It’s cyclical: When will the biggest-ever boom end?

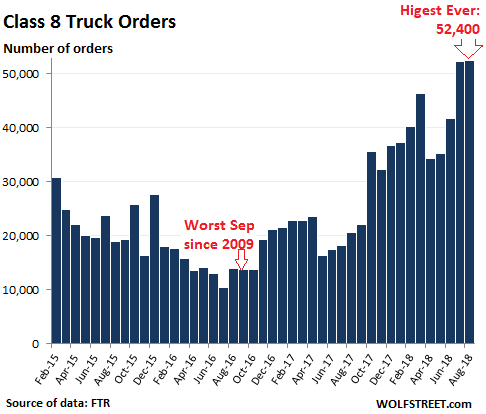

Orders for Class 8 trucks in August jumped 153% from a year ago to 52,400 trucks, beating by a smidgen the orders in July, which had been the highest number of monthly orders ever recorded. These are the heavy trucks that haul the products of the goods-based economy across the US, and trucking companies cannot seem to get enough of them:

FTR Transportation Intelligence, which provided the data, explained:

Carriers continue to scramble to get enough trucks on the road to handle the robust freight growth. The surging economy and vibrant manufacturing sector are stretching the logistics system to the limit. In some markets, goods are moving slower due to supply chain gridlocks, necessitating even more trucks to deliver goods.

In total for the first eight months this year, order volume of Class 8 trucks has jumped by 108% compared to the same period a year ago.

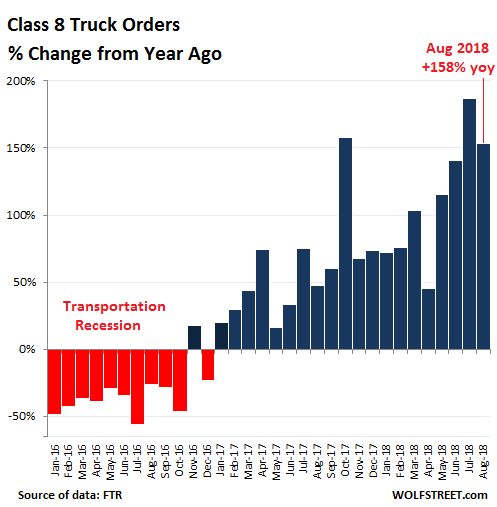

The chart below shows the percentage change of Class 8 truck orders compared to the same month a year earlier. Note the effects of the “transportation recession” on truck orders in 2015 and 2016 when orders plunged to the lowest level since 2009, and truck and engine makers reacted with layoffs:

Truckers are trying to upsize their fleets after shrinking them during the transportation recession. And truck manufacturers and their supply chains, after laying off people during the transportation recession, are now scrambling to build these trucks.

“The good news is, it appears the supplier shortage issues that significantly slowed production earlier this year, have been largely abated for now,” said Don Ake, FTR VP of commercial vehicles. “However, the supply chain remains tight, and fleets and dealers continue to place large orders to lock down build slots in 2019.”

But he cautioned: “FTR does expect some easing to occur in the second half of next year.”

For the freight industry – after having been gripped by the transportation recession – it has been a phenomenal year. In July, shipments by all modes of transportation – trucks, rail, air, and barge – of goods that are not bulk commodities jumped by 10.6% from July a year ago. Rail intermodal traffic (containers and trailers loaded on trains) rose nearly 7%. Freight rates truckers charge have soared by the double digits. But companies that need to ship merchandise are squealing: They spent 18% more on shipping expenses in July than in July last year.

Industry observers are getting cautious. This is a very cyclical business. But that worry-moment, as FTA also pointed out, will likely occur later in 2019. J.D. Power notes:

It would not be illogical to assume the order cancellation rate will increase later in 2019, as new truck deliveries catch up to actual needs and the build slot reservations are no longer needed.

J.D. Power also tracks the used truck market, believes when these new trucks get delivered, fleets will start flooding the market with their older trucks – though that hasn’t happened yet:

We don’t foresee a massive wave all at once, but we do expect a higher volume of used trucks entering the market going forward. Frankly, we’re surprised this activity hasn’t come to pass yet. We’re looking at the 2nd Quarter of 2019 for any changes to become apparent. Why then? We won’t have a completely clear picture of freight dynamics until then.

The next couple of months will include a contentious midterm election, which traditionally suppresses activity to a degree. Then, winter weather will impact freight volume. Through all this, buyers will continue to receive their new trucks. So we’ll regroup in the early 2nd Quarter to see where things stand. We expect a somewhat more normal market for used trucks at that point.

But for now, the used truck market remains tight: At used truck dealers in the US, according to a separate report by J.D. Power, the average sleeper tractor that was retailed in July (the most recent data available) was older, had more miles on it, and brought more money:

- 82 months old: 7 months older than in July last year

- 462,125 miles on the odometer: 8,131 miles more than in July last year

- Sold for $53,196: up $5,606 (or +11.8%) from July last year.

For now, fleets are not trading in their older trucks as much as they might normally do when they’re taking delivery of a large number of new trucks. And the whole industry is fired up by the higher freight rates that are now sticking, and by the surge in freight volume, as the goods-based economy is pushing its limits before the industry’s infamous cyclicality causes the next change in direction. Read… What Truckers & Railroads Just Said about the US Economy

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

While there is a boom in truck freight, trouble seems to be brewing in bulk commodities. For the first time ever I have seen 8-10 large bulk carriers anchored in the Canadian Gulf Islands far away from commercial ports. They are empty (floating high) and not moving the last 4 weeks. I wonder what is going on.

@GSH

If you log on to this site (down below), then click on the ship icon it tells you the ships name, size and particulars, status, destination etc.

Pretty interesting. This is where I live, but you can scroll down to Gulf Islands and create your own site. I use it to track crusie ships, etc. in case we want to go look at them.

https://aprs.fi/#!lat=50.35000&lng=-125.91670

regards

What you are seeing is called “lay-up”: the shipowner basically moors the ship when freight and charter hire rates fall below operating cost levels. There are several types of lay-up, depending on how long the ship will ride at anchor: what you are seeing is, in my opinion, “hot lay-up”, meaning the ships can be quickly reactivated with minimum cost.

The reasons can be many but in my opinion the reasons are:

1) Apart from the US (whose components have wholly driven the SCFI and CCFI this year), freight rates worldwide are stagnating while average bunker costs have only inched slightly lower from their yearly highs.

2) The glut in cargo capacity is getting really bad: I had a very quick look at the ships moored off Valdez Island with my software and saw at least one of K-Line’s Corona-class bulk carriers. You don’t lay-up brand new ships like these unless there’s a glut of epic proportions.

3) There’s definetely something moving in China, which started before President Trump even mentioned the word “tariff”.

As the saying goes if China sneezes commodities catch a cold, so keep an eye on this.

What is happening is that the supply chain is collapsing. One unnoticed reason is uncertainty about the U.S. constitutional regime. We are not in the West Coast Hotel/Carolene Products scrutiny regime any more, as Kagan pointed out in the recent Janus case. As more people realize that the doctrine of the new regime is in flux, they will withdraw from investing. This withdrawal will have a catastrophic effect.

The music is getting louder the race around the chairs getting faster. Moar Champage,coke,crack just moar, moar debt moar of everything. When the music ends there will be a huge sigh of relief..”thank fuck it’s over!”

I just wish the gods would figure out another way to move these mountains of consumer junk–maybe telepathy? The freeways around here are jammed with semis pounding along at maximum speeds and actively trying to intimidate the rest of us off the roads. Last week a trucker threw a bottle of water at my car. Maybe he didn’t like my bumper stickers? Maybe he’d been up for 24 hours? Personally, I can’t wait for the next economic downturn.

Similar in my area. Except that Semis clog the highway during rush hour 3 lanes wide while driving in creeper gear.

I would bet these truckers are barely making $7/hr while creeping along in rush hour traffic.

That’s inexcusable behavior but he probably had more of an issue with your driving than your bumper stickers. It’s implausible that truck drivers are waging a campaign of intimidation to get passenger cars off the roads.

Just keep in mind that economic downturns wreak havoc in ordinary people’s lives. They can cause a lot of personal pain. So maybe temper that wish a little.

This too shall pass.

“Orders for Class 8 trucks in August jumped 153% from a year ago to 52,400 trucks, beating by a smidgen the orders in July, which had been the highest number of monthly orders ever recorded. ”

The notion that this surge is due to purely cyclical factors is doubtful. Which leaves me to ask Wolf whether Trump is a great president, or perhaps the greatest president of the United States ever?

The silence of this site concerning Trump’s astonishing achievements is concerning. The Trade war with China will no doubt spur record factory formation in the United States.

Loosening if EPA regulation is allowing mining, fracking to rip. Bogus regulations are being flushed as the government is ‘doing as little as possible’, which the market views as a good thing!

Observer,

You said: “Which leaves me to ask Wolf whether Trump is a great president, or perhaps the greatest president of the United States ever?”

If you base your evaluation of Trump on heavy-truck orders, ask me the same question a year from now when the columns in the second chart — year-over-year comparisons — are turning red, with truck orders plunging and cancellations piling up. Because this industry is cyclical regardless of who is in the White House.

But don’t worry: when the columns are turning red next year, I won’t rub it into you and blame Trump :-]

I’m going to mercifully ignore the second half of your comment — except to say that there are two policies of Trump’s that I support, one of which is trade, which I have written about. So if you check a little, you will find it.

But it looks like he’s bungling the trade issue because he has totally caved to Corporate America, which is the primary source of the massive US trade deficit. No one is forcing Corporate America to shift production to China and Mexico. Companies did it in search of cheap labor and because there are US tax benefits (transfer pricing) to shifting production overseas. And that should be the primary target.

I have written the White House about this issue and how to tackle it. I have zero hopes that anyone will read it and less than zero hopes that I will hear back from them. So sometime in the future, I will publish part of this letter.

Wolf, to your comment: I have a nephew who is a senior vice pres of a major car parts company. I won’t mention the name being management, etc. He is an engineer by profession, but currently in charge of logistics and supply, etc. His observation: tariffs have already cost his company millions. His work load has increased big time. The manufacturing relocated to Mexico will never return to the US, and tarriffs against Cdn auto mfg will be economic suicide. The current mess is just from the steel and aluminum tariffs…..+ NAFTA posturing.

Add on: Harley Davidson building in Europe is foregone and irrevocable. Get used to more down pressures and expect more.

I expect a disaster from this nonsense. There needed to be remedy, however, there might be better ways to achieve positive results. If everything is a nail a hammer works just fine, but……. :-)

regards

Paulo,

A country has to collect taxes to pay for its expenditures. It’s just a question of who pays the taxes.

Corporate America just got a HUGE tax CUT. Tariffs are a tax increase — a sin tax. They counterbalance the tax benefits in the US from offshoring production. Tariffs are going to squeeze corporate margins and profits. But the same corporations just got a huge tax cut. They need to stop whining.

The trade deficits the US has are not sustainable for the US. The incentives for Corporate America to offshore production need to be changed. Tariffs help change those incentives. It is not the government’s job to maximize corporate profits at the expense of everything else.

After Wilbur Ross met with some US Steel execs (the company) Trump decided to use national security to impose steel tariffs. This got around Congress which normally imposes tariffs after debate.

The target was supposedly China and the move was marketed as such.

Then it turns out that China is a distant number 11 in steel exports to US while number one is Canada!

And lo! the US runs a two billion dollar SURPLUS in steel with Canada.

Of course Canada responded with its tariff. The result at the moment is that steel shipments are down single- digits from Canada and down- double digits to Canada.

The Trump move in this case has backfired; it was never researched. That would involve reading the briefing papers that

Trump tears into pieces each morning. (Two long- time WH archivists were fired for leaking that they spent hours taping them together)

An odd feature of the tariffs: they are on raw steel and aluminum but not things made of them.

So a small business in the US making beer kegs that was competing against Chinese kegs can no longer compete.

The CEO has said he used to buy from US Steel but had quality issues so he switched to imports.

He has applied for a waiver from the tariffs, joining over 22, 000 US businesses that are negatively affected. As of last week about 50 had been approved. e.g., Gillette which probably has a bigger legal / lobby department than the keg guy.

“China is a distant number 11 in steel exports to US”– as you said — because it transships its steel and steel products through various other countries, where they may or may not be further processed. Vietnam is the #1 destinations of Chinese steel, from where it then gets shipped to the US. This is very well documented.

Hear hear.

Astonishing achievements?

“Trump is perhaps the greatest president of the United States ever?”

It is far more likely that history will prove Trump to be the most destructive president in US history.

Trump has shown that it is easy to destroy treaties, agreements, alliances, regulations, executive orders etc. However, Trump has not demonstrated that they are easy to improve and or replace.

Trump alone owns the Trade war and all the destruction that it will bring. The disruption of the global supply chain and the ensuing economic carnage has just begun.

Trumps timing could not be worse. As the U.S. dollar strengthens and yields rise, many emerging markets are being squeezed into crisis mode.

In six month to a year the US and the world will be in dire need of true leadership. Trumps presidency will not end well for himself and the world.

You can’t knock Trump on trade. He is making needed moves to end trade deficits which have caused our jobs to move offshore. The last four presidents watched as millions of jobs were outsourced.

Trade wars are temporary, business investments are made for the long term.

The idea that Businesses will flock back to the US and build out

large new factories will not happen for several reasons.

Trade tariffs like tax cuts are temporary both can easily be repealed/replaced. Business will take a long term approach and ignore both tactics.

As tariffs are applied and prices increase demand will likely decline.

Why would a business invest in manufacturing a product with diminishing demand?

In the end markets will find a way around tariffs until they are eliminated.

Automation and the elimination of labor costs is the future.

Currently, labor costs are the real driver determining manufacturing location. As labor needs decline manufacturing destinations will be made based on a new set of requirements.

Trump needs to get the US government out of the way. Tariffs ad unnecessary costs and bureaucracy that help no one but big government!

A lot of this activity may be due to the 100% expensing of capital goods under the TCJA. But unless Congress extends it, this will end in 2022 as it has a 5 year limit.

Congress knows to do what they are paid to do. Thus, such things are always extended. Unless of course someone else pays them more not to do so. Americcan democracy in action.

How much of the increase in heavy trucks is brick and mortar retail (ma a pa drive to the retail store for purchase and pickup) being replaced by online retail (ma and pa order online and a truck delivers the goods purchased)?

Not sure it really changes. The goods still make it from the port to the consumer, just by a different route.

The new model is that the goods go from the port to the Amazon warehouse. Then UPS ships them by truck to their local distribution center. Then a little brown truck makes the local delivery to the home.

Only slightly different than the old system where by goods went from the port to the retailers warehouse. Then from the warehouse to the local store where the customer picks them up and takes them home in their own vehicle, unless the store offers delivery by local truck.

I suppose the port to Amazon leg has heavier traffic along that one route to the warehouse compared to the various port to retailer warehouse routes. But that’s really just the number of trucks along the route. Perhaps its maybe a percentage point or two more efficient in having fully loaded trucks, but that’s a small difference.

I agree with your tariff statement, Wolf. However, not much can be immediately done when the corporations have so much influence. In my comment I should have added that the mentioned auto parts business is not an American company, and that they work with car companies all over the world. They just have an American division.

But go back to NAFTA and trade agreements in general…plus, your comments on taxes, etc. In Canada we have a supply management program, often referred to as a Quota system. With Dairy, it is a US focus and irritant. What it ensures is we remain self-sufficient in food production, while making it possible for Cdn farmers to earn a decent living. The money for this is provided by the consumer, at time of purchase. (The Canadian consumer). If the price is too high, consumers can forgo purchase. Cheese consumption can be reduced, and water is our own family preferred liquid at supper…etc.

The US has farm subsidies. It directly provdes farmers with money from tax dollars, and helps create over-production. In other words, take tax dollars and give it directly to industrial ag farmers in order to keep prices low. The same thing could be achieved by just giving consumers cash to buy their groceries….with tax dollars. I guess this isn’t too big of deal when the tax dollars are to a large part, borrowed. However, you can see how ludicrous it is.

From the Economist, re new subsidy program: “Most importantly Congress abolished direct payments based on land ownership. Instead, farmers now get more subsidised insurance, and new payments which are linked to past crop prices and productivity. ” and: ” the new system could cost much more, says Vincent Smith, an agricultural economist at Montana State University. It could also get America into trouble with the World Trade Organisation if payments exceed certain thresholds.

Ominously, on February 10th the USDA predicted that net farm income would decline by 32% between 2014 and 2015. ” (The warning was clear).

Because of failing/failed US policies in so many areas, (energy, offshoring production, subsidies, Citizen United, election funding, etc) there is a backlog of issues that need redress. Unfortunately, the remedies seem to be finger pointing and blaming others as opposed to step by step logical fixes. The rest of the World is not beholden to adopt the US system(s) simply to keep US citizens happy, employed, whatever. Fixes cannot be done in months for that which took years to become problems.

As for NAFTA, and Kudlow’s offensive, “M-I-L-K” statement, that will be a deal breaker for Canadians. Trump has actually threatened to destroy Canada economically….just yesterday. Screw it. The idiot tariff fix attempts will literally force once friends and partners into adversaries, is doing so, and will complete the job. It will also crash the World economy unless saner heads prevail.

This is a dire situation. Dire. But hey, no problem as stocks are still high and corporate profits are booming. Just look at those class 8 truck orders! Gotta have those trucks to haul subsidised products and plastic toys. :-)

Not sure if tariffs are an answer to US misapplied trade policies invoked by congress and big corps causing a slow bleed of massive amounts of US industrial capital to flow over seas. Federal deficits contribute to current account imbalances also, but nothing was done. Heck the wings of the F16 fighter jet will be made in India. Kinda paulo leaning on this issue. This is a congressional debacle that needs to solved by legislative action.Trump’s bully pulpit will only result in animus, inflation, and job loss . looking forward to the letter.

There is a reason that DT is now president of the US. It is a failure of the “professional” politicians and no real opposition party to the two corporate ones. The mess we are seemingly in and its escalation is because too many Americans don’t have time for, “politics”. The next sign of our increasing debt and failed policies could well be: R.I.P.

The Canadian dairy tariffs are ridiculously high at 250 %.

They are all about appeasing Quebec which has had two votes on leaving Canada, one losing narrowly.

Quebec has half the Canadian quota for industrial milk, i.e. milk dried for use other than fresh use.

The final straw was a new designation to be protected: ultra-filtered milk that the US had been able to sell and abruptly left some of their farmers in the lurch.

Talk about painting a target on your back. Since we are going to have give something on dairy to get a deal, Trudy might as well get his cheque book out to pacify Quebec. ( I use the Canadian spelling of ‘cheque’ to quell any doubts about my patriotism.)

JD Power seems easily confused. Carriers need more trucks so they are buying new trucks but surprisingly not selling their old trucks-?? Someone tell JDP if they sell a truck each time they buy a truck they’re left with the same number of trucks.

I always assume JDP sells glowing ratings to the known-crappiest quality car manufacturers. What the heck is “Highest in Initial Quality”? Every time I hear that I think it must take a week or so to figure out you bought a piece of junk.

Very interested to see that White House letter!

->JD Power seems easily confused.

Always wrong but never in doubt. A lot of that going around these days.

->When will the biggest boom ever end?

In a few weeks. It’s a domino. US consumers have nearly maxed out their credit, and the household deficit is already in record territory. Nearly three-quarters of Americans die in debt anyway. Time to find something to hold on to.

My shop is just a few blocks from DTNA (Daimler Trucks North America) headquarters and their Western Star Factory so I can see the parking lots at headquarters and the trucks leaving the factory. Boom times for sure, with DTNA renting up available space to put testing labs, and logistics centers. My theory about the cause of the current trucking boom is related to the giant wave of apartments that is nearing completion in all the big west coast cities and that Wolf has analyzed extensively. In the first stages of this construction boom these hundreds of thousands of apartments just used concrete, wood and steel which helped get this trucking boom going. But now that so many are nearing completion they are being fitted out with windows, doors, appliances, factory cabinets, HVAC , carpets and flooring which is less dense and has really got the trucks rolling. This huge bulge is apartment completion is really the only thing I can see that has really changed in the economic environment, and in the case of these large complexes it may not show up in the metrics for brick and mortar sales.

This sounds right; it’s build-build-build out here. The flooring, carpeting, cabinetry, etc companies are fat and sassy and there are tons of them.

Paint companies have stores right on prime real estate like “the Alameda” which is one of the toniest parts of Santa Clara Street AKA El Camino Real. There are two of them on that locally esteemed 1/2 mile stretch.

I think you’re onto something. I found this article:

http://blog.chrobinson.com/freight-services/whats-driving-flatbed-shipping-demand-and-is-it-here-to-stay/

It sounds like things driving this HUGE freight demand are:

1. Housing construction boom: lots of building as housing & rent costs are crazy high in many cities

2. Energy construction boom: Lighter regulation, more oil & gas projects onshore and offshore, as well as the push in wind and solar

3. Capex spending boom, as the tax change allows very favorable treatment for investing in property, plants & equipment.

4. Inventory buildups due to tariff/trade war threats which are exacerbated by the low inventory levels following a long trend of pushing “just in time” inventory systems.

Cycles always happen like the waves in the sea, and both can be quite large at times. I not saying prepare for disaster, just be somewhat cautiously optimistic as all of the activities I mentioned as pushing this boom are cyclical – but they won’t necessarily all end at the same time.

The US has a big dairy trade surplus with Canada. Wisconsin and another state have big dairy surpluses (raw milk??) that Trump wants to off load to Canada. I think it’s called dumping.