A massive survey of recent homebuyers reveals all.

By Stephen Punwasi, Better Dwelling:

Have you ever woken up after a night of drinking, and only had a vague recollection of what happened? Then your responsible friend sets off a chain of text messages, trying to figure out where you went wrong? Well that’s what the Canadian real estate industry just did, and man-o-man did people screw up. The Canada Mortgage and Housing Corporation (CMHC), the Crown corporation in charge of mortgage liquidity, conducted a massive survey of recent buyers in Toronto, Vancouver, and Montreal. After getting drunk on exuberance, buyers indulged in a little too much borrowing, blaming everything from land scarcity to foreign buyers for the bidding wars they entered.

About The Survey

The CMHC designed a massive survey to try and figure out where buyer exuberance started. Buyers in Toronto and Vancouver saw a quick rise in home prices, and adopted “excessive” expectations of price growth. To determine where the disconnect between fundamentals and price growth started, they took a novel approach – they asked the buyers. 30,000 recent buyers were sent surveys, asking questions ranging from what their budgets were, to why they didn’t stick to their budget.

The majority of price movements were driven by exuberance in Toronto and Vancouver. Yes, fundamentals played a part – but a small part. Instead, the survey focuses on finding out which data points buyers felt drove their FOMO. The fear of being “locked out” is always a powerful motivator, which tends to amplify the read on fundamentals.

Now, issues like foreign buyers are important, and need to be tracked and dealt with. However, no one forced anyone to buy in the small window of exuberance. The homeowner life didn’t choose these buyers, buyers chose the homeowner life. Despite what you may have heard, not all renters are poor and struggling to eat. Actually, a surprising number of bank executives are now renters, but I digress. Let’s find out what these people were thinking.

55% of Toronto and Vancouver Real Estate Buyers Entered A Bidding War

First up, the CMHC found that buyers use “rule of thumb mechanisms” to determine home prices. “It’s a hot market,” “I can’t miss out,” and “it’s really tight right now” are phrases analysts cited as examples of this mechanism. According to the CMHC, these were “phrases pushing homebuyers to overvalue an investment.” FOMO helps to build an overreaction to data, which resulted in a lack of self-control. The best example of this is a buyer’s willingness to engage in a bidding war.

The majority of buyers entered a bidding war in Toronto and Vancouver. 55% of survey respondents in both cities said they entered a bidding war to buy their current home. To contrast, just 17% of Montreal’s buyers experienced a bidding war.

The Discipline Was Not Strong With These Ones

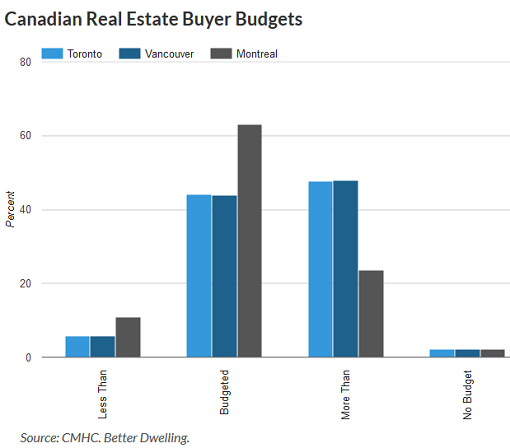

Buyers that accelerated their buy, tended to break their budget according to the CMHC. Vancouver saw 47.91% of buyers pay more than they had planned. Toronto saw similar levels, with 47.79% of buyers paying more than budgeted. To contrast, Montreal only saw 23.67% of buyers pay more than they budgeted.

FOMO was the primary driver of breaching, with most of these homeowners buying sooner or later than expected. CMHC analysts believe that those that bought sooner likely lacked market information, pushing budgets higher. Those that bought later couldn’t find what they wanted in their budget, driving them to an upward budget revision.

Canadian Real Estate Buyer Budgets

The Foreign Buyers Made Me Do It

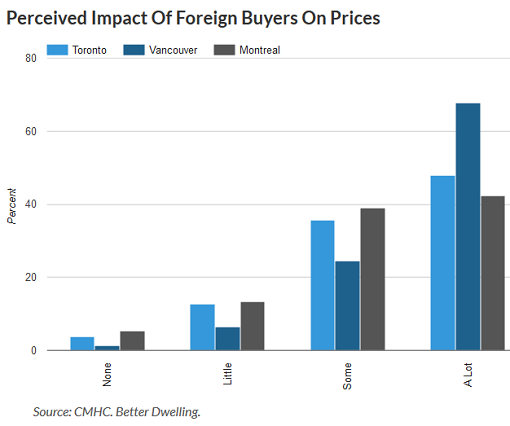

If Canadian real estate markets had a phrase of the year, “foreign buyer” would have been it in 2017. In Vancouver, 67.8% of buyers said foreign buyers had “a lot of influence” on home prices. Toronto was a little further behind, but not much at 47.88%. To contrast, 42.31% of Montreal buyers felt foreign buyers had a strong influence. Foreign buying is actually a part of the development strategy in cities like Vancouver, but they always tend to show up in droves when local credit expands – just like in the late 1980s. Funny how that works.

Perceived Impact of Foreign Buyers on Prices

CMHC survey responses from recent buyers, on the perceived impact of foreign buyers on real estate prices.

Who Needs A Job When You’ve Got Credit?

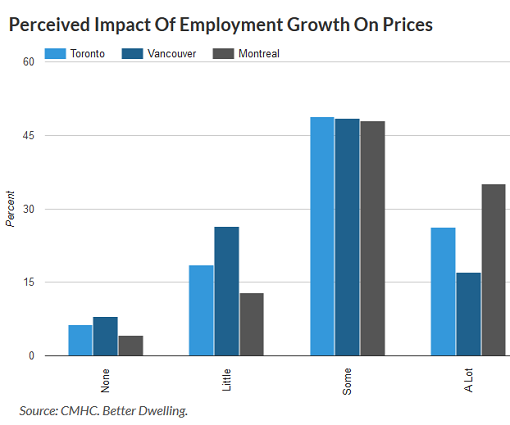

Employment growth is normally an important fundamental factor, but buyers didn’t agree. In Vancouver, only 17.03% of buyers felt it had a lot of influence. Toronto buyers felt it was a little more important, with 26.24% of people thinking it had a lot of influence. To contrast, 35.05% of Montreal buyers felt it had a lot of influence on home prices. The bulk of respondents in all cities felt it had some influence on prices.

Perceived Impact of Employment Growth on Prices

CMHC survey responses from recent buyers, on the perceived impact of employment growth on real estate prices.

There’s Too Many People!

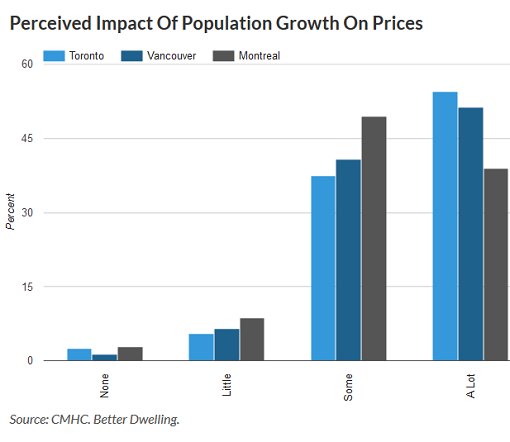

None of these locations are growing like they used to, but population growth was still a perceived factor. Toronto had 54.56% of respondents claim population growth had a lot of influence on prices. Vancouver came in just under that, with 51.39% of buyers feeling the same way. Montreal only had 38.94% of buyers that felt population growth had a lot of influence on prices. For context, Montreal has the fastest growing population of the three regions.

Perceived Impact of Population Growth on Prices

CMHC survey responses from recent buyers, on the perceived impact of population growth on real estate prices.

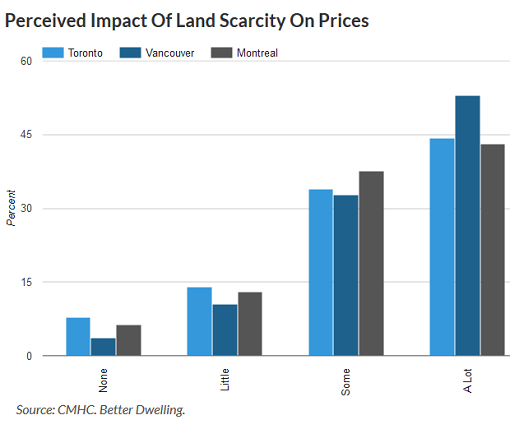

We’re Running Out of Land!

My favorite narrative, we’re running out of land – a.k.a. land scarcity. Vancouver had the most buyers that felt land scarcity had a lot of influence, with 52.94% of buyers agreeing. In Toronto that dropped to 44.22% of buyers. Montreal was just under that, with 43.06% of buyers agreeing it had a lot of influence.

Perceived Impact of Land Scarcity on Prices

CMHC survey responses from recent buyers, on the perceived impact of land scarcity on real estate prices.

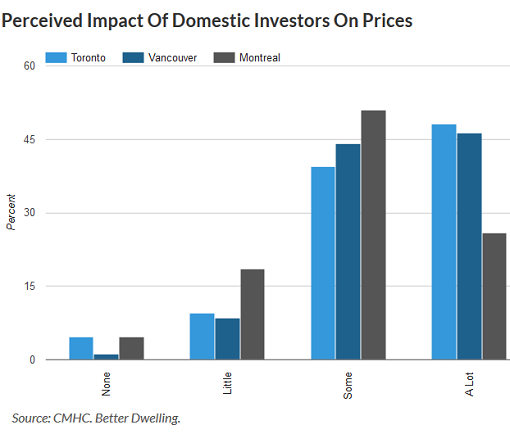

Those Darn Rich Locals!

Locals seem to underestimate the impact of domestic investors in all three regions. Toronto had the highest ratio of people that felt they had a strong influence, at 48.11% of buyers. In Vancouver, that number dropped to 46.33% of people feeling they had a lot of influence. Montreal only had 25.9% of buyers that felt domestic investors were a contributor to prices. I’m guessing not a lot of people in Toronto know the city’s domestic investor numbers, or that agents in Vancouver are sometimes paid with condos. Ah well, another article for another day.

Perceived Impact of Domestic Investors on Prices

CMHC survey responses from recent buyers, on the perceived impact of domestic investors on real estate prices.

These factors did contribute to higher prices, but buyers added emotional premiums. During the peak of a real estate cycle, buyers will always become exuberant as prices accelerate. Speculators, both international and domestic, can usually smell the blood and begin circling. Did people line up, and are foreign buyers accumulating massive portfolios of homes? Or were people paid to stand in line for condo assignments, with employees posing as Mainland Chinese buyers? Probably a little of both. However, it often doesn’t matter if the narrative is true or not, it just matters if you’re willing to max out your credit. As my favorite real estate agent once posted on her Instagram, “anything is possible if you belief [sic] it is.” By Stephen Punwasi, Better Dwelling

Subprime goes to the Toronto condo market. Read… Canada Has a Subprime Real Estate Problem, You just Don’t Know It

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great write up on an interesting survey. Plus, today the report on BC money laundering was to come out.

I have a friend whose daughter lives in Vancouver; married, with a combined income of $150,000, or thereabouts. Presently they are renting a small 1 bdr apartment for $2,000/month in YVR. He says they understnd they will never be able to buy unless they leave the city. (Student loans, too).

People need to do some serious critical thinking BEFORE making life choices such as where to settle and buying a home. Rushing into buying is beyond foolish.

regards

Why? Because house prices will always rise forever? Because government policies have been effective in reducing real estate price growth? Because now is a good time to buy?

To say nothing about CHMC cheer leading it all the way. In the US, the insured mortgage was temporarily raised to some 0.5mil or so, whereas in Canada to a cool 1mil. Then in the middle of it all, the CMHC report stated that prices in a small prairie province, Sakskatchewan, are inflated, whereas in Vancouver are supported by fundamentals (Chinese cash). But I guess, this was filtered out of the survey.

CHMC probably has done this survey now before the blame game starts to play innocent and exonerate themselves.

The list of agencies involved in this is long; BoC, the finance ministry, Fintrac, CMHC. Inspector Clouseau would have his work cut out for him, with criminal negligence the minimum charge.

How is it I never FOMO on my rent?

We recently went to see a house in LA where the selling agent “just couldn’t find a time that didn’t conflict with our appointment” for “this other couple” to see the home. Made for a good laugh. House was a complete dump asking way too much. Thought agents posing as buyers might be an LA thing but it sounds like it’s fairly common practice! We were considering making an offer, but this tactic really left a bad taste and we decided nothing good could come of dealing with such a selling agent.

What?!

You mean there are not thousands of foreign buyers with suitcases full of money going to Canada to buy property?

You mean the second largest country in the world with a population of only 36 million people may not be running out of land?

Could it be that locals with large home equity lines of credit with very low variable interest rates were hoarding empty homes hoping to make a quick profit caused the prices to increase rapidly in larger cities in Canada?

That doesn’t seem possible, the media in Canada would have told the truth and not let people believe these false narratives…oh wait…

https://www.huffingtonpost.ca/steve-lafleur/toronto-suburb-highlights_b_1343611.html

https://www.thestar.com/business/2017/02/10/milton-booming-as-crisis-looms-in-toronto-region-housing-supply.html

https://www.cbc.ca/news/canada/toronto/toronto-laneway-homes-housing-crisis-1.3882923

https://business.financialpost.com/real-estate/vancouvers-hot-housing-market-gets-tougher-for-wealthy-chinese-2

https://www.reuters.com/article/us-canada-housing-foreign/foreign-money-driving-top-of-housing-market-in-vancouver-toronto-idUSKBN1EG280

http://montrealgazette.com/news/local-news/west-island-gazette/montreal-housing-market-attracting-more-chinese-buyers

Actually, in Nanaimo on Vancouver Island there is actually a dearth of available land for housing development. Building lots cost the earth, which contributes to the high house prices.

The city has the ocean on one hand and is surrounded by agricultural reserve land.

Nanaimo is increasingly popular with well-heeled retirees from Vancouver, Calgary and Edmonton. There is an awful lot of infill happening with houses and townhouses being squeezed onto very small lots.

Elderly people living in humble homes on large lots are constantly hounded by developers asking if they want to sell.

People on Vancouver Island BC constantly use the “running out of land” reasoning. I don’t know how people afford some of these prices or why.

Plus all the zoning restrictions, permitting, inspection regimes. $$$

I live in a rural non-inspection area….for a reason. My wife and I just returned from our evening walk along the river. We had a good laugh tonight as a neighbour asked us if my son might consider chopping off the nicest part of his property for some German friends of theirs to park their rv on? uhhhhh no, I don’t think so.

I find it absoutely incredible that perfect strangers would ask such a thing. For me it is beyond rude and is absolutely mind boggling. Lots and lots of Germans coming here now. More Europeans than Americans these days.

Very rude, lie someone visiting one’s house and saying ‘Lovely painting: how much to buy it?’

In colonial North America, settlers of German origin were notoriously the most, so we say, awkward, neighbours, and very litigious.

Paulo you have many interesting experiences and insights and I always look forward to reading your posts…except regarding your property.

It seems you have some pent up arrogance regarding your kingdom. It’s fine to be proud of your accomplishments and the beautiful land you have acquired. There was obviously a lot of work and smarts behind it. And luck…we’re all just a little bad luck away from completely different paths in life, whether due to health, accidents, etc so how about a little humility?

Maybe next time someone compliments you on your beautiful land and asks if you would ever consider selling some of it, how about saying (with a smile) that you’re glad they share your appreciation for what you have managed to accomplish, but you would never consider selling any of it!

Or you can carry laminated menus to pass out on your walks that detail proper conversational topics and etiquette ;)

I second your opinion for sure :-)

ouch…again. I did not mean to offend you or anyone else.

It wasn’t my property,,,it was my sons. You may have missed that.

You might find this interesting, though. When we bought up here people thought were nuts. I would walk into the pub in the town where we lived and people would hum the theme from the movie Deliverance. Nowadays, it doesn’t look so bad. In fact, all my friends would move here but their wives won’t think of it.

As an aside, I was actually born in Oakland CA. We lived in a quiet area of Walnut Creek, then covered with walnut orchards and fields. Even our school janitor had acreage and we used to catch horses and ride them behind his house, hunt doves and quail, etc. That might seem incredible to some of you folks who live in the Bay Area. The school janitor, Mr Benjamson had 2 acres and a nice house. His wife stayed at home and ran the gardens, etc.

In the late 60’s we spent one year in North Vancouver. I would catch the bus with my crab trap and bring a few home for supper. I was 12. Then, we moved to the Island, Duncan. The Cowichan valley had 7,000 people and we could fish and hunt at will, before school even. I lived on a creek and could take my 12′ boat down to the Cowichan River and fish steelhead down on the Reserve. Newish arrivals to VI might find that as incredible as what Walnut Creek used to be like. Campbell River in the 70’s was idyllic. You would know everyone and the fishing was world class. Now, there are 40,000 people there and it is more than busy. Moved again 12 years ago and we are still being chased around.

Anyway, that is my perspective and why us Islanders are somewhat worried. 15 years ago everyone knew everyone else here. Every car driver would wave a hello. Now, we don’t even recognize the cars and no one waves. Even in the 70s (when you could afford to catch a ferry to vancouver) you would know a great many people on the boat.

That is why I am somewhat sensitive about things. I did not intend to sound smug or complacent….just tired of the changes.

Like I said, Paulo, I never skip your interesting posts. Just felt like I had a minor nitpick to share.

It’s the last thing I would want to discourage you from sharing great stories, and looks like we’re OK on that :-)

Eh a house is not something you should rush about unless you “really need to live there now” and even then you should still not rush.

“Did people line up, and are foreign buyers accumulating massive portfolios of homes? Or were people paid to stand in line for condo assignments, with employees posing as Mainland Chinese buyers?”

The author avoids the false dichotomy, and correctly and honestly acknowledges both. However, Canadian politicians at all levels: civic, provincial and federal, did not. The RE industry assiduously propagated the “myth of the foreign buyer”, and attempted to shame anyone who suggested otherwise by accusations of racism:

http://vancouversun.com/opinion/columnists/douglas-todd-vancouver-real-estate-and-the-xenophobia-question

To quote Jim Grant: a hard learned life lesson… never stand in line to buy anything – you will pay too much.

He was referring to paying over $800/ounce for gold in the early 80’s but it seems to apply to most everything in life.

Remember there’s always 2 sides to the coin.

“Foreign buyers” = “Local sellers”

“Entered A Bidding War”

This has been going on for quite some time. I only heard about it first in 2015: http://www.cbc.ca/news/canada/toronto/new-ontario-real-estate-rules-bar-phantom-bids-1.3102810 and then https://www.thestar.com/business/2015/06/14/phantom-real-estate-bids-targeted-by-new-ontario-law.html opened my eyes very well.

Of course, this being Canada, now run by potheads, will never result in any prosecutions. I just hope those exuberant home buyers don’t come looking for a bailout from the taxpayer when they loose their jobs (soon) and can’t meet there payments.

Of course they will. Western society has pretty much given up on the whole notion of personal responsibility. No doubt, the foreigners made them do it.

Not all of western Society has given up – here’s a place where we talk about that:

LenPenzo.com – The offbeat personal finance blog for responsible people.

You’ll be overrun. The stupid and the heartless overnumber the real good and responsible by at least 1000 to 1. The fact that we are here to talk about responsibility attests to that.

Sheeple

FOMO is an example of the primitive medulla oblongata (“lizard brain”) overruling the higher level reasoning of the cerebellum. In an ancestral environment, the medulla served a useful purpose in your survival to procure food resources and avoid death. It is still present in modern man, but can cause perverse results like believing that you will not have shelter if you don’t buy a house right now, for any price.

The real estate business preys on this primitive behavior with Bernaysian marketing. It takes a stubborn personality to reject the propaganda and rely on higher reasoning.

Tonight I was on our Emergency Radio net for the Island Trunk System (HAM). I heard some people talking about a worrisome increase at one of their seismic monitoring stations. If the Big One hits (subduction) Richmond will vibrate into the jelly of liquified clay, plus it’s below sea level. A Tsunami will seal the deal. A few bridge collapses and assortive mayhem and Bob’s your uncle. Reality will return, and then some.

I grew up in Richmond and bought my first house there in the early eighties. We sold at a loss a couple of years later, after the house sat on the market for 6 months; in a great neighbourhood, in the center of town. The poor schlepp RE agent wore himself out with all the open houses that no one came to. In my memory, he looked like Columbo, driving a K car. Oh, how times have changed.

We had an earthquake there in the late seventies. Nothing big, but I was always told, that no high rises would be built in Richmond. The exception were the three towers on Minorou Blvd. Don’t know why they were built, but being the only ones, you could see them on a clear day, all the way from the Northshore mountains. Earlier this spring, I showed my kids where the old man grew up, and I was lost in the canyons of high rises. Hundreds, and more coming. Unbelivable. Wolf wrote an article not too long ago about the same phenomenon in Seattle and down to SF. All they can hope for is that the Big One is off by a couple of centuries

Paulo,

I, too, lived in Richmond, within a short bike ride of the western dike walk. That was for a couple of years in the early ’90s. As I remember, all of Richmond is built on alluvial soil, definitely not the place to build any highrise, I don’t care how Ph.Ds the engineers have behind their names.

That’s a great title, and “soon to come to USA, and Australia at a theater near you.”

RE industry is disgusting; they resort into all types of fraud to make a quick buck, and they don’t care even one bit that they are destroying families; stupid families who probably end up in divorce and living in poverty as a result of RE fraud.

Good point. Sadly. The upcoming financial distress will surely to be the mother of many societal ills.

Given that Mortgages are typically recourse loans everywhere in Canada other than Alberta and Saskatchewan, it is going to be a noose round the person’s neck. Can the Canadian Government allow so many household to go down under? Unlikely. Then you can very well expect Canadian Government and Central bank to organize a bailout with the savers and prudent people skinned to the bone and looting tax-payers to fund a bailout. After all this is how capitalism is supposed to work world over. Privatize profits, socialize losses. That is the way to save free markets when the sucker is going down – US President in 2008.

Correction in the above post…

go down under?… should have been go down?

Bailouts are for banks, not homeowners. No bailout saved homeowners from foreclosure in the US just delayed the inevitable by years, millions were still kicked out of their homes eventually.

So far the politicians in Canada have not bailed out anyone, and have quietly let people/private lenders/banks take the losses on their speculative purchases. They are calling the process court-ordered sales not foreclosures or power of sales in Canada.

http://vancouversun.com/news/local-news/student-wins-judgment-after-vancouver-real-estate-deals-fall-through

https://pbs.twimg.com/media/DgpOvrWXUAEYYw5.jpg:large

https://pbs.twimg.com/media/DfiIBaXUcAEhuVn.jpg:large

https://www.mortgagebrokernews.ca/news/fortress-real-receiver-provides-update-244387.aspx

https://www.moneysense.ca/spend/real-estate/how-to-lose-big-money-in-toronto-real-estate/

Will they bailout banks with a federal election coming up in 2019? Probably not as Prime Minister Trudeau is already becoming unpopular in Canada and Ontario the most populated province in Canada, went from his political party (Liberal, left-wing party) to a more right-wing party, the Conservatives in the elections held this month, leaving the party he represents with fewer seats than required to be even recognized as an official political party.

https://www.macleans.ca/opinion/ontarios-liberals-face-annihilation-heres-what-happened-and-what-happens-next/

The problem for the banks with pushing millions out of their homes was that it was a double edge sword. They impaired the credit of millions who will never be able to buy again or pay the old debts. It is a huge population of perpetually pissed off voters. You can see the results play out on corporate media in the US, nobody wants to deal with the truth.

I always read your take on whatever you post upon.

I bought two goomint owned single family dwellings at the bottom here in SE Wisconsin. Thus is an extremely highly taxed RE market and the houses that I bought were taxed at 12% to 23% per annum on the purchase price. It isn’t though as I got some inside deal like Blackrock. Both were on publicly listed sites for 117-142 days.

My big fail was to not evict rotten tenants. There are masses of truly rotten folks out there that mess it up for the responsibles.

Great article I’ve been wondering what was going on for a long while.

FOMO (Fear of Missing Out) is a strong motivator…

Housing is a basic human need, and should NOT be allowed to become a vehicle for financial speculation, given there are thousands of assets one can use for that particular pastime.

But when you have a global system geared towards paying people ever-smaller salaries to increase short-term stockholder returns, being able to position a house as a cash dispenser – and pension pot – is a very convenient facility for politicians too loosely wedded to the financial sector (our intrinsic societal problem) and looking only for easy answers to get through the next election.

Massaged (and meaningless) GDP figures, manipulated (and mostly meaningless) inflation figures, manipulated stockmarkets, manipulated unemployment figures, distorted housing markets…ladies and gentlemen we have them all.

..but that’s what you get when the state steps aside and lets the financier have his head!

Industrialists build great economies (ref: China)…financiers destroy them.

Too CLOSELY wedded I meant to say!

And, what a great opportunity for the criminal enterprise system of ever increasing debt…….indebted slavery…..

There are ramifications to the establishment from the bubble bursting. You can see them being played out in the US on both sides of the political aisle. They can only mess with people so much, then the victims fight back where they can.

Great analysis.

Would add if inflation is understated the GDP growth is overstated. And wealth creation is overstated. If inflation is 6-8% but you claim 2%, one is manipulated to believe your wealth increased 4-6%. Wall Street gets the praise.

Some game where your currency is devalued over time and you allow others to claim they “invest” your money to gain wealth. Manipulation, you bet we are.

Plain as day.

In conversation with friends and family

the biggest effort is getting them to stop mouthing the platitudes promulgated in the MSM and to parse the reality in front of us.

We will be hearing same out of Australia.. in about six months time.

This is great news lets face it we are all excited let the free fall begin we do not care about rich developers banks or property owners as most canadians are renters as am I.

This is the best thing for us we need s 60 to 70 percent decline just to make affordable

Polos needs to raise rates to double digits he will Trudeau needs to tax America and we need more social housing .

Tax the rich way to many loopholes Also cut wages of 6 figure public servants not just admin I mean drs nurses policemen firemen no public employees should make more than 100k drs included we need to rejig the system way more capitalism needed