For investors there is little clarity through the smoke and haze.

By Leonard Hyman and Bill Tilles for WOLF STREET:

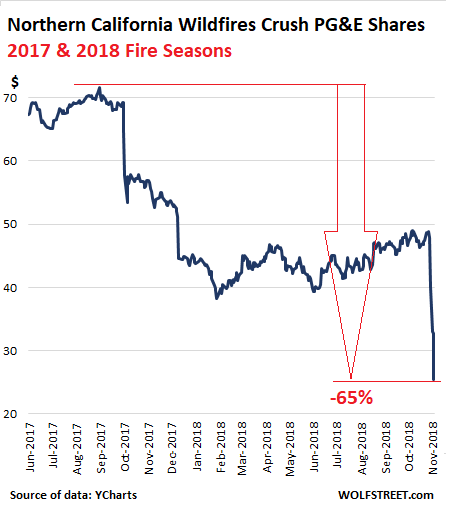

The common shares of Pacific Gas & Electric [PCG] plunged nearly 22% to $25.59 on Wednesday and are now down 47% since November 8, when the “Camp Fire” began near the city of Paradise, Butte County, in Northern California.

This repeats and continues a scenario that commenced in the fall of 2017, with the wildfires that ravaged parts of the countries of Sonoma and Napa, north of San Francisco. At the time, the shares plunged from around $70 on October 11 to about $38 by February 8. Then they recovered some until the next fire hit (data via YCharts):

The reason for today’s stock decline is now apparent. In an 8-K filing with the SEC yesterday, the company listed several sources of potential concern for PCG’s investors.

First, both the utility and the holding company fully drew down their revolving lines of credit of $3.0 billion and $300 million, respectively. They now sit on a cash hoard of about $3.4 billion which they coyly described as being “for greater financial flexibility, general corporate purposes and upcoming debt refundings.”

This is a big red flag. Solidly investment grade corporations should be able to access US capital markets virtually at will. This action suggests that PCG’s management fears something will impede that market access. This action is akin to a ship’s captain lowering the lifeboats and not simply for practice.

Second, later on in the 8-K, the company states: “While the cause of the Camp Fire is still under investigation, if the Utility’s equipment is determined to be the cause, the Utility could be subject to significant liability in excess of insurance coverage that would be expected to have a material impact on PG&E Corporation’s and the Utility’s financial condition, results of operations, liquidity, and cash flows.”

Their wildfire liability insurance coverage totals $1.4 billion extending from August 2018 through July 2019. Doesn’t seem like much given the still growing immensity of destruction and loss of life.

Why is the company so concerned? Their 8-K also listed under “Other Events – Camp Fire” that their 115 kv Caribou-Palermo transmission line experienced an outage on November 8 in the vicinity of the fire’s origins.

From an investor’s perspective how should we think about this unfortunate turn of events?

In a previous 8-K document filed with the SEC in late June, PCG’s President and CEO, Geisha Williams, claimed that fire “liability regardless of negligence undermines the financial health of the state’s utilities and has the potential to materially impact the ability of utilities to access the capital markets.” She blamed the state’s policy of inverse condemnation for the utility’s difficulties.

According to the utility, California is one of the few states where courts have applied the principle of inverse condemnation liability associated with investor-owned utility equipment. In this instance, a utility remains liable for all property damages and attorneys fees related to a wildfire even if all inspection and safety protocols have been observed rigorously.

The prospective liabilities from wildfires presently underway probably total amounts far in excess of PCG shareholders equity. Will the company have to file for bankruptcy protection?

In a way this ceases to be about finance and enters the realm of politics. What does the state legislature want? Do they want vibrant, healthy investor owned electric utilities? If so, then appropriate legislative remedies are needed, and fast.

On the other hand, if legislators bankrupt California’s investor-owned utilities, for the second time in recent memory we should point out, the politicians would be more directly and transparently responsible for utility services under a municipal structure. California is interesting in that it has both investor-owned and municipal utilities operating side by side in state.

In terms of the dividend, the damage has already been done. PG&E suspended its dividend on December 20, 2017, citing “uncertainty related to causes and potential liabilities associated with the extraordinary October 2017 Northern California wildfires.” The new set of troubles and potential liabilities aren’t going to help matters.

A company that needs to conserve cash in the manner demonstrated cannot entertain the possibility of restarting a robust dividend policy.

To us this is an odd situation. The company’s fate is in the hands of the courts or the legislature. The state’s regulators appear to be bystanders at this point. This Camp Fire tragedy poses a difficult question for California. Should we bankrupt our utilities in pursuit of fire related liability claims? Today’s turmoil in the utility equity markets shows that for investors there is little clarity through the smoke and haze. By Leonard Hyman and Bill Tilles for WOLF STREET

Fears the bull market died sent people & algos scrambling out of the way. Read… FANGMAN Come Re-Unglued. Debacles Sink Goldman Sachs, Apple, and — Oh Gosh, Not Again — GE

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

regarding liability…this statement: “even if all inspection and safety protocols have been observed rigorously.”

I read they didn’t follow protocols by keeping the lines energized knowing full well the winds were gusting beyond acceptable limits. Furthermore, the line had exhibited problems before the failures occured, and they still kept them energized and operational with this knowledge.

I will add that as this plays out BC will need to ensure they are beyond lawsuits when PG and E needs to buy power from other sources at market value.

From John Horgan, who is now our Premier, “California deregulated their energy market, found they had no energy, and the people of British Columbia provided that energy at the cost that the market was prepared to pay at that time. It was unfortunate for them. It was fortunate for us,” he said.

“Whether it be with softwood lumber or energy, whenever our American trading partners don’t like what we’re doing they go to court.”

If PG&E goes under Californians will need a reliable source of electrical power. BC has excess hydro generated electricity, which is also fully renewable and fits in with the Californian green aspirations. However, sellers beware.

Beyond PG&E problems, watching these news reports on the fire has been terrible. While Canada does have fire fighting equipment in the battle, I would like to see our Provincial Govt reach out to California in other ways, possibly even providing power at our domestic rates for a given period of time. Perhaps the Federal US Govt might reduce the softwood tariffs on Canadian lumber while Californians rebuild.

“If PG&E goes under Californians will need a reliable source of electrical power.”

Don’t worry. If PG&E goes bankrupt (chapter 11), the power generators and the grid will continue to operate, no problem. But some of the ownership will get shuffled around, with stockholders losing out.

Hi Paulo, Wolf,

I like to think of electric utility assets like matter in physics–you can alter its states but can’t destroy it. Same with electric utility assets because they serve an enormously critical, valuable public purpose. All the “shootin'” here so to speak (as Wolf implied) will be on the liability side of the B/S–equity investors possibly wiped out, bondholders impaired–these prospective hits are all to the providers of capital.

First of all, our lovely president don’t like California, and he doesn’t think much of Canada either, so no thank you. The tariff stays, if California can build its own earth overacting satellites, it can deal with its own water shortages and power issues. For Trump, this is what the codex calls a win win situation.

As for PG&E, has anyone in the state conclusively provided official data that the Santa Rosa fire was the result of PG&E negligence?

2017 wine country fires:

https://www.pressdemocrat.com/news/8806191-181/one-year-later-cause-of

Nobody knows it’s PGE’s fault. That would have to be determined through a very long court battle. We won’t see resolution for 5 years or more. In the meantime PGE should be able to build up some cash. Utilities have a near guaranteed profit. My guess is there will be a settlement that will be tough to swallow but will not bankrupt the company. Similar to ExxonMobil Valdez and BP Gulf disaster.

Hi Bobber,

In the company’s 8K they kinda admit to having t.mission line problems in the immediate vicinity of where the fire originated.

Fault?

Note how many fires there were pre 2000, about 1 to 3 per decade. Post, I counted 38.

https://en.wikipedia.org/wiki/List_of_California_wildfires

*Maybe* if you happen to be the company providing a necessary good, with thousands of miles hotwires that pass through all this drought dried tinder wood, you are inevitably going to spark up a fire? Hmmm?

Maybe, everyone who uses the electricity is thus partly way culpable, if this is in fact the only way to deliver power?

IMO, anyone rational person who has been to the region that is curently aflame would not be surprised at current events.

CA was never meant for its current population based on water use alone. There is a reason it was never as populated like other parts of the west by Natives

So they can be sued into oblivion and bankruptcy? Liquidated and sold off to pay these new judgments?

So. Then. How do people get their electricity then?

It was only a matter of time anyways.

Population moves to fire prone areas + suppression of natural fires for 30 years + new population demands electricity = lottery payouts

What company in their right mind would ever supply electricity in these fire prone areas again????

******

“In this instance, a utility remains liable for all property damages and attorneys fees related to a wildfire even if all inspection and safety protocols have been observed rigorously.”

PG&E was forced into bankruptcy 15-or-so years ago when gutless CA politicians deregulated wholesale but not retail price of power (PG&E cost could skyrocket, with no relief from ratepayers). When that predictably blew up, CA Gov Gray Davis cut a tragic deal with Enron for absurdly high-price power (don’t know if those contracts were voided or if they’ve expired), Davis was recalled, and Schwarzenegger was elected governor.

One of Schwarzenegger first acts was to impregnate his maid. WAY TO GO, ARNIE!.

State politics have only gone downhill sine then.

Jeez – you can’t make this stuff up.

I never understood the model that PG&E rate-payers (not the property owner) are responsible for brush/trees near power lines. Why aren’t the tens of millions of CA property owner’s responsibile to safely maintain their property?

Not all ratepayers live near power lines & for those that do, not all have trees/brush on their property. Why do some ratepayers get free tree-trimming?.

While we’re at it maybe PG&E should be made responsible for detailing everybody’s car, too.

At least with my utility (SCANA), it’s the tradeoff for the perpetual easement to run the lines over private property.

Hi Fred,

SCANA was interesting insofar as they combined a failed nuclear construction effort with a concerted and probably misguided political effort to reshape the state’s electricity industry.

Last year I was talking with the owner of a large tree removal company from Arkansas. They mostly work for local utility companies and forest management agencies.

He told me he had considered expanding to California “several times over the past decade” because between the forest fire hazard and the tree dieoffs that’s where the big jobs are, but each time had decided against it.

The reason is the State of California has some mind-boggling absurd regulations regarding how trees are to be cut down, increasing the time needed to cut down each tree beyond what’s reasonable. He reckoned in California his teams would cut down just two trees in the same time they would cut down twenty-two in Arkansas. “If we cut trees at that pace in Arkansas we’d be losing every single contract we have” he finished.

Tree removal services in California have accumulated a backlog miles long due to droughts and bark beetle infestations, and after each fire that backlog grows even further.

Wages in California are good enough to attract arborists from far away, at least for seasonal work, but due to that legislation work proceeds at snail pace.

PG&E is subject to those State regulations when removing trees from their powerlines, and there’s little they can do about it. They probably have a backlog miles long just like everybody else.

The wonders of one party rule, and the inherent idiocy of our ballot initiatives, want all these services? Yes. Want to pay for them? No.

Our elected officials: “fine, you can have your cake and eat it too.”

Please note this has nothing to do with money.

According to my contact California customers pay good money for tree removal, so much some younger arborists work the Summer in California and move to the East Coast for hurricane season and before the fires start in California. It’s good money, but it’s also a grinding job, as Summer heat in most of California is something only fit young men can take. I worked on a farm to pay the bills in my youth, I still cut my own trees and firewood but felling trees in California in the Summer… no thank you since I passed 35.

The problem is the size of the squad you need to have cutting down each and every tree and how they need to proceed, meaning you have a lot of people moving at a snail pace. If you want to bid on those large State and utility contracts you have to play by the rules, otherwise you can lose the contract and be fined to boot.

I tremble to think what will happen if/when California will have a bark beetle outbreak as bad as Colorado has been experiencing. Considering how beaten up her forests are by droughts, fires and mismanagement it can/will be a catastrophe.

Hi MC01,

We agree, the issue of vegetation management is really important. But it is unpopular for several reasons. First it’s an operating expense and every utility, with encouragement from regulators, tries to cut costs. Second it generates lots of customer complaints. And yes they prob. need to do a lot more of it.

good post , i like comments that get to the root cause . from what i read 120 million trees died because of drought and infestation over the last decade on both federal and state land. it seems that very little effort was done to harvest/remove this potential tinder. I talked to a arborist here in florida. He has contracts with the state to mark trees for harvest in state forests to thin and prune. Controlled burns are conducted periodically to clear under brush which promotes growth of native grasses/plants for wildlife. The electric companies have free reign to cut trees the might endanger power lines on public easements.

Seems underground utilities..maybe a better option? Eliminates many above ground problems. I dont know the economic cost comparisons.

“You can’t make this stuff up”….

Well actually Javert – you can, and it was.

It was ‘made up’ in the form of small state, neoliberal economics, a fundamentalist system in which everything is handed over to serve the profit motive and then left to sort itself out by deregulated private corporations.

Fine for consumer goods maybe, but a model that should never have been applied to democratic infrastructure such as transport and utilities.

Amen to that. PG&E has been deliberately cutting maintenance staff and maintenance cost for decades–they used to have more budget and staff to maintain their lines. But they haven’t cut back on overcharging their customers in the meantime!

MD

Except PG&E was not totally deregulated.

CA politicians deregulated the wholesale cost of electricity (the resource PG&E sells to consumers…), but the retail price (what consumers pay PG&E) was NOT deregulated.

When wholesale prices massively increased, PG&E was not given retail rate relief (ie PG&E had to buy electricity for more than it could charge retail customers). A short period of that and PG&E was bankrupt.

Government ownership is not a panacea. Government ownership is not always a better steward of public utilities (eg water) than private companies.

1) Flint, MI was a city-owned water utility that knew for years it was distributing (lead) contaminated water to Flint citizens.

2) US congress gave San Francisco ownership & maintenance responsibility for the Hetch Hetchy water utility (meant to supply the greater bay area, not just San Francisco). Over the years, San Francisco allowed the infrastructure to deteriorate so badly, that water supply to significant parts of the Bay Area outside the 49-sq-mile city of San Francisco were put at serious risk. Congress threatened San Francisco with loss of owners if proper maintenance was not reinstituted.

Hi 2banana,

Sued into oblivion? Yes. Liquidated? No. The assets would remain firmly in place whike the management and or the ownership structure might change.

I don’t think you really understand what it takes to generate and transmit electricity. Let alone maintenance.

And I know you don’t understand what trail lawyers and the insane tort system is going to demand from PG&E.

+++++

“Sued into oblivion? Yes. Liquidated? No. The assets would remain firmly in place whike the management and or the ownership structure might change.”

2banana,

Chapter 11 bankruptcy is essentially a court-supervised change of ownership, from shareholders to creditors. For the company’s activities, it’s business as usual. PG&E already filed for bankruptcy once (also Chap 11).

Once a company files for bankruptcy, it’s protected from lawsuits, and any claims become part of the bankruptcy.

That’s why we say that a company files for “bankruptcy protection,” because that’s what it is. It protects the company from creditors and lawsuits, but it doesn’t protect the old shareholders — they usually end up losing. Many creditors and claimants that are lower on the totem pole (unsecured creditors, etc.) usually end up losing some or all of their stakes as well.

At the end of this, Californian PG&E rate-payers will be the ones backstopping the insurance industry losses from the fire.

https://www.bloomberg.com/news/articles/2018-09-01/california-approves-bill-to-help-pg-e-pay-for-wildfire-costs

Hi AC,

Or the state legislature could change the liability statutes I believe. They could, for example, provide liability limits per fire event as is currently enjoyed by the nuclear power industry under Price-Anderson Act which limits utility industry libility per nuclear “event,” an enormously valuable provision.

An enormously market distorting and corrupt provision.

What kind of crony capitalist paid for this in the first place?

Hi Julian,

What type of crony capitalist? Er, the US Congress.

Julian

Try suing a sovereign governmental entity for anything.

A San Quentin inmate on California death row was recently murdered. Had that been a “private industry” prison, lawsuits would be flying. However, the prison belongs to California, and sovereign immunity applies (so no lawsuits…).

Damned if they do. Damned if they don’t.

Cut off power when winds exceed a safety level and get fired at by residents pissed-off at having no lights and luxuries?

Or leave the lines alive and be sued and stomped in court when two lines arc in the wind laying sparks on the ground, or hot wires break and land on the arid matchbox ground.

I say PG&E is pretty gutsy even attempting to co-exist in California with the arid, drought-stricken country combined with the multiple layers of rule and regulations.

Can’t have your cake and eat it too CA residents. Stand up and be responsible for your property. Lose lose situation for PG&E. And, by the way, I have a brother and a mom who lived in Paradise. Both of them lost everything. Everything. Their homes, their businesses, their equipment Everything.

It’s actually pretty easy.

They should bury all the power lines.

It totally removes the risk of sparking fires. Yes, it will cost a bit more, but it’s also an eyesore having powerlines criss-crossing the landscape.

If nothing else PG&E should be fined for eye pollution for the above ground power lines.

Put them underground you cheap pricks.

You live in a fire prone area you get what comes to you.

Only crazy people would choose to live in amongst tonnes of kindling in a hot dry arid state like California.

It’s like morons who live in floodprone areas next to the Mississippi or hurricane areas on the Florida/Carolinas/Louisiana coast.

Madness – and its because of these nincompoops that insurance premiums get pushed up.

Just crazy. No sympathy.

Julian,

This is a nutty and heartless thing to say. People in this country have to live somewhere, and it’s either hurricanes, or tornadoes, or floods, or polar vortexes and blizzards, or brutal heat, or earthquakes, or wildfires… Find a spot on the US map that has none of them and that is large enough for 325 million people. In fact, most places have a combination of them.

When it comes to nature, the US is a rough place.

Julian,

Concur. I moved out of southern California in 1996. It was obvious even then that people were buying houses in areas that were highly arid and brushy. Nor did most of them bother to remove the highly incendiary brush from their property. They thought they couldn’t afford property closer to the ocean, so they bought in places like San Bernadino and Riverside. I also get frustrated with people in areas like NC’s Outer Banks and on the Gulf Coast. I’ve bought homes in three states (CA, TX, and VA) and I’ve always managed to avoid weather-hazardous areas.

Condolences for your family Wapiti, and for all the others affected as well.

You have summed up the situation spot on I’m afraid.

Private ownership of Utilities is beyond absurd.

So with this comment, do you mean to say that with public ownership, this fire never would have happened? This seems like a pointless observation, whether one agrees with it or not.

There are longer-term solutions to many of these issues.

First of all, many of the transmission lines can be shifted into underground conduits. This is already common in newer urban areas.

Second, the older above-ground lines can and should be de-energized more conservatively when high winds are present. The current sensor network is too sparse, so unique situations develop that aren’t adequately modeled. In this case it looks like a NE-running canyon funneled a NE wind downhill directly towards the high-voltage tower that failed. But it’s no longer that expensive to build the necessary sensor network. The wind conditions at every remaining tower, transformer and substation should be monitored continuously.

Third, an additional sensor upgrade combined with improved switching gear could allow the power in a given line to be shut off between the time the wire breaks and the time it hits the ground. No power, no spark, no fire. There are a lot of milliseconds in there. Modern control systems can handle that timescale.

Fourth, and most importantly, the state (not just the utility) needs to get serious about removing wildfire fuels within a larger radius of the transmission lines. (And more generally about reducing fuel inventory anywhere lightning might strike.) Electrical equipment is going to fail sometimes, that’s the nature of any high-power system. (And lightning will strike sometimes as well.) What turns a routine accident (or act of nature) into a billion dollar tragedy is the accumulation of massive quantities of fuel right next to a likely source of ignition.

Finally, when people’s lives are at stake, it’s not sufficient to rely upon conflicted corporate financial incentives to promote safety. The short-term profit drive will often outweigh the long-term risk to corporate survival, and neither of those will directly impact management or workers in the way that failure will impact the community. There need to be additional checks and balances in the system.

Oh no, not this again, remember the problems are due to man made climate change. Don’t confuse the issue with things like poor management of the shrubs. The “narrative” will get distorted and not be understood by the voting sheeples.

Hi Wisdom Seeker,

Agree with all points, esp. re underground lines in fire prone areas. But I will say, as a rural resident that aggressive vegetation mgmt is sometimes unattractive, at least temporarily and thus unpopular.

You’ve hit most of the high notes. I can only add that the costs of the insane California Residential Sprinkler Code ($5,000.00+/- per dwelling) would be better spent burying transmission lines where they serve vulnerable areas.

Second: someone mentioned above if they cut power they would also get sued into oblivion by the customers for failing to provide service.

PG&E knows who it is up against. One of my favorite quotes is from the “Money Pit” where Estelle blames her woes on “the Blood Sucking Lawyers”

This is California and when you combine the quantity of lawyers in this state and a natural calamity, its feeding frenzy time.

This whole discussion leaves me wondering…

Of course, PG&E might be liable for this specific fire, but is this really the point? Even destroying this company, or for that matter completely eliminating the use of electricity, is not going to stop forest fires from breaking out. It just eliminates a single cause from many.

I live in France and there are forest fires every year here, ravaging large tracts of forest and sometimes houses and villages too. After investigation it is discovered that these were caused by campfires, barbecues, lightning, shorted power lines, sun shining in broken bottles, discarded cigarette butts, sparks from truck or train brakes, children playing with matches or even set deliberately by arsonists.

It seems to me that spending enormous sums of money and effort on just laying blame is futile. This would be better spent on devising ways of mitigating the effects of forest fires and limiting their spread. Things like careful monitoring of forested landscapes, early detection/warning systems, fire corridors worthy of that name and a supremely equipped firefighting force. Perhaps even zoning regulations that discourage building in forested areas unless specific precautions are taken like adequate water reservoirs and separations to stop fires from spreading.

As long as there are forests there are going to be forest fires. Better to try to manage the next one than discussing about what has caused the latest one.

Hi Jos,

I had a similar thought. It’s like the old question, what caused the fire, the gasoline soaked rags (precondition) or the carelessly tossed match or trasmission line (the precipitant). Takes both. But simply blaming the utility for events caused perhaps as much by a long term drought etc. seems more than a bit facile.

PG&E should have been broken up after the Enron fiasco.

I used to live in western Sonoma County, and our electricity “service” was a major reason why so many people bought solar panel set-ups. I had a generator and three days of water storage.

Every winter, there would be storms and the lights would go out. PG&E would then pay absurd amounts of money to have emergency crews to take the fallen trees off the power lines. Every summer, people would suggest that they send out crews during the good weather when, like, you know, it would cost a lot less. Never happened.

On the average, western Sonoma County has a blackout lasting more than 48 hours at least once per year. Usually, it is caused to a predictable (and preventable) tree fall.

PG&E are morons. What California needs is a law that says that no one company is allowed to provide power for more than 5% of the state’s population. PG&E needs to be broken up.

That’s not going to happen. The state legislature is hopelessly corrupt. The last 30 years of electric “policy” proves that.

PG&E will be forced to file for bankruptcy. They’re caught in an impossible situation.

Legislators know this law will kill all utilities in California and they know they can’t bailout PG&E.

They will sacrifice PG&E for the public show and then reform/remove inverse condemnation so that utilities will be able to operate normally again.

As for PG&E, they’ll operate as normal while they sort through which creditors get paid and wipe out shareholders.

Just my two cents.

Hi Rza,

To get out of this financialy unscathed, after the legislature limited liability for fires, PCG needed one thing–no big fires in 2018. The new law goes into effect next year. They didn’t make it.

Update: PG&E [PCG] is down another 21% this morning, to $20.22

Good thing I didn’t get in at $33..! waiting for it to bottom out to buy

To borrow a phrase, just a flesh wound.

Wolf, are you saying it’s time to buy put options in PG&E?

I wonder how things will go if PG&E has to declare bankruptcy.

There is a serious possibility that PG&E will file for bankruptcy, and then shareholders will likely get wiped out. The Camp Fire catastrophe is much worse than last year’s fires.

At the same time, the California legislature could cobble together some kind of salvation that makes sure the company survives with shareholders intact. They did for last year’s fires.

I’m not taking any bets either way. The outcome is way too random for me to bet on. But I think that option 1 has a slightly higher probability than option 2.

Of course the standard American home, whether it be a trailer modular or a 10-20,000 sq ft Trophy 3rd home, is designed as a tinderbox meant to be torn down and replaced every few decades. Or burned to the grown by fire.

I wonder how many homes would still be standing in Paradise if the architectural norm were an earth sheltered structure similar to the New Mexico Earthships?

RV’s are the new ex-middle class home. I recently read that a million people in the country now live in them. Perfect match for working as a temp in an Amazon warehouse.

And perfect for escaping from a wildfire or hurricane as long as you beat the traffic jam.

This was an enteresting article and thread. Born, raised and still live in San Diego. I remember the the Laguna Fire vividly from 1971. These fires are devastating, I’m sorry for what’s happened in Paradise. I’m not quite sure it’s appropriate to put all the blame on the utility. Fires are a natural part of the ecosystem in Cali. We had record rains just a few years ago which results in heavy plant growth. If you are lucky to be in SD in March you can catch a very short window of beautiful green hills. First bit of heat those hills go brown the rest of year. Santa Ana’s are an amazing phenomenon; cold sinking air over the Great Basin fans out and heats up as it compresses to lower elevations. Powder keg conditions result. Another interesting note is that Native Americans used fire to sculpt the landscape. The Great Plains got great because NA’s used fire to create grasslands for more animals to hunt. I love this stuff as you can see. I could go on but my point is that Cali landscape has evolved over eons and fire has been a part of that process and will continue to do so

As Chief Seattle so wisely remarked, “Humankind has not woven the web of life. We are but one thread within it. Whatever we do to the web, we do to ourselves. All things are bound together. All things connect.”

How can it possibly be allowable for CPUC president and state regulator Michael Picker to participate in a PG&E conference call on Nov 14 with financial analysts and investors? That seems wildly inappropriate to me, to the level of possible prosecution.

Agree. I wish some securities lawyers started looking into this. It seems like it was a desperate effort by everyone to halt the plunge of the share price. But if that was the intent, involving regulators making offhand comments, than that doesn’t pass the smell test.