“The authorities should prepare contingency plans.” The big four banks are too exposed to mortgages. Even if the banks don’t topple, the economy will get hit hard.

In its latest report on Australia, the OECD focuses to a disturbing extend on housing, household debt, what the current housing downturn might do to the otherwise healthy economy, and what the risks are that this housing downturn will lead to a financial crisis for the big four Australian banks, an eventuality that it says “authorities” should make “contingency plans” for.

The big four banks are huge in relation to the Australian stock market and the overall economy: Their combined market capitalization, at A$341 billion, even after today’s sell-off following the OECD report – accounts for 26% of Australia’s total stock market capitalization.

How they dominate the stock market showed up on Monday after the release of the report:

- Common Wealth Bank of Australia (CBA): -2.98%

- Westpac (WBC): -3.38%

- Australia and New Zealand Banking Group (ANZ): -4.09%

- National Australia Bank (NAB): -2.54%

The overall ASX stock index on Monday dropped 2.27%.

These big four are heavily owned by Australian pension funds, retail investors, and the like and form a big part of the retirement nest egg of the nation. So a banking crisis that involves the Big Four matters on all fronts – and the OECD report even pointed out that a collapse in the share prices of the Big Four would itself impact the overall economy negatively.

The report (PDF) starts by explaining just how strong the economy is in Australia:

With 27 years of positive economic growth, Australia has demonstrated a remarkable capacity to sustain steady increases in material living standards and absorb economic shocks.

The labor market has been equally resilient, with rising employment and labor-force participation. Life is good, with high levels of well-being, including health, and education.

It expects “continued robust growth of around 3%” in the near future. And the OECD’s “resilience indicators” suggest “that there is no emerging downturn at present.”

But then there’s the housing bubble, household debt, and the banks that have funded this bubble and that households owe this debt to.

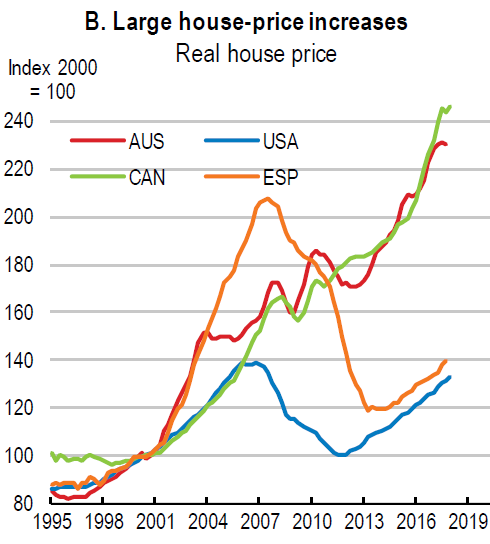

The charts below are from the report. The first chart compares inflation-adjusted house prices of the two most magnificent housing bubbles, Australia (red) and Canada (green), Spain (ESP), and the US. The index measures changes in price levels, adjusted for inflation. Clearly, Australia and Canada are in a world of their own, but Spain, whose bubble collapsed disastrously and led to numerous bank resolutions and bailouts, got close:

The Australian and Canadian two-decade long housing bubbles make the old US Housing Bubble 1 look practically infantile. However, with the US housing market being so much larger, and with US banks and financial products such as mortgage-backed securities being so interwoven in the financial world, the US housing bust that morphed into the US Financial Crisis became the Global Financial Crisis.

This is not going to happen with Australia and Canada: If they get into a financial crisis, they’re not big enough to drag the entire world into it.

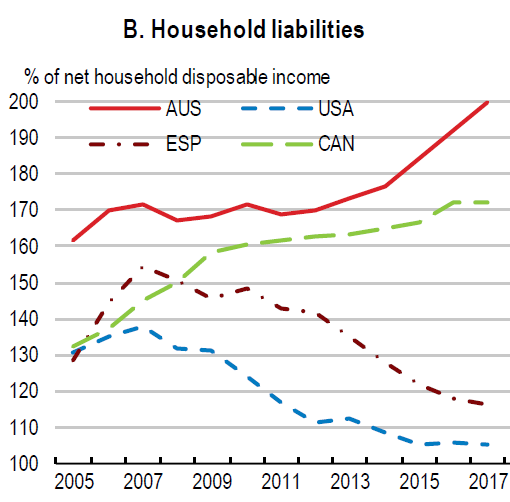

Australia’s household indebtedness, mostly tied to mortgages, and mostly owed to the above big four banks, reached 200% of net household disposable income, the highest ratio in the world. Even Canadian households can’t keep up with that. And US households, after the Financial Crisis, just fell of the mortgage wagon:

All this household debt has been incurred by households and provided by the banks on the assumption that the housing bubble would continue to inflate forever. But late last year, home prices began falling in Australia’s two largest housing markets – with prices in the Sydney metro down 9% and prices in Melbourne down 6% by last month. That was never part of the plan.

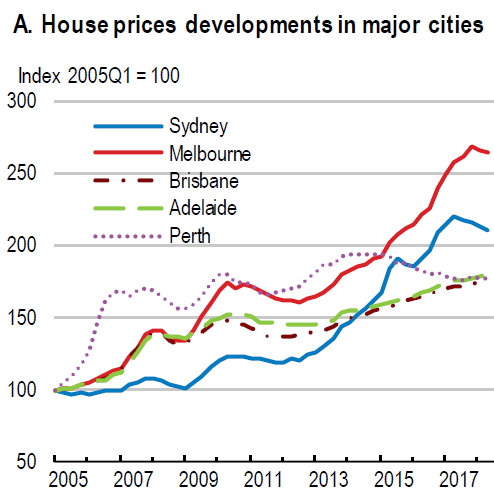

The OECD’s chart below depicts house prices in the big five capital cities. House prices in Perth (dotted line) have been in decline since 2014 due to the mining bust:

The ongoing sell-off in Sydney and Melbourne is “a welcome cooling of house prices,” the report says, which also lists some factors that contribute to it:

- “Prudential measures taken by the Australian authorities” to halt the “deterioration in lending standards.” This includes limits on interest-only loans, and many other measures.

- “A sizable pick up in new housing supply” – with new construction now flooding both markets at a record pace.

- “A fall off globally in the appetite for housing as an asset class,” which may, without naming names, refer to the sudden loss of appetite for Australian housing among Chinese investors.

- “Domestic rule changes and alterations to state-level taxes that may have deterred some foreign buyers.”

But the price declines haven’t done anything yet to fix the situation. The OECD warns that “though house prices have eased recently, they remain high in level terms (they have more than doubled in Sydney and Melbourne since 2005).”

And this housing downturn is happening even as Australia’s central bank (RBA) has kept interest rates at a record low 1.5%, which stimulated the housing market until it didn’t.

First, the report holds out hope: “The current trajectory would suggest a soft landing, but some risk of a hard landing remains.” But then it takes that hope away: “Past OECD work has found soft landings are rare.”

So how will it impact the banks?

The Australian “authorities” are in denial, the OECD seems to say ever so politely in between the lines: “Direct risk to the financial sector from mortgage defaults, triggered for instance by a hard landing in house prices or interest rates hikes, is viewed as limited by the authorities (for instance, see, RBA, 2018).”

More denials from the “authorities” that encouraged this housing bubble to form in the first place:

- “A particular feature of the housing loan market is that it comprises mainly variable rate mortgages. This makes household loan repayments more sensitive to movements in interest rates….” But that’s not considered to be an issue.

- And: “Risk of financial stress from the large numbers of mortgages with interest-only phases that are due to transition to principal-plus-interest repayment is also not considered substantial.”

Nevertheless, here’s what authorities should do, after they get through with their denials (emphasis added):

“The authorities should prepare contingency plans for a severe collapse in the housing market. These should include the possibility of a crisis situation in one or more financial institutions.” The contingency plans should include “a loss-absorbing regime (including bail-in provisions) in the case of financial-institution insolvency.”

Despite the big four banks passing the stress tests, “the possibility of financial-institution crisis should not be discounted entirely.”

So when this “financial-institution crisis” happens, who should pay? The OECD explains:

Insured account holders will be fine: “For account holders there is a deposit insurance scheme, the Financial Claims Scheme, which provides protection up to a limit of A$250,000 per account holder at each bank.”

But bank shares – that A$341 billion in current market cap – senior debt, and uninsured deposits may be bailed in:

“As regards the institutions, a crisis would put recently passed crisis-resolution legislation under test. Unlike in the United States or European Union, the legislation does not include explicit bail-in provisions on senior debt or deposits owed by financial institutions. This gives flexibility to adjust resolution plans to the specific characteristics of the crisis.”

“On the other hand, the absence of explicit bail-in provisions could slow down the speed of resolution and risk encouraging financial institutions to gamble for resuscitation. APRA has indicated that it will start a consultation on its loss-absorbing capacity framework in late 2018;”

“Loss-absorbing and recapitalization capacity should consist of a financial entity’s equity (shareholders) as well as debt instruments (certain bondholders and uninsured depositors) on which losses can credibly be imposed in a resolution.

Even if the banks don’t topple…

The report warns that “substantial impact of a hard landing in house prices on the wider economy may occur through other channels”: “If house prices collapse, consumer spending could suffer, via negative impact on wealth, including from exposure to bank shares, which would encourage deleveraging. Together with reduced housing-related expenditures, this would put pressure on the whole economy.”

“A large drop off in house prices could cut household consumption, prompt collapse in the construction sector, increase mortgage defaults, and freeze bank lending to business.”

In its own OECD bold, it says: “Financial supervisors and bank regulators should be prepared in the event of a hard landing in the housing market.”

And the RBA should hike its policy rates to remove the stimulus under the housing market: “In the absence of negative shocks, policy rates should start to rise soon. Monetary conditions remain very accommodative, with the risk of imbalances accumulating further if the low-interest rate environment persists. In the absence of a downturn, a gradual tightening should start as inflation edges up and wage growth gains momentum.”

So “a start to policy-rate normalization is now firmly on the horizon.” And “Though there are risks” to this “gradual tightening” envisioned by the OECD, “it could potentially bring welcome unwinding of the tensions and imbalances that have accumulated from the low-interest environment, notably housing-related issues.”

Which should have been done years ago before “the tensions and imbalances” got so big that they threaten to trigger the next financial crisis.

The house price declines in Sydney and Melbourne aren’t exactly slow motion anymore. Read… Update on the Housing Bust in Sydney & Melbourne, Australia

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I like the recommendations for handling any banking crisis, which include bail in of stock, senior debt, and uninsured depositors. However, if enough people are impacted, I predict legislators will kindly offer up a taxpayer bailout to help those folks who suffered “through no fault of their own”. Greed and stupidity are never faults, of course.

Why should depositors pay? they are not investors

Depositors with money in the bank are investors. They’re unsecured creditors, and they get paid a small amount in interest. They lend money to the bank. But they’re at the low end of the capital structure. So when something goes wrong, in theory, they’re the first ones to get hit. That’s why you need deposit “insurance,” so that depositors won’t be spooked into yanking their money out of the bank (“run on the bank”), which would topple the bank.

So depositors are “unsecured” creditors, but they are (if the follow the rules) “insured.” So the risk for them is minimal.

Deposit insurance wouldn’t even be necessary if depositors were placed at the top the capital structure, ahead of senior secured bondholders, because the losses would be absorbed by investors on the lower end of the capital structure (from the bottom up: stock holders, preferred stockholders, contingent convertible bond holders, unsecured bond holders, and up).

The advertisement shown to me right after the article above proclaims:

ITS LIKE A POWER WASH FOR YOUR INSIDES

For a moment I thought the ad was directed at the banks.

You wrote, “Deposit insurance wouldn’t even be necessary if depositors were placed at the top the capital structure, ahead of senior secured bondholders…”

Well, not to be too sarcastic, but that kind of approach makes entirely too much logical sense. From an Engineering perspective, the design of the Financial System is deliberately constructed to maximize adverse outcomes to someone’s obvious benefit.

The problem isn’t depositors taking their money out, in a run.

It’s putting any money back in.

After some deposits have been seized.

The lesson from the Great Depression, surely, has bee learnt.

Wolf, Depositors as investors concept is problematic. Depositors are ‘forced’ to deposit money in financial institutions – just think of the consequences of keeping a large sum of notes at home! So a ‘forced’ investor is a contradiction in terms. Depositors put money in a bank only for safe keeping and depositors insurance is more like personal effects insurance.

Which means that, since they own their own currency, printing more money; ergo, inflation, lower consumer spending, jobs loss, lower productivity, etc. This should be interesting to watch…

You forgot to mention all 4 banks are under investigation for Fraud and every other type of financial crimes. The Royal Commission is the highest investigating power in Australia.

The Banks Are Bastards. Liar loans, if you signed up for free debt it’s yours to pay back in full.

I didn’t forget. I mentioned it many times before. Broken record. This article was about a different topic than wrongdoing by the banks. Every article has its own specific focus.

Well, to be fair to Wolf, he would need an entire website to catalog malfeasance, misfeasance, wrongdoing and muddleheaded lending by the global systematically important banks, financial institutions and insurance companies. Just look at the institutions on the hook for those massive aircraft orders from Boeing and Airbus. Having retired from the Aerospace Industry I can tell you from first hand experience how brutal airline recessions can be and will be when the next one comes along.

I think if Wolf Street did a complete list of fraud committed by banks, it would not be a Street any more. More like a gigantic parking lot. . .

“The banks are barstards” indicates you don’t understand what went on.

The banks were being malious putting their balance sheet in harms way.

They were ignorant.

I watched all the mortgage related royal commission. The bankers never indicated irresponsible lending would be bad for them. They didn’t, still don’t, realise.

“The bankers never indicated irresponsible lending would be bad for them. ”

When the bankers have the political power to declare Socialism Only For Banks, thus making sure that others pay their losses for them, then of course irresponsible lending won’t be bad for them.

Is Australia like America in that if you keep bank notes around the police can seize them on a whim and force you to go to court to prove that you have the money legitimately? Otherwise, there is little reason to put money into a bank for the pitiful interest rates they pay. Just getting a Safe Deposit Box might be safer with less risk and only a very small reduction in income. Haven’t yet heard of a bank cracking open the safe deposit boxes to ‘bail-in’ what they can grab?

You have a parasitical financial elite running existing systems to the ground to their own benefit. It’s been mentioned many times before, like the idea of “heads I win, tails you lose” capitalism we kept hearing about in 2009.

A simple way to think of it is that those managing the banks are lending other people’s money (indirectly through a sales force) to generate short-term profits based on book value. They get a lot of fees for this, much of it linked to the amount they can jack up the stock price in a short period of time. When the banks investments start to go bad, their money is still safe. They retire, new management blames the old for the problems, and “investors” such as pension funds lose money. Most depositors are bailed out by the government (unless an outside force like the ECB prevents this). No one involved loses their fortune or goes to jail – they blame unforseen events and the people who took the loans – and the cycle repeats with the next crew.

As long as QE is politically acceptable as a fix, this can go on for a long time without a major crisis – but the workers do see their cost of living skyrocket as a result which causes political instability.

Sorry that was mean to be the banks weren’t being malious*

So basically, the Chinese blew up property bubbles all along the Pacific Ocean?

4-D Chess.

“So basically, the Chinese blew up property bubbles all along the Pacific Ocean?”

How did Mandarins do that ?

Did they use Yuan to buy or they use dollars?

Did they lower western interest rate?

Did they write laws that give them right to buy?

Did they force you to buy their cheap staff ?

THE MANDARINS LAUNDERED AND STASHED THEIR IGG.

All along the Pacific rim.

As they can NOT OWN LAND in china. Blaming the west for the issues is pathetic.

Start with the real root of the whole pacific rim property bubble. Restrictive and unfair MERCANTILE CCP TRADE PRACTICES.

All those UNFAIR Trillions, in trade surplus $, have to go somewhere.

Talking interest rate,s do you have any idea what you pay for money in CCP china, or as the case is, dont pay, if you have CCP connection’s.

This stupid statement “Did they lower western interest rate?” says you dont. CCP member interest rates in china, are less than 1%, STILL. INTEREST ONLY. The CCP chinese dont borrow western money for anything other than cosmetic reasons. They pay with LAUNDERED chinese IGG.

Yes sir, across the world as well.

Really is unprecedented!

This is exactly what happens with unlimited fiat; and yes currency backed by nothing is always unlimited.

Yeah the Aussie dollar has been in the tank. They do have a fair amount of gold, and a stronger dollar might cut off foreign investment. They should try what the US did to shore up its currency, raise rates.

whoa whoa whoa… the Australian housing bubble is almost as big as the Canadian’s? What’s going on here?

Obviously, the Hong Kongers and the mainlanders going to Canada are doing not a good enough job of inflating that market compared to the Chinese going to Australia. Come on, children of Huawei’s founders, you guys have to buy more houses to keep the Vancouver housing bubble going. There are not nearly as many famous rich Chinese people in Australia as they are in Canada.

:)

ShellBeRightMate

Perhaps more “crikey!”, than “no wuckin’ furries”, this time round

“This is not going to happen with Australia and Canada: If they get into a financial crisis, they’re not big enough to drag the entire world into it.”

Would they be big enough to drag the world markets down a goodish bit?

“More denials from the “authorities” that encouraged this housing bubble to form in the first place..”

“The contingency plans should include “a loss-absorbing regime (including bail-in provisions) in the case of financial-institution insolvency.””

So, as is normal in capitalism today, “authorities” will create a mess with their policiies and the same “authorities” will be asked to fix it. Beautiful system, ain’t it?

“loss-absorbing regime”- did they mean bag-holders by the way. Tax-payers, savers, prudent people and retirees would not be far behind. Hopefully sometime in the future they will decide enough is enough and do something about it.

Looks like we need a system where policy makers are brought to book if you really want a system that works for the common man. Otherwise as in the past, it is rinse, repeat.

Yes, an Australian or Canadian financial crisis will drag down markets around the world a “goodish bit.”

Wolf, have you been keeping an eye on the AUD to USD currency rate? A drop in the Aussie dollar will put pressure on inflation and a possible need to increase interest rates. Leading to more pain for mortgaged homeowners in Oz.

In genuine,authentic free market ( Capitalism ), there is no central bank and money is gold or silver.

That system, more or less existed in North america from 1620 – 1913.

American government was limited and was taking around 5% of GDP.

That system was best system for common man, taxes where 5 cents in dollar — basically you work for yourself 14 years and than one year for government.

Now taxes are probably more than 20 cent in dollar which mean you work 3.5 years for yourself and than whole year of government.

We will not have honest markets or sound money until we end the Fed.

– Yeah, sure. Blame it all on the FED, right ? Look at the amount of outstanding debt in mid 2008. It stood at $ 56 trillion and the balance sheet of the FED was at about $ 800 billion. If you know how money is being created then you have to draw the conclusion that say 98% of all the money/credit (in mid 2008) in the US was created (out of thin air) by (commercial) banks.

– If you want to blame someone/something then blame rising prices.

– No, commercial banks can create all the money/credit they want without borrowing one cent/euro/yen/…… (from e.g. a central bank). Steve Keen has written about/explained this extensively.

>Luck is when opportunity meets preparation.

>Think what comes up must come down, e.g. inflated asset classes.

>Consider the rot within the system.

>More remains to be seen.

HF

With the distinct possibility of a change in government in 2019 to a union dominated LABOR party its going to be interesting Their previous record in government is ominous.

It’s certainly very strange that for 40 years those who work in manufacturing were told, as their production plants closed and their jobs moved overseas, that they are subject to ‘market forces’, that industrial planning and state aid to save the factories and jobs would represent ‘communism’.

So the factories closed and the jobs went to places where slave wages could be paid.

HOWEVER…when it comes to the world of banking and finance, strangely it appears those same rules do not apply – market forces should NOT be allowed to apply when [self-imposed] trouble strikes, and authorities must prepare ‘contingency plans’ to deal with the fallout – once again – of the recklessness and greed of the world of private finance.

How very, very strange it all is. One rule for some, it seems…

Also, Social Security, withheld from your own wages, is “entitlement”, while tax cuts for corporations are just …. “for job creation”.

No more ominous than the other side – it’s just that your ‘confirmation bias’ means you ignore all the mess-ups the party your political proclivities induce you to follow, whilst latching on like a limpet to the mess-ups the ‘other side’ makes as proof positive of your rigid, strongly-held belief that they are no good.

That’s all it is.

After all, most of Australia’s prosperity of the last 20 years has been the result of the investment of the communists in China, has it not?

Given that, seems more than a little strange to fear a ‘slightly left-leaning’ (actually probably in reality no more than centrist) government in your own country, no?

More than a little hypocritical, too…

Such anger, such bile, attack the the only answer from the left,sad.

Bile – mostly the right, and in many places as well. Well said to incriminating the side thats tied to this mess LOL – the right is losing so deal with it.

– Yeah, sure. Blame “the left” for all what went wrong in Australia. But there was a right wing government government (remember the name John Howard ?) in power from 1996 and 2007 who introduced the socalled “Capital Gains Tax Discount” in 1999. As a result of this tax deduction australian real estate/property prices went through the roof. #SAD.

Spot on, the only union’s more corrupt than Australian ones, are American ones.

Check out Hollywood Unions.

The Cinematographer’s Union is legendary. . .

– Politicians THINK that they are in control of an economy. But they aren’t. In that regard, every government has to make do with the (financial, economic) cards they have been dealt. And that applied to the Rudd/Gillard goverment (2007 – 2013) as well.

Politicians are often in control of the economy enough to come out rich, often through simple stock market manipulation.

Whether they actually believe their reasoning or they just cynically say anything to defend themselves is another question, though an irrelevant one overall.

I do not think the US ever had a housing bubble. What we had was a financial panic.

What had was a hot housing market that was killed with a financial panic. After the financial panic subsided, prices jumped back up. If it was a real bubble, prices would have not recovered so quickly and completely. It was not a bubble … it was a financial panic. The media did a great job brainwashing the public with the thought that their house was going to zero and that triggered the panic.

People that believe the bubble theory explain the recovery as another bubble. It is not believable that we get repeat bubbles. I don’t buy it.

@SocalJim-

>I do not think the US ever had a housing bubble.

If there were true economic fundamentals in the housing market there would be no need for government guarantees of the mortgage industry.

I agree. Home prices would be so much lower without govt support.

I’m afraid that you are missing a central point: interest rates are designed to reflect risk, and when rates are artificially suppressed for a long period of time – 10 years and counting in this remarkable instance – a HUGE amount of malinvestment is assured.

People across the U.S., Australia, and elsewhere have been able to finance homes based on those artificially low rates, and now that they are (invariably) going up, the cost of home ownership also rises.

It most certainly is a bubble, and is beginning to pop.

I think Australia and Canada are bubbles while the US is not. Investors look to Australia and Canada as a hard asset play since those countries have a lot of natural resources in their lands that implicitly back their financial systems. So, I think those two countries have home prices that are too high because investors where plowing money into those markets. They wanted exposure to protect themselves from the US financial system which was wobbling.

As far as the low rates go, some of the lowness reflects the deflationary winds from Chinese imports. That may be curtailed if Trump wins re-election.

Did the Fed buying MBS have anything to do with home prices “ jumping back up”?

“The media did a great job brainwashing the public with the thought that their house was going to zero and that triggered the panic.”

There you go with that theme again. When the media reports on weakness in the housing market, it’s “brainwashing”. But the media cheerleading on the way up – what do you call that? Accurate reporting?

“It is not believable that we get repeat bubbles. I don’t buy it.”

Will you believe it when Housing Bubble II pops? Or will you blame the media for panicking people a second time?

You’re kidding, right? No money down loans, ‘investors’ buying 2-3 homes on credit, sub-prime?

And when it was over once flush RE agents taking foreclosure buyers on bus tours to snap up the vacant properties.

You are right … all of that did happen. But, that kind of stuff happens in an overheated housing market. A tradeoff in that market was expected. It should have been a normal tradeoff .. prices drop 20% then eventually recover. Instead, it morphed into a financial panic and prices dropped much farther than they should have. But, I don’t think it was a bubble. Bitcoin … now that was a classic bubble.

– There is one GOOD metric to gauge whether or not there is a housing bubble. When over the course of SEVERAL years housing prices go up more than the (REAL) purchasing power of wages/salaries then you can bet your bottom dollar that there is a housing bubble.

– That was here the case between say 1995 and 2006 and that is the case right now here in the US, Canada, Australia, New Zealand, …………

– Perhaps Wolf Richter can pull up data/charts on this topic ?

– In the 2000s the USD fell against a bunch of currencies. That way the purchasing power of US wages fell more than in e.g. the Eurozone.

– Currently US interest rates have risen since say 2012/2013, making a mortgage more expensive.

– Or look at the Case-Shiller index. Two links:

1)

Case Shiller index from 1890 up to 2006:

https://theblogbyjavier.com/2010/05/20/a-house-is-no-investment/

2)

Case-Shiller index from 1987 up to now:

https://www.calculatedriskblog.com/2018/10/case-shiller-national-house-price-index.html

(Didn’t know the current housing bubble was this large)

(Thanks to GOOGLE search)

The fact that such extreme housing bubbles have occurred in Australia and Canada of all places, vast countries with small populations, is absurd. But I guess all you need is bubble psychology, the banks to fuel it and government to allow it. In Australia’s case, one benefit to a housing bubble is that it helped hide the effects of the offshoring of most of its industry over the last 40 years. Not a single car is manufactured in Australia anymore. Financialization to the extreme.

“Not a single car is manufactured in Australia anymore.”

Rather than lament the loss of its auto industry, Australians should rejoice. Not only will they gain access to better and cheaper cars (the ones, incidentally, they have been buying for many decades now), but they will not have to support an industry that is better suited elsewhere.

Canadian here,

I have said this numerous times on WS. Canadian indebtedness for RE is pretty much limited to a few major cities. The rest of Canada does not even go to those cities to visit, let alone live there. Interesting the debt cities are within a stones throw of the US border. :-)

Where I live most people own their homes outright and haven’t had a mortgage for years. In fact, almost everyone I know does not have a mortgage. My Daughter is 39 and will have her home paid off before age 50. My 35 year old son will have his home paid for by age 45, although he might turn it into a vacation rental and build something smaller on the same property. This is the traditional Cdn mindset. The Toronto and Vancouver buying insanity is relatively new to our psyche, and I believe was heavily influenced by the proliferation of home reno and improvement shows, and made even more toxic due to social media and general lemming bandwagon pressures.

Our comeuppance is long over due.

regards

Just to add to your point as to why most other regions are not as bad but are still “inflated”. A lot of other towns see spikes from industry – oil, lumber, auto, etc. natural bumps in population as jobs arrive. But all of these areas correct when the work dries up and only farmers or fishermen are left.

I saw a few people attempt to gamble on housing, owning rental properties. They always end up selling at a loss, that game only works in large transient population hubs.

That’s why I am enjoying my popcorn, as Vancouver and Toronto put on a show.

For what it’s worth, I live in a small condo (545 sq. ft.) I own in downtown Toronto.

Bought Jan. 2000 (a relative bottom due to everyone wanting tech stocks):

C$145,000

Current estimated value (based on 5% nominal annual compound increase):

C$366,000

Current estimated value (based on recent comparable sales):

C$446,000

And I too finally paid off my mortgage early last year.

Does anyone else think that our monetary system is totally bust and incomplete?

Why do “assets” with paper value get accepted as collateral for loans?

Why is it ok to hand out mortgages with 0% down?

It seems to me that the core of all these bubbles is money creation from credit. The more loans there are, the more money there is. This creates perverse incentives to people and governments over many years to always create more credit, just to fill in any speculative debt holes.

The only way out of this housing debt mess is to print money and hand it out to the people (inclusive of speculators). And how do we print money? More debt either by govt or by people or by corporations. This is just kicking the can to the future.

Hi Wolf – I think you are forgetting about depositor preference in Australia which ranks depositors ahead of all but about 10% of bondholders. While this may not stop bank collapses it should limit losses to equity and bondholders.

Not usually a fan of the ABC, but this is an interesting interactive article:

https://www.abc.net.au/news/2018-12-10/how-hard-has-australias-property-downturn-hit-your-suburb/10588960

Hi Wolf

I am a British and have lived all my life but for my sins I have two 35-40 year old sons, one who lives in Brisbane , the other in Melbourne. The former has never been financially able to buy a home, the other, until I told him to sell one a few months ago, had already bought a second and rented out the first.

Hence I can confirm that indeed the values of similar properties in these two State Capitals are significantly different and your charts clearly illustrate this anomaly.

I also can confirm that Bank lending to fund residential mortgages appears to be very easy to secure, even at high loan to value, in Brisbane.

I have always remembered a dramatic front page newspaper headline when I was on holiday in Surfers Paradise (now Gold Coast, it sounds better!) about 30 years ago. At that time there was several thousand of high rise apartments that had been bought by wealthy Japanese, Melbourne and Sydney investors, when suddenly the market collapsed.

The headline read ” THE BUYERS ARE PICKING THE EYES OUT OF THE SELLERS”.

Looks like they may have avoided 2008-9 but the best, or should I say worst, is yet to come.

Mortgage lending WAS easy to secure. No longer. A significant prorpotion of mortgage lending has effectively been criminalised

The current local understanding is mixed in terms of house prices, somewhere along the five stages of grief. Don’t even try to explain credit economics to a person that thinks they understand economics because they painted a wall.

But the vast majority still periecve the banks to be rock solid. Beyond question.

They don’t understand and whereas they were under an illusion that yourself prices always went up.

The bankers were under a collective delusion that that increasing house price was independent of their lending.

The banks are toast.

Even with zero respect for the intellgicne ofmpkticans, surely it is obvious they will have to bailout depeotors if they want a financial intermediation to continue.

I live in Perth. Even now with prices, like for like prices have fallen far further than indicated, having fallen long and deep many (the innumerati) still think they are uppy-going things.

The money lenders control the economy, they cause both the boom and bust cycles by extending credit and tightening credit and dealing in usury creating debt that is mathematically impossible to correct. It is a game rigged against lenders destroying Individuals, families and freedom. Bankers are running the world but Communist counties like china have learned how to play the game. The capitalists are driving the people into the hands of the socialists. We are now capitalist slaves. The bankers are inheriting to world. The slaves can’t figure it out its to simple.

Please excuse the grammar errors in the post I have just submitted.

Carelessness by an old Oxford University Graduate.

PS. Can your readers been given the opportunity to comment on another ex Oxford Graduate, surname MAY.

The distinction between a cyclical downturn and a more substantial secular downturn is clear.

In a cyclical downturn authorities loosen credit conditions.

Credit conditions have been tightened in Australia in a response to widespread mortgage fraud. They will not be loosened.

This is going to be less of a regular downturn and more of the extrmemly serious variety.

What you just described applies equally to Canada. Forgive me as I invoke the most over-used cliché of 2018 – winter’s coming.

or

Something wicked this way comes……….

Ding, Ding…we have a winner, nice one Copernicus!

What most people outside Straya don’t fully understand is the outright criminality that has backed this (I can’t even call it a bubble) FRAUD. Just in the last couple of weeks you had the CEO’s of the Big4 admit that up to 75%!!! of their loans were based on a completely BS made up expense measurement called the HEM. Basically admitting that 75%+ of all their loans are fraudulent, and make no mistake they are, the income stats back it up. The income(s) aren’t there, its all fake. They were COUNTERFIETING! mortgages. That’s the reason why everyone is panicking behind the scenes. Once the lawyers get a hold of this, the Big4 are toast! For years Strayans always said that our banks were safe because of the full recourse of the mortgages, but what they didn’t say is if the mortgage was fill out improperly (illegally) or is deemed to have been given improperly, the borrower gets the property free and clear. Not too long before the billboards and radio adds go up: “Are you under water/mortgage stress? Did your broker/banker get you in over your head? Do you want your house for free? Call me, Bill Buttlicker, Dewey, Cheatum & Howe 1300 BITE ME. And once that starts, how long to you think it takes for all the institutional holders of these now radioactive/illegal/toxic RMBS to get on the phone and ask for their money back, 100%, NOW! Hello institutional bank run, and boom go the banks! Done and dusted!

Pavlovhouse… your appreciatation is appreciated. It’s even more fascinating.

Economics Primer… economics isn’t like other fields of study. It isn’t understanding something. It’s understanding how others misunderstand.

Australian banking is ripe for economics lessons.

Put this at the front of you mind.

The CEO’s and Chairmen of the banks wrote an open letter to the (then) Prime Minister asking for a Royal Commission.

Significance? They didn’t know there was a problem in their mortgage book.

Although it’s true they used fraud (so they could be defrauded – which is odd) it wasn’t with criminal intent.

It was delusional.

((An illusion is a sense that misdirected you. A delusion is being misdirected by a thought. Nothing external is giving you any clue the thought is real))

The Australian public was under the illusion that house prices always go up. For they are uppy-going things.

The bankers werve under the delusion that the increase in house prices was independant of their lending.

That’s why they ignored serviceability.

Raising house prices would ensure any future defaults would cover the mortgage. Elementary dear Watson.

Your note demands another vital question is answered, if 75% of mortgage were bogus how can they still be current/money good?

Take a look at page 63

https://www.asx.com.au/asxpdf/20181101/pdf/43zx6w6jqx2v0j.pdf

That’s clearly saying the banks are lending to mortgagees to cover their mortgage interest.

All of the growth in outstanding mortgages can be attributed to capitalising interest.

Which is an interesting answer to the question.

I live in Perth.

Additionally, the Lender’s Mortgage Insurers (QBE & Genworth) would have definitely got a whiff of the Big4 Australian mortgage fraud. They’ll be tearing up the bank’s insurance should the borrower default if it can be demonstrated that the loan application form was “massaged”. The Banks are fully holding the can now. I’ve not seen any reporting on this issue but it logically follows that insurers will not pay out if they don’t have to.

Arron from Melbourne

I could not agree more.

I have looked at this. As Genworth seems to be in run off anyway why wouldn’t it stand aside? In run off it has no future business to maintain a relationship for.

Also if the Mortgages insurers standnaise the banks will have to increase the capital they hold again those mortgages. Their dividend were only maintained due to shrinking their provisions.

Once the market fathoms the scale and painted corner (fixed commitments) the Aussie banks are in its curtains.

The federal judgement of westpac’s fine $35m, was a call to the royal comsion for clarity. The treatment ahayne dished out in the short open testimony after the weak interim findings indicated he understood his message isn’t getting through.

I anticipate a clearer sterner final finding.

If just four companies account for 25% of the stock market capitalization it means they are effectively the stock market and the rest just dressing.

As a measure of comparison the four largest components of the S&P500 by capitalization (Apple, Microsoft, Amazon and Facebook) account for a measly 12%, and the S&P500 is just an index, not the whole stock market.

I am pretty sure Australia, like all other countries in the world, has big funds that will automatically buy these stocks the moment they go down enough, further reinforced by panic buyers (meaning smaller funds and retail investors that buy the dip in quantity out of fear of being “priced out” by the maxi-funds) but over the last three months dip and panic buyers have been routinely slaughtered, losing billions worth of funds. And remember: these are good times and Australians are among the most enthusiastic dip and panic buyers worldwide, precisely because the local stock market is so small and these four stocks are so important to it.

Italian savers have been told since time immemorial to buy banking stocks and bonds because “they cannot go burst”. The local government and European authorities have literally left no stone unturned to keep that promise, even when the impunity given to banking executives (no doubt to keep them from turning Queen’s evidence) generated a massive political backlash. Yet Italian banking stocks have been routed time and time again and dip buyers throughly crushed.

Deutsche Bank is literally “too big to fail”: it’s an officially sanctioned systemically important financial institution, meaning it will always be bailed out no matter what. Its exalted and protected status resulted in the Teflon™ coating we see these days: scandals pass over it without any apparent ill effect. Yet shareholders seem eager to get rid of DB shares like it’s some sort of radioactive waste.

Coming to an Australian theater very soon: you can only suspend the laws of economics and when you do they get back with a vengeance.

Just about all large European banks have little stock market capitalization, with most of them ranging from $15B to $40B. This is extremely low equity capitalization for institutions that have $1T to $3T in assets.

This tells me the banks are all bankrupt in substance and the equity would be worthless in a free market. But as you indicate, they are being kept on life support by artificial accounting, intervention, and other forces.

I think it would be messy to put these banks into bankruptcy, so they might try to keep them floating with near zero market value. They really can’t make new loans though.

You can buy stocks of Carige, one of Italy’s many zombie banks, for the princely sum of €0.0017 each. That’s right: a 1c coin will buy you over five Carige stocks. With a capitalization of €95 million and assets worth on paper around €25 billion (don’t ask how much they are really worth though), it’s in many way typical: nobody wants to touch Euro banking stocks bar speculators and hapless retail investors, and these are still booming times for equity markets.

These banks will soon have to deal with all the crazy loans they have extended over the past four years, deals that are already turning toxic as stimulus is still in full swing. These loans were not risky: risky investments will find capital if they pay enough. These loans made literally no sense but to push growth at all costs and avoid more years-old bad calls from being liquidated.

If we can resist the temptation of doubling down on stimulus and stick with tightening we may be able to have a long orderly liquidation and debt restructuring. And some banks will need to go bankrupt and the lawyers let loose if we want to avoid a repetition of the past decade.

As one of my professors used to say, Capitalism without the threat of bankruptcy works as well as Christianity without the threat of Hellfire.

(MCO1) Thank you for being so “succinct”!! We live within an economic criminal enterprise system and somebody is going to pay big time when this circus tent collapses. When you go to the dentist and need a root canal the dr. will numb your mouth. Next time around the public “root canal” for the global economy will be done without Novocaine.

John Bogle says 3 index funds own 30% of the entire stock market.

https://www.seattletimes.com/business/vanguard-founder-john-bogle-warns-index-funds-becoming-too-big/

The elasticity of demand for index funds in 401ks is practically vertical. It’s just “buy” regardless of fundamentals.

until it isn’t.

Looks like Americans are paragons of financial virtue compared to the Canadians on those charts.

Why are my Canadian friends always criticizing our spendthrift habits?

I think when the Canadian bubble bursts, if ever , it will be spectacular.

Will CAD go to 50cents?

Rarely government guarantees go uncalled.

Looks like a lot of mortgage debt secured by the government CHMC that will come due.

The Canadian bubble is confined to the large cities for the most part. You can go to parts of rural Canada like Saskatchewan and Manitoba or Nova Scotia and New Brunswick where the small towns have lost population for decades and there is excess housing stock and buy a house for less than $C50,000.

This is how financial cracks snowball and become self-fulfilling. Now that you’ve read the OECD report, as a supplier of wholesale funding for instance, how will you react to the knowledge that a housing (and CRE) collapse is on the cards, and that you can expect to be bailed in? You withdraw funding or drastically increase its cost. What does that do to the housing market? We saw this movie in the UK with Northern Rock etc.

These credit crunches are developing simultaneously in various outposts: Australia and Canada, also Hong Kong and China and now India. Collectively they will matter, a lot. The action in US corporate debt looks similarly ominous. Once these dunes start to collapse there is little that can prevent them cascading.

Thank you Wolf for publishing my previous comments as regards the forthcoming Australian economic depression.

Many outlets of the Australian main stream media have censored my comments because they do not tolerate dissenting voices.

New Zealand similar to Australiaad well reference housing debt. The interesting one this time is that people affected this time are in well paid jobs, the US one was people with no income.

False. Most defaults were among prime loans. It was speculation. And we’ve done it all again, except bigger this time.

During the GFC about the only useful thing Rudd did as Australian PM was to ‘Guarantee’ bank depositors funds and thus prevent a major bank run.

We later discovered that in fact a run had already begun with more than a few individuals taking their cash out of the banking system as well as very large digital transfers to ‘safer’ parts of the World.

People I know have for some time moved funds to short term deposits and are VERY nervous, intending to go to ‘at call’ as they mature, irrespective of the dismal interest rate.

There could be quite a queue forming outside the Big Four at (or before) the first sign of a ‘bail-in’.

This time it’s different. In a bad way.

house next door to a family friend on sydney’s northern beaches just sold.

they’ve been there since 1966 and we often have marveled at each sale….all AUD

June 1994 – $335K

Sept 2001 – $650K

June 2003 – $950k

Feb 2008 – $1.162m

June 2012 – $1.205m

Dec 2018 – $2.08m

they wanted $2.49m, then advertised to $2.19m….only got $2.08m

some reno’s but quite small on 2nd story…

amazing what a load of credit will do to goose your housing mkt

https://www.realestate.com.au/property/7-angle-st-balgowlah-nsw-2093?rsf=syn:oth

So if a bail- in happens in Australia, who would you rather be: a regular depositor or a shareholder?

Also, what sort of percentage of the total deposit will be taken by the bank ?

Insured depositor is fine. In a true bail-in situation, as shareholder, expect to lose much or all of your investment.

“Insured depositor is fine. ”

Insured by ‘The Government’ = ‘The Taxpayer’

In a major crisis with bush fires out of control on many fronts, how long will ‘the insurance’ last?

Look at the Financial Crisis: not a single insured depositor lost a dime. It’s not going to get much worse than that.

– From the australian website MACROBUSINESS:

https://www.macrobusiness.com.au

“John Adams: The establishment knows CRISIS is coming”.

https://www.macrobusiness.com.au/2018/12/john-adams-establishment-knows-crisis-coming/

– John Adams & Martin North have talked about this topic many times:

http://digitalfinanceanalytics.com/blog/adams-north/

E.g.

“Australia Has “Stage 4 Economic Cancer””

https://www.youtube.com/watch?v=z7VLUqPu3gs

“Parliament Nervous As Australia’s Economic Illusion Begins To Crack”

https://www.youtube.com/watch?v=3A7jCVtg4ow

– Recently I came across some new figures about real estate in Australia. The amount of dwellings (houses, apartments, condos) currently under construction in Australia is NOT 80,000 but some 130,000.

Building Approvals/consents do not equal actual dwellings/apartments being built.

What I will say though is parts of the country are going crazy and your numbers probably aren’t far off. On my train ride from Geelong to Melbourne I look out the window at Tarneit and Wyndamvale. You can count the excavators tilling the rock from former sheep paddocks. So much rock has been piled up it is quite impressive to see it higher than the chimney height of the old rubbish incinerator (preumably they are about to build over the old rubbish tip!). You can count the concrete pumps pouring slabs (one morning I saw 6 at once) or watch the asphalt crews laying tarmac road by road. With each day there are new house frames up and the next paddock undergoes its transformation.

Look across the city skyline and count the cranes. Towers going up everywhere.

https://www.abc.net.au/news/2018-10-17/crane-numbers-still-growing-despite-housing-downturn/10381094