Ugly long-term charts that Wall Street doesn’t want us to see. And now US stocks are infected too.

How well does a buy-and-hold strategy work in the stock market over the long term – as measured in years and decades? In the largest markets around the world, it has crushed investors. There are two exceptions: the US and India. And the US is infected too.

The Everything Bubble in the US, a period of nearly 10 years when just about all asset classes have skyrocketed, was perhaps the most magnificent bubble the world as ever seen. But it peaked in 2018 and has since given up some of its gains to the wailing and gnashing of teeth on Wall Street. So it behooves us to see how this has turned out in the other major markets, and how it might turn out in the US.

The results and charts below exclude the effects of dividends, which would have increased returns or rather lessened the losses; and they exclude the impact of inflation which would have decreased “real” returns and increased “real” losses.

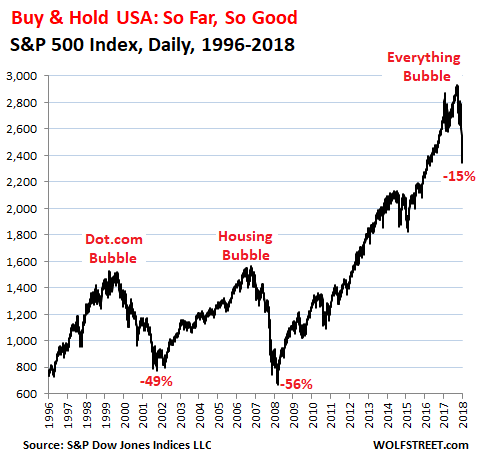

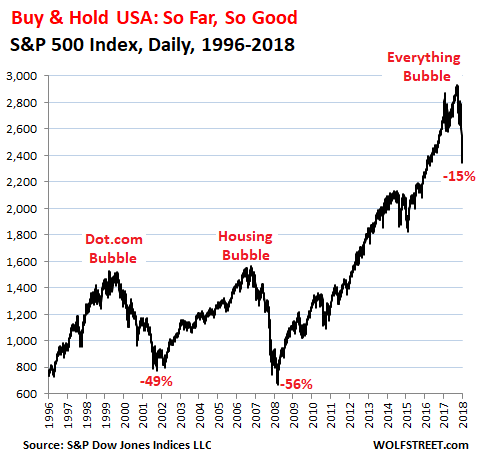

Buy & Hold in the USA: So far, so good.

The S&P 500 fell 6.2% in 2018, its first annual decline in a decade. The swoon came in the last three months, with the index falling 14.8% from the peak at the end of September.

Buy-and-hold results: If you bought an index fund at the dot.com peak in March 2000, and held it until today, you would have made 64% in 19 years.

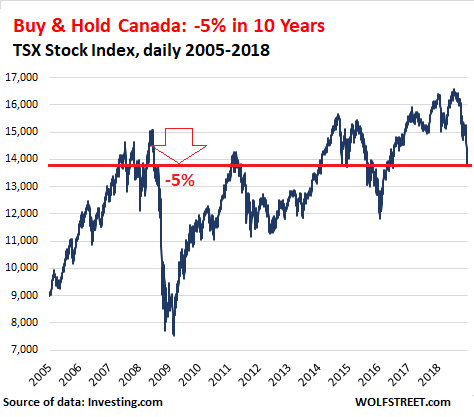

Buy & Hold in Canada, been a drag.

The Canadian stock index TSX fell 11.6% in 2018. It has moved sharply up and down for an entire decade to end up 5% below where it had been in June 2008:

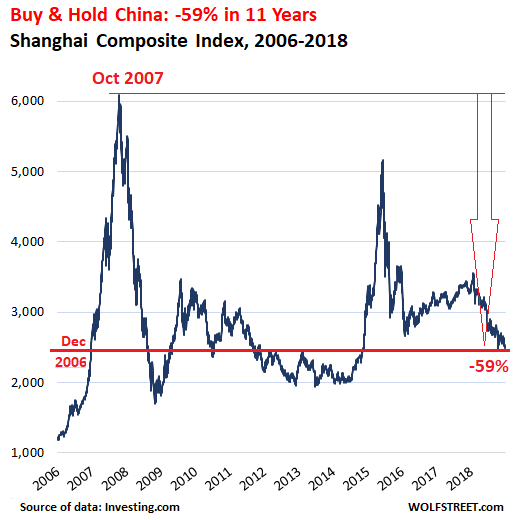

Buy & Hold in China, oh my!

Buy-and-hold did a magic job in China. The Shanghai Composite Index dropped 24.6% in 2018, closing the year at 2,494. That’s quite an accomplishment. The index is down 52% from its last bubble-peak on June 12, 2015, and down 59% from its all-time bubble-peak in October 2007. It’s now back where it had first been in December 2006.

Here’s the magnificent double-bubble and the destruction it has wreaked on buy-and-hold investors. Note that the index would have to skyrocket by 150% just to get back to where it had been at the peak in 2007:

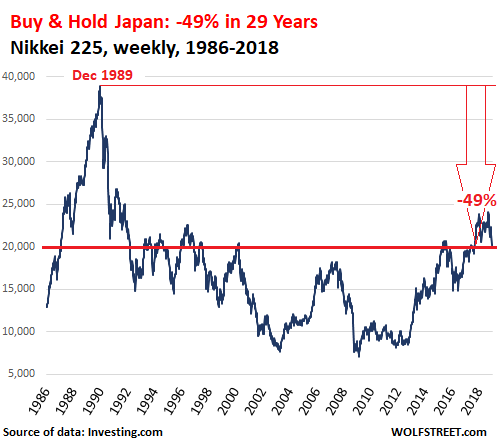

Buy & Hold in Japan, 3 decades of destruction

The Japanese stock market is the modern record-breaker in terms of buy & hold destruction: It’s already measured in decades, and it’s still going on.

The Nikkei 225 dropped 12.1% to 20,015 in 2018 and is down 18% from its 52-week high. But the historical high of the Nikkei was 38,951 in December 1989. The index is still down 49% from that peak nearly three decades ago, and is back where it had first been in February 1987, 31 years ago when many people working in finance today hadn’t even been born.

Over the past 20 years, Japan had relatively little inflation, and so the soothing veil, finely woven out of the methodical destruction of the purchasing power of the currency, has not been thrown over the index. To get back to its peak in 1989, the index would have to soar 95%:

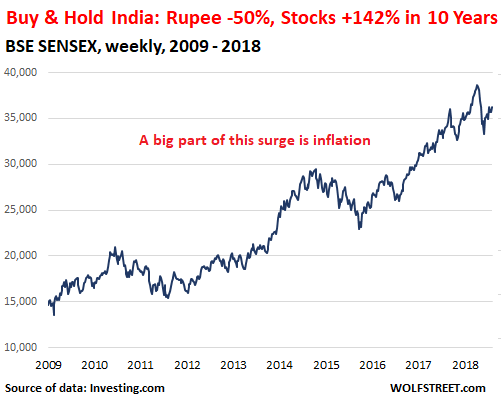

Buy & Hold in India, it gets complicated:

The other large stock market in Asia is India. This market falls into the category of markets whose results are obscured by sharp inflation and declines in the currency. At the extreme end of this category is Venezuela. Its stocks have experienced exponential price increases, as has toilet paper. When a stock market is denominated in a currency that quickly loses its purchasing power, the index says more about inflation than about stocks.

The Indian rupee has dropped nearly 50% against the USD since November 2009, largely driven by inflation (the consumer price index in India has soared 80% over the period). At the same time, the BSE Sensex stock index has risen 153%. Due to the loss of purchasing power of the rupee over the period, a big part of the stock index’s move is an expression of the devaluation of the currency. Even then, buy & hold has worked so far:

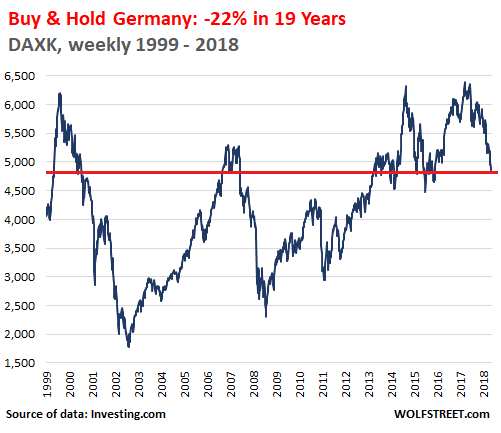

Buy & Hold in Germany, hope got gutted

The German DAX is a total-return index that includes dividends. So it is not comparable to the S&P 500 Index or any of the other indices we discuss here. So I use the DAXK index, which tracks prices-only levels (same as the S&P 500). It fell 20.6% this year and is down 24.5% from the 52-week high in January 2018. And it is down about 22% from its peak in March 2000, almost 19 years ago:

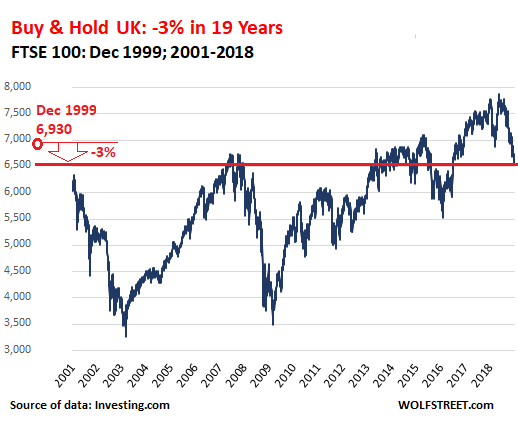

Buy & Hold in the UK, almost back to 1999

The UK’s FTSE 100 stock index reached an all-time closing high on May 22, 2018 of 7,877. But then it dropped 14.6% to close the year at 6,728. This is 3% below the peak of 6,930 in December 1999.

My data source for this, Investing.com, only offers FTSE 100 data through 2001. In the chart below, I added the high of December 1999:

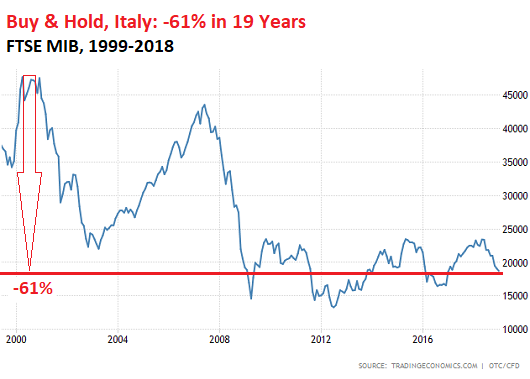

Buy & Hold in Italy: crushed, crushed, crushed

The Italian FTSE MIB stock index dropped 16.1% in 2018 to close the year at 18,324. This was down 58% from May 2007, the peak of Italy’s euro bubble. The index is still down a breath-taking 61% from the peak of the dot.com bubble in March 2000.

Note that for the index to go back to where it had been in May 2007, it would have to skyrocket by 160%. So good luck with that in the near future (chart via Trading Economics):

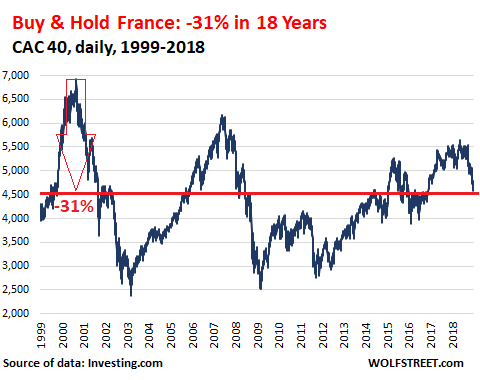

Buy & Hold in France, c’est la vie

The CAC 40 index fell 11% to 4,731 in 2018. The index is now down 22% from its euro-bubble-peak in 2007 and down 31% from the dot.com bubble-peak in September 2000:

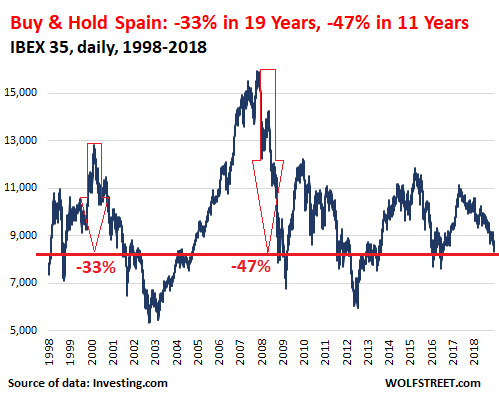

Buy & Hold in Spain, ouch!

The market in Spain is a tad too small to fit into this lineup, but since we report on Spain a lot, here it is. The stock market bubble in the dot.com era was magnificent enough, and the IBEX 35 index surged to 12,667, before crashing 58%. But then came Spain’s even more fabulous housing bubble, one of the craziest in the world, fired up by the euro bubble that other Eurozone countries also experienced. It pulled stocks with it, and the IBEX soared to 16,000 by December 2007.

It too collapsed, along with housing and banks, dragging the housing-dependent economy into a tailspin. These dynamics played a big role in the subsequent euro debt crisis. The Ibex eventually dropped 63% from the peak in 2007 to 5,956 in July 2012, before bouncing somewhat. At the end of 2018, the IBEX closed at 8,539, a level the index had first achieved in February 1998. It is now down 33% from the dot.com peak in 2000 and down 47% from the peak in December 2007:

So in all but two of the largest stock markets in the world has the buy-and-hold strategy destroyed investors. So what we have learned on a global basis is this rule:

“Buy and hold works very well, as long you buy low and hold till the peak and then sell.”

With this in mind, let’s take another look at the same S&P 500 chart. This bubble-peak has outdone other bubble-peaks depicted in the above charts. And now comes the long-term aftermath of the Everything Bubble. Let’s imagine for a moment where we are in the downdraft and how long it might take to get back to the peak of September 2018, given what we have seen in Canada, China, Japan, Germany, the UK, France, Spain, and Italy:

Corporate debt, after years of encouragement by the Fed via artificially low interest rates, has reached historic levels. Now even the Fed is worried about its handiwork. Many of these companies will default over the next few years. This is a cleansing process that is part of the business cycle – only this time, it’s so much larger. Here I discuss “How the Corporate Debt Bubble Will Crush Stocks”… THE WOLF STREET REPORT

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The US has had the most shareholder friendly fiscal policies of any large country. But this came at a cost , much greater inequality of income.

In the coming years, many companies which have either incurred a great deal of debt or are projected to run negative cash flows in the future will either not survive or will decline substantially in price. The FAANG era is over

“The FAANG era is over.”

It appears so and that is a positive sign for the future.

One can only hope

Over the last 5 yrs, the DJIA has appreciated 50%. My small company has limited choice for 401k options. 2 of the “recommended” ones for my age group, ABALX and AAGTX have earned 0 return over the last 5 years, based on dollar cost averaging over that time. So, during one of the better bull stretches in history, I have earned 0 return in my 401k. Any dividends during that time have been offset by the fees of the fund.

One of the problems of working for a small company is that their retirement benefits are often lousy. I would not put any more into the plan (through payroll deduction) than is required to receive the company match. All too often, small employers are hit with high fees by plan sponsors who manage their retirement plans and the employers pass these on to their employees. In addition, many employees don’t have a clue about the fees they are paying.

In my company I eschewed any managed crud and made it all a SEP IRA for all. I warned all about the front and back loaded funds and gave them my pretty good advice on what to go with from what I was seeing.

I told them about the coming collapse from the RE bubble and then told them to BTFD once the FED zirped out, and gave them the reasons.

All doubted me and none really got on board. It was a waste of my time showing them what was a lengthy explanation for Dummies. I was free to give individual explanations at most any time. -No takers.

Market success over time is measured in Compound Annual Growth Rate (CAGR). In USA since 2000 CAGR is only 3% for S&P. Dividends roughly equal inflation. Most people must subtract fund costs and advisory fees, leaving almost no return at all. Buy and hold is not successful in USA despite the article.

Oh I think Wall Street knows perfectly well that the scheme will not work. They were even the ones financing the “academic research” that allowed for the immense marketing in favor of the buy and hold.

With the end result of giant assets under permanent “management” (often hidden indexing) generating billions of $ in fees.

But in the end the experiment has never proven to work unless you live long enough to whether any brutal bear market.

I won’t even mention inflation which is notably underestimated drastically in the actuarial calculations.

I won’t mention either that even at the recent peak of this giant bubble a large number of public and private pension funds (who rely on the strategy, while the managers are paid large salaries doing absolutely nothing, all in the name of fiduciary liability) were already largely insolvent.

It’ll be an interesting real life experiment for the boomers.

Do others agree with Carlito on this point? Have we been bamboozled by the investment advisor industry? (I wouldn’t doubt it.) Carlito, do you have inside information or are you just speculating? I read Ben Stein’s book “Yes, you can time the market”, and I’ve since wondered whether buy and hold is really the right strategy. I had ignored my 401K performance for many years – I was following instructions to just hold – and was dismayed to see that the percentage increase over 15 years was paltry. I’m not sure what the answer is because market timing is harder than it looks.

A 401k has another big issue: fees. Some are disclosed up front, others are disclosed in the footnotes of the documents, and others are not disclosed, and you can find out only by calling a number in the documents. These are layers of fees… It’s very tough to get to the bottom of it. A few years ago, I spent a long time trying to dig though the 401k offered by my wife’s employer. It was an ING product. There were ING mutual funds to choose from. By the time I got through, I had identified 7% in fees per year, layered into this thing in bits and pieces. ING will simply eat your retirement.

There are other 401k plans that are far superior and have low fees. But small employers and their employees are sitting ducks for outfits like ING.

Wolf, going back to your contention that the Fed funded the banks with only the $15 trillion in loans, you omitted the trillions of dollars in Fed asset purchases, without which the TBTF banks would have tanked. As far as your contention that the Fed gets audited yearly, please explain why Sanders/Ron Paul and Bloomberg went to court to have the Fed audited, and then explain this:

“SENATE DEMOCRATS blocked a vote Tuesday on legislation from Sen. Rand Paul, R-Ky., that would have required an audit and greater transparency on monetary policy-making from the Federal Reserve, the powerful central banking system that sets interest rates and manages the money supply.

The bill won near-unanimous Republican support and votes from Sen. Tammy Baldwin, D-Wis., and Vermont independent Sen. Bernie Sanders, who is seeking the Democratic presidential nomination, but fell short of the 60 votes needed for consideration.

Measures to audit the Fed have met mixed success since the 2008 economic crisis. The House passed similar measures in 2012 and 2014 and the Government Accountability Office gained some oversight powers and performed an audit pursuant to the 2010 Dodd-Frank financial reform act.”

One strategy for sussing out stealthy 401K fees is to invest in funds with obvious matching benchmarks. Check your account values each period (biweekly, monthly, quarterly etc) against the benchmarks. If your funds consistently underperform, you’re getting robbed. Note that you don’t want to look at the companies’ charts, you want to look at the actual price and account-value data in your statements.

Of course, the fund companies will reshuffle their deck of fund offerings in order to disguise the turds.

When you change jobs, you can roll 401K money out of the old 401K and into a self-directed IRA (at a more reputable institution), and choose your own investments from a much wider set of options. But this takes effort.

Thanks Wolf,

I will get this printed out for my employees to study or toss.

This is the most powerful set of charts and comment that I have seen anywhere.

Fees can eat up gains. To be successful investing you must avoid large downturns. Since 2000 S&P has a compound annual growth rate of only 3% due to loss years. Impossible to guess when to be in or out. I favor tactical managers who use algorithms to be in or out of market based on momentum. We got out into short term treasuries Late Nov 2018, missing the worst Dec on record. Same guys called dot com and great recession. Since 2000 they have been out about 20% of the time, closely matching the bear markets. Avg return, net of fees, is over 12%

Getting out when the ETF/fund goes below the 200-day moving average absolutely works. Especially in retirement funds, where you have fewer tax issues.

https://www.advisorperspectives.com/dshort/updates/2019/01/01/moving-averages-december-month-end-update

So if one cannot rely on buy and hold to work in the long haul even when extended to the entire world market cap for entire decades (so not just USA), what can a typical investor do? Just succumb to the idea that they’ll eventually lose all their money, either because of market forces (if kept in the stock market) or because inflation (if kept in cash-like securities)?

The recent divergence in the performance of US equities, versus the rest of the world is unprecedented in history.

This has never occurred before.

In 2017 the DOW was either up or down by 1% or more just 8 times.

In 2018 this has happened 64 times! Volatility has returned big time.

Most indices point to an imminent recession occurring, if not already here.

I’m conflicted for many individuals their 401k is their biggest asset (whether they know it or not). This massive deflation will, of course, eat away at their wealth. However, interest rates rising allows the average citizen to at least beat inflation and take back some wealth. I guess we should all just invest in pogs?

Having assets and incomes diminish in a deflationary down turn will be bad enough but there is a possibility that we will have a StagFlationary depression where prices do not fall yet incomes and wealth are destroyed.

Wolf is right as usual. For the future of the US stock market, just remember that song by that English band “The Vapors”..

I’m turning Japanese

I think I’m turning Japanese

I really think so

Turning Japanese

I think I’m turning Japanese

I really think so

(apologies to David Fenton)

This is what should happen and hopefully will happen after they lockup all the crooks and criminals who manipulated the U.S. stock market to heights that shouldn’t have been seen for the next century.

I agree. Same mistakes, same reckless greed, same rampant gambling and speculation, same hubris = same result.

“Turning Japanese” is even more appropriate than you may realize: apparently the expression refers to j–king off (sorry, but I remember an article when the song was new) — which is what the investment houses have been doing to us retail investors, and what we’ll be doing to ourselves if we buy and hold without paying attention to Wolf’s charts. Waste of precious resources, if you will.

Happy New Year Wolf and thanks for sharing your critical thinking with the world. I really appreciate you. So few appear to be able to think any more. Way to many just following along with the cognitive dissonance that is so prevalent in our world.

I am hoping you are correct that the unwind will not be rapid and violent yet history seems to not favor that.

So with a bubble in everything, what are folks putting their nest egg into? I have a mix of stocks, bonds, precious metals, and cash like instruments. But I worry with a bubble in everything. I got taken to the woodshed in 2000 and 2008. At my age now, I need to preserve capital.

I have the same concern about what to invest in. I am in 90% short term treasuries

and the balance in stock etfs.

I fear for my country.

I’m 40, and although I’ve been in mostly stocks since my retirement saving started in earnest at 26, I just moved about 90% into US Treasuries in October. I just can’t feel bad about that. Even if I’m just keeping pace with inflation for a year or two or three… I can live with it. I wanted to get out of stocks in previous bubbles but never had the guts – or to be more accurate, I was disuaded by my financial advisor. We’ll see what happens. For now, I sleep well at night.

I’ve studied “the markets” extensively and ultimately concluded that the best investment one can make is to sleep well at night.

Same as these guys. Over the pleas of my “investment advisor,” I went to 95% cash right after Thanksgiving. I can sit for a year or two to see how things shake out, and like Marcus I sleep well.

As I have said before on this, in my company it was all done to credit 11%-15% of their gross pay to their preferred account.

I did not allow the pitch men in to slag them with fees. I was always around to answer their questions and throw in what I thought was going on. I warned about the dot.com bubble and why it would puke.

Bob Brinker was pretty accurate for a while in 1999-2000 and I could see his point, so I passed that along for popular consumption.

My sources of import were on the old Kitco.com board when they had some fine financial analysts posting there.

What an education from 1997-2007!

In 2002 advised that the FED was signalling that they were to blow up the money supply after the bust and that gold should perform well.

blah blah blah.

There was a lot of money to be made in the wrecks and in precious metals.

You can lead a horse to water but you can’t make him drink.

LT listen (or re-listen) to the December 16 WOLF STREET REPORT.

Been reading (and now listening to) WS for about 1.5 years and Wolf does not often (once that I can recall, on 12/16) spell out in no uncertain terms what you should do…

Believe he said that for a while, making a little return in Treasuries beats losing a lot in stocks / bonds…Or something like that. I need to re-listen too.

Nice charts, goes to show you have to be a good trader!

Then these charts are fun as riding a roller coaster hehehe.

Wouldn’t want it any other way.

Great service!!

Wow. A Must read article and a must share with friends and family. Thank you.

regarding: “Buy-and-hold results: If you bought an index fund at the dot.com peak in March 2000, and held it until today, you would have made 64% in 19 years.”

I have often commented on this Site about buying property. You have to live somewhere, so I believed renting was a waste of money provided a mortgage payment was in the same ball park as rent, and the eventual goal was to pay off the home.

Buy and hold results for my homes. Bought a home with a mortgage payment comparable to rent at age 33. (My second home…first one purchased at age 24). I held #2 for 18 years and it appreciated 500% over that time. The house was paid for at the time of sale. Traded in a portion of equity on a rural home needing work. I have held this home for the last 15 years, invested $50,000 in materials and the same amount in sweat equity (labour value) for additional renovation value. In 15 years the increase in home value has been 300% plus it allowed further land purchases. In today’s market it would cost $2,000/month to rent our home so it is reasonable to add this saving to a required income stream. You have to live somewhere, anyway. Not having rent to pay is the same as a huge pay raise.

I have also bought long term stock holdings for retirement planning. It deferred income taxes at the time of purchase and promised a retirement return for a later date. I haven’t crunched the numbers because it pisses me off. I might have made 30% in 20 years…maybe. But as I presently draw down the fund I now have to pay taxes on the money. A home sale in Canada (primary residence) is tax free. Which strategy was a better investment strategy is a no brainer.

I know quite a few people who have made their fortune buying homes, fixing them up and selling at market peaks, taking the ‘tax free’ gains to rinse and repeat. Some branch out into rentals using the rental income to pay for the mortgage, then move in for 1 year to give it primary residence status for another tax free sale when it makes sense to do so.

I am thankful I bought very little stock in my working life. My son is now paying off his first home and is also putting money into an RRSP as his company pays him an extra $7.00/hour specifically for that purpose. I will recommend he use that asset as a borrowing platform for additional property purchase in the next RE downturn.

When my doughter bought a home I advised them to buy 2 acres just outside of a city and put a modular home on it. Build something, later. Instead, they bought a townhouse that needed work, renovated it, then used their equity at time of sale to buy a house on a large lot. They are currently resisting the trend to trade up and go granite and should have their modest home paid off by age 50. This will allow them to retire early.

As far as I am concerned the Stock Market is over hyped and a waste of time unless you can manipulate it or have inside information to trade on. Since a Larry Lunchbucket like myself can do neither, it is best to give it a wide berth. I’m glad I did.

@Paulo – Real estate investors need to do their due diligence. I have heard too many good stories but not everyone talks about the marginal or bad home buying stores.

I own two houses. One I live in and one I rent. The one I live was 4 years old when I bought it 19 years ago. Typical suburban 2400 sqft with 4 bedrooms, 2 1/2 baths and a 2 car garage. It is in a great subdivision with a very highly rated school system (probably one of the top 5 in the state) and houses sell very fast. This house has appreciated 50% in these 18 years or 2.1% annually. I purchased the house in Nov 1999, which was also about peak dot.com. Thus as a comparison, if I would have bought the SP500 instead of the house I would be only have a ROI of 22%. So the house was a better deal but not great because even though it went up 50%, I also had to replace a roof, windows, driveway, carpet, mow the yard, etc. I would say maintenance has been about equals 25% of the gains. Thus 45k maintenance bill and a 90k of house appreciation. So the home I live in has been an okay investment. You have to live somewhere.

Also I have a rental I bought in 2002. Of course it appreciated about 20% going into 2008 but in 2010, it dropped below 2002 prices by 15%. Just this year the price of the rental house has risen above my 2002 purchase prices. I would say about 5% over the purchase price. This house is in a lower income neighborhood but it has a decent yearly cash flow. The Rental house has only appreciated 5% in 16 years. If I would have bought the SPY in 2002, my 16 year ROI would be 115%. My total 16 year ROI from the cash flow of the rental is probably 80-90%.

FYI….I live in the Midwest, which unlike the coasts, has plenty of land and little housing appreciation. Thus in the Midwest, one would have been better off dollar cost averaging investing with the stock market month after month.

Paulo and ru82, how do you you make out on return when you factor in property taxes and insurance (not to mention interest)?

I’m not questioning your logic — but I’ve run numbers where I live. (Supposedly) because we don’t have state or local income tax, our property taxes are disproportionately high (although probably no worse than the blue states, which have all three).

Thanks for your input.

Hi Clete. I am getting about 5% CAP rate after property taxes, insurance, and management fees. Nothing to write home about. …but the house will never go bankrupt like a stock could.

I only paid $60k for this rental house and I am charging $650 a month rent. LOL…I have never raised the rent in 16 years…because the house has not appreciated. Property tax runs about 85 a month and insurance is about 60, management fee is 50. The good thing is property tax has not gone up during the past 16 years and the insurance has gone up maybe 50. So I clear about $450 a month but if a water heater breaks…etc. That will eat up 2 months of profit.

FYI…The house price rose to 80k in 2008 (Bank of America told me that when I refinanced) and dropped to $45k in 2012 based on compatibles and zillow.

Why is China gains flat for 12 years. Crazy when a country grows at 7% to 9 % GDP during that time period while the U.S. only GDP growth was so much lower (2% to 3% avg) yet the SP500 gains 100%.

What “the market returned” is not what you get.

The market went up over 10% a year from 1985 to 2015, but the average investor made just 3.66 % in this period.

There are taxes and fees inside funds.

I would like to see net return numbers, for example, for three different tax brackets.

Demographics, demographics, demographics.

Countries with inverted population pyramids, especially once the immigrant population is excluded, fare pretty bad, because stock prices are still a function of buyers/sellers. Japan, Italy, Germany,

Immigrants neen housing too, Merkels open door policy lead to an empty housing market in Germany.

Buy & Hold. Someone I once knew, who started life as a Wall Street chalky, bought silver (buying/selling gold prohibited then) for cents and held (didn’t trust Banksters/Elites). But later sold at multiples as required to finance a very comfortable life indeed.

But, ‘gold is just gold’ and I guess, ‘silver is just silver’ just as ‘money is what we decide it is’.

Let me check my retirement account…. Oooops! And it’s gone!

I have a number of SoCal beach close fixers with back yards that I have bought and held. The returns are astounding. They say never to put all of your eggs in one basket. But, I did and it paid off.

The only serious problem I am now facing is decades of neglect. I am spending a lot of time and money going through them one by one.

However, I feel much better about these than investments in the market. For years, I was a PM at three of the largest buy side firms on the street and they frowned on any equity investments so I leaned into houses. Needless to say they did me a favor. Everytime I see a study concluding equity investments are superior to housing, I laugh since I am retired in my 40s.

I mean, yeah, if you are discounting dividends…And it is not equivalent to then exclude inflation, because inflation eats away at all asset classes.

Also, “Buy and Hold” isn’t only an investment strategy for broad index funds. If you buy into a well-run company you understand and believe in, and is reasonably priced, preferably with a stable and secure dividend, why wouldn’t you buy into it and enhance your positions when prices get cheaper? Lower prices in the near- to medium-term also mean DRIPping gets you more bang for the buck and a compounding yield.

This.

I am starting to buy right now after being 80% cash for over 5 years. I couldn’t bring myself to pay nosebleed prices.

There are finally some good companies at decent prices with good dividend growth. I want an income stream from dividends alone so that I never have to sell under duress. Buy and hold works if you have a plan and do some research.

I don’t see any buys out there. Are you buying early at the start of a down market? A recession will take everything down farther.

I see at least a dozen good companies with low debt and fair value.

‘Fair value’ is a meaningless concept in a world saturated with debt, wherein people live chronically beyond their means (ie their ‘prosperity’ is illusory) and companies borrow to buy back their own stock

You’re just ‘putting it on red’ basically; good luck with that.

How about buy and hold for gold ?does it work

Absolutely. If you’re 17.

Oddly enough, Gold has crushed the S&P500 over the time frame Wolf charted above (2000 peak to 2018 peak or year-end). Gold including transaction and carrying costs has also outperformed the stock market including dividends. Gold was at a long-term low in 2000 so it had a valuation tailwind over this period.

Meanwhile, a low-cost total bond market index fund has done almost as well as stocks (peak to peak) over this same 18-year period, but with much lower drawdowns. The latest drop in stocks has brought them back to parity with bonds.

Funny thing about gold.

In pre-2000 when the Y2-K nuts were buying 1/10 gold eagles at an 18% premium to spot, they all seemed to dump them in 2000 when the whirld didn’t collapse.

I bought 2000 of them at spot with free delivery. 28.50 each.

Now, if I still had them, they are 128.80 spot plus 15%. Of course they were up to 192.00 at the peak of the bubble plus ten percent, but as they say, “you can’t time the market”.

A couple points from my side. Premise: I’m a huge supporter of Long -Term Investing.

Nice analysis, but missing the dividends component in a study on long term equity returns is a very big mistake. You may be surprised to see how much of the total return of an equity investment may be due to dividends. It would be like saying that bonds never give you a return, because prices at the end ends up at 100, the nominal value.

Also, the sample is biased. From late 90’s to today we had two HUGE crisis..we may have forgotten it, but in 2008 the financial world was about to come to an end. Add Europe 2011 sovereign debt turmoils, and several Emerging woes, and you may contextualise the poor equity performance (again, poor in capital appreciation, you would still have earned the dividends).

Finally, I don’t see why Wall Street, which is undoubtedly the biggest seller of active funds and trading and brokerage services may be hiding that long term investing does not work. They would be very (very) happy to market this headline. The fees they earn on ETFs/passive funds is really meagre compared to active funds/trading commissions.

Honestly, I think that for retail investors and poor risk takers (thus, many institutional) long term investing is key to an increased financial well being. By looking at the online trading platform data, is clear that the more you trade, the more harm you do yourself.

Long Term Investing and a careful tax management are the best solution for 95% of the people.

Bob, here’s a thought to add to your thought:

The average yield from corporate bonds is normally quite a bit higher than the stock market’s average dividend yield. And unless the bond defaults, you get paid face value when the bond matures. And even if the bond defaults, unless it’s a junior unsecured bond, you’ll get a (big) portion of face value. But stocks routinely go to zero.

With stocks: if your principal goes down and you just make money from dividends, it’s as if you’re paying the dividend to yourself.

I like your premise, but dividends have a significant impact as you can see from your decision to select DAXK over DAX. So does inflation (although that would affect any alternative investment as well).

However, even taking dividends into account, I’ve seen several analyses showing the flaws of buy and hold over any <10 year period in the U.S. (e.g. Robert Shiller, Irrational Exuberance). It would be interesting to do the same for international markets with the same mwthodolgy.

Ok, I’m going to challange this article. Corporate debt will NOT crush the stock market. In fact, what we are going to see is a collapse in GOVERNMENT debt.

That is going to cause a rush of capital from the HUUUGGGEE govvie debt market into the comparatively tiny equity market.

This is a mere correction in equities. Corporate fundamentals matter not as much as the flow of capital. Talk of “trade” being everything (i.e. – Trump vs. China and BREXIT) is misplaced. (unless you are germany).

What matters is capital allocation.

The stock market is not beginning a bear market. This is a mere correction after eight years of non-stop bullish action.

MooMoo,

US government debt will never and cannot “collapse” because the Fed can and will buy unlimited amounts to keep it from collapsing. The US cannot go bankrupt for that very reason. That’s why credit risk (risk of default) is about zero for US Treasury securities.

The same applies to Japan, whose government is much more indebted than the US government.

However, inflation could surge and destroy the purchasing power of the dollar, and so the purchasing power of those Treasury securities, as well as the purchasing power of every other asset, including corporate bonds. And that is a risk, if the Fed starts propping up US government debt.

So if you’re waiting for the “collapse of US government debt,” you’ll be in for the wait of your lifetime. If you’re waiting for inflation, well, we already got it :-]

I made good bank in bonds since 2008 dividend and cap gains and expect the curve to modestly pay out again this year. Dividend income may be what becomes the gain in equities next decade? The 10/02 year interest rate spread will fix itself the first half of year as excess reserves become investment capital as banks bargain hunt? 2019 is shaping up as a hard year of a multi-year trend were creditors take less in “workouts”?

Buy and hold workd during bull markets. In bear markets obviously this is not a good choice. Look for a loong term dow/gold chart for clues where we are now.

There may be a turning point coming up; if so get out of stocks and into gold.

If one got into gold in 2000 or so the position is up three times and beats even the s&p.

The last years gold did not well, stocks were better. But hen it gets into timing and choosing the right asset class what is more difficult then buy and hold.

Gold? Come on man! 30 day paper popcorn and 18 pack ! (Vonny Quin)

Looks like Italian and Japanese investors were putting their capital into the U.S. instead of their local markets. Will this continue?

If others follow suit we might well get DOW 40K before THE top.

Time will tell…

But end up at DOW 5,000 or less. Known as winning the battle but losing the war. Fact is the U.S. stock market is about 4 to 6 times what it should be (presently) and going forward in time into the distant future more like 50 to 100 times what it should be right now.

You got that right T.

Got YEN!

agreed. Capital is abandoning Europe. Its flowing into US equities.

My system in down markets is to invest in things like debt reduction and small personal capital items that reduce my overall cost of living. Living inexpensively, but still nicely, puts you in a position of not having to worry about market returns.

I like to remind the “buy and hold no matter what” idiots that if they bought into the Nikkei in 89 they would STILL be underwater.

The standard argument I get back is “well you pick good companies that pay good dividends”. As if dividends are sacred and will always be paid out.

Buy and hold is not a sound long term strategy. It does get encouraged by every major financial news outlet though as if you get enough people to believe it, it will keep overpriced markets lofty and prevent true price discovery.

I’m just about to turn 40. I have watched a lot of market corrections and I try to remind myself to look at my gains every 7 years or so and lock them in (as much as possible)

I have most of my disposable income tied up in good quality rural land (note: not houses). Don’t expect it to make me rich but I also don’t expect it’s value to change violently in a short period of time.

What I do have in my 401k & Roth I rotated into stable vaule funds back in January and I’m still up %6 for the year.

Bull markets don’t last forever and IMHO it’s far better to miss a year’s worth of gains than get stuck with 6 months of losses. Also keep the Nikkei in the back of your mind as a friendly reminder that markets don’t always bounce back and time is valuable.

Thanks for all your wonderful articles wolf, happy New Year!

Shizz-

Interesting what you said about locking in gains. Recently had the same thoughts and for the first time since I started investing 15 years or so ago, I sold my gains off.

Now feels like I really have something, rather than a # on a screen. I can use this to pay down a substantial amount of my mortgage, re-do a kitchen and bath, etc. But the gain is real, as I will be able to feel it shortly.

Clearly you can see from all the charts the major U.S. stock market indexes have been rigged to the bull’s tits yet no one does any jail time or gets arrested for this mass market manipulation.

+1000

We live in a financial/criminal enterprise system. Buyer beware!

I’m a capitalist but do not believe in the criminality that has been exposed in our “financial system” without penalties. Any “fines” levied in too many cases have become just the routine of business costs.

Human society needs incentives to produce goods and services. It is a delicate balance between true incentives and descending into outright criminality when “things” get out of whack. They have been in this place for too many decades now and getting worse. We need to “wring” out the speculation and bring in true values. That went out when the rules of “mark to market” were trashed in 2009.

I did the math. If you want a better return with no effort, buy and sell at 200 day moving average or alternatively get out of the market when Shiller PE is at 90th percentile. You will be in the market 90% of the time and avoid the disasters.

Do you have a link that shows Shiller PE by percentile ? Haven’t come across that and makes sense.

Perhaps of interest.

https://dqydj.com/shiller-pe-cape-ratio-calculator/

Thanks. Came across this, which coincidentally was just updated today: https://www.advisorperspectives.com/dshort/updates/2019/01/02/is-the-stock-market-cheap

Haven’t examined it or the source with a fine toothed comb yet, so take with a grain of salt, but at first blush seems really useful.

I don’t try to time the market. I’ve had the same two mutual funds for decades: no-load, low management fee, both value-oriented. I let them determine when to take capital gains. Unless I had an immediate need for funds, I would sell all or portions of those investments only if I had lost faith in management. Both have worked out well for me.

As for my 401(k), the account management fee is 33 cents for every $1,000 invested, which is very reasonable.

Market volatility looks far more dramatic when you’re swimming among the waves. From a perspective of decades, perceived volatility is considerably lessened.

I agree. Buy in a bear market and hold for the long term. At least in the U.S. it has worked for 200 years.

I personally never hold more than 75% in stocks at any given point and never less than 20%.

Both the “buy and hold houses” and “buy and hold stocks” folks are going to be feeling pain in years to come.

“Buy in a bear market and hold for the long term. At least in the U.S. it has worked for 200 years.”

Past performance is not indicative of future returns.

You can readily estimate future expected returns, and they don’t support current prices in either housing or stocks.

See follow-up comment below.

Wolf, I generally agree with your bottom line that buy and hold primarily helps line the pockets if advisors and fund managers who get paid as a %of AUM. You must be disciplined and alter allocations based on irrational values. That said, the charts and examples seem to presuppose that the investor went all-in at each peak. While I’m sure this is true for some hapless souls, particularly the least informed money responding to bubble hype, but for the majority this would be highly unlikely just based on it being unlikely for anyone to have max investibale assets precisely timed with market tops. Wouldn’t the more accurate adage be never buy at the peak? As an example, if investors bought at say even 75% of the top and held how would they have done? Or similarly allocated 50% to equities at the top and 25% at some point on the way up and down? Infinite possibilities, but you get what I’m saying. Just like starting this analysis from each market bottom would unfairly make everyone look like a genius.

I agree. Plus, a lot of the charts don’t go back far in time. If we looked at 40 or 50 years worth of data, for example, the picture might look different.

I’m having a problem with this statement, though:

“Wouldn’t the more accurate adage be never buy at the peak? ”

I think you have to be careful recommending actions when you already know the long-term trajectory. (In other words, it assumes one has a crystal ball at the time which, of course, one doesn’t.) So how is one to know when the peak is when even nobel laureates don’t know?

It seems to me that the best one can do is to buy stocks/funds when they appear to be *relatively* “on sale”. So even with Japan, if you bought when prices seemed to be at bargain prices (2002-2013) relative to past prices, you would have been ok today. Lots of people are able to do this with consumer goods – why can’t we do the same with assets?!

That’s the buy part which I think is easier than selling. At least two things make selling problematic:

1. Many people follow a “buy and hold” strategy when, in fact, they need the money in the fairly near term. I witnessed this among coworkers nearing retirement with the 2007 Great Recession, and they were pissed that they had to keep working an additional, say, 8 years, putting them in their 70’s.

2. When a stock or fund is doing incredibly well, we humans have a hard time giving it up and being content with the gains we’ve made. Greed gets the better of us, and we can end up missing out on a reasonable amount of profit. Maybe others can recommend how you deal with this problem.

Agreed. My adage was equally tongue in cheek, or at least aspirational, as Wolfs buy at the bottom sell at the top, since no one can do either. On a pragmatic basis I think you can alter allocations or get more conservative when valuations are very high or bull markets very aged. Never going to get it exact, but could save some powder for when things reverse.

The other buy and hold propaganda is pointing to people like Buffett who spurn cash. That’s great but BH has near limitless access to cheap capital to utilize during a downturn to bring down their cost basis, whereas the retail investor is usually at his most illiquid. That is where I agree with Wolf that it’s at least worth trying to take some off the table at the most stretched valuations/times even knowing you could be getting out too soon.

Yes, if you time the entry point and the exit point successfully, things look a lot better, but then you’re doing market timing. This is why I wrote near the bottom of the article:

“So what we have learned on a global basis is this rule: “Buy and hold works very well, as long you buy low and hold till the peak and then sell.”

10-4 and no argument from me that blindly buying and holding is a fool’s errand. As is market timing, ironically making buying and holding that much more risky since you don’t know when you are going in during a peak. I just point out that it’s unlikely to look as bad in the real world as the examples you cited because those are worst case scenarios in accidentally entering at 100% at the worst possible times. I wonder what an even distribution of investments over the 6 month periods before and after a peak (12 months total) would look like over the subsequent 10, 20 year periods, opposed to the examples of buying all at the peak. Genuine question, not trying to poke holes in the conclusion to be a pedant, since not sure what alternatives there are to buying and holding if you can’t time the market (excluding dedicating a TON of time to identifying individual undervalued companies), other than $ cost averaging. Could also fade major deviation excesses from the historical mean valuations if you are a patient l-t investor willing to sit on cash.

Wolf- Your system does not let me respond in place to what you wrote to me…thereby cutting off the dialogue. I’ll respond here?

Who said I’m waiting for the US government to go bust? I’m talking about international capital flowing from countries that are in a near default stage, and private capital. Just because a government isn’t technically broke doesn’t mean that Government Paper maintains its value (the USA is probably in the best position in the world.)

Your response misses the point… I’m not “waiting for the US government to go broke”. I’m saying that private paper will no longer look to Government securities (including the USA) as a trustworthy place to park money to the same extent they have for the past 30 years. ZIRP is one reason… but instability is another. When people shy from government debt there is little place to run for big money… except equities. I don’t really think they are looking at property (lol) anymore. Your taking an “all or none” approach… I’m talking bout a mere 10% of the money that would usually go into gov debt finding its way into equities. That will cause the stock market to soar.

We are not at the end of the rally. You seem to think we are. I am challenging that.

And while the USA “cannot go broke” officially, history does not stop. In case you haven’t noticed, France is almost on the brink of a revolution.

WOLF,

p.s. – you mention inflation. Do you not think that inflation won;t make the stock market rise?

Take a look at Venezuela.. When capital runs from an inflating currency it parks in equities. That’s another reason this rally isn;t over.

MooMoo,

Asset price inflation has already made the stock market surge — along with other assets.

“Asset price inflation has already made the stock market surge — along with other assets.”

..while the US dollar rises! Have you got it yet? The US equity market is acting as a safe haven.

And while you think the US government can’t go broke (sure, and technically the Venezuelan government hasn’t either)… a surge in interest rates reflects a govt. debt market that few wish to hold.

The point is – Interest rates, at a 1,000 year low have hit bottom, at a time when government debt has exploded. A slight uptick in interest rates from a historic low means unservice-able debt which can be met with default or the printing press.

If my municipality turns out all the lights and fails to pick up the garbage while its bonds collapse and the govt. pensions are still paid, you say it hasn’t gone broke. I say it has. i.e. I say Illinois IS broke.

December 1989 Japan peak equivalent to December 2018 US/UK peak (plus many other neoliberal fanboy economies)?

IMO very much ‘yes’ because the same mistakes have been made by TPTB (because pandering to people’s greed is the easiest way to get and hold on to power – takes no planning and little oversight), and the respective bubbles are characterized by exactly the same type of rampant greed, gambling, speculation, wastefulness and multi-generational debt.

However there are many who think that it’s the divine right of the US investor to achieve permanent stock price growth, interrupted only by ‘blips’ and that the DJ will hit 30K before too long. And in a world wherein stock prices seem to have little to do with old-fashioned things like P/L accounts, but a re a function of computer algo trading based on news events and CB jawboning, who’s to say they won’t be correct…crazy, increasingly irrational world – crazy financial system. I suppose that’s only right and proper.

“… there are many who think …” (etc.)

But there are many who do not.

IMO, they will position themselves “under the radar” so to speak while the debauchery continues and be on top of the reformation when the debauchery ends.

It begins. Time for interest cuts. QE next? When you spend 3 years to get just well below 3%, can you blame them? Time for a change. Out with the old in with the new:

(Bloomberg) — “Some of the most accurate gauges of economic health are pricing in lower Fed rates for the first time in more than a decade.

The little-known near-term forward spread, which reflects the difference between the forward rate implied by Treasury bills six quarters from now and the current three-month yield, fell into negative territory on Wednesday for the first time since March 2008. Two-year yields dipped below those on one-year paper in December.

“This is a crystal ball, it’s telling you about the future and what the market thinks of the Fed and what it will do with its policy rate,” Tony Crescenzi, market strategist and portfolio manager at Pimco, said in an interview with Bloomberg TV. “The market is predicting a rate cut at the beginning part of next year.”

Federal Reserve economists said looking at forward rates relative to those on current Treasury bills has served traders well in the past.

“When market participants expected — and priced in — a monetary policy easing over the next 18 months, their fears were validated more often than not,” Eric C. Engstrom and Steven A. Sharpe wrote in a research paper dated July 2018.”

If you averaging in for two decades your BE is about 1450, when we get to the 1600 level a lot of buy and hold investors will throw in the towel because they will be underwater since the 2008 highs and that has the potential to turn a bear market into something far more serious. The last time we had a three crash sequence of progressively lower lows was in the 1970s which has some interesting parallels.

This post is for Paulo, whose way of going in life I admire.

In 1966, I was a U.S. Patent Examiner, lived in Warrenton, VA and commuted fifty miles to Crystal City, VA, where the Patent Office had just moved, from the Maine Commerce Building at 14th and Constitution Avenue, in Washington, DC. I drove 3-cylinder Saab Models 93, 95 and 96 automobiles and maintained them myself.

I had observed what happened when PMI (Parking Management Inc.) got control of parking in DC (shakedown price for parking) and determined to obviate that for myself in the new Patent Office location.

In the immediate environs of Crystal City’s burgeoning new office construction was a rundown neighborhood of brick duplex houses. I bought one of them and rented it to a fellow Patent Examiner. The previous owner held the mortgage on it, thinking himself lucky because the sewer backed up and the basement stank (more about that, later).

But I had to come up with a thousand dollars down and I didn’t have it.

On evening I was working with the JayC’s on one of their projects, when a fellow member of the club, an automobile salesman, asked: “Who owns the Saab parked out front”. Turned out, he had taken in a wrecked 1964 Saab 96 and sold it to me for $200.

I took its title as collateral to the Patent Office federal Credit Union and borrowed the thousand I needed. (The engine a lesser parts entered my maintenance inventory.)

The rent more than made the payments on the loan and the mortgage.

After awhile, the local government undertook to upgrade its sewer system in the area to correct old problems, like my stinking basement and new ones, like inadequate capacity to accommodate Crystal City’s growth. A representative asked me if I would sign a release of claims for damages when they tore up the street in front of my house. I told them I would, if they indemnified me for any damage or, in the alternative, put a driveway curb break in the new road and pave half the back yard connected to it.

They opted for the latter, and I had parking for myself and two extra spaces, for which fellow examiners gave me a gratuity of fifteen dollars a month to use (Spaces in the office parking garage had already climbed well above that).

When I qualified for early retirement a few years later, I sold the house for $51,000 (along with other property which had enjoyed the real estate boom of the sixties and seventies) and retired, age 44.

From then on, my time was my own:

https://lenpenzo.com/blog/grandfather-says

I’m with Wolf and many others here in thinking US Stock prices are near another historic peak.

Stock prices are a mathematical product of four factors:

1) Stock Price, P, relative to company Earnings, E. (P/E ratio)

2) Earnings as a share of Revenues, R. (Earnings/Rev = Margins)

3) Revenues relative to the host economy (Rev/GDP: US, Global)

4) The size (and growth) of the economy (GDP).

Thus P = (P/E)*(E/R)*(R/GDP)*GDP.

Aggregating this data to look at the whole stock market, all of these appear to be at max and/or stalling out due to historical factors.

Real estate and long-term bonds don’t look much better, largely since interest rates can’t really get much lower.

While individuals have the option to select particular assets and securities, the economy as a whole has no such option. Someone, somewhere has to own the stocks and bonds and real estate, so people must cope with losses or low returns for years to come.

The blog piece and the comments today are so

good I’ve bookmarked them.

For most of us when we sell a house we also buy a house

so we are forced to buy and sell in the same market.So to

make money we have to see a seam everyone else misses.

i bought a corner lot a one time and generally corner

lot offer more land but are less desirable .It turned out

because land was short and I was later well rewarded.

Same with stocks.With most stocks trading for technical

reasons , flip it and look for reasons that company will do well.

Be aware of debt .During a down turn a company’s assets

will decrease in value but their debt will stay the same. One

last thing .A manager who has done well at one company

will probably do well at the next company.Think GE. Although

that is a big risk. Lots of debt.

Just one thing.

Buy & hold strategy (index funds, etc…) goes hand in hand with dollar-cost averaging technique, so yes, in my humble opinion, it remains a good solution, in a long time vision.

This is not quite as bad as it seems since these charts are not total return charts (i.e., they don’t take dividends into account).

The major U.S. stock market seemed to be crashing a little under Trump. And I don’t think that it’s going to stop. I hope it rebounds from 500 points lost.

Some thoughts on the article and on many of the comments.

Article assumes one buys at the peaks. Buy and hold absolutely works over the long term if one dollar cost averages. This is even more true if one factors in dividends of 2% or so. Unfortunately, this is a lesson I learned late in life.

The comments on real estate ignores a huge factor ie, taxes. In most of NYS (including rural where I live), real estate taxes equal the mortgage payment. Then factor in mortgage interest and insurance. Sure, in some markets appreciation is out the roof, but when looking at national averages, this is not the case. It becomes virtually a dead heat with simply renting. The real benefit of real estate is for rental owners who get the massive write offs due to depreciation tax write off. In my local market, I bought in 2005 at $500,000. Price today is the same as it was in 2005. But my taxes averaged $11K per year. Add 3% interest and $1100 per year insurance and maintenance and there is no gain over renting. Of course there is the satisfaction of owning.

Interetingly, I put my 401K into a guaranteed 4.5% retirement account back in 1989 and am quite satisfied with the return albeit not stellar. My roth IRAs on the other hand have only yielded about 3% per year including dividends from the stocks that I owned. That is probably due to my poor stock picking which focused on biotechs .

The point of course is that there is no free lunch, especially when factoring in inflation. The advice I give to my daughter is to dollar cost average over decades balancing several funds, some in small cap, some in value, and some in large cap dividend paying stocks. Hopefully, she will grow 7-8%/year over the decades.

“Buy and hold absolutely works over the long term if one dollar cost averages. This is even more true if one factors in dividends of 2% or so. Unfortunately, this is a lesson I learned late in life.”

Look at the S&P 500 chart. Anything worked so far, even automatic buy-and-hold. Any stock-market strategy worked because these stocks just went up (until they didn’t). As long as you didn’t short the market, you came out ahead.

Then compare how the same strategies might have worked in China or Italy or wherever. If the S&P 500 chart start to look like some of the other charts, buy-and-hold and dollar-cost-averaging will not be a money-maker going forward. That was the point.

But that is generally not how people invest. Just because stock bought at the peak would have broken even, that would be weighted against stock bought through the down turn and rebound. Nearly all of which were bought for less than their 20 year long term gain.

Maybe this makes sense for a retiree with no new income.

Wolf. You are on a roll. 2019 is your year. You own 2019.