Residential Construction Skids, Nonresidential Construction Stagnates. The delay gave markets a break from lousy data.

OK, it looks like GDP growth, released last week for the fourth quarter (+2.6% annualized rate), will be revised lower on March 28, given today’s data on construction spending for December, which had been delayed due to the government shutdown.

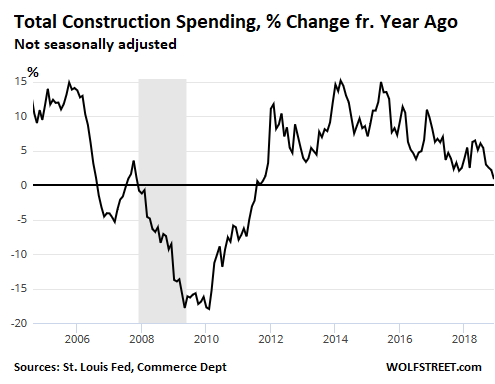

Construction spending fell 0.6% in December from November, based on a seasonally adjusted annual rate, released today by the Commerce Department. Compared to December a year earlier, total construction spending inched up only 0.8% (not seasonally adjusted), the lowest growth rate since Oct 2011, coming out of the great recession. For the whole year of 2018, construction spending rose 4.1% (not seasonally adjusted), showing that the downturn came late in the year:

Construction spending peaked in 2005, then declined through the Great Recession and into early 2010, followed by a catch-up building boom with year-over-year growth rates of over 20% for brief periods and over 10% for most of the time between mid-2012 and late 2015.

Construction spending, at nearly $1.3 trillion in 2018, accounted for over 6% of the US economy. It can’t be offshored and has a large secondary impact on the economy, from companies buying construction equipment to workers buying new vehicles and sandwiches. It matters to the US economy.

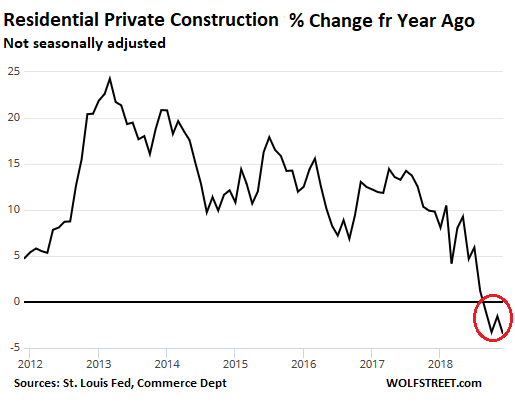

Private residential construction was the problem. Spending on single-family houses, multi-family apartment buildings, etc., but not public residential construction, fell 3.5% in December compared to December 2017 (not seasonally adjusted), the fourth month in a row of year-over-year declines:

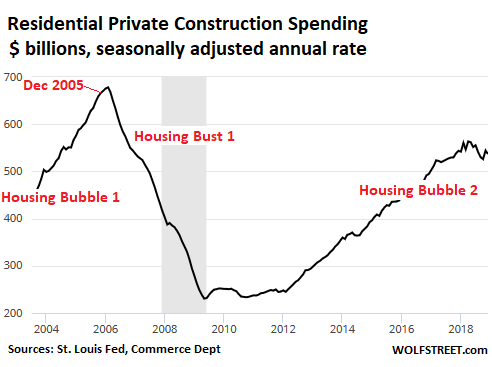

In terms of dollars, private residential construction is forming a peculiar pattern: An epic construction boom during Housing Bubble 1, an epic construction bust during Housing Bust 1, and a construction boom during Housing Bubble 2 that is now losing its grip. In December, private residential construction spending, at $537 billion seasonally adjusted annual rate, while down from December a year earlier, was more than double the range during the 3-year span between 2009 and 2012, but remains below the crazy peak in 2005 (December 2005 $671 billion):

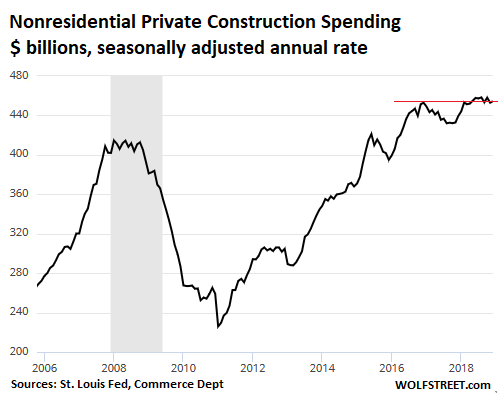

Private non-residential construction – office buildings, warehouses, hospitals, manufacturing facilities, etc., but not including projects for oil-and-gas drilling – rose 3.8% compared to December 2017. But December 2017 is an easy comparison: that month, spending had dropped 3.5% year over year. Compared to December 2016, spending in December 2018 was about flat, stagnating at $454 billion seasonally adjusted annual rate:

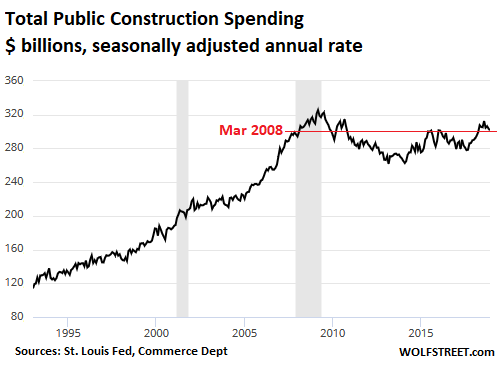

Public construction spending – including on the infamous US infrastructure such as highways and water-and-sewer systems – rose 4.2% year-over-year in December (not seasonally adjusted). But in dollar terms, it has not gone anywhere in 10 years, after peaking in March 2009. December’s spending at $301 billion seasonally adjusted annual rate was back where it had first been in March 2008:

This report on December construction spending was another in a series of reports for late last year that had been delayed due to the government shutdown, and that showed, when they were finally released, an economy whose growth was slowing toward the end of the year, with some actual year-over-year declines cropping up, such as in residential construction.

For the markets, the government shutdown, and the accompanying blackout of economic data, was precisely what was needed the most to sustain the blistering rally in January and February. But this data is now trickling out. And it is putting together the uninspiring image of an economy that is growing but at a considerably slower rate than earlier in 2018, and is right back in the range of where it had been in prior years despite the enormous dual stimulus of huge tax cuts and ballooning government spending.

The four giants of manufacturing – China, the US, Japan, and Germany – account for 58% of global manufacturing value added. And the three biggest exporters are getting hit. Read… US is Cleanest Dirty Shirt Among Manufacturing Giants. China, Japan & Germany Sink

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Why are there so many revisions? I get it that new data comes in ‘after’ to modify the conclusions, particularly after the shutdown, so then why is the growth result announced anyway? Is it all just politics?

And: If the results were looking to be negative, would the report be then delayed just in case they might rise?

The adjusted growth numbers never receives as much publicity as the wrong amount first released. If WS didn’t give us this revision in an article I doubt it would even be noticed.

I believe you just answered your own question – goose the market with an upbeat number and don’t worry, no one ever looks at the revisions!

Wolf, do you have a chart that go far back beyond 2004. Comparing it to the last bubble is OK but what is the average construction spending prior to Housing Bubble 1.0.

The data series goes back to 1994. So here you go…

That’s some hedonistic fancy stuff going on right there if my reading of

https://fred.stlouisfed.org/series/COMPUTSA

is good, like same number of units as ’90s but three times total cost.

Repent !

So I find it is inflation that does that fancy because the fred data is nominal. Hedonic debt tst tst…

https://edzarenski.com/2018/03/09/construction-spending-is-back/

…is what it looks with inflation taken off. Steve Hansen he has some not hedonic stuff at econintersect for October too. Not much anywhere else cause they’re all comparing real GDP fixed in people’s thinking and nominal looks good for houses and who gonna complain at big dollars, is what I am thinking too.

Then comparing with population growth? That looked kinda flattish over half a century…

Annualized residential spending divided by annualized housing starts (both SA), adjusted for CPI, 2019 dollars. More expensive, but not as bad as one might think.

https://fred.stlouisfed.org/graph/fredgraph.png?g=naUl

Heading Down

Another fundamental that underpins the economy.

In the same vein as Wolf’s article. North of the border, Canadian real estate inventories are rising and sales are falling. Both the hottest markets of Toronto and Vancouver, are seeing mortgage delinquencies start to climb.

Which means that motivated sellers will bring prices down further, as they become increasingly alarmed at getting caught with an underwater mortgage. While prospective buyers hold off purchasing, while watching real estate prices fall, hoping for even a lower price. Self reinforcing deflationary loop.

Just another of those pesky “fundamentals” that equities seem to ignore.

Falling big time in Vancouver. However, everything gets snapped up where I live on Vancouver Island. There are two empty houses down the road from me and a friend of ours might start dickering before they even come up for sale. The homes are older and will need some updating, but with 2+ acres either will sell lower to mid 200K. One has a very large shop. You could move in, tomorrow.

I listened to a cbc radio program yesterday and they were talking about prices in Vancouver. Apparently, out Cambie way, some new condos are going for $2,000 per sq foot. Think about that one for a minute. Cause? Land prices and development fees.

A friend of mine’s daughter has a 5 year science degree in physio. Her husband….the same. They live in a small apt in Vancouver for just over 2 K per month. They commute to work over to North Van. He says they have resigned themselves to never owning a home if they stay in Vancouver. With their income they could build or buy new if they chose to relocate.

Yup, housing recession is a leading indicator for general recession.

Here in Palm Beach County, Florida, the PB Post publishes recent closings on homes and condos every week. For the past few weeks in my zip code of 33467 these have fallen to 5 to 6 sales or transfers versus 15 to 20 or more in much of 2017-2018. This includes new construction sales too.

Realtor friends are saying things are a little slow…my take is that sales have fallen off a cliff. Yet no articles on this as lots of big ads for new home sales fill the paper every Sunday….

The danger is, bad news like this is used as pretext for lower rates & more QE, dispite Wolf’s recent graphs showing there isn’t correlation that this improves the economy and arguably slows the economy. If the Fed looked at Wolf’s data it would say “Oh! Our low rates and big QE and balance sheet hurts the general economy and really really benefits Wall Street…..So everything going according to plan give us a gold star!”

– QE won’t help when prices are falling. Because then Mr. Margin will take control.

The central banksters can see that in their own data but don’t care. Saving the economy isn’t their job. Pushing up asset prices and saving their fellow banksters is.

Where does residential construction end, and where does related FIRE service sector begin as percentage of the economy? Clearly construction must have a bigger footprint than the meager 6%: flippers can start flipping, realtors, lawyers, insurance, home improvement, municipal taxes… There is a whole chain that would be cut off.

Residential housing equals “bricks and mortar”, the overall chart is strong. People are living in warehouses.

I’m a retired construction management pro & I know all about construction spending falling off a cliff. I was a CM for one of the largest retail shopping center developers in the US. in 2009. I saw how fast the retail industry fell apart from the inside. Imploded is a better analogy.

Bankruptcies occuring now are just the bow of the Titanic going down. And now the startling reaility is that the next crisis may already be upon us, despite stock market, commodity & data manipulations. The same stuff happened back then. But eventually the truth cannot be hidden or glossed over any longer.

In the 4th quarter 2018, site development began on a new 20 acre Mixed Use shopping center not far from my house in Northern California. It’s master planned to include affordable housing, next to the freeway that Cal Trans just finished widening & close to the new BART (bay area rapid transit station). Great location & awesome for surrounding property values. I told my wife back then, maybe things aren’t so bad after all if a developer is coming in to build this in our community.

The only problem is the heavy equipment being used for the site development has been sitting idle for over a month. It looks like the contractor or maybe the developer has gone BK. This isn’t small potatoes. It’s millions of dollars of equipment not being utilized somewhere in the Bay area. That’s a big problem & a sign if there ever was one.

Are you referring to the Milpitas area?

This is in Antioch which is the low end of the spectrum in Bay area real estate prices but where the median home price is still about $440,000.

Then there is Ocean Wide in LA. possibly the largest current project in the US. Chinese backed. Shut down with exterior complete and multi- million dollar liens going back 6 months. .

The FBI has LA City Hall and all of the Chinese investmentCompanies under investigation for bribery, money laundering among other things.

Livermore?

Maybe they got their financing signed off a couple of years ago because they had a great bunch of anchor tenants under contract. Then when it came for the first big draw, the banks took another look and realized that the tenants they had lined up were Sears, Radio Shack, Toys R Us, Payless Shoes, Dicks Sporting Goods, and many others that are now in liquidation. Just a Guess.

The developer I worked for wouldn’t even do a deal unless it included front line anchor tenants like Target, Home Depot, Lowes etc. But yes a lot of these so-called front line tenants may now be having more financial problems. One tenant though even if it were a Target, wouldn’t stop a project like this. They’d just scramble & plug someone else in. This is different. I can’t wait to find out what the real story is.

Thanks. There is a fed research around which says that housing and construction have been the drivers to recent GDP increases post gfc. That is a loop of debt for construction and debt for purchase paying for that activity which feeds into spending and retail, all working while prices rise fast enough to gain attention, and while there are still buyers/lenders willing to underwrite the whole show. Low rates also easing for existing owners for household spending relative to before measures. If so a proper reset is going to take out more than new business but also pre-existing business that was spared by the various easing measures and low rates. I don’t know how the last decade felt in the US, in Europe it was/is like the recovery that wasn’t, sort of like being more haunted by the last slowdown than actually finding a way out.

I can’t imagine the US on NIRP, it is a dark art.

If you want to see a real estate market on NIRP I can post some pictures of my latest Italian odyssey. It’s beyond insane.

People speak ill of China, but at least in China all those residential developments find buyers, albeit they have no intention of living there and no clear path on how to make money out of those “investments”.

But Italy? Construction companies are building like there’s no tomorrow… with no buyers in sight.

Part of the reason is due to the fact Italy has an enormous stock of unsold housing (variously estimated between 1.2 and 1.8 million units, and that’s without counting those needing work to be lived in), ranging from tiny flats to luxury villas. But asking prices not only remain high: they keep on going higher.

Another part of the reason is new developments are a mixture of Australian (tiny single/dual family houses packed like brined sardines) and Chinese (sold unfinished). They are as unappetizing as they are expensive.

Finally there’s the bull in the china shop: home ownership rates are somewhat down since 2010, but still well above EU averages. Only Romania and Spain have higher home ownership rates. With depopulation finally hitting even the most affluent Northern provinces it means buyers are evaporating, quite literally.

Allow me a final tirade: city councils have been using real estate as an ATM for about two decades. Impact fees and land sales in particular have long been used to “sell” to an often recalcitrant population more concrete. Problem is this money has rarely, if ever, been used to mitigate the impact of the new developments. New roads and sewers, proper drainage work etc… what are those things? The money gets instantly wasted in useless vanity projects and more senseless GDP goosing which invariably eats through that blood-stained money and ends up leaving the exchequer saddled with more debt.

China at least has some decent infrastructures…

Thanks MC01. Could you please elaborate on the “depopulation” in northern Italy that you noted? Is this mainly a demographic issue, or is there something else contributing?

I ask partly because I spend time in Bressannone every year, and recently noted, to my surprise, a couple of attractive properties that seemed to be priced more reasonably than usual.

Thanks in advance.

China’s problem now is their shrinking and quickly aging population. If only China were immigrant friendly….no chance of that.

i have seen a few properties in sicily (retirement dream :( ), at the same asking price for the last 8 years !!!

nothing’s budging, sellers want the same money, and noone is biting.

in the meantime, gem villages like marzamemi are turning into chinese plastic selling circus, so, the, you think, what’s the point?

che fai?

…may already be upon us…unless you look at the data with a microscope like Wolf does, you’ll never see it comin’. When it finally happens the cake is baked, and all you can do is get out of the way and wait for it to end.

When you see nuth’n goin’ on in a “sizzling” area, I think that’s a very clear sign.

This is exactly what I look for… Although, the rain has put a delay in a lot of work at the moment… Let’s see what happens when the sun comes out. IMHO that’s when we will see for sure..

We’ve got a few similar projects going here in the Central Valley (Modesto, Tracy,Lathrop) I will be taking a drive to see for myself after the racing holds off.

In Portland there are a huge number of Apartment complexes that were started a year or two ago that are rushing to completion. There are almost no fresh new starts to follow them in the pipeline, the same is true for new SFR construction. When these all reach completion this summer it looks like construction employment as well as associated jobs will drop off a cliff. This will decrease demand for new housing as many of the workers will return to the states they came in from and drive demand for apartments and housing down more, in a kind of feed-forward loop.

I was in New Orleans right after the New Year, stopped for lunch at the new “it” place in the new “it” part of town, the warehouse district. There was construction on every side of every street, gentrification central. The apts are all in the $1M+++ range, well above the affordability range of the area. They seem to be flying off the shelf because Zillow only has two listings there today.

Wolf, i was going to comment on this, but your last paragraph was exactly what I wanted to comment. Trumpian economics does not work. Now our children will be saddled with this new regime of exponential unrestricted government debt growth. Social security and Medicare were already on the endangered list and the chopping block before all of this mess. I feel very bad and sorry for our children. It’s like watching an accident occur in slow motion, with one’s hands tied behind their back……What can we do?!

“For the markets, the government shutdown, and the accompanying blackout of economic data, was precisely what was needed the most to sustain the blistering rally in January and February. But this data is now trickling out. And it is putting together the uninspiring image of an economy that is growing but at a considerably slower rate than earlier in 2018, and is right back in the range of where it had been in prior years despite the enormous dual stimulus of huge tax cuts and ballooning government spending.”

Hmmm, did we learn something about why pols do what they do? That is, obscuring things so that we can’t connect the dots?

This developement got approved in Boise. Now it’s for sale.

What’s sad is that they tore down a bunch of beautiful trees.

https://boisedev.com/news/2019/03/01/barber-hill-vista/

Construction workers losing their jobs!!

Celebrate!!!

And apparently Amazon is not coming to Idaho

https://boisedev.com/news/2019/02/28/big-amazon-project-in-nampa-put-on-hold/

Not mentioned so far: Bezo’s financial condition is indefinite until his marital situation is resolved.

Major spending put on hold is not surprising.

Also, Bezos has recognized the inevitability of amazon’s eventual faiure:

https://www.businessinsider.com/jeff-bezos-says-amazon-will-fail-one-day-2018-11

Bezo’s state of mind is apparently in play and the pols are missing a chance to blame Bezos for their disappointment, instead of themselves.

He was making the point that A should not take its success for granted.

He was not making a market prediction.

Everything happens ‘eventually’

‘It is a hypothesis that the sun will rise tomorrow’: Wittgenstein

Netflix’s “Roma” won three Oscars, despite the fact that almost no normal human being in America had ever heard of the movie, much less watched it. But of course, it had spent some $25-50 million on an Oscars campaign for the film, more than any other film

Meanwhile it has had to raises prices as the owners of the content it must deliver to its subscribers start their own streaming channels and demand more money from Netflix.

Debt out the wazoo finances the relatively low monthly subscriber rates with absolutely positively no way they will be able to pay back that debt with subscription fees.

Of course y’all know that already here on Wolfstreet.

I just thought that I should point out for posterity that the Tres Oscars for “Roma” will likely be pointed to as the sign of Peak Netflix in the coming Debt Apocalypse

PS, the Oscar campaign for “Roma” cost more than the film itself. Now that’s hubris

> Debt out the wazoo finances the relatively low monthly subscriber rates

Dude, I finance eeeevrything.

– Debt Wazoo

Could rising interest rates have anything to do with the health of zombie construction companies?

Increasing real negative interest rates will revive all of these zombies!

Those who borrowed to finance growth deserve to fail..

Those who borrowed to finance a job/P.O. so they can grow,deserve help.

Chickens come home to roost when investors expect growth without borrowing….. You know, the old fashion way….lol

Looking again at housing units built per year for the last half century, that tells me something about population growth without looking at the actual pop. stats. Housing has gotten bigger with fewer people livig in each unit, so since the number of units built is constant, population growth must have been slowing down. There’s a very notable slump in new construction from 2010 till today, with an extremely weak top happening now.

Residential Private Construction is a leading indicator in a normal business cycle. It is important enough to be one of the causes of what happens next, rather than just an indicator.

Commercial Private Construction is typically a current-to-lagging indicator. A lot of these projects have sunk costs/funding in place, and take long enough, that they will continue well into the recession. But the time it takes to get them started means they are almost never rolling at the start of an economic uptick.

Public/Institutional Construction is a lagging indicator. It often doesn’t even get really rolling until the economy is at its peak. If you can make the switch, it’s a useful place to be if your heading downward.

So if housing peaked in 2005, and the real economy went into recession in 2008, depending on your geographical area, government/institutional construction still had some activity well into 2010. The AIA Index (Architect Billing Index) is an interesting index to look at for the larger projects. On an anecdotal level, working in the industry, we are solidly in the late phase with the Government/Institutional work really ramping up with lost of work being put our for pricing at the moment. Which as noted above, is not necessarily good news for the rest of the economy.

All good stuff and I agree within the limited scope. However: ‘the normal business cycle’

We left normal a long time ago. It’s not normal for the Fed to have to save the banking system from collapse. But in terms of financial history that was yesterday.

Second point: which business cycle? There are several with different wave lengths.

(E.g. In our bodies there are many: the cycle of your breathing is ten times slower than your heart’s.

There are relatively rapid economic cycles occurring within much slower and much larger cycles. In the Depression nearly all construction stopped. (a notable exception, the Empire State Building,was committed to before the real downturn. It didn’t break even until the mid 50’s)

A cycle by definition is reciprocal: it returns to its starting point.

Then we can say: ‘seen this before’ and predict the next move.

But the cycle of US debt (and others) has never returned to its starting point. We can’t say we’ve seen this before because its never happened before.

On a related but different cycle, it may be that the mall concept itself is

waning within a larger slower cycle than the normal shorter cycle expressed in lease rates per square foot.

Wolf,

Love your writing.

Small typo under heading Public construction spending, ” not gone anywhere in 20 years, after peaking in March 2009. December’s” …. should be 10 years, not 20.

Oops. Thanks.

Great thing about this blog are all the personal observations/anecdotes from some very obviously intelligent and insightful people.

Thanks!

Out of the left field nosebleed bleachers – probably been mentioned before, but just noticed how Dow volume over the last month has returned to pre-2016 election levels. Volume noticeably tripled right after the election and stayed there consistently until last month. Am I seeing this right? Trivial?

Algorithmic trading volume as a percentage of overall volume is up, but the retail investor is sitting on the sidelines until there is some clarity on the trade front and perhaps the Brexit fallout.