Personal income sets record. Bond market bet on inflation may get challenged.

Everyone – well, not quite everyone – is sitting on the edge of their chair wanting to know how the economy did in the first quarter. This edge-sitting has been complicated by the government shutdown which impacted the timing (delays) and perhaps the quality of the data (as seen by the sharp month-to-month zigzags).

So today, the Bureau of Economic Analysis released on schedule its February personal income figures; and behind schedule, it finally released consumer spending data for January, but February spending data is still delayed. For the economy, consumer spending is a biggie. So at least we have January now, because December had been an outlier in terms of being lousy, after a strong October and November.

So still, things are still messed up in the government-shutdown manner, but a pattern begins to emerge: Consumer spending has backed off from its red-hot pace through the third quarter last year. The backing-off phase started in the fourth quarter, and now in Q1 consumer spending is further backing off from this red-hot pace in mid-2018. Consumer spending is still growing – but merely in the post-Financial Crisis normal-ish range. Economic growth in Q1 is shaping up to be weaker than last year, but it’s still growth.

Personal income growth is solid.

Personal income in February increased 4.2% from February last year, to an annual rate of $18.04 trillion, a new record. This 4.2% year-over-year increase was in the range of the past two years.

Personal income in December had spiked by an inexplicable 1% from November. This was a big zig in a zigzag line, followed invariably by a sharp zag in January, as personal income fell from December, all of it exaggerated perhaps by data collection problems during the government shutdown. Negative numbers being rare in this metric, the January zag caused all kinds of gyration in the media. But now for February, we got another zig, and personal income growth is back on track.

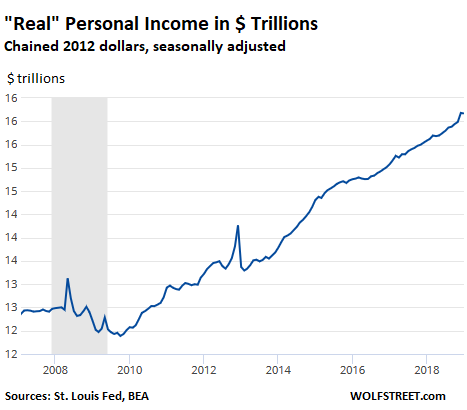

Adjusted for inflation, “real” personal income in February increased by 2.9% year-over-year, thanks to relatively low inflation, after a 3.2% increase in January, which had been the biggest increase since December 2015. This year-over-year data irons out the drama of the month-to-month zigzags. The dollar chart below of inflation-adjusted “real” personal income dispels any reason to panic about consumer incomes at the moment:

Consumer spending growth reverts to post-Financial-Crisis “normal”

Still trying to catch up from the shutdown, the BEA wasn’t able to put together its February personal consumption expenditures (PCE) data. But we finally got the delayed January PCE data this morning.

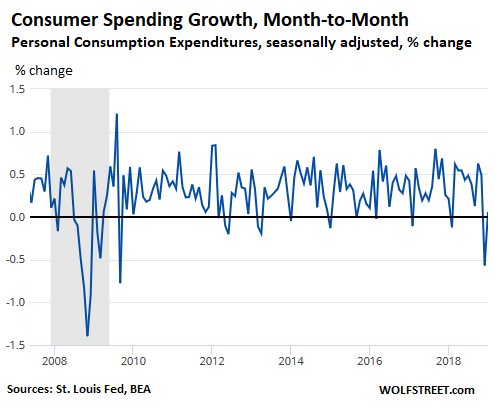

On a month-to-month basis, consumer spending on goods and services – from buying cars to paying for health insurance and rent – ticked up 0.1% from December, the zig after December’s awful zag, that had followed strong October and November spending data. The chart below shows this whiplash data of month-to-month change in percentages:

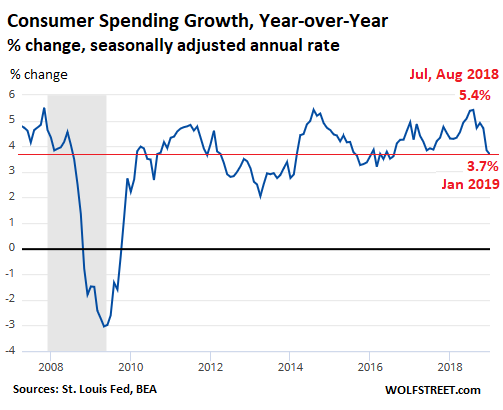

The trend becomes better visible when comparing the current month to the same month a year earlier. Year-over-year, spending rose 3.7% in January, which is still fairly solid, but the trend is down from the red-hot pace in mid-2018, which had peaked with 5.4% increases in July and August. As the chart shows, any overshoot of 5% is eventually followed by an undershoot:

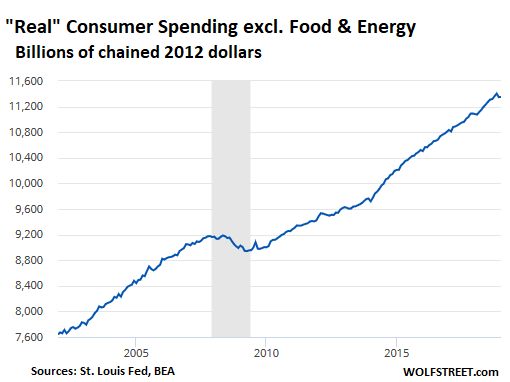

On an inflation-adjusted basis, “real” consumer spending without the volatile sectors of food and energy increased 2.4% from a year ago, also in the middle of the range since 2011. The chart below shows “real” consumer spending excluding food and energy, in inflation-adjusted dollars. Note the little dimple at the end of the line, but dimples like this are not that unusual. For a downturn in consumer spending that is big enough to turn GDP growth negative (recessionary environment), we would have to see a larger and sustained dimple:

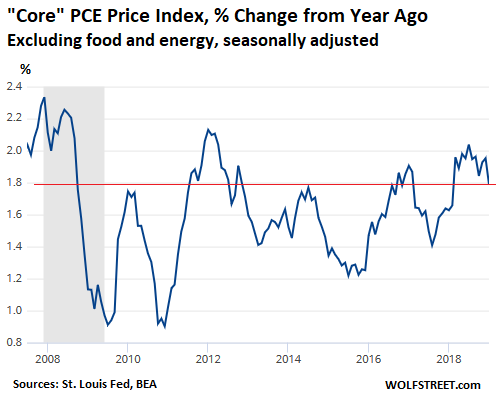

Fed’s favorite inflation measure near target

The Fed’s preferred inflation indicator, the PCE price index without food and energy, for January was also released this morning. The year-over-year increase of 1.8% is just two notches below the Fed’s target (not a “minimum” but a “target”) of 2.0%. The oil bust that re-started last September is gently working its way into services, such as transportation services, via lower fuel prices. But this measure of inflation that the Fed constantly cites remains at the upper portion of the range since 2011, and the bond market might be in for a surprise on the inflation front as the effects of the oil bust are getting washed out of the year-over-year comparisons:

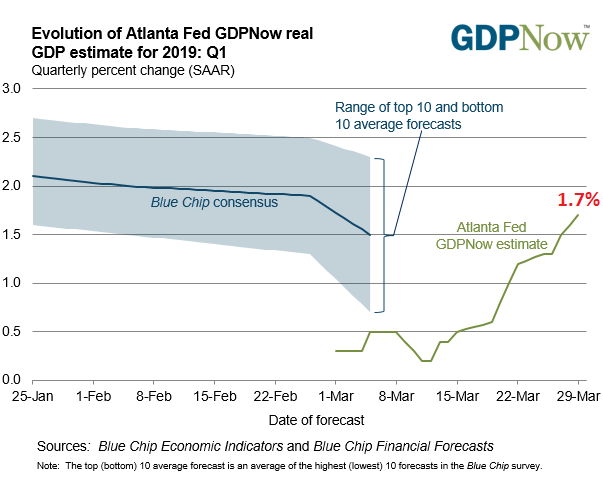

And the Atlanta Fed’s GDPNow – after a widely mediatized horrible start for Q1 on very little data because most was delayed – has been picking up the flow of delayed data. From the original estimates for Q1 of 0.3% GDP growth, it rose today to 1.7%, which is in a range that makes sense:

Much of the data for Q1, including the all-important data for February and March consumer spending, are still not available, and it’s still too early to draw conclusions. But the trends show slowing growth, heading back to post-Financial-Crisis normal, without signs of a recession at the moment.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Possible Typo: “Personal income in December had spiked by an inexplicable 1% from November. … Negative numbers being rare in this metric, it caused all kinds of gyration in the media. ”

The text describes a negative number, but none is presented. Which number was negative?

No typo, just shitty phrasing: a dangling “it” :-]

I think I got that fixed now. Thanks.

The issue will it be an inflation based recession? If it is then QE is not going to fix anything. If inflation runs at a steep premium to rates that is significant, even if both are low nominally.

AB,

QE won’t fix anything, regardless.

China is discovering this now. A $685B credit injection barely registered. Credit addiction, like any substance addiction, requires ever greater quantities to obtain the same high.

At this stage, additional debt issued is simply to pay off older debt. European banks will likely partake of TLTRO-III to repay borrowings under TLTRO-II (which mature next year).

Doesn’t mean QE won’t be proposed as the fix again.

What other tools they have left?

Besides as part of Fed’s PUT ( hidden policies) Ms. Yellen has/is suggesting that STOCKS should be bought like MBSs too? BOJ has done it already So is Bank od Sweden!

Where does it stop?

Yellen put forward the idea of expanded powers. Should the need arise Treasury will buy the securities, not Fed, which comes under Congressional oversight.

Kudlow just called for a rate reduction. Ha Ha Ha

This tells me even the cheerleaders know that everything is running on borrowed time and outright confiscation.

Weimar, here we come.

I saw that, too. Hawkish Gradualism on the way up, reckless addition on the way down.

And Yellen says the Fed should buy stocks and corporate bonds…of course it should, Janet. If only you had done that we’d be just like Japan and Europe.

Jerome Powell supposedly once said there has to be an off ramp to QE.

I think he, and we, have learned that Hawkish Gradualism if not that off ramp…but in fact quite the opposite – an guarantee of enteral on ramps.

And now, sit back and watch how the Fed cuts rates with it’s legendary Hawkish Gradualism….NOT.

If you blink you might miss how fast the Fed gets to zero.

Kudlow is a nutcake – a card-carrying TV personality nutcake.

I wouldn’t have put it further than that description. :)

The reality is we’re going to need Mr Musk after all!

For his space craft that is, preferably manned by Non Google AI Robots !

Otherwise we might crashland on the other side of the moon where the “ communist Chinese “ are building their bases :)

I would!

Facts on record:

Mr’ kudlow is a known an ex coke addict and has been shameless sycophant for the Mkts on the CNBC for decades! Now, he has a big MEGAPHONE as an adviser to Prez.

Stephen Moore is an another toady, ready to fight for DJT at FOMC, the moment he gets appointed.

Actually Kudlow is a powerful politician, protected by secret service agents as “Assistant to the President on Economic Policy”. His words convey official White House economic positions and the President gets to choose who to put in the Fed. Members of the Fed owe the President their patronage and will do his bidding. Witness Powell reversing monetary policy after the President told him to continue with a policy of debasement.

You keep saying Kudlow is a nutcake, and that may be true, but he is a “nutcake” endowed with tremendous power to manipulate the monetary system. Like a cat with a doomed mouse, he is a powerful fool playing with the fate of the working class. He is a child with dynamite and matches – better talk nice to the child.

Looking at the advisers Trump surrounded himself, tells you something about President

How can that be…..I always thought that our President would only surround himself with the best and brightest.

All Presidents live in a bubble, surrounded by advisers. All those advisers come from the establishment. The Deep State.

Goldman.

That is why whichever party is in power, health never gets fixed and endless war continues.

Wow! I thought I was the only one in the US that felt that way!!!!

Outright confiscation won’t work on the stackers.

“… weaker than last year, but it’s still growth”.

This is like being told last year, that you have terminal cancer.

Yet the doctor says the good news this year is, it’s slowed down!

Kind of brings to mind ZH’s moniker of:

“On a long enough timeline the survival rate for everyone drops to zero”.

Or how about Ben Burn-the-Banky’s “Green Shoots”!

Its the fundamentals that matter. Globally? They bad going to worse.

4.2% income growth (aggregate) is about 1.5% real per-capita growth, after factoring out 2% for inflation and about 0.7% in population growth. That’s not awesome (especially if inflation is higher), but for an aging population it’s not bad.

Some of the income growth reflects more people getting to work. Total employment is rising relative to total population (FRED data, Civilian Employment / Total Population). The graph says the US is still a year or two below the peaks of 1990, 2000 and 2007.

The growth downshift from higher levels could be due to the aging-out of the tax cut (paycheck boost). That’s no longer goosing year-over-year comparisons.

Those who came of age during the Great Recession seem to have worked past it. Know a lot of people having children, some belatedly, but all ready to spend money to raise the next generation.

It’s spring, the weather is good, things are blooming, the youth are enjoying Spring Break… while the world has its usual share of problems, and the US has its share as well, nothing seems too dire at the moment! (Famous last words?)

Also consider the 1.5% growth is way overstated. Spending growth is ultimately tied to GDP growth, so it matters how much of the GDP growth is attributable to unsustainable increases in debt. Subtract out the excess of debt growth over GDP growth, and then what do you get?

The growth in debt should include personal, corporate, and government debt, including growth in unfunded liabilities.

Whatever the real “growth” is, we know it’s a big negative that nobody wants to admit to.

I don’t think that credit growth and inflation are disconnected. It’s the credit growth that drives the inflation, and some of that is needed so the financial gears don’t break. So you can take 2% off of credit growth just as you can personal income.

Also, a certain amount of credit growth is needed due to larger population. New people need money just like the rest of us, otherwise there’d be deflation. That’s another 0.7%.

Next, a large portion of US$ credit growth ends up overseas (trade deficit), and doesn’t cause inflation at home. That is in large part because others can’t trust their own money and prefer the US$ (hello Venezuela, Argentina, Zimbabwe…), or need US$ reserves to maintain public confidence in theirs (hello China). That isn’t a sustainability issue in the US.

Take those away and things are not so bad. And since it’s now spring and not winter :), we don’t have to worry about the unfunded liabilities (yet)! Some cities and states will undoubtedly blow themselves up, leaving everyone with unmet expectations, but they’ll cope. And the painful examples will help everyone else sort out their liabilities sooner rather than blowing up.

Let’s say growth is 1.5%. Is it a problem that pensions assume 7% return and the stock market has even higher returns baked in? Seems to me there’s a reckoning on the horizon.

Only because of the massive debt fueled stimulus. That next generation will end up paying for today’s party. I am appalled that the same people in government that screamed about ARRA when stimulus was needed to revive a morbid economy look the other way at a huge counter cyclical expenditure. Interesting that many consumers learned the lesson of the financial crisis, but our current leadership not so much.

=>That next generation will end up paying for today’s party.

Born bankrupt. And hopelessly in debt.

That should keep the masses in line. What’s left of them. If any.

One must pity the children, knowing they have no future. Hence the need to eliminate ACA, to shorten the misery.

Best quarter in America in a long time

its starting ro look like venezueala

https://www.bloomberg.com/quote/IBVC:IND

204.000.000%

Wages up almost 5% for the year. The stock market ripping higher every day. Record and ever-increasing corporate profits (almost $200 per S&P 500 share now projected in earnings – this is up almost 4X from pre-crisis earnings). Everything is running red hot and Americans don’t even blink at the $50,000 price tag for a new pick-up or $1,000,000 price tag for a house.

Everyone is getting rich – except me. I need to save every dollar I can to try to keep up with relentless inflation and a stagnant wage. But congratulations to the rest of you, I hear you are living the life.

Sour grapes? You bet.

Van: It might not be much consolation but I know where you’re coming from. Retired, no debt and living on a fixed income sucks too. Available credit up the wazoo but doesn’t do much good if you are old school and dedicated to living within your means and paying your bills.

On the other hand, if I knew I was terminally ill I’d max out the cards and go ape $hit while it lasted.

Cheers

My sister always said that when she got really old she was going to start robbing banks.

CK: As evidenced by the last 10 years White Collar crime pays better + you get to keep the money. ;)

Kinda like banks robbing your sister :)

It depends the reason. Some people it is to hit back and money is secondary. You have then to be prepared to live a life of outlaw even if you are not caught (which is different) , or go to jail (which I think must be miserable), or to take a bullet (which is sort of sad) . So a long time ago I lived this, I don’t say how but I used no weapon just a chat with the manager and it’s ok ( and the news they said how and someone copied and went to jail :-( ) . It is not a good idea really, and events after were very unusual, things like getting off a train and police van pulls up and many armed police jump out and run at me, around me, then past me. Or you find a place that is quiet after, and you have one neighbour only, and he invites you for a drink, and you ask what he does and he is chief of police for the city , says he can check my record if I would like. Good person too. So you know it’s all a bit different and you end up in another world if you don’t get jailed or shot. I just don’t recommend anyone do this. Statutory limits now, but still you don’t know what the authorities can come up with, they don’t forget.

You get caught, its three hots and a cot, cable TV and healthcare. Not as good as Rancho Deluxe, however.

Funny I was thinking the same today!

As I get closer to retirement and the FED likely to lower rates to near zero AKA “do anything it takes” I should just borrow the maximum I can.

Leverage up and cash it all out where it can’t never be found. Then just go BK.

Why not I ask as it’s pointless playing by the old rules of sensible financial management i.e. no debt, live within means.

Mike T. FWIW I’ve heard that casinos make great ” washing

machines” for certain types of ” laundry”. Apparently you don’t get the same “shrinkage” of your laundry as in other

” mechanisms” if you catch my drift.

Thought about it but it would be hard looking at the man in the

mirror every day.

Mike,

Don’t forget to max out your credit cards before you leave the grid.

Van, you should be thanking the Federal Reserve for having the courage to inflate asset prices. Once the rich have all the wealth, they may feel generous and trickle some to you. It may take a while though because with stocks continually rising the money goes there first.

A friend’s company just laid off 20% of their workers and at the same time announced a Yuuge stock buyback with the saved money.

I told him to hold onto his stock.

I suppose, then he should get a job as a low paying bookkeeper (24K/year), and then embezzle 6 figures to compensate for that.

There is some soothing relief for your pain: REALITY. Despite all the financial engineering, S&P 500 Q4 EPS ticked up just 3% year-over-year, worst growth since Q2 2016. And heading lower for Q1, as EPS estimates for Q1 have been cut by the largest amount since Q1 2016 (FactSet).

Ooooooooh.. have I been rude to the Wolf’s favourite poster and thus deleted??

Income is not wages there is a lot more that goes into income, from the December report

“The increase in personal income in December primarily reflected increases in personal dividend income, compensation of employees, and farm proprietors’ income (table 3). Personal dividend income increased $83.4 billion, primarily reflecting a one-time special dividend payment by VMware Incorporated. Farm proprietors’ income increased $29.2 billion, which included subsidy payments associated with the Department of Agriculture’s Market Facilitation Program.”

According to the March Non Farms Payroll nominal wages increased 3.4 and real wages about 1.9. Which is not bad, hence not a time for a rate cut.

Actual farm proprietor’s income cannot be known. Some of it is consumed in-house without ever being measured in money terms and much of that which is monetized is effectively hidden.

=>nominal wages increased 3.4 and real wages about 1.9.

That was the raise workers were supposed to get in 1978.

What have you done for them lately?

Interesting how consistently cheating on the published inflation numbers makes the numbers like ‘inflation adjusted personal income’ look so good.

Here’s a couple of fact checks. If inflation is 2%, then the price of a gallon of milk should only go from $2.00 to $2.04. How’s that check with reality? And of course, that inflation adjusted personal income chart makes it look like the whole nation is so very rich and everyone is ready for an early retirement and a middle age of visiting Tahiti and a grand tour of Europe. Yep, that sounds like the reality I see around me in the trailer park every day.

The price of a gallon of milk or a dozen eggs fluctuates wildly, going up and down based on all kinds of market conditions. Prices of eggs at Trader Joe’s plunged 50% over the past couple of years and are back where they had been years ago. To quote you: “How’s that check with reality?”

Real income growth is 2.9% and all you hear in the MSM is recession, recession, recession.

Oooohhh kay.

Really have tried to expand my redneck knowledge from owning land, properties v.s. stocks & bonds.

Waded into the online sites.

What a bunch of gloom & doom people. I have no idea how most have

the will or energy to get out of bed in the morning.

Self employeed: 1) health insurance dropped by 350.00/month

2.) Diesel price for my equipment: a wash or slightly

higher…though I remember well the +$4.00/gal.

days.

3.) the 1000 insurance policies we carry for the

business….another wash.

4.) Office costs, down by about 150.00/month…able

eliminate lines, improved cell packages for field.

5.) Will do this as long as I’m fit to do so. If I still wish

to keep working….I’ll start a business that does not

require the physical work of this one. 56yrs

young, changed my diet long ago to stay fit for

work & fun.

Its incredible the opportunities out there today. Recessions, housing depression, have always found a way to stay in business.

The great debt reset will be no different….I’ll just be a little older.

Amen!

Amen also!

A few comments.

1) Glad ObamaCare could help you despite Trump and the Republicans saying they are trying to kill it. Still waiting for the better Trump plan he promised almost 3 years ago. IMHO, he needs to get off the golf course and start working for America.

2) America is pumping all of the oil it can. No more oil dependency until we run out before the Saudis. And then we are screwed.

3) Business tax deductions are all we poor folks have left. Trump eliminated most of the personal deductions for owning a home.

4) The competition in business IT is still good. Who uses landlines anymore?

5) I have had to start watching the diet this year also. Getting old is harder.

I agree, the opportunities still are out there.

Let’s be real here ,hyperinflation already happened IMO .Some of my stocks are up 600% since 2009 and my house went from 100.000 dollars to 350 000 well over 100% .Also my box of cereal used to be 1000gr for 5.00 dollars it’s still 5 dollars but for 500gr that’s 100% increase there too

I understand hyperinflation to be anything above 50% I’m sure if the dow was at 500.000 S&P at 50.000 people would be excited but it would just be a repeat of every other hyperinflationary episode whereby stock markets and realestate explode to the upside tremendously ,,trust me American people won’t be dancing then ,a sharply rising stock market and realestate beware ,it’s actually not a good sign

Baloney,

I agree with you. If you don’t own real estate and only rent, and don’t own stocks. are working for less than $20/hr, and have held your cash securely in a .01% savings account for the last 10 years, you are likely to vote for Bernie and AOC.

The real question is how many are there in this situation? And how many will vote in the next election?

AOC is too young to run for POTUS. I’ll vote for Bernie not because I think he’ll fix anything but because I’m tired of being lied to. Bernie is misguided but I believe he is an honest do-gooder and I would rather the system go down at the hand of a do-gooder then a self serving, greedy, criminal (such as Trump or Obama).

How wonderful that the 56 year old business man, who commented above, is doing great but I’m afraid there will be a reckoning – even for him.

When Bernanke debased the currency and wiped out the value of much of the savings it took 25 years to earn, he put me in a situation where I no longer have any stake in my society and I no longer have any motivation to continue toiling as an engineer, after all anything I save will be destroyed by debasement.

There no longer appears to be viable investments, having yields above actual inflation, so my plan now is to quit my job and move to Spain or Latin America and hope a million will last the dozen years until I can collect my welfare check (social security). I don’t have a lot of faith in either my savings holding out against inflation or the government making good on the promised welfare (they have already reneged on two years of benefits) but I will at least have some time to enjoy – my time, what’s left of it.

Venezueala hyperinflation happening now and their stock market is up

204,000.%

Funny aside…I was reading the beige book looking at New York and they stated consumer spending was high due to retail sales. This, of course, is in a city with 60 million tourist a year! So, maybe the tourists got the cash but the natives are so poor due to high rents they hardly ever go out.

“Note the little dimple at the end of the line, but dimples like this are not that unusual. For a downturn in consumer spending that is big enough to turn GDP growth negative (recessionary environment), we would have to see a larger and sustained dimple …” – Wolf

Larry Kudlow just opined that the Fed should lower interest rates by 50 basis points. In his position within the administration, is it not reasonable to assume he has pre-publicaion knowledge of the next consumer spending report and the “dimple” will enlarge downwardly?

=>Larry Kudlow just opined that the Fed should lower interest rates by 50 basis points.

When Larry Kudlow died three years ago as a tax-avoidance scheme they fitted him out with servo motors so he could be operated by remote control. Once they’ve upgraded him with AI it will be the only “I” he ever had.

Jim Cramer is proof that financial fraud is not illegal.

Proving Buffett made his money with insider trading was a parlour game for freshman finance majors until it was included on midterm exams.

As I said elsewhere: Kudlow is a card-carrying TV-personality nutcake. He doesn’t concern himself with data.

Sure enough …

https://www.reuters.com/article/us-usa-economy/weak-february-u-s-retail-sales-underscore-slowing-economy-idUSKCN1RD2CK

Yeah, well, why don’t you look at the actual data rather than just reading headlines, RD Blakeslee?

Today, we learned that January was REVISED UP by a BIG jump and now suddenly looks strong with +0.7% growth MoM.

Today data also gave us the “advance” retail data for February with a margin of error of +-0.5%. So that -0.2% MoM decline may actually be +0.3% growth after revisions.

And given the big January, even if February is weak, March is already looking OK-ish, and Q1 retail sales are going to be fine (though not red-hot).

The media is being totally idiotic about this, including Reuters.

However, a WSJ article pegged it correctly this morning: “A Perfectly Good Bad Retail Sales Report.”

This is important because markets are delusional about a rate cut, and the media are feeding this delusion with their superficial nonsense. Even the Fed doves like Kashkari say that there is no rate cut in sight with this kind of economy. Many doves now put a rate HIKE on the table instead.