It’s cyclical.

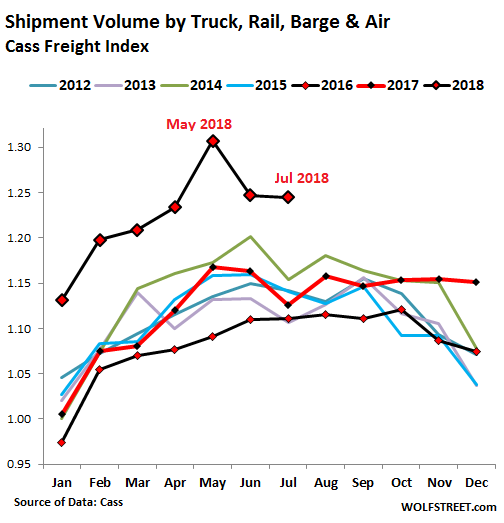

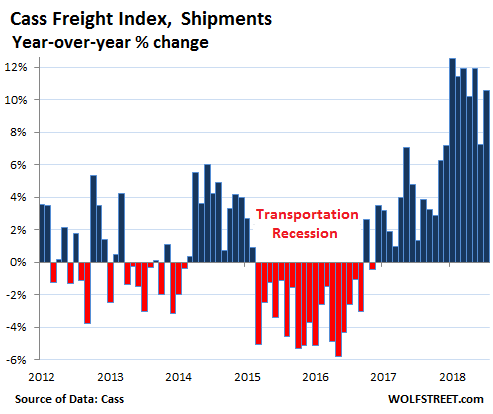

The transportation sector is a reflection of the goods-based economy in the US. Demand has been blistering across all modes of transportation. Freight shipment volume (not pricing… we’ll get to pricing in a moment) by truck, rail, air, and barge, according to the Cass Freight Index jumped 10.6% in July compared to a year earlier. This pushed the index, which is not seasonally adjusted, to its highest level for July since 2007.

The dynamics in the transportation sector are “clearly signaling that the US economy, at least for now, is ignoring all of the angst coming out of Washington D.C. about the trade wars,” the report by Cass said.

The Cass Shipments Index does not include shipments of bulk commodities, such as grains or chemicals. But shipments of commodities were strong too, according to the Association of American Railroads. Excluding the carload category of coal, which is facing a structural decline in the US, carloads rose by 6.7% year-over-year, including grain, up 14.7%; petroleum & petroleum products, up 27%; and chemicals, up 4.6%. Of the 20 commodity carload categories, only five showed declines, including nonmetallic minerals, metallic ores, and the biggie, coal.

And intermodal traffic – shipments of containers and trailers via a combination of rail and truck – surged 6.9% in July compared to July last year, the AAR reported.

The pop in the Cass Shipments Index of 10.6% was the sixth double-digit increase so far this year. Only June had come in with a single-digit increase (7.2%):

Capacity in trucking is very tight. Some of the squeeze, especially among small trucking companies, earlier this year was triggered by the newly required Electronic Logging Devices (ELDs) that record drive times by truckers and thus help enforce the legal hourly limits truckers can drive. This hurt capacity and utilization earlier this year. But Cass points out:

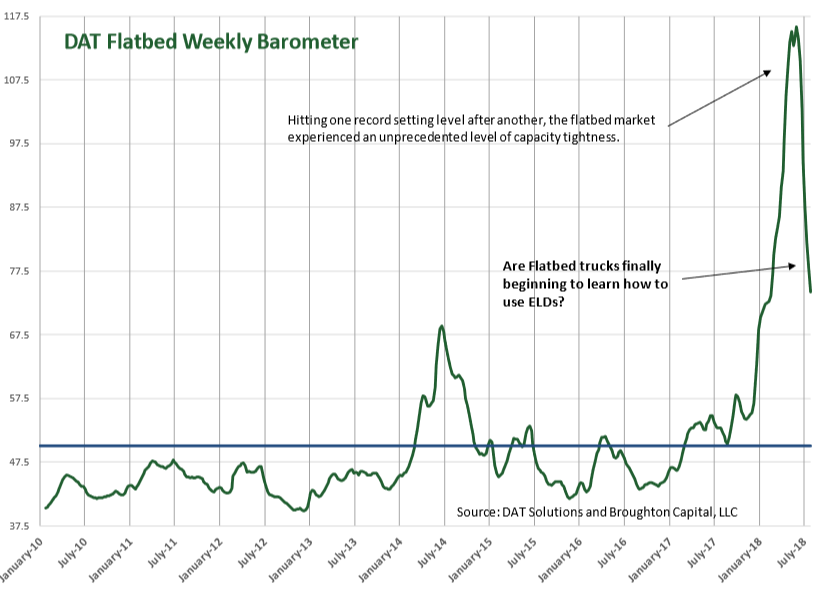

[M]any of the truckers most adversely affected are now beginning to get some of the loss in utilization back, especially in the dry van and reefer (temperature control) marketplaces. The flatbed segment of trucking, however, is continuing to struggle with productivity after the adoption of ELDs.

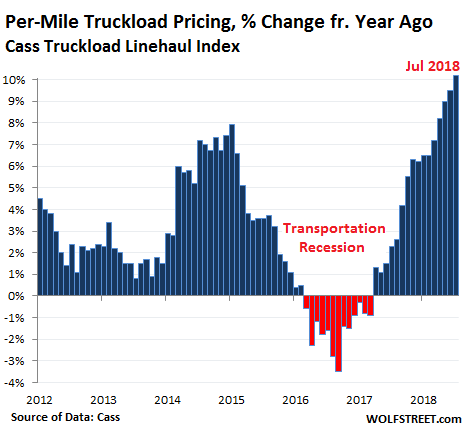

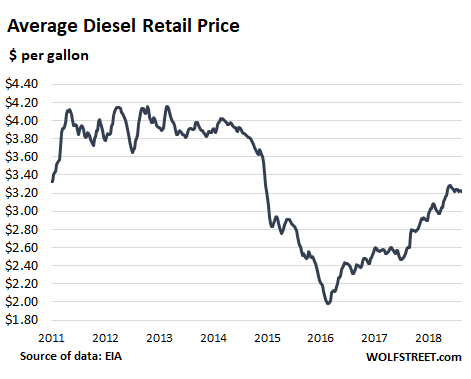

Under pressure from this demand from shippers, tight capacity, and rising costs of diesel, pricing has been surging across the board.

The Cass Truckload Linehaul Index, which tracks per-mile full-truckload pricing but does not include fuel or fuel surcharges and is therefore not impacted by diesel price increases, jumped 10.2% in July, the largest year-over-year increase in the data going back to 2005:

One of the factors in creating pricing pressures is diesel. The US average retail price of diesel rose 24% at the end of July ($3.23) from a year ago, according to EIA data, but remains substantially below the range of the years before the Oil Bust:

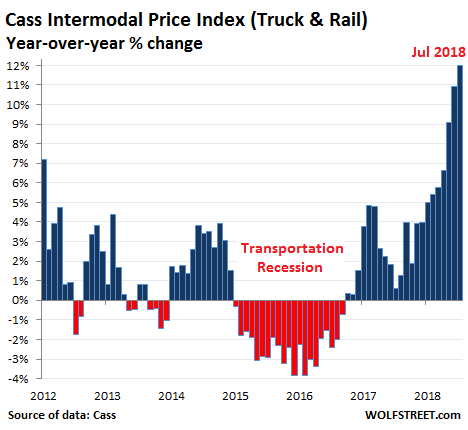

The Cass Intermodal Price Index, which includes fuel prices, jumped 12.0% in June compared to a year ago, the 22nd month in a row of year-over-year increases, and the sharpest year-over-year increase since July 2011.

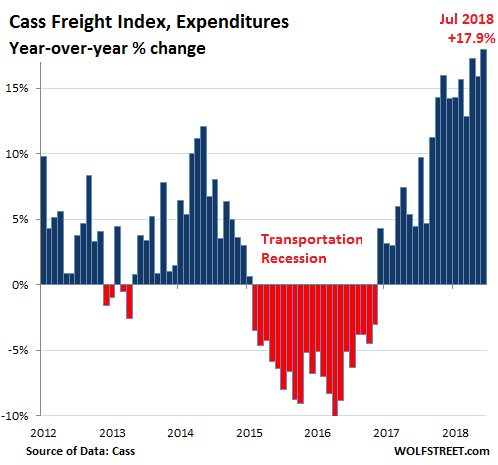

In aggregate, across all modes of transportation, the amount companies spent on shipping soared by 17.9% in July compared to July last year, according to the Cass Freight Expenditures index. This surge is a function of higher prices and fuel surcharges, as well as higher shipment volumes at those higher prices:

Retail sales – particularly e-commerce sales – have been strong all year. In July, retail sales jumped 6.4% from a year ago. That explains part of the surge in transportation demand. But industrial demand is hot too.

The Census Bureau reported yesterday that the combined value of distributive trade sales and manufacturers’ shipments for June – so lagging a month behind, but that’s as close as we can get – jumped 8.2% year-over year.

Some of this surge in shipments went into business inventories, which rose 4.2% year-over-year to a record $1.94 trillion. This number is important in the cyclicality of the goods-based economy. At some point, when sales growth tapers off, these record inventories are perceived as too high, and the inventory reduction mode sets in across industries, which causes orders to drop and then shipments to drop. This was one of the factors leading to the last transportation recession. And the way inventories are going now, it will be one of the factors leading to the next transportation recession.

But for now, there is a capacity squeeze, so everyone speeds up orders to get their stuff in time, which tightens the squeeze, increases inventories, pushes up demand for transportation, and inflates pricing.

Demand from the industrial sector shows up in demand for flatbed trailers that haul equipment and supplies for the revived oil-and-gas drilling boom, construction, manufacturing, etc. Demand surged just as capacity tightened, and suddenly the DAT Flatbed Weekly Barometer, cited by Cass, spiked. The spike, as the chart below shows, was historic and blistering, but there is no infinite spike or endless exponential increase, as the recent plunge toward the mean shows. In this barometer, values above 50 (blue line) indicate demand exceeds capacity (click to enlarge):

As the above charts show, transportation is an notoriously cyclical industry that experienced a “transportation recession” from 2015 through much of 2016, just as a lot of capacity had been added, while business inventories were suddenly deemed too high and orders slowed in the goods-based sector, which caused demand for transportation to drop and pricing to collapse. Suddenly there was no more talk about a shortage of drivers.

Cass points out that the capacity squeeze and price increases are unlikely to become permanent: “We are confident that the increased spending on equipment, technology, and people will eventually result in increased capacity in most transportation modes.”

“Increased spending” may be an understatement. Trucking companies are responding to the capacity squeeze: In July, their orders for Class 8 trucks soared 187% from a year ago, to 52,250 units, the highest number of monthly orders ever. Truck manufacturers, which had been laying off people during the transportation recession, now have their own capacity squeeze that goes all the up the supply chain. “It is a bizarre occurrence and it will not be resolved soon,” FTR Transportation Intelligence explained. Read… Cyclical Heavy-Truck Industry Soars to Cloud 9

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

One can only imagine the frictional losses caused by having to suffer along with such a massively underfunded and horrifically governed transportation infrastructure.

And yet, the cyclical nature of the business does make for a convenient excuse for chronic public underinvestment and crappy management. That’s not something the mythical Invisible Hand is going to fix. It’s just going to wave to you and smile and expect you to wave and smile back.

It’s a symptom of the ‘just-in-time’ paradigm, applied to processes for which it is inappropriate.

Since the 1980s managers have been indoctrinated and compelled to focus on short-term costs and short-term gains, almost to the exclusion of concepts like total cost of ownership and life cycle profitability. When you systematically remove all the slack from the system to save money you end up with a system that’s brittle when it needs to be flexible, without reserve capacity, that can’t cope with unforeseen downtime, and ends up costing you multiples in cost overruns and missed opportunities than you ever could have saved by starving the system.

Why do I get the feeling I should be charging fat fees for this?

What we are witness to is a ‘Blow Off Top’.

All politico, economic, and social fundamentals, both macro and micro, point to an upcoming calamity. The current frantic activity in the transportation sector, does not mirror what is happening globally.

Otherwise, a bulk freighter with a cargo of 70,000 tonnes of soya beans, that missed its off loading deadline according to recent tariffs, has been circling mid ocean for past +30 days at a cost of $14,000 per day!

Both events reveal a classic ‘Blow Off Top’.

This points to high inflation coming our way, along with higher interest rates. Although the Fed may be dovish and say this inflation is transitory, causing the bubble to expand then burst in everyone’s face.

Nonsupervisory workers salaries are flat to down. That’s the bulk of the population. So what kind of inflation are we going to have that’s different than the current insurance/housing/education based inflation that’s been going on all along?

The housing market is stalling due to unafordability. The cheap homes in my area go in a snap while the list of 500K plus houses grows and grows.

A strong dollar means cheaper stuff from Walmart, so it won’t be a goods based inflation. Now there’s obviously a goods transportation based inflation, but that won’t bring the house down.

Really this inflation hysteria is nonsense. The Fed may need to raise rates because Treasuries won’t sell, but that’s a different matter entirely. So long as the government ignores the true sources of inflation everything will be fine.

:)

“Really this inflation hysteria is nonsense.”

Have you shopped at all at your grocery store lately?

Mine are raising prices by 25-35% slowly but constantly.

Agree completely. Joe Sixpack’s wages aren’t going up and with increasing rent and healthcare, his disposable income is going down. You can try and raise prices on Joe, but he’ll just have to forgo on buying altogether. Prices go up just a little and sales collapse.

Economists still think we’re in the ’60’s and ’70’s when the labor force was unionized and had COLAs. Those days are long gone.

Economists keep pindexing why average wages aren’t rising much. I guess unions did do something….

The economy has bifurcated on wages and demand. High earners get more benefits from the economy because interest rates are low and their wages are high. They can easily afford more and better stuff. The average to low wage earners are being squeezed on all the necessities, housing, food, medical care, education, etc.

Your comment on Walmart was especially interesting because the middle class can barely afford to shop there. From what I can see the dollar stores are expanding and undercutting them. Before the financial crisis I would see many people with overflowing carts at Target. I never see that anymore, except at Goodwill.

If you go to the thrift stores, who have zero cost of goods, you will see they are raising their prices because there is so much demand.

The second hand business has even expanded to luxury goods. There are resale websites for clothing, handbags, and shoes. Not all the items are exclusively from luxury labels, many are “working” quality items.

I have not been in a Wal-Mart in ten years. I refuse to shop there and buy their Made in China crap. I absolutely loathe Trump but China is not our friend.

Well said and accurate! I find the same here in Canada. But the believers in empirical data will dismiss any common-sense observations. They want “charts” and “statistics” and will continue to insist the US economy is roaring away – in spite of on-the-ground observations.

The transport area is prime hunting ground to find future bankruptcies.

One issue we are seeing is that to get ahead of the Tariffs (301 – list one and two; list three 10% to 25%) – affect upon 7000 HTS codes), the shipments out of China are sped up and processed now before any tariff increases occur. So all of that ocean volume made for an earlier peak season start so the goods can beat any new tariffs. This volume will need to move inland for warehousing. Would be interested in ocean volumes for July and August YOY to see if there is a big jump. So many of your Xmas goods for Black Friday are already headed to our shores and the carrying cost of inventory outweighs the cost of increased tariffs. I would look toward most companies carrying more on the books in 2018 than in years past.

Flatbed finally learning to use ELD’s…… it isn’t that. In January most of the O&G budgets were opened up and inventories held off until the end of 17. Everyone in O&G had flatbed freight ready to roll come January 1 2018…. but not enough equipment on the road. There are fewer flatbeds, and fewer flatbed drivers. Flatbed drivers have to do more labor intensive work…. tarping and strapping down goods takes time and is tough and sometimes dangerous work. Driving a Van up to a dock is easy. Full truckload van drivers do not load or unload the van. Flatbed drivers must tarp and strap down loads in all sorts of weather. Imagine tarping a large generator not crated that may be 12′ feet high on cold wet morning … that could take an hour or two. Not many people want to do that anymore. Flatbed tarp fees are typically under $100.

“Tarp fees 100.00”

For me to tarp 12′ high starts at 750.00 and goes up from there, it takes 4 hours minimum and very dangerous . Workers comp polices are starting to not write polices if you tarp, also many large insurance companies are pulling out of the Calif market if you operate over 20% of your miles in Calif due to lawsuits involving trucks and cars.

Just some of my latest challenges owning a trucking company here in Calif.

As a Canadian logistics specialist, one of my major concerns is incompetent truck drivers. This is partly demographic. Older, more experienced drivers are retiring. As well, the ELD’s and increased regulation (“too much BS!”) is discouraging older, experienced drivers and forcing them into retirement.

Many new drivers are immigrants who can barely read or speak the local language. It’s not surprising that truck accidents are increasing.

And competent drivers are becoming rare. Recently it took seven hours to load and tie down a mobile machine that should have taken less than an hour. No wonder capacity is tight; they take forever to hit the road.

My brother runs a city office for one of the largest freight forwarders in the world. He says his location is not making money.

He says the trucking wages/rates are tight and the drivers aren’t seeing any of the increases. I’m not sure where it is all going, but fuel might be the major place.

Anyway, from his point of view things are better than they were a couple of years ago, but it’s not that great in his areas.

He deals with air freight mostly, and the air carriers call all the shots for costs (whatever that means.)

I buy , sell and ship commodity raw materials for a living. The pending tariffs are actually boosting the transportation industry for the time being because so many companies are scrambling to get inventory into the country and into their warehouses as soon as possible, to avoid the higher costs. This is especially impacting international freight and port congestion and should continue for a month or so. Freight has been very crazy over the past year but some close contacts at the largest freight broker in the country informed us that rates have started tanking over the past 2 weeks and they expect the reverse to continue, without giving any good reason as to why.

Front-running tariffs, that is very interesting.

Back in 1973 there was a lot of front-running of demand to keep ahead of inflation. In 1974 prices crashed.

I’m wondering if we’re hitting a similarly here, if this will turn. I wouldn’t short it because the timing is always a gamble, but I did recently lock some good money into a 12-month CD at 2.4% – maybe that’ll find better use next year.

Given the massively overbought USD, given the participation rate, the income divide, the debt levels…WHO is supposedly “buying” all this expensive “production”???

Seeing lots of highly blindered, narrowly-focused “conventional wisdom” bandied about in these comments.

Can anyone provide a tad more comprehensive “global” (all emcompassing) perspective?

After all, from the point of view of many individual soldier/participants, observing only what’s around themselves at the time, Waterloo and

D-Day were massive failures on the part of the eventual victors!

– I have another (fairly) reliable indicator for the health of the US economy and its called “the US trade deficit”. Every time the Trade Deficit (TD) shrinks (and with it the Current Account Deficit (CAD)), it signals that US demand for imported stuff is shrinking as well (=recession) and/or import prices (e.g. oil) are falling.

– Financial news shows are cheering when the TD is shrinking but that’s actually a sign of a potentially deteriorating economy. In that regard one Donald Trump and his trade hawk buddies “don’t get it.”. These folks want to get rid of the TD ASAP with their (import) tariffs. But as mentioned above, a shrinking TD is a (possible) sign of a “recession” (with or without quotation marks).

– We saw that in the late 1980s and in 2007 & 2008. In both cases the Trade Deficit shrank. In 1990 the Trade Deficit even turned into a small Surplus for one year. And in 2006-2007-2008 the TD actually shrank by some 60 to 70%.

– However, the 2001 + 2002 recession in the US shrank the Trade Deficit only slightly. There was only a “minor” reduction of the Trade Deficit. Don’t know what to make of that. Was the 2001 & 2002 recession really that shallow ?

– Currently it seems the TD has peaked and seems to have shrunk (a bit). In that regard the TD follows actually the freight index surprisingly well (see the info at the top of this thread). It could (!!) signal an upcoming recession. We’ll have to wait and see how the TD develops in the coming months. Still WAY too early to make a decent call on a possible turn of the US economy.

– With US car sales falling for 2 years in a row I would have expected that the TD also would have started to shrink (like in 2006 & 2007) in the last say 2 years. But it turned out otherwise.

– A website that provides an excellent TD chart is (Bill McBride’s) Calculated Risk. (Use the search feature).

– June Trade Deficit charts:

https://www.calculatedriskblog.com/2018/08/earlier-trade-deficit-increased-to-463.html

If the trade deficit shrinks because exports are surging, that’s a great thing… though that’s not happening.

If the trade deficit shrinks because imports of petroleum products are plunging due to surging US oil and gas production, that’s also a good thing. Imports of petroleum products have plunged. And the US has become a net-exporter of natural gas. The fact that the trade deficit is so huge despite the decline in imports of petroleum products and natural gas is a sign that imports of goods other than petroleum products are surging.