Bottom fishers were taken out the back and shot.

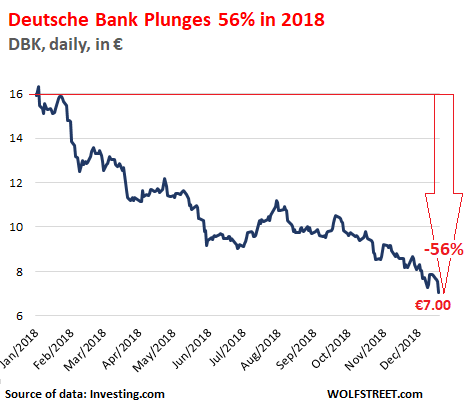

It just doesn’t let up with Deutsche Bank — or with European banks in general. A new day, a new scandal, a new historic low in the share price that has been in a death-spiral for over 10 years. Deutsche Bank shares plunged 7% today in Frankfurt, to a new historic low of €7.00, after briefly threatening to close at an ignominious €6.99. Its market cap is now down to just €14 billion. The stock has plunged 56% so far this year:

The European Commission — the executive branch of the EU — after nearly three years of investigating this, announced today that is suspects four unnamed banks of colluding to manipulate the vast market for US-dollar-denominated government-backed bonds between 2009 and 2015.

“The European Commission has informed four banks of its preliminary view that they have breached EU antitrust rules by colluding, in periods from 2009 to 2015, to distort competition in secondary market trading in the EEA of supra-sovereign, sovereign and agency (SSA) bonds denominated in US Dollars,” the statement said.

The Commission has “concerns” that the four banks “exchanged commercially sensitive information and coordinated on prices…,” it said. “These contacts would have taken place mainly through online chatrooms.”

Deutsche Bank and Credit Suisse confirmed that they are among the four.

This is just the latest in an endless series of allegations of wrongdoing and costly settlements of such cases. This is in addition to the bank’s bulging portfolio, so to speak, of operational and financial problems.

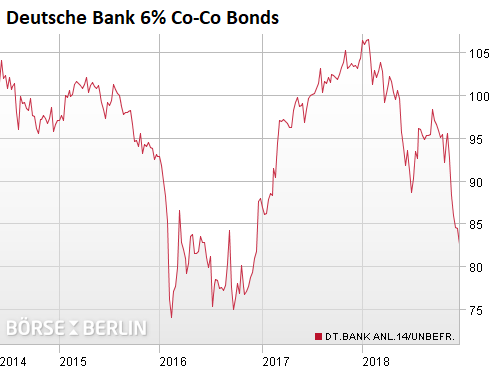

Deutsche Bank’s contingent convertible bonds — designed to be bailed in when the bank’s regulatory capital falls below a certain level — are a measure of what the market thinks about the chances of such an event. They’re unsecured perpetual bonds that can be canceled when regulators think the bank needs more capital to avoid toppling. In this event, stockholders and Co-Co bond holders would likely get wiped out by taking the first loss. Other creditors might get a haircut. And taxpayers would be shanghaied into paying for further capital if needed.

With these risks, Co-Cos have a fairly high coupon payment to begin with, to make them attractive. And now the 6% Co-Cos are at it again, giving their opinion about the chances of a bail-in – they have been plunging, closing today at 83.6 cents on the euro:

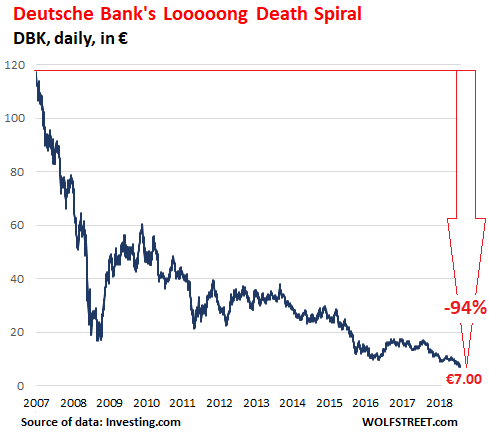

Deutsche Bank’s stock has been in a death-spiral since 2007, following an intense price bubble that ensued as the once conservatively run bank for Germany Inc. and German retail customers transitioned to becoming a global player in just about everything that has caused banks to collapse. Bottom fishers were regularly taken out the back and shot.

But it’s not just Deutsche Bank. The outfit is an example of a broader development in Europe where the years following the financial crisis, the years of zero-interest-rate policy and negative-interest-rate policy — ZIRP and NIRP — weren’t used to rebuild bank capital and clean up balance sheets and get rid of non-performing loans, but were instead used to prop up the sovereign debt of euro countries whose governments can’t handle a hard currency they can’t devalue, such as Greece, Italy, Spain, and Portugal. Propping up government debts worked.

But the banks, the financial infrastructure of an economy, are a massive unfixed risk. Under the new rules, bailouts would now wipe out, or at least crush, shareholders and some junior creditors, such as Co-Co bondholders, before taxpayers will be shanghaied into cleaning up the rest.

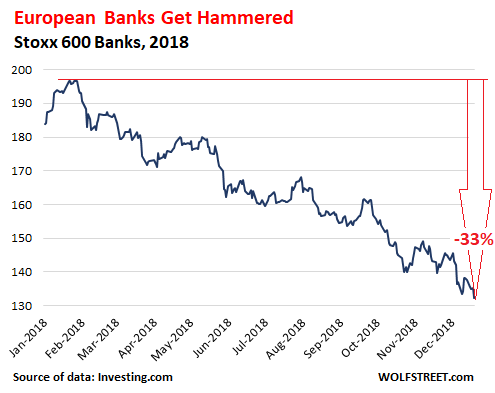

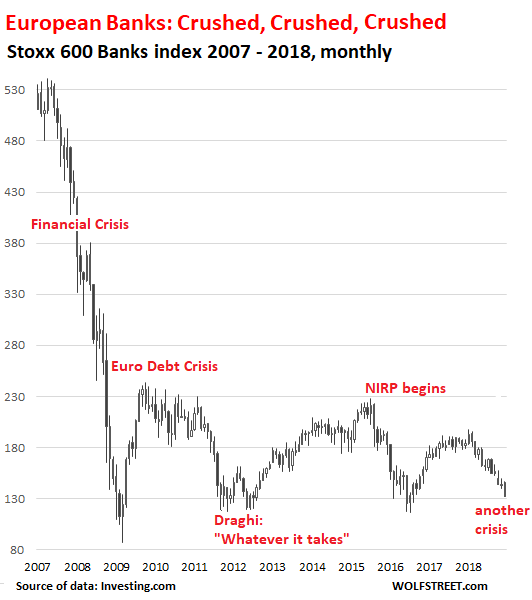

Today the stocks of European banks, as depicted by the Stoxx 600 Banks index, dropped 2.5%. The index has plunged 33% from its 52-week high in January:

But going back a decade, this 33% plunge is just a dimple, compared to the epic 75% collapse since the European bank peak in 2007 that rivals the Nasdaq-collapse of 78% in 2001-2003. The Nasdaq has more than recovered, while the European banks are just bumping along from hopeless to hope and back to hopeless:

Clearly, the market sees these European banks as a mess that will remain a mess and has a superb chance of getting a lot messier.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This is from their Twitter account:

“Information on antitrust investigations of the European Commission: Deutsche Bank has proactively cooperated in this matter and as a result has been granted immunity. In accordance with the EC’s guidelines, Deutsche Bank does not expect a financial penalty.”

https://twitter.com/DeutscheBank/status/1075797592829767682

White collar criminals always are above the law, until they swindle other white collar criminals (Ask Bernie Madoff) .

Banks swindling the public is a business model fully endorsed by the state. As the US showed, all you do is fine them for a cut of the vig, but of course no one goes to jail. Works better than a tax hike or borrowing.

Yea, but US bank fines, since 2007, are about $300B ($300,000,000,000).

As a taxpayer, would I rather have Bubba fined $25,000 and sent to prison (which costs me $50,000/year), or have the bank fined Billions…stupid question.

Chip —- Your thinking process where crooks are not severely punished for gaming the system, only ensures this criminal behavior will continue.

These bankers are every bit the killer Jeffery Dahmer was

Send em to jail for a long term and have the banks pay for the costs not the taxpayer…

Do the math, the corporation(bank name of your choice) pays x amount in the billions for a fine. More than enough to replace the tax payers funding for the jail time all of the employees should be serving.

The system at the moment is tilted in the favour of the wealthy criminals, while poor people sit in jail for lesser crimes funded by tax payers. If the criminals funded their jail time with the ill-gotten gains you would see a lot more bankers and drug dealers in jail.

So the question is why are you allowing tax payers to foot the bill if the corporation will be fined plenty to cover the bill.

All of that changes, though, when Bubba finds out that he can run the bank, contribute to certain political campaigns – and thereby manage the legislative and executive processes to some degree (or wholly) – and then get the bank bailed out, fined less-than-lethally, and move on to a new bank. Or move directly into politics. This is probably why it’s only the unconnected Bubbas that are now in jail in the first place.

And the bail out was ~$700 B, if I recall, and so banks are ahead on that score.

As a taxpayer, would you rather have the banks bailed out at a rate higher than the fines?

jaco is right. Millions of jobs lost, families destroyed, lives shortened,… jail time.

Jaco, I absolutely agree with your sentiment that crooked bankers should be sent to jail. However, the American legal system requires proof of Mens Rea (the intention or knowledge of wrong-doing). In an organization like a bank, this is very difficult to prove beyond a reasonable doubt for a given individual.

Thus the gargantuan bank fines (which essentially punish mostly uninvolved shareholders).

Personally, I’d be comfortable using proceeds from bank fines to finance the government going after a few individual bankers. This would still be very problematical, but if a few high-profile individuals got sucked thru a couple years of the legal system, it might have an impact.

However, constitutionally, a government, with relatively infinite resources, going after individuals with a high probability of “not guilty” begins to smell more like persecution than prosecution. Courts would not tolerate much of that.

A highly unusual & very political approach might be to sanction a bank as a “criminal enterprise” (Wells Fargo, for example), and resolve the bank out of existence (essentially sell the branches & lower-level employees to better behaving banks. This is the essence of what happened to Arthur Andersen.

Laws/regulations could be sharpened to allow regulators to declare only certain parts of a bank to be a “criminal Enterprise”, causing only that portion of the bank to be resolved. Again using Wells Fargo as an example, its retail bank would be a prime candidate. This would eliminate jobs of all senior managers, while preserving jobs of branch manager on down (the vast bulk of the employees).

I’m probably remiss for not having mentioned earlier that banks, along with lawyers, are congress’ biggest campaign contributors. See the problem?

Read Bill Black. The reason no bankers went to jail is not because proof of intent was lacking.

There should be a corporate death penalty for contemptible crimes like the financial crisis or LIBOR rate rigging.

This should mandate the firing for cause, without notice, severance, benefits, or ‘golden parachute’, all management participating in the scheme, and all those people who were charged with supervision of the criminals. All of their assets, and those of their families, should be seized as the proceeds of crime.

All of the criminal company’s debts should be revoked. No payment should be made for bonds, bank loans, debentures, preferred shares, or any other kind of investment, as these people and institutions made investments in a criminal enterprise. If any of these so-called investors can be shown to have encouraged the company’s crimes, then they should lose all of their assets as well.

The company’s stock is declared worthless and new stock issued for sale to the general public, excluding all previous shareholders. The sale proceeds to be used by the government to correct the company’s crimes.

This way the productive part of the enterprise remains and the criminals lose everything, instead of getting bonuses, like the US banks awarded immediately after the so-called ‘financial crisis’.

Good old Satander bank has been rumbled for keeping the money of customers that passed away. Of course this is down to incompetence so only a minimal fine and carry on as normal.

(https://www.google.com/amp/s/amp.theguardian.com/business/2018/dec/19/santander-fined-for-keeping-dead-customers-money)

@Prairies

If a bank does something unlawful and the bank pays a fine and the top execs get off with golden parachutes and new gig at the FED, Treasury or a lobbying firm, why/how is it a deterrent?

We need banks to pay fines and their execs to go to jail. You can include the charges for feeding and housing these fat cats in the fine.

DEREGULATION

Since deregulation went into effect under Clinton’s watch, in which commercial banks could also operate as investment banks.

The seven year stretch from 2000 – 2007:

OTC FX derivatives went from $15.7 trillion to $57.6 trillion

OTC rate derivatives went from $64.7 trillion to $381.4 trillion

OTC equity derivatives went from $1.9 trillion to $9.5 trillion

After the 2008 – 09 meltdown nothing was fixed. The only thing that has occurred since, is the fueling of the fire by the central banks throwing more gasoline on the fire.

We are now seeing the results of the conflagration.

After the embers have gone out, the financial/economic world will be a totally different place. Now the big question is, will we get there without a major military conflict?

nothing to do with deregulation problem is system made for good old boys, start with The Bank of England Established 27 July 1694

Joseph T. Salerno:

fractional-reserve banking can only exist for as long as the depositors have complete confidence that regardless of the financial woes that befall the bank entrusted with their “deposits,” they will always be able to withdraw them on demand at par in currency, the ultimate cash of any banking system.

Are we in the quadrillions now? And if so, how many? I have heard some WILD numbers.

The point is NOBODY knows for sure. The number I read stated the derivative portfolio slushing around in the banking system would be 1.500 TRILLION US$ ( and the global GNP is about 70 trillion, or 70.000 billion US$ ).

So, the derivatives nominal count would stand at 20+ times the global GNP. If the domino’s start falling THERE, fiat currency investors/savers are toast. No one central bank can print that size of bailout money without causing Weimar-type hyperflation.

PPP: Check out the Depository Trust Clearing Corporation. They handle 1.7 Quadrillion in investments. Most of these investments involve Forwards, Options, Swaps and Futures

The other thing that changed after 2008-9 was that the notional value of the OTC derivates went up. And why not? The ECB made it possible to use them as collateral for new EUR loans so whats a poor banker to do other than fire up those laser printers and get printing while the offer stands!

I should imagine the people of Greece are devastated by this news…

Smiling through their tears, smiling so brightly it’s blinding, especially since the Greek bailout actually was a German/French bailout.

Greeks got themselves into their financial mess more-or-less all by themselves.

Trying to “recover” by having everybody in the EU pay as well as anybody contributing ti the IMF (Hello, USA taxpayer!) is a different story.

Greece can now go back to doing what they do best – being a third-world country. Italy & Spain might soon follow.

Follow? They are pretty close to there already…

Except most of that ‘bail-out’ money didn’t go to the Greeks, but to German and French banks. Same old story, the banks get bailed out Blame it on the Greeks is one of those cover stories that is just true enough to be believed long enough for the German and French bankers to slip unnoticed out the back door.

The constant is that the banks don’t really take risks when they make the loans if they know the taxpayer money will flow to them if it all falls apart. For the bankers, its win-win, either the Greeks pay high taxes and watch people starve to pay the money back, or they get bailed out. The Greeks kept asking for some sort of a write down in their debt, and that was the one thing the bankers said a flat no to because of course they liked it where they got paid completely fully either way.

When there is no risk, the riskier and more desperate the borrower who is willing to agree to higher rates just to get the loan is the better deal. Because there is no risk with the taxpayer money always behind them.

“… there is no risk with the taxpayer money always behind them.”

But is it taxpayer “money” or taxpayer debt, “financed” by central banks issuing more fiat money?

In reality, taxpayers collectively could not possibly come up with enough personally saved money to fund these bank bailouts by means of a real tax.

Creditors should be punished for bad underwriting. Quit moralizing business transactions.

“more-or-less all by themselves.”

… I’m sure GS helped somewhere along the way…

You say that we are following the Greek’s lead by piling on debt financed late cycle stimulus. Basically throwing away our fiscal bullets for when a recession happens for a sugar high in the stock market. So maybe the last sentence should be “Italy, Spain and the US might follow soon”.

Should be “You might say”

“Greeks got themselves into their financial mess more-or-less all by themselves.”

When you say Greeks, you mean GS and corrupt Greek politicians and officials, I hope. Because otherwise, it’s like saying Americans caused the 2007-08 meltdown all by themselves, a ridiculous blanket statement.

In today market, 6% for such a high risk is basically just slighty over trash when the US treasuries are getting highter and highter and have such a low risk.

No wonder they are just sinking more and more.

Wonder who owns all the bank shares…must still be worth something or they would be worth nothing, unless maybe there are collectors around.

Maybe all the shares are owned by share collectors and will never be traded again and never lose more value, like antiques.

Even then though the charts are saying something more. The share value roughly represents how the European banking business is going, and that roughly represents how the EU economy is going.

Maybe when they raise rates again, if they ever remember to, it will all calculate out nicely, but I still cannot figure out how.

Huh?

The largest Deutsche Bank shareholder at last check was the Qatar Investment Authority (6.1%) after the previous largest shareholder (7.6%), HNA, was ordered to sell their stake by Chinese regulators earlier this year as part of the government-dictated plan to reduce leverage.

The rest of the large shareholders are the usual gaggle of private equity firms and offshore funds: BlackRock (4.8%), Hudson Executive Capital (3.1%), Paramount Service Holdings (3%), Supreme Universal Holdings (3%) etc. There surely are some more interesting shareholders, but under the German Securities Trading Act only up to 1% ownership is made known to the public.

There have been lots of talks about a “forced merger” between Deutsche Bank and Commerzbank, still partially owned by the Federal government, something that would dwarf even the State-arranged “mergers” (actually thinly disguised fire sales) among big keiretsu banks in Japan. There’s little appetite for it, but the alternatives are politically even worse.

A merger with a foreign bank would mean a French bank, and all the systemically important ones have the French government as the main shareholder, not exactly the best bedfellow.

A breakup of Deutsche Bank would be the most sensible and cheapest (for the taxpayer) solution, if only the bank weren’t so scandal-ridden, meaning lots and lots of liability issues. As old legislators and regulators ride into the sunset, the incentives to avoid grilling banking executives decrease, just as the political benefits of doing so increase.

He who has ears to hear let him hear.

However, If “Brussels” maybe wanted to make the EUR into a real EUR-Zone currency like the USD is, then “rescuing” DB might not get the Germans in the mode for some flexibility in the matter.

Brussels can say to the German ordoliberatarians: “Yes, it is really bad with DB, but, we can’t really do anything under the current regime, deficits and fiscal rules old chum. We totally agree on those, of course. If it does blow up, it could be a real mess for you chaps to clean up all on your own? Maybe it can’t even really be done within the current regime? Anyway, must dash. Brexit to do. Think about it, eh?”

Brussels is not at all that soft and incompetent that they are portrayed as. I think they like it like that.

DB and CS each have around $20B market cap, yet each bank manages $1 to $2T in assets. Thus, the market caps are only about 1% of assets.

This is very strange and indicates the banks are being managed on life support. My guess is that they are sitting on lots of non-performing loans that haven’t been written down on the books. Why else would these banks be operating with just a sliver of market capitalization. The stocks of these banks are more like options.

go back & re-do the numbers:

Deutsche Bank

o assets $1.5T

o mkt cap $16.4B

o Asset as % of mkt cap: 1.1%

Credit Swiss

o assets $800B

o Asset as % of mkt cap: 3.8%

Humbly suggest a better metric is market cap to book value.

I’m confused

Assets 1,500 Billion

Market Cap 16.4 Billion

Assets as a % of Market Cap 1.1% ?

The point is that the market cap is a sliver relative to assets.

Yes that’s the point, so if J’chip confuses numerator with denominator, as a teenage math student might do, maybe his other comments should be treated with a pinch of salt ?

However I totally agree with the point he is trying to make. In fact a year ago I posted the following nemonic on this site :

Does Everyone Understand That Shxt Comes Home Eventually. But Accountants Never Know.

You are missing some info.

The Credit Suisse market cap is 27.2B

A little ironic given your opening line to this comment…

Point taken.

Good point. Didn’t the Icelandic banks have a similar situation? They were managing more money than Iceland could come up with in a decade. When things went south (poor metaphor, what isn’t south of Iceland?) recovery was basically impossible.

They paying over market for deposits (300 B from UK ) and making junk loans to locals who didn’t know what they were doing. Some were crooks no doubt but apparently they were so new to this they really believed.

One method of Icelandic asset inflation (from Micheal Lewis in Boomerang)

‘You have a cat and I have a dog. I sell you the cat for a billion and you sell me the dog for a billion. Now we each have assets worth a billion.’

In reality the ‘dogs’ were things like second- tier airlines. As long as this Ponzi variation continued there was no shortage of money from the three Icelandic banks (soon to go bust) because in the short term it looked as though they could ‘afford’ to outbid everyone for deposits.

The U.S.Big banks are going in there in deep, eg, JP Morgan,

Goldman Sachs, Morgan Stanley, etc. Even mid-tier banks are diving in. Europen Capital is small;;;;;;;; It is the time of AMAZON. Death to us all!

Love this site but do you ever have any positive financial news?

Right now? When everything is overvalued after years of central-bank engineered asset price inflation and now even central banks are worried about what they’ve wrought and they’re trying to tamp down on this asset price inflation?

But earlier this year, I was writing about massive home prices surges, the trucking boom, the junk bond boom, the leveraged loan boom, etc. so this was “positive financial news” (things go up). Alas, they’re now all deflating, all of them.

Oh, and I also write occasionally about rising short-term interest rates and yields, which is fantastic news for savers and conservative investors, and they have been exuberant. But you have to shop around to get it — that was the message, and I gave some clues about where to go to find these higher interest rates on savings products, etc. Very positive news for millions of people, including many commenters here.

So yeah, lots of positive financial news too — just not for stockholders, and not for holders of many other assets, not now.

Wolf is merely the Ghost of Christmas future.

Bah humbug, and a merry Xmas to every one!

What’s the contagion angle in all this, the interdependence of global banking has gotten more embedded into the system. What’s the IMFs role in all this? I say that only because I assume the IMF will be lender of last resort in the next financial crisis.

All markets are two-sided. Somebody is making money even if asset prices are going down – if you are on the right side of the trade.

This site is Wolf Street. You won’t get bullstreet here. Waugh waugh.

Somebody is making money if you are on the right side of the trade of a stock.

Options to buy or put are just ‘paper’ side bets on the fluctuation of the future price so will net out between the option buyers and sellers. One gains the other makes a loss, the intermediate takes a small cut.

The underlying share still exists so there is a loss to whoever owns the share.

Same with ‘paper’ gold. The trades done in ‘paper’ gold net out between the gambles.

But the owners of the real gold surely make money if the ‘paper’ price goes up and loose money if it goes down.

Someone please remind Gordon Brown of this fact.

I contend owners of physical gold don’t make or lose money; they see a rise or fall in its fiat price. The gold IS the money.

Gold is money. Everything else is toilet paper.

Escierto,

There is an easy way to get rid of your unwanted and hated “toilet paper,” and this is via the “How to Donate” Button in the top menu of this site :-]

Good News?

The Gini coefficient in the US should be reduced since poor people don’t own financial assets.

https://www.stlouisfed.org/on-the-economy/2016/may/does-stock-market-impact-income-inequality

RDB

Yes you are 100% right.

I defer to your superior intellect.

I will recommend you for a job at the Fed as Jay’s right hand man.

Positive financial news doesn’t exist. Bitcoin 2017 was all positive PR machine hype, now look at it. RE was impervious to bad news until 2007, the most positive PR was always home ownership over renting. They always end up trash once the hype machine makes its money.

I have hit the point of skepticism where betting against any mainstream PR is the way to go. Makes for a lot of negativity but a lot less disappointment in the end.

Bubbles bursting is the best financial news in a decade, Ed. Long may it continue and much may they deflate! The bad news was that they got so inflated and then reinflated in the first place.

Want some “good” news? Go read Fortune, Forbes, Business Insider or google for news related to SoftBank.

No disrespect but Please feel free to tune in CNBC if you prefer fake news

Banking corruption is wide spread, and when-ever & where-ever a major bank topples, the contagion could be global and virtually immediate.

Question is, will depositors be protected by govt deposit ‘insurance’. Or to put it another way, do we trust the liars, thieves & vagabonds who have ruled us so well, to date?

During the GFC I was spooked and took out quite a chunk of my hard earned. Whilst awaiting better, safer investment opportunities (sarc) and as things settled down, I put a fair amount back in (to watch interest rates dwindle..another story)

I’m feeling spooked again. This time around, as things deteriorate, I suspect it won’t be no questions asked, ‘here’s your money Sir’. I smell capitol controls dead ahead.

As a great believer in ‘panic early, panic often’ I’d rather be 9 months early than a day too late..

So, poised to hit the panic button once again and be in front of the queue…

I wouldnt trust Gov “insurance” to pay out squat. Anyone with money tied up in a bank is likely to be robbed comprehensively.

He who panics first, panics best.

“Anyone with money tied up in a bank is likely to be robbed comprehensively.”

Small-fry cynic here tries in his picayune way to game that:

I direct deposit all receipts into a U.S. Govt credit union, suspecting that the pols and their underlings will take care of themselves before anybody else.

I think you are reading too much zero hedge. You are in the wrong forum here.

When was the last time depositors lost money in the US?

Can you imagine BoA or WF going under and depositors loosing their money ? The government will just print the money as usual. We will be screwed by inflation but that is another story, we are used to that 2% deeper every year.

MM

Yes I can imagine BoA or WF going under.

I’m with RDB on this one.

Will anyone care about a connection between trump and Deutsche Bank money laundering (at this point)?

Nope. His base doesn’t care what he does, as long as it irritates the liberals; rational people are too fatigued to give a crap anymore.

Nailed it!

Federal and State prosecutors will care, especially those in New York State.

How else dies one tie together these inconvenient truths:

1. Deutsche Bank has been nailed in court already for massive money laundering of money from Russia. That had been a major source of its funding for its business loans

2. A leaked portion of Trump’s 1995 tax return showed that he’d lost $915 million through multiple bankruptcies.

3. How the heck does anybody recover from bankruptcies of that magnitude? No bank will lend you money after business disasters like that. No American bank anyway. Deutsche Bank and the Russians were willing to lend money to Trump and that was the KEY factor in Trump’s rise from the ashes of his bankruptcies

4. Trump was known to have worked extensively with the section of Deutsche Bank later shown to be the main money launderers for the Russians. Interestingly enough, another section of Deutsche Bank that had loaned money to Trump was sued by Trump

5. Over a year ago, news came out that Mueller had subpoenaed records from that particular Deutsche Bank section. Nothing since has been heard about this, but I would be surprised if Federal, State, or NYC prosecutors aren’t working on this. Mueller’s mission statement doesn’t include investigating Trump’s business practices well before his running for President, but he’s free to pass these referrals on to the appropriate agencies

These are the known facts, there is much more speculation about the rest, which should start seeing the light of day in the coming year

Always same story about The banks, they can create money themself and lend it out with good profit until The shxt hit The fan. The banks then want to be bailed out with our taxmoney… Buy gold/silver and stay outside and watch

Banks (excepting the Federal Reserve Bank) do not create money.

Right again J’Chip. Half right maybe ?

The Banks lend/loan out the ‘new’ money by putting it in your account. But as soon as you spend it they owe the same amount of money to whoever you spend it with.

Hence there is no ‘net’ new money just an added asset and an added liability on their Balance Sheet.

The Banks overall assets=liability total increases and gives the impression of new money but it is really artificially created new money offset by equal amount of new debt.

Why is the Euro gaining against the greenback after a fed hike and with all the easy monetary policy, austerity,apolitical and economic turmoil and uncertainty in the EU? And why is the 10y T-bill yield down, if ever so slightly, after the hike?

Book squaring at the end of the year. Shorts are covering to go home flat for the holidays.

Once the covering is done….. we resume the trend… $ up/Euro toast

Yet more proof regulation doesn’t work for a system in which those licensed to operate get so big that they cannot be allowed to fail lest they bring the whole lot down. A regulated free market = oligopoly.

How do we go about fixing it? I think Buckminster Fuller had the right idea, you don’t fix it, you create a better system.

Co-Cos… One of the best weapons invented after the last financial terrorist attack of 2007/8!

The reason why “The Markets” behave incredulously is because there is NO such thing as Truth within “Materialism”/Selfishness. You know, when ”Fear-Greed” is Humanity’s Blame/”Musical-Chairing” Game, so to speak. When “Robbing PeterTo Pay Paul” in The ONLY Game in Town.

It is as if Incredulity is The ONLY Energy Creator’s way of informing about The Consequences of Blindly Accepting-Rejecting Materialism as The Be-All, End-All. You know, when Blindess is certifiable as “20-20 Vision”. Especially when there are some who are able to “see”/perceive/realise The [ONLY] Energy Creator.

You know, those who are able to realise their own reality as The Guiding Principle in Life. Those who are able to-realise that “self-Judgement” is The ONLY thing worth judging. Those who realise that ALL are “Similarly-Flawed”., which is why The ONLY Energy Creator is also The Embodiment of Humility/Forgiveness.

“…from hopeless to hope and back to hopeless…”

What a great line.

Can anyone explain why DB 6% Co-Cos were trading at 106 about a year ago? There’s got to be an interesting story behind that!

Could honest banks be a non-trade advantage for China?

Honest in the sense that profits are socialized and even foregone in the national interest.

Deutsche Bank is a lesson in Zombie Banking & Zombie Central Banking.

Stress tests have concluded for well over a decade that DB is insolvent.

Watch closely for their next private investor to bail them out for another six months with a couple hundred billion of loose change they had lying around in the couch cushions.

Some ‘magical’ investor will appear to bail them out as per usual I guarantee it.

MOU