Down 70% from the peak. This is just not fun anymore.

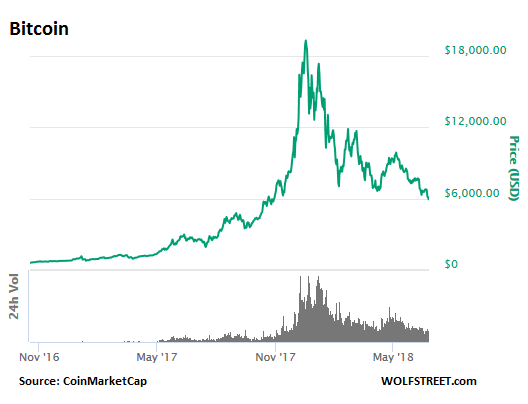

Bitcoin dropped to $5,860 at the moment, below $6,000 for the first time since October 29, 2017. It has plummeted 70% in six months from the peak of $19,982 on December 17. There have been many ups on the way down, repeatedly dishing out fakes hopes, based on the ancient theory that nothing goes to hell in a straight line (chart via CoinMarketCap):

If you’re a True Believer and you just know that bitcoin will go to $1 million by the end of 2020, as promised by a whole slew of gurus, including John McAfee – “I will still eat my dick if wrong,” he offered helpfully on November 29 – well you probably don’t need this sort of punishment. You’re suffering enough already. And I apologize. I feel your pain. I was a true believer too a few times, and every single time it was a huge amount of fun, and I felt invincible and indestructible until I got run over by events.

With 17.11 million bitcoins circulating today, if bitcoin were at $1 million today, it would amount to a market cap of $17 trillion. But new bitcoins are constantly being created out of nothing (“mined”) by computers that suck up enormous amounts of electricity. And by the end of 2020, there will be many more bitcoins, and if the price were $1 million each, the total would amount to about the size of US GDP.

This doesn’t even count all the other cryptos that would presumably boom in a similar manner, amounting perhaps to half of global GDP, or something.

People who promote this brainless crap are either totally nuts or the worst scam artists. But I feel sorry for the True Believers whose fiat money got transferred and will continue to get transferred from them to others.

So OK, there’s still some time left. It’s not the end of 2020 yet. And True Believers still have room for the fake hope of a $1-million bitcoin.

But at the moment, bitcoin is even worse – incredibly – than one of the worst fiat currencies in the world, the Argentine peso, which has plunged “only” 35% over the period during which bitcoin plunged 70%. That takes some doing!

There is always some reason or other that is cited for the drops: The endless series of hacks into exchanges during which crypto tokens and coins just vanish. Nervous regulators cracking down on the scams surrounding cryptos, initial coin offerings (ICOs), and how they’re being promoted. Or advertising platforms such as Facebook, Google, and Twitter, and email newsletter platforms restricting ads and promos about cryptos and ICOs.

And then there were studies that showed how Tether, via the crypto exchange Bitfinex, was used to manipulate up bitcoin last year. Manipulation is good as long as it is upward manipulation. But it’s apparently not working anymore.

A lot of big hedge-fund and family-office money was plowed into it last year with great fanfare that was thickly plastered all over the media, thus creating artificial demand for something useless that is in artificially limited supply. It worked amazingly well for a while. Now these funds are having trouble getting their money out without crashing the cryptos any further.

Whatever it is, it’s just not fun anymore.

In the end it’s always same: A miraculous ascent of anything begets more buying in the belief that this miraculous ascent will continue, and it continues until some folks decide to pull their money out. They have the early-mover advantage and they’re laughing all the way to the hated fractional reserve bank with their hated fiat currency. Everyone else is getting dragged down.

The overall crypto space peaked on January 4, when market cap reached $707 billion, according to CoinMarketCap. Less than six months later, market cap has now plunged by 66% to $243 billion, despite continued creation and sale of coins and tokens that add to that number.

Among the other biggest cryptos:

Ethereum plunged 68% from its peak of $1,426 on January 13, to $440 at the moment. Market cap collapsed from $138 billion to $44 billion:

Ripple plunged 88% from its peak of $3.84 on January 4 to $0.453. Market cap went from $148 billion to $17.8 billion.

Bitcoin Cash plunged 83% from its peak of $4,138 on December 20 to $679 at the moment. Market cap dropped from $70 billion to $11.6 billion. On November 12, I featured Bitcoin Cash in an article subtitled, “Peak Crypto Craziness?” where I was observing how it quadrupled in two days to $2,448.

EOS plunged 59% from its peak of $18.16 on January 12, to $7.18. I pooh-poohed it on December 18 with “The Hottest, Largest-Ever Cryptocurrency ICO Mindblower.” The purchase agreement that buyers in the ICO had to sign – the ICO was not offered in the US due to legality issues – stated explicitly that holders of EOS have no rights to anything related to the EOS platform, and that they get nothing other than the digital token. A perfect digital scam surrounded by piles of logical-sounding gobbledygook.

Litecoin plunged 79% from its peak of $363 on December 19, to $76 at the moment. Market cap went from $19.7 billion to $4.3 billion. Its founder admitted on December 20 that he’d wisely cashed out his entire stake, with the first-mover advantage. The True Believers have simply gotten run over by events.

There are now 1,586 cryptos listed on CoinMarketCap. Anyone can create them, and they do. This compares to about 160 fiat currencies. And in the end, it was fun for those that got out in time – those that grabbed the first-mover advantage in one of the most elegant wealth transfers of the century.

One of the biggest such deals ever, happening now: How investors allow a group of PE firms to extract $3.75 billion from a company after they’d already extracted billions. Read… This Deal Shows How the Junk-Credit Market is Still Irrationally Exuberant

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

JP Morgan said it best:

“Gold is money, all the rest are credit”.

There is no free lunch. Hopefully those who lost wealth will take the lesson to heart. Kind of late though, closing the barn door after the horse is long gone. I wonder how a particular “crypto coin king” is doing, after liquidating a very strong physical precious metals position, to buy cryptos?

It reminds me of watching friends caught up in the I-Omega frenzy of ’99. Much greater scale today but similar “feel.”

McAfee surely knows how to respond to mild skepticism directed his way, eh?

Yes, and he testified before a hearing in Congress in 1912 when made that statement. In December of the following year, Congress passed, and President Wilson signed into law the Federal Reserve Act.

I understand the motivation of those who advocate bitcoin, and I agree with much of the ideology, but the amount of electrical energy consumed to mine new bitcoins is obscene.

Gold still only holds it’s value due to it’s inherent properties making it a good currency. Scarce ,hard to counterfit, and divisible.

But never forget, similar to fiat and cryptos is it is still just a currency with little to no value to an average person. The only difference is the scarcity aspects is almost completely out of human hands.

Gold is a good hedge against the volatility of global currencies and likely even good for attempting to sneek wealth accross borders. But in the zombie appocolypse your gold is as worthless as my Bitcoin…

The violence against your life makes every thing lose “value”.

Gold competes with fiat and bits.

I do NOt analyze “value”.

I analyze domestic and international military power against each other and citizen voting power the military/police power controls.

The answer is simple. If you can NOT use violence against the people/country you trade, you have to use gold.

If you could use violence against the people/country you trade, you use fiat currencies and the best is the currency you print.

Bit Coin is like fashion. It is sexy and attractive. But it does NOT matter at the level of violence and military power.

If you can use violence

if you want to get out of dodge, across a border or anywhere in the world, gold will definitely have more value. I know 2 people who it helped get them across the border. One in Europe, the other in SE Asia. Bitcoins don’t work without the internet…

Seems that those properties make it useful as a medium of exchange, which is what money is. This is like saying a basketball is useful because it bounces.

Gold offers claims on real value solely due to its cultural adoption. So far that sounds a lot like crypto to me, but it is still early… only time will tell.

In my view crypto and gold share number of common traits:

-both create fake scarcity unrelated to real economic activity

-both are abhorrent on the ecology

-both appeal to those who believe the fantasy that somehow intrinsic value is stored within a money thing

-both are broadly misunderstood

Money is whatever a community agrees money is, which historically has been issued by some form of authority. Unit of account, and record of account are the critical functions any money thing performs, everything else is BS or BS ideology.

Actually J. P. Morgan never said “Gold is money, all the rest are credit”.

In J. P. Morgan’s testimony before the Bank and Currency Committee of the House of Representatives in 1912 he said,

“Money is gold, and nothing else.”

He was not simply stating that gold was money but that the only money is gold. But was he right? Is not silver also considered money? I think it is even though most people today would not think it was as they would think that paper currency is money.

The government decides what money is. Always has, always will.

Unfortunately, but historically gold and silver has been the only lasting form of money.

Yep, the government decides what money is …to the extent that it can. But money requires trust ….and that is something a government cannot dictate. In fact, the more it tries to dictate power, the lower the trust.

Another, more detailed descriptor:

Gold is the money of kings.

Silver is the money of gentlemen.

Barter is the currency of peasants.

Debt is the medium of slaves.

Fiat is the medium of banks.

Fraud is the medium of Capitalism.

War is what happens when fraud & fiat no longer function according to the initial schemes set forth to appropriate wealth.

BitCoin is just more fiat.

MOU

Gold was money, but last I checked I can’t spend it to buy anything – the most basic requirement of money.

Do you foresee a day when the cashier at Walgreens (one of our 30 largest industrial companies according to Dow Jones) will weigh and assay your gold, to verify it isn’t plated tungsten counterfeit? How exactly would gold work as money in a modern society? You can’t spend it, it’s not money.

Of course you can sell it to buy money that can be used to buy stuff, but the same can be said for my 2008 Dodge Caravan – is my old van also money?

Today I don’t deny Gold has value, because people still want and hoard it, and it has been a better store of value then currency, but humans are fickle and there is no guarantee they will continue to hoard this metal, with little utility, into the future. I don’t care for Warren Buffet but I have to admit he is correct with regards to gold – it just lays around and collects dust.

That being said, I own gold, because people continue to hoard it and I doubt that will change suddenly. Cryptos have no real value either, they are useless as money, but if you own one bitcoin you can still get over $5000 dollars for it – people are crazy.

Oh boy.

gary sees the coming gold argument and exhales sharply while he grabs his popcorn

Not a goldbug by any stretch, but I recently sold a crtified (professionally graded and plastic-slabbed) gold coin purchased in the late 1990s on ebay for roughly 4x what I paid for it – How’s your 2008 van doing in terms of what you could sell it for?

“I don’t deny Gold has value, because people still want and hoard it, and it has been a better store of value then currency, but humans are fickle…”

So despite the fact that humans have valued gold (where it was available) due to its portability, indestructibility and adornment value pretty consistently since the dawn of civilization, their ‘fickleness’ makes owning it some kind of crazy speculative bet? OK, I’ll take a gamble and take any you might have off your hands for $1000/oz – since its price could collapse at any moment you clearly will want to leap at this offer.

ewmayer – From the late 1990s, how much would that same amount of money you spent on the certified/slabbed cold coin, if put into Vanguard funds, have increased? Or any decent S&P 500 fund?

Van’s van isn’t an investment; it’s cheaper than market rent. If the price of a year’s public transit where I am is $840 a year for a VTA pass, my bicycle at $550 all told with panniers, lock, lights, etc. is simple cheaper, more flexible transport. The same goes for van’s van. It will degrade, break down, simply get old. Then he’ll buy another one. He’s just paying less for a more versatile “building” to live in. He’s probably achieving a $1000+ rent quality of life for $300 a month or so.

I doubt gold is going anywhere. 1000’s of years of history are hard to deny. Keep in mind also that huge parts of the Earth’s population are Chinese or Indian, both populations that can look back over many thousands of years of history, rises and collapses of Empires, and they are great believers in gold.

Van …,

All that gold must be hard on the suspension of that old Chrysler product …

Who?, Bix lol. Havent heard from him lately. I doubt he really sold all his physical, i think he is a paid propagandist.

a fool and his money are easily parted !

Bitcoin’s price over the year[1]:

Sun June 25 2017 : $2,622

Sun June 24 2018 : $6,190

That’s not bad for something many, maybe the majority, do not understand. For something many see as “useless”. They seem to ignore, or miss, that bitcoin enables two anonymous parties to exchange value, over the net or phone to phone etc, without need of a trusted third party. If someone thinks that is useless then I can only assume they think the internet (and mobile phones) is some sort of fad.

Oops! Didn’t position the cursor correctly. Here’s another attempt…

Sat June 25 2017 : $2,752

Sun June 24 2018 : $5.858

…anyway, you can check the prices for yourself, maybe on another site.

You didn’t even read the article, did you? You just posted this from your email without seeing the chart in the article right at the top? Not cool.

I did read the article, and more than once, as I was hoping to see some analysis as to why you think bitcoin is dead or dying[1]. That’s what I think this article is about, have I misread it?

[1] The fact it’s falling dramatically in price is no reason, IMO, to think it’s dying this time, I’m sure it’s had greater falls in the past. And let’s not forget bitcoin has died more times than a few dozen cats, https://99bitcoins.com/bitcoinobituaries/. Time will tell.

What I was saying in the article is that true believers got suckered. They should have sold at $18,000 or $17,000 or at $10,000 or at $8,000…. You can always buy it back after it plunges, hoping for a short ride up before selling it again. It’s not easy to do. But that’s what “traders” are trying to do. “True believers” just get ripped off in the process. It’s the “early movers” that got out at the peak that made all the money.

Hmmm…. I suspect you won’t be seeing anymore YOY comparisons come November 2018 LOL.

In just a few months year over year comparisons could be negative. What then?

of course, the “value” is great, if you received bitcoin for some asset yesterday and didn’t convert to that worthless fiat monet. only down 20% or so ….

It is heartwarming to hear true believers talk — the earnestness, the relentless hope, the ability to be impervious to reality, such as seeing anything good in the above chart that looks horrible to non-believers :-]

The true believers believe that some crypto will replace national currencies at some point in the future, so discussion with them is futile: they don’t see it as a speculative vehicle. No discussion with them can be solid without debunking the money out-of-thin-air “economic theory”, where it all started.

To me that chart looks pretty similar to the chart for gold or silver (over a decade’s time rather than just one year). I think cryptos are useless, but if enough “true believers” continue to hodl and believe then tinker-bell might still come back to life.

It could eventually hit a sustainable plateau, say $50, and hover over and under that level for the rest of our lives. It might be something people continue to trade and hoard into perpetuity. It might continue to hold value as a way conduct crime and launder money. Don’t write the obituary just yet – the story is still unfolding and we have front row seats. Exciting stuff!

van_down_by_river,

$50 or anywhere near that, or even with a zero added, is not nearly enough to sustain bitcoin mining with its horrendous electricity consumption. But you need miners to process transactions. The whole system is based on miners. So this would open up a huge challenge: who’s going to pay the extraordinary costs of maintaining the network’s functioning?

Bitcoin is under tremendous presser from .gov, banks ets. They are scared shitless of it.

No wonder futures trading was so easy started as an instrument of fraudsters/gov/banksters to suppress and manipulate the price.

Compare to gold unwarranted moves and artificial limits.

And this misinformation in the .gov media about electricity use and thefts. All this small devices on standby in your house take many times the amount of electricity than mining.

I’m surprised the price is holding this high.

Got a couple of it early and still having fun with it. :)

Let me give you my reason why BTC is dead. The same reason you find it attractive, and that is ONLY TWO ANONYMOUS party involved.

People will go to ruthless and rob each other. A BTC robbed does NOT need a third party to verify and you can use it.

If BTC tries to reach the scale of existing currencies in trade, it has to have all the police, lawyer and supervising power (3rd party) to make sure your wealth is protected.

BTC is useful to do small transactions without the 3rd party being aware. This is sexy. But at large scale trade and finance, you need all the 3rd parties you can get to protect yourself from crimes.

Verification of a bitcoin transaction is cumbersome and costly, once most of the coins have been mined third parties would only be motivated to

verify transactions in exchange for a substantial fee. There is no guarantee anyone would even verify the transaction or it might takes hours to verify – not so good if you just want to buy a beach chair or towel at Walgreens (popular items at Walgreens here in San Juan PR).

“bitcoin enables two anonymous parties to exchange value, over the net or phone to phone etc, without need of a trusted third party”

Presumably you have traded in BTC – so how did you do it? Did you just exchange bitstrings via your own dedicated internet pipe which no one else has access to? I’d really love to hear about this fabulous personal internet tech you’re using which does not rely on any technological intermediaries.

Or did you use some kind of online exchange, in which case you must obviously be the owner and operator of said exchange, since otherwise it would represent the dreaded third party you mention.

This is called “distributed ledger”, as opposed to a single entity such as banks or central banks keeping the ledgers for all transactions.

The ledger can be verified on any anonymous computer connected to the internet. Since you do NOT need any centralized banks to keep the ledger/accounting, they do NOT have power over you. Nobody knows what you bought. Nobody can lock your account and freeze your asset.

It is truly sexy and beautiful technology. But to say BTC will replace fiats at the scale of international trade/economy, I do NOT think so simply because there is NO 3rd party to protect you from crimes.

So ‘connected to the internet’ doesn’t involve having to trust multiple third parties?

And how does that ‘beautiful and sexy’ tech scale in terms of power and hardware costs needed to run a network at the scale of, say Visa’s worldwide transaction processing? (Not that that doesn’t have its own problems, but they have been operating for a long time at massive scale with relatively rare outages.) Or does the surreal power usage of, say, the BTC ecosystem, which appears to be currently running at roughly 1/1000th the processing rate, tell us the answer?

Also, I’ve seen lots of articles hyping this-or-that alleged solution to the scaling problem … all of which rely on piling on even *more* technical intermediation, often of proprietary tech by companies that have only existed for a few years. Moar tech and moar 3rd parties is always the answer in this field.

Briefly: To spend bitcoin you effectively compose a cryptographically signed transaction (tx), which can be done offline, and broadcast it onto the bitcoin network. You do not care who gets a copy of it, it’s of no use anyone other than bitcoin miners. The miners effectively paste the tx into bitcoin’s public ledger (block chain). That’s it.

Essentially, bitcoin’s ledger is comprised of a set of addresses and txs. It couldn’t be simpler.

Bitcoiners can exchange value, but the last averaged statistics I’ve seen say the transaction takes at least an hour, and costs something like 22 dollars.

Some of the other coins, Ripple as an example, do claim transaction speeds of something like 4 or 5 seconds.

But all these coins are just derivatives of fiat money, or derivatives of other coins which are derivatives of fiat money. So you are paying a fiat price, which is translated to a coin, which is then translated to fiat money. And the problem of course is that if you have these coins on an exchange, the plug could be pulled at any time for any reason, including fraud, and theft by hacking. Then of course there is the wild fluctuation in value of the coin. Also, try to find the physical address of any of these exchanges, or the coin issuer itself which usually doesn’t provide a physical address – it’s usually just a mail drop in some remote location.

A credit card transaction takes 4 seconds on average, and you get the free use of the funds for up to a month. Plus, if you have difficulty with the seller, you can just reverse the payment – with the added bonus that suspicious transactions are caught before you even notice.

“bitcoin enables two anonymous parties to exchange value”

Ever heard of CASH. It already exists, you should try it sometime. It won’t get manipulated from $2600 in June 2017 to $18000 in Jan. 2018, it also won’t crash when power goes out or phone signals go down.

A person has to go to my bank to rob it, and if they leave with money it won’t be counted as my money. It is insured by the bank. But a bitcoin from the wrong currency vendor can vanish, disappear, turn to a 0 sum.

Bitcoin is just another market manipulation, like Uber/Lyft vs taxis, AirBnB vs Hotels, etc. This current era of try and “kill everyone else financially” has to end. Bitcoin isn’t a remedy, it’s just another attack on a market.

Any grown ups left?

No of course is it useful. But I can do it for $0.00001 with XAHDI coin, and I can do it for $.0000001 with &#*#$ coin. Please tell me why I need to consider BTC a store of value, if its main benefit is anonymity at the instant the transaction takes place? For example, why couldn’t the website via which i’m diong the transcation, simply allow me to swap into a crypto currency the second I want do do the transaction? Why do i need to “hold” crypto?

Why should I hold crypto as opposed to gold? Or, why should I hold a non gold backed crypto like BTC vs a gold back crypto?

Wolf thanks for your honesty–belated. I always thought this was a joke and tried to warn people. Some still believe. The issue was this a play for the super rich to get super richer. There were many flaws, the huge energy cost that would never subside, the numbers of scams and thefts. It was the Tesla for Libertarians, and in the in end any idiot could see that when it got popular enough, the world governments would either outlaw it or co-opt it. The latter may still happen:

https://altcointoday.com/the-fed-should-get-serious-about-crypto-says-former-fdic-chair/

and of course the Libertarian dupes will be believers right up to the point that the Fed co-opts it, but they might pay off some of the rich fat cats. And once again the tortoise gold is still in race as it has been since almost the beginning of time.

“Belated?” I’ve been pooh-poohing and lambasting these things, the scams surrounding them, ICOs, and related issues forever. You can check out my articles on cryptos here:

https://wolfstreet.com/category/cryptos/

You should just go ahead and start up WolfCrypto and collect all your articles about it under that blog. Then somehow set it to be viewable only when enough computer power is mining it. (I know that doesn’t make sense, but I bet some 20 year old in SF can make it happen)

Andy Hoffman has already tried this tact. Liquidating a very strong physical precious metals position to do so! I don’t think its working out so well, since traffic at his site has fallen into the crapper.

http://www.cryptogoldcentral.com.

http://www.srsroccoreport.com/watch-out-below-major-cryptos-falling-to-key-support-levels/

I’m a libertarian (by birth not affiliation – it’s just my nature) and I’ve never owned nor believed in bitcoin. The ultimate libertarian, Ron Paul, certainly never advocated owning cryptos – in fact quite the opposite – so don’t try to twist the narrative into some kind of libertarian driven mania.

I don’t deny that fiat currency has some value as a medium of exchange, but fiat currency has little utility as a store of value.

As a libertarian I believe you should keep only enough fiat around to buy the necessities of life but never, ever use currency (this includes bonds) as a store of wealth. Any currency is very risky over time and your wealth should be kept in productive assets – so says this libertarian.

Peter Schiff is as libertarian as they come, yet he is bitcoin enemy #1. Don’t know where you get your notions about libertarians.

I used to be libertarian. I really try to have no affiliation now, kind of an anarchist who realizes human nature sucks so you need laws to control our base instinct. I would suggest you watch……

http://www.pbs.org/independentlens/films/park-avenue/

I also voted/campaigned for Ron Paul in 2008. I still believe he was the better choice.

Just like I believed Bernie was the better choice in 2016.

“…in end any idiot could see that when it got popular enough, the world governments would either outlaw it or co-opt it.”

Hmmm… your view of government morality is not exactly optimistic. Sounds sorta like a closet libertarian :-)

That it has not been outlawed is probably because some simply chose to tax it. But maybe, considering a plan to co-opt as you mentioned, taxing gains is simply an interim step.

Somehow governments need to find a way to make the trillions in debt tenable. What better way than a currency switch with embedded devaluation. But the smart money needs the opportunity to get out of harms way.

It took a lot of resources to create bitcoin, so if it wasn’t designed as a Ponzi scheme or quasi-govt sanctioned effort what other explanations exist for the motivation to create it?

It’s all too easy to pan something while it’s down but my take is that cryptocurrency’s role is quite unique and has yet to be fulfilled. And that role is to provide a borderless, non-inflationary, non-government currency to transact in while governments print their economy into either very high inflation or hyperinflation.

Now…

I do not believe crypto is money

I do not believe crypto is a store of value

And I do not believe crypto is a perfect currency

I do believe that crypto has unique qualities that give it value beyond fiat currencies and any other known asset class such as…

global/borderless

non-inflationary/cannot be printed

can be purchased, sold & transacted in from a mobile phone 24/7

Let’s say Bank of Japan eventually eventually prints a trillion too many Yen and it begins to rapidly devalue and hyperinflate. Many will flood into US, EU & CA real estate as well as stocks; maybe even at a time while global markets are tanking as a result of Japan imploding. Certainly many will buy Gold & Silver, although the inverse correlation with them and JPYUSD will mean a weakening Yen causes precious metals to sell off. But what’s the sole asset class the average Joe can instantly buy, sell and ‘transact’ in outside of the Yen, namely from his or her mobile?

Average Joe?

This is also a great facilitator for organised crime, money laundering, etc. At least the crooks are getting hosed.

“There were over 250 000 listings for illegal drugs and toxic chemicals on AlphaBay, and over 100 000 listings for stolen and fraudulent identification documents and access devices, counterfeit goods, malware and other computer hacking tools, firearms, and fraudulent services. A conservative estimation of USD 1 billion was transacted in the market since its creation in 2014. Transactions were paid in Bitcoin and other cryptocurrencies.”

https://www.europol.europa.eu/newsroom/news/massive-blow-to-criminal-dark-web-activities-after-globally-coordinated-operation

People don’t use Bitcoin to buy on the Dark Web as Bitcoin is not truly anonymous and if you tried you would ultimately get caught as Bitcoin can be tracked. Those buying on the darkweb use “cryptonote” algorithm coins like Monero and ZCash which are Anonymous.

The US dollar is the number one currency and always has been which is used for illicit trades including the ones done by Obama when he delivered cold hard cash in the dead of the night to the Iranians.

Less than 2% of transactions are estimated to be used for nefarious purposes in the world of crypto whereas the majority of people see it as a way to take control back from the centralized banks of their hard earned wealth and be able to transact with others around the globe 24/7 and without waiting periods and large fees caused by the likes of western union.

Paulo, if you live in Argentina or Greece or Venezuela or Zimbawe you would be thanking God right now that you have an alternate means of storing your wealth than your national fiat currency which devalutates by the hour and is subject to seizure and confiscation by the banks to pay their debts

Re. Obama giving ‘cold hard cash’ to Iran, there is no evidence of this

https://www.snopes.com/fact-check/obama-bribed-iran-400-million-to-release-u-s-prisoners/

Paulo, I guess you just think that those predatory lending, housing bust, bailout, money printing at the level of Trillions of “currency units “ is NOT a “crime” because it is carried out by people in suits and done in board rooms.

I am NOT suggesting Cryptos are “Clean”. But I think to give Cryptos a bad name because it helps “crimes” is just NOT fair.

Ouch. Okay okay.

yesterday we went to a pig roast barbecue. The hosts were aussie ex-pats so we had to stand around for the traditional cricket match as opposed to baseball. (I freaking hate cricket). Anyway, the coffee can was passed and it was full of twenties, tens, and fives. nary a bitcoin.

Good comments on ‘stores of wealth’. Good read and great discussion. My cashie 2 cents worth? Buy land and start from there. Good land, away from cities and angry people; zombies, etc. :-)

regards

“But what’s the sole asset class the average Joe can instantly buy, sell and ‘transact’ in outside of the Yen, namely from his or her mobile?” – This is also the problem. The “sole” asset class is easily replicated yet massively expensive to run as time passes. This seems to align the incentives towards inflation via additional cryptocurrencies, since they cost less to produce a new coin. If one cc wins then its price gets inflated too, or becomes an easier target for governmental suppression. After all, just because the transaction can take place does not mean it is legal!

The argument of being able to create an endless supply of other cryptos loses validity if you consider Bitcoin has become the accepted name brand (like the U.S. dollar) and all other cryptos marginalized. Humans stick with whatever becomes commonly accepted – much like Amazon.

There are lots of online retailers that could threaten the value of Amazon but Amazon has become the accepted monopoly and very few use any other option.

Bitcoin has brand awareness.

One of the great things about belief is that it is pretty resistant to evidence to the contrary. There is something about the human mind that can hardly bring itself to the realisation that something emotionally invested in (or actually invested in for that matter) is fictitious. If there is anything about bitcoin which is interesting is its ability to find vulnerable minds around the world that came to believe they could retire in their 20’s or 30’s or whatever because they were ‘smart’ in recognising ‘value’.

The effect of propaganda is powerful, on all of us. Clinicians who work with psychopaths are known to be taken in by their lies. It is only afterwards they realise they have been conned.

When you wake up from the spell you are under you will wonder what on earth you were thinking. You just aren’t there yet.

My step father in his old age has ended up extremely right-wing. He firmly believes, and tells everyone he knows, that we are entering a period of global cooling due to an increase in sun spots.

He has such a need for “those liberal scientists” to be wrong, that he is willing to believe any kind of garbage. He has told other members of my family that I want them all to die because I won’t use my money to by farm land in Florida. Apparently I could be the savior for when the starving hordes begin moving south to escape the new Ice Age.

Maybe I should create an ice age coin that will allow only select holders to buy food? You can’t have enough insurance for the apocalypse.

Si:

I appreciate your comments about what people choose to believe and how durable beliefs are. There is a lot to think about here.

I have just finished going through about 85 comments and think that this is the best discussion thread I have read in a long time. Thank you to all the contributors.

“Store of value” is one of my favorite topics. It is a very elusive thing and I have enjoyed many of the posts on the subject.

There are threads like this and better every day here.

If it’s not a store of value, then how can it be used in an exchange of goods or services?

Store of value and medium of exchange are two completely different things – don’t confuse them. The U.S. dollar is now worth only about 1/40th of its original value, by no measure a good store of value, yet it still functions well as a medium of exchange.

The institution that oversees the dollar has openly announced a policy of dollar devaluation – the opposite of a store of value – yet people around the world still accept it as a medium of exchange (but store of wealth not so much).

Beanie babies. People ought to be buying gold bullion or royalty companies.

Ah, but is it a blockchain-enabled Beanie Baby? That makes all the difference.

Call me old-fashioned, but I’d prefer having a trusted third party serving as an escrow for significant transactions. Too many things can go wrong in the absence of a third party. Example: if I pay with a credit card, and the seller sends me an empty box rather than what I ordered, I can complain to the credit card company.

#Cryptards

http://farm8.staticflickr.com/7236/6918834286_483518f635_b.jpg

Bitcoin is defined as property by the IRS and is subject to capital gains tax. Which means that audit trail information has to be collected for each and every transaction. That doesn’t sound like a currency to me.

So Bitcoin can never be a currency because the US government says so? The big picture is that there will be an alternative store of value (in addition to gold) at some point. We just don’t know whether it will be Bitcoin or something else. All governments are abusing their currencies, picking winners and losers in the process, and this is destabilizing the world population.

Well said.

I think a large part of the crypto story (aside from the frenzied speculation) has to do with the fact that people feel powerless in the face of obvious and accelerating debasement of the popular fiat currencies.

Many people are desperate to hold onto what they have worked so hard to earn yet can’t afford to buy real estate or speculate in the market at astounding high valuations. People wish to find a low risk asset to put their wealth that will hold value – unfortunately the world will never oblige that wish.

Practically everything is measured in the USD. Yet it remains highly despised.

An old man’s point of view:

When I looked at bitcoin – when? – don’t remember, exactly, it was something like $70, going up rapidly. By the time I got my bitcoin wallet downloaded and opened, it went to $90 and I decided the downside risk was more than I was going to take. How do I feel about that now? Neutral.

Attitude toward money can be laid back and life can be lived without too much regret, and without envy or greed.

Perhaps people pursue these things for the fun of it, like gambling. I assume that’s why you bought a small amount. As long as people don’t bet the farm, is there really any harm done? Moderation is the key.

Agree.

Well, don’t forget about the amount of manipulation on cryto transaction. Most of the transaction are (some popular crypto) to (some nobody know crypto) vice versa. I estimate fiat-crypto transaction only make up 10-15% of the total volume.

BTFD!,

Never forget that Bitcoins fundamental value is the Electron.

I trust Electrons, always there. always predictable.

Ah, but where precisely is the electron, and exactly how fast is it moving? Inquiring physicists want to know.

Of course, in a scam, Heisenberg’s Certainty Principle states that you can both know where the money you invested is (the scammer’s pocket) and how fast it is moving (as fast as the scammer can run).

Electrons are not predicable. Go read Heisenberg.

Tom Stone, I think I know you from 25 years ago at NTE

When I read your line: “…creating artificial demand for something useless that is in artificially limited supply…” it occurred to me that Bitcoins are building on the jewelry diamond business strategy. Just to prove that there is “nothing new under the sun”.

Totally agree; Jewelry and diamonds are such a scam. Friend of mine bought an $80K diamond ring for his bride to be. 6 month later, and they are divorcing, and of course that $80K is poof, gone. Can you imagine how stupid you have to be to pay $80K for a ring?

It’s not poof and gone. There are 4 price caregories for diamond rings.

1. Full Retail. That’s the $80k ring sold to the starry eyed groom. Not to worry, since they will give you written insurance appraisal for $120-160k for your files, and to make you feel that you were not taken.

2. Discount retail. That’s the $50-60k price you pay for a similar ring at Costco or Blue Nile.

3. Wholesale. That’s the $40k paid for the ring by the retail jeweler, before markup.

4. Liquidation or half wholesale. That’s the $20k the jeweler will pay you outright for the ring if you decide to sell it to them. Jewelers try to make you feel better by offering you $40k for a trade in, with the requirement that you buy a more expensive item from them at, you guessed it, full retail.

Sorry to wander off topic, but I was in the business years ago.

Yeah, but the rarity of diamond itself is a scam; diamonds have not been scarce since the discovery of diamond mines in South Africa. It’s a cartel 1000 times worse than OPEC that keeps the prices inflated; otherwise, you should be able to buy a one karat diamond for $50. Watch this video on the history of diamond: https://www.youtube.com/watch?v=yplI48hSt2E

$80K for a ring that the guy should’ve bought for $400; what a laugh.

2020 just doesn’t have the cache of 2030 if you ask me.

Sure, it’s closer, but 2KXX or MMXX just doesn’t sound as cool as 2KXXX or MMXXX. I think that extra X there makes all the difference in the world, would certainly draw a larger crowd.

Having no idea how all of this works, this sounds just like a Ponzi scheme with the goal of sucking up all the electricity in the world. The block chain for bitcoin is supposed to be sustained by mining activities. There is supposedly a limit to the number of bitcoins in the world, and it’s supposed to get harder to mine as more bitcoins are on the market. So, I would be curious on how hard it would be to make that last coin. It’s value must be near infinity given the amount of computational power needed to crank it out, but after that point, what would be the incentive to mine anything. This is starting to sound like a giant alien plot to take over the world.

Back when bitcoin traded at the 17900 handle I posted the comment “i was going to buy crypto but with silver on sale there was no fiat left at the end of the month.”A reply was “I hope you bought some crypto ” Well now the cryptonites lament “I could have had pieces O eight.”

Wolf let’s take a look at the historical facts of Bitcoin.

From it’s release in 2009 at $1 until today in 2018 Bitcoin is up 5000X

When I first heard about Bitcoin back in 2015 or so Bitcoin was under $500. I looked into mining and people told me it was too late so i went back to sleep.

Two years ago in 2017 I remember John McAfee tweeting Bitcoin had hit $2800 to the utter amazement of the skeptics and I took a second look and began to Mine equihash coins and currently operate 23 GPU cards.

We have seen BTC go as high as $20k and although today it is at $5800 it is still 5000x up from when it started in 2009, 10x from when I first heard about it in 2015 and 2x from 2 years ago in 2017 at which point I began to buy and to mine…..

I would say Bitcoin is doing great and considering there will never be more than $21 Million Bitcoin issued there is a scarcity factor built in unlike fiat or gold or anything else traded on the planet and it’s value may reach 1 million per coin in the future.

This is the BEST time ever to buy in while it is comparatively low priced.

As long as people keep mining it the value will drop. The more coins in the pile the more watered down the value. Maybe hold off on buying in again until it drops to $2000 or $1000, with the size of the bitcoin farms popping up it will only go down.

Learn a lesson from oil, fuel, grain, and maybe even tulips.

Not sure what the article is trying to convey, I guess that bubbles happen and you should always get out at the top? Always easy to say with hindsight. I own some crypto and used my speculation dollars to buy it. Nothing significant, it forces me to keep up to date on the space. Will bitcoin be around in 1-5 years time, no one knows. It certainly has lots of challenges (BIS just put out a report on it) but so does Fiat currencies. Ask any Venezuelan how they feel about the Bolivar. Most Fiat currencies end up in the garbage heap at some point, a function of human management. With crypto, you remove the human part from the equation to a certain degree. Up hear in Canada we have a central bank that doesn’t even own gold as part of it’s reserves, crypto helps me diversify my Fiat holdings. Enjoyed your article. Thanks

Very, very few fiats have ever ended up in the garbage heap.

You may mean very, very, few fiats have NOT ended up on the garbage heap.

Virtually every fiat currency has gone to zero and started over sometimes with a new name sometimes the same name; even the US dollar has gone to zero, twice. The dollar is now on its third version, and since 1913 has lost 98% of its value.

If you were humorously referring to Fiat the car, its record is no better, though they’ve often been quite lovable. The Fiat 500 Topolino convertible from the 1930s looks like Mickey Mouse’s car – Topolino is the Italian name for Mickey …

https://commons.wikimedia.org/wiki/File:Fiat_500_Topolino_Cabrio_1.jpg

There was a Canadian gold mining compnay called “Bre-X” in the mid 1990s that managed to fool and rip-off a whole bunch of people. At that time my banker called me in to her office to tell me that I should buy some Bre-X stock back. Fortunately, I didn’t bite.

Today, I guess there’s one good thing about getting old–you remember these lessons if your brain is still working, and I never even considered jumping on the Bitcoin bandwagon.

Bitcoin may drop.Bitcoin may rise…

But it is f… wonderful to have USD $1B in your account-out of reach of those who try to grab,suspend,levy or seize it.

Top 100 Richest Bitcoin Addresses:

https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html

The problem with any cryptocurrency is that to buy anything, from a a few apples to an escavator, you need to either sell that cryptocurrency for a legal tender, be it US dollars, euro, yen or Venezuelan bolivars, or find somebody that will accept a straight swap. Due to that chart above I honestly doubt all the people who at the top of the craziness promised to accept Bitcoins, Ethereum or Ripple as payments for cars, gold bullion and the like are keeping their commitments.

This doesn’t mean cryptocurrencies are bad or good. It merely means they are not currency but an asset, like Apple stocks, US Treasuries or silver coins. Unfortunately they are also an asset that has gone through a bubble without any support from governments or central banks so now air is hissing out of that bubble: there’s no European Central Bank or People’s Bank of China patching up the holes and frantically pumping air to reinflate it so to avoid investors, from large funds to mom and pops types, to take to streets beating on their pans to demand a bailout.

Perhaps that’s a strategy cryptocurrency enthusiasts should try.

This guy with a $1B in his wallet #1 is not a buy-and-hold-till-you-die Little Old Lady from Dubuque,Iowa.

He is very active,probably doing something but I can’t figure out what.And for him Bitcoin is not an asset but means of value transfer.

Because all Bitcoin transactions are recorded in the Ledger since Beginning of Time it is possible to analyze his shenanigans but it requires appropriate software and processing power which I don’t have.

On a much smaller scale our lives became much easier after Bitcoin Cash fork.There are many things one wants & needs but can’t buy at Amazon or Ebay or local store.

Hence cryptocurrencies and dark net markets (that our parents warned us against).

Also if one is not allergic to college-level math studying how Bitcoin works is kind of free refresher course in applied number theory,cryptography and abstract algebra.

That chart still has some room to fall when compared to the South Seas or Tuplip bubbles. Get out NOW!

I had a friend who told me that bitcoin was going to $1M when it was at $12K. I told him I was reluctant to “invest”, and then I thought I was an idiot, and my friend was a genius, when BC went to $19K. Talk about FOMO. I am glad I sat on my hands, and I don’t even bring up the subject when I talk to him now.

I think there is a need for bitcoin, and understand the benefits of a non-government controlled means of exchange, but am puzzled as to why so much electricity and resources are wasted in the “mining” of this “currency”. Gold mining is faulted as an environmental disaster due to use of mercury, and other effects on the environment, but it appears as though bitcoin, through electricity consumption, is perhaps equally damaging.

If you pour a beer into a glass rapidly, you can wind up with 90% foam and 10% beer. The mug appears to be full, but you are not getting what you paid for. This is the way I look at bitcoin. There was a lot of froth when the price spiked to $19K, and now the foam is settling down. There is still some beer at the bottom of the glass, and similarly, bitcoin is going to be worth something, but until the foam is gone, we will not know–but it will be obvious because when you look at the price graph, is will level out. It will not go to zero. What is interesting is that like any bubble, the price is likely to overshoot by correcting below its inherent “value”. So if the true value if bitcoin is say $2000, it may go to $1000 before it levels off. Capitulation will be required for price cycle completion. This is where the speculative opportunity lies, along with the inherent danger of loss by not getting your timing right. Along the way, there will be several suckers rallies, as Wall St. players try to “shake the beer”, but when the price graph stabilizes, that may be the time to get a few coins with your play money. Normally, I would be much more aggressive in buying, but with so many other competing coin offerings, there is no guarantee that bitcoin will be the winner, hence this trade will always be speculation, not an investment.

Just for fun, anybody like to predict the “bottom” price? It is just a guess, but I will be the first and say $1300 at the capitulation point.

It will absolutely go to zero. And it will be written about in economics classes 100 years from now. It is the act of mining that gives it any value whatsoever. But, because there is a limit to the number that can be produced, there is an endpoint for mining. Then the value must go to zero. Not at first, but very shortly afterward.

The originators have to know this. Those who don’t really understand this are the marks.

I don’t know about zero. Even Beanie Babies didn’t go to zero. They have some inherent value, even if used for heating in a wood stove. :)

The 21st million , the last Btc , will be mined around 2140. Yes , after 120 years from now.

That is because as time passes , less and less Btc will be produced.

So for sure we will not be here to see the end

As for the value, could be whatever,personally I give more probabilities to go up, way up.

After then, the value has to be way up, so to keep the miners surviving by getting fees from transactions. Otherwise, if the price is down, no network will exist so all collapses.

At current times, the electricity needed to mine a Btc is some 4-6000 US dollars, depending on the country

Historically for Btc, the price usually goes up when the exchange price touches the line of production cost.

Time will tell what happens at the end,

The endpoint is a long way into the future. Within the next few years Bitcoin will be able to operate smart contracts – and fees will be earned much in the same way as Ethereum.

If any “big swinging d***s” get burned on crypto currencies, you can bet there will be lawsuits and indictments forthcoming.

I don’t think they will just quietly disappear. I certainly wouldn’t sleep well if I were in charge of any of these crypto scams.

What is also interesting about bitcoin is that when the price was going up, retailers were lining up to accept this as a form of payment, including car dealers. Now that the price is taking the escalator down, I can imagine that of the few car dealers left that will do the transaction, they will write the contract so that the coins are sold immediately, and then this value will be written into the sales contract. Whereas last year, most car dealers would be intrigued with accepting bitcoin, now most of them would laugh out loud at the prospect.

https://www.bloomberg.com/news/articles/2018-06-17/bitcoin-could-break-the-internet-central-banks-overseer-says

when I read this I was mentally listing all the fallacies. One of course is that there will never be enough Bitcoins to sustain a system, or enough electricity. (wrong) The real leap of faith (backwards as it were) is can Bitcoin instantly translate goods and services across international borders. (GM makes cars in Mexico with $3 hour workers, and to that end you know GM is not in favor of it) Matters not is Bitcoin useful? Will all these companies fail? Call the fraud, PUHLEEZE. Bitcoin is not supposed to be fun its supposed to drive those cockroach central bankers back into their holes. Its supposed to level the playing field for workers. Should the SEC regulate crypto? Should they regulate anything?

“This is just not fun anymore”

You’re a better person than I am, Wolf, because I’m really getting off on the schadenfreude.

As a connoisseur of manias, panics, scams, hustles, cons, flim-flam and fraud, I’m enjoying this memorable vintage!

We should all be thankful that at the end of the day it’s a nothing market.

No one had to sell their house, liquidate their holdings, etc, etc. No financial institutions were affected.

Lots of hype, but I bet you the amount involved is pretty small in the end.

Bitcoin suicide? Zero.

500 billion in market cap lost had to hurt a lot of people, especially those who got in at the final stage of the mania when a lot of distribution was taking place. The Litecoin founder who sold all his holdings at highs was the most notable example of distribution.

There were people buying on credit cards to the max (which is why many of the banks finally disallowed coin buying on credit cards), people borrowed money, and even took out mortgages, so yeah, a lot of people got burned. Bitconnect alone ruined many thousands – when it went from over 400 dollars to a few cents literally overnight.

There are a lot of stories of grief, and for some strange reason the media hasn’t made a thing out of it, but the forums and YouTube have many sad tales.

I am sure it hurt some people, but not in any way that’s devastating.

For most people it seemed like it’s basically they invested, made a ton of profit and then lost all that profit, but not much more than that.

I looked through Youtube and did some Googling but couldn’t find much. Reddit has some materials although most people were basically HODLRing which is sad and laughable at the same time.

Assuming they don’t go bankrupt, they might learn some lessons from this.

I think the Bitcoin believers want a reliable store of value, not a currency. The USD is a great currency, but it’s an awful store of value. Gold will protect you from inflation in theory, but the problem with gold is that the supply might be unlimited, as far as we know. Who really knows how much gold is out there to be mined? There are so many questionable gold experts out there delivering the propoganda.

What if there a new technology comes about that allows gold to be mined more easily. With cryptos, at least they can put a clear cap on the supply, but there is always the risk another currency will develop. But that is true for gold as well. Someday silver or some other physical commodity could take the place of gold.

The notion of a dead thing being a “reliable store of value” is laughable in the first place. It’s an oxymoron.

You want a real store of value? You build communities. Like real ones.

That aside, your statement is filled with contradictions. If gold is mined more easily then its value will drop because it will be less scarce. You can’t have value and scarcity at the same time.

What do you mean you can cap the value of crypto. Let’s say we make a leap forward with quantum computers in 10 years time that’s 10000 times faster than current tech? The rarity of bitcoin is predicated on computers going on the current trajectory. Someone in the pipeline (all pun intended) will break that in the future. There’s also someone in the pipeline who will come up with algos that will break the current Bitcoin protocol. Bitcoin also does not solve the question of Credit, which is the underlying grease of our financial systems.

In the end you can NOT build lasting values because human beings have given up on other human beings hence people are always trotting out the latest tech that’s also made by flawed human beings.

The most practical thing is still to spread your wealth a bit. Not do this “the one store of value to beat all other stores of value”. Been watching too much Lord of The Rings, have we not?

“That aside, your statement is filled with contradictions. If gold is mined more easily then its value will drop because it will be less scarce. You can’t have value and scarcity at the same time.”

You are not representing what I said. If you want contradictions, your statement above seems to have an obvious one.

Also, tell a person near retirement or a person saving for his kids’ education that a store of value isn’t necessary.

Crypto has popped and on it’s way down. Now, will the SF bay area housing market do the same? Also, can you buy a house with Gold?

I suspect you can with the right seller.

Can you buy a $2 million dollar home with cash? “You sure can!”, I hear you say.

But no, I am talking about a suitcase with $2M cash, to which I say “not happening”. But with the right seller……..

Is there any hope that a Bitcoin collapse followed by the other kleptocurrencies will free up a good chunk of internet bandwidth?

Bitcoin is cool but the technology that creates a transportable ledger is much cooler, this will be where the crypto money is made in banking, auto, loans, micro loans etc….

Sell high, buy back in low.

It’s so easy!

I prefer to just stay in given I bought at $150.

I’ve missed a high blip on an otherwise long term upward trajectory. Oh noes!

“Democracy is the worst form of government, except for all the others.”

― Winston S. Churchill

I suspect the same is true of gold as money.

Oh, the humanity!

Let me ask you something: What is a Dollar? Really, what is it? Perceived value, nothing more. Not backed by ANYTHING. Can you go anywhere in the country and exchange your dollar for the same worth in gold? Of course not, but that was the intent. They simply print money, plain and simple. So for those of you questioning the value of Bitcoin, ask the same of that Fiat you hold in your hand. It’s an unlimited supply of paper they print over and over and over…controlled centrally by big banks and the Fed. yes, THAT Fed. The one that we are supposed to trust with, well, pretty much everything.

Fast Forward to Bitcoin. Nobody is in control, it’s decentralized (PLEASE go DYOR to understand that), and we can keep the Fed completely out of our matters. Yes transactions are traceable, yes it’s easier to track than Fiat (People who say it’s easier than money to launder or for the bad guys, you need to go to bed), and yes it has value. It’s a limited supply of a currency that is easily transferable. Good luck with both of those and Fiat.

From the tone of this article a few things become obvious. Richter is terrified of Bitcoin (Although I’ll bet you a Dollar to a dog turd he owns some), doesn’t truly understand it, or both.

“Two roads diverged in a wood, and I-I took the one less traveled by, and that has made all the difference.”

-Robert Frost

Cliff Carling,

This is hilarious. Thanks. Amazing the kind of rationales that true believes in bitcoin come up with. Been spending too much time reading too many bitcoin “white papers”?

And this is good too: “Richter is terrified of Bitcoin…” ha, I would be terrified if I had bought it stupidly late last year or earlier this year. Now I’m just amused.

We agree on that, I had friends purchase close to $20,000. i bought at $1900.

White Papers are boring. So is Gold. At least Bitcoin is entertaining! Ha ha

Even the vendors are having a hard time in China. http://www.sixthtone.com/news/1002482/vendors-left-gasping-after-burst-bitcoin-bubble

Game Over soon.

While bitcoin has had an insanely volatile year, the fact is that if you had bought it at $2500 a year ago and held it you would have doubled your money.

It appears someone got forked, skewered or roasted. Or maybe knived? Not sure the correct terminology.

They got bit.

even with the technical difficulties currently in scaling (that might be solved or not in the near future) there are some characteristics that can’t be denied (there is a lot of misinformation or misunderstanding of those)

– i know of no other method that it is possible in 5 minutes or max one hour to transfer whatever amount of wealth (btc or whatever crypto coin from 1 to millions) to a friend of mine at any place on earth, whatever country, securely and without need of a 3rd party like a bank. From my wallet to his wallet.

-And when it comes to transfer your wealth (ie some gold bars) to another place , you will have to carry with you some kilos of yellow metal, risking to be cought by state officers.

At the same time some people will choose to travel with just their clothes having their wealth on btc (or whatever) and not carrying anything with them, because they don’t need to.

Only thing that is needed in the latter is to have somewhere (on you , in your mind or anywhere , the 10 word needed to recover your wallet from anywhere on the planet.

This is the cornerstone of this technology. and a matter of philosophical discussion.

We have a current system that usually needs a third party to do whatever transaction we wish (bank, insurance etc) . It works as we all know

if with a new technology we can just cut the middleman, then this is a step forward for society .

it will take time to be accepted in human mindsets . it might be a simpler method of doing things.

if btc holds or collapses might be another story. But what btc gave is actually this new technology that might change (for best or worst) the way things are moving.

if btc or any other crypto will mature or accepted in the future as a store

of value or medium of exchange by masses, remains to be seen.Not sure the verdict is written on the wall as of yet, despite the price volatility and rises and collapse of it.

Similar debates have always occured in history when some new things came in use. We might have here this new thing.

Maybe from an trader’s point of view it’s no longer fun but if you’re a HODLer and you look behind the scenes then there’s some exciting innovation going on. In particular the Lightning Network (LN). It’s being rolled out now but will take time to mature. There are problems to solve and, no doubt, new ones will pop up. This is evolution as much as innovation. I am pretty sure that eventually a bank will offer bitcoin accounts (channels in LN jargon) and maybe other services on LN too. Once that happens bitoin’s price will likely rocket. Whether I’ll still be here to benefit is another matter. I’d love to at least see the lift off. Of course, it could fail altogether, go to zero, but I very much doubt it. It’s a sound system that has been kept simple (contrast it with Ethereum), that’s exactly what you want when dealing with money, clarity. Writing clever code is easy – writing easy code is clever.