Core CPI jumps the most year-over-year since 2008.

The Fed doesn’t actually need more ammo to justify “normalizing” its monetary policy. But it got it anyway.

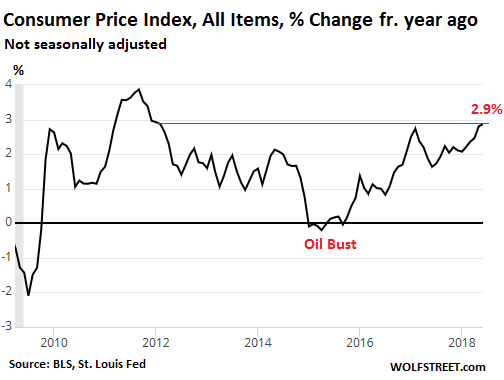

Inflation as measured by the Consumer Price Index for all Urban Consumers in July rose 2.9% from a year ago (not seasonally adjusted), the fastest rate since February 2012, according to the Bureau of Labor Statistics this morning.

This includes a 3.5% year-over-year increase for the costs of “shelter,” which includes rent and “owners equivalent rent.” This is the biggie because it weighs about one-third in the overall index — though for many consumers, it weighs well over half of their budget.

It also includes a 4% year-over-year increase in the costs in “transportation services” – we’ve seen the surging costs in trucking and rail for a while.

In terms of the volatile groups of food and energy, it includes a 12% year-over-year increase in the costs of energy (which weighs 8% in the overall index). Within this group, the price of gasoline surged 25%. But there has been only a 1.4% increase in the cost of food (which weighs 13% in the index).

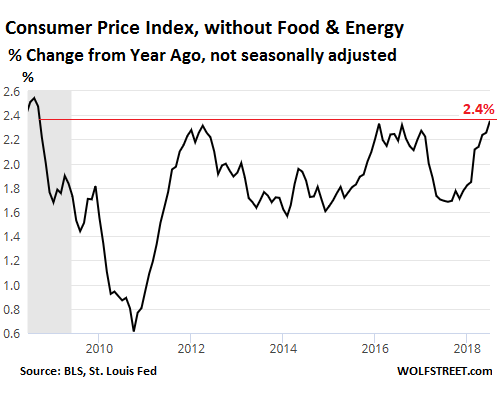

The Consumer Price Index without food and energy – the “core CPI” – rose 2.4%, the fastest rate since September 2008, edging out by a smidgen the prior highs in 2016 and 2012:

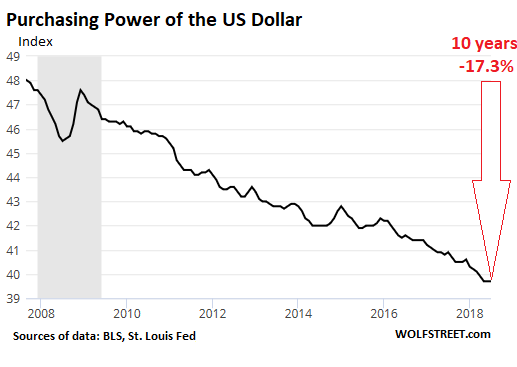

Conversely, the purchasing power of the dollar with regards to consumer goods – a data set the BLS also provides to let us know what is really happening when we talk about inflation – dropped 2.9% from a year ago and has dropped 17.3% over the past decade.

The chart below shows the index for the purchasing power of your hard-earned dollar with regards to the consumer goods in the CPI basket. It does not show what happened to the purchasing power of the dollar with regards to assets, such as housing, where it has gotten totally crushed in recent years. So this is the most benign view of the relentless destruction of the purchasing power of the dollar:

The Fed keeps its eye on all kinds of inflation measures, including some rarely cited ones, though its inflation target, currently at 2%, is based on the Personal Consumption Expenditures Index, Excluding Food and Energy, the so-called “core” PCE index, which usually runs cooler than CPI. And many consumers claim with considerable justification that even CPI runs a lot cooler than their actual increases in the costs of living. This includes renters in cities where rents are surging by 10% or 15% a year, and whose rental expense is a lot more than one-third of their total expenditures. But people in cities where rents are dropping experience much less inflation.

In terms of the Fed, this CPI reading – particularly the core CPI reading which jumped the most year-over-year since 2008 – is another paving stone on its by now well-defined path to becoming ever more hawkish, as even the doves are becoming less dovish – and in some cases outright hawkish.

Consumers have their way of trying to dodge inflation the best they can: As “affordability challenges” hit new vehicles, consumers switch to used, prices spike to record, inflation psychology sets in. Read… What’s Going On in the Used Car & Truck Market?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yeah! Even the government numbers now show we are getting the copious and wonderful dollar devaluation that the Fed promised. I think we can all agree we badly needed this gift of runaway inflation in order to default on our debts without ruining our credit ratings. Besides, the Fed says inflation is good and necessary so this must be a reason to celebrate.

Hurray Ben Bernanke! You did it, cash is trash. Time to throw Ben a ticker tape parade but we cam throw worthless confetti cash in celebration instead of old fashioned ticker tape. Let us all thank god that Ben showed up and had the courage to act.

Well back to the salt mines – I have valuable confetti to earn.

The king of merica has a real estate empire he still enjoys! Sell one MBS to buy two new mbs lather rinse purchase less!

What the BLS count is price.

The stealth inflation passes them without notice.

The downsizing of either quantity quality, or both, and charging a higher sticker price is rampant (stealthy) in the food industry.

This “less for more” equation does not figure into the BLS measure.

So the BLS reported inflation rate is pure BS!

And what is the root word for “stealthy”? Clue; A thief does it.

The BLS takes quantity and size into account. Shrinkflation is fully part of the inflation figures. This is easy to do.

But crapification is less easy to track (when quality is degraded to keep the price the same). Who knows what else is in that hamburger paddy instead of meat?

“The BLS takes quantity and size into account”.

After they run those stats through their seasonal adjustment calculator and hedonistic comparison equation, then computing against a different set of consumer examples, they come up with a fantasy number that they like!

Meanwhile, I think they still manufacture “Pink Slime” don’t they?

The questions re what’s really in the hamburger, are why I have used the Cod Index for the last 10- plus years. Cod fillets have been a very steady $ 4.99 per pound. In the past year, excursions to higher prices have been common. Recently I paid $ 7.99 per pound; but then the price came down to $ 6.99 (my last purchase).

I’m in the Inland Northwest; cod is almost always available where I shop. I’m unaware of any farming of cod; it always looks and tastes about the same. The Cod Index works for me, and the Cod Index says that the price of food is going up.

The price of eggs has plunged by about half over the last 18 months or so. That’s my egg index. It tells me that we’re in a huge bout of world-ending deflation :-]

Crapification: I’m added this one to my dictionary. So many uses for this word now.

When the Mfg takes the quart jar of a product and over a period of months/years, sizes it at 30oz, then 28oz, then 25oz. Does this fall under the Shrinkflation banner ?

About eggs: where I live, what they now label “extra large” eggs are medium sized eggs from 20 years ago.

– And what are the futures telling us about a possible rate hike ?

Ha, I’m going to write an article about the futures, and how they systematically lag behind and only catch up gradually and at the last moment. But even they see four rate hikes in 2018. Currently, they see a 61% change of four hikes by Dec 19. This will go to 90% by mid-November. It was 15% in February, when I said there would be four hikes and got pooh-poohed for it. If you follow the futures, you’re months behind.

“Ha, I’m going to write an article about the futures, and how they systematically lag behind and only catch up gradually and at the last moment.”

I’d like to read it. If possible, could you add a thread about herd following. It’s likely intertwined and represented by the numbers. After all, people and their behavior are what the numbers represent. Why the numbers did this and do that, to me, is the story behind the story. Many people act as if the numbers are the beginning and end of everything. To me, they are only a clue and a trail to what people are up to.

– Currently I have changed my mind because the 3 month T-bill rate kept rising. I do think a rate hike is indeed possible.

There will be one in Sep (almost fully priced in) and one in Dec (about 60% priced in) for a total of 4 this year. This is really a done deal, pretty much.

Next year is now the question. The Fed is setting up to do more than four rate hikes: It announced that every meeting will be followed by a press conference, instead of just four meetings. This makes all eight meetings “live.” Next year, the market needs to be ready for a rate hike at whichever of the 8 meetings — and so there could be more than four.

I’m still pooh-poohing the notion of two more rate hikes in 2018. Almost everyone wants rampant inflation (Americans are heavily in debt and they don’t want to pay it back) and the Fed likes to be liked. I think the Fed will take a “wait and see” approach from here (and into eternity). Don’t count on Powell to do the right thing and step in to save the dollar – the dollar (along with the other major currencies) is confetti. After the Fed refuses to raise rates further, in the face of rampant inflation, the jig is up.

LIBOR which is the truer measure has backed off a bit, HYG is making new highs, it feels like a wash of liquidity is going through the markets, and that may dampen inflation. Or it may be deflation, and the best way to fight deflation is to raise rates. You can end a financial crisis with QE, but a cyclical market event is a different story.

Libor is finished. There are hardly anymore interbank loans. Libor is not a market rate anymore — and never has been. It was always more theoretical, and hence easily manipulated. It’s going to be replaced. The replacement measures are already available. The only reason why it is still being cited is because a large amount of loans and derivative contracts are tied to it, and it’s not easy to untie them, and tie them to a new measure.

For the record, HYG and JNK are Not making new highs. But they are holding up very well and for twisted reasons outperformed bonds during recent interest rate increases. I believe both hyg and jnk will be zeros at some point in the future (I used to confidently predict dates :-)

LIBOR is dead, long live LIBOR.

The etf designated HYG made a new high a few days ago.

@Wolf Richter: No, I don’t consider LIBOR to be “dead”. It’s like with other bonds/stocks and real estate. It can be manipulated/rigged but in the end Mr. Market WILL take control of rates.

– Banks do still borrow/lend to each other on a short term basis and then they use LIBOR.

J.M.Keynes,

During the Financial Crisis, interbank lending in the US peaked at $490 billion. This was a big problem because of contagion. Interbank lending then plunged, and by 2011 it was down 77% (to about $115 billion). And it has since continued to taper off. In February, it was down to $68 billion — an 86% plunge from the peak. Then St. Louis Fed stopped reporting it because it’s just not a big factor anymore.

This compares to about $15 trillion (with a T) in total bank liabilities in the US. Interbank lending these days is a small item in the huge US banking system.

Whether you like it or not, Libor will go away. That has been decided years ago. Most of the replacements are already here. It’s now just a matter of phasing in the new system without big disruption. In the US, the replacement for dollar libor is SOFR”:

https://wolfstreet.com/2018/04/03/dollar-libor-replacement-rate-sofr/

Does anybody in their right mind believe the “Deep State” government figures we are being fed quantifying inflation?

Passing 4th grade math can tell you that we’re at least 8-9% inflation annually, and have been for over 5 years.

I don’t see 8-9% inflation (outside of health care and education), but I live in Ohio.

25%_mark up at bigblue boxstore is getting tested!

Double

8-9% inflation annually would mean everything costs 50% more than 5 years ago if I use the mean of 8.5% and that is simply not the case.

Default on 50% and re-peg to gold. Term Limits for Congress. Buy across state lines for Health Care.

One more thing (to quote Colombo)

As you said: “In terms of the Fed, this CPI reading – particularly the core CPI reading which jumped the most year-over-year since 2008 – is another paving stone on its by now well-defined path to becoming ever more hawkish”

So if the Fed now has no excuse to not to raise rates above the ultra easy money level of 1.875%, will you concede their easy money policy is now permanent and structural and there will never again be a monetary “normalization” if the Fed fails to raise rates in September and December.

The Fed has already been making noise about having gone far enough, I just don’t believe they will ever raise the FFR above 2%. They can let assets crash or they can let the dollar crash – seems obvious to me they will (continue to) sacrifice the dollar.

Borrow as much money as you can because the Fed is forgiving debts via inflation.

They could dump the balance sheet any time and dr.strangelove your butt to the stone age? The Fed is in the catbirdseat!. coke bottle? Watch the short end auctions.

What should I buy with the money I can borrow? I guess stocks if they continue to rise inexorably. Anything else?

Seems like a good plan to me. I’m regretting having sold my positions two weeks ago – not a good move. I will inevitably end up buying back in at a much higher level – some people never learn.

The next time the market corrects it will probably drop to a level much higher then stocks are trading at today.

The inexorable rise continues – even today, with plenty of bad news, the market will probably run higher in the last half hour of trading (per usual).

Before you jump back in, look up Sir Isaac Newton and the South Sea Bubble. He got in, made 100%, and got out. Then he saw that he got out “too soon” and got back in at about 3x the price than he sold. He rode to the top and all the way back down, pretty much getting wiped out.

Pigs get fat, hogs get slaughtered.

Did I get out too soon? I sure did because I bought individual stocks instead of ETFs that were being carried by 5 stocks. As the “S&P 495” underperformed the FANGS my positions hit their trailing stops. I sold them off and when I went looking to reinvest there wasn’t anything reasonably priced so I sat on cash until I decided to go to Treasury Direct and start buying 2 year floaters. Is inflation eating me bit by bit? Yes but it’s better than getting eaten by a bear.

Look at the cash position of Warren Buffett. All he can come up with is to buy back shares – an absolutely brilliant idea at nosebleed valuations (/sarc) .

That will come back to bite a lot of stocks in the ass when rates go up, stocks go down, and the loans they took out to buy back overpriced shares roll over at higher rates while the value of the stock they repurchased falls.

What could possibly go wrong?

The inevitable market recovery later today will be interpreted as bullish and touted as a reason for the market to run higher.

Small 1% dips in the market used to be a regular occurrence now they are no longer tolerated. There are huge piles of cash, at the ready, to prevent even a small dip from occurring. The groups who have been granted the power and authority to manipulate markets (The Fed, Swiss National Bank, all other powerful central banks, investment banks…) all want the market to run higher. So guess what – the market will continue the inexorable rise. Close green today? I would not be surprised, would you?

You want the market to correct. Institutions with lots of money want the market to continue to levitate. Guess who’s going to win that battle (not you).

Speaking form the perspective of, “…the day after..” (or after the close) how did Friday’a close work for u??

Enjoy your comments; entertaining!

I agree with Mr. Richter; there (must) will be two more rate hikes before this year is over. There has to be some “discipline” levied on this “market” to return to some sanity and yes, there will be some pain also.

Just don’t get caught in the gears…….OUCH!

And if the next hike happens to push it above 2%, will you admit you were wrong?

Yes, in that event I would admit my magic 8-ball malfunctioned. It would be a relief to see the Fed tighten in a meaningful way – just hard to imagine.

This is the FED put explained.

The FED can’t raise rates because asset prices will crash.

it forces the fED to chose between stock market wealth effects and it’s own existence.

Guess which one they will pick?

It the Fed has real balls and it was truly data dependent then given that core CPI is running at almost 50% higher than the magical 2% floor it should set the next rate hike at .5% rather than .25%. Unfortunately, the chances of that happening are slim to none.

Oops, just realized that core was at 2.4, not 2.9%. Nevertheless, it’s definitely trending higher.

I think it would also be useful to see a graph of real interest rates (Fed funds rate – CPI).

Core CPI is heavily muted by the bogus measurement of housing inflation, which is by far the largest component of core CPI.

One of the banksters’ greatest financial scams was convincing the masses that it’d be a good thing for house prices to go up faster than wages. Thus pricing out their own kids.

And then not counting those prices in “inflation”, because a survey of “owners’ equivalent rent” is used as the price of shelter in CPI, not the huge downpayment or the mortgage, property taxes etc.

BTW, what fraction of mortgages today are still ARMs and how are their payments changing as rates rise?

->Core CPI is heavily muted by the bogus measurement of housing inflation, which is by far the largest component of core CPI.

Er, um, well, sort of. Apartment rents are included in CPI because they’re expenditures that are ‘consumed’ over a definite period, but house prices are not because they’re treated as capital assets.

If you wanted CPI to be an accurate reflection of the cost of living you would want to include student loans, medical costs, and other costs as well as mortgage expenses. Add it all up and extrapolate the trends and you can see that most Americans are going to be living like Haitians in no time. Millions are already there.

National policy, sorry. You get what you vote for.

“One of the banksters’ greatest financial scams was convincing the masses that it’d be a good thing for house prices to go up faster than wages.”

Ah, but raising the government receipts of property taxes…

On the CPI farce:

Sheehan on Michael Boskin

January 19, 2010

http://ritholtz.com/2010/01/economists-serving-their-political-masters/

Frederick Sheehan is the co-author of “Greenspan’s Bubbles: The Age of Ignorance at the Federal Reserve”

“The debate about the CPI was really a political debate about how, and by how much, to cut real entitlements.” – Greg Mankiw, chairman of George W. Bush’s Council of Economic Advisers from 2001-2003

Excerpt:

On January 14, 2010, an academic economist took a rare stance. Tenured professors rarely lift the veil from numbers that governments invent. In “Don’t Like the Numbers? Change ‘Em,” Michael J. Boskin, Ph.D., formerly, an economics professor at Harvard and Yale; formerly, chairman of the Counsel of Economic Advisers in the George H.W. Bush administration; currently, T. M. Friedman Professor of Economics at Stanford University; research associate at the National Bureau of Economic Research; senior fellow at the Hoover Institution; and board member of the Exxon Mobil Corporation, Oracle Corporation and Vodafone PLC (among others), wielded his sword.

The Wall Street Journal devoted a half page to Boskin’s list of offenders. Politicians are interfering with the Gross Domestic Product calculations in France and Venezuela. They have toyed with the inflation rate in Argentina. In the U.S., the Obama administration has taken the phony numbers game “to a new level.” Here, Boskin is writing of the current administration’s calculations of jobs “created or saved” from its stimulus bill.

Could it be the “bankers” strategies to make consumers believe that they would continue to use their equity at the ATM or more secondary loans??? (At huge increases in interest payable) This is going to get real ugly once that concept is abolished. And somewhere down the line it has to be.

I would say none to negative slim.

For the first time in over ten years a bank here in Pittsburgh is paying 2.75 percent on a 20 month CD…with rates rising it’s time to start laddering again…

Despite the prospect of more rate hikes to come until something in the global Ponzi bubble goes ‘boink’, I decided to pull the trigger this week on a 3-year brokered CD from JPM yielding 3.05%. Thanks to Wolf for cluing me/us in on the ins and outs of those.

If people wouldn’t take out such humonguous quantities of debt there wouldn’t be all this extra money floating around and they wouldn’t have these inflation problems. Instead, they would have other problems.

It’s all about maximizing the confiscation of wealth from the lower classes. It works best if wage suppression and debt peonage have been firmly established before following it up with inflation. Once those are all going just finish up the job with a severe austerity program, making sure dispossessed minorities and helpless immigrants have been set up to take the blame.

If I wanted to subjugate the population and reduce it to destitution for fun and profit, this is probably how I would do it. After that they’ll come begging and all my dirty deeds can be done dirt cheap.

Wolf,

The dollar is getting smashed for sure… hopefully soon I will get rewarded for saving….

Would love to see an article about Gold Backed Dollar…

Why it went away and why we shouldn’t (or should imho)bring it back…

All the gold in the world up out of or still in the ground can’t support the global economy……..as it is. Our only alternative is a fiat currency backed by the “Iron Fist”…….That’s just my opinion…….

The Fed says they want 2% inflation. In reality, they want more. How much? Probably 5-6%. After the 08 crisis, they couldn’t get any. No velocity/demand in the economy. So they are playing catch up.

The problem though is we have 2 economies. The OK economy is somewhat buffered as wage/salaries are climbing as inflation goes up.

Unfortunately, there is a huge group of Americans for which stagflation is the more appropriate term. Low income people are becoming even lower income as stagnant wages and rising living costs for food, etc. are killing them. How do you spell social uprest?

I think you spell it……s o c i a l u n r e s t

10-2 spread is looking awfully tight, especially after this Turkey business knocked the 10 year yield down into the 2.8-2.9% range today.

Two more FFR hikes and a bit of crummy economic news should be enough for a yield curve inversion. You can almost see the recession clouds on the horizon now…

Core CPI pops but bonds drop? US treasuries slide.

https://www.finviz.com/futures_charts.ashx?t=BONDS&p=d1

I’d say Mr Market sees rate cuts in the near future. Although

could be Euro liquidations into Treasuries.

Rate hikes have come predictably as a clockwork since Dec 2016, even as the markets have bounced all over the place. The Fed leads, markets may or may not immediately follow. But when markets “fight” the Fed, they’ll lose.

To sit here today thinking that “2 more hikes in 2018 and 8 live meetings where rates can be hiked in 2019” is likely to pan out requires one to believe that “the rest of the world won’t have any major crisis that derails FED hiking during that period”. Fat chance methinks.

Agreed.

I posted a pretty detailed explanation of what I think has been going on with inflation in this country, as well as the consequences of the Fed basing its interest rate policy on what is almost certainly a falsely low inflation rate. Please note that this explanation is based on some recent analysis by economist Mark Perry and has nothing to do with other arguments made by shadowstats.com, etc. about how the CPI numbers have been deliberately cooked since 1983 to make inflation appear lower (and “real GDP” appear higher), and is instead based solely on the much harder to refute effects of globalization/offshoring and automation in lowering the cost of durable goods.

https://wolfstreet.com/2018/07/27/heres-why-real-gdp-freaks-me-out-today/

Search for the two posts under ‘Gandalf’. I could copy and paste them, but seriously you guys (and that includes you Wolf) need to read up on this topic.

Inflation is raging, and with the current Global War on Trade (GWOT II) and war on offshoring and other cheap labor (including illegal immigrants), is certain to increase. Which means the Fed rates are too high and have set us up for another asset bubble explosion as well as even higher inflation in the future, a la the 1970s.

Correction: I meant to say in the last sentence “the Fed rates are too low”

Dimon says 4 to 5% on the 10 year……….. who knows but I wouldn’t bet against it. maybe down the road a bit. Need to get inflation raging if they can