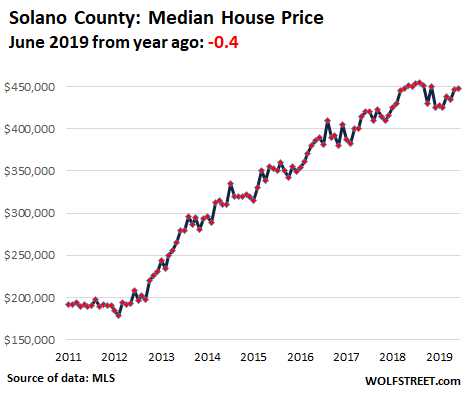

In Solano County, the median home price in June ticked down 0.4% year-over-year, to $448,000 and is down 1.6% from the peak in August 2018:

For the nine-county Bay Area, the year-over-year decline of 8.1% is the steepest decline since November 2011, during the trough of Housing Bust 1. December last year was the first month with year-over-year declines of any kind since March 2012. During the headiest days of Housing Bubble 2, year-over-year price increases of 20% were not uncommon and maxed out at 38% in May 2013. So this situation is not a sudden collapse or anything, but clearly, the Bay Area’s Housing Bubble 2 has lost its mojo.

In some of the hottest most overpriced rental markets, changes are afoot. Read… Apartment Rents Fall in Seattle, Southern California, New York, Oakland, San Jose, Chicago, Honolulu

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This is NOT southern california, Boston. Ignore it. I think I beat SocalJim to it.

The same report shows home prices in Southern California have increased Y over Y.

SocalJim – Southern California may not appear as bad on aggregate, but the high end segment is getting crushed. Can’t be long before the entire market gets hit.

Be completely honest…Are you buying million dollar houses in SoCal right now? Would you recommend anyone else buy a $1M+ home anywhere in California right now?

I agree … above 3M is a problem in nearly all areas. But below 2M, and especially below 1.25M is strong in coastal zips, as well as on the west side of LA. Very strong. It has been that way for a while. The Valley is also seeing a very strong market.

In the last few weeks, I have seen a jump in pendings up to the 3M line. Not much at all sells above 8M … that is unusual.

However, rents on single family homes is surging. What this means is people have done the rent vs. buy calc with the new tax law and a flood of renters are causing rents to jump. This is a positive for home prices as the so called “cheaper to rent” argument is closing quickly.

As far as buying a 1M+ home in California … only in a handful of zip codes would it be smart to purchase any home in California right now. You have to be very selective … in NoCal or SoCal.

Yet… we are very early into what could be the next housing slump/bubble. All the chips won’t fall all at once. Last time the west coast preceded the east by a year. This time next year the picture should be clear.

Buying now has way more potential downside than upside pretty much anywhere in the US.

Of course the big question is whether the upcoming Fed rate cut will have any impact on housing? Give it a bounce? Or the de facto announcement of a downturn in the economy…

It will have zero impact. Investors are exiting the market and the economy is chugging along at near capacity. Where are the new buyers going to come from?

” A man’s view of the future depends very much on the amount of debt he holds”..!

Good one! And true too…

JZ, my opinion is if not NYC or LA, then ignore it. The country revolves around NYC or LA. But, I do love Boston.

Really weird perspective. NYC I can understand, but LA is increasingly irrelevant compared to SF/Bay Area. This is the 21st century, Youtube matters more than Hollywood, everything LA is on the decline. Netflix is even in the Bay Area and the GDP of the bay area is higher than the LA area.

LA was important during the 20th century, but times have changed.

The GDP from Southern California is much larger than the GDP from Northern California. If there is any doubt, more 7 figure homes are sold in Southern California than Northern California. Wealthy people tend to stick to LA and NYC. There is no culture in Northern California. Just a bunch of tech dudes. You can have it.

Latest numbers on GDP:

NY-Newark – 1603 Billion GDP

LA-Long Beach – 931 Billion GDP

SF-Oakland – 432 Billion GDP

Boston – 397 Billion GDP

The bay area is not even in the big boy leagues. It is comparable to Boston.. End of story.

Also, Chicago, Houston, Washington DC, and Dallas-Ft Worth all have larger GDP than SF-Oakland.

Just because a handful of tech companies are overvalued from central bank money printing does not mean GDP is being produced. This is a common pattern and why the bay area routinely crashes so much harder than LA … LA has a more diverse and much larger economy.

So I look up populations. San francisco 850K, Oakland 420K, call it 1.3 million people TOGETHER competing with LA’s 4 million and Long beach’s 500K. I guess GDP per capita matters?

Bra.gov data shows LA-Long beach GDP2017=1 trillion while San Francesco-Oakland 500B and San Jose -Santa clara/Sunnyvale 250B.

JZ, SocalJim, etc.

We’re starting to mix apples and oranges and cherry-picking cities, to mix the metaphors. So let me clarify.

The nine-county Bay Area as described in this article has a population of nearly 8 million people. The county of Los Angeles alone has a population of over 10 million people. And there are other big counties in the Southland. About half the people of California live down there. So yes, it’s far bigger than the Bay Area, but the Bay Area is not THAT small.

But what about the Porn industry, will it thrive it’s the capital of the world; ie… billion dollar industry

LA-Long Beach is more than SF–Oakland and SV combined. In SoCal, we also have OC, SD, Ventura, Riverside, and San Bernadino. Add those to LA-Long Beach … Imagine that total. Bottom line is the GDP is down here, as is the money. LA is a world class city in the same league as London, Tokyo, NYC, …. SF is a US city in the Boston, Houston, and Philly league.

Great news from LA. Means you can afford more reverse osmosis plants for pools and golf courses, and not have to tap the Sacramento so far up river because getting it’s too salty for y’all.

Wolf, the data does NOT matter and we can ignore apples/oranges…. The thing here is that LA is a bigger dick than SF and Socaljim is going to swing it. SF had a bunch of overvalued companies due to FED printing and LA houses are anchored on solid robust world class GDP.

Agreed. Jim is living in the wrong century. DC and Seattle are arguably more powerful than LA as well.

Ed, the power is in the money. And, when it comes to GDP, LA is the only area in the country that rivals NYC. If you add the GDP from all SoCal counties, you will find a GDP that is just short of NYC. There is no third place. Money is power, and GDP is the money. Nothing is different this time.

Those charts don’t look anything as impending disaster in the near future.

I think housing is going to trend in a small range up and down with the general direction up as other prices catch up to the current money printing.

Don’t forget, this is what it looked like in 2005-2006, too. While I think we are unlikely to see a drop as large as that, housing is like a cruise ship, takes a long time to turn around. This run-up was unjustified and fueled by cheap debt and pulled-forward demand. I see a 15% or so correction in th ecoastal markets, then followed by stagnation as you describe while inflation chips away at its real value slowly for the better part of a decade. The fed will not have the tools nor the willpower to jump in for a more mild correction.

Right now homes are I think as expensive as they’ll get for quite a while in terms of real value

Yeah that was a theory put forward 30 years ago too, after Thatcherite/Reaganite deregulation and monetarist policy screwed up our housing markets for the first time by allowing them to get out of control in order to buy votes…I remember well.

The scenario you describe, has never happened, won’t ever happen.

This, entirely. Wild swings are the new norm, thanks to the credit markets intertwining housing with the business cycle.

I’ve never once seen a “soft landing” in recent history.

+1

A few months after the downturn in CA, you will see the flood of people from there to other states slow to a trickle.

Seems like major home builders are losing their mojo too…

“Shares of Hovnanian Enterprises Inc. HOV, -18.65% plunged 14% in afternoon trading Thursday, after the home builder disclosed that it received a de-listing warning from the New York Stock Exchange…”

https://www.marketwatch.com/story/hovnanians-stock-tumbles-after-disclosure-of-nyse-delisting-notice-2019-07-18?mod=hp_realestate

Wolf, I am curious how you think this will trend into the 2nd half of the year and into 2020. It seems like prices fall in the Bay Area every November when winter / rainy season starts. Do you suspect we will see a drop again this year and a continued downtick into 2020?

Yes, seasonally, we’re now looking at the downhill side of the curve through the winter. This data is volatile as you can see, so there will be ups and downs. But my gut feeling is that this Housing Bubble 2 in the Bay Area is cooked, and that prices will trend lower going forward, in a zigzagging sort of way. This might take a long time to play out, unless we get a stock market crash which tends to trigger a housing bust in a hurry in the Bay Area.

I’m curious Wolf, in your opinion, do you see it spreading to other “hot” coastal cities? Seems it’s already in Seattle and NYC. I’ve been noticing a softer Boston than I’ve seen for the past three years, but it is still slightly up. DC? Philadelphia? What about T2 cities like Raleigh-Durham?

If the economy holds up and people have jobs, in the end what matters is that housing is affordable for incomes in that market. This is no longer the case in the Bay Area, so high prices are tamping down on demand.

Each market is different. If local incomes are relatively high, and employment is growing, and home prices relatively affordable for those incomes, they may have room to grow. It really depends on the dynamics of each market. I have not studied the markets on your list.

In Boise, ID, house prices are only raising. A lot of outstaters are moving in and has already settled in Boise and nearby cities.

I’m not surprised, you can get worlds more value there, even with the soaring prices. People are waking up to this fact. Beware, however, that if deflation happens in the coastal cities, you’ll hear a giant sucking sound and see that money rush back out to the T1 cities. I’m bullish on Boise for the long-term, though. Just like I am for Nashville and Raleigh.

Also, I keep having to say… “For now”. Prices don’t drop nationally all at once. It was about a two year spread for bubble 1 to engulf the whole country. This time, I think most of the deflation will be limited to the coasts.

It’s easy to be bullish on Raleigh, since it has a built-in floor for its housing market – government and education are Huge portions of the local economy.

College towns and capitols are affected much less in a downturn, and Raleigh is both.

Eh, in prior downturns Raleigh had quite a bit of job loss.

Nortel, IBM, Ericcson, Redhat (now IBM), Cisco, etc etc

Yes and No.

Sacramento was absolutely crushed in bubble 1.0 in California.

FluffyGato – The only thing Raleigh has going for it that it’s affordable. Affordable places are affordable for a reason.

The fact that property assessments reset to fair market value on a sale (under Prop 13) may create some sort of ceiling on prices. The carrying costs start getting onerous as prices escalate, unless you are truly wealthy.

Another market that seems to be cratering is Dallas, where sales volume is down 11% year-over-year in June and inventory is up 23%:

https://www.dallasnews.com/business/real-estate/2019/07/17/dallas-rockwall-counties-biggest-june-home-sales-declines

Prices are still up slightly. But of course in Dallas, there is no Prop 13 and DCAD is quick to reassess to market. Property taxes are 2.5-3% of value in most areas, so your carrying costs are escalating with the value of your home, even if you stay put, far outstripping any income growth.

People are priced out of Dallas and the north Dallas suburbs. $350k doesn’t buy much of a house in Oakcliff. They are moving to the mid-cities. Properties in Tarrant county are moving quick.

Property taxes of 3% run at close to the same rate as the bottom in 30 year mortgages. People fail to realize how onerous property taxes can be. Californians saved themselves with prop 13.

Think of 3% over 100 years and you have 300% of property value going into taxes. When people talk about 99 year leases on property, the extinguishing rate is 1% per year. Yes in 100 years you lose occupancy. 3% property tax is higher than land rental.

Sf rise is partly due to IPO craziness and lower rates, so right back at peak. My buddy just lost another bid in Glenn Park. I think it listed around $1.3m they bid a little over $1.5m and came in second to $1.6m. Said the place had 10 bids, definitely listed low.

Dumb to bid there now. Most of these IPOs are for non-profitable companies.

Don’t forget, lockup periods expire in Nov and December 2019.

Spring 2020 is gonna be crazy hot.

This is just real-estate media hype. What people don’t get is that:

#1. most of the IPO money goes to institutional investors around the globe, such as VCs, PE firms, Softbank, etc. It doesn’t show up in SF.

#2. most of the employees who have shares in these companies have already been able to use them in various ways for years to buy homes with, using the shares as collateral or selling them before the IPO either back to the company, or to other investors, or in special markets, and they’re already living in expensive homes that they bought that way, and those purchases were in part responsible for driving up home prices in prior years. The high housing prices in SF are a result of this.

Here are the details of that works:

https://wolfstreet.com/2019/04/14/whatll-happen-to-home-prices-in-silicon-valley-san-francisco-after-the-mega-ipos-last-two-times-we-got-a-housing-bust/

It don’t look like much of a trend change yet from where I’m standing in the Silicon Cleavage. Let’s see some new lows first.

Really, we’re in the heart of Silicon Valley and houses are falling fast. They are down 10% in the last 12 months and Zillow predicts out the current trend and estimates a 13% decline over the next 12 months. With inflation at 5-6% in the Bay Area over the last 2 years, that takes us back to the 2013-2014 real values.

We’re looking to buy in the South Bay next winter 2020-2021. I estimate we’ll be at 2013 real values by then, unless something crazy happens.

Plus points, if there is a stock correction before then.

What does around comes around. Are you old enough to remember when the Japanese bought Rockeller Center here in NYC, then afterwards it tanked ? Or the cost of real estate in Japan?

I rented from a building in Queens, NY near La Guardia Airport that owners from Hong Kong have never been to according to their manager. They lost money then sold.

In 1993, the price of houses in the suburbs of NYC tanked. IBM laid off people and some of them “invested” in multiple houses in the area.

That’s when I bought a house at less than half they were selling a few years back.

Things are very strange now. You’ve got a lot in the media that you can’t believe. I wonder who’s buying all those expensive homes? Maybe they are part of the 1 percent. Data must be so skewed and we need to look closer what the mainstream really buys.

Oh yeah – Japanese tourists were all over the place then, splashing their RE and stockmarket gains. Hubris-a-plenty. Scoffed that the piece of land their emperor’s palace stood on was worth more than the whole of California, as I remember.

Tokyo RE values were NEVER going to fall, nacth, because of the population density, the shortage of space and the fact that Tokyo was one of the world’s largest finance centers and hence a safe bet.

More than a little like you hear from VIs (VERY heavily ‘V’d’…) about London/NY now, strangely enough.

Then 1990 happened.

2019 is seeing the start of the repeat (2018 in Oz) of history in many major capitals. Bubble reinflated for a decade with easy credit/money creation but soon the true nature of the difference between debt and real wealth will reveal itself; already started to happen.

The Super Ultra Dove Deluxes at the Fed are calling for .50% rate cut and NIRP because its the Feds job to prevent an earnings recession and make stock prices go up and we all know the Fed bases it’s policies on stock market performance. That’s why Super Ultra Dove Deluxe did his UTurn back in December.

Was there a rate cut in December that no one seemed to mention anywhere?

That is a reference to Powell’s about-face in the beginning of this year in which he went from rate hikes/balance sheet normalization “on autopilot” to accommodative dove as the stock market tanked. You’ll note there were no more rate hikes after December 2018.

San Francisco made the global housing bubble cities list like Vancouver, Sydney and Hong Kong. The Vancouver real estate market is cooling. Sydney prices have been in a free fall. A China report revealed rapid M2 money supply growth.

On the other hand, there may be value in the Ft. Wayne, Indiana real estate market.

What worries me is not the deflation of asset prices, but the loss of buying power of individual currencies. Deflating the housing market, and costing voters their “equity” is political suicide. Increasing the minimum wage faster than average wages only decreases the value of the dollar (or any other currency), and yet this type of inflation is hardly noticed by the greater public.

All of the above graphs show steady upward movement if averaged out. Unless that trends down for 3-4 years, or suddenly drops 40% (which won’t happen), those assets will continue to increase in cost and value over the long run. Even then, historically, they will either level out or continue their upward progression.

But society cannot afford to make it impossible for the majority of the workforce to be unable to afford housing. That requires maintaining a level of compensation for labor that cannot be too far off from the increase in property values. At a time when the value of products, and labor, is flattening out due to globalization and information connectedness we are either going to get hit with huge inflation and/or a forced migration of the workforce to affordable climes.

Immigration is warfare. Poorer regions increase their GDP per capita by sending those “undesirables” away to decrease the wealth of other (competitor) nations. Third world countries often use this as political policy to promote stability and consolidate ideologies. Here in the USA we’re seeing this between States as 20-40 year olds move to find places where they can maintain the lifestyle they’ve grown accustomed to. Big corporations know this, and that’s partially why they too have been moving to more favorable areas. An individual moving from Mississippi to California has more in common with someone from Guatemala who’s likewise try to get there than not. And those prime wage earners leaving CA are very like those also competing for the same standard of living as their counterparts both nationally and worldwide.

I see inflation and migration steadily leveling the standard of living globally. Unfortunately for more developed nations that means a decrease for the large majority of the population.

You have it totally backwards. The most educated in emerging economies often emigrate to developed nations on work visas (temporarily or permanently), and subsequently send back remittances. Think doctors, engineers, scientists, bankers ect…. Remittances make up a SIGNIFICANT parts of many emerging economies in Africa and Asia.

When an emerging economy experiences healthy growth, some of the clever, educated emigrants come back home and start their own businesses, benefiting from fast domestic growth. This will be the story of our post-global world for the next fifty years where economies in Africa and Asia will have sustained 5-10% economic growth.

Of course, if some western countries continue electing nativist politicians, they risk losing out.

Ding ding ding, on the nose. Exporting the poorest from Mexico and Central America has a positive economic impact on those countries. When a migrant makes 8-10 times more in the US at an unskilled labor job he or she sends remittances back home. Competition for low skilled work in the US is dominated by migrants, and low skilled locals turn to govt programs. This drains and levels the economy of the host country. Snark about nativists is foolish. The real issue is that floods of low income people cannot be absorbed into an economy continuously without affecting the bottom line in housing, jobs, schools, healthcare, law enforcement et al.

Distressed Capital Investors supposedly have $82B in dry powder.

So why don’t they buy these “distressed” real estate?

Because they believe there is more room to drop.

Makes a lot of sense.

BC perspective so off topic a bit. However, there has been much interest and discussion on WS about the crackdown on foreign RE buyers in Vancouver this past year. So, an amazing stat just out today, is that new housing starts and forecasts are up, and up considerably higher than before the crackdown began, and also above the average when the right-wing pro business party was in power.

2 excerpts: “Namely, that residential-home construction “has significantly increased over the past three years.” In fact, given April’s statistics, the province was on track to see 51,093 housing starts in 2019. “Which,” said James, “is a very strong number.”

That last sentence may be the understatement of the year.

If B.C. does surpass 51,000 housing starts this year that not only would be a “very strong number,” it would be astonishing and extraordinary.

Yet, James’ utterance, made to the Select Standing Committee on Finance and Government Services, received no publicity. Nothing. Nada. Zilch.”

and: “Since 2001, the start of the BC Liberal Party’s 16-year reign in government, annual housing starts in B.C. averaged 30,680, so the finance ministry’s projection for 2019 was more than 3,300 greater than the recent historic average.”

Full article here (and it’s from a pinko rag that hates development unless it’s free public housing

….go figure.)

https://thetyee.ca/Analysis/2019/07/19/BC-Housing-Starts-Blow-Past-Forecasts/

It was quite interesting…as interesting as all (ALL) the forecasts that a left wing govt (called socialist) would drive the economy into the ground….that they couldn’t run a peanut stand….and yet they just announced yesterday a 1.4 billion dollar budget surplus forecast for the year. Surplus, and we have no premiums on our single payer health coverage as of this year, and spending on K-12 up considerably as well as is on post secondary opportunities. Those durn pro-union socialists, anyway, they’ll be killing off our housing boom :-) Not.

regards and off to work!

I was just thinking about how the Fed’s control nearly all aspects of the economy. The inflation rate, the tax rates, the minimum wage, the mortgage rate, the short term interest rate, the debt to gdp, the social security tax and pay out rates, 50% plus of health payment system, the black market illegal immigration labor market. On an On. I am sure when this crashes it will be capitalism’s fault.

Boom-and-crash is how capitalism works.

Kondratieff got sent to the gulag by Stalin by studying it like hell and announcing to Stalin that capitalism won’t fail, it can just keep oscillating, booming and crashing, indefinitely.

Stalin wanted to know the approximate time of “the” collapse of capitalism. We should be so lucky!

Do the FOREIGNERS have extra liquidity available for R.E. investment purposes in USA or CANADA???

China has tightened outflows so those who are excited about R.E. need to know where the money is coming from.

The Balance of Trade deficit is about $52B a month. That can’t all go to R.E., right? They’ll have to buy US Securities first.

How much does climate change affect RE values? Sonoma? How much change would make BC less habitable? Turn Hawaii into a desert island? Top reason Chinese buy here? Environmental.

I don’t think they have done their tax homework if and when they die. US situs assets of foreigners is a big pain in the you know where.

The death tax exemption is very small.

by very small, do you mean many millions of dollars? :)

I live in Charleston, SC where much of the old city is below sea level. Instead of moving, we’ve got idiots spending tens of thousands to lift a 300 year old house 10 feet higher…

Prices /median incomes are by far the highest in the country in SF

Chinese money has been waning as a positive factor and will eventually become a negative influence .

California has been blessed with the most amazing and diverse natural wonders anywhere .

Unfortunately people realize this and have resulted in the state being vastly overpopulated at almost 40m. Traffic is unbelievable during rush hours in the Bay Area. Homelessness is rampart with stories being featured on the local tv stations on almost a daily basis.

Yet more and more illegal immigration is being encouraged by the politicians. This homelessness has spread to Apple’s home of Cupertino/ Mountainview, where one can see shacks constricted along 680s.

So how do the politicians react to the homeless problem. They buy up land from their cronies at unbelievable prices and build mixed use developments. Of course union construction labor is used. This has resulted in units costing $700,000-1m. Then some of these units are rented at submarket rents and the politicians brag about their efforts to reduce housing costs.and every additional person moving into the Bay Area results in greater stress on the transportation system. Highways will go from horrendous to just plain unbelievable. The BART transportation system is a mess with flighty cars and rampart crime.

CA needs to bring back rooming houses, flophouses, and SRO’s. If a guy wants to live in 100 square feet with the bathroom down the hall, why not?

I don’t agree with most of what you say but want to comment on one part.

If the bay area had high-speed rail (elevated or below ground for speed rather than at street level) befitting a modern nation that took pride in itself and cared about its citizens – like Japan and many European nations – it would run more than once per hour! It would run more than once per twenty minutes during rush hour! And it would go much faster than traffic.

If major US cities like Boston and NYC can have trains run more than once per hour (some as regularly as every 5 minutes), you’d think the bay area could.

For that, I can place some blame with politicians and also with home owners – i.e. voters who vote for politicians.

I presume they vote a very narrow interest when it comes to property value consideration. Some want to keep their values artificially high and deny progress for the region by keeping it difficult to get around and vote down public works that involve connecting highways and trains. I’ve seen it happen elsewhere and traffic is worse because of it yet they don’t mind complaining bitterly about it as long as the highways don’t connect anywhere near them. Better to have slow, polluting, winding traffic snake through city streets than a fast and efficient highway connection it seems they think.

Of course, if you live in a place where a new station could be built, then you’d naturally vote for it to increase your access and property value. Everyone is a bit selfish by nature so having a more collectivist attitude about public goods would benefit more of us at different times in our lives if we resisted being shortsighted and voted in our long-term, collective interests.

As it is, the major highways in the bay area are not nearly as bad SoCal freeways but I never like driving in SF itself. I’ll give you that as ridiculous.

Seattle has become so crazy expensive, that Tacoma and other surrounding cities, Snohomish county, are getting the buyers creating more bidding wars in towns with blue collar workers and service industry workers and more nightmare traffic. Went to Seattle yesterday could hardly wait to leave, which makes me very sad, but its only going to get worse. I don’t see any big contraction in prices in Seattle not when AMZN has 8000 job openings and AAPL relocating more up here as well

I just took a look at the MLS data for Sonoma County, YoY June 18-June 19 showed a 22.8% growth in inventory.

Prices follow inventory, with a lag.

And the low end always gets hit harder and faster than the high end, a reminder to choose your parents carefully.

I have got a special circumstance rental situation that is dirt cheap and just right for me. I could buy, but being a single male I don’t have the need for a feathered nest.

I think one of the most attractive options out there for older people who can make a cash purchase are used manufactured homes. You can’t get a mortgage on them, so it’s a cash market and therefore price can’t get inflated. Low property taxes, easy maintenance and one level living important to older folks. Key is to find one in good area. You don’t really care about appreciation as its probably your last home. Yes, they are usually finished out cheap but they are functional shelter at a low price and will last your lifetime.

Except this is how Warren Buffett makes a lot of money; buying up mobile home parks and jacking the rent ‘way up.

If you own the land and the zoning allows putting a mobile home on the land, then great. You’re probably out in the less-desirable parts of “flyover” country, and more power to you if you can make that work.

If the President get his way and weakens the dollar,

real estate prices will soar.

Chinese repo rate just skyrocketed to % 1000. This translates to demand for dollars and is a precursor to a crash in Chinese assets and huge selling pressure among Chinese owned assets overseas in order to repatriate monies.

The Bible warned that “the end is nigh”

Look for a crash in real estate in markets where Chinese have been buying property for cash(SF,LA,NYC,MIA,SEA,,VAN,BOS,TOR)

hmmmm. The psychology of the investors is the key. Should the investors be more interested in rising prices supporting the value of their asset purchase, they will dump RE like a hot potato. http://watsoninternationalorganization.com/the-value-of-the-dollar-and-how-it-affects-real-estate/

Hard To Ignore

Realogy Holdings Corp (RLGY) is the leading provider of real estate services in the US under the brand names of Coldweel Banker, ERA, Sotheby’s, and a few others.

Existing home sales represent 90% of total home sales and RLGY is the largest real estate brokerage in the US.

Losses are accelerating as transaction volume has collapsed. Since December 1st 2018 RLGY is down almost 75%

Hi wolf, Thanks for the article. I am saving downpayment to buy a house in the Sacramento area, whats your opinion about Sacramento? Few years ago bidding wars were blamed on Institutional investors who were buying houses in cash and by bulk, recently realtors are saying its the people from the Bay area who are buying investment properties in Sacramento to rent it out and 1 in 10 people is putting 20% down which makes me think how are they buying investment properties to rent if they are not putting 20% down. Home prices have gone so much especially for the starter homes (1000 – 1300 sq ft) which use to be 200-250k from 2009-2014 are now selling for 350 – 425k. Should I just wait and keep on saving?

Andy,

Look, I always say, if you’re in a place in life where you need to buy a house (kids, etc.), and you can afford it comfortably, then do it. Life moves pretty quickly. And not every part of life is going to make sense as an investment in dollar terms. You might lose some money, so be it, but if you’re planning to stay there for the long term, you should be OK as long as you can make the payments.

But if you buy homes as an investment, which you’re not, then you need to apply a different calculus.

Thank you for the update Wolf. I have a question: you have the average for the area at -8%. The average for each county though is a number higher than -8%. Some much higher – SF. That seems mathematically impossible. How should I reconcile this?

Sandu,

Good question. These are not “averages.” They’re median prices per county. And the median price for the entire Bay Area. Median means half sell for more, half sell for less. So for each county, there is a median price. Then ALL transactions of ALL counties are thrown into one big bucket — not the 9 median prices but each of the tens of thousands of transactions — and the halfway line through those thousands of transactions is the median price for the Bay Area.

Got it. Thanks Wolf.

I’m not sure that the GDP of the Bay Area is larger than the LA area. I suppose it depends what cities you include. It’s hard to compare metro areas.

For example:

https://investingmatters.co.za/the-top-25-metro-areas-make-up-half-of-us-gdp/

And

https://en.m.wikipedia.org/wiki/List_of_U.S._metropolitan_areas_by_GDP

Perhaps people are tiring of the number 2 on the sidewalk in SF.

Also, the SF-Oakland is much more than just SF-Oakland. As far as per capita, who cares. SoCal is the money center of California. It always has been and it always will be. The bay area is not even close.

Real Per capita data favors Bay area and as a lifelong California resident born in Long Beach and now living in SF your reaching to hard,

S. Cal will fall 20%+, count on it, up for small wager for Wolf Donation. 36 Months from today

https://i.postimg.cc/W4KZy64V/2018-GDP-California.png

cd,

The bay area counties with a high per capita GDP are all small … like around 1M people. You can easily draw lines around coastal LA and OC with 1M people where per capita GDP is also very high. LA county has more than 10M people. Same with NYC. People in NYC make far more money than anywhere else, yet the per capita is low because just like LA, it is a massive county. Also, Long Beach is a low income area.

your reaching again, I grew up in Long Beach, its old money….

I guess you didn’t know what Pine street looked like in 1990….

I attached the numbers above to help you learn, looks like all you want to do is obscure or overreact….

Please don’t think I’m a choir boy, I was at new century financial when the housing bubble was a baby, now with reckless fed induced housing rally nearing its end. I expect bad mojo for your RE empire….

Old money in Long Beach? You sure they didn’t all move to Corona Del Mar when it was still a sleepy area?

Trend looks up