Here’s my math when this “balance sheet normalization” will end.

In August, the Federal Reserve was supposed to shed up to $24 billion in Treasury securities and up to $16 billion in Mortgage Backed Securities (MBS), for a total of $40 billion, according to its QE-unwind plan – or “balance sheet normalization.” The QE unwind, which started in October 2017, is still in ramp-up mode, where the amounts increase each quarter (somewhat symmetrical to the QE declines during the “Taper”). The acceleration to the current pace occurred in July. So how did it go in August?

Treasury Securities

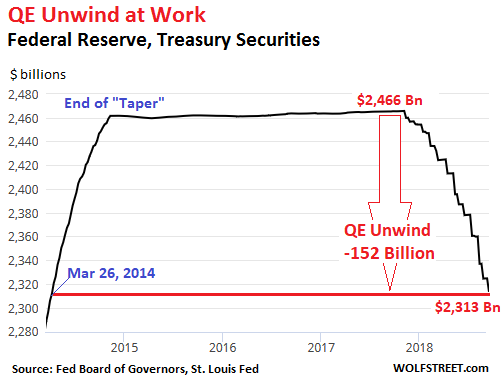

The Fed released its weekly balance sheet Thursday afternoon. Over the period from August 2 through September 5, the balance of Treasury securities declined by $23.7 billion to $2,313 billion, the lowest since March 26, 2014. Since the beginning of the QE-Unwind, the Fed has shed $152 billion in Treasuries:

The step-pattern of the QE unwind in the chart above is a consequence of how the Fed sheds Treasury securities: It doesn’t sell them outright but allows them to “roll off” when they mature; and they only mature mid-month or at the end of the month.

On August 15, $23 billion in Treasuries matured. On August 31, $21 billion matured. In total, $44 billion matured during the month. The Fed replaced about $20 billion of them with new Treasury securities directly via its arrangement with the Treasury Department that cuts out Wall Street – the “primary dealers” with which the Fed normally does business. Those $20 billion in securities were “rolled over.”

But it did not replace about $24 billion of maturing Treasuries. They “rolled off” and became part of the QE unwind.

Mortgage-Backed Securities (MBS)

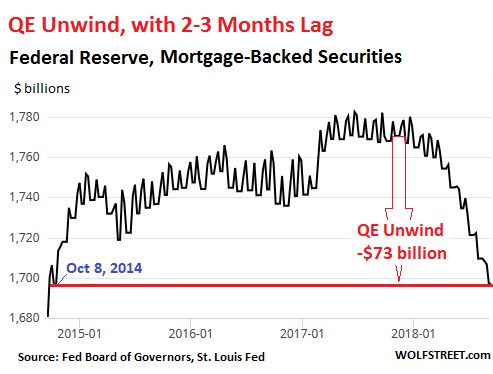

The Fed is also shedding is pile of MBS. Under QE, the Fed bought residential MBS that were issued and guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Holders of residential MBS receive principal payments as the underlying mortgages are paid down or are paid off. At maturity, the remaining principal is paid off. To keep the balance of MBS from declining after QE had ended, the New York Fed’s Open Market Operations (OMO) kept buying MBS.

The Fed books the trades at settlement, which occurs two to three months after the trade. Due to this lag of two to three months, the Fed’s balance of MBS reflects trades from the second quarter. In August, the cap for shedding MBS was $16 billion. But at the time of the trades reflected on the August balance sheet, the cap was $12 billion.

Over the period from August 2 through September 5, the balance of MBS fell by $11.5 billion, to $1,697 billion, the lowest since October 8, 2014. In total, $73 billion in MBS have been shed since the beginning of the QE unwind:

The QE unwind is scheduled to reach cruising speed in October, when the unwind is capped at $50 billion a month. The plan calls for shedding up to $420 billion in securities in 2018 and up to $600 billion a year in each of the following years until the Fed deems its balance sheet adequately “normalized” – or until something big breaks. Based on current discussions, as part of this “normalization,” the Fed is likely to get rid of all its MBS and retain only Treasury securities.

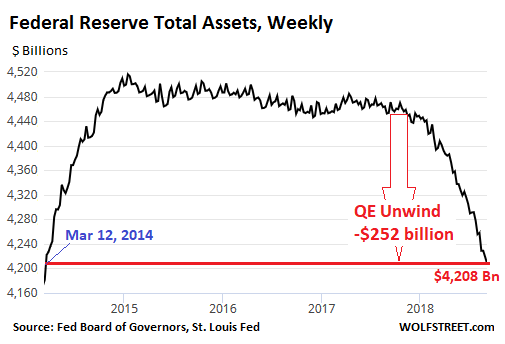

Total Assets on the Balance Sheet

The balance sheet also reflects the Fed’s other activities. Total assets for the period from August 2 through September 5 dropped by $47 billion. This brought the decline since October 2017, when the QE unwind began, to $252 billion. At $4,208 billion, total assets are now at the lowest level since March 12, 2014:

When will this Balance Sheet Normalization end?

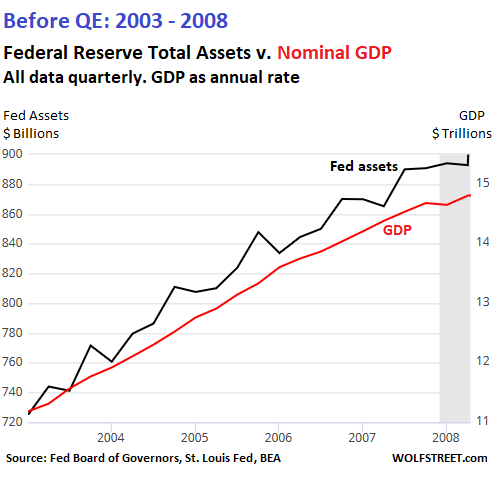

It took the Fed about six years to pile on these securities. It’s going to take a number of years to shed them. But the balance sheet will never go back to where it had been before QE for the simple reason that as the economy grows, the Fed’s balance sheet expands along with it.

The chart below shows this relationship as it existed before the Financial Crisis. It depicts the total assets on the Fed’s balance sheet (black line) and nominal GDP seasonally adjusted annual rate (red line). All data is quarterly:

There is no telling what the Fed will do in terms of its balance sheet. But by looking at the past and extrapolating into the future, we can a least get a feel for the lower range — the level below which the Fed will certainly not go.

GDP: Since 2008, nominal GDP has grown 38% from $14.8 trillion to $20.4 trillion.

Balance sheet: In 2008, just before the Fed’s gyrations started, total assets amounted to $892 billion. If the Fed’s balance sheet had grown since then at the same rate as nominal GDP, it would be $1.23 trillion today. That’s sort of a base line.

The Future:

If nominal GDP (not adjusted for inflation) grows at 5% per year (slightly below the current rate), it will reach $24.8 trillion in Q2 2022.

If the Fed’s balance sheet had not experienced QE, and if it had grown since 2008 at the same rate as nominal GDP, it would reach about $1.5 trillion in Q2 2022.

So, if the QE unwind proceeds at $550 billion a year (below the cap of $600 billion), the Fed’s total assets will drop to about $2 trillion by Q2 2022.

This range between $1.5 trillion and $2 trillion will mark the absolute low end of the Fed’s balance sheet by the time normalization ends in 2022. And most of those assets will be Treasury securities. What little MBS will be left on its balance sheet by then will be shed in future years. This is my math, and I’m sticking to it.

An entire generation on Wall Street has never seen Treasury yields this high. Read… These “Gradual” Rate Hikes Start to Add Up: US Treasury Yields up to Three Years Hit 10-Year Highs

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Seems like we are beginning to see some signs of stress from this. Thus far mainly in the emerging markets debts and currencies. Higher US interest rates means more money flowing to safer investments in the US instead of chasing above-zero interest rates in the EM’s. If this was just Argentina, Turkey and other places, that might not be a huge deal. But as Don Quixotes has reported, European banks are highly exposed. And I believe I saw some the name of the United States on the list of countries exposed to EM debt. Such things do tend to snowball as they unfold.

Eamon, you have swallowed the wide misconception that “money flows to investments”. In the big picture that’s impossible because for every buyer there is a seller. The money flows from the buyer to the seller, not to the investment. The investment flows from the seller to the buyer but doesn’t change. The only exception is when a security is being issued or retired.

From https://www.hussmanfunds.com/wmc/wmc070312.htm :

“Dear Wall Street analysts and financial reporters – when investors purchase a stock in the secondary market, the dollars that buyers bring “into” the market are immediately taken “out of” the market in the hands of the sellers. It is an exchange. This is why the place it happens is called a “stock exchange.” The stock market is not an air balloon into which money goes in or out and expands or contracts that balloon. Nor is it a water balloon that is expanded by pouring in “liquidity.” Prices are not driven by the amount of money that buyers “put in” or sellers “take out” (as those dollar amounts are identical). Prices are determined by the relative eagerness of the buyer versus the seller.”

Moot point. When a market is priced more attractively than another, it will tend to have more buyers, and some of its sellers will stop selling and maybe even buy more. The volume of money flow is not really important. When we say “money flows to a market,” what we are of course actually saying is that demand has picked up in that market relative to other markets and relative to supply, hence there are good odds of appreciation there, along with a chance of relative depreciation elsewhere. So whether there is a net change in money flow, there is definitely a change in prices, and that’s what most investors really care about.

The history of the EU & US banks has been US banks detect problems faster, work-out/write-off problems faster, raise additional capital faster and better provision against losses than EU banks.

I can’t make heads or tails of the Federal Reserve, but I’m hoping the end of QE, interest rates rising to “market” rates, and declining FED balance sheet continue. A return to “normalcy” is in itself economically healthy, but sooner or later, financial shocks may require future Fed action, a capability that is now being reinvigorated.

“future Fed action,”

The amount of debt overhang from the debt boom of pre-2008, in conjunction with the amount of new debt created since, precludes very little new debt creation to drive growth, since there is not enough productive economic activity to pay the old debt. In this situation, only an extended period of low interest rates plus monetary expansion, can keep the economy from having a major coronary. Possibly fatal.

So, what happens if interest rates stay low? My guess is the bubble expands further and we have a deeper recession or a depression down the road. The Fed is on the right track by raising rates.

Have you ever seen any of Steve Keen’s work on debt. There are lots of videos with great charts using verifiable data on youtube.. He has been a rebel economist for decades.

Basically increased debt drives increased consumption and thus increases in the GDP. He is a big fan of Minsky and according to Minsky’s Instability Hypothesis and Keen and the charts he shows, once you reach a point of No ROI due to to much debt, gravity does what it does.

So Steve is still analyzing 2008. 2008 and Minsky is about PRIVATE debt. You talk about MBS and Leman and AIG. This time, it is NOT PRIVATE debt. It is about confidence on the definition of money and currency. You talk about central banks, currencies, gold, political divide, war, trade or shooting. If you use Minsky on central banks and currencies and politics, I am sorry.

Hyman Minsky’s Late Stage Ponzi Capitalism ends in disaster due to the fact that the myriad Ponzi schemes that are currently operating will ultimately fail outright due to no new entrants or money to prop the Global Ponzi up. The Giant Vampire Squid built a Global Ponzi with no regulatory framework. The $1.8 quadrillion USD dark pool derivatives universe will ultimately implode due to zero liquidity to keep it inflated.

USD is currently repatriating all those EM USD dollars that are no longer finding safe haven in EM. The USA Titanic will list when all the EM gets repatriated to USD and everyone in the USA finds themselves all on one side of the USA Titanic as it begins to take on water. Once the bulkheads are filled with water the Titanic will sink to the bottomless pit of the end of civilization.

Ergo, AI is not really what we need to be worrying about as Elon Musk suggests because the USA Titanic & EM will coincide in the abyss of zero liquidity when Deutsche Bank & GE topple along with all the other systemically too big to fail banks & blue chip corporations like Tesla, GE, CAT, et cetera.

Trump’s tax cuts and prime of the money pump in excess of QE was all for stock buybacks and nothing more. The entire corporate sector of the USA erroneously thinks that stock buybacks are going to keep them all afloat for the duration of their existence. None are investing in real machines or new plants/factories. China has the lion’s share of manufacturing base in this world now and when Thermonuclear World War Three breaks out there will be no manufacturing sector to support the USA war effort.

Zero Sum Game!

GAME OVER

Please Insert Another Trillion Dollar Coin

[—————————————]

[—————————————]

[PRESS START]

MOU

“Normalcy” is not a constant, it is always in flux, the interest rates you remember as being normal will never return. Even the Fed says this rate hike cycle will not go beyond 3% on the FFR (I doubt they will get anywhere near that) and the balance sheet is not to drop below $2.5 trillion (again they will never get close to that level).

The Fed needs to keep the easy money flowing so Americans can have the welfare programs (social security) and large government they love without having to pay for it. You can’t fund bloated government and social programs forever with easy money and not cause catastrophic inflation. The Fed will keep easy money flowing in the face of inflation and the dollar will die, we have chosen this path.

Not everyone wants to get something for nothing or work a worthless BS job, some people enjoy being productive, but those people are a small minority being trampled by a thundering heard screaming gimme gimme gimme.

Who are all the people out driving around, in the middle of a work day, and where do they get the resources to waste all the time and money doing nothing productive? Look out your office window, the streets are clogged with people just driving around during work hours.

Maybe they work nights, or on days off? Most jobs are not Mon-Fri 8-4:30. Those days are long long gone.

You do realize the U.S. also has millions of retired people, as well as people that work from home and can set their own hours ?

Yes! a nation of bartenders, cooks and waitress’. Perfect! We can all cook or carry meals out to one another, hey it’s a living.

As long as one can spend half the day driving around eating junk food and the other half the day shopping on Amazon for consumer goods from China what’s there to complain about. A booming economy brought to you by Bernanke, Yellen, Powell and company Co.

Thundering herd of waitresses (grammar not my forte apparently)

You seem to have swallowed hook, line and sinker the Reaganesque version of “lower society” depicting them as eternal suckers of government monies. Our society is far from that. Tens of millions of our citizens work very hard to make ends meet, save some, looking to a better future. I would hate to be living within a mental attitude so dark as yours.

I am very wary of this economy. I too don’t think that we can continue to sustain the maniacal consumer society that is required to maintain our “crapified” economy.

But, think better of the “common human”; that’s all we have.

We’ll get a massive liquidity crisis a la 2008 well before 2022.

My guess is, Trump’s Wall Street enemies will try to engineer it right in time for the 2020 election, but don’t be surprised if it comes in a year ahead of schedule. That schedule implies another massive Fed balance sheet expansion within three years. No way the balance sheet ever dips below $3 trillion IMO. Buckle up for a $10-20 trillion Fed balance sheet by 2022.

Is it not true that by selling the MBS to the banks, the banks then create new loans (at say 30 to 1) based on these new capital reserves? This then increases liquidity in the system and also ups the velocity of money (The securities sitting on the FEDs balance sheet had no velocity). An increase of money in circulation at increased velocity should stoke inflation… runaway inflation unless interest rates rise proportionately… a la 1980.

This is a very fine balancing act by the FED. Once started, it cannot be reversed without causing a Deflationary collapse a la 2008.

Is this correct?

First, selling MBS to banks takes money away from them, it does not give them new money to lend.

If lending is done by the limit by all banks, the fractional banking money multiplier is one divided by the reserve ratio, which I believe is 10%, so the limit is 10, not 30.

Presently, there is little demand for loans by qualified applicants, so I believe the multiplier is very, very low, maybe 2?

Selling treasuries or MBS reduces liquidity.

Securities are not a component of any money supply metric on which the velocity of money is based.

You seem to have just about everything wrong.

How’s your golf game?

The Fed buying MBS withdrew liquidity from the market as they have been sitting on the Feds balance sheet at zero velocity. it was dead money. As the MBS is sold back into the market into bank balance sheets.. the banks create new loans ( I think the existing multiplier is around 30 times it may be 20 or even 10 but it is definitely not 2. Money is general circulation is increased and its velocity … the speed at which money is turned over also increases.

Monetary inflation is equal to the total money IN Circulation times times the rate at which the money changes hands (expressed as a constant,,, see Fishers law). Higher interest rates also increases the velocity of money. Going forward we can expect an inflationary event… not a liquidity crisis.

I shot 87 today.. couple of wayward drives and 2 three puts.

$ted!

So, as interest rates rise in the value of some of the securities decline does that count as a reduction in the feds balance sheet?

No. The Fed books the securities at cost and does not adjust them to market. Since it sheds them at maturity, it gets face value for them. When it gets face value that means that on some it makes a little money (it bought long maturities during QE when 10-year yields and longer where much higher) and on some it loses a little money.

Thank you.

What about the Fed’s 30-year treasuries? If they rely strictly on maturation, and they only bought newly issued treasuries directly from Treasury without buying in the secondary market, then no 30-year bonds will be maturing for years.

Wouldn’t that mean the Fed balance sheet’s duration must be increasing as only shorter-term stuff is run off? That’s going to cause more yield curve flattening than I expect they want.

I also wonder about the MBS’s. Is the entire drop in the MBS balance due to buying less than is expiring or are some being sold on the secondary market? Seems like most of them would be long-term enough that they wouldn’t be expiring yet.

Concerning your point on 30-year Treasuries: Assuming that the amount of securities on the Fed’s balance sheet will be around $2 trillion at the end of this QE unwind (if it goes this low), there’s plenty of room for the 30-year Treasuries it bought a few years ago.

Holders (such as the Fed) of MBS regularly get principal payments as homeowners pay down, pay off, or refinance their mortgages as principal payments that homeowners make are passed on to the holders of MBS. So the principal of each MBS shrinks throughout the term. The speed with which this happens depends on the housing market, the mortgage market, and interest rates. So the shrinkage of the Fed’s MBS balance, if it bought no more MBS, would be quite fast.

30 year and the 10 and eventually the 7 year go bye bye? You will not be interested in long paper for generations!

So like everything else there is no mark to market any more.

I wonder why the Fed would not submit to audit.

They don’t want frontrunning I suppose which everyone does anyway as the Fed tells everyone what they are doing.

The system is so clearly set up to make the banks richer.

The Fed’s financial statements are audited every year. What is not audited are the goings-on at the Fed … and that’s what everyone really wants to know.

Msshell,

If you hold US Treasuries, where there is practically no credit risk, and you hold them to maturity when the US government will pay you face value, I don’t think it’s necessary to mark to market. You’re going to get your money, you know how much you’re going to get, and you know how much interest you’re going to collect until then. So I think in that limited case, booking them at cost makes sense.

If you’re a trader in Treasuries and try to make money by buying low and selling high, and you don’t hold till maturity, I think mark-to-market should be required.

The point of the audit would be to verify whether the Fed indeed is only holding US Treasuries.

We know that in the 2008 crisis it did not. Aside from the general Maiden Lane shenanigans, at the time it was also illegal for the Fed to be buying MBS, which were not full-faith-and-credit obligations of the US government like Treasuries (and still aren’t…).

There were also various international agreements in which US taxpayers were apparently put on the hook for behind-the-scenes bailouts of foreign banks. It might have been in the national interest to make those bailouts, particularly given the regulatory nonfeasance that led to such atrocious securities being issued by US institutions, but it might not. Regardless, they were not adequately publicized nor accounted for.

More sunshine is needed to dry out the swamp.

Fanny Mae & Freddi Mac have paid the FED roughly $68 billion past what they owed so far, but the FED is still shedding the MBS they had to take on because of the nationalization of those behemoths of incompetence & fraud. Moreover, they are still nationalized and the NON-Bank Lenders have 80% of all the new issuance because the marquee banks decided to let the NON-Bank lenders take all the subprime MBS and charge 15% or more on all the loans outstanding. Debt overhang will kill the consumer and the whole system will crash again very soon.

MOU

Its rather unfortunate that the FED has destroyed the real economy with all this balance sheet nonsense. My observation in my career has been theory and actual reality are not the same.

At the depth of the financial crisis in 2009, the Fed could have proclaimed that it is sick and tired of declining stock prices and would be willing to print whatever is necessary to guarantee a 9% annual return in the S&P 500 index. After 17 years, in 2026, the index would have gone from 666 to 2882. That would have been more responsible and sustainable than the current path we’re on.

In theory there is no difference between theory and practice. In practice there is. – Yogi Berra

The real questions are:

1. Why hasn’t this QT hyperinflated the dollar yet?

2. Doesn’t it make more sense for holders of these bonds to just use them for their own benefit instead of keeping them locked in? I’m guessing this is why China is spending so much on infrastructure projects all around the world while the US govt licks its wounds servicing debts

3. When so many trillions (with a capital T) of dollars are just funds creating more wealth for themselves, circulating in the hidden system without humans, how is the US economy even functional? This constant printing of money can go on forever. What happens if the rest of the world starts using something else as primary reserve currency and global demand for US dollar drops?

Because essentially all of it went into excess reserves of large banks deposited at the Fed and getting interest.

Essentially none of it ever entered the real economy.

And lucky it didn’t. Can you imagine the inflation if even a small % of that cash ended up chasing real goods in the real economy?

Can you imagine the crash that is coming because all that false money only inflated stocks???

The day when hyper happens, either inflate or deflate, the FED ends. That is the day, a round table of a dozen people stop being able to control the accounting units of wealth, goods, services. It is the day the confidence of the ruling class is destroyed. It is the day war, civil or international will start. It is the day gold will shine and gold will be banned or confiscated. It is the day rule of man will kill rule of law. Do you think central bankers want to kill themselves without putting a survival effort to make sure hyper in either direction will NOT happen? The question is, can they maintain the status quo?

But it did!

QE pumped up stocks and real estate, increasing hedge fund balances. QT is allowing the same hedge funds to take profits out of markets and put it into bonds.

This has got to hyper inflate. This is quite simply printing money over the years.

I suspect the only reason we haven’t seen inflation is because when hedge funds start pulling this inflated money out of stocks, they aren’t really investing in real businesses, only in government spending, which increasingly is just interest payments.

Where is the real boost to economy? Where are newer businesses?

China’s much lauded “Silk Roads” are nothing more than an international extension of their domestic infrastructural binge, as proven by the fact the State-owned Development Bank of China and Export-Import Bank of China behind a large number of these projects, which are actually nothing more than white elephants.

The new highway being built in Montenegro is the poster child of this approach.

The Export-Import Bank of China is financing work with a 20-years, 2% fixed rate loan with a 6 years grace period, but… Chinese contractors got 70% of the work and all building materials they are bringing in is both VAT- and custom duty-exempted. COSCO and other Chinese shipping companies get to bring all the materials, from bags of cement to escavators, to the port of Bar.

Of the 4,000 men directly working on the highway as of July 2018 3,600 were Chinese nationals. Even the bungalows housing them are prefabricated in China.

Everybody, starting from the Chinese government, knows this is a classic white elephant. Montenegro cannot afford this project and will never be able to repay the Export-Import Bank of China. But that’s not the point.

The point is to keep the Chinese GDP growing at any cost, and to provide plenty of work for all Chinese firms involved, from the China Road and Bridge Corporation to COSCO, from CNPC to Sany. Do they really need it? Of course not, but it doesn’t matter.

“1. Why hasn’t this QT hyperinflated the dollar yet?”

QT is deflationary, it destroys money so it means there is less money “chasing the same number of goods.” QE is inflationary because it creates money so there becomes more money “chasing the same number of goods.”

It is theoretically possible that the deflation from QT could break something that might eventually and indirectly cause some nasty inflation, but QT itself is not directly inflationary – it is the opposite.

“If, if, if. If the Queen had balls, she’d be King.”

Bill Boosalis, owner of Olympia Restaurant where I worked at as a waiter in high school days in Faribault, MN.

“At this the king laughed. Not because he wanted two, but because he had two.”

Old army humour, it seems.

The Queen has her sons’ balls in her purse and always has. Ergo, the Queen has balls and is not a king.

MOU

it’s actually an old yidosh expression.

As di bubbe volt gehat beytsim volt zi gevain mayn zaidah (AS DEH BUH-bee VOLT ge-HAT BAYT-sihm VOLT ZEH ge-VAYN MAY-n ZAY-deh) – “If my grandmother had balls she would be my grandfather.” In context, used as a sarcastic response if someone says something like, “I’d be a great model if I was 5 inches taller and 30 lbs lighter.” We’re a very sarcastic people.

https://groupthink.kinja.com/a-guide-to-swearing-in-yiddish-483890863

Wolf

Good thought, but financial matters rarely proceed in a linear fashion. The dreaded inversion in the two/ten Treasury yield is about four months away and the unexpected/unforeseen recession should appear next spring.

At that point the Fed will stop raising rates. If that doesn’t work, and it won’t, the Fed will begin lowering rates. When that fails to revive the economy, the next step will be to revive QE.

I would love to see the unwind go to 2022, but I give your scenario less than a 5% chance of occurring. I would love to be wrong but all the other things you write about on a daily basis are likely to implode long before 2022. This implosion will likely make the Fed rethink the normalization policy.

In the near future, everyone will become an expert in the causes and effects of a dollar liquidity crisis so check up on how the Fed provides dollar swaps to other central banks.

David I agree with that It sure feels a lot closer than 2022 to me

What happens when the Feds monthly reduction in its Treasury holdings exceed the amount of the Feds treasuries holdings that mature.

You are trying to suggest that the FED can not manage maturity dates 30, 60, and 90 days out, to ensure such a thing never happens.

Remember, the FED can get what ever debt it needs, directly from Treasury, with the maturity dates it needs, and nobody outside the FED Treasury loop, will even know the phone call to arrange that, took place.

This is already happening this month. They’ll allow all maturing Treasuries to roll off, but the total will be quite a bit under the cap.

They can always sell Treasuries but have not so far made any official noises in that direction though there was a suggestion by a Fed governor earlier this year to do so.

Hi Wolf . Minor edit:

“It depicts the total assets on the Fed’s balance sheet (blue line) and nominal GDP seasonally adjusted annual rate (red line).”

The graph uses a black line.

Cheers

Mark

Wold:

If I understand correctly, the ongoing escalation in the amount of currency is not part of this analysis?

That is some $150 billion a year of new liquidity entering the market?

Is that cash issued to buy treasuries that are then shredded, not held by the Fed?

I’m not totally sure what you mean. Let me just say that the article discusses the asset side of the balance sheet. Currency (“Federal Reserve Notes”) are on the liability side of the Fed’s balance sheet.

To your last line: No, the Fed does not use cash to buy Treasuries. The amounts, as you can see, are in the tens of billions of dollars. Doing this in 100-dollar bills would be a logistical challenge. Each $1 billion would be 10 million 100-dollar bills. So a $30 billion purchase under QE would require 300 million 100-dollar bills. I have no idea how many trucks it would take to haul that much currency around, but I would assume, quite a few.

What is the mechanism of issuing currency?

My recollection was that it was “monetization of debt” and involved purchase of treasuries.

Wolf

God bless the internet, which claims $100B of $100 dollar bills would weigh 100 tons. Thus, $300B of $100 bills would weigh 300 tons (600,000 pounds)

A 15,000 puund (empty) 18-wheeler can carry (under most rules) 65,000 of cargo.

300 tons of $100 bills at 65,000 pounds per 18-wheeler equals 9.25 fully loaded trucks.

(full disclosure: I thought it would be a lot more)

Thanks!!

:-]

They have visualized it quite nicely (including trucks):

http://demonocracy.info/infographics/usa/us_debt/us_debt.html

our about money printing

http://demonocracy.info/infographics/usa/federal_reserve-qe3/money_printing-2012-2013.html

The Fed “rolling off” of Treasuries sounds so innocent. The “rolling off” means the US Treasury Dept transfers the principle amount of the Notes/Bills coming due, to the Fed, and the money disappears. To date that is $152B.

Of course, the US Treasury Dept doesn’t have this $152B, they have to borrow it on the open Treasury market. And in a few more years, QT will ramp up to $550B/yr. The US Fed govt is going to pay the Fed back a huge chunk of what it borrowed during QE.

That huge chunk of QE debt moves from the Fed, to who ever is currently buying Treasuries. The QE debt doesn’t simply go away – it can’t, since the US Govt already blew all the QE money, you know guns, bread and circuses..

I had not looked at it this way but you are absolutely correct. QT means the Fed debt is being rolled over to the private sector. It is not going away. Let’s hope all the NIRP and ZIRP refugies have deep pockets

Commercial banks excess reserve dropped by similar amount since the beginning of QT. The effect of QT will be muted as long as excess reserve continues to drop in tandem.

Well, that should be expected as excess reserves is where almost all the money went when it was issued, and that is why it had little effect on the economy.

G46R and Paul,

Excess reserves peaked in April 2014 at $2.7 trillion. They then dropped sharply though the Fed’s QE balances didn’t change. By Dec 2016, they were down to $1.9 trillion. Then, as the Fed raised the interest rate it pays on those excess reserves, they rose again to about $2.1 trillion, but have since fallen to $1.8 trillion.

Excess reserves are bank deposits at commercial banks that these banks then deposit at the Fed to cash in on the interest the Fed pays on them, currently 1.95% — totally liquid and risk free! Best deal in town.

Excess reserves represent about 15% of total deposits are commercial banks

Some banks have a lot in excess reserves at the Fed, others have nearly nothing. Some banks are chasing deposits, others are not.

The other thing banks can do with their deposits is lend them to companies and individuals, and they’re doing that. But they have $12 trillion in deposits, and loan demand isn’t THAT huge, given how debt-burdened these companies and individuals already are.

The point on excessive reserve is that the commercial banks have significant room on their balance sheet to soak up Treasuries unloaded by QT. Even with IEOR, they can step out of duration a bit to get a better yield on Treasuries, especially if & when the treasury yield goes up as the result of QT. Additionally the Fed can gradually wind down IOER to nudge the commercial banks to soak up the Treasuries. Afterall, IOER itself is an aberration, introduced as an emergency measure to prop up the banking system when the Fed conducted QE.

How much of the rolloff is Treasury going to replace next month? What a lot of crap, we roll off assets and then go behind the back to replace them. The rolloff of MBS has nothing to do with the aggregate, (and since there is no real slowdown in home lending in the new housing bubble) which is now held by GSEs you would suppose. If they get in trouble its right back to daddy. Huge shell game going on here. USG is going to bring new debt to market one way or another, and that provides liquidity for investment.

You got it backwards, especially this: “USG is going to bring new debt to market one way or another, and that provides liquidity for investment.”

I remember the meme of the Fed having to raise short rates above zero to make room for returning back to zirp at first sign of trouble > trouble

Re: Fed’s balance sheet is allowed to be up after normalizing because ‘GDP is up 38% since 2008.’

This is the problem with GDP, it includes all expenditure no matter how rational or even real. It includes all the froth that can dissipate in a few months in a recession: e.g. meal kits.

The US medical system, the most expensive in the world with the worst results in the developed world, grows at double inflation or more every year. Harvard has studied this and one finding: every item, drug and service is priced higher in the US than the equivalent in ten countries: e.g. Germany, Denmark, Canada etc.

US drugs are 12 % of total wholesale. How useful are most of these things?

Then there are the govt boondoggles.

I seriously doubt that the productive economy is more than one- third larger than in 2008.

PS: admin accounts for about 3 % of total in the developed world’s medical systems, ex. US.

In the latter it’s 8%. This does not include the waste of the most expensive time in the system, the MD’s, who rank arguing with insurers one of their biggest problems.

Nick, the 38% includes inflation. The actual real growth is much smaller.

On top of that, it also includes population growth. The per-capita real growth is much smaller still (about 10%).

On top of that, it aggregates everyone together, but the wealthy and high-income folks have been getting all the raises. For a typical person at the median, the growth has been much smaller yet, maybe 5% if you look at hourly wages.

On top of that, the government’s measurement of inflation is deeply but subtly skewed to favor the government (as the world’s largest debtor) at the expense of the public.

And then, as you point out, aggregating the total cost of everything purchased, and assuming that all of that GDP is equally good, is a huge farce. And many things that are obvious public goods don’t get counted in GDP at all.

So yeah, the GDP number is up 38% but most of the public is not better off, and the travesty of a healthcare “system” is a huge part of why.

Trump may or may not be doing a good job, and Hillary might or might not have had a right to derail Sanders, but the public ire that fueled Trump and Sanders in 2016 is still building up as more people recognize that they’ve been had by the establishment “leaders” for many, many years.

The link below is a chart from the Federal Reserve’s own database showing that average hourly earnings of “production and non-supervisory” workers, adjusted for the official inflation, are about $22-$23 dollars/hour. The chart shows this being in an uptrend, but the range is very small (+/-15% from the middle). With the inflation adjustment today’s level is no better than the 1970s! Although it’s up maybe 20% from the 1990s, but I suspect back then more workers were teens rather than adults.

https://fred.stlouisfed.org/graph/fredgraph.png?g=l79Q

Wolf, it occurred to me that there’s another way to get at the Fed’s “minimum balance sheet size”, using the liability side of the Fed’s balance sheet (H.4.1) instead of the asset side.

On the liability side, the $1.7T of US$ Currency is nearly as large as the $1.9T of Reserve Balances. The next largest contribution is only $0.3T (US Treasury General Account) and everything else put together is only $0.4T or so.

A historical plot of the Fed’s Reserve Balance liabilities is very informative.

Reserve Balances was essentially nil until the Great Recession in 2008:

https://fred.stlouisfed.org/graph/fredgraph.png?g=l7eO

So it looks like the Fed can Q.T. until Reserve Balances goes to zero, but not much farther without cutting into Currency in Circulation or making some other substantial policy change. (Right now Fed has $0.2T in reverse repos with foreign accounts, that has sometimes been smaller but never zero… not much wiggle room there.)

So without another policy change, at the current run rate of $0.6T/year, the Reserve Balances hit zero and the end of QT comes in late 2021, in line with your analysis above, although maybe a tad earlier or later depending on whether they taper to avoid a market shock.

Of course, if something adverse happens along the way, everything changes!

I think that is reasonable math — and an interesting approach, from a different angle.

That balance sheet will get huge again. JP Morgan predicts so: http://wallstreetonparade.com/2018/09/jpmorgan-is-thinking-pitchforks-and-fed-stock-buying-in-the-next-financial-crash/

Otherwise it will be pitchforks people!!!!

Reading the article and the comments has left me a bit dizzy. Thx Mr. Richter again for trying to educate (us) me.

US will close the “old USD” and create a new USD. US citizen/companys with USD in US banks will convert one to one, the rest of the world will be paid in old soon worthless USD. That will happen if Trump will be reelected.