But it wasn’t the central bank that pricked the bubble; its interest rate is at a record low!

The relentlessness of the housing busts in the regions of Sydney and Melbourne – they account for about 55% of Australia’s housing stock by value – is quite something. At some point, it seems, the price declines would slow down at least for a little while, or even perform a quick bounce, before falling again. But no. The downward momentum is picking up.

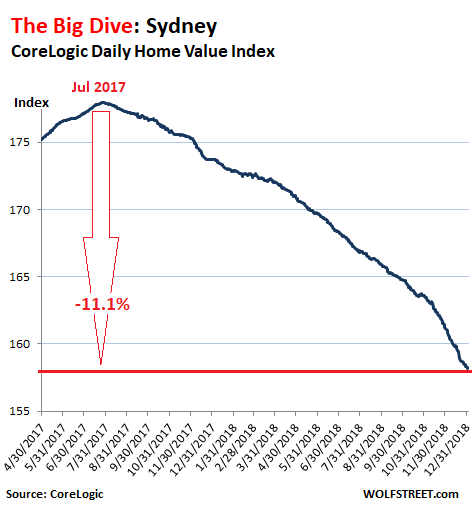

For Sydney, according to CoreLogic’s Daily Home Value Index, prices dropped 1.8% in December from November, in just one month! The index is now down 11.1% from its peak in July last year:

In the calendar year 2018 in Sydney, the prices of all types of dwellings fell 8.9%, with prices of single-family houses down 10.0%, and prices of condos (“units”) down 6.3%. These declines pushed the index back to its level of August 2016.

Prices of more expensive homes are falling faster: Prices in the upper quartile of the market fell 10.0%; prices in the lower quartile of the market fell 6.8%.

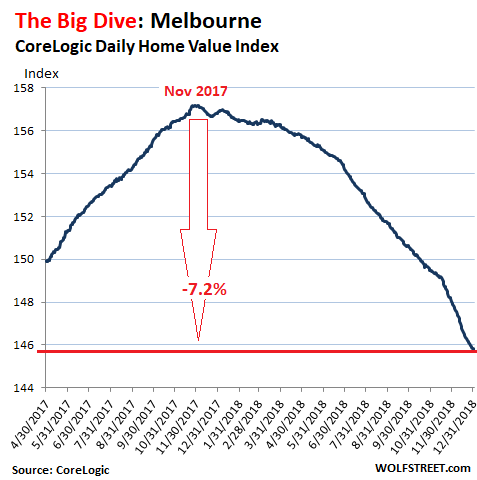

In Melbourne, the second largest market in Australia, the housing bust lags Sydney’s bust by about four months. According to the CoreLogic Daily Home Value Index, since the peak in November 2017, prices of all types of dwellings fell 7.2%, which pushed prices back to February 2017 levels:

In the calendar year 2018, Melbourne’s prices of all types of dwellings fell 7.0%, with single-family houses down 9.2% — having plunged nearly 2% in just the month of December — and “unit” prices down 2.3%.

High-priced homes are on the chopping block: Prices in the most expensive quartile of the market dropped 11.2%; prices in the bottom quartile inched up 0.5%.

In the other capital cities in the year 2018: The housing bust pushed prices back to 2007 levels in Darwin and to 2009 levels in Perth, while prices gained in the remainder:

- Brisbane, Queensland: +0.2%

- Adelaide, South Australia: +1.3%

- Perth, Western Australia: -4.7%; which pushed prices back to levels last seen in March 2009. After peaking in 2014, prices were then felled by the mining bust.

- Darwin, Northern Territory: -1.5%; this pushed prices back to levels last seen in October 2007, after having peaked in 2014.

- Canberra, Australian Capital Territory: +3.3%

- Hobart, Tasmania: +8.7%; but that pace is down from double-digit year-over-year gains earlier in 2018.

CoreLogic’s national home price index is down 5.2% from its October 2017 peak. Head of research Tim Lawless said in the report that this is a broad weakening in market that goes “well beyond the correction in Sydney and Melbourne.”

The increasingly steep price declines in Sydney and Melbourne can be blamed on the confluence of factors:

Prices are too darn high: After years of steamy price gains, unaffordability for many potential buyers who’d actually live in the homes they’d buy reached crisis levels.

The construction boom is dousing the market with record new supply.

Exposure of the banks’ mortgage shenanigans, first in the media and eventually by the Royal Commission investigation, is putting a damper on said shenanigans, thus crimping mortgage lending.

Generally tighter credit availability, according to CoreLogic’s report:

Interest-only lending has tracked well below the recently discarded 30% limit, credit growth for investment purposes is virtually flat-lining and owner occupier credit growth slowed sharply over the second half of the year. Lenders are generally seeking out larger deposits from borrowers and have become much more forensic in detailing borrower expense profiles and servicing capacity.

“Lenders are understandably risk averse against a backdrop of falling dwelling values, high household debt, rising supply and heightened regulatory focus following the banking royal commission,” said CoreLogic’s Lawless.

Consumer sentiment has soured on real estate, not surprisingly, given the well-publicized drop in prices, after the years of you-cannot-lose-money-in-real-estate hype. CoreLogic cites the Westpac/Melbourne Institute Consumer Sentiment survey which showed that measures of housing sentiment were “pessimistic.”

Chinese investors got cold feet, after seeing prices drop. CoreLogic explained that “the substantial reduction in foreign buyer activity” and “a reduction in overseas migration” were among the factors “dragging market conditions down even further over the year.” And this in a housing market that has become desperately dependent on both – as many locals can no longer afford to buy at these prices.

Interestingly, all this is occurring as mortgage interest rates remain near historic lows, and as the policy rate (cash rate) of the Reserve Bank of Australia remains at its all-time low of 1.5%, where it has been since the last rate cut in August 2016. In other words, it’s not the central bank that has pricked this bubble.

In Seattle, house prices dropped 4.4% in four months, the biggest four-month drop since Housing Bust 1, according to the Case-Shiller Home Price Index. Prices also deflated in the San Francisco Bay Area, San Diego, Denver, and Portland. Read… The Most Splendid Housing Bubbles in America Decline

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Looks like Australia has run out of greater fools. What are the chances of banks failing? It will be Australia’s turn to mark assets to fantasy. Voila no more insolvencies. The unscruplous politicians, banksters and central banksters are at the ready to make the hapless tax-payet bend over.

Yeah what makes that a tad bit politically harder in aus right now is that thr banksters have just been put through a publicly aired grilling into all their “shenanigans”. That’s quite a lead up to “lets now give them support to bail them out”.

Further more, the labour party is set to win the next election, the liberal national party in govt has just had a year of scandal after scandal and a knifing of their leader that the country has not gotten over. Labour govt petitionrd hard for the banking royal commission and arent likely to go easy on bankers. For them to do a 180 now on this is also tricky.

I am not saying impossible, but the bail outs will need to be far more covert than what has been on public display in other countries.

The liberal nat party on the other hand are distracted by the voter base that it is losing in droves to the One Nation party, lets call this party the equivalent of your Trump voter base. They want the immigration tap turned off. It is actually hard to disagree with this at this point as the excess immigration is ruining the environment here. I actually mean the natural enviroment. The massive immigration program is only there to support big corporates like the building industry that is so reliant on the immigration program, crush loading the roads, medicare and suppressing wages of the population. Classic privatise profits and publicilse the losess model with a debt ponzi to boot.

Coming to the big corporates, is what is currently also playing out is one of the recent high rise developments in Sydney by one of the big developers and builders. One of their high rises that only opened doors a few months ago, has now had cracks appear and large cracking sounds that forced an evacuation on christmas eve. At first they said it was isolated to the 10th floor and let everyone back in and said it was not structural. Over the period to nye, new cracks have appeared on other floors now and everyone has been evacuated again.

Now theres definitively sentiment growing for a building royal commission.

Again, the bailouts will happen but it will as usual be coming too late because Aus is in no mood to extend an olive branch to the FIRE industry right now. So this will drag and only come to be when we are dragged kicking and screaming with a busted economy.

No bailouts.

One “solution” we can do without is socialism.

Let the market work. Let companies that are broke, go bankrupt.

No socialism. It is a failed economic model.

I say this as an Australian of course.

We do not want any “bailouts” of miscreants and criminals. NONE.

Deeply ironic comment given that just about all of Australia’s economic prosperity of the last 20 years has been due to the growth of a country which has a communist dictatorship, and is the largest, centralized command-and-control economy the world has ever seen – it even has Stalinist 5-year plans, and announces what growth figures are to be a year before they happen…

Excellent summary thanks. I know a family in Sydney. Husband, wife and two adult kids, all don’t do much jobe wise, brag about owning three maybe four houses. What do you think is going to happen to them and people like them in this downturn?

Bail-ins are the new bail outs.

https://theconversation.com/bail-ins-are-the-new-bail-outs-but-they-wont-save-banking-15826

On February 14 2018, the Federal Parliament passed the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Bill 2017, which gives the Australian Prudential Regulation Authority (APRA) extraordinary powers during a financial crisis, including the possibility to confiscate deposits in order to rescue collapsing banks (“bail-in”)

http://cecaust.com.au/main.asp?sub=bail-in&id=bail-in2017.html

Martin North has been covering the ** possibility ** of bank bail-ins recent legislation extensively over at Digital Finance Analytics blog, see this link for all posts tagged with bail-in: https://digitalfinanceanalytics.com/blog/tag/bail-in/

Labor’s backing of the Banking Royal CommisSion was purely political theatre. They will back the bank bailout , the banks are still their masters, who , after all sold the PeOple’s bank off to them and floated the Ozzy dollar , financilising the Australian economy for the 1% to skim their billions? LABOR.

Run out?!? That’s hard to believe, Kpl. We’re “fool rich” down here!

If your country’s not having a house price crash it’s likely turning Japanese.

If it is having a house price crash, it’ll likely be turning Japanese later. In the long run we’re all turning Japanese.

That’s my view. It’s based on the level of private debt and the premise that banks don’t simply act as intermediaries between savers and borrowers. That loans create deposits, not deposits enable loans. That loans create deposits is not in and of itself bad, it depends how it’s used. If loans are mostly for houses, and few for production, then it’s indistinguishable from a Ponzi scheme. A Ponzi run by the government and and funded by the tax payer[1].

[1] For instance, by the government running Help to Buy schemes (in reality, help to sell at the same time as help to pump).

Canada borrowed it’s Phoenix payroll solution from Australia and we know how that worked out for civil servants…..the interest rate item in Canada appears to be twinned with the US with just enough variation to make the voting public and consumers think we still are a separate sovereign nation.

Sovereignty is a dieing attribute around the world as the UN and similar world bodies offer to assist nations in return for control of those countries boarder policy.

would love to see the full analysis of how much of the bank funding is due to RE asset prices and how much they rely on wholesale funding. Could there be a perfect storm where the banks are getting their foreign funding pulled as their mortgage assets take massive write-offs and the RBA has to jack up rates, causing further pain? Can’t help but feel that many things might coincide to make this particularly nasty within 2-4 years.

Housing Market downturns can become positive feedback loops where the decrease in prices discourages people from purchasing because they believe they will see a cheaper price in the future, and the sellers get scared of the downward acceleration and bail to avoid worse losses. House prices are very sticky early in a housing downturn but cut loose when the momentum gets going. Coming to a neighborhood near you.

I agree completely, but you didn’t mention that the costs of property are far stickier than the prices.

My experience is that when in the USA the properties tanked (50% and more) the taxes and fees took years to decline and never got back to the newly determined market value of the property.

That is a big consideration for buying depressed property and will accelerate the loss of buying pressure.

There will be other stresses on the Australian housing market in 2019.

Many loans have been interest only and this year become principal and interest loans.

A lot of loans are sourced in US dollars and as the Australian dollar falls in value will cost more in local currency to pay back.

US and inter bank interest rates are rising.

I’m forecasting a dip in retail and coupled with the housing downturn will see unemployment rise and confidence drain.

Another blow to confidence has been the Opal Tower.

https://www.smh.com.au/topic/opal-tower-outrage-1mj9

This year sees many political issues come to a head and I believe an election.

China is slowing.

And there is the rest of the world’s geopolitical macroeconomic picture.

Not good.

China consumer slowing just took down AAPL.

AAPL slowing down production in China??

– (Australian) Property expert Edwin Almeida discusses the Opal tower failure with Martin North. and Almeida comes up with A LOT OF reasons why building in Australia has been (a bit) “shoddy”.

http://digitalfinanceanalytics.com/blog/sick-buildings-the-latest-from-our-property-insider-edwin-almeida/

Wow, that’s a long ride down should it collapse. I’d ask for my money back.

The cash rate has been at 1.5% for years, but the yield curve went wonky over the last month.

http://www.worldgovernmentbonds.com/country/australia/

Contagion from the US?

Chinese investors might be fleeing because they see a hostile government that is only 2nd behind the USA in attacking and seeming to want a war with China. In this modern world where trade sanctions can be imposed on a government’s whim, its not really wise to have your money invested in a land governed by a increasingly hostile government.

” In this modern world where trade sanctions can be imposed on a government’s whim, its not really wise to have your money invested in a land governed by a increasingly hostile government.”

Yep. I don’t understand why any US corporation has assets in China

Good, it has taken a long time for the media to start telling the facts about China which is the largest criminal enterprise on earth, criminal from the top to the bottom. Huge losses for all those invested in Australian real estate over the last twenty years is what is needed to normalise our economy to the point that young Australians can afford to buy a home. This meltdown will hopefully put one more nail in the coffin of the globalisation of Australian assets.

It seems the common denominator in price falls is China. Things are slowing and credit is tightening there and that is affecting commodities, stocks and real estate globally. Potentially China could finally have its ‘moment’ of financial panic like Japan before them. And where all those hyped up stories of them taking over the world leadership gets put in the trasch can. Awaiting China’s lost decades.

I’m sure that all your readers know that the last move in interest rates by three of the four big banks here was actually an INCREASE in variable mortgage rates for existing customers………

The variable mortgage rate and the RBA discount rate have disconnected from about the time of the GFC.

Since the GFC the spread between the RBA discount rate and variable mortgage rates has expanded by about 250 – 275 basis points.

Banks here in Australia have managed to do that by:

1. Increasing rates by more than when the RBA increased rates.

2. Cut rates by less than when the RBA cut rates.

3. Out of cycle rates increases (As shown by the last increase.)

Pull up a chart of the big four banks’ share prices and you see something interesting – a huge bull market in the share prices that started as soon as they started jacking up the rates on these types of loans.

After Apples dismal report this evening on iPhone sales collapsing in China it appaears China’s day of reckoning has arrived.

Hot off the press:

https://wolfstreet.com/2019/01/02/iphone-sales-croak-china-particularly-bad-apple-warns-shares-plunge/

People dont understand the difference between capital and income any more, and banks play upon that.

All well and good for a bank to say that you can draw against the increased equity in your property, but if you’re not planning on selling it, you’ve just effectively given yourself a big ongoing long term pay cut.

It’s getting worse fast when half built apartment buildings go bust in Sydney using non bank funding!

Wolf are you able to summarize from the AFR report below?

https://www.afr.com/real-estate/lainson-holdings-halfbuilt-apartment-project-goes-under-administration-20181221-h19dso

You can probably get around the paywall by googling:

lainson holdings half-built apartment project under administration

https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=2ahUKEwjQms6M79jfAhXWc3AKHd7TAjgQFjABegQIJRAB&url=https%3A%2F%2Fwww.afr.com%2Freal-estate%2Flainson-holdings-halfbuilt-apartment-project-goes-under-administration-20181221-h19dso&usg=AOvVaw12430YjTGTpgEGfAMX0OME

It’s interesting to see that the Australian treasurer, (finance minister), is jaw-boning the banks to ease up on their very sensible and long overdue new-found prudence in lending. This line or persuasion is being reinforced by a cheer squad in the usual places, which regrettably includes Australia’s major financial newspaper, “The Australian Financial Review”.

In this, the treasurer and cheer squad have the appearance of requesting a resumption of irresponsible lending practices disclosed by the Royal Commission into the banking industry. Kicking the can, at least until the election in May, looks to be the urgent imperative of the Treasurer. Let the Labor Party, (expected to defeat the government), take the blame for as much of the necessary real estate price falls as possible.

It’s most unedifying.

Really?

Is questioning a person about how many take out lunches they have a week or if they have a streaming movie account ‘sensible’ lending practice or is it overkill?

Maybe the banks shouldn’t lend money to anybody for the purchase of a house as there is no certainty that the person borrowing the money will keep the job they have or the current income they have over the life of the loan either.

Are the banks questioned in that detail when they borrow money in the markets? I doubt it.

So banks are now going from one ‘extreme’ to another. Supposedly they lent out hundreds of billions of dollars ‘irresponsibly’ to fund RE purchases. Funny how over the past ten years that all those hundreds of billions of dollars of loans had few defaults!!!

Now they are implement the exact recipe that will result in a disaster for both the banks themselves and the country as well: restricting credit to such an extent that the needed credit to maintain a functioning economy will dry up.

And as usual once the Labor Party gets into office no doubt that they will also add to the disaster by coming up with some ridiculous new laws and of course more taxes across the entire economy which will make Australia an even higher cost country in which to do business.

Interest rates in Australia for borrowers never fell to the low levels in other countries despite having a very low central bank discount rate here. All that profit from the low interest rates in the economy accrued to the big four banks.

I have no doubt that RE prices in many places in Australia are falling and will continue to fall. Prices in some places (Sydney) are ridiculous and have been ridiculous for decades even before the latest price increases.

Other areas have increasing or stable prices. Does that mean that banks should turn off the flow of credit to the entire economy?

They’re not turning off credit, they are simply following the rules that have been in place but not followed for 10 yrs.

This then let partly to an unnatural increase in house prices that could not be sustained, and loans that had very little margin for error, although many hoped it could be……

40% of interest only loans in a system just so it gets by is not healthy either !

It’s interesting viewing on that appartment being evacuated. As some one said, a relatively newly finished building meaning virtually “new” owners/occupiers.

As the occupants were pouring out of the condemened building, the “demographic” on our TV screens was overwhelmingly Asian.

Is 10% fall really a “bust” considering that prices have gone up more than 200% in the past 15 years in major cities?

It’s not the end of the bust, but the beginning.

The drops have been very tiny.

Vancouver or as locals call it Hongcouver, the drops have been tragic, with no stopping it seems. Sure it rains 25 days out of 30, but folks from China love it there.

Rates are at record lows…”It’s not the central bank that pricked this bubble”

It was the judiciary.

Their cracking down on fruadulent mortgages can only be undone by the government legalising mortgage fraud. Until that happens the market will have to adjust to banks unwillingness to lend, for legal reasons.

…

It was a bubble, but “bubble” is a flawed metaphor. As bubbles grows they weaken, they become more vulnerable.

As market manias grow they gain strength. Higher prices prove the validity of higher prices. They very rarely end due to a prick. They have to be smashed as they are strongest at the peak.

‘Their cracking down on fruadulent mortgages can only be undone by the government legalising mortgage fraud ‘ ….. exactly what our govt treasurer is advocating now !

Personally, I’m luv’in it. I told my rich, but dipshit brother-in-law not to buy a year ago, and gave him an exhaustive explanation as to why. What did he do? Went right ahead and bought some hideous MacMansion in the Sydney exo-burbs. But then he’s Asia-Pacific sales manager and I’m a no, nothing ESL teacher.

The fact that he can barely form a sentence, let alone a coherent one, and that he counts pro-wrestling as his primary pastime perfectly sums-up this oxygen thief. That dunderheads like him can rise so effortlessly up the corporate ladder speaks volumes about the health (or lack thereof) of modern, multinational capitalism.

Corporate politics doesn’t reward intelligence, it rewards aggression and vacuous confidence.

Thank you for this article, most everyone else has no idea Australia exists.

i would welcome most grateful if you were to write about our banking sector every now & then, it will be the only reality we will hear about them from anyone …

A Royal Commission is seen as a White Wash by most Australians.

The look of doing something when you are actually doing nothing but squandering Taxpayer Monies.

I just moved to Melbourne and it’s a joke. The owner paid A$1.5M for this place and I pay A$600/w in rent. So 2% gross yield PA. After fees, insurance, period vacant, repairs, rates… probably 1.5% net yield.

Doesn’t make sense.