Homebuilders, a bedraggled bunch recently, breathe a sigh of relief, but get crushed anyway.

“NOTICE: Due to a lapse in federal funding this website is not being updated,” the Commerce Department’s website says currently on the page where the Census Bureau would have published this morning’s data for new-home sales, inventory, and prices for the month of November.

The main page of the Commerce Department’s website explains: “Due to the lapse in Congressional Appropriations for Fiscal Year 2019, the U.S. Department of Commerce is closed. Commerce Department websites will not be updated until further notice. For more information, see Shutdown Due to Lapse of Congressional Appropriations.”

And that’s a good thing for our bedraggled homebuilders.

On November 28, when the October data for new home sales, inventory, and prices were released, homebuilder stocks got punished, after already having been brutally punished for much of the year. The data was nasty (my take at the time, including charts):

- Sales of new single-family houses plunged 12% compared to a year ago.

- The supply of new single-family houses for sale spiked to 7.4 months, up from 5.6 months a year ago, and the highest since February 2011, during Housing Bust 1.

- The median sale price of new single-family houses sold in October dropped 6.6% from a year ago to $309,700, a price that was first reached in November 2015.

So this morning, the data for November would have come at the worst possible moment, with stocks already getting hammered for much of December, and getting re-hammered today, after the blockbuster one-day-wonder rally yesterday.

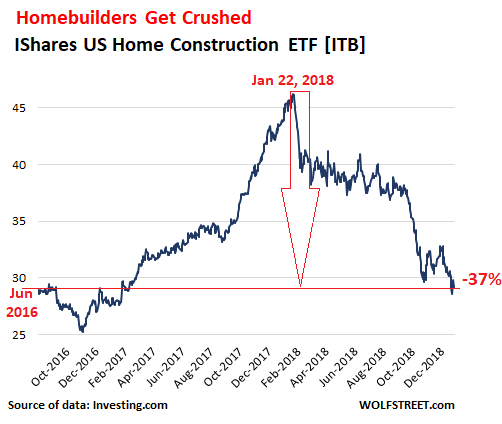

When the November 28 data was released, the iShares U.S. Home Construction ETF [ITB] fell 2.7%. At the time, it was down 29% from its peak on January 22, 2018. Some of the biggest homebuilder stocks lost nearly 4% on that day.

So homebuilders don’t really need a replay of this. Nevertheless, and despite the hushed-up November data, the Home Construction ETF sank 2.5% this morning.

On Wednesday, when the overall stock market had one of its most explosive rallies and epic short-squeezes ever, with all indices surging, the homebuilders too surged, and the Home Construction ETF jumped 4.3%, bouncing off its Christmas-Eve low of 28.55, the lowest closing price since January 23, 2017, and back where it had first been in June 2016.

The Christmas Eve close was down 38% from peak of 46.25 on January 22, 2018. It completely unwound its fantastical Trump bump. And yesterday’s huge bounce is a barely visible dimple in the two-year chart:

Thanks to the hushed-up data, the ITB is only down 2.5% this morning. At 29.01, it has plunged 37% from its peak on January 22 this year. And the individual homebuilders are moderately lower instead of getting a full whack from unwelcome housing data:

- Toll Brothers [TOL]: -3.0%

- Lennar [LEN]: -3.0%

- Pulte [PHM]: -2.4%

- KB Home [KBH]: -3.8%

- D.R. Horton [DHI]: -1.8%

- Hovnanian [HOV], a penny stock selling for 70 cents a share at the moment: +4.7%

So let’s thank the government shutdown for preventing a further debacle among our bedraggled homebuilders and for pulling a much needed blanket, at least temporarily, over the deteriorating housing market data.

In Seattle, house prices dropped 4.4% in four months, the biggest four-month drop since Housing Bust 1, according to the Case-Shiller Home Price Index. Prices also deflated in the San Francisco Bay Area, San Diego, Denver, and Portland. Read… The Most Splendid Housing Bubbles in America Decline

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How big a reaction would the new data likely cause? Is there any possibility they did not simply get lucky, or that the shut down is being tolerated in Congress because postponing this information might help preserve consumer confidence? A decline in home value is felt as an immediate threat to many families, whereas a shut-down can be seen as localized suffering. The average person thinks of the 2008 collapse as real-estate loan driven (not deregulation/derivative run amok), and has a bad association with negative housing news. New reader, here. Please be gentle.

Kristine,

Thanks for venturing out into the open here. Welcome to WOLF STREET.

Outside estimates indicate that new-home sales might have fallen 17% – 19% in November. I don’t know how accurate this is, but it could be on target. Months supply likely went up further. And new-home prices might have taken another hit.

Concerning your comment: “A decline in home value is felt as an immediate threat to many families…,” here are some fundamental things about housing to keep in mind:

1. Potential buyers see declining home prices as an opportunity, after prices have declined enough by their estimates.

2. Current homeowners just need to sit tight and make their mortgage payments. If they bought a few years ago, they’ll be fine, but some of their imagined paper profits will evaporate. No biggie.

3. Recent buyers are going to be underwater, and they’ll have to stick it out and live in that home for many years. They might lose some money if they try to sell. They took a bet on the housing bubble, and they lost. No biggie. When you make a big bet like that, you should know that you can lose money. I have tracked housing data for a while, and these buyers could have informed themselves on WOLF STREET (and elsewhere) about the condition of the market to avoid buying near the top.

4. A home is primarily an expense whose role is to provide shelter and comfort. Once it is treated as an investment, the insanity starts. People should know better.

5. Long-term housing investors know how to deal with downturns and saw this coming some time ago.

6. Housing speculators will be taken to the cleaners in a declining market, and they will try to roll their losses off to the banks and non-bank mortgage lenders.

7. Banks and non-bank mortgage lenders sell most of the mortgages to government entities (such as Fannie Mae, Freddie Mac, and Ginnie Mae), which guarantee the mortgages, package them into mortgage-backed securities (MBS), and sell them to investors. So much of the credit risk lies with the guaranteeing government entities.

8. Banks and non-banks are on the hook for “non-conforming” mortgages that the government entities don’t take. But they can also package them into MBS and sell them, in which case investors are on the hook for losses.

9. In the 12 “non-recourse” states, homeowners can walk away from their home and mortgage when underwater and let the lenders, investors, and taxpayers take the losses.

10. Even in the 38 “recourse” states, investors and speculators can walk away from a home and a mortgage if the property is held in a special LLC and if there is no personal guarantee involved.

You see, housing-market losses spread from homeowners to investors, taxpayers, and banks, that often bear the biggest portion of the risks.

Thank you! I think that perhaps if values drop, frozen HELOCS might create a credit crunch and decrease discretionary spending. I am going to do some research on what percentage of homeowners have HELOCs, and if there are any stats on debt to credit ratio of HELOC borrowers, and how much of the consumer market it captures. Thank you so much for all this information! Did not know about the LLC angle- interesting. As far as non-conforming mortgages- a bank really has no business making dubious loans, unless they are in favor of an occasional jubilee year. Love the site, sure to be a regular reader! Got here via the automatic earth.

Good thoughts! … and probably makes sense to try to isolate those stats just in the markets with recent value losses. Overall, the HELOCs originated over the past decade were made to people who are able to walk on water, and new loans are not replacing old ones, so any impact on spending should be minimal for now. Also check out reasons for nonconforming further, i.e. rarely dubious in this cycle.

Wolf, I have to take exception to your items 2 & 3 & 4. Job security is a delusion in the US– especially in the event of an economic downturn such as accompanies a major decline in housing valuations. When your job is off-shored or your company transfers you to Omaha you don’t have the option to “stick it out and live in the house for years.” A large percentage of Americans can’t survive a month without a paycheck.

After you’ve burned the furniture to keep warm and eaten the dog, what is left but to throw the keys on the banker’s desk and hit the road? I’ve been there. Eugene Oregon during the Ronald Regan Depression. One year, voted the most desirable small city in the USA. Less than two years later, interest rates at 16%, every fourth house for sale, no buyers at any price, and people moving to Houston to live in their cars and work in the oil fields.

As for item #4, for most Americans their home may provide a place to stay, but it is their only large asset and only chance at accumulating a nest egg for the future. Exactly what is the return on investment on a savings account over the past 10 years? Certainly negative compared to the inflation in the real cost of living.

People who purchase a home for shelter will usually not sell their home because it loses value. It is the speculator that cannot affford to see values decrease. It is also the speculators who run up the prices in the first place.

It would affect HELOC borrowers, who would experience a credit crunch in the case of devaluation, but I’ve no idea how big that is in the overall scheme.

Helocs in the US have been declining since the Financial Crisis – despite the industry’s efforts to get them going again. I’ may do an article on this shortly. In the overall scheme of things, they’re no longer the big issue they once were, though some individual over-leveraged households may still get tripped up by them.

Ha! I just cancelled a decades old HELOC and got charged $52 for the privilege. County processing fee to take the bank off the real estate records.

Helocs still need to income qualify and most lenders will not go above 85% loan to value.

That being said, I have referred a few past clients recently out to a HELOC source bc they refinanced before with me and have a good rate in the 3’s and wouldn’t want a new loan something close to 5% now.

“It is also the speculators who run up the prices in the first place.”

Speculators fully deserve to lose their asses, and possibly other body parts as well. Home buyers should not be paying speculative prices. It distorts the markets unfavorably.

We are informed that most US government employees not getting paid as a result of the shutdown are Democrats. This proves that some truth is purely accidental: they used to be Republicans.

It’s a good thing the US is not in recession. Otherwise home prices would be seriously falling.

Thank you Wolf for this timely post and for your detailed response to Kristine. As I understand it, housing in general, and new (house) and pending sales components are leading indicators for the economy. The Case-Shiller Index is a lagging indicator. Anyway, housing has already turned due to the well understood and predictable behavior of asset bubbles. Apparently the Fed is the only entity on the planet that’s not aware of the mechanics of asset bubbles. Go figure. There’s nothing organic about economic growth when the Fed added 3+ (?) $T to it’s balance sheet buying Treas. + MBS (QE), and dropped FF rate to essentially zero. Guess what happens when this process reverses? QT is maybe down only ~10% and FFR isn’t that high, yet things are already breaking due to extreme debt levels (public + private). In my view, the outcome for The Everything Bubble is already “baked into the cake”. A week or two delay in the gov’t. housing data won’t matter much in the long run, and it’s pretty obvious to most now that housing prices are falling while inventory is climbing. Humpty Dumpty.

+1

Well said

My concern is the currency printers “fed” will start to buy real estate again.

“They” are trying to buy the world, which will guarantee a feudal system.

In 1950 you could buy a house in a year as an auto parts store manager.

That’s mike Maloney hidden secrets of money episode 6. This guys videos are amazing, please share

‘“They” are trying to buy the world, which will guarantee a feudal system.”

Don’t let me rewrite your comments, but I think you mean ‘increasingly feudal’. It’s already entrenched, and most people have accepted it and can be relied upon to vote for more.

There’s good news and bad news. The bad news is that this time ‘they’ have the technological means to make ‘feudalism’ permanent. The really bad news is that ‘they’ also have the means to make technological unemployment and underemployment practically comprehensive, obsoleting most of the population. The good news is that this will make ‘feudalism’ self-limiting. So on and so forth.

Indebtedness is not feudalism.

https://www.reuters.com/article/us-usa-economy-homes/u-s-pending-home-sales-fall-unexpectedly-in-november-idUSKCN1OR14Q

“Pending home contracts are seen as a forward-looking [leading] indicator of the health of the housing market because they become sales one to two months later.

Compared to one year ago, pending sales were down 7.7 percent in November, the eleventh straight year-over-year drop.

– There’s that word “unexpectedly” again… The MSM and FIRE industry are perpetually blindsided by the facts. No one ever sees anything coming despite legions of highly paid PhD economists, analysts, etc. The narrative must be defended at all costs…

“It is difficult to get a man to understand something when his salary depends on his not understanding it.” – Upton Sinclair

“stops nasty housing data”…

If the shutdown carries on until the end of January, then that’s not the only thing that will stop.

Food stamps. The SNAP cards.

Real trouble will begin when 37 million poor and disadvantaged American’s are denied their food handout.

You can foresee troops dispensing MRE’s out of the back of trucks in Wal mart parking lots, overseen by armed troops keeping order.

The big elite meet and greet in Davos Switzerland is coming up shortly.

The list of who’s who that are attending, has not been this extensive in many years. President Trump and his entourage will be there, plus many other heads of state and all the central bankers, along with the CEO’s of most large global corporations. Don’t forget the TBTF’s banks! Of course they will be there, like buzzards sniffing around for bail outs!

Is it just me? Or do significant events seem to be occurring at an accelerated rate?

One of the great injustices of the legal code. Housing speculators can write down the value of their mortgages in bankruptcy court, but primary home owners can not.

\\\

Hmmm…so what I hear you say Wolf is that a significant part of this problem would be resolved if we were to treat realestate ownership differently for tax purposes.

Example: A family can own a max. of 1 house/condo/whatever, after which all further units are to be treated as “higher tier” realestate, with purposefully significantly higher local, state and federal taxes.

But this would slow down the economy…or what is left of it.

\\\

But/and the rich hold all of the “excess” real estate so why would they let that happen.

hoping this “everything bubble” has quite a bit of exaggeration to it although I might be able to afford a house if things pop. Talk of the level of debt around the world and far right nationalists/populists springing up around the world is a potentially scary combination with odd parallels with the past

“A family can own a max. of 1 house/condo/whatever, after which all further units are to be treated as “higher tier” realestate, with purposefully significantly higher local, state and federal taxes.”

That’s a great idea I think. I’d love to be able to own my own home someday, or at least be able to rent a reasonable place for a 5+ year span. In LA, neither seem likely at the moment, and just leaving my job to find one elsewhere is not the answer either – I’ve moved around enough and I’m tired of being stuck at an entry level pay scale.

As for slowing the economy, that all depends how much extra tax you’re talking about. If it’s a just a new tax break for home owners the economy would pick up for example … Home ownership should get preferential treatment to properly speculation or vacation homes though.

I really like the idea of a special vacancy tax for homes and condos that aren’t lived in, but they’ve only been willing to try it in a couple cities in Canada so far. I fear the current system just encouages hedge funds to concentrate buying, creating local monopolies in housing and then keeping enough units empty to drive up prices with artificial shortages.

“So let’s thank the government shutdown for preventing a further debacle among our bedraggled homebuilders and for pulling a much needed blanket, at least temporarily, over the deteriorating housing market data.”

Which clearly shows that the Future Prosperity of America depends on permanently shutting down democracy in the US and repressing all negative information. Enterprising national officials have already embraced this as a winning political strategy.

Happy days are here again. Who says gaslighting isn’t an art form?

I am a first time buyer trying to find a place in maybe Merced county or somewhere similar that is affordable in California. I have a decent amount of cash saved up, soon it will be enough to be able to make an all cash purchase potentially, I am wondering if prices will likely come down in that area, or is it more just the major metro bubbles? Should I buy in the next year or so or just wait for awhile? Sorry to ask for specific advice but I am so lost even though I have been reading as many financial/RE blogs as I can for about a year now. This is the biggest purchase I will ever make and I am nervous as hell thanks for any help you can give, love this site

This is the way housing typically moves…

First tier locations – like major cities with a lot of jobs – get a lot of investor interest and the price moves up.

Then locals who are priced out of those cities start to look further afield and purchase where they can afford, pushing prices up elsewhere.

When prices take a significant turn in the cities, locals interested in buying look nearby first. If accompanied by a recession, the pool of local buyers shrinks and it can be very hard to sell a house that’s further out. Those places tend to spike up after the big cities, drop in price before the big cities, and have higher swings than the big cities. Note that this is generally info and I’m not specifically familiar with the Merced market.

My two cents is that now is not the time to stretch. If you’re comfortable with living there 5 years or more and making the payments that’s fine, but don’t be afraid to offer low on a couple and see if they’ll bargain in order to test the waters. If buying will lock you into wage slave status with long hours, long commutes, and little savings to show for it then wait and rent. When waiting though remember… Last time housing stalled like now in 2006, but the good time for buying wasn’t till 2009-2012 (not helpful personally as I was getting my MBA and in no position to buy). Point is that if you wait you might have to be patient a few years to get the best opportunity in the cycle.

That being said, It may also happen differently this time as big investors have been building up cash for such a drop. Prior to 2012, big investors weren’t typically involved with single family homes.

We are at a top and some areas here in SoCal have dropped as it takes a 10% price reduction to find a buyer. There are people that bought at the last 2006 top that are still underwater. Keep building your down payment at the same time watch the market fall for the next two years. Good luck!

I’m in the Central Valley, and have property’s also… keep doing what your doing… Save, educate yourself nd keep an eye on the market…the whole valley is going down at the moment… The big question is how far…

When I was starting out, my theory was…. If I got layed off, that my mortgage could still be paid if I needed to get on unemployment…. That allowed me to treat the slow times like a vacation…..

Good luck!!

Donald Trump helping out Real Estate Developers. Who’d have seen that coming?

Stock traders amaze me.

The ones who sold today when there was no data ….. what did you learn today that you didn’t know yesterday? Were you just waiting for the data to sell? Had you always planned to sell on data day?

And for the ones who didn’t sell today because the data didn’t come out, I suppose they practice the “If I close my eyes it will go away” system for investing? After all, if there is no government report, the real world just ceases to exist, right?

What’s the problem of bubbles if everyone is happyly living in this low level rate reality? Wall street have been living on heaven and main street is also happy, although their salaries haven’t rise at same pace than stocks, because there is full employment, low inflation and have access to low credit rates for buying everything they dreamed of…Yes, the debt is huge and increansing but, as long as rates remain very low, everyone can manage their own hell of debt.