But these are still the good times.

Don’t blame the December debacle on the partial government shutdown – it “has not had a significant effect on December closings,” the National Association of Realtors explained in its report this morning. The shutdown started too late in December to have much of an impact. But it might impact January closings. So that will be interesting because December was bad enough.

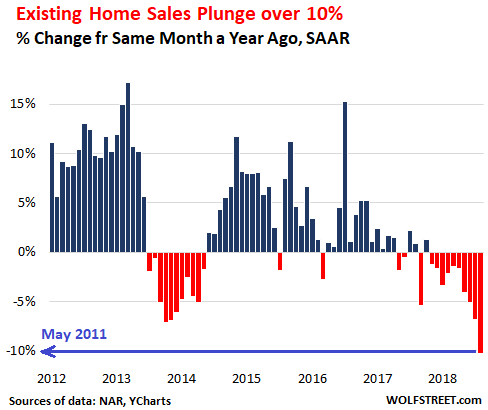

Sales of “existing homes” — including single-family houses, townhouses, condos, and co-ops — in December, plunged 10.3% from a year earlier, to a seasonally adjusted annual rate (SAAR) of 4.99 million homes, according to the National Association of Realtors this morning. This was the biggest year-over-year drop since May 2011, during the throes of Housing Bust 1 (data via YCharts):

“The housing market is obviously very sensitive to mortgage rates,” the NAR said in the report. Mortgage rates ticked up from 4.2% in December 2017 for an average conforming 30-year fixed rate mortgage, to 5.2% at the peak in mid-November, according to the Mortgage Bankers Association. Then mortgage rates fell sharply and hit 4.75% by mid-December.

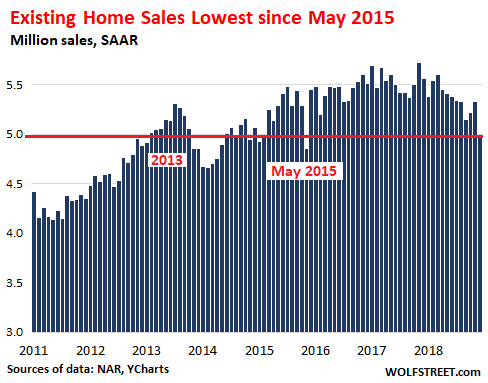

Analysts had expected a drop in home sales, but not that kind of drop. The median expectation, cited by the Wall Street Journal, was a drop from the November sales rate of 5.33 million to a December rate of 5.25 million. The drop to 4.99 million was sort of a wake-up call. It was the lowest since May 2015:

By category, sales of single-family houses in December plunged 10.1% from a year earlier to a seasonally adjusted annual sales rate of 4.45 million. Condo sales plunged 11.5% year-over-year to a rate of 540,000.

Note the accelerating drop in sales of existing homes in the Midwest and the unabated plunge in the West:

- Northeast: -6.8%, to an annual rate of 690,000.

- Midwest: -10.5%, to an annual rate of 1.19 million.

- South: -5.4%, to an annual rate of 2.09 million.

- West: -15.0%, to an annual rate of 1.02 million.

Total unsold housing inventory at the end of December stood at 1.55 million homes, up 6.2% from December 2017. That works out to be a supply of 3.7 months at the December sales rate, up from 3.2 months’ supply a year earlier. This measure of supply has been increasing for seven months in a row. And the average time properties stayed on the market jumped from 40 days a year ago to 46 days.

But this rising supply is still the wrong supply – it’s too darn expensive after years of rampant price increases, as NAR report said, “there is still a lack of adequate inventory on the lower-priced points and too many in upper-priced points.”

The market, if allowed to do its job, will fix that problem by bringing prices down across the board. And ever so gradually, averaged out across the country – with prices still soaring in some markets but falling in others – this is starting to happen.

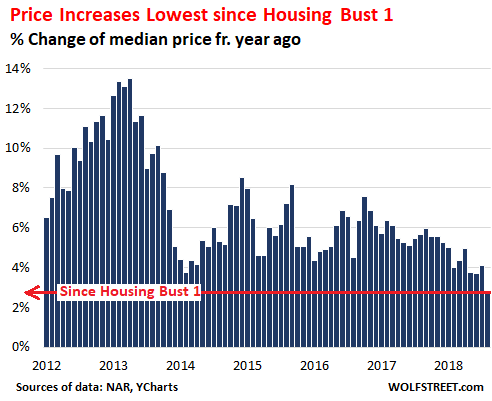

Across the US, the median sales price – meaning that half of the homes sold for more and half sold for less — sill rose 2.9% year-over-year to $253,600, but it was the lowest growth rate since the price declines in early 2012:

The median price in December was down 7.4% from June. June is usually the seasonal price peak in a given year. But the June-December decline in 2018 was the steepest since 2013. In 2017, the June-December decline was just 2.1%.

Median home prices by region:

- Northeast: rose 8.2% year-over-year, to $283,400.

- Midwest: flat year-over-year, at $191,300.

- South: rose 2.5% year-over-year, to $224,300.

- West: essentially flat (+0.2%) year-over-year, at $374,400.

The regional and national averages reflect everything mixed together. Prices are still rising sharply in some local housing markets. And they’re declining in others. These national numbers have begun to deteriorate because more local markets have begun to deteriorate. But it’s just a slow deterioration from what in many cities were very tight markets with ludicrously inflated prices.

Housing markets move slowly and normally play out over years. Big sudden moves even in local markets are rare. On a national basis, Housing Bust 1 took over five years to play out and was helped along by over 10 million job losses and a banking system that was teetering on the brink.

This housing downturn moved into the scene in 2018, a year when the economy was strong and created 2.6 million jobs. This downturn has been triggered by sky-high prices and rising mortgage rates, not by a recession or job losses. Those events – unavoidable as part of the business cycle – are still waiting in the wings.

With Seattle’s economy still strong, the housing downturn isn’t caused by layoffs and defaulting mortgages. The fabulous bubble has run out of steam on its own. Read… Housing Bubble Trouble in the Seattle-Bellevue Metro

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Winter on the west coast has been rougher than usual, more rain, cold, mudslides. I have a friend in NoCal who wants to sell her house, but may not be able, it seems the new pot laws have caused a drop in prices and houses in her area are sitting empty. The pot farmers moved out. Now large corporate farms are starting up, money moves from individuals to corporations. Unintended consequences.

Pretty vague to just say NoCal.

Can you provide more details?

rural, but you know this area was the hub of illegal growing and most of THEM voted against legalization, for economic reasons.

This is a really interesting comment.

Were the pot farmers owners or renters? Down here on The Other West Coast we have Miami pot growers coming over and renting houses for growing — the only way they get caught is when the electric bills are too high for the size of the property. The owners are mostly still in Dade County and never seem to know that their rental was being used as a grow house…

It would have to be a very small grow to not exceed house needs.

In cold climes (best for indoor) electric heat is a good cover.

You heat with wood or gas but tell co you use electric.

The veg cycle is 18 hr. Any other than hobby grow is 3 bulbs @ 1000 watts each.

Don’t know how you ‘d cover this in Miami but then I’m not familiar with AC costs.

Hypothetically, find someone to rent out solar panels for the back yard, to supplement the normal level of metered electricity.

LED lighting to the rescue.

https://grist.org/living/can-you-grow-pot-with-led-lights/

You are allowed to grow your own pot, but it’s limited to X number of plants.

For some reason pot and pot products are still expensive as hell so there’s still a thriving black market.

The feeling here in NorCal is that the big tobacco companies want to get into the pot trade.

What baffles me is, it seems to be legal to grow your own tobacco, but no one seems to do that any more. Why not? The stuff’s more addictive and it’s expensive, too.

In Oregon, currently you have to own to get a permit to grow.. So some of the vacancies are renters who can no longer get permits and others are people who came here from somewhere else, bought on time and then had no plan to survive w/o the pot income.. Pot prices crashed here. Best remedy for high prices is high prices.. There were just to many trying to make a killing and most all got killed themselves. All but those who stayed in the black market.. And even those took big hits.

And same here, lots of properties for sale.. But then again, there really is little income other than a few wineries and pot. Majority of real income here is transfer payments.. i.e. retirement.

No, you use air cooled lights in the basement and exhaust the heat into the house air ducts in winter with a temperature sensor on a relay.

Source: tier 2 Oregon indoor grower.

“Winter on the west coast has been rougher than usual, more rain, cold, mudslides.”

Not in California. Precipitation in California has been right around normal; some parts a little high, others a bit low. Not unusually cold either. And in any case December closings would have been deals inked prior to the arrival of winter.

Hear hear. We got some rain in San Jose, but I’m not finding myself wearing my knit cap day and night so it’s not *that* cold.

Seeing this is music to my ears for sure…the bigger question is if this will eventually lead to a major crash coming soon. California, especially in SoCal/NorCal can use some major price correction for sure. I am sure if all the Chinese investors start pulling out their money from the market, it will be a pretty decent size catalyst to get this party started.

These numbers mean it’s just about time to queue up another round of US softwood tariffs on Canadian lumber producers as US lumber suppliers begin to feel the squeeze from falling housing starts as the housing price decline continues.

From Global News: “The Trump administration’s tariffs on Canadian softwood lumber are pushing up the cost of wood, claims the U.S.-based National Association of Home Builders (NAHB), adding approximately USD $9,000 to the cost of single-family homes in the United States.”

When a reliable and robust supplier is punished to protect a less efficient and moribund domestic industry the consumer always suffers. So much for Free Trade, Softwood Lumber Agreements, and newer Trade Agreements as this dispute continues to wind through the WTO rulings and further litigation.

Meanwhile, Canadian firms continue to buy up US sawmills in order to process their wood in the States and avoid tariffs. Crazy. The US sawmill industry has gone from two Canadian foreign owned sawmills to over forty, with numbers climbing. Of course any profits flow north as Canadian logs/lumber still supplies 30% of the US housing market.

A $9,000 lumber tariff surcharge on a new home doesn’t sound like much, but add to that increased prices of rebar, structural steel, appliances, and it all adds on to rising mortgage costs. These cost increases are all financed at ever increasing rates.

regards

Lets not forget that on top of higher mortgage rates the tax incentive for owning a home was also shot to hell. Possibly for the best but people had to think the combination would impact overpriced markets.

Anyway there are simply multiple factors that have made the overall carrying cost higher month to month at the same sale price.

You do realize that the tax benefits are not gone forever at all. It all sunsets in 2025. Not that long in a lifetime. SALT Goes right back to the way it was after that. Unless you think the liberal crazies will never get back the WH.

“Waiting in the wings”. Not for long!

All fundamentals point to a recession already here. It’s arrival occurred last Summer, most probably in the month of August.

Currently there are so many ‘Black Swans’ circling, that all it will take is for one to land and push the global economy into a full blown recession, or worse, a depression. Which will most likely occur.

Only this time around it will start out in the short term as a deflationary depression as in “The Great Depression”, ending in a deeper inflationary depression. Which means the occurrence of a hyper-inflationary event.

The “Big Reset” will then be set in motion, or, major war.

Although I know “Prediction” should be avoided for our health in Financial decisions, we can all fantasize and “anticipate”. My “anticipation” would be that FED will defend your deflation with “what ever it takes, you hear me?” and the FED will find another Volcker to survive themselves if “hyper inflation” happens. There will be up and downs but it will be on FED terms, NOT market terms. Yes, the FED and the market are “interwined” now. Those who says “Mr. Market” will eventually take out “Mr. FED chair” need to revisit that conclusion.

Debt will be inflated away, everybody and every corporation will be zombified, you are NOT dead but you are NOT alive either. There is NO reset, no clean up, no restart. It will be like a chronicle disease, eating you and corrupting you and zombifying US of A like Japan.

A kind of synthetically stimulated boredom, clockwork chaos that makes sense if you don’t try to figure it out, where the answer is free as long as you empty the question of meaning. All that would be missing would be signboards everywhere that say “You are in bliss so stfu”.

Lovely.

It is hard to inflate debt away when it is increasing faster than inflation!

The Military ‘Industrious’ CONgressional Complex inflates away it’s debt with impunity !

So why can’t the rest of us poor mopes do the same ??

Answer : Because we can’t have nice things … that work !

I consider myself have average IQ. I know the Ph.Ds hired by the FED and treasury can out game and out math me one by one and they have an army with super computers. With the power they have to manipulate money, you think they can NOT somehow transfer the actual burden onto your shoulders? You think they can NOT inflate or using what ever other means to off load that debt into you and they are cornered? No matter how difficult for us to imagine they can NOT get out of it, in the end, You will NOT be able to pay bills, they will.

“Debt will be inflated away”

Where did this notion come from? And just how does that work, care to explain?

In its simplest form. I eat your bread and tell you I owe you 1$ and promise to pay you back 10year later. 10 year later, I give you 1$. But the same bread costs 10$.

Everybody’ W2 is 10X more. TAX revenue is 10X more. Even the 10$ bread’s sales TAX can cover the 1$ debt promised 10 years ago.

In another word, debt as a number does NOT change but the same number means different things.

You don’t care about the number, you care about the bread.

JZ — your analogy to support the notion that debt can be “inflated” away assumes a couple of things that are highly unlikey: that TAX revenues will be 10x more and wages 10x more as well. Say what?? That will NOT be the case so your idea of debt being “inflated” away makes no sense. Why would you presume wages are going up consistent with price inflation? There would be absolutely no reason to assume this – especially considering how little they’ve gone up over the past 15 years.

@Lisa, Motel 6 is called Motel “6” because it WAS 6$ per night. Now it is 60$ per night. So please don’t @me and saying 10X won’t happen. Please study the inflation period from 1969 to 1984, domestic US, not Zimbabwe , Weimar or recent Venezuela. I do NOT think it was X10, but something like X3 in 15 years.

Above said, I am just reasoning in a simplistic way. You can argue with all the assumptions but the principle of the idea that the .GOV will borrow 1 bread and repay half bread under the name of borrowing 1$ and repay 1$ with interest is sound. Or does NOT fast in plain sight. It will happen like pernicious disease rotting you away from inside and disguised under all kinds of situations like war and conflict with other nations so that you are NOT paying attention to their stealing.

Back to the forecast of deflation followed by inflation and then reset. Great depression style deflation is possible. Hyper inflation with 10 thousand $ gold is possible. Muddling through with debt gradually inflated away is possible. Muddling through with debt staying there zombie japan style is possible.

I do NOT know the answer to how it goes. Let’s just see and react, no prediction needed. What I do know 100% is that “they” .gov will be able to pay the bills but “we” he sheeple will NOT.

JZ’s explanation is largely accurate. Inflation makes each $1 worth less in terms of real goods. For a more detailed explanation: https://www.ft.com/content/08d3c7b1-4c23-3058-9ad8-6f2cc5dea319

Countries inflating their way out of debt has occurred many times. As a result many things are now “indexed to inflation”. For example, Social Security payments increase each year by the inflation rate. That keeps recipients from getting “poorer” year after year.

A side effect of all these “inflation indexed” payments is that the US cannot inflate it’s way out of debt. The majority of the US debt payments ( starting with Social Security ) will increase at the same rate as inflation.

In JZ’s example – the $1 that is owed inflates to $10 along with everything else.

@JZ

Yes they will do all that. 250 bps on the short end won’t do much this time around. They can ramp up the QE again and destroy what’s left of the long term bond market. (It’s not much either) They will have to let Congress grant them permission to buy equities outright to reinflate the equity market the following decade. Then it’s welcome to Japan for the next 20 years of lackluster growth and productivity. The fruits of abuse and misuse of monetary policy. As a bonus we will have persistent negative interest rates. Thanks FED.

Two distinctly different inflations

Common currency inflation is purely a pricing event.

Hyper-inflation is a monetary event, as people lose confidence in a particular currency and its perceived value goes to zero.

“All fundamentals point to a recession already here. It’s arrival occurred last Summer, most probably in the month of August.”

Can you expand on this thought?

NotBuying –

Sorry for not answering sooner. Been away from the net.

There are so many indicators to chose from. Where to start?

I have picked a few for you listed below.

There has been a major long term trend change, in all four asset categories happening concurrently. Highly unusual.

SPX peaked at the end of August 2018

Smart Money Flow Index (weekly) has crashed during 2018, now at the lows of 2008

Suggest you watch a video titled “A sea change in market momentum” by Michael Oliver listed on you tube.

http://www.youtube.com/watch?v=1l0gN9-iDZk

If this is gonna happen will it just hurry up already.

No, a recession did not start last summer. GDP is still growing as are corporate earnings, plus employment is still very robust. A recession is most likely coming but it’s probably about 9-12 months out at this point.

@MP

How much of the increase in GDP and corporate earnings can be attributed to the changes in the tax code?

What percentage of “employed” are Uber drivers ? Or others in the gig economy, or employed by fake unicorn companies whose funding will soon dry up? Or underemployed? Or not filing for unemployment? Or sleeping in tents under freeway overpasses?

The numbers just don’t add up – in the picture I’m looking at.

I think you’re confusing cause and effect.

Whether we are in a recession or not is the only question that was being asked, not why we might or not might be in a recession.

Are ‘corporate earnings’ growing – or is it just EPS growth via buybacks?

Not the same thing at all.

Revenues and absolute earnings are up as well.

Sorry, but the numbers simply do not support indicating us having entered a recession last summer.

Also, if we entered a recession that far back, by now we should be seeing some effect on employment, which we are not.

In the big picture again though, I also believe there will be a recession – it’s just that to claim that one already started in the summer is not supported by most measures.

There won’t be a ‘recession’ – there will be the implosion of the biggest debt bubble the world has ever seen…

All IMHO, naturally. DYOR.

Kind of on an obtuse angle on housing. House = Asset and all assets are in a bubble with way to much promised repayment vs the reality of earned incomes. Those in charge who pushed forward so much demand via cheap credit have such a poor understanding of the bigger picture. They now own much of this debt themselves either directly or indirectly. I am sure they have no real concern for the consequences for the average person when this pile of steaming compost catches on fire.

I have been reading and listening about the Davos conferencees. For the most part, I am staying with my assessment that most of these people are Marie Antoinettes. They are so disconnected to the majority of us that there is no way that they could possibly do anything other than what they do. They are takers and not givers. They talk about environment yet there are over 150 private jets there. For them it is all about them and they will do nothing to make the world a better place unless it makes them even wealthier.. It is the epitome of the Hunger Games..

The media ran “real estate crash” stories frequently in the 4th quarter. These stories did suppress the market. However, it will not last. When buyers with cold feet see that prices did not drop, they will be back in with both feet.

Let’s revisit this in six months.

Let’s add some skin in the game. How about you two bet some numbers within 6 months. Each give Wolf 100$, who ever wins receive 180$ and Wolf take 20$ administering fee?

Wolf,

I got impression those sales figures were for existing homes. Any difference in the new home sales.

Sincerely,

J. Bigelow

New home sales come from the Commerce Department, and the Commerce Department is shut down, and no figures have emerged since the shutdown. This is part of what I have been lamenting: we’re starting to fly with our eyes partially closed.

Wolf,

I love the site, I love your commentary but enough with the end of the world crap. PLUNGED! PLUMMETED, EXPLODED! I’m supposed to slit my wrists?

All these dramatic adjectives. 5.5 to 5.3 to 4.9?

Isn’t a correction in order at some point without taking up Prozac with my Jack Daniels?

Let me know when it gets to 2 million homes (still positive) sold and I’m diggin the plunged hype.

All the best,

KMOUT

verbs.

KMOUT,

On second thought, I don’t remember explaining in this article how the beginning of a housing downturn would lead to the “end of the world,” as you said so elegantly. Where did you get the idea that a housing downturn leads to the end of the world? It might lead to a recession, but recessions are a normal part of a business cycle. And if the housing downturn spreads over many years, as I expect it will, rather than all at once, people will get used to the idea that a home is an expense, not an investment. The Japanese have figured this out some time ago. That’s all.

Wolf – this is what my dear old neighbors in Costa Mesa, who could tell me all about how Southern California was *before* WWII, always said. You don’t make money in real estate. At best a house is a forced savings plan if you downscale when you retire.

What is the alternative, be a lifetime renter or settle in to a government sponsored ghetto? We all know the economy is cyclical, prices go up and down so show me a point in history when prices went down and stayed down. Only when fools rush in and buy at peak prices and are then forced to sell are they hurt. As an investor and landlord however, I hope your prediction is correct because SFR’s will “plummet” and rents will skyrocket.

From what I have heard over the years is that the older crowd prepping for retirement plan on using their homes as a retirement fund. No savings due to keeping up with the Jones’ or wage stagnation, or health problems. Which ever excuse is needed to justify the decision.

To these homeowners a downturn of any kind will destroy their retirement, I find it to be horrible retirement planning but I am not one of the people scared of a downturn either.

I am running out of popcorn watching this play out though, it has been such a slow burn. Maybe this shutdown or Brexit will speed this process up.

My experience, as a neighbor of Mountain View, CA, of Silicon Valley, is that MV construction has added additional units of higher-density housing (ie. condos and apartments), which increased supply to meet demand. However, construction takes time, so when it’s another depressed cycle, projects are still being completed, and the market has continued additional supply when demand is lower.

Meanwhile, neighboring city Palo Alto has a pro-growth city council, which doesn’t realize that Mountain View is next door. They’re slowly getting their way, and I’m sure once they do, we’ll be in the middle of another housing glut.

According to Zillow estimate, my home in Union City CA is now worth less than I paid for it 14 months ago, is losing value to the tune of over $1000 per day, and at this rate will be worth nothing by the middle of 2021. That looks pretty ugly to me.

Remember one of my two dicta: “Nothing goes to hell in a straight line.”

For a house, “hell” is not zero. “Hell” means lower than it was but way above zero ;-]

I’m eagerly awaiting the same in the Sacramento, CA house my new foreign-investor landlord just bought (paying double the previous price). He’s saying he’s going to raise the rent another $300 because he can, and when I’m arguing with him about it he just shrugs and says: “shupply and deemand…”

Needless to say I’m moving if he does.

Excellent comments. As you point out these are the good times. We’re still adding jobs and home sales are rolling over under the weight of UNaffordability. What will the professional economists say when we do actually enter an official recession? Oh, wait, economists never forecast a recession. :)

Not true – economists always forecast a recession. It’s just that they have only been accurate 2 of the last 20 times – and both times by looking backwards! :)

Do commercial and multifamily housing #s track w/the single family housing #s?

I own a small mobile home park that I’m considering putting on the market & I’m wondering about the trends 4 multifamily.

I haven’t seen the #s but from driving around the Tampa Bay area I am not seeing any kind of slowdown.Lots of land is still being cleared so there seems to be large amounts of all kinds of construction in the pipeline here.

I have a good friend in the Sierras who’s ready to put her house on the market. She’s worried it won’t sell – not because of the market (though that’s a concern), but because it’s getting harder and more and more expensive to get fire insurance.

Her house is right in the thick timber. She’s done lots of fire prevention (cutting down nearby trees, raking up needles, etc.) but it would still go in a big fire. Every time they have a fire out there, her insurance goes up and up.

Well Wolf, I hate to break it to you but all this insightful analysis of the market is nothing compare to this…I guess it’s nothing to worry about and business as usual, brought to you by BofA :)

https://www.yahoo.com/finance/news/bofa-says-don-apos-t-172147754.html

They see “challenges” and not a “collapse.” I don’t see a “collapse” either.

The housing industry (new housing) is already in a bear market in California which is one reason existing is over-priced and vacant property never caught up to 2008 valuations. So if you consider those three metrics housing is really over valued on one account. This assumes high density and residential are not the same thing, or you add a fourth metric.

Looks like the first ever successful Fed-engineered “soft landing” is actually happening.

Its not the decent that will harm you. Its the sudden stop!

The “soft landing” attempt, is just that. An attempt.

https://www.wsj.com/articles/no-pay-stub-no-problem-unconventional-mortgages-make-a-comeback-11548239400

Can’t read the whole article (pay wall) but how pervasive is this?

There has to be more to the story. Otherwise, how does a nursing student who works part time afford a $610,000 mortgage?

Prices in the Bay Area do not look like they have budged a bit. $1.5 million still doesn’t get you much in most nice areas. Stock market is still up big since Trump and there is no sense of panic from what I can tell.

Prices need to drop 25% but how long will that shit take?

I noticed and completely appreciated your “if allowed to do its job” qualification in the write-up.

One wonders if the market will get that allowance, or if there will be some kind of need – since “the next election” always draws nigh, and a certain class of politicians views every market move against aggrieved constituents as “market failure” requiring massive government intervention to “fix” a non-existent problem … and assure a real one in the future.

“Debt will be inflated away”

This is not really true. The reason being is that during inflation period products that you use and need everyday are going up in price. So you will have to make a choice buy food for the family or pay that mortgage payment. In inflationary environment prices for nessecities go up in price but not your pay. If hyperinflation ever happen in America it will be quick 3-6 months, you won’t have time to pay off your debt. After you default on your payments the bank will reissue your new debt with the new currency after the reset.

P.S. Government debt will be inflated away but not personal debts.