SOFR, so good?

The LIBOR (London Interbank Offered Rate) was essentially designed to be conveniently rigged for the profit of those rigging it. And so it was widely rigged, as we found out during the “LIBOR Scandal,” in which some of the biggest and most notorious banks had gotten tangled up. Some criminal charges were brought against low-level traders, and some fat fines were levied against the banks.

But the big thing that came out of the scandal was the realization: LIBOR, crucial to the credit-based economy and to hundreds of trillions of dollars in derivatives, had to go.

LIBOR is an average interest rate based on submissions by major banks of what they expect to pay if they borrowed from other banks across the world. There are different LIBORs for different currencies and durations. LIBOR is not based on actual transactions between banks, but on their opinions of what it would cost to borrow from each other. Hence the invitation to rig.

But LIBOR isn’t easy to replace all in one fell swoop. In the US, the Alternative Reference Rate Committee (ARRC), which was put in charge of finding a replacement for the dollar LIBOR, said in March that dollar LIBOR underpins $200 trillion in derivatives and loans. This was 25% more than previous estimates. Derivatives account for about 95% of the $200 trillion.

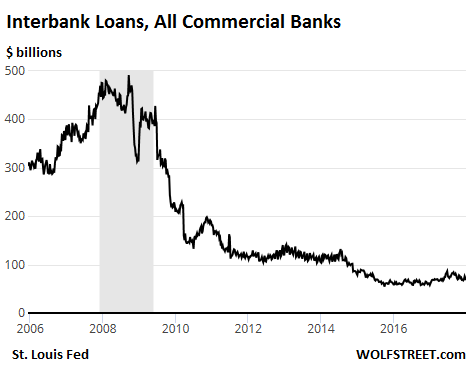

And yet, despite this gargantuan amount that is based on the dollar LIBOR, actual borrowing between all commercial banks has plunged from nearly $500 billion at the peak before and during the Financial Crisis to just $68 billion in February, when the St. Louis Fed stopped updating the data as interbank loans have become an irrelevant indicator of anything other than that banks are awash in cash and don’t need to borrow from each other:

ARRC decided last June that the SOFR (Secured Overnight Financing Rate) would be the replacement for the dollar LIBOR. And today was the first day that the New York Fed, in cooperation with the US Office of Financial Research, published the first SOFR.

But LIBOR-based rates are written into the contracts of these $200 trillion in derivatives and loans currently outstanding. So LIBOR isn’t going away today, but will phase out gradually. And SOFR has got a big job ahead.

SOFR, so good?

The New York Fed explains:

The [SOFR] is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. The SOFR includes all trades in the Broad General Collateral Rate plus bilateral Treasury repurchase agreement (repo) transactions cleared through the Delivery-versus-Payment (DVP) service offered by the Fixed Income Clearing Corporation (FICC), which is filtered to remove a portion of transactions considered “specials.”

The SOFR is calculated as a volume-weighted median of transaction-level tri-party repo data collected from the Bank of New York Mellon (BNYM) as well as GCF Repo transaction data and data on bilateral Treasury repo transactions cleared through FICC’s DVP service, which are obtained from DTCC Solutions LLC, an affiliate of the Depository Trust & Clearing Corporation. Each business day, the New York Fed publishes the SOFR on the New York Fed website at approximately 8:00 a.m.

Additional technical explanations on how SOFR is calculated, other links, and data are here. The NY Fed notes that “transactions to which a Federal Reserve Bank is a counterparty are excluded from all three rates.”

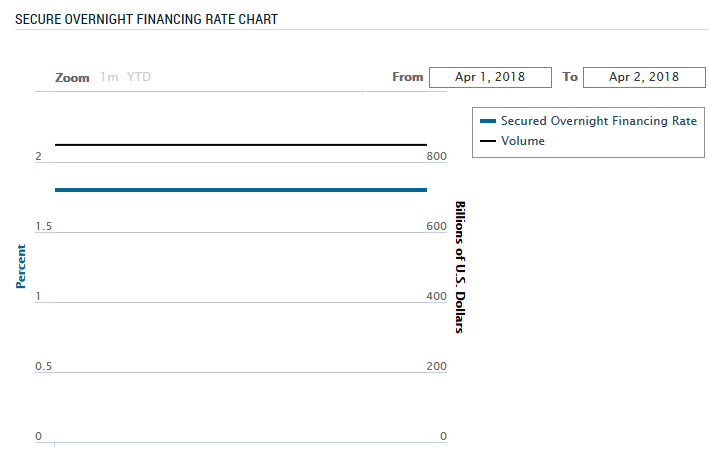

This morning’s rate, the first one, is based on $849 billion in overnight transactions from April 1 to April 2. So unlike LIBOR, this rate is based on hundreds of billions of dollars in actual transactions, and not on opinions of what the rate might be. And that rate is – massive drum roll please – 1.80%. The chart, since it only covers the first day, shows a straight line. Over time, the line will become jagged:

The other two rates…

The New York Fed has also started producing and publishing two other rates:

The BGCR (Broad General Collateral Rate) “is a measure of rates on overnight Treasury GC repo transactions, and is calculated based on the same tri-party repo transactions used for the TGCR (see below), plus General Collateral Finance (GCF) repo transactions cleared through The Depository Trust & Clearing Corporation’s GCF Repo service.”

Today, on its first day to be published, the rate, based on $362 billion in transactions, is – somewhat less drum roll please – 1.77%.

The TGCR (Tri-Party General Collateral Rate) “is a measure of rates on overnight, specific-counterparty tri-party repo transactions secured by Treasury securities, and is calculated based on data collected from the Bank of New York Mellon, excluding GCF Repo. Specific-counterparty transactions refer to those in which the counterparties involved know each other’s identity at the time of the trade.”

On its first day of making a public appearance, the rate, based on $329 billion in transaction, is – some drum roll please, but don’t overdo it – 1.77%.

Other than being much harder to rig, an additional good thing about SOFR, given how much it will be used in daily finance speak over decades to come – including in mundane things like credit lines – is that it’s an easily pronounceable acronym. However, BGCR and TGCR remain vowel-less tongue twisters.

What will finally pull the rug out from under the dollar’s hegemony? The euro? The Chinese yuan? Cryptocurrencies? The Greek drachma? Whatever it will be, and however fervently the death-of-the-dollar folks might wish for it, it’s not happening at the moment. Read… What Could Dethrone the Dollar as Top Reserve Currency?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Good material. You will note the terms and conditions for reporting the rates are strictly vetted for accuracy. No errors omissions nor interruptions of service tolerance for such financial data feed. But compare it with what retail investors are left with where atleast one big bank in Canada has inked into its terms of engagement for retail discount brokerage clients that any decisions based on errors omissions or interruptions of service and harm resulting are the liability of the retail investor to absorb. Not the big bank nor its thrid party service providers. Ahem.

Was that TD bank and TD Ameritrade? They are starting to piss me off.

Yup. In Canada the “pure”

“This Could Be Huge”: Gold Bar Certified By Royal Canadian Mint Exposed As Fake (https://www.zerohedge.com/news/2017-10-30/could-be-huge-gold-bar-certified-royal-canadian-mint-exposed-fake)

What do you expect from banks of a country that not only sells fake gold to customers, but also says you can’t even ask for a compensation?

Don’t read ZH, it will rot your brain.

That news was everywhere; not just on ZH.

Back in the 1990’s before subprime mortgages, all mortgages were prime and priced off of the prime rate plus a spread. They started pricing car loans off of Libor because it was always a higher rate than the published prime rate. The mortgages priced off of Libor came later. It was also because the Libor rate was always higher than the prime rate and the mortgages were also easier to sell overseas.

I guess that now that we are going local once more we will have more control over rates and they may be going down.

Thanks for your unstinting devotion to research. Hope you don’t go blind reading. Much appreciated.

My understanding is that QE traded cash for t-bonds and MBSs and that cash ended up as excess reserves on the banks balance sheets.

If that is true, why would banks need to borrow in the overnight markets?

QE is a swap, Treasury Bonds for corporate bonds or MBS. The bonds are then collateralized. The Fed couldn’t raise interest rates without Reverse Repo, which means they raise the rates and pay the borrower to accept their terms. When someone says SOFR is tied to the Repo window and its not rigged I fall out of my chair laughing. The notion that raising rates would help the banks, who borrow at the short end and lend at the long end, has been met by a collapsing yield curve, while the rise in LIBOR is flashing a likely credit squeeze problem. The upshot of the credit squeeze problem is that no one wants to borrow anyway. The Fed knows if they raise rates that borrowers will feel pressure to step up now while rates are low, the markets are saying, no one is borrowing, the economy will stagnate and you will have to lower rates. We can wait.

>>QE is a swap, Treasury Bonds for corporate bonds or MBS.

Kent, what Ambroise says quoted above is incorrect.

1. QE is not a swap for Treasury Bonds, it is acceptance of specific bonds as a semi-permanent backing for new reserves (=MONEY). Bonds are received, credits to (increases in) selling banks’s reserve balances are issued.

2. QE in the US: FRB has not accepted corporate bonds. QE in Eurozone of Europe: ECB has accepted corporate bonds.

My comment is only about the quoted sentence, no comment about the rest of what AB said.

“QE is not a swap for Treasury Bonds, it is acceptance of specific bonds as a semi-permanent backing for new reserves (=MONEY).”

Your description makes it sound so innocuous. QE was the creation of new money by the Federal Reserve to purchase MBS and treasuries (at above free-market prices) directly from primary-dealer banks and indirectly from connected insiders who were able to sell their bonds through the banks.

Understanding that the Fed paid more for these bonds than what could have been obtained in the open market is to comprehend the crux of the heist. By being such large buyers, the Fed completely reshaped the supply/demand dynamic which means they paid much more than what the market would have paid. This would have been especially true for the less-liquid mortgage-backed securities.

For example, let’s say a bank could sell a MBS into the open market for $500. But the Fed comes along and creates a program (QE) and starts buying massive amounts of MBS with the equivalent of newly printed money. This causes the price of the bonds to start going up (directly and via the front running effect of others) which allows the bank to sell its MBS to the Fed for $750. The additional $250 the bank received can be thought of as a gift straight from the “helicopter.”

In the example above, the Fed paid a 50% premium to the free market. We don’t know exactly how much this premium was in reality, but it would have been large given the amount (roughly $3.5T) of bonds purchased. It surely would have been higher than 50% for some of the MBS and probably lower for the treasuries. There was a lot of speculation at the time that many of these MBS could have been worthless and probably would not have caught a bid without the Fed’s intervention.

In essence. the Fed gifted newly created fiat to banks who channeled the funds directly and indirectly (via collateralized credit creation) into the asset markets that were made very inexpensive with the Fed’s implementation of zero-interest-rate policy. Of course, this led to an epic and unjust wealth-transfer that has completely transformed the nation and will likely lead to momentous political and social ramifications for generations to come.

Perhaps the fairest way to proceed is to tax the extreme wealth and use it to pay down the nation’s debt. Although, since that wealth pulls the political levers of the country, this may not be a reality any time soon.

Wow, jrmcdowell. Excellent, pithy explanation of the last decade and a hint of the hangover that is yet to be felt. This should be posted and re-posted via social media for the less informed (I don’t do social media).

>>Your description makes it sound so innocuous.

I was not trying to impart a value judgement, I was just explaining the mechanics of QE, and correcting an error or misunderstanding some people have. As for the value judgement, I think my comments on this blog over the last several years show clearly that I think QE was an atrocity.

That being said, I think your statement that FRB “surely” bought “some” amount of MBS at 50% over market value *may* be true, but only for a quite limited chunk of MBS. Some of the bonds and swaps in the infamous FRB-bankrolled Maiden Lane I-II-III companies may very well fall into this category, but to be fair it was for a total of 73B, much smaller than the ~3.5T total of QE. I think it is fair to say that Maiden Lane I-II-III was part of QE, if not in name then in spirit. A good overview of Maiden Lane I-II-II LLC can be found in Wikipedia.

Jeez. I can’t believe that I am sitting her writing something that (some people will claim) borders on defending QE. I’m not defending QE. I’m defending FACT. As far as opinion, need I repeat my opinion that QE was an atrocity? QE devalued labor and savings, but inflated assets and debt. It never should have happened. But let’s keep the facts straight!

“That being said, I think your statement that FRB “surely” bought “some” amount of MBS at 50% over market value *may* be true, but only for a quite limited chunk of MBS.”

Justme, I have to respectfully disagree that this applied to a “quite limited” chunk of MBS. It’s not that all these bonds were worthless, but that the Fed paid a much higher price than what the free market would have paid at the time. If those roughly $1.7T worth of MBS had been dumped into the open market during those years, they would have cratered in price – big time. This would have been even more apparent coming out of the financial crisis when there was a great deal of uncertainty in the market.

In any event, we can agree that QE was a terrible policy that inflated assets while devaluing labor and savings.

“”2. QE in the US: FRB has not accepted corporate bonds. QE in Eurozone of Europe: ECB has accepted corporate bonds.””

Sooo – what happens in the EU banking system if those corporate bonds suffer a failure?

Then the total value of the assets (the debt) that backs the Euro (the currency) is dropping, while amount of Euro reserves + banknotes + debt stays the same. Each Euro is worth less. You might call that inflation.

I do NOT know the details but the definition of bank is that banks borrow paying short term interest and lending collecting long term interest. The old banks borrow from depositors and lend in capital markets to corporations or individuals with long term structures. The new banks (shadow banks) borrow from money market and lend in capital market. Those overnight, X day repo, 3 month commercial papers are considered money markets while the mortgages and corporation loans are considered capital markets. See? A bank, by their business model,

is to borrow from money market or depositors. That’s

what they do. If you think they have a lot of “reserves”, I think of those reserves as what’s regulation needed for them to borrow more. say If you have a billion, you can borrow up to 5 billion based on bank regulations, such as Bassle 3.

Correction, if I remember right, there are requirement such as capital ratio and reserve ratio. Capital ratio may limit how much you can borrow and reserve ration may limit how much you can lend as a bank. Again I am NOT banking expert but I do know, the business of bank is to borrow in money(short) market and lend in capital(long) market. Short and long means duration of loans. So they have to borrow, that’s what they do.

JZ, you need to read “Money Creation in the Modern Economy”, published by the Bank of England (link below).

Banks don’t borrow from savers and then extend loans.

They extend loans in exchange for promissory notes (collateral and promises to repay), creating both the credit and the debt “ex nihilo” (from nothing).

Then they arrange to maintain the necessary financial reserves.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

P.S. The fact that econ classes failed for decades to teach even this simple, absolutely fundamental fact of modern post-gold-standard banking tells you everything you need to know about whether or not econ is a science… it’s not. And you then have to wonder how much of the rest of economic theory is totally wrong because it also wasn’t updated when the gold standard was abandoned and fiat money printing became the norm.

It’s amazing that there can be $200 trillion in derivatives trades. How did such a useless economic activity become so valued?

Because it could be monetized. Fees could be generated by packaging a products people would bet on if it would go up or down. This is why they call Wall Street, ‘Vegas’. Not much different than betting if the bird on the right or left will fly away first. Only, you can get suckers to take a part of the action and look respectable while doing it.

Re the original question about if this new idea will catch on: Probably not unless some angle can be figured out so that it can still be gamed, but in such a way it’s harder to get caught at criminalizing. Otherwise, not a chance.

Seriously, trading on the fringes adds liquidity so pricing can be calculated more accurately … in text books, that is. Central Bank QE ruins that concept as they destroy pricing, replacing it with an approved range of prices. Wall Street does not care, and possibly approves, as that removes ‘uncertainty’. Only Yellen was uncertain about much of anything over the past few years.

0.1% of $200 trillion is $2 billion a year. That’s a lot of income for a skim so small no one would even notice!

Greenspan said derivatives make the global financial community more safe. He is fundamentally right, he also thought allowing people to access equity locked in their homes would release new economic activity. In the right now, the cost of derivative insurance is rising, and that causes more risk aversion for investors (esp those hedging the currency, half of all derivatives are currency based, the other half interest rate) and so money is leaving the stock market. The idea that derivatives might be registered (and regulated) has not quite happened, according to WSOP, only half of interest rate derivatives are registered and almost none of the currency derivatives so we are flying blind.

Wolf – thanks for posting this informative article.

In time, I guess relative LIBOR-SOFR data will be interesting to measure.

Whatever they chose to use and publish, I think we can all rest assured it will be rigged in the banks favour and not the end customer. Same old, same old.

And totally agree Drango, when did such a useless and totally self serving process like a derivative trade create value to anyone, except those involved?

It’s all about the hyper theticals ya know .. or perhaps I should say ‘they know’ .. opinions from on high street, to wall street..

Instead of estimating what banks in LIBOR expected to pay tomorrow, they could have used what they DID pay yesterday. No room to massage that data, or less anyway.

I wonder if London feels slighted by the new base rate, if in fact it does turn out to be that.

“I wonder if London feels slighted by the new base rate, if in fact it does turn out to be that.”

In the recent past, if anything highly crooked involving uncountable money happened, it was more likely than not in London. Of course they feel slighted.

I’m sure if London do feel slightly miffed by it, they’ll soon find a way round it to screw us all over. They are, after all, the best trained and have the biggest help from dodgy lawyers, banks and accountants than anywhere else in the world.

“an additional good thing about SOFR … is that it’s an easily pronounceable acronym”

So why don’t you tell us how to pronounce it? so-fer? so-fra? so-far? so-fear? How about so-fro?

I guess from the sub-headline I’m supposed to infer it’s pronounced so-far. It’s so easily pronounced there are a lot of possible ways to pronounce it…

wow. you’re new here, aintcha?

understand that our host has La-La Land superimposed on TX lathered on top of DE; I might suggest he hire a diction coach (Swabian?) but then none of these remarks [yours included] are substantive, are they?

do try to keep up.

I pronounce it so-fer, so good.

Its not a particularly good Acronym as US Acronyms go.

People around here tend to go for “Sof R”.

But then they actually Speak and Write “English”. Not the gobbledygook, you peopel call English.

Eastwind,

It is obviously ‘Sofia’

Eh give it time, thry will find some other way to cheat.

A secret look into the ongoing Fed Control Room debate:

https://www.youtube.com/watch?v=oqsDyZhxLLA

The Fed rate is the floating ratio in LOIS, the OIS, while LIBOR is fixed. Since the Fed only sets rates quarterly, and surreptitiously, LIBOR represents today’s cost to borrow, the rate between commercial banks. SOFR is their way of nailing jello to a tree. Would you rather know what bankers would charge each other today, or what the Fed might do six weeks from now? SOFR is going to set up for the mother of all interest rate shocks, because whatever you say about those various acronyms all based on the faith in and the promise of the Fed to raise rates on a designated date. Pure Bull Feathers…

https://www.theinstitutionalriskanalyst.com/single-post/2018/04/02/Kotok-LOIS-is-Screaming

The Fed “only sets rates quarterly, surreptitiously…” ??? Where the heck to you get this nonsense? Don’t spread this nonsense here! People might actually take it seriously.

If they’re going to go with SOFR they should also go to the Taylor Rule, although that could be problematic. It works so well in a data backfit what could go wrong?

√