And some of the rot is oozing to the surface.

The sell-off on Tuesday didn’t weigh on the scale of sell-offs: The Dow, the S&P 500, and the Nasdaq were down only around 0.5%, give or take a little. But in the broader sense, declines of individual stocks were widespread, and this situation has been going on for months.

On the surface, it still looks hunky-dory. For the 52-week period, the Dow is up 7.5%, the S&P 500 is up 6.7%, and the Nasdaq is up 12.7%.

Yet, even as major indices rose so nicely over the 52-week period, 496 individual stocks of those on the New York Stock Exchange dropped to new 52-week lows today, while only 8 reached 52-week highs. How many stocks are listed or traded on the NYSE depends on who you ask. The WSJ data section shows 2,080; others go over 2,400. If there are 2,080 stocks actively traded on the NYSE, this means near a quarter hit new 52-week lows today.

And according to my own math, 176 stocks on the NYSE have by now plunged at least 50% from their 52-week highs.

Despite the small drop on Tuesday of the major indices, here is what a random page in alphabetical order of the NYSE listings looks like in terms of red for the day – there is a lot of it, and it doesn’t even include Caterpillar, which dropped 7.6%:

In terms of the S&P 500 – which tracks the largest stocks in their industries, regardless of what exchanges they trade on – a whopping 353 stocks are down at least 10% from their 52-week highs, and 179 of them (that’s over a quarter) have dropped by at least 20%.

Why are the overall indices not down more? Well, Apple is a big reason.

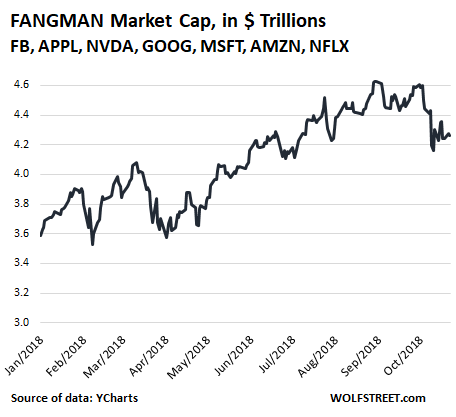

The bunch I call FANGMAN stocks – Facebook, Amazon, Netflix, Google’s parent Alphabet, Microsoft, Apple, and NVIDIA – sported a market cap of $4.63 trillion at the end of August. Since then, they have dropped 7.8%, which is just another dimple (data via YCharts):

But individually, some of these declines are not so sanguine anymore. This is how these seven stocks performed since their 52-week highs:

- FB: -29%

- NVDA: -25%

- NFLX: -21%,

- AMZN: -14%

- GOOG: -13%,

- MSFT: -7%

- AAPL: -4.7%

So three of the seven have plunged over 20% from their recent peaks, and another two are down 13% and 14%.

But Apple, by far the largest among the FANGMAN in terms of market cap (still over $1 trillion), is down only 4.7%. This covers up a lot of bloodletting in the smaller stocks. And Microsoft, the third largest with a market cap of $830 billion, is down only 6.7%.

Those two stocks – AAPL and MSFT – make the FANGMAN bunch look reasonably well-behaved, and they soften the drop of the rest of the market.

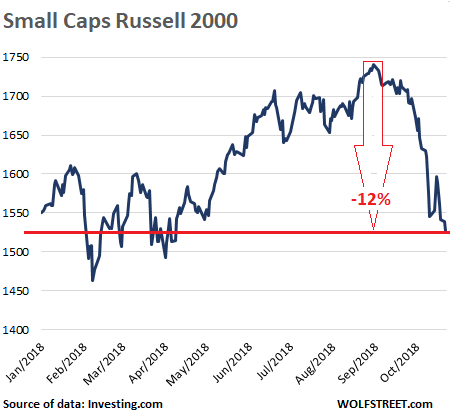

For another view on the same scene, check out the small-cap stocks, the hottest performers until recently that barely even dipped during the January and February sell-off. Since August 31, the Russell 2000 index, which tracks them, has dropped 12%. And it’s down 1.6% for the year:

These are the hallmarks of a market that is rotting “gradually,” as the Fed would say, at every corner underneath the covers – the covers being a few large stocks, such as Apple, that have held up reasonably well. But they can no longer cover the rotting process.

Why? Why now? There are many theories. Four of the most basic theories are:

- The stock market is ludicrously overpriced, and that sort of thing eventually and invariably unravels.

- Interest rates are rising, and funding for these credit-dependent companies is going to get scarcer and more expensive, and so investors are re-doing their math.

- Risk is being repriced, and investors are demanding to be rewarded more for taking those risks.

- Yield investors, long drawn to dividend stocks in a ZIRP world, can now get better yields in Treasury securities, without having to take the risks associated with stocks.

On Monday, I discussed US bank stocks. The KBW banks index, which tracks the largest US banks, dropped some more on Tuesday and is now down 17% from its peak in January. But even that peak didn’t quite make it to the peak before the Financial Crisis. So that’s a big drop from very lofty highs. But EU bank stocks got crushed during the Financial Crisis, and then they got crushed and crushed, and now they’re getting crushed again. Read… It’s the Banks Again

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Like jazz, it’s not dead, it just smells funny?

– Look at the ratio between the S&P 500 and the S&P 500 equal weigthed indexes. This ratio has been deteriorating since early 2017. (It matters because the S&P 500, like the Dow Jones, is a capitalization weighted index.) It simply means the large caps have shown a better performance than the small caps.

For those not in the know, “China New Borun” is a Chinese company that produces food-grade ethanol for the internal market, almost exclusively for the production of the infernal “baiju” liquor. Like so many Big Agra companies around the world they are heavy subsidized by the government, in this case the Shandong Provincial Government.

So what are they doing on the NYSE? Same thing as that host of other Chinese companies on the same page.

Which isn’t there at random, isn’t it? ;-)

MC01,

You may have part of your question answered by watching “The China Hustle” documentary. Why are Chinese companies on the NYSE or NASDAQ? It’s not strictly due to Chinese operators, as one might imagine.

Wolf Street is much to sophisticated a website for the little faces to show hey.

:-D :-P :-) ;-)

Since the Fed stepped on the QE program, companies have been buying their own shares by the boatload. Just this year alone and according to Zacks, U.S. companies have announced $209 billion worth of share buybacks.

QE, the multi-billion dollar share buybacks as well other factors such as the repatriation policy boosted valuations to the stratosphere. What goes up must come down. While almost no one predicts a recession in the immediate future, it seems to me that stocks have entered, or about to enter a bear market.

As Martin Zweig used to say, “Don’t fight the Fed”.

The projected buyback activity for 2018 is actually about $700 billion. This provides a floor under the market.

As I mentioned in another article’s comment, we are now inside of an embargo period for buybacks due to earnings season. This removes the “floor” and consequently stocks drop as few sane individuals outside corporate boards would actually buy shares at these ridiculous valuations.

Nevertheless, buyback activity should resume soon and the market will probably stabilize.

To me this situation illustrates nicely just how full of $#!+ the politicians are. The public was told the coprporate tax cut and repatriation relief would be mostly directed at capital investments and pay raises. Yeah right, that has turned out to be about as true as “don’t worry, the tax cuts will pay for themselves”. Sigh.

“The public was told the corporate tax cut and repatriation relief would be mostly directed at capital investments and pay raises.”

I’m sure someone believed that, but for the life of me, I can’t think of anyone.

Wolf, have you read about Rowland Baring, the real Goldfinger?

https://www.theguardian.com/news/2018/sep/07/the-real-goldfinger-the-london-banker-who-broke-the-world

The current “Moneyland” problems are largely his fault.

There’s an interesting little line in that article ‘societies became more equal’.

Those who saw themselves as the gilded didn’t like that one bit – the wealthy don’t want a middle class, the want serfs to lord it over.

And sadly they’ve got their way, because that’s what we’re going back to. It’s just that now the serfs have credit cards, so there is the illusion of their prosperity (in their leased, never-to-be-owned cars and their 40-year mortgaged houses) – as long as credit stays cheap.

The human race has got to find a better way of ordering its societies than this.

Thanks for the link, excellent articles. Explains a lot, actually explains how broken the system is for the non .01%. Thinking of the person who just won the 1.6 billion lottery. They aren’t even close to this club.

I have this feeling that news headlines in mainstream sites such as Marketwatch have suddenly become more bearish, warning us of much greater losses. I don’t diligently follow the headlines, but I remember that Marketwatch for the most part has liked to strike a balance where they’ll have the bullish case and then the bearish case.

I remember around year ago, many were convinced that stocks would continue to go up until around the 3rd quarter of 2018. But that worry was forgotten and the new meme was that we’ll have a recession in about 1 or 2 years, around 2019 or 2020.

Current stock market action looks remarkably like it did in February, March, and April, where we bounce around the bottom until buybacks come to the rescue.

Buybacks are becoming a whole lot more expensive to finance: the $2 billion bond issue Netflix has announced will be split in $800 million and €1.1 billion. Why? Because Netflix has to offer a 6.725% coupon on US dollar bonds but “just” 4.25% on the Reverse Yankee issue.

If 4.25% seems awfully low for a junk-rated company like Netflix is, the BofAML Euro High Yield (the index tracking average euro-denominated junk bond issues) is presently 3.69%.

Interest rates are going up, even in Europe: the Reverse Yankee door won’t stay open for long regardless of what Mr Draghi and his successors will do and especially say. The “monetary bazooka” stopped being effective against Mr Market’s armor as risks are already piled sky high.

Netflix is a member of the FANGMAN stocks, and as such “special”, at least until their rapidly worsening financials can be ignored, hence it can access funding at favorable rates.

But companies that aren’t “special” will have to make a choice between keep on throwing money at record buybacks and capital expenditure, and will have to do that choice over the next year. I suspect over the next decade a whole lot of stock market darlings will commit ritual suicide in the name of stock prices.

not before the govvie bond people, retirees and pension-expectants do it en masse first.

Yeah…..a good primer on the oncoming avalanche of pension defaults was hit fairly well on the recent “Frontline” show about Kentucky’s pension mess. (PBS)

https://www.pbs.org/video/the-pension-gamble-hzokyh/

How interesting — euro-bonds from Warburg in ’62… PJS

If buy backs begin anew after earnings and establish a floor, what happens to bond yields like the 10 year. I believe in a correlation with stocks and the 10 year at/ near 3.2 % triggering (signaling) a stock sell off while we’ve been in this embargo period. Does this cause the 10 to go above 3.2?

Market Watch mentioning this piece today and sorta borrowing your headline. Nice.

Yes I saw that too, but it has been “disappeared” already…

Here’s the link:

“Under the surface, this stock market is slowly ‘rotting away’ ”

https://www.marketwatch.com/story/under-the-surface-this-stock-market-is-slowly-rotting-away-2018-10-24?mod=MW_story_top_stories

This is reminiscent of the late 90’s. I think the overall market began to roll over towards late 1998 as indicated by the equal-weighted Value Line Index. The big indices kept moving upwards as lead by the YHOOs of the day – I guess the modern equivalents of AAPL, AMZN and the likes. I think it was March of 2000 that the Nasdaq finally topped out.

On a more value-oriented and bullish note, a lot of older economy stocks seem reasonably well-priced today. I suppose they could go lower, but hard to argue that we have not already experienced a bear market in some of these names. And I am not just talking about the market activity for a past week or two – I am talking for a few years now.

Without continuous injections of the Fed’s financial crack cocaine, these Ponzi markets are doomed to implode under the weight of their own fraud and fictitious valuations.

Start the countdown to ECB, BoE and Fed stock buyback programs…

Turning Japanese, I think I’m turning Japanese, I really think so…

What numbers are you taking issue with?

You have to assume that flight to safety in bonds and gold is driving down yields. Real question is how far? Fed keeps hiking and yields keep falling the curve will invert and more trouble for banks. This started with China and could end there, if the regime buys more stock like it always does. There is a snap rally in here someplace and that will go a long way to measuring the strength of the market. Trump will fall all over himself to save this market. Powell will footprints on his back.

I highly recommend the history of the Great Depression by Dan Blatt available free on- line.

Six of so sections have names like Prelude to Wall Street Crash, Collapse of Agriculture, Collapse of International Finance etc.

It’s quite witty as well as informative. One frequent target: ‘the confidence game’

This refers to the ongoing chorus of academics, politicos, shills, etc. that the economy ‘is fundamentally sound and the downturn is a buying opportunity’.

In Kenneth Galbraith’s ‘The Great Crash’ he mentions White House paranoia: whenever the President made a positive statement about the underlying strength of the economy, a new downturn in the markets followed so quickly it seemed coordinated to embarrass the WH.

A formal group of Harvard economists were boosters until about 1933 when it was liquidated.

If you want to see current examples, see Jim Cramer on CNBC.

However, even he is beginning to tune his spiel, with talk of defensive stocks etc.

I watched a bit of Cramer yesterday and he choked up his fellow pundits by saying the economy wasn’t so hot, then he went on to list all the same reasons many of us write on WS.

It was interesting, and I expected to see a hook drag him away or a falling bookshelf. Then, I could only stand him so much and turned off the tube.

– 608 at the close for today, 24 October.

But you know, on the other hand, Tesla profit. Woohooo Elon, you go, girl.

Uh… yeah.

The funny thing though is that while the rest of the market tanked, TSLA was among one of the few tech stocks that didn’t have a meltdown level of drops.

I can’t wait to see what happens with Facebook and Apple.

Love how everything these days are no longer about profits, but all about how business should be more… what’s the word I’m looking for… moral actors, just like Apple who refuses so righteously to weaponize your data to sell to everyone else. (instead, they’ll just provide the best means for suckers to get addicted to little tiny screens) You go, Tim. Show’em who’s da man, you don’t weaponize data, you just provide the best pipes to weaponize the data, no responsibility there at all.

Tim would rather let someone else weaponize the data for a fee. $9 Bn seems to be the price Google/Alphabet had to pay.

Re – “176 stocks on the NYSE have by now plunged at least 50% from their 52-week highs” –

An article exploring the companies in the “50%-off Club” might be an interesting followup.

If the market plunge goes a bit farther there will also be an interesting “75%-off Club”. It can be very illustrating to find out whose shares got hammered and why.

Right now it looks like there are 61 (out of 1850) NASDAQ stocks in the 75%-off Club, including some ADRs, Biotechs, and Overstock.com.

On NYSE, there are 29 out of 2084 stocks in the 75%-off club, including Blue Apron, Kodak, some energy issues, some ADRs, and the venerable 150-year old engineering firm Babcock & Wilcox. (Pier 1 Imports and JC Penney are a few bad days away from joining the club.)

Oh, and after today, fewer than 300 NYSE issues and under 120 NASDAQ stocks remain within 10% of their 52-week highs.

A chart in the WSJ today showed the totals per quarter of share buy-backs since 1998. By my rough calculations there have been $4.5 trillion in share buy-backs since 1st quarter 2009. All this has gone to unproductive unsustainable means and in my opinion this is part of the over valuation of the stock market.

With rising rates, even with the buy-back block out resuming, it will mean eventually very little but falling stock prices. The Fed used low rates to ramp up the market, so raising the rates means a ramp back down.

No doubt the past decade has been an enormous debt for equity swap fueled by central bank largess.

As for buyback activity, at this point in the earnings cycle over 50% of the market participants are still in blackout. We won’t see the full effect of the blackout lifting for another 2-3 weeks… just in time for the end-of-year Santa Claus rally.

One of your best Mr. Richter; pulled lots of good comments (and links)….Thx.