The ruse that helped shares jump 20%.

It would be a joke for a small niche automaker, specialized in luxury cars, with a global market share of less than 1% to get this kind of global attention. But Tesla is unique because of its extraordinarily ludicrous stock price. Though that price has come down by about 32% from its peak in June 2017, it’s still ludicrously high. More on that in a moment.

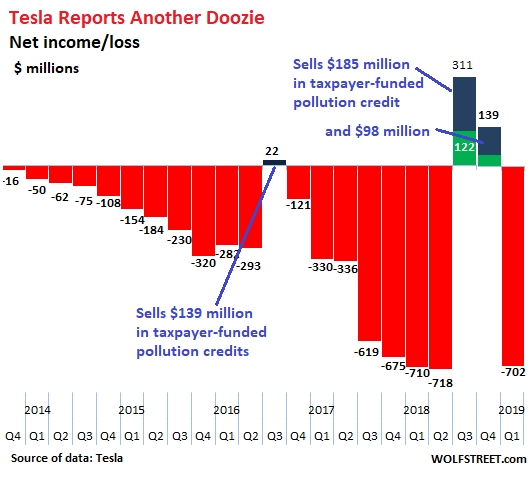

We’re going to skip over all the glossy stuff and go straight to the financial statement, more specifically to the bottom line of the income statement, where Tesla reported a zinger of a net loss of $702 million, its third-worst quarterly net loss ever. We note here that part of Tesla’s business model is to sell taxpayer-funded pollution credits to other companies, but they’re not fully disclosed until Tesla files its 10-Q at a later date:

The ruse that helped shares jump 20%.

These pollution credits are pure profit. For Q1, Tesla disclosed only $15 million of these credits. For the full disclosure we have to wait until Tesla files its 10-Q report for Q1 at a later date, when no one pays attention.

For example, in the miraculous third quarter last year, Tesla reported a profit of $311 million on October 24, and all the world was left speculating and digging into how it accomplished this. At the time, it disclosed $52 million in “regulatory credits,” as it calls them. But then on November 2, Tesla filed its 10-Q for that quarter, disclosing that $189.5 million of its $311 million in profits had come from the sale of those “regulatory credits,” a much larger amount than typical.

Reporting a $311 million profit and not fully disclosing that $189.5 million were regulatory credits, some of which it may have saved up from prior quarters, was an artful ruse that worked because its shares jumped by 20%. Tesla would do anything to get its shares to jump because the convertible notes were coming due – but that’s another story that didn’t pan out.

In its annual report for the year 2018 (10-K filed earlier this year), Tesla disclosed a total of $418.6 million in sales of “regulatory credits,” including $315.2 million in Zero Emission Vehicle (ZEV) credits and $103.4 million in non-ZEV regulatory credits. Without these credits, its annual loss for 2018 would have been $1.4 billion.

In terms of Q1 2019, we don’t know yet the full amount of the “regulatory credits” that were included in its Q1 results that lowered its net loss to $702 million.

But kudos on revenues.

In Q1, total revenue of $4.5 billion was down 37% from Q4 2018, but was still up 33% from Q1 2018. Year-over-year revenue growth of 33% in the auto industry is a big deal.

Model 3 mass production got started in Q1 2018, and global deliveries jumped from 8,182 vehicles that quarter to 50,928 in Q1 2019. So – ignore for a moment the quarter-over-quarter 20% plunge of deliveries in Q1 – on a year-over-year basis, kudos!

But global deliveries of the Model S and Model X plunged 45% year-over-year, and 56% quarter-over-quarter to merely 12,091 in Q1. Just looking at the numbers, and not knowing what miracles the company has up its sleeve, I’d say there’s a wee bit of a problem.

Operating expenses were nearly flat, at $1.09 billion, up 6% from Q4 and up 3% from a year ago, thanks perhaps to the cost-cutting and mass-offs.

Bleeding cash.

Operating cash flow in Q1 was a cash drain of a negative $919.5 million, more than wiping out that mysterious $909.5 million positive cash flow in Q4, but was slightly less catastrophic than the $1.05 billion cash drain in Q1 last year.

Tesla said it had $2.1 billion in cash on hand at the end of March, down from $3.7 billion at the end of December, so it better come up pronto with some positive cash flow or it will have to ask investors for more money to burn.

Lots of debt and a deep-junk credit rating.

The company has $22 billion in liabilities, including these three big items, together nearly $15 billion:

- Customer Deposits: $768 million (down a tad from a year ago)

- Long-term debt & finance leases, including current portion: $11.5 billion

- Other long-term liabilities: $2.5 billion.

If Tesla were the paragon of profitability and positive cash flow, this amount of debt would not be a big issue. But it’s a paragon of losses and cash burn, and so this debt could turn out to be an issue. Moody’s rates Tesla “B3” — six notches into junk and considered highly speculative (my cheat sheet for the corporate credit rating scales of Moody’s, S&P, and Fitch).

The Tesla market cap joke.

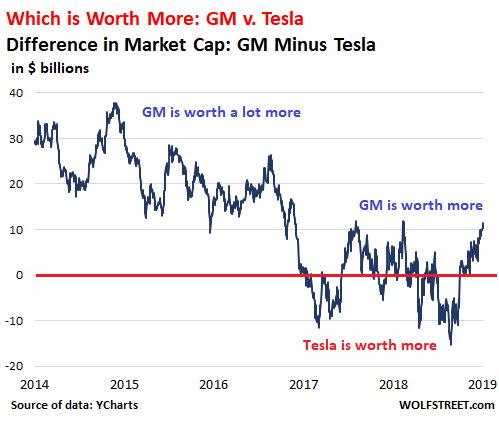

Nevertheless, Tesla’s share price has continued to blow out rational minds, even after its 32% drop from the top of the spike in June 2017. The company has a history of nothing but annual losses and cash-burn, and “production hell,” as its chaotic CEO Elon Musk called it so aptly, is standard operating procedure. It has a global market share of less than 1%. And yet, at the price of $258.66 a share at the close today, Tesla has a market capitalization of $44.7 billion.

By comparison, GM – and I’m no fan of GM at this price – which made $48 billion in net income over the past four years and whose revenues of $147 billion in 2018 were seven times the size of Tesla’s, has a market cap of $56.6 billion. And at peak Tesla nuttiness, there were long periods when the market cap of Tesla exceeded that of GM.

So to have some fun, I created this chart to show the difference in market cap (GM minus Tesla) in billion dollars. When values become negative and dip below the red line, they indicate that Tesla’s market cap exceeded GM’s. Positive values above the red line indicate that GM’s market cap exceeded Tesla’s (market cap data via YCharts):

On December 13, 2018, Tesla’s market cap exceeded GM’s by over $15 billion. Then it swung the other way. Currently, GM’s market cap exceeds Tesla’s by $11.5 billion. But the silly thing is that they’re even in the same ballpark – testifying to just how crazy this market has become.

There are now 486 EV manufacturers in China, triple from two years ago. Most will disappear. Read… China EV Manufacturing Bubble Faces Getting Bludgeoned

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

But Wolf you don’t understand..PT Musk promise they will have huge profit by Q3..he pinky swear it will as long as investors give him more money. He needs it to build his super best AI and the best self driving car ever…what a visionary leader..

Did anyone else think of ludicrous speed from the first paragraph?

I’m starting to hate the word ludicrous…

Tesla factory operates with nice margin –> profit. Deploying charging stations around the globe is likely expensive. China factory will be massive. EV is not an economical issue it is an ecological/humanitarian issue for most countries, including China because the air quality is terrible.

Where are these profits you are referring to? They are a cash furnace, burning about $10M per day. Profitable companies are not cash furnaces.

I think Tesla is run by the Underpants Gnomes

The worst of them–the ones that forgot step 1

Yes, Tesla is an experiment, but they should have developed tech and sold it to real automakers. Trying to invent the automobile all over again is just stupid. All it proves is the ginormous hubris of the Lone Musketeer. They’ve proved absolutely totally that they suck at producing cars.

Stupid?

Did u not just read what I just read?

The founders of Tesla have made a crap ton of profit. Someone else is going to be left holding the bag. The “stupidity” is going to be someone else’s problem.

Given the potential for disrupting the nature of car ownership via driverless taxis/ubers, debt of a few billion (or tens) is inconsequential and the question of Tesla’s viability simply boils down to whether the technology comes to fruition before investors get cold feet about further funding.

I watched their ~2-hour technology presentation (released yesterday or the day before). It seems they have a massive lead with regard to the self-driving technology on all fronts – hardware, software, and data/training-set size, but then again I don’t follow closely.

Wolf’s analysis treats Tesla like a traditional automaker and doesn’t appreciate that – if they deliver on the technology – they will upend a massive market. That’s what I see elevating the stock price. Or maybe I’m just gullible :)

What a timely technology propaganda… euh I mean presentation to hype up the stock before droping the stinker today.

Given EM’s track record (Tesla missed self-driving tech goals in the past), this is all vaporware for now. Showing pictures of a Samsung chip means little.

As an engineer I have to say I was impressed up to the part where musk promised level 5 later this year. They appear to have a talented team and a decent strategy. But they clearly do not have working software yet (everyone has a neat demo video) and there were clues that they do not even have an approach they are certain will be able to deliver level 5 yet.

They have lots of potential. I don’t understand why musk can’t leave it at that until an update in six months. They won’t hit his deadline, and this just discredits him further and will eventually demoralise the engineering team. It certainly lends credit to the theory that the company has pending funding issues.

The marketing from that presentation was very impressive. However after recent bad experiences in the valley with Theranos, I would hope investors are more cautious about taking marketing at face value.

I’ll believe they have that tech when impartial and critical engineers agree they have achieved a major leap in AI driving. Or they can demonstrate their tech in the wild. Beyond the semi autonomous capability we know they have.

Overhyped. If you want a better analysis, start with this:

https://www.eetimes.com/document.asp?doc_id=1334599

and this:

https://www.eetimes.com/document.asp?doc_id=1334131

Eh, the competitors and technology you link aren’t clearly better – IMO it’s just a lot of opinions and not much real technical analysis. Not that Tesla will necessarily win, but they appear to me to be in a better spot in terms of technology, but I realize that market conditions and solvency may prevent realization of potential.

Zero. You do not follow it closely, but you do believe that Level 5 autonomy is happening in the next 6 months, but in reality Level 5 autonomy is not happening any time soon. General AI (or close to it) is probably required for self driving, yet today we build/train ML algorithms with specific limited functionality, while driving is the pinnacle of human cognitive and processing ability. Apparently, you believe that Tesla makes better cars than Benz, better GPU then NVidia, better new tech model then Uber, and have better sensor tech than Lidar. Yet these are only stories, and fantastic ones too. Launching the rocket built on technology from 1940s-60s, with today’s computing power is easy. Next. Tesla will be selling the car worth $200K (with robo-taxi income) for $40K? Giving away $160K per car. Why don’t Tesla realize such profits by releasing their own stable of robo-taxis? They could definitely use it. The silliness with Tesla and Tesla’s Stans never ends.

“It seems they have a massive lead with regard to the self-driving technology on all fronts – hardware, software, and data/training-set size, but then again I don’t follow closely.”

A lie or propaganda, what’s the difference. Audi has already built the first level 3 self driving car, the Audi A8. Followed by Volvo. Maybe Ford. Waymo is heading for Detroit.

https://autonationdrive.com/2018-audi-a8-first-level-3-self-driving-car/

Where is Tesla?

But wait, Tesla’s bringing a quiet cordless leaf-blower to market, using parts from the Model S’s HVAC system so there’s no tooling cost, and they’re also thinking of getting into the car insurance business, as well as having fully autonomous robot-driving in a year so you can let your Tesla be a taxi while you’re not using it, allowing you to own a Tesla for free.

Anyway, an analyst on Yahoo said he didn’t have a problem with the numbers at all, that it’s the future that matters so it’s all OK.

One thing about a cult is that it’s almost impossible to make people un-believe, no matter what the bashers, who are probably short, say.

As Michael McDonald and Kenny Loggins once wrote:

“What a fool believes he sees – No wise man has the power to reason away”

Tesla is a growing brand. I see the cars everywhere this year here in King County, WA.

Also, Microsoft and Facebook reported strong results. 10 years into a bull market and no Lehman type event lurking .

Stocks are looking a little expensive again. It would be nice to see a pull back to add at reasonable prices.

A little risk taking can go a long way. Overall, life is very very good.

Good luck to all.

Lehman-type event and lurking is a oxymoron. It never “lurks”.

If they still have a tech edge they should sell themselves to Daimler, VAG or somebody.

Yes, good luck to all.

But Tesla does remind me of a Cult.

Stocks by some measures are not just a little expensive.

It seems to be very possible that the next pull back will not be little.

And life for some will continue to be great as long as the economy is juiced with ever expanding debt.

It’s not about luck. Did you ever hear about the everything bubble, numerous danger situations “lurking”.? That’s another word to hate. Wow, two new ones in one comment thread, the other one being ludicrous-

Lubrification ?

(And no, I’m not offering).

Cult, luck, ludicrous….

These featured words might now make it into the next automotive marketing offering: They are heavily populated with Mars, planetary patron saint of cars and driving.

Where you have luck and cult, find no ego, but your personal resources may be called upon. Where ludicrous shows up, there is a lack of sensitivity and feelings.

Understanding the esoteric behind ELON MUSK

If someone lacks ego then they might not be aware when they are hurting someone else’s, just as ludicrous (meaning sportive but in a naively playful or staged sense) does not combine happily with cold resource…but then Mars is understood as conflictive I suppose.

What about ludrification, the Enron Musketeer process of trying too hard to alter reality using ludicrous amounts of hubris lubrification?

“Elon luddified me” bumper sticker for you I’m afraid.

Outside of the West Coast, you don’t see many Teslas. Especially in cold climates.

Tons here in Northern VA. Have friends with them, they like them. 3, X and S. And not just locally, NY, Blacksburg Va, etc.

Yes, cold saps batteries. Many of them in cold Norway though. Norwegians must be stupid. I’m Norwegian…

Very true. BUT, I have never seen so many TESLA’s parked all in one place, like I saw just yesterday at-West Mayfield Road in Cleveland, OH. at the TESLA -dealer???- distribution site??- dead vehicle parking lot???

I think you are being sarcastic, right?

You totally forget about december 2018 like it never happened and means nothing? Dec 2018 is what natural market wanted to do. At this moment, EVERYTHING is what FED wants it to do. And you are saying EVERYTHING is good….

Yet the stock is up AH?

Typo? AP says Tesla’s Q1 revenue was $3.5 billion, not $4.5 million as reported above.

Total revenue = $4.5 billion; automotive sales alone = $3.5 billion. The m was a typo.

The difference: revenues from Automotive leasing, Energy generation and storage, Services and other =$1 billion.

Tesla is insolvent yet they keep hanging around. Tesla should be bankrupt but they aren’t.

Tesla loses about $11,000 for every car they sell and don’t pay their bills on time.

It really defies logic how they stay in business, but I suspect Enron Musk will declare bankruptcy during the last 5 minutes of an earnings conf. call soon.

On a positive note, I heard P.T. Musk is working on a Tesla leaf blower.

Wow, Enron the Lonely magic carblower Musketeer!

“But global deliveries of the Model S and Model X plunged 45% year-over-year, and 56% quarter-over-quarter to merely 12,091 in Q1.”

Oh dear.

How about the solar business that Musk did aquire from his relatives ?

“Funding secured.”

Tesla’s stock is a bet on a couple of things

1) It has a high brand value with the Apple fan type millennial, giving them higher potential profit margins. Part of that is due to marketing fluff, but part of it is for real reasons: They are the first car manufacturer focusing on software, others need to learn from this.

2) Many countries are starting to regulate towards BEV. Tesla still has the lead in this segment and will probably continue to do so for 1-2 more years, which means they will also get some good marketshare outside of the above target group. They have a decent profit margin on their model 3, and new production capacity coming up, so more market share potentially means an improving financial situation.

3) Tesla has a very different approach to autonomous driving from competitors. It skips the cost of LIDAR and high resolution maps. If it succeeds it will be a lot more practical for inclusion in consumer cars. Judgement is out if regulators will accept it and when.

4) They plan to be an integrated Uber 2 if the autonomous driving ever comes true which fits well with their software focus model. If you look at Uber’s & Lyft’s ridiculous evaluations, Tesla’s market cap looks moderate in comparison. Their timelines are ludicrous, tough. There is no way this is going to happen 2020. 2025, maybe.

A lot will depend whether the market will stay frothy until 3 and 4 are proven to work. If they fail with regulator approval and easy money stops, Tesla will be in big trouble. But I doubt it’s going to be full bankruptcy. At the value of its debt of 20B, it’s good enough value for an acquisition.

I’m sorry Yaun but you are incorrect on most points Tesla is at best towards the middle losing out to Ford and GM in terms of autonomous vehicle capabilities:

https://www.businessinsider.com/the-companies-most-likely-to-get-driverless-cars-on-the-road-first-2017-4

“If you look at Uber’s & Lyft’s ridiculous evaluations, Tesla’s market cap looks moderate in comparison.”

I believe you mean valuations, and the fact that other cash burning machines are worse doesn’t mean Tesla will magically survive. They might be even more vulnerable with the rules regarding subsidies changing.

Any see an Uber + Tesla merger/acquisition?

They do share similar core competencies afterall….

Manufacturing automobiles is a competitive business, it’s not apparent to me and seems irrational but some believe TSLA builds a better auto?

Stanley Druckenmiller years ago had one of his younger analysts present to him as to why TSLA would be a good short, but after buying a model S, his overall impression of the company changed, and he didn’t do the short. Things might have changed since then regarding quality, but there are believers.

He’s got a large put position in TSLA, at least as of the Dec. 31, 2018 filing deadline.

Tesla would not happen without the wholesale firehouse phoney money the CBs print madly. When chaos breaks loose in the markets in 2020 (as many predict; buybacks will float this year’s market), will Tesla survive that?

‘building them’ requires no dealerships/ no repair places/ no advertising.

‘Selling them’ to the general public is going to be harder without those…

The insurance thing seems like a reach. Probably will have to team with existing company for that?

For value comparison, you shouldn’t compare market cap alone – have to use enterprise value (so debt + market cap – cash). using book values (probably wrong given rating), I get

– GM: $143bn EV

– Tesla: $75bn EV (using numbers above)

so GM is roughly worth twice as much as Tesla

I am still amazed people still invest in Tesla. But then again, how this company has not yet crashed and burned is probably a manual to follow for any other unicorn.

Oh and those Microsoft profits? They will probably have a bump in December when everyone and their grandma rushes to update Windows 7 into Windows 10. Just remember is gonna be a bump and nothing else.

Oh and today profits? In part is cause Windows XP finally died so machines either have to be replaced or updated with a new embedded Windows.

Watch out for those ATMs!

Rent out your Tesla? Wonder how many seconds it will take the litigation industry to produce ads asking..”were you injured while renting a vehicle P2P? Did your rental EV burn?, call Beatem & Cheatem now”.

Not to mention the insurance industry. You think they will cover that fatal accident caused by the guy you rented your Tesla (or any vehicle) to. That multi million judgment is likely yours to pay. Did you read the entire insurance policy??? Same for those data loggers sold as “we just want to help you drive safe”. You better pray there isn’t anything odd on your data logger at the time of the accident. Perhaps a tad over speed limit, an odd hard braking, or no braking…etc., etc.

Oil and coal are the favored pariahs now, but just wait til the radical environmentalists figure out exactly what is in those huge battery packs…….could be a whole new movement/industry just over the horizon.

By the way, anyone have an idea of how to, or the cost of disposal on an EV battery?

LI battery disposal? Right now, they just let them catch on fire and burn out.

“Currently most lithium-ion batteries are landfilled,” according to Battery Resourcers. Forbes ( because they are reducing valuable metals in construction possibly recycling would be more costly also – depends)

“Recycling operations using our Toxco estimates of $2.25/lb would cost would cost $1800/battery.” Medium

Though https://www.bloomberg.com/news/features/2018-06-27/where-3-million-electric-vehicle-batteries-will-go-when-they-retire thinks they will get reused.

Wolf is hyperbolizing the rally, this stock has been in a range with some interesting divergences. I will put the chart up on my website.

About 5 years i visited my friend living in this humungous loft in downtown Brooklyn. The guy that was paying the majority lease was mostly absent and had a few chairs with headphone and computer set up, which I was told was his business. The guy partied all the time, had a Maserati, but never worked and looked like a train wreck. Something was amiss. So I checked out some of the paperwork he left lying around and sure enough he was being sued for millions of dollars from small businesses all across the Midwest. Turns out the guy was selling pulltiim credits, or something very similar developed during the Obama administration . He was apparently acting as a broker and seeking credits he didn’t actually possess. He made millions before it all came crashing down and left the country. Is this the same thing as Tesla’s pollution credits? I was wondering how many of these fraudulent transactions took place. Poor saps too…it was all small businesses this guy stole from.

I think this was an episode on “American Greed.”

I think I figured out the purpose of Tesla. When a population hits overshoot the purpose of disease is to thin the herd so that food will be left for the strongest so they can survive. Tesla is like a virus, in the next recession the muppets who purchased Tesla Stock and Tesla Automobiles will be wiped out to leave more for the rest of us.

Seneca, very sage comments. Hopefully a Chapter 7 bankruptcy will be the cure for this cult disease.

Seneca

Compared to the the smart phone virus unleashed upon the world by Steve Jobs, the Tesla Muskrat flu is a mild sniffle easily overcome.

Walk through any airport in the world and observe the zombie addicts linked to their brain cell extraction devices. Compute the worldwide number of hours wasted playing death games or searching for another “friend” to add to your Facefu** list and it will dwarf the distance to the nearest galaxy.

Tesla just did a $750 million emissions credit deal with FCA in Europe.

That will probably cover them for declining Model S/X sales.

When did this 20% pop happen?

It was part of the 44% surge starting Oct 22, 2018, two days before the earnings announcement upon leaks of a big profit, through Dec 13. Over the period, TSLA went from 260 to $376.

Like most of Enron Musk’s ideas, they were borrowed, not original. Take his Hype Loop, which is actually borrowed from an early 1900s vaccum tube patent. I’ve been trying to remember where he borrowed his Tesla body designs and they sure look similar to some 1990s Buick designs. Good ole Enron Musk! Just like PayPal, which he didn’t create, he showed up later and led the Ebay negotiations. Not a genius, just a ponzi scheme frauder, who borrows recycled ideas. He sure purrs like a smitten kitten when compared to Steve Jobs, though.

\\\

Anyone can have an idea, it is the one that materialises the concept that deserves the praise. If I were to apply your logic we should credit the entire space program to Jules Verne and his visionary space travel books…Anyone can dream, but only a select few can bring ideas to fruition…Kind of giving life to an inanimate object.

\\\

He managed a great deal of achievements, but one is truly praiseworthy…he brought back, but not for long, direct investment by banks into tech development. Something not seen since the time of Tesla-Westinghouse-Edison and the direct vs. alternate competition. After this period banks avoided direct investment diverting the risk to the creditors through liabilities and other forms of loan insurance. After the “Avoid the responsibility but keep the gain” policy is implemented, a halfwitted desk clerk reviews new ideas and decides on their viability.

\\\

Now we need a new Tesla, someone to challenge our current Edison.

\\\

Musk is Edison?!?! I’m thinking he’s more like Elizabeth Holmes. Both of them fooled a lot of sheep.

\\\

There are quite a few nuances between Homes and Musk. One lied about a technological breakthrough (a complete hoax) and the other made over the top promises regarding the delivery.

\\\

Yes, in a way Musk is continuing the path of Edison. Outstanding marketing, strong political backing, great media presence and good ties to the financial sector. Who do you think Edison was? An inventor? A person with original ideas?

\\\

Dunno about Tesla’s future as a viable car maker, but Musk’s comments about Lidar are correct, and even one of the pioneers of Lidar, Anthony Levandowski, has admitted as such. Basically, Lidar was used originally in early self driving car technologies (pioneered at Carnegie Mellon and other places) because there was no other way to easily gauge the distances of objects and their approaching speeds in the early days.

All of that has changed with 3-D rendering of photos – take multiple pictures of something and you can reconstruct a 3-D model with depth. Do this in real time with fast enough computers and you can gauge approaching speeds. This all comes from the vast increases in computing power and speed available today.

So Lidar, which Waymo spent a lot of effort to develop cheaper versions of, is no longer necessary. That really is a dead end.

The hard part is the AI needed to make correct decisions that will fully mimic the correct driving decisions of an expert human driver in response to all this 3-D data. That part will require further AI development with neural network learning and massively parallel and very fast supercomputing power.

Musk’s slam against Nvidia’s chips on the other hand, was another one of his whoppers – the new Tesla chip he touted was not nearly as powerful as Nvidia’s top of the line massively parallel chips. Dunno why they spent all that money developing their own chips

Chris

The Tesla model S styling was stolen from Fiskar— an early competitor.

As a side note, I did a brief design study for the battery containment module for the Li battery system for that project. The battery was being developed by a company called Advanced Lithium in Canada. Even to my semi educated eye the battery concept looked more like an explosive device than a power source, and I quickly ran in the opposite direction.

You probably also know how Lucas created Star Wars using action shots from W2 era war movies, and overlaying his own graphics. Maybe Musk can sell his franchise to Disney? For the correlation to entertainment and power look no further than WH. They always accused Walt of being a fascist. It is remarkable what Hitler was able to do with just radio.

bbbut everyone wants EVs, the MSM keeps telling me so.

EVs are great for many things and uses. It’s just that Tesla is losing a ton of money making them, and that its share price is way too high.

The real carmakers are getting started making EVs. Tesla had better sell itself.

The main problem with Tesla is that it has never made an annual profit during an economic expansion. You need profits during an economic expansion to have a cushion when the recession hits. Thus, if Tesla does not make profit now, it will never make a profit because we are at the late-stages of the expansion.

“But the silly thing is that they’re even in the same ballpark – testifying to just how crazy this market has become.”

Well said. The fruits of funny money and suppressed interest rates. Can you imagine what the yield on those B3 junk bonds would be in markets running on “price discovery”?…..and Credit spreads across the board are still contracting as we speak! Their cash flows would be much worse. Tesla is essentially the most wildly popular zombie corporation currently in existence. I do give the CEO credit for that.